Attached files

| file | filename |

|---|---|

| EX-12.1 - EXHIBIT 12.1 - TerraVia Holdings, Inc. | solazyme10kex121.htm |

| EX-23.1 - EXHIBIT 23.1 - TerraVia Holdings, Inc. | solazyme10kex231.htm |

| EX-21.1 - EXHIBIT 21.1 - TerraVia Holdings, Inc. | solazyme10kex211.htm |

| EX-32.1 - EXHIBIT 32.1 - TerraVia Holdings, Inc. | solazyme10kex321.htm |

| EX-31.2 - EXHIBIT 31.2 - TerraVia Holdings, Inc. | solazyme10kex312.htm |

| EX-10.36 - EXHIBIT 10.36 - TerraVia Holdings, Inc. | ex1036131210coleemployment.htm |

| EX-10.37 - EXHIBIT 10.37 - TerraVia Holdings, Inc. | ex1037141008coleprofession.htm |

| EXCEL - IDEA: XBRL DOCUMENT - TerraVia Holdings, Inc. | Financial_Report.xls |

| EX-31.1 - EXHIBIT 31.1 - TerraVia Holdings, Inc. | solazyme10kex311.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2014

OR

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Transition Period from to

Commission File Number: 001-35189

Solazyme, Inc.

(Exact name of Registrant as specified in its charter)

Delaware | 33-1077078 | |

(State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification Number) | |

Solazyme, Inc.

225 Gateway Boulevard

South San Francisco, CA 94080

(650) 780-4777

(Address and telephone number principal executive offices)

Securities Registered Pursuant to Section 12(b) of the Exchange Act:

Title of Each Class: | Name of Each Exchange on which Registered: | |

Common Stock, par value $0.001 per share | The NASDAQ Global Select Market | |

Securities Registered Pursuant to Section 12(g) of the Exchange Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one.

Large accelerated filer | x | Accelerated filer | ¨ | |||

Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act.): Yes ¨ No x

The aggregate market value of the registrant’s common stock, $0.001 par value, held by non-affiliates of the registrant as of June 30, 2014, the last business day of our second fiscal quarter, was approximately $852.2 million based on the closing sale price as reported on the Nasdaq Global Select Market.

As of February 20, 2015, there were 79,598,087 shares of the registrant’s common stock, par value $0.001 per share, outstanding.

Documents Incorporated by Reference

Portions of the registrant’s definitive proxy statement for its 2015 Annual Meeting of Stockholders are incorporated by reference into Part III hereof.

Solazyme, Inc.

Annual Report on Form 10-K

For The Year Ended December 31, 2014

INDEX

PART I | ||||

Item 1 | — | |||

Item 1A | — | |||

Item 1B | — | |||

Item 2 | — | |||

Item 3 | — | |||

Item 4 | — | |||

PART II | ||||

Item 5 | — | |||

Item 6 | — | |||

Item 7 | — | |||

Item 7A | — | |||

Item 8 | — | |||

Item 9 | — | |||

Item 9A | — | |||

Item 9B | — | |||

PART III | ||||

Item 10 | — | |||

Item 11 | — | |||

Item 12 | — | |||

Item 13 | — | |||

Item 14 | — | |||

PART IV | ||||

Item 15 | — | |||

Our registered trademarks include Solazyme®, Soladiesel®, Soladiesel®BD, Soladiesel®RD, Solajet®, Algenist® and Alguronic Acid®. This Annual Report on Form 10-K also contains trademarks, service marks and trade names owned by us as well as others.

2

The following discussion and analysis should be read together with our audited consolidated financial statements and the related notes and other financial information appearing elsewhere in this Annual Report on Form 10-K. This Annual Report on Form 10-K contains forward-looking statements reflecting our current expectations and involves risks and uncertainties. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “intend,” “potential” or “continue” or the negative of these terms or other comparable terminology. For example, statements regarding our expectations as to future financial performance, expense levels, future manufacturing capacity, addressable market size, target average selling prices and liquidity sources are forward-looking statements. Our actual results and the timing of events may differ materially from those discussed in our forward-looking statements as a result of various factors, including those discussed below and those discussed in the section entitled “Risk Factors” included in this Annual Report on Form 10-K and in our other filings with the Securities and Exchange Commission (SEC).

PART I

Item 1. Business

Our Company

Starting with microalgae, we create new, sustainable, high-performance products. Our proprietary technology uses highly optimized microalgae in an industrial fermentation process to transform a range of abundant plant-based sugars into high-value triglyceride oils and other bioproducts. These include renewable oils and ingredients that serve as the foundation for healthier foods; better home, personal care and industrial products; and more sustainable fuels and chemicals.

Our main commercial focus is to sell high-value oils, encapsulated oils and whole algal powdered products to companies that use them as intermediates and ingredients. We have also built a consumer-focused personal care business that commercializes branded products formulated with our various proprietary ingredients.

Our renewable products can replace or enhance products derived from the world’s three existing sources of oils: petroleum, plants, and animal fats. We tailor the composition of our oils and other bioproducts to address specific customer requirements, offering superior performance characteristics and value via a renewable pathway. For example, our renewable products can replace or improve intermediates and ingredients in major markets served by conventional oils as well as specialty markets. As another example, one of our first powdered food ingredient can replace dairy fats, oils and eggs in food products providing food and beverage customers with an improved nutrition profile, a reduction in allergens, and improved taste and texture.

Our high-value renewable oils can enable our customers to improve product performance, reduce processing costs and/or improve their products’ sustainability profile. In addition, our encapsulated oils can provide a unique delivery mechanism for targeted lubrication, increasing performance, reducing overall costs and improving the environmental footprint. Many of our products are drop-in replacements and can be used in the existing production, refining, finishing and distribution infrastructure in our target markets. Because our products deliver superior value to end customers by addressing real market needs in a novel and relevant way, we anticipate the average selling prices (ASPs) of our products will capture the enhanced value that results from heightened performance.

Market Need

Growing global demand for both triglyceride and petroleum oils coupled with a number of substantive issues are driving the need to find alternative oil sources. Specifically, petroleum is a finite, non-renewable resource that is becoming increasingly difficult to extract, raising local and geopolitical energy security and environmental concerns. Meanwhile, plant-based oils present other challenges, including production and cost variances related to unpredictable weather, and forest and habitat destruction resulting from expanded planting.

Higher industrial output, urbanization, improved living standards, and changing diets are driving increased demand for food, transportation, personal care items, plastics and other oil-based products. The ability to convert carbohydrate-rich plant materials into unique high-value oils and materials offers a potential solution to the growing global demand for oil and oil-based products.

As a result of these market drivers, companies are aggressively seeking new sources of oils that have greater price stability than petroleum and other conventional oils, and are also looking for new sources of oils with improved characteristics versus

3

conventional oils. Finally, initiatives focused on fulfillment of corporate sustainability objectives and government mandates support an increased use of renewable oils.

Despite the growing need to find replacement oils for petroleum based products, market demand for petroleum oils continues to grow. Further, with the advent of horizontal drilling and improved recovery technologies, companies are looking for novel drilling fluids that improve the speed of drilling and reduce downtime from operational issues (e.g. non-productive time from equipment damage) to help facilitate the development of challenging basins economically. As easily accessible resources have become less prevalent, drilling engineers are requiring technology to improve horizontal drilling techniques to efficiently develop unconventional sources of hydrocarbons. Our encapsulated oils provide a solution that can increase the performance, lower costs and reduce the environmental impact in this area.

