Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - APARTMENT INVESTMENT & MANAGEMENT CO | aivnavq3presentation.htm |

| 8-K - 8-K - APARTMENT INVESTMENT & MANAGEMENT CO | a8-knareitnovember2017.htm |

1

INVESTOR PRESENTATION

NOVEMBER 2017

Pacific Bay Vistas

San Bruno, CA

2

12

Primary Markets

141

Apartment Communities

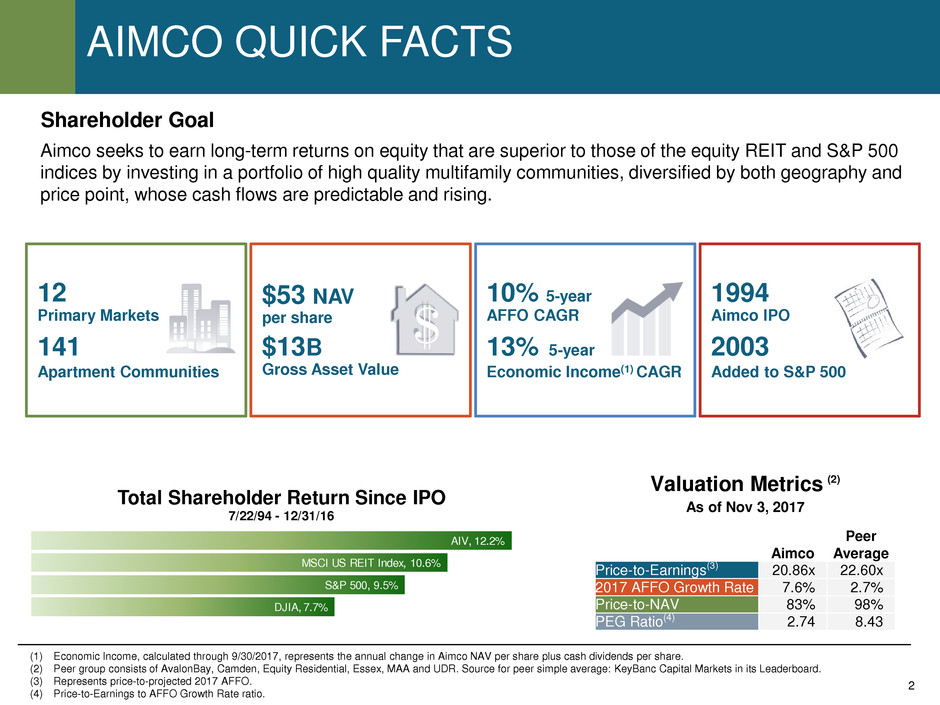

AIMCO QUICK FACTS

Aimco seeks to earn long-term returns on equity that are superior to those of the equity REIT and S&P 500

indices by investing in a portfolio of high quality multifamily communities, diversified by both geography and

price point, whose cash flows are predictable and rising.

(1) Economic Income, calculated through 9/30/2017, represents the annual change in Aimco NAV per share plus cash dividends per share.

(2) Peer group consists of AvalonBay, Camden, Equity Residential, Essex, MAA and UDR. Source for peer simple average: KeyBanc Capital Markets in its Leaderboard.

(3) Represents price-to-projected 2017 AFFO.

(4) Price-to-Earnings to AFFO Growth Rate ratio.

AIV, 12.2%

MSCI US REIT Index, 10.6%

S&P 500, 9.5%

DJIA, 7.7%

Total Shareholder Return Since IPO

7/22/94 - 12/31/16

10% 5-year

AFFO CAGR

13% 5-year

Economic Income(1) CAGR

1994

Aimco IPO

2003

Added to S&P 500

$53 NAV

per share

$13B

Gross Asset Value

Shareholder Goal

Valuation Metrics (2)

As of Nov 3, 2017

Aimco

Peer

Average

Price-to-Earnings(3) 20.86x 22.60x

2017 AFFO Growth Rate 7.6% 2.7%

Price-to-NAV 83% 98%

PEG Ratio(4) 2.74 8.43

3

AIMCO QUICK FACTS

Consistent Growth Over Time; Better Than Peer Average

(1) Peer group consists of AvalonBay, Camden, Equity Residential, Essex, MAA and UDR. Source for peer simple average: SNL Financial.

(2) Source for peer average: Company financials.

(3) Source for peer simple average: KeyBanc Capital Markets in its Leaderboard.

