Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Internap Corp | exhibit991pressrelease9302.htm |

| 8-K - 8-K - Internap Corp | a8-k.htm |

© 2017 Internap Corporation (INAP)

3rd Quarter 2017

Earnings Report

Peter D. Aquino

President & Chief Executive Officer

Robert M. Dennerlein

Chief Financial Officer

November 2, 2017

2

FORWARD-LOOKING STATEMENTS

This presentation contains forward-looking statements. These forward-looking statements include statements related to sales, improved

profitability, margin expansion, operations improvement, cost reductions, participation in strategic transactions, our strategy to align into pure-

play businesses and our expectations for full-year 2017 revenue, Adjusted EBITDA and capital expenditures. Our ability to achieve these

forward-looking statements is based on certain assumptions, including our ability to execute on our business strategy, leveraging of multiple

routes to market, expanded brand awareness for high-performance Internet infrastructure services and customer churn levels. These

assumptions may prove inaccurate in the future. Because such forward-looking statements are not guarantees of future performance or

results and involve risks and uncertainties, there are important factors that could cause INAP’s actual results to differ materially from those

expressed or implied in the forward-looking statements, due to a variety of important factors. Such important factors include, without limitation:

our ability to execute on our business strategy into a pure-play business and drive growth while reducing costs; our ability to maintain current

customers and obtain new ones, whether in a cost-effective manner or at all; the robustness of the IT infrastructure services market; our ability

to achieve or sustain profitability; our ability to expand margins and drive higher returns on investment; our ability to sell into new and existing

data center space; the actual performance of our IT infrastructure services and improving operations; our ability to correctly forecast capital

needs, demand planning and space utilization; our ability to respond successfully to technological change and the resulting competition; the

geographic concentration of the company’s data centers in certain markets and any adverse developments in local economic conditions or

the demand for data center space in these markets; ability to identify any suitable strategic transactions; the availability of services from

Internet network service providers or network service providers providing network access loops and local loops on favorable terms, or at all;

failure of third party suppliers to deliver their products and services on favorable terms, or at all; failures in our network operations centers,

data centers, network access points or computer systems; our ability to provide or improve Internet infrastructure services to our customers;

our ability to protect our intellectual property; our substantial amount of indebtedness, our possibility to raise additional capital when needed,

on attractive terms, or at all, our ability to service existing debt or maintain compliance with financial and other covenants contained in our

credit agreement; our compliance with and changes in complex laws and regulations in the U.S. and internationally; our ability to attract and

retain qualified management and other personnel; and volatility in the trading price of INAP common stock. These risks and other important

factors discussed under the caption “Risk Factors” in our most recent Annual Report on Form 10-K filed with the Securities and Exchange

Commission (“SEC”), and our other reports filed with the SEC could cause actual results to differ materially from those indicated by the

forward-looking statements made in this presentation.

Given these risks and uncertainties, investors should not place undue reliance on forward-looking statements as a prediction of actual results.

All forward-looking statements attributable to INAP or persons acting on its behalf are expressly qualified in their entirety by the foregoing

forward-looking statements. All such statements speak only as of the date made, and INAP undertakes no obligation to update or revise

publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

© 2017 Internap Corporation (INAP)

3

NON-GAAP MEASURES

In addition to results presented in accordance with GAAP, this presentation includes non-GAAP

financial measures. INAP believes these non-GAAP financial measures provide additional

information that is useful to investors in helping to understand our underlying performance and

trends.

Non-GAAP financial measures have inherent limitations, which are not required to be uniformly

applied. Readers should be aware of these limitations and should be cautious with respect to the

use of such measures. To compensate for these limitations, we use non-GAAP financial

measures as comparative tools, together with GAAP financial measures, to assist in the

evaluation of our operating performance or financial condition. Our method of calculating these

non-GAAP financial measures may differ from methods used by other companies. These non-

GAAP financial measures should not be considered in isolation or as a substitute for those

financial measures prepared in accordance with GAAP.

As required by SEC rules, we have provided in this presentation reconciliations of the non-GAAP

financial measures included in this presentation to the most directly comparable GAAP financial

measures. Reconciliations of non-GAAP financial measures are also available in the attachment

to our third quarter 2017 earnings press release available on our website at www.ir.Internap.com.

© 2017 Internap Corporation (INAP)

4

INAP Continues Building Momentum

• INAP’S Emerging Identity, as a Strong Colocation Services Provider with…

Value Added Products beyond Colocation, including: Managed Services &

Hosting, Cloud, and High-performance Network Services.

A significant presence in 12 of top 15 U.S. markets and 2nd largest market in

Canada.

• Sales Force Recruiting now at Target Levels, positioning INAP well for 2018

productivity.

