Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - ZHEN DING RESOURCES INC. | ex32_2.htm |

| EX-32.1 - EXHIBIT 32.1 - ZHEN DING RESOURCES INC. | ex32_1.htm |

| EX-31.2 - EXHIBIT 31.2 - ZHEN DING RESOURCES INC. | ex31_2.htm |

| EX-31.1 - EXHIBIT 31.1 - ZHEN DING RESOURCES INC. | ex31_1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-Q

(Mark One)

|

☒

|

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|||||||||||||||||||

|

For the quarterly period ended

|

June 30, 2017

|

|||||||||||||||||||

|

or

|

||||||||||||||||||||

|

☐

|

TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|||||||||||||||||||

|

For the transition period from

|

to

|

|||||||||||||||||||

|

Commission File Number

|

333-188152

|

|||||||||||||||||||

|

ZHEN DING RESOURCES INC.

|

||||||||||||||||||||

|

(Exact name of registrant as specified in its charter)

|

||||||||||||||||||||

|

Delaware

|

11-335926

|

|||||||||||||||||||

|

(State or other jurisdiction of incorporation or organization)

|

(IRS Employer Identification No.)

|

|||||||||||||||||||

|

Suite 205, 353 St. Nicolas, Montreal, Quebec, Canada

|

H2Y 2P1

|

|||||||||||||||||||

|

(Address of principal executive offices)

|

(Zip Code)

|

|||||||||||||||||||

|

438-882-4148

|

||||||||||||||||||||

|

(Registrant’s telephone number, including area code)

|

||||||||||||||||||||

|

N/A

|

||||||||||||||||||||

|

(Former name, former address and former fiscal year, if changed since last report)

|

||||||||||||||||||||

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

|

||||||||||||||||||||

|

☒

|

YES

|

☐

|

NO

|

|||||||||||||||||

|

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

|

||||||||||||||||||||

|

☒

|

YES

|

☐

|

NO

|

|||||||||||||||||

|

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a small reporting company or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

||||||||||||||||||||

|

Large accelerated filer

|

☐

|

Accelerated filer

|

☐

|

|||||||||||||||||

|

Non-accelerated filer

|

☐

|

(Do not check if a smaller reporting company)

|

Smaller reporting company

|

☒

|

||||||||||||||||

|

Emerging growth company

|

☒

|

|||||||||||||||||||

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

||||||||||||||||||||

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act)

|

||||||||||||||||||||

|

☐

|

YES

|

☒

|

NO

|

|||||||||||||||||

|

APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY

PROCEEDINGS DURING THE PRECEDING FIVE YEARS Check whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Exchange Act after the distribution of securities under a plan confirmed by a court.

|

||||||||||||||||||||

|

☐

|

YES

|

☐

|

NO

|

|||||||||||||||||

|

APPLICABLE ONLY TO CORPORATE ISSUERS

|

||||||||||||||||||||

|

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

|

||||||||||||||||||||

|

63,968,798 common shares issued and outstanding as of August 11, 2017

|

||||||||||||||||||||

ZHEN DING RESOURCES INC.

FORM 10-Q

Contents

|

PART I - FINANCIAL INFORMATION

|

1

|

||

|

Item 1.

|

1

|

||

|

Item 2.

|

11

|

||

|

Item 3.

|

18

|

||

|

Item 4.

|

18

|

||

|

PART II - OTHER INFORMATION

|

18

|

||

|

Item 1.

|

18

|

||

|

Item 1A.

|

18

|

||

|

Item 2.

|

18

|

||

|

Item 3.

|

18

|

||

|

Item 4.

|

18

|

||

|

Item 5.

|

19

|

||

|

Item 6.

|

19

|

||

|

21

|

|||

Our unaudited interim financial statements for the six month period ended June 30, 2017 form part of this quarterly report. They are stated in United States Dollars (US$) and are prepared in accordance with generally accepted accounting principles in the United States.

|

Zhen Ding Resources Inc.

|

|

Balance Sheets

(Unaudited)

|

|

|

June 30,

|

December 31,

|

||||||

|

|

2017

|

2016

|

||||||

|

Assets

|

||||||||

|

|

||||||||

|

Current Assets:

|

||||||||

|

Cash and cash equivalents

|

$

|

13,491

|

$

|

6,918

|

||||

|

Total current assets

|

13,491

|

6,918

|

||||||

|

|

||||||||

|

Total assets

|

$

|

13,491

|

$

|

6,918

|

||||

|

|

||||||||

|

Liabilities and Equity (Deficit)

|

||||||||

|

|

||||||||

|

Current Liabilities:

|

||||||||

|

Accounts payable and accrued liabilities

|

$

|

326,510

|

$

|

305,804

|

||||

|

Accrued interest-related parties

|

3,073,762

|

2,737,056

|

||||||

|

Deferred revenues

|

148,478

|

144,926

|

||||||

|

Due to related parties

|

785,240

|

749,219

|

||||||

|

Short-term debt-related parties

|

3,786,033

|

3,642,110

|

||||||

|

Total current liabilities

|

8,120,023

|

7,579,115

|

||||||

|

|

||||||||

|

Equity (Deficit):

|

||||||||

|

Common stock, 150,000,000 authorized, $0.0001 par

value, 63,968,798 shares issued and outstanding

|

6,397

|

6,397

|

||||||

|

Additional paid-in capital

|

12,762,875

|

12,762,875

|

||||||

|

Subscriptions receivable

|

(5,431

|

)

|

(5,431

|

)

|

||||

|

Accumulated other comprehensive loss

|

403,118

|

524,801

|

||||||

|

Accumulated deficit

|

(18,812,106

|

)

|

(18,530,405

|

)

|

||||

|

Total deficit attributable to Zhen Ding Resources Inc.

|

(5,645,147

|

)

|

(5,241,763

|

)

|

||||

|

Non-controlling interests

|

(2,461,385

|

)

|

(2,330,434

|

)

|

||||

|

|

||||||||

|

Total equity (deficit)

|

(8,106,532

|

)

|

(7,572,197

|

)

|

||||

|

|

||||||||

|

Total liabilities and equity (deficit)

|

$

|

13,491

|

$

|

6,918

|

||||

The accompanying notes are an integral part of these consolidated financial statements.

|

Zhen Ding Resources Inc.

