Attached files

| file | filename |

|---|---|

| EX-32.1 - EXHIBIT 32.1 - SELLAS Life Sciences Group, Inc. | gale20170930ex321.htm |

| EX-31.1 - EXHIBIT 31.1 - SELLAS Life Sciences Group, Inc. | gale20170930ex311.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

________________________________

FORM 10-Q

________________________________

ý | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2017

OR

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ________ to ________

Commission File Number: 001-33958

Galena Biopharma, Inc.

(Exact name of registrant as specified in its charter)

________________________________

Delaware | 20-8099512 | |

(State of incorporation) | (I.R.S. Employer Identification No.) | |

2000 Crow Canyon Place, Suite 380, San Ramon, CA 94583

(855) 855-4253

(Address, including zip code, and telephone number, including

area code, of registrant's principal executive offices)

________________________________

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter time that the registrant was required to submit and post such files). Yes ý No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act (Check one):

Large accelerated filer | ¨ | Accelerated filer | ý | |||

Non-accelerated filer | ¨ | (Do not check if a smaller reporting company) | Smaller reporting company | ý | ||

Emerging growth company | ¨ | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act): ¨ Yes ý No

As of November 9, 2017, Galena Biopharma, Inc. had outstanding 45,712,912 shares of common stock, $0.0001 par value per share, exclusive of treasury shares.

GALENA BIOPHARMA, INC.

FORM 10-Q - Quarterly Report

For the Quarter Ended September 30, 2017

TABLE OF CONTENTS

Part No. | Item No. | Description | Page No. | ||

I | |||||

1 | |||||

Condensed Consolidated Balance Sheets as of September 30, 2017 (unaudited) and December 31, 2016 | |||||

Condensed Consolidated Statements of Operations (unaudited) for the three and nine months ended September 30, 2017 and 2016 | |||||

Condensed Consolidated Statement of Stockholders' Equity (unaudited) for the nine months ended September 30, 2017 | |||||

Condensed Consolidated Statements of Cash Flows (unaudited) for the nine months ended September 30, 2017 and 2016 | |||||

2 | |||||

3 | |||||

4 | |||||

II | |||||

1 | Legal Proceedings | ||||

1A | Risk Factors | ||||

2 | |||||

3 | |||||

4 | |||||

5 | |||||

6 | |||||

EX-31.1 | |||||

EX-32.1 | |||||

1

NOTE REGARDING FORWARD-LOOKING STATEMENTS

Some of the information contained in this quarterly report may include forward-looking statements that reflect our current views with respect to our development programs, business strategy, business plan, business combination transactions, financial performance and other future events. These statements include forward-looking statements both with respect to us, specifically, and our industry, in general. Statements that include the words “expect,” “intend,” “plan,” “believe,” “project,” “estimate,” “may,” “should,” “anticipate,” “will” and similar statements of a future or forward-looking nature identify forward-looking statements for purposes of the federal securities laws and otherwise. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on our current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of our control. There are or will be important factors that could cause actual results to differ materially from those indicated in these statements. These factors include, but are not limited to, statements about future expectations, plans and prospects for the completion of the Proposed Merger as defined in Note 1 of the condensed consolidated financial statements below, final agreements among the U.S. Attorney's Office of the District of New Jersey, or USAO NJ, and the Department of Justice, or the DOJ, and the Company, the settlement terms among USAO NJ, DOJ and the Company, the settlement of any claims that might be made by state agencies in the future, the settlement terms with federal agencies such as U.S. Department of Defense, the Office of the Personnel Management, the Office of the Inspector General for the U.S. Department of Health and Human Services, future expectations, plans and prospects of Galena’s clinical programs, the cash projections, and other future events. These factors also include, but are not limited to, those factors set forth in the sections entitled ” Risk Factors,” “Legal Proceedings,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Quantitative and Qualitative Disclosures About Market Risk” and “Controls and Procedures” in this quarterly report, all of which you should review carefully. Please consider our forward-looking statements in light of those risks as you read this quarterly report. We undertake no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise, except as required by law. If one or more of these or other risks or uncertainties materializes, or if our underlying assumptions prove to be incorrect, actual results may vary materially from what we anticipate. All subsequent written and oral forward-looking statements attributable to us or individuals acting on our behalf are expressly qualified in their entirety by this forward-looking statement.

2

PART I FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

GALENA BIOPHARMA, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(Amounts in thousands, except share and per share data)

September 30, 2017 | December 31, 2016 | ||||||

(Unaudited) | |||||||

ASSETS | |||||||

Current assets: | |||||||

Cash and cash equivalents | $ | 12,914 | $ | 18,083 | |||

Restricted cash | 12,372 | 18,022 | |||||

Prepaid expenses and other current assets | 520 | 581 | |||||

Current assets of discontinued operations | 830 | 813 | |||||

Total current assets | 26,636 | 37,499 | |||||

Equipment and furnishings, net | 123 | 199 | |||||

In-process research and development | 9,300 | 12,864 | |||||

GALE-401 rights | 8,100 | 9,255 | |||||

Goodwill | 5,386 | 5,898 | |||||

Deposits and other assets | 50 | 96 | |||||

Total assets | $ | 49,595 | $ | 65,811 | |||

LIABILITIES AND STOCKHOLDERS’ EQUITY | |||||||

Current liabilities: | |||||||

Accounts payable | $ | 211 | $ | 840 | |||

Accrued expenses and other current liabilities | 3,186 | 4,292 | |||||

Litigation settlement payable | 1,300 | 950 | |||||

Fair value of warrants potentially settleable in cash | 4,395 | 1,860 | |||||

Current portion of long-term debt | 12,170 | 16,397 | |||||

Current liabilities of discontinued operations | 6,759 | 6,059 | |||||

Total current liabilities | 28,021 | 30,398 | |||||

Deferred tax liability | 5,661 | 5,661 | |||||

Contingent purchase price consideration | 1,277 | 1,095 | |||||

Total liabilities | 34,959 | 37,154 | |||||

Commitments and contingencies | |||||||

Stockholders’ equity: | |||||||

Preferred stock, $0.0001 par value; 5,000,000 shares authorized; no shares issued and outstanding | — | — | |||||

Common stock, $0.0001 par value; 350,000,000 shares authorized, 41,849,725 shares issued and 41,815,975 shares outstanding at September 30, 2017; 15,224,223 shares issued and 15,190,473 shares outstanding at December 31, 2016 | 4 | 2 | |||||

Additional paid-in capital | 347,610 | 335,436 | |||||

Accumulated deficit | (329,129 | ) | (302,932 | ) | |||

Less treasury shares at cost, 33,750 shares | (3,849 | ) | (3,849 | ) | |||

Total stockholders’ equity | 14,636 | 28,657 | |||||

Total liabilities and stockholders’ equity | $ | 49,595 | $ | 65,811 | |||

See accompanying notes to condensed consolidated financial statements.

3

GALENA BIOPHARMA, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Amounts in thousands, except share and per share data)

(Unaudited)

Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||

2017 | 2016 | 2017 | 2016 | ||||||||||||

Operating expenses: | |||||||||||||||

Research and development | $ | 951 | $ | 3,624 | $ | 5,357 | $ | 15,242 | |||||||

General and administrative | 3,511 | 2,848 | 9,104 | 9,490 | |||||||||||

Total operating expenses | 4,462 | 6,472 | 14,461 | 24,732 | |||||||||||

Operating loss | (4,462 | ) | (6,472 | ) | (14,461 | ) | (24,732 | ) | |||||||

Non-operating income (expense): | |||||||||||||||

Litigation settlements | — | — | (1,300 | ) | (1,800 | ) | |||||||||

Change in fair value of warrants potentially settleable in cash | 4,115 | 3,652 | 7,822 | 14,172 | |||||||||||

Goodwill and intangible assets impairment loss | (5,231 | ) | — | (5,231 | ) | — | |||||||||

Interest expense, net | (565 | ) | (1,377 | ) | (2,225 | ) | (1,988 | ) | |||||||

Change in fair value of the contingent purchase price liability | (50 | ) | (145 | ) | (182 | ) | 5,182 | ||||||||

Total non-operating income (expense), net | (1,731 | ) | 2,130 | (1,116 | ) | 15,566 | |||||||||

Loss from continuing operations | (6,193 | ) | (4,342 | ) | (15,577 | ) | (9,166 | ) | |||||||

Income (loss) from discontinued operations | 118 | (2,587 | ) | (10,620 | ) | (8,867 | ) | ||||||||

Net loss | $ | (6,075 | ) | $ | (6,929 | ) | $ | (26,197 | ) | $ | (18,033 | ) | |||

Net loss per common share, basic and diluted: | |||||||||||||||

Basic and diluted net loss per share, continuing operations | $ | (0.15 | ) | $ | (0.41 | ) | $ | (0.45 | ) | $ | (0.97 | ) | |||

Basic and diluted net income (loss) per share, discontinued operations | $ | — | $ | (0.25 | ) | $ | (0.31 | ) | $ | (0.93 | ) | ||||

Basic and diluted net loss per share | $ | (0.15 | ) | $ | (0.66 | ) | $ | (0.76 | ) | $ | (1.90 | ) | |||

Weighted-average common shares outstanding, basic and diluted | 39,250,419 | 10,465,164 | 34,406,397 | 9,515,316 | |||||||||||

See accompanying notes to condensed consolidated financial statements.

