Attached files

| file | filename |

|---|---|

| EX-32.1 - EXHIBIT 32.1 - EZCORP INC | a2017-q410xkex321.htm |

| EX-31.2 - EXHIBIT 31.2 - EZCORP INC | a2017-q410xkex312.htm |

| EX-31.1 - EXHIBIT 31.1 - EZCORP INC | a2017-q410xkex311.htm |

| EX-23.1 - EXHIBIT 23.1 - EZCORP INC | a2017-q410xkex231.htm |

| EX-21.1 - EXHIBIT 21.1 - EZCORP INC | a2017-q410xkex211.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the Fiscal Year Ended September 30, 2017

or

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the transition period from to

Commission File No. 0-19424

EZCORP, INC.

Delaware | 74-2540145 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

2500 Bee Cave Road, Bldg One, Suite 200, Rollingwood, Texas | 78746 | |

(Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code: (512) 314-3400

Securities Registered Pursuant to Section 12(b) of the Act:

Securities Registered Pursuant to Section 12(g) of the Act: None

Title of Each Class | Name of Each Exchange on Which Registered | |

Class A Non-voting Common Stock, $.01 par value per share | The NASDAQ Stock Market | |

(NASDAQ Global Select Market) | ||

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No o

Indicate by check mark if disclosures of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | o | Accelerated filer | þ |

Non-accelerated filer | o | (Do not check if a smaller reporting company) | |

Smaller reporting company | o | ||

Emerging growth company | o | ||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No þ

The only class of voting securities of the registrant issued and outstanding is the Class B Voting Common Stock, par value $.01 per share, all of which is owned by a single stockholder. There is no trading market for the Class B Voting Common Stock. The aggregate market value of the Class A Non-Voting Common Stock held by non-affiliates of the registrant was $432 million, based on the closing price on the NASDAQ Stock Market on March 31, 2017.

As of November 10, 2017, 51,427,832 shares of the registrant’s Class A Non-Voting Common Stock, par value $.01 per share, and 2,970,171 shares of the registrant’s Class B Voting Common Stock, par value $.01 per share, were outstanding.

Documents incorporated by reference: None

EZCORP, INC.

YEAR ENDED SEPTEMBER 30, 2017

INDEX TO FORM 10-K

Item | Page |

No. | No. |

PART I

This report contains forward-looking statements that reflect our future plans, estimates, beliefs and expected performance. Our actual results may differ materially from those currently anticipated and expressed or implied by those forward-looking statements because of a number of risks and uncertainties, including those discussed under “Part I, Item 1A — Risk Factors.” We caution that assumptions, expectations, projections, intentions or beliefs about future events may, and often do, vary from actual results, and the differences can be material. See also “Part II, Item 7 — Management's Discussion and Analysis of Financial Condition and Results of Operations — Cautionary Statement Regarding Risks and Uncertainties That May Affect Future Results.”

Unless otherwise specified, references to the “company,” “we,” “our,” “us” and “EZCORP” refer to EZCORP, Inc. and its consolidated subsidiaries, collectively. References to a “fiscal” year refer to our fiscal year ended September 30 of the specified year. For example, “fiscal 2017” refers to the fiscal year ended September 30, 2017. All currency amounts preceded with “$” are stated in U.S. dollars, except otherwise indicated.

ITEM 1 — BUSINESS

Overview

EZCORP, Inc. is a Delaware corporation headquartered in Austin, Texas. We are a leading provider of pawn loans in the United States and Mexico with approximately 5,200 team members.

Our vision is to be the market leader in responsibly and respectfully meeting our customers’ desire for access to cash when they want it. That vision is supported by four key imperatives:

• | Market Leading Customer Satisfaction; |

• | Exceptional Staff Engagement; |

• | Attractive Shareholder Returns; and |

• | Most Efficient Provider of Cash. |

As of September 30, 2017, we operated a total of 786 locations, consisting of:

• | 513 United States pawn stores (operating primarily as EZPAWN or Value Pawn & Jewelry); |

• | 246 Mexico pawn stores (operating as Empeño Fácil); and |

• | 27 financial services stores in Canada (operating as CASHMAX). |

At our pawn stores, we offer pawn loans, which are non-recourse loans collateralized by tangible personal property, and sell merchandise to customers looking for good value. We are a market leader in growth of pawn loans outstanding. The merchandise we sell consists of second-hand collateral forfeited from our pawn lending activities or purchased from customers. The pawn industry in the U.S. is highly fragmented with up to an estimated 13,000 pawn stores. By store count, we are the second largest pawn store owner and operator in the U.S. On October 6, 2017, we acquired an additional 112 pawn stores located in Guatemala, El Salvador, Honduras and Peru and operated primarily under the trade names GuatePrenda and MaxiEfectivo (“GPMX”), bringing our total pawn store count to 871 (513 in the U.S. and 358 in Latin America).

In addition to our core pawn business in the U.S. and Latin America, we operate CASHMAX financial services locations in Canada and own approximately 32% of Cash Converters International Limited (“Cash Converters International”), based in Australia, which franchises and operates a worldwide network of nearly 700 locations that provide financial services and also buy and sell second-hand goods.

During fiscal 2016, we disposed of our 94%-owned subsidiary, Prestaciones Finmart, S.A.P.I. de C.V., SOFOM, E.N.R. ("Grupo Finmart"), and recast all results of its operations as discontinued operations. During fiscal 2015, we announced and implemented a plan to exit our U.S. Financial Services business (“USFS”), ceasing all payday, installment and auto title lending in the U.S and recast all results of USFS’s operations as discontinued operations. For additional information about our discontinued operations, see Note 16 of Notes to Consolidated Financial Statements included in “Part II, Item 8 — Financial Statements and Supplementary Data.”

3

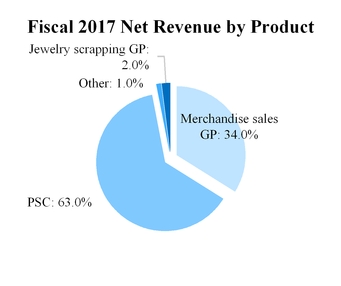

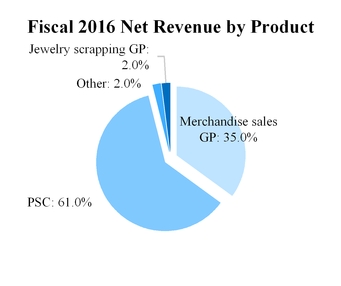

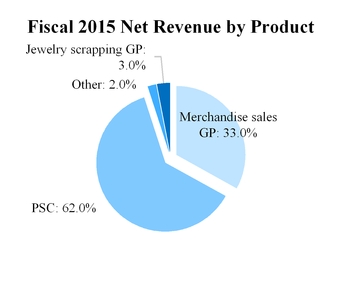

The company remains focused on growing our balance of pawn loans outstanding (“PLO”) and generating higher pawn service charges (“PSC”). The following charts present sources of net revenues, including merchandise sales gross profit (“Merchandise sales GP”), PSC and jewelry scrapping gross profit (“Jewelry scrapping GP”):

4

Segment and Geographic Information

Our business consists of three reportable segments: “U.S. Pawn,” which includes our EZPAWN, Value Pawn & Jewelry and other branded pawn operations in the United States; “Mexico Pawn,” which includes our Empeño Fácil pawn operations in Mexico; and “Other International,” which primarily includes our CASHMAX financial services operations in Canada and our equity interest in the net income of Cash Converters International. The following tables present store data by segments included in our continuing operations:

U.S. Pawn | Mexico Pawn | Other International | Consolidated | Franchises | ||||||||||

As of September 30, 2014 | 504 | 261 | 39 | 804 | 5 | |||||||||

New locations opened | 5 | 3 | — | 8 | — | |||||||||

Locations acquired | 25 | — | — | 25 | — | |||||||||

Locations sold, combined or closed | (12 | ) | (27 | ) | (12 | ) | (51 | ) | (4 | ) | ||||

As of September 30, 2015 | 522 | 237 | 27 | 786 | 1 | |||||||||

New locations opened | — | 3 | — | 3 | — | |||||||||

Locations acquired | 6 | — | — | 6 | — | |||||||||

Locations sold, combined or closed | (8 | ) | (1 | ) | — | (9 | ) | (1 | ) | |||||

As of September 30, 2016 | 520 | 239 | 27 | 786 | — | |||||||||

New locations opened | — | 10 | — | 10 | — | |||||||||

Locations acquired | 2 | — | — | 2 | — | |||||||||

Locations sold, combined or closed | (9 | ) | (3 | ) | — | (12 | ) | — | ||||||

As of September 30, 2017 | 513 | 246 | 27 | 786 | — | |||||||||

For additional information about our segments and geographic areas, see Note 15 of Notes to Consolidated Financial Statements included in “Part II, Item 8 — Financial Statements and Supplementary Data.”

