Attached files

| file | filename |

|---|---|

| EX-21.1 - EXHIBIT 21.1 SEPTEMBER 30, 2017 - NEW JERSEY RESOURCES CORP | njrex211sep2017.htm |

| EX-32.2 - EXHIBIT 32.2 SEPTEMBER 30, 2017 - NEW JERSEY RESOURCES CORP | njrex322sep2017.htm |

| EX-32.1 - EXHIBIT 32.1 SEPTEMBER 30, 2017 - NEW JERSEY RESOURCES CORP | njrex321sep2017.htm |

| EX-31.2 - EXHIBIT 31.2 SEPTEMBER 30, 2017 - NEW JERSEY RESOURCES CORP | njrex312sep2017.htm |

| EX-31.1 - EXHIBIT 31.1 SEPTEMBER 30, 2017 - NEW JERSEY RESOURCES CORP | njrex311sep2017.htm |

| EX-23.1 - EXHIBIT 23.1 SEPTEMBER 30, 2017 - NEW JERSEY RESOURCES CORP | njrex231sep2017.htm |

| EX-10.27 - EXHIBIT 10.27 SEPTEMBER 30, 2017 - NEW JERSEY RESOURCES CORP | njrex1027ranjrandmd.htm |

| EX-10.21 - EXHIBIT 10.21 SEPTEMBER 30, 2017 - NEW JERSEY RESOURCES CORP | njrex10212017sep.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10‑K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

FOR THE FISCAL YEAR ENDED SEPTEMBER 30, 2017

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

FOR THE TRANSITION PERIOD FROM TO | ||

Commission file number 001‑08359 | ||

NEW JERSEY RESOURCES CORPORATION | ||

(Exact name of registrant as specified in its charter) | ||

New Jersey | 22‑2376465 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) | |

1415 Wyckoff Road, Wall, New Jersey 07719 | 732‑938‑1480 | |

(Address of principal executive offices) | (Registrant’s telephone number, including area code) | |

Securities registered pursuant to Section 12 (b) of the Act: | ||

Common Stock ‑ $2.50 Par Value | New York Stock Exchange | |

(Title of each class) | (Name of each exchange on which registered) | |

Securities registered pursuant to Section 12 (g) of the Act: None | ||

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes: x No: o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes: o No: x

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes: x No: o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes: x No: o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S‑K is not contained herein, and will not be contained, to the best of the Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and "emerging growth company" in Rule 12b‑2 of the Exchange Act.

Large accelerated filer: x | Accelerated filer: o | Non-accelerated filer: o | |

(Do not check if a smaller reporting company) | |||

Smaller reporting company: o | Emerging growth company: o | ||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes: o No: x

The aggregate market value of the Registrant’s Common Stock held by non-affiliates was $3,356,717,008 based on the closing price of $39.60 per share on March 31, 2017, as reported on the New York Stock Exchange.

The number of shares outstanding of $2.50 par value Common Stock as of November 17, 2017 was 86,866,461.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s definitive Proxy Statement for the Annual Meeting of Shareowners (Proxy Statement) to be held on January 24, 2018, are incorporated by reference into Part I and Part III of this report.

New Jersey Resources Corporation

TABLE OF CONTENTS

Page | |||

PART I | |||

ITEM 1. | |||

ITEM 1A. | |||

ITEM 1B. | |||

ITEM 2. | |||

ITEM 3. | |||

ITEM 4. | |||

ITEM 4A. | |||

PART II | |||

ITEM 5. | |||

ITEM 6. | |||

ITEM 7. | |||

ITEM 7A. | |||

ITEM 8. | |||

ITEM 9. | |||

ITEM 9A. | |||

ITEM 9B. | |||

PART III* | |||

ITEM 10. | |||

ITEM 11. | |||

ITEM 12. | |||

ITEM 13. | |||

ITEM 14. | |||

PART IV | |||

ITEM 15. | |||

* Portions of Item 10 and Items 11-14 are Incorporated by Reference from the Proxy Statement. | |||

i

New Jersey Resources Corporation

GLOSSARY OF KEY TERMS

Adelphia | Adelphia Gateway, LLC |

AFUDC | Allowance for Funds Used During Construction |

AOCI | Accumulated Other Comprehensive Income |

ARO | Asset Retirement Obligations |

ASC | Accounting Standards Codification |

ASU | Accounting Standards Update |

Bcf | Billion Cubic Feet |

BGSS | Basic Gas Supply Service |

BPU | New Jersey Board of Public Utilities |

CIP | Conservation Incentive Program |

CME | Chicago Mercantile Exchange |

CR&R | Commercial Realty & Resources Corp. |

Degree-Day | The measure of the variation in the weather based on the extent to which the average daily temperature falls below 65 degrees Fahrenheit |

DM | Dominion Midstream Partners, L.P., a master limited partnership |

DM Common Units | Common units representing limited partnership interests in DM |

Dodd-Frank Act | Dodd-Frank Wall Street Reform and Consumer Protection Act |

DRP | NJR Direct Stock Purchase and Dividend Reinvestment Plan |

Dths | Dekatherms |

EDA | New Jersey Economic Development Authority |

EDA Bonds | Collectively, Series 2011A, Series 2011B and Series 2011C Bonds issued to NJNG by the EDA |

EDECA | Electric Discount and Energy Competition Act |

EE | Energy Efficiency |

FASB | Financial Accounting Standards Board |

FCM | Futures Commission Merchant |

FERC | Federal Energy Regulatory Commission |

Financial Margin | A non-GAAP financial measure, which represents revenues earned from the sale of natural gas less costs of natural gas sold including any transportation and storage costs, and excludes any accounting impact from the change in the fair value of certain derivative instruments |

FMB | First Mortgage Bonds |

FRM | Financial Risk Management |

GAAP | Generally Accepted Accounting Principles of the United States |

HCCTR | Health Care Cost Trend Rate |

Home Services and Other | Home Services and Other Operations (formerly Retail and Other Operations) |

ICE | Intercontinental Exchange |

IEC | Interstate Energy Company, LLC |

Iroquois | Iroquois Gas Transmission L.P. |

IRS | Internal Revenue Service |

ISDA | The International Swaps and Derivatives Association |

ITC | Investment Tax Credit |

LIBOR | London Inter-Bank Offered Rate |

LNG | Liquefied Natural Gas |

Loan Agreement | Loan Agreement between the EDA and NJNG |

MetLife | Metropolitan Life Insurance Company |

MetLife Facility | NJR’s unsecured, uncommitted $100 million private placement shelf note agreement with MetLife, Inc., which expired in September 2016 |

MGP | Manufactured Gas Plant |

MLP | Master limited partnership |

Moody’s | Moody’s Investors Service, Inc. |

Mortgage Indenture | The Amended and Restated Indenture of Mortgage, Deed of Trust and Security Agreement between NJNG and U.S. Bank National Association dated as of September 1, 2014 |

MW | Megawatts |

MWh | Megawatt Hour |

NAESB | The North American Energy Standards Board |

NFE | Net Financial Earnings |

NGV | Natural Gas Vehicles |

Page 1

New Jersey Resources Corporation

GLOSSARY OF KEY TERMS (cont.) | |

NJ RISE | New Jersey Reinvestment in System Enhancement |

NJCEP | New Jersey’s Clean Energy Program |

NJDEP | New Jersey Department of Environmental Protection |

NJNG | New Jersey Natural Gas Company or Natural Gas Distribution segment |

NJNG Credit Facility | The $250 million unsecured committed credit facility expiring in May 2019 |

NJR Credit Facility | NJR’s $425 million unsecured committed credit facility expiring in September 2020 |

NJR Energy | NJR Energy Corporation |

NJR or The Company | New Jersey Resources Corporation |

NJRCEV | NJR Clean Energy Ventures Corporation |

NJRES | NJR Energy Services Company |

NJRHS | NJR Home Services Company |

NJRPS | NJR Plumbing Services, Inc. |

NJRRS | NJR Retail Services Company |

NJR Retail Holdings | NJR Retail Holdings Corporation |

Non-GAAP | Not in accordance with Generally Accepted Accounting Principles of the United States |

NPNS | Normal Purchase/Normal Sale |

NYMEX | New York Mercantile Exchange |

O&M | Operation and Maintenance |

OCI | Other Comprehensive Income |

OPEB | Other Postemployment Benefit Plans |

PBO | Projected Benefit Obligation |

PennEast | PennEast Pipeline Company, LLC |

PEP | Pension Equalization Plan |

PIM | Pipeline Integrity Management |

PPA | Power Purchase Agreement |

Prudential | Prudential Investment Management, Inc. |

Prudential Facility | NJR’s unsecured, uncommitted private placement shelf note agreement with Prudential |

