Attached files

| file | filename |

|---|---|

| 8-K - 8-K - iHeartCommunications, Inc. | d461165d8k.htm |

Exhibit 99.1

iHeartCommunications, Inc.

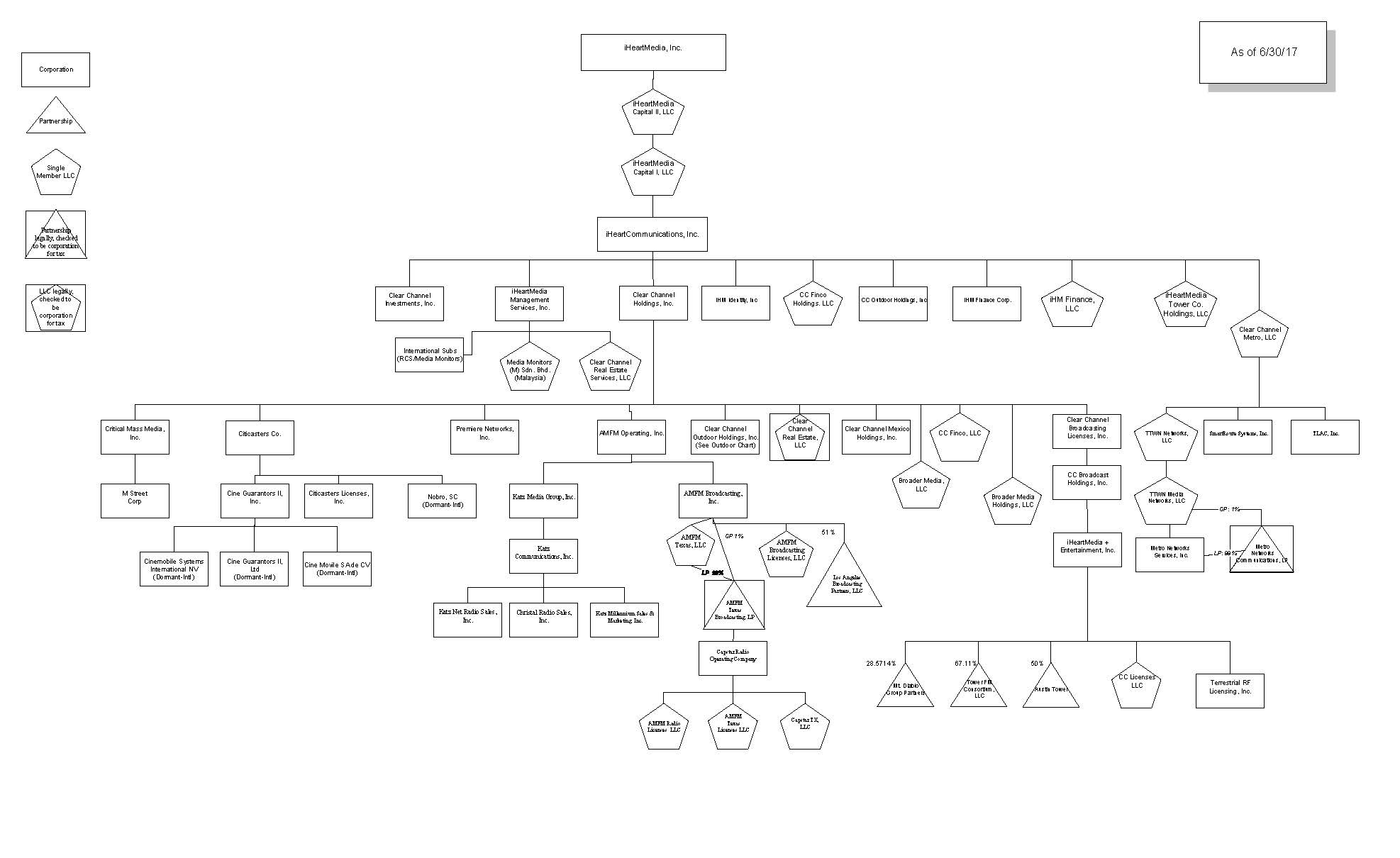

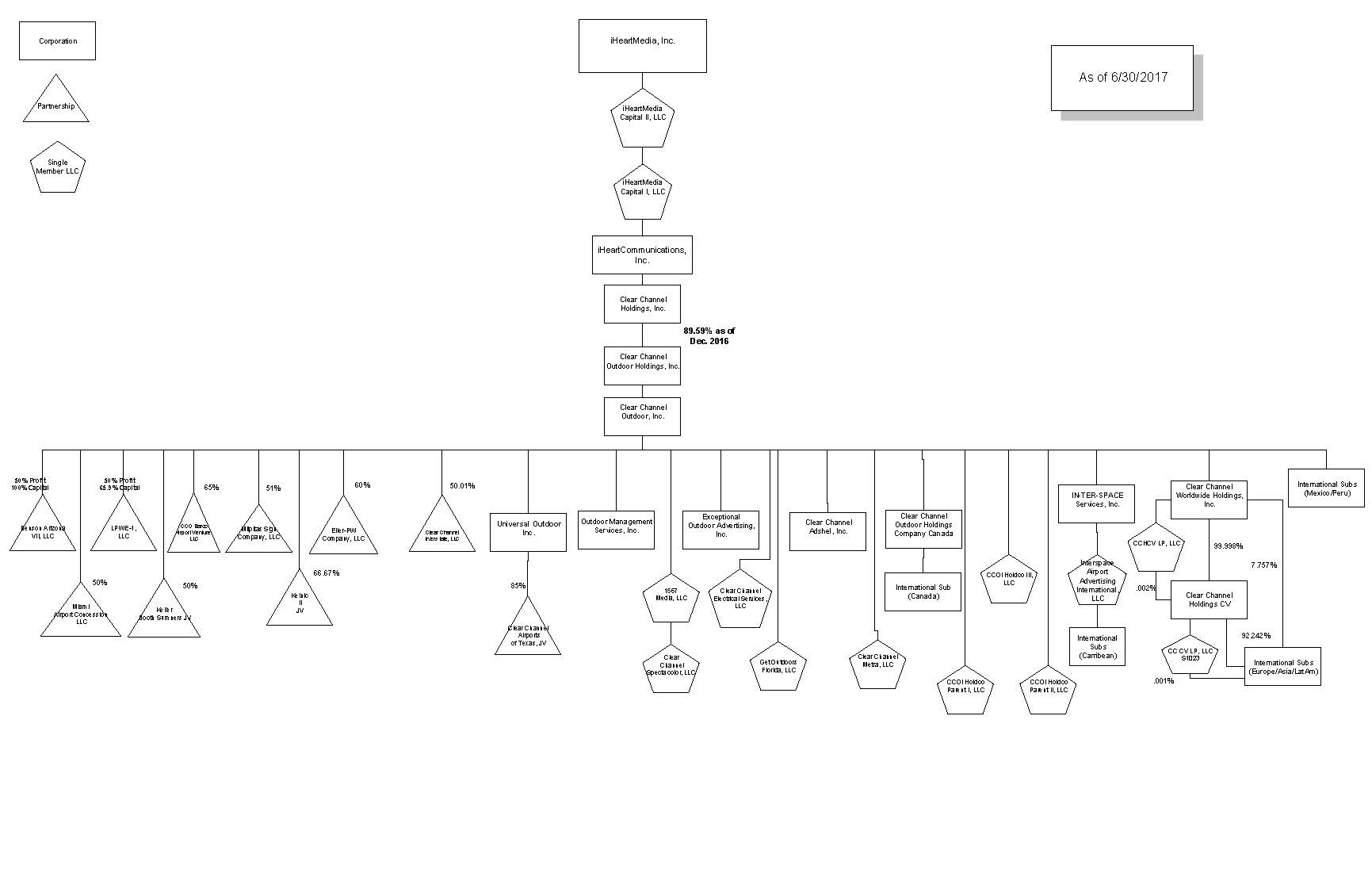

Certain Tax and Corporate Structure Information

| • | Based on recent trading prices of Clear Channel Outdoor Holdings, Inc.’s Class A common stock and subject to certain assumptions, the Company estimates that a taxable disposition of all of iHeartMedia Inc.’s interest in Clear Channel Outdoor Holdings, Inc. would give rise to taxable gain in excess of $3.7 billion. |

| • | The Company currently estimates that as of December 31, 2016, iHeartCommunications, Inc. had a tax basis in the stock of its direct subsidiary Clear Channel Holdings, Inc. in excess of $4 billion and that Clear Channel Holdings, Inc. had an estimated aggregate tax basis in the stock of its direct subsidiaries engaged in the iHeartMedia business segment of approximately $3.4 billion. |

| • | The Company estimates that as of December 31, 2016, its tax basis in the domestic fixed and intangible assets related to the iHeartMedia business segment was approximately $1.1 billion and that its basis in the domestic fixed and intangible assets of the Americas Outdoor business segment was approximately $520 million. |

| • | As of December 31, 2016, Clear Channel Outdoor Holdings, Inc. and its subsidiaries had a federal net operating loss carryforward of approximately $275 million and iHeartMedia, Inc. and its subsidiaries (excluding Clear Channel Outdoor Holdings, Inc. and its subsidiaries) had a federal net operating loss carryforward of approximately $2.9 billion. |