Outsized Growth in Quality of Portfolio and Earnings

4

LEADERSHIP TEAM

Paul Beldin

EVP &

Chief Financial Officer

9 Years

John Bezzant

EVP &

Chief Investment

Officer

11 Years

Lisa Cohn

EVP &

General Counsel

15 Years

Miles Cortez

EVP &

Chief Administrative

Officer

16 Years

Steve Crane

Real Estate Tax

14 Years

Matt Eilen

Property Operations

Finance

7 Years

Patti Fielding

EVP

Redevelopment

20 Years

Michael Englhard

Redevelopment

Construction Services

4 Years

Andrew Higdon

Chief Accounting

Officer

10 Years

Evan Hoffman

Property Operations

Revenue Management

9 Years

Kristina Howe

Property Operations

Shared Services

15 Years

Jennifer Johnson

Human Resources

13 Years

Keith Kimmel

EVP

Property Operations

15 Years

Stephanie Lambert

Redevelopment

Finance

16 Years

Didi Meredith

Property Operations

West Operations

11 Years

Leann Morein

Compliance

23 Years

Kevin Mosher

Property Operations

East Operations

10 Years

Susan Pickens

IT Strategy

23 Years

Wes Powell

Redevelopment

13 Years

Patti Shwayder

Communications

15 Years

Lynn Stanfield

Finance & Tax

17 Years

Terry Considine

Chairman &

CEO

42 Years

5

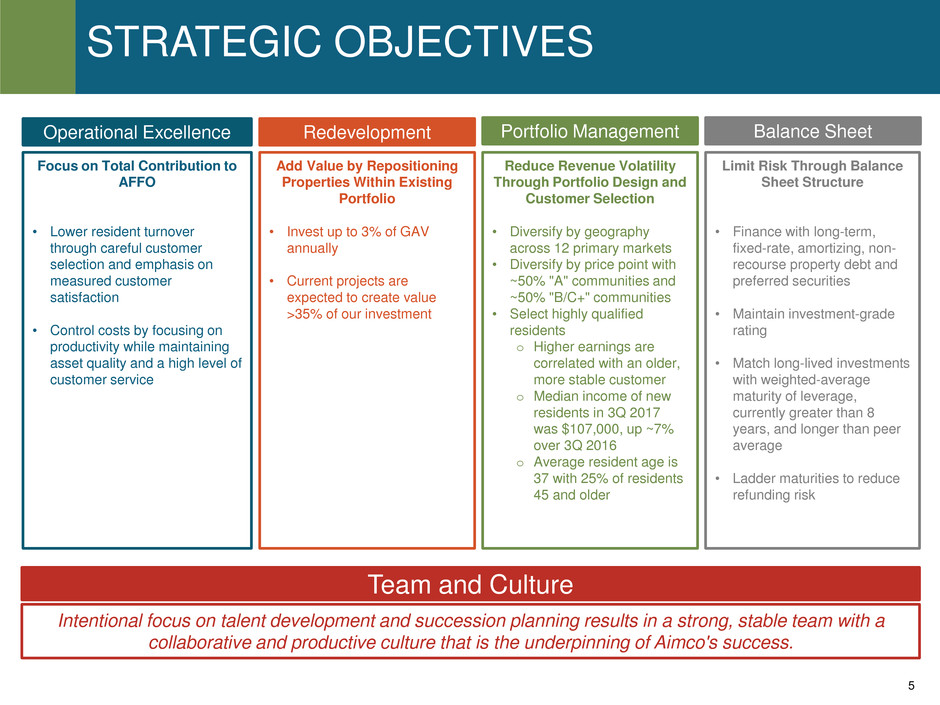

STRATEGIC OBJECTIVES

Operational Excellence Redevelopment

Focus on Total Contribution to

AFFO

• Lower resident turnover

through careful customer

selection and emphasis on

measured customer

satisfaction

• Control costs by focusing on

productivity while maintaining

asset quality and a high level of

customer service

Add Value by Repositioning

Properties Within Existing

Portfolio

• Invest up to 3% of GAV

annually

• Current projects are

expected to create value

>35% of our investment

Portfolio Management

Reduce Revenue Volatility

Through Portfolio Design and

Customer Selection

• Diversify by geography

across 12 primary markets

• Diversify by price point with

~50% "A" communities and

~50% "B/C+" communities

• Select highly qualified

residents

o Higher earnings are

correlated with an older,

more stable customer

o Median income of new

residents in 3Q 2017

was $107,000, up ~7%

over 3Q 2016

o Average resident age is

37 with 25% of residents

45 and older

Balance Sheet

Limit Risk Through Balance

Sheet Structure

• Finance with long-term,

fixed-rate, amortizing, non-

recourse property debt and

preferred securities

• Maintain investment-grade

rating

• Match long-lived investments

with weighted-average

maturity of leverage,

currently greater than 8

years, and longer than peer

average

• Ladder maturities to reduce

refunding risk

Team and Culture

Intentional focus on talent development and succession planning results in a strong, stable team with a

collaborative and productive culture that is the underpinning of Aimco's success.

6

ECONOMIC INCOME

(1) Represents the compounded annual return assuming a) IPO share price, b) quarterly cash dividends when paid, c) stock dividends declared in 2007-2008 as though sold for cash, and d) NAV as of

September 30, 2017.

Economic Income is Aimco’s primary measure of performance.

• Economic Income reflects shareholder value creation as measured by changes in Net Asset Value per

share and cash dividends per share received over a defined time period.

• Net Asset Value is calculated as the market value of a company's assets less its liabilities and obligations.

Net Asset Value is used by many investors in real estate companies because the value of company assets

can be readily estimated, even for non-earning assets such as land or properties under development. Net

Asset Value has the advantage of incorporating the investment decisions of the many thousands of real

estate investors. It enhances comparability among companies that have differences in their accounting. It

avoids distortions that can result from application of GAAP to investment properties and ownership

structures.

• While Net Asset Value is not identical to liquidation value in that some costs and benefits are disregarded,

it is often considered a floor with upside for value ascribed to the operating platform. Net Asset Value also

provides an objective basis for the perceived quality, or predictability, of future cash flows as well as their

expected growth as these are factors considered by real estate investors. As a result, Net Asset Value can

be a valuable starting point for projecting future earnings.

• Since IPO, Aimco’s Economic Income has compounded annually at 14.1%(1)

7

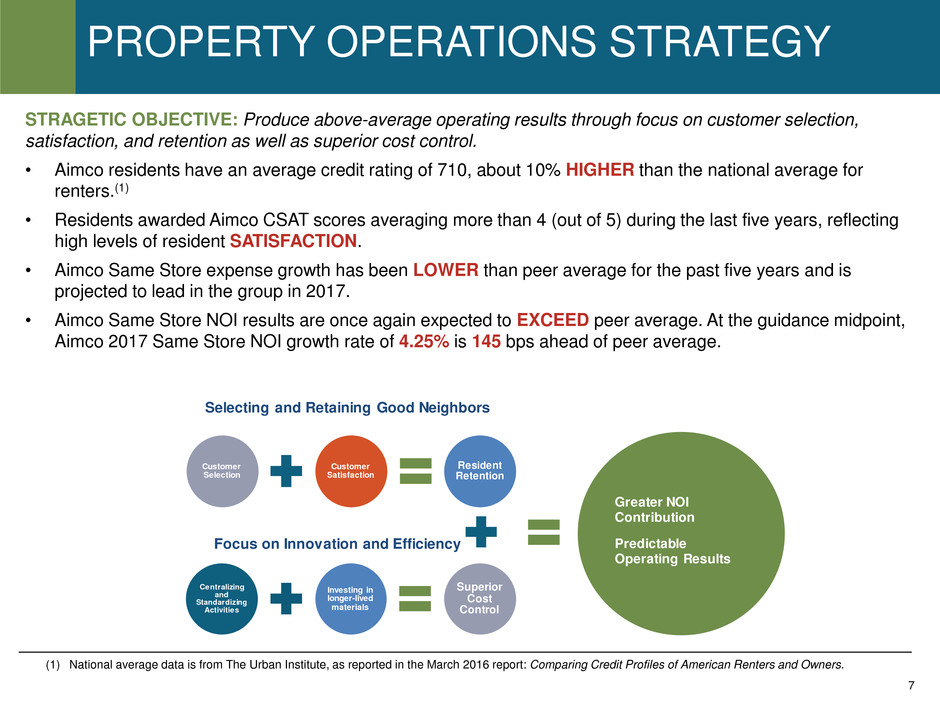

PROPERTY OPERATIONS STRATEGY

Customer

Selection

Customer

Satisfaction

Resident

Retention

Centralizing

and

Standardizing

Activities

Investing in

longer-lived

materials

Superior

Cost

Control

Focus on Innovation and Efficiency

Greater NOI

Contribution

Predictable

Operating Results

Selecting and Retaining Good Neighbors

STRAGETIC OBJECTIVE: Produce above-average operating results through focus on customer selection,

satisfaction, and retention as well as superior cost control.

• Aimco residents have an average credit rating of 710, about 10% HIGHER than the national average for

renters.(1)

• Residents awarded Aimco CSAT scores averaging more than 4 (out of 5) during the last five years, reflecting

high levels of resident SATISFACTION.

• Aimco Same Store expense growth has been LOWER than peer average for the past five years and is

projected to lead in the group in 2017.

• Aimco Same Store NOI results are once again expected to EXCEED peer average. At the guidance midpoint,

Aimco 2017 Same Store NOI growth rate of 4.25% is 145 bps ahead of peer average.

(1) National average data is from The Urban Institute, as reported in the March 2016 report: Comparing Credit Profiles of American Renters and Owners.

8

PREDICTABLE REVENUE GROWTH

(1) Peer group consists of AvalonBay, Camden, Equity Residential, Essex and UDR. Source for peer information: Bank of America Merrill Lynch, which does not track MAA turnover. Retention is

calculated as the difference between 100% and turnover.

(2) Aimco measures changes in Same Store rental rates by comparing, on a lease-by-lease basis, the rate on a newly executed lease to the rate on the expiring lease for that same apartment.

Newly executed leases are classified either as a new lease, where a vacant apartment is leased to a new customer, or as a renewal.

(3) Executed leases as of November 7th, 2017, consisting of transacted leases for future move-ins during November and December.

Focus on customer satisfaction and resident retention leads to more predictable revenue growth:

• ~90,000 customers grade Aimco each year: Customer satisfaction has averaged more than 4.0 (on a 1 to 5

scale) for the past sixteen quarters and averaged 4.24 in each quarter of 2017, an all-time high for Aimco.

• Aimco resident retention is above peer average: For the five years ended 2016, Aimco retention rate was 52%,

500 bps above the peer average of 47%.(1) Aimco retention rate through October 2017 was 53.5%.

• Higher resident retention leads to better NOI growth: Aimco 2017 NOI guidance is 145 bps above peer average

about three-fourths of which relates to higher retention.

2017 transactions are largely complete and on track to produce revenue growth within Aimco’s guidance range:

Aimco expects to transact about 24K leases in 2017. We have completed 23.5K leases year-to-date, 22K for

occupancy in January through October and another 1.5K executed for occupancy in November and December, leaving

fewer than 1K, 4% of full year transactions, still to go. The weighted average rent increase for all 23.5K transactions

completed year-to-date was 2.7%.

