Attached files

| file | filename |

|---|---|

| EX-10.3 - EXHIBIT 10.3 - TerraVia Holdings, Inc. | tvia2017-08x28exx103.htm |

| EX-10.2 - EXHIBIT 10.2 - TerraVia Holdings, Inc. | tvia2017-08x28exx102.htm |

| EX-3.1 - EXHIBIT 3.1 - TerraVia Holdings, Inc. | tvia2017-08x28exx31.htm |

| 8-K - 8-K - TerraVia Holdings, Inc. | a170828form8-k.htm |

IN THE UNITED STATES BANKRUPTCY COURT

FOR THE DISTRICT OF DELAWARE

FOR THE DISTRICT OF DELAWARE

In re: TERRAVIA HOLDINGS, INC., et al., Debtors. | : : : : : : | Chapter 11 Case No. 17-11655 (CSS) Jointly Administered |

INITIAL MONTHLY OPERATING REPORT

File report and attachments with Court and submit copy to United States Trustee within 15 days after order for relief.

Certificates of insurance must name United States Trustee as a party to be notified in the event of policy cancellation. Bank accounts and checks must bear the name of the debtor, the case number, and the designation “Debtor in Possession.” Examples of acceptable evidence of Debtor in Possession Bank accounts include voided checks, copy of bank deposit agreement/certificate of authority, signature card, and/or corporate checking resolution.

REQUIRED DOCUMENTS | Document Attached | Explanation Attached |

12-Month Cash Flow Projection (Form IR-1) | Exhibit A | Exhibit A |

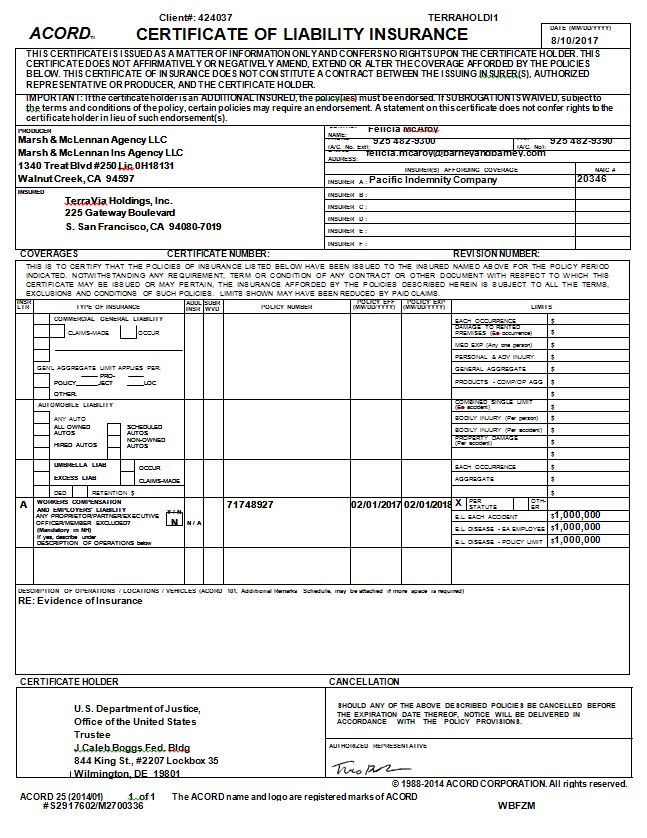

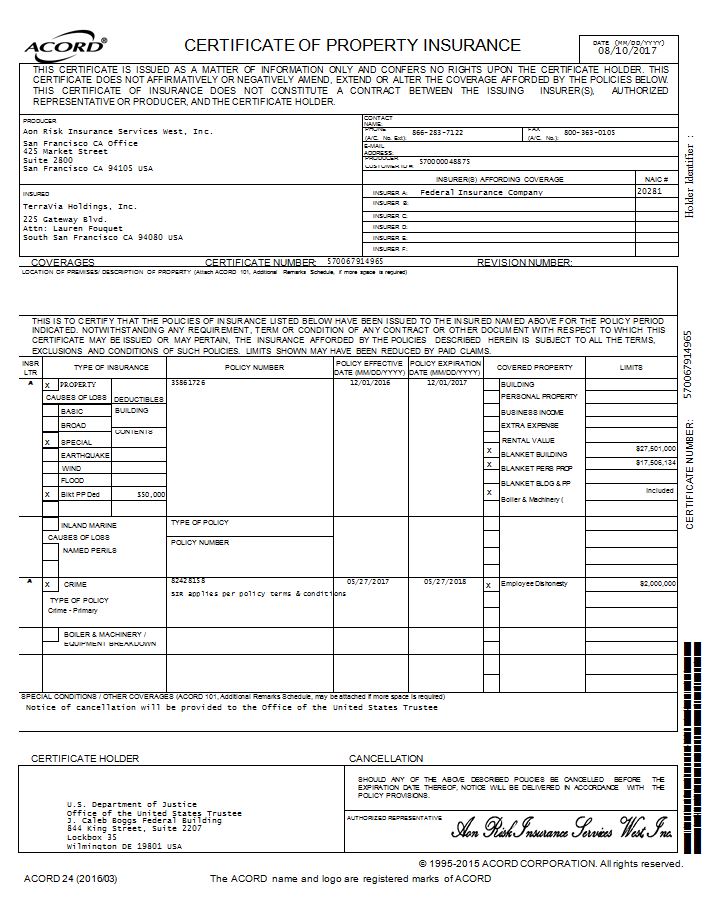

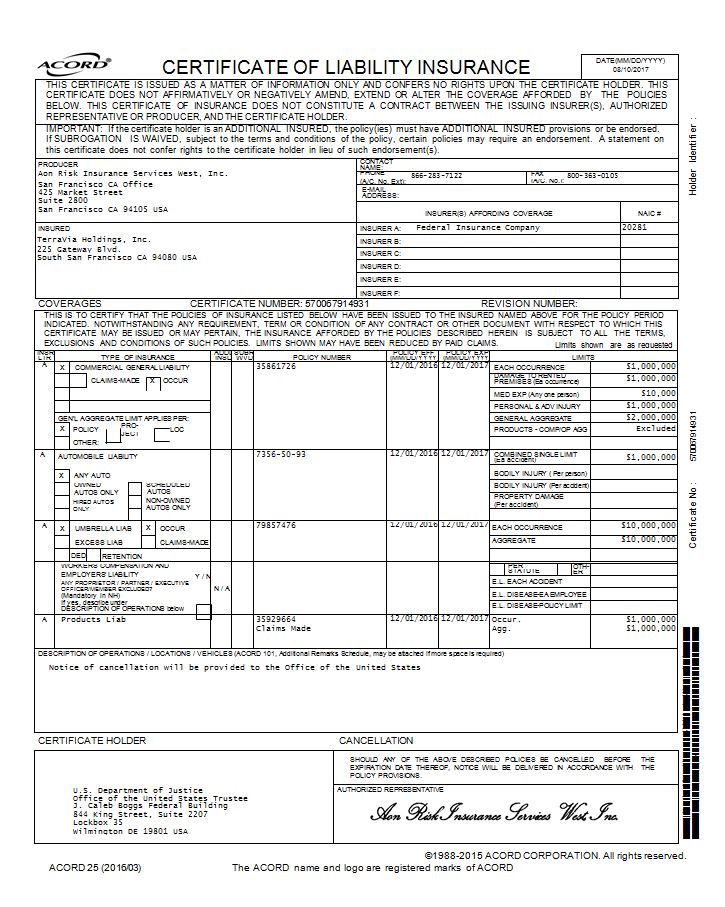

Certificates of Insurance: | Exhibit B | N/A |

Workers Compensation | ||

Property | ||

General Liability | ||

Vehicle | ||

Other: | ||

Identify areas of self-insurance with liability caps | ||

Evidence of Debtor in Possession Bank Accounts | Exhibit C | N/A |

Tax Escrow Account | ||

General Operating Account | ||

Money Market Account Pursuant to Local Rule 4001-3 for | ||

the District of Delaware only. Refer to: | ||

http://www.deb.uscourts.gov | ||

Other: | ||

Retainers Paid (Form IR-2) | Exhibit D | N/A |

I declare under penalty of perjury (28 U.S.C. Section 1746) that this report and the documents attached are true and correct to the best of my knowledge and belief.

RLF1 3255301v.1 Form IR (4/07)

Signature of Debtor | Date | |

Signature of Joint Debtor | Date | |

/s/ Tyler Painter Signature of Authorized Individual* | August 16, 2017 Date | |

Tyler W. Painter Printed Name of Authorized Individual | Chief Financial Officer and Chief Operating Officer Title of Authorized Individual | |

*Authorized individual must be an officer, director or shareholder if debtor is a corporation; a partner if debtor is a partnership; a manager or member if debtor is a limited liability company.

RLF1 3255301v.1 Form IR (4/07)

Exhibit A

13 Week Budget and Explanation

The Debtors did not prepare a 12 month cash flow in accordance with Form IR-1. However, per the Interim Order Pursuant to 11 U.S.C. §§ 105, 362, 364(c), 364(d)(1), 364(e), 503 and 507 (i) Authorizing the Debtors To Obtain Senior Secured Super-Priority Post-Petition Financing, (ii) Granting Liens and Providing Superpriority Administrative Expense Status, (iii) Modifying the Automatic Stay, (iv) Scheduling a Final Hearing and (v) Granting Related Relief [D.I. 62] dated August 3, 2017 (the “DIP Order”), the Debtors prepared an Approved Budget (as defined in the DIP Order). The Debtors provide this Approved Budget, as detailed on the following page, in lieu of Form IR-1.

