Attached files

| file | filename |

|---|---|

| 8-K - 8-K - DST SYSTEMS INC | a8-kseptember2017.htm |

DST SYSTEMS, INC.

September 2017

2

Certain material presented in this presentation include forward-looking statements intended to qualify for the safe

harbor from liability established by the Private Securities Litigation Reform Act of 1995. These forward-looking

statements include, but are not limited to, (i) all statements, other than statements of historical fact, included in

this presentation that address activities, events or developments that we expect or anticipate will or may occur in

the future or that depend on future events, or (ii) statements about our future business plans and strategy and

other statements that describe the Company’s outlook, objectives, plans, intentions or goals, and any discussion of

future operating or financial performance. Whenever used, words such as “may,” “will,” “would,” “should,”

“potential,” “strategy,” “anticipates,” “estimates,” “expects,” “project,” “predict,” “intends,” “plans,” “believes,” “targets”

and other terms of similar meaning are intended to identify such forward-looking statements. Forward-looking

statements are uncertain and to some extent unpredictable, and involve known and unknown risks, uncertainties

and other important factors that could cause actual results to differ materially from those expressed or implied in,

or reasonably inferred from, such forward-looking statements. Factors that could cause results to differ materially

from those anticipated include, but are not limited to, the risk factors and cautionary statements included in the

Company’s periodic and current reports (Forms 10-K, 10-Q and 8-K) filed from time to time with the Securities and

Exchange Commission. All such factors should be considered in evaluating any forward-looking statements. The

Company undertakes no obligation to update any forward-looking statements in this presentation to reflect new

information, future events or otherwise.

COPYRIGHT © 2017 BY DST SYSTEMS, INC. ALL RIGHTS RESERVED. OUR TRADEMARKS AND SERVICE MARKS AND THOSE OF THIRD

PARTIES USED IN THIS PRESENTATION ARE THE PROPERTY OF THEIR RESPECTIVE OWNERS.

FORWARD LOOKING STATEMENTS

3

COMPANY PROFILE

71%

29%

Domestic and International

Financial Services

Healthcare Services

2016 Operating Revenue from continuing operations - $1,474.4 million

• Leading provider of:

• Technology

• Strategic advisory

• Business processing solutions

• Strategic focus on two growth industries:

• Financial

• Healthcare

• NYSE: DST

• Headquartered in Kansas City, MO

• Operates with ~16,000 employees

(including BFDS and IFDS UK)

4

LONG HISTORY OF VALUE CREATION

1973:

Formed BFDS,

joint venture

with State

Street Bank

1989:

Acquired 50%

interest in

Argus Health

Systems

1992:

Formed IFDS,

UK, a joint

venture with

State Street

Bank

1995:

Began trading

on the New

York Stock

Exchange

2005:

Acquired DST

Health

Solutions

2008:

Acquired Blue

Door

Technologies

Formed DST

Retirement

Solutions

2009:

Acquired

remaining

stake of

Argus Health

Systems

2011:

Acquired ALPS

Holdings

2012:

Steve Hooley

appointed CEO

Defined

contribution

participants

exceeded 5

million

2013:

Subaccounts

processed

exceeds 25

million

2015:

Acquired kasina, Red Rocks Capital

LLC and Wealth Management Systems

Inc

Completed the sale and leaseback of

Customer Communications’ North

America production facilities

19

73

19

89

19

92

19

95

20

05

20

08

20

09

20

11

20

12

20

13

20

15

20

16

2016:

Acquired Kaufman

Rossin Fund Services LLC.

Completed the sale and leaseback of

Customer Communications’ Bristol, UK

production facilities

Sold Customer Communications North

America business

19

69

20

17

20

16

2017:

Acquired remaining 50% of

BFDS & IFDS UK

Sold Customer

Communications UK business

Completed conversion of

2.5 million new registered

accounts

5

LEADERSHIP POSITIONS IN HEALTH AND WEALTH

Domestic and International Financial Services Healthcare Services

Distribution

Solutions

Serve

45 of 50 largest asset

management firms

Exclusive distributor of

Sector SPDR ETFs

Medical

Solutions

Covered Lives:

21.9M

Pharmacy

Solutions

Pharmacy Claims Paid

in 2016:

507.0M

Asset

Management

ALPS AUM

$18.6B

Retirement

Solutions

TRAC® 6.6M

participants

Largest SaaS

Provider

Brokerage

Solutions

Subaccounting

44.0M accounts

Infrastructure Leverage

Data Centers | Communication Networks | Business Continuity | Disaster Recovery

Business Process Management

Applied Analytics

Compliance

Business Process Outsourcing

Asset Manager

Solutions

TA2000® 59.7M

accounts

Fast 8.7M accounts

iFast 14.0M accounts

ALPS AUA $197.5B

6

ATTRACTIVE BUSINESS MODEL

SAAS

Strategic

Advisory

Applied

Analytics

Customer

Experience

Risk and

Compliance

Business

Process

Management

Full

Service

20

Years

Top 5

Financial

Services

Companies

19

Years

Top 5

Healthcare

Services

Companies

Average Length of Customer Relationships:

Long-Term Contracts

Deeply Embedded in Client Work Flow

Significant Switching Costs

Recurring Revenue

Significant Recurring Sources of Revenue:

7

CRITICAL DEMANDS OF THE FINANCIAL AND HEALTHCARE

INDUSTRIES

Complex and Changing

Regulations & Compliance

Heightened Privacy

Sensitivities

Demand for Top-Tier

Security

Capacity/Scale

Requirements

Data Analytics Dependent

Digital Transformation

Increased Outsourcing of

Processing Services

Empowered Consumers

8

• Asset Management

• $75 million seed fund commitment

• Brokerage Solutions

• Sub-accounting platform

• Distribution Solutions

• Marketshare platform

• Advisor segmentation

• DST SalesConnect™

• Retirement Solutions

• Retirement plan participant analytics

• Rollover services

• Wealth Management Solutions

• SAAS and Full Service

• Wealth Platform

• Pharmacy Solutions

• Government programs administration

• Pharmacy network solutions

• Specialty pharmacy

• Formulary and rebate management

• Healthcare Administration

• Revenue management

• Provider network administration

• Health plan compliance and program integrity

• Health Outcomes Optimization

• Quality incentive management (Star5)

• Population assessment, stratification and care gaps

• Disease/care management

• Predictive/prescriptive analytics

• Behaviorally based interventions

Domestic and International Financial Services Healthcare Services

KEY FOCUS AREAS FOR GROWTH

9

More than 200 years of cumulative industry experience | Leadership team with deep industry expertise

EXPERIENCED, PROVEN MANAGEMENT TEAM

Steve Hooley

Chief Executive

Officer and

President

Named DST’s Chief

Executive Officer

in 2012

Served as President and Chief

Executive Officer of Boston

Financial Data Services, Inc., a

DST joint venture

Joined BFDS in 2004 and DST

in 2009

Gregg Givens

Chief Financial

Officer

Named DST CFO

in 2014

Served as senior manager at

Price Waterhouse for 14 years

Joined DST in 1996 and has been

significantly involved with DST’s

M&A activities, financing

transactions, and joint venture

operations

Beth Sweetman

Head of

Human Capital

Appointed Senior

Vice President and

Chief Human

Resources Officer in 2013

In June 2013, assumed

responsibility for leading the

entire DST Human Resources

organization, both domestically

and internationally

Maria Mann

Chief Information

Officer

Appointed Chief

Information Officer

in 2016

Served as CTO, Managing

Director at JPMorgan Chase for

15 years

Vercie Lark

Head of U.S.

Financial Services

Appointed Head

of U.S. Financial

Services in 2016

Joined DST in 2010 as Chief

Information Officer

Ned Burke

Head of ALPS

Joined ALPS in

1991 as National

Sales Manager and

became President

in 2000

William Slattery

Head of

International

Financial Services

Appointed

CEO of DST International

Financial Services in 2017

Previously held senior roles at

State Street Europe and Deutsche

Asset Management

Jonathan Boehm

Head of Healthcare

Services

President and CEO

of DST Healthcare

as well as President

and CEO of DST Pharmacy

Solutions

Joined DST in 1984

Randy Young

Head of Legal

Named DST

General Counsel

in 2002

Joined DST in 1995 and been

significantly involved with DST's

M&A activities, Board governance,

SEC compliance and litigation

activities

Background in private practice

law with an emphasis on M&A

and Tax

Stacy Kempf

Head of

Internal Audit

Joined DST in 2012

and leads all internal

audit functions

13 years with Ernst & Young

Background includes managing

and directing financial,

operational and internal controls

on multi-national publicly-held

and privately owned companies

10

DST FINANCIAL DISCUSSION

11

FINANCIAL HIGHLIGHTS

Significant recurring revenues

Strong cash flows

Solid balance sheet

Robust revolving debt capacity

Monetization of assets

Focus on returning capital to shareholders

12

Non-GAAP Net Income from Continuing Operations and

EPS from Continuing Operations(1) Non-GAAP Operating Revenues

HISTORICAL FINANCIAL PERFORMANCE

$1,362

$1,446 $1,405

$1,474

$500

$600

$700

$800

$900

$1,000

$1,100

$1,200

$1,300

$1,400

$1,500

2013 2014 2015 2016

$185.9

$201.1

$179.8

$190.9

$2.11

$2.49 $2.47

$2.87

$1.00

$1.50

$2.00

$2.50

$3.00

$40.0

$60.0

$80.0

$100.0

$120.0

$140.0

$160.0

$180.0

$200.0

2013 2014 2015 2016

(M

ill

io

ns

)

(M

ill

io

ns

) EPS

Note: Please refer to Non-GAAP reconciliation slides for adjustment details. (1) Non-GAAP net income from continuing operations after non-controlling interest.