PTC | Production Tax Credit |

RAC | Remediation Adjustment Clause |

REC | Renewable Energy Certificate |

S&P | Standard & Poor’s Financial Services, LLC |

SAFE | Safety Acceleration and Facility Enhancement |

Sarbanes-Oxley | Sarbanes-Oxley Act of 2002 |

SAVEGREEN | The SAVEGREEN Project® |

Savings Plan | Employees’ Retirement Savings Plan |

SBC | Societal Benefits Charge |

SEC | Securities and Exchange Commission |

SREC | Solar Renewable Energy Certificate |

SRL | Southern Reliability Link |

Steckman Ridge | Collectively, Steckman Ridge GP, LLC and Steckman Ridge, LP |

Superstorm Sandy | Post-Tropical Cyclone Sandy |

Talen | Talen Energy Marketing, LLC or Talen Generation, LLC |

Tetco | Texas Eastern Transmission |

The Exchange Act | The Securities Exchange Act of 1934, as amended |

Trustee | U.S. Bank National Association |

TSR | Total Shareholder Return |

U.S. | The United States of America |

Union | International Brotherhood of Electrical Workers Local 1820 |

USF | Universal Service Fund |

Page 2

New Jersey Resources Corporation

TABLE OF CONTENTS

INFORMATION CONCERNING FORWARD-LOOKING STATEMENTS

Certain statements contained in this report, including, without limitation, statements as to management expectations, assumptions and beliefs presented in Part I, Item 1. Business and Item 3. Legal Proceedings, and in Part II, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations and Item 7A. Quantitative and Qualitative Disclosures About Market Risk, and in the notes to the financial statements are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995. Forward-looking statements can also be identified by the use of forward-looking terminology such as “anticipate,” “estimate,” “may,” “could,” “might,” “intend,” “expect,” “believe,” “will” “plan” or “should” or comparable terminology and are made based upon management’s current expectations, assumptions and beliefs as of this date concerning future developments and their potential effect on us. There can be no assurance that future developments will be in accordance with management’s expectations, assumptions or beliefs, or that the effect of future developments on us will be those anticipated by management.

We caution readers that the expectations, assumptions and beliefs that form the basis for forward-looking statements regarding customer growth, customer usage, qualifications for ITCs, PTCs and SRECs, future rate case proceedings, financial condition, results of operations, cash flows, capital requirements, future capital expenditures, market risk, effective tax rate and other matters for fiscal 2018 and thereafter include many factors that are beyond our ability to control or estimate precisely, such as estimates of future market conditions, the behavior of other market participants and changes in the debt and equity capital markets. The factors that could cause actual results to differ materially from our expectations, assumptions and beliefs include, but are not limited to, those discussed in Part I, Item 1A. Risk Factors, as well as the following:

• | risks associated with our investments in clean energy projects, including the availability of regulatory and tax incentives, the availability of viable projects, our eligibility for ITCs and PTCs, the future market for SRECs and electricity prices, and operational risks related to projects in service; |

• | our ability to obtain governmental and regulatory approvals, land-use rights, electric grid connection (in the case of clean energy projects) and/or financing for the construction, development and operation of our unregulated energy investments and NJNG’s infrastructure projects in a timely manner; |

• | risks associated with acquisitions and the related integration of acquired assets with our current operations; |

• | volatility of natural gas and other commodity prices and their impact on NJNG customer usage, NJNG’s BGSS incentive programs, our Energy Services segment operations and on our risk management efforts; |

• | the level and rate at which NJNG’s costs and expenses are incurred and the extent to which they are approved for recovery from customers through the regulatory process, including through future base rate case filings; |

• | the impact of a disallowance of recovery of environmental-related expenditures and other regulatory changes; |

• | the performance of our subsidiaries; |

• | operating risks incidental to handling, storing, transporting and providing customers with natural gas; |

• | access to adequate supplies of natural gas and dependence on third-party storage and transportation facilities for natural gas supply; |

• | the regulatory and pricing policies of federal and state regulatory agencies; |

• | timing of qualifying for ITCs and PTCs due to delays or failures to complete planned solar and wind energy projects and the resulting effect on our effective tax rate and earnings; |

• | the results of legal or administrative proceedings with respect to claims, rates, environmental issues, gas cost prudence reviews and other matters; |

• | risks related to cyberattacks or failure of information technology systems; |

• | changes in rating agency requirements and/or credit ratings and their effect on availability and cost of capital to our Company; |

• | our ability to comply with current and future regulatory requirements; |

• | the impact of volatility in the equity and credit markets on our access to capital; |

• | the impact to the asset values and resulting higher costs and funding obligations of our pension and postemployment benefit plans as a result of potential downturns in the financial markets, lower discount rates, revised actuarial assumptions or impacts associated with the Patient Protection and Affordable Care Act; |

• | commercial and wholesale credit risks, including the availability of creditworthy customers and counterparties, and liquidity in the wholesale energy trading market; |

• | accounting effects and other risks associated with hedging activities and use of derivatives contracts; |

• | our ability to optimize our physical assets; |

• | any potential need to record a valuation allowance for our deferred tax assets; |

• | changes to tax laws and regulations; |

• | weather and economic conditions; |

• | our ability to comply with debt covenants; |

• | demographic changes in NJR’s service territory and their effect on NJR’s customer growth; |

• | the impact of natural disasters, terrorist activities and other extreme events on our operations and customers; |

• | the costs of compliance with present and future environmental laws, including potential climate change-related legislation; |

• | environmental-related and other uncertainties related to litigation or administrative proceedings; |

• | risks related to our employee workforce; and |

• | risks associated with the management of our joint ventures and partnerships, and investment in a master limited partnership. |

While we periodically reassess material trends and uncertainties affecting our results of operations and financial condition in connection with the preparation of management’s discussion and analysis of results of operations and financial condition contained in our Quarterly and Annual Reports on Form 10-Q and Form 10-K, respectively, we do not, by including this statement, assume any obligation to review or revise any particular forward-looking statement referenced herein in light of future events.

Page 3

New Jersey Resources Corporation

Part I

ITEM 1. BUSINESS

ORGANIZATIONAL STRUCTURE

New Jersey Resources Corporation is a New Jersey corporation formed in 1981 pursuant to a corporate reorganization. We are an energy services holding company whose principal business is the distribution of natural gas through a regulated utility, providing other retail and wholesale energy services to customers and investing in clean energy projects and midstream assets. We are an exempt holding company under section 1263 of the Energy Policy Act of 2005. Our subsidiaries include:

New Jersey Natural Gas Company provides regulated retail natural gas service to approximately 529,800 residential and commercial customers in central and northern New Jersey and participates in the off-system sales and capacity release markets. NJNG, a local natural gas distribution company, is regulated by the BPU and comprises the Company’s Natural Gas Distribution segment and is referred to herein as NJNG or Natural Gas Distribution.

NJR Clean Energy Ventures Corporation includes the results of operations and assets related to the Company’s unregulated capital investments in clean energy projects, including commercial and residential solar projects and onshore wind investments. NJRCEV comprises the Company’s Clean Energy Ventures segment and is referred to herein as Clean Energy Ventures.

NJR Energy Services Company maintains and transacts around a portfolio of physical assets consisting of natural gas storage and transportation contracts in the U.S. and Canada. NJRES also provides unregulated wholesale energy management services to other energy companies and natural gas producers.

NJR Retail Services Company provides unregulated retail natural gas supply and transportation services to commercial and industrial customers in Delaware, Maryland, Pennsylvania and New Jersey.

NJRES and NJRRS comprise our Energy Services segment and are referred to herein as Energy Services.

NJR Energy Investments Corporation is an unregulated affiliate that consolidates our unregulated energy-related investments.

NJR Midstream Holdings Corporation invests in energy-related ventures through its subsidiaries, NJR Steckman Ridge Storage Company, which holds the Company’s 50 percent combined interest in Steckman Ridge, a natural gas storage facility, NJR Pipeline Company, which holds the Company’s 20 percent ownership interest in PennEast and NJNR Pipeline Company, which holds approximately 1.84 million DM Common Units in Dominion Midstream Partners, L.P. The investments in Steckman Ridge, PennEast and DM comprise the Company’s Midstream segment.

NJR Retail Holdings Corporation is an unregulated affiliate that consolidates our unregulated retail operations.

NJR Home Services Company provides heating, ventilation and cooling service, sales and installation of appliances to approximately 112,000 service contract customers, as well as solar installation projects.

Commercial Realty & Resources Corp., holds commercial real estate.

NJR Plumbing Services, Inc. provides plumbing repair and installation services.

NJR Service Corporation provides shared administrative services, including corporate communications, finance and accounting, internal audit, legal, human resources and information technology for NJR and all of its subsidiaries.

