Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - ODP Corp | d467313dex991.htm |

| EX-10.1 - EX-10.1 - ODP Corp | d467313dex101.htm |

| EX-2.1 - EX-2.1 - ODP Corp | d467313dex21.htm |

| 8-K - 8-K - ODP Corp | d467313d8k.htm |

Acquisition of CompuCom: Transforming into a Powerful Omnichannel Business Services Platform October 3, 2017 Exhibit 99.2

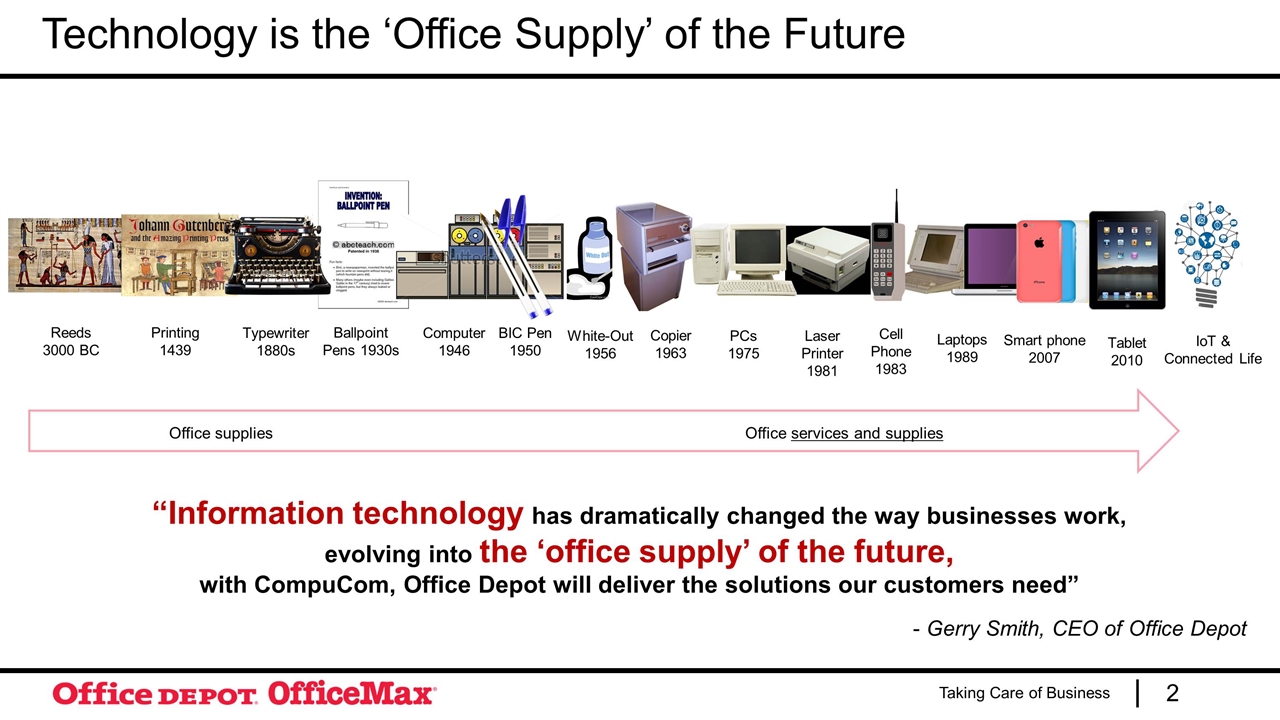

Reeds 3000 BC Printing 1439 Computer 1946 BIC Pen 1950 Typewriter 1880s PCs 1975 Laser Printer 1981 Ballpoint Pens 1930s Copier 1963 Cell Phone 1983 Laptops 1989 Smart phone 2007 Tablet 2010 IoT & Connected Life White-Out 1956 Technology is the ‘Office Supply’ of the Future Office suppliesOffice services and supplies “Information technology has dramatically changed the way businesses work, evolving into the ‘office supply’ of the future, with CompuCom, Office Depot will deliver the solutions our customers need” - Gerry Smith, CEO of Office Depot

