Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Shire plc | dp84959_8k.htm |

Exhibit 99.1

Value Creation by Execution and Focus Flemming Ornskov, MD, MPH, Chief Executive Officer JP Morgan Healthcare Conference January 8, 2018

2 “Safe Harbor” Statement Under The Private Securities Litigation Reform Act Of 1995 Statements included herein that are not historical facts, including without limitation statements concerning future strategy, plans, objectives, expectations and intentions, projected revenues, the anticipated timing of clinical trials and approvals for, and the commercial potential of, inline or pipeline products, are forward - looking statements. Such forward - looking statements involve a number of risks and uncertainties and are subject to change at any time. In the event such risks or uncertainties materialize, Shire’s results could be materially adversely affected. The risks and uncertainties include, but are not limited to, the following: • Shire’s products may not be a commercial success; • increased pricing pressures and limits on patient access as a result of governmental regulations and market developments may affect Shire’s future revenues, financial condition and results of operations; • Shire conducts its own manufacturing operations for certain of its products and is reliant on third party contract manufacturers to manufacture other products and to provide goods and services. Some of Shire’s products or ingredients are only available from a single approved source for manufacture. Any disruption to the supply chain for any of Shire’s products may result in Shire being unable to continue marketing or developing a product or may result in Shire being unable to do so on a commercially viable basis for some period of time; • the manufacture of Shire’s products is subject to extensive oversight by various regulatory agencies. Regulatory approvals or interventions associated with changes to manufacturing sites, ingredients or manufacturing processes could lead to, among other things, significant delays, an increase in operating costs, lost product sales, an interruption of research activities or the delay of new product launches; • certain of Shire’s therapies involve lengthy and complex processes, which may prevent Shire from timely responding to market forces and effectively managing its production capacity; • Shire has a portfolio of products in various stages of research and development. The successful development of these products is highly uncertain and requires significant expenditures and time, and there is no guarantee that these products will receive regulatory approval; • the actions of certain customers could affect Shire’s ability to sell or market products profitably. Fluctuations in buying or distribution patterns by such customers can adversely affect Shire’s revenues, financial conditions or results of operations; • Shire’s products and product candidates face substantial competition in the product markets in which it operates, including competition from generics; • adverse outcomes in legal matters, tax audits and other disputes, including Shire’s ability to enforce and defend patents and other intellectual property rights required for its business, could have a material adverse effect on the Company’s revenues, financial condition or results of operations; • inability to successfully compete for highly qualified personnel from other companies and organizations; • failure to achieve the strategic objectives, including expected operating efficiencies, cost savings, revenue enhancements, synergies or other benefits at the time anticipated or at all with respect to Shire’s acquisitions, including NPS Pharmaceuticals Inc., Dyax Corp. or Baxalta Incorporated may adversely affect Shire’s financial condition and results of operations; • Shire’s growth strategy depends in part upon its ability to expand its product portfolio through external collaborations, which, if unsuccessful, may adversely affect the development and sale of its products; • a slowdown of global economic growth, or economic instability of countries in which Shire does business, as well as changes in foreign currency exchange rates and interest rates, that adversely impact the availability and cost of credit and customer purchasing and payment patterns, including the collectability of customer accounts receivable; • failure of a marketed product to work effectively or if such a product is the cause of adverse side effects could result in damage to Shire’s reputation, the withdrawal of the product and legal action against Shire; • investigations or enforcement action by regulatory authorities or law enforcement agencies relating to Shire’s activities in the highly regulated markets in which it operates may result in significant legal costs and the payment of substantial compensation or fines; • Shire is dependent on information technology and its systems and infrastructure face certain risks, including from service disruptions, the loss of sensitive or confidential information, cyber - attacks and other security breaches or data leakages that could have a material adverse effect on Shire’s revenues, financial condition or results of operations; • Shire incurred substantial additional indebtedness to finance the Baxalta acquisition, which has increased its borrowing costs and may decrease its business flexibility ; • Our ongoing strategic review of our Neuroscience franchise may distract management and employees and may not lead to improved operating performance or financial results; there can be no guarantee that, once completed, our strategic review will result in any additional strategic changes beyond those that have already been announced; and a further list and description of risks, uncertainties and other matters can be found in Shire’s most recent Annual Report on Form 10 - K and in Shire’s subsequent Quarterly Reports on Form 10 - Q, in each case including those risks outlined in “ITEM 1A: Risk Factors”, and in subsequent reports on Form 8 - K and other Securities and Exchange Commission filings, all of which are available on Shire’s website. All forward - looking statements attributable to us or any person acting on our behalf are expressly qualified in their entirety by this cautionary statement. Readers are cautioned not to place undue reliance on these forward - looking statements that speak only as of the date hereof. Except to the extent otherwise required by applicable law, we do not undertake any obligation to update or revise forward - looking statements, whether as a result of new information, future events or otherwise.

3 Agenda ▪ Our Journey to a rare disease company The New Shire 2017 Priorities Strategic Review 2018 and beyond ▪ A year of integration and execution ▪ Value creation through sharpened focus ▪ Reinforcing leadership in rare disease; Investing in Neuroscience & enhancing optionality