Page 4

New Jersey Resources Corporation

Part I

ITEM 1. BUSINESS (Continued)

REPORTING SEGMENTS

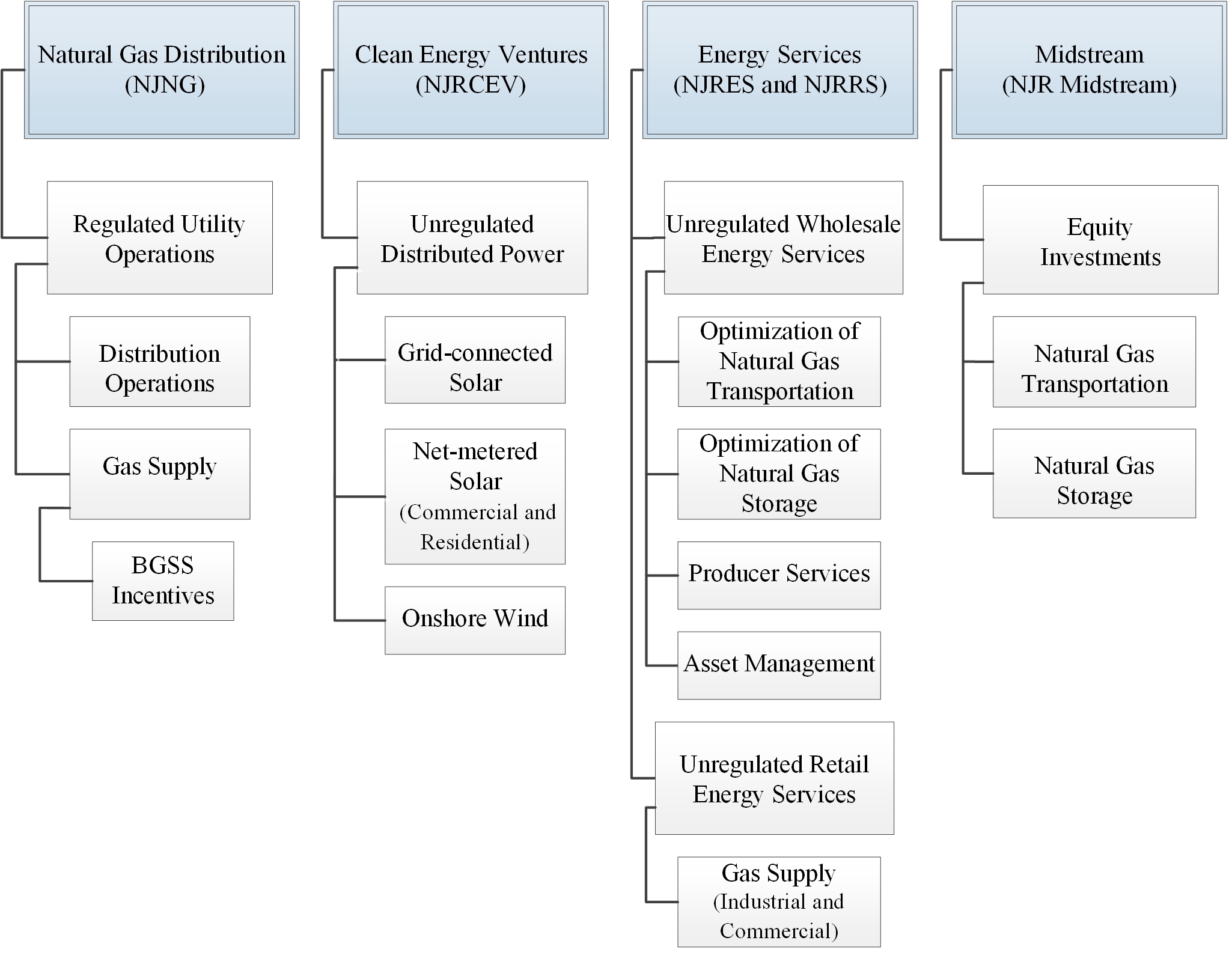

We operate within four reporting segments: Natural Gas Distribution, Clean Energy Ventures, Energy Services and Midstream.

The Natural Gas Distribution segment consists of regulated natural gas services, off-system sales, capacity and storage management operations. The Energy Services segment consists of unregulated wholesale and retail energy operations. The Clean Energy Ventures segment consists of capital investments in clean energy projects. The Midstream segment consists of investments in the midstream natural gas market, such as natural gas transportation and storage facilities.

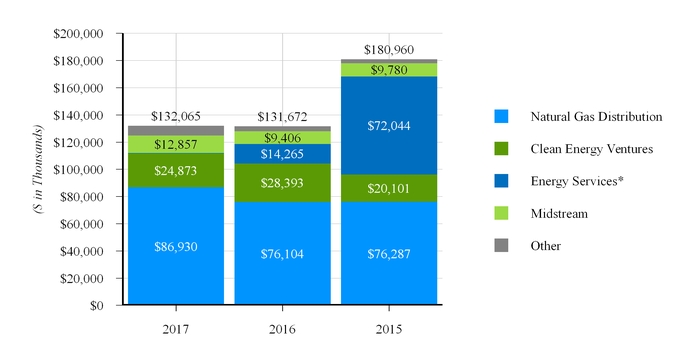

Net income by reporting segment and other operations for the years ended September 30, are as follows:

* Energy Services’ net income for fiscal 2017 was $476,000 and does not show clearly in the above graph.

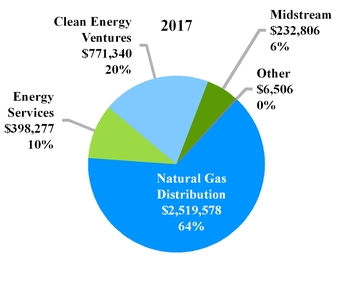

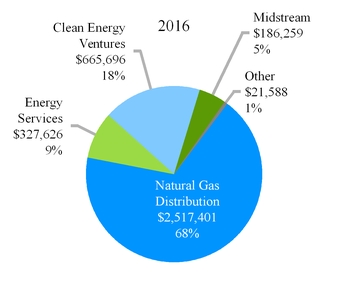

Assets by reporting segment and other operations at September 30, are as follows ($ in Thousands):

Page 5

New Jersey Resources Corporation

Part I

ITEM 1. BUSINESS (Continued)

Management uses NFE, a non-GAAP financial measure, when evaluating our operating results. NFE is a measure of the earnings based on eliminating timing differences surrounding the recognition of certain gains or losses to effectively match the earnings effects of the economic hedges with the physical sale of gas and, therefore, eliminates the impact of volatility to GAAP earnings associated with the derivative instruments. Energy Services economically hedges its natural gas inventory with financial derivative instruments and calculates the related tax effect based on the statutory rate.

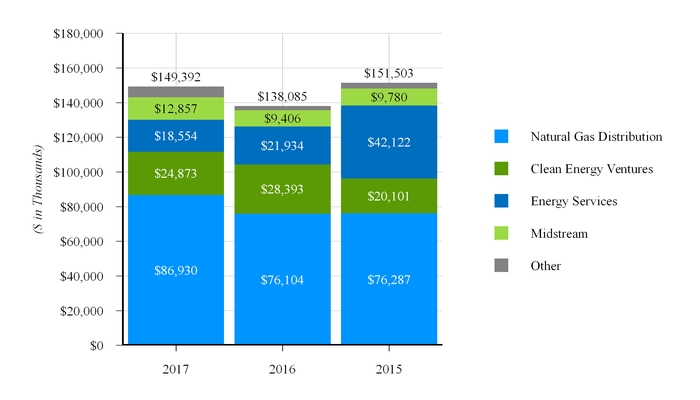

Non-GAAP financial measures are not in accordance with, or an alternative to GAAP, and should be considered in addition to, and not as a substitute for, the comparable GAAP measure. The following is a reconciliation of consolidated net income, the most directly comparable GAAP measure, to NFE:

(Thousands) | 2017 | 2016 | 2015 | ||||||

Net income | $ | 132,065 | $ | 131,672 | $ | 180,960 | |||

Add: | |||||||||

Unrealized (gain) loss on derivative instruments and related transactions | (11,241 | ) | 46,883 | (38,681 | ) | ||||

Tax effect | 4,062 | (17,018 | ) | 14,391 | |||||

Effects of economic hedging related to natural gas inventory | 38,470 | (36,816 | ) | (8,225 | ) | ||||

Tax effect | (13,964 | ) | 13,364 | 3,058 | |||||

NFE | $ | 149,392 | $ | 138,085 | $ | 151,503 | |||

Basic earnings per share | $ | 1.53 | $ | 1.53 | $ | 2.12 | |||

Add: | |||||||||

Unrealized (gain) loss on derivative instruments and related transactions | (0.13 | ) | 0.55 | (0.45 | ) | ||||

Tax effect | 0.05 | (0.20 | ) | 0.17 | |||||

Effects of economic hedging related to natural gas inventory | 0.45 | (0.43 | ) | (0.10 | ) | ||||