As more countries adopt a western-style diet, the problems of the obesity epidemic continue to impact the health of many global populations. Faced with increasing pressure to improve the nutritional profile of their products from consumers, governments and activist groups, food and beverage manufacturers are looking for new food ingredient solutions that will better enable reductions in saturated fat, calories, and cholesterol without sacrificing performance, taste, or cost metrics.

The continuous improvement of living standards globally also drives a critical trend toward increased consumption of proteins. Many Western consumers consider protein consumption to be an effective strategy for weight and energy management. The environmental impact of addressing the increased demand for protein is important. Animal-derived proteins have a significant impact on land use, deforestation and greenhouse gas emissions. To address this demand for protein, food and beverage manufacturers are looking for new efficiently-produced, vegan sources of protein.

Our Strategy

We intend to be a global market leader in the design and production of renewable oils and related bioproducts from microalgae. Our products supplement, replace or enhance conventional products derived from petroleum, plant or animal sources. The principal elements of our strategy are:

• | Prioritize market entry based on unit economics and capital requirements. We have been working for years to bring large-scale manufacturing of our products online. In advance of this, we initiated commercialization efforts several years ago by launching low-volume, high-margin personal care products and nutritional ingredients that could be produced on an economically attractive basis via tolled manufacturing. In January 2014, we commenced commercial operations at both Archer Daniels Midland Company's (ADM) Clinton, Iowa facility (Clinton Facility), and the downstream companion facility operated by American Natural Processors, Inc. (ANP) in Galva, Iowa (Clinton/Galva Facilities). In May 2014, our joint venture with Bunge Global Innovation, LLC (together with its affiliates, Bunge) (Solazyme Bunge JV) produced its first run of products at the Solazyme Bunge Renewable Oils plant in Brazil (the Solazyme Bunge JV Plant). We are now expanding commercial production and sales of intermediate and ingredient products across the (1) Industrial Products (2) Food Products, and (3) Personal Care Products markets. We intend to focus first on higher-value specialty products that generate attractive margins in our target markets while we scale operations. |

• | Execute on our customer-driven approach to technology and product development. We focus our innovation efforts on creating a broad suite of high performance products that meet defined market needs. We intend to continue to work closely with our partners and customers to understand their requirements and design products to specifically address their needs. It is our intent to provide both branded and unbranded products to our three primary target markets: (1) Industrial applications including specialty chemicals, fuels, personal care products and branded oilfield drilling lubricant, Encapso™; (2) Food applications including branded protein and lipid powders, AlgaVia™, and food oils; and (3) Consumer Product applications including our branded personal care line, Algenist®, and other products to be developed. |

• | Enter into sales agreements and additional partnership agreements to advance commercialization efforts. We are currently engaged in development activities with multiple partners. In addition to funding development work and performing application testing, we expect that our partners will enter into long-term commercial supply agreements with us. |

• | Execute on our capital-efficient strategy to access feedstock and manufacturing capacity. We expect to scale production in a capital-efficient manner by entering agreements whereby our partners will invest capital and operational resources in building manufacturing capacity, while providing us access to feedstock. By |

4

working with us, we expect that partners can improve the return they realize on their feedstock and diversify their business beyond their current product portfolios, enabling potentially higher margins and reducing price volatility. In addition to our work with existing partners, we are actively evaluating a range of possible new partners and feedstock sources.

Our Technology

We create renewable oils and bioproducts that mirror or enhance the chemical composition of conventional oils used in the marketplace today. Until now, the physical and chemical characteristics of conventional oils have been dictated by oil compositions found in nature. Our platform technology enables us to design and produce a variety of novel Tailored™ oils that cannot be achieved through blending of existing oils alone. Additionally, with our screening and fermentation capabilities, we are able to identify native microalgae strains and produce them efficiently at scale. Through our ability to tailor the composition of our products or expand the production of native microalgae strains, we can create first of kind products that exhibit unique benefits not available in the marketplace today.

Our technology platform combines a highly efficient and productive oil-producing organism, microalgae, for the creation of oils with scalable and cost-effective standard industrial fermentation processes in order to deliver high value, cost effective, Tailored™ oils and materials.

Our ability to tailor the composition and properties of oil is based on our unique and proprietary technology and instructed by a deep understanding of triglyceride chemistry. The functionality of oils that are formulated into everyday products is derived from differences in the chemistry of triglycerides.

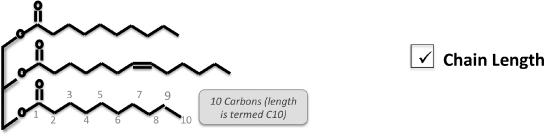

Triglyceride molecules are comprised of three fatty acids attached to a glycerol backbone.

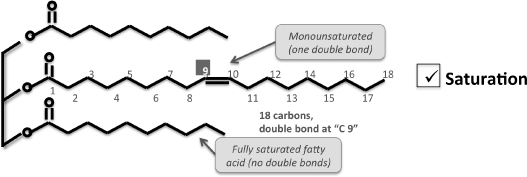

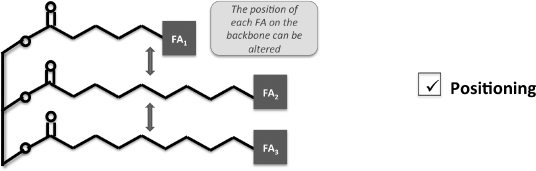

We have pioneered an industrial biotechnology platform that allows us to optimize oil profiles by tailoring the structures of the oil molecules. First, we can specify the carbon chain lengths of the fatty acid chains. Second, we can alter the saturation level of a fatty acid chain, which refers to the existence, or lack thereof, and number of double bonds between carbon molecules within the chain. Third, we can determine the position of specific fatty acid chains on the glycerol backbone. In addition, we can add specific functional groups, such as hydroxyl groups, to the fatty acid chains, which further alters the performance characteristics of the triglyceride oils.

5

In this diagram, the three fatty acid chains are shown extending from the glycerol backbone of a triglyceride molecule. Our proprietary technology allows us to alter the number of carbons in each fatty acid chain.

This diagram demonstrates the use of our technology to alter the saturation levels within the fatty acid chains. Saturation is a critical determinant of many of the physical properties of oils.

This diagram demonstrates the use of our technology to change the position of the fatty acids on the glycerol backbone, which also affects the physical characteristics of the oil.

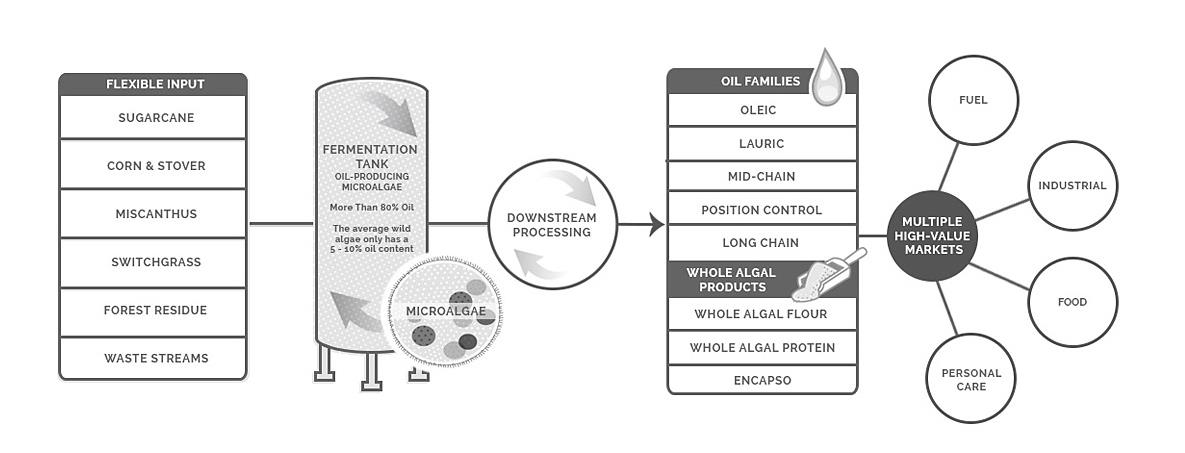

Microalgae have long been recognized as organisms capable of rapid and efficient oil production under certain conditions. Oleaginous microalgae evolved over billions of years, synthesizing large amounts of oil rapidly when exposed to the right environment. Our proprietary microalgae are heterotrophic. They grow without the need for sunlight by consuming sugars derived from plants that have already harnessed the sun’s energy. Our process is therefore a form of “indirect photosynthesis.” When grown in the absence of light, our microalgae are highly efficient at converting the sun’s energy embedded within the plant sugars (feedstocks) into valuable end products.