TerraVia Holdings, Inc. | DRAFT SUBJECT TO MATERIAL CHANGE | |||||||

Weekly Cash Flow Forecast | CONFIDENTIAL - SUBJECT TO NDA | |||||||

($M's U.S. Dollars) | ||||||||

1 | 2 | 3 | 3 QTR | |||||

Projected Quarter | Q3'17 | Q4'17 | Q1'18 | Total | ||||

Funded Programs | (1 | ) | (1 | ) | (2 | ) | (4 | ) |

Sublease/Other Income | (1 | ) | (1 | ) | — | (1 | ) | |

Total Receipts | (2 | ) | (2 | ) | (2 | ) | (5 | ) |

Labor Costs | 3.0 | 3 | 3 | 10 | ||||

Retention/Early payment of on-target annual bonus | 1 | 1 | 1 | 2 | ||||

Other Cash Operating Expenses | 7 | 5 | 5 | 18 | ||||

Working Capital | 2 | (1 | ) | (1 | ) | 1 | ||

Total Operating Burn | 13 | 9 | 9 | 30 | ||||

SBO Equity Payments | 4 | 2 | 3 | 8 | ||||

Debt Financing/Transaction Costs | 4 | 2 | 7 | |||||

DIP Financing Fees | — | |||||||

Total Cash Burn | 19 | 11.0 | 9 | 40 | ||||

Beginning cash | 27 | 7 | (4 | ) | 27 | |||

Less total cash burn | 19 | 11.0 | 9 | 40 | ||||

Ending Cash | 7 | (4 | ) | (13 | ) | (13 | ) | |

Less: restricted cash | (12 | ) | (12 | ) | (12 | ) | (12 | ) |

Ending unrestricted cash before debtor financing | (5 | ) | (16 | ) | (25 | ) | (25 | ) |

Debtor Financing | – | – | – | — | ||||

Ending unrestricted cash | (5 | ) | (16 | ) | (25 | ) | (25 | ) |

(1) Assumes run rate payroll and expense in a 363 scenario. Stand alone company scenario could reduce operating expenses by > $4M (excl. severance costs). | ||||||||

(2) Excludes transaction fees | ||||||||

RLF1 3255301v.1 Form IR (4/07)

Exhibit B

Certificates of Insurance

-1-

-2-

Exhibit C

Cash Management Motion and Interim Order

IN THE UNITED STATES BANKRUPTCY COURT

FOR THE DISTRICT OF DELAWARE

FOR THE DISTRICT OF DELAWARE

In re: TERRAVIA HOLDINGS, INC., et al., Debtors. | : : : : : : | Chapter 11 Case No. 17-__________ (___) Joint Administration Requested |

MOTION OF DEBTORS FOR ENTRY OF INTERIM AND FINAL ORDERS AUTHORIZING (I) THE DEBTORS TO CONTINUE TO MAINTAIN EXISTING CASH MANAGEMENT SYSTEM, BANK ACCOUNTS, CREDIT CARD PROGRAM AND BUSINESS FORMS AND (II) FINANCIAL INSTITUTIONS TO HONOR

AND PROCESS RELATED CHECKS AND TRANSFERS

AND PROCESS RELATED CHECKS AND TRANSFERS

TerraVia Holdings, Inc. (formerly known as Solazyme, Inc.) (“TerraVia”) and certain of its subsidiaries that are debtors and debtors in possession (collectively, the “Debtors”) in the above-captioned chapter 11 cases (the “Chapter 11 Cases”) hereby file this Motion of Debtors for Entry of Interim and Final Orders Authorizing (i) the Debtors To Continue To Maintain Existing Cash Management System, Bank Accounts and Business Forms and (ii) Financial Institutions To Honor and Process Related Checks and Transfers (this “Motion”). This Motion is supported by (i) the Declaration of Tyler W. Painter in Support of Debtors’ Chapter 11 Proceedings and First Day Pleadings (the “Painter Declaration”) filed contemporaneously herewith and (ii) the entire record of the Chapter 11 Cases. In further support of this Motion, the Debtors respectfully state as follows:

Relief Requested

1.By this Motion, and pursuant to sections 105(a), 345 and 363(c)(1) of title 11 of the United States Code (the “Bankruptcy Code”), the Debtors seek entry of interim and final orders (the “Proposed Orders”) (a) authorizing, but not directing, the Debtors, in their sole discretion, to

-3-

(i) continue to operate their prepetition cash management system (the “Cash Management System”), as further described below, (ii) maintain their existing bank accounts (collectively, and together with any accounts opened after the Petition Date, the “Bank Accounts” and each, a “Bank Account”) located at certain banks and financial institutions (collectively, the “Banks”), (iii) maintain their Credit Card Program (as defined below) and (iv) maintain their existing business forms and (b) waiving the requirements of section 345(b) of the Bankruptcy Code on an interim basis.

2. A nonexclusive list of the Bank Accounts (with account numbers partially redacted) is attached hereto as Exhibit A. All Bank Accounts are held in the name of TerraVia. The Debtors believe that all of the Bank Accounts are maintained at stable financial institutions.

Jurisdiction and Venue

3. The United States Bankruptcy Court for the District of Delaware (the “Court”) has jurisdiction over this Motion pursuant to 28 U.S.C. §§ 157 and 1334 and the Amended Standing Order of Reference from the United States District Court for the District of Delaware, dated February 29, 2012.

4. This matter is a core proceeding within the meaning of 28 U.S.C. § 157(b)(2) and, pursuant to Rule 9013-1(f) of the Local Rules of Bankruptcy Practice and Procedure of the United States Bankruptcy Court for the District of Delaware (the “Local Rules”), the Debtors consent to the entry of a final order by the Court in connection with this Motion to the extent that it is later determined that the Court, absent consent of the parties, cannot enter final orders or judgments consistent with Article III of the United States Constitution.

5. Venue of the Chapter 11 Cases and related proceedings is proper in this district pursuant to 28 U.S.C. §§ 1408 and 1409.

Background

-4-

6. On August 2, 2017 (the “Petition Date”), each of the Debtors filed a voluntary petition for relief under chapter 11 of the Bankruptcy Code. The Debtors have continued in possession of their property and have continued to operate and manage their businesses as debtors in possession pursuant to sections 1107(a) and 1108 of the Bankruptcy Code.

7. No request has been made for the appointment of a trustee or examiner, and no statutory committee has been appointed in the Chapter 11 Cases.

8. Additional information about the Debtors’ businesses and affairs, capital structure and prepetition indebtedness, and the events leading up to the Petition Date, can be found in the Painter Declaration, which is incorporated herein by reference.

Cash Management System

9. In the ordinary course of business, the Debtors utilize the Cash Management System to collect and disburse funds generated by the sale of their products or received pursuant to various research and development agreements. The Cash Management System also enables the Debtors to monitor the collection and disbursement of funds and maintain control over the administration of their Bank Accounts. The Cash Management System is not automated; the Debtors’ employees are required to monitor the system, manage the proper disbursement of funds, utilize the wire and ACH capabilities of Wells Fargo Bank, National Association (“Wells Fargo”) and Silicon Valley Bank (“SVB”) to disburse funds and manually deposit checks using an internal remote capture tool. To administer the Cash Management System, the Debtors’ employees utilize computer software to record and track receivables and payables and to convert data regarding such financial information into a user-friendly format for management and other users. The Debtors regularly and periodically review the data loaded into the Debtors’ computer software to confirm its accuracy and completeness.

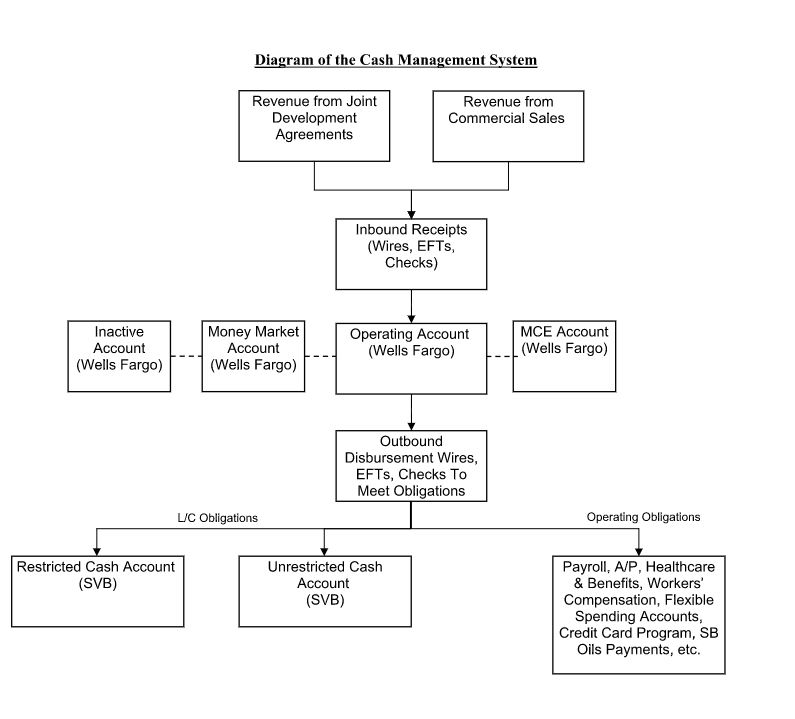

10. The Cash Management System has two main components: (a) cash receipts and (b) cash disbursements. To provide an overview of the movement of cash through the Debtors’ Cash

-5-

Management System, a schematic diagram illustrating the flow of funds through the Cash Management System is attached hereto as Exhibit B.

Cash Receipts and Concentration

11. The Debtors generate and receive funds from (a) sales of the Debtors’ products, such as Thrive® Culinary Algae Oil, AlgaVia Powders and other products and (b) various business partners to finance research and development pursuant to joint development agreements entered into between certain of the Debtors and such business partners. A majority of the Debtors’ revenue derives from such joint development agreements, with the remainder of revenue derived from commercial sales. Funding pursuant to joint development agreements occurs on a rolling and staggered basis due to differences in the timing of payments set forth in the Debtors’ joint development agreements. Revenue derived from sales of products occurs on different cycles as well. In addition, the Debtors may generate receipts from other miscellaneous sources.

