Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - SCHULMAN A INC | shlmq417newsrelease.htm |

| 8-K - 8-K - SCHULMAN A INC | shlm171025pressrelease.htm |

0

38

84

229

162

38

0

119

193

157

194

75

117

167

192

83

94

125

192

77

55

127

127

127

89

89

89

1

JOE GINGO – CHAIRMAN, PRESIDENT AND CEO

JOHN RICHARDSON – EVP AND CFO

October 2017

A. Schulman Fiscal 2017 Fourth Quarter

Earnings Call Supplemental Slides

Exhibit 99.2

0

38

84

229

162

38

0

119

193

157

194

75

117

167

192

83

94

125

192

77

55

127

127

127

89

89

89

2

Cautionary Note

A number of the matters discussed in this document that are not historical or current facts deal with potential future circumstances and developments may constitute "forward-looking

statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by the fact that they do not relate strictly to historic or

current facts and relate to future events and expectations. Forward-looking statements contain such words as "anticipate,” "estimate," "expect," "project," "intend," "plan," "believe," and

other words and terms of similar meaning in connection with any discussion of future operating or financial performance. Forward-looking statements are based on management's current

expectations and include known and unknown risks, uncertainties and other factors, many of which management is unable to predict or control, that may cause actual results, performance

or achievements to differ materially from those expressed or implied in the forward-looking statements. Important factors that could cause actual results to differ materially from those

suggested by these forward-looking statements, and that could adversely affect the Company's future financial performance, include, but are not limited to, the following:

– worldwide and regional economic, business and political conditions, including continuing economic uncertainties in some or all of the Company's major product markets or

countries where the Company has operations;

– the effectiveness of the Company's efforts to improve operating margins through sales growth, price increases, productivity gains, and improved purchasing techniques;

– competitive factors, including intense price competition;

– fluctuations in the value of currencies in areas where the Company operates;

– volatility of prices and availability of the supply of energy and raw materials that are critical to the manufacture of the Company's products, particularly plastic resins derived from oil

and natural gas;

– changes in customer demand and requirements;

– effectiveness of the Company to achieve the level of cost savings, productivity improvements, growth and other benefits anticipated from acquisitions, joint ventures and

restructuring initiatives;

– escalation in the cost of providing employee health care;

– uncertainties and unanticipated developments regarding contingencies, such as pending and future litigation and other claims, including developments that would require increases

in our costs and/or reserves for such contingencies;

– the performance of the global automotive market as well as other markets served;

– further adverse changes in economic or industry conditions, including global supply and demand conditions and prices for products;

– operating problems with our information systems as a result of system security failures such as viruses, cyber-attacks or other causes;

– our current debt position could adversely affect our financial health and prevent us from fulfilling our financial obligations; and

– failure of counterparties to perform under the terms and conditions of contractual arrangements, including suppliers, customers, buyers and sellers of a business and other third

parties with which the Company contracts.

The risks and uncertainties identified above are not the only risks the Company faces. Additional risk factors that could affect the Company's performance are set forth in the Company's

Annual Report on Form 10-K for the fiscal year ended August 31, 2017. In addition, risks and uncertainties not presently known to the Company or that it believes to be immaterial also

may adversely affect the Company. Should any known or unknown risks or uncertainties develop into actual events, or underlying assumptions prove inaccurate, these developments

could have material adverse effects on the Company's business, financial condition and results of operations.

2

0

38

84

229

162

38

0

119

193

157

194

75

117

167

192

83

94

125

192

77

55

127

127

127

89

89

89

3

Use of Non-GAAP Financial Measures

This presentation includes certain financial information determined by methods other than in accordance with accounting principles

generally accepted in the United States (“GAAP”). The Company uses segment gross profit, SG&A expenses excluding certain items,

segment operating income, operating income before certain items, net income excluding certain items, net income per diluted share

excluding certain items and adjusted EBITDA to assess performance and allocate resources because the Company believes that these

measures are useful to investors and management in understanding current profitability levels that may serve as a basis for evaluating