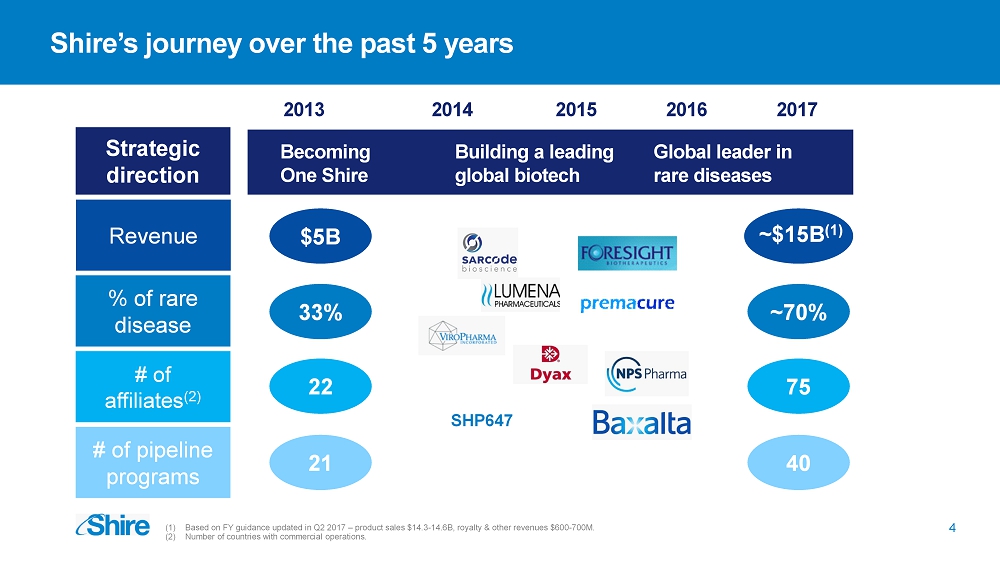

Shire’s journey over the past 5 years 2013 Building a leading global biotech Becoming One Shire Global leader in rare diseases (1) Based on FY guidance updated in Q2 2017 – product sales $14.3 - 14.6B, royalty & other revenues $ 600 - 700M. (2) Number of countries with commercial operations. Strategic direction Revenue 2014 2015 2016 2017 % of rare disease $5B 33% ~70% # of affiliates (2 ) 22 75 # of pipeline programs 21 40 4 ~$15B (1) SHP647

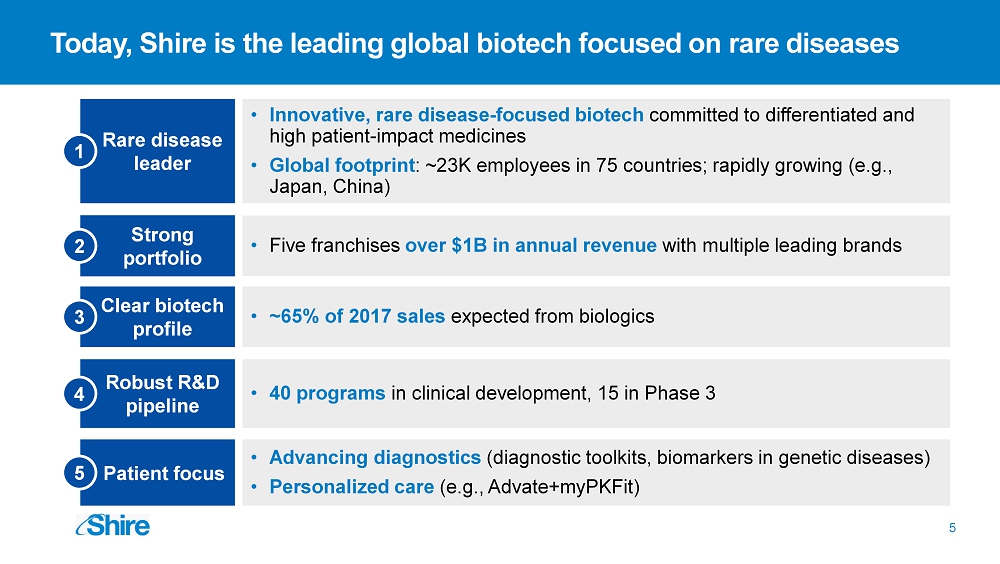

Robust R&D pipeline Strong portfolio 5 Rare disease leader 2 • Innovative, rare disease - focused biotech committed to differentiated and high patient - impact medicines • Global footprint : ~23K employees in 75 countries; rapidly growing (e.g., Japan , China) 4 • 40 programs in clinical development, 15 in Phase 3 • Five franchises over $1B in annual revenue with multiple leading brands Clear biotech profile • ~65% of 2017 sales expected from biologics 1 3 • A dvancing diagnostics (diagnostic toolkits, biomarkers in genetic diseases) • Personalized care ( e.g., Advate+myPKFit ) 5 Patient focus Today, Shire is the leading global biotech focused on rare diseases

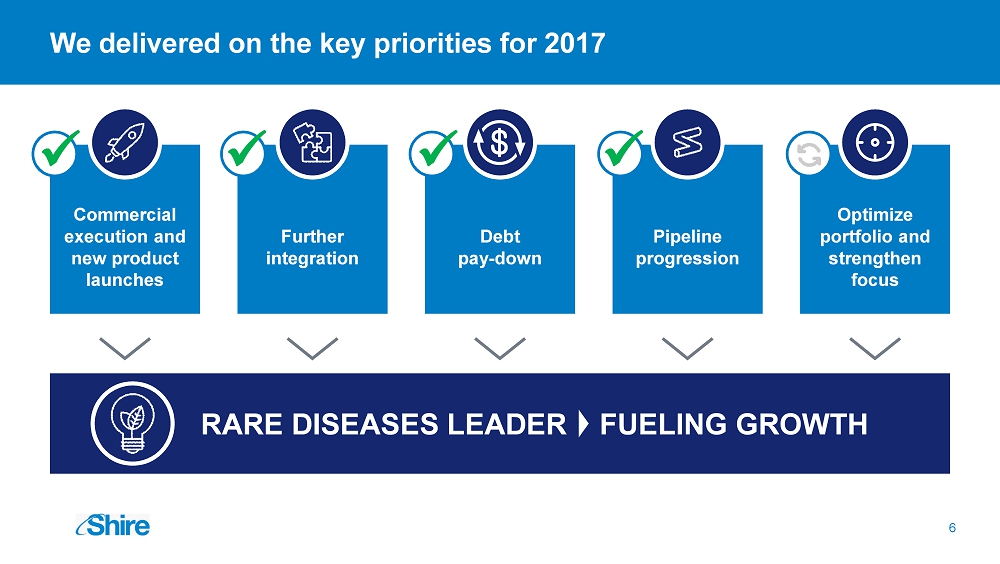

Debt pay - down Further integration Pipeline progression We delivered on the key priorities for 2017 RARE DISEASES LEADER FUELING GROWTH Optimize portfolio and strengthen focus 6 Commercial execution and new product launches x x x x