|

|

Consolidated Statements of Operations and Comprehensive Loss

|

|

(Unaudited)

|

|

Three months ended

|

Six months ended

|

|||||||||||||||

|

June 30,

2017 |

June 30,

2016 |

June 30,

2017 |

June 30,

2016 |

|||||||||||||

|

Operating expenses:

|

||||||||||||||||

|

General and

administrative |

36,257

|

34,530

|

89,881

|

60,713

|

||||||||||||

|

|

||||||||||||||||

|

Total operating expenses

|

36,257

|

34,530

|

89,881

|

60,713

|

||||||||||||

|

|

||||||||||||||||

|

|

||||||||||||||||

|

Operating loss

|

(36,257

|

)

|

(34,530

|

)

|

(89,881

|

)

|

(60,713

|

)

|

||||||||

|

|

||||||||||||||||

|

Other expenses:

|

||||||||||||||||

|

Interest expenses

|

(136,454

|

)

|

(138,844

|

)

|

(270,621

|

)

|

(276,959

|

)

|

||||||||

|

|

||||||||||||||||

|

Net loss

|

(172,711

|

)

|

(173,374

|

)

|

(360,502

|

)

|

(337,672

|

)

|

||||||||

|

|

||||||||||||||||

|

Loss attributable to non-

controlling interests |

39,569

|

41,525

|

78,800

|

83,084

|

||||||||||||

|

|

||||||||||||||||

|

Net loss attributable to

Zhen Ding Resources Inc. |

$

|

(133,142

|

)

|

$

|

(131,849

|

)

|

$

|

(281,702

|

)

|

$

|

(254,588

|

)

|

||||

|

|

||||||||||||||||

|

Basic and diluted loss per

common share |

$

|

(0.00

|

)

|

$

|

(0.00

|

)

|

$

|

(0.00

|

)

|

$

|

(0.01

|

)

|

||||

|

|

||||||||||||||||

|

Basic and diluted

weighted average number of common shares

outstanding |

63,968,798

|

63,968,798

|

63,968,798

|

63,968,798

|

||||||||||||

|

|

||||||||||||||||

|

Comprehensive loss:

|

||||||||||||||||

|

Net loss

|

$

|

(172,711

|

)

|

$

|

(173,374

|

)

|

$

|

(360,502

|

)

|

$

|

(337,672

|

)

|

||||

|

Other comprehensive

income (loss): |

||||||||||||||||

|

Foreign currency

translation adjustments |

(119,259

|

)

|

209,062

|

(173,834

|

)

|

161,507

|

||||||||||

|

Total comprehensive

loss |

(291,970

|

)

|

35,688

|

(534,336

|

)

|

(176,165

|

)

|

|||||||||

|

Comprehensive

income (loss) attributable to non- controlling interest |

75,347

|

(21,194

|

)

|

130,951

|

34,632

|

|||||||||||

|

Comprehensive

income (loss) attributable to Zhen Ding Resources Inc. |

$

|

(216,623

|

)

|

$

|

14,494

|

$

|

(403,385

|

)

|

$

|

(141,533

|

)

|

|||||

The accompanying notes are an integral part of these consolidated financial statements.

|

Zhen Ding Resources Inc.

|

||||||||

|

Consolidated Statements of Cash Flows

|

||||||||

|

(Unaudited)

|

||||||||

|

|

||||||||

|

|

June 30, 2017

|

June 30, 2016

|

||||||

|

Cash flows from operating activities

|

||||||||

|

Net loss

|

$

|

(360,502

|

)

|

$

|

(337,672

|

)

|

||

|

Adjustments to reconcile net loss to net cash used in

operating activities: |

||||||||

|

Change in operating assets and liabilities

|

||||||||

|

Accounts payables and accrued liabilities

|

13,907

|

14,201

|

||||||

|

Accrued interest-related parties

|

270,621

|

278,663

|

||||||

|

Net cash used in operating activities

|

(75,974

|

)

|

(44,808

|

)

|

||||

|

|

||||||||

|

Cash flows from financing activities

|

||||||||

|

Net change in advances from related parties

|

17,440

|

-

|

||||||

|

Proceeds from borrowings on short-term debt – related

parties |

65,093

|

51,151

|

||||||

|

Net cash provided by financing activities

|

82,533

|

51,151

|

||||||

|

|

||||||||

|

Foreign currency translation

|

14

|

(17

|

)

|

|||||

|

|

||||||||

|

Net change in cash

|

6,573

|

6,326

|

||||||

|

Cash and cash equivalents - beginning of the period

|

6,918

|

4,320

|

||||||

|

|

||||||||

|

Cash and cash equivalents - end of the period

|

$

|

13,491

|

$

|

10,646

|

||||

|

|

||||||||

|

Supplement cash flows information:

|

||||||||

|

Cash paid for interest

|

$

|

-

|

$

|

-

|

||||

|

Cash paid for income tax

|

$

|

-

|

$

|

-

|

||||

The accompanying notes are an integral part of these consolidated financial statements.

Zhen Ding Resources Inc.

Notes to Consolidated Financial Statements

(Unaudited)

Note 1. Description of Business

Zhen Ding Resources Inc. (formerly Robotech Inc.) (the “Company”, “Zhen Ding DE”, or “ZDRI”) was incorporated in the State of Delaware in September 1996 and began its business activities in the development and marketing of specialized technological equipment. In early 2010, the business direction of our Company was changed to seek opportunities to focus particularly on searching for companies engaged in the mining of gold, silver and copper.

The Company, then known as Robotech Inc., entered into negotiations with Zhen Ding Resources Inc., a Nevada entity (“Zhen Ding NV”). Zhen Ding NV indirectly owns 70% of a Chinese Joint Venture entity, Zhen Ding Mining Co. Ltd. (“Zhen Ding JV” or “JXZD”) through a 100% owned subsidiary in California, Zhen Ding Corporation (“Z&W CA”). During 2012 and 2013, total issued and outstanding common stock of Zhen Ding NV were tendered to our Company. On October 28, 2013, our Company dissolved Zhen Ding NV by merging it into our Company and we changed our name from Robotech Inc. to Zhen Ding Resources Inc.