future performance and facilitating comparability of results. In addition, segment operating income, operating income before certain items

and net income excluding certain items are important to management as all are a component of the Company’s annual and long-term

employee incentive plans. Non-GAAP measures are not in accordance with, nor are they a substitute for, GAAP measures, and tables

included in this release reconcile each non-GAAP financial measure with the most directly comparable GAAP financial measure. The

most directly comparable GAAP financial measures for these purposes are gross profit, SG&A expenses, operating income, net income

and net income per diluted share. The Company's non-GAAP financial measures are not meant to be considered in isolation or as a

substitute for comparable GAAP financial measures, and should be read only in conjunction with the Company's consolidated financial

statements prepared in accordance with GAAP.

While the Company believes that these non-GAAP financial measures provide useful supplemental information to investors, there are

very significant limitations associated with their use. These non-GAAP financial measures are not prepared in accordance with GAAP,

may not be reported by all of the Company’s competitors and may not be directly comparable to similarly titled measures of the

Company’s competitors due to potential differences in the exact method of calculation. The Company compensates for these limitations

by using these non-GAAP financial measures as supplements to GAAP financial measures and by reviewing the reconciliations of the

non-GAAP financial measures to their most comparable GAAP financial measures.

0

38

84

229

162

38

0

119

193

157

194

75

117

167

192

83

94

125

192

77

55

127

127

127

89

89

89

4

REINVIGORATED BUSINESS MODEL - ACCELERATING GROWTH

2017 Reset Year

Realign

• Realignment of product families driving savings of ~$6MM annually

• Simplified customer relations

Refocus on Sales

• Created improved performance-based global sales incentive plan for fiscal 2018

• Enhanced reporting metrics

• Focus intensely on cross-selling and full product portfolio training

Reinvigorate Innovation

• Spreading new innovation globally through inter-regional collaboration

• Conducting quarterly product innovation reviews

Return Operational Stability

• Minimal property damage from Hurricane Harvey but experienced business interruptions

• Major operational improvements in LaPorte, Texas to improve capacity utilization and quality

• Operational optimization in Evansville, Indiana to improve capacity utilization and margins

0

38

84

229

162

38

0

119

193

157

194

75

117

167

192

83

94

125

192

77

55

127

127

127

89

89

89

5

Financial Highlights – FY17 vs. FY16

FISCAL 2017 RESET YEAR; POSITIONED FOR RECOVERY IN FISCAL 2018

FULL YEAR FINANCIAL HIGHLIGHTS ($MM, $/SH)

GAAP Comparison Adjusted Comparison

FY17 FY16 FY17 FY16

REVENUE 2461.1 2496.0 2461.1 2496.0

OP INCOME 85.8 (309.2) 126.5* 145.9*

NET INCOME 25.5 (364.6) 51.8* 61.2*

EBITDA* 203.4 228.9

EPS - diluted 0.86 (12.44) 1.75* 2.08*

* Reflects Non-GAAP results. Refer to the Appendix for a reconciliation between GAAP and Non-GAAP results.

• Revenues flat excluding foreign currency translation

• FY17 adjusted EPS of $1.75 includes USCAN operational issues and

unrecovered raw material increases in EMEA

• Includes negative $0.08/sh foreign currency impact

0

38

84

229

162

38

0

119

193

157

194

75

117

167

192

83

94

125

192

77

55

127

127

127

89

89

89

6

Financial Highlights – FY17Q4 vs. FY16Q4

FOURTH QUARTER FINANCIAL HIGHLIGHTS ($MM, $/SH)

GAAP Comparison Adjusted Comparison

FY17Q4 FY16Q4 FY17Q4 FY16Q4

REVENUE 646.7 604.6 646.7 604.6

OP INCOME 13.1 (383.0) 27.0* 33.6*

NET INCOME 7.4 (385.1) 9.6* 13.7*

EBITDA* 46.1 53.9

EPS - diluted 0.25 (13.12) 0.32* 0.47*

* Reflects Non-GAAP results. Refer to the Appendix for a reconciliation between GAAP and Non-GAAP results.