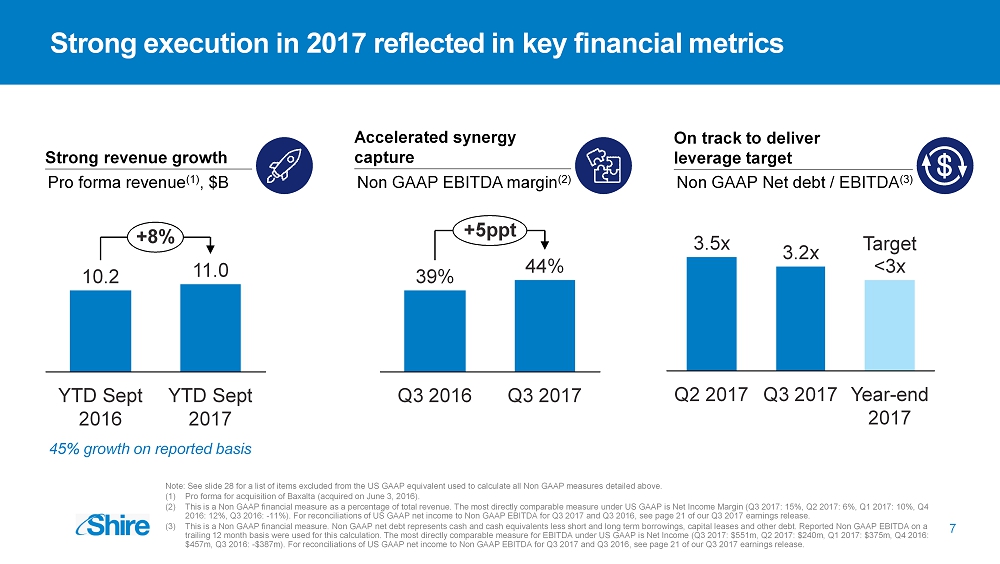

7 Strong execution in 2017 reflected in key financial metrics Strong revenue growth Pro forma revenue (1) , $B Accelerated synergy capture Non GAAP EBITDA margin (2) On track to deliver leverage target Non GAAP Net debt / EBITDA (3) YTD Sept 2017 11.0 YTD Sept 2016 10.2 +8% Q3 2016 44% + 5ppt Q3 2017 39% Q3 2017 Year - end 2017 3.5x Q2 2017 3.2x <3x 45% growth on reported basis Target Note: See slide 28 for a list of items excluded from the US GAAP equivalent used to calculate all Non GAAP measures detailed above. (1) Pro forma for acquisition of Baxalta (acquired on June 3, 2016). (2) This is a Non GAAP financial measure as a percentage of total revenue. The most directly comparable measure under US GAAP is Net Income Margin (Q3 2017: 15%, Q2 2017: 6%, Q1 2017: 10%, Q4 2016: 12%, Q3 2016: - 11%). For reconciliations of US GAAP net income to Non GAAP EBITDA for Q3 2017 and Q3 2016, see page 21 of our Q3 2017 earnings rel ea se. (3) This is a Non GAAP financial measure. Non GAAP net debt represents cash and cash equivalents less short and long term borrowi ngs , capital leases and other debt. Reported Non GAAP EBITDA on a trailing 12 month basis were used for this calculation. The most directly comparable measure for EBITDA under US GAAP is Net Income ( Q3 2017: $551m, Q2 2017: $240m, Q1 2017: $375m, Q4 2016: $457m, Q3 2016: - $387m). For reconciliations of US GAAP net income to Non GAAP EBITDA for Q3 2017 and Q3 2016, see page 21 of our Q3 2017 earnings rel ea se.