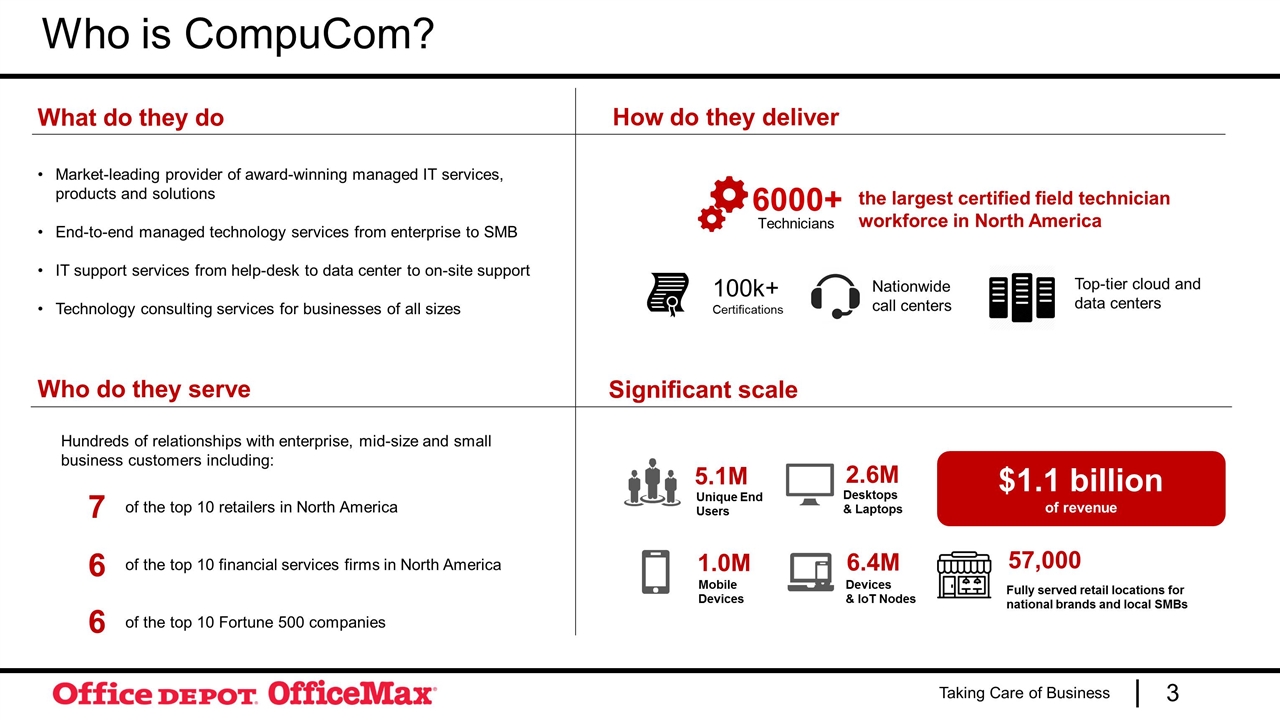

Who is CompuCom? Significant scale What do they do Who do they serve How do they deliver Technicians 6000+ the largest certified field technician workforce in North America Nationwide call centers 57,000 Market-leading provider of award-winning managed IT services, products and solutions End-to-end managed technology services from enterprise to SMB IT support services from help-desk to data center to on-site support Technology consulting services for businesses of all sizes 5.1M Unique End Users 2.6M 100k+ Certifications 1.0M 6.4M Desktops & Laptops Mobile Devices Devices & IoT Nodes of the top 10 retailers in North America of the top 10 financial services firms in North America of the top 10 Fortune 500 companies 7 6 6 Hundreds of relationships with enterprise, mid-size and small business customers including: $1.1 billion of revenue Top-tier cloud and data centers Fully served retail locations for national brands and local SMBs