Our proprietary, highly productive microalgae produce and accumulate oil that routinely constitutes over 80% of the dry cell weight. Typical wild microalgae, in contrast, usually have only 5-20% oil content. We produce three main product types: products where the oil is retained within the polysaccharide cell walls (our Encapso™ and AlgaVia™ product lines exhibit these characteristics); oils that are extracted from the microalgae cell to produce oils; and residual materials remaining after oil is extracted from the microalgae cells. These residual materials, Algal Meal Products (AMPs), are being commercialized in a range of product applications that use the protein, fiber and other compounds found in the cell wall and algal bodies of the microalgae.

6

We rely on multiple microalgae strains including: 1) natural, 2) classically improved, and 3) targeted recombinant strains. The key components of our industrial biotechnology platform are strain screening, classical strain improvement, strain optimization through targeted gene recombination, fermentation process development, and downstream process development. Our selection process is iterative; as strains progress through classical strain improvement and targeted recombinant strain optimization they feed back into the strain screening program, re-emerging for additional rounds of strain improvement, strain optimization, and process development.

Our Biotechnology Platform

Our process begins by selecting one of our microalgae strains to produce a specific oil or whole algal product. Then, through industrial fermentation, the microalgae convert sugars into the desired end product. Fermentation helps accelerate microalgae’s natural biological process, allowing us to produce large amounts of a desired product in a matter of days. After fermentation, the microalgae go through a few final steps depending on the product, such as drying or standard mechanical oil extraction, before being shipped to customer in a variety of end markets. Our biotechnology platform enables us to produce a broad array of products and oil profiles with the same infrastructure.

Our platform is feedstock flexible and can utilize a variety of renewable plant-based sugars. We currently use sugarcane-based sucrose and corn-based dextrose as our two primary feedstock sources. Our technology can also support sugar from other sustainable biomass sources including cellulosics, which we believe will represent an important alternative feedstock in the future.

The controlled environment of the standard industrial fermentation tanks minimizes contamination and allows us to tightly regulate acidity, temperature and other key parameters. Our core competencies include (1) identifying, isolating and further optimizing strains of microalgae to achieve high cell densities, high yields converting sugar to product and high time-based productivity rates compared to other alternatives, and (2) tailoring the oil outputs to meet specific market needs.

Some of our oils and all of our AlgaViaTM whole algal products, AlgaViaTM Lipid Powder and AlgaViaTM Protein, are currently made from native microalgae strains as well as our current Encapso™ products. These native strains are selected through a rigorous screening process in which we look at thousands of microalgae, seeking properties that translate into product benefits for our customers.

Sometimes our customers request specific oils that cannot be efficiently produced by native algae strains. In this case, we seek to optimize a strain to provide significant product performance benefits - for example, oil with a higher flash point to improve the safety of lubricants or a more sustainable and healthier alternative to palm oil.

When we use traditional genetic engineering techniques, we begin with a native strain or one selected through classical strain improvement. To make the desired oil profile, we introduce one or sometimes a few genes from a plant with desired properties, or make only modest changes to the microalgae’s existing genes, for example, shutting off production of an undesired oil component. Those products made using traditional genetic engineering techniques include: high stability high oleic and lauric oils.

7

We believe that the following advantages of our platform allow us to offer a new source of high-value Tailored™ oils, encapsulated oils, and powdered products to address the major markets served by conventional oils:

• | Large and diverse market opportunities. Because we make oils, we can access the vast markets currently served by petroleum, plant oils and animal fats. In addition, we leverage our proprietary biotechnology platform to tailor oils that address specific customer requirements by offering superior performance and sustainability compared to conventional oils. |

• | Cost-competitive at commercial scale. We harness the innate oil-producing characteristics of microalgae through a proven industrial fermentation process in a controlled environment that is able to produce large volumes of oils in a cost-effective, scalable and predictable manner. |

• | Compatible with existing equipment and infrastructure. We use standard industrial fermentation and downstream processing equipment that needs little or no modification. Our oils are compatible with existing production, refining, finishing and distribution infrastructure, logistics channels, and technical specifications, which enables them to be a drop-in replacement for conventional oils. |

• | Rapid time to market. Our tailored-to-specification oils can improve upon triglyceride oils currently used in commerce and can be integrated quickly into our customers’ platforms because they are chemically similar to existing conventional oils. Additionally, if a customer desires a novel oil profile, our development timelines for new profiles can be on a scale of several months to several years as opposed to timelines demonstrated with plant-based oils, which are on the scale of 10-15 years. |

In summary, our innovative industrial biotechnology platform exploits the prolific oil production capabilities of microalgae as a biocatalyst while leveraging standard fermentation processes and existing industrial equipment to transform plant-based sugars and other types of renewable biomass into Tailored™ oils.

Our Products

Our primary products are the targeted outputs from our processes and include Tailored™ and encapsulated oils, powdered products and other bioproducts.

We are commercializing our primary products as either Intermediates/Ingredients that include branded products such as Encapso™, AlgaViaTM Flour and AlgaViaTM Protein, or as Personal Care Products that include branded products such as our Algenist® skin and personal care products.

Our Intermediate/Ingredient products include Tailored™ oils, powdered oils, and other closely related products targeted at customers in the (1) Industrial Products, (2) Food Products and (3) Personal Care Products market. Our technology allows us to devise tailored solutions for our customers ranging from drop-in equivalents for replacement of conventionally-sourced products to novel offerings providing a broad array of value-added benefits.

Within Personal Care Products, we are currently selling our Algenist® skin and personal care line.

Intermediates/Ingredients

We are commercializing two main classes of products: Tailored™ oils and powdered oils. The inherent flexibility of our technology platform and the broad usage of triglyceride oils across multiple industries, allows us to approach a wide range of customers across myriad end markets.

High-value oils include: the Oleic Family that offers high levels of oleic acid and low levels of polyunsaturates and/or saturates, providing benefits such as high lubricity, stability and low volatile organic compound; the Lauric Family that offers innovative compositions of fatty acid chain lengths that are differentiated from palm kernel and coconut oils by specific targeted fatty acids between C10 and C14; the Mid-Chain Family that target optimized levels of C8 (caprylic acid) and C10 (capric acid); Structured Fats that has enabled the production of an algal butter with a structure similar to cocoa butter; and Long Chain Family that includes the current development of highly unique oils with high levels of erucic acid (C22:1) with the benefit of not having to segregate high erucic rapeseed oil from the food supply.

