Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Kraton Corp | kra1025178-kxearningsprese.htm |

October 25, 2017

Kraton Corporation

Third Quarter 2017

Earnings Presentation

Kraton Third Quarter 2017 Earnings Call 2

Disclaimers

Forward Looking Statements

Some of the statements and information in this presentation contain forward-looking statements within the meaning of the Private Securities Litigation

Reform Act of 1995. This presentation includes forward-looking statements that reflect our plans, beliefs, expectations, and current views with respect

to, among other things, future events and financial performance. Forward-looking statements are often identified by words such as “outlook,” “believes,”

“estimates,” “expects,” “projects,” “may,” “intends,” “plans”, “on track” “on trend”, or “anticipates,” or by discussions of strategy, plans or intentions,

including all matters described on the slide titled “2017 Modeling Assumptions” and our expectations for targeted debt reduction, cost reductions,

G&A synergies and operation cost improvements.

All forward-looking statements in this presentation are made based on management's current expectations and estimates, which involve known and

unknown risks, uncertainties, and other important factors that could cause actual results to differ materially from those expressed in forward-looking

statements. These risks and uncertainties are more fully described in our latest Annual Report on Form 10-K, including but not limited to “Part I, Item

1A. Risk Factors” and “Part II, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” therein, and in our other

filings with the Securities and Exchange Commission, and include, but are not limited to, risks related to: the integration of Arizona Chemical (now,

AZ Chem Holdings LP); Kraton's ability to repay its indebtedness; Kraton's reliance on third parties for the provision of significant operating and other

services; conditions in the global economy and capital markets; fluctuations in raw material costs; limitations in the availability of raw materials;

competition in Kraton's end-use markets; and other factors of which we are currently unaware or deem immaterial. Readers are cautioned not to

place undue reliance on our forward-looking statements. Forward-looking statements speak only as of the date they are made, and we assume no

obligation to update such information in light of new information or future events.

Kraton Third Quarter 2017 Earnings Call 3

GAAP Disclaimer

This presentation includes the use of non-GAAP financial measures, as defined below. Tables included in this presentation reconcile each of these non-

GAAP financial measures with the most directly comparable GAAP financial measure. For additional information on the impact of the spread between

the FIFO basis of accounting and estimated current replacement cost (“ECRC”), see our Annual Report on Form 10-K for the fiscal year ended December

31, 2016.

We consider these non-GAAP financial measures to be important supplemental measures in the evaluation of our absolute and relative performance.

However, we caution that these non-GAAP financial measures have limitations as analytical tools and may vary substantially from other measures of our

performance. You should not consider them in isolation, or as a substitute for analysis of our results under GAAP in the United States.

EBITDA, Adjusted EBITDA, and Adjusted EBITDA Margin: For our consolidated results, EBITDA represents net income (loss) before interest, taxes,

depreciation and amortization. For each reporting segment, EBITDA represents operating income before depreciation and amortization, disposition and

exit of business activities and earnings of unconsolidated joint ventures. Among other limitations, EBITDA does not: reflect the significant interest

expense on our debt or reflect the significant depreciation and amortization expense associated with our long-lived assets; and EBITDA included herein

should not be used for purposes of assessing compliance or non-compliance with financial covenants under our debt agreements since it calculation

differs in such agreements. Other companies in our industry may calculate EBITDA differently than we do, limiting its usefulness as a comparative

measure. As an analytical tool, Adjusted EBITDA is subject to all the limitations applicable to EBITDA. We prepare Adjusted EBITDA by eliminating from

EBITDA the impact of a number of items we do not consider indicative of our on-going performance but you should be aware that in the future we may

incur expenses similar to the adjustments in this presentation. Our presentation of Adjusted EBITDA should not be construed as an inference that our

future results will be unaffected by unusual or non-recurring items. In addition, due to volatility in raw material prices, Adjusted EBITDA may, and often

does, vary substantially from EBITDA and other performance measures, including net income calculated in accordance with U.S. GAAP. We define Adjusted

EBITDA Margin as Adjusted EBITDA as a percentage of revenue (for each reporting segment or on a consolidated bases, as applicable).

Adjusted Gross Profit and Adjusted Gross Profit Per Ton: We define Adjusted Gross Profit Per Ton as Adjusted Gross Profit divided by total sales volume

(for each reporting segment or on a consolidated basis, as applicable). We define Adjusted Gross Profit as gross profit excluding certain charges and

expenses. Adjusted Gross Profit is limited because it often varies substantially from gross profit calculated in accordance with U.S. GAAP due to volatility

in raw material prices.

Adjusted Diluted Earnings Per Share: Adjusted Diluted Earnings Per Share is Diluted Earnings (Loss) Per Share excluding the impact of a number of non-

recurring items we do not consider indicative of our on-going performance.

Net Debt: Net debt for Kraton is total debt (excluding debt of KFPC due to its own capital structure) less cash and cash equivalents. Consolidated net

debt is Kraton net debt plus debt of KFPC less KFPC’s cash and cash equivalents. Management believes that net debt is useful to investors in determining

our leverage since we could choose to use cash and cash equivalents to satisfy our debt obligations.

Disclaimers

Kraton Third Quarter 2017 Earnings Call 4

Third Quarter 2017 Highlights

Chemical segment

Cost outs and

synergy capture

▪ Delivered $65 million of transaction synergies and operational improvements as of

September 30, 2017

▪ Expect to achieve approximately $50 million of Polymer segment cost reductions by FYE'17

▪ Estimated cost to achieve transaction synergies and cost reductions reduced from $145

million to $108 million

Debt Reduction

▪ Reduced Kraton net debt by $87.3 million Q3'17

▪ Expect full year 2017 reduction in Kraton net debt of $125-$150 million, despite incurring

$15.5 million in refinancing costs

Polymer segment

▪ Adjusted EBITDA(1) of $77.4 million, up $27.8 million or 56.0% vs. Q3'16

▪ Q3'17 Adjusted EBITDA margin(2) of 24.6%, up 650 basis points

▪ Strong unit margins following the second quarter raw material price declines

▪ Sales volume up 6.9%

(1) See non-GAAP reconciliations included in the accompanying financial tables for the reconciliation of each non-GAAP measure to its most directly comparable GAAP measure.