12. The Debtors receive funds by wire, electronic fund transfer or check. The Debtors’ receipts are deposited directly into the Debtors’ operating account with Wells Fargo (the “Operating Account”). Historically, a small percentage of receipts were collected into the Debtors’ multi-currency euro checking account at Wells Fargo (the “MCE Account”). The source of funds in the MCE Account was receipts from sales of Algenist skincare products. In August 2016, however, the Debtors sold a majority stake in their Algenist business to a third party and retained an approximately 20% interest in Algenist Holdings, Inc. The Debtors do not anticipate that any additional cash receipts will be deposited into the MCE Account. Additionally, the Debtors maintain two Bank Accounts at Wells Fargo (with account numbers ending in 8171 and 0500), each of which has a zero-dollar balance. As of the Petition Date, the balance of cash in the Operating Account is approximately $5.1 million and the balance of cash in the MCE Account is approximately $2,000.

-6-

13. In addition to the Bank Accounts at Wells Fargo, the Debtors maintain two Bank Accounts at SVB (collectively, the “SVB Accounts”) as required by the Amended and Restated Loan and Security Agreement, dated as of May 2, 2017, between SVB and TerraVia (as may be amended, restated or otherwise modified from time to time, the “SVB Loan Agreement”). Pursuant to the SVB Loan Agreement, the Debtors are required to maintain (a) a restricted cash account with SVB that will contain not less than 110% of the dollar equivalent of the amount of all outstanding letters of credit under the SVB Loan Agreement (the “Restricted Cash Account”) and (b) a second Bank Account at SVB that will contain not less than $5 million in cash at all times (the “Unrestricted Cash Account”). Because the letter of credit issued under the SVB Loan Agreement is denominated in a foreign currency (Brazilian Reals), the Debtors monitor exchange rates on a monthly basis and transfer capital from the Operating Account into the Restricted Cash Account, if necessary, in order to remain in compliance with the SVB Loan Agreement. No funds derived from the Debtors’ receivables are deposited directly into the SVB Accounts. As of the Petition Date, the balance of cash in the Restricted Cash Account is approximately $12.2 million and the balance of cash in the Unrestricted Cash Account is approximately $375,000.

Cash Disbursements

14. Receipts concentrated in the Operating Account are used by the Debtors to satisfy their financial obligations. Disbursements by check, ACH or wire are generally made through the Operating Account. The Debtors make cash disbursements to support the following major disbursement programs:

▪Payroll. The Debtors use a third party, ADP, to administer payroll disbursements. Payroll is funded by wire to ADP generally two days in advance of each biweekly pay date, which pay date generally occurs on a Friday.

-7-

▪Accounts Payable. The Debtors’ accounts payable payments on account of revenue, interest, taxes and regulatory fees, utilities and other vendors are paid or auto-debited by wire, check and ACH.

▪SB Oils Operating Payments. Pursuant to a business plan approved by Solazyme Bunge Renewable Oils Coöperatief U.A. (“Renewable Oils”), a non-debtor entity in which TerraVia holds a 50.1% ownership interest, TerraVia makes periodic payments to Solazyme Bunge Produtos Renováveis Ltda. (“SB Oils”), a wholly-owned subsidiary of Renewable Oils, in connection with operations conducted by SB Oils in Orindiúva, Brazil. Bunge Global Innovation, LLC, which owns the remaining 49.9% ownership interest in Renewable Oils, also makes periodic payments to SB Oils to fund SB Oils’ operations. Payments from TerraVia to SB Oils are transferred from the Operating Account directly into a bank account held in the name of SB Oils.

▪Healthcare and Benefits. The Debtors fund claims from the Debtors’ employees through their health and other benefit plans. The Debtors provide insurance to their employees through self-insurance and third party providers, such as Metlife, Kaiser Foundation Health Plan, Blue Shield of California and Discovery Benefits, Inc. Health and welfare benefits are funded by check, ACH, direct debit or wire to pay for monthly premiums. In addition, pursuant to TerraVia’s 2011 Employee Stock Purchase Plan, on a semiannual basis, TerraVia may use funds withheld from its employees’ paychecks to purchase shares of common stock of TerraVia on behalf of and for the benefit of such employees.

▪Flexible Spending Accounts. The Debtors’ Operating Account is used to reimburse employee expenditures from tax-advantaged flexible spending accounts. Such disbursements are made by check, ACH, wire or direct debit.

▪Workers’ Compensation. The Debtors have obligations on account of workers’ compensation claims. The Debtors pay a regular workers’ compensation premium and remit payment

-8-

by check, ACH, direct debit or wire to Barney & Barney LLC, the Debtors’ workers’ compensation insurance broker, when billed for quarterly premiums. Annually, upon completion of an annual audit, a true-up payment is made to or from the Debtors from or to the relevant insurance carriers.

15. The Debtors do not currently maintain any investment accounts. The Debtors do, however, maintain a credit card program (the “Credit Card Program”) with SVB. The Credit Card Program is used by approximately 20 employees and the travel agency of the Debtors to pay for authorized expenses incurred by such employees in the ordinary course of the Debtors’ business. The Debtors pay any outstanding balance under the Credit Card Program to SVB at the end of each month. Based on historical averages, the Debtors estimate that approximately $100,000 is outstanding under the Credit Card Program as of the Petition Date.

Basis for Relief

The Continued Use of the Debtors’ Cash Management System Is Essential to the Debtors’ Ongoing Operations and Restructuring Efforts

16. The Debtors hereby seek authority to continue using their current centralized, integrated Cash Management System. It is essential that the Debtors be permitted to continue to consolidate the management of their cash as necessary and appropriate to continue the operation of their businesses.

17. The basic structure of the Cash Management System constitutes the Debtors’ ordinary, usual and essential business practices. The Cash Management System is similar to those commonly employed by corporate enterprises comparable to the Debtors in size and complexity. The Cash Management System is integrated with the Debtors’ accounting processes and software that produce the Debtors’ financial statements and enables the Debtors, as well as other interested parties in the Chapter 11 Cases, to trace funds through the Cash Management System, which requires the dedicated efforts of a significant number of the Debtors’ employees. If the Debtors were required to dismantle the Cash Management System, it would disrupt the Debtors’ day-to-day operations and their

-9-

accounting processes and software. Dismantling the Cash Management System would also impair the Debtors’ ability to generate timely reports of transactions and balances, as well as annual and quarterly SEC filings.

18. The widespread use of similar cash management systems is attributable to the numerous benefits they provide, including the ability to tightly control corporate funds, ensure cash availability and reduce administrative expenses by facilitating the expeditious movement of funds and developing of timely and accurate account balance and presentment information. These controls are particularly important given the significant amount of cash that flows through the Cash Management System on an annual basis.

19. The Office of the United States Trustee, Region 3 (the “U.S. Trustee”) has established operating guidelines (the “U.S. Trustee Guidelines”) for debtors in possession to facilitate the administration of chapter 11 cases. The U.S. Trustee Guidelines generally require that a chapter 11 debtor, among other things, (a) establish one debtor-in-possession account for all estate monies required for the payment of taxes (including payroll taxes), (b) close all existing bank accounts and open new debtor-in-possession accounts, (c) maintain a separate debtor-in-possession account for cash collateral, (d) obtain checks that bear the designation “Debtor in Possession” and (e) reference the debtor’s bankruptcy case number and type of account on each such check. See U.S. Trustee Guidelines § 2. Local Rule 2015-2(a) generally requires that, upon exhausting its existing check stock, a chapter 11 debtor must order new checks labeled “Debtor in Possession” with the corresponding bankruptcy number. These requirements are designed to establish a clear line of demarcation between prepetition and post-petition claims and payments and to help protect against a debtor’s inadvertent payment of prepetition claims by preventing banks from honoring checks drawn before the commencement of the debtor’s chapter 11 cases. The Debtors seek a waiver of the requirements of the U.S. Trustee

-10-

Guidelines to the extent that they prohibit the Debtors from continuing to utilize their existing Cash Management System.

20. It would be very time consuming, difficult and costly for the Debtors to establish an entirely new system of accounts, credit card program and cash management system, and doing so would disrupt the Debtors’ relationships with their key counterparties and suppliers. The attendant delays from opening new Bank Accounts, establishing a new credit card program, revising cash management procedures and instructing their commercial counterparties and countless other entities to redirect payments would negatively impact the Debtors’ ability to operate their businesses. Under the circumstances, maintenance of the Cash Management System, as well as the Credit Card Program, is essential and clearly in the best interest of the Debtors’ estates. Furthermore, preserving the “business as usual” atmosphere and avoiding the unnecessary and costly distractions that would inevitably be associated with any substantial disruption to the Cash Management System will facilitate the Debtors’ efforts to maximize the value of their estates in the Chapter 11 Cases. In short, any benefits of the Debtors’ strict compliance with the U.S. Trustee Guidelines and Local Rule 2015-2(a) would be far outweighed by the resulting expense, inefficiency and disruption to the Debtors’ businesses.

21. The Debtors request authority to (a) continue using the Cash Management System and Credit Card Program in a similar manner as they did before the Petition Date and (b) implement ordinary course changes to the Cash Management System consistent with past practices. The Debtors submit that the foregoing relief is appropriate under section 363(c) of the Bankruptcy Code, which authorizes a debtor in possession operating its business pursuant to section 1108 of the Bankruptcy Code to “enter into transactions . . . in the ordinary course of business without notice or a hearing, and . . . use property of the estate in the ordinary course of business without notice or a hearing.” 11 U.S.C. § 363(c)(1).