CHANGES IN SAME STORE RENTAL RATES(2)

YTD 3Q

2017

Oct

2017

Executed

Leases(3)

YTD

Leases

RENEWALS 4.6% 4.6% 4.6% 4.6%

NEW LEASES 0.9% -1.1% 1.1% 0.7%

WT. AVG. 2.7% 1.8% 3.2% 2.7%

AVERAGE DAILY OCCUPANCY 95.9% 96.2%

YTD October 2017 Average Daily Occupancy is 96.0%.

9

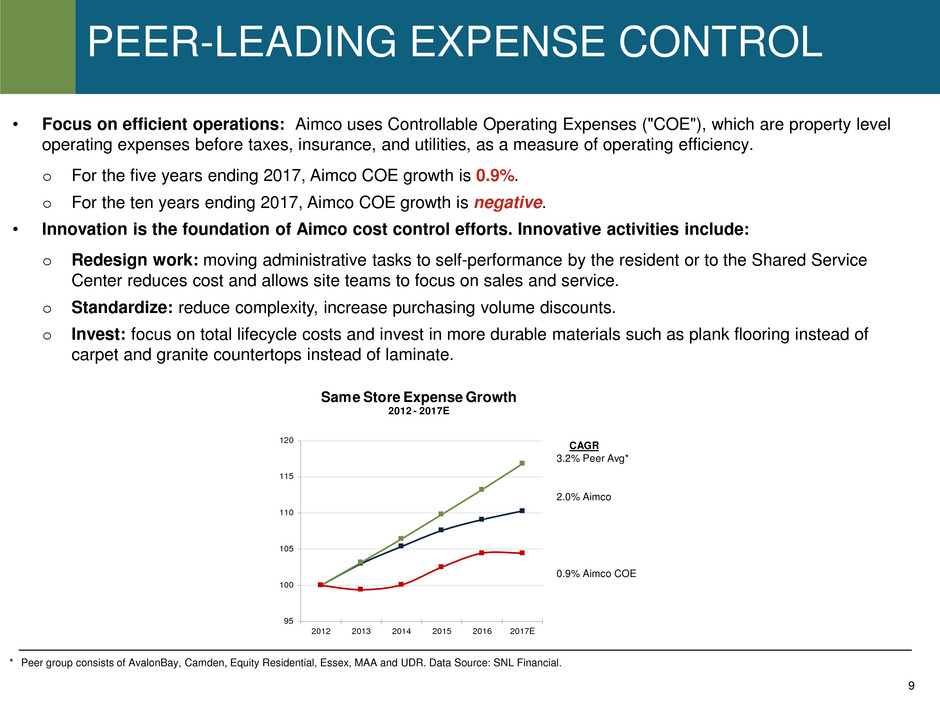

PEER-LEADING EXPENSE CONTROL

• Focus on efficient operations: Aimco uses Controllable Operating Expenses ("COE"), which are property level

operating expenses before taxes, insurance, and utilities, as a measure of operating efficiency.

o For the five years ending 2017, Aimco COE growth is 0.9%.

o For the ten years ending 2017, Aimco COE growth is negative.

• Innovation is the foundation of Aimco cost control efforts. Innovative activities include:

o Redesign work: moving administrative tasks to self-performance by the resident or to the Shared Service

Center reduces cost and allows site teams to focus on sales and service.

o Standardize: reduce complexity, increase purchasing volume discounts.

o Invest: focus on total lifecycle costs and invest in more durable materials such as plank flooring instead of

carpet and granite countertops instead of laminate.

* Peer group consists of AvalonBay, Camden, Equity Residential, Essex, MAA and UDR. Data Source: SNL Financial.

CAGR

3.2% Peer Avg*

2.0% Aimco

0.9% Aimco COE

95

100

105

110

115

120

2012 2013 2014 2015 2016 2017E

Same Store Expense Growth

2012 - 2017E

10

REDEVELOPMENT STRATEGY

REDEVELOPMENT APPROACH

• Own communities where land value is a high percentage of total

value. Lower price-point communities with high land values support

redevelopment and entitlement activities.

• Provide predictable cash flows through excellence in property

operations and incubate land value while it appreciates.

• Where appropriate, re-entitle land in anticipation of adding future

value. Entitlement requires little capital.

• Redevelop properties when market conditions support accretive

repositioning.

• Execute large scale projects in phases, to refine product offerings and

to reduce risk.

• Adjust pace and scope of redevelopment to match market acceptance

and to reduce lease-up inventory risk.

AIMCO RISK MANAGEMENT POLICIES

• Invest up to 3% of GAV in redevelopment and development annually.

• In all investment activities, require unlevered returns that reflect risk

acceptance.

• Arrange in advance required capital both from property debt financing

and equity raised in "paired trades."

• Rely on third-party developers whose expertise and balance sheet limit

Aimco exposure to construction risks.

• Limit exposure to lease-up risk, including by taking on an equity

partner if indicated.

11

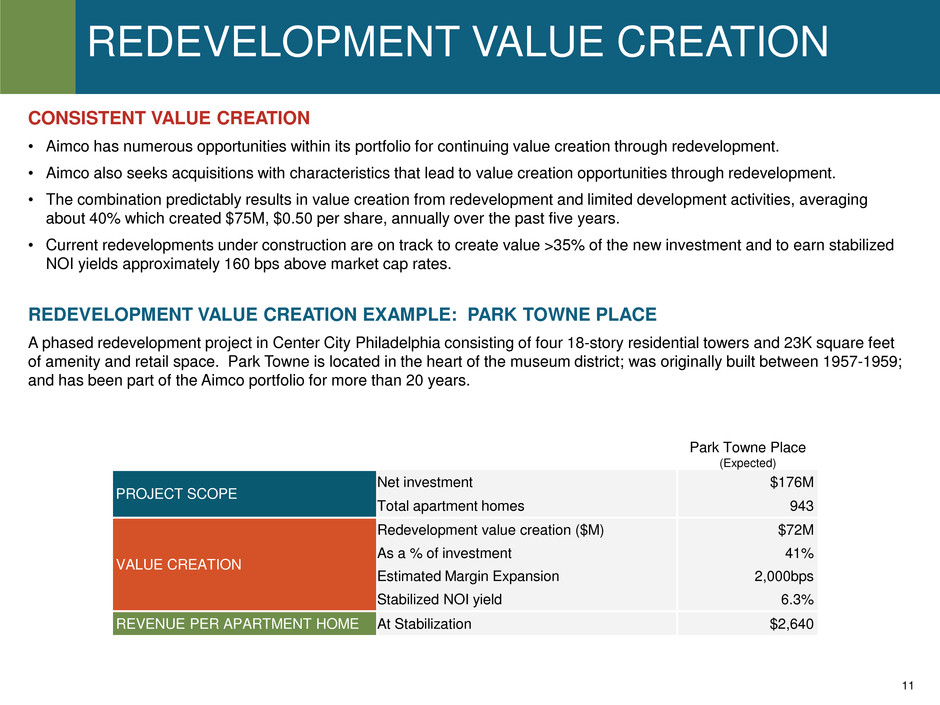

Park Towne Place

(Expected)

PROJECT SCOPE

Net investment $176M

Total apartment homes 943

VALUE CREATION

Redevelopment value creation ($M) $72M

As a % of investment 41%

Estimated Margin Expansion 2,000bps

Stabilized NOI yield 6.3%

REVENUE PER APARTMENT HOME At Stabilization $2,640

REDEVELOPMENT VALUE CREATION

CONSISTENT VALUE CREATION

• Aimco has numerous opportunities within its portfolio for continuing value creation through redevelopment.