• Reported sales up 6%, excluding FX; USCAN recorded first positive

comparison in the last five quarters

• Positive operating income comparisons in LATAM & EC; APAC continues to

deliver strong results

• Stabilization of USCAN operations improved results substantially on a

sequential basis

• Unrecovered raw material price increases in EMEA; significant portion of

earnings shortfall

0

38

84

229

162

38

0

119

193

157

194

75

117

167

192

83

94

125

192

77

55

127

127

127

89

89

89

7

Segment Financial Highlights – Q4FY17

7

Revenue

• USCAN positive revenue growth driven by strong

pricing

• CCS performance strong, both price and volume,

helped by improved oil field activity

Operating Income

• Lower slightly but notable sequential improvement

Revenue

• Volumes were flat to up in nearly all product lines; PM

hurt by lower customers activity due to raw material

price uncertainty

• Revenue gain on price mix improvements; CC&S

particularly strong

Operating Income

• Unrecovered raw material prices increases a significant

portion of shortfall

• Lower structural SG&A costs were a partial offset

USCAN ($MM)

FY17Q4 FY16Q4

Revenue 164.2 158.9

Change 3%

Operating Income1 8.7 8.9

Operating Margin1 5.3% 5.6%

EMEA ($MM)

FY17Q4 FY16Q4

Revenue 317.8 299.2

Change (ex FX) 4%

Operating Income1 11.8 17.4

Operating Margin1 3.7% 5.8%

1. Reflects Non-GAAP results. Refer to the Appendix for a reconciliation between GAAP and Non-GAAP results.

0

38

84

229

162

38

0

119

193

157

194

75

117

167

192

83

94

125

192

77

55

127

127

127

89

89

89

8

Segment Financial Highlights – FY17Q4

8

Revenue

• Revenue increased largely driven

PM in China and Malaysia

Operating Income

• Price/cost mix positive

• Increased SG&A to support growth

initiatives

Revenue

• Base revenue up double-digit

• Volumes rose at both PM and CCS;

overall pricing positive

Operating Income

• Operating income increased as a

result of higher volumes

• SG&A lower on percentage of sales

basis

Revenue

• Quantum carbon fiber shipments

strong

• Notable gains in oil field and

electrical markets

Operating Income

• Positive price/cost mix

• SG&A lower in dollars and as a

percentage of sales

APAC ($MM)

FY17Q4 FY16Q4

Revenue 55.6 49.3

Change (ex FX) 15%

Operating Income1 4.2 4.4

Operating Margin1 7.5% 9.0%

LATAM ($MM)

FY17Q4 FY16Q4

Revenue 50.1 44.9

Change (ex FX) 11%

Operating Income1 6.0 5.7

Operating Margin1 12.0% 12.7%

EC ($MM)