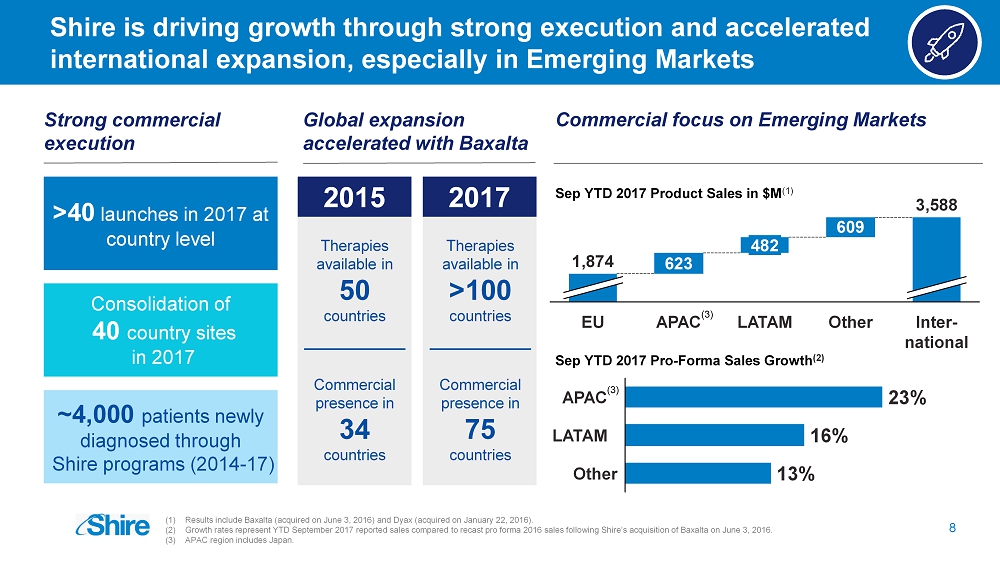

Shire is driving growth through strong execution and accelerated international expansion, especially in Emerging M arkets 8 Sep YTD 2017 Product Sales in $M (1 ) Commercial presence in 34 countries Therapies available in 50 countries 2015 Commercial presence in 75 countries Therapies available in >100 countries Global expansion accelerated with Baxalta 2017 Strong commercial execution >40 launches in 2017 at country level Consolidation of 40 country sites in 2017 ~4,000 patients newly diagnosed through Shire programs (2014 - 17) Commercial focus on Emerging Markets 609 623 Inter - national 3,588 Other LATAM 482 APAC EU 1,874 Sep YTD 2017 Pro - Forma Sales Growth (2 ) 23% Other 13% LATAM 16% APAC (3) (3) (1) Results include Baxalta (acquired on June 3, 2016) and Dyax (acquired on January 22, 2016). (2) Growth rates represent YTD September 2017 reported sales compared to recast pro forma 2016 sales following Shire’s acquisition of Baxalta on June 3, 2016. (3) APAC region includes Japan.

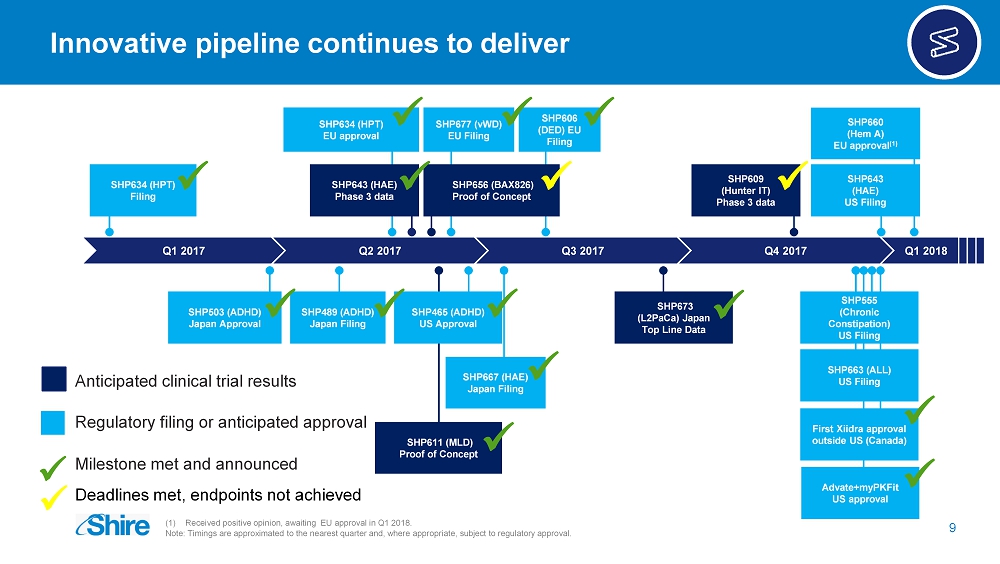

Q1 2017 Q2 2017 Q3 2017 Q4 2017 SHP656 (BAX826) Proof of Concept SHP643 (HAE) Phase 3 data SHP611 (MLD) Proof of Concept SHP609 (Hunter IT) Phase 3 data SHP634 (HPT) EU approval SHP465 (ADHD) US Approval SHP660 (Hem A) EU approval (1) SHP503 (ADHD) Japan Approval SHP677 (vWD) EU Filing SHP634 (HPT) Filing SHP673 (L2PaCa) Japan Top Line Data SHP489 (ADHD) Japan Filing SHP667 (HAE) Japan Filing SHP606 (DED) EU Filing x x x x x x SHP643 (HAE) US Filing Q1 2018 Innovative pipeline continues to deliver 9 (1) Received positive opinion, awaiting EU approval in Q1 2018. Note: Timings are approximated to the nearest quarter and, where appropriate, subject to regulatory approval. x x x x x x x x Milestone met and announced Anticipated clinical trial results Regulatory filing or anticipated approval Deadlines met, endpoints not achieved x First Xiidra approval outside US (Canada) x Advate+myPKFit US approval x SHP555 (Chronic Constipation) US Filing SHP663 (ALL) US Filing

Key innovation achievements in 2017 • 10 Dossiers submitted • 2 FDA Fast Track Designations, 2 Orphan Drug Designations, 1 Breakthrough Therapy Designation • 3 INDs submitted • Initiated 6 Phase 3 Global Programs (and two Phase 3 studies in Japan) • Licensing SHP659 for DED • Licensing agreement with Novimmune S.A. Development Progress • Approval and Launch of MYDAYIS for ADHD in adults and adolescents in the US • Approval and Launch of NATPAR for hypoparathyroidism in EU • Approval for lyophilized ONCASPAR for ALL in EU • Approval and Launch of INTUNIV for ADHD in Japan • CHMP Positive Opinion for ADYNOVI for adults and adolescents with Hemophilia A • CHMP Positive Opinion for FIRAZYR for acute HAE attacks in pediatric patients Major Approvals & Launches • New state - of - the - art research lab facility in Kendall Square – occupancy in 1H 2018 Building innovation hub in Cambridge 54 MAJOR MARKET FILINGS 126 PRODUCT APPROVALS GLOBALLY 9 PHASE 3 STUDIES COMPLETED 10

