Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - AVADEL PHARMACEUTICALS PLC | q32017earningsrelease.htm |

| 8-K - 8-K - AVADEL PHARMACEUTICALS PLC | avadel_8kxq3x2017.htm |

Q3 2017

Earnings Conference Call

September 8, 2017

2

Safe Harbor

This presentation may include forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934. The words “will,” “may,” “believe,” “expect,” “anticipate,” “estimate,” “project”

and similar expressions, and the negatives thereof, identify forward-looking statements, each of which speaks only as of the date the

statement is made. Although we believe that our forward-looking statements are based on reasonable assumptions within the

bounds of our knowledge of our business and operations, our business is subject to significant risks and as a result there can be no

assurance that actual results of our research, development and commercialization activities and our results of operations will not

differ materially from the results contemplated in such forward-looking statements. These risks include: (i) risks relating to our

license agreement with Serenity Pharmaceuticals, LLC including that our internal analyses may overstate the market opportunity in

the United States for the drug desmopressin acetate (the “Drug”) or we may not effectively exploit such market opportunity, that

significant safety or drug interaction problems could arise with respect to the Drug, that we may not successfully increase awareness

of nocturia and the potential benefits of the Drug, and that the need for management to focus attention on the development and

commercialization of the Drug could cause our ongoing business operations to suffer; and (ii) the other risks, uncertainties and

contingencies described in the Company's filings with the U.S. Securities and Exchange Commission, including our annual report on

Form 10-K for the year ended December 31, 2016, in particular under the captions “Forward-Looking Statements” and “Risk Factors,”

including without limitation: our dependence on a small number of products and customers for the majority of our revenues; the

possibility that our Bloxiverz®,Vazculep® and Akovaz® products, which are not patent protected, could face substantial competition

resulting in a loss of market share or forcing us to reduce the prices we charge for those products; the possibility that we could fail to

successfully complete the research and development for pipeline products we are evaluating for potential application to the FDA

pursuant to our "unapproved-to-approved" strategy, or that competitors could complete the development of such products and

apply for FDA approval of such products before us; the possibility that our products may not reach the commercial market or gain

market acceptance; our need to invest substantial sums in research and development in order to remain competitive; our

dependence on certain single providers for development of several of our drug delivery platforms and products; our dependence on

a limited number of suppliers to manufacture our products and to deliver certain raw materials used in our products; the possibility

that our competitors may develop and market technologies or products that are more effective or safer than ours, or obtain

regulatory approval and market such technologies or products before we do; the challenges in protecting the intellectual property

underlying our drug delivery platforms and other products; and our dependence on key personnel to execute our business plan.

Except as may be required by law, we disclaim any obligation to publicly update any forward-looking statements to reflect events

after the date of this presentation.

3

Strategy Execution

Cash Generation Proprietary Product

Development

Business Development

$39.7 Million Q3 Revenues

$30 Million in Operating

Cash Flow YTD

REST-ON Phase III Trial of

FT218, Micropump® Sodium

Oxybate

In-licensed Noctiva™ on

September 1, 2017

Continued Growth Through Cash Generation, Application of Proprietary Technology and

Business Development

Noctiva is not yet available for prescription

For full prescribing and important safety information please see slide 16 in the appendix

4

Noctiva™

First & Only FDA Approved Product to Treat Nocturia due to Nocturnal Polyuria in Adults

Noctiva:

Proprietary, low-dose (7 – 27x lower than existing

forms), intranasal desmopressin acetate formulation

Condition:

Nocturia due to nocturnal polyuria causes patients to

awaken 2 or more times / night to urinate

Prevalence: ~40 million U.S. patients with nocturia*

Diagnosed:

Independent research & claims data estimate 3 million

patients diagnosed & on some form of treatment *

*Data on file

Noctiva is not yet available for prescription

For full prescribing and important safety information please see slide 16 of the appendix

5

Hospital Products

*Based on IMS data

For full prescribing information for Bloxiverz, Vazculep and Akovaz, please see slide 17 of the appendix

**AV001 is part of Avadel’s Unapproved Marketed Drug (UMD) strategy, for which it takes currently unapproved products through the FDA approval process