Pawn Activities

At our pawn stores, we offer pawn loans, which are typically small, non-recourse loans collateralized by tangible personal property. As of September 30, 2017, we had a closing pawn loan principal balance of $169.2 million, from which we earn pawn service charges. In fiscal 2017, pawn service charges accounted for approximately 37% of our total revenues and 63% of our net revenues.

While allowable pawn service charges vary by state and loan size, our U.S. pawn loans primarily earn 13% to 25% per month as permitted by applicable law, excluding forfeitures. The total U.S. pawn loan term generally ranges between 30 and 90 days. Individual loans vary depending on the valuation of each item pawned, but our U.S. pawn loans made typically average approximately $100 to $120.

In Mexico, pawn loans earn 15% to 21% per month as permitted by applicable law, excluding forfeitures. The Mexico pawn loan primary term is 30 days. Individual loans are made in Mexican pesos and vary depending on the valuation of each item pawned, but our Mexico pawn loans typically average approximately 1,000 to 1,200 Mexican pesos, or approximately $50 to $60 using the average exchange rate for fiscal 2017.

Collateral for our pawn loans consists of tangible personal property, generally jewelry, consumer electronics, power tools, sporting goods and musical instruments, taking into account the estimated resale value of the collateral and the perceived probability of the loan’s redemption. We generally lend from 40% to 70% of the collateral’s estimated resale value depending on an evaluation of these factors, and may additionally offer to purchase the product outright. We consider general merchandise more susceptible to obsolescence while jewelry generally retains commodity value.

If a customer chooses not to repay, renew or extend a loan, the collateral is forfeited and becomes inventory available for sale. We do not record loan losses or charge-offs of pawn loans because the principal amount of an unpaid loan becomes the inventory carrying cost of the forfeited collateral. If the subsequent sale of the forfeited collateral is less than the loan value, this is reflected in gross margin.

5

The following table presents our pawn loan redemption rates by segment:

Fiscal Year Ended September 30, | ||||||||

2017 | 2016 | 2015 | ||||||

U.S. Pawn loan redemption rate* | 84 | % | 84 | % | 84 | % | ||

Mexico Pawn loan redemption rate* | 78 | % | 78 | % | 77 | % | ||

* | Our pawn loan redemption rate represents the percentage of loans made that are repaid, renewed or extended at a point in time as opposed to the life of the loan. |

Our ability to offer quality second-hand goods at prices significantly lower than original retail prices attracts value-conscious customers. The gross profit on sales of inventory depends primarily on our assessment of the loan or purchase value at the time the property is either accepted as loan collateral or purchased. As our inventory and sales involve gold and jewelry, our results can be heavily influenced by the market price of gold.

Customers may purchase a product protection plan that allows them to exchange certain general merchandise (non-jewelry) sold through our retail pawn operations within six months of purchase. We also offer a jewelry VIP package, which guarantees customers a minimum future pawn loan amount on the item sold, allows them full credit if they trade in the item to purchase a more expensive piece of jewelry, and provides minor repair service on the item sold. Customers may also purchase an item on layaway by paying a minimum layaway deposit of typically 10% of the item’s sale price. We hold the item for a 90 to 180-day period, during which the customer is required to pay the balance of the sales price.

Other

We also operate 27 financial services stores in Canada under the CASHMAX brand, all located in the Ontario province. These small footprint locations currently offer payday loan services. We expect to offer installment loans in these stores beginning in the second quarter of fiscal 2018.

Operations

Our pawn operations provide the optimum level of support to the store team, supplying coaching, mentoring and problem solving to identify opportunities to better serve our customers and position us to be the leader in customer service and satisfaction.

Our risk management structure comprises asset protection and compliance departments, which monitor the inventory system, lending practices, regulatory compliance and compliance with our policies and procedures. We perform full physical audits of active inventory at each store at least annually. Inventory counts are completed daily for jewelry and firearms, and targeted high risk inventory categories are cycle counted multiple times annually. We record shrink adjustments for known losses at the conclusion of each inventory count, as estimates during interim periods and as discovered during cycle counts.

Our success is dependent upon our team members’ ability to provide prompt and courteous customer service and to execute our operating procedures and standards. To achieve our long-range people goals, we offer management and technical skills training utilizing computer-based training modules that can be accessed at the store and district levels. It is mandatory that all field and corporate team members complete specific compliance training annually. We offer formalized management development training to specific executives to enhance their management capabilities and effectiveness and to enhance their career progression. We maintain a group of field trainers who travel to stores to provide hands-on training in high skill areas, such as jewelry evaluation, firearms handling and information technology. Generally, we expect that store team members, including managers, will meet certain competency criteria prior to hire or promotion and participate in on-going training classes and formal instructional programs. Our store level and management training programs are designed to develop and advance our employees and provides training for the efficient integration of experienced managers and team members from outside the company.

Growth and Expansion

We plan to expand the number of locations we operate through opening new (“de novo”) locations and through acquisitions. We believe there are growth opportunities with de novo stores in Latin America and pawn store acquisitions in both Latin America and in the U.S. Our ability to add new stores is dependent on several variables, such as the availability of acceptable sites or acquisition candidates, the regulatory environment, local zoning ordinances, access to capital, availability of qualified personnel and projected financial results meeting our investment hurdles. As previously discussed, on October 6, 2017 we acquired 112 pawn stores located in Guatemala, El Salvador, Honduras and Peru.

6

For information about our acquisitions, see Note 2 of Notes to Consolidated Financial Statements included in “Part II, Item 8 — Financial Statements and Supplementary Data.”

Ongoing Enhancements in Store Profitability

In addition to growth and expansion through de novo stores and acquisitions, we review on an ongoing basis the profitability opportunities of our existing stores. We believe our employee training programs, proprietary IT systems and processes provide a platform for future expansion of existing store profitability. We commenced rollout of our upgraded point of sale system in the second quarter of fiscal 2017 in addition to a store refreshment program in the third quarter of fiscal 2017. The upgraded point of sale system will deliver improved customer experience and increased productivity, leveraging the use of IT systems to make better lending decisions and improving new employee learning curves and onboarding of new store employees. Additionally, we continue to invest in analytics of customer behavior and product data to further drive profitability.

Seasonality and Quarterly Results

Historically, pawn service charges are highest in our fourth fiscal quarter (July through September) due to a higher average loan balance during the summer lending season. Loan balances are generally lower in our second fiscal quarter (January through March). Merchandise sales are highest in our first and second fiscal quarters (October through March) due to the holiday season, jewelry sales surrounding Valentine’s Day and the availability of tax refunds in the United States. As a net effect of these factors, our earnings generally are lowest during our third fiscal quarter (April through June).