Today we have two market - leading, but distinct businesses which led to our strategic review 11 (1) Includes Oncology. (2) Established brands are Lialda, Pentasa , and Fosrenol . (3) Based on net product sales, Q4 2016 – Q3 2017. (4) Subject to regulatory approval. Note: CRM: chronic respiratory morbidity; UC: ulcerative colitis; DED: dry eye disease; CIC: chronic idiopathic constipation; HAE: her editary angioedema; CD: Crohn’s disease; EoE : Eosinophilic Esophagitis; CMV: cytomegalovirus, SE: status epilepticus. Revenue mix (Q4 2016 – Q3 2017) Rare Diseases Neuroscience • >$13B • >$4B Revenue outlook (2020) Modalities • > 90% biologics • 100% small molecules Geographic split (3 ) (% ex - US) • 42% • 14% Key pipeline programs (4) • SHP643 (HAE), SHP620 (CMV), SHP621 ( EoE ), SHP647 (UC/CD), SHP607 (CRM), Xiidra EU (DED), Resolor / SHP555 US (CIC) • SHP680 (multiple neurological conditions), Vyvanse Japan (ADHD), Buccolam / SHP615 US (SE) Neuropsychiatry Established brands (2) $3.9B Hematology Genetic Diseases / Internal Medicine (1) Immunology Ophthalmics $10.9B

We have evaluated options to maximize the performance of the Neuroscience business 12 Neuroscience business requires focus and investment to maximize performance Stage 1 of the strategic review – Completed Strategic options for Neuroscience Invest and grow Remain within Shire External options including independent listing Harvest Stage 2

Neuroscience Division Rare Disease Division Separation into two divisions to optimally manage distinct businesses 13 Therapeutic focus Commercial model R&D strategy • Rare and orphan diseases • Personalized , high - touch model • Small field forces focused on CoEs • Global presence (75 countries) • Emphasis on first - in - class, breakthrough innovation, emphasis on biologics • Neuropsychiatry • Broad - based promotion, including DTC • Larger sales forces covering primary care and specialists • Focused on US and key international markets • Provide differentiated treatment options to meet diverse patient needs; emphasis on small molecules and lifecycle management

New divisional structure will enhance Shire’s ability to maximize the future value of our Neuroscience platform 14 Potential benefits to Neuroscience business Accelerate development of key pipeline programs (SHP680, Buccolam US / SHP615) Drive Mydayis launch and market penetration Invest behind international expansion and market development Expand portfolio with new indications and disciplined BD / bolt - on M&A Key changes with divisional structure Focused management teams Dedicated budgets and resources Tailored incentives Clear investment priorities Increased visibility on operating performance Future optionality

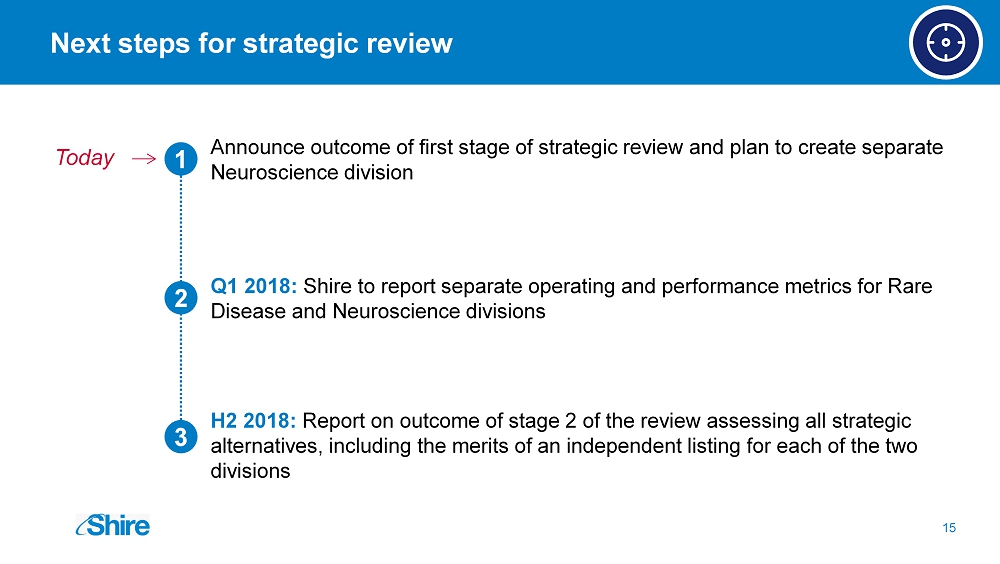

Announce outcome of first stage of strategic review and plan to create separate Neuroscience division 1 2 3 Q1 2018: Shire to report separate operating and performance metrics for Rare Disease and Neuroscience divisions H2 2018 : Report on outcome of stage 2 of the review assessing all strategic alternatives, including the merits of an independent listing for each of the two divisions Today Next steps for strategic review 15

Key priorities for 2018 16 Rare Disease Priority Neuroscience Priority • Strengthen our leadership in r are diseases through investment into immunology and innovation • Invest in Neuroscience and expand beyond ADHD to enhance optionality for the business

Increased focus on Immunology has accelerated growth 17 Global Immunology revenue (1 ) $B +6% +21% Shire’s goal is to continue outperforming the market 2.2 1.8 1.7 Sep YTD 2017 Sep YTD 2016 Sep YTD 2015 >8% IG Market Growth (2017 - 2020) (2) 6 - 8% Shire Outlook (2017 - 2020) Key Shire brands ▪ Share growth ▪ International subcutaneous launches and tenders ▪ Strong demand for subcutaneous immunoglobulin (e.g., HyQvia and Cuvitru) Shire growth drivers (1) Pro forma for acquisition of Baxalta (acquired on June 3, 2016). (2) Source: EvaluatePharma / Shire analysis.

