Attached files

| file | filename |

|---|---|

| EX-32.1 - EXHIBIT 32.1 - Versum Materials, Inc. | vsmexhibit3219302017.htm |

| EX-31.2 - EXHIBIT 31.2 - Versum Materials, Inc. | vsmexhibit3129302017.htm |

| EX-31.1 - EXHIBIT 31.1 - Versum Materials, Inc. | vsmexhibit3119302017.htm |

| EX-23 - EXHIBIT 23 - Versum Materials, Inc. | vsmexhibit239302017.htm |

| EX-21 - EXHIBIT 21 - Versum Materials, Inc. | vsmexhibit219302017.htm |

| EX-10.16 - EXHIBIT 10.16 - Versum Materials, Inc. | vsmexhibit10169302017.htm |

| EX-10.15 - EXHIBIT 10.15 - Versum Materials, Inc. | vsmexhibit10159302017.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One) | |

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended September 30, 2017

or

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from __________ to __________

Commission file number 1-37644

VERSUM MATERIALS, INC.

(Exact name of registrant as specified in its charter)

Delaware | 47-5632014 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

8555 South River Parkway, Tempe, Arizona 85284

(Address of principal executive offices) (Zip code)

(602) 282-1000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange on which registered | |

Common Stock, par value $1.00 per share | New York Stock Exchange | |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. | Yes | x | No | o |

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. | Yes | ¨ | No | x |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. | Yes | x | No | ¨ |

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). | Yes | x | No | ¨ |

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. | x | |||

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. | ||||||

Large accelerated filer | x | Accelerated filer | ¨ | |||

Non-accelerated filer | o | (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | ||

Emerging Growth Company | o | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o | ||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). | Yes | ¨ | No | x |

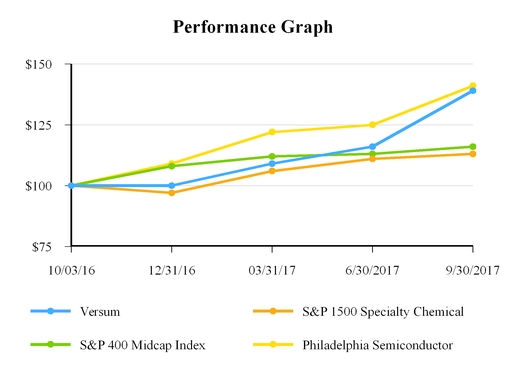

Based on the closing sale price as reported on the New York Stock Exchange, the aggregate market value of the voting common stock held by non-affiliates of the registrant as of the last business day of the registrant’s most recently completed second fiscal quarter, March 31, 2017, was approximately $3.3 billion. The registrant has no non-voting common stock.

At November 10, 2017, 108,816,851 shares of common stock, par value $1.00 per share, were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement relating to its 2018 Annual Meeting of Stockholders are incorporated by reference into Part III of this Annual Report on Form 10-K.

VERSUM MATERIALS, INC.

ANNUAL REPORT ON FORM 10-K

For the fiscal year ended September 30, 2017

TABLE OF CONTENTS

ITEM 16. | ||

1

All references in this Annual Report on Form 10-K, unless the context otherwise requires:

• | “Versum,” “Versum Materials,” “we,” “our,” “us” and “the company” refer to Versum Materials, Inc. and its consolidated subsidiaries for periods subsequent to the Separation and Distribution completed on October 1, 2016; |

• | “Air Products” refers to Air Products and Chemicals, Inc. and its consolidated subsidiaries, not including, for all periods following the Separation and Distribution, Versum. |

• | References to the “Separation” refer to the October 1, 2016 legal separation resulting in the allocation, transfer and assignment to Versum of the assets, liabilities and operations of Air Products’ Electronic Materials business and the creation, as a result of the Distribution, of a separate, publicly traded company, Versum. |

• | References to the “Distribution” refer to the distribution by Air Products to its stockholders completed on October 1, 2016, of 100% of the outstanding shares of Versum. |

CAUTIONARY STATEMENT CONCERNING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains certain “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements may be identified by references to future periods, and include statements about business strategies, operating plans, growth prospects, sales expectations, future operating income and Adjusted EBITDA, estimates regarding future capital requirements and needs for additional financing, estimates of expenses and cost reduction efforts, our future operating results on a segment basis, our ability to execute on our strategy, including our ability to enhance our portfolio positions through future organic and inorganic investments, to increase our share of next generation node opportunities and to and deliver on our commitments to customers and stakeholders, the success of our announced inorganic transactions, Dynaloy and NuMat, the impact of the Dynaloy acquisition, including our expectations as to earnings per share accretion and future profitability, anticipated cash flows, estimates of the size of the market for our products, forecasted industry demand, estimates of the success of other competing technologies that may become available, our ability to successfully compete as a leading materials supplier to the semiconductor industry, our future success as an independent public company, and other matters. The words “believe,” “expect,” “anticipate,” “project,” “estimate,” “budget,” “continue,” “could,” “intend,” “may,” “plan,” “potential,” “predict,” “seek,” “should,” “will,” “would,” “objective,” “forecast,” “goal,” “guidance,” “outlook,” “target” and similar expressions, among others, generally identify forward-looking statements, which are based on management’s reasonable expectations and assumptions as of the date the statements were made. In particular, information included in “Risk Factors,” “Business” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” contain forward-looking statements. Actual results and the outcomes of future events may differ materially from those expressed or implied in the forward-looking statements because of a number of risks and uncertainties, including, without limitation, product supply versus demand imbalances in the semiconductor industry or in certain geographic markets may decrease the demand for our goods and services; our concentrated customer base; the dependence of our DS&S segment upon the capital expenditure cycles of our customers; our ability to continue technological innovation and successfully introduce new products to meet the evolving needs of our customers; our ability to protect and enforce our intellectual property rights and to avoid violating any third party intellectual property or technology rights; unexpected interruption of or shortages in our raw material supply; inability of sole source, limited source or qualified suppliers to deliver to us in a timely manner or at all; hazards associated with specialty chemical manufacturing, such as fires, explosions and accidents, could disrupt our operations or the operations of our suppliers or customers; increased competition and new product development by our competitors, changing customer needs and price changes in materials and components could result in declining demand for our products; operational, political and legal risks of our international operations; the impact of changes in environmental and health and safety regulations, anticorruption enforcement, sanctions, import/export controls, tax and other legislation and regulations in jurisdictions in which Versum Materials and its affiliates operate; our available cash and access to additional capital may be limited by substantial leverage and debt service obligations; uncertainty regarding the availability of financing to us in the future and the terms of such financing; agreements governing our indebtedness may restrict our current and future operations, and hamper our ability to respond to changes or to take certain actions; government regulation of raw materials, products and facilities may impact our product manufacturing processes, handling, storage, transportation, uses and applications; possible liability for contamination, personal injury or third party impacts if hazardous materials are released into the environment; cyber security threats may compromise our data or disrupt our information technology applications or services; fluctuation of currency exchange rates; costs and outcomes of litigation or regulatory investigations; the timing, impact, and other uncertainties of future acquisitions or divestitures; restrictions in our governing documents and of Delaware law may prevent or delay an acquisition of us; our ability to complete, on a timely or cost-effective basis, the changes necessary to successfully

2

complete our transition to an independent public company; our historical financial data as part of Air Products may not reflect what our financial results would have been had we been an independent company; the loss of certain benefits enjoyed as part of Air Products; increased costs as a separate public company; our ability to satisfy customers that our financial stability on a stand-alone basis is sufficient to satisfy their requirements; tax and other potential liabilities to Air Products assumed in connection with the separation and spin-off; restrictions against engaging in certain corporate transactions for two years following the Distribution; potential conflicts of interest between us and Air Products by our directors and officers; potential liabilities arising out of state and federal fraudulent conveyance laws and legal dividend requirements with respect to the Separation and Distribution and related internal reorganization transactions; and other risk factors described in “Business,” “Risk Factors,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Versum Materials assumes no obligation to update any forward-looking statements or information contained in this document to reflect any subsequent change in assumptions, beliefs or expectations, or any change in events, conditions, or circumstances occurring after the date of this Annual Report on Form 10-K.