(2) Defined as Adjusted EBITDA as a percentage of revenue.

(1)

▪ Adjusted EBITDA(1) of $44.3 million, up $2.8 million or 6.8% vs. Q3'16

▪ Q3'17 Adjusted EBITDA margin(2) of 22.5%

▪ Second quarter of sequential improvement

▪ Continued price and margin improvement for TOFA products

▪ Sales volume up 3.3%

▪ Consolidated net loss of $4.0 million and Adjusted EBITDA(1) of $121.7 million compared

to net income of $15.6 million and Adjusted EBITDA(1) of $91.1 million in Q3'16

▪ Q3'17 Adjusted EBITDA margin(2) of 23.8%

Consolidated

highlights

Kraton Third Quarter 2017 Earnings Call 5

(1) See non-GAAP reconciliations included in the accompanying financial tables for the reconciliation of each non-GAAP measure to its most directly comparable GAAP measure.

(2) Defined as Adjusted EBITDA as a percentage of revenue.

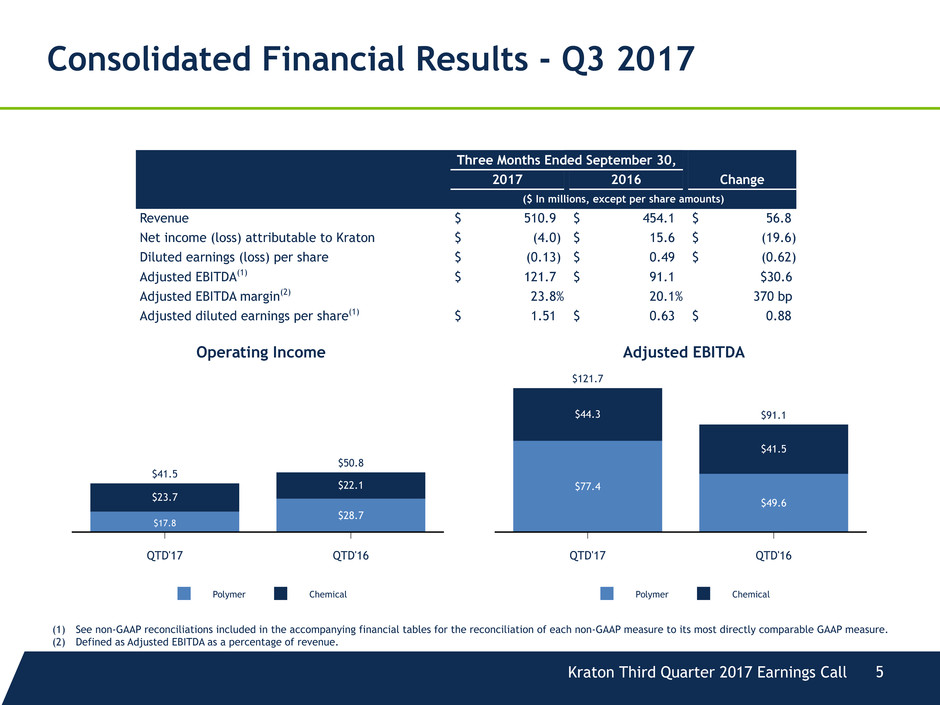

Consolidated Financial Results - Q3 2017

Three Months Ended September 30,

2017 2016 Change

($ In millions, except per share amounts)

Revenue $ 510.9 $ 454.1 $ 56.8

Net income (loss) attributable to Kraton $ (4.0) $ 15.6 $ (19.6)

Diluted earnings (loss) per share $ (0.13) $ 0.49 $ (0.62)

Adjusted EBITDA(1) $ 121.7 $ 91.1 $30.6

Adjusted EBITDA margin(2) 23.8% 20.1% 370 bp

Adjusted diluted earnings per share(1) $ 1.51 $ 0.63 $ 0.88

Polymer Chemical

Adjusted EBITDA

QTD'17 QTD'16

$77.4

$49.6

$44.3

$121.7

$41.5

$91.1

Polymer Chemical

Operating Income

QTD'17 QTD'16

$17.8

$28.7

$23.7

$41.5

$22.1

$50.8

Kraton Third Quarter 2017 Earnings Call 6

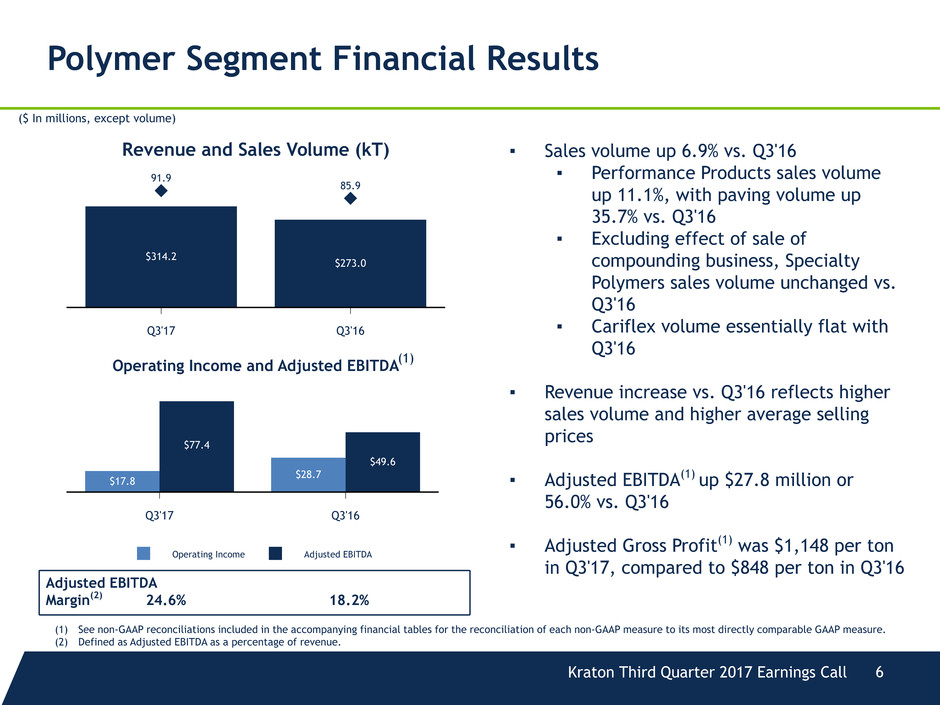

Polymer Segment Financial Results

(1) See non-GAAP reconciliations included in the accompanying financial tables for the reconciliation of each non-GAAP measure to its most directly comparable GAAP measure.