Tax effect | (0.17 | ) | 0.16 | 0.04 | |||||

Basic NFE per share | $ | 1.73 | $ | 1.61 | $ | 1.78 | |||

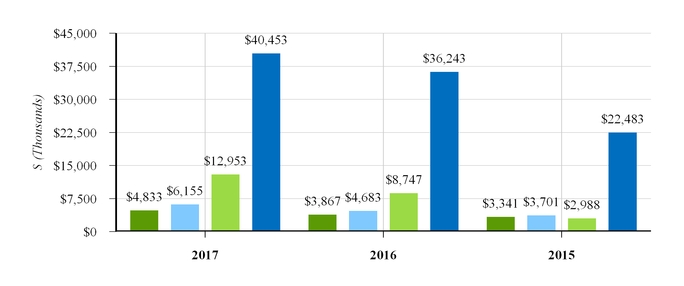

NFE by reporting segment and other operations for the years ended September 30, are as follows:

Additional financial information related to these reporting segments are set forth in Note 15. Reporting Segment and Other Operations Data in the accompanying Consolidated Financial Statements and Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Page 6

New Jersey Resources Corporation

Part I

ITEM 1. BUSINESS (Continued)

Natural Gas Distribution

General

Our Natural Gas Distribution segment consists of regulated utility operations that provide natural gas service to approximately 529,800 customers. NJNG’s service territory includes New Jersey’s Monmouth and Ocean counties and parts of Burlington, Morris and Middlesex counties. It encompasses 1,516 square miles, covering 105 municipalities with an estimated population of 1.5 million people. It is primarily suburban, highlighted by approximately 100 miles of New Jersey coastline. It is in close proximity to New York City, Philadelphia and the metropolitan areas of northern New Jersey and is accessible through a network of major roadways and mass transportation.

NJNG’s business is subject to various risks, such as those associated with adverse economic conditions, which can negatively impact customer growth, operating and financing costs, fluctuations in commodity prices, which can impact customer usage, customer conservation efforts, certain regulatory actions and environmental remediation. It is often difficult to predict the impact of trends associated with these risks. NJNG employs strategies to manage the challenges it faces, including pursuing customer conversions from other fuel sources and monitoring new construction markets through contact with developers, utilizing incentive programs through BPU-approved mechanisms to reduce gas costs, pursuing rate and other regulatory strategies designed to stabilize and decouple gross margin, and working actively with consultants and the NJDEP to manage expectations related to its obligations associated with its former MGP sites.

Operating Revenues/Throughput

For the fiscal year ended September 30, operating revenues and throughput by customer class are as follows:

2017 | 2016 | 2015 | |||||||||||||||

($ in thousands) | Operating Revenue | Bcf | Operating Revenue | Bcf | Operating Revenue | Bcf | |||||||||||

Residential | $ | 395,315 | 40.7 | $ | 345,597 | 36.9 | $ | 466,464 | 45.9 | ||||||||

Commercial and other | 98,777 | 8.7 | 80,994 | 7.3 | 106,505 | 9.6 | |||||||||||

Firm transportation | 73,206 | 14.4 | 69,696 | 14.1 | 77,974 | 16.0 | |||||||||||

Total residential and commercial | 567,298 | 63.8 | 496,287 | 58.3 | 650,943 | 71.5 | |||||||||||

Interruptible | 7,970 | 55.0 | 8,867 | 61.5 | 10,049 | 47.1 | |||||||||||

Total system | 575,268 | 118.8 | 505,154 | 119.8 | 660,992 | 118.6 | |||||||||||

BGSS incentive programs (1) | 120,369 | 49.5 | 89,192 | 56.6 | 120,978 | 47.8 | |||||||||||

Total | $ | 695,637 | 168.3 | $ | 594,346 | 176.4 | $ | 781,970 | 166.4 | ||||||||

(1) | Does not include 128.9, 160.1 and 174.6 Bcf for the capacity release program and related amounts of $6.5 million, $8.1 million and $8.9 million, which are recorded as a reduction of gas purchases on the Consolidated Statements of Operations for the fiscal years ended September 30, 2017, 2016 and 2015, respectively. |

NJNG added 9,126 and 8,170 new customers and added natural gas heat and other services to another 662 and 644 existing customers in fiscal 2017 and 2016, respectively. NJNG expects its new customer annual growth rate to continue to be approximately 1.7 percent with projected additions in the range of approximately 26,000 to 28,000 new customers over the next three years. This anticipated customer growth represents approximately $5.3 million in new annual utility gross margin, a non-GAAP financial measure, as calculated under NJNG’s current CIP tariff. For a definition of utility gross margin see Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations - Natural Gas Distribution Segment.

In fiscal 2017, no single customer represented more than 10 percent of consolidated operating revenues.

Seasonality of Gas Revenues

Therm sales are significantly affected by weather conditions with customer demand being greatest during the winter months when natural gas is used for heating purposes. The relative measurement of the impact of weather is in degree-days. Degree-day data is used to estimate amounts of energy required to maintain comfortable indoor temperature levels based on each day’s average temperature. A degree-day is the measure of the variation in the weather based on the extent to which the average daily temperature falls below 65 degrees Fahrenheit. Each degree of temperature below 65 degrees Fahrenheit is counted as one heating degree-day. Normal heating degree-days are based on a 20-year average, calculated based on three reference areas representative of NJNG’s service territory.

Page 7

New Jersey Resources Corporation

Part I

ITEM 1. BUSINESS (Continued)

The CIP, a mechanism authorized by the BPU, stabilizes NJNG’s utility gross margin, regardless of variations in weather. In addition, the CIP decouples the link between utility gross margin and customer usage, allowing NJNG to promote energy conservation measures. Recovery of utility gross margin is subject to additional conditions, including an earnings test, a revenue test and an evaluation of BGSS-related savings achieved over a 12-month period. In May 2014, the BPU approved the continuation of the CIP program with no expiration date.

Concurrent with its annual BGSS filing, NJNG files for an annual review of its CIP, during which time it can request rate changes, as appropriate. For additional information regarding the CIP, including rate actions and impact to margin, see Note 4. Regulation in the accompanying Consolidated Financial Statements and Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations - Natural Gas Distribution Segment.

Gas Supply

Firm Natural Gas Supplies

In fiscal 2017, NJNG purchased natural gas from approximately 80 suppliers under contracts ranging from one day to one year and purchased over 10 percent of its natural gas from one supplier. NJNG believes the loss of this supplier would not have a material adverse impact on its results of operations, financial position or cash flows as an adequate number of alternative suppliers exist. NJNG believes that its supply strategy should adequately meet its expected firm load over the next several years.

Firm Transportation and Storage Capacity

NJNG maintains agreements for firm transportation and storage capacity with several interstate pipeline companies to take delivery of firm natural gas supplies, which ensures the ability to reliably service its customers. NJNG receives natural gas at 10 citygate stations located in Middlesex, Morris and Passaic counties in New Jersey.

The pipeline companies that provide firm transportation service to NJNG’s citygate stations, the maximum daily deliverability of that capacity for the upcoming winter season and the contract expiration dates are as follows:

Pipeline | Dths(1) | Expiration | ||

Texas Eastern Transmission, L.P. | 300,738 | Various dates between 2018 and 2023 | ||

Columbia Gas Transmission Corp. | 50,000 | Various dates between 2024 and 2030 | ||

Transcontinental Gas Pipe Line Corp. | 42,531 | Various dates between 2018 and 2032 | ||

Tennessee Gas Pipeline Co. | 25,166 | Various dates between 2018 and 2023 | ||

Algonquin Gas Transmission | 12,000 | 2019 | ||

Total | 430,435 | |||

(1) | Numbers are shown net of any capacity release contracted amounts. |

Dominion Energy Transmission, Inc. provides NJNG firm contract transportation service and supplies the pipelines included in the table above.

In addition, NJNG has storage contracts that provide an additional 102,941 Dths of maximum daily deliverability to NJNG’s citygate stations from storage fields in its Northeast market area. The storage suppliers, the maximum daily deliverability of that storage capacity and the contract expiration dates are as follows:

Pipeline | Dths | Expiration | ||

Texas Eastern Transmission, L.P. | 94,557 | 2019 | ||

Transcontinental Gas Pipe Line Corp. | 8,384 | 2019 | ||

Total | 102,941 | |||

NJNG also has upstream storage contracts. The maximum daily deliverability and contract expiration dates are as follows:

Company | Dths | Expiration | ||

Dominion Transmission Corporation | 154,714 | Various dates between 2020 and 2023 | ||

Steckman Ridge, L.P. | 38,000 | 2020 | ||

Central New York Oil & Gas | 25,337 | 2023 | ||

Total | 218,051 | |||

Page 8

New Jersey Resources Corporation

Part I

ITEM 1. BUSINESS (Continued)

NJNG utilizes its transportation contracts to transport gas to NJNG’s citygates from the Dominion Transmission Corporation, Steckman Ridge and Central New York Oil & Gas storage fields. NJNG has sufficient firm transportation, storage and supply capacity to fully meet its firm sales contract obligations.