Bloxiverz®

~35% share of neostigmine

market volume in Q3*

Four competing neostigmine

products during the 3rd quarter

Sugammadex has taken ~

50% neostigmine volume*

Akovaz®

~42% share of ephedrine sulfate

market volume in Q3*

Four competing neostigmine

products during the 3rd quarter

More competition expected

in 2018

Vazculep®

~40% share of 1mL vial volume

100% share of 5mL & 10mL vial

volume*

Two competing 1mL formats

More competition expected

in 2018

AV001**

Undisclosed sterile injectable

product

Market value ~$30 - $40 million Filing mid-2018

Hospital Products Accounted for $38 Million of 3Q 2017 Revenues

6

REST-ON Progress

5 of 6 sites active in Canada

24 of 31 sites active in US

16 of 18 sites active in Europe

Additional sites to be added in US and UK

Sodium Oxybate Naïve Criterion Remains High Hurdle During Screening Process

For more details on our clinical trial, please visit www.rethinknarcolepsy.com

7

Non-GAAP Financial Results

*Reconciliations from GAAP to Non-GAAP can be found in the appendix

Three Months Ended

(in 000s) 09/30/17 06/30/17 09/30/16

Sales $ 39,675 $ 47,411 $ 32,087

Cost of products and services sold 3,790 4,561 2,844

Research and development expenses 8,095 6,792 8,143

Selling, general and admin expenses 11,563 12,429 12,740

Intangible asset amortization — — —

Restructuring costs — — —

Operating Expenses 23,448 23,782 23,727

Contingent consideration payments and accruals 7,264 8,516 5,884

Operating income (loss) 8,963 15,113 2,476

Interest and other expense (net) 847 264 226

Other expense - contingent consideration payments and

accruals (963) (1,166) (785)

Income (loss) before income taxes 8,847 14,211 1,917

Income tax provision 5,100 6,046 5,416

Net income (loss) $ 3,747 $ 8,165 $ (3,499)

Diluted earnings (loss) per share $ 0.09 $ 0.19 $ (0.08)

(in $000s, except for per share amounts)

8

GAAP Financial Results

Three Months Ended

(in 000s) 09/30/17 06/30/17 09/30/16

Sales $ 39,675 $ 46,311 $ 32,087

Cost of products and services sold 3,790 4,561 2,844

Research and development expenses 8,095 6,792 8,143

Selling, general and admin expenses 11,563 12,429 12,740

Intangible asset amortization 564 564 3,702

Restructuring costs (549) 1,069 —

Operating Expenses 23,463 25,415 27,429

(Gain)/loss - changes in fair value of related party contingent

consideration (9,906) (13,230) 20,848

Operating income (loss) 26,118 34,126 (16,190)

Interest and other expense (net) 714 501 1,475

Other income (expense) - changes in fair value of related party

payable 768 1,670 (1,828)

Income (loss) before income taxes 27,600 36,297 (16,543)

Income tax provision 5,921 7,370 3,451

Net income (loss) $ 21,679 $ 28,927 $ (19,994)

Diluted earnings (loss) per share $ 0.52 $ 0.68 $ (0.48)

(in $000s, except for per share amounts)

9

Revenues (GAAP)

(in $000's) Q3 2017 Q2 2017 Q3 2016

Q3 2017

vs.

Q2 2017

Q3 2017

vs.

Q3 2016

Bloxiverz $ 9,920 $ 13,719 $ 15,591 $ (3,799) $ (5,671)

Vazculep 9,573 10,154 9,340 (581) 233

Akovaz 18,561 20,912 5,568 (2,351) 12,993

Other 1,093 2,320 841 (1,227) 252

Total product sales and services 39,147 47,105 31,340 (7,958) 7,807

License and research revenue 528 794 747 (266) (219)

Total revenues $ 39,675 $ 47,899 $ 32,087 $ (8,224) $ 7,588

10

Cash Flow Summary

(in $000's) Nine Months Ended September 30,

Total Cash and Marketable Securities 2017 2016

Beginning Balance 154,195 144,802

Operating Cash Flows (excl tax and earnout payments) 73,258 49,636

Earnout/Royalty Payments (29,136) (24,227)

Income Taxes (14,605) (22,200)