• Aimco also seeks acquisitions with characteristics that lead to value creation opportunities through redevelopment.

• The combination predictably results in value creation from redevelopment and limited development activities, averaging

about 40% which created $75M, $0.50 per share, annually over the past five years.

• Current redevelopments under construction are on track to create value >35% of the new investment and to earn stabilized

NOI yields approximately 160 bps above market cap rates.

REDEVELOPMENT VALUE CREATION EXAMPLE: PARK TOWNE PLACE

A phased redevelopment project in Center City Philadelphia consisting of four 18-story residential towers and 23K square feet

of amenity and retail space. Park Towne is located in the heart of the museum district; was originally built between 1957-1959;

and has been part of the Aimco portfolio for more than 20 years.

12

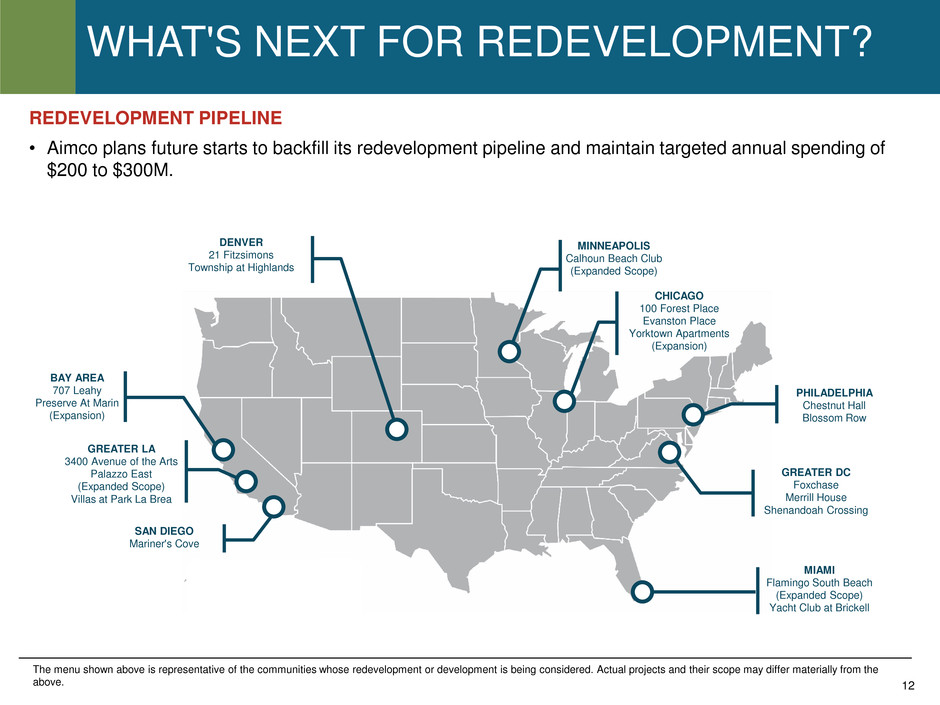

BAY AREA

707 Leahy

Preserve At Marin

(Expansion)

CHICAGO

100 Forest Place

Evanston Place

Yorktown Apartments

(Expansion)

MIAMI

Flamingo South Beach

(Expanded Scope)

Yacht Club at Brickell

PHILADELPHIA

Chestnut Hall

Blossom Row

DENVER

21 Fitzsimons

Township at Highlands

GREATER LA

3400 Avenue of the Arts

Palazzo East

(Expanded Scope)

Villas at Park La Brea

MINNEAPOLIS

Calhoun Beach Club

(Expanded Scope)

GREATER DC

Foxchase

Merrill House

Shenandoah Crossing

SAN DIEGO

Mariner's Cove

WHAT'S NEXT FOR REDEVELOPMENT?

REDEVELOPMENT PIPELINE

• Aimco plans future starts to backfill its redevelopment pipeline and maintain targeted annual spending of

$200 to $300M.

The menu shown above is representative of the communities whose redevelopment or development is being considered. Actual projects and their scope may differ materially from the

above.

13

To upgrade our portfolio through redevelopment, property upgrades,

acquisitions, and limited development activity.

• We do this through a strict paired-trade discipline with:

• DISPOSITION of up to 10% of our portfolio annually, primarily from submarkets

with lower revenue growth prospects; and

• REINVESTMENT of disposition proceeds in communities with better locations,

higher expected rent growth, and higher projected free cash flow internal rates of

return.

• We maintain geographic and price point DIVERSIFICATION sufficient to limit

volatility and concentration risk, while focusing investment in higher rent-growth,

higher-margin submarkets.

• We offer a product that ATTRACTS highly qualified residents with positive

prospects for income growth and the ability and willingness to pay for high quality

homes and service.

PORTFOLIO STRATEGY

14

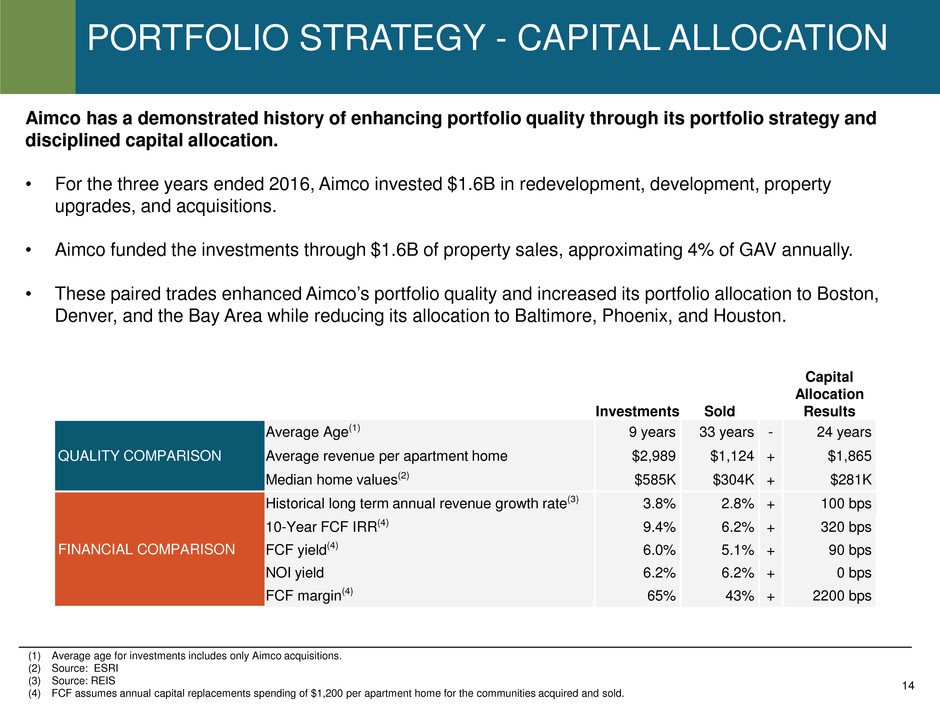

PORTFOLIO STRATEGY - CAPITAL ALLOCATION

Aimco has a demonstrated history of enhancing portfolio quality through its portfolio strategy and

disciplined capital allocation.

• For the three years ended 2016, Aimco invested $1.6B in redevelopment, development, property

upgrades, and acquisitions.

• Aimco funded the investments through $1.6B of property sales, approximating 4% of GAV annually.

• These paired trades enhanced Aimco’s portfolio quality and increased its portfolio allocation to Boston,

Denver, and the Bay Area while reducing its allocation to Baltimore, Phoenix, and Houston.

(1) Average age for investments includes only Aimco acquisitions.

(2) Source: ESRI

(3) Source: REIS

(4) FCF assumes annual capital replacements spending of $1,200 per apartment home for the communities acquired and sold.