13

Non-GAAP Net Income from Continuing Operations and

EPS from Continuing Operations(1) Non-GAAP Operating Revenues

(2)

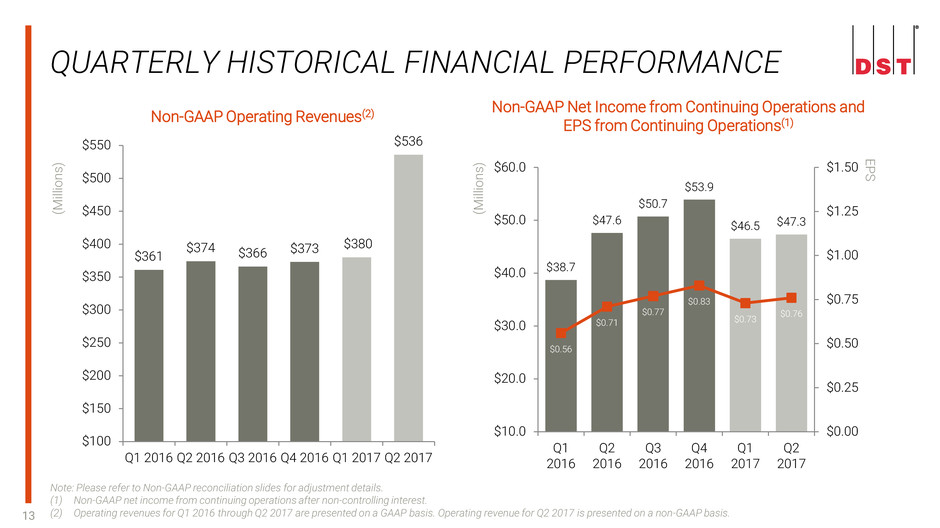

QUARTERLY HISTORICAL FINANCIAL PERFORMANCE

$361

$374 $366 $373

$380

$536

$100

$150

$200

$250

$300

$350

$400

$450

$500

$550

Q1 2016 Q2 2016 Q3 2016 Q4 2016 Q1 2017 Q2 2017

$38.7

$47.6

$50.7

$53.9

$46.5 $47.3

$0.56

$0.71

$0.77

$0.83

$0.73 $0.76

$0.00

$0.25

$0.50

$0.75

$1.00

$1.25

$1.50

$10.0

$20.0

$30.0

$40.0

$50.0

$60.0

Q1

2016

Q2

2016

Q3

2016

Q4

2016

Q1

2017

Q2

2017

(M

ill

io

ns

)

(M

ill

io

ns

) EPS

Note: Please refer to Non-GAAP reconciliation slides for adjustment details.

(1) Non-GAAP net income from continuing operations after non-controlling interest.

(2) Operating revenues for Q1 2016 through Q2 2017 are presented on a GAAP basis. Operating revenue for Q2 2017 is presented on a non-GAAP basis.

14

Domestic

Financial Services

International

Financial Services Healthcare Services

Operating Revenue

(in Millions)

Operating Margin

NON-GAAP SEGMENT FINANCIAL HIGHLIGHTS – YTD 2ND QUARTER

Note: Please refer to Non-GAAP reconciliation slides for adjustment details.