4

GALENA BIOPHARMA, INC.

CONDENSED CONSOLIDATED STATEMENT OF STOCKHOLDERS' EQUITY

(Amounts in thousands, except share amounts)

(Unaudited)

Common Stock | Additional Paid-In Capital | Accumulated Deficit | Treasury Stock | Total | ||||||||||||||||||

Shares Issued | Amount | |||||||||||||||||||||

Balance at December 31, 2016 | 15,224,223 | $ | 2 | $ | 335,436 | $ | (302,932 | ) | $ | (3,849 | ) | $ | 28,657 | |||||||||

Issuance of common stock, net of $356 in issuance costs | 17,000,000 | 2 | 15,522 | — | — | 15,524 | ||||||||||||||||

Fair value of common stock warrants granted in connection with 2017 common stock offerings | — | — | (10,357 | ) | — | — | (10,357 | ) | ||||||||||||||

Issuance of common stock as repayment of principal and interest on long-term debt | 9,460,991 | — | 6,305 | — | — | 6,305 | ||||||||||||||||

Issuance of common stock in connection with employee stock purchase plan | 4,048 | — | 5 | — | — | 5 | ||||||||||||||||

Stock-based compensation for directors and employees | — | — | 576 | — | — | 576 | ||||||||||||||||

Fair value of common stock issued in exchange for services | 160,463 | — | 123 | — | — | 123 | ||||||||||||||||

Net loss | — | — | — | (26,197 | ) | — | (26,197 | ) | ||||||||||||||

Balance at September 30, 2017 | 41,849,725 | $ | 4 | $ | 347,610 | $ | (329,129 | ) | $ | (3,849 | ) | $ | 14,636 | |||||||||

See accompanying notes to condensed consolidated financial statements.

5

GALENA BIOPHARMA, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Amounts in thousands)

(Unaudited)

For the Nine Months Ended September 30, | ||||||||

2017 | 2016 | |||||||

Cash flows from operating activities: | ||||||||

Cash flows from continuing operating activities: | ||||||||

Net loss from continuing operations | $ | (15,577 | ) | $ | (9,166 | ) | ||

Adjustment to reconcile net loss to net cash used in operating activities: | ||||||||

Depreciation and amortization expense | 76 | 95 | ||||||

Non-cash accretion of debt issuance costs | 1,423 | 1,280 | ||||||

Non-cash GALE-401 rights impairment charge | 1,155 | — | ||||||

Non-cash In-process research and development impairment charge | 3,564 | — | ||||||

Non-cash goodwill impairment charge | 512 | — | ||||||

Issuance of common stock as repayment of interest on long-term debt | 765 | — | ||||||

Non-cash stock-based compensation | 576 | 1,830 | ||||||

Fair value of common stock issued in exchange for services | 123 | — | ||||||

Fair value of common stock issued in connection with litigation settlements | — | 2,650 | ||||||

Change in fair value of common stock warrants | (7,822 | ) | (14,172 | ) | ||||

Change in fair value of contingent consideration | 182 | (5,182 | ) | |||||

Changes in operating assets and liabilities: | ||||||||

Prepaid expenses and other assets | 107 | 381 | ||||||

Litigation settlement insurance recovery | — | 21,700 | ||||||

Litigation settlement payable | 350 | (25,000 | ) | |||||

Accounts payable | (629 | ) | (703 | ) | ||||

Accrued expenses and other current liabilities | (1,106 | ) | (1,473 | ) | ||||

Net cash used in continuing operating activities | (16,301 | ) | (27,760 | ) | ||||

Cash flows from discontinued operating activities: | ||||||||

Net loss from discontinued operations | (10,620 | ) | (8,867 | ) | ||||

Changes in operating assets and liabilities attributable to discontinued operations | 683 | (288 | ) | |||||

Net cash used in discontinued operating activities | (9,937 | ) | (9,155 | ) | ||||

Net cash used in operating activities | (26,238 | ) | (36,915 | ) | ||||

Cash flows from investing activities: | ||||||||

Cash paid for purchase of equipment and furnishings | — | (6 | ) | |||||

Net cash used in continuing investing activities | — | (6 | ) | |||||

Selling costs paid for sale of commercial assets | — | (1,050 | ) | |||||

Net cash used in discontinued investing activities | — | — | (1,050 | ) | ||||

Net cash used in investing activities | — | (1,056 | ) | |||||

2017 | 2016 | |||||||

Cash flows from financing activities: | ||||||||

Net proceeds from issuance of common stock | 15,524 | 31,804 | ||||||

Net proceeds from exercise of stock options | — | 261 | ||||||

Proceeds from exercise of warrants | — | 233 | ||||||

Proceeds from common stock issued in connection with Employee Stock Purchase Plan | 5 | 95 | ||||||

Net proceeds from issuance of long-term debt | — | 23,641 | ||||||

Change in restricted cash related to debt principal paid in common stock | 5,650 | — | ||||||

Minimum cash covenant on long-term debt | — | (18,500 | ) | |||||

Principal payments on long-term debt | (110 | ) | (4,779 | ) | ||||

Net cash provided by financing activities | 21,069 | 32,755 | ||||||

Net decrease in cash and cash equivalents | (5,169 | ) | (5,216 | ) | ||||

Cash and cash equivalents at the beginning of period | 18,083 | 29,730 | ||||||

Cash and cash equivalents at end of period | $ | 12,914 | $ | 24,514 | ||||

Supplemental disclosure of cash flow information: | ||||||||

Cash received during the periods for interest | $ | 83 | $ | 84 | ||||

Cash paid during the periods for interest | $ | 102 | $ | 636 | ||||

Supplemental disclosure of non-cash investing and financing activities: | ||||||||

Fair value of warrants issued in connection with common stock recorded as issuance cost | $ | 10,357 | $ | 9,866 | ||||

Repayment of interest and principal on long-term debt through issuance of common stock | $ | 6,305 | $ | — | ||||

Fair value of warrants issued in connection with long-term debt recorded as debt issuance costs | $ | — | $ | 1,139 | ||||

Reclassification of warrant liabilities upon exercise | $ | — | $ | 324 | ||||

6

GALENA BIOPHARMA, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

1. Business and Basis of Presentation

Overview

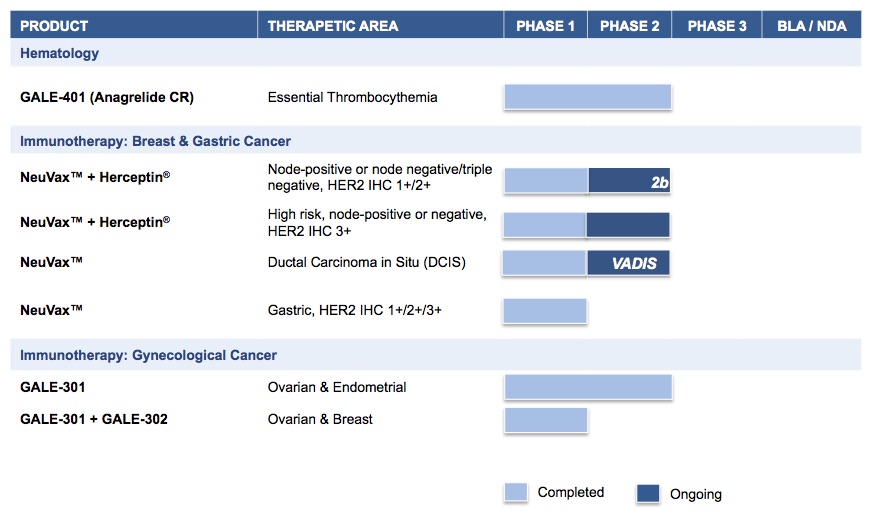

Galena Biopharma, Inc. ("Company," “we,” “us,” “our,” or “Galena”) is a biopharmaceutical company developing hematology and oncology therapeutics that address unmet medical needs. The Company’s pipeline consists of multiple mid- to late-stage clinical assets, including our hematology asset, GALE-401, and our novel cancer immunotherapy programs including NeuVax™ (nelipepimut-S), GALE-301 and GALE-302. GALE-401 is a controlled release version of the approved drug anagrelide for the treatment of elevated platelets in patients with myeloproliferative neoplasms. NeuVax is currently in multiple investigator-sponsored Phase 2 clinical trials in breast cancer. GALE-301 and GALE-302 have completed early stage trials in ovarian, endometrial and breast cancers.