Investments Sold

Capital

Allocation

Results

QUALITY COMPARISON

Average Age(1) 9 years 33 years - 24 years

Average revenue per apartment home $2,989 $1,124 + $1,865

Median home values(2) $585K $304K + $281K

FINANCIAL COMPARISON

Historical long term annual revenue growth rate(3) 3.8% 2.8% + 100 bps

10-Year FCF IRR(4) 9.4% 6.2% + 320 bps

FCF yield(4) 6.0% 5.1% + 90 bps

NOI yield 6.2% 6.2% + 0 bps

FCF margin(4) 65% 43% + 2200 bps

15

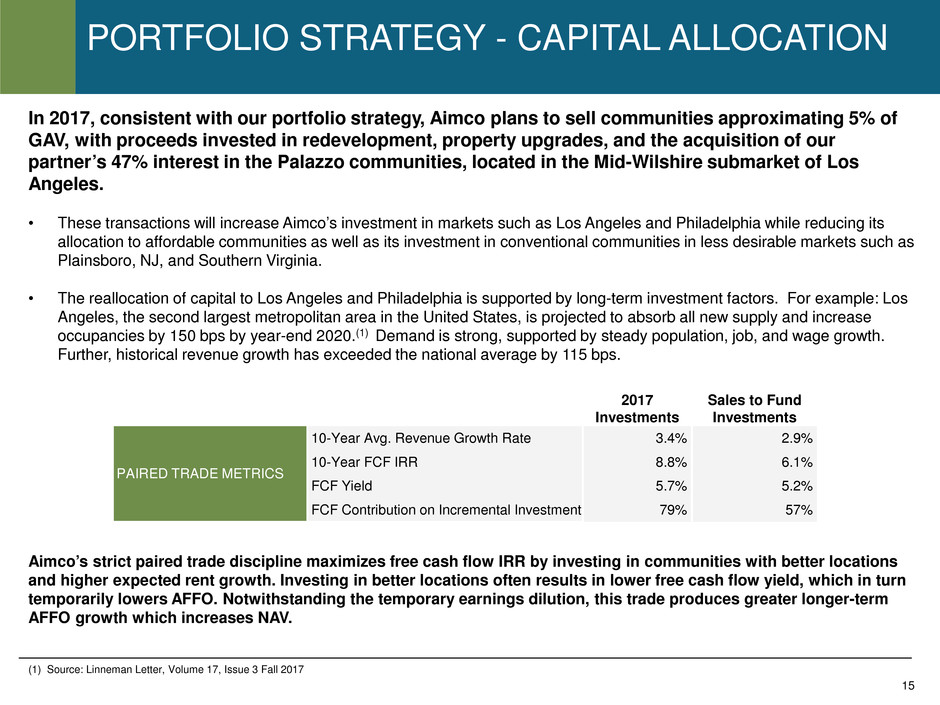

PORTFOLIO STRATEGY - CAPITAL ALLOCATION

In 2017, consistent with our portfolio strategy, Aimco plans to sell communities approximating 5% of

GAV, with proceeds invested in redevelopment, property upgrades, and the acquisition of our

partner’s 47% interest in the Palazzo communities, located in the Mid-Wilshire submarket of Los

Angeles.

• These transactions will increase Aimco’s investment in markets such as Los Angeles and Philadelphia while reducing its

allocation to affordable communities as well as its investment in conventional communities in less desirable markets such as

Plainsboro, NJ, and Southern Virginia.

• The reallocation of capital to Los Angeles and Philadelphia is supported by long-term investment factors. For example: Los

Angeles, the second largest metropolitan area in the United States, is projected to absorb all new supply and increase

occupancies by 150 bps by year-end 2020.(1) Demand is strong, supported by steady population, job, and wage growth.

Further, historical revenue growth has exceeded the national average by 115 bps.

Aimco’s strict paired trade discipline maximizes free cash flow IRR by investing in communities with better locations

and higher expected rent growth. Investing in better locations often results in lower free cash flow yield, which in turn

temporarily lowers AFFO. Notwithstanding the temporary earnings dilution, this trade produces greater longer-term

AFFO growth which increases NAV.

2017

Investments

Sales to Fund

Investments

PAIRED TRADE METRICS

10-Year Avg. Revenue Growth Rate 3.4% 2.9%

10-Year FCF IRR 8.8% 6.1%

FCF Yield 5.7% 5.2%

FCF Contribution on Incremental Investment 79% 57%

(1) Source: Linneman Letter, Volume 17, Issue 3 Fall 2017

16

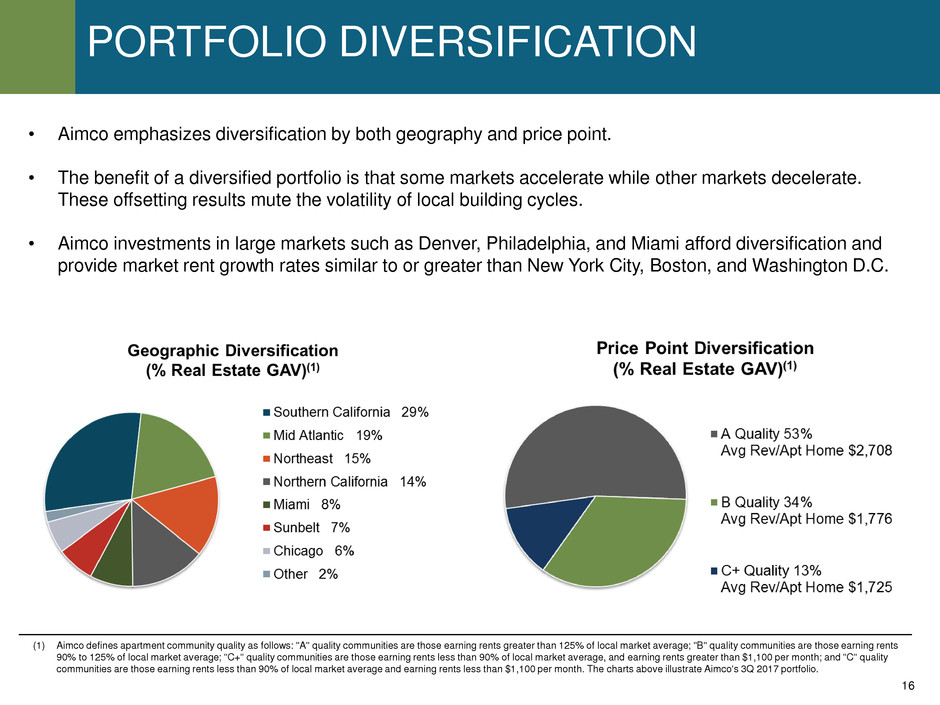

PORTFOLIO DIVERSIFICATION

(1) Aimco defines apartment community quality as follows: "A" quality communities are those earning rents greater than 125% of local market average; "B" quality communities are those earning rents

90% to 125% of local market average; "C+" quality communities are those earning rents less than 90% of local market average, and earning rents greater than $1,100 per month; and "C" quality

communities are those earning rents less than 90% of local market average and earning rents less than $1,100 per month. The charts above illustrate Aimco's 3Q 2017 portfolio.

• Aimco emphasizes diversification by both geography and price point.

• The benefit of a diversified portfolio is that some markets accelerate while other markets decelerate.

These offsetting results mute the volatility of local building cycles.

• Aimco investments in large markets such as Denver, Philadelphia, and Miami afford diversification and

provide market rent growth rates similar to or greater than New York City, Boston, and Washington D.C.