17.1% 18.1%

Q2 2016 Q2 2017

2.6%

10.0%

1.3%

Q2 2016 Q2 2017

17.8% 18.5%

Q2 2016 Q2 2017

$500

$566

Q2 2016 Q2 2017

$56

$171

Q2 2016 Q2 2017

$208 $209

Q2 2016 Q2 2017

13.2% 205% 0.4%

15

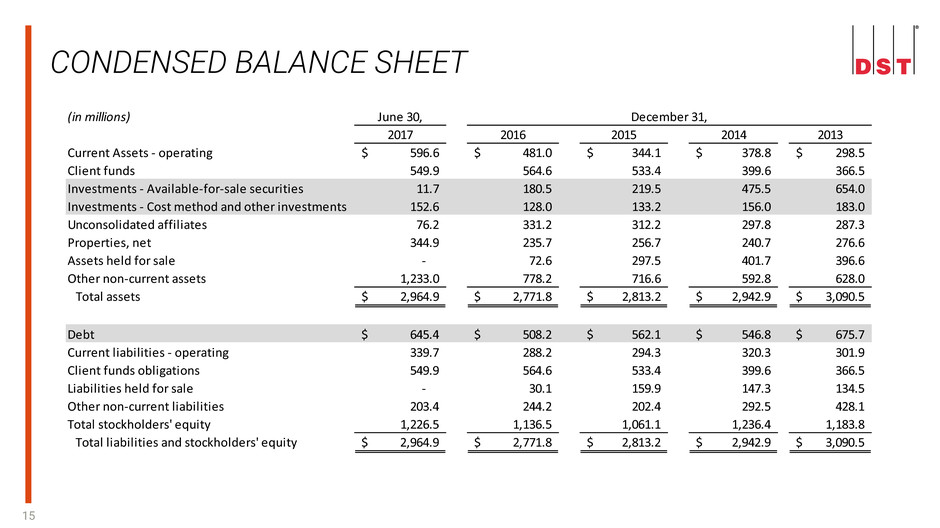

CONDENSED BALANCE SHEET

(in millions) June 30,

2017 2016 2015 2014 2013

Current Assets - operating 596.6$ 481.0$ 344.1$ 378.8$ 298.5$

Client funds 549.9 564.6 533.4 399.6 366.5

Investments - Available-for-sale securities 11.7 180.5 219.5 475.5 654.0

Investments - Cost method and other investments 152.6 128.0 133.2 156.0 183.0

Unconsolidated affiliates 76.2 331.2 312.2 297.8 287.3

Properties, net 344.9 235.7 256.7 240.7 276.6

Assets held for sale - 72.6 297.5 401.7 396.6

Other non-current assets 1,233.0 778.2 716.6 592.8 628.0

Total assets 2,964.9$ 2,771.8$ 2,813.2$ 2,942.9$ 3,090.5$

Debt 645.4$ 508.2$ 562.1$ 546.8$ 675.7$

Current liabilities - operating 339.7 288.2 294.3 320.3 301.9

Client funds obligations 549.9 564.6 533.4 399.6 366.5

Liabilities held for sale - 30.1 159.9 147.3 134.5

Other non-current liabilities 203.4 244.2 202.4 292.5 428.1

Total stockholders' equity 1,226.5 1,136.5 1,061.1 1,236.4 1,183.8

Total liabilities and stockholders' equity 2,964.9$ 2,771.8$ 2,813.2$ 2,942.9$ 3,090.5$

December 31,

16

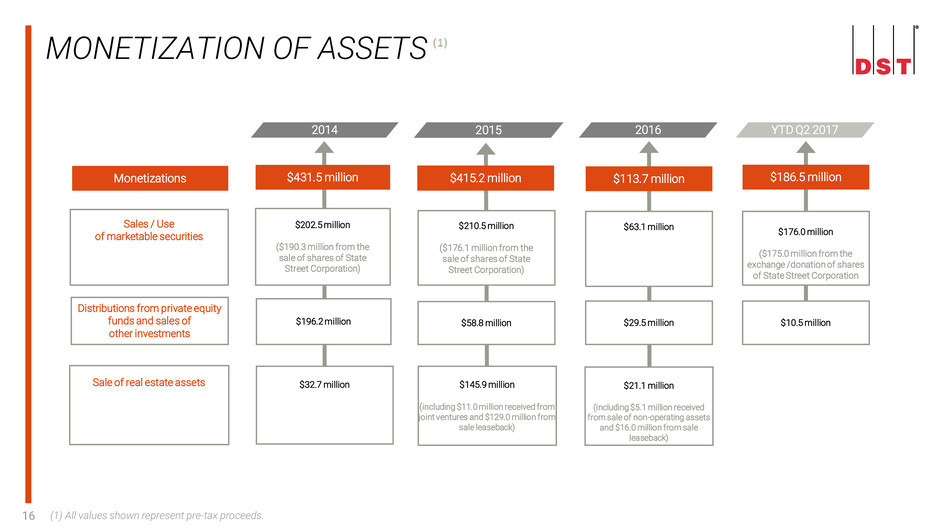

MONETIZATION OF ASSETS

(1) All values shown represent pre-tax proceeds.