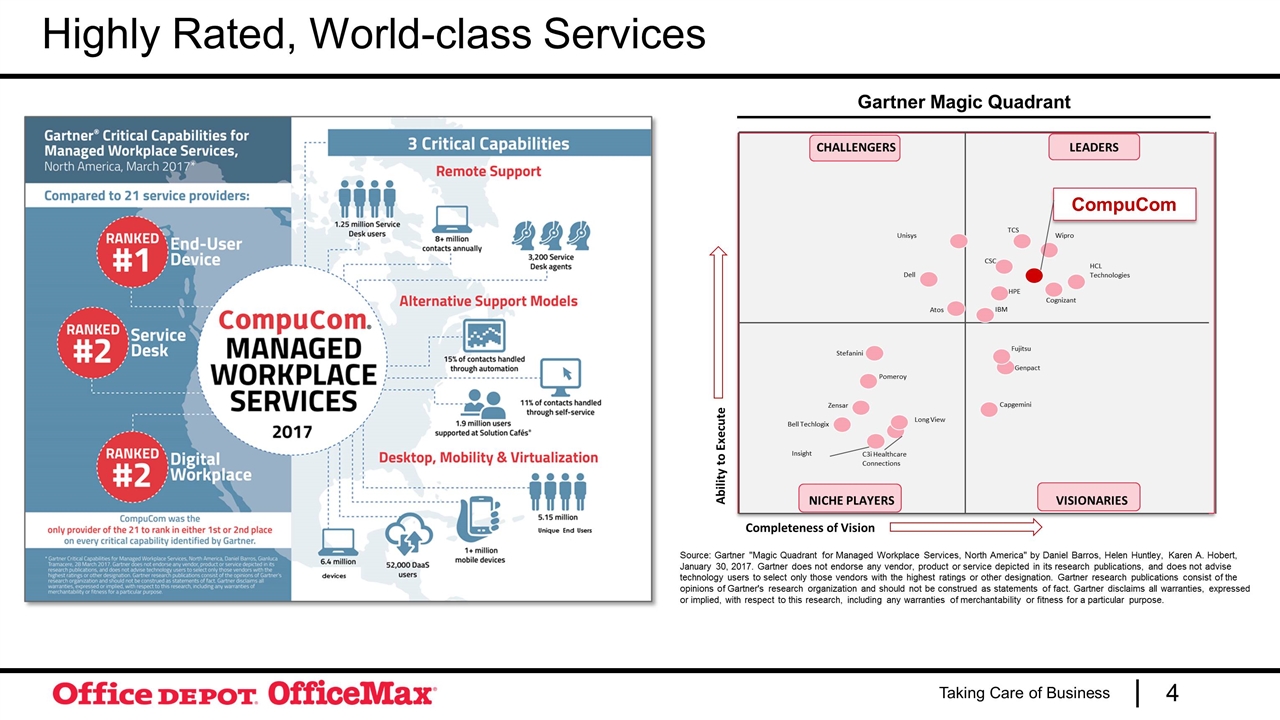

Highly Rated, World-class Services Gartner Magic Quadrant NICHE PLAYERS VISIONARIES CHALLENGERS LEADERS Stefanini Pomeroy Long View C3i Healthcare Connections Unisys Dell Atos Zensar Bell Techlogix Insight Capgemini Genpact Fujitsu HPE Cognizant HCL Technologies Wipro TCS CSC IBM Ability to Execute Completeness of Vision CompuCom Source: Gartner "Magic Quadrant for Managed Workplace Services, North America" by Daniel Barros, Helen Huntley, Karen A. Hobert, January 30, 2017. Gartner does not endorse any vendor, product or service depicted in its research publications, and does not advise technology users to select only those vendors with the highest ratings or other designation. Gartner research publications consist of the opinions of Gartner's research organization and should not be construed as statements of fact. Gartner disclaims all warranties, expressed or implied, with respect to this research, including any warranties of merchantability or fitness for a particular purpose.

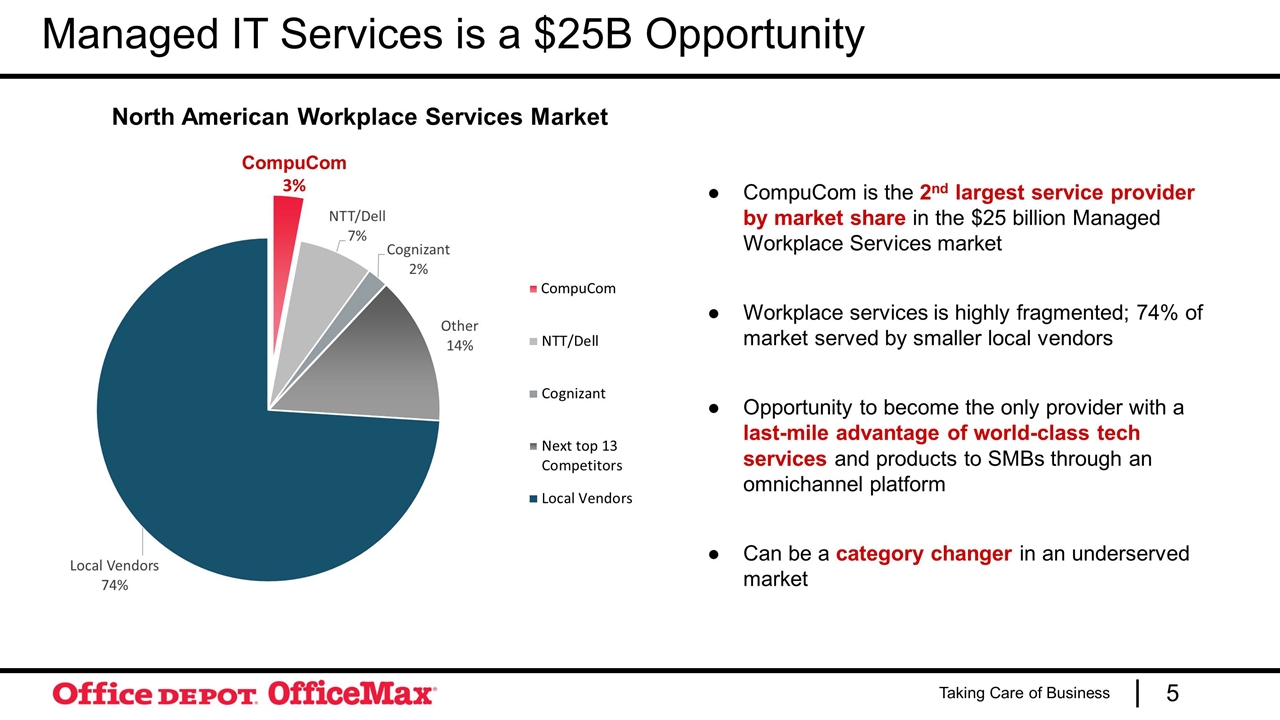

CompuCom is the 2nd largest service provider by market share in the $25 billion Managed Workplace Services market Workplace services is highly fragmented; 74% of market served by smaller local vendors Opportunity to become the only provider with a last-mile advantage of world-class tech services and products to SMBs through an omnichannel platform Can be a category changer in an underserved market Managed IT Services is a $25B Opportunity North American Workplace Services Market CompuCom 3% CompuCom