On January 31, 2017, the Company announced that its Board of Directors had initiated a process to explore and review a range of strategic alternatives. As a result of this process, on August 7, 2017, the Company, SELLAS Life Sciences Group Ltd, a Bermuda exempted company (“SELLAS”), Sellas Intermediate Holdings I, Inc., a Delaware corporation and a wholly owned subsidiary of Galena (“Holdings I”), Sellas Intermediate Holdings II, Inc., a Delaware corporation and a wholly owned subsidiary of Holdings I (“Holdings II”) and Galena Bermuda Merger Sub, LTD., a Bermuda corporation and a wholly owned subsidiary of the Company (“Merger Sub”), entered into an Agreement and Plan of Merger and Reorganization, as amended on November 5, 2017 (the “Merger Agreement”) pursuant to which, among other things, and subject to the satisfaction or waiver of the conditions set forth in the Merger Agreement, Merger Sub will merge with and into SELLAS, and the separate existence of Merger Sub shall cease and SELLAS will continue its corporate existence as the surviving company of the merger (the "Proposed Merger" or "Merger"). As a result of the Proposed Merger, SELLAS will become a wholly owned indirect subsidiary of Galena. See below for more information regarding the Proposed Merger.

If the Proposed Merger is completed, under the terms of the Merger Agreement, at the effective time of the Proposed Merger (the “Effective Time”), (a) each outstanding share of SELLAS (excluding shares held by Galena, Merger Sub or SELLAS, which will be canceled without conversion or payment) will be converted into the right to receive shares of Galena Common Stock based on an exchange ratio specified in the Merger Agreement and (b) each outstanding SELLAS stock option and restricted stock unit award will be assumed by Galena. No fractional shares will be issued in connection with the Proposed Merger and Galena will pay cash in lieu of any such fractional shares. Immediately following the Effective Time, (a) Galena stockholders immediately prior to the Effective Time are expected to own approximately 32.5% of the aggregate number of shares of Galena Common Stock, and (b) SELLAS shareholders immediately prior to the Effective Time are expected to own approximately 67.5% of the aggregate number of shares of Galena Common Stock, each calculated on a fully diluted basis for the combined company, except for the exclusion of 2,556,851 out-of-the money Galena warrants. Though the allocation percentage between SELLAS and Galena will remain the same, both SELLAS and Galena are subject to dilution from (i) any shares of Galena Common Stock issued in connection with a potential third party financing that SELLAS has consented to, and (ii) Galena Common Stock underlying certain Galena warrants (other than the warrants outstanding as of immediately prior to the Effective Time that were issued by Galena under the Warrant Agreement dated February 13, 2017). Upon closing of the Proposed Merger, the name of the combined company will become SELLAS Life Sciences Group, Inc. and shares of the combined company are expected to continue trading on the NASDAQ Capital Market under a new the ticker symbol, SLS.

If the Proposed Merger is completed, our three, Phase 2, investigator-sponsored clinical trials with NeuVax in breast cancer will remain ongoing. Our other development programs, GALE-401 and GALE-301/GALE-302 will be evaluated for potential internal development or strategic partnership by management of the continuing company post-Merger.

7

GALENA BIOPHARMA, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - Continued

(Unaudited)

Basis of Presentation and Significant Accounting Policies

The accompanying consolidated financial statements included herein have been prepared by Galena pursuant to the generally accepted accounting principles (GAAP). Unless the context otherwise indicates, references in these notes to the "Company," “we,” “us,” “our,” or “Galena” refer (i) to Galena, our wholly owned subsidiary, Apthera, Inc., or “Apthera,” and our wholly owned subsidiary, Mills Pharmaceuticals, Inc. or "Mills."

These condensed consolidated financial statements and accompanying notes should be read in conjunction with the Company's annual consolidated financial statements and the notes hereto included in its Annual Report on Form 10-K for the year ended December 31, 2016, which was filed on March 15, 2017. The accompanying condensed financial statements at September 30, 2017 and for the three and nine months ended September 30, 2017 and 2016, respectively, are unaudited, but include all adjustments, consisting of normal recurring entries, that management believes to be necessary for a fair presentation of the periods presented. Interim results are not necessarily indicative of results for a full year. Balance sheet amounts as of December 31, 2016 have been derived from the audited financial statements as of that date.

On October 31, 2016, we announced a reverse stock split of our shares of common stock at a ratio of 1-for-20 as approved by the Board of Directors on October 26, 2016. The reverse stock split was authorized by the Company’s stockholders at the Special Meeting of Stockholders held on October 21, 2016. The reverse stock split became effective on November 11, 2016 and the Company’s common stock commenced trading on a split-adjusted basis on Wednesday, November 14, 2016. Unless otherwise stated, all shares and price per share numbers set forth in the condensed consolidated financial statements for periods prior to November 11, 2016 are presented after giving effect to the reverse stock split.

Liquidity & Management's plan - At September 30, 2017, the Company’s capital resources consisted of cash and cash equivalents of $12.9 million. On January 31, 2017, the Company announced that its Board of Directors had initiated a process to explore and review a range of strategic alternatives. As a result of this process, on August 8, 2017 we announced the Proposed Merger. In light of the strategic alternatives process, the Company limited expenditures for its operations through headcount reductions and a general deferral of programs and operational items except that we continued to support the NeuVax investigator-sponsored immunotherapy trials and we have continued to advance activities related to GALE-401 manufacturing in preparation for potential future initiation of a Phase 3 trial. The Company intends to continue to operate at these reduced levels in order to preserve liquidity while completing the Proposed Merger.

Additional funding sources that in certain circumstances may be available to the Company, include 1) approximately $12.0 million of restricted cash associated with the outstanding principal balances as of September 30, 2017 of a debenture with original principal amount of $25.5 million that we sold in May 2016 to the extent we repay the debenture through issuance of common stock in accordance with the terms of the debenture, as detailed further in Note 5; 2) a Purchase Agreement with Lincoln Park Capital, LLC (LPC); 3) At The Market Issuance Sales Agreements (collectively, the ATM) with FBR & Co. (formerly MLV & Co. LLC) and Maxim Group LLC; and 4) amendments to the outstanding warrants; and 5) private or public offerings. See Note 7 below for current restriction on our ability to use the Purchase Agreement with LPC and the ATM with FBR & Co. (formerly MLV & Co. LLC) and Maxim Group LLC. In addition, there are certain restrictions on our ability to amend the outstanding warrants and engage in a private or public offering in the Merger Agreement.

The Company cannot provide assurances that its plans for sources and uses of cash will not change or that changed circumstances will not result in the depletion of its capital resources more rapidly than it currently anticipates. Whether or not we complete the Proposed Merger, we expect to need to raise additional capital to fund our operations, whether through a sale of equity or debt securities, a strategic business transaction, the establishment of other funding facilities, licensing arrangements, asset sales or other means, in order to continue the development of the Company's product candidates and to support its other ongoing activities. However, the Company cannot be certain that it will be able to raise additional capital on favorable terms, or at all, which raises substantial doubt about the Company’s ability to continue as a going concern. The Company is currently evaluating its capital requirements in light of both pursuing the Proposed Merger and funding the development of its clinical

8

GALENA BIOPHARMA, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - Continued

(Unaudited)

programs. In addition, the Company is working with SELLAS to develop a comprehensive capital program to fund all product development programs currently prioritized by SELLAS and the Company subsequent to the Proposed Merger. For example, the Merger Agreement states that subsequent to the Merger the Company will use commercially reasonable best efforts to fund the NeuVax ongoing programs in the amount of up to $3 million through the December 31, 2019.

