Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE DATED NOVEMBER 2, 2017 - NEW JERSEY RESOURCES CORP | njr3331591-ex991.htm |

| EX-99.2 - INVESTOR FACT SHEET DATED NOVEMBER 2, 2017 - NEW JERSEY RESOURCES CORP | njr3331591-ex992.htm |

| 8-K - CURRENT REPORT - NEW JERSEY RESOURCES CORP | njr3331591-8k.htm |

Execution Version

| PURCHASE AND SALE AGREEMENT |

| by and between |

| TALEN GENERATION, LLC, |

| and |

| ADELPHIA GATEWAY, LLC |

| October 27, 2017 |

TABLE OF CONTENTS

| Page | ||||

| Article 1 DEFINITIONS | 1 | |||

| 1A. | Definitions | 1 | ||

| 1B. | Usage | 1 | ||

| Article 2 PURCHASE AND SALE | 2 | |||

| 2A. | Purchase and Sale of the Interests | 2 | ||

| 2B. | Delivery of Estimated Closing Statement | 3 | ||

| 2C. | Post-Closing Purchase Price Adjustment | 3 | ||

| 2D. | Closing | 6 | ||

| 2E. | Seller’s Deliverables | 6 | ||

| 2F. | Buyer’s Deliverables | 7 | ||

| 2G. | Purchase Price Allocation | 7 | ||

| Article 3 REPRESENTATIONS AND WARRANTIES RELATING TO SELLER | 8 | |||

| 3A. | Organization and Existence | 8 | ||

| 3B. | Authorization | 8 | ||

| 3C. | Legal Proceedings | 8 | ||

| 3D. | Noncontravention | 8 | ||

| 3E. | Capitalization | 9 | ||

| 3F. | Brokers | 9 | ||

| Article 4 REPRESENTATIONS AND WARRANTIES RELATING TO THE COMPANY | 9 | |||

| 4A. | Organization and Existence | 9 | ||

| 4B. | Subsidiaries | 9 | ||

| 4C. | Noncontravention | 9 | ||

| 4D. | Financial Statements; Absence of Undisclosed Liabilities | 10 | ||

| 4E. | Absence of Certain Changes or Events | 10 | ||

| 4F. | Legal Proceedings | 10 | ||

| 4G. | Compliance with Laws; Permits | 11 | ||

| 4H. | Material Contracts | 11 | ||

| 4I. | Real Property; Personal Property | 13 | ||

| 4J. | Employee Matters | 14 | ||

| 4K. | Environmental | 16 | ||

| 4L. | Insurance | 17 | ||

| 4M. | Tax Matters | 17 | ||

| 4N. | Regulatory Status | 18 | ||

| 4O. | Intellectual Property | 18 | ||

| 4P. | Banks | 18 | ||

| 4Q. | Affiliate Arrangements | 18 | ||

| 4R. | Support Obligations | 18 | ||

| 4S. | No Other Business | 18 | ||

| 4T. | Bankruptcy | 18 | ||

| 4U. | Non-Disclosure | 18 | ||

| 4V. | Solvency; Fraudulent Conveyance | 18 | ||

| Article 5 REPRESENTATIONS AND WARRANTIES OF BUYER | 19 | |||

| 5A. | Organization and Existence | 19 | ||

i

| 5B. | Authorization | 19 | ||

| 5C. | Legal Proceedings | 19 | ||

| 5D. | Noncontravention | 19 | ||

| 5E. | Brokers | 20 | ||

| 5F. | Investment Intent | 20 | ||

| 5G. | Available Funds | 20 | ||

| 5H. | Investigation | 20 | ||

| 5I. | Solvency; Fraudulent Conveyance | 20 | ||

| Article 6 COVENANTS | 20 | |||

| 6A. | Access to Information | 20 | ||

| 6B. | Conduct of the Company Pending Closing | 22 | ||

| 6C. | Support Obligations | 25 | ||

| 6D. | Confidentiality; Publicity; Restrictive Covenants | 26 | ||

| 6E. | Expenses | 27 | ||

| 6F. | Regulatory and Other Approvals and Consents | 27 | ||

| 6G. | Seller Marks | 29 | ||

| 6H. | Termination of Certain Affiliate Arrangements | 29 | ||

| 6I. | Distributions | 30 | ||

| 6J. | Employee, Labor and Benefits Matters | 30 | ||

| 6K. | Tax Matters | 32 | ||

| 6L. | Exclusive Transaction | 35 | ||

| 6M. | Further Actions | 36 | ||

| 6N. | Data Room | 36 | ||

| 6O. | Delivery of Books and Records | 36 | ||

| 6P. | Provisions Respecting Representation of the Company | 36 | ||

| 6Q. | Disposition of Excluded Assets | 37 | ||

| 6R. | Title Cooperation | 39 | ||

| 6S. | Casualty | 39 | ||

| 6T. | Insurance | 40 | ||

| 6U. | PHMSA | 40 | ||

| 6V. | Seller’s Letter of Credit Obligations | 40 | ||

| 6W. | Cure of Defects and Obtaining Additional Real Property Interests | 41 | ||

| 6X. | Martins Creek Control Room Matters | 42 | ||

| Article 7 CONDITIONS TO CLOSING | 42 | |||

| 7A. | Buyer’s Condition Precedents | 42 | ||

| 7B. | Seller’s Condition Precedents | 43 | ||

| 7C. | Conditions to All Parties’ Obligations | 44 | ||

| 7D. | Waiver of Condition; Frustration of Conditions | 45 | ||

| Article 8 INDEMNIFICATION AND RELEASE | 45 | |||

| 8A. | Survival | 45 | ||

| 8B. | Indemnification by Seller | 46 | ||

| 8C. | Indemnification by Buyer | 47 | ||

| 8D. | Indemnification Procedures | 47 | ||

| 8E. | General | 48 | ||

| 8F. | Environmental Matters | 49 | ||

| Article 9 TERMINATION | 51 | |||

| 9A. | Grounds for Termination | 51 | ||

ii

| 9B. | Effect of Termination | 52 | ||

| 9C. | Disposition of Initial Payment, Remediation Cost Advances and Letter of Credit | 53 | ||

| Article 10 MISCELLANEOUS | 54 | |||

| 10A. | Notices | 54 | ||

| 10B. | Severability | 55 | ||

| 10C. | Counterparts | 55 | ||

| 10D. | Complete Agreement | 55 | ||

| 10E. | Third-Party Beneficiaries and Obligations | 56 | ||

| 10F. | Governing Law | 56 | ||

| 10G. | CONSENT TO JURISDICTION | 56 | ||

| 10H. | WAIVER OF JURY TRIAL | 56 | ||

| 10I. | Assignment | 57 | ||

| 10J. | Headings | 57 | ||

| 10K. | Construction | 57 | ||

| 10L. | Amendment and Waiver | 57 | ||

| 10M. | Company Disclosure Letter | 57 | ||

| 10N. | No Additional Representations; Disclaimer | 58 | ||

| 10O. | Payments under Agreement | 59 | ||

| 10P. | Specific Performance | 59 | ||

| 10Q. | No Partnership Created | 60 | ||

| 10R. | Non-Recourse | 60 | ||

LIST OF EXHIBITS

| Exhibit A | Definitions | |

| Exhibit B | Required Governmental Authorizations | |

| Exhibit C | Designated Contacts | |

| Exhibit D-1 | Knowledge Persons of Seller | |

| Exhibit D-2 | Knowledge Persons of Buyer | |

| Exhibit E | Excluded Assets | |

| Exhibit F | Precedent Agreements | |

| Exhibit G | Net Working Capital Methodology | |

| Exhibit H | Form of Buyer Guaranty | |

| Exhibit I | Form of Seller Guaranty | |

| Exhibit J | Form of Letter of Credit | |

| Exhibit K | Post-Closing Access and Delineation of Gas Infrastructure Ownership – Summary of Terms | |