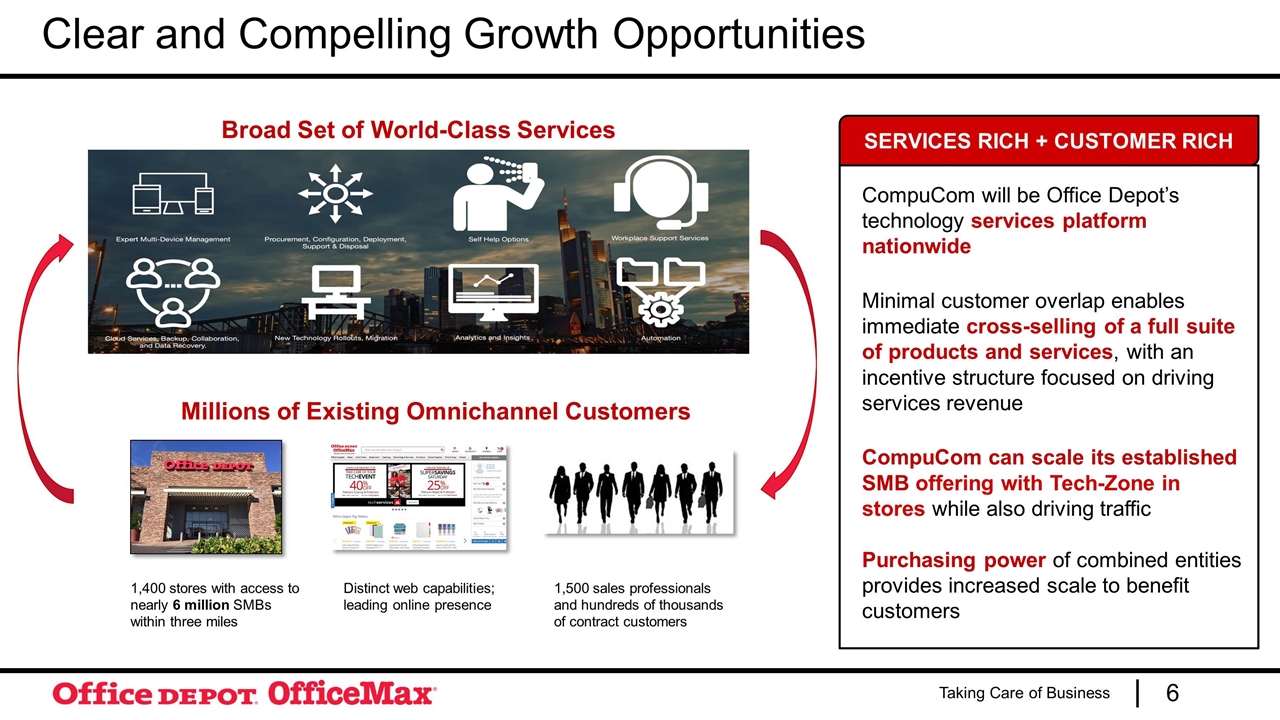

Clear and Compelling Growth Opportunities 1,400 stores with access to nearly 6 million SMBs within three miles 1,500 sales professionals and hundreds of thousands of contract customers Distinct web capabilities; leading online presence Broad Set of World-Class Services Millions of Existing Omnichannel Customers CompuCom will be Office Depot’s technology services platform nationwide Minimal customer overlap enables immediate cross-selling of a full suite of products and services, with an incentive structure focused on driving services revenue CompuCom can scale its established SMB offering with Tech-Zone in stores while also driving traffic Purchasing power of combined entities provides increased scale to benefit customers SERVICES RICH + CUSTOMER RICH