FY17Q4 FY16Q4

Revenue 58.9 52.3

Change (ex FX) 12%

Operating Income1 4.7 4.3

Operating Margin1 8.0% 8.2%

1. Reflects Non-GAAP results. Refer to the Appendix for a reconciliation between GAAP and Non-GAAP results.

0

38

84

229

162

38

0

119

193

157

194

75

117

167

192

83

94

125

192

77

55

127

127

127

89

89

89

9

Net Debt / Leverage Covenant

• Net debt $863MM at end of fiscal 2017

• 2017 net debt reduction - $38MM

• Net leverage ratio at 4.15x

• Company has paid approximately $200MM of total

debt since the purchase of Citadel in mid-2015

• Covenant amended to increase financial flexibility

0

38

84

229

162

38

0

119

193

157

194

75

117

167

192

83

94

125

192

77

55

127

127

127

89

89

89

10

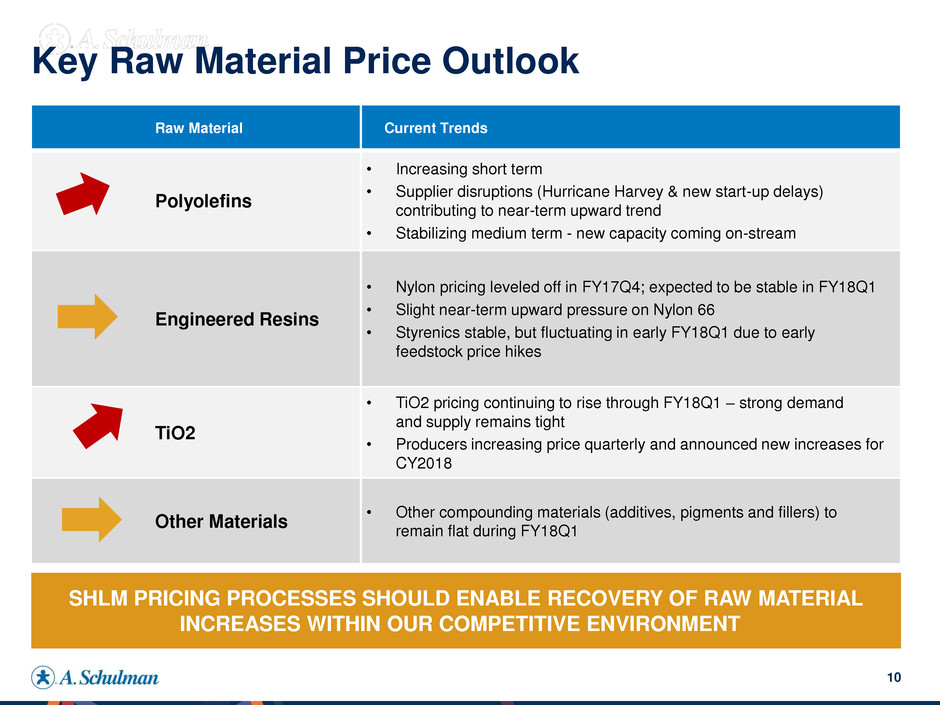

Key Raw Material Price Outlook

(In Millions & USD)

Raw Material Current Trends

Polyolefins

• Increasing short term

• Supplier disruptions (Hurricane Harvey & new start-up delays)

contributing to near-term upward trend

• Stabilizing medium term - new capacity coming on-stream

Engineered Resins

• Nylon pricing leveled off in FY17Q4; expected to be stable in FY18Q1

• Slight near-term upward pressure on Nylon 66

• Styrenics stable, but fluctuating in early FY18Q1 due to early

feedstock price hikes

TiO2

• TiO2 pricing continuing to rise through FY18Q1 – strong demand

and supply remains tight

• Producers increasing price quarterly and announced new increases for

CY2018

Other Materials

• Other compounding materials (additives, pigments and fillers) to

remain flat during FY18Q1

SHLM PRICING PROCESSES SHOULD ENABLE RECOVERY OF RAW MATERIAL

INCREASES WITHIN OUR COMPETITIVE ENVIRONMENT

0

38

84

229

162

38

0

119

193

157

194

75

117

167

192

83

94

125

192

77

55

127

127

127

89

89

89

11

SHLM 2018 Targets and Risk Factors

*FY18 guidance assumes Euro rate of $1.15 compared with $1.10 on average in FY17. Metrics are on a non-GAAP basis. Refer to the

reconciliation of GAAP and Non-GAAP financial measures for types of items excluded from our business outlook.

.