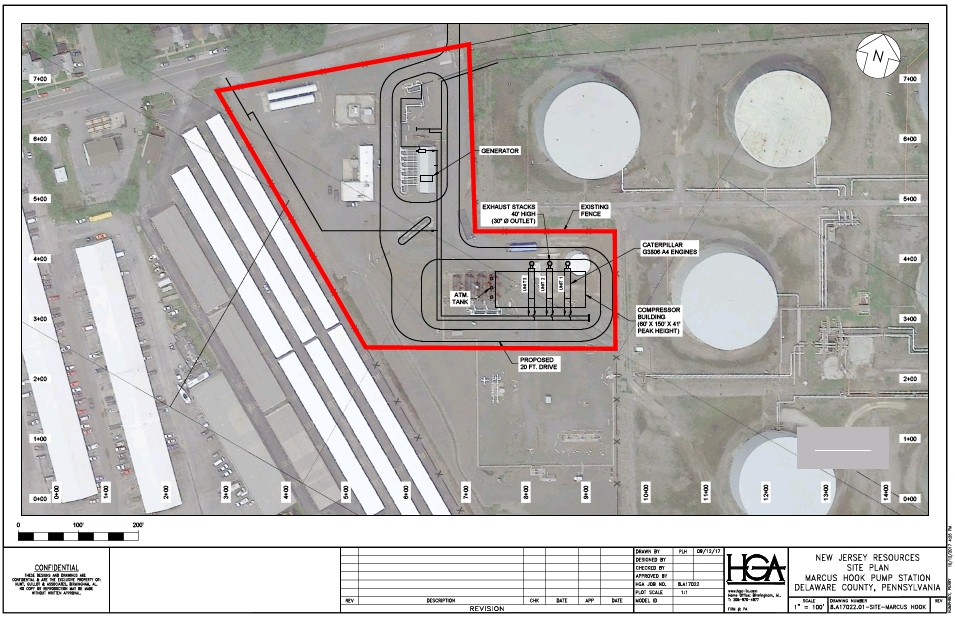

| Exhibit L | Marcus Hook Site Map |

iii

PURCHASE AND SALE AGREEMENT

THIS PURCHASE AND SALE AGREEMENT (as hereinafter amended, modified or changed from time to time in accordance with the terms hereof, this “Agreement”) is dated as of October 27, 2017, by and between Talen Generation, LLC, a Delaware limited liability company (“Seller”) and Adelphia Gateway, LLC, a Delaware limited liability company (“Buyer”).

WHEREAS, Seller owns one hundred percent (100%) of the membership interests (the “Interests”) in Interstate Energy Company LLC, a Delaware limited liability company (the “Company”);

WHEREAS, in accordance with this Agreement, Buyer desires to purchase, and Seller desires to sell to Buyer, the Interests;

WHEREAS, Buyer desires to acquire the Company through the purchase of the Interests from Seller upon the terms and subject to the conditions of this Agreement; and

WHEREAS, contemporaneously with the execution and delivery of this Agreement, (i) New Jersey Resources Corporation, a New Jersey corporation (the “Buyer Guarantor”) has executed and delivered to Seller a guaranty, in substantially the form attached hereto as Exhibit H, dated as of the date hereof, pursuant to which the Buyer Guarantor has guaranteed certain obligations of Buyer under this Agreement (the “Buyer Guaranty”), (ii) Talen Energy Supply, LLC, a Delaware limited liability company (the “Seller Guarantor”) has executed and delivered to Buyer a guaranty, in substantially the form attached hereto as Exhibit I, dated as of the date hereof, pursuant to which the Seller Guarantor has guaranteed certain obligations of Seller under this Agreement (the “Seller Guaranty”), and (iii) each of Martins Creek, LLC and Lower Mount Bethel Energy, LLC, each an Affiliate of Seller, as customers, and Buyer have entered into those certain Precedent Agreements for Firm Transportation of Natural Gas, copies of which are attached hereto as Exhibit F, dated as of the date hereof (collectively, the “Precedent Agreements”).

NOW, THEREFORE, in consideration of the premises and the mutual covenants, representations, warranties and agreements in this Agreement and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties intending to be legally bound, hereby agree as follows:

ARTICLE 1

DEFINITIONS

1A. Definitions. Capitalized terms used in this Agreement have the meanings ascribed to them by definition in this Agreement or in Exhibit A hereto. The definitions on Exhibit A are incorporated into this Agreement as if fully set forth herein and all references to a section in such Exhibit A are references to such section of this Agreement.

1B. Usage.

(i) Whenever the words “include,” “includes” or “including” are used in this Agreement, they shall be deemed to be followed by the words “without limitation.”

(ii) Words denoting any gender shall include all genders (including the neutral gender). Where a word is defined herein, references to the singular shall include references to the plural, and vice versa.

(iii) A reference to any Party to this Agreement or any other agreement or document shall include such Party’s successors and permitted assigns.

(iv) All references to “$” and dollars shall be deemed to refer to United States currency unless otherwise specifically provided.

(v) Whenever this Agreement refers to a number of days, such number shall refer to calendar days unless Business Days are specified. Whenever any action must be taken hereunder on or by a day that is not a Business Day, then such action may be validly taken on or by the next day that is a Business Day. Relative to the determination of any period of time, “from” means “including and after,” “to” means “to but excluding” and “through” means “through and including.”

(vi) Unless otherwise expressly provided herein, any reference to any agreement, contract, statute or regulation referenced herein or in the Company Disclosure Letter shall be a reference to such agreement, contract, statute or regulation, as amended, modified, supplemented or waived from time to time.

(vii) The phrase “to the extent” means “the degree by which” and not “if.”

(viii) The terms “hereof,” “herein,” “hereunder” and derivative words refer to this entire Agreement, unless the context otherwise requires. The words “either,” “or,” “neither,” “nor” and “any” are not exclusive.

(ix) Unless the context otherwise requires, references in this Agreement to Articles, Sections, Exhibits, Schedules, Appendices and Attachments shall be deemed references to Articles and Sections of, and Exhibits, Schedules, Appendices and Attachments to, this Agreement. References to this Agreement shall include a reference to all Schedules, as the same may be amended, modified or supplemented from time to time in accordance with this Agreement.

(x) All accounting terms used herein and not expressly defined shall have the meanings given to them under, and all accounting determinations hereunder shall be made in accordance with, GAAP.

(xi) With respect to the Company, the term “ordinary course of business” will be deemed to refer to the conduct of the business of the Company in a manner consistent with the ordinary course of business of the Company consistent with past practice.

(xii) In the event of any conflict between the provisions of this Agreement and those of any Exhibit or Schedule, the provisions of this Agreement shall prevail.

(xiii) The terms “United States” and “U.S.” mean the United States of America and its territories and possessions.

ARTICLE 2

PURCHASE AND SALE

2A. Purchase and Sale of the Interests.

(i) In accordance with the terms and subject to the conditions set forth in this Agreement, at the Closing, Buyer shall purchase and acquire from Seller, and Seller shall sell, transfer, convey, assign and deliver to Buyer, all of the Interests, in each case free and clear of any Liens, other than Permitted Encumbrances (the “Purchase”), in consideration of the payment by Buyer of (x) $166,000,000 (the “Base Purchase Price”), as adjusted in accordance with Section 2C (as adjusted, the “Purchase Price”) and (y) subject to the provisions of Section 2A(iii), the Contingent Payment, in each case, payable in accordance with the provisions of this Agreement. As promptly as commercially reasonably practicable, and in any event within two (2) Business Days, following Buyer’s receipt of the initial Letter of Credit in accordance with Section 6V(i), Buyer shall pay to Seller an amount equal to $10,000,000 (the “Initial Payment”) as an initial payment toward the payment of the Base Purchase Price, to be retained by Seller except as otherwise set forth in this Agreement. If Buyer fails to pay such Initial Payment within such two (2) Business Day period, such failure shall constitute a material breach by Buyer under this Agreement and the Initial Payment, until paid to Seller, shall accrue interest thereon at the Prime Rate.

2

(ii) Except as otherwise set forth in this Agreement, the amount payable at the Closing for the Interests (the “Closing Payment”) shall be an amount equal to: (a) the Base Purchase Price, minus (b) the Initial Payment, plus (c) the amount (if any) by which the Estimated Closing Net Working Capital exceeds the Targeted Net Working Capital, minus (d) the amount (if any) by which the Targeted Net Working Capital exceeds the Estimated Closing Net Working Capital, minus (e) the amount (if any) of the Estimated Closing Indebtedness, minus (f) the Remediation Cost Advances (if any).

(iii) After the Closing Date, as of the first day that the Southern Mainline is placed in service as a FERC-regulated natural gas pipeline (the “In-Service Date”), if Buyer has secured binding natural gas capacity commitments for the Southern Mainline for an average term of ten (10) years, for the full capacity of Two Hundred and Fifty Thousand (250,000) dekatherm per day (“Dth/day”) of the Southern Mainline (“Full Southern Mainline Capacity”) then, if applicable, an additional payment (the “Contingent Payment”) shall be paid by Buyer to Seller as determined by the average daily demand rate at which the Full Southern Mainline Capacity is contracted, calculated in the manner set forth on Schedule 2A(iii). The Contingent Payment, if any, shall be paid on or before the forty-fifth (45th) day after the In-Service Date. Notwithstanding any provision in this Agreement to the contrary, the Precedent Agreements entered into simultaneously with the execution of this Agreement and Service Agreements for firm transportation service under the Rate Schedule FTS to be entered into under the Precedent Agreements will not be included in the calculation of the average daily demand rate or any other calculations relating to the Contingent Payment.