Competition

We encounter significant competition in connection with all of our activities. These competitive conditions may have an impact on our revenues, profitability and ability to expand. We compete with other pawn stores, credit service organizations, banks, credit unions and other financial institutions, such as consumer finance companies. We believe that the primary elements of competition are the quality of customer service and relationship management including understanding our customers’ needs better than anyone else, convenience, store location and a customer friendly environment. In addition, we believe the ability to compete effectively will be based increasingly on strong general management, regional focus, automated management information systems, access to capital and superior customer service.

Our competitors for merchandise sales include numerous retail and wholesale stores, such as jewelry stores, discount retail stores, consumer electronics stores, other pawn stores, other resale stores, electronic commerce retailers and auction sites. Competitive factors in our retail operations include the ability to provide the customer with a variety of merchandise at an exceptional value coupled with exceptional customer service and convenient locations.

The pawn industry in the United States is large and highly fragmented. The industry consists of pawn stores owned primarily by independent operators who own one to three locations, and the industry is relatively mature. We are the second largest of two public operators of pawn stores in the United States.

The pawn industry in Latin America is also fragmented, but less so than in the United States. The industry consists of pawn stores owned by independent operators and chains, including some not-for-profit organizations. The pawn industry, particularly full-line stores offering general merchandise and jewelry loans and resale, remains in an expansion stage in Latin America.

Trademarks and Trade Names

We operate our U.S. pawn stores principally under the names “EZPAWN” or “Value Pawn” and the Mexico pawn stores under the name “EMPEÑO FÁCIL.” Our financial services stores in Canada operate under the name “CASHMAX.” We have registered with the United States Patent and Trademark Office the names EZPAWN and EZCORP, among others. We hold a trademark in Mexico for the name “EMPEÑO FÁCIL.” On October 6, 2017, we acquired 112 pawn stores located in Guatemala, El Salvador, Honduras and Peru. These entities operate under the registered trade names “GuatePrenda” in Guatemala and “MaxiEfectivo” in El Salvador, Honduras and Peru.

7

Regulation

Compliance with federal, state and local laws and regulations is an integral part of how we manage our business, and we conduct our business in material compliance with all of these rules. The following is a general description of significant regulations affecting our business. For a geographic breakdown of our operating locations, see “Part I, Item 2 — Properties.”

U.S. Regulations

Pawn Regulations — Our pawn stores are regulated by the states in which they are located and, in some cases, by individual municipalities or other local authorities. The applicable statutes, ordinances and regulations vary from location to location and typically impose licensing requirements for pawn stores or individual pawn store employees. Licensing requirements typically relate to financial responsibility and character, and may establish restrictions on where pawn stores can operate. Additional rules regulate various aspects of the day-to-day pawn operations, including the pawn service charges that a pawn store may charge, the maximum amount of a pawn loan, the minimum or maximum term of a pawn loan, the content and format of the pawn ticket and the length of time after a loan default that a pawn store must hold a pawned item before it can be offered for sale. Failure to observe applicable regulations could result in a revocation or suspension of pawn licenses, the imposition of fines or requirements to refund service charges and fees, and other civil or criminal penalties. We must also comply with various federal requirements regarding the disclosure of the annual percentage rate, finance charge, amount financed, total of payments and payment schedule related to each pawn loan transaction. Additional federal regulations applicable to our pawn lending business are described in “Other Regulations” below.

The majority of our pawn stores, voluntarily or pursuant to applicable laws, provide periodic (generally daily) reports to local law enforcement agencies. These reports provide local law enforcement with information about the items received from customers (whether through pawn or purchase), including a detailed description of the goods involved and the name and address of the customer. If we accept as collateral or purchase merchandise from a customer and it is determined that our customer was not the rightful owner, the merchandise is subject to recovery by the rightful owner and those losses are included in our shrinkage. Historically, we have not experienced a material number of claims of this nature.

Some of our pawn stores in the U.S. handle firearms and each of those stores maintains a federal firearms license as required by federal law. The federal Gun Control Act of 1968 and regulations issued by the Bureau of Alcohol, Tobacco, and Firearms also require each pawn store dealing in firearms to maintain a permanent written record of all receipts and dispositions of firearms. In addition, we must comply with the Brady Handgun Violence Prevention Act, which requires us to conduct a background check before releasing, selling or otherwise disposing of firearms.

Other Regulations — Our pawn lending activities are subject to other state and federal statutes and regulations, including the following:

• | We are subject to the federal Gramm-Leach-Bliley Act and its underlying regulations, as well as various state laws and regulations relating to privacy and data security. Under these regulations, we are required to disclose to our customers our policies and practices relating to the protection and sharing of customers’ nonpublic personal information. These regulations also require us to ensure that our systems are designed to protect the confidentiality of customers’ nonpublic personal information, and many of these regulations dictate certain actions that we must take to notify customers if their personal information is disclosed in an unauthorized manner. We are subject to the Fair Credit Reporting Act, which was enacted, in part, to address privacy concerns associated with the sharing of consumers’ financial information and credit history contained in consumer credit reports and limits our ability to share certain consumer report information. We are subject to the Federal Fair and Accurate Credit Transactions Act, which amended the Fair Credit Reporting Act, and requires us to adopt written guidance and procedures for detecting, preventing and mitigating identity theft, and to adopt various policies and procedures (including employee training) that address and aid in detecting and responding to suspicious activity or identify theft “red flags.” |

• | Under the USA PATRIOT Act, we must maintain an anti-money laundering compliance program that includes the development of internal policies, procedures and controls; the designation of a compliance officer; an ongoing employee training program; and an independent audit function to test the program. |

• | We are subject to the Bank Secrecy Act and its underlying regulations, which require us to report and maintain records of certain high-dollar transactions. In addition, federal laws and regulations prohibit us from doing business with terrorists and require us to report certain suspicious transactions to the Financial Crimes Enforcement Network of the Treasury Department (“FinCen”). Generally, a transaction is considered to be suspicious if we know, suspect or have reason to suspect that the transaction (a) involves funds derived from illegal activity or is intended to hide or disguise such funds, (b) is designed to evade the requirements of the Bank Secrecy Act or (c) appears to serve no legitimate business or lawful purpose. |

8

• | The Foreign Corrupt Practices Act ("FCPA") was enacted for the purpose of making it unlawful for certain classes of persons and entities to make payments to foreign government officials to assist in obtaining or retaining business. Specifically, the anti-bribery provisions of the FCPA prohibit the willful use of mail or any means of instrumentality of interstate commerce corruptly in furtherance of any offer, payment, promise to pay, or authorization of the payment of money or anything of value to any person, while knowing that all or a portion of such money or thing of value will be offered, given or promised, directly or indirectly, to a foreign official to influence the foreign official in his or her official capacity, induce the foreign official to do or omit to do an act in violation of his or her lawful duty, or to secure any improper advantage in order to assist in obtaining or retaining business for or with, or directing business to, any person. |

• | Effective October 2016, Department of Defense regulations promulgated under the Military Lending Act (the “MLA”), formerly applicable to payday loans and auto title loans, were expanded to include various additional forms of consumer credit, including pawn loans. The MLA regulations limit the annual percentage rate charged on consumer loans made to active military personnel or their dependents to 36%. |

Mexico Regulations

Pawn Regulations — Federal law in Mexico provides for administrative regulation of the pawnshop industry by Procuraduría Federal del Consumidor (PROFECO), Mexico’s primary federal consumer protection agency. PROFECO regulates the form and terms of pawn loan contracts (but not interest or service charge rates) and defines certain operating standards and procedures for pawnshops, including retail operations, and establishes registration, disclosure, bonding and reporting requirements. There are significant fines and sanctions, including operating suspensions, for failure to comply with PROFECO’s rules and regulations.

PROFECO requires that we report certain transactions (or series of transactions) that exceed certain monetary limits. Anti-money laundering regulations restrict the use of cash in certain transactions. Relevant aspects of the law specifically affecting the pawn industry include monthly reporting on “vulnerable activities,” which includes certain high-value pawn and precious metal transactions.