Whole algal products include: AlgaVia Whole Algal Flour that is a lipid rich ingredient that can replace or reduce dairy fat, egg yolks and oil in recipes that reduces fat, cholesterol and calories with the added benefits of texture enhancement, water binding and flavor delivery; AlgaVia Whole Algal Protein that is a vegan protein source that is non-allergenic, gluten-free and

8

a sustainable source of high quality protein; and Encapsulated Oils that is a family of product that offers targeted friction inhibitors, delivering lubrication on demand while providing biodegradability and other environmental benefits.

Industrial Products: Powders and Oils

Powders

Our powdered oils products are an alternative application for our proprietary microalgae, in that the oil is not extracted but retained within the cell wall. We believe our encapsulated lubricants provide a novel application for delivery of oil for use in multiple industrial and commercial markets.

Encapsulated Oils

In 2014, we began selling our intermediate and ingredient products more broadly to customers in the oil field drilling fluids market with the launch of Encapso™. Our initial industrial use for our encapsulated oil technology is as a biodegradable lubricant additive for drilling fluids. In the oil field services market, Encapso™ competes with incumbent drilling lubricants and other specialty lubricants. We believe our product offers superior performance to conventional drilling alternatives available in the marketplace. Laboratory testing has demonstrated equal or improved performance relative to incumbent technologies. These results have been confirmed in field trials, where our Encapso™ product has been associated with operational improvements such as reductions in torque and drag, increases in rates of penetration and drilling speed, and reduction in non-productive time during use in over 37 commercial wells. Encapsulation also uniquely protects the lubricant from negatively affecting fluid dynamics while circulating in the drilling fluid, or “mud” system. And, with environmental concerns regarding the use and disposal of drilling fluids, our Encapso™ product provides a bio-degradable and non-hazardous solution.

Thus far, our Encapso™ product has been used in basins across the United States and Canada, demonstrating benefits, for example, in the Williston Basin, the Western Canadian Sedimentary Basin, the Anadarko/Woodford Basin, and the Permian Basin. We intend to expand sales beyond North America in 2015, including sales to regions and to companies with compelling drilling economics in an environment of lower oil prices. The product has been primarily used in water-based mud systems, which represent approximately 55% of the drilling fluids market, but we are also testing oil-based mud system applications and other applications of the product, as well as testing the use of our encapsulated oil platform in other markets and for other industrial uses.

Oils

Our Tailored™ oils are triglyceride oils that feature prominently in multiple industrial markets. We have several oils in various stages of development that can address one or more end markets. For example, our oleic oils (including high oleic and high stability high oleic) provide sustainable solutions within the food, lubricant, functional fluid and oleochemical markets, offering advantages such as better nutrition, higher lubricity, longer life, and lower levels of volatile organic compounds. Similarly, we are commercializing our renewable, sustainable lauric oils within the home and personal care markets for surfactant and oleochemical use.

We tailor our products to meet industry specifications and unique customer demands, and we believe we will be able to charge premium pricing as a result of the higher performance, higher value products we can deliver. Products derived from our oils also offer drop-in replacements and higher value blendstocks for marine, motor vehicle and jet fuels, as well as replacements for petrochemicals, oleochemicals and functional fluids.

Specialty Chemicals & Personal Care

We believe our renewable oils will become the basis for a next generation of high performance bio-based industrial fluids. Our Tailored™ oils platform enables replacement and enhancement of petroleum, plant, or animal derived oils that are used as raw materials for the chemicals industry. In many cases, we expect to create novel oils and high-performing end products that do not exist in nature or are prohibitively expensive to synthesize. In the industrial fluids markets, we have already developed first-of-a-kind oils and have begun to sell those oils to industrial chemical companies that can either use the oils directly as functional fluids (often including an additive package) or as intermediates to convert into replacements and enhancements for their existing petrochemical and oleochemical products.

For example, within functional fluids, our high stability high oleic oils can replace synthetic petroleum-based lubricants used in machinery and hydraulics, enhancing both performance and reducing environmental impact. In oleochemical applications, our ability to modify oil profiles allows us to make oil that is high in myristic acid, a common ingredient used as

9

an emollient within the home and personal care markets. We are focusing our initial Tailored™ oils for the industrial markets in two distinct target areas:

• | Oleochemicals are chemicals that are derived from natural oils, typically from plant or animal fats. Oleochemicals appear in the industrial, home and personal care industries in applications such as surfactants, detergents, soaps, cosmetics, lubricants and many others. Triglyceride oils derived from plants and animals are processed through a variety of oleochemical manufacturing steps including fatty acid splitting, fatty alcohol production, and esterification. We plan to sell our oils to industry partners that will either incorporate our oils directly, or use them as intermediates/ingredients to replace and/or enhance existing products. |

• | Functional Fluids span a wide range of non-fuel industrial applications such as lubricants, heat transfer fluids, antifreeze, dielectric fluids, defoamers, solvents, and drying agents. Physical properties (e.g., viscosity and pour point), chemical properties (e.g., oxidation and reactivity) and environmental impact (e.g., biodegradability) of the oils tend to be the principal drivers of value in the functional fluid segment. |

We have identified many novel applications for our tailored products that have been validated with our customer and partner relationships. As we ramp up commercial production, we expect to sell our oils into the sample applications listed in the table below, as well as a wide array of other opportunities. We have produced oils suitable for all of these applications, and expect to build on our initial library of oils in the future.

Market Segment | Sample Application | Value Proposition |

Oleochemicals | Surfactants | • Novel surfactants from natural sources • Improved margins to fatty alcohol producers • More valuable fatty acid mix from splitting • Logistically advantaged • Reduced processing steps • Sustainable source of renewable oil |

Bar and Liquid Soaps | • Enhanced bar soap performance (reduced skin sensitivity, enhanced foaming, etc.) • Sustainable source of renewable oil | |

Functional Fluids | Lubricants | • Enhanced lubricity • Enhanced stability • Reduced processing • Meets food-grade standards with performance of mineral oil equivalents • Biodegradable • Sustainable source of renewable oil |

Fuels

Within the fuels market, our renewable oils can be sold as replacements for materials that are traditionally derived from petroleum or other conventional oils, or refined and sold as drop-in replacements for marine, motor vehicle and jet fuels. We can either manufacture the end product by contracting with refiners to produce fuels of targeted specifications, or sell our unrefined oils to refiners. Near term, our focus in fuels is providing oils that will be used as high-value fuel additives and blendstocks, an area which allows us to target attractive selling prices while offering enhanced performance and sustainability to customers. Fuels and additives derived from our oils are compatible with the existing refining and distribution infrastructure, meet industry specifications, and can be used with factory-standard engines without modifications. Our fuels products range from drop-in replacement fuels, such as Soladiesel®BD and Soladiesel®RD for on-road applications and for ultra-low sulfur diesel; and Solajet® for aviation use, to high-value fuel additives and blendstocks.

Food Products - Powdered Ingredients and Food Oils

We believe that some of the largest opportunities and most valuable uses for our oils and powdered ingredients are in food. We have developed and commercialized microalgae-based food ingredients that enhance the nutritional profile and functionality of a wide range of foods and beverages.

10

In 2014, we launched our food ingredients products under the AlgaVia™ brand name. AlgaVia™ Microalgae Food Ingredients are new, healthful and sustainable sources of food with benefits that we believe enhance nutrition, performance and taste. We currently have three commercial food ingredient product lines: lipid powders and proteins (which are powdered ingredients), and high oleic oils (which are food oils). AlgaVia™ Microalgae Food Ingredients are sold to food and beverage manufacturers and foodservice providers through a combination of direct sales, distributors and strategic partnerships.