3

Part 1

Item 1. Business

OUR COMPANY

Versum is a global provider of innovative solutions to the semiconductor and display industries with expertise in the development, manufacturing, transportation and handling of specialty materials. We employ expertise in molecular design and synthesis, purification, advanced analytics, formulation development and containers and delivery systems for the handling of high purity materials to deliver leading edge solutions and critical process support to our customers. Versum’s business consists of two operating segments, Materials and Delivery Systems and Services (“DS&S”), under which we manage our operations and assess performance, and a Corporate segment. Our two operating segments are not aggregated, and are reported separately.

We are a leading global supplier of critical materials through our Materials segment, including high purity specialty process gases, cleaners and etchants, slurries, organosilanes and organometallics deposition films, and through equipment in our DS&S segment, which we provide to the semiconductor and display industries. Our technical capabilities enable us to foster strong customer relationships which are critical to collaborative development. Unique product positioning and a strong global infrastructure with flexible manufacturing and supply chain capabilities are fundamental to our businesses. Our Corporate segment includes certain administrative costs associated with operating a public company, non-core operating activities, foreign exchange gains and losses, and other income and expense that cannot be directly associated with the operating segments.

Throughout its history, the business has been known for innovative product development and as a safe, reliable and sustainable supplier of materials needed to fabricate semiconductors and displays. Our business is supported by an in-depth knowledge of the chemistries and technologies which underlie the manufacturing process for these electronic devices. We first invested in the electronic materials business to provide specialty gas supply to the semiconductor industry in the 1980s to address the emerging need for higher purity materials. Over the years, we have grown our business both organically and through acquisitions into a supplier of broad based materials for the industry.

On October 1, 2016, Air Products completed the Separation by means of a tax-free spin-off to Air Products stockholders. As a result of the Distribution, Versum is now an independent public company and its common stock is listed under the symbol “VSM” on the New York Stock Exchange.

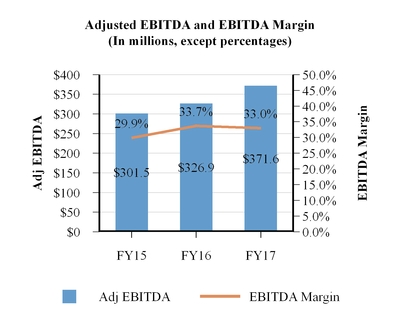

As an independent company, we believe Versum is well positioned to benefit from secular growth trends and a leading position in the semiconductor materials market, supported by its global manufacturing and research infrastructure, product innovation capabilities, a strong new product pipeline and low capital intensity. Our competitive strengths have enabled us to achieve strong earnings and cash flow. For the fiscal year ended September 30, 2017, our net sales were $1,126.9 million; operating income was $300.1 million, or 26.6% of sales; net income was $193.0 million; and Adjusted EBITDA was $371.6 million, or 33.0% of sales. For an explanation of Adjusted EBITDA and a reconciliation to generally accepted accounting principles in the United States of America ("GAAP") net income, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations - Reconciliation of Non-GAAP Financial Measures” in Part II, Item 7 of this Annual Report on Form 10-K.

4

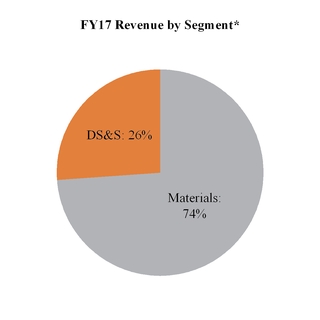

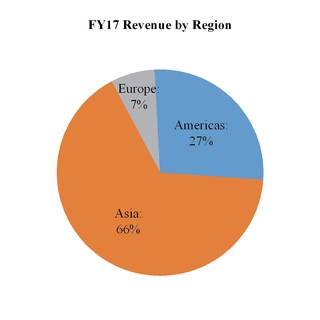

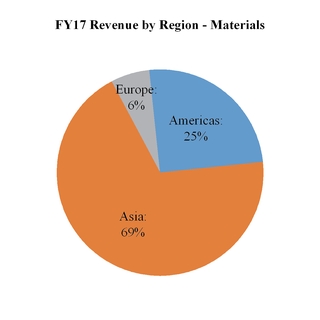

Our revenues by segment and destination region are as follows:

* Operating segments only, excludes corporate segment which is 0.3% of total revenue

Total Revenue $1,126.9 million

For more information about geographic areas, see Note 22, “Segment and Geographic Information”, to our Annual Consolidated Financial Statements in Part II, Item 8 of this Annual Report on Form 10-K.

Our Competitive Strengths

Innovative Product Development

Collaborative product development, a high level of technical innovation, products vetted through customers’ rigorous qualification processes and safe, consistent and reliable supply and distribution have enabled the business to establish strong positions in key product areas. Using Versum products, semiconductor manufacturers create faster, smaller and more efficient devices for both the logic and memory market segments. Our innovative products deliver differentiated performance to our customers’ fabrication processes by enhancing their productivity, quality, and yield; yet they constitute in relative terms a small fraction of the overall costs to develop and manufacture the end product.

Longstanding Relationships with Key Industry Leaders

Versum has maintained long-term relationships, often spanning decades, with Integrated Device Manufacturers (“IDMs”), foundries and Original Equipment Manufacturers (“OEMs”). These collaborative relationships position us to understand the future requirements of our customers and to jointly develop innovative solutions that enable the development and manufacture of new products including next generation nodes. These relationships also position us to supply product delivery systems and on-site services to our customers.

Technology Leadership

To be an innovative supplier to the semiconductor industry requires a substantial long-term commitment of investing in technology. Our customers continually seek to introduce new generations of semiconductors and we often collaborate with them to develop new molecules, formulations and technological improvement to satisfy their needs. Historically, over the past four years, approximately 31% of annual revenues in our advanced materials product lines of our Materials segment were based on new products or applications introduced within the last five years. Versum currently has approximately 1,600 patents worldwide and has a highly qualified workforce comprising approximately 380 research scientists, lab technicians

5

and engineers that allow us to sustain our competitive advantage.