(2) Defined as Adjusted EBITDA as a percentage of revenue.

▪ Sales volume up 6.9% vs. Q3'16

▪ Performance Products sales volume

up 11.1%, with paving volume up

35.7% vs. Q3'16

▪ Excluding effect of sale of

compounding business, Specialty

Polymers sales volume unchanged vs.

Q3'16

▪ Cariflex volume essentially flat with

Q3'16

▪ Revenue increase vs. Q3'16 reflects higher

sales volume and higher average selling

prices

▪ Adjusted EBITDA(1) up $27.8 million or

56.0% vs. Q3'16

▪ Adjusted Gross Profit(1) was $1,148 per ton

in Q3'17, compared to $848 per ton in Q3'16

Adjusted EBITDA

Margin(2) 24.6% 18.2%

($ In millions, except volume)

Revenue and Sales Volume (kT)

Q3'17 Q3'16

91.9 85.9

$314.2 $273.0

(1)

Operating Income Adjusted EBITDA

Operating Income and Adjusted EBITDA

Q3'17 Q3'16

$17.8 $28.7

$77.4

$49.6

Kraton Third Quarter 2017 Earnings Call 7

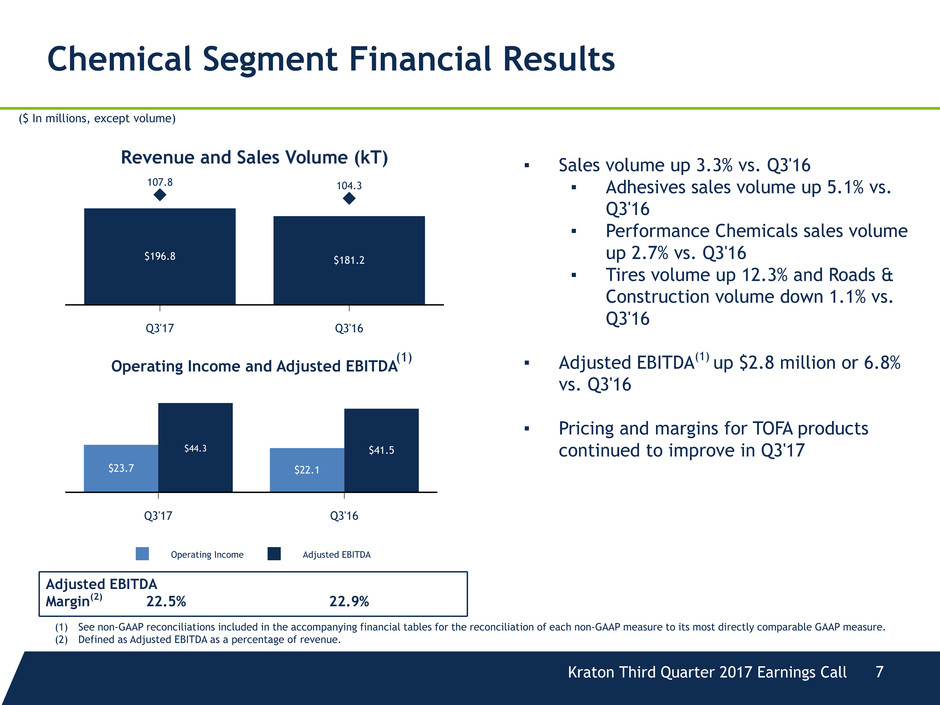

Operating Income Adjusted EBITDA

Operating Income and Adjusted EBITDA

Q3'17 Q3'16

$23.7 $22.1

$44.3 $41.5

Chemical Segment Financial Results

(1) See non-GAAP reconciliations included in the accompanying financial tables for the reconciliation of each non-GAAP measure to its most directly comparable GAAP measure.

(2) Defined as Adjusted EBITDA as a percentage of revenue.

Adjusted EBITDA

Margin(2) 22.5% 22.9%

Revenue and Sales Volume (kT)

Q3'17 Q3'16

107.8 104.3

$196.8 $181.2

(1)

($ In millions, except volume)

▪ Sales volume up 3.3% vs. Q3'16

▪ Adhesives sales volume up 5.1% vs.

Q3'16

▪ Performance Chemicals sales volume

up 2.7% vs. Q3'16

▪ Tires volume up 12.3% and Roads &

Construction volume down 1.1% vs.

Q3'16

▪ Adjusted EBITDA(1) up $2.8 million or 6.8%

vs. Q3'16

▪ Pricing and margins for TOFA products

continued to improve in Q3'17

Kraton Third Quarter 2017 Earnings Call 8

Cost Reductions On Track -

Cost to Achieve Lower Than Expected

▪ Achieved $65 million of transaction synergies and operational improvements as of September 30,

2017 vs. original completion target of FYE'18

▪ These initiatives are expected to provide full-year benefit of approximately $28 million

compared to 2016

▪ Polymer segment cost reduction initiatives are expected to be approximately $50 million on a

life-to-date basis by year-end 2017

▪ These initiatives are expected to provide incremental benefit of approximately $17 million

in 2017

▪ Expect to realize the full $70 million(1) by FYE'18

▪ Total cost to achieve both tranches is estimated at $108 million vs. original estimate of $145

million

(1) Constant currency basis.