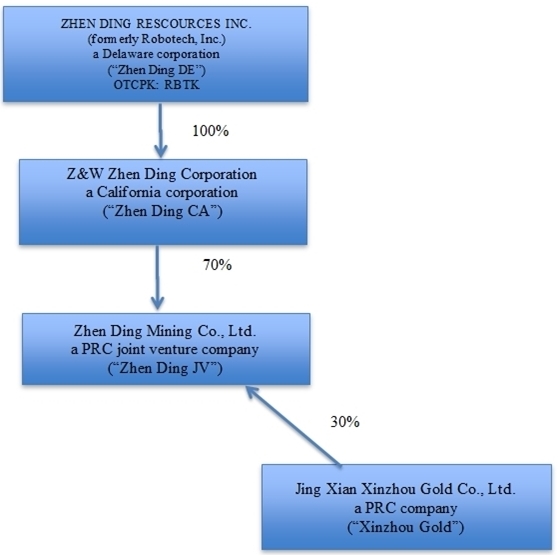

Our Company, now through Zhen Ding NV’s wholly owned subsidiary, Z&W CA, participates in a joint venture with Jing Xian Xinzhou Gold Co., Ltd. (“Xinzhou Gold”), a company organized under the laws of the People’s Republic of China (“PRC”). The joint venture company JXZD is 70% held by our Company through Z&W CA who has the mineral exploration, mineral mining and gold mining rights to a property located in the southwestern part of Anhui province in China, near the town of Jing Xian. Xinzhou Gold, the other 30% partner of JXZD is the actual named owner of the various licenses used by JXZD and transferred all rights emanating from these licenses as part of the joint venture agreement between Z&W CA and Xinzhou Gold. Our Company’s primary activity, through JXZD, is ore processing and production in China. The Company had limited operations and plans to resume selling processed ore concentrate as soon as possible to provide Zhen Ding JV the cash flow needed to keep its plant operating and to maintain a viable work force for future expansion.

Note 2. Summary of Significant Accounting Policies

The summary of significant accounting policies presented below is designed to assist in understanding the Company’s financial statements. Such financial statements and accompanying notes are the representations of the Company’s management, which is responsible for the integrity and objectivity. These accounting policies conform to accounting principles generally accepted in the United States of America (“U.S. GAAP”) in all material respects and have been consistently applied in preparing the accompanying financial statements.

Basis of Presentation and Principles of Consolidation

The accompanying unaudited consolidated financial statements and related notes have been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) for interim unaudited consolidated financial information. Accordingly, they do not include all of the information and footnotes required by U.S. GAAP for complete consolidated financial statements. The unaudited consolidated financial statements furnished reflect all adjustments (consisting of normal recurring adjustments) which are, in the opinion of management, necessary for a fair presentation of the results for the interim periods presented. Interim results are not necessarily indicative of the results for the full year. These unaudited consolidated financial statements should be read in conjunction with the audited consolidated financial statements of the Company for the year ended December 31, 2016 and notes thereto contained in the Company’s Annual Report on Form 10-K.

The consolidated financial statements include the accounts of the Company, its wholly subsidiaries Z&W CA and its majority owned subsidiary JXZD. All inter-company transactions and balances were eliminated. The portion of the income applicable to non-controlling interests in subsidiary undertakings is reflected in the consolidated statements of operations.

Use of Estimates and Assumptions

The Company prepares its financial statements in conformity with U.S. GAAP, which requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Foreign Currency Adjustments

Assets and liabilities recorded in foreign currencies are translated at the exchange rate on the balance sheet date. Revenue and expenses are translated at average rates of exchange prevailing during the year. Any translation adjustments are reflected as a separate component of stockholders’ equity (deficit) and have no effect on current earnings. Gains and losses resulting from foreign currency transactions are included in current results of operations. During the six months ended June 30, 2017 and 2016, the Company had aggregate foreign currency translation gain (losses) of $(173,834) and $161,507, respectively.

Cash and Cash Equivalents

The Company considers all highly liquid investments purchased with an original maturity of six months or less to be cash equivalents.

Accounts Receivable

Accounts receivable are stated at the amount the Company expects to collect. The Company maintains allowances for doubtful accounts for estimated losses resulting from the inability of its customers to make required payments. Management considers the following factors when determining the collectability of specific customer accounts: customer credit-worthiness, past transaction history with the customer, current economic industry trends, and changes in customer payment terms. Past due balances over 90 days and other higher risk amounts are reviewed individually for collectability. If the financial condition of the Company’s customers were to deteriorate, adversely affecting their ability to make payments, additional allowances would be required. Based on management’s assessment, the Company provides for estimated uncollectible amounts through a charge to earnings and a credit to a valuation allowance. Balances that remain outstanding after the Company has used reasonable collection efforts are written off through a charge to the valuation allowance and a credit to accounts receivable. As of June 30, 2017 and December 31, 2016, the Company had an allowance of $181,391 and $177,087, respectively, for doubtful accounts.

Property, plant and Equipment

Property, plant and equipment is stated at the historical cost, less accumulated depreciation. Depreciation on property, plant and equipment is provided using the straight-line method over the estimated useful lives of the assets for both financial and income tax reporting purposes as follows:

|

Buildings

|

20 years

|

|

Motor vehicles

|

5 years

|

|

Production and office Equipment

|

5 years

|

Expenditures for normal repairs and maintenance are charged to expense as incurred. Significant renewals and improvements are capitalized. The costs and related accumulated depreciation of assets retired or otherwise disposed of are eliminated from the accounts, and any resulting gain or loss is recognized in the year of disposal.

Impairment of Long-Lived Assets

Management reviews long-lived assets for impairment whenever events or changes in circumstances indicate that the carrying amount may not be realizable or at a minimum annually during the fourth quarter of the year. If an evaluation is required, the estimated future undiscounted cash flows associated with the asset are compared to the asset’s carrying value to determine if an impairment of such asset is necessary. The effect of any impairment would be to expense the difference between the fair value of such asset and its carrying value.

Income Taxes

An asset and liability approach is used for financial accounting and reporting for income taxes. Deferred income taxes arise from temporary differences between income tax and financial reporting and principally relate to recognition of revenue and expenses in different periods for financial and tax accounting purposes and are measured using currently enacted tax rates and laws. In addition, a deferred tax asset can be generated by net operating loss carry forwards. If it is more likely than not that some portion or all of a deferred tax asset will not be realized, a valuation allowance is recognized. The Company has tax losses that may be applied against future taxable income. The potential tax benefit arising from these loss carryforwards are offset by a valuation allowance due to uncertainty of profitable operations in the future.

Fair Values of Financial Instruments

Management believes that the carrying amounts of the Company’s financial instruments, consisting primarily of cash, account receivable and accounts payable, approximated their fair values as of June 30, 2017 and December 31, 2016, due to their short-term nature.

Non-controlling Interests

Non-controlling interests in the Company’s subsidiaries are reported as a component of equity, separate from the parent’s equity. Purchase or sale of equity interests that do not result in a change of control are accounted for as equity transactions. Results of operations attributable to the minority interest are included in our consolidated results of operations and, upon loss of control, the interest sold, as well as interest retained, if any, will be reported at fair value with any gain or loss recognized in earnings.