-11-

22. One purpose of section of 363 of the Bankruptcy Code is to provide a debtor with the flexibility to engage in the ordinary course transactions required to operate its business without undue supervision by its creditors or the court. See, e.g., In re Roth Am., Inc., 975 F.2d 949, 952 (3d Cir. 1992) (“Section 363 is designed to strike [a] balance, allowing a business to continue its daily operations without excessive court or creditor oversight and protecting secured creditors and others from dissipation of the estate’s assets.”) (citations omitted); In re Vision Metals, Inc., 325 B.R. 138, 145 (Bankr. D. Del. 2005) (same). Included within the purview of section 363(c) of the Bankruptcy Code is a debtor’s ability to continue “routine transactions” necessitated by a debtor’s business practices. See, e.g., In re Nellson Nutraceutical, Inc., 369 B.R. 787, 796 (Bankr. D. Del. 2007) (noting that courts have shown a reluctance to interfere in a debtor’s making of routine, day-to-day business decisions) (citations omitted); In re Vision Metals, 325 B.R. at 142 (“[W]hen a chapter 11 debtor in possession continues to operate its business, as permitted by section 1108, no court authorization is necessary for the debtor to enter transactions that fall within the ordinary course of its business.”).

23. The Bankruptcy Code does not define “ordinary course of business.” In determining whether a transaction qualifies as “ordinary course”, the Third Circuit has adopted the “horizontal” dimension test (i.e., whether “from an industry-wide perspective, the transaction is of the sort commonly undertaken by companies in that industry”) and “vertical” dimension test (i.e., whether the transaction “is consistent with the reasonable expectations of hypothetical creditors”). In re Roth Am., Inc., 975 F.2d at 953. “The touchstone of ‘ordinariness’ is . . . the interested parties’ reasonable expectations of what transactions the debtor in possession is likely to enter in the course of its business.” Id. (citing In re James A. Phillips, Inc., 29 B.R. 391, 394 (Bankr. S.D.N.Y. 1983)); see also In re Nellson Nutraceutical, Inc., 369 B.R. at 797 (“In other words, the vertical analysis looks at the ‘debtor’s pre-petition business practices and conduct.’”); Sportsman’s Warehouse, Inc. v. McGillis/Eckman Invs.-Billings, LLC (In re Sportsman’s Warehouse, Inc.), Case No. 09-10990 (CSS), 2013

-12-

Bankr. LEXIS 497, at *30 (Bankr. D. Del. Feb. 7, 2013) (“In determining whether a transaction is in the ordinary course of business, the Third Circuit has adopted the two-part horizontal and vertical dimension test”); In re Blitz U.S.A., Inc., 475 B.R. 209, 214 (Bankr. D. Del. 2012) (same).

24. Included within the purview of section 363(c) is a debtor’s ability to continue the “routine transactions” necessitated by a debtor’s cash management system. Amdura Nat’l Distrib. Co. v. Amdura Corp. (In re Amdura Corp.), 75 F.3d 1447, 1453 (10th Cir. 1996). Accordingly, the Debtors seek authority under section 363(c)(1) of the Bankruptcy Code to continue the collection and disbursement of cash pursuant to their Cash Management System described above.

25. The Court may also exercise its equitable powers to grant the relief requested herein. Under section 105(a) of the Bankruptcy Code, the Court has expansive equitable powers to fashion any order or decree that is in the interest of preserving or protecting the value of the Debtors’ assets. See In re Combustion Eng’g, Inc., 391 F.3d 190, 236 (3d Cir. 2004) (noting that section 105 “has been construed to give a bankruptcy court ‘broad authority’ to provide equitable relief appropriate to assure the orderly conduct of reorganization proceedings”); In re Nixon, 404 F. App’x 575, 578 (3d Cir. 2010) (“It is well settled that the court’s power under § 105(a) is broad”); In re Nortel Networks, Inc., 532 B.R. 494, 554 (Bankr. D. Del. 2015) (“The Third Circuit has construed [section 105 of the Bankruptcy Code] to give bankruptcy courts ‘broad authority’ to provide appropriate equitable relief to assure the orderly conduct of reorganization proceedings, and to craft flexible remedies that, while not expressly authorized by the Code, effect the result the Code was designed to obtain.”) (citations omitted).

26. Continuing the Debtors’ Cash Management System without interruption is vital to the Debtors’ survival. In particular, an integrated cash management system “allows efficient utilization of cash resources and recognizes the impracticalities of maintaining separate cash accounts for the many different purposes that require cash.” In re Columbia Gas Sys., Inc., 136 B.R. 930, 934 (Bankr. D. Del. 1992), aff’d in part and rev’d in part, 997 F.2d 1039 (3d Cir. 1993), cert. denied sub nom. Official

-13-

Comm. of Unsecured Creditors v. Columbia Gas Transmission Corp., 510 U.S. 1110 (1994). The requirement to maintain all accounts separately “would be a huge administrative burden and [be] economically inefficient.” Columbia Gas, 997 F.2d at 1061; see also In re Southmark Corp., 49 F.3d 1111, 1114 (5th Cir. 1995) (cash management system allows debtor “to administer more efficiently and effectively its financial operations and assets”).

27. The Cash Management System is the mechanism whereby the Debtors are able to transfer their revenue toward the payment of their obligations and without which the Debtors’ operations would be severely disrupted. It is well within the Court’s equitable power under section 105(a) to approve the continued use of the Cash Management System.

28. As noted above, the Cash Management System is similar to those employed by comparable corporate enterprises. Moreover, the relief requested herein seeking to maintain the Debtors’ existing Cash Management System is routinely granted by courts in this district. See, e.g., In re Bonanza Creek Energy, Inc., Case No. 17-10015 (KJC) (Bankr. D. Del. Jan. 30, 2017); In re Basic Energy Servs., Inc., Case No. 16-12320 (KJC) (Bankr. D. Del. Dec. 8, 2016); In re Key Energy Servs., Inc., Case No. 16-12306 (BLS) (Bankr. D. Del. Nov. 14, 2016); In re Halcón Res. Corp., Case No. 16-11724 (BLS) (Bankr. D. Del. Aug. 19, 2016); In re Seventy Seven Fin. Inc., Case No. 16-11409 (LSS) (Bankr. D. Del. June 28, 2016); In re Offshore Grp. Inv. Ltd., Case No. 15-12422 (BLS) (Bankr. D. Del. Jan. 5, 2016); In re Millennium Lab Holdings II, LLC, Case No. 15-12284 (LSS) (Bankr. D. Del. Dec. 14, 2015).

The Debtors Should Be Allowed To Maintain

Their Existing Bank Accounts and Business Forms

Their Existing Bank Accounts and Business Forms

29. It is important that the Debtors be permitted to continue to maintain the Bank Accounts with the same account numbers following the commencement of the Chapter 11 Cases, subject to a prohibition against honoring checks issued or dated before the Petition Date absent a prior order of the

-14-

Court, to avoid delays in payments to administrative creditors, ensure as smooth a transition into chapter 11 as possible with minimal disruption and aid in the Debtors’ efforts to preserve and enhance the value of the Debtors’ estates,

30. By avoiding the disruption and delay to the Debtors’ disbursements that would necessarily result from closing the Bank Accounts and opening new Bank Accounts, all parties in interest, including employees, vendors and counterparties, will be best served by preserving business continuity. The benefit to the Debtors, their business operations and all parties in interest will be considerable. The confusion that would ensue absent the relief requested herein would substantially hinder the Debtors’ restructuring efforts.

31. The Court has authority to waive the strict enforcement of the bank account closing requirements imposed pursuant to the U.S. Trustee Guidelines. Similar relief is routinely granted by courts in this district. See, e.g., In re Bonanza Creek Energy, Inc., Case No. 17-10015 (KJC) (Bankr. D. Del. Jan. 30, 2017); In re Key Energy Servs., Inc., Case No. 16-12306 (BLS) (Bankr. D. Del. Nov. 14, 2016); In re Halcón Res. Corp., Case No. 16-11724 (BLS) (Bankr. D. Del. Aug. 19, 2016); In re Seventy Seven Fin. Inc., Case No. 16-11409 (LSS) (Bankr. D. Del. June 28, 2016); In re Offshore Grp. Inv. Ltd., Case No. 15-12422 (BLS) (Bankr. D. Del. Jan. 5, 2016); In re Parallel Energy LP, Case No. 15-12263 (KG) (Bankr. D. Del. Dec. 22, 2015); In re New Gulf Res., LLC, Case No. 15-12566 (BLS) (Bankr. D. Del. Dec. 18, 2015); In re Hercules Offshore, Inc., Case No. 15-11685 (KJC) (Bankr. D. Del. Sept. 8, 2015).

32. To minimize expenses, the Debtors further request that they be authorized to continue to use their correspondence and business forms, including, but not limited to, purchase orders, letterhead, checks, invoices, sales order acknowledgements and other business forms (collectively, the “Business Forms”), in each case substantially in the form existing immediately before the Petition Date, without reference to their status as debtors in possession. As a result of the press releases issued

-15-

by the Debtors and other press coverage, parties doing business with the Debtors undoubtedly will be aware of the Debtors’ status as debtors in possession. In the absence of such relief, the Debtors’ estates will be required to bear a potentially significant expense that the Debtors respectfully submit is unwarranted.

33. Once the Debtors’ existing checks have been used, the Debtors will, when reordering checks, ensure that the designation “Debtor in Possession” and the corresponding bankruptcy case number will be printed on all checks. With respect to electronic checks and checks that the Debtors or their agents print themselves, the Debtors will begin printing the “Debtor in Possession” legend on such items within ten days of the date of entry of the interim order approving the relief requested herein. In other cases, courts in this district have allowed debtors to use their prepetition business forms without the “debtors in possession” label with similar conditions. See, e.g., In re Bonanza Creek Energy, Inc., Case No. 17-10015 (KJC) (Bankr. D. Del. Jan. 30, 2017); In re Basic Energy Servs., Inc., Case No. 16-12320 (KJC) (Bankr. D. Del. Dec. 8, 2016); In re Key Energy Servs., Inc., Case No. 16-12306 (BLS) (Bankr. D. Del. Nov. 14, 2016); In re Parallel Energy LP, Case No. 15-12263 (KG) (Bankr. D. Del. Dec. 22, 2015); In re New Gulf Res., LLC, Case No. 15-12566 (BLS) (Bankr. D. Del. Dec. 18, 2015); In re Santa Fe Gold Corp., Case No. 15-11761 (MFW) (Bankr. D. Del. Aug. 27, 2015); In re EveryWare Global, Inc., Case No. 15-10743 (LSS) (Bankr. D. Del. Apr. 9, 2015).