The current unrestricted cash and cash equivalents as of the date of this filing will fund the Company's operations for at least six months from the date that the unaudited condensed consolidated financial statements as of September 30, 2017 were issued. This projection is based on our current limited operations and estimates of resolution and legal expenses associated with the ongoing government investigation and legal matters pending against the Company, and is subject to changes in our operating plans, legal matters, uncertainties inherent in our business, transaction costs incurred at closing of the Proposed Merger, that could individually or in the aggregate cause us to need to seek to replenish our existing cash and cash equivalents sooner than we project and in greater amounts that we had projected. There is no guarantee that any debt, additional equity or other funding will be available to us on acceptable terms, or at all. If we fail to obtain additional funding when needed or the Proposed Merger is not completed, we would be forced to scale back, or terminate, our operations and may not be able to consummate the Proposed Merger. The Company prepared the consolidated financial statements as of and for the three and nine months ended September 30, 2017 using the generally accepted accounting principles applicable to a going concern. These consolidate financial statements do not include any adjustments relating to the recoverability and classification of recorded assets and liabilities amounts that may be necessary should the Company be unable to continue as going concern.

Reclassifications — The prior year amounts for outstanding common stock at par and related additional paid-in capital have been reclassified to correctly present those amounts. These reclassifications had no effect on total equity, or net loss per share.

Goodwill and Intangible Assets — Goodwill and indefinite-lived intangible assets are not amortized but are tested annually for impairment at the reporting unit level, or more frequently if events and circumstances indicate impairment may have occurred. Factors the company considers important that could trigger an interim review for impairment include, but are not limited to, the following:

• | Significant changes in the manner of its use of acquired assets or the strategy for its overall business; |

• | Significant negative industry or economic trends; |

• | Significant decline in stock price for a sustained period; and |

• | Significant decline in market capitalization relative to net book value. |

Intangible assets with indefinite lives are evaluated for impairment first by a qualitative assessment to determine the likelihood of impairment. If it is determined that impairment is more likely than not, the Company will then proceed to the two step impairment test. The first step is to compare the fair value of the reporting unit to the carrying amount of the reporting unit (the “First Step”). If the carrying amount exceeds the fair value, a second step must be followed to calculate impairment (the “Second Step”). Otherwise, if the fair value exceeds the carrying amount, the intangible asset is not considered to be impaired as of the measurement date. In its review of the carrying value of the indefinite-lived intangible assets, the Company determines fair values of its indefinite-lived intangible assets using the income approach.

Intangible assets not considered indefinite-lived are reviewed for impairment when facts or circumstances suggest that the carrying value of these assets may not be recoverable. The Company’s policy is to identify and record impairment losses, if necessary, on intangible product rights when events and circumstances indicate that the assets might be impaired and the undiscounted cash flows estimated to be generated by those assets are less than the carrying amounts of those assets. Refer to Note 2 of the condensed consolidated financial statements for the Company's preliminary interim impairment analysis on intangible assets.

9

GALENA BIOPHARMA, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - Continued

(Unaudited)

Goodwill is evaluated for impairment using the simplified test of goodwill impairment as defined by the FASB Accounting Standards Update No. 2017-04. Under the new guidance, goodwill impairment will be measured by the amount by which the carrying value of a reporting unit exceeds its fair value, without exceeding the carrying amount of goodwill allocated to that reporting unit. In its review of the carrying value of the goodwill for its single reporting unit and its indefinite-lived intangible assets, the Company determines fair values of its goodwill using the market approach. Refer to Note 2 of the condensed consolidated financial statements for the Company's preliminary interim impairment analysis on goodwill.

Recently Issued Accounting Pronouncements

In November 2015, the FASB issued ASU No. 2015-17, Balance Sheet Classification of Deferred Taxes or ASU 2015-17. ASU 2015-17 requires that deferred tax liabilities and assets be classified as noncurrent on the balance sheet. Previous guidance required deferred tax liabilities and assets to be separated into current and noncurrent amounts on the balance sheet. The guidance will become effective for us beginning in the first quarter of 2017 and may be applied either prospectively or retrospectively. Early adoption is permitted. At the time of adoption, we will reclassify current deferred tax amounts on our Consolidated Balance Sheets as noncurrent. The Company adopted this ASU on January 1, 2017. There was no impact to the Company’s consolidated financial statements upon adoption.

In March 2016, the FASB issued Accounting Standards Update No. 2016-09, Compensation-Stock Compensation or ASU-2016-09. ASU 2016-09 includes several areas of simplification to stock compensation including simplifications to the accounting for income taxes, classification of excess tax benefits on the Statement of Cash Flows and forfeitures. ASU 2016-09 is effective for annual reporting periods beginning after December 15, 2016. An entity that elects early adoption must adopt all of the amendments in the same period. The Company adopted this ASU on January 1, 2017. There was no impact to the Company’s consolidated financial statements upon adoption.

In January 2017, the FASB issued Accounting Standards Update No. 2017-01, Business Combinations or ASU 2017-01. ASU 2017-01 provides guidance for evaluating whether transactions should be accounted for as acquisitions (or disposals) of assets or businesses. The guidance provides a screen to determine when an integrated set of assets and activities (a “set”) does not qualify to be a business. The screen requires that when substantially all of the fair value of the gross assets acquired (or disposed of) is concentrated in an identifiable asset or a group of similar identifiable assets, the set is not a business. If the screen is not met, the guidance requires a set to be considered a business to include, at a minimum, an input and a substantive process that together significantly contribute to the ability to create outputs and removes the evaluation as to whether a market participant could replace the missing elements. The new standard will be effective for us on January 1, 2018 and will be adopted on a prospective basis. Early adoption is permitted. The Company is currently evaluating the impact of our pending adoption of the new standard on the consolidated financial statements.

In January 2017, the FASB issued Accounting Standards Update No. 2017-04, Simplifying the Test for Goodwill Impairment. ASU 2017-04 simplifies the goodwill impairment test. Under the new guidance, goodwill impairment will be measured by the amount by which the carrying value of a reporting unit exceeds its fair value, without exceeding the carrying amount of goodwill allocated to that reporting unit. This guidance will be effective for us beginning in the first quarter of 2020 and is required to be adopted on a prospective basis. Early adoption is permitted. The Company adopted this ASU on September 30, 2017 and was used to determine the impairment loss to goodwill as of September 30, 2017.

In May 2017, the FASB issued Accounting Standard Update No. 2017-09, Compensation - Stock Compensation (Topic 718): Scope of Modification Accounting. ASU 2017-09 provides guidance about which changes to the terms or conditions of a share-based payment award require an entity to apply modification accounting in Topic 718. The new standard will be effective for us on January 1, 2018; however, early adoption is permitted. The Company is currently evaluating the impact of our pending adoption of the new standard on the consolidated financial statements.

10

GALENA BIOPHARMA, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - Continued

(Unaudited)

2. Goodwill and Intangible Assets

Intangible assets include the Company’s GALE-401 rights asset and in-process research and development (IPR&D) asset which were acquired in business combinations and recorded at their respective fair values as of the acquisition date. IPR&D is related to the NeuVax asset. Intangible assets related to GALE-401 rights and IPR&D are considered indefinite-lived intangible assets and are assessed for impairment annually or more frequently if impairment indicators exist. If the associated research and development effort is abandoned, the related assets will be written-off and the Company will record a noncash impairment loss on its consolidated statements of operations. For those compounds that reach commercialization, the IPR&D assets will be amortized over their estimated useful lives.

The impairment test for indefinite-lived intangible assets is a one-step test, which compares the fair value of the intangible asset to its carrying value. If the carrying value exceeds its fair value, an impairment loss is recognized in an amount equal to the excess. Based on accounting standards, it is required that these assets be assessed at least annually for impairment unless a triggering event occurs between annual assessments which would then require an assessment in the period which a triggering event occurred.

The Company entered into the Merger Agreement on August 7, 2017 and the intangible assets were fair valued with the latest preliminary valuation as of October 26, 2017. The preliminary fair values of IPR&D and GALE-401 rights using the income approach. The preliminary interim valuation indicated that the carrying values for IPR&D and GALE-401 rights exceeded the respective carrying values and therefore, the Company recorded impairment losses were recorded to adjust the carrying values to approximate fair values. The impairment losses on GALE-401 rights and IPR&D are aggregated in the statement of operations in goodwill and intangible assets impairment loss.