The Federal Personal Information Protection Law requires us to protect our customers’ personal information. Specifically, the law requires us to inform customers if we share customer personal information with third parties and to post (both online and in-store) our privacy policy.

Our pawn business in Mexico is also subject to regulation at the state and local level through state laws and local zoning and permitting ordinances. For example, some states require permits for pawn stores to operate, certification of employees as trained in the valuation of merchandise, and strict customer identification controls. State and local agencies often have authority to suspend store operations pending resolution of actual or alleged regulatory, licensing and permitting issues.

Other Regulations — Our pawn business in Mexico is subject to the General Law of Administrative Responsibility (“GLAR”), effective July 2017. GLAR establishes administrative penalties for improper payments to government officials, influence peddling (including the hiring of public officials and the use of undue influence) and other corrupt acts in public procurement processes.

We are also subject to The Federal Law for the Prevention and Identification of Transactions with Funds From Illegal Sources, which requires reporting of certain transactions exceeding certain monetary limits, maintenance of customer identification records and controls, and reporting of all non-Mexican customer transactions. This law affects all industries in Mexico and is intended to detect commercial activities arising from illicit or ill-gotten means through bilateral cooperation between Mexico’s Ministry of Finance and Public Credit and Mexico’s Attorney General’s Office. The law also restricts the use of cash in certain transactions associated with high-value assets and limits, to the extent possible, money laundering activities protected by the anonymity that cash transactions provide. Relevant aspects of the law specifically affecting the pawn industry include monthly reporting on “vulnerable activities,” which include pawn transactions exceeding 103,000 Mexican pesos and retail transactions of precious metals exceeding 52,000 Mexican pesos. Retail transactions of precious metals exceeding 207,000 Mexican pesos are prohibited. There are significant fines and sanctions for failure to comply with these rules.

In addition to the above, our pawn business in Mexico is subject to various general business regulations in the areas of tax compliance, customs, consumer protections, money laundering, public safety and employment matters, among others, by various federal, state and local governmental agencies.

9

Other Latin American Regulations

Similar to Mexico, certain federal, state and local governmental entities in Guatemala, El Salvador, Honduras and Peru also regulate pawn and retail businesses. Certain federal laws and local zoning and permitting ordinances require basic commercial business licenses and signage permits. Operating in these countries also subjects us to other types of regulations, including regulations related to financial reporting, data protection and privacy, tax compliance, labor and employment practices, real estate transactions, anti-money laundering, commercial and electronic banking restrictions, credit card transactions, marketing, advertising and other general business activities. As the scope of our international operations increases, we may face additional administrative and regulatory costs in managing our business. In addition, unexpected changes, arbitrary or adverse court decisions, administrative interpretations of federal or local requirements or legislation, or public remarks by elected officials could negatively affect our operations and profitability.

Available Information

We maintain an Internet website at www.ezcorp.com. All of our reports filed with the Securities and Exchange Commission (the “SEC”), including annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and Section 16 filings, are accessible, free of charge, through the Investor Relations section of our website as soon as reasonably practicable after electronic filing. The public may read and copy any materials that we file with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Room 1580, Washington, D.C. 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC at www.sec.gov. Information on our website is not incorporated by reference into this report.

ITEM 1A — RISK FACTORS

There are many risks and uncertainties that may affect our operations, performance, development and results. Many of these risks are beyond our control. The following is a description of the important risk factors that may affect our business. If any of these risks were to actually occur, our business, financial condition or results of operations could be materially adversely affected. Additional risks and uncertainties not currently known to us or that we currently consider to be immaterial may also materially adversely affect our business, financial condition or results of operations.

Changes in, or failure to comply with, laws and regulations affecting our products and services could have a material adverse effect on our operations and financial performance.

Our products and services are subject to regulation under various laws and regulations in each country and jurisdiction in which we operate (see “Part I, Item 1 — Business — Regulation”), and adverse legislation or regulations could be adopted in any such country or jurisdiction. If such legislation or regulation is adopted in any particular jurisdiction, we generally evaluate our business in the context of the new rules and determine whether we can continue to operate in that jurisdiction with new or modified products or whether it is feasible to enhance our business with additional product offerings. In any case, if we are unable to continue to operate profitably under the new rules, we may decide to close or consolidate stores, resulting in decreased revenues, earnings and assets. Further, our failure to comply with applicable laws and regulations could result in fines, penalties or orders to cease or suspend operations, which could have a material adverse effect on our results of operations.

A significant portion of our U.S. business is concentrated in Texas and Florida.

As of September 30, 2017, more than 60% of our U.S. pawn stores were located in Texas (42%) and Florida (19%), and those stores account for a significant portion of our revenues and profitability. The legislative, regulatory and general business environment in Texas and Florida has been relatively favorable for our pawn business activities, but a negative legislative or regulatory change in either of those states could have a material adverse effect on our overall operations and financial performance. Further, as discussed below, areas in Texas and Florida where we have significant operations are particularly susceptible to hurricane and tropical storm activity.

We have significant operations in Latin America, and changes in the business, regulatory, political or social climate could adversely affect our operations there, which could adversely affect our results of operations and growth plans.

We own and operate a significant number of pawn stores in Mexico and recently acquired an additional 112 stores located in other countries in Latin America (Guatemala, El Salvador, Honduras and Peru). Further, our growth plans include potential expansion in those countries as well as, potentially, other countries in Latin America. Doing business in those countries exposes us to risks related to political instability, corruption, economic volatility, drug cartel and gang-related violence, social unrest including riots and looting, tax and foreign investment policies, public safety and security, and uncertain application of laws

10

and regulations. Consequently, actions or events in any of those countries that are beyond our control could restrict our ability to operate there or otherwise adversely affect the profitability of those operations. Furthermore, changes in the business, regulatory or political climate in any of those countries, or significant fluctuations in currency exchange rates, could affect our ability to expand or continue our operations there, which could have a material adverse impact on our prospects, results of operations and cash flows. For a brief description of the current regulatory environment in the Latin American countries in which we currently operate, see “Mexico Regulations” and “Other Latin America Regulations” under “Part I, Item 1 — Business — Regulation.”

A significant or sudden decrease in gold values or the volume of gold transactions may have a material impact on our earnings and financial position.

Gold jewelry comprises a large portion of the collateral security for our pawn loans and our inventory. Pawn service charges, sales proceeds and our ability to liquidate excess jewelry inventory at an acceptable margin are dependent upon gold values and the volume of gold transactions. A decline in the availability of gold or our customers’ willingness or ability to sell us gold or use gold as collateral for pawn loans could impact our business. From 2012 through 2015, we experienced a significant softening of gold prices and volumes in the aggregate, which had a negative impact on our profitability. The impact on our financial position and results of operations of further decreases in gold values or volumes or a change in customer behavior cannot be reasonably estimated because the market and customer response to changes in gold values is not known; however, a significant decline in gold values or gold volumes could result in decreases in sales, sales margins and pawn service charges.

A significant change in foreign currency exchange rates could have a material adverse impact on our earnings and financial position.

We have foreign operations in Latin America (Mexico, Guatemala, El Salvador, Honduras and Peru) and Canada, and an equity investment in Australia. Our assets and investments in, and earnings and dividends from, each of these countries must be translated to U.S. dollars from their respective functional currencies. A significant weakening of any of these foreign currencies could result in lower assets and earnings in U.S. dollars, resulting in a potentially material adverse impact on our financial position, results of operations and cash flows.

Fluctuations in our sales, pawn loan balances, sales margins and pawn redemption rates could have a material adverse impact on our operating results.

We regularly experience fluctuations in a variety of operating metrics. Changes in any of these metrics, as might be caused by changes in the economic environment, competitive pressures, changes in customers’ tastes and preferences or a significant decrease in gold prices could materially and adversely affect our profitability and ability to achieve our planned results of operations.