Q2 2013

2014

$32.7 million

$431.5 million

$202.5 million

($190.3 million from the

sale of shares of State

Street Corporation)

$196.2 million

$145.9 million

(including $11.0 million received from

joint ventures and $129.0 million from

sale leaseback)

$415.2 million

$210.5 million

($176.1 million from the

sale of shares of State

Street Corporation)

$58.8 million

2015

$21.1 million

(including $5.1 million received

from sale of non-operating assets

and $16.0 million from sale

leaseback)

$113.7 million

$63.1 million

$29.5 million

2016

Sales / Use

of marketable securities

Distributions from private equity

funds and sales of

other investments

Sale of real estate assets

Monetizations $186.5 million

$176.0 million

($175.0 million from the

exchange /donation of shares

of State Street Corporation

$10.5 million

YTD Q2 2017

17

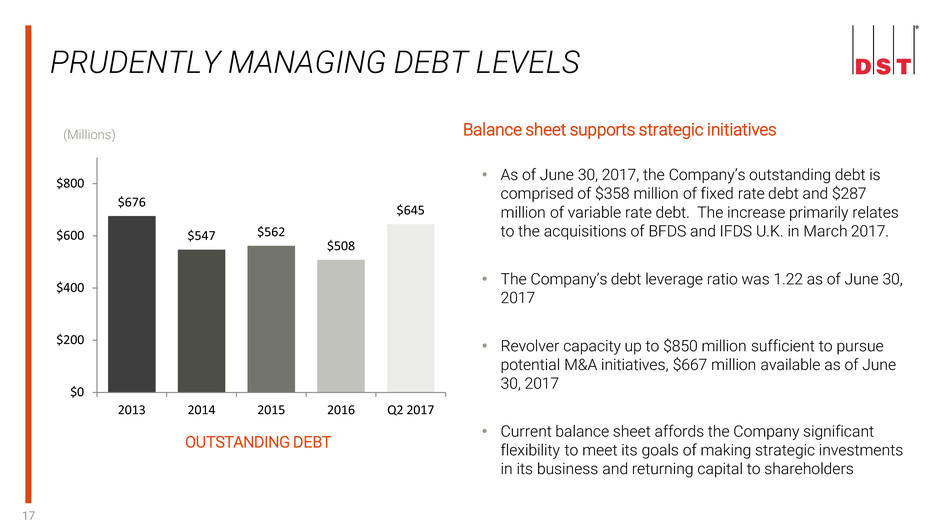

OUTSTANDING DEBT

Balance sheet supports strategic initiatives

• As of June 30, 2017, the Company’s outstanding debt is

comprised of $358 million of fixed rate debt and $287

million of variable rate debt. The increase primarily relates

to the acquisitions of BFDS and IFDS U.K. in March 2017.

• The Company’s debt leverage ratio was 1.22 as of June 30,

2017

• Revolver capacity up to $850 million sufficient to pursue

potential M&A initiatives, $667 million available as of June

30, 2017

• Current balance sheet affords the Company significant

flexibility to meet its goals of making strategic investments

in its business and returning capital to shareholders

PRUDENTLY MANAGING DEBT LEVELS

$676

$547 $562

$508

$645

$0

$200

$400

$600

$800

2013 2014 2015 2016 Q2 2017

(Millions)

18

Since 2010, DST has returned $2.1 billion of capital to shareholders

RETURN OF CAPITAL TO SHAREHOLDERS

Total: $447.6 million

DST spent $200 million to

repurchase 4.4 million

shares of Common Stock

DST paid $47.6 million in

dividends

($0.60 per share)

DST spent $200 million to

repurchase 4.8 million

shares directly from the

Argyros group

2014

Total: $443.1 million

DST paid $43.1 million in

dividends

($0.60 per share)

DST spent $400.0 million to

repurchase 7.2 million shares

of Common Stock

2015

Total: $343.4 million

DST paid $43.4 million in

dividends

($0.68 per share)

DST spent $300 million to

repurchase 5.3 million

shares of Common Stock

2016

Total: $172.1 million

DST paid $22.1 million in

dividends

($0.36 per share)

DST spent $150 million to

repurchase 2.6 million

shares of Common Stock

YTD Q2 2017

(1) All shares have been retroactively adjusted for all periods presented to reflect the stock split

19

KEY TAKEAWAYS

Leadership position in industries served

Deep, longstanding customer relationships

Robust, scalable technology platform and infrastructure

Deep regulatory compliance expertise

Attractive business model with significant recurring and diversified revenues

Experienced management team with proven track record

20

Termination of Employee Stock Ownership Plan (“ESOP”)

• Effective July 28, 2017, the DST Systems’ ESOP was terminated and the participants’ respective account balances,

which were comprised solely of DST common stock, began being liquidated into cash and distributed in accordance

with the plan agreement. Liquidations are expected to continue from the effective date through mid-October 2017.

Litigation Update – Class action suits involving DST Systems’ 401(k) Profit Sharing Plan

• In September 2017, two new complaints alleging breach of fiduciary duties and other violations of the Employee

Retirement Income Security Act were filed, Ferguson, et al. v. Ruane, Cuniff & Goldfarb Inc., et al., in the Southern

District of New York and Ostrander v. DST Systems, Inc., et al. in the U.S. District Court for the Western District of

Missouri.