17

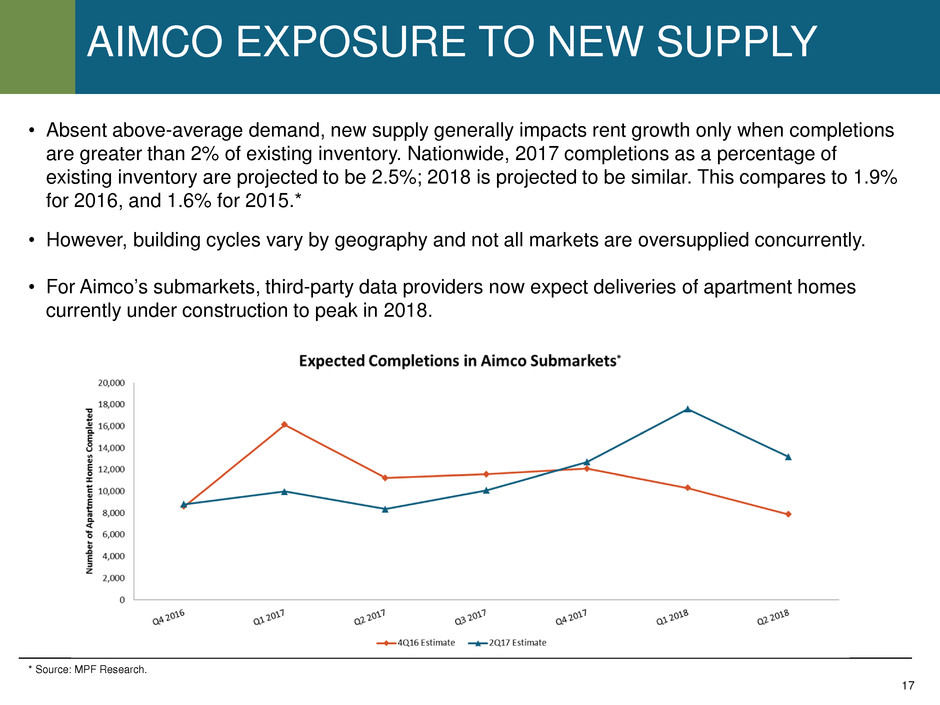

AIMCO EXPOSURE TO NEW SUPPLY

• Absent above-average demand, new supply generally impacts rent growth only when completions

are greater than 2% of existing inventory. Nationwide, 2017 completions as a percentage of

existing inventory are projected to be 2.5%; 2018 is projected to be similar. This compares to 1.9%

for 2016, and 1.6% for 2015.*

• However, building cycles vary by geography and not all markets are oversupplied concurrently.

• For Aimco’s submarkets, third-party data providers now expect deliveries of apartment homes

currently under construction to peak in 2018.

* Source: MPF Research.

18

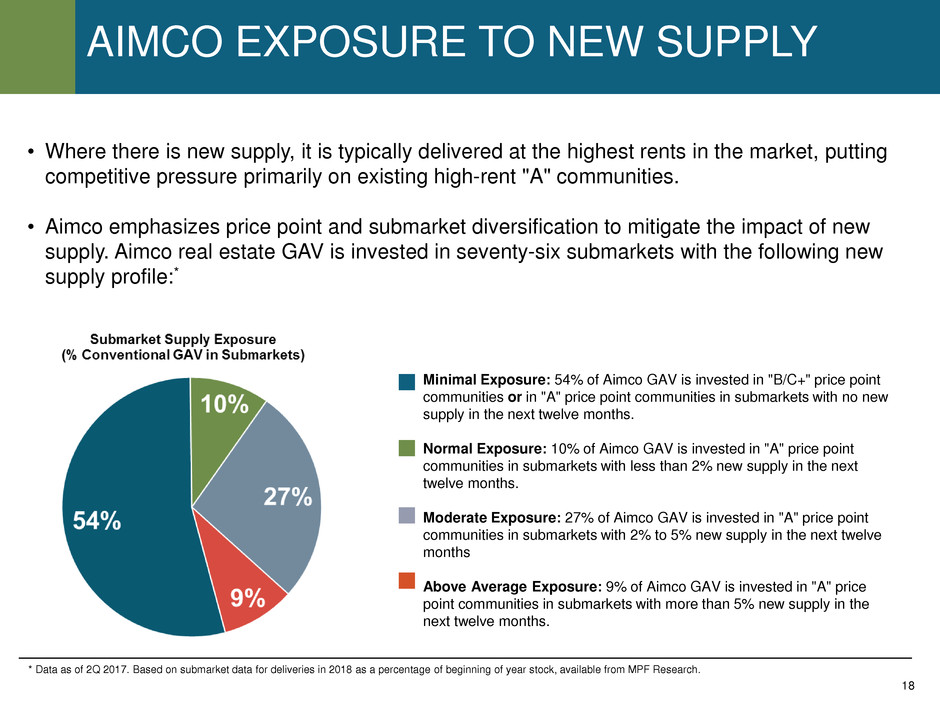

AIMCO EXPOSURE TO NEW SUPPLY

• Where there is new supply, it is typically delivered at the highest rents in the market, putting

competitive pressure primarily on existing high-rent "A" communities.

• Aimco emphasizes price point and submarket diversification to mitigate the impact of new

supply. Aimco real estate GAV is invested in seventy-six submarkets with the following new

supply profile:*

* Data as of 2Q 2017. Based on submarket data for deliveries in 2018 as a percentage of beginning of year stock, available from MPF Research.

Minimal Exposure: 54% of Aimco GAV is invested in "B/C+" price point

communities or in "A" price point communities in submarkets with no new

supply in the next twelve months.

Normal Exposure: 10% of Aimco GAV is invested in "A" price point

communities in submarkets with less than 2% new supply in the next

twelve months.

Moderate Exposure: 27% of Aimco GAV is invested in "A" price point

communities in submarkets with 2% to 5% new supply in the next twelve

months

Above Average Exposure: 9% of Aimco GAV is invested in "A" price

point communities in submarkets with more than 5% new supply in the

next twelve months.

19

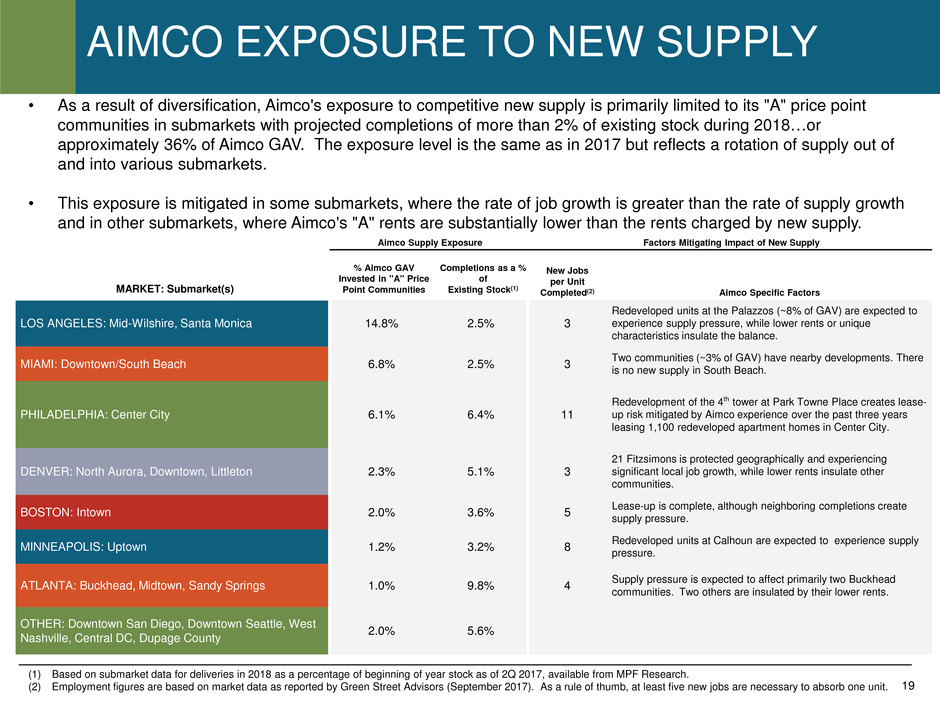

AIMCO EXPOSURE TO NEW SUPPLY

• As a result of diversification, Aimco's exposure to competitive new supply is primarily limited to its "A" price point

communities in submarkets with projected completions of more than 2% of existing stock during 2018…or

approximately 36% of Aimco GAV. The exposure level is the same as in 2017 but reflects a rotation of supply out of

and into various submarkets.