Achievement of our growth objectives is dependent upon our ability to open and acquire new stores.

Our expansion strategy includes acquiring existing stores and opening de novo store locations. Our acquisition strategy is dependent upon the availability of attractive acquisition candidates, while the success of our de novo store strategy is contingent upon numerous factors that cannot be predicted or controlled, such as the availability of acceptable locations with a desirable customer base, the negotiation of acceptable lease terms, the ability to obtain required government permits and licenses and the existence of a suitable competitive environment. The achievement of our growth objectives is also subject to our ability to attract, train and retain qualified team members. Failure to achieve our expansion goals could adversely affect our prospects and future results of operations.

Our continued success is dependent on our ability to recruit, hire, retain and motivate talented executives and other key employees.

To remain competitive, sustain our success over the long-term and realize our strategic goals, we need to attract, hire, retain and motivate talented executives and other key employees to fill existing positions and reduce our succession risks. If our recruitment and retention programs (including compensation programs) are not viewed as competitive, or we fail to develop and implement appropriate succession plans for key executive positions, our results of operations, as well as our ability to achieve our long-term strategic goals, will be adversely affected.

11

We have exposure to Grupo Finmart through promissory notes that we received as part of our divestiture of that business in September 2016. The repayment of those promissory notes was restructured in September 2017. Our ability to recover the amounts owed under those promissory notes is heavily dependent on the success and performance of Grupo Finmart and its parent company, AlphaCredit.

In connection with the completion of the sale of Grupo Finmart to Alpha Holding, S.A. de C.V. (“AlphaCredit”) in September 2016, we received two “Parent Loan Notes” in the original principal amount of $60.2 million. We recently restructured the repayment arrangements with respect to such Parent Loan Notes. See “Part II, Item 7 — Management’s Discussion and Analysis of Financial Condition and Results of Operations — Liquidity and Capital Resources — Sources and Uses of Cash — Sale of Grupo Finmart.” Under the restructured arrangements, the total principal balance continues to be repayable over the original three-year term, but the payments have been shifted toward the later portions of that term. The payment restructuring was requested by AlphaCredit to accommodate their working capital requirements as they continue to grow their business.

Our ability to recover full payment of the Parent Loan Notes is dependent on the success and performance of the business of Grupo Finmart (as primary obligor) and its parent AlphaCredit (as guarantor). To the extent that Grupo Finmart and AlphaCredit are unable to repay these amounts, our financial performance and cash flows would be adversely affected. Prior to the payment restructuring, Grupo Finmart had already paid us $34 million that was owed to us in connection with the sale transaction.

If our assessment of and expectations concerning various factors affecting the collectability of the Parent Loan Notes change in the future, we may be required to record an allowance for losses or otherwise impair the carrying value of the Parent Loan Notes and associated accrued fees receivable, which could adversely affect our financial performance in the period of recordation or impairment. The Parent Loan Notes were recorded at fair value on the date of the sale of Grupo Finmart, which initially accounted for the risk of default, with an adjustment recorded in September 2017 upon the payment restructuring described above. See Note 5 of Notes to Consolidated Financial Statements included in “Part II, Item 8 — Financial Statements and Supplementary Data.”

Litigation and regulatory proceedings could have a material adverse impact on our business.

We are currently subject to various litigation and regulatory actions, including those described in Note 14 of Notes to Consolidated Financial Statements included in “Part II, Item 8 — Financial Statements and Supplementary Data,” and additional actions could arise in the future. Potential actions range from claims and assertions arising in the ordinary course of business (such as contract, customer or employment disputes) to more significant corporate-level matters or shareholder litigation. All of these matters are subject to inherent uncertainties, and unfavorable rulings could occur, which could include monetary damages, fines and penalties, or other relief. Any unfavorable ruling or outcome could have a material adverse effect on our results of operations or could negatively affect our reputation.

Under our certificate of incorporation, we are generally obligated to indemnify our directors and officers for costs and liabilities they incur in their capacity as directors or officers of the Company. Consequently, if a proceeding names or involves any of our directors or officers, then (subject to certain exceptions) we are generally obligated to pay or reimburse the cost or liability such director or officer incurs as a result of such proceeding (including defense costs, judgments and amounts paid in settlement). We maintain management liability insurance that protects us from much of this potential indemnification exposure, as well as potential costs or liabilities that may be directly incurred by the Company in some cases. However, our insurance coverage is subject to deductibles, and there may be elements of the costs or liabilities that are not covered under the insurance policies. In addition, to the extent that our ultimate liability in any such proceeding (or any combination of proceedings that are included in the same policy year) exceeds the management liability policy limits, our results of operations and financial condition could be adversely affected.

One person beneficially owns all of our voting stock and controls the outcome of all matters requiring a vote of stockholders, which may influence the value of our publicly-traded non-voting stock.

Phillip E. Cohen is the beneficial owner of all of our Class B Voting Common Stock. As a result of his equity ownership stake, Mr. Cohen controls the outcome of all issues requiring a vote of stockholders and has the ability to appoint or remove directors and officers who control our policies and operations. All of our publicly-traded stock is non-voting stock. Consequently, stockholders other than Mr. Cohen have no vote with respect to the election of directors or any other matter requiring a vote of stockholders except as required by law. This lack of voting rights may adversely affect the market value of our publicly-traded Class A Non-Voting Common Stock (“Class A Common Stock”).

12

Our acquisitions, investments and other transactions could disrupt our ongoing business and harm our results of operations.

In pursuing our business strategy, we routinely conduct discussions, evaluate opportunities and enter into agreements regarding possible acquisitions, investments and other transactions. These transactions may involve significant challenges and risks, including risks that we may not realize the expected return on an acquisition or investment, that we may not be able to retain key personnel of an acquired business, or that we may experience difficulty in integrating acquired businesses into our business systems and processes. If we do enter into agreements with respect to acquisitions, investments or other transactions, we may fail to complete them due to inability to obtain required regulatory or other approvals or other factors. Furthermore, acquisitions, investments and other transactions require substantial management resources and have the potential to divert our attention from our existing business. These factors could harm our business and results of operations.

We recently completed the acquisition of GPMX, a business that owns and operates 112 pawn stores in Latin America (Guatemala, El Salvador, Honduras and Peru). Our realization of the expected benefits of that acquisition will be dependent on our ability to timely and efficiently integrate the GPMX business into our operational and financial reporting systems and processes. Our ability to successfully integrate complex, multi-jurisdictional acquisitions is unproven. Our management has spent considerable time and resources in designing an integration plan and is in the early stages of implementing it. There can be no assurance, however, that we will be successful or that we will realize the expected return on the GPMX acquisition.

We have a significant firearms business in the U.S., which exposes us to increased risks of regulatory fines and penalties, lawsuits and related liabilities.

As discussed under “Part I, Item 1 — Business — Regulation — U.S. Regulations — Pawn Regulations,” some of our stores in the U.S. conduct pawn and retail transactions involving firearms, which may be associated with an increased risk of injury and related lawsuits. We may be subject to lawsuits relating to the improper use of firearms that we sell, including actions by persons attempting to recover damages from firearms retailers relating to misuse of firearms. We may also incur fines, penalties or liabilities, or have our federal firearms licenses revoked or suspended, if we fail to properly perform required background checks for, and otherwise record and report, firearms transactions. Any such actions could have a material adverse effect on our business, prospects, results of operations and financial condition.

Our business is subject to employee and third-party robberies, burglaries and other crimes at the store level.