• We intend to defend these cases vigorously, and because the suits are in their preliminary stages, have not yet

determined what effect these lawsuits will have, if any, on our financial position or results of operations.

APPENDIX - BENEFIT PLAN UPDATES

21

APPENDIX - CUSTOMER CONCENTRATION BY SEGMENT

Percentage of Segment's 2016 Operating Revenue

Segment Largest Customer of Segment Largest Five Customers of Segment

Domestic Financial Services 11.5% 21.5%

International Financial Services 16.5% 33.1%

Healthcare Services 17.8% 51.4%

The customer concentration metrics disclosed within the 2016 Form 10-K have been updated below to

reflect the new segment realignment. The amounts below exclude sales to operating joint ventures.

22

APPENDIX – USE OF NON-GAAP FINANCIAL INFORMATION

In addition to reporting financial information on a GAAP basis, DST has disclosed certain non-GAAP financial information which has been reconciled to the

corresponding GAAP measures. In making these adjustments to determine the non-GAAP results, the Company takes into account the impact of items that are not

necessarily ongoing in nature, that do not have a high level of predictability associated with them or that are non-operational in nature. Generally, these items include

net gains on dispositions of businesses, net gains (losses) associated with securities and other investments, acquired intangible asset amortization, restructuring and

impairment costs and other similar items. Our non-GAAP net income from continuing operations attributable to DST Systems, Inc. and Diluted earnings per share from

continuing operations are also adjusted for the income tax impact of the above items, as applicable. The income tax impact of each item is calculated by applying the

statutory rate and local tax regulations in the jurisdiction in which the item was incurred. The Company believes that the exclusion of these items provides a useful

basis for evaluating underlying business unit performance, but should not be considered in isolation and is not in accordance with, or a substitute for, evaluating

business unit performance utilizing GAAP financial information. The Company uses non-GAAP measures in its budgeting and forecasting processes and to further

analyze its financial trends and “operational run-rate,” as well as making financial comparisons to prior periods presented on a similar basis. The Company believes that

providing such adjusted results allows investors and other users of DST’s financial statements to better understand DST’s comparative operating performance for the

periods presented.

Company’s management uses these non-GAAP financial measures in its own evaluation of the Company’s performance, particularly when comparing performance to

past periods. Company’s non-GAAP measures may differ from similar measures by other companies, even if similar terms are used to identify such measures.

Although Company’s management believes non-GAAP measures are useful in evaluating the performance of its business, the Company acknowledges that items

excluded from such measures may have a material impact on the Company’s financial information calculated in accordance with GAAP and prospective investors

should not rely solely on the non-GAAP information. Therefore, Company’s management typically uses non-GAAP measures in conjunction with GAAP results. These

factors should be considered when evaluating DST’s results. See “Historical Financials - Reconciliation of GAAP to Non-GAAP Results.”

The tables on the following pages reconcile the GAAP financial results to the corresponding non-GAAP financial results. Additional descriptions of the non-GAAP

adjustments can be found in DST’s Form 10-K filings.

23

APPENDIX:

RECONCILIATION OF GAAP TO NON-GAAP OPERATING INCOME BY SEGMENT

(in millions)