Basic and Diluted Earnings (Loss) Per Common Share

The basic net loss per common share is computed by dividing the net loss by the weighted average number of common shares outstanding. Diluted net loss per common share is computed by dividing the net loss adjusted on an “as converted” basis, by the weighted average number of common shares outstanding plus potential dilutive securities. For all periods presented, there is no difference in the number of shares used to calculate basic and diluted shares outstanding due to the Company’s net loss position.

Subsequent Events

The Company evaluated events subsequent to June 30, 2017 through the date the financial statements were issued for disclosure consideration.

Recently Issued Accounting Pronouncements

In August 2014, the FASB issued ACU 2014-15, Disclosure of Uncertainties about an Entity’s Ability to Continue as a Going Concern. The new standard requires management to assess the company’s ability to continue as a going concern. Disclosures are required if there is substantial doubt as to the company’s continuation as a going concern within one year after the issue date of financial statements. The standard provides guidance for making the assessment, including consideration of management’s plans which may alleviate doubt regarding the Company’s ability to continue as a going concern. ASU 2014-15 is effective for years ending after December 15, 2016. The Company has adopted this standard for the year ending December 31, 2016, and management has concluded that there is substantial doubt as to the Company’s continuation as a going concern within one year after the issue date of the financial statements.

Note 3. Going Concern

These financial statements have been prepared on a going concern basis, which implies the Company will continue to meet its obligations and continue its operations for the next twelve months. As of June 30, 2017, the Company had accumulated losses of $18,812,106 since inception and had a working capital deficit of $8,106,532. These factors raise substantial doubt regarding the Company’s ability to continue as a going concern. The continuation of the Company as a going concern is dependent upon financial support from its stockholders, the ability of the Company to obtain necessary equity financing to continue operations, and the attainment of profitable operations. Realization value may be substantially different from carrying values as shown and these financial statements do not include any adjustments to the recoverability and classification of recorded asset amounts and classification of liabilities that might be necessary should the Company be unable to continue as a going concern.

Note 4. VAT Receivables

The VAT receivables are the input tax of VAT to the purchased materials and property and equipment. As of June 30, 2017 and December 31, 2016, the Company fully reserved the VAT receivable of approximately $159,000 due to uncertainty of recovering this receivable from the local tax authority.

Note 5. Property, plant and Equipment

Property and equipment consisted of the following as of:

|

|

June 30,

|

December

31, |

||||||

|

|

2017

|

2016

|

||||||

|

|

||||||||

|

Buildings

|

$

|

1,255,486

|

$

|

1,225,448

|

||||

|

Motor vehicles

|

59,334

|

57,914

|

||||||

|

Production and office equipment

|

1,229,844

|

1,200,419

|

||||||

|

Construction in progress

|

158,227

|

154,441

|

||||||

|

Subtotal

|

2,702,891

|

2,638,222

|

||||||

|

Less: Accumulated depreciation

|

(1,096,187

|

)

|

(1,069,960

|

)

|

||||

|

Less: Impairment of long-lived assets

|

(1,606,704

|

)

|

(1,568,262

|

)

|

||||

|

Property, plant and equipment, net

|

$

|

-

|

$

|

-

|

||||

For the six months ended June 30, 2017 and 2016, the Company recorded depreciation expense of $0.

In the PRC, land use rights, are the legal rights for an entity to use land for a fixed period of time. The PRC adopts a dual land tenure system under which land ownership is independent of land use rights. The land is either owned by the state (“State Land”) or by a rural collective economic organization (“Collective Land”). As of June 30, 2017, the Company does not have any land use rights agreements with the PRC for the office buildings owned by the Company. The Government owns the land where the Company’s buildings are located and allows the Company free usage of the land.

Property and equipment mainly consisted of equipment or buildings in relation to ore processing operation in Anhui, China. The Company only had access to lower quality ore powder and the probability to sell these low quality processed ore powder is low. Accordingly, the Company had no production since 2015.

Note 6. Related Party Transactions

Accounts payable

As of June 30, 2017 and December 31, 2016, the Company had payables of $785,240 and $749,219, respectively, to Xinzhou Gold. These payables bear no interest, are unsecured and are due on demand.

Short-term debt

As of June 30, 2017 and December 31, 2016, the Company had short-term debts to related parties of $3,786,033 and $3,642,110, respectively. The details of the loans are described as below.

At June 30, 2017:

|

Annual

|

|||||||||||

|

Name

|

Relationship to the Company

|

Amount

|

Interest Rate

|

Start Date

|

Maturity

|

||||||

|

Shor-term debt

|

|||||||||||

|

Wei De Gang

|

CEO & Legal person of JXZD

|

$

|

2,652,028

|

15

|

%

|

May 31, 2011

|

May 31, 2014

|

||||

|

Zhao Yan Ling

|

Former office manager of JXZD, wife of Zhou Zhi Bin

|

15,488

|

15

|

%

|

January 1, 2011

|

December 31, 2013

|

|||||

|

Zhou Zhi Bin

|

Former CEO & Legal person of JXZD

|

7,375

|

15

|

%

|

January 1, 2011

|

December 31, 2013

|

|||||

|

Tang Yong Hong

|

Manager of JXZD

|

317,498

|

15

|

%

|

February 28, 2015

|

February 28, 2016

|

|||||

|

Yan Chun Yan

|

Accountant of JXZD

|

7,956

|

15

|

%

|

August 31, 2014

|

August 31, 2015

|

|||||

|

Wen Mei Tu

|

President & shareholder of ZDRI

|

354,800

|

12

|

%

|

Various

|

Various

|

|||||

|

Importation Tresor

Plus Inc |

Shareholder of ZDRI

|

30,000

|

12

|

%

|

July 9, 2012

|

July 12, 2013

|

|||||

|

Tony Ng Man Kin

|

Shareholder of ZDRI

|

25,000

|

12

|

%

|

February 27, 2013

|

February 27, 2014

|

|||||

|

Wei Tai Trading

Inc. |

Shareholder of ZDRI

|

12,000

|

12

|

%

|

June 3, 2015

|

September 3, 2015

|

|||||

|

JYS Technologies

Inc. |

Owned by Wen Mei Tu’s brother-in-law

|

6,000

|

12

|

%

|

May 22, 2015

|

July 19, 2016

|

|||||

|

Philip Pak

|

Consultant & shareholder of ZDRI

|

41,000

|

12

|

%

|

Various

|

Various

|

|||||

|

Victor Sun

|

Consultant & shareholder of ZDRI

|

3,923

|

0

|

%

|

January 1, 2013

|

On Demand

|

|||||

|

Helen Chen

|

President of Z&W CA

|

17,965

|

0

|

%

|

January 1, 2011

|

On Demand

|

|||||

|

Current portion of long-term debt

|

|||||||||||

|

Zhou Qiang

|

Office manager of JXZD

|

295,000

|

15

|

%

|

December 18, 2012

|

December 18, 2015

|

|||||

|

Total

|

|

$

|

3,786,033

|

|

|||||||

For the six months ended June 30, 2017, the Company entered into two loan agreements with its shareholder, Philip Pak. Pursuant to the agreements, the Company loaned a total of $41,000 with interest rate of 1% per month. The principal and interest shall be due and payable in March and June 2018. Accrued interest can be converted into the Company’s common stock at $0.20 or $0.30 per share.

At December 31, 2016:

|

Annual

|

|||||||||||

|

Name

|

Relationship to the Company

|

Amount

|

Interest Rate

|

Start Date

|

Maturity

|

||||||

|

Shor-term debt

|

|||||||||||

|

Wei De Gang

|

CEO & Legal Person of JXZD

|

$

|

2,588,518

|

15

|

%

|

May 31, 2011

|

May 31, 2014

|

||||

|

Zhao Yan Ling

|

Former Office Manager in JXZD, wife of Zhou Zhi Bin

|

15,117

|

15

|

%

|

January 1, 2011

|

December 31, 2013

|

|||||

|

Zhou Zhi Bin

|

Former CEO & Legal Person of JXZD

|

7,200

|

15

|

%

|

January 1, 2011

|

December 31, 2013

|

|||||

|

Tang Yong Hong

|

Manager of JXZD

|

309,901

|

15

|

%

|

February 28, 2015

|

February 28, 2016

|

|||||

|

Yan Chun Yan

|

Accountant of JXZD

|

6,686

|

15

|

%

|

August 31, 2014

|

August 31, 2015

|

|||||

|

Wen Mei Tu

|

President & shareholder of ZDRI

|

331,800

|

12

|

%

|

Various

|

Various

|

|||||

|

Importation Tresor

Plus Inc |

Shareholder of ZDRI

|

30,000

|

12

|

%

|

July 9, 2012

|

July 12, 2013

|

|||||

|

Tony Ng Man Kin

|

Shareholder of ZDRI

|

25,000

|

12

|

%

|

February 27, 2013

|

February 27, 2014

|

|||||

|

Wei Tai Trading

Inc |

Shareholder of ZDRI

|

12,000

|

12

|

%

|

June 3, 2015

|

September 3, 2015

|

|||||

|

JYS Technologies

Inc. |

Owned by Wen Mei Tu’s brother-in-law

|

6,000

|

12

|

%

|

May 22, 2015

|

July 19, 2016

|

|||||

|

Victor Sun

|

Consultant & shareholder of ZDRI

|

3,923

|

0

|

%

|

January 1, 2013

|

On Demand

|

|||||

|

Helen Chen

|

President of Z&W CA

|

17,965

|

0

|

%

|

January 1, 2011

|

On Demand

|

|||||

|

Current portion of long-term debt

|

|||||||||||

|

Zhou Qiang

|

Office manager of JXZD

|

288,000

|

15

|

%

|

December 18, 2012

|

December 18, 2015

|

|||||

|

Total

|

|

$

|

3,642,110

|

|

|||||||

As of June 30, 2017 and December 31, 2016, the Company had accrued interest payable to related parties of $3,073,762 and $2,737,056, respectively. For the periods ended June 30, 2017 and 2016, the Company recorded interest expense of $270,621 and $276,959, respectively. As of June 30, 2017 and December 31, 2016, $3,671,881 and $3,541,957 of debt was in default. The Company has not received any demand for payment from these creditors.

Note 7. Deferred Revenues

As of June 30, 2017 and December 31, 2016, the Company had deferred revenue of $148,478 and $144,926, respectively, related to advances that the Company received from its customers.

Note 8. Contingencies

Concentration of Credit Risk

Substantially all of the Company’s bank accounts are in banks located in The People’s Republic of China and are not covered by protection similar to that provided by the FDIC on funds held in United States banks.

Vulnerability Due to Operations in PRC

The Company’s operations in China may be adversely affected by significant political, economic and social uncertainties in the PRC. Although the PRC government has been pursuing economic reform policies for more than twenty years, no assurance can be given that the PRC government will continue to pursue such policies or that such policies may not be significantly altered, especially in the event of a change in leadership, social or political disruption or unforeseen circumstances affecting the PRC’s political, economic and social conditions. There is also no guarantee that the PRC government’s pursuit of economic reforms will be consistent or effective in the future.

Note 9. Income Taxes

The Company and its subsidiaries are subject to income taxes on an "entity" basis that is, on income arising in or derived from the tax jurisdiction in which each entity is domiciled. It is management's intention to reinvest all the income earned by the Company's subsidiaries outside of the US. Accordingly, no US federal income taxes have been provided on earnings of the foreign based subsidiaries.

The Company was incorporated in the United States and is subject to United States federal income taxes and has incurred operating losses since its inception. The Company's joint venture in China is subject to a 25% statutory PRC enterprise income tax rate and has also incurred operating losses since its inception. As of June 30, 2017, the Company had net operating losses (“NOL”) carryforwards of approximately $18 million. The NOL carryforwards expire between fiscal year 2016 through 2035. The value of these carryforwards depends on the Company’s ability to generate taxable income. Tax laws in both China and United States limit the time during which the net operating loss carryforwards may be applied against future taxes, if the Company fails to generate taxable income prior to the expiration dates, the Company may not be able to fully utilize the net operating loss carryforwards to reduce future income taxes. The Company has had cumulative losses and there is no assurance of future taxable income; therefore, valuation allowances have been recorded to fully offset the deferred tax asset at June 30, 2017 and December 31, 2016.

FORWARD LOOKING STATEMENTS

This quarterly report contains forward-looking statements. These statements relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as “may”, “should”, “expects”, “plans”, “anticipates”, “believes”, “estimates”, “predicts”, “potential” or “continue” or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors that may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

Our unaudited financial statements are stated in United States Dollars (US$) and are prepared in accordance with United States Generally Accepted Accounting Principles. The following discussion should be read in conjunction with our financial statements and the related notes that appear elsewhere in this quarterly report. The following discussion contains forward-looking statements that reflect our plans, estimates and beliefs. Our actual results could differ materially from those discussed in the forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those discussed below and elsewhere in this quarterly report.