Kraton Third Quarter 2017 Earnings Call 9

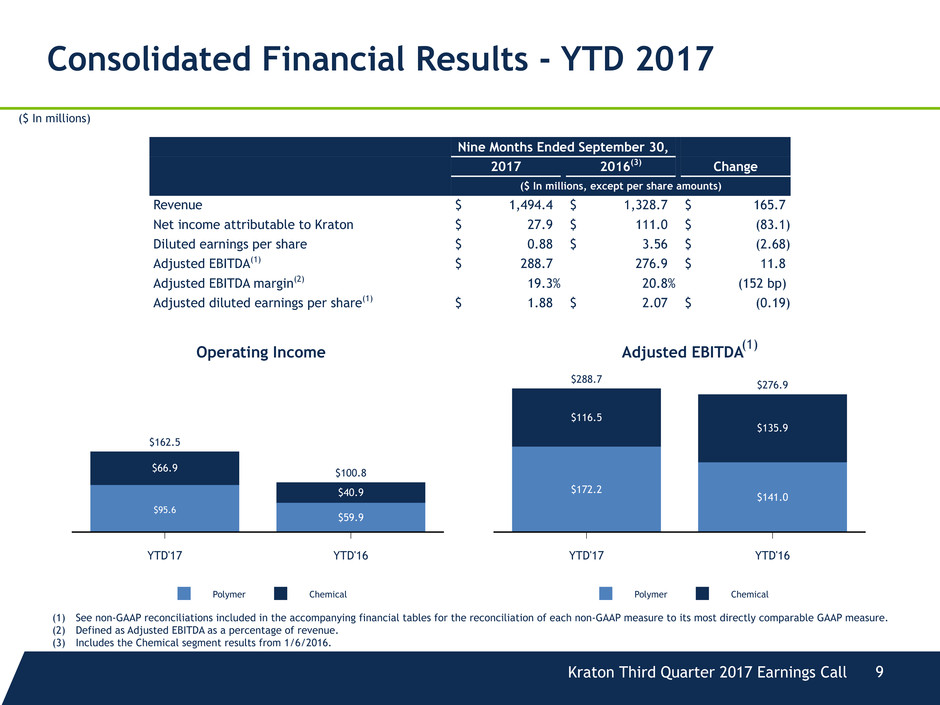

Polymer Chemical

Operating Income

YTD'17 YTD'16

$95.6

$59.9

$66.9

$162.5

$40.9

$100.8

Polymer Chemical

Adjusted EBITDA

YTD'17 YTD'16

$172.2

$141.0

$116.5

$288.7

$135.9

$276.9

(1) See non-GAAP reconciliations included in the accompanying financial tables for the reconciliation of each non-GAAP measure to its most directly comparable GAAP measure.

(2) Defined as Adjusted EBITDA as a percentage of revenue.

(3) Includes the Chemical segment results from 1/6/2016.

Consolidated Financial Results - YTD 2017

Nine Months Ended September 30,

2017 2016(3) Change

($ In millions, except per share amounts)

Revenue $ 1,494.4 $ 1,328.7 $ 165.7

Net income attributable to Kraton $ 27.9 $ 111.0 $ (83.1)

Diluted earnings per share $ 0.88 $ 3.56 $ (2.68)

Adjusted EBITDA(1) $ 288.7 276.9 $ 11.8

Adjusted EBITDA margin(2) 19.3% 20.8% (152 bp)

Adjusted diluted earnings per share(1) $ 1.88 $ 2.07 $ (0.19)

(1)

($ In millions)

Kraton Third Quarter 2017 Earnings Call 10

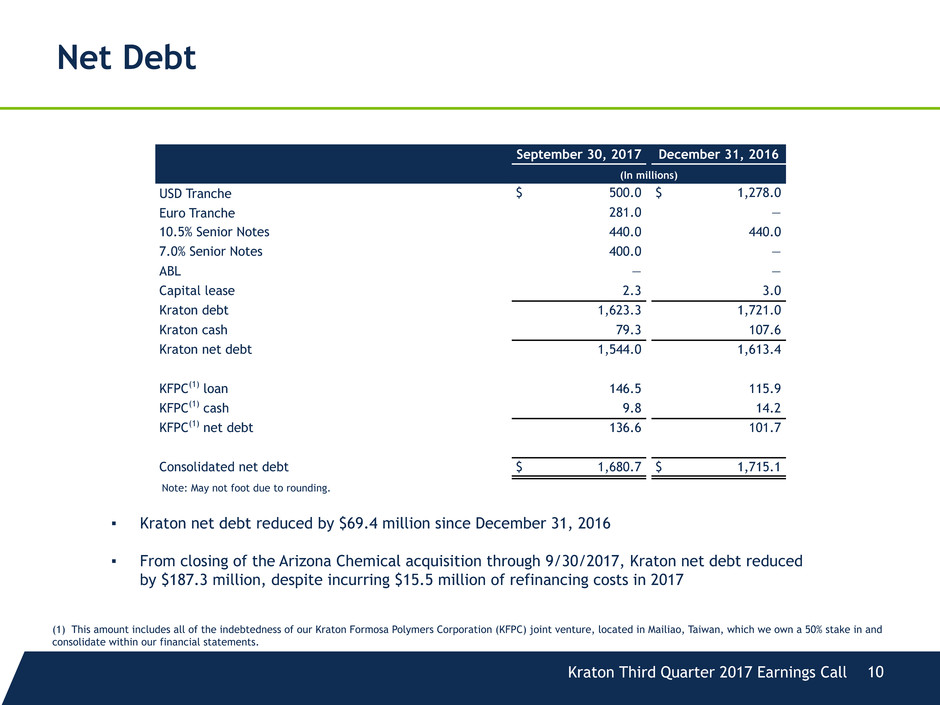

Net Debt

September 30, 2017 December 31, 2016

(In millions)

USD Tranche $ 500.0 $ 1,278.0

Euro Tranche 281.0 —

10.5% Senior Notes 440.0 440.0

7.0% Senior Notes 400.0 —

ABL — —

Capital lease 2.3 3.0

Kraton debt 1,623.3 1,721.0

Kraton cash 79.3 107.6

Kraton net debt 1,544.0 1,613.4

KFPC(1) loan 146.5 115.9

KFPC(1) cash 9.8 14.2

KFPC(1) net debt 136.6 101.7

Consolidated net debt $ 1,680.7 $ 1,715.1

(1) This amount includes all of the indebtedness of our Kraton Formosa Polymers Corporation (KFPC) joint venture, located in Mailiao, Taiwan, which we own a 50% stake in and

consolidate within our financial statements.

Note: May not foot due to rounding.