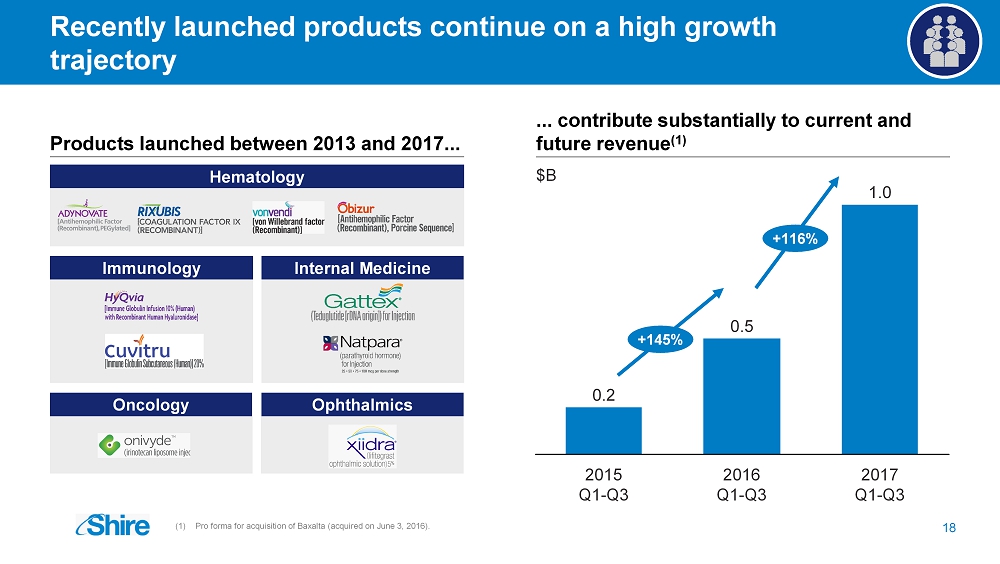

Recently launched products continue on a high growth trajectory 18 (1) Pro forma for acquisition of Baxalta (acquired on June 3, 2016 ). Hematology ... contribute substantially to current and future revenue (1 ) Products launched between 2013 and 2017... 0.5 0.2 1.0 2017 Q1 - Q3 2016 Q1 - Q3 2015 Q1 - Q3 Immunology Internal Medicine Oncology Ophthalmics $B +116% +145%

Sharpened focus on Neuroscience 19 Key priorities for 2018 ▪ Build on best - in - class launch of Mydayis ▪ Drive growth in international markets ▪ Consider bolt - on opportunities to expand portfolio (1) IMS PlanTrak* and Connective Rx redemption data from approval to December 22, 2017. * IMS data: IMS information is an estimate derived from the use of information under license from the following IMS Health I nfo rmation service: IMS PlanTrak. IMS expressly reserves all rights including rights of copying, distribution and republication. ~59K Total prescriptions (1) ~25K Unique patients (1) ~8K Unique prescribers (1) Mydayis launch in US (1) (Total Rx) 0 500 1,000 1,500 2,000 2,500 3,000 3,500 4,000 4,500 5,000 +427% Official U.S. Launch: Aug 28, 2017

Innovative R&D pipeline with several near - term catalysts 20 SOURCE: Pipeline as of December 2017. NOTES: CRM: chronic respiratory morbidity; UC: ulcerative colitis; DED: dry eye disease; CIC: chronic idiopathic constipation ; H AE: hereditary angioedema; CD: Crohn’s disease; EoE : Eosinophilic Esophagitis; All programs subject to regulatory approval. Clinical Programs in Pipeline S T AGE NUMBER OF PROGRAMS Phase 1 1 7 10 Phase 2 2 15 Phase 3 3 8 Registration R Recent a ppr o val s R A 3 Key Program Highlights for 2018 • SHP643 (HAE) – US approval expected H2 • Xiidra (DED) – EU approval expected H2 • Vyvanse (ADHD) – Japan approval expected mid - year • SHP555 (CIC) – US approval expected Q4 2018 / Q1 2019 • SHP647 (CD) – Phase 3 start expected H1 (UC indication started Q4 2017) • SHP621 ( EoE ) – Topline data expected Q4 2018 / Q1 2019 • SHP654 (GT Hem A) – First patient dose expected Q1 • SHP643 (HAE) – Pediatric Phase 3 start expected Q4

Lanadelumab has potential to significantly improve treatment in HAE (1 ) (1) Subject to regulatory approval. (2) Study DX - 2930 - 03 with lanadelumab 300 mg q2wks vs placebo for the duration of the 6 - month study (P<0.001). Primary efficacy endp oint LS mean monthly attack rate, Day 0 to 182; secondary endpoints - reduction of HAE attacks that required acute treatment, were moderate or severe, or started after Day 14 ( Poisson regression model); Estimated steady state period (Day 70 - 182); 77% of patients attack free Day 70 - 182. (3) Change in AE - QoL total and domain scores and minimal clinically important difference from Day 0 to 182 (Weller et al, 2016 ). “ Achieved attack - free results for the majority of HAE patients, in the Phase III trial taking Lanadelumab every two weeks, once steady state is achieved (2 ) ” Efficacy approaching attack free • Overall 87% attack reduction over 26 weeks (2) • During steady state stage of trial (Day 70 - 182) (2) : − 91% attack reduction − 8 out of 10 patients attack free Enhancing patients’ treatment experience • Simple and convenient subcutaneous injection that takes <1 minute to self - administer, every 2 weeks • 75% reduction in number of injections vs traditional preventive therapies • Based on an Angioedema Quality of Life ( QoL ) Questionnaire, subjects reported improved health - related QoL compared to placebo (3) 21

New Shire Executive Committee Members joining early 2018 Thomas Dittrich Chief Financial Officer Member of the Board of Directors Andreas Busch, PhD Executive Vice President Head of R&D and Chief Scientific Officer 22

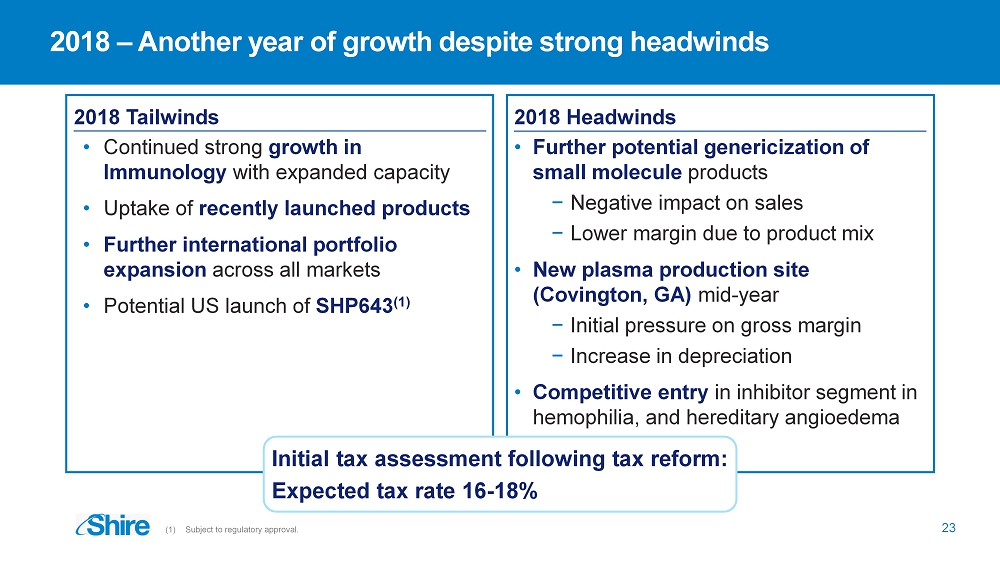

2018 – Another year of growth despite strong headwinds 23 (1) Subject to regulatory approval. 2018 Headwinds • Further potential genericization of small molecule products − Negative impact on sales − Lower margin due to product mix • New plasma production site (Covington, GA) mid - year − Initial pressure on gross margin − Increase in depreciation • Competitive entry in inhibitor segment in hemophilia, and hereditary angioedema 2018 Tailwinds • Continued strong growth in Immunology with expanded capacity • Uptake of recently launched products • Further international portfolio expansion across all markets • Potential US launch of SHP643 (1 ) Initial tax assessment following tax reform: Expected tax rate 16 - 18%

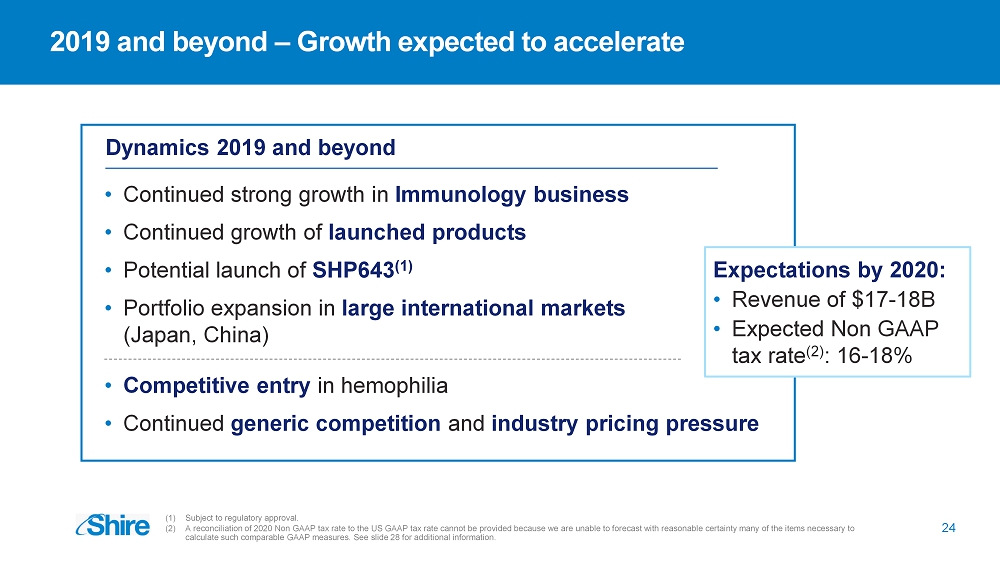

2019 and beyond – Growth expected to accelerate (1) Subject to regulatory approval. (2) A reconciliation of 2020 Non GAAP tax rate to the US GAAP tax rate cannot be provided because we are unable to forecast with rea sonable certainty many of the items necessary to calculate such comparable GAAP measures. See slide 28 for additional information. Dynamics 2019 and beyond • Continued strong growth in Immunology business • Continued growth of launched products • Potential launch of SHP643 (1) • Portfolio expansion in large international markets (Japan, China) Expectations by 2020: • Revenue of $17 - 18B • Expected Non GAAP tax rate (2) : 16 - 18% 24 • Competitive entry in hemophilia • Continued generic competition and industry pricing pressure

▪ Organic growth – Invest behind leading products and pipeline ▪ Leverage reduction – Targeting to below 2.5x (1)(2) by end of 2018 ▪ Dividends – Maintain a progressive policy ▪ Selective business development – Focus on in - licensing and bolt - on opportunities ▪ Share buybacks – Remain under consideration CREATING SHAREHOLDER VALUE 2018 capital allocation priorities 25 (1) On a Non GAAP Net debt / EBITDA basis. See slide 28 for a list of items excluded from US GAAP equivalent used to calculate all Non GAAP measures. (2) This leverage reduction target excludes the effect of any bolt - on acquisitions or licensing transactions.