The following table presents amounts presents the gross amounts of intangible assets and the impairment losses recognized to arrive at the carrying values that approximate fair values as of September 30, 2017 (in thousands):

December 31, 2016 | Impairment Loss | September 30, 2017 | |||||||||

GALE-401 rights | $ | 9,255 | $ | (1,155 | ) | $ | 8,100 | ||||

In-process research and development | 12,864 | (3,564 | ) | 9,300 | |||||||

Total other intangible assets | $ | 22,119 | $ | (4,719 | ) | $ | 17,400 | ||||

Goodwill represents the excess of purchase price over the fair value of net assets acquired by the Company in the acquisition of Apthera, Inc. in 2011 with their sole product candidate, NeuVax. Goodwill is not amortized, but assessed for impairment on an annual basis or more frequently if impairment indicators exist. The impairment model prescribes a simplified goodwill impairment test. Under the new guidance, goodwill impairment will be measured by the amount by which the carrying value of a reporting unit exceeds its fair value, without exceeding the carrying amount of goodwill allocated to that reporting unit.

During the three and nine months ended September 30, 2017, the Company experienced a significant decline in our stock price, and our stock price continued to trend lower through September 30, 2017. Following the public announcement of the entry into the Merger Agreement on August 8, 2017, our stock price declined 27%. The Company determined that this event constituted substantive changes in circumstances that would more likely than not reduce the fair value of the Company's single reporting unit below its carrying amount. Accordingly, the Company tested its goodwill for impairment as of September 30, 2017.

11

GALENA BIOPHARMA, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - Continued

(Unaudited)

In determining, the fair value of the Company's sole reporting unit, the estimated fair value of our reporting unit was determined utilizing a market-based approach, as the primary input in this approach was a quoted market price in an active market. Based on our interim impairment analysis we determined that our carrying value as of September 30, 2017 exceeded the market capitalization of the Company due to the declining stock price. Based on our interim impairment analysis, we recorded a goodwill impairment charge of $0.5 million in the third quarter of 2017 to adjust goodwill to its implied fair value. After recording the goodwill impairment loss, the fair value of equity approximates the carrying value of equity. The impairment loss on goodwill was recorded to adjust the carrying value to approximate fair value. The impairment losses on GALE-401 rights and IPR&D are aggregated in the statement of operations in goodwill and intangible assets impairment loss.

The following table presents amounts presents the gross amount of goodwill and the impairment losses recognized to arrive at the carrying values that approximate fair values as of September 30, 2017 (in thousands):

December 31, 2016 | Impairment Loss | September 30, 2017 | |||||||||

Goodwill | $ | 5,898 | $ | (512 | ) | $ | 5,386 | ||||

The following table presents the impairment losses that aggregate in the statement of operations in goodwill and intangible assets impairment loss for the three and nine months ended September 30, 2017 and 2016, respectively (in thousands):

Three Months Ended September 30, | Nine months ended September 30, | ||||||||||||||

2017 | 2016 | 2017 | 2016 | ||||||||||||

GALE-401 rights impairment loss | $ | (1,155 | ) | $ | — | $ | (1,155 | ) | $ | — | |||||

In-process research and development impairment loss | (3,564 | ) | — | (3,564 | ) | — | |||||||||

Goodwill impairment loss | (512 | ) | — | (512 | ) | — | |||||||||

Goodwill and intangible assets impairment loss | $ | (5,231 | ) | $ | — | $ | (5,231 | ) | $ | — | |||||

12

GALENA BIOPHARMA, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - Continued

(Unaudited)

3. Fair Value Measurements

The following tables present information about our assets and liabilities measured at fair value on a recurring basis in the condensed consolidated balance sheets (in thousands):

Description | September 30, 2017 | Quoted Prices In Active Markets (Level 1) | Significant Other Observable Inputs (Level 2) | Unobservable Inputs (Level 3) | |||||||||||

Assets: | |||||||||||||||

Cash equivalents | $ | 11,162 | $ | 11,162 | $ | — | $ | — | |||||||

Restricted cash equivalents | 12,093 | 12,093 | — | — | |||||||||||

Total assets measured and recorded at fair value | $ | 23,255 | $ | 23,255 | $ | — | $ | — | |||||||

Liabilities: | |||||||||||||||

Warrants potentially settleable in cash | $ | 4,395 | $ | — | $ | 4,395 | $ | — | |||||||

Contingent purchase price consideration | 1,277 | — | — | 1,277 | |||||||||||

Total liabilities measured and recorded at fair value | $ | 5,672 | $ | — | $ | 4,395 | $ | 1,277 | |||||||

Description | December 31, 2016 | Quoted Prices In Active Markets (Level 1) | Significant Other Observable Inputs (Level 2) | Unobservable Inputs (Level 3) | |||||||||||

Assets: | |||||||||||||||

Cash equivalents | $ | 16,192 | $ | 16,192 | $ | — | $ | — | |||||||

Restricted cash equivalents | 17,622 | 17,622 | — | — | |||||||||||

Total assets measured and recorded at fair value | $ | 33,814 | $ | 33,814 | $ | — | $ | — | |||||||

Liabilities: | |||||||||||||||

Warrants potentially settleable in cash | $ | 1,860 | $ | — | $ | 1,860 | $ | — | |||||||

Contingent purchase price consideration | 1,095 | — | — | 1,095 | |||||||||||

Total liabilities measured and recorded at fair value | $ | 2,955 | $ | — | $ | 1,860 | $ | 1,095 | |||||||

The Company did not transfer any financial instruments into or out of Level 3 classification during the nine months ended September 30, 2017 and 2016. A reconciliation of the beginning and ending Level 3 liabilities for the nine months ended September 30, 2017 is as follows (in thousands):

Fair Value Measurements Using Significant Unobservable Inputs (Level 3) | |||

Balance, January 1, 2017 | $ | 1,095 | |

Change in the estimated fair value of the contingent purchase price consideration | 182 | ||

Balance at September 30, 2017 | $ | 1,277 | |

13

GALENA BIOPHARMA, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - Continued

(Unaudited)

The fair value of the contingent purchase price consideration is measured at the end of each reporting period using Level 3 inputs in a probability-weighted, discounted cash-outflow model. The significant unobservable assumptions include the probability of achieving each milestone, the date we expect to reach the milestone, and a determination of present value factors used to discount future expected cash outflows. The decrease in the estimated fair value of the contingent purchase price consideration during the period reflects a lowering of the probability and lengthening of the timeline for the potential approval of NeuVax, as these assumptions are now based principally on our Phase 2 combination trial of trastuzumab and NeuVax with HER2 low-to-intermediate expressing patients. Previously, the valuation was based on the probability of achieving each milestone for our Phase 3 PRESENT trial, which was stopped in June 2016 and subsequently closed in the third quarter due to futility as recommended by the Independent Data Monitoring Committee ("IDMC").

See Note 8 for discussion of the Level 2 liabilities relating to warrants accounted for as liabilities.

4. Accrued Expenses and Other Current Liabilities

Accrued expenses and other current liabilities consist of the following (in thousands):

September 30, 2017 | December 31, 2016 | ||||||

Clinical trial costs | $ | 324 | $ | 3,088 | |||

Professional fees | 1,827 | 229 | |||||

Compensation and related benefits | 1,035 | 975 | |||||

Interest expense | — | — | |||||

Accrued expenses and other current liabilities | $ | 3,186 | $ | 4,292 | |||

14

GALENA BIOPHARMA, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - Continued

(Unaudited)

5. Long-Term Debt

On May 10, 2016, the Company entered into a Securities Purchase Agreement (the “Securities Purchase Agreement”), with JGB (Cayman) Newton Ltd. (the “Purchaser”) pursuant to which the Company sold to Purchaser, at a 6.375% original issue discount, a $25,530,000 Senior Secured Debenture (the “Initial Debenture”) and warrants to purchase up to 100,000 shares of the Company's common stock, $0.0001 par value per share (“Common Stock”). Net proceeds to the Company from sale of the Initial Debenture and warrants, after payment of commissions and legal fees, were approximately $23,400,000. The Initial Debenture contained no conversion features to shares of Common Stock.

The Initial Debenture carried an interest only period of six months following which the holder of the Initial Debenture had the right, at its option, to require the Company to redeem up to $1,100,000 of the outstanding principal amount of the Initial Debenture per calendar month. The Company is required to promptly, but in any event no more than three trading days after the holder delivers a redemption notice to the Company, pay the applicable redemption amount in cash or, at the Company’s election and subject to certain conditions, in shares of Common Stock. If the Company elects to pay the redemption amount in shares of Common Stock, then the shares will be delivered at the lesser of A) 7.5% discount to the average of the 3 lowest volume weighted average prices over the prior 20 trading days or B) a 7.5% discount to the prior trading day’s volume weighted average price (the “Stock Payment Price”). Pursuant to the Initial Debenture, the Company may only opt for payment in shares of Common Stock if certain equity conditions are met or waived, including, among others, that the volume weighted price of the Common Stock be at least $15.00 (the “Original Minimum Price Condition”).

The Initial Debenture was amended and restated in its entirety on August 22, 2016 (as so amended, the “Debenture”) pursuant to an Amendment Agreement, dated August 22, 2016, among the Company, the Purchaser and JGB Collateral LLC (the “Amendment Agreement”). As previously reported, interest on the Debenture is payable at the end of each month based on the outstanding principal. The Debenture matures on November 10, 2018, and accrues interest at 9% per year. In addition, on the maturity date of the Debenture (or such earlier date that the principal amount of the Debenture is paid in full by acceleration or otherwise) a fixed amount, which shall be deemed interest under the Debenture, equal to $765,900, will be due and payable to the holder of the Debenture on such date in, at the option of the Company, cash and, subject to the same conditions for the payment of interest in shares of Common Stock, shares of Common Stock or a combination of cash and Common Stock.

The Company’s obligations under the Debenture are secured under a Security Agreement by a senior lien on all of the Company’s assets, including all of the Company’s interests in its consolidated subsidiaries. Under the subsidiary guarantee agreement, each subsidiary guarantees the performance of the Company of the Purchase Agreement, Debenture and related agreements.

15

GALENA BIOPHARMA, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - Continued

(Unaudited)

After giving effect to the Amendment Agreement, the Debenture contains the following modified and/or additional terms, among others:

• | With respect to interest accruing on the outstanding principal amount under the Debenture for the period prior to November 10, 2016, the Company was permitted to satisfy such interest payments in kind by adding such amount to the outstanding principal. |

• | The Purchaser can from time to time during the term of the Debenture require the Company to prepay in cash all or a portion of the outstanding principal plus accrued and unpaid interest (the “Outstanding Amount”) on written notice to the Company, provided, that such prepayment amount shall not exceed the lesser of $18,500,000 and the Outstanding Amount. If the holder elects such prepayment of the Debenture, then the number of shares subject to the warrants issued to the holder will be reduced in proportion to the percentage of principal and accrued interest required to be prepaid by the Company. In addition, the Company shall have the right to prepay in cash all (but not less than all) of the Outstanding Amount (1) at any time after November 10, 2017, or (2) upon a “change of control” (as such term is used in the Debenture), in each case with a 10% premium on the Outstanding Amount. |

• | The Purchaser shall continue to have the right, which commenced on November 10, 2016, to require the Company to redeem the Outstanding Amount, except that the maximum monthly amount of such redemptions was increased from $1,100,000 to $1,500,000; provided, that if the trading price of Common Stock is at least $8.00 per share (as may be further adjusted appropriately for stock splits, combinations or similar events) during such calendar month, then such monthly maximum redemption amount may be increased to $2,200,000 at the Purchaser’s election and if the Company has already elected to satisfy such redemptions in shares of Common Stock. In addition, notwithstanding the foregoing limitations on the monthly redemption amount, the Purchaser may elect up to three times in any 12-month period to increase the monthly maximum to $2,500,000. |

• | Among the various conditions that must be satisfied (or waived) in order for the Company to be able to elect to satisfy the monthly redemption amounts in shares of Common Stock, the Original Minimum Price Condition of $15.00 was decreased to a volume-weighted average price of $4.00 per share (the “Amended Minimum Price Condition”). |

• | Following November 10, 2016, the Purchaser may elect to convert any portion of the Outstanding Amount into shares of Common Stock at a fixed price of $12.00 per share (as adjusted appropriately for stock splits, combinations or similar events). |

• | Under the Initial Debenture, the Company was required to maintain a minimum of $24,000,000 of unencumbered cash in a restricted account as security for its obligations under the Initial Debenture. Such minimum amount has been reduced to the lesser of $18,500,000 or the Outstanding Amount. |

In addition, in accordance with the terms of the Amendment Agreement, the exercise price of the Series A Warrant was reduced from $30.20 per share to $8.60 per share (as may be further adjusted appropriately for stock splits, combinations or similar events).

16

GALENA BIOPHARMA, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - Continued

(Unaudited)

On December 14, 2016, the Company and the Purchaser entered into a waiver (the “First Waiver”) pursuant to which, as contemplated by the Debenture, the Purchaser waived with respect to the calendar months of December 2016, January 2017, February 2017 and March 2017 (collectively, the “First Specified Months”) the Amended Minimum Price Condition, provided that, among other things, with respect to the First Specified Months, the volume weighted average price of the Common Stock was not less than $1.00 and the Company’s cash on hand exceeded the outstanding principal amount of the Debenture by $10 million. Furthermore, the First Waiver set out a monthly amount to be redeemed for each of the First Specified Months equal to $1,500,000 and amended the Debenture to require the Company to withdraw all cash and/or cash equivalents in excess of $18,500,000 from certain accounts and deposit such funds into an account in a form acceptable to the Purchaser, to be executed by the Company, U.S. Bank, N.A. and SVB Asset Management such that the Company requires the prior written consent of the Purchaser for certain withdrawals. The First Waiver amends the Debenture to grant the Purchaser the right to redeem any portion of the outstanding principal amount of the Debenture in Common Stock if the price per share of Common Stock on a principal trading market at any point in time of any trading day exceeds the closing price per share of the Common Stock on the immediately preceding trading day by more than 25%.

On April 1, 2017, the Company and Purchaser entered into a waiver (the “Second Waiver”) pursuant to which, as contemplated by the Debenture, the Purchaser waived with respect to the calendar months of April 2017, May 2017, June 2017, July 2017, August 2017 and September 2017 (collectively, the “Second Specified Months”) the Amended Minimum Price Condition, provided that, among other things, with respect to the Second Specified Months, the volume weighted average price of the Common Stock is not less than $0.30 and the Company’s cash on hand exceeds the outstanding principal amount of the Debenture by $10 million.

On May 1, 2017, the Purchaser, the Company and the guarantors of the Company’s obligations under the Debenture entered into an amendment agreement (the “2017 Amendment Agreement”) pursuant to which the Purchaser may, from time to time, at the Purchaser’s option waive the Amended Minimum Price Condition; provided, however, the Purchaser cannot waive the Amended Minimum Price Condition to the extent that the resulting Stock Payment Price would be less than $0.35 per share as a result of any such waiver (the “Minimum Stock Payment Price Condition”). The 2017 Amendment Agreement further provides that, in the event of any Equity Conditions Failure (as such term is defined in the Debenture) that is not, or cannot be as a result of the 2017 Amendment Agreement, waived by the Purchaser, the Company shall honor the holder redemption amounts in cash or, at the Company’s election, with the prior written consent of the Purchaser, deliver aggregate consideration in shares of Common Stock and cash in satisfaction of the applicable holder redemption amount as follows: (i) the number of shares of Common Stock equal to the quotient obtained by dividing such holder redemption amount and $0.35 (each such share having a deemed value per share at the Stock Payment Price that would have been in effect but for the Minimum Stock Payment Price Condition of $0.35 per share) and (ii) cash equal to the difference between the holder redemption amount and the aggregate deemed value of the shares of Common Stock delivered in clause (i).

As of May 1, 2017 pursuant to the 2017 Amendment Agreement, the Company estimated that the maximum number of shares of Common Stock that the Company could issue pursuant to the terms of the Debenture subsequent to May 1, 2017 was 45,000,000. As of November 9, 2017, the date of issuance of the Company's condensed consolidated financial statements for the quarter ended September 30, 2017, the Company had issued 8,102,082 shares since the 2017 Amendment Agreement.

On July 10, 2017, the Purchaser, the Company and the guarantors of the Company’s obligations under the Debenture entered into an amendment agreement (the “July 2017 Amendment Agreement”) pursuant to which the definition of “Stock Payment Price” in the Debenture was amended and restated to be the lower of (a) 80% (previously 92.5%) of the VWAP for the Trading Day immediately prior to, as the case may be, the applicable Interest Payment Date, the applicable Advance Date or, with respect to any redemption pursuant to Section 6(a) of the Debenture, the date of the applicable Holder Redemption Notice (the “Prior Day VWAP”) and (b) 80% (previously 92.5%) of the average of the three lowest VWAPs during the 20 consecutive Trading Day period immediately preceding, as the case may be, the applicable Interest Payment Date, the applicable Advance Date or, with respect to any redemption pursuant to Section 6(a) of the Debenture, the date of the applicable Holder Redemption Notice (the “Twenty Day VWAP”); provided, however, to the extent that, on any given Trading Day, the price per share of Common Stock on such Trading Day on the Principal Market equals or exceeds 115% of the Prior Day VWAP or Twenty Day VWAP, then for the such Trading Day, and such Trading Day only, each reference to eighty percent (80%) shall be deemed, for such Trading Day only, to be ninety two and one-half percent (92.5%).

17

GALENA BIOPHARMA, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - Continued

(Unaudited)

The effect of the July 2017 Amendment Agreement is to increase the discount to the Prior Day VWAP and the Twenty Day VWAP granted to the Holder with respect to redemption of, or the payment of interest on, the Debenture in shares of Common Stock from 7.5% to 20%, unless the on any given Trading Day, the price per share of Common Stock on such Trading Day on the Principal Market equals or exceeds 115% of the Prior Day VWAP or Twenty Day VWAP. However, the maximum number of shares of Common Stock issuable pursuant to the Debenture was not changed by the July 2017 Amendment Agreement.

On August 7, 2017, the Company and Purchaser entered into a consent to the Debenture in which the Purchaser consented to the Company’s entry into the Merger Agreement and the Merger as well as an amendment to the Debenture in which: (a) the Company shall not prepay all or any portion of the Debenture prior to the first anniversary of the consummation of the Merger, (b) the Purchaser may increase the dollar amount of the monthly allowance up to the outstanding principal balance of the Debenture by written notice to the Company and may deliver an unlimited number of redemption notices during any calendar month, and (c) to the extent commercially reasonable under the circumstances the Purchaser shall limit the redemption amounts for any given trading day to fifteen percent (15%) of the greater of (1) the daily dollar trading volume for our common stock for such trading day and (2) the average daily dollar trading volume for our common stock for the five (5) consecutive trading days preceding such trading day.

As of September 30, 2017, the outstanding principal balance of the Debenture was $11,971,702. The current portion of long-term debt as of September 30, 2017 of $12,170,059 is net of unamortized discounts and debt issuance costs of $198,357. During the nine months ended September 30 2017, the holder of the Debenture redeemed $5,650,000 of principal, which the Company satisfied with 7,806,708 shares of our common stock. As of December 31, 2016, the outstanding principal balance of the Debenture was $17,621,702. The current portion of long-term debt of $16,397,030 as of December 31, 2016 is net of unamortized discounts and debt issuance costs of $1,224,672. Subsequent to September 30, 2017 and prior to November 9, 2017, the date of issuance of the Company's condensed consolidated financial statements for the quarter ended September 30, 2017, the holder of the Debenture redeemed an additional $1,150,000 of principal, which the Company satisfied with 3,285,711 shares of our common stock.

18

GALENA BIOPHARMA, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - Continued

(Unaudited)

6. Legal Proceedings, Commitments and Contingencies

Legal Proceedings

Settled Matters

On December 16, 2015, Galena received a subpoena issued by the U.S. Attorney’s Office for the District of New Jersey, or USAO NJ, requesting the production of a broad range of documents pertaining to Galena’s marketing and promotional practices for Abstral. Through its communications with the USAO NJ and the DOJ, Galena came to understand that the investigation being undertaken by the USAO NJ and DOJ was a criminal investigation in addition to a civil investigation that could ultimately involve Galena as well as one or more former employees. Pursuant to Galena’s charter, Galena was reimbursing certain former employees’ attorney’s fees with respect to the investigation but stopped on May 1, 2017. Galena cooperated with the civil, and is continuing to cooperate with the criminal, investigations, and on September 8, 2017, DOJ announced a settlement agreement with Galena regarding the USAO NJ’s and DOJ’s investigation. The settlement agreement involves a non-criminal resolution and a civil payment in equal installments over twelve months of approximately $7.6 million, plus interest accrued since the date of reaching an agreement in principle, in return for a release of government claims in connection with the investigation. The $7.6 million civil payment is payable over four equal quarterly installments, with the first payment being made in the third quarter of 2017, and is presented in discontinued operations in the statement of operations. As set forth in that settlement agreement, for a release of all claims against Galena and its officers and directors and dismissal with prejudice of the qui tam lawsuit described below, the relator received a portion of the civil payment to the federal government. Upon payment of the settlement amount, the federal government and the relator will dismiss with prejudice their claims against Galena in the qui tam lawsuit.

In addition, there is a qui tam action pending in the U.S. District Court of the District of New Jersey related to the investigation by USAO NJ and DOJ. On September 18, 2017, the Company executed a settlement agreement with the attorneys for the relator in the qui tam action to settle their statutorily mandated attorney fees award by payment of $100,000 in cash and $200,000 in Galena Common Stock subject to court approval, which amounts were accrued during the second quarter 2017. Galena also obtained the consent of SELLAS under the terms of the Merger Agreement. However on November 7, 2017, attorneys for the qui tam relator agreed to have Galena pay the $200,000 in cash. We also obtained the consent of SELLAS under the terms of the Merger Agreement. The Company paid the $300,000 in cash for the statutorily mandated attorney fees award in the fourth quarter of 2017.

Open Matters

On October 13, 2016, Galena filed a complaint in the Circuit Court for the County of Multnomah for the State of Oregon against Aon Risk Insurance Services West, Inc. (Aon) where Galena is seeking attorney’s fees, costs and expenses incurred by Galena related to its coverage dispute with a certain insurer and for amounts Galena was required to contribute to the settlements of In re Galena Biopharma, Inc. Derivative Litigation and In re Galena Biopharma, Inc. Securities Litigation as a direct result of certain insurer’s failure to pay its full policy limits of liability and other relief. Galena and Aon are currently engaged in written discovery.

On February 13, 2017, a putative shareholder securities class action complaint was filed in the U.S. District Court for the District of New Jersey captioned, Miller v. Galena Biopharma, Inc., et al. On February 15, 2017, a putative shareholder securities class action complaint was filed in the U.S. District Court for the District of New Jersey entitled, Kattuah v Galena Biopharma, Inc., et al. The actions assert that the defendants failed to disclose that Galena's promotional practices for Abstral® (fentanyl sublingual tablets were allegedly improper and that the Company may be subject to civil and criminal liability, and that these alleged failures rendered the Company’s statements about its business misleading. Two groups of shareholders and one individual shareholder filed three motions to be appointed lead plaintiff on April 14, 2017 and April 17, 2017. Subsequently, one of the shareholders groups withdrew its motion for lead plaintiff status and the individual shareholder notified the court that he does not object to the appointment of the remaining shareholder group, GALE investor group, as lead plaintiff. On July 17, 2017, the Court approved the GALE investor group as named lead plaintiff and its counsel as lead and liaison counsel. The Court also consolidated both actions. An amended complaint was filed on October 6, 2017. It is expected that Galena and former officers and current and former employees will respond to the amended complaints through an appropriate pleading or motion.

19

GALENA BIOPHARMA, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - Continued

(Unaudited)

On March 16, 2017, a complaint captioned Keller v. Ashton et al., CA No. 2:17-cv-01777 was filed in the U.S. District Court for the District of New Jersey against the Company's current directors and the Company, as a nominal defendant. The complaint purports to assert derivative claims for breach of fiduciary duty on Galena's behalf against its directors based on substantially similar facts as alleged in the putative shareholder securities class action complaints mentioned above. The Company's response to the complaint was due on June 1, 2017; however, the Court on May 21, 2017, entered a stay of the proceedings pending resolution of motions to dismiss in the securities litigations described above.

Galena also received a stockholder demand dated April 14, 2017, pursuant to 8 Del. C. Sec. 220, from a shareholder (Albert Zhang) demanding access to Galena’s books and records relating to its sales of Abstral and the U.S. Attorney’s investigation into Galena’s sale of Abstral in order for Mr. Zhang to determine, among other things, whether to file a derivative lawsuit against Galena’s management and directors. Galena has responded to the demand and Mr. Zhang has indicated that he will file a derivative complaint soon.

On April 27, 2017, a putative shareholder class action was filed in the Chancery Court of Delaware captioned Patel vs. Galena Biopharma, Inc. et. al, CA No. 2017-0325 alleging breaches of Section 225 of the Delaware General Corporate Law (DGCL) and breaches of fiduciary duties by the Galena Board of Directors regarding the voting results of authorized shares and the reverse stock split proposals in the proxy statements for the July 2016 and October 2016 stockholder meetings. On June 2, 2017, an amended verified complaint was filed along with a motion to expedite the proceedings. On June 5, 2017, Galena filed a verified petition under Section 205 of the DGCL and a motion to expedite the proceedings. On June 8, 2017, the court denied a request by the plaintiff to schedule a preliminary injunction motion and ordered a prompt trial on both the plaintiff and Galena’s claims. On June 20, 2017, the court consolidated the claims into In re Galena Biopharma, Inc., C. A. No. 2017-0423-JTL. On July 10, 2017, the court ordered that the trial of the claims be held on August 28, 30 and 31, 2017. On July 24, 2017, Galena entered into a binding settlement term sheet, which the parties will use to enter into a Stipulation of Settlement that is intended to settle the litigation currently pending in the Court of Chancery of the State of Delaware, captioned In re Galena Biopharma, Inc., C. A. No. 2017-0423-JTL. The settlement resolves the putative stockholder class action claims against Galena and/or certain of its current and former officers and directors, as well as Galena’s petition to validate certain corporate actions. The settlement will not become effective until approved by the Court. Due to the decline in the price of the Galena Common Stock, the plaintiff has demanded to renegotiate the binding settlement term sheet. On September 7, 2017, Galena moved to enforce the binding settlement term sheet. The parties have filed supporting briefs and the hearing will be held on November 30, 2017.

Under the terms of the settlement, the class will receive a settlement payment of $1.3 million, in addition to attorney fees in an amount to be approved. The settlement payment of $1.3 million consists of $50,000 in cash to be paid by the Defendants or their insurers and $1,250,000 in unrestricted shares of the Company’s common stock (“Settlement Stock”), which valuation will be based on the volume-weighted average closing price for the 20 trading days immediately preceding the day before the transfer of the Settlement Stock to the settlement fund pursuant to the terms and conditions of the settlement. The Company anticipates that the Settlement Stock will be issued, pursuant to the terms of the Stipulation of Settlement, in a transaction that is exempt from the registration requirements of the Securities Act of 1933, as amended (the “Securities Act”), pursuant to Section 3(a)(10) of the Securities Act. Any amounts awarded by the Court for attorneys’ fees will be paid in part by the settlement fund and in part by the Company’s insurance carriers. Upon the effectiveness of the proposed settlement, the Defendants will be released from the claims that were asserted or could have been asserted in the class action by class members participating in the settlement.

On July 6, 2017, a complaint captioned Jacob v. Schwartz et al., Case No. C17-01222, was filed in the Superior Court of California, County of Contra Costa against the Company's current and former directors and the Company, as a nominal defendant. The complaint purports to assert derivative claims for breach of fiduciary duty on Galena's behalf against its directors based on substantially similar facts as alleged in the derivative complaint mentioned above. The Company's response to the complaint was due on July 7, 2017; however, the court on September 5, 2017, entered a stay of the proceedings pending resolution of motions to dismiss in the securities litigations described above.

20

GALENA BIOPHARMA, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - Continued

(Unaudited)

On November 7, 2017, a written demand was made on the Company by a shareholder requesting that additional financial projections and valuation analyses be made in the Company’s Form S-4 relating to the Merger, which was declared effective on November 6, 2017. The demand stated, among other thing, that, if such disclosures are not made within a reasonable period of time, the shareholder intends to file a securities class action lawsuit in federal court. The Company will review the demand letter and make the appropriate response

21

GALENA BIOPHARMA, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - Continued

(Unaudited)

7. Stockholders’ Equity

Preferred Stock — The Company has authorized up to 5,000,000 shares of preferred stock, $0.0001 par value per share, for issuance. The preferred stock will have such rights, preferences, privileges and restrictions, including voting rights, dividend rights, conversion rights, redemption privileges and liquidation preferences, as shall be determined by the Company’s Board of Directors upon its issuance. To date, the Company has not issued any preferred shares.

Common Stock — The Company has authorized up to 350,000,000 shares of common stock, $0.0001 par value per share, for issuance.

November 2014 Purchase Agreement with Lincoln Park Capital, LLC - On November 18, 2014, the Company entered into a purchase agreement (LPC Agreement) with Lincoln Park Capital, LLC (LPC), pursuant to which the Company has the right to sell to LPC up to $50 million in shares of the Company's common stock, subject to certain limitations and conditions over the 36-month term of the LPC Agreement. Pursuant to the purchase agreement, LPC initially purchased 125,000 shares of the Company's common stock at $40.00 per share and the Company issued 31,561 shares of common stock to LPC as a commitment fee, which was recorded as a cost of capital. As a result of this initial issuance, the Company received initial net proceeds of $4.9 million, after deducting commissions and other offering expenses. The Company did not sell any shares of our common stock under the LPC Agreement during the nine months ended September 30, 2017. On February 6, 2017, the LPC Agreement was amended to decrease the total value of common stock that the Company may sell to LPC from $55,000,000 to $15,600,000. Except as noted below, the Company has $2.1 million of remaining availability under the LPC Agreement. Use of the purchase agreement with LPC is not currently available to the Company because the Company is not currently eligible to use a Form S-3 registration statement, and it does not expect to be eligible to use a Form S-3 registration statement until May 1, 2018 at the earliest.

At-The-Market Issuance Sales Agreements - On May 24, 2013, the Company entered into At-The-Market Issuance Sales Agreements (ATM) with FBR & Co. (formerly MLV & Co. LLC) and Maxim Group LLC (the Agents). From time to time during the term of the ATM, we may issue and sell through the Agents, shares of our common stock, and the Agents collect a fee equal to 3% of the gross proceeds from the sale of shares, up to a total limit of $20 million in gross proceeds. Except as noted below, the ATM is available to the Company until it is terminated by the Agents, or the Company. The Company did not sell any shares of our common stock under the ATM during the nine months ended September 30, 2017. On December 4, 2015 we replenished the ATM limit up to $20 million in gross proceeds available for future sales of our common stock. Except as noted below, the Company has $19.1 million of remaining availability under the ATM. Use of the ATM is not currently available to the Company because the Company is not currently eligible to use a Form S-3 registration statement, and it does not expect to be eligible to use a Form S-3 registration statement until May 1, 2018 at the earliest.

February 2017 Underwritten Public Offering - On February 13, 2017, the Company closed an underwritten public offering of 17,000,000 shares of common stock and warrants to purchase 17,000,000 shares of common stock priced at $1.00 per share and accompanying warrant (February 2017 Offering). The warrants are immediately exercisable with a strike price of $1.10 and will expire on the fifth anniversary of the date of issuance. The shares of common stock and the warrants were issued separately and were separately transferable immediately upon issuance. The net proceeds of the February 2017 Offering were $15.5 million, after deducting underwriting discounts and commissions and offering expenses paid by the Company. The fair value of the warrants to purchase shares of our common stock issued in connection with the February 2017 Offering was $10.4 million recorded as an issuance cost.

22

GALENA BIOPHARMA, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - Continued

(Unaudited)

Shares of common stock for future issuance are reserved for as follows (in thousands):

As of September 30, 2017 | ||

Warrants outstanding | 19,557 | |

Stock options outstanding | 443 | |

Options reserved for future issuance under the Company’s 2016 Incentive Plan | 457 | |

Shares reserved for future issuance under the Employee Stock Purchase Plan | 17 | |

Total reserved for future issuance | 20,474 | |

8. Warrants

The following is a summary of warrant activity for the nine months ended September 30, 2017 (in thousands):

Warrant Issuance | Outstanding, December 31, 2016 | Granted | Exercised | Expired | Outstanding, September 30 2017 | Expiration | ||||||||||

February 2017 | — | 17,000 | — | — | 17,000 | February 2022 | ||||||||||

July 2016 | 700 | — | — | — | 700 | January 2022 | ||||||||||

January 2016 | 682 | — | — | — | 682 | January 2021 | ||||||||||