• This exposure is mitigated in some submarkets, where the rate of job growth is greater than the rate of supply growth

and in other submarkets, where Aimco's "A" rents are substantially lower than the rents charged by new supply.

(1) Based on submarket data for deliveries in 2018 as a percentage of beginning of year stock as of 2Q 2017, available from MPF Research.

(2) Employment figures are based on market data as reported by Green Street Advisors (September 2017). As a rule of thumb, at least five new jobs are necessary to absorb one unit.

Aimco Supply Exposure Factors Mitigating Impact of New Supply

MARKET: Submarket(s)

% Aimco GAV

Invested in "A" Price

Point Communities

Completions as a %

of

Existing Stock(1)

New Jobs

per Unit

Completed(2) Aimco Specific Factors

LOS ANGELES: Mid-Wilshire, Santa Monica 14.8% 2.5% 3

Redeveloped units at the Palazzos (~8% of GAV) are expected to

experience supply pressure, while lower rents or unique

characteristics insulate the balance.

MIAMI: Downtown/South Beach 6.8% 2.5% 3 Two communities (~3% of GAV) have nearby developments. There is no new supply in South Beach.

PHILADELPHIA: Center City 6.1% 6.4% 11

Redevelopment of the 4th tower at Park Towne Place creates lease-

up risk mitigated by Aimco experience over the past three years

leasing 1,100 redeveloped apartment homes in Center City.

DENVER: North Aurora, Downtown, Littleton 2.3% 5.1% 3

21 Fitzsimons is protected geographically and experiencing

significant local job growth, while lower rents insulate other

communities.

BOSTON: Intown 2.0% 3.6% 5 Lease-up is complete, although neighboring completions create supply pressure.

MINNEAPOLIS: Uptown 1.2% 3.2% 8 Redeveloped units at Calhoun are expected to experience supply pressure.

ATLANTA: Buckhead, Midtown, Sandy Springs 1.0% 9.8% 4 Supply pressure is expected to affect primarily two Buckhead communities. Two others are insulated by their lower rents.

OTHER: Downtown San Diego, Downtown Seattle, West

Nashville, Central DC, Dupage County 2.0% 5.6%

20

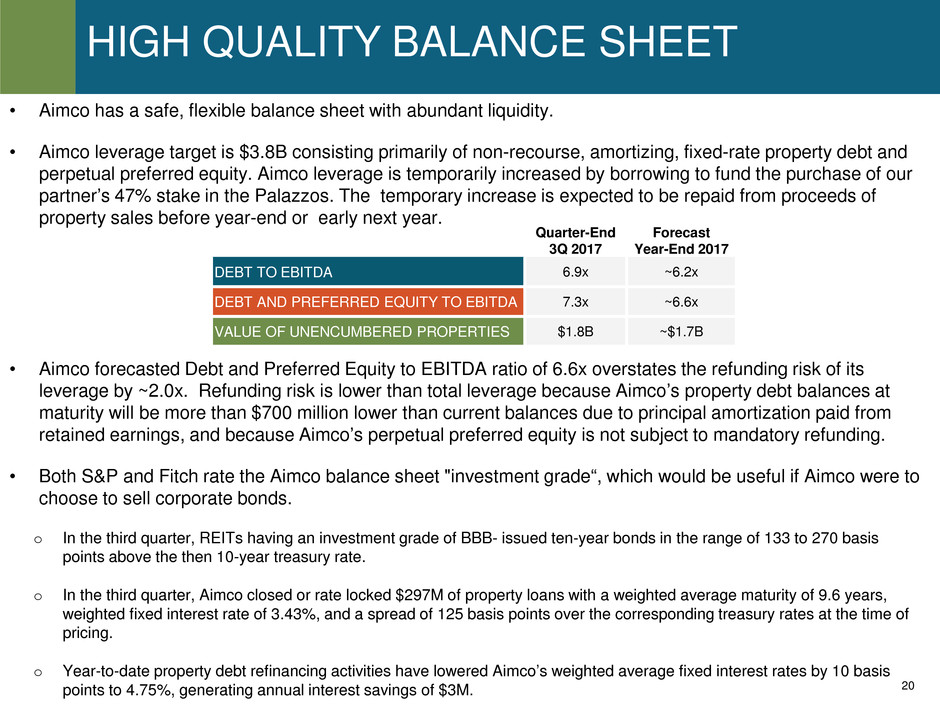

HIGH QUALITY BALANCE SHEET

• Aimco has a safe, flexible balance sheet with abundant liquidity.

• Aimco leverage target is $3.8B consisting primarily of non-recourse, amortizing, fixed-rate property debt and

perpetual preferred equity. Aimco leverage is temporarily increased by borrowing to fund the purchase of our

partner’s 47% stake in the Palazzos. The temporary increase is expected to be repaid from proceeds of

property sales before year-end or early next year.

• Aimco forecasted Debt and Preferred Equity to EBITDA ratio of 6.6x overstates the refunding risk of its

leverage by ~2.0x. Refunding risk is lower than total leverage because Aimco’s property debt balances at

maturity will be more than $700 million lower than current balances due to principal amortization paid from

retained earnings, and because Aimco’s perpetual preferred equity is not subject to mandatory refunding.

• Both S&P and Fitch rate the Aimco balance sheet "investment grade“, which would be useful if Aimco were to

choose to sell corporate bonds.

o In the third quarter, REITs having an investment grade of BBB- issued ten-year bonds in the range of 133 to 270 basis

points above the then 10-year treasury rate.

o In the third quarter, Aimco closed or rate locked $297M of property loans with a weighted average maturity of 9.6 years,

weighted fixed interest rate of 3.43%, and a spread of 125 basis points over the corresponding treasury rates at the time of

pricing.

o Year-to-date property debt refinancing activities have lowered Aimco’s weighted average fixed interest rates by 10 basis

points to 4.75%, generating annual interest savings of $3M.