Powdered Ingredients

We have developed novel methods of preparing powdered forms of triglyceride oils and vegan proteins, and our powdered ingredients are composed of unmodified whole algal cells. AlgaVia™ Lipid Powder (commonly known as whole algal flour) and AlgaVia™ Protein (commonly known as whole algal protein) are whole algae ingredients that improve the nutritional profile of foods and beverages. AlgaVia™ Lipid Powder is a new fat source that allows for the reduction or replacement of dairy fats, oils, and eggs. AlgaVia™ Protein is a new vegan source of protein that is free of gluten and known allergens. Because the protein resides within the algal cell wall, it uniquely enables protein fortification into applications such as low pH beverages where protein fortification is typically difficult. Both AlgaVia™ Lipid Powder and Protein can be used across a range of applications such as beverages (ready-to-drink and powdered), bakery, snacks, bars, dressings, sauces and frozen desserts. We have received an FDA GRAS “No Questions” letter for these ingredients. They may also be sold in other regions/countries including Europe, Mexico, Australia, and New Zealand.

Food Oils

We have developed and continue to market opportunities for a range of food oils that have the potential to improve upon conventionally utilized specialty fats and oils and have received an FDA GRAS "No Questions" letter for high oleic algae oil.

Our first high performance food oil captured the 2014 IFT Food Expo Innovation Award. Our High Stability High Oleic algae oil is extremely stable, with zero trans fats and high levels of healthy Omega-9 (monounsaturated) fatty acids. With very low levels of polyunsaturates, this oil provides exceptional stability in a wide range of applications such as frying, baking, spreads, coatings, sauces, and dressings. Higher stability means lower systems costs overall and greater simplicity. It can enable longer shelf life with fresher tasting products, longer fry life, and less polymerization in frying and baking. High Stability algae oil can also reduce saturated fat and eliminate trans fats in foods, which is a major industry need.

In preparation for a continued expansion of our suite of algae oils in 2015, we successfully conducted pilot trials and produced our Low Saturate High Oleic algae oil at scale. This oil has an extremely low level of saturated fats, which will enable the reduction of saturated fats in food products such as bakery, spreads, sauces, dressings, and meal replacement beverages. We also made significant progress toward developing sustainable alternatives to tropical fats and oils that are currently grown in regions that are under environmental stress from deforestation.

Ingredient Type | Sample Ingredient | Sample End Customer Product |

Food Powders | Lipid Powder | • Bakery • Ice Cream • Sauces/Dressings • Snack Bars • Beverages |

Protein | • Snack Bars • Beverages | |

Food Oils | High Stability High Oleic | • Frying Oils • Bakery • Margarines and Spreads • Spray Coatings • Sauces/Dressings • Retail bottles of oil |

Personal Care Products

We have also developed branded personal care products. This is driven by our view that in certain instances, branded consumer products will drive the highest returns from our unique, high performance intermediates/ingredients. Specifically, there are certain markets in which ingredient adoption timelines and value accrual to brands rather than performance ingredients create a strong incentive to sell branded consumer products.

11

Skin and Personal Care

We have developed a portfolio of innovative and branded microalgae-based products. During our algal strain screening process, we discovered and isolated key compounds that microalgae synthesize to protect themselves against environmental hazards, such as UV exposure, changes in extremes of temperature, and dehydration. Our first major ingredient is Alguronic Acid®, which we have formulated into a full range of skin care products with significant anti-aging benefits. For example, since 2011, we have commercialized our Algenist® anti-aging skin care line, which is available at Sephora S.A. and its affiliates (Sephora), QVC, Inc., SpaceNK Limited, select Nordstrom stores and ULTA Beauty. We have seen success in expanding our international distribution of Algenist® products and are currently selling in 21 countries including member countries of the EU, Mexico, Canada and China. In 2013, we further leveraged our innovative ingredient research and expertise by broadening the Algenist® line to include products that use Microalgae Oil as a replacement for the essential oils currently used in skin care products. Some of our key Algenist® products are outlined in the table below.

Representative Algenist® Products | ||

Product | Description | |

| Concentrated Reconstructing Serum | An anti-aging serum formulated with high concentrations of Alguronic Acid®. |

| Complete Eye Renewal Balm | An eye cream formulated with Alguronic Acid®, vitamin C, and caffeine, as well as cucumber, aloe and green tea extracts. |

| Firming & Lifting Cream | An anti-aging moisturizing cream formulated with Alguronic Acid®. |

| Advanced Anti-Aging Repairing Oil | A face oil formulation containing Microalgae Oil. |

| Genius Cream | This moisturizer cream combines Alguronic Acid® and Microalgae Oil, as well as a plant-based collagen. |

Our Competitive Strengths

We harness the power of microalgae to yield substantial volumes of renewable oils and other bioproducts. Our key competitive advantages are:

• | Proprietary and innovative technology. Our technology platform creates a new paradigm that enables us to produce novel Tailored™ oils that cannot be achieved through blending of existing conventional oils alone. We have made significant investments to protect the intellectual property and know-how related to our technology platform, including screening, classical strain development, targeted recombinant strain optimization, product and applications development and manufacturing capabilities. |

• | Premium pricing for tailored products. While our cost structure allows us to access existing markets at prevailing prices, we also believe that the enhanced value of our Tailored™ oils as compared to conventional oils should garner premium pricing. In industrial applications, our oils provide unique performance properties including enhanced lubricity, viscosity, pour point, and oxidative stability. Examples in food applications include oils with low levels of polyunsaturates for improved shelf and frying life and structuring fats, like algae-based butter, providing specific melting profiles. |

12

• | Technology proven at scale. We have been operating our large-scale fermentations at multiple partner facilities since 2008 in 75,000-liter vessels and in our integrated biorefinery in Peoria, Illinois since 2012 in 125,000-liter vessels. In 2012, we completed our first fermentations at the Clinton Facility in approximately 500,000-liter vessels. We have exhibited linear scalability of our process from laboratory scale and in January 2014 we announced that we had commenced commercial-scale production at the Clinton Facility. We perform some of the downstream processing of products from the Clinton Facility at the facility of ANP in Galva, Iowa. Oils from the Clinton/Galva Facilities are now being sold domestically and internationally and are being shipped to Brazil for market development activity. |

• | Capital efficient access to manufacturing capacity. In structuring our capacity and feedstock partnerships, we have deployed a capital efficient strategy to source low-cost financing with our partners. For example, for our joint venture with Bunge Global Innovation, LLC in Brazil, over $100 million of capital expenditure related to investments for the Solazyme Bunge JV Plant was approved for financing through an 8-year loan from the Brazilian Development Bank (BNDES) at an average interest rate of approximately 4% per annum. For the Clinton/Galva Facilities, we partnered with ADM and ANP to retrofit part of their respective existing manufacturing facilities, avoiding significant capital outlay associated with purchasing and installing commercial scale fermentation and downstream processing equipment. |

• | Commercial products today. We have launched our Algenist® brand within the Personal Care Products market. The Algenist® product line has grown to 34 SKUs with a number of additional product launches planned for 2015. The Algenist® product line has consistently shown strong growth since launch with 2014 sales up 23% year over year. We commenced commercial scale production of our renewable, tailored products manufactured at the Clinton/Galva Facilities in January 2014 and at the Solazyme Bunge JV Plant in May 2014. |

• | Feedstock and target market flexibility. Our technology platform provides us with the flexibility to choose from among multiple feedstocks on the input side and multiple specific products (and markets) on the output side, while using the same standard industrial fermentation equipment. A manufacturing facility utilizing a given plant-based sugar feedstock can produce oils with many different oil compositions. Conversely, we can produce the same oil compositions by processing a variety of plant-based sugar feedstock. This flexibility enables us to choose the optimal feedstock for any particular geography, while also enabling us to produce a variety of oils from the same manufacturing facility. |