Our financial statements are stated in United States Dollars (US$) and are prepared in accordance with United States Generally Accepted Accounting Principles.

In this quarterly report, unless otherwise specified, all dollar amounts are expressed in United States dollars and all references to “common shares” refer to the common shares in our capital stock.

As used in this quarterly report, the terms “we”, “us”, “our” and “our company” mean Zhen Ding Resources Inc., unless otherwise indicated.

General Overview

We are engaged in seeking business partnership opportunities with companies that are in the field of exploration and extraction of precious and/or base metals, primarily in China, which are in need of funding and improved management. We would provide the necessary management expertise and assist in financing efforts of these mining operations. In exchange, we would acquire metal ores produced by these mines and process the ores in our ore milling plant and sell the ore concentrates to metal refineries. Our only operating company is Zhen Ding JV, which engages in the processing of metal ore and the selling of ore concentrates of gold, silver, lead, zinc and copper at purity levels ranging from 65% to 80%. Zhen Ding JV purchases metal ore in rock form from its joint venture partner, Xinzhou Gold, which has rights to explore and mine ore from a property located in the southwestern part of Anhui province in China.

Our Corporate History and Structure

Our principal office is located at 353 St. Nicolas, Suite 205, Montreal, Quebec H2Y 2P1.

Our operational offices are located at: Zhen Ding Mining Co. Ltd., Wuxi County, Town of Langqiao, Jing Xian, Anhui Province, China, Tel: 86-6270-9018.

We were incorporated in September 1996 as Robotech Inc., and began our business in the development and marketing of specialized technological equipment. At that time we estimated that we would require approximately $6,000,000 to realize our plans. Through the year of 2003, we had not reached our financing goals and therefore abandoned that particular business plan. Since that time, we have been seeking suitable candidates for acquisition.

From the early 2000s until approximately 2013, there was an overall worldwide recovery in the price and markets for precious metals, minerals and industrial commodities. Such interest was fueled to a large degree, by the economic awakening of the two most populous nations, China and India and further bolstered by a sharp decline in the US dollar. These circumstances resulted in significant increases in the market prices of gold, silver and copper. Thus, in early 2010, the business direction of our company was changed to seek to profit from this commodities revival, and we began to focus our acquisition search in that industry, particularly on companies engaged in the mining of gold, silver and copper.

In January 2012, our board of directors, with authorization from the majority of the shareholders of our company, made an offer to the shareholders of Zhen Ding Resources Inc., a Nevada corporation (“Zhen Ding NV”), to acquire, at the very least, the majority of their common shares, and, if available, up to 100% ownership.

Zhen Ding NV through its wholly owned subsidiary, Z&W Zhen Ding Corporation, a California corporation (“Zhen Ding CA”), has been engaged in a joint venture with Jing Xian Xinzhou Gold Co., Ltd. (“Xinzhou Gold”), a company organized under the laws of the People’s Republic of China (“PRC”). The joint venture company, Zhen Ding Mining Co. Ltd. (“Zhen Ding JV”) is 70% held by Zhen Ding NV through Zhen Ding CA. It is a common practice in China to append the name of the town or city where an enterprise is located to its legally incorporated name. Thus many documents referencing Zhen Ding JV may refer to it as Jing Xian Zhen Ding Mining Co. Ltd. Zhen Ding JV engages in the processing of metal ore and the selling of ore concentrates of gold, silver, lead, zinc and copper at purity levels ranging from 65% to 80%. Zhen Ding JV purchases metal ore in rock form from Xinzhou Gold.

On March 8, 2012, we changed our name from Robotech, Inc. to Zhen Ding Resources Inc., in anticipation of the acquisition of Zhen Ding NV. Our trading symbol, RBTK, however remained unchanged.

During 2012, a total of 50,746,358 shares of the issued and outstanding common stock of Zhen Ding NV were tendered to our company. On August 13, 2013, an additional 13,100,000 shares were tendered to us. Thus, as of August 13, 2013 the shareholders of Zhen Ding NV had tendered 100% of the issued and outstanding shares of common stock, representing 100% of the issued and outstanding equity of Zhen Ding NV to us.

On October 23, 2013, we issued 122,440 shares of our common stock, on a one-for-one basis, to the tendering shareholders of Zhen Ding NV making Zhen Ding NV a wholly owned subsidiary of our company.

On October 28, 2013, we dissolved Zhen Ding NV by merging it with and into Zhen Ding DE. As a result, Zhen Ding CA became a wholly-owned subsidiary of Zhen Ding DE. Zhen Ding CA continues to exist as an intermediate holding company with no operations of its own, but which in turn owns our 70% interest in Zhen Ding JV.

The following illustrates our corporate and share ownership structure:

Current Operations

Presently, we are conducting our operations exclusively through Zhen Ding JV, our joint venture company. However, we continue to look for other attractive potential acquisition targets in the mining industry.

Our joint venture, Zhen Ding JV, is equipped to process ore mined by our joint venture partner Xinzhou Gold when in operation. Zhen Ding JV purchases the ore in rock form from Xinzhou Gold and processes the ore into our final product, which is a gold, silver, lead, zinc and copper ore concentrate. We estimate that our processed product is 65% to 80% pure. The product is then sold to refineries which further purify and separate the concentrate. Zhen Ding JV also arranges all exploration, mining process and operations, and financial and administrative support for Xinzhou Gold’s mine, known as the Wuxi Gold Mine.

When our plant is operating, we purchase all of our raw material from Xinzhou Gold for our ore processing operation and rely solely on Xinzhou Gold for our supply of ores. The veins most recently excavated by Xinzhou Gold in the permitted areas of our mines are very low grade and, as such, the production is minimal. The higher yielding and therefore more profitable veins run outside Xinzhou Gold’s permitted mining area boundaries under its current license. Xinzhou Gold applied for an extension of the permitted mining area, however, the application was rejected by the government in December 2016 due to Xinzhou Gold’s insufficient working capital. Xinzhou Gold intends to reapply for an extension of the permitted mining area when it is able to demonstrate sufficient working capital to drill the extended area. However, if sufficient working capital is unavailable, or should the application be denied on other grounds, we would not be able to secure another source with higher grade ores for our processing plant, which would severely limit our ability to execute our plan of operation and our potential profitability.