34. If the Debtors are not permitted to maintain and use the Bank Accounts and continue to use their existing Business Forms as set forth herein, the resulting prejudice will include (a) disruption of the ordinary financial affairs and business operations of the Debtors, (b) delay in the administration of the Debtors’ estates, (c) compromise of the Debtors’ internal controls and accounting system and (d) costs to the Debtors’ estates to set up new systems, open new Bank Accounts and print new Business Forms.

-16-

The Debtors Should Be Authorized To Open and Close Bank Accounts

35. Pursuant to this Motion, the Debtors also seek authorization to implement changes to the Cash Management System in the ordinary course of business, including opening any additional Bank Accounts or closing any existing Bank Account as they may deem necessary and appropriate. The Debtors request that the Court authorize and direct the Banks to honor the Debtors’ requests to close or open, as the case may be, such existing Bank Accounts or additional Bank Accounts; provided, however, that, unless otherwise ordered by the Court, the Debtors shall open any such new Bank Account at a Bank that has executed a Uniform Depository Agreement with the U.S. Trustee or at a Bank willing to immediately execute such an agreement.

36. The Debtors further request that nothing contained in the Proposed Orders granting the relief requested herein shall prevent the Banks from modifying or terminating any Bank Accounts or related services in accordance with the agreements governing such accounts or services.

The Banks Should Be Authorized To Continue To Treat, Service and

Administer the Bank Accounts in the Ordinary Course of Business

Administer the Bank Accounts in the Ordinary Course of Business

37. The Debtors also seek entry of the Proposed Orders granting the Banks authority to continue to treat, service and administer the Bank Accounts as accounts of the respective Debtor as a debtor in possession without interruption and in the ordinary course of business, and to receive, process, honor and pay any and all post-petition checks, drafts, wires or automated clearinghouse transfers (collectively, “ACH Transfers”) drawn on the Bank Accounts by the holders or makers thereof, as the case may be, to the extent that the Debtors have sufficient funds standing to their credit with such Bank.

38. The Debtors request that the Banks (a) be authorized and directed to accept and honor all representations from the Debtors as to which checks, drafts, wires or ACH Transfers should be honored or dishonored, consistent with any order of the Court and governing law, whether such

-17-

checks, drafts, wires or ACH Transfers are dated prior to, on or subsequent to the Petition Date, and whether the Banks believe that the payment is or is not authorized by an order of the Court and (b) have no duty to inquire as to whether such payments are authorized by an order of the Court. Pursuant to the relief requested in this Motion, the Debtors request that the Banks shall not be liable to any party on account of (x) following the Debtors’ instructions or representations as to any order of the Court, (y) the honoring of any prepetition check or item in a good faith belief that the Court has authorized such prepetition check or item to be honored or (z) an innocent mistake made despite implementation of reasonable item handling procedures.

39. The Debtors also request that, in accordance with current practice and any applicable agreement governing the Bank Accounts, the Banks be authorized to “charge back” to the Debtors’ Bank Accounts any amounts incurred by the Banks resulting from returned checks or other returned items, and the Debtors be authorized, but not directed, to pay, in their sole discretion, any fees and expenses owed to the Banks (and the Banks be authorized to debit or charge back to the Bank Accounts for any such fees and expenses unless notified by the Debtors that any such fees or expenses are disputed), in each case, regardless of whether such items were deposited prepetition or post-petition or relate to prepetition or post-petition items.

40. The Debtors further request that any payment from a Bank Account at the request of the Debtors made by a Bank prior to the Petition Date (including any ACH Transfer such Bank is or becomes obligated to settle), or any instruments issued by such Bank on behalf of any Debtor pursuant to a “midnight deadline” or otherwise, be deemed to be paid prepetition regardless of whether or not actually debited from such Bank Account prepetition.

-18-

The Deposit and Investment Requirements of Section 345(b) of the

Bankruptcy Code Should Be Waived on an Interim Basis

Bankruptcy Code Should Be Waived on an Interim Basis

41. Section 345 of the Bankruptcy Code governs a debtor’s deposit and investment of cash during a chapter 11 case and authorizes deposits or investments of money as “will yield the maximum reasonable net return on such money, taking into account the safety of such deposit or investment.” 11 U.S.C. § 345(a). For deposits or investments that are not “insured or guaranteed by the United States or by a department, agency or instrumentality of the United States or backed by the full faith and credit of the United States,” section 345(b) of the Bankruptcy Code requires the estate to obtain, from the entity with which the money is deposited or invested, a bond in favor of the United States and secured by the undertaking of an adequate corporate surety, unless the court, for cause, orders otherwise.

42. Pursuant to Local Rule 2015-2(b), and subject to certain exceptions not relevant here, a waiver of the requirements set forth in section 345(b) of the Bankruptcy Code may not be granted without notice and a hearing. However, Local Rule 2015-2(b) provides that “if a motion for such a waiver is filed on the first day of a chapter 11 case in which there are more than 200 creditors, the Court may grant an interim waiver until a hearing on the debtor’s motion can be held.” Del. Bankr. L.R. 2015-2(b).

43. Here, the Debtors satisfy both the procedural and substantive requirements necessary to obtain an interim waiver of section 345(b) of the Bankruptcy Code. The Debtors have filed this Motion on the first day of the Chapter 11 Cases and the Debtors, collectively, have more than 200 creditors. Accordingly, the Debtors’ present request for an interim waiver is appropriate.

44. The Debtors submit that cause exists to waive the investment and deposit restrictions of section 345(b) of the Bankruptcy Code on an interim basis, as set forth in the Proposed Order, to the extent that the Debtors’ cash management deposits do not comply. The Banks at which the Debtors

-19-

maintain Bank Accounts are financially stable banking institutions and are FDIC insured (up to an applicable unit per account). Because the Debtors do not and do not plan to have any investments other than cash, the Debtors do not believe that any additional guaranties or sureties are necessary.

45. Courts in other large chapter 11 cases in this district have regularly granted such an interim waiver under similar circumstances. See, e.g., In re Bonanza Creek Energy, Inc., Case No. 17-10015 (KJC) (Bankr. D. Del. Jan. 30, 2017); In re Key Energy Servs., Inc., Case No. 16-12306 (BLS) (Bankr. D. Del. Oct. 25, 2016); In re Seventy Seven Fin. Inc., Case No.

16-11409 (LSS) (Bankr. D. Del. June 8, 2016); In re New Gulf Res., LLC, Case No. 15-12566 (BLS) (Bankr. D. Del. Dec. 18, 2015); In re Haggen Holdings, LLC, Case No. 15-11874 (KG) (Bankr. D. Del. Sep. 10, 2015); In re The Standard Register Co., Case No. 15-10541 (BLS) (Bankr. D. Del. Mar. 13, 2015).

16-11409 (LSS) (Bankr. D. Del. June 8, 2016); In re New Gulf Res., LLC, Case No. 15-12566 (BLS) (Bankr. D. Del. Dec. 18, 2015); In re Haggen Holdings, LLC, Case No. 15-11874 (KG) (Bankr. D. Del. Sep. 10, 2015); In re The Standard Register Co., Case No. 15-10541 (BLS) (Bankr. D. Del. Mar. 13, 2015).

Necessity for Immediate Relief

46. Bankruptcy Rule 6003 provides that “[e]xcept to the extent that relief is necessary to avoid immediate and irreparable harm, the court shall not, within 21 days after the filing of the petition, issue an order granting ...(b) a motion to use, sell, lease, or otherwise incur an obligation regarding property of the estate, including a motion to pay all or part of a claim that arose before the filing of the petition ....” Fed. R. Bankr. P. 6003. If the Debtors are not permitted to continue their ordinary business operations by continuing to use their Cash Management System, the Credit Card Program and Business Forms in their current form, the Debtors could suffer immediate and irreparable harm. Accordingly, the Debtors respectfully submit that, because of the reasons set forth herein, Bankruptcy Rule 6003 has been satisfied.

Debtors’ Reservation of Rights

47. Nothing contained herein is intended or should be construed as or deemed to constitute an agreement or admission as to the validity of any claim against the Debtors on any grounds, a waiver

-20-

or impairment of the Debtors’ rights to dispute any claim on any grounds or assumption or rejection of any agreement, contract or lease under section 365 of the Bankruptcy Code. The Debtors expressly reserve their rights to contest any claims related to their Cash Management System. Likewise, if the Court grants the relief sought herein, any payment made pursuant to the Court’s order is not intended and should not be construed as an admission as to the validity of any claim or a waiver of the Debtors’ rights to dispute such claim subsequently.

Waiver of Stay Under Bankruptcy Rule 6004(h)

48. The Debtors also request that, to the extent applicable to the relief requested in this Motion, the Court waive the stay imposed by Bankruptcy Rule 6004(h), which provides that “[a]n order authorizing the use, sale, or lease of property other than cash collateral is stayed until the expiration of 14 days after entry of the order, unless the court orders otherwise.” Fed. R. Bankr. P. 6004(h). As described above, the relief that the Debtors seek in this Motion is necessary for the Debtors to operate their businesses without interruption and to preserve value for their estates. Accordingly, the Debtors respectfully request that the Court waive the 14-day stay imposed by Bankruptcy Rule 6004(h), as the exigent nature of the relief sought herein justifies immediate relief.