Citygate Supplies from Energy Services

NJNG has several citygate supply agreements with Energy Services. NJNG and Energy Services have an agreement where NJNG releases 10,000 Dths/day of Texas Eastern Transmission capacity, 2,200 Dths/day of Dominion Energy Transmission, Inc. capacity, 10,728 Dths/day of Tennessee Gas Pipeline capacity and 1.6 million Dths of Central New York Oil & Gas storage capacity to Energy Services for the period of April 1, 2017 to March 31, 2018. NJNG can call upon a supply of up to 20,000 Dths/day delivered to NJNG’s Texas Eastern citygate. Energy Services manages the storage inventory and NJNG can call on that storage supply as needed at NJNG’s Tennessee citygate or storage point.

NJNG also has agreements where it releases 80,000 Dths/day of its Texas Eastern Transmission capacity to Energy Services for the period of April 1, 2016 to October 31, 2020. Under these agreements, NJNG can call upon a supply of up to 80,000 Dths/day delivered to its Texas Eastern citygate as needed. See Note 16. Related Party Transactions in the accompanying Consolidated Financial Statements for additional information regarding these transactions.

Peaking Supply

To manage its winter peak day demand, NJNG maintains two LNG facilities with a combined deliverability of approximately 170,000 Dths/day, which represents approximately 19 percent of its estimated peak day sendout. In June 2016, NJNG’s liquefaction facility became operational and now allows NJNG to convert natural gas into LNG to fill NJNG’s existing LNG storage tanks. See Item 2. Properties-Natural Gas Distribution for additional information regarding the LNG storage facilities.

Basic Gas Supply Service

BGSS is a BPU-approved clause designed to allow for the recovery of natural gas commodity costs on an annual basis. The clause requires all New Jersey natural gas utilities to make an annual filing by each June 1 for review of BGSS rates and to request a potential rate change effective the following October 1. The BGSS is also designed to allow each natural gas utility to provisionally increase residential and small commercial customer BGSS rates on December 1 and February 1 for up to a five percent increase to the average residential heat customer’s bill on a self-implementing basis, after proper notice and BPU action on the June filing. Such increases are subject to subsequent BPU review and final approval.

In addition to making periodic rate adjustments to reflect changes in commodity prices, NJNG is also permitted to refund or credit back a portion of the commodity costs to customers when the natural gas commodity costs decrease in comparison to amounts projected or to amounts previously collected from customers. Decreases in the BGSS rate and BGSS refunds can be implemented with five days’ notice to the BPU. Rate changes, as well as other regulatory actions related to BGSS, are discussed further in Note 4. Regulation in the accompanying Consolidated Financial Statements.

Wholesale natural gas prices are, by their nature, volatile. NJNG mitigates the impact of volatile price changes on customers through the use of financial derivative instruments, which are part of its storage incentive program, its BGSS clause and was part of its FRM program. The FRM program was terminated effective November 2015.

Future Natural Gas Supplies

NJNG expects to meet the natural gas requirements for existing and projected firm customers into the foreseeable future. If NJNG’s long-term natural gas requirements change, NJNG expects to renegotiate and restructure its contract portfolio to better match the changing needs of its customers and changing natural gas supply landscape.

Regulation and Rates

State

NJNG is subject to the jurisdiction of the BPU with respect to a wide range of matters such as base rates and regulatory rider rates, the issuance of securities, the safety and adequacy of service, the manner of keeping its accounts and records, the sufficiency of natural gas supply, pipeline safety, environmental issues, compliance with affiliate standards and the sale or encumbrance of its properties. In September 2016, the BPU approved NJNG's filing for an increase to base rates in the amount of $45 million, effective October 2016. See Note 4. Regulation in the accompanying Consolidated Financial Statements for additional information regarding NJNG’s rate proceedings.

Page 9

New Jersey Resources Corporation

Part I

ITEM 1. BUSINESS (Continued)

Federal

FERC regulates rates charged by interstate pipeline companies for the transportation and storage of natural gas. This affects NJNG’s agreements with several interstate pipeline companies for the purchase of such services. Costs associated with these services are currently recoverable through the BGSS.

Competition

Although its franchises are nonexclusive, NJNG is not currently subject to competition from other natural gas distribution utilities with regard to the transportation of natural gas in its service territory. Due to significant distances between NJNG’s current large industrial customers and the nearest interstate natural gas pipelines, as well as the availability of its transportation tariff, NJNG currently does not believe it has significant exposure to the risk that its distribution system will be bypassed. Competition does exist from suppliers of oil, coal, electricity and propane. At the present time, however, natural gas is used in over 95 percent of new construction due to its efficiency, reliability and price advantage. Natural gas prices are a function of market supply and demand. Although NJNG believes natural gas will remain competitive with alternate fuels, no assurance can be given in this regard.

The BPU, within the framework of the EDECA, fully opened NJNG’s residential markets to competition, including third-party suppliers, and restructured rates to segregate its BGSS and delivery (i.e., transportation) prices. New Jersey’s natural gas utilities must provide BGSS in the absence of a third-party supplier. On September 30, 2017, NJNG had 32,653 residential and 10,137 commercial and industrial customers utilizing the transportation service.

Clean Energy Ventures

Our Clean Energy Ventures segment invests in, owns and operates clean energy projects, including commercial and residential solar installations located in New Jersey, and wind farms located in Montana, Iowa, Kansas, Wyoming and Pennsylvania.

As of September 30, 2017, Clean Energy Ventures constructed a total of 189.1 MW of solar capacity in New Jersey that has qualified for ITCs, including a combination of residential and commercial net-metered and grid-connected solar systems. As part of its solar investment program, Clean Energy Ventures operates a residential lease program, The Sunlight Advantage®, which provides qualifying homeowners with the opportunity to have a solar system installed at their home with no installation or maintenance expenses. Clean Energy Ventures owns, operates and maintains the system over the life of the lease in exchange for monthly lease payments. In addition, certain qualified non-profit institutions are served under PPAs. The program is operated by Clean Energy Ventures using qualified contracting partners in addition to strategic suppliers for material standardization and sourcing. The residential solar lease and PPA market is highly competitive with various companies operating in New Jersey. Clean Energy Ventures competes on price, quality and brand reputation, leveraging its partner network and customer referrals.

Clean Energy Ventures’ commercial solar projects are sourced through various channels and include both net-metered and grid-connected systems. Net-metered projects involve the sale of energy to a host and grid-connected systems into the wholesale energy markets. Project construction is competitively sourced through third parties. New Jersey has the fifth largest solar market in the U.S. according to the Solar Energy Industries Association®, with a large number of firms competing in all facets of the market including development, financing and construction.

The solar systems are registered and certified with the BPU’s Office of Clean Energy and qualified to produce SRECs. One SREC is created for every MWh of electricity produced by a solar generator. Clean Energy Ventures sells the SRECs it generates to a variety of counterparties, including electric load serving entities that serve electric customers in New Jersey and are required to comply with the solar carve-out of the Renewable Portfolio Standard. Solar projects are also currently eligible for federal ITCs in the year that they are placed into service.

In addition to its solar investments, Clean Energy Ventures invests in small to mid-size onshore wind projects that fit its investment profile. As of September 30, 2017, Clean Energy Ventures has a total of 126.6 MW of wind capacity. The wind projects are eligible for PTCs for a 10-year period following commencement of operations and have PPAs of various terms in place, which typically govern the sale of energy, capacity and/or renewable energy credits. An $89 million, 39.9 MW wind project in Somerset County, Pennsylvania was completed in December 2016.

Page 10

New Jersey Resources Corporation

Part I

ITEM 1. BUSINESS (Continued)

Clean Energy Ventures is subject to various risks including those associated with adverse federal and state legislation and regulatory policies, construction delays that can impact the timing or eligibility of tax incentives, technological changes and the future market of SRECs. See Item 1A. Risk Factors for additional information regarding these risks.

Energy Services

Our Energy Services segment consists of unregulated wholesale and retail natural gas operations and provides producer and asset management services to a diverse customer base across North America. Energy Services has acquired contractual rights to natural gas storage and transportation assets it utilizes to implement its strategic and opportunistic market strategies. The rights to these assets were acquired in anticipation of delivering natural gas, performing asset management services for customers or in conjunction with identifying strategic opportunities that exist in or between the market areas that it serves. These opportunities are driven by price differentials between market locations and/or time periods. Energy Services’ activities are conducted in the market areas in which it has strong expertise, including the U.S. and Canada. Energy Services differentiates itself in the marketplace based on price, reliability and quality of service. Its competitors include wholesale marketing and trading companies, utilities, natural gas producers and financial institutions. Energy Services’ portfolio of customers includes regulated natural gas distribution companies, industrial companies, electric generators, natural gas/liquids processors, retail aggregators, wholesale marketers and natural gas producers.