• EBITDA Margin Expansion continues to improve.

• INAP Investing for the Future - Upcoming Capital Projects:

Dallas raised floor and power expansion to meet growing demand

New Phoenix data center space accelerated to full occupancy, inside of six

months

Expanding Montreal Colocation footprint in 2018

• INAP announces 1 for 4 reverse stock split, effective on November 20, 2017.

• INAP reaffirms/raises guidance targets for calendar year 2017.

© 2017 Internap Corporation (INAP)

INAP on Track for Year End Targets

5

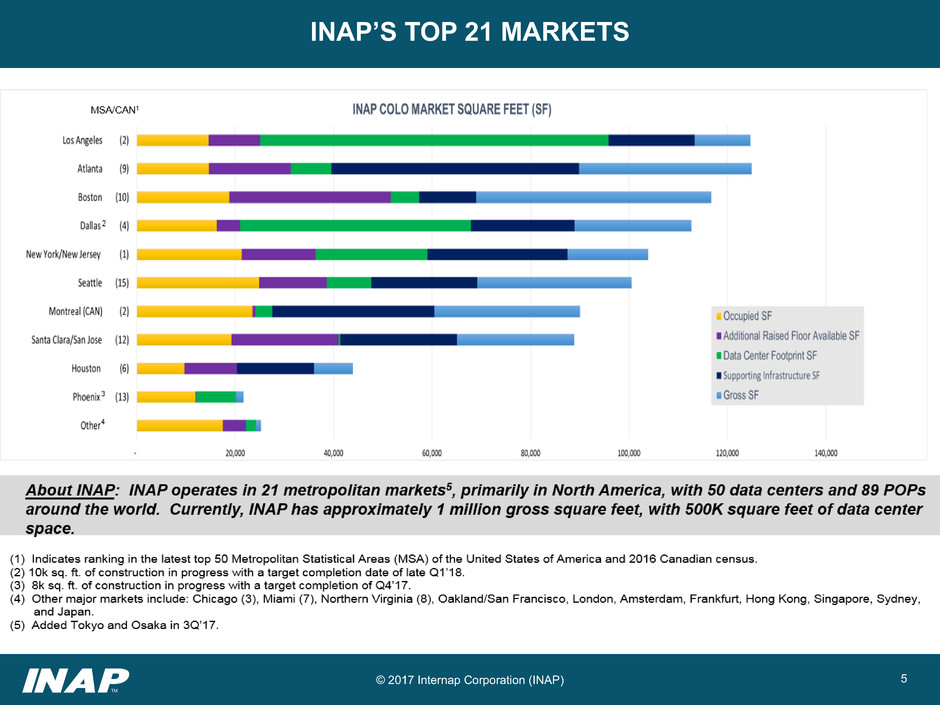

INAP’S TOP 21 MARKETS

© 2017 Internap Corporation (INAP)

6

CONSOLIDATED EARNINGS SUMMARY

*Reconciliation to GAAP on pages 13-17

© 2017 Internap Corporation (INAP)

Solid Financial Performance and Consistency Demonstrated Through 3Q’17

7

INAP COLO BUSINESS UNIT RESULTS

*Reconciliation to GAAP on pages 13-17

© 2017 Internap Corporation (INAP)