▪ Kraton net debt reduced by $69.4 million since December 31, 2016

▪ From closing of the Arizona Chemical acquisition through 9/30/2017, Kraton net debt reduced

by $187.3 million, despite incurring $15.5 million of refinancing costs in 2017

Appendix

Kraton Third Quarter 2017 Earnings Call 12

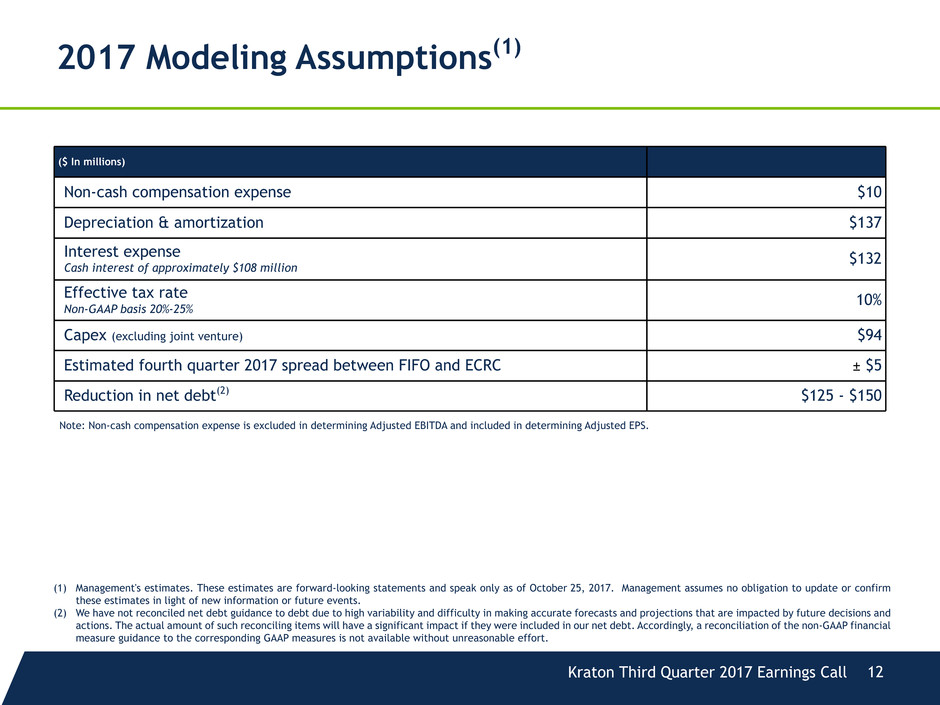

2017 Modeling Assumptions(1)

($ In millions)

Non-cash compensation expense $10

Depreciation & amortization $137

Interest expense

Cash interest of approximately $108 million $132

Effective tax rate

Non-GAAP basis 20%-25% 10%

Capex (excluding joint venture) $94

Estimated fourth quarter 2017 spread between FIFO and ECRC ± $5

Reduction in net debt(2) $125 - $150

(1) Management's estimates. These estimates are forward-looking statements and speak only as of October 25, 2017. Management assumes no obligation to update or confirm

these estimates in light of new information or future events.

(2) We have not reconciled net debt guidance to debt due to high variability and difficulty in making accurate forecasts and projections that are impacted by future decisions and

actions. The actual amount of such reconciling items will have a significant impact if they were included in our net debt. Accordingly, a reconciliation of the non-GAAP financial

measure guidance to the corresponding GAAP measures is not available without unreasonable effort.

Note: Non-cash compensation expense is excluded in determining Adjusted EBITDA and included in determining Adjusted EPS.