While focusing on maintaining a low-risk operating and counterparty credit profile, Energy Services’ activities specifically consist of the following elements:

• | Providing natural gas portfolio management services to nonaffiliated and affiliated natural gas utilities, electric generation facilities and natural gas producers; |

• | Managing strategies for new and existing natural gas storage and transportation assets to capture value from changes in price due to location or timing differences as a means to generate financial margin (as defined below); |

• | Managing transactional logistics to minimize the cost of natural gas delivery to customers while maintaining security of supply. Transactions utilize the most optimal and advantageous natural gas supply transportation routing available within its contractual asset portfolio and various market areas; and |

• | Managing economic hedging programs that are designed to mitigate the impact of changes in market prices on financial margin generated on its natural gas storage and transportation commitments. |

On July 27, 2017, we acquired certain wholesale transportation and retail natural gas energy contracts from Talen, providing service to large industrial retail and commercial customers in Delaware, Maryland, New Jersey and Pennsylvania. Our competitors include other retail marketing companies that provide service in the same states.

In fiscal 2017, Energy Services purchased over 10 percent of its natural gas from one supplier. Energy Services believes the loss of this supplier would not have a material adverse impact on its results of operations, financial position or cash flows as an adequate number of alternative suppliers exist.

Transportation and Storage Transactions

Energy Services focuses on creating value from the use of its physical assets, which are typically amassed through contractual rights to natural gas storage and transportation capacity. These assets become more valuable when favorable price changes occur that impact the value between or within market areas and across time periods. On a forward basis, Energy Services may hedge these price differentials through the use of financial instruments. In addition, Energy Services may seek to optimize these assets on a daily basis, as market conditions warrant, by evaluating natural gas supply and transportation availability within its portfolio. This enables Energy Services to capture geographic pricing differences across various regions as delivered natural gas prices may change favorably as a result of market conditions. Energy Services may, for example, initiate positions when intrinsic financial margin is present, and then enhance that financial margin as prices change across regions or time periods.

Energy Services also engages in park-and-loan transactions with storage and pipeline operators, where Energy Services will either borrow (receive a loan of) natural gas with an obligation to repay the storage or pipeline operator at a later date or “park” natural gas with an obligation to withdraw at a later date. In these cases, Energy Services evaluates the economics of the transaction to determine if it can capture pricing differentials in the marketplace and generate financial margin. Energy Services evaluates

Page 11

New Jersey Resources Corporation

Part I

ITEM 1. BUSINESS (Continued)

deal attributes such as fixed fees, calendar spread value from deal inception until volumes are scheduled to be returned and/or repaid, as well as the time value of money. If this evaluation demonstrates that financial margin exists, Energy Services may enter into the transaction and hedge with natural gas futures contracts, thereby locking in financial margin.

Energy Services maintains inventory balances to satisfy existing or anticipated sales of natural gas to its counterparties and/or to create additional value, as described above. During fiscal 2017 and 2016, Energy Services managed and sold 521.6 Bcf and 551.1 Bcf of natural gas, respectively. In addition, as of September 30, 2017 and 2016, Energy Services had 53.9 Bcf or $122.9 million of gas in storage and 62 Bcf or $130.5 million of gas in storage, respectively.

Weather/Seasonality

Energy Services activities are typically seasonal in nature as a result of changes in the supply and demand for natural gas. Demand for natural gas is generally higher during the winter months when there may also be supply constraints; however, during periods of milder temperatures, demand can decrease. In addition, demand for natural gas can also be high during periods of extreme heat in the summer months, resulting from the need for additional natural gas supply for gas-fired electric generation facilities. Accordingly, Energy Services can be subject to variations in earnings and working capital throughout the year as a result of changes in weather.

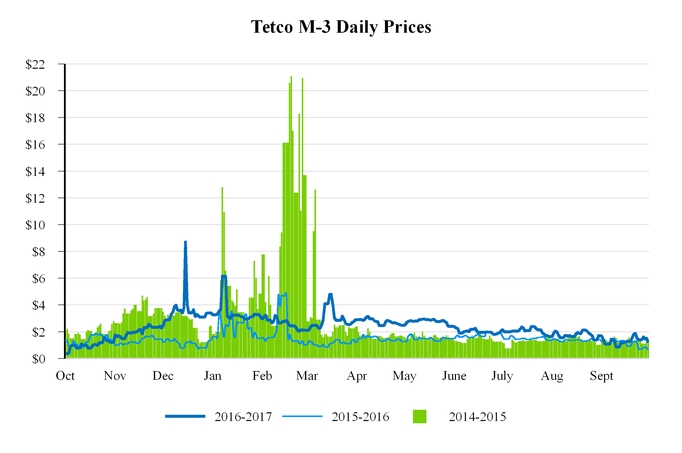

Volatility

Energy Services’ activities are also subject to price volatility or supply/demand dynamics within its wholesale markets, including in the Northeastern, Appalachian, West Coast and Mid-Continent regions. Changes in natural gas supply can affect capacity values and Energy Services’ financial margin, described below, that is generated from the optimization of transportation and storage assets. With its focus on risk management, Energy Services continues to diversify its revenue stream by identifying new growth opportunities in producer and asset management services. Energy Services has added new counterparties and strategic storage and transportation assets to its portfolio, which currently includes an average of approximately 44.6 Bcf of firm storage and 1.1 Bcf/day of firm transportation capacity. Energy Services continues to expand its geographic footprint.

Financial Margin

To economically hedge the commodity price risk associated with its existing and anticipated commitments for the purchase and sale of natural gas, Energy Services enters into a variety of derivative instruments including, but not limited to, futures contracts, physical forward contracts, financial swaps and options. These derivative instruments are accounted for at fair value with changes in fair value recognized in earnings as they occur. Energy Services views “financial margin” as a key internal financial metric. Energy Services’ financial margin, which is a non-GAAP financial measure, represents revenues earned from the sale of natural gas less costs of natural gas sold including any storage and transportation costs, and excluding any accounting impact from changes in the fair value of certain derivative instruments. For additional information regarding financial margin, see Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations - Energy Services Segment.

Risk Management

In conducting its business, Energy Services mitigates risk by following formal risk management guidelines, including transaction limits, segregation of duties and formal contract and credit review approval processes. Energy Services continuously monitors and seeks to reduce the risk associated with its counterparty credit exposures. The Risk Management Committee of the Company oversees compliance with these established guidelines.

Midstream

Our Midstream segment includes investments in FERC-regulated interstate natural gas transportation and storage assets and is comprised of the following subsidiaries:

• | NJR Steckman Ridge Storage Company, which holds the Company’s 50 percent equity investment in Steckman Ridge. Steckman Ridge is a Delaware limited partnership, jointly owned and controlled by subsidiaries of the Company and subsidiaries of Enbridge Inc., that built, owns and operates a natural gas storage facility with up to 12 Bcf of working gas capacity in Bedford County, Pennsylvania. The facility has direct access to the Texas Eastern and Dominion Transmission pipelines and has access to the Northeast and Mid-Atlantic markets; |

• | NJR Pipeline Company, which consists of a 20 percent equity investment in PennEast. PennEast is expected to construct a 120-mile FERC-regulated interstate natural gas pipeline system that will extend from northern Pennsylvania to western New Jersey and is estimated to be completed and operational in 2019; and |

Page 12

New Jersey Resources Corporation

Part I

ITEM 1. BUSINESS (Continued)

• | NJR Midstream Holdings Corporation, which, through its subsidiary NJNR Pipeline Company, holds approximately 1.84 million DM Common Units. |

OTHER BUSINESS OPERATIONS

Home Services and Other

Home Services and Other operations consist primarily of the following unregulated affiliates:

• | NJRHS, which provides heating, ventilation and cooling service, sales and installation of appliances to approximately 112,000 service contract customers, as well as installation of solar equipment; |

• | NJRPS, which provides plumbing repair and installation services; |

• | CR&R, which holds commercial real estate; |

• | NJR Energy, which was dissolved on November 28, 2016, invested in energy-related ventures; and |

• | NJR Service Corporation, which provides shared administrative and financial services to the Company and all of its subsidiaries. |

ENVIRONMENT

We along with our subsidiaries are subject to legislation and regulation by federal, state and local authorities with respect to environmental matters. We believe that we are, in all material respects, in compliance with all applicable environmental laws and regulations.

NJNG is responsible for the environmental remediation of five MGP sites, which contain contaminated residues from former gas manufacturing operations that ceased at these sites by the mid-1950s and, in some cases, had been discontinued many years earlier. NJNG periodically, and at least annually, performs an environmental review of the MGP sites, including a review of potential estimated liabilities related to the investigation and remedial action on these sites. Based on this review, NJNG estimated that the total future expenditures to remediate and monitor the MGP sites for which it is responsible will range from approximately $117.6 million to $205.2 million.