Manufacturing Operations

Our process is compatible with commercial-scale, widely-available fermentation and oil recovery equipment. We operate our lab and pilot fermentation and recovery equipment as scaled-down versions of our large commercial engineering designs, such as those used to perform development work under certain agreements with strategic partners and to fulfill commercial supply agreements with certain partners. This allows us to more easily scale up to larger fermentation vessels. We have scaled up our technology platform and have successfully operated at lab (5-15 liter), pilot (600-1,000 liter), demonstration (120,000 liter) and commercial (approximately 500,000 liter and above) fermenter scale. The fermentation equipment used to achieve commercial scale at the Clinton Facility is comparable to the fermentation equipment at the Solazyme Bunge JV Plant in Brazil. Our existing manufacturing operations are as follows:

• | Our pilot plant in South San Francisco, California, with recovery operations capable of handling material from both 600 and 1,000 liter fermenters, enables us to produce samples of our algal oils for testing and optimization by our partners, as well as to test new process conditions at an intermediate scale. |

• | In 2012, we announced successful commissioning of our first fully integrated biorefinery (IBR) at our Peoria, Illinois facility (Peoria Facility), to produce algal oil. The IBR was partially funded with a federal grant that we received from the U.S. Department of Energy (DOE) in December 2009 to demonstrate integrated commercial-scale production of renewable algae-derived fuels. The Peoria Facility has a nameplate capacity of two million liters of oil annually and provides an important platform for continued work on feedstock flexibility and scaling of new algal oils into the marketplace. We have also modified our Peoria Facility to produce food ingredients in conjunction with market development activity. In January 2014, we commenced commercial operations at the Clinton/Galva Facilities in Iowa. The Clinton Facility uses corn sugars as a feedstock and currently has an initial target nameplate capacity of 20,000 MT per year of algal triglyceride oil products, which we are targeting to attain as we refocus the Clinton Facility on higher margin products such as Encapso™ and otherwise balance production with operating expenses. We have the |

13

option to expand the capacity to 40,000 MT per year with the potential to further expand production to 100,000 MT per year.

• | In May 2014, the Solazyme Bunge JV Plant produced its first products on full-scale production lines, including 625,000 liter fermenter tanks. The Solazyme Bunge JV Plant leverages our technology and Bunge’s sugarcane milling and natural oil processing capabilities to produce microalgae-based products. In addition, the Solazyme Bunge JV Plant has been designed to be expanded for further production in line with market demand. The facility was constructed as part of our Joint Venture with Bunge, and was financed with equal equity contributions by both Bunge and us and over $100 million in project financing from BNDES. |

• | We utilize contract manufacturing to assist in the production and sale of our Algenist® products, and we closely monitor and advise these contract manufacturers to maintain stringent quality standards for our products. We also produce some active ingredients for Solazyme Personal Care Products at our Peoria Facility. |

Intellectual Property

Our success depends in part upon our ability to obtain and maintain intellectual property protection for our products and technologies, and to operate without infringing the proprietary rights of others. With respect to the former, our policy is to protect our proprietary position through filing for patent applications on inventions, filing for trademark protection on our product names and related materials and methods, and through trade secret protection when and where appropriate. We seek to avoid infringing the proprietary rights of others by: (1) monitoring patents and publications in our product areas; (2) monitoring the technological developments of others; and (3) evaluating and taking appropriate courses of action whenever we identify such developments.

As of December 31, 2014, we own 37 issued U.S. patents, 33 issued foreign patents and over 225 pending patent applications filed in the United States and in various foreign jurisdictions. The expiration dates of the patents are between 2023 and 2029. Patents that issue, if any, from our currently pending patent applications will expire between 2026 and 2032, twenty years from the date of filing. Our patents and patent applications claim and are directed to compositions such as custom oils, fuel products, chemicals, food products, cosmetics, strains of microbes, and gene sequences; methods of manufacturing finished goods and raw materials; and methods of using our raw materials and products. We also protect our proprietary information by requiring our employees, consultants, contractors and other advisors to execute nondisclosure and assignment of invention agreements upon commencement of their respective employments or engagements. Agreements with our employees also prohibit them from bringing the proprietary rights of third parties to us. In addition, we protect our proprietary information through creating written obligations of confidentiality with outside parties who are exposed to confidential information. Where appropriate we also employ material transfer agreements governing the use, intellectual property rights, and transfer of materials such as custom oils when sending them to third parties for purposes such as conversion into fuels, chemicals and personal care products.

We believe that the creation, when possible and appropriate, of multiple, overlapping mechanisms and forms of protection will offer the possibility of broadest and longest proprietary positions for our products and technologies. It is possible that our current and future patents may be successfully challenged or invalidated in whole or in part. It is also possible that we may not obtain issued patents from our filed applications, and may not be able to obtain patents covering other inventions we seek to protect. Due to uncertainties inherent in prosecuting patent applications, some patent applications may be rejected and we may subsequently abandon them. We may also abandon applications when we determine that a product or method is no longer of interest. It is also possible that we may develop products or technologies that will not be patentable or that the patents of others will limit or preclude our ability to do business. In addition, any patent issued to us may provide us with little or no competitive advantage, in which case we may abandon such patent or license it to another entity.

Government Regulation

Our development and production processes involve the use, generation, handling, storage, transportation and disposal of hazardous chemicals and radioactive and biological materials. We are subject to a variety of environmental, health and safety, federal, state, local and international laws, regulations and permit requirements governing, among other matters, the use, generation, manufacture, transportation, storage, handling and disposal of these materials, in the US, Brazil and other countries where we intend to operate or may operate or sell our products in the future. These laws, regulations and permits can cause delays, require expensive fees, pollution control equipment, capital expenditures or operational changes to limit actual or potential impact of our operations on the environment.

14

We are also subject to regulation by the Occupational Safety and Health Administration (OSHA), the California and federal Environmental Protection Agency (EPA), and to regulation under the Toxic Substance Control Act (TSCA). OSHA, the California or federal EPA or other government agencies may adopt regulations that affect our research and development programs. In particular, our renewable chemical products may be subject to regulation by government agencies in our target markets. The EPA administers the requirements of the TSCA, which regulates the commercial use of chemicals. Before an entity can manufacture a chemical, it needs to determine whether that chemical is listed in the TSCA inventory. If the substance is listed, then manufacture can commence immediately. If not, then a pre-manufacture notice (PMN) must be filed with the EPA, which has 90 days to review it. Some of the products we produce or plan to produce are on the TSCA inventory, after successful PMN submissions and Notice of Commencements (NOC) filed. Others are not yet listed. A similar program exists under the European Chemicals Agency (ECHA) called REACH. Under REACH, we are required to register some of our products with the ECHA, and this process could cause delays or involve significant costs.

The use of recombinant microbes like many of our microbial strains is subject to laws and regulations in many countries. In the US, the EPA regulates the commercial use of recombinant microbes as well as potential products from recombinant microbes. When used in an industrial process, our microalgae strains designed using recombinant technology may be considered new chemicals under TSCA, administered by the EPA. We will be required to comply with the EPA’s Microbial Commercial Activity Notice (MCAN) process and have filed MCANs for strains of recombinant microalgae that we use for our chemicals and fuels businesses, which have been dropped from review. We have subsequently filed NOCs for dropped MCANs allowing commercial use. In Brazil, engineered microbes are regulated by CTNBio. We have filed an application, and in the future may file additional applications, for approval from CTNBio to import and use engineered microbes in our Brazilian facilities for research and development purposes. In addition, we received commercial approval from CTNBio for one of our current microbial strains in October 2013. We expect to encounter regulations concerning engineered microbes in most if not all of the countries in which we may seek to make our fuel and chemical products, however, the scope and nature of these regulations will likely be different from country to country. In February 2014, CTNBio granted a CQB (Certificate of Quality in Biosafety) to the Solazyme Bunge JV Plant for activities including industrial production, import and export, disposal and storage of our key production organisms, allowing the Solazyme Bunge JV Plant to run strains without prior commercial approval, under controlled conditions.