Positioned to Take Advantage of Secular Growth Trends

Our business supplies materials used in the manufacture of semiconductors and displays supporting a wide range of electronic consumer products providing us with a diversified portfolio of growth opportunities into the future. We believe we will continue to witness the proliferation of semiconductors and displays into durable goods and other devices and growth will be further enhanced by the following secular trends:

• | The continued drive for chip productivity through improved scaling which we expect to drive the shift to new nodes and the need for new enabling materials; |

• | Strong bit demand growth which we expect will continue to fuel underlying growth in the memory market, first increasing the demand for legacy materials and then driving the need for new materials as structural complexity increases; |

• | The “Internet of Things”, cloud computing, need for data monitoring and storage which we expect will continue to drive the demand for semiconductors especially impacting legacy materials demand; and |

• | Semiconductor growth in China and ultimately in other parts of the world which we expect will drive increased demand for future innovation and materials. |

Strategically Located Global Manufacturing Footprint and Infrastructure

Versum has a well-established global infrastructure with fourteen strategically located manufacturing and seven research and development facilities in the Americas and Asia. We believe Versum’s global network of production and research facilities are geographically positioned to serve high growth areas and enable us to collaborate with our customers. Our manufacturing facilities include locations in the United States, South Korea and Taiwan.

Strong Financial Performance and Cash Flow Generation

Versum has a strong financial profile with net income of $193.0 million, operating margin of 26.6% and Adjusted EBITDA margin of 33.0% for the fiscal year ended September 30, 2017. We expect these strong margins to enable the business to service its debt obligations and generate significant cash flow to drive both future organic and inorganic growth. For an explanation of Adjusted EBITDA and Adjusted EBITDA Margin and a reconciliation to GAAP net income, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations-Reconciliation of Non-GAAP Financial Measures” in Part II, Item 7 of this Annual Report on Form 10-K.

6

Net income attributable to Versum was $193.0 million in 2017, $212.0 million in 2016, and $184.1 million in 2015. Our Adjusted EBITDA and EBITDA margins are as follows:

Capital expenditures for the business have averaged approximately $41 million per year over the last three years including maintenance capital to support the business of about 1.5 - 2.0% of sales. Given the anticipated increasing market demand for new products combined with our own increased opportunities to enhance our geographic, cost and capacity positions, we expect to increase our level of growth capital in fiscal year 2018.

The combination of strong operating margins and low maintenance capital needs should allow us to generate substantial cash flow even with the increased level of expected growth capital opportunities.

Experienced Management Team

We have a strong management team which combines individuals with long-standing industry experience and leadership in specialty chemicals, materials and the semiconductor industry with key outside hires who bring a diverse perspective to the business from various other companies. Of our top seven senior leaders, five spent the majority of their careers with these businesses within Air Products while two joined our team from outside. Guillermo Novo, our Chief Executive Officer, has 30 years of materials industry operating and executive experience at Rohm & Haas Company and Dow Chemical Company.

Business Strategies

Drive Operational Excellence and Asset Efficiency

Driving operational excellence, including a commitment to safety, environmental stewardship and supply chain reliability, are critical to the success of our business. We maintain rigorous environmental, health and safety processes and believe excellence in safety performance translates to excellence in operational and financial performance. We also expect to continue to implement various initiatives to improve the efficiency, effectiveness and reliability of our operations including investing in state of the art manufacturing facilities, locating capacity and research capability close to our customers and continually globalizing our supply chain.

Maintain Strong Customer Focus

A key element of our success has been our ability to establish long-standing working relationships with most of the key semiconductor manufacturers as well as with OEMs. Our understanding and anticipation of our customer’s needs and our ability to develop innovative product solutions in a timely manner, together with providing safe and reliable supply, high

7

quality products and analytical capabilities, have been critical in developing these long-term relationships.

Leverage our Leadership to Drive Growth

We have invested approximately 4% to 5% of total sales in new technology, primarily for our advanced materials business, over the last three years and expect to continue a similar level of spending to deliver innovative solutions for our customers. We expect our leadership position, together with the strength of our product portfolio, to drive growth in the markets we compete in. We also believe there are significant opportunities for us to invest capital in strategic acquisitions to strengthen our businesses, broaden our product offerings and geographic positioning, and expand our technology portfolio.

Focus on Cash-Flow Generation

Versum has a successful track record of delivering strong financial results. Given the low capital intensity of our business, this results in significant cash flow generation. We believe our anticipated strong future cash flow will enable us to service our debt obligations, fund organic and inorganic growth opportunities, return capital to stockholders or reduce leverage.

Operating Segments

Materials Segment

The Materials segment provides leading edge specialty materials focusing on IC and flat-panel display customers. Its products include specialty chemicals and materials utilized in the latest generation of semiconductors as well as high-purity specialty gases used in the semiconductor manufacturing process. These products include organosilanes, organometallics and other specialty precursors for thin film deposition, CMP slurries and post CMP cleans, formulated products for post etch and advanced packaging cleaning, process gases for deposition and metallization, chamber cleaning and etchant gases, as well as high purity gases that are used in ion implantation to alter the electrical properties of thin films. The semiconductor industry accounts for more than 80% of segment sales. Materials operates in two product categories: advanced materials and process materials. The segment benefits from synergies across the business units, including serving the same customer base, developing joint market strategies, sharing common supply chain processes and infrastructure, and utilizing common commercial resources.

Through our global network, our Materials segment positions its research, manufacturing and technical support close to customer facilities, enabling supply chain optimization and rapid response times to product and service needs. Many of our products have undergone rigorous product performance and quality reviews by our customers to be qualified for use in their products or manufacturing processes. Once these qualification processes are completed and our products are designated by our customers for use in their processes or products, it is often time consuming and costly for our customers to change suppliers. Our products perform critical tasks in customers’ products or manufacturing processes, yet typically represent a very small portion of the cost to manufacture the end products. Over nearly three decades, our Materials segment has developed strong customer relationships with the majority of the industry-leading IDMs, foundries and OEMs through joint product development and providing on-site service and technical personnel at our customers’ facilities.

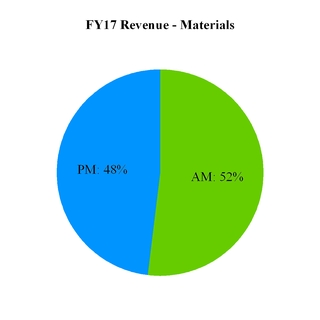

8

Materials sales were $829.7 million, $756.7 million, and $743.4 million for fiscal years 2017, 2016 and 2015 respectively. Materials operating income was $274.4 million, $252.3 million, and $213.7 million for fiscal years 2017, 2016 and 2015 respectively. Materials adjusted EBITDA was $317.5 million, $296.9 million, and $262.8 million for fiscal years 2017, 2016 and 2015 respectively. Materials products are sold on a global basis, with revenue by business unit (Process Materials “PM” and Advanced Materials “AM”) and destination region as follows:

The Materials segment has approximately 1,000 employees, operates 12 production and 7 research and development facilities and serves more than 225 customers.