Notice

49. Notice of this Motion will be provided to (a) the U.S. Trustee, (b) each of the Debtors’ 20 largest unsecured creditors on a consolidated basis, (c) each of the Debtors’ 20 largest unsecured creditors on a consolidated basis, (c) Brown Rudnick LLP, as counsel to (i) that certain ad hoc consortium of (x) holders of 5.00% convertible senior subordinated notes due 2019 issued by TerraVia pursuant to that certain Indenture, dated as of April 1, 2014, between TerraVia and GLAS Trust Company LLC (“GLAS”), as successor trustee to Wells Fargo and (y) holders of 6.00% convertible senior subordinated notes due 2018 issued by TerraVia pursuant to that certain Indenture, dated as of January 24, 2013, between TerraVia and Wilmington Trust, N.A. (“Wilmington”), as successor trustee

-21-

to Wells Fargo, (ii) the lenders under the Debtors’ post-petition debtor-in-possession financing facility (the “DIP Facility”) and (iii) Wilmington Savings Fund Society, FSB, the administrative agent under the DIP Facility (the “DIP Agent”), (d) Seward & Kissel LLP, as counsel to GLAS, (e) Katten Muchin Rosenman LLP, as counsel to Wilmington, (f) Winston & Strawn LLP, as counsel to the DIP Agent, (g) Baker & McKenzie LLP and Whiteford Taylor Preston, LLP, as counsel to Corbion N.V., the proposed stalking horse bidder to purchase certain assets of the Debtors, (h) the Securities and Exchange Commission, (i) the Internal Revenue Service, (j) the United States Attorney’s Office for the District of Delaware and (k) each of the Banks listed on Exhibit A (collectively, the “Notice Parties”).

50. Notice of this Motion and any order entered hereon will be served on all parties required by Local Rule 9013-1(m). A copy of this Motion and any order approving it will also be made available on the Debtors’ case information website located at http://www.kccllc.net/TerraVia. Based on the urgency of the circumstances surrounding this Motion and the nature of the relief requested herein, the Debtors respectfully submit that no further notice is required.

No Prior Request

51. The Debtors have not previously sought the relief requested herein from the Court or any other court.

WHEREFORE, the Debtors respectfully request that the Court enter the Proposed Orders, substantially in the forms attached hereto as Exhibit C and Exhibit D, respectively, granting the relief requested herein and such other and further relief as the Court deems just and proper.

Dated: | August 2, 2017 Wilmington, Delaware |

-22-

Respectfully submitted, RICHARDS, LAYTON & FINGER, P.A. /s/ Mark D. Collins Mark D. Collins (No. 2981) Amanda R. Steele (No. 5530) One Rodney Square 920 North King Street Wilmington, Delaware 19801 Tel.: (302) 651-7700 Fax: (302) 651-7701 collins@rlf.com steele@rlf.com -and- DAVIS POLK & WARDWELL LLP | |

Damian S. Schaible (pro hac vice pending) Steven Z. Szanzer (pro hac vice pending) Adam L. Shpeen (pro hac vice pending) 450 Lexington Avenue New York, New York 10017 Tel.: (212) 450-4000 Fax: (212) 701-5800 damian.schaible@davispolk.com steven.szanzer@davispolk.com adam.shpeen@davispolk.com Proposed Counsel to the Debtors and Debtors in Possession | |

-23-

Exhibit A

The Bank Accounts

Bank Accounts

DEBTOR | FINANCIAL INSTITUTION | ACCOUNT NUMBER | ACCOUNT DESCRIPTION |

TerraVia Holdings, Inc. | Wells Fargo Bank, National Association 420 Montgomery Street San Francisco, CA 94014 | ******6219 | Operating Account |

TerraVia Holdings, Inc. | Wells Fargo Bank, National Association 420 Montgomery Street San Francisco, CA 94014 | ******9115 | Multi-Currency Euro Account |

TerraVia Holdings, Inc. | Wells Fargo Bank, National Association 420 Montgomery Street San Francisco, CA 94014 | ******8171 | Inactive Account |

TerraVia Holdings, Inc. | Wells Fargo Bank, National Association IRT – Minneapolis 550 S. 4th Street MAC N9310-084 Minneapolis, MN 55415 | ****0500 | Money Market Account |

TerraVia Holdings, Inc. | Silicon Valley Bank 3003 Tasman Drive Santa Clara, CA 95054 | ******3608 | Restricted Cash Account |

TerraVia Holdings, Inc. | Silicon Valley Bank 3003 Tasman Drive Santa Clara, CA 95054 | ******3635 | Unrestricted Cash Account |

Exhibit B

Schematic Diagram of Cash Management System

Exhibit C

Proposed Interim Order

IN THE UNITED STATES BANKRUPTCY COURT

FOR THE DISTRICT OF DELAWARE

FOR THE DISTRICT OF DELAWARE

_________________________________________ | ||||

In re: TERRAVIA HOLDINGS, INC., et al., Debtors. | ) ) ) ) ) ) ) | Chapter 11 Case No. 17-__________ (___) Jointly Administered | ||

_________________________________________ ) | ||||

INTERIM ORDER AUTHORIZING (I) THE DEBTORS TO CONTINUE TO MAINTAIN EXISTING CASH MANAGEMENT SYSTEM, BANK ACCOUNTS, CREDIT CARD PROGRAM AND BUSINESS FORMS AND (II) FINANCIAL INSTITUTIONS TO HONOR AND PROCESS RELATED CHECKS AND TRANSFERS

Upon the motion (the “Motion”) of TerraVia Holdings, Inc. (formerly known as Solazyme, Inc.) and certain of its subsidiaries that are debtors and debtors in possession in the Chapter 11 Cases (collectively, the “Debtors”) for entry of interim and final orders, pursuant to sections 105(a), 345 and 363(c)(1) of the Bankruptcy Code, (i) authorizing, but not directing, the Debtors to (a) continue to use their Cash Management System, (b) maintain, open and close Bank Accounts, (c) maintain the Credit Card Program and (d) maintain the Business Forms and (ii) waiving the requirements of section 345(b) of the Bankruptcy Code, in each case, on an interim basis and as more fully described in the Motion; and the Court having jurisdiction to consider the matters raised in the Motion pursuant to 28 U.S.C. § 1334 and the Amended Standing Order of Reference from the United States District Court for the District of Delaware, dated February 29, 2012; and the Court having authority to hear the matters raised in the Motion pursuant to 28 U.S.C. § 157; and the Court having venue pursuant to 28 U.S.C. §§ 1408 and

1409; and consideration of the Motion and the requested relief being a core proceeding that the Court can determine pursuant to 28 U.S.C. § 157(b)(2); and due and proper notice of the Motion and opportunity for a hearing on the Motion having been given to the parties listed therein, and it appearing that no other or further notice need be provided; and the Court having reviewed and considered the Motion and the Painter Declaration; and the Court having held an interim hearing on the Motion (the “Interim Hearing”); and the Court having determined that the legal and factual bases set forth in the Motion and at the Interim Hearing establish just cause for the relief granted herein; and the Court having found that the relief requested in the Motion is in the best interests of the Debtors, their creditors, their estates and all other parties in interest; and upon all of the proceedings had before the Court; and after due deliberation and sufficient cause appearing therefor,

IT IS HEREBY ORDERED THAT:

-2-

1.The relief requested in the Motion is hereby granted on an interim basis as set forth herein.

2.The Debtors are authorized, but not directed, pursuant to sections 105(a) and 363(c)(1) of the Bankruptcy Code, to continue, in their sole discretion, to maintain, operate and make transfers under their Cash Management System as described in the Motion.

3.The Debtors shall maintain full, accurate and complete records of all transfers within the Cash Management System at least to the same extent as they were recorded by the Debtors before the Petition Date in order to reconcile net amounts that may become due from one Debtor to another Debtor or non-Debtor affiliate in respect to cash disbursements or transfers made between them or for their benefit from and after the Petition Date. A Debtor that is owed money from another Debtor on account of cash disbursements or transfers made from and after the Petition Date shall have an administrative claim against any other Debtor or non-Debtor affiliate in respect to any such post-petition disbursement or transfer.

4.The Debtors are authorized, but not directed, to continue, in their sole discretion, to maintain the Bank Accounts with the same account numbers following the commencement of the Chapter 11 Cases.

5.The Banks are authorized and directed to (a) continue to treat, service and administer the Bank Accounts, as accounts of the respective Debtor as a debtor in possession, without interruption and in the ordinary course of business and (b) receive, process, honor and pay any and all post-petition checks, drafts, wires or ACH Transfers drawn on the Bank Accounts by the holders or makers thereof, as the case may be, to the extent that the Debtors have sufficient funds standing to their credit with such Bank.

-3-

6.The Banks (a) are authorized and directed to accept and honor all representations from the Debtors as to which checks, drafts, wires or ACH Transfers should be honored or dishonored, consistent with any order of the Court and governing law, whether such checks, drafts, wires or ACH Transfers are dated prior to, on or subsequent to the Petition Date, and whether the Banks believe that the payment is or is not authorized by an order of the Court and (b) have no duty to inquire as to whether such payments are authorized by an order of the Court.

7.The Banks shall not be liable to any party on account of (a) following the Debtors’ instructions or representations as to any order of the Court, (b) the honoring of any prepetition check or item in a good faith belief that the Court has authorized such prepetition check or item to be honored or (c) an innocent mistake made despite implementation of reasonable item handling procedures.

8.In accordance with current practice and any applicable agreement governing the Bank Accounts, the Banks are authorized to “charge back” to the Bank Accounts any amounts incurred by the Banks resulting from returned checks or other returned items, and the Debtors are authorized, but not directed, in their sole discretion, to pay any fees and expenses owed to the Banks (and the Banks are authorized to debit or charge back the Bank Accounts for any such fees and expenses unless notified by the Debtors that any such fees or expenses are disputed), in each case regardless of whether such items were deposited prepetition or post-petition or relate to prepetition or post-petition items.

9.Any payment from a Bank Account at the request of the Debtors made by a Bank prior to the Petition Date (including any ACH Transfer such Bank is or becomes obligated to settle), or any instruments issued by such Bank on behalf of any Debtor pursuant to a “midnight

-4-

deadline” or otherwise, shall be deemed to be paid prepetition, regardless of whether or not actually debited from such Bank Account prepetition.