Domestic International

Financial Financial Healthcare

For the Three Months Ended December 31, 2016 Services Services Services

Reported GAAP Operating Income 49.2$ 2.7$ 23.5$

Restructuring charges 0.8 1.0 -

Amortization of intangible assets 4.4 - 1.6

Adjusted Non-GAAP Operating Income 54.4$ 3.7$ 25.1$

For the Three Months Ended September 30, 2016

Reported GAAP Operating Income 53.7$ 2.5$ 18.1$

Amortization of intangible assets 4.2 - 1.6

Reversal of accrued contingent consideration (6.5) - -

Adjusted Non-GAAP Operating Income 51.4$ 2.5$ 19.7$

For the Three Months Ended June 30, 2016

Reported GAAP Operating Income 24.3$ 4.3$ 17.3$

Amortization of intangible assets 4.4 - 1.5

Restructuring charges 10.4 - 0.7

Software impairment 6.0 - -

Adjusted Non-GAAP Operating Income 45.1$ 4.3$ 19.5$

For the Three Months Ended March 31, 2016

Reported GAAP Operating Income 35.3$ 1.3$ 15.1$

Amortization of intangible assets 3.8 - 1.6

Restructuring charges 1.4 - 0.9

Adjusted Non-GAAP Operating Income 40.5$ 1.3$ 17.6$

2016

Domestic International

Financial Financial Healthcare

For the Three Months Ended June 30, 2017 Services Services Services

Reported GAAP Operating Income 28.2$ 50.1$ 17.9$

Amortization of intangible assets 5.5 3.7 0.8

Restructuring charges 8.0 - -

Advisory expense 3.2 1.0 -

Chartitable contribution of securities 11.6 - -

Contract termination - (53.5) -

Adjusted Non-GAAP Operating Income 56.5$ 1.3$ 18.7$

For the Three Months Ended March 31, 2017

Reported GAAP Operating Income 38.2$ (0.6)$ 18.3$

Amortization of intangible assets 4.2 - 1.6

Restructuring charges 0.6 0.8 -

Advisory expenses 2.7 0.8 -

Adjusted Non-GAAP Operating Income 45.7$ 1.0$ 19.9$

2017

24

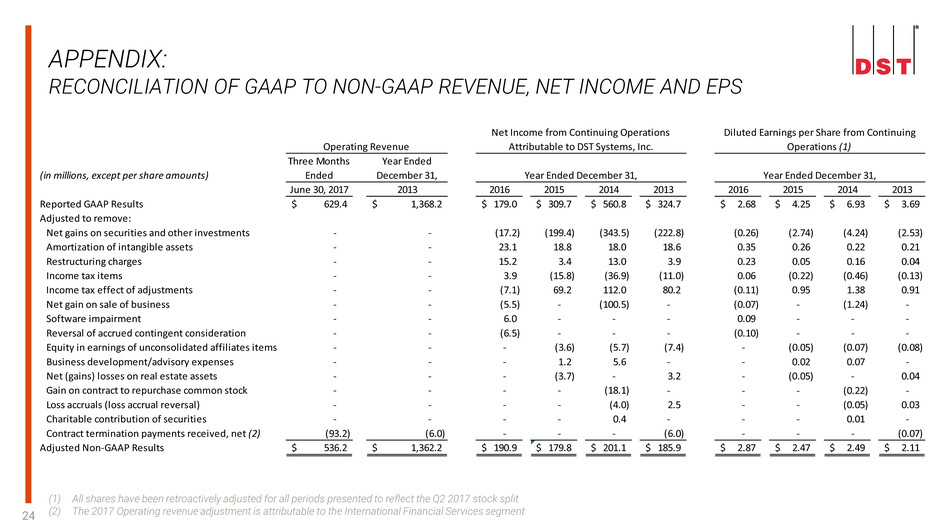

APPENDIX:

RECONCILIATION OF GAAP TO NON-GAAP REVENUE, NET INCOME AND EPS

(1) All shares have been retroactively adjusted for all periods presented to reflect the Q2 2017 stock split

(2) The 2017 Operating revenue adjustment is attributable to the International Financial Services segment

(in millions, except per share amounts)

Three Months

Ended

Year Ended

December 31,

June 30, 2017 2013 2016 2015 2014 2013 2016 2015 2014 2013

Reported GAAP Results 629.4$ 1,368.2$ 179.0$ 309.7$ 560.8$ 324.7$ 2.68$ 4.25$ 6.93$ 3.69$

Adjusted to remove:

Net gains on securities and other investments - - (17.2) (199.4) (343.5) (222.8) (0.26) (2.74) (4.24) (2.53)

Amortization of intangible assets - - 23.1 18.8 18.0 18.6 0.35 0.26 0.22 0.21

Restructuring charges - - 15.2 3.4 13.0 3.9 0.23 0.05 0.16 0.04

Income tax items - - 3.9 (15.8) (36.9) (11.0) 0.06 (0.22) (0.46) (0.13)

Income tax effect of adjustments - - (7.1) 69.2 112.0 80.2 (0.11) 0.95 1.38 0.91

Net gain on sale of business - - (5.5) - (100.5) - (0.07) - (1.24) -

Software impairment - - 6.0 - - - 0.09 - - -

Reversal of accrued contingent consideration - - (6.5) - - - (0.10) - - -

Equity in earnings of unconsolidated affiliates items - - - (3.6) (5.7) (7.4) - (0.05) (0.07) (0.08)

Business development/advisory expenses - - - 1.2 5.6 - - 0.02 0.07 -

Net (gains) losses on real estate assets - - - (3.7) - 3.2 - (0.05) - 0.04

Gain on contract to repurchase common stock - - - - (18.1) - - - (0.22) -

Loss accruals (loss accrual reversal) - - - - (4.0) 2.5 - - (0.05) 0.03

Charitable contribution of securities - - - - 0.4 - - - 0.01 -

Contract termination payments received, net (2) (93.2) (6.0) - - - (6.0) - - - (0.07)

Adjusted Non-GAAP Results 536.2$ 1,362.2$ 190.9$ 179.8$ 201.1$ 185.9$ 2.87$ 2.47$ 2.49$ 2.11$

Operating Revenue

Year Ended December 31,

Diluted Earnings per Share from Continuing

Operations (1)

Net Income from Continuing Operations

Attributable to DST Systems, Inc.