Acquisition of Noctiva Asset (52,139) —

Share Repurchases (16,707) —

Capital Spending (533) (1,000)

Other 1,277 2,656

Change in Total (38,585) 4,865

Ending Balance 115,610 149,667

11

2017 Non - GAAP Guidance

2017 Guidance

Updated Previous

Sales $165M - $175M $165M - $175M

R&D Expense $30M - $35M $30M - $40M

Income Tax Rate 55% - 65% 60% - 70%

Diluted EPS (Adjusted) $0.25 - $0.35 $0.30 - $0.45

12

APPENDIX

13

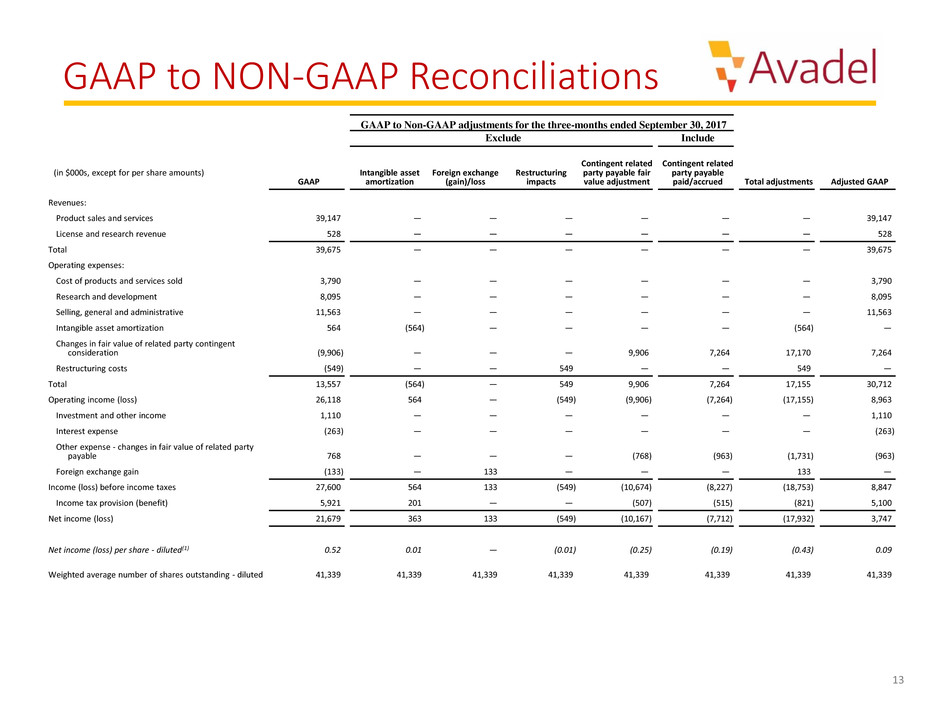

GAAP to NON-GAAP Reconciliations

GAAP to Non-GAAP adjustments for the three-months ended September 30, 2017

Exclude Include

GAAP

Intangible asset

amortization

Foreign exchange

(gain)/loss

Restructuring

impacts

Contingent related

party payable fair

value adjustment

Contingent related

party payable

paid/accrued Total adjustments Adjusted GAAP

Revenues:

Product sales and services 39,147 — — — — — — 39,147

License and research revenue 528 — — — — — — 528

Total 39,675 — — — — — — 39,675

Operating expenses:

Cost of products and services sold 3,790 — — — — — — 3,790

Research and development 8,095 — — — — — — 8,095

Selling, general and administrative 11,563 — — — — — — 11,563

Intangible asset amortization 564 (564) — — — — (564) —

Changes in fair value of related party contingent

consideration (9,906) — — — 9,906 7,264 17,170 7,264

Restructuring costs (549) — — 549 — — 549 —

Total 13,557 (564) — 549 9,906 7,264 17,155 30,712

Operating income (loss) 26,118 564 — (549) (9,906) (7,264) (17,155) 8,963

Investment and other income 1,110 — — — — — — 1,110

Interest expense (263) — — — — — — (263)

Other expense - changes in fair value of related party

payable 768 — — — (768) (963) (1,731) (963)

Foreign exchange gain (133) — 133 — — — 133 —

Income (loss) before income taxes 27,600 564 133 (549) (10,674) (8,227) (18,753) 8,847