At the beginning of fiscal 2015, we idled our mineral processing plant due to an overall downturn in the demand and market prices for our concentrates. This downturn has coincided with an overall economic recession in China and downturn in the global commodities market over the past years. During 2015, we evaluated the recoverability of our plant assets and determined that, based on current conditions, that the assets were fully impaired for financial reporting purposes.

Summary of Operations during the Six Months Ended June 30, 2017

During the six months ended June 30, 2017, we actively sought an investment of approximately $3,000,000, which we believe is required to expand Xinzhou Gold’s mining permit, and which would allow us to resume our ore extraction and refinery activities. However, as at the date of this report we have not successfully secured any financing commitment.

Due to our continued inability to raise sufficient financing to expand Xinzhou Gold’s mining permit, Xinzhou Gold elected to reapply for a new drilling permit based on a scaled-down drilling plan. The resulting new permit application, which was submitted to the Anhui Province Land & Resources Bureau for approval on March 8, 2017, seeks renewed permission to continue drilling in the areas directly adjacent to our concentration plant.

We intend to resume selling processed ore concentrate as soon as possible in order to supply Zhen Ding JV with the cash flow needed to keep its plant running and to maintain a viable work force for future expansion. However, we are not able to predict at this time when economic conditions will allow us to resume our ore refinery operation.

As at the date of this report, Xinzhou Gold and we continue to seek investment of approximately $3,000,000, which would allow Xinzhou Gold to resume drilling under its anticipated permit, and allow us to resume refinery activities. In anticipation of financing and permit approval, our joint venture engaged contractors during the six months ended June 30, 2017 to conduct safety inspections and repairs, and to plan anticipated drilling locations. We also engaged Mr. Dai Honglin as Chief Engineer and general manager of Xinzhou Gold’s and our gold mining operations.

Mr. Dai brings over thirty years’ experience to our company in the evaluation, development and exploration of gold, copper, zinc, and lithium projects throughout China and South Africa. He completed training in mineral exploration at the Heilongjiang Institute of Mines in 1983. Mr. Dai also currently holds the position of the chairman of Beijing Hongbang Pile Geotechnical Engineering Co., Ltd.

Going forward, we will continue to seek sufficient financing to re-establish our mineral extraction and refining operations. We will also seek to identify and evaluation businesses opportunities and other strategic transactions on an ongoing basis with a view toward diversifying our business and optimizing shareholder value.

Results of Operations

Three Months Ended June 30, 2017 compared to the Three Months Ended June, 2016

We had a net loss of $172,711 for the three month period ended June 30, 2017, which was $663 more than the net loss of $173,374 for the three month period ended June 30, 2016. The change in our results over the two periods is a result of a nominal increase in general and administrative expense offset by a decrease in interest expense during the most recent period.

The following table summarizes key items of comparison and their related increase (decrease) for the three month periods ended June 30, 2017 and 2016:

|

Three Months

Ended June 30, 2017 |

Three Months

Ended June 30, 2016 |

Percentage Increase

(Decrease) Between Three Month Periods Ended June 30, 2017 and June 30, 2016

|

||||||||||

|

General and administrative

|

$

|

36,257

|

$

|

34,530

|

5

|

%

|

||||||

|

Interest expense

|

136,454

|

138,844

|

(1.72

|

%)

|

||||||||

|

Net loss

|

$

|

172,711

|

$

|

173,374

|

(0.38

|

%)

|

||||||

Six Months Ended June 30, 2017 compared to the Six Months Ended June, 2016

We had a net loss of $360,502 for the six month period ended June 30, 2017, which was $22,830 more than the net loss of $337,672 for the six month period ended June 30, 2016. The change in our results over the two periods is a result of a 48.04% increase in general and administrative expense and a nominal decrease in interest expense. The increased general and administrative expenses resulted from an increase in professional fees, and increased travel and administrative expense incurred in relation to business evaluation and capital raising activities.

The following table summarizes key items of comparison and their related increase (decrease) for the six month periods ended June 30, 2017 and 2016:

|

Six Months

Ended June 30, 2017 |

Six Months

Ended June 30, 2016 |

Percentage Increase

(Decrease) Between Six Month Periods Ended June 30, 2017 and June 30, 2017

|

||||||||||

|

General and administrative

|

$

|

89,881

|

$

|

60,713

|

48.04

|

%

|

||||||

|

Interest expense

|

270,621

|

276,959

|

(2.29

|

%)

|

||||||||

|

Net loss

|

$

|

360,337

|

$

|

337,672

|

6.76

|

%

|

||||||

Revenue

We have not earned any revenues in the six months ended June 30, 2017 or June 30, 2016. Our lack of revenue is due to our inability to find better quality materials for our production.

Liquidity and Capital Resources

Our balance sheet as of June 30, 2017 reflects current assets of $13,491 consisting of cash and cash equivalents, and a working capital deficit in the amount of $8,106,532. We have insufficient working capital to carry out our stated plan of operation for the next twelve months.

Working Capital

|

At

June 30, 2017 |

At

December 31, 2016 |

|||||||

|

Current assets

|

$

|

13,491

|

$

|

6,918

|

||||

|

Current liabilities

|

8,120,023

|

7,579,115

|

||||||

|

Working capital

|

$

|

(8,106,532

|

)

|

$

|

(7,572,197

|

)

|

||

As of June 30, 2017, we had accumulated losses of $18,812,106 since inception. We anticipate generating additional losses and, therefore, may be unable to continue operations further in the future.

Cash Flows

|

|

Six Months Ended | |||||||

|

|

June 30,

|

|||||||

|

|

2017

|

2016

|

||||||

|

Net cash used in operating activities

|

$

|

(75,974

|

)

|

$

|

(44,808

|

)

|

||

|

Net cash provided by financing activities

|

82,533

|

51,151

|

||||||

|

Foreign currency transaction

|

14

|

(17

|

)

|

|||||

|

Net increase in cash during period

|

$

|

8,573

|

$

|

6,326

|

||||

Operating Activities

Net cash used in operating activities during the six months ended June 30, 2017 was $75,974, a 70% increase from the $44,808 net cash outflow during the six months ended June 30, 2016. The decrease was a result of an overall increase in professional fees, and expenses related to business evaluation and capital raising activities during the most recent period. During the six months ended June 30, 2017, we had no sales and did not purchase any raw materials.

Financing Activities

Cash provided by financing activities during the six months ended June 30, 2017 was $82,533, which was a 61.35% increase from the $51,151 cash provided by financing activities during the six months ended June 30, 2016. The increase was a result of increased related party loans during the most recent period.