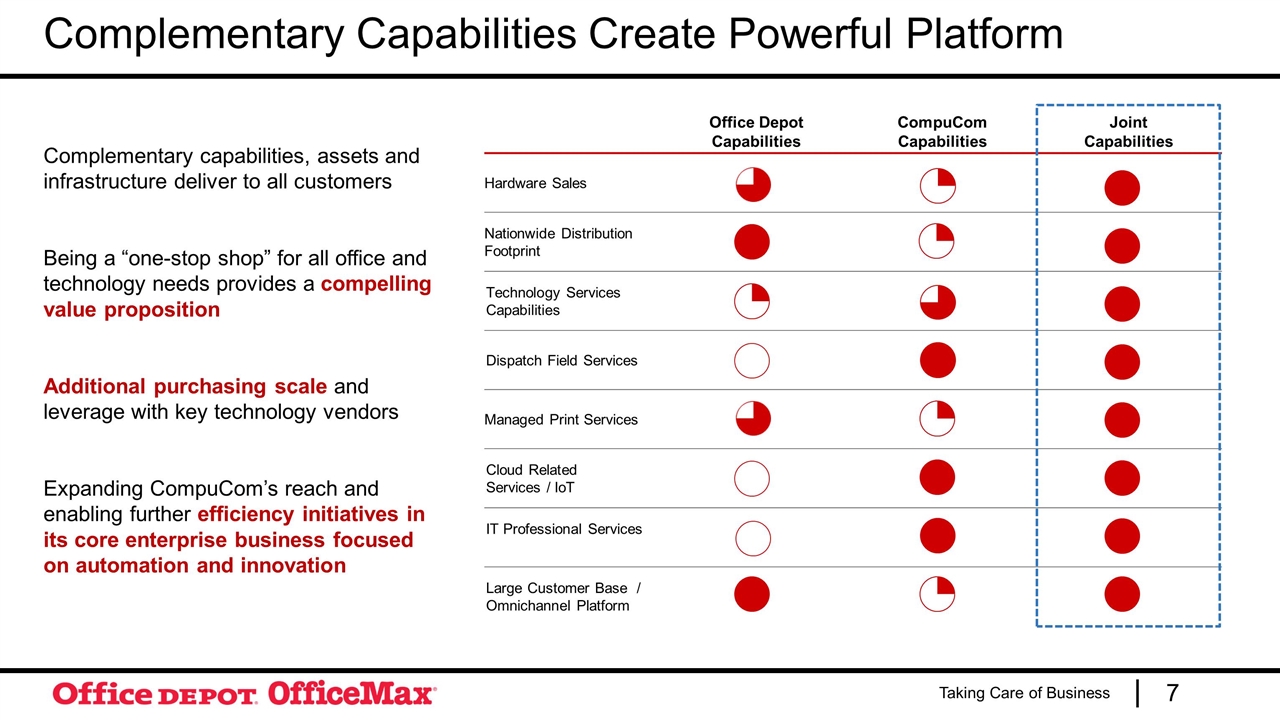

Office Depot Capabilities CompuCom Capabilities Joint Capabilities Hardware Sales Nationwide Distribution Footprint Technology Services Capabilities Dispatch Field Services Managed Print Services Cloud Related Services / IoT IT Professional Services Large Customer Base / Omnichannel Platform Complementary Capabilities Create Powerful Platform Complementary capabilities, assets and infrastructure deliver to all customers Being a “one-stop shop” for all office and technology needs provides a compelling value proposition Additional purchasing scale and leverage with key technology vendors Expanding CompuCom’s reach and enabling further efficiency initiatives in its core enterprise business focused on automation and innovation

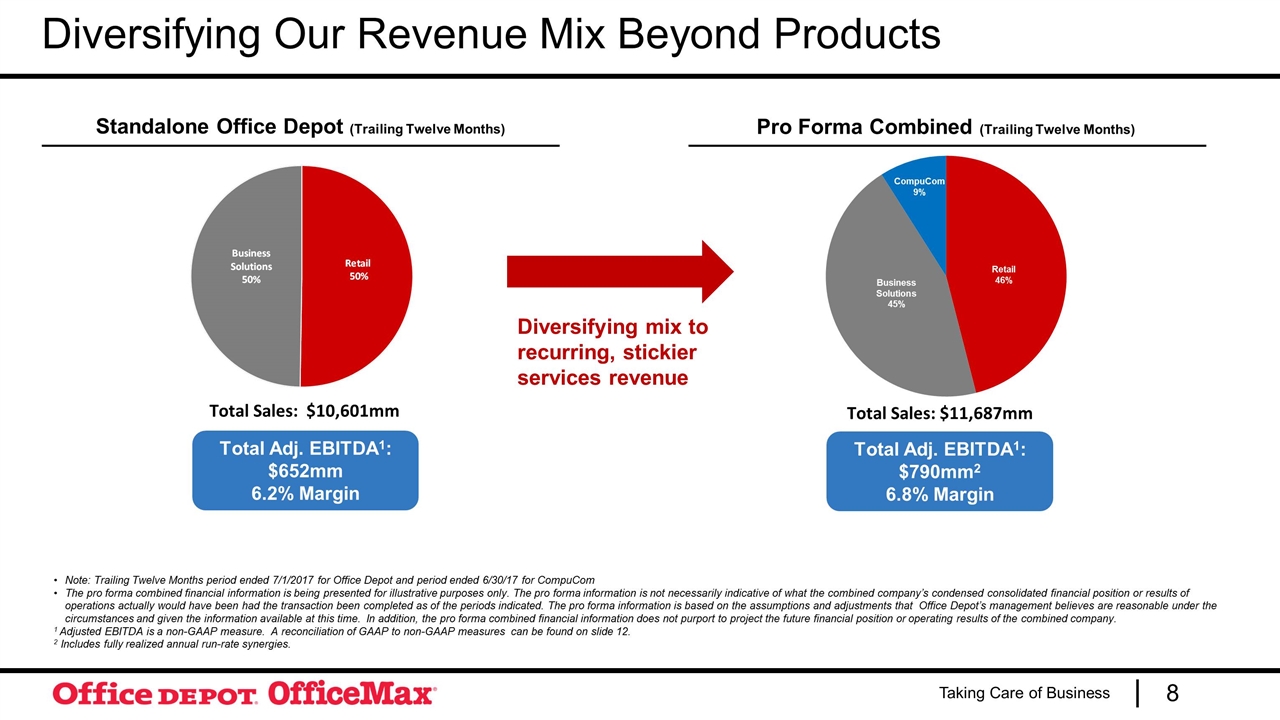

Pro Forma Combined (Trailing Twelve Months) Standalone Office Depot (Trailing Twelve Months) Diversifying Our Revenue Mix Beyond Products Total Sales: $10,601mm Diversifying mix to recurring, stickier services revenue Total Sales: $11,687mm Note: Trailing Twelve Months period ended 7/1/2017 for Office Depot and period ended 6/30/17 for CompuCom The pro forma combined financial information is being presented for illustrative purposes only. The pro forma information is not necessarily indicative of what the combined company’s condensed consolidated financial position or results of operations actually would have been had the transaction been completed as of the periods indicated. The pro forma information is based on the assumptions and adjustments that Office Depot’s management believes are reasonable under the circumstances and given the information available at this time. In addition, the pro forma combined financial information does not purport to project the future financial position or operating results of the combined company. 1 Adjusted EBITDA is a non-GAAP measure. A reconciliation of GAAP to non-GAAP measures can be found on slide 12. 2 Includes fully realized annual run-rate synergies. Total Adj. EBITDA1: $652mm 6.2% Margin Total Adj. EBITDA1: $790mm2 6.8% Margin