Kraton Third Quarter 2017 Earnings Call 13

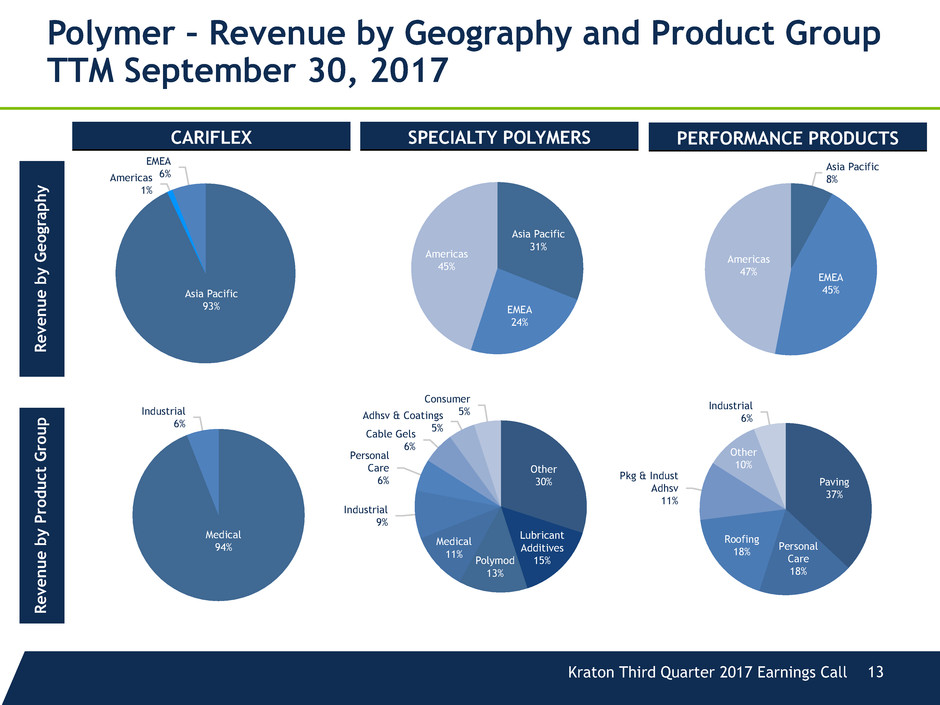

Polymer – Revenue by Geography and Product Group

TTM September 30, 2017

CARIFLEX PERFORMANCE PRODUCTSSPECIALTY POLYMERS

Revenue by Geog

raph

y

Revenue by Product Grou

p

Asia Pacific

93%

Americas

1%

EMEA

6%

Asia Pacific

31%

EMEA

24%

Americas

45%

Asia Pacific

8%

EMEA

45%

Americas

47%

Medical

94%

Industrial

6%

Other

30%

Lubricant

Additives

15%Polymod

13%

Medical

11%

Industrial

9%

Personal

Care

6%

Cable Gels

6%

Adhsv & Coatings

5%

Consumer

5%

Paving

37%

Personal

Care

18%

Roofing

18%

Pkg & Indust

Adhsv

11%

Other

10%

Industrial

6%

Kraton Third Quarter 2017 Earnings Call 14

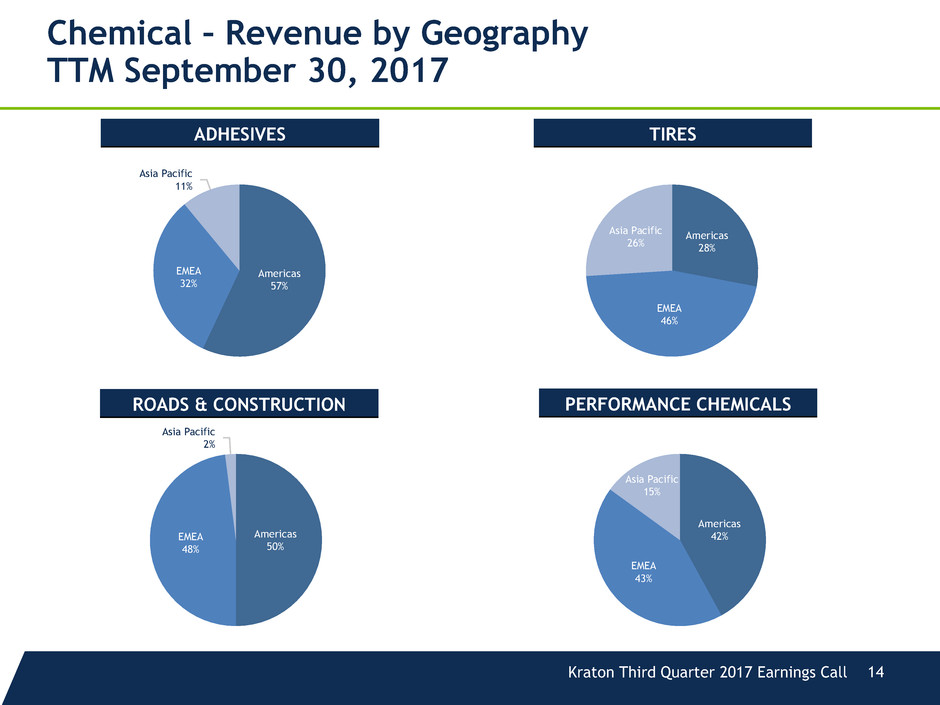

Chemical – Revenue by Geography

TTM September 30, 2017

ADHESIVES TIRES

ROADS & CONSTRUCTION PERFORMANCE CHEMICALS

Americas

57%

EMEA

32%

Asia Pacific

11%

Americas

28%

EMEA

46%

Asia Pacific

26%

Americas

50%

EMEA

48%

Asia Pacific

2%

Americas

42%

EMEA

43%

Asia Pacific

15%

Kraton Third Quarter 2017 Earnings Call 15

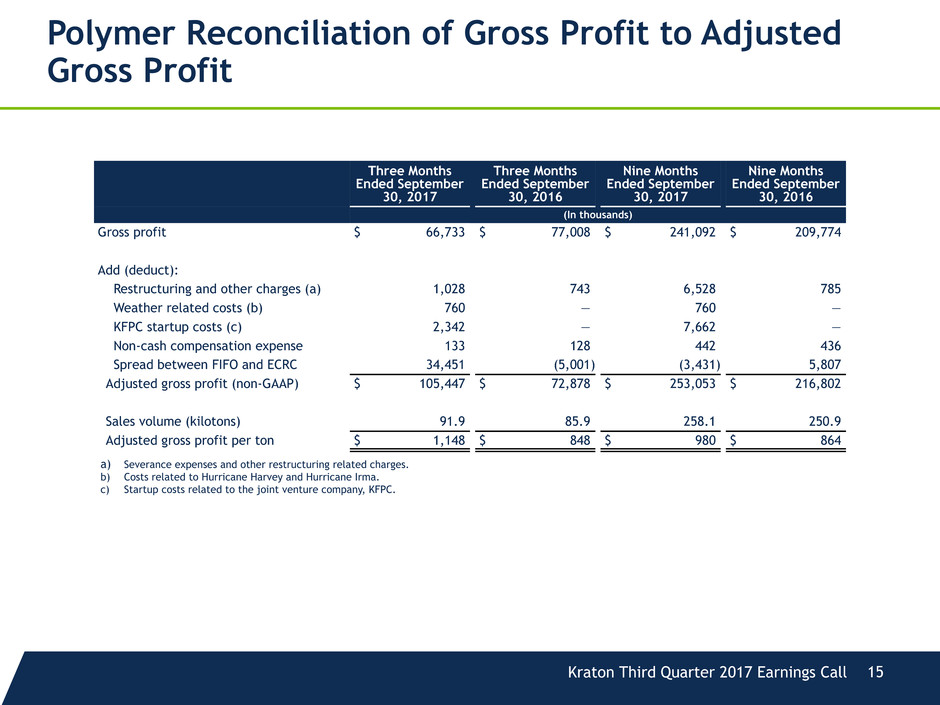

Polymer Reconciliation of Gross Profit to Adjusted

Gross Profit

Three Months

Ended September

30, 2017

Three Months

Ended September

30, 2016

Nine Months

Ended September

30, 2017

Nine Months

Ended September

30, 2016

(In thousands)

Gross profit $ 66,733 $ 77,008 $ 241,092 $ 209,774

Add (deduct):

Restructuring and other charges (a) 1,028 743 6,528 785

Weather related costs (b) 760 — 760 —

KFPC startup costs (c) 2,342 — 7,662 —

Non-cash compensation expense 133 128 442 436

Spread between FIFO and ECRC 34,451 (5,001) (3,431) 5,807

Adjusted gross profit (non-GAAP) $ 105,447 $ 72,878 $ 253,053 $ 216,802

Sales volume (kilotons) 91.9 85.9 258.1 250.9

Adjusted gross profit per ton $ 1,148 $ 848 $ 980 $ 864

a) Severance expenses and other restructuring related charges.

b) Costs related to Hurricane Harvey and Hurricane Irma.

c) Startup costs related to the joint venture company, KFPC.