Materials Product Categories

Advanced Materials. Advanced materials supplies products and services through three key product platforms that are employed in the fabrication of ICs:

• | Advanced deposition materials (“ADM”) products include high purity specialty gases and chemicals, such as organosilane and organometallic precursors that are used to deposit thin films which comprise an IC; |

• | Planarization (“PLA”) products include CMP slurries and post CMP cleans that are used to prepare chips with deposited thin films for the next stage of fabrication; and |

• | Surface prep and clean (“SP&C”) formulated products are designed to selectively etch and remove debris and contamination during many stages of the wafer fabrication process including the advanced packaging activity. |

For fiscal year 2017, approximately 85% of our advanced materials sales are based on proprietary or patent-protected positions. Product innovation is a key differentiator for advanced materials. For example, an organosilane precursor, which we developed in collaboration with a leading OEM, is an enabler for self-aligned double patterning, a process that has allowed device size to decrease far beyond expectations using present day lithography. We believe the move to more advanced transistors has created needs for new innovation in polishing dielectric materials. Our shallow trench isolation CMP slurries are exceeding the requirements for dishing control, selectivity, removal rate, and most importantly reduction in defects.

Advanced materials has seven technology centers strategically located near our customers, with four in the United States and three in Asia. Our focused research and development efforts offer customers the opportunity to collaborate on the joint development of new materials, align new materials requirements with their product technology cycles and enhance the quality and scale of their specialty material needs.

9

In fiscal year 2018 we expect to continue to invest in enhancing our innovation capabilities including adding additional research and manufacturing capabilities in Korea.

Process Materials. Process materials supplies products such as high-purity gases and chemicals utilized in the processes of cleaning, etching, doping, and film deposition for our semiconductor, displays and light emitting diode (“LED”) customers. Our cleaning and etchant gases, like nitrogen trifluoride (NF3) and hexafluorobutadiene (C4F6), are used for chamber cleaning and high aspect etching applications in the production of semiconductors. Our process gases for deposition and metallization, such as tungsten hexafluoride (WF6) are used in the process of depositing film layers to enable the continued advancement of the semiconductor industry. Our dopants such as arsine (AsH3) are used for ion implantation for semiconductors and our hydride gases such as ammonia (NH3) support applications in display and LEDs. Our process materials’ products are used in a wide variety of LCD-based displays and LED-based displays, and logic and memory technology. We supply these products to our customers throughout the U.S., Asia and Europe.

Process materials leverages its geographically situated asset capabilities and strong safety performance to maintain its position as a reliable and sustainable supplier of high purity specialty gases and chemicals. In fiscal year 2018 we expect to invest to improve our cost position and increase capacity in certain key products.

Delivery Systems & Services Segment

Our DS&S segment designs, manufactures, installs, operates, and maintains state-of-the-art chemical, gas and slurry delivery and distribution systems enabling the safe and cost efficient use of specialty gases and chemicals delivered directly to our customers’ manufacturing tools. Product development in this business is enhanced through close collaboration with our OEM customers as well as the advanced materials and process materials businesses of our Materials segment.

In addition to the safe distribution of specialty gases and chemicals by our employees and equipment located at customer facilities, we monitor the purity of the materials from the source container through the point of use as well as build and maintain monitoring and control systems that facilitate real-time metrics management of critical customer process conditions.

The business provides turnkey installation during facility construction and startup as well as onsite operating services. We supply trained and dedicated technical experts to manage all aspects of the customer’s gas and chemical distribution and handling needs through our MEGASYS branded services group. The scope of services offered includes inventory management, material handling, gas and chemical container change-out, equipment operation, maintenance, repair, engineering and safety management.

DS&S Product Categories

Our DS&S segment consists of the following product categories:

Equipment (Gas, chemical and slurry delivery systems): We develop, design, manufacture and sell bulk gas, specialty gas and specialty chemical cabinets and systems that are critical to managing the delivery of key materials into the semiconductor manufacturing process. Our systems help our customers improve their productivity, manage the application and use of our products and other materials, and enable our customers to handle materials in a safe manner. We also provide flow and temperature control systems and analytical systems to capture key data for our customers.

Installation Services: We offer resources to assist a new semiconductor fab in the design, installation, startup, and commissioning of the gases and specialty materials delivery systems and quality assurance. Our scope includes project management for installation and startup of the gas and chemical delivery systems, and inventory management. In addition, we sell spare parts, equipment upgrades, equipment maintenance and provide training.

10

On-Site Services (MEGASYS): We offer on-site services to assist our customers in managing their inventory of gases and chemicals, including ordering, product changes and monitoring, quality assurance, operating our delivery systems, and managing the bulk gas and specialty gas operations. In this part of our business, our employees are physically located at our customers’ fabs and are critical to the efficient operation of such facilities. MEGASYS employs more than 400 employees servicing more than 30 customer locations and has approximately 100 engineers to assist our customers with their delivery system and service needs.

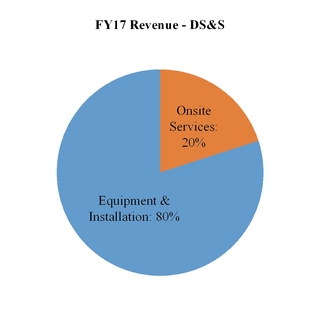

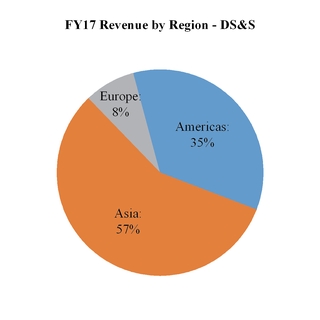

DS&S sales were $293.6 million, $213.4 million, and $265.9 million for fiscal years 2017, 2016 and 2015 respectively. DS&S operating income was $71.7 million, $50.8 million, and $49.1 million for fiscal years 2017, 2016 and 2015 respectively. DS&S adjusted EBITDA was $73.1 million, $52.9 million, and $57.4 million for fiscal years 2017, 2016 and 2015 respectively. Our products are sold on a global basis, with revenue by product category and destination region as follows:

The DS&S segment has approximately 750 employees and operates two production facilities with one in the U.S. and one in Asia. In fiscal year 2018 we anticipate commissioning an additional production facility in China.

Corporate Segment

In addition to our operating segments, our Corporate segment includes certain administrative costs associated with operating a public company, non-core operating activities, foreign exchange gains and losses, and other income and expense that cannot be directly associated with our operating segments. Assets in the Corporate segment include cash and deferred tax assets.

Additional financial and other information relating to our segments is further described in Note 22, “Segment and Geographic Information”, of our Annual Consolidated Financial Statements in Part II, Item 8 of this Annual Report on Form 10-K.

11

Products and End Uses

Segment | Key Products | Applications | End Uses | ||||||

Materials | Ÿ | CMP Slurries | Ÿ | PLA via polishing | Ÿ | Semiconductors | |||

Ÿ | Post-CMP Cleans | Ÿ | Cleaning after polishing | Ÿ | Semiconductors | ||||

Ÿ | Organosilanes | Ÿ | Thin film deposition | Ÿ | Semiconductors | ||||

Ÿ | Organometallics | Ÿ | Thin film deposition | Ÿ | Semiconductors | ||||

Ÿ | Formulated Cleans | Ÿ | Post-etch cleaning, advanced packaging | Ÿ | Semiconductors | ||||

Ÿ | High-Purity Gases for Deposition & Metallization | Ÿ | Thin film deposition | Ÿ | Semiconductors | ||||

Ÿ | Chamber Cleaning & Etching Gases | Ÿ | Residue removal from deposition chambers and etching high aspect ratio features | Ÿ | Semiconductors and Displays | ||||

Ÿ | Ion Implantation Gases | Ÿ | Doping thin films to alter electrical properties | Ÿ | Semiconductors and LED | ||||

Delivery Systems | Ÿ | Ultra-High Purity Gases and Chemical Supply Systems | Ÿ | Safe storage and delivery of gases, liquids and solids | Ÿ | Semiconductors, Displays and LEDs | |||

Ÿ | Slurry Delivery Systems | Ÿ | Mixing and delivery of CMP slurries | Ÿ | Semiconductors | ||||

Competition. The semiconductor market is global in scope with nearly all major semiconductor manufacturers having operations in multiple countries. We serve our customers across three continents and participate in the specialty gases and materials space spanning six of the seven critical processes steps required for semiconductor manufacturing.