10.The Debtors are authorized, but not directed, in their sole discretion, to implement changes to the Cash Management System in the ordinary course of business, including opening any additional Bank Accounts or closing any existing Bank Account, as they may deem necessary and appropriate, upon notice to and with the prior consent of the DIP Agent (at the direction of the Required DIP Lenders), which consent shall not be unreasonably withheld (each as defined in the DIP Order (as defined below)).

11.The Banks are authorized and directed to honor the Debtors’ requests (which shall be in compliance with the foregoing Paragraph 10) to close or open, as the case may be, existing Bank Accounts or additional Bank Accounts, the Debtors shall give notice to the U.S. Trustee and any statutory committee appointed in the Chapter 11 Cases within 14 days of opening a new Bank Account or closing an existing Bank Account; provided, however, that, unless otherwise ordered by the Court, the Debtors shall open any new Bank Account at a Bank that has executed a Uniform Depository Agreement with the U.S. Trustee or at a Bank willing to immediately execute such an agreement.

12.For Banks that have not signed a Uniform Depository Agreement with the U.S. Trustee, the Debtors shall have 45 days from the Petition Date (the “Extension Period”) within which to comply with section 345(b) of the Bankruptcy Code or to make arrangements (subject to Paragraph 10 hereof) to which the U.S. Trustee agrees, and such extension is without prejudice to the Debtors’ right to request a further extension of the Extension Period or waiver of the requirements of section 345(b) of the Bankruptcy Code in the Chapter 11 Cases. For Banks that

-5-

have signed a Uniform Depository Agreement with the U.S. Trustee, all Bank Accounts with such Banks are deemed to satisfy section 345(b) of the Bankruptcy Code.

13.Within 14 days of the date of entry of this Order, with respect to Banks that are party to a Uniform Depository Agreement with the U.S. Trustee, the Debtors shall (a) contact each Bank, (b) provide the Bank with each of the Debtors’ tax identification numbers and (c) identify each of their Bank Accounts held at such Bank as being held by a debtor in possession in a bankruptcy case.

14.Within 30 days of the date of entry of this Order, with respect to Banks that are not party to a Uniform Depository Agreement with the U.S. Trustee, the Debtors shall send the Banks a Uniform Depository Agreement in a form prescribed by the U.S. Trustee and request that the Banks execute said Uniform Depository Agreement. The U.S. Trustee’s rights to seek relief from the Court on notice in the event that the aforementioned Banks are unwilling to execute a Uniform Depository Agreement in a form prescribed by the U.S. Trustee are fully reserved.

15.Nothing contained herein shall prevent the Banks from modifying or terminating any Bank Accounts or related services in accordance with the agreements governing such accounts or services.

16.The Debtors, in their sole discretion, are authorized, but not directed, to continue to use the Business Forms substantially in the forms existing immediately before the Petition Date, without reference to their status as debtors in possession; provided, that once the Debtors’ existing checks have been used, the Debtors will, when reordering checks, ensure that the designation “Debtor in Possession” and the corresponding bankruptcy case number be printed on all checks; provided further that, with respect to electronic checks and checks that the Debtors or

-6-

their agents print themselves, the Debtors will begin printing the “Debtor in Possession” legend on such items within ten days of the date of entry of this Order.

17.Notwithstanding anything contained herein, despite the Debtors’ use of a consolidated cash management system, the Debtors shall calculate their quarterly fees under 28 U.S.C. § 1930(a)(6) based on disbursements of each Debtor, regardless of which Debtor pays those disbursements.

18.The Debtors, in their sole discretion, are authorized, but not directed, to maintain and continue to use their Credit Card Program consistent with its terms, including the payment of any obligations thereunder whether arising on, before or after the Petition Date.

19.A final hearing to consider the relief requested in the Motion shall be held on, ________________, 2017 at _______ (Prevailing Eastern Time) and any objections or responses to the Motion shall be filed and served on the Notice Parties so as to be actually received on or prior to ___________________, 2017 at 4:00 p.m. (Prevailing Eastern Time).

20.Nothing in this Order or any action taken by the Debtors in furtherance of the implementation hereof shall be construed as or deemed to constitute an assumption or rejection of any agreement, contract or lease under section 365 of the Bankruptcy Code, and all of the Debtors’ rights with respect to such matters are expressly reserved.

21.Notwithstanding the relief granted herein and any actions taken hereunder, nothing contained herein shall (a) create, nor is it intended to create, any rights in favor of, or enhance the status of any claim held by, any person or entity or (b) be deemed to convert the priority of any claim from a prepetition claim into an administrative expense claim.

22.Nothing in this Order nor the Debtors’ payment of claims pursuant to this Order shall be construed as or deemed to constitute (a) an agreement or admission by the Debtors as to

-7-

the validity of any claim against the Debtors on any grounds, (b) a waiver or impairment of the Debtors’ rights to dispute any claim on any grounds, (c) a promise by the Debtors to pay any claim or (d) an implication or admission by the Debtors that such claim is payable pursuant to this Order.

23.Notwithstanding anything to the contrary in this Order, in the event of any inconsistency between the terms of this Order and the terms of any order of this Court approving the debtor-in-possession financing facility and use of cash collateral (the “DIP Order”), the terms of the DIP Order shall govern.

24.For the reasons set forth on the Motion, Bankruptcy Rule 6003 has been satisfied.

25.Any Bankruptcy Rule (including, but not limited to, Bankruptcy Rule 6004(h)) or Local Rule that might otherwise delay the effectiveness of this Order is hereby waived, and the terms and conditions of this Order shall be effective and enforceable immediately upon its entry.

26.The Debtors are authorized to take all such actions as are necessary or appropriate to implement the terms of this Order.

27.Proper, timely, adequate and sufficient notice of the Motion has been provided in accordance with and satisfaction of the Bankruptcy Code, Bankruptcy Rules and the Local Rules, and no other or further notice of the Motion or the entry of this Order shall be required.

28.The Court shall retain exclusive jurisdiction to hear and determine all matters arising from or related to the implementation, interpretation and enforcement of this Order.

Dated: | ___________________, 2017 Wilmington, Delaware |

-8-

UNITED STATES BANKRUPTCY JUDGE |

-9-

Exhibit D

Proposed Final Order

IN THE UNITED STATES BANKRUPTCY COURT

FOR THE DISTRICT OF DELAWARE

FOR THE DISTRICT OF DELAWARE

In re: TERRAVIA HOLDINGS, INC., et al., Debtors. | Chapter 11 Case No. 17-__________ (___) Jointly Administered | |

FINAL ORDER AUTHORIZING (I) THE DEBTORS TO CONTINUE TO MAINTAIN EXISTING CASH MANAGEMENT SYSTEM, BANK ACCOUNTS, CREDIT CARD PROGRAM AND BUSINESS FORMS AND (II) FINANCIAL INSTITUTIONS

TO HONOR AND PROCESS RELATED CHECKS AND TRANSFERS

TO HONOR AND PROCESS RELATED CHECKS AND TRANSFERS

Upon the motion (the “Motion”) of TerraVia Holdings, Inc. (formerly known as Solazyme, Inc.) and certain of its subsidiaries that are debtors and debtors in possession in the Chapter 11 Cases (collectively, the “Debtors”) for entry of interim and final orders, pursuant to sections 105(a), 345 and 363(c)(1) of the Bankruptcy Code, (i) authorizing, but not directing, the Debtors to (a) continue to use their Cash Management System, (b) maintain, open and close the Bank Accounts, (c) maintain the Credit Card Program and (d) maintain the Business Forms and (ii) waiving the requirements of section 345(b) of the Bankruptcy Code, in each case, as more fully described in the Motion; and the Court having jurisdiction to consider the matters raised in the Motion pursuant to 28 U.S.C. § 1334 and the Amended Standing Order of Reference from the United States District Court for the District of Delaware, dated February 29, 2012; and the Court having authority to hear the matters raised in the Motion pursuant to 28 U.S.C. § 157; and the Court having venue pursuant to 28 U.S.C. §§ 1408 and 1409; and consideration of the Motion and the requested relief being a core proceeding that the Court can determine pursuant to

28 U.S.C. § 157(b)(2); and due and proper notice of the Motion and opportunity for a hearing on the Motion having been given to the parties listed therein, and it appearing that no other or further notice need be provided; and the Court having reviewed and considered the Motion and the Painter Declaration; and the Court having held an interim hearing on the Motion; and the Court having granted interim relief on the Motion on __________________ , 2017 (D.I. [•]); [and the Court having held a final hearing on the Motion (the “Final Hearing”);] and the Court having determined that the legal and factual bases set forth in the Motion [and at the Final Hearing] establish just cause for the relief granted herein; and the Court having found that the relief requested in the Motion is in the best interests of the Debtors, their creditors, their estates and all other parties in interest; and upon all of the proceedings had before the Court; and after due deliberation and sufficient cause appearing therefor,

IT IS HEREBY ORDERED THAT:

-2-

1. The relief requested in the Motion is hereby granted as set forth herein.

2. The Debtors, in their sole discretion, are authorized, but not directed, pursuant to sections 105(a) and 363(c)(1) of the Bankruptcy Code, to continue to maintain, operate and make transfers under their Cash Management System as described in the Motion.

3. The Debtors shall maintain full, accurate and complete records of all transfers within the Cash Management System at least to the same extent as they were recorded by the Debtors before the Petition Date in order to reconcile net amounts that may become due from one Debtor to another Debtor or non-Debtor affiliate in respect to cash disbursements or transfers made between them or for their benefit from and after the Petition Date. A Debtor that is owed money from another Debtor on account of cash disbursements or transfers made from and after the Petition Date shall have an administrative claim against any other Debtor or non-Debtor affiliate in respect to any such post-petition disbursement or transfer.