Kraton Third Quarter 2017 Earnings Call 16

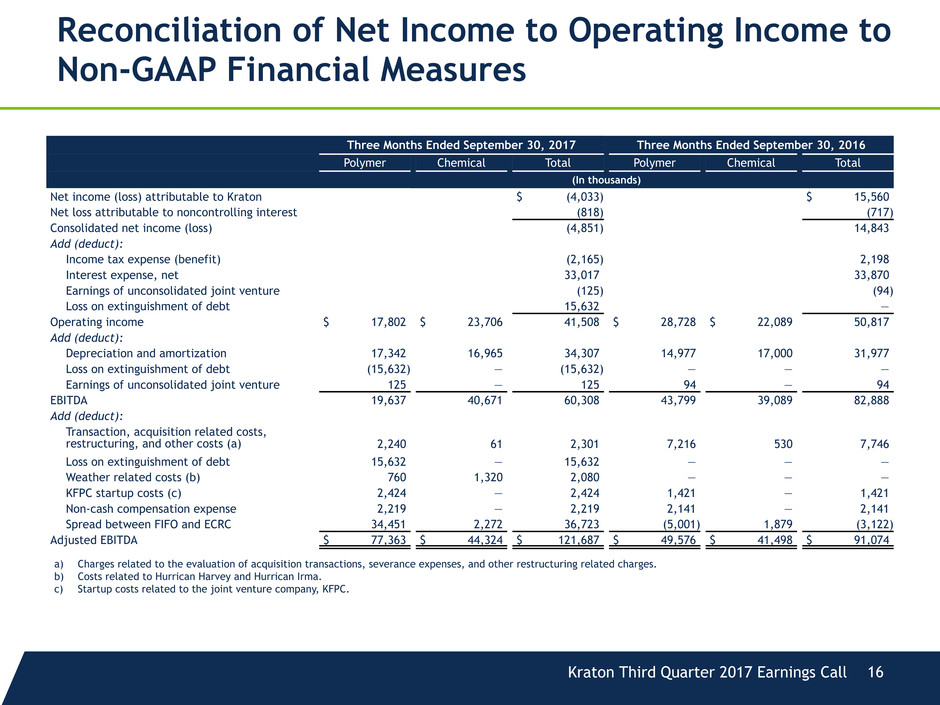

Reconciliation of Net Income to Operating Income to

Non-GAAP Financial Measures

Three Months Ended September 30, 2017 Three Months Ended September 30, 2016

Polymer Chemical Total Polymer Chemical Total

(In thousands)

Net income (loss) attributable to Kraton $ (4,033) $ 15,560

Net loss attributable to noncontrolling interest (818) (717)

Consolidated net income (loss) (4,851) 14,843

Add (deduct):

Income tax expense (benefit) (2,165) 2,198

Interest expense, net 33,017 33,870

Earnings of unconsolidated joint venture (125) (94)

Loss on extinguishment of debt 15,632 —

Operating income $ 17,802 $ 23,706 41,508 $ 28,728 $ 22,089 50,817

Add (deduct):

Depreciation and amortization 17,342 16,965 34,307 14,977 17,000 31,977

Loss on extinguishment of debt (15,632) — (15,632) — — —

Earnings of unconsolidated joint venture 125 — 125 94 — 94

EBITDA 19,637 40,671 60,308 43,799 39,089 82,888

Add (deduct):

Transaction, acquisition related costs,

restructuring, and other costs (a) 2,240 61 2,301 7,216 530 7,746

Loss on extinguishment of debt 15,632 — 15,632 — — —

Weather related costs (b) 760 1,320 2,080 — — —

KFPC startup costs (c) 2,424 — 2,424 1,421 — 1,421

Non-cash compensation expense 2,219 — 2,219 2,141 — 2,141

Spread between FIFO and ECRC 34,451 2,272 36,723 (5,001) 1,879 (3,122)

Adjusted EBITDA $ 77,363 $ 44,324 $ 121,687 $ 49,576 $ 41,498 $ 91,074

a) Charges related to the evaluation of acquisition transactions, severance expenses, and other restructuring related charges.

b) Costs related to Hurrican Harvey and Hurrican Irma.

c) Startup costs related to the joint venture company, KFPC.

Kraton Third Quarter 2017 Earnings Call 17

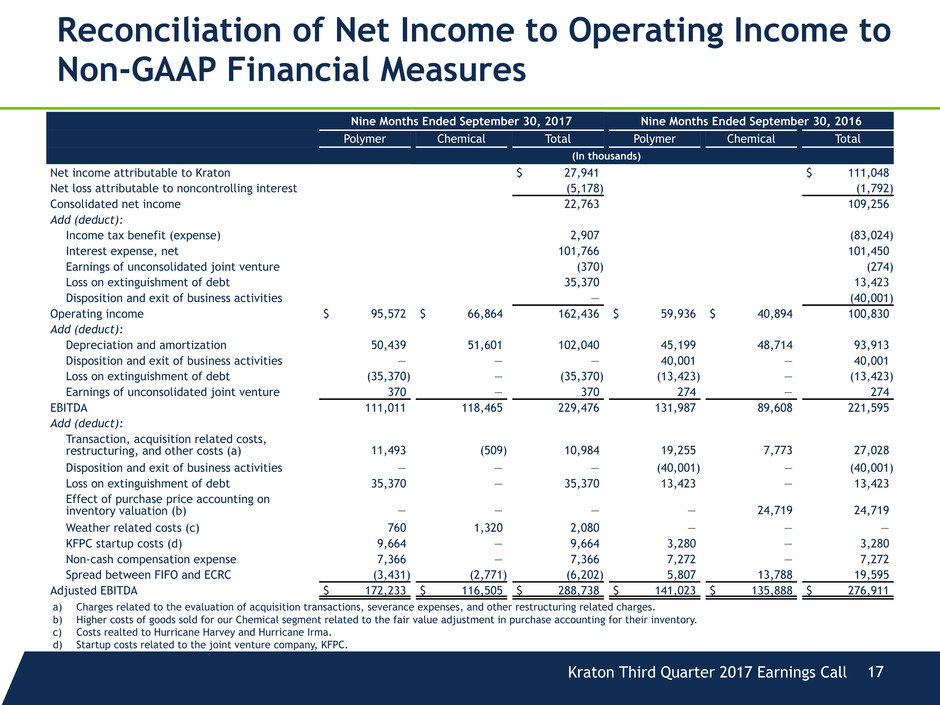

Reconciliation of Net Income to Operating Income to

Non-GAAP Financial Measures

Nine Months Ended September 30, 2017 Nine Months Ended September 30, 2016

Polymer Chemical Total Polymer Chemical Total

(In thousands)