Dan Stone, CEO, CompuCom Steve Hare, CFO Jerri DeVard, CMO Gerry Smith, CEO, Office Depot Steve Calkins, President, Business Solutions Division Deep Experience in Tech and Services: Janet Schijns, Chief Merchant and Services Officer Introducing new services platforms across a multi-channel presence Successfully incorporating acquisitions and leading transformational integration efforts Capturing expected synergies and realizing full potential Generating demand for services in a subscription-based model Growing a technology brand to a leading market share position The Right Team to Unlock This Opportunity N. David Bleisch, CLO John Gannfors, Chief Strategy and Supply Chain Officer Marko Ibrahim, Head of Retail Kevin Moffitt, Chief Digital Officer and Head of Online Michael Allison, CAO

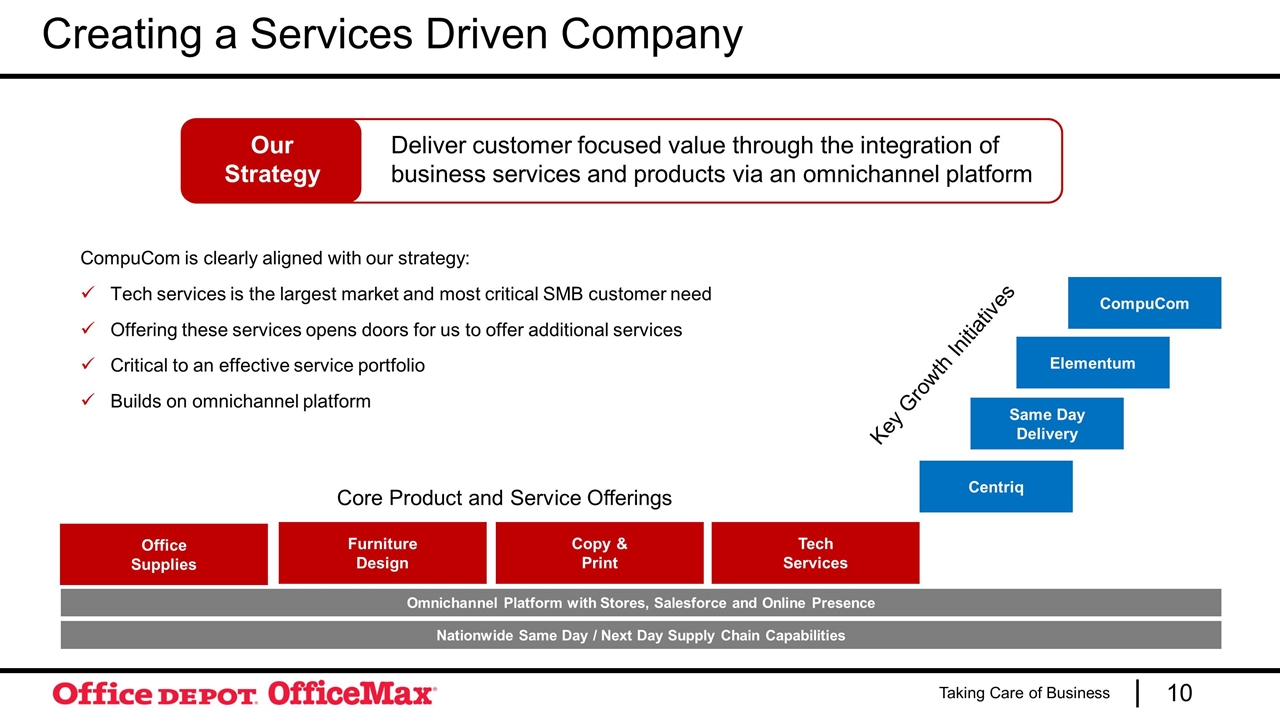

CompuCom is clearly aligned with our strategy: Tech services is the largest market and most critical SMB customer need Offering these services opens doors for us to offer additional services Critical to an effective service portfolio Builds on omnichannel platform Furniture Design Copy & Print Tech Services Office Supplies Centriq Same Day Delivery Elementum CompuCom Key Growth Initiatives Core Product and Service Offerings Nationwide Same Day / Next Day Supply Chain Capabilities Omnichannel Platform with Stores, Salesforce and Online Presence Creating a Services Driven Company Deliver customer focused value through the integration of business services and products via an omnichannel platform Our Strategy