The nature of our business requires us to maintain significant cash on hand, loan collateral and inventories in our stores. Consequently, we are subject to loss of cash or merchandise as a result of robberies, burglaries, thefts, riots, looting and other criminal activity in our stores. Further, we could be subject to liability to customers or other third parties as a result of such activities. While we maintain asset protection and monitoring programs to mitigate these risks, as well as insurance programs to protect against catastrophic loss or exposure, there can be no assurance that these crimes will not occur or that such losses will not have an adverse effect on our business or results of operations.

We may be exposed to liabilities under applicable anti-corruption, anti-money laundering and other general business laws and regulations, and any determination that we violated these laws or regulations could have a material adverse effect on our business.

We are subject to various anti-corruption laws that prohibit improper payments or offers of payments to foreign governments and their officials for the purpose of obtaining or retaining business, including the Foreign Corrupt Practices Act in the U.S. and the General Law of Administrative Responsibility in Mexico. We are also subject to various laws and regulations designed to prevent money laundering or the financial support of terrorism or other illegal activity, including the USA PATRIOT Act and the Bank Secrecy Act in the U.S. and The Federal Law for the Prevention and Identification of Transactions with Funds From Illegal Sources in Mexico. See “Part I, Item 1 — Business — Regulation.” Further, our business is expanding in countries and regions that are less developed and are generally recognized as potentially more corrupt business environments.

While we maintain controls and policies to ensure compliance with applicable laws and regulations, these controls and policies may prove to be less than effective. If employees, agents or other persons for whose conduct we are held responsible violate our policies, we may be subject to severe criminal or civil sanctions and penalties, and we may be subject to other liabilities that could have a material adverse effect on our business, results of operations and financial condition.

Changes in our liquidity and capital requirements or in access to capital markets or other financing sources could limit our ability to achieve our plans.

A significant reduction in cash flows from operations or the availability of debt or equity financing could materially and adversely affect our ability to achieve our planned growth and operating results. We have outstanding $195 million aggregate

13

principal amount of 2.125% Cash Convertible Senior Notes Due 2019 (the “2019 Convertible Notes”) and $143.75 million aggregate principal amount of 2.875% Convertible Senior Notes Due 2024 (the “2024 Convertible Notes” and, with the 2019 Convertible Notes, the “Convertible Notes”). Our ability to obtain additional debt or equity financing (including the possible refinancing of the 2019 Convertible Notes) will depend upon market conditions, our financial condition and the willingness of financing sources to make capital available to us at acceptable rates. The inability to access capital at acceptable rates and terms could restrict or limit our ability to achieve our growth objectives, which could adversely affect our financial condition and results of operations.

Changes in competition from various sources could have a material adverse impact on our ability to achieve our plans.

We encounter significant competition from other pawn stores, consumer lending companies and other retailers, many of which have significantly greater financial resources than we do. Increases in the number or size of competitors or other changes in competitive influences, such as aggressive marketing and pricing practices, could adversely affect our operations. In Mexico, we compete directly with certain pawn stores owned and operated by government affiliated or sponsored non-profit foundations, and the government could take actions that would harm our ability to compete in that market.

Our continued profitability and growth plans are dependent on our ability to successfully design or acquire, deploy and maintain information technology and other business systems to support our current business and our planned growth and expansion.

The success of our business depends on the efficiency and reliability of our information technology and business systems, including the point-of-sale system utilized in our store locations. If access to our technology infrastructure is impaired (as may occur with a computer virus, a cyber attack or other intentional disruption by a third party, natural disaster, telecommunications system failure, electrical system failure or lost connectivity), or if there are flaws in the design or roll-out of new or refreshed technology systems (such as our point-of-sale system), we may be unable to process transactions or otherwise carry on our business in a timely and efficient manner. An infrastructure disruption could damage our reputation and cause us to lose customers and revenue.

We collect and store a variety of sensitive customer information, and breaches in data security could harm our business operations and lead to reputational damage.

In the course of conducting our business, we collect and store on our information technology systems a variety of information about our customers, including sensitive personal identifying and financial information. We could be subject to fines, penalties and liabilities if any such information is misappropriated from our systems or we otherwise fail to maintain the security and confidentiality of such information. Further, any such data security breach could cause damage to our reputation and a loss of confidence in our data security measures, which could adversely affect our business and prospects.

We invested in Cash Converters International Limited for strategic reasons and we may not realize a return on our investment.

We currently have a significant investment in Cash Converters International Limited, which is a publicly-traded company based in Australia. We made this investment principally in November 2009, and may in the future make additional investments in this or other companies, to further our strategic objectives. The success of these strategic investments is dependent on a variety of factors, including the business performance of the companies in which we invest and the market’s assessment of that performance. If the business performance of Cash Converters International Limited suffers, then the value of our investment may decline. We wrote down a portion of our investment in Cash Converters International Limited during the fourth quarter of both fiscal 2016 and fiscal 2015. See Note 4 of Notes to Consolidated Financial Statements included in “Part II, Item 8 — Financial Statements and Supplemental Data.” If we determine that any future other-than-temporary declines in the fair value exist, we will be required to write down that investment to its fair value and recognize the related write-down as an investment loss. Any future realized investment loss would adversely affect our results of operations.

We may incur property, casualty or other losses, including losses related to natural disasters such as hurricanes and earthquakes. Not all of such losses will be covered by insurance.

We maintain a program of insurance coverage for various types of property, casualty and other risks. The types and amounts of insurance that we obtain vary from time to time, depending on availability, cost and our decisions with respect to risk retention. The policies are subject to deductibles and exclusions that result in our retention of a level of risk on a self-insurance basis. Losses not covered by insurance could be substantial and may increase our expenses, which could harm our results of operations and financial condition.

14

We have significant operations located in areas that are susceptible to hurricanes (notably the Atlantic and Gulf Coast regions of Florida, as well as the Gulf Coast regions of Texas, including Houston), and other areas of our operations are susceptible to other types of natural disasters, such as earthquakes and tornadoes. As noted above, not all physical damage that we incur as a result of any such natural disaster will be covered by insurance due to policy deductibles and risk retentions. In addition, natural disasters could have a significant negative impact on our business beyond physical damage to property, and only limited portions, if any, of those negative impacts will be covered by applicable business interruption insurance policies. As a result, geographically isolated natural disasters could have a material adverse effect on our overall operations and financial performance. For a discussion of the negative impact from recent hurricanes in the U.S. and an earthquake in Mexico, see “Part II, Item 7 — Management’s Discussion and Analysis of Financial Condition and Results of Operations — Results of Operations — Fiscal 2017 vs. Fiscal 2016 — Summary Financial Data.”

Events beyond our control could result in business interruption or other adverse effects on our operations and growth.

Our business and operations could be subject to interruption or damage due to inclement weather, natural disaster, power loss, acts of violence, terrorist attacks, war, civil unrest or similar events. Such events could impair our customers' access to our business, impact our ability to expand or continue our operations or otherwise have an adverse effect on our financial condition.

We could be subject to changes in tax rates, the adoption of new tax laws in the U.S. or other countries, or exposure to additional tax liabilities.

We are subject to taxes in the U.S. and several foreign jurisdictions. Current economic and political conditions make tax rates in any of these jurisdictions subject to significant change. Our future effective tax rates could be affected by changes in the mix of earnings in countries with differing statutory tax rates, changes in the valuation of deferred tax assets and liabilities, changes in tax rates or changes in tax laws or their interpretation.

Goodwill comprises a significant portion of our total assets. We assess goodwill for impairment at least annually, which could result in a material, non-cash write-down and could have a material adverse effect on our results of operations and financial conditions.

The carrying value of our goodwill was $255 million, or approximately 25% of our total assets, as of September 30, 2017. In accordance with Financial Accounting Standards Board Accounting Standards Codification 350-20-35, we test goodwill and intangible assets with an indefinite useful life for potential impairment annually, or more frequently if an event occurs or circumstances change that would more likely than not reduce the fair value of a reporting unit below its carrying value. These events or circumstances could include a significant change in the business climate, a change in strategic direction, legal factors, operating performance indicators, a change in the competitive environment, the sale or disposition of a significant portion of a reporting unit, or future economic factors such as unfavorable changes in the estimated future discounted cash flows of our reporting units. Our annual goodwill impairment test is performed in the fourth quarter utilizing the income approach. This approach uses future cash flows and estimated terminal values for each of our reporting units (discounted using a market participant perspective) to determine the fair value of each reporting unit, which is then compared to the carrying value of the reporting unit to determine if there is an impairment. The income approach includes assumptions about revenue growth rates, operating margins and terminal growth rates discounted by an estimated weighted-average cost of capital derived from other publicly-traded companies that are similar but not identical from an operational and economic standpoint. See Note 7 of Notes to Consolidated Financial Statements included in “Part II, Item 8 — Financial Statements and Supplementary Data” for a discussion of our annual impairment tests performed for goodwill and indefinite-lived intangible assets during fiscal 2017.

The conversion feature of our Convertible Notes, if triggered, may adversely affect our financial condition and operating results.

In the event the conversion feature of our Convertible Notes is triggered, holders will be entitled to convert the notes at any time during specified periods at their option. If one or more holders elect to convert their notes, we may be required, or may choose, to settle the obligation through the payment of cash, which could adversely affect our liquidity. In addition, even if holders do not elect to convert their notes, we could be required under applicable accounting rules to reclassify all or a portion of the outstanding principal of the Convertible Notes as a current rather than long-term liability, which would result in a material reduction of our net working capital.

Conversion of our Convertible Notes into stock may dilute the ownership interests of existing stockholders or may otherwise depress the price of our Class A Common Stock.

The conversion Convertible Notes will dilute the ownership interests of existing stockholders to the extent we deliver shares of Class A Common Stock upon conversion. Any sales in the public market of such shares could adversely affect prevailing market prices of our Class A Common Stock. In addition, the existence of the Convertible Notes may encourage short selling

15

by market participants because the conversion of such notes could be used to satisfy short positions, or anticipated conversion of the notes into shares of our Class A Common Stock could depress the price of our Class A Common Stock.

We face other risks discussed under "Part II, Item 7A — Quantitative and Qualitative Disclosures about Market Risk."

ITEM 1B — UNRESOLVED STAFF COMMENTS

None.

ITEM 2 — PROPERTIES

Our typical pawn store is a freestanding building or part of a retail strip center with contiguous parking. Store interiors are designed to resemble small retail operations and attractively display merchandise by category. Distinctive exterior design and attractive in-store signage provide an appealing atmosphere to customers. We maintain property and general liability insurance for each of our stores. Our stores are open six or seven days a week.

We generally lease our locations with terms of three to ten years with one or more renewal options. Our existing leases expire on dates ranging between October 2017 and February 2030, with a small number of leases on month-to-month terms. All leases provide for specified periodic rental payments at market rates. Most leases require us to maintain the property and pay the cost of insurance and taxes. We believe the termination of any one of our leases would not have a material adverse effect on our operations. Our strategy generally is to lease rather than own space for our stores unless we find what we believe is a superior location at an attractive price. On an ongoing basis, we may close or consolidate under-performing store locations.

16

The following table presents the number of store locations by state or province as of September 30, 2017:

United States: | ||

Texas | 218 | |

Florida | 97 | |

Colorado | 34 | |

Illinois | 21 | |

Oklahoma | 21 | |

Arizona | 20 | |

Nevada | 17 | |

Indiana | 15 | |

Tennessee | 13 | |

Iowa | 11 | |

Utah | 9 | |

Georgia | 8 | |

Minnesota | 7 | |

Alabama | 5 | |

Oregon | 5 | |

Virginia | 3 | |

Wisconsin | 3 | |

New York | 2 | |

Pennsylvania | 2 | |

Mississippi | 1 | |

Arkansas | 1 | |

Total United States locations | 513 | |

Mexico: | ||

Distrito Federal | 43 | |

Estado de Mexico | 39 | |

Veracruz | 35 | |

Jalisco | 16 | |

Guanajuato | 15 | |

Puebla | 11 | |

Tabasco | 9 | |

Michoacán | 8 | |

Nuevo León | 7 | |

Chiapas | 7 | |

Guerrero | 6 | |

Campeche | 6 | |

Tamaulipas | 6 | |

Hidalgo | 6 | |

Queretaro | 6 | |

Coahuila | 5 | |

Quintana Roo | 4 | |

Oaxaca | 4 | |

Morelos | 4 | |

Aguascalientes | 4 | |

Tlaxcala | 3 | |

San Luis Potosí | 2 | |

Total Mexico locations | 246 | |

Canada: | ||

Ontario | 27 | |

Total Canada locations | 27 | |

Total Company locations | 786 | |

17

In addition to our store locations, we lease corporate office space in Austin, Texas (179,400 square feet, of which 90,940 square feet has been subleased to other tenants), Querétaro, Mexico (8,400 square feet) and Ontario, Canada (8,400 square feet).

For additional information about store locations during fiscal 2017, 2016 and 2015, see “Segment and Geographic Information” included in “Part I, Item 1 — Business.”

ITEM 3 — LEGAL PROCEEDINGS

For a discussion of legal proceedings, see Note 14 of Notes to Consolidated Financial Statements included in “Part II, Item 8 — Financial Statements and Supplementary Data.”

ITEM 4 — MINE SAFETY DISCLOSURES

Not applicable.

18

PART II

ITEM 5 — MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Market Information

Our Class A Non-Voting Common Stock (“Class A Common Stock”) is traded on the NASDAQ Stock Market under the symbol “EZPW.” As of November 10, 2017, there were 85 stockholders of record of our Class A Common Stock. There is no trading market for our Class B Voting Common Stock (“Class B Common Stock”), which was held by one stockholder as of November 10, 2017.

The high and low per share sales price for our Class A Common Stock for the past two fiscal years, as reported by the NASDAQ Stock Market, were as follows:

High | Low | ||||||

Fiscal 2017: | |||||||

Fourth quarter ended September 30, 2017 | $ | 10.35 | $ | 7.58 | |||

Third quarter ended June 30, 2017 | 9.90 | 7.55 | |||||

Second quarter ended March 31, 2017 | 10.98 | 7.75 | |||||

First quarter ended December 31, 2016 | 12.00 | 9.35 | |||||

Fiscal 2016: | |||||||

Fourth quarter ended September 30, 2016 | $ | 11.12 | $ | 7.19 | |||

Third quarter ended June 30, 2016 | 7.59 | 2.94 | |||||

Second quarter ended March 31, 2016 | 5.15 | 2.44 | |||||

First quarter ended December 31, 2015 | 7.14 | 4.68 | |||||

As of September 30, 2017, the closing sales price of our Class A Common Stock, as reported by the NASDAQ Stock Market, was $9.50 per share.

We have not declared or paid any dividends and currently do not anticipate paying any dividends in the immediate future. As described in Note 8 of Notes to Consolidated Financial Statements included in “Part II, Item 8 — Financial Statements and Supplementary Data,” payment of a dividend requires an adjustment to the conversion rate of our Convertible Notes. Should we pay dividends in the future, our certificate of incorporation provides that cash dividends on common stock, when declared, must be declared and paid at the same per share amounts on both classes of stock. Any future determination to pay cash dividends will be at the discretion of our Board of Directors.