NJNG’s estimate of these liabilities is based upon known and measurable facts, existing technology and enacted laws and regulations in place when the review was completed in fiscal 2017. Where it is probable that costs will be incurred, and the information is sufficient to establish a range of possible liability, NJNG accrues the most likely amount in the range. If no point within the range is more likely than the other, it is NJNG’s policy to accrue the lower end of the range. As of September 30, 2017, NJNG recorded an MGP remediation liability and a corresponding regulatory asset of $149 million on the Consolidated Balance Sheets, which represents its most likely possible liability and recoverable regulatory asset; however, actual costs may differ from these estimates. NJNG currently recovers approximately $9.4 million annually through its SBC RAC. NJNG will continue to seek recovery of these costs through its remediation rider. On November 17, 2017, NJNG filed it's annual SBC application requesting a reduction in the RAC, which will decrease the annual recovery to $7 million, effective April 1, 2018.

EMPLOYEE RELATIONS

As of September 30, 2017, the Company and its subsidiaries employed 1,052 employees compared with 1,034 employees as of September 30, 2016. Of the total number of employees, NJNG had 444 and 441 and NJRHS had 104 and 106 Union or “Represented” employees as of September 30, 2017 and 2016, respectively. NJNG and NJRHS have collective bargaining agreements with the Union, which is affiliated with the American Federation of Labor and Congress of Industrial Organizations, that expire in December 2018 and April 2019, respectively. The labor agreements cover wage increases and other benefits, including the defined benefit pension (which was closed to all employees hired on or after January 1, 2012, with the exception of certain rehires who are eligible to resume active participation), the postemployment benefit plan (which was closed to all employees hired on or after January 1, 2012) and the enhanced 401(k) retirement savings plan. The Company considers its relationship with employees, including those covered by collective bargaining agreements, to be in good standing.

Page 13

New Jersey Resources Corporation

Part I

ITEM 1. BUSINESS (Continued)

AVAILABLE INFORMATION AND CORPORATE GOVERNANCE DOCUMENTS

The following reports and any amendments to those reports are available free of charge on our website at http://njr360.client.shareholder.com/sec.cfm as soon as reasonably possible after filing or furnishing them with the SEC:

• | Annual reports on Form 10-K; |

• | Quarterly reports on Form 10-Q; and |

• | Current reports on Form 8-K. |

The following documents are available free of charge on our website (http://njr360.client.shareholder.com/governance.cfm):

• | Bylaws; |

• | Corporate Governance Guidelines; |

• | Wholesale Trading Code of Conduct; |

• | NJR Code of Conduct; |

• | Charters of the following Board of Directors Committees: Audit, Leadership Development and Compensation and Nominating/Corporate Governance; |

• | Audit Complaint Procedure; |

• | Communicating with Non-Management Directors Procedure; and |

• | Statement of Policy with Respect to Related Person Transactions. |

In Part III of this Form 10-K, we incorporate certain information by reference from our Proxy Statement for our 2018 Annual Meeting of Shareowners. We expect to file that Proxy Statement with the SEC on or about December 14, 2017. We will make it available on our website as soon as reasonably possible following that filing date. Please refer to the Proxy Statement when it is available.

A printed copy of each document is available free of charge to any shareowner who requests it by contacting the Corporate Secretary at New Jersey Resources Corporation, 1415 Wyckoff Road, Wall, New Jersey 07719.

ITEM 1A. RISK FACTORS

When considering any investment in our securities, investors should consider the following risk factors, as well as the information contained under the caption “Information Concerning Forward-Looking Statements,” in analyzing our present and future business performance. While this list is not exhaustive, management also places no priority or likelihood based on their descriptions or order of presentation. Unless indicated otherwise or the content requires otherwise, references below to “we,” “us,” and “our” should be read to refer to the Company and its subsidiaries.

Our investments in clean energy projects are subject to substantial risks and competition.

Commercial and residential solar energy projects and onshore wind projects, such as those in which we invest, are dependent upon current regulatory and tax incentives and there is uncertainty about the extent to which such incentives will be available in the future. The potential return on investment of these solar projects is based substantially on our eligibility for ITCs and the future market for SRECs that are traded in a competitive marketplace in the State of New Jersey. As a result, these projects face the risk that the current regulatory regimes and tax laws may expire or be adversely modified during the life of the projects. Furthermore, a sustained decrease in the value of SRECs would negatively impact the return on investment of solar projects. Legislative changes or declines in the price of SRECs could also lead to an impairment of solar project assets. The market for such projects is also limited, which creates competition for customers and higher investment costs and could potentially result in lost investment opportunities.

Page 14

New Jersey Resources Corporation

Part I

ITEM 1A. RISK FACTORS (Continued)

In addition, there are risks associated with our ability to develop and manage such projects profitably, including logistical risks and potential delays related to construction, permitting, regulatory approvals (including any approvals by the BPU required pursuant to recently enacted solar energy legislation in the State of New Jersey) and electric grid interconnection, as well as the operational risk that the projects in service will not perform according to expectations due to equipment failure, suboptimal weather conditions or other economic factors beyond our control. All of the aforementioned risks could reduce the availability of viable solar energy projects for development. Furthermore, at the development or acquisition stage, our ability to predict actual performance results may be hindered and the projects may not perform as predicted.

We may be unable to obtain governmental approvals, property rights and/or financing for the construction, development and operation of our proposed energy investments and projects in a timely manner or at all.

Construction, development and operation of energy investments, such as natural gas storage facilities, NJNG infrastructure improvements, such as SRL and NJ RISE, pipeline transportation systems, such as PennEast and IEC, solar energy projects and onshore wind projects are subject to federal and state regulatory oversight and require certain property rights, such as easements and rights-of-way from public and private property owners, as well as regulatory approvals, including environmental and other permits and licenses for such facilities and systems. We or our joint venture partnerships may be unable to obtain, in a cost-efficient or timely manner, all such needed property rights, permits and licenses to successfully construct and develop our energy facilities and systems. Successful financing of our energy investments requires participation by willing financial institutions and lenders, as well as acquisition of capital at favorable interest rates. If we do not obtain the necessary regulatory approvals, property rights and financing, our equity investments could be impaired. Such impairment could have a materially adverse effect on our financial condition, results of operations and cash flows.

Uncertainties associated with our planned acquisition of IEC could adversely affect our business, results of operations, financial condition and cash flows. Furthermore, any acquisitions that we undertake might involve risks and uncertainties. We may not realize the anticipated synergies, cost savings and growth opportunities as a result of these transactions.

In October 2017, we announced the entry into an agreement to purchase IEC, whose principle operations relate to the operation and maintenance of an oil and natural gas transmission pipeline extending approximately 90 miles into eastern Pennsylvania. As part of the acquisition we expect to convert the remaining sections of the southern mainline of the pipeline utilized to transport oil to transport natural gas. The completion of the acquisition is subject to various closing conditions, including, but not limited to, receipt of necessary permits and regulatory actions, such as those from the FERC and the Pennsylvania Public Utility Commission, and other pending regulatory determinations, such as compliance with anti-trust laws. There can be no assurance that we will receive the necessary approvals for the transaction or receive them within the expected timeframe. The announcement and pendency of the IEC acquisition, as well as any delays in the expected timeframe, could cause disruption and create uncertainties, which could have an adverse effect on our business, results of operations and financial condition, regardless of whether the acquisition is completed.

Furthermore, the integration of any acquisition requires significant time and resources, which could result in significant ongoing operating expenses and may divert resources and management attention from other areas of our business. If we fail to successfully integrate assets and liabilities through the entities which we acquire, we may not realize the benefits expected from the transaction and, as a result, the fair value of assets acquired could be impaired and could have a material impact on our financial condition and results of operations.

The benefits that we expect to achieve from acquisitions will depend, in part, on our ability to realize anticipated growth opportunities and other synergies with our existing businesses. The success of these transactions will depend on our ability to integrate these transactions within our existing businesses timely and seamlessly. We may experience challenges when combining separate business cultures, information technology systems and employees. Even if we are able to complete the integration successfully, we may not fully realize all of the growth opportunities, cost savings and other synergies that we expect.

Major changes in the supply and price of natural gas may affect financial results.

While NJNG expects to meet the demand for natural gas from its customers for the foreseeable future, factors impacting suppliers and other third parties, including increased competition, further deregulation, transportation costs, possible climate change legislation, transportation availability and drilling for new natural gas resources, may impact the supply and price of natural gas. NJNG actively hedges against the fluctuation in the price of natural gas by entering into forward and financial contracts with third parties. Should these third parties fail to perform and regulators not allow the pass-through of expended funds to customers, it may result in a loss that could have a material impact on our financial condition, results of operations and cash flows.