Plan of Operation

Our operating plan for the 12 months beginning from July 1, 2017 is as follows:

• Continue to pursue potential financing activities.

• The funds raised would be used to (a) identify additional veins, (b) to re-start the mill, (c) re-test the mill, (d) develop expansion plans for our plant capacity, (e) drilling additional holes near the concentration plant and (f) undertake at least three deep drill holes in the permit area.

• To re-commence greater milling operations as soon as possible. This will involve re-hiring all personnel laid off as a result of the mining halt.

• Actively seek partnerships with mining enterprises primarily active in the gold, silver and/or copper fields and subject to the general parameters described earlier to increase our supply of raw material.

The extent of this program is dependent on the success of the $3,000,000 financing efforts currently underway, as described earlier.

Accordingly, we estimate that our operating expenses and working capital requirements for the next 12 months to be as follows:

Estimated Net Expenditures During The Next Twelve Months

|

General and administrative expenses

|

$

|

1,000,000

|

||

|

Exploration expenses: identify additional veins; re-start mill; re-test mill;

develop expansion plan for plant capacity

|

$

|

2,000,000

|

||

|

Total

|

$

|

3,000,000

|

To date we have relied on proceeds from the sale of our shares and on loans from our directors, officers and shareholders in order to sustain our basic minimum operating expenses; however, we cannot guarantee that we will secure any further sales of our shares or that our related parties with provide us with any future loans. We estimate that the cost of maintaining our current operations and reporting requirements will be approximately $20,000 per month. Due to our cash position of $13,491 as of June 30, 2017, we estimate that we will require approximately $227,000 to sustain our current operations for the next twelve months, or approximately $3,000,000 to execute our above described exploration plan.

We are not aware of any known trends, demands, commitments, events or uncertainties that will result in or that are reasonably likely to result in our liquidity increasing or decreasing in any material way.

Future Financings

We anticipate continuing to rely on equity sales of our common stock in order to continue to fund our business operations. Issuances of additional shares will result in dilution to our existing stockholders. There is no assurance that we will achieve any additional sales of our equity securities or arrange for debt or other financing to fund our planned business activities.

We presently do not have any arrangements for additional financing for the expansion of our exploration operations, and no potential lines of credit or sources of financing are currently available for the purpose of proceeding with our plan of operations.

Off-Balance Sheet Arrangements

We have no off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, and capital expenditures or capital resources that are material to stockholders.

Critical Accounting Policies

Foreign Currency Adjustments

Assets and liabilities recorded in foreign currencies are translated at the exchange rate on the balance sheet date. Revenue and expenses are translated at average rates of exchange prevailing during the year. Any translation adjustments are reflected as a separate component of stockholders’ equity (deficit) and have no effect on current earnings. Gains and losses resulting from foreign currency transactions are included in current results of operations.

Non-controlling Interest

Non-controlling interests in our company’s subsidiaries are reported as a component of equity, separate from the parent’s equity. Purchase or sale of equity interests that do not result in a change of control are accounted for as equity transactions. Results of operations attributable to the minority interest are included in our consolidated results of operations and, upon loss of control, the interest sold, as well as interest retained, if any, will be reported at fair value with any gain or loss recognized in earnings.

As a “smaller reporting company”, we are not required to provide the information required by this Item.

Management’s Report on Disclosure Controls and Procedures

We maintain disclosure controls and procedures that are designed to ensure that information required to be disclosed in our reports filed under the Securities Exchange Act of 1934, as amended, is recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange Commission’s rules and forms, and that such information is accumulated and communicated to our management, including our president (our principal executive officer) and our chief financial officer (our principal financial officer and principle accounting officer) to allow for timely decisions regarding required disclosure.

As of the end of the quarter covered by this report, we carried out an evaluation, under the supervision and with the participation of our president (our principal executive officer) and our chief financial officer (our principal financial officer and principle accounting officer), of the effectiveness of the design and operation of our disclosure controls and procedures. Based on the foregoing, our management concluded that our internal controls are not effective. due to material weaknesses in our control environment and financial reporting process, lack of a functioning audit committee, a majority of independent members and a majority of outside directors on our Board of Directors, resulting in ineffective oversight in the establishment, and lack of monitoring of required internal control and procedures.

Changes in Internal Control Over Financial Reporting

During the period covered by this report there were no changes in our internal control over financial reporting that materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

We know of no material, existing or pending legal proceedings against our company, nor are we involved as a plaintiff in any material proceeding or pending litigation. There are no proceedings in which any of our directors, executive officers or affiliates, or any registered or beneficial stockholder, is an adverse party or has a material interest adverse to our interest.

As a “smaller reporting company”, we are not required to provide the information required by this Item.

None.

None.

Not applicable.

None.

|

Exhibit

Number |

|

Description

|

|

(3)

|

|

Articles of Incorporation and Bylaws

|

|

3.1

|

|

Articles of Incorporation filed with the Secretary of State of the State of Delaware on September 6, 1996 (Incorporated by reference to our Registration Statement on Form S-1 filed January 6, 2014)

|

|

3.2

|

|

Bylaws (Incorporated by reference to our Registration Statement on Form S-1 filed January 6, 2014)

|

|

3.3

|

|

Certificate of Amendment of Certificate of Incorporation filed with the Secretary of State of the State of Delaware on November 4, 1996 (Incorporated by reference to our Registration Statement on Form S-1 filed January 6, 2014)

|

|

3.4

|

|

Certificate of Amendment of Certificate of Incorporation filed with the Secretary of State of the State of Delaware on February 28, 2012 (Incorporated by reference to our Registration Statement on Form S-1 filed January 6, 2014)

|

|

3.5

|

|

Certificate of Amendment of Certificate of Incorporation filed with the Secretary of State of the State of Delaware on March 20, 2012 (Incorporated by reference to our Registration Statement on Form S-1 filed January 6, 2014)

|

|

3.6

|

|

Certificate of Ownership and Merger filed with the Secretary of State of the State of Delaware on October 28, 2013 (Incorporated by reference to our Registration Statement on Form S-1 filed January 6, 2014)

|

|

(10)

|

|

Material Contracts

|

|

10.1

|

|

The Contract for Sino-Foreign Equity Joint Venture dated as of November 12, 2004 by and between Zhen Ding Corporation and Jing Xiang Xin Zhou Gold Co. Ltd. (Incorporated by reference to our Registration Statement on Form S-1 filed January 6, 2014)

|

|

10.2

|

|