4. The Debtors, in their sole discretion, are authorized, but not directed, to continue to maintain the Bank Accounts with the same account numbers following the commencement of the Chapter 11 Cases.

5. The Banks are authorized and directed to (a) continue to treat, service and administer the Bank Accounts, as accounts of the respective Debtor as a debtor in possession, without interruption and in the ordinary course of business and (b) receive, process, honor and pay any and all post-petition checks, drafts, wires or ACH Transfers drawn on the Bank Accounts by the holders or makers thereof, as the case may be, to the extent that the Debtors have sufficient funds standing to their credit with such Bank.

6. The Banks (a) are authorized and directed to accept and honor all representations from the Debtors as to which checks, drafts, wires or ACH Transfers should be honored or

-3-

dishonored, consistent with any order of the Court and governing law, whether such checks, drafts, wires or ACH Transfers are dated prior to, on or subsequent to the Petition Date, and whether the Banks believe that the payment is or is not authorized by an order of the Court and (b) have no duty to inquire as to whether such payments are authorized by an order of the Court.

7. The Banks shall not be liable to any party on account of (a) following the Debtors’ instructions or representations as to any order of the Court, (b) the honoring of any prepetition check or item in a good faith belief that the Court has authorized such prepetition check or item to be honored or (c) an innocent mistake made despite implementation of reasonable item handling procedures.

8. In accordance with current practice and any applicable agreement governing the Bank Accounts, the Banks are authorized to “charge back” to the Bank Account any amounts incurred by the Banks resulting from returned checks or other returned items, and the Debtors are authorized, but not directed, in their sole discretion, to pay any fees and expenses owed to the Banks (and the Banks are authorized to debit or charge back the Bank Accounts for any such fees and expenses unless notified by the Debtors that any such fees or expenses are disputed), in each case regardless of whether such items were deposited prepetition or post-petition or relate to prepetition or post-petition items.

9. Any payment from a Bank Account at the request of the Debtors made by a Bank prior to the Petition Date (including any ACH Transfer such Bank is or becomes obligated to settle), or any instruments issued by such Bank on behalf of any Debtor pursuant to a “midnight deadline” or otherwise, shall be deemed to be paid prepetition, regardless of whether or not actually debited from such Bank Account prepetition.

-4-

10. The Debtors are authorized, but not directed, in their sole discretion, to implement changes to the Cash Management System in the ordinary course of business, including opening any additional Bank Accounts or closing any existing Bank Account, as they may deem necessary and appropriate, upon notice to and with the prior consent of the DIP Agent (at the direction of the Required DIP Lenders), which consent shall not be unreasonably withheld (each as defined in the DIP Order (as defined below)).

11. The Banks are authorized and directed to honor the Debtors’ requests (which shall be in compliance with the foregoing Paragraph 10) to close or open, as the case may be, existing Bank Accounts or additional Bank Accounts, the Debtors shall give notice to the U.S. Trustee and any statutory committee appointed in the Chapter 11 Cases within 14 days of opening a new Bank Account or closing an existing Bank Account; provided, however, that, unless otherwise ordered by the Court, the Debtors shall open any new Bank Account at a Bank that has executed a Uniform Depository Agreement with the U.S. Trustee or at a Bank willing to immediately execute such an agreement.

12. For Banks that have not signed a Uniform Depository Agreement with the U.S. Trustee, the Debtors shall have 45 days from the Petition Date (the “Extension Period”) within which to comply with section 345(b) of the Bankruptcy Code or to make arrangements (subject to Paragraph 10 hereof) to which the U.S. Trustee agrees, and such extension is without prejudice to the Debtors’ right to request a further extension of the Extension Period or waiver of the requirements of section 345(b) of the Bankruptcy Code in the Chapter 11 Cases. For Banks that have signed a Uniform Depository Agreement with the U.S. Trustee, all Bank Accounts with such Banks are deemed to satisfy section 345(b) of the Bankruptcy Code.

-5-

13. Nothing contained herein shall prevent the Banks from modifying or terminating any Bank Accounts or related services in accordance with the agreements governing such accounts or services.

14. The Debtors, in their sole discretion, are authorized, but not directed, to continue to use the Business Forms substantially in the forms existing immediately before the Petition Date, without reference to their status as debtors in possession; provided, that once the Debtors’ existing checks have been used, the Debtors will, when reordering checks, ensure that the designation “Debtor in Possession” and the corresponding bankruptcy case number be printed on all checks.

15. Notwithstanding anything contained herein, despite the Debtors’ use of a consolidated cash management system, the Debtors shall calculate their quarterly fees under 28 U.S.C. § 1930(a)(6) based on disbursements of each Debtor, regardless of which Debtor pays those disbursements.

16. The Debtors are, in their sole discretion, authorized, but not directed, to maintain and continue to use their Credit Card Program consistent with its terms, including the payment of any obligations thereunder whether arising on, before or after the Petition Date.

17. Nothing in this Order or any action taken by the Debtors in furtherance of the implementation hereof shall be construed as or deemed to constitute an assumption or rejection of any agreement, contract or lease under section 365 of the Bankruptcy Code, and all of the Debtors’ rights with respect to such matters are expressly reserved.

18. Notwithstanding the relief granted herein and any actions taken hereunder, nothing contained herein shall (a) create, nor is it intended to create, any rights in favor of, or

-6-

enhance the status of any claim held by, any person or entity or (b) be deemed to convert the priority of any claim from a prepetition claim into an administrative expense claim.

19. Nothing in this Order nor the Debtors’ payment of claims pursuant to this Order shall be construed as or deemed to constitute (a) an agreement or admission by the Debtors as to the validity of any claim against the Debtors on any grounds, (b) a waiver or impairment of any Debtors’ rights to dispute any claims on any grounds, (c) a promise by the Debtors to pay any claim or (d) an implication or admission by the Debtors that such claim is payable pursuant to this Order.

20. Notwithstanding anything to the contrary in this Order, in the event of any inconsistency between the terms of this Order and the terms of any order of this Court approving the debtor-in-possession financing facility and use of cash collateral (the “DIP Order”), the terms of the DIP Order shall govern.

21. For the reasons set forth in the Motion, Bankruptcy Rule 6003 is satisfied.

22. Any Bankruptcy Rule (including, but not limited to, Bankruptcy Rule 6004(h)) or Local Rule that might otherwise delay the effectiveness of this Order is hereby waived, and the terms and conditions of this Order shall be effective and enforceable immediately upon its entry.

23. The Debtors are authorized to take all such actions as are necessary or appropriate to implement the terms of this Order.

24. Proper, timely, adequate and sufficient notice of the Motion has been provided in accordance with and satisfaction of the Bankruptcy Code, Bankruptcy Rules and the Local Rules, and no other or further notice of the Motion or the entry of this Order shall be required.

25. The Court shall retain exclusive jurisdiction to hear and determine all matters arising from or related to the implementation, interpretation and enforcement of this Order.

-7-

Dated: | ___________________, 2017 Wilmington, Delaware |

UNITED STATES BANKRUPTCY JUDGE |

-8-

ORIGINAL

IN THE UNITED STATES BANKRUPTCY COURT

FOR THE DISTRICT OF DELAWARE

FOR THE DISTRICT OF DELAWARE

In re: TERRAVIA HOLDINGS, INC., et al., Debtors. | : : : : : : | Chapter 11 Case No. 17-11655 (CSS) Jointly Administered |

Re: Docket No. 4 | ||

INTERIM ORDER AUTHORIZING (I) THE DEBTORS TO CONTINUE TO MAINTAIN EXISTING CASH MANAGEMENT SYSTEM, BANK ACCOUNTS, CREDIT CARD PROGRAM AND BUSINESS FORMS AND (II) FINANCIAL INSTITUTIONS TO HONOR AND PROCESS RELATED CHECKS AND TRANSFERS

Upon the motion (the “Motion”) of TerraVia Holdings, Inc. (formerly known as Solazyme, Inc.) and certain of its subsidiaries that are debtors and debtors in possession in the Chapter 11 Cases (collectively, the “Debtors”) for entry of interim and final orders, pursuant to sections 105(a), 345 and 363(c)(1) of the Bankruptcy Code, (i) authorizing, but not directing, the Debtors to (a) continue to use their Cash Management System, (b) maintain, open and close Bank Accounts, (c) maintain the Credit Card Program and (d) maintain the Business Forms and (ii) waiving the requirements of section 345(b) of the Bankruptcy Code, in each case, on an interim basis and as more fully described in the Motion; and the Court having jurisdiction to consider the matters raised in the Motion pursuant to 28 U.S.C. § 1334 and the Amended Standing Order of Reference from the United States District Court for the District of Delaware, dated February 29, 2012; and the Court having authority to hear the matters raised in the Motion pursuant to 28 U.S.C. § 157; and the Court having venue pursuant to 28 U.S.C. §§ 1408 and 1409; and consideration of the Motion and the requested relief being a core proceeding that the Court can determine pursuant to 28 U.S.C. § 157(b)(2); and due and proper notice of the Motion and opportunity for a hearing on the Motion having been given to the parties listed therein, and

-9-

it appearing that no other or further notice need be provided; and the Court having reviewed and considered the Motion and the Painter Declaration; and the Court having held an interim hearing on the Motion (the “Interim Hearing”); and the Court having determined that the legal and factual bases set forth in the Motion and at the Interim Hearing establish just cause for the relief granted herein; and the Court having found that the relief requested in the Motion is in the best interests of the Debtors, their creditors, their estates and all other parties in interest; and upon all of the proceedings had before the Court; and after due deliberation and sufficient cause appearing therefor,

IT IS HEREBY ORDERED THAT:

-10-

1. The relief requested in the Motion is hereby granted on an interim basis as set forth herein.

2. The Debtors are authorized, but not directed, pursuant to sections 105(a) and 363(c)(1) of the Bankruptcy Code, to continue, in their sole discretion, to maintain, operate and make transfers under their Cash Management System as described in the Motion..