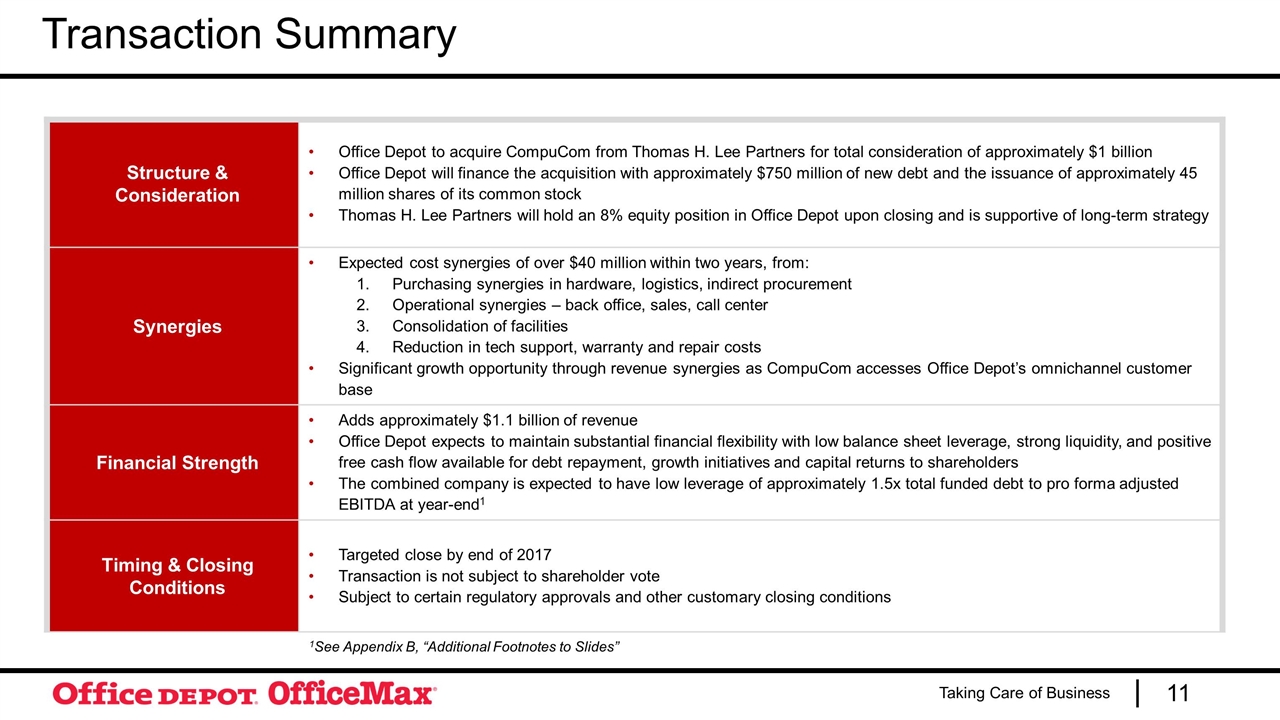

Transaction Summary Structure & Consideration Office Depot to acquire CompuCom from Thomas H. Lee Partners for total consideration of approximately $1 billion Office Depot will finance the acquisition with approximately $750 million of new debt and the issuance of approximately 45 million shares of its common stock Thomas H. Lee Partners will hold an 8% equity position in Office Depot upon closing and is supportive of long-term strategy Synergies Expected cost synergies of over $40 million within two years, from: Purchasing synergies in hardware, logistics, indirect procurement Operational synergies – back office, sales, call center Consolidation of facilities Reduction in tech support, warranty and repair costs Significant growth opportunity through revenue synergies as CompuCom accesses Office Depot’s omnichannel customer base Financial Strength Adds approximately $1.1 billion of revenue Office Depot expects to maintain substantial financial flexibility with low balance sheet leverage, strong liquidity, and positive free cash flow available for debt repayment, growth initiatives and capital returns to shareholders The combined company is expected to have low leverage of approximately 1.5x total funded debt to pro forma adjusted EBITDA at year-end1 Timing & Closing Conditions Targeted close by end of 2017 Transaction is not subject to shareholder vote Subject to certain regulatory approvals and other customary closing conditions 1See Appendix B, “Additional Footnotes to Slides”