The competitive landscape is varied, from multinational chemical companies to small regional, narrow-portfolio focused companies. Overall, competitive trends are supporting the need for localized, cost competitive supply chains, which is especially critical for larger volume customers.

Because of our breadth, we do not believe there are any global competitors that compete with us across the full range of our product offerings. Many of our competitors are local companies that participate in only a few products or in specific geographies. While there are other broad-based materials suppliers, many are concentrated in specific product areas, such as CMP pads, photoresists or liquid crystals. Key competitors include Adeka, Air Liquide, Cabot Microelectronics, Dow/DuPont, Entegris, FujiFilm, Hyosung, Avantor, Merck EM, and SK Materials.

Customers

We primarily serve the semiconductor industry for both memory and logic. The semiconductor industry is characterized by large scale global players and, while we serve a variety of customers from smaller technology firms to OEMs to multinational semiconductor companies, the majority of our sales are concentrated to these large scale global players. In fiscal 2017, the top 20 customers accounted for 83% of our total sales with the top three, Intel, Samsung and Taiwan Semiconductor Manufacturing Company accounting for 48% of sales.

Sales, Marketing & Distribution

We sell our products and services globally through our direct sales force primarily directed to end use customers but also to OEMs. The direct sales force is organized based on geographic region and business units with coordinated teams for key industry players. As of September 30, 2017, total in-house sales forces consisted of approximately 200 personnel worldwide.

12

Raw Materials

We purchase raw materials and chemical intermediates from a large number of third parties. Major requirements for our key raw materials and energy are typically satisfied pursuant to contractual agreements ranging from purchase orders to long-term relationships with suppliers. We are generally not dependent on any one supplier for a significant portion of our raw material requirements, but due to the specialty nature of our products there are a limited or a sole number of suppliers that are qualified to supply raw materials for use in our customers’ products. Where we have limited sources of supply, or a sole supplier, we generally have developed contingency plans to minimize the effect of interruption or reduction in supply, such as developing alternative or back-up suppliers, sourcing from suppliers with multiple facilities or utilizing alternative formulations.

Temporary shortages of raw materials may occasionally occur due to several factors such as supply-demand imbalances, supplier outages or regional market shifts. In recent years, these shortages have not resulted in long-term unavailability of raw materials. However, the continuing availability and price of raw materials are affected by other factors such as unscheduled plant interruptions occurring during periods of high demand, domestic and world market and political conditions, as well as the direct or indirect effect of governmental regulations. During periods of high demand, some raw materials may be subject to significant price fluctuations, and such fluctuations may have an adverse impact on the results of operations of our business. The impact of any future raw material shortages or price fluctuations on our business as a whole or in specific geographic regions or in specific business lines cannot be accurately predicted.

We have a broad raw material base with the cost of no single raw material representing more than 3% of our cost of goods sold in 2017. Raw material costs in total constituted 24% of our sales in our Materials segment in 2017. The table below lists the key raw materials and the principal product category for which the materials were used.

Raw Material | Segment | Principal Product Category | ||

Specialty Silanes | Materials | Advanced Materials | ||

Tungsten Powder | Materials | Process Materials | ||

Metallic Oxide Abrasives | Materials | Advanced Materials | ||

Controllers | DS&S | Equipment | ||

Hydrogen Chloride | Materials | Process Materials | ||

Hydrogen Fluoride | Materials | Process Materials | ||

Etchant Gases | Materials | Process Materials | ||

Nitrous Oxide | Materials | Process Materials | ||

Phosphine | Materials | Process Materials | ||

Ammonia | Materials | Process Materials | ||

Specialty silanes are sourced from multiple sources under multi-year contracts. We source several types of silanes depending upon the application and prices are generally fixed for the term of the contract.

Tungsten powder is supplied from multiple sources under multi-year contracts. Prices are generally subject to periodic adjustments based upon pricing for a derivative of tungsten ore. A majority of tungsten resources are located in China, and supply and pricing is subject to fluctuation. There have been significant fluctuations in pricing in recent years.

Metallic oxide abrasives are sourced under multi-year contracts. We source different types of abrasives each from a single source. Pricing is generally subject to market conditions.

Controllers are critical to the operation of our delivery systems units. We source different types of controller units from a single source under a multi-year contract. These control units are built by the supplier to our design specifications. We believe there are other sources of supply for these controllers.

Hydrogen chloride is sourced in the U.S. through a production joint venture and in Asia through a sole supplier. Our sole supply in the U.S. is a by-product of another chemical production process and sold through our joint venture. Our hydrogen chloride in Asia is produced as a by-product of another chemical process of a major chemical company. Both supply arrangements are under multi-year contracts.

13

Hydrogen fluoride is sourced in two countries from multiple suppliers under multi-year contracts. Prices under these contracts vary from fixed to market-based pricing.

Etchant gases are sourced from multiple suppliers under multi-year contracts. We have previously experienced some supply tightness for certain etchant gases and prices are generally subject to annual adjustment.

We source different grades of nitrous oxide in multiple countries from multiple sources under multi-year contracts. However, a customer may choose to qualify only one of those sources for its use. Our pricing is generally fixed for the term of such arrangements.

Phosphine is sourced from a single source under a multi-year contract. Our pricing is subject to periodic adjustment.

Ammonia is sourced from multiple sources under multi-year contracts. We believe there are a number of available sources. Pricing is generally tied to market conditions.

Key materials in our Delivery Systems & Services operating segment include valves, fittings and other components necessary to design and build our delivery systems and devices. We also purchase returnable containers that are a critical part of the quality and safe transportation, handling and use of our materials. We believe most of these materials are readily available from numerous sources.

Working Capital

Versum maintains inventory where required to facilitate the supply of products to customers on a specified delivery schedule. In some cases, higher inventory levels of certain products are maintained to manage specific supply chain risks and to meet customer requirements for responsiveness. For example, for some of the products, a higher level of inventory is maintained to mitigate the risk associated with a single manufacturing plant or single source of a critical raw material. A majority of our product inventory is maintained at warehouses in close proximity to our customers’ manufacturing locations to provide the responsiveness expected by our semiconductor customers.

Seasonality

Versum’s businesses are typically slightly stronger in fiscal third and fourth quarters due to the industry ramp up in advance of the holiday season. However, semiconductor industry technology ramps and materials market supply and demand dynamics can alter these seasonal trends. A portion of our DS&S segment is susceptible to the cyclical nature of capital investment in the semiconductor industry.