Net income attributable to Kraton $ 27,941 $ 111,048

Net loss attributable to noncontrolling interest (5,178) (1,792)

Consolidated net income 22,763 109,256

Add (deduct):

Income tax benefit (expense) 2,907 (83,024)

Interest expense, net 101,766 101,450

Earnings of unconsolidated joint venture (370) (274)

Loss on extinguishment of debt 35,370 13,423

Disposition and exit of business activities — (40,001)

Operating income $ 95,572 $ 66,864 162,436 $ 59,936 $ 40,894 100,830

Add (deduct):

Depreciation and amortization 50,439 51,601 102,040 45,199 48,714 93,913

Disposition and exit of business activities — — — 40,001 — 40,001

Loss on extinguishment of debt (35,370) — (35,370) (13,423) — (13,423)

Earnings of unconsolidated joint venture 370 — 370 274 — 274

EBITDA 111,011 118,465 229,476 131,987 89,608 221,595

Add (deduct):

Transaction, acquisition related costs,

restructuring, and other costs (a) 11,493 (509) 10,984 19,255 7,773 27,028

Disposition and exit of business activities — — — (40,001) — (40,001)

Loss on extinguishment of debt 35,370 — 35,370 13,423 — 13,423

Effect of purchase price accounting on

inventory valuation (b) — — — — 24,719 24,719

Weather related costs (c) 760 1,320 2,080 — — —

KFPC startup costs (d) 9,664 — 9,664 3,280 — 3,280

Non-cash compensation expense 7,366 — 7,366 7,272 — 7,272

Spread between FIFO and ECRC (3,431) (2,771) (6,202) 5,807 13,788 19,595

Adjusted EBITDA $ 172,233 $ 116,505 $ 288,738 $ 141,023 $ 135,888 $ 276,911

a) Charges related to the evaluation of acquisition transactions, severance expenses, and other restructuring related charges.

b) Higher costs of goods sold for our Chemical segment related to the fair value adjustment in purchase accounting for their inventory.

c) Costs realted to Hurricane Harvey and Hurricane Irma.

d) Startup costs related to the joint venture company, KFPC.

Kraton Third Quarter 2017 Earnings Call 18

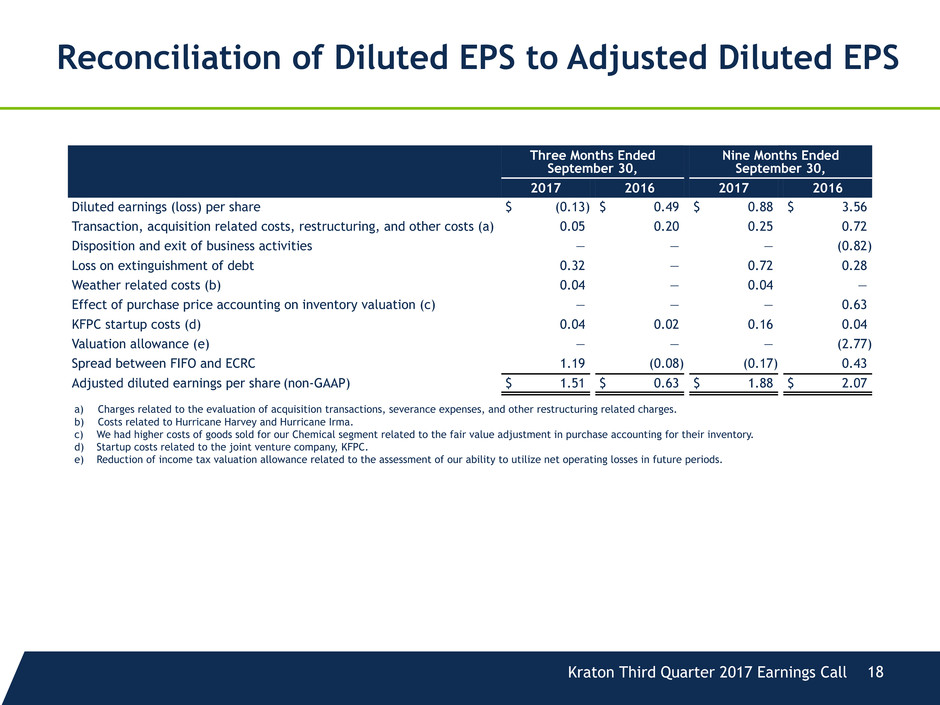

Reconciliation of Diluted EPS to Adjusted Diluted EPS

a) Charges related to the evaluation of acquisition transactions, severance expenses, and other restructuring related charges.

b) Costs related to Hurricane Harvey and Hurricane Irma.

c) We had higher costs of goods sold for our Chemical segment related to the fair value adjustment in purchase accounting for their inventory.

d) Startup costs related to the joint venture company, KFPC.

e) Reduction of income tax valuation allowance related to the assessment of our ability to utilize net operating losses in future periods.

Three Months Ended

September 30,

Nine Months Ended

September 30,

2017 2016 2017 2016

Diluted earnings (loss) per share $ (0.13) $ 0.49 $ 0.88 $ 3.56

Transaction, acquisition related costs, restructuring, and other costs (a) 0.05 0.20 0.25 0.72

Disposition and exit of business activities — — — (0.82)

Loss on extinguishment of debt 0.32 — 0.72 0.28

Weather related costs (b) 0.04 — 0.04 —

Effect of purchase price accounting on inventory valuation (c) — — — 0.63

KFPC startup costs (d) 0.04 0.02 0.16 0.04

Valuation allowance (e) — — — (2.77)

Spread between FIFO and ECRC 1.19 (0.08) (0.17) 0.43

Adjusted diluted earnings per share (non-GAAP) $ 1.51 $ 0.63 $ 1.88 $ 2.07