Strategic Uses of Cash

• Debt service

• Maintain dividend

• Capital investment/restructuring

• Additional debt pay down

METRIC* FY18

EBITDA $220 – $230MM

EPS $2.00 – $2.20/sh

EPS GUIDANCE (AT THE MID-RANGE) REPRESENTS A 20% INCREASE OVER FY17

0

38

84

229

162

38

0

119

193

157

194

75

117

167

192

83

94

125

192

77

55

127

127

127

89

89

89

12

Significant Events

Lucent Litigation Update:

• Cooperating with federal government in its investigations

- Company understands investigation relates to its allegations of fraud against Citadel

- Company identified as a possible victim of a crime by the Federal Bureau of Investigation

• Civil litigation subject to a motion for a 90 day stay (from March 2018 scheduled trial date)

New Board Members:

• Added Carol Eicher & Allen Spizzo to board in September

- Both highly experienced industry leaders

• Added Dr. William Joyce as senior advisor to the Board & consultant to the Company

- Renowned chemicals industry executive with proven track record of delivering value

0

38

84

229

162

38

0

119

193

157

194

75

117

167

192

83

94

125

192

77

55

127

127

127

89

89

89

13

2017 Reset Year: Momentum in FY17Q4

Fiscal 2017 Fiscal 2018 Fiscal 2019 Fiscal 2020 Fiscal 2021

REINVIGORATED BUSINESS MODEL ACCELERATING GROWTH

RECOVER

GROWTH

TRAJECTORY RESET

YEAR

NEW

MANAGEMENT

TEAM

BUILD

UPON PAST

SUCCESSES

0

38

84

229

162

38

0

119

193

157

194

75

117

167

192

83

94

125

192

77

55

127

127

127

89

89

89

14

Appendix

0

38

84

229

162

38

0

119

193

157

194

75

117

167

192

83

94

125

192

77

55

127

127

127

89

89

89

15

0

38

84

229

162

38

0

119

193

157

194

75

117

167

192

83

94

125

192

77

55

127

127

127

89

89

89

16

0

38

84

229

162

38

0

119

193

157

194

75

117

167

192

83

94

125

192

77

55

127

127

127

89

89

89

17

Explanation of Adjustments

1. Asset impairments are related to goodwill and intangible assets, and also include information technology assets, in the Company's

USCAN, EC and EMEA segments. Refer to Note 4 and Note 19 of the 2017 Annual Report on Form 10-K for further discussion.

2. Accelerated depreciation is related to restructuring plans in the Company's USCAN, LATAM and EMEA segments. Refer to Note 16

of the 2017 Annual Report on Form 10-K for further discussion.

3. Costs related to acquisitions and integrations primarily include third party professional, legal, IT and other expenses associated with

successful and unsuccessful full or partial acquisition and divestiture/dissolution transactions, as well as certain employee-related

expenses such as travel, bonuses and post-acquisition severance separate from a formal restructuring plan.

4. Restructuring and related costs include items such as employee severance charges, lease termination charges, curtailment

gains/losses, other employee termination costs, and professional fees related to the reorganization of the Company’s legal entity

structure, facility operations and compliance with new legislation, and costs associated with new software implementation that are not

eligible for capitalization. Refer to Note 14 of the 2017 Annual Report on Form 10-K for further discussion.

5. Lucent costs primarily represent legal and investigation costs related to resolving the Lucent matter, product manufacturing costs for

reworking existing Lucent inventory, obsolete Lucent inventory reserve costs, and dedicated internal personnel costs that would have

otherwise been focused on normal operations in fiscal 2016.

6. Accelerated amortization of deferred financing costs related to Term Loan B prepayments. Refer to Note 5 of the 2017 Annual Report

on Form 10-K for further discussion.

7. CEO transition costs represent charges related to the separation of the Company's previous CEO, Bernard Rzepka.

8. Tax (benefits) charges represent the Company's adjustment of reported tax expense to non-GAAP tax based on the overall

estimated annual non-GAAP effective tax rates.