Employees

As of September 30, 2017, Versum and its subsidiaries had approximately 2,200 employees. Of our employees, approximately 200 are subject to collective bargaining agreements or other similar arrangements.

We observe local customs, legislation and practice in labor relations. Management believes that its relations with employees and their representatives are good. We have not suffered any material work stoppages or strikes in our worldwide operations in the last five years.

14

Environmental and Regulatory Matters

Versum is subject to various environmental laws and regulations in the countries in which it has operations. Compliance with these laws and regulations results in capital expenditures and costs. Our expense related to compliance with environmental laws and regulations totaled $10.2 million, $9.5 million, and $11.0 million in 2017, 2016, and 2015, respectively. These amounts represent an estimate of expenses for compliance with environmental laws and activities undertaken to meet internal company standards.

Some of our operations are within jurisdictions that have or are developing regulations governing emissions of greenhouse gases (“GHG”). The U.S. Environmental Protection Agency is regulating GHG emissions for new construction and major modifications to existing facilities. Increased public awareness and concern may result in more international, U.S. federal, and regional requirements to reduce or mitigate the effects of GHG. Although uncertain, these developments could increase our costs related to consumption of electric power and the production of certain products, such as fluorinated gases. We believe we may be able to mitigate some of the potential costs through our contractual terms; however, we are unable to predict the impact of any potential changes in regulation or future regulation of GHG. Any legislation that limits or taxes GHG emissions from our facilities could impact our results of operations by increasing our operating costs or reducing demand for certain of our products.

The company is also subject to the Homeland Security Agency’s regulations, which address chemical plant safety and vulnerability. Similarly, the Frank R. Lautenberg Chemical Safety for the 21st Century Act, reforms the Toxic Control Substances Act (“TSCA”) by requiring the United States Environmental Protection Agency (“EPA”) to prioritize and evaluate the environmental and health risks of existing chemicals and providing EPA with greater authority to regulate chemicals posing unreasonable risks. The law also requires that EPA make an affirmative finding that a new chemical will not pose an unreasonable risk before such chemical can be manufactured or imported. TSCA reform also incorporates additional thresholds and checks to substantiate Confidential Business Information (“CBI”) claims. These reforms update TSCA so that it operates in a similar fashion to the Registration, Evaluation, and Authorization of Chemicals (“REACH”) legislation in Europe. Regulations similar to REACH have been enacted in South Korea and Taiwan. Based upon currently available information, the company does not believe that these regulations will have a material impact on its financial condition, results of operations or cash flows.

Research & Development

Versum is committed to further investing in its businesses through research and development. The objective of our research and development effort is to develop innovative chemistries and technologies with applications relevant within targeted key markets. Our technology spending comprised mainly of research and development costs were approximately 4% of our total sales in fiscal 2017. We staff our research and development resources based on the needs and requirements of each business line to develop innovative products. Research and development costs are charged to expense, as incurred. Such costs were $45.1 million, $43.9 million and $40.7 million for the years ended September 30, 2017, 2016 and 2015, respectively.

Research and development efforts are generally focused on both product and process development, which is the stage at which products move from development to manufacturing, and new product development.

Each of our segments manages its own research and development effort and has separate research and development facilities dedicated to its specific area. However, where technologically feasible, advances and findings are shared between business lines to foster greater cross-fertilization of ideas and applications. In certain cases, we conduct research and development efforts with third parties, including universities, customers and other entities. We endeavor to obtain ownership of or license to intellectual property developed with a third party on terms favorable to us.

Versum owns approximately 400 United States patents and 1,200 foreign patents, 600 pending patent applications globally and is a licensee under certain patents owned by others. While the patents and licenses are considered important, the company does not consider its business as a whole to be materially dependent upon any particular patent, patent license, or group of patents or licenses.

15

Where You Can Find More Information

Our Internet address is www.versummaterials.com. On this website, under the “Investors” section, we post the following filings as soon as reasonably practicable after they are electronically filed with, or furnished to, the U.S. Securities and Exchange Commission (“SEC”): our annual, quarterly, and current reports on Forms 10-K, 10-Q, and 8-K; our proxy statements; any amendments to those reports or statements, and Form SD. All such filings are available on our website free of charge. The SEC also maintains a website (www.sec.gov) that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. The content on our website, and any other website, as referred to in this Form 10-K is not incorporated by reference into this Form 10-K unless expressly noted.

Item 1A. Risk Factors

You should carefully consider the following risks and other information in this Annual Report on Form 10-K in evaluating us and our common stock. Any of the following risks could materially and adversely affect our financial condition, results of operations or cash flows. Our operations could be affected by various risks, many of which are beyond our control. Based on current information, we believe that the following list identifies the most significant risk factors that could affect our financial condition, results of operations or cash flows. There may be additional risks and uncertainties that adversely affect our financial condition, results of operations or cash flows in the future that are not presently known, are not currently believed to be material, or are not identified below because they are common to all businesses. Past financial performance may not be a reliable indicator of future performance and historical trends should not be used to anticipate results or trends in future periods. For more information, see “Cautionary Statement Concerning Forward-Looking Statements.”

Risks Related to Our Business

Overall Economic and Supply/Demand Conditions - Economic conditions or product supply versus demand imbalance in the semiconductor industry or in certain geographic markets in which we do business may decrease the demand for our goods and services and adversely impact our financial condition, results of operations and cash flows.

Demand for our products and services depends in part on global and regional economic conditions affecting the countries in which we do business and the semiconductor industry. Our revenue is primarily dependent on semiconductor demand. Semiconductor demand, in turn, is impacted by changes in consumer demand, since in recent years the industry has seen a significant shift in demand from semiconductor devices for personal computers, which now are largely enterprise-related, to those for mobile devices, which are more consumer-oriented. Historically, semiconductor demand has fluctuated significantly due to economic and industry cycles and seasonal shifts in demand, which can dramatically affect our business, causing demand for our products to fluctuate. Furthermore, competitive dynamics within the semiconductor industry may impact our business. If the global economy or the semiconductor industry weakens, whether in general or as a result of specific factors, such as macroeconomic conditions, political instability or unpredictable events such as natural disasters, we could experience material adverse impacts on our results of operations and financial condition. In the past few years, uncertain or adverse economic conditions in certain geographies and changing supply and demand balances in areas served by us have impacted and may in the future impact demand for our products and services, in turn negatively impacting our results of operations. Any changes in capital spending by our customers or demand in the semiconductor industry may negatively impact our cash flow, our ability to service our debt and our results of operations.

Unfavorable global or regional economic conditions could have other negative impacts to our business or our results of operations, including depressing demand in a given region or industry, affecting our margins, constraining our operating flexibility and impacting our customers. Any excess capacity in our or our competitors’ manufacturing facilities, or due to new entrants into the industry, could decrease our ability to maintain pricing and margins and generate profits. Adverse global economic, political and industry conditions could have other negative effects on our company. For instance, we could experience negative impacts on cash flows due to the inability of our customers to pay their obligations to us or our production process could be harmed if our suppliers cannot fulfill their obligations to us. In such circumstances, we may also have to reduce the carrying value of goodwill and other intangible assets, which could harm our financial position and results of operations.

Some additional factors that affect demand for our products include: the types of electronic devices that are in demand;

16

products that our customers may produce, such as logic IC devices versus memory devices; the various technology nodes at which those products are manufactured and whether our products are part of the production process; customers’ specific manufacturing process integration schemes; the short order to delivery time for our products; quarter-to-quarter changes in customer order patterns; market share gains and losses; and pricing changes by us and our competitors.

Concentrated Customer Base - We are exposed to risks associated with a concentrated customer base.

Our customer base historically has been, and is becoming even more, concentrated as a result of economic and industry conditions. In fiscal 2017, three customers accounted for approximately 48% percent of Versum’s global sales. In fiscal 2017, our top twenty customers accounted for approximately 83% of our global sales. Certain customers have experienced significant ownership or management changes, consolidated with other manufacturers, outsourced manufacturing activities, or engaged in collaboration arrangements with other manufacturers. Customers have entered into strategic alliances or industry consortia that have increased the influence of key industry participants in technology decisions made by their partners. Certain semiconductor and display customers are making an increasingly greater percentage of their respective industry’s capital equipment investments.

In this environment, contracts or orders from a relatively limited number of semiconductor and display manufacturers have accounted for, and are expected to continue to account for, a substantial portion of our business, which may result in added complexities in managing customer relationships and transactions. The mix and sales to any single customer may vary significantly from quarter to quarter and from year to year. If customers do not place orders, or they substantially reduce, delay or cancel orders, or if our products are not specified for our customers’ products or production processes we may not be able to replace the business. Because our products are configured to customer specifications, the changing, rescheduling or canceling of orders may result in significant, non-recoverable costs. Changes in customer qualification requirements could result in significant delays in the sale of our products. Major customers may also seek and on occasion receive, pricing, payment, intellectual property-related, or other commercial terms that are less favorable to Versum. These factors could have a material adverse effect on our financial condition, results of operations and cash flows.

Consolidation between customers, changes in technologies or solutions used by customers, changes in products manufactured by customers or in end-user demand for those products, selection of suppliers other than us, customer bankruptcies or customer departures from the industry may result in even fewer customers accounting for a high percentage of our revenue and reduced demand from any single major customer. The cancellation, reduction or deferral of purchases of our products by even a single customer could significantly reduce our revenues in any particular quarter. If we were to lose any of our significant customers, if our products are not specified for these customers’ products or production processes, or if we suffer a material reduction in their purchase orders, revenue could decline and our business, financial condition and results of operations could be materially and adversely affected. Furthermore, due to continued industry consolidation, the loss of any one customer or significant order may have a greater impact than we anticipate. We cannot guarantee that we will be able to continue to secure contracts with our more substantial customers in the future.

Capital Expenditure Cycle - Our DS&S segment is dependent upon the capital expenditure cycles of our customers.

Our DS&S operating segment is dependent upon the capital expenditures of manufacturers of microelectronics, semiconductors, computers, wireless communications and other electronic products. DS&S depends upon the sale of its gas and chemical delivery systems and bulk special gas projects which are tied to the capital expenditures of our customers. The capital equipment market for microelectronics, semiconductor, and consumer electronics manufacturers has historically been characterized by sudden and severe cyclical variations in product supply and demand due to a number of factors including capacity utilization, timing of customers’ new product introductions and demand for their products, inventory levels relative to demand and access to affordable capital. The timing, severity and duration of these market cycles are difficult or impossible to predict. As a result, business levels can vary significantly from quarter to quarter or year to year. Significant volatility in investment cycles in the market for microelectronics, and semiconductors used in electronic devices or in demand for consumer electronics may reduce demand for our products and may materially and adversely affect the DS&S operating segment. The degree of the impact of any downturn depends on a number of factors, including: the strength of the global economies, particularly those of Asia and the United States; the overall level of demand for consumer electronics products; the stability of global financial systems; and the overall health of the microelectronics, semiconductor, and consumer electronics industries.

17

Product Innovation - If we are not able to continue our technological innovation and successful commercial introduction of new products, our financial condition, results of operations and cash flow could be adversely affected.

The electronics and semiconductor industries into which we sell our products experience periodic technological change and product improvement. Our customers continually introduce new generations of products or require new technological capacity to further develop their products. Our customers rely on us to develop new materials to support their new product development. Our future growth will depend on our ability to gauge the direction of the commercial and technological progress in all key end-use markets and upon our ability to fund and successfully develop, manufacture and market products in such changing end-use markets. We will have to continue to identify, develop and market innovative products on a timely basis to replace or enhance existing products in order to maintain our profit margins and our competitive position. We may not be successful in developing new products and technology, either alone or with third parties, or licensing intellectual property rights from third parties on a commercially competitive basis. Our new products may not be accepted by our customers. If we fail to keep pace with the evolving technological innovations in our end-use markets on a competitive basis, our financial condition, results of operations and cash flows could be adversely affected.

Intellectual Property Rights - If our intellectual property is compromised or copied by competitors, if our competitors were to develop similar or superior intellectual property or technology, or, if our intellectual property or technology violate third-party rights, our financial condition, results of operations and cash flow could be negatively affected.

Intellectual property rights, including patents, trade secrets, confidential information, trademarks, and trade names, are important to our business. Our success depends to a significant degree upon our ability to protect and preserve our intellectual property rights. We endeavor to protect our material intellectual property rights in the jurisdictions in which our products are produced and used, and also in the jurisdictions into which our products are imported and used. Although we seek to enforce our intellectual property, because of the limitations of the legal systems in many countries, the effectiveness of patents obtained or that may in the future be obtained, if any, is uncertain. While we own and have applied for numerous patents and trademarks throughout the world covering aspects and improvements for many of our technologies, we may be unable to obtain protection for our intellectual property in key jurisdictions. Although we own and have applied for numerous patents and trademarks throughout the world covering aspects and improvements for many of our technologies, we may be unable to obtain protection for our intellectual property in key jurisdictions where we rely on local judicial enforcement of our patents and other proprietary rights. For example, although patents were granted in several countries related to a key technology in our advanced deposition product portfolio, the relevant patent was invalidated in South Korea in 2015 and is currently being challenged in Taiwan. Patent protection for individual products extends for varying periods in accordance with the legal life of patents in the various countries. The protection afforded, which may also vary from country to country, depends upon the type of patent and its scope of coverage. Our patents and other intellectual property rights may expire, be challenged, invalidated, circumvented, and rendered unenforceable or otherwise compromised. For example, some of our patents related to a key technology in our advanced deposition product portfolio will expire in 2018. An inability to protect, defend or enforce our intellectual property could have an adverse effect on our financial condition, results of operations and cash flows.

Similarly, third parties may assert claims against us and our customers and distributors alleging our products infringe upon or otherwise violate third party intellectual property rights. If we were to discover that our products infringe or otherwise violate the valid intellectual property rights of others, we might need to obtain licenses or substantially re-engineer our products to avoid infringement. We may not be able to obtain licenses on acceptable terms, or at all, or be able to re-engineer our products successfully.

We also rely materially upon unpatented proprietary technology, know-how and other trade secrets to maintain our competitive position. While we enter into confidentiality agreements with our employees and third parties to protect our proprietary expertise and other trade secrets, these agreements may not be enforceable in every jurisdiction or, even if legally enforceable, we may not have adequate remedies for breaches of such agreements. We also may not be able to readily detect breaches of such agreements. The failure of our patents or confidentiality agreements to protect our proprietary technology, know-how or trade secrets could negatively impact our financial condition, results of operations and cash flows.

If we must take legal action to protect, defend or enforce our intellectual property rights, any suits or proceedings could result in significant costs and diversion of our resources and our management’s attention, and we may not prevail in any such suits or proceedings. Any failure to protect, defend or enforce our intellectual property rights could have an adverse

18

effect on our financial condition, results of operations and cash flows.

Raw Material Cost and Availability - Interruption in ordinary sources of supply or an inability to recover increases in raw material costs from customers could adversely impact our financial condition, results of operations and cash flows.

We use a wide variety of raw materials, including tungsten powder, hydrogen fluoride, specialty silanes, specialty abrasives, ammonia, and nitrous oxide. Shortages or price escalation in these materials could negatively impact our financial results. For example, starting in late 2016 we experienced an ongoing nitrous oxide supply disruption resulting from reduced production by a key supplier. We may not be able to find alternative sources of supply in sufficient quantities to meet the needs of our customers, and may not be able to raise prices to recover any increases in raw material costs due to competitive pressures. Increases in raw material costs that cannot be passed on to customers for competitive or other reasons could negatively impact our financial condition, results of operations and cash flows. Even where costs are successfully passed through, price increases may result in lower sales volume.

Suppliers - If any of our sole source or limited source suppliers, or suppliers that were required to satisfy our customers’ rigorous qualification requirements, were unable to deliver to us in a timely manner or at all, our financial condition, results of operations and cash flows could be adversely affected.

Our operations depend on obtaining sufficient supplies of raw materials and components used in our manufacturing processes. In certain cases, qualification requirements in customers’ manufacturing processes limit us to certain qualified suppliers. In the event that it becomes necessary for us to find another supplier, we would first be required to ensure such new supplier could be qualified through our customers’ rigorous qualification processes for suppliers. Additionally, certain of our businesses rely on limited source suppliers to provide raw materials, such as hydrogen chloride and nitrous oxide, which are critical materials for certain of our customers. Although we have business continuity plans in place, our customers may be unwilling to qualify a new supplier, such suppliers may experience financial difficulties, be unable to deliver products to us in a timely manner, have insufficient capacity to meet our requirements, or suffer business disruption resulting from damage to or destruction of their facilities due to accidents, natural disasters or other events, and we might not be able to secure an alternative source of supply in a timely manner or at all. These events could have a material adverse impact on our business, financial condition, results of operations and cash flows.

Nature of Chemical Manufacturing Business - Hazards associated with specialty chemical manufacturing could disrupt our operations or the operations of our suppliers or customers, having a negative impact on our financial condition, results of operations, and cash flows.

Due to the nature of our business and those of some of our key suppliers, we are exposed to the hazards associated with specialty chemical manufacturing and the related storage and transportation of raw materials, products and waste in our manufacturing facilities or distribution centers and those of our suppliers, such as fires, explosions and accidents. Our operations could be impacted by catastrophic events outside our control, including natural disasters and severe weather conditions such as hurricanes, floods, earthquakes, and storms, epidemics, or acts of war and terrorism. Any such event could cause a material business disruption that could affect our ability to produce and distribute our products and have an adverse effect on the productivity and profitability of our Company.

Our operations by their nature involve the use and manufacture of hazardous materials. Other hazards include piping and storage tank leaks and ruptures, mechanical failure, employee or third-party exposure to hazardous substances, lack of process safety, chemical spills and other discharges or releases of toxic or hazardous substances or gases. These hazards may cause personal injury and loss of life, damage to property and contamination of the environment, which could lead to government fines or work stoppage injunctions and lawsuits by injured persons. Such events could impact our suppliers or customers, in which case raw materials may be unavailable to us, or our customers may be unable to purchase or accept our products and services. Any such occurrence could have a negative impact on our financial condition, results of operations and cash flows.

19

Competition - The markets in which we compete are highly competitive. Our inability to compete effectively could adversely impact our financial condition, results of operations and cash flows.

We face significant competition from major international producers as well as smaller regional competitors. Our most significant competitors include major chemicals and materials manufacturers and diversified companies, a number of which have revenues and capital resources exceeding ours. In addition, our products are facing increasing competition from market participants in Asia. We expect to see more competition as China continues to invest in semiconductor manufacturing.

We face risk that certain events, such as new product development by our competitors, changing customer needs, production advances for competing products, price changes in raw materials and product components, our failure to secure or protect patents or the expiration of patents, could result in declining demand for our products as our customers switch to substitute products or undertake manufacturing of such products on their own. If we are unable to develop, produce or market our products to effectively compete against our competitors, our financial condition, results of operations and cash flows may materially suffer.

We believe that our customers are increasingly looking for strong, long-term relationships with a few key suppliers that help them improve product performance, reduce costs, or support new product development. As a result, we may need to invest and spend more on research and development and marketing costs to strengthen existing customer relationships, as well as attract new customers. Our indebtedness could limit our flexibility to react to these industry trends and our ability to remain competitive.

Operational, Political, and Legal Risks of International Operations - Our international operations may be adversely impacted by political or economic instability, nationalization or expropriation of property, or undeveloped property rights and legal systems.

The majority of our revenue is derived from international operations. For the period ended September 30, 2017, 73% of our revenue was generated by sales to customers outside of the United States, including in South Korea, Taiwan, China and the European Union. Our operations in certain foreign jurisdictions, including manufacturing, research and development, sales and customer support, may be affected directly and indirectly by global and local regulation, and economic and political conditions and may be subject to disruption due to:

• | the United Kingdom’s formal trigger of the process for its exit from the European Union, and related negotiations, may cause instability in European economies and may negatively impact the outlook for the global economy; |

• | political, economic and social instability, including hyperinflationary conditions, regional and international hostilities and regional and international responses to these hostilities; |

• | unanticipated government actions, such as trade wars, nationalization of private enterprises and expropriation risk; |

• | failure to maintain compliance with multiple legal and regulatory systems and increased difficulty in ensuring compliance by employees, agents, and contractors with the laws of multiple jurisdictions; |

• | increased difficulty in controlling and maintaining foreign operations from the United States; |

• | potential difficulties in protecting intellectual property; |

• | controls on the investment, repatriation and exchange rates of capital; |

• | potentially adverse tax consequences, including the possible imposition of new taxes, a new corporate tax regime, increased taxes on repatriation or other payments, or challenges to the taxation of the Separation from Air Products in connection with the spin-off in such countries; and |

• | cancellation of contractual relationships within these jurisdictions without full compensation for loss. |

In addition, economic and political conditions within foreign jurisdictions, social unrest, or strained relations between

20

countries can cause fluctuations in demand, price volatility, supply disruptions, or loss of property. Our developing market operations may be subject to greater risks than those faced by our operations in mature economies, including geopolitical, legal, economic and talent risks. The occurrence of any of these risks could have a material adverse impact on our financial condition, results of operations and cash flows.

Regulatory Compliance - We are subject to extensive government regulation in jurisdictions around the globe. Any changes in regulations addressing, among other things, environmental compliance, anticorruption, sanctions, import/export controls, and taxes, may negatively impact our financial condition, results of operations and cash flows.