Income tax provision (benefit) 5,921 201 — — (507) (515) (821) 5,100

Net income (loss) 21,679 363 133 (549) (10,167) (7,712) (17,932) 3,747

Net income (loss) per share - diluted(1) 0.52 0.01 — (0.01) (0.25) (0.19) (0.43) 0.09

Weighted average number of shares outstanding - diluted 41,339 41,339 41,339 41,339 41,339 41,339 41,339 41,339

(in $000s, except for per share amounts)

14

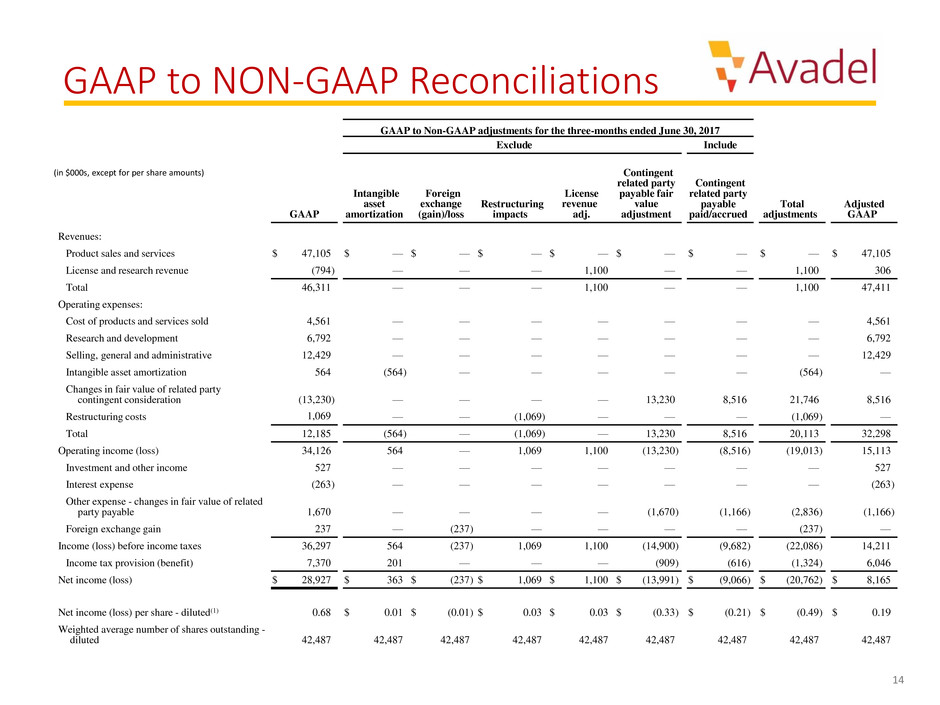

GAAP to NON-GAAP Reconciliations

GAAP to Non-GAAP adjustments for the three-months ended June 30, 2017

Exclude Include

GAAP

Intangible

asset

amortization

Foreign

exchange

(gain)/loss

Restructuring

impacts

License

revenue

adj.

Contingent

related party

payable fair

value

adjustment

Contingent

related party

payable

paid/accrued

Total

adjustments

Adjusted

GAAP

Revenues:

Product sales and services $ 47,105 $ — $ — $ — $ — $ — $ — $ — $ 47,105

License and research revenue (794) — — — 1,100 — — 1,100 306

Total 46,311 — — — 1,100 — — 1,100 47,411

Operating expenses:

Cost of products and services sold 4,561 — — — — — — — 4,561

Research and development 6,792 — — — — — — — 6,792

Selling, general and administrative 12,429 — — — — — — — 12,429

Intangible asset amortization 564 (564) — — — — — (564) —

Changes in fair value of related party

contingent consideration (13,230) — — — — 13,230 8,516 21,746 8,516

Restructuring costs 1,069 — — (1,069) — — — (1,069) —

Total 12,185 (564) — (1,069) — 13,230 8,516 20,113 32,298

Operating income (loss) 34,126 564 — 1,069 1,100 (13,230) (8,516) (19,013) 15,113

Investment and other income 527 — — — — — — — 527

Interest expense (263) — — — — — — — (263)