9. Gain related to sale of assets that had previously been classified as held for sale.

0

38

84

229

162

38

0

119

193

157

194

75

117

167

192

83

94

125

192

77

55

127

127

127

89

89

89

18

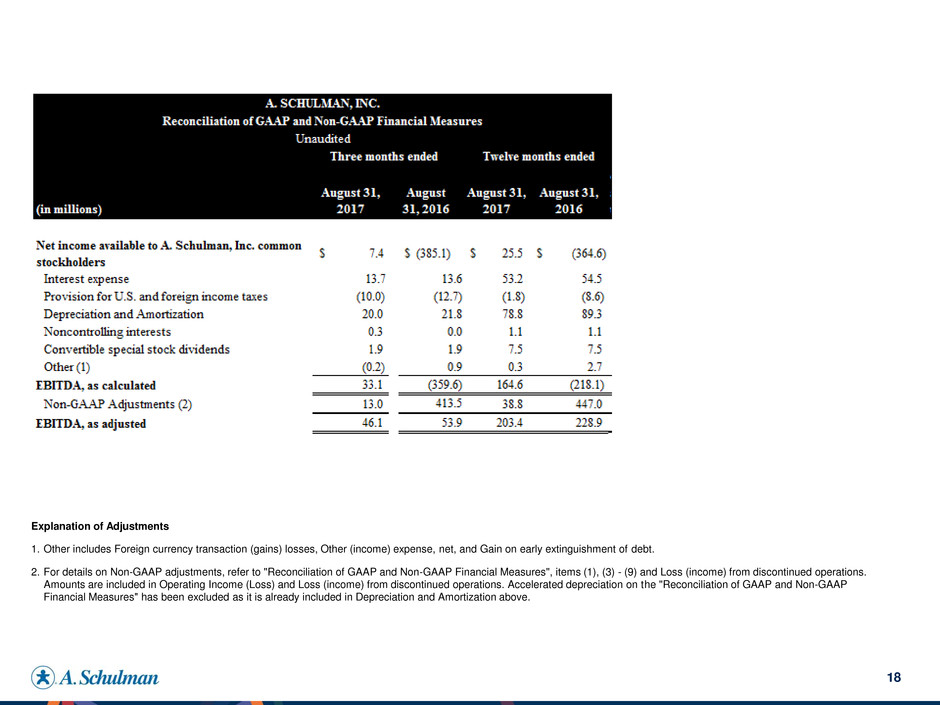

Explanation of Adjustments

1. Other includes Foreign currency transaction (gains) losses, Other (income) expense, net, and Gain on early extinguishment of debt.

2. For details on Non-GAAP adjustments, refer to "Reconciliation of GAAP and Non-GAAP Financial Measures", items (1), (3) - (9) and Loss (income) from discontinued operations.

Amounts are included in Operating Income (Loss) and Loss (income) from discontinued operations. Accelerated depreciation on the "Reconciliation of GAAP and Non-GAAP

Financial Measures" has been excluded as it is already included in Depreciation and Amortization above.

0

38

84

229

162

38

0

119

193

157

194

75

117

167

192

83

94

125

192

77

55

127

127

127

89

89

89

19

0

38

84

229

162

38

0

119

193

157

194

75

117

167

192

83

94

125

192

77

55

127

127

127

89

89

89

20

Explanation of Adjustments

1. Restructuring related costs primarily included in selling, general and administrative expenses in the Company’s statements of operations, are costs associated with professional fees

for outside strategic consultants regarding actions to improve the profitability of the organization, improve efficiency of its operations or comply with new legislation, and costs

associated with reorganizations of the legal entity structure of the Company. Restructuring expenses included in restructuring expense in the Company’s statements of operations

include costs permitted under ASC 420, Exit or Disposal Obligations, such as severance costs, outplacement services and contract termination costs and related costs are costs

associated with professional fees for outside strategic consultants regarding actions to improve the profitability, improve efficiency of its operations, comply with new legislation, and

costs associated with reorganizations of the legal entity structure of the Company. Refer to Note 16, Restructuring, of this Annual Report on Form 10-K for further discussion.

2. Refer to Note 17, Contingencies and Claims, of this Annual Report on Form 10-K for additional discussion on this matter. Lucent costs primarily represent legal and investigation

costs related to resolving the Lucent matter, product manufacturing costs for reworking existing Lucent inventory, obsolete Lucent inventory reserve costs, and dedicated internal

personnel costs that would have otherwise been focused on normal operations in fiscal 2016.

3. .