26 Shire is well positioned for further growth ▪ The leading global biotech focused on rare diseases ▪ Delivered on all key priorities through strong execution 2017 Strategic review 2018 and beyond ▪ Targeting leverage ratio of below 2.5x (1)(2) by end of 2018 ▪ Another year of growth despite strong headwinds with acceleration of growth expected during 2019 ▪ Decision to invest in Neuroscience and operate as two independent divisions Stage 1 Stage 2 ▪ Reporting of operational performance from Q1 2018 ▪ Continuing to evaluate all strategic alternatives , incl. independent listing (1) On a Non GAAP Net debt / EBITDA basis. See slide 28 for a list of items excluded from US GAAP equivalent used to calculate all Non GAAP measures. (2) This leverage reduction target excludes the effect of any bolt - on acquisitions or licensing transactions.

27

This presentation contains financial measures not prepared in accordance with US GAAP. These measures are referred to as “Non GAAP” measures and include: Non GAAP operating income; Non GAAP net income; Non GAAP diluted earnings per ADS; effective tax rate on Non GAAP income before income taxes and (losses/earnings) of equity method investees (effective tax rate on Non GAAP income); Non GAAP CER; Non GAAP cost of sales; Non GAAP gross margin; Non GAAP R&D; Non GAAP SG&A; Non GAAP other expense; Non GAAP free cash flow, Non GAAP net debt, Non GAAP EBITDA and Non GAAP EBITDA margin. The Non GAAP measures exclude the impact of certain specified items that are highly variable, difficult to predict, and of a size that may substantially impact Shire’s operations. Upfront and milestone payments related to in - licensing and acquired products that have been expensed as R&D are also excluded as specified items as they are generally uncertain and often result in a different payment and expense recognition pattern than ongoing internal R&D activities. Intangible asset amortization has been excluded from certain measures to facilitate an evaluation of current and past operating performance, particularly in terms of cash returns, and is similar to how management internally assesses performance. The Non GAAP financial measures are presented in this presentation as Shire’s management believes that they will provide investors with an additional analysis of Shire’s results of operations, particularly in evaluating performance from one period to another. Shire’s management uses Non GAAP financial measures to make operating decisions as they facilitate additional internal comparisons of Shire’s performance to historical results and to competitor’s results, and provides them to investors as a supplement to Shire’s reported results to provide additional insight into Shire’s operating performance. Shire’s Remuneration Committee uses certain key Non GAAP measures when assessing the performance and compensation of employees, including Shire’s executive directors. The Non GAAP financial measures used by Shire may be calculated different from, and therefore may not be comparable to, similarly titled measures used by other companies - refer to the section “Non GAAP Financial Measure Descriptions” below for additional information. In addition, these Non GAAP financial measures should not be considered in isolation as a substitute for, or as superior to, financial measures calculated in accordance with US GAAP, and Shire’s financial results calculated in accordance with US GAAP and reconciliations to those financial statements should be carefully evaluated. Non GAAP Financial Measure Descriptions Where applicable the following items, including their tax effect, have been excluded when calculating Non GAAP earnings and from our Non GAAP outlook: Amortization and asset impairments: • Intangible asset amortization and impairment charges; and • Other than temporary impairment of investments. Acquisitions and integration activities: • Up - front payments and milestones in respect of in - licensed and acquired products; • Costs associated with acquisitions, including transaction costs, fair value adjustments on contingent consideration and acquired inventory; • Costs associated with the integration of companies; and • Noncontrolling interests in consolidated variable interest entities. Divestments, reorganizations and discontinued operations: • Gains and losses on the sale of non - core assets; • Costs associated with restructuring and reorganization activities; • Termination costs; and • Income/(losses) from discontinued operations. Legal and litigation costs: • Net legal costs related to the settlement of litigation, government investigations and other disputes (excluding internal legal team costs). Additionally, in any given period Shire may have significant, unusual or non - recurring gains or losses which it may exclude from its Non GAAP earnings for that period. When applicable, these items would be fully disclosed and incorporated into the required reconciliations from US GAAP to Non GAAP measures. Depreciation, which is included in Cost of sales, R&D and SG&A costs in our US GAAP results, has been separately disclosed for presentational purposes. Free cash flow represents net cash provided by operating activities, excluding up - front and milestone payments for in - licensed and acquired products, but including capital expenditure in the ordinary course of business. Non GAAP net debt represents cash and cash equivalents less short and long term borrowings, capital leases and other debt. 2020 Financial Targets A reconciliation of 2020 Non GAAP tax rates to the US GAAP tax rates cannot be provided because we are unable to forecast with reasonable certainty many of the items necessary to calculate such comparable GAAP measures, including asset impairments, acquisitions and integration related expenses, divestments, reorganizations and discontinued operations related expenses, legal settlement costs, as well as other unusual or non - recurring gains or losses . These items are uncertain, depend on various factors, and could be material to our results computed in accordance with GAAP. We believe the inherent uncertainties in reconciling Non GAAP measures for periods after 2018 to the most comparable GAAP measures would make the forecasted comparable GAAP measures nearly impossible to predict with reasonable certainty and therefore inherently unreliable. Non GAAP financial measures 28