Other expense - changes in fair value of related

party payable 1,670 — — — — (1,670) (1,166) (2,836) (1,166)

Foreign exchange gain 237 — (237) — — — — (237) —

Income (loss) before income taxes 36,297 564 (237) 1,069 1,100 (14,900) (9,682) (22,086) 14,211

Income tax provision (benefit) 7,370 201 — — — (909) (616) (1,324) 6,046

Net income (loss) $ 28,927 $ 363 $ (237) $ 1,069 $ 1,100 $ (13,991) $ (9,066) $ (20,762) $ 8,165

Net income (loss) per share - diluted(1) 0.68 $ 0.01 $ (0.01) $ 0.03 $ 0.03 $ (0.33) $ (0.21) $ (0.49) $ 0.19

Weighted average number of shares outstanding -

diluted 42,487 42,487 42,487 42,487 42,487 42,487 42,487 42,487 42,487

(in $000s, except for per share amounts)

15

GAAP to NON-GAAP Reconciliations

GAAP to Non-GAAP adjustments for the three-months ended September 30, 2016

Exclude Include

GAAP

Intangible asset

amortization

Foreign exchange

(gain)/loss

Contingent related

party payable fair value

adjustment

Contingent related

party payable

paid/accrued Total adjustments Adjusted GAAP

Revenues:

Product sales and services 31,340 — — — — — 31,340

License and research revenue 747 — — — — — 747

Total 32,087 — — — — — 32,087

Operating expenses:

Cost of products and services sold 2,844 — — — — — 2,844

Research and development 8,143 — — — — — 8,143

Selling, general and administrative 12,740 — — — — — 12,740

Intangible asset amortization 3,702 (3,702) — — — (3,702) —

Changes in fair value of related party

contingent consideration 20,848 — — (20,848) 5,884 (14,964) 5,884

Restructuring costs — — — — — — —

Total 48,277 (3,702) — (20,848) 5,884 (18,666) 29,611

Operating income (loss) (16,190) 3,702 — 20,848 (5,884) 18,666 2,476

Investment and other income 490 — — — — — 490

Interest expense (264) — — — — — (264)

Other expense - changes in fair value of

related party payable (1,828) — — 1,828 (785) 1,043 (785)

Foreign exchange gain 1,249 — (1,249) — — (1,249) —

Income (loss) before income taxes (16,543) 3,702 (1,249) 22,676 (6,669) 18,460 1,917

Income tax provision (benefit) 3,451 1,329 — 1,021 (385) 1,965 5,416

Net income (loss) (19,994) 2,373 (1,249) 21,655 (6,284) 16,495 (3,499)

Net income (loss) per share - diluted(1) (0.48) 0.06 (0.03) 0.53 (0.15) 0.40 (0.08)

Weighted average number of shares outstanding

- diluted 41,241 41,241 41,241 41,241 41,241 41,241 41,241

(in $000s, except for per share amounts)

16

Noctiva™ (desmopressin acetate)

Boxed Warning

WARNING: HYPONATREMIA

NOCTIVA can cause hyponatremia. Severe hyponatremia can be life-threatening, leading to seizures,

coma, respiratory arrest, or death.

NOCTIVA is contraindicated in patients at increased risk of severe hyponatremia, such as patients with

excessive fluid intake, illnesses that can cause fluid or electrolyte imbalances, and in those using loop

diuretics or systemic or inhaled Glucocorticoids.

Ensure serum sodium concentrations are normal before starting or resuming NOCTIVA. Measure

serum sodium within seven days and approximately one month after initiating therapy or increasing the

dose, and periodically during treatment. More frequently monitor serum sodium in patients 65 years of

age and older and in patients at increased risk of hyponatremia.

If hyponatremia occurs, NOCTIVA may need to be temporarily or permanently discontinued.

17

Product & Safety Information

www.bloxiverz.com

www.vazculep.com

www.akovaz.com

Full Prescribing & Safety

Information

www.karbinaler.com

http://www.aciphexsprinkle.com

http://cefaclororal.com

http://flexichamber.com

Akovaz®

Bloxiverz®

Vazculep®

Noctiva™

Karbinal™ER

Aciphex®Sprinkle™

Cefaclor

Flexichamber®