Page 15

New Jersey Resources Corporation

Part I

ITEM 1A. RISK FACTORS (Continued)

Significant regulatory assets recorded by NJNG could be disallowed for recovery from customers in the future.

NJNG records regulatory assets on its financial statements to reflect the ratemaking and regulatory decision-making authority of the BPU as allowed by GAAP. The creation of a regulatory asset allows for the deferral of costs, which, absent a mechanism to recover such costs from customers in rates approved by the BPU, would be charged to expense on its income statement in the period incurred. Primary regulatory assets that are subject to BPU approval include the recovery of BGSS and USF costs, remediation costs associated with NJNG's MGP sites, CIP, NJCEP, economic stimulus plans, certain deferred income tax and pension and other postemployment benefit plans. If there were to be a change in regulatory positions surrounding the collection of these deferred costs there could be a material impact on NJNG’s financial condition, results of operations and cash flows.

NJR is a holding company and depends on its operating subsidiaries to meet its financial obligations.

NJR is a holding company with no significant assets other than possible cash investments and the stock of its operating subsidiaries. We rely exclusively on dividends from our subsidiaries, on intercompany loans from our unregulated subsidiaries, and on the repayments of principal and interest from intercompany loans and reimbursement of expenses from our subsidiaries for our cash flows. Our ability to pay dividends on our common stock and to pay principal and interest on our outstanding debt depends on the payment of dividends to us by our subsidiaries or the repayment of loans to us by our subsidiaries. The extent to which our subsidiaries are unable to pay dividends or repay funds to us may adversely affect our ability to pay dividends to holders of our common stock and principal and interest to holders of our debt.

NJNG’s regulated operations are subject to certain operating risks incidental to handling, storing, transporting and providing customers with natural gas.

NJNG’s regulated operations are subject to all operating hazards and risks incidental to handling, storing, transporting and providing customers with natural gas, including its NGV refueling stations and LNG facilities. These risks include explosions, pollution, release of toxic substances, fires, storms, safety issues and other adverse weather conditions and hazards, each of which could result in damage to or destruction of facilities or damage to persons and property. NJNG could suffer substantial losses should any of these events occur. Moreover, as a result, NJNG has been, and likely will be, a defendant in legal proceedings and litigation arising in the ordinary course of business. Although NJNG maintains insurance coverage, insurance may not be sufficient to cover all material expenses related to these risks.

NJNG and Energy Services rely on storage, transportation assets and suppliers, which they do not own or control, to deliver natural gas.

NJNG and Energy Services depend on natural gas pipelines and other storage and transportation facilities owned and operated by third parties to deliver natural gas to wholesale and retail markets and to provide retail energy services to customers. Their ability to provide natural gas for their present and projected sales will depend upon their suppliers’ ability to obtain and deliver additional supplies of natural gas, as well as NJNG’s ability to acquire supplies directly from new sources. Factors beyond the control of NJNG, its suppliers and the independent suppliers that have obligations to provide natural gas to certain NJNG customers, may affect NJNG’s ability to deliver such supplies. These factors include other parties’ control over the drilling of new wells and the facilities to transport natural gas to NJNG’s citygate stations, competition for the acquisition of natural gas, priority allocations, impact of severe weather disruptions to natural gas supplies, the regulatory and pricing policies of federal and state regulatory agencies, as well as the availability of Canadian reserves for export to the United States. Energy deregulation legislation may increase competition among natural gas utilities and impact the quantities of natural gas requirements needed for sales service. Energy Services also relies on a firm supply source to meet its energy management obligations to its customers. If supply, transportation or storage is disrupted, including for reasons of force majeure, the ability of NJNG and Energy Services to sell and deliver their products and services may be hindered. As a result, they may be responsible for damages incurred by their customers, such as the additional cost of acquiring alternative supply at then-current market rates. Particularly for Energy Services, these conditions could have a material impact on our financial condition, results of operations and cash flows.

Risks related to the regulation of NJNG could affect the rates it is able to charge, its costs and its profitability.

NJNG is subject to regulation by federal, state and local authorities. These authorities regulate many aspects of NJNG’s distribution and transmission operations, including construction and maintenance of facilities, operations, safety, tariff rates that NJNG can charge customers, rates of return, the authorized cost of capital, recovery of pipeline replacement, environmental remediation costs and relationships with its affiliates. NJNG’s ability to obtain rate increases, including base rate increases, extend

Page 16

New Jersey Resources Corporation

Part I

ITEM 1A. RISK FACTORS (Continued)

its BGSS incentive and CIP programs and maintain its currently authorized rates of return may be impacted by events, including regulatory or legislative actions. There can be no assurance that NJNG will be able to obtain rate increases and continue its BGSS incentive, CIP, RAC and SAVEGREEN programs or continue the opportunity to earn its currently authorized rates of return.

A change in our effective tax rate as a result of a failure to qualify for ITCs and PTCs or being delayed in qualifying for ITCs due to delays or failures to complete planned solar energy projects and wind projects within the safe harbor period may have a material impact on our earnings.

GAAP requires that we apply an effective tax rate to interim periods that is consistent with our estimated annual effective tax rate. As a result, we project quarterly the annual effective tax rate and then adjust the tax expense recorded in that quarter to reflect the projected annual effective tax rate. The amount of the quarterly adjustment is based on information and assumptions, which are subject to change and may have a material impact on our quarterly and annual NFE. Factors we consider in estimating the probability of projects being completed during the fiscal year include, but are not limited to, Board of Directors approval, construction logistics, permitting, interconnection completion and execution of various contracts, including PPAs. If we fail to qualify for ITCs or are delayed in qualifying for some ITCs during the fiscal year due to delays or failures to complete planned solar energy projects as scheduled, our quarterly and annual net income and NFE may be materially impacted. This could have a material adverse impact on our financial condition, results of operations and cash flows.

For a wind facility to be considered a qualified facility for purposes of the PTCs, the construction of the facility must have begun prior to January 1, 2020, and placed in service before January 1, 2024. A taxpayer may establish that construction has begun by starting “physical work of a significant nature.” Only physical work of a significant nature on tangible personal property used as an integral part of the activity performed by the facility is considered for purposes of determining when construction begins. Alternatively, a taxpayer may establish that construction has begun by paying or incurring five percent of eligible project costs (the “five percent safe harbor”).

We are involved in legal or administrative proceedings before various courts and governmental bodies that could adversely affect our results of operations, cash flows and financial condition.

We are involved in legal or administrative proceedings before various courts and governmental bodies with respect to general claims, rates, taxes, environmental issues, gas cost prudence reviews and other matters. Adverse decisions regarding these matters, to the extent they require us to make payments in excess of amounts provided for in our financial statements or covered by insurance, could adversely affect our results of operations, cash flows and financial condition.

Cyberattacks or failure of information technology systems could adversely affect our business operations, financial condition and results of operations.

We continue to place greater reliance on technological tools that support our business operations and corporate functions, including tools that help us manage our natural gas distribution operations and infrastructure. The failure of, or security breaches related to, these technologies could materially adversely affect our business operations, our financial position, results of operations and cash flows.

We rely on information technology to manage our natural gas distribution and other corporate operations, maintain customer, employee, Company and vendor data, prepare our financial statements and perform other critical business processes. This technology may fail due to cyberattack, physical disruption, design and implementation defects or human error. Disruption or failure of business operations and information technology systems could harm our facilities or otherwise adversely impact our ability to safely deliver natural gas to our customers, serve our customers effectively or manage our assets. Additionally, an attack on, or failure of information technology systems, could result in the unauthorized release of customer, employee or other confidential or sensitive data. Any of the foregoing events could adversely affect our business reputation, diminish customer confidence, disrupt operations, subject us to financial liability or increased regulation, increase our costs and expose us to material legal claims and liability.

There is no guarantee that redundancies built into our networks and technology, or the procedures we have implemented to protect against cyberattack and other unauthorized access to secured data, are adequate to safeguard against all failures of technology or security breaches.

Page 17

New Jersey Resources Corporation

Part I

ITEM 1A. RISK FACTORS (Continued)

Credit rating downgrades could increase financing costs, limit access to the financial markets and negatively affect NJR and its subsidiaries.

Rating agencies Moody’s and S&P currently rate NJNG’s debt as investment grade. If such ratings are downgraded below investment grade, borrowing costs could increase, as will the costs of maintaining certain contractual relationships and obtaining future financing. Even if ratings are downgraded without falling below investment grade, NJR and NJNG could face increased borrowing costs under their current credit facilities. Our ability to borrow and costs of borrowing have a direct impact on our subsidiaries’ ability to execute their operating strategies, particularly in the case of NJNG, which relies heavily upon capital expenditures financed by its credit facility.