2B. Delivery of Estimated Closing Statement. At least five (5) Business Days prior to the Closing Date, Seller will prepare and deliver to Buyer a written statement setting forth in reasonable detail Seller’s good faith estimate of: (i) the Closing Net Working Capital (the “Estimated Closing Net Working Capital”), (ii) the Closing Date Indebtedness (the “Estimated Closing Indebtedness”), (iii) the Remediation Cost Advances, if any (the “Estimated Remediation Cost Advances”), and (iv) the Closing Payment resulting therefrom. Buyer shall have the right, acting in good faith, to review and comment upon the Estimated Closing Net Working Capital, the Estimated Closing Indebtedness and the Closing Payment resulting therefrom, as set forth in the statement delivered by Seller, and shall provide any such comments to Seller no later than three (3) Business Days prior to the Closing Date. Seller will review and consider Buyer’s comments to such closing statement and, acting in good faith, shall incorporate such comments into such closing statement in its reasonable judgment, in which case the Estimated Closing Net Working Capital, the Estimated Closing Indebtedness and Estimated Remediation Cost Advances, if any, used to calculate the Closing Payment pursuant to Section 2A(ii) shall be the respective amounts set forth in such adjusted closing statement delivered to Buyer at least one (1) Business Day prior to the Closing Date.

2C. Post-Closing Purchase Price Adjustment.

(i) Within sixty (60) days following the Closing Date, Buyer shall prepare and deliver to Seller a written statement (the “Closing Statement”) setting forth Buyer’s calculation (together with reasonable supporting detail of each such calculation) of the Closing Net Working Capital, the Closing Indebtedness, the Remediation Cost Advances, if any, and the resulting Final Purchase Price, together with a certificate of Buyer certifying that it has complied with the covenants set forth in Section 2C(vii). The Closing Statement shall be prepared in accordance with GAAP and the applicable definitions in this Agreement. During the thirty (30) days immediately following Seller’s receipt of the Closing Statement and any period of dispute thereafter with respect to such Closing Statement, Buyer shall, and shall cause the Company to, (a) provide Seller and its Representatives with reasonable access to the books, records (including work papers, schedules, memoranda and other documents), supporting data and, upon prior written notice, the facilities and employees of the Company reasonably necessary for Seller to complete its review of the Closing Statement, and (b) reasonably cooperate with Seller and its Representatives in connection with such review. The Closing Statement (including the Closing Net Working Capital, the Closing Indebtedness, the Remediation Cost Advances, if any, and Final Purchase Price set forth thereon) shall become final and binding upon the Parties thirty (30) days following Seller’s receipt thereof unless Seller gives written notice of its disagreement (a “Notice of Disagreement”) to Buyer prior to such date; provided, however, that the Closing Statement shall alternatively become final and binding upon the Parties upon Seller’s delivery, prior to the expiration of such thirty (30)-day period, of written notice to Buyer of its acceptance of the Closing Statement delivered by Buyer. Any Notice of Disagreement shall specify in reasonable detail the nature and amount of any disagreement so asserted, including the item(s) in dispute and Seller’s calculation thereof.

3

(ii) If a timely Notice of Disagreement is delivered by Seller, then the Closing Statement (as revised in accordance with this Section 2C(ii)), and the Closing Net Working Capital, the Closing Indebtedness, the Remediation Cost Advances, if any, and the Final Purchase Price set forth thereon shall become final and binding upon the Parties on the earlier of (a) the date all matters specified in the Notice of Disagreement are finally resolved in writing by Seller and Buyer and (b) the date all matters specified in the Notice of Disagreement not resolved in writing by Seller and Buyer are finally resolved in writing by an independent, nationally recognized accounting, consulting or valuation firm (other than a so-called “Big Four” accounting firm) mutually selected by Seller and Buyer (such firm, the “Arbiter,” or absent such agreement then upon written notice to the other Party, each Party shall each have three (3) Business Days to select a nationally recognized accounting, consulting or valuation firm (other than a so-called “Big-Four” accounting firm) and such selected firms shall together select the Arbiter, and if any Party does not select a such a firm, then the firm selected by the other Party shall be the Arbiter) in accordance with this Section 2C(ii). During the thirty (30) days immediately following the delivery of a Notice of Disagreement, or such longer period as Seller and Buyer may agree in writing, Seller and Buyer shall seek in good faith to resolve in writing any differences that they may have with respect to any matter specified in the Notice of Disagreement, and all such discussions related thereto shall (unless otherwise agreed by Buyer and Seller) be governed by Rule 408 of the Federal Rules of Evidence (as in effect as of the date of this Agreement) and any applicable similar state rule. At the end of such thirty (30)-day period or such agreed-upon longer period, Seller and Buyer shall promptly retain the Arbiter and execute a customary engagement letter with respect to such engagement. Within ten (10) Business Days of such engagement (the “Submission Deadline”), the Parties shall submit to the Arbiter for review and resolution all matters (but only such matters) that remain in dispute and that were properly included in the Notice of Disagreement (the “Disputed Items”) as follows: Buyer shall deliver the Closing Statement and Seller shall deliver the relevant Notice of Disagreement, and each Party will submit a supporting brief and any supporting materials, in each case, to the Arbiter. Subject to the immediately following sentence, each Party may make an oral presentation to the Arbiter (in which case the applicable Party will provide prompt prior notice of such presentation to the other Party, who will be entitled to attend or have a representative attend such presentation (the supporting brief and any materials submitted being referred to as a Party’s “Submission”)). Each Party shall, on or prior to the Submission Deadline, notify the Arbiter and the other Party as to whether or not it will make an oral presentation and, should any Party so elect, shall make such oral presentation on or before the date that is ten (10) Business Days after the Submission Deadline. The Parties shall instruct the Arbiter to, and the Arbiter shall, deliver its final, written determination of the Disputed Items in accordance with the guidelines and procedures set forth in this Agreement (which final determination shall be delivered as promptly as possible, but no later than the 20th day after the later of (x) the Submission Deadline and (y) if either or both Parties elect to make an oral presentation, the date of the last such presentation), and such determination by the Arbiter shall be final and binding and shall not be subject to court review or otherwise appealable. Seller and Buyer shall cooperate with the Arbiter during the term of its engagement. Seller and Buyer shall instruct the Arbiter to determine, with respect to each Disputed Item, whether Buyer’s Submission or Seller’s Submission with respect to such Disputed Item reflects the more accurate calculation of such Disputed Item (for example, if the amount of accounts receivable is a Disputed Item, the Arbiter may select only the amount of accounts receivable proposed by Buyer in the Closing Statement, as supported by its Submission, or Seller in the Notice of Disagreement, as supported by its Submission, as the final amount of accounts receivable incorporated into the final Closing Net Working Capital). Seller and Buyer shall also instruct the Arbiter to, and the Arbiter shall, make its determination based solely on the Closing Statement, the Notice of Disagreement and the Submissions submitted by Seller and Buyer to the Arbiter that are in accordance with the guidelines and procedures set forth in this Agreement (i.e., not on the basis of an independent review). The Closing Statement shall be revised to the extent necessary to reflect any mutual resolution in writing by Seller and Buyer and/or any final resolution made by the Arbiter in accordance with this Section 2C(ii) (the “Final Closing Statement”), and the Final Closing Statement shall be final, binding and conclusive on all Parties. The costs, fees and expenses of the Arbiter shall be paid by Buyer, on the one hand, and Seller, on the other hand, determined on the basis of the degree to which the Arbiter’s determination of the Final Purchase Price, as contained in the Final Closing Statement, as modified by this Section 2C(ii), accepts the respective positions of Buyer and Seller with respect to the Disputed Items. The “Adjustment Finalization Date” shall refer to the date the Closing Statement becomes final and binding on the Parties pursuant to this Section 2C.

4

(iii) If (a) the sum of (1) the Closing Payment plus (2) the Initial Payment is less than (b) the Final Purchase Price (such shortfall, the “Adjustment Amount”), then, subject to the other terms and conditions of this Agreement, within five (5) Business Days after the Adjustment Finalization Date, Buyer shall pay by wire transfer in immediately available funds to Seller the Adjustment Amount, together with interest thereon pursuant to Section 2C(v).