Year Ended December 31,

25

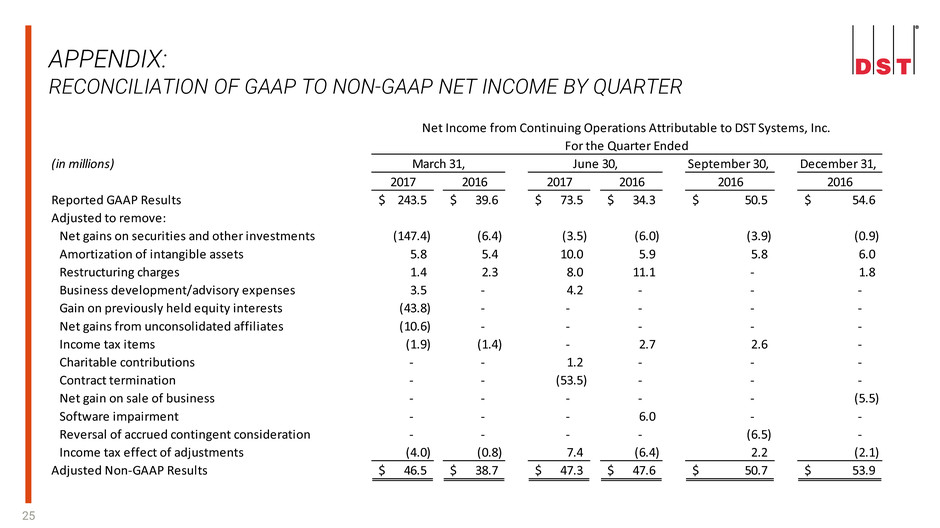

APPENDIX:

RECONCILIATION OF GAAP TO NON-GAAP NET INCOME BY QUARTER

(in millions) September 30, December 31,

2017 2016 2017 2016 2016 2016

Reported GAAP Results 243.5$ 39.6$ 73.5$ 34.3$ 50.5$ 54.6$

Adjusted to remove:

Net gains on securities and other investments (147.4) (6.4) (3.5) (6.0) (3.9) (0.9)

Amortization of intangible assets 5.8 5.4 10.0 5.9 5.8 6.0

Restructuring charges 1.4 2.3 8.0 11.1 - 1.8

Business development/advisory expenses 3.5 - 4.2 - - -

Gain on previously held equity interests (43.8) - - - - -

Net gains from unconsolidated affiliates (10.6) - - - - -

Income tax items (1.9) (1.4) - 2.7 2.6 -

Charitable contributions - - 1.2 - - -

Contract termination - - (53.5) - - -

Net gain on sale of business - - - - - (5.5)

Software impairment - - - 6.0 - -

Reversal of accrued contingent consideration - - - - (6.5) -

Income tax effect of adjustments (4.0) (0.8) 7.4 (6.4) 2.2 (2.1)

Adjusted Non-GAAP Results 46.5$ 38.7$ 47.3$ 47.6$ 50.7$ 53.9$

Net Income from Continuing Operations Attributable to DST Systems, Inc.

For the Quarter Ended

March 31, June 30,

26

APPENDIX:

RECONCILIATION OF GAAP TO NON-GAAP DILUTED EPS BY QUARTER

(1) All shares have been retroactively adjusted for all periods presented to reflect the stock split

2017 2016 2017 2016 2016 2016

Reported GAAP Results 3.81$ 0.58$ 1.18$ 0.51$ 0.76$ 0.84$

Adjusted to remove:

Net gains on securities and other investments (2.30) (0.09) (0.06) (0.09) (0.06) (0.01)

Amortization of intangible assets 0.09 0.07 0.16 0.09 0.09 0.09

Restructuring charges 0.02 0.03 0.13 0.17 - 0.03

Business development/advisory expenses 0.05 - 0.07 - - -

Gain on previously held equity interests (0.68) - - - - -

Net gains from unconsolidated affiliates (0.17) - - - - -

Income tax items (0.03) (0.02) - 0.04 0.04 -

Charitable contributions - - 0.02 - - -

Contract termination - - (0.86) - - -

Net gain on sale of business - - - - - (0.09)

Software impairment - - - 0.09 - -

Reversal of accrued contingent consideration - - - - (0.10) -

Income tax effect of adjustments (0.06) (0.01) 0.12 (0.10) 0.04 (0.03)

Adjusted Non-GAAP Results 0.73$ 0.56$ 0.76$ 0.71$ 0.77$ 0.83$

Diluted EPS from Continuing Operations

For the Quarter Ended

March 31, September 30, December 31,June 30,