Our fuel products are subject to regulation by various government agencies, including the EPA and the California Air Resources Board in the US and Agencia Nacional do Petroleo in Brazil. We have registered fuels with the EPA and are preparing to secure approval for use of our diesel in Brazil. In addition, we may decide to register our fuel with the California Air Resources Board and the European Commission. Registration with each of these bodies is required for the sale and use of our fuels within their respective jurisdictions. Our jet fuels meet the standards set by ASTM D7566 and may therefore be used in commercial aviation.

The manufacture, sale and use of our foods products are regulated as food ingredients in the United States by the U.S Food and Drug Administration (FDA) under the federal Food, Drug, and Cosmetic Act. Food ingredients are broadly defined as any substance that may become a component, or otherwise affect the characteristics, of food. Food ingredients are regulated as food additives and must be approved through a formal Food Additive Petition (FAP) process or affirmed as substances generally recognized as safe, or GRAS. A substance can be listed or affirmed as GRAS by the FDA or self-affirmed by its manufacturer upon determination by independent qualified experts who generally agree that the substance is GRAS for a particular use. Although the FDA does not officially affirm the GRAS status of ingredients, it does review, at the notifier’s request, the notifier’s determination of ingredients’ GRAS status. FDA endeavors to respond to GRAS notices by issuing a letter that either does not question the basis of the notifier’s determination of GRAS status or concludes that the notice does not provide a sufficient basis for a GRAS determination. Self-affirmation of GRAS status without FDA notification allows the marketing and sale of the ingredient, but reliance on self-affirmation alone may limit its marketability, as many food manufacturers require that the FDA issue a letter confirming that it does not question the notifier’s determination of GRAS status before such manufacturers will purchase food ingredients from third parties. We submitted a GRAS Notice to the FDA for our first algal oil in June 2011, and received a “No Questions” letter from the FDA in June 2012. A panel of qualified experts in the field of food toxicology has determined that an additional oleic algal oil, our second algal oil, is GRAS. We submitted a GRAS Notice for the oleic algal oil in July 2014, and received a “No Questions” letter from the FDA in February 2015. We submitted a GRAS Notice for whole algal flour in the third quarter of 2012 and received a “No Questions” letter from the FDA in June 2013. We also submitted a GRAS Notice for whole algal protein in June 2014 and received a “No Questions” letter from the FDA in December 2014.

Food ingredients that are not suitable for the GRAS affirmation process are regulated as food additives and require the submission of a FAP to the FDA and the FDA’s approval prior to commercialization. The food additive petition process is generally expensive and time consuming, with approval, if secured, taking years. The petition must establish with reasonable

15

certainty that the food additive is safe for its intended use at the level specified in the petition. If a food additive petition is submitted, the FDA may choose to reject the petition or deny any desired labeling claims. Furthermore, the FDA may require the establishment of regulations that necessitate costly and time-consuming compliance procedures. All products may also fall under the jurisdiction of the U.S. Department of Agriculture if the intended applications are for meat, dairy, organic or other specialty food areas.

The sale of ingredients for use in animal feed is regulated by agencies including the FDA Center for Veterinary Medicine, or CVM. CVM requirements for suitability must be met by providing data form studies.

Countries other than the U.S. also regulate the manufacture and sale of food ingredients. Regulations vary substantially from country to country, and we will be required to comply with applicable regulations in each country in which we choose to market our food ingredients. In February 2014, the Sao Paulo State Environmental Department granted a license to operate the Solazyme Bunge JV Plant, which was necessary to begin commercial production. We submitted a dossier for oleic algal oil to the Brazilian food safety agency ANVISA in the first quarter of 2014, and anticipate approval for use in foods by the second quarter of 2015.

Our skin and personal care products are also subject to regulation by various government agencies in the countries in which our products are sold. We completed several rounds of testing in connection with launching the Algenist® product line, including Human Repeat Insult Patch Testing. We will continue to evaluate regulatory requirements as we launch new skin and personal care products.

Employees

As of December 31, 2014, we had 266 full-time employees, excluding the employees of our joint venture. Our employees’ roles include research, process development, manufacturing, regulatory affairs, program management, finance, human resources, administration, sales and marketing and business development. None of our employees are covered by collective bargaining agreements and we consider relations with our employees to be good.

Investor Information

Our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, current reports on Form 8-K and any amendments to those reports are available free of charge on the Investor Relations section of our website at http://investors.solazyme.com/sec.cfm as soon as reasonably practicable after they are electronically filed with or furnished to the Securities and Exchange Commission (SEC). The public may read and copy any materials filed us with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Room 1580, Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC at http://www.sec.gov. Except as expressly set forth in this Annual Report on Form 10-K, the contents of these websites are not incorporated into, or otherwise to be regarded as part of this report.

Item 1A. | Risk Factors. |

You should carefully consider the risks and uncertainties described below before investing in our publicly-traded securities. Additional risks and uncertainties not presently known to us or that our management currently deems immaterial also may impair our business operations. If any of the risks described below were to occur, our business, financial condition, operating results, and cash flows could be materially adversely affected. In such an event, the trading price of our common stock could decline and you could lose all or part of your investment. In assessing these risks and uncertainties, you should also refer to the other information contained in this Report, including our consolidated financial statements and related notes. The risks and uncertainties discussed below also include forward-looking statements, and our actual results may differ substantially from those discussed in these forward-looking statements. See Management’s Discussion and Analysis of Financial Condition and Results of Operations-Forward-Looking Statements.

Risks Related to Our Business and Industry

We have a limited operating history and have incurred significant losses to date, anticipate continuing to incur losses and may never achieve or sustain profitability.

We are an early stage company with a limited operating history. We only recently began commercializing our products. To date, a substantial portion of our revenues has consisted of funding from third party collaborative research agreements and government grants. We have generated only limited revenues from commercial sales, which have been principally derived from

16

sales of our personal care products. Although we expect a significant portion of our future revenues to come from commercial sales in the food ingredients, fuels and chemicals and oil field services markets, only a small portion of our revenues to date has been generated from those markets.

We have incurred substantial net losses since our inception, including a net loss of $162.1 million during the year ended December 31, 2014. We expect these losses may continue as we ramp up our manufacturing capacity and build out our product pipeline. As of December 31, 2014, we had an accumulated deficit of $468.5 million. We expect to incur additional costs and expenses related to the continued development and expansion of our business, including research and development, the operation of our Peoria Facility, the ramp up and operation of the Solazyme Bunge JV production facility (described below), the ramp up and operation of the Clinton/Galva Facilities (as described below) and other commercial facilities. As a result, our annual and quarterly operating losses may continue.

We, along with our development and commercialization partners, will need to develop products successfully, cost effectively produce them in large quantities, and market and sell them profitably. If we fail to become profitable, or if we are unable to fund our continuing losses, we may be unable to continue our business operations. There can be no assurance that we will ever achieve or sustain profitability.

We have generated limited revenues from the sale of our products, and our business may fail if we are not able to successfully commercialize these products.