(iv) If (a) the sum of (1) the Closing Payment plus (2) the Initial Payment is greater than (b) the Final Purchase Price (such shortfall, the “Excess Amount”), then, subject to the other terms and conditions of this Agreement, within five (5) Business Days after the Adjustment Finalization Date, Seller shall pay by wire transfer in immediately available funds to Buyer the Excess Amount, together with interest thereon pursuant to Section 2C(v).

(v) Any payment pursuant to Section 2C(iii) or Section 2C(iv) shall be made together with interest thereon at Prime Rate, calculated on the basis of the number of days elapsed from the Closing Date to the date of payment.

(vi) Buyer agrees that (a) the payment of the Adjustment Amount (if any) in accordance with Section 2C(iii), (b) the payment of the Excess Amount (if any) in accordance with Section 2C(iv), (c) the Closing Net Working Capital and the Closing Indebtedness adjustments provided for in this Section 2C, and (d) the dispute resolution provisions provided for in this Section 2C, shall be the exclusive remedies for the matters addressed or that could be addressed by this Section 2C.

(vii) Buyer agrees that following the Closing it will not, and it will cause the Company not to, take any actions with respect to the accounting books, records, policies and procedures of the Company for the purpose of obstructing or preventing the preparation of the Closing Statement as provided in this Section 2C.

5

2D. Closing. On the terms and subject to the conditions set forth in this Agreement, the closing of the Purchase (the “Closing”) shall take place at the offices of Bracewell LLP at 1251 Avenue of the Americas, New York, NY 10020 at 10:00 a.m. local time, on the fifth (5th) Business Day following the satisfaction or waiver of all conditions to the Closing set forth in Article 7 (other than those conditions that by their terms or nature are to be satisfied by performance at the Closing (but subject to the satisfaction or waiver of such conditions at the Closing)) or at such other time, date and place as may be mutually agreed to in writing by the Parties; provided, however, notwithstanding the foregoing, the Parties acknowledge and agree that (x) Closing must occur contemporaneously with the time Buyer’s FERC gas tariff becomes effective, as agreed to or accepted by FERC, (y) in recognition thereof, if FERC issues the FERC Certificate, Buyer shall request in the letter it sends to FERC to accept the FERC Certificate that FERC agree to the effectiveness of Buyer’s FERC gas tariff as of a specified time, and (z) subject to satisfaction or waiver of conditions as provided in this Section 2D, Closing shall occur simultaneously with such specified time. The date on which the Closing actually occurs is referred to herein as the “Closing Date.” The Closing shall be deemed effective contemporaneously with the time on the Closing Date that Buyer’s FERC gas tariff becomes effective.

2E. Seller’s Deliverables. At the Closing, subject to the terms and conditions of this Agreement, Seller shall have delivered, or caused to have been delivered, to Buyer (or to the applicable beneficiary specified below) each of the following, with each delivery being deemed to have occurred simultaneously with the other events:

(i) a certified copy of the resolutions or consent of the sole member of Seller approving the transactions contemplated by this Agreement, including the Purchase, and this Agreement;

(ii) membership interest certificates evidencing the Interests, accompanied by duly executed membership interest powers or other instruments of transfer;

(iii) a letter of resignation for all officers and directors of the Company, effective as of the Closing Date;

(iv) a properly executed certificate establishing the non-foreign status of Seller (or its direct or indirect regarded parent if Seller is a disregarded entity) as set forth in Treasury Regulations promulgated under Section 1445 of the Code;

(v) the certificate described in Section 7A(iii);

(vi) a certificate of good standing of the Company from the Secretary of State of Delaware and each other jurisdiction where the Company is registered to do business as a foreign entity, if any, each dated not more than five (5) Business Days prior to the Closing Date;

(vii) evidence reasonably satisfactory to Buyer that Seller’s covenant in Section 6Q has been performed, including fully executed copies of any assignments, deeds or other conveyance and assumption documentation and evidence that any documents required to be filed with any Governmental Entity to effect or otherwise document such transfer, if any, have been sent by Seller for filing to the appropriate Governmental Entities; and

(viii) any other documents required to be delivered by Seller at or prior to the Closing pursuant to this Agreement.

6

2F. Buyer’s Deliverables. At the Closing, subject to the terms and conditions of this Agreement, Buyer shall have delivered, or caused to have been delivered, to Seller (or to the applicable beneficiary specified below) each of the following, with each delivery being deemed to have occurred simultaneously with the other events:

(i) a certified copy of the resolutions or consent of the board of directors of Buyer approving the transactions contemplated by this Agreement, including the Purchase, and this Agreement;

(ii) the certificate described in Section 7B(iii);

(iii) by wire transfer of immediately available funds to Seller (to such account or accounts as Seller shall have designated to Buyer in writing at least one (1) Business Day prior to the Closing Date), an aggregate amount equal to the Closing Payment; and

(iv) any other documents required to be delivered by Buyer at or prior to the Closing pursuant to this Agreement.

2G. Purchase Price Allocation.

(i) As promptly as practical, but in no event later than ninety (90) days after the Closing Date (or, if later, the date that is thirty (30) days following the date on which the Closing Statement has become final and binding pursuant to Section 2C), Buyer shall deliver to Seller a statement (the “Allocation Statement”) reflecting the allocation of the purchase price determined for federal income Tax purposes, all in accordance with the Treasury Regulations promulgated under Section 1060 of the Code (the “Allocation”).

(ii) Within sixty (60) days following the receipt by Seller of the Allocation Statement, Seller shall review the Allocation Statement. If Seller does not dispute the Allocation Statement (by written notice to Buyer specifying the reasons therefor in reasonable detail) by the expiration of such sixty (60) day period, it shall be deemed agreed upon by the Parties and shall be deemed conclusive for purposes of the Allocation.

(iii) The Parties shall attempt to resolve any dispute with respect to the Allocation Statement within thirty (30) days after Buyer receives notice of such dispute from Seller. If during such thirty (30) day period any dispute cannot be resolved, the Parties shall, within ten (10) days thereafter, refer the matter to a mutually agreed upon arbitrator, which shall be a nationally recognized accounting firm (the “Independent Appraiser”) and which may (but is not required to) be the Arbiter pursuant to Section 2C, solely for the purposes of the Allocation required by this Section 2G. The Independent Appraiser shall be instructed to deliver to the Parties a written determination of the issue in dispute within thirty (30) days after the date of referral thereof to the Independent Appraiser. The Parties agree to accept the Independent Appraiser’s determination of the issue in dispute. The cost of the appraisal shall be borne equally by Buyer and Seller. Neither Buyer nor Seller nor any of their Affiliates shall file any Tax Return or take a position with any Tax Authority that is inconsistent with the agreed upon Allocation unless otherwise required by Law, provided however, that nothing contained herein shall prevent Buyer or Seller from settling any proposed deficiency or adjustment by any Tax Authority based upon or arising out of the Allocation, as applicable, and neither Buyer nor Seller shall be required to litigate before any court any proposed deficiency or adjustment by any Tax Authority challenging the Allocation, as applicable. If any Tax Authority disputes any portion of an Allocation Statement, the Party receiving notice shall notify the other Party concerning the dispute and its resolution.

(iv) In the event that there is any adjustment to the purchase price determined for federal income Tax purposes (including any payment of the Contingent Payment) subsequent to the determination of the Allocation, then within fifteen (15) days following any such adjustment, the Parties shall make any resulting adjustments to the Allocation in a manner that is consistent with the events that gave rise to the adjustment of the purchase price determined for federal income Tax purposes or, if they cannot agree within fifteen (15) days, any dispute shall be resolved in accordance with Section 2G(iii).

7

ARTICLE 3

REPRESENTATIONS AND WARRANTIES RELATING TO

SELLER

As an inducement to Buyer to enter into this Agreement, Seller hereby represents and warrants as of the date of this Agreement and as of the Closing Date as follows:

3A. Organization and Existence. Seller is a limited liability company duly formed, validly existing and in good standing under the Laws of the State of Delaware and in each jurisdiction in which the failure to so exist or be in good standing would adversely affect Seller’s ability perform its obligations hereunder.

3B. Authorization. Seller has all necessary power and authority to execute and deliver this Agreement and the Ancillary Documents to which it is or will be a party and the capacity and authority to make and perform the representations, warranties, covenants and agreements made by Seller herein and therein and to consummate all of the transactions contemplated by this Agreement and the Ancillary Documents to which it is or will be a party. The execution, delivery and performance by Seller of this Agreement and the Ancillary Documents to which Seller is or will be a party and the consummation by Seller of the transactions contemplated hereby and thereby are within Seller’s limited liability company powers and have been duly authorized by all necessary action on the part of Seller and no other limited liability company actions or other proceedings are necessary to authorize this Agreement and the Ancillary Documents to which Seller is or will be a party or for Seller to consummate the transactions contemplated hereby and thereby. This Agreement has been duly executed and delivered by Seller and constitutes, and as of the Closing, each Ancillary Document to which Seller is or will be a party, will constitute, when executed and delivered by Seller, in each case assuming due authorization, execution and delivery by Buyer, the valid and legally binding obligation of Seller enforceable against Seller in accordance with its terms, except as limited by the application of bankruptcy, moratorium and similar Laws affecting creditors’ rights generally and the application of equitable principles (whether considered in a proceeding in equity or at law) (the “Bankruptcy and Equity Exception”).

3C. Legal Proceedings. Except as set forth in Schedule 3C of the Company Disclosure Letter, there are no Claims pending or, to Seller’s Knowledge, threatened against Seller (i) that would, individually or in the aggregate, be reasonably likely to restrain, prevent, prohibit or materially delay the consummation of the transactions contemplated by this Agreement or the Ancillary Documents or (ii) with respect to the Company, its assets or the Interests. Seller is not subject to any Order that prohibits the consummation of the transactions contemplated hereby, including the Purchase, that would, individually or in the aggregate, be reasonably likely to restrain, prevent, prohibit or materially delay the consummation of the transactions contemplated by this Agreement or the Ancillary Documents or otherwise adversely affect the Company, its assets or the Interests.

3D. Noncontravention. Except as set forth on Schedule 3D of the Company Disclosure Letter, the execution, delivery and performance by Seller of this Agreement and the Ancillary Documents to which Seller is or will be a party do not, and the consummation by Seller of the transactions contemplated hereby and thereby will not, (i) contravene or violate any provision of the Organizational Documents of Seller; (ii) constitute a material default or violation of, give any Person the right to terminate, modify or accelerate any obligation under, or create any Lien on any of the assets of Seller pursuant to, any Contract to which Seller is a party (with or without notice, lapse of time or both); or (iii) assuming receipt of the HSR Approval and the Governmental Authorizations, require any authorization, consent, approval, exemption or other action by, or notice to, any Governmental Entity or constitute a material breach or violation of, or a default under any Law to which Seller is subject or by which the assets of Seller are bound, except, with respect to the foregoing clauses (ii) and (iii) as would not, individually or in the aggregate, materially and adversely affect Seller’s ability to perform its obligations hereunder.

8

3E. Capitalization. Except for the Interests, there are no issued and outstanding equity interests in the Company. Seller owns, beneficially and of record, all of the Interests. Except as set forth on Schedule 3E of the Company Disclosure Letter, the Interests are free and clear of all Liens other than Permitted Encumbrances. The Interests have been duly authorized and validly issued, and were issued in accordance with the Company’s Organizational Documents, and were not issued in violation of the terms of any Contract binding on the Company or Seller. Except as set forth on Schedule 3E of the Company Disclosure Letter, there are no authorized or outstanding (i) options, warrants or other rights to purchase or otherwise acquire any of the Interests or other securities of the Company or obligations of any kind convertible into or exchangeable for any of the Interests or other securities of the Company, (ii) contractual obligations of the Company to repurchase, redeem or otherwise acquire any of the Interests or other securities of the Company, (iii) profit participation, phantom equity or similar rights with respect to the Company, (iv) bonds, debentures, notes or other Indebtedness that entitles the holders thereof to vote (or that are convertible or exercisable for or exchangeable into securities that entitle the holders to vote) on any matter on which members or stockholders of the Company may vote and (v) there are no voting trusts, member agreements, stockholder agreements, proxies, preemptive rights, subscription rights, rights of first refusal or other agreements or understandings to which Seller (or any of its Affiliates) or the Company is a party with respect to the voting, distribution rights or transfer of any of the Interests or other securities of the Company (except with respect to (i) the Purchase of the Interests contemplated by this Agreement and (ii) as set forth in the Organizational Documents of the Company).

3F. Brokers. Except as set forth on Schedule 3F of the Company Disclosure Letter, neither Seller nor any of its Affiliates (including, for these purposes, the Company) have any liability or obligation to pay fees or commissions to any broker, finder or agent with respect to the transactions contemplated by this Agreement.

ARTICLE 4

REPRESENTATIONS AND

WARRANTIES RELATING TO THE COMPANY

As an inducement to Buyer to enter into this Agreement, Seller hereby represents and warrants as of the date of this Agreement and as of the Closing Date as follows:

4A. Organization and Existence. The Company is a limited liability company validly existing and in good standing under the Laws of the State of Delaware and in each jurisdiction in which the failure to so exist or be in good standing would materially and adversely affect the business of the Company. The Company has all requisite power and authority necessary to own and operate its properties and to carry on its businesses as now conducted, except as would not materially and adversely affect the business of the Company. Each jurisdiction where the Company is qualified to do business is set forth on Schedule 4A of the Company Disclosure Letter. A true, correct and complete copy of the Organizational Documents of the Company, as in effect on the date of this Agreement, have been made available to Buyer.

4B. Subsidiaries. The Company does not have any Subsidiaries.

4C. Noncontravention. Except as set forth on Schedule 4C of the Company Disclosure Letter, the execution, delivery and performance by the Company of the Ancillary Documents to which the Company is or will be a party do not, and the consummation of the transactions contemplated by this Agreement and the Ancillary Documents will not, (i) contravene or violate any provision of the Organizational Documents of the Company; (ii) constitute a default or violation of, give any Person the right to terminate, modify or accelerate any obligation under, or create any Lien on any of the assets of the Company pursuant to, any Contract to which the Company is a party (including any Lease) or any Permit or Additional Property Right (with or without notice, lapse of time or both); or (iii) assuming receipt of the HSR Approval and the Governmental Authorizations, require any authorization, consent, approval, exemption or other action by, or notice to, any Governmental Entity or constitute a material breach or violation of, or a default under any Law to which the Company is subject or by which the assets of the Company are bound, except, with respect to the foregoing clauses (ii) and (iii) as would not materially and adversely affect the Company’s ability to perform its obligations thereunder.

9

4D. Financial Statements; Absence of Undisclosed Liabilities.

(i) Schedule 4D(i) of the Company Disclosure Letter sets forth true and complete copies of the unaudited balance sheets and related statements of income of the Company for the years ended December 31, 2015 and December 31, 2016, and that nine-month period ended September 30, 2017 (collectively, the “Financial Statements”). Except as set forth on Schedule 4D(i) of the Company Disclosure Letter, the Financial Statements fairly present, in all material respects, in conformity with GAAP (applied on a consistent basis), the financial position and results of operations, revenues and expenses of the Company as of the dates and for the periods indicated therein, subject to normal year-end adjustments (which Seller does not expect to be material in the aggregate) and the absence of footnotes.

(ii) Except as set forth on Schedule 4D(ii) of the Company Disclosure Letter, the Company does not have any liabilities or obligations that would be required to be disclosed on a balance sheet of the Company prepared in accordance with GAAP applied on a consistent basis, except (a) liabilities or obligations reflected or reserved against in the Financial Statements, (b) liabilities or obligations that have arisen in the ordinary course of business since September 30, 2017, (c) liabilities or obligations arising after the date of this Agreement under this Agreement and (d) liabilities or obligations under any Contract set forth on Schedule 4H of the Company Disclosure Letter (excluding liabilities or obligations for any breaches thereof by the Company).

(iii) Except as set forth on Schedule 4D(iii) of the Company Disclosure Letter, the books and records of the Company are and have been properly prepared and maintained in all material respects in form and substance adequate for preparing financial statements in accordance with GAAP, and accurately reflect in all material respects the financial condition of the Company as of each date this representation is made hereunder.

4E. Absence of Certain Changes or Events. Except (i) as set forth on Schedule 4E of the Company Disclosure Letter, (ii) for any action taken by the Company that is expressly contemplated by this Agreement or that would be permitted to be taken by the Company without Buyer’s consent under Section 6B(i) and (iii) for Seller entering into this Agreement, since December 31, 2016, the Company’s business has been conducted in accordance with the ordinary course of business, and no action has been taken that would have been prohibited by Section 6B if such action had been taken during the Interim Period. Since December 31, 2016, there has not been any change, event or development that, individually or in the aggregate, has resulted in, or would be reasonably expect to result in, a Material Adverse Effect.

4F. Legal Proceedings. Except as set forth on Schedule 4F of the Company Disclosure Letter, (i) as of the date of this Agreement, there are no Claims pending or, to Seller’s Knowledge, threatened, and there are no Orders outstanding (other than Orders of general applicability to participants in the oil pipeline industries), against the Company, its assets or with respect to the Interests and (ii) as of the Closing Date, there are no Claims pending or, to Seller’s Knowledge, threatened, and there are no Orders outstanding (other than Orders of general applicability to participants in the oil pipeline industries), against the Company, its assets or with respect to the Interests that would reasonably be expected to have a material and adverse impact on the business, condition, assets or operation of the Company.

10

4G. Compliance with Laws; Permits.

(i) Since June 30, 2013, the Company has been in compliance in all material respects with all applicable Laws.

(ii) The Company has all material Permits necessary for the Company to own, lease, maintain or operate its assets or to conduct its business as currently conducted, except as set forth on Schedule 4G(ii) of the Company Disclosure Letter (the “Material Permits”). The Material Permits are in full force and effect and have not been terminated or withdrawn. No suspension or cancellation of any Material Permit is pending or, to Seller’s Knowledge, threatened. The Company is in compliance with the Material Permits in all material respects.

(iii) Since June 30, 2013, the Company has not received any written notice from any Person alleging any material violation under any applicable Law or Material Permit.

4H. Material Contracts.

(i) Schedule 4H(i) of the Company Disclosure Letter sets forth, as of the date of this Agreement, a list of the following Contracts to which the Company is a party or by which the Company or the assets of the Company may be bound (the “Material Contracts”):

(a) Contracts for the transport, balancing, gathering, processing, treating, storage or provision of natural gas, fuel oil, or other fuels;

(b) natural gas or crude oil interconnection Contracts;

(c) any Contract (I) for the construction, purchase, exchange or sale of any capital asset or (II) that grants a right or option to purchase, exchange or sell any capital asset, other than, in each case, a Contract that (A) has been fully performed by the Company or (B) was entered into in the ordinary course of business relating to capital assets with a value of less than $250,000 individually or $1,000,000 in the aggregate;

(d) Contracts under which it has created, incurred, assumed or guaranteed any outstanding Indebtedness;

(e) any Contract involving a loan (other than accounts receivable owing from trade debtors in the ordinary course of business) or advance to any Person (other than travel and entertainment advances to the Business Employees extended in the ordinary course of business);

(f) outstanding Swaps, including the market value of each such Swap as of the most recent date for which such information is available and specifying such date (each, a “Derivative Instrument”);

11

(g) Contracts that have underlying value and payment liability driven by or tied to fluctuations in the price of commodities, including electric power, natural gas, fuel oil, other fuel or securities, including the market value of each such Contract as of the most recent date for which such information is available and specifying such date;

(h) any lease, sublease, license or similar agreement under which (I) the Company is lessee of, or holds or uses, any machinery, equipment, vehicle or other tangible personal property owned by a third party or (II) the Company is a lessor or sublessor of, or makes available for use by any third party, any tangible personal property owned or leased by the Company, in each case that has future required scheduled payments in excess of $25,000 per annum;

(i) each Lease;

(j) any Contract (other than confidentiality agreements entered into in the ordinary course of business) containing a covenant not to compete (or similar covenant limiting the ability of the Company to compete with any Person) granted by the Company in favor of any other Person;

(k) partnership, joint venture or limited liability company agreements or other agreements involving a sharing of profits or other assets with a Third Party;

(l) any Contract involving resolution or settlement of any actual or threatened Claim in an amount greater than $25,000 that has not been fully performed by the Company or otherwise imposes continuing financial or operational obligations on the Company;

(m) any collective bargaining agreement with any labor union and any such agreements currently in negotiation or proposed;

(n) any Contract that relates to (I) the acquisition or disposition by the Company of any business, (II) the acquisition or disposition by the Company of any assets (other than capital assets) or properties involving consideration of more than $25,000, individually or in the aggregate, other than assets or properties that are worn out, obsolete or damaged, or (III) (A) the acquisition of equity interests of any Person or (B) the merger, consolidation, business combination or reorganization of the Company, in each of the foregoing clauses (A) and (B)to the extent the Company has continuing material rights, obligations or liabilities; and

(o) any other Contract (other than Contracts of the nature addressed by subparagraphs (a) through (n) of this Section 4H(i) that has future scheduled payments to or from the Company of more than $100,000 in the aggregate, other than Contracts that can be cancelled or terminated by the Company without payment or penalty upon notice of ninety (90) days or less.

(ii) Each Material Contract (a) constitutes the valid and binding obligation of the Company and, to Seller’s Knowledge, the other parties thereto and (b) is in full force and effect, subject to the Bankruptcy and Equity Exception.

(iii) Except as set forth on Schedule 4H(iii) of the Company Disclosure Letter, the Company, and to Seller’s Knowledge, each other party thereto, has performed all material obligations required to be performed by it to date under the Material Contracts and is not in material breach or material default thereunder, and there does not exist any event, condition or omission that would constitute such a material breach or material default (with or without the lapse of time or the giving of notice, or both).

12

(iv) The Company has made available to Buyer a true and complete copy of each Material Contract (including all amendments thereto) set forth on Schedule 4H(i) of the Company Disclosure Letter.

4I. Real Property; Personal Property.

(i) Schedule 4I(i) of the Company Disclosure Letter sets forth a true and complete list of each parcel of Owned Real Property (other than the Martins Creek Terminal Property). The Company owns and has good and marketable fee title to all of the Owned Real Property (other than severed oil, gas and/or mineral rights and other hydrocarbon interests), free and clear of all Liens other than Permitted Liens. Seller has delivered or made available to Buyer copies of the deeds or other instruments conveying title in the Owned Real Property to the Company to the extent in the possession or control of Seller or any Affiliate thereof.

(ii) Schedule 4I(ii) of the Company Disclosure Letter sets forth a true and complete list of all Leases (together with any amendments or modifications thereto) for each parcel of Leased Real Property (other than the Martins Creek Terminal Property). Except as set forth on Schedule 4I(ii) of the Company Disclosure Letter, the Company has a valid, binding and enforceable leasehold interest in the Leased Real Property subject to the terms and conditions of each Lease, free and clear of all Liens other than Permitted Liens. The Company is in possession of each parcel of Leased Real Property necessary to operate the Company’s business as currently being conducted as of the date of this Agreement. Seller has delivered or made available to Buyer copies of all Leases to the extent in the possession or control of Seller or any Affiliate thereof.

(iii) The Company Real Property constitutes all of the real property interests necessary for (a) the conduct of the Company’s business, in all material respects, and (b) the ownership and operation of the Company’s assets in connection with the operation of the Company’s business, each as currently being conducted as of the date of this Agreement.

(iv) Except (a) as set forth on Schedule 4I(iv) of the Company Disclosure Letter, (b) as of the date of this Agreement, as set forth on Schedule 4I(iv)(A) and Schedule 4I(iv)(B) of the Company Disclosure Letter, (c) Permitted Liens and (d) as would not materially and adversely affect the business of the Company, the Company has or, as of the Closing, will have a valid and enforceable real property interest in all easements, rights-of-way, permits, licenses, land use permits and other similar agreements granting rights in the owned real property of another Person held by the Company necessary to conduct the Company’s business as currently being conducted as of the date of this Agreement (the “Additional Property Interests”) and each Additional Property Interests is a valid and binding on the Company and, to Seller’s Knowledge, the grantor thereunder. Except as set forth on Schedule 4I(iv) of the Company Disclosure Letter, (I) the Company is not in material default under any Additional Property Interest, (II) to Seller’s Knowledge, no grantor of any such Additional Property Interest is in default thereunder, and (iii) no event has occurred that constitutes a material default or, with lapse of time or giving of notice or both, would constitute a material default under any of the Additional Property Interests.

(v) To Seller’s Knowledge and except as would not materially and adversely affect the business of the Company, there is no part of the Company’s pipeline systems that are not located within the boundaries of or under a (a) parcel of Owned Real Property or Leased Real Property or (b) parcel of real property pursuant to an Additional Property Interest.

(vi) Except (a) as set forth on Schedule 4I(vi) of the Company Disclosure Letter or (b) for Permitted Liens, the Company has good and valid title to, free and clear of all Liens, or has the right to use, all of the personal property necessary for the conduct of the business of the Company and in the ownership and operation of its assets in connection with the operation of the Company’s business, each as currently being conducted as of the date of this Agreement.

13

(vii) Except as set forth on Schedule 4I(vii) of the Company Disclosure Letter, the Company’s pipelines and related machinery, equipment, buildings, structures and improvements are, in all material respects, in good repair, working order and operating condition for facilities of a similar age and adequate to operate the business of the Company as currently being conducted as of the date of this Agreement, ordinary wear and tear excepted.

(viii) There (a) is no pending or, to the Knowledge of Seller, threatened, condemnation of any Owned Real Property or (b) to the Knowledge of Seller, pending or threatened condemnation of any Leased Real Property or any real property in which the Company has an Additional Property Interest.

(ix) Except as set forth on Schedule 4I(ix) of the Company Disclosure Letter, the Company is not obligated under any right of first refusal, option or other contractual right to sell, assign or otherwise dispose of its interest in any Company Real Property.

4J. Employee Matters.

(i) Schedule 4J(i) of the Company Disclosure Letter sets forth a list of each material Employee Benefit Plan. The Company does not sponsor or administer, has not previously sponsored or administered, and is not and has not been a party to, any Employee Benefit Plan. The Company does not have any liability with respect to (a) any Employee Benefit Plan, other than liability for ordinary course contributions to qualified defined contribution plans in which Business Employees participate, or (b) any other employee benefit plan.

(ii) Except as set forth on Schedule 4J(ii), each Employee Benefit Plan that is intended to be qualified under Section 401(a) of the Code is, to Seller’s Knowledge, so qualified and has received a currently effective determination letter, or is entitled to rely on an opinion letter, from the Internal Revenue Service. Seller has provided to Buyer a copy of each such determination and opinion letter.

(iii) Other than routine claims for benefits, there is no Claim pending or, to Seller’s Knowledge, threatened in writing against the Company arising out of an Employee Benefit Plan or involving any Business Employee. The Company has timely made all required contributions to Employee Benefit Plans. Except as could not reasonably be expected to result in liability to Buyer, each Employee Benefit Plan has been maintained in all material respects in accordance with its terms and applicable Law, including ERISA and the Code.

(iv) The Company does not contribute to, or have any obligation to contribute to, or have any liability (including liability on account of an ERISA Affiliate) with respect to, any Title IV Plan or any Multiemployer Plan. The Company does not have any liability (including liability on account of an ERISA Affiliate) with respect to any failure to comply with Section 4980B of the Code or Part 6 of Subtitle B of Title I of ERISA.

(v) Except as set forth on Schedule 4J(v), no Employee Benefit Plan provides or has an obligation to provide health insurance, life insurance, disability insurance or death benefits to Business Employees beyond their retirement or other termination of service, other than as required by Section 4980B of the Code or applicable Law.

14

(vi) Except as set forth on Schedule 4J(vi), neither the execution of this Agreement nor the consummation of the transactions contemplated hereby (whether alone or together with any other events) will (a) result in any material payment becoming due to any Business Employee, (b) materially increase any benefits otherwise payable to any Business Employee, or (c) result in the acceleration of the time of payment or vesting of any such benefits. Neither the execution of this Agreement nor the consummation of the transactions contemplated hereby (whether alone or together with any other events) will, or would reasonably be expected to, result in any payment or benefit constituting a “parachute payment” for purposes of Section 280G of the Code.

(vii) Each Employee Benefit Plan that is subject to Section 409A of the Code has, with respect to the Business Employees, been maintained and operated in all respects in accordance with Section 409A of the Code.

(viii) Except as set forth on Schedule 4J(viii), no Business Employee provides services not primarily related to the Company and no employee of Seller or any of its Affiliates (other than the Company) provides regular and ongoing material services to the Company.

(ix) Except as set forth in Schedule 4J(ix) of the Company Disclosure Letter, with respect to the Company:

(a) there are no collective bargaining agreements, labor agreements, work rules or practices or any other labor-related agreements or arrangements with any labor union or labor organization to which the Company is a party;

(b) there are no actual, or to Seller’s Knowledge, threatened material arbitrations, material written grievances or material labor disputes involving any labor union or labor organization against or affecting the Company;

(c) to Seller’s Knowledge there are no formal organizing campaigns, petitions or other unionization activities underway or threatened nor have any such activities occurred within the three (3) years preceding the date of this Agreement; and

(d) there are no strikes, slowdowns, work stoppages, lockouts or other similar labor disputes pending or, to Seller’s Knowledge, threatened and no such disputes have occurred within the three (3) years preceding the date of this Agreement.

(x) Schedule 4J(x) of the Company Disclosure Letter contains a complete and accurate list of the following information for each Business Employee, including each such Person on leave of absence or layoff status: name; job title; date of hire; the current year’s base cash compensation and, separately, any promised or targeted bonus compensation; exempt or non-exempt status; amount of current accrued vacation; and promised severance or separation benefits (conditional or unconditional), other than those available under a severance or separation plan of general application. Except as set forth on Schedule 4J(x) of the Company Disclosure Letter, the Company has not made any promises for the payment of back pay or other cash remuneration to any Business Employee. Except as set forth on Schedule 4J(x) of the Company Disclosure Letter, all Business Employees are “employees at will,” and their employment may be terminated without more than fourteen (14) days’ notice. Schedule 4J(x) of the Company Disclosure Letter separately sets forth a true and complete list of the following information for each individual engaged by Seller or any of its Affiliates as an independent contractor who regularly provides material services to the Company: name, duties and rate of compensation.

(xi) The Company is in material compliance with all applicable Laws respecting employment and employment practices relating to the Business Employees, including all laws respecting terms and conditions of employment, health and safety, wages and hours, child labor, immigration, employment discrimination, disability rights or benefits, equal opportunity, plant closures and layoffs, affirmative action, workers’ compensation, labor relations, employee leave issues and unemployment insurance relating to the Business.

15

(xii) Since January 1, 2014, the Company has not received: (a) written notice of any unfair labor practice charge or complaint pending or threatened against it before the National Labor Relations Board or any other similar Governmental Entity responsible for labor relations, (b) written notice of any charge or complaint with respect to or relating to it pending before the Equal Employment Opportunity Commission or any other Governmental Entity responsible for the prevention of unlawful employment practices, (c) written notice of the intent of any Governmental Entity responsible for the enforcement of labor, employment, wages and hours of work, child labor, immigration, or occupational safety and health laws to conduct an investigation with respect to or relating to it or written notice that such investigation is in progress, or (d) written notice of any complaint, lawsuit or other proceeding pending or threatened in any forum by or on behalf of any present or former Business Employee or any applicant for employment as a Business Employee alleging breach of any express or implied contract of employment, any applicable Law governing employment or the termination thereof or other discriminatory, wrongful or tortious conduct in connection with the employment relationship, in the case of each of clauses (a) through (d), that has not been resolved as of the date of this Agreement.

(xiii) In the past twelve (12) months the Company has not experienced any “plant closing” or “mass layoff” (as defined in the Worker Adjustment or Retraining Act of 1988, as amended, or any similar Law (collectively, the “WARN Act”) and, during the 90-day period preceding the date hereof, no Business Employee has suffered an “employment loss” (as defined in the WARN Act).

(xiv) The Company is not (a) a “contractor” or “subcontractor” (as defined by Executive Order 11246), (b) required to comply with Executive Order 11246 or (c) required by federal law to maintain an affirmative action plan relating to the Business Employees.

(xv) All Persons classified or treated by the Company as independent contractors or otherwise as non-employees satisfy all applicable laws, rules, regulations and other requirements of Law to be so classified or treated as non-employees, and the Company has fully and accurately reported their compensation of any kind on IRS Forms 1099 or as otherwise required by requirements of Law.

