Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - iHeartCommunications, Inc. | d491297dex992.htm |

| 8-K - 8-K - iHeartCommunications, Inc. | d491297d8k.htm |

Exhibit 99.1

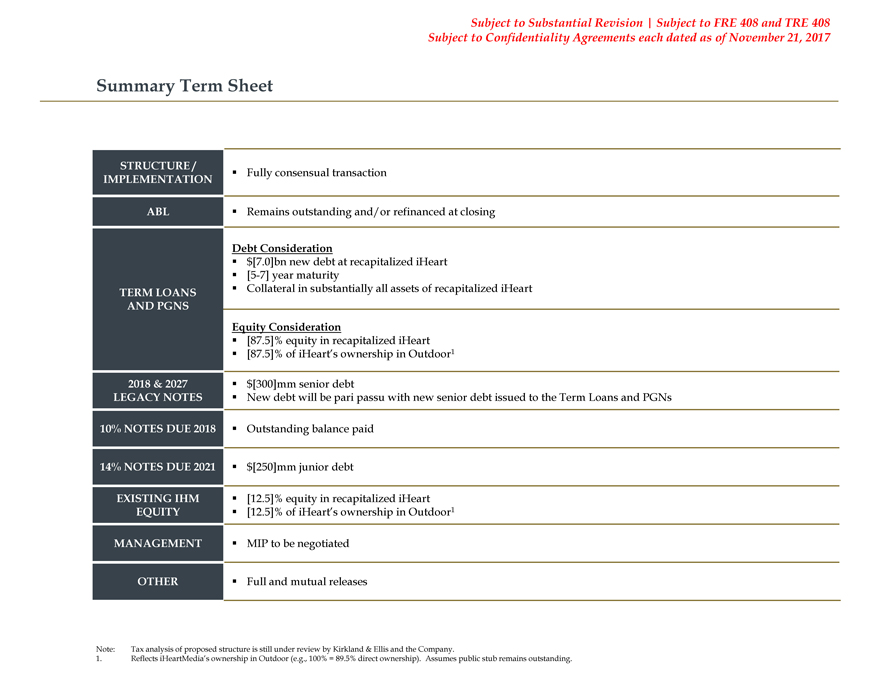

Subject to Substantial Revision | Subject to FRE 408 and TRE 408 Subject to Confidentiality Agreements each dated as of November 21, 2017 Summary Term Sheet STRUCTURE / Fully consensual transaction IMPLEMENTATION ABL Remains outstanding and/or refinanced at closing Debt Consideration $[7.0]bn new debt at recapitalized iHeart [5-7] year maturity TERM LOANS Collateral in substantially all assets of recapitalized iHeart AND PGNS Equity Consideration [87.5]% equity in recapitalized iHeart [87.5]% of iHeart’s ownership in Outdoor1 2018 & 2027 $[300]mm senior debt LEGACY NOTES New debt will be pari passu with new senior debt issued to the Term Loans and PGNs 10% NOTES DUE 2018 Outstanding balance paid 14% NOTES DUE 2021 $[250]mm junior debt EXISTING IHM [12.5]% equity in recapitalized iHeart EQUITY [12.5]% of iHeart’s ownership in Outdoor1 MANAGEMENT MIP to be negotiated OTHER Full and mutual releases Note: Tax analysis of proposed structure is still under review by Kirkland & Ellis and the Company. 1. Reflects iHeartMedia’s ownership in Outdoor (e.g., 100% = 89.5% direct ownership). Assumes public stub remains outstanding.