Quarter-End

3Q 2017

Forecast

Year-End 2017

DEBT TO EBITDA 6.9x ~6.2x

DEBT AND PREFERRED EQUITY TO EBITDA 7.3x ~6.6x

VALUE OF UNENCUMBERED PROPERTIES $1.8B ~$1.7B

21

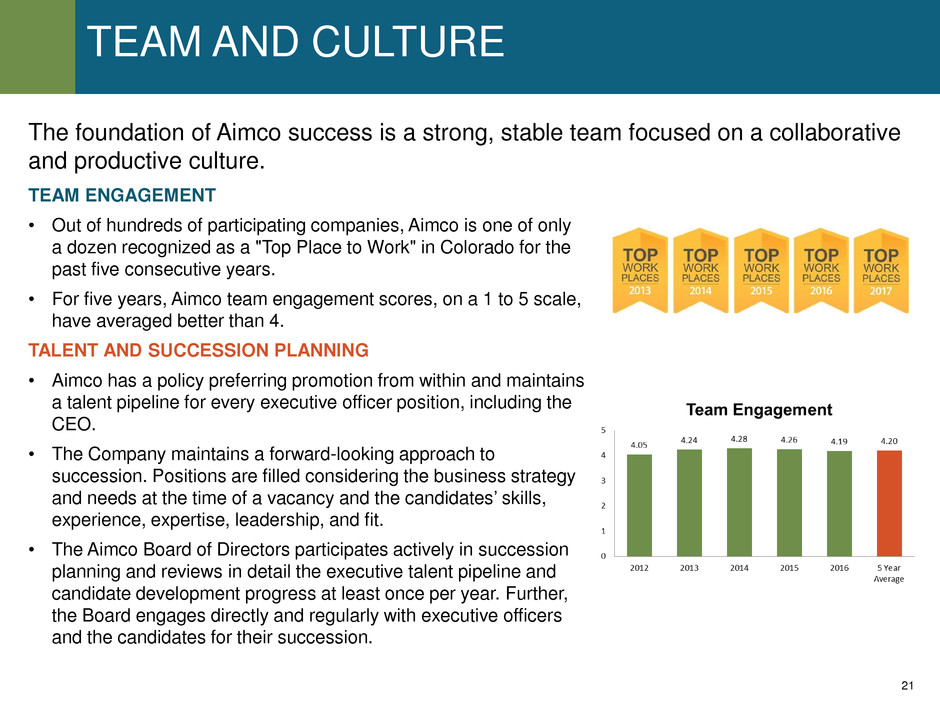

TEAM AND CULTURE

TEAM ENGAGEMENT

• Out of hundreds of participating companies, Aimco is one of only

a dozen recognized as a "Top Place to Work" in Colorado for the

past five consecutive years.

• For five years, Aimco team engagement scores, on a 1 to 5 scale,

have averaged better than 4.

TALENT AND SUCCESSION PLANNING

• Aimco has a policy preferring promotion from within and maintains

a talent pipeline for every executive officer position, including the

CEO.

• The Company maintains a forward-looking approach to

succession. Positions are filled considering the business strategy

and needs at the time of a vacancy and the candidates’ skills,

experience, expertise, leadership, and fit.

• The Aimco Board of Directors participates actively in succession

planning and reviews in detail the executive talent pipeline and

candidate development progress at least once per year. Further,

the Board engages directly and regularly with executive officers

and the candidates for their succession.

The foundation of Aimco success is a strong, stable team focused on a collaborative

and productive culture.

22

AIMCO COMMITMENT

COMMITMENT TO CONSERVATION

In 2016, Aimco invested strategically $3.5M in

energy conservation. Over the last ten years,

Aimco has achieved:

COMMITMENT TO COMMUNITY

Team members turn their passion for community

service into action through Aimco Cares, which gives

teammates 15 paid hours each year to apply to a

volunteer activity of their choosing. In 2016:

The Aimco Cares Charity Golf Classic has grossed

nearly $4M to benefit patriotic causes and provides

scholarships for students in affordable housing.

23

APPENDIX: MULTIFAMILY LANDSCAPE

(1) Green Street Advisors, 2017 U.S. Apartment Outlook, January 2017

(2) Bureau of Labor Statistics

(3) Moody’s Economy.com

(4) U.S. Census Bureau, Current Population Survey/Housing Vacancy Survey

HOUSING DEMAND IS HEALTHY

New Households Job Growth Income Growth(1)

• Greater than 1 Million New Households

in both 2015 & 2016(1)

• New Household formation is expected

to remain above 1 Million in 2017(1)

• Returned to pre-recession levels in 2014(2)

• The number of employed people in the

prime renting age cohort of 20 to 34 year-

olds has increased by ~3.0M since 2014(2)

• Sluggish income growth was

experienced during the early part of the

economic recovery

• Income growth accelerated in 2015 &

2016

• 2018 - 2021 ~4.4M New Households(1)

• ~45% Renter Households(1)

• 2018 - 2021 11.6M new jobs projected(3) • Incomes are expected to continue to rise

DEMOGRAPHICS FAVOR MULTIFAMILY

U.S. Population Age Structure(3) Propensity to Rent

• Cohort of 20 to 34 year-olds projected to

increase by ~1M from 2018 to 2021

• Historically, 64% of people aged 20 to 34 choose to rent while 21% of people over the

age of 55 do so(1)

• Aging of population alone translates into ~2.1M potential new renters from 2018 to 2021

• 55 and older age cohort projected to

increase by ~7.5M from 2018 to 2021

• Share of households renting 5% over last 10 years(4)

GROWTH WILL BE GOVERNED BY NEW SUPPLY

• New supply generally impacts rent growth when completions are greater than 2% of existing inventory, absent of above-average job

growth or other factors.

• New supply is typically delivered at the highest rents in the market, putting competitive pressure primarily on existing high-rent "A"

communities.

• Favorable job and population growth mitigates the impact of new supply.

• Supply risk is also reduced at the portfolio level through geographic and price point diversification, and careful market selection.

• 2018 impact from completed new supply is expected to remain elevated as in 2017.

24

FORWARD LOOKING STATEMENTS &

OTHER INFORMATION

This presentation contains forward-looking statements within the meaning of the federal securities laws, including, without limitation, statements regarding projected

results and specifically forecasts of 2017 results, including but not limited to: Pro forma FFO and selected components thereof; AFFO; Aimco redevelopment and

development investments and projected value creation from such investments; and Aimco liquidity and leverage metrics.

These forward-looking statements are based on management’s judgment as of this date, which is subject to risks and uncertainties. Risks and uncertainties include, but

are not limited to: Aimco’s ability to maintain current or meet projected occupancy, rental rate and property operating results; the effect of acquisitions, dispositions,

redevelopments and developments; Aimco’s ability to meet budgeted costs and timelines, and achieve budgeted rental rates related to Aimco redevelopments and

developments; and Aimco’s ability to comply with debt covenants, including financial coverage ratios. Actual results may differ materially from those described in these

forward-looking statements and, in addition, will be affected by a variety of risks and factors, some of which are beyond Aimco’s control, including, without

limitation:

• Real estate and operating risks, including fluctuations in real estate values and the general economic climate in the markets in which Aimco operates and

competition for residents in such markets; national and local economic conditions, including the pace of job growth and the level of unemployment; the amount,

location and quality of competitive new housing supply; the timing of acquisitions, dispositions, redevelopments and developments; and changes in operating costs,

including energy costs;

• Financing risks, including the availability and cost of capital markets’ financing; the risk that cash flows from operations may be insufficient to meet required

payments of principal and interest; and the risk that earnings may not be sufficient to maintain compliance with debt covenants;

• Insurance risks, including the cost of insurance, and natural disasters and severe weather such as hurricanes; and

• Legal and regulatory risks, including costs associated with prosecuting or defending claims and any adverse outcomes; the terms of governmental regulations that

affect Aimco and interpretations of those regulations; and possible environmental liabilities, including costs, fines or penalties that may be incurred due to necessary

remediation of contamination of apartment communities presently or previously owned by Aimco.

In addition, Aimco’s current and continuing qualification as a real estate investment trust involves the application of highly technical and complex provisions of the

Internal Revenue Code and depends on Aimco’s ability to meet the various requirements imposed by the Internal Revenue Code, through actual operating results,

distribution levels and diversity of stock ownership.

Readers should carefully review Aimco’s financial statements and the notes thereto, as well as the section entitled “Risk Factors” in Item 1A of Aimco’s Annual Report

on Form 10-K for the year ended December 31, 2016, and the other documents Aimco files from time to time with the Securities and Exchange Commission.

These forward-looking statements reflect management’s judgment as of this date, and Aimco assumes no obligation to revise or update them to reflect future events or

circumstances. This presentation does not constitute an offer of securities for sale.

Glossary & Reconciliations of Non-GAAP Financial and Operating Measures

Financial and operating measures discussed in this document include certain financial measures used by Aimco management, some of which are measures not defined

under accounting principles generally accepted in the United States, or GAAP. These measures are defined in the Glossary and Reconciliations of Non-GAAP Financial

and Operating Measures included in Aimco's Third Quarter 2017 Earnings Release dated Oct 26, 2017.