19

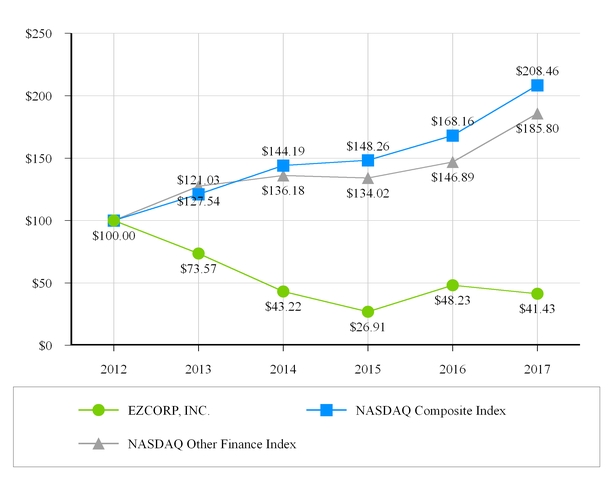

Stock Performance Graph

The following Stock Performance Graph and related information shall not be deemed to be “filed” with the Securities and Exchange Commission, nor shall such information be incorporated by reference into any future filing under the Securities Act of 1933 or the Securities Exchange Act of 1934.

The following table compares cumulative total stockholder returns for our Class A Common Stock for the last five fiscal years, with the cumulative total return on the NASDAQ Composite Index (ticker symbol: IXIC) and the NASDAQ Other Financial Index (ticker symbol: IXFN) over the same period. The graph shows the value, at the end of each of the last five fiscal years, of $100 invested in our Class A Common Stock or the indices on September 30, 2012. The graph depicts the change in the value of our Class A Common Stock relative to the indices at the end of each fiscal year and not for any interim period. Historical stock price performance is not necessarily indicative of future stock price performance.

20

ITEM 6 — SELECTED FINANCIAL DATA

The following selected financial information should be read in conjunction with, and is qualified in its entirety by, the accompanying consolidated financial statements and related notes.

Operating Data

Fiscal Year Ended September 30, | |||||||||||||||||||

2017 | 2016 | 2015 | 2014 | 2013 | |||||||||||||||

(in thousands, except per share and store figures) | |||||||||||||||||||

Operating data: | |||||||||||||||||||

Total revenues | $ | 747,954 | $ | 730,505 | $ | 720,000 | $ | 745,770 | $ | 765,039 | |||||||||

Net revenues | 435,510 | 428,230 | 403,020 | 421,857 | 447,661 | ||||||||||||||

Restructuring | — | 1,921 | 17,080 | 6,664 | — | ||||||||||||||

Impairment of investments | — | 10,957 | 26,837 | 7,940 | 43,198 | ||||||||||||||

Income (loss) from continuing operations, net of tax | 32,033 | (8,998 | ) | (52,182 | ) | 3,438 | 13,583 | ||||||||||||

Basic earnings (loss) per share attributable to EZCORP, Inc. — continuing operations | $ | 0.62 | $ | (0.15 | ) | $ | (0.94 | ) | $ | 0.08 | $ | 0.27 | |||||||

Diluted earnings (loss) per share attributable to EZCORP, Inc. — continuing operations | $ | 0.62 | $ | (0.15 | ) | $ | (0.94 | ) | $ | 0.08 | $ | 0.27 | |||||||

Weighted average shares outstanding: | |||||||||||||||||||

Basic | 54,260 | 54,427 | 54,369 | 54,148 | 53,657 | ||||||||||||||

Diluted | 54,368 | 54,427 | 54,369 | 54,292 | 53,737 | ||||||||||||||

Stores attributable to continuing operations at end of period | 786 | 786 | 786 | 804 | 799 | ||||||||||||||

Balance Sheet Data

September 30, | |||||||||||||||||||

2017 | 2016 | 2015 | 2014 | 2013 | |||||||||||||||

(in thousands) | |||||||||||||||||||

Balance sheet data: | |||||||||||||||||||

Pawn loans | $ | 169,242 | $ | 167,329 | $ | 159,964 | $ | 162,444 | $ | 156,637 | |||||||||

Inventory, net | 154,411 | 140,224 | 124,084 | 138,175 | 145,200 | ||||||||||||||

Working capital (a) | 508,382 | 387,165 | 318,107 | 370,247 | 325,263 | ||||||||||||||

Total assets (a) | 1,024,363 | 983,244 | 898,908 | 1,023,982 | 1,044,136 | ||||||||||||||

Long-term debt, less current maturities (a) | 284,807 | 283,611 | 197,976 | 213,265 | 139,894 | ||||||||||||||

EZCORP, Inc. stockholders’ equity | 662,375 | 594,983 | 656,031 | 812,346 | 879,027 | ||||||||||||||

(a) | Amounts exclude assets and liabilities held for sale as discussed in Note 16 of Notes to Consolidated Financial Statements included in “Part II, Item 8 — Financial Statements and Supplemental Data.” |

21

ITEM 7 — MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The discussion in this section contains forward-looking statements that are based on our current expectations. Actual results could differ materially from those expressed or implied by the forward-looking statements due to a number of risks, uncertainties and other factors, including those identified in “Part I, Item 1A — Risk Factors.” See also “Cautionary Statement Regarding Risks and Uncertainties That May Affect Future Results” below.

This discussion and analysis should be read in conjunction with the consolidated financial statements and the accompanying notes included in “Part II, Item 8 — Financial Statements and Supplementary Data.”

Overview and Fiscal 2017 Highlights

• | Earnings per share from continuing operations grew $0.77 in the current year to $0.62 and net income from continuing operations grew $41.0 million in the current year to $32.0 million. |

• | We continued to lead the U.S. market in same store PLO growth. PLO increased 19% in our Mexico Pawn segment. |

• | Operating contribution from the Mexico Pawn segment improved significantly to $18.7 million, up 119% in the current year. Our Mexico Pawn segment provided 15% of our total segment contribution. |

• | We ended the year with a cash and cash equivalents balance of $164.4 million, a 150% increase. |

• | We successfully completed a $143.8 million offering of convertible notes, improving liquidity with a coupon rate of 2.875% and seven-year term. |

• | We completed a restructuring of the notes receivable from AlphaCredit, improving the return and risk profile and increasing future cash flow and profit. |

• | Shortly after the end of the year, we completed the acquisition of 112 pawn stores in Latin America (Guatemala, El Salvador, Honduras and Peru), which provides immediate accretion to future earnings and a platform for further growth and expansion in Latin America. |

22

Results of Operations

Fiscal 2017 vs. Fiscal 2016

Summary Financial Data

The following table presents selected summary consolidated financial data. This table, as well as the discussion that follows, should be read with the consolidated financial statements and related notes included in “Part II, Item 8 — Financial Statements and Supplementary Data.”

During the fourth quarter of fiscal 2017, Hurricanes Harvey and Irma negatively impacted our U.S. Pawn segment and a major earthquake impacted our Mexico Pawn segment. The majority of the financial impacts resulted from the temporary closure of stores as a result of the hurricanes, causing a decline in the U.S. pawn loan balances of approximately $5.0 million, with a resulting reduction in pawn service charges. As a result of the storms, 79 stores in Texas and 97 stores in Florida were closed. We were able to reopen most of the stores within two days, and had reopened all of the stores by September 30, 2017. We believe the reduction in pawn loan balances was partially due to the significant inflow of relief funds to our customers and the temporary abatement of rent, utilities and some other monthly bills for affected customers, temporarily reducing the demand for pawn loans. We expect our pawn loan balance to return to its normal level following the annual tax refund season in the U.S., which is in the second quarter of fiscal 2018. Until rebuilt, we expect the lower pawn loan balance will suppress fiscal 2018 net revenues compared to what we would otherwise have expected. The earthquake in Mexico had an immaterial impact in the fourth quarter, and we do not expect any material impact in fiscal 2018.

23

Fiscal Year Ended September 30, | Change | ||||||||

2017 | 2016 | ||||||||

(in thousands) | |||||||||

Net revenues: | |||||||||

Pawn service charges | $ | 273,080 | $ | 261,800 | 4% | ||||

Merchandise sales | 414,838 | 409,107 | 1% | ||||||

Merchandise sales gross profit | 148,313 | 150,836 | (2)% | ||||||