Subject to Substantial Revision | Subject to FRE 408 and TRE 408 Subject to Confidentiality Agreements each

dated as of November 21, 2017

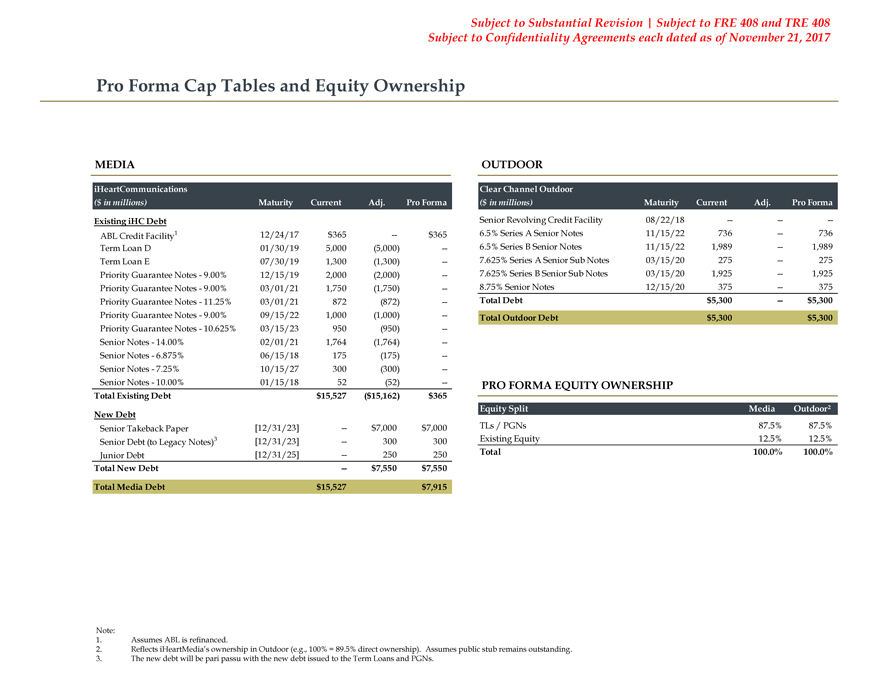

Pro Forma Cap Tables and Equity Ownership

MEDIA

iHeartCommunications

($ in millions) Maturity Current Adj. Pro Forma

Existing iHC Debt

ABL Credit Facility1 12/24/17 $365 — $365

Term Loan D 01/30/19 5,000 (5,000) —

Term Loan E 07/30/19 1,300 (1,300) —

Priority Guarantee Notes—9.00%

12/15/19 2,000 (2,000) —

Priority Guarantee Notes—9.00% 03/01/21 1,750 (1,750) —

Priority Guarantee Notes—11.25% 03/01/21 872 (872) —

Priority Guarantee

Notes—9.00% 09/15/22 1,000 (1,000) —

Priority Guarantee Notes—10.625% 03/15/23 950 (950) —

Senior Notes—14.00% 02/01/21 1,764 (1,764) —

Senior Notes—6.875% 06/15/18 175

(175) —

Senior Notes—7.25% 10/15/27 300 (300) —

Senior

Notes—10.00% 01/15/18 52 (52) —

Total Existing Debt $15,527 ($15,162) $365

New Debt

Senior Takeback Paper [12/31/23] — $7,000 $7,000

Senior Debt (to Legacy Notes)3 [12/31/23] — 300 300

Junior Debt

[12/31/25] — 250 250

Total New Debt — $7,550 $7,550

Total Media

Debt $15,527 $7,915

OUTDOOR

Clear Channel Outdoor

($ in millions) Maturity Current Adj. Pro Forma

Senior Revolving Credit Facility 08/22/18

— — —

6.5% Series A Senior Notes 11/15/22 736 — 736

6.5%

Series B Senior Notes 11/15/22 1,989 — 1,989

7.625% Series A Senior Sub Notes 03/15/20 275 — 275

7.625% Series B Senior Sub Notes 03/15/20 1,925 — 1,925

8.75% Senior Notes 12/15/20 375

— 375

Total Debt $ 5,300 — $ 5,300

Total Outdoor Debt $ 5,300 $

5,300

PRO FORMA EQUITY OWNERSHIP

Equity

Split Media Outdoor²

TLs / PGNs 87.5% 87.5%

Existing Equity 12.5% 12.5%

Total 100.0% 100.0%

Note:

1. Assumes ABL is refinanced.

2. Reflects iHeartMedia’s ownership in Outdoor (e.g., 100% = 89.5% direct ownership). Assumes public stub remains outstanding.

3. The new debt will be pari passu with the new debt issued to the Term Loans and PGNs.