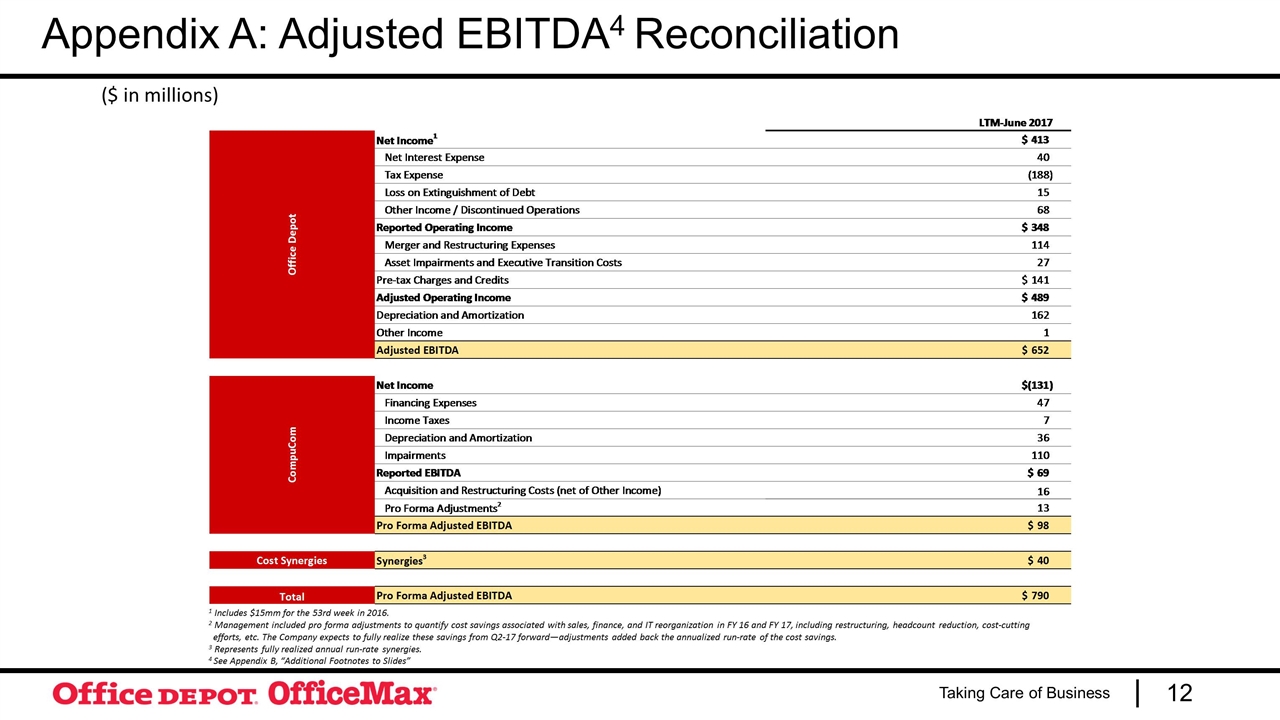

Appendix A: Adjusted EBITDA4 Reconciliation ($ in millions) 1 Includes $15mm for the 53rd week in 2016. 2 Management included pro forma adjustments to quantify cost savings associated with sales, finance, and IT reorganization in FY 16 and FY 17, including restructuring, headcount reduction, cost-cutting efforts, etc. The Company expects to fully realize these savings from Q2-17 forward—adjustments added back the annualized run-rate of the cost savings. 3 Represents fully realized annual run-rate synergies. 4 See Appendix B, “Additional Footnotes to Slides”

Slide 11: 1Expected leverage and pro forma Adjusted EBITDA for the combined company at year end are non-GAAP numbers that exclude charges or credits not indicative of core operations, which may include but not be limited to merger integration expenses, restructuring charges, asset impairments and other significant items that currently cannot be predicted. The exact amount of these charges or credits are not currently determinable, but may be significant. Accordingly, the company is unable to provide a reconciliation to an equivalent pro forma GAAP net income measure for year end without unreasonable effort. Slide 12: 4Adjusted EBITDA is a non-GAAP number. Management believes that the presentation of non-GAAP financial measures enhances the ability of investors to analyze trends in its business and provides a means to compare periods that may be affected by various items that might obscure trends or developments in its business. Management uses both GAAP and non-GAAP measures to assist in making business decisions and assessing overall performance. Non-GAAP measures help to evaluate programs and activities that are intended to attract and satisfy customers, separate from expenses and credits directly associated with merger, restructuring, and certain similar items. Appendix B: Additional Footnotes to Slides

Safe Harbor Statement This communication shall not constitute an offer to sell or the solicitation of an offer to buy securities. The securities offered and sold in the private placement have not been registered under the Securities Act of 1933, as amended, or any state securities laws, and may not be offered or sold in the United States absent registration, or an applicable exemption from registration under the Securities Act and applicable state securities laws. FORWARD LOOKING STATEMENTS This communication may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements or disclosures may discuss goals, intentions and expectations as to future trends, plans, events, results of operations, cash flow or financial condition, or state other information relating to, among other things, Office Depot, based on current beliefs and assumptions made by, and information currently available to, management. Forward-looking statements generally will be accompanied by words such as “anticipate,” “believe,” “plan,” “could,” “estimate,” “expect,” “forecast,” “guidance,” “outlook,” “intend,” “may,” “possible,” “potential,” “predict,” “project,” “propose” or other similar words, phrases or expressions, or other variations of such words. These forward-looking statements are subject to various risks and uncertainties, many of which are outside of Office Depot’s control. There can be no assurances that Office Depot will realize these expectations or that these beliefs will prove correct, and therefore investors and stockholders should not place undue reliance on such statements. Factors that could cause actual results to differ materially from those in the forward-looking statements include, among other things, the ability to consummate the transaction between Office Depot and CompuCom pursuant to the terms and in accordance with the timing described in this communication, the risk that Office Depot may not be able to realize the anticipated benefits of the transaction due to unforeseen liabilities, future capital expenditures, expenses, and indebtedness and unanticipated loss of key customers or the inability to achieve expected revenues, synergies, cost savings or financial performance after the completion of the transaction with CompuCom, the risk that the refinancing of CompuCom’s outstanding debt is not obtained on favorable terms, uncertainty of the expected financial performance of Office Depot following the completion of the transaction, impact of weather events on Office Depot’s business, impacts and risks related to the termination of the attempted Staples acquisition, disruption in key business activities or any impact on Office Depot’s relationships with third parties as a result of the announcement of the termination of the Staples Merger Agreement; unanticipated changes in the markets for Office Depot’s business segments; the inability to realize expected benefits from the disposition of the European and other international operations; fluctuations in currency exchange rates, unanticipated downturns in business relationships with customers or terms with the company’s suppliers; competitive pressures on Office Depot’s sales and pricing; increases in the cost of material, energy and other production costs, or unexpected costs that cannot be recouped in product pricing; the introduction of competing technology products and services; unexpected technical or marketing difficulties; unexpected claims, charges, litigation, dispute resolutions or settlement expenses; new laws, tariffs and governmental regulations. The foregoing list of factors is not exhaustive. Investors and stockholders should carefully consider the foregoing factors and the other risks and uncertainties described in Office Depot’s Annual Report on Form 10-K, as amended, and Quarterly Reports on Form 10-Q filed with the U.S. Securities and Exchange Commission. Office Depot does not assume any obligation to update or revise any forward-looking statements.