4K. Environmental. Except as set forth on Schedule 4K of the Company Disclosure Letter: (i) since June 30, 2013, the Company has been in material compliance with all applicable Environmental Laws; (ii) the Company maintains and is in material compliance with all Permits required pursuant to Environmental Laws for the operation of its business as conducted on the date hereof (“Environmental Permits”); (iii) the Company has not received since June 30, 2013, any written notice regarding any actual or alleged violation of applicable Environmental Laws; (iv) there are no Claims pending or, to Seller’s Knowledge, threatened in writing against the Company or any of its assets before or by any Governmental Entity or by any other Person pursuant to applicable Environmental Laws; (v) to Seller’s Knowledge, there has been no Release, prior to the date hereof, of Hazardous Substances at, on or from the Owned Real Property or by the Company at, on or from the Leased Real Property or any real property subject to Additional Property Interests, in material violation of any Environmental Laws or in a manner that would, or would reasonably be expected to, give rise to a material remedial or corrective action obligation pursuant to Environmental Laws and (vii) Seller has made available to Buyer copies of all material, non-privileged environmental reports, audits, and assessments of the Owned Real Property and the Leased Real Property that are in the possession or control of the Company or, to Seller’s Knowledge, Seller or any Affiliate thereof (other than the Company). This Section 4K contains the sole and exclusive representations and warranties of the Seller with respect to any environmental, health or safety matters, including any relating to Environmental Laws or Hazardous Substances.

16

4L. Insurance. Schedule 4L of the Company Disclosure Letter sets forth (i) a true and complete list of all policies of insurance insuring the properties, assets, employees and/or operations of the Company (collectively, the “Policies”) and (ii) any outstanding claims under such Policies with respect to the Company or its assets. Such Policies are in full force and effect and summaries of such Policies have been made available to Buyer. All premiums due and payable under such Policies (including with respect thereto covering all periods up to and including the Closing Date) have been or will be paid prior to the Closing. No notice of cancellation of, or indication of an intention not to renew, any Policy has been received with respect to any of the Policies.

4M. Tax Matters. Except as set forth on Schedule 4M of the Company Disclosure Letter:

(i) The Company has timely filed or caused to be timely filed all Tax Returns that are required to be filed by, or with respect to, the Company (taking into account any applicable extension of time within which to file) and all such returns are true and correct in all material respects;

(ii) All Taxes of the Company that are due and payable have been paid;

(iii) The Company has withheld and paid over to the appropriate Tax Authority all Taxes required to have been withheld and paid over in connection with any amounts paid or owing to any employee, independent contractor, creditor, member, stockholder or other third party;

(iv) The Company is not currently the subject of an audit or other examination relating to the payment of Taxes by any Tax Authority, and the Company has not received any written notices from any Tax Authority that such an audit or examination is contemplated or pending;

(v) The Company has not entered into a written agreement or waiver extending any statute of limitations relating to the payment or collection of Taxes, in each case, that has not expired, and is not presently contesting any Tax before any Tax Authority;

(vi) In the last six (6) years, no written Claim has been made by a Tax Authority in a jurisdiction where the Company does not file Tax Returns that the Company is or may be subject to taxation by that jurisdiction;

(vii) The Company is, and has been since its conversion from a corporation as of September 15, 2017, an entity disregarded from its owner for U.S. federal income tax purposes and the Company has not elected to be treated as an association or corporation for U.S. federal income tax purposes;

(viii) The Company does not have any liability for the Taxes of any Person under Treasury Regulation Section 1.1502-6 (or any corresponding provision of state, local or non U.S. Tax Law); and

(ix) The Company is not currently or ever has been a party to any “listed transaction” as defined in Section 6707A(c)(2) of the Code.

This Section 4M contains the sole and exclusive representations and warranties of Seller with respect to any Tax matters. No representation or warranty contained in this Section 4M shall be deemed to apply directly or indirectly with respect to any taxable period (or portion thereof) ending after the Closing Date. Notwithstanding anything to the contrary in this Section 4M, Seller makes no representation as to the amount of, or limitations on, any net operating losses, Tax credits or other Tax attributes that it may have.

17

4N. Regulatory Status. The Company is, and, until Seller receives the Required Governmental Authorization contemplated in Section 6F(ii)(b), will be, a public utility under the Pennsylvania Public Utility Code licensed to provide transportation of oil and natural gas to electric generating stations pursuant to certificates of public convenience granted by the PPUC.

4O. Intellectual Property. Schedule 4O of the Company Disclosure Letter sets forth all of the following that are owned by or filed in the name of the Company: (i) patented or registered Intellectual Property Rights and (ii) pending patent applications and applications for registration of other Intellectual Property Rights (together, the “Company Intellectual Property”). Except as set forth on Schedule 4O of the Company Disclosure Letter, the Company owns and possesses good title to all material Company Intellectual Property. No Claims (including any Claims that the Company is infringing on the Intellectual Property Rights of any third party) are pending in writing or, to Seller’s Knowledge, threatened in writing against the Company as of the date of this Agreement with respect to the ownership, use or validity of any Company Intellectual Property.

4P. Banks. Schedule 4P of the Company Disclosure Letter sets forth a true and complete list of all deposit, demand, time, savings, passbook or security accounts that the Company maintains with any bank or financial institution, the names and addresses of the financial institutions maintaining each such account and the authorized signatories on each such account.

4Q. Affiliate Arrangements. Except as set forth on Schedule 4Q of the Company Disclosure Letter, there are no Affiliate Arrangements, other than the Organizational Documents of the Company.

4R. Support Obligations. Schedule 4R of the Company Disclosure Letter lists all credit support provided by Seller or its Affiliates (each, a “Credit Support Obligor”) to or on behalf of the Company pursuant to applicable Law or the terms of a Material Contract or Permit, including guarantees, letters of credit, escrows, sureties and performance bonds, security agreements and other similar arrangements that are outstanding (collectively, the “Support Obligations”).

4S. No Other Business. During the period of ownership of the Company by Seller or any of its Affiliates, the Company has not engaged in any material respect in any business other than the business of owning and operating the fuel or natural gas pipelines and other midstream assets connected to or otherwise relating to the facilities of the Company or its Affiliates located at Martins Creek, Pennsylvania or Marcus Hook, Pennsylvania and matters incidental thereto.

4T. Bankruptcy. There are no bankruptcy proceedings pending against, being contemplated or pursued by or, to Seller’s Knowledge, threatened against the Company.

4U. Non-Disclosure. To Seller’s Knowledge, there are no documents or instruments of the Company or of Seller related to the Company, its assets or its business that are protected by an attorney-client privilege or that qualify as attorney work product that (i) have not been disclosed or made available to Buyer and (ii) contain any fact or other circumstances that would, individually or in the aggregate, be considered material and adverse by a reasonable buyer in making a decision to purchase the Interests.

4V. Solvency; Fraudulent Conveyance. Immediately after giving effect to the transactions contemplated hereby, the Company (i) shall be able to pay its debts as they become due and (ii) shall own assets that have a fair saleable value (if sold as an entirety with reasonable promptness in an arm’s length transaction under present conditions) in excess of their liabilities (whether liquidated, unliquidated, fixed, contingent, matured, unmatured, disputed, undisputed, secured, unsecured or otherwise). Immediately after giving effect to the transactions contemplated hereby, the Company shall have adequate capital to carry on its business. No transfer of property is being made and no obligation is being incurred in connection with the transactions contemplated by this Agreement or the Ancillary Documents with the intent to hinder, delay or defraud either present or future creditors of the Company.

18

ARTICLE 5

REPRESENTATIONS AND WARRANTIES OF BUYER

As an inducement to Seller to enter into this Agreement, Buyer hereby represents and warrants as of the date of this Agreement and as of the Closing Date as follows:

5A. Organization and Existence. Buyer is a limited liability company duly formed, validly existing and in good standing under the Laws of the State of Delaware and in each jurisdiction in which the failure to so exist or be in good standing would adversely affect Buyer’s ability perform its obligations hereunder.

5B. Authorization. Buyer has all necessary power and authority to execute and deliver this Agreement and the Ancillary Documents to which it is or will be a party and the capacity and authority to make and perform the representations, warranties, covenants and agreements made by Buyer herein and therein and to consummate all of the transactions contemplated by this Agreement and the Ancillary Documents to which it is or will be a party. The execution, delivery and performance by Buyer of this Agreement and the Ancillary Documents to which Buyer is or will be a party and the consummation by Buyer of the transactions contemplated hereby and thereby are within Buyer’s limited liability company powers and have been duly authorized by all necessary action on the part of Buyer and, subject to the consents, approvals, authorizations, filings and notices referred to in Section 6F, no other actions or other proceedings are necessary to authorize this Agreement and the Ancillary Documents to which Buyer is or will be a party or for Buyer to consummate the transactions contemplated hereby and thereby. This Agreement has been duly executed and delivered by Buyer and constitutes, and as of the Closing, each Ancillary Document to which Buyer is or will be a party, will constitute, when executed and delivered by Buyer, in each case assuming due authorization, execution and delivery by Seller, the valid and legally binding obligation of Buyer enforceable against Buyer in accordance with its terms, except as limited by the Bankruptcy and Equity Exception.