We have had only limited product sales to date. If we are not successful in further advancing our existing commercial arrangements with strategic partners, developing new arrangements, ramping up or otherwise increasing our manufacturing capacity and securing reliable access to sufficient volumes of low-cost feedstock, we will be unable to generate meaningful revenues from our products. We are subject to the substantial risk of failure facing businesses seeking to develop products based on a new technology.

Certain factors that could, alone or in combination, prevent us from successfully commercializing our products include:

• | our ability to secure reliable access to sufficient volumes of low-cost feedstock; |

• | our ability to achieve commercial-scale production of our products on a cost-effective basis and in a timely manner; |

• | technical or operational challenges with our manufacturing processes or with development of new products that we are not able to overcome; |

• | our ability to consistently manufacture our products within specifications; |

• | our ability to establish and maintain successful relationships with development, feedstock, manufacturing and commercialization partners; |

• | our ability to gain market acceptance of our products with customers and maintain customer relationships; |

• | our ability to sell our products at an acceptable price; |

• | our ability to manage our growth; |

• | our ability to meet applicable regulatory requirements for the production, distribution and sale of our products and to comply with applicable laws and regulations; |

• | actions of direct and indirect competitors that may seek to enter the markets in which we expect to compete or that may seek to impose barriers to one or more markets that we intend to target; and |

• | public concerns about the ethical, legal, environmental and social ramifications of the use of targeted recombinant technology, land use and the potential diversion of resources from food production. |

The production of our microalgae-based products requires fermentable feedstock. The inability to obtain feedstock in sufficient quantities or in a timely and cost-effective manner may limit our ability to produce our products.

A critical component of the production of our microalgae-based products is access to feedstock in sufficient quantities and at an acceptable price to enable commercial production and sale. Other than as described below, we currently purchase feedstock, such as sugarcane-based sucrose and corn-based dextrose, for the production of our products at prevailing market prices. We are currently in discussions with additional potential feedstock partners.

17

We do not have any long-term supply agreements or other guaranteed access to feedstock other than (i) for the supply of feedstock to Solazyme Bunge Produtos Renováveis Ltda. (“Solazyme Bunge Renewable Oils” or the “Solazyme Bunge JV”) by our partner, Bunge Global Innovation, LLC and certain of its affiliates (“Bunge”), pursuant to our joint venture arrangement that includes a feedstock supply agreement, and (ii) pursuant to our strategic collaboration with Archer-Daniels-Midland Company (“ADM”) (“Solazyme/ADM Collaboration”) at the ADM facility in Clinton, Iowa (“Clinton Facility”). As we scale our production, we anticipate that the production of our microalgae-based products will require large volumes of feedstock, and we may not be able to contract with feedstock producers to secure sufficient quantities of feedstock at reasonable costs or at all. For example, corn-based dextrose feedstock for the Clinton Facility is being provided from ADM’s adjacent wet mill and sugarcane-based sucrose for the Solazyme Bunge JV facility in Moema, Brazil is being provided by Bunge. Corn and sugar are traded as commodities and are subject to price volatility. While we may seek to manage our exposure to fluctuations in the price of sugar and corn-based dextrose by entering into hedging transactions directly or through our joint venture or collaboration arrangements, we may not be successful in doing so. If we cannot access feedstock in the quantities we need at acceptable prices, we may not be able to successfully commercialize our food ingredients, fuels, chemicals, encapsulated lubricant and other products, and our business will suffer. We are currently in discussions with additional potential feedstock partners, but we cannot be sure that we will successfully execute additional long-term feedstock contracts on terms favorable to us, or at all. If we do not succeed in entering into long-term supply contracts or successfully hedge against our exposure to fluctuations in the price of feedstock, our costs and profit margins may fluctuate from period to period as we will remain subject to prevailing market prices.

Although our plan is to enter into partnerships, such as the Solazyme Bunge JV and the Solazyme/ADM Collaboration, with feedstock providers to supply the feedstock necessary to produce our products, we cannot predict the future availability or price of such feedstock or be sure that our feedstock partners will be able to supply such feedstock in sufficient quantities or in a timely manner. The prices of feedstock depend on numerous factors outside of our or our partners’ control, including weather conditions, government programs and regulations, changes in global demand, rising or falling commodities and equities markets, and availability of credit to producers. Crop yields and sugar content depend on weather conditions such as rainfall and temperature. Variable weather conditions have historically caused volatility in feedstock crop prices due to crop failures or reduced harvests. For example, excessive rainfall can adversely affect the supply of feedstock available for the production of our products by reducing the sucrose content of feedstock and limiting growers’ ability to harvest. Crop disease and pestilence can also occur from time to time and can adversely affect feedstock crop growth, potentially rendering useless or unusable all or a substantial portion of affected harvests. The limited amount of time during which feedstock crops keep their sugar content after harvest poses a risk of spoilage. Also, the fact that many feedstock crops are not themselves traded commodities limits our ability to substitute supply in the event of such an occurrence. If our ability to obtain feedstock crops is adversely affected by these or other conditions, our ability to produce our products will be impaired, and our business will be adversely affected. In the near term we believe Brazilian sugarcane-based sucrose will be an important feedstock for us. Along with the risks described above, Brazilian sugarcane prices may also increase due to, among other things, changes in the criteria set by the Conselho dos Produtores de Cana, Açúcar e Álcool (Council of Sugarcane, Sugar and Ethanol Producers), known as Consecana. Consecana is an industry association of producers of sugarcane, sugar and ethanol that sets market terms and prices for general supply, lease and partnership agreements and may change such prices and terms from time to time. Moreover, Brazil has a developed industry for producing ethanol from sugarcane, and if we have manufacturing operations in Brazil that do not have a partner providing the sugarcane feedstock, such as Bunge as part of the Solazyme Bunge JV, we will need to compete for sugarcane feedstock with ethanol producers. Such changes and competition could result in higher sugarcane prices and/or a significant decrease in the volume of sugarcane available for the production of our products, which could adversely affect our business and results of operations.

We have entered into, and plan to enter into other, arrangements with feedstock producers to co-locate production at their existing mills, and if we are not able to complete and execute on these arrangements in a timely manner and on terms favorable to us, our business will be adversely affected.

In April 2012, we entered into a Joint Venture Agreement with Bunge, forming the Solazyme Bunge JV, which is doing business as Solazyme Bunge Renewable Oils. The Joint Venture Agreement was amended in October 2013 to expand the field and product portfolio. The Solazyme Bunge JV produces microalgae-based products in Brazil using our proprietary technology and sugarcane feedstock provided by Bunge. The Solazyme Bunge JV’s production facility is located adjacent to a sugarcane processing mill in Brazil that is owned by Bunge. The acquisition of the facility site by the Solazyme Bunge JV from Bunge is in process, is complex, is subject to multiple approvals from governmental authorities and will take time to complete. The construction of the Solazyme Bunge JV’s production facility began in June 2012, and the first commercial product from the Solazyme Bunge JV production facility was produced in the second quarter of 2014. Manufacturing operations and processes continue to be optimized as the facility is ramped up. In addition, in May 2011, we entered a joint development agreement with Bunge that, among other things, advanced our work on Brazilian sugarcane feedstocks and extended through September 2014.

18

In May 2011, we entered into a Warrant Agreement, amended in August 2011, with Bunge Limited a portion of which vested upon the successful completion of milestones that targeted the completion of construction of the Solazyme Bunge JV facility with a targeted nameplate capacity of 100,000 metric tons (“MT”) of output oil. We intend to continue to expand our manufacturing capacity by entering into additional agreements with feedstock producers that require them to invest some or all of the capital needed to build new production facilities to produce our products. In return, we expect to share in profits anticipated to be realized from the sale of these products. We are currently in discussions with additional potential feedstock and manufacturing partners.