INAP’s Colocation Portfolio is Positioned for Profitable Growth

COLOCATION

MANAGED

HOSTING

NETWORK

8

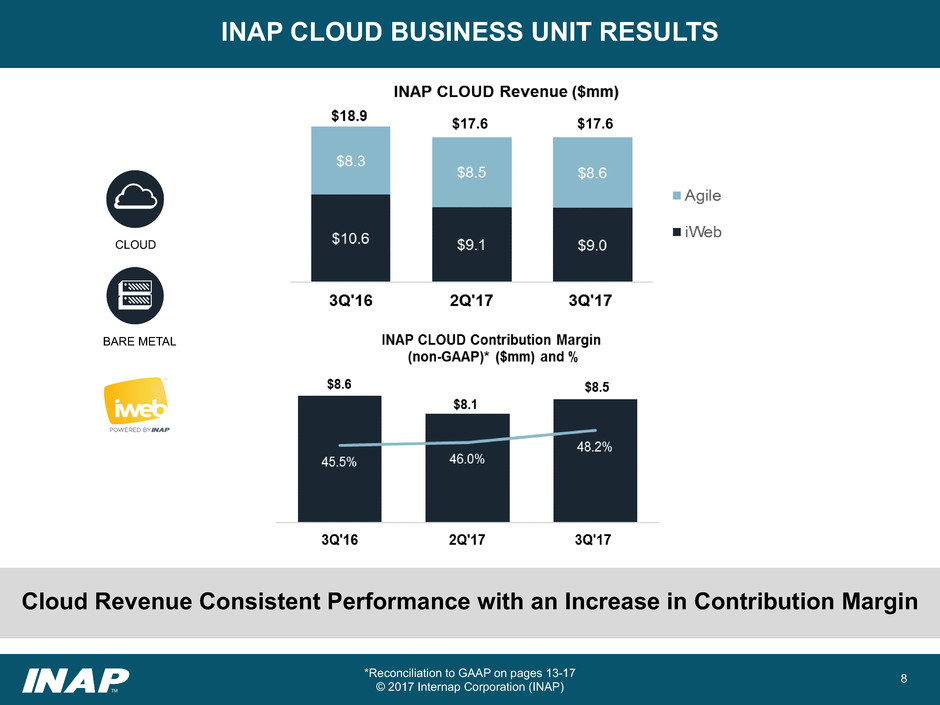

INAP CLOUD BUSINESS UNIT RESULTS

*Reconciliation to GAAP on pages 13-17

© 2017 Internap Corporation (INAP)

Cloud Revenue Consistent Performance with an Increase in Contribution Margin

CLOUD

BARE METAL

$17.6 $17.6

9

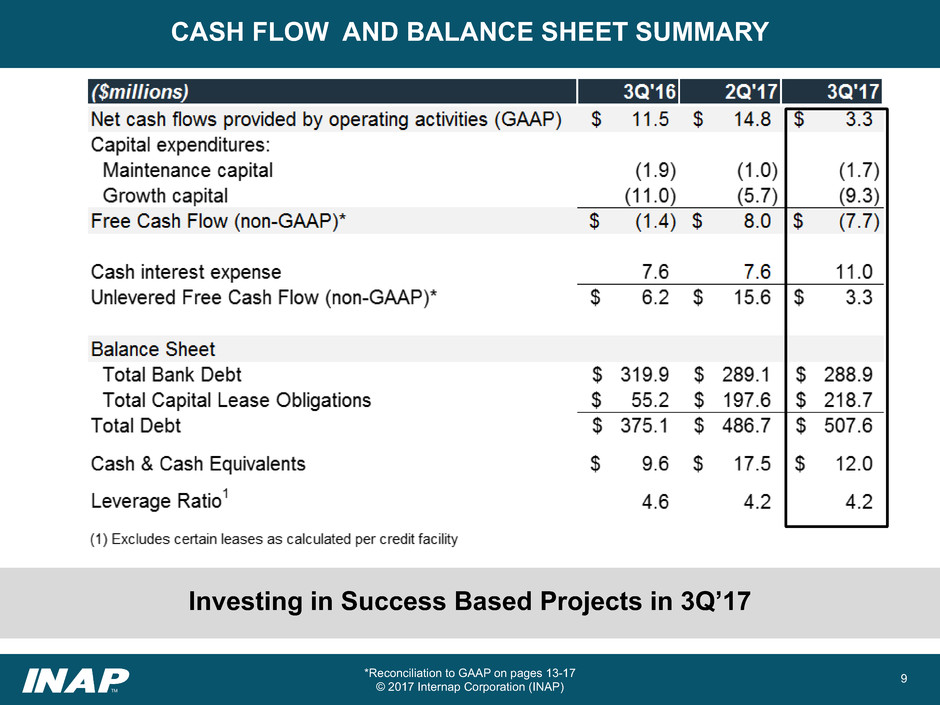

CASH FLOW AND BALANCE SHEET SUMMARY

*Reconciliation to GAAP on pages 13-17

© 2017 Internap Corporation (INAP)

Investing in Success Based Projects in 3Q’17

10

FULL YEAR 2017 EXPECTED RANGE

($ millions)

Previous

Guidance

Current

Guidance

Revenue $275 to $285 $277 to $282

Adjusted EBITDA

(non-GAAP)* $85 to $90 $87 to $92

Capital Expenditures $32 to $37 Reaffirming

*Reconciliation to GAAP on pages 13-17

© 2017 Internap Corporation (INAP)

INAP Raising Adjusted EBITDA Guidance

11

LOOKING AHEAD TO 2018

© 2017 Internap Corporation (INAP)

Combining Organic Growth and M&A Activity in 2018

• Executing on Management 2017 Objectives:

Improved Balance Sheet

Margin Expansion

Focus on Rebuilding Sales Force for Revenue Growth

• Focusing on Tuck-in Targets in COLO and Managed Services & Hosting in the

near term.

• Investing in Data Centers in Major Markets – Dallas, Montreal, and Phoenix.

• Continue to Manage Salesforce Productivity and Channel Partners

Performance.

• Reviewing and Improving INAP’s Global Portfolio - Emphasizing our Emerging

Identity as a Colocation Leader in Major Markets with Value Added Services,

including Managed Services & Hosting, Cloud, and High Performance Network

Services.

12© 2017 Internap Corporation (INAP)

APPENDIX

Reconciliation of Non-GAAP Financial Measures

13

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

Normalized Net Loss is a non-GAAP measure. Normalized Net Loss is net loss plus exit

activities, restructuring and impairments, stock-based compensation, non-income tax contingency,

strategic alternatives and related costs, one time interest expense, and organizational realignment

costs.

© 2017 Internap Corporation (INAP)

14

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

Business Unit Contribution and Business Unit Contribution Margin are non-GAAP

measures. Business Unit Contribution is defined as business unit revenues less direct costs of

sales and services, customer support, and sales and marketing, exclusive of depreciation and

amortization. Business Unit Contribution Margin is Business Unit Contribution as a percentage of

business unit revenues.

($ in thousands)

© 2017 Internap Corporation (INAP)

15

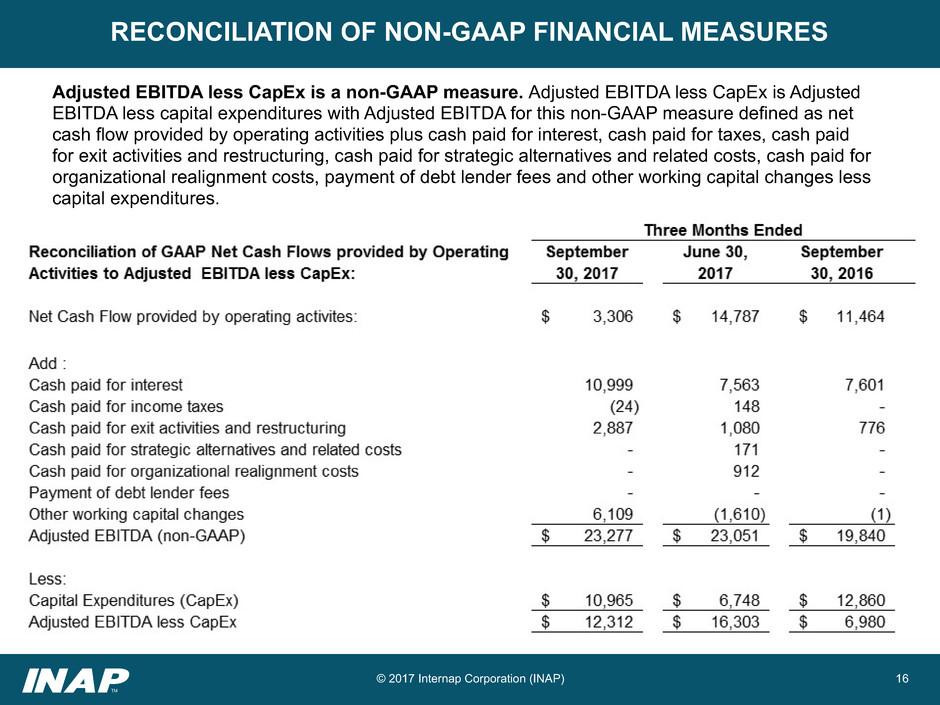

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

Adjusted EBITDA and Adjusted EBITDA Margin are non-GAAP measures. Adjusted EBITDA is

GAAP net loss plus depreciation and amortization, interest expense, provision (benefit) for income

taxes, other expense (income), (gain) loss on disposal of property and equipment, exit activities,

restructuring and impairments, stock-based compensation, non-income tax contingency, strategic

alternatives and related costs and organizational realignment costs. Adjusted EBITDA margin is

adjusted EBITDA as a percentage of revenues.

© 2017 Internap Corporation (INAP)

16

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

Adjusted EBITDA less CapEx is a non-GAAP measure. Adjusted EBITDA less CapEx is Adjusted

EBITDA less capital expenditures with Adjusted EBITDA for this non-GAAP measure defined as net

cash flow provided by operating activities plus cash paid for interest, cash paid for taxes, cash paid

for exit activities and restructuring, cash paid for strategic alternatives and related costs, cash paid for

organizational realignment costs, payment of debt lender fees and other working capital changes less

capital expenditures.

© 2017 Internap Corporation (INAP)

17

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

© 2017 Internap Corporation (INAP)

Free Cash Flow and Unlevered Free Cash Flow are non-GAAP measures. Free Cash Flow is net cash flows

provided by operating activities minus capital expenditures. Unlevered Free Cash Flow is Free Cash Flow plus

cash interest expense:

Below is a reconciliation of GAAP net loss to forward looking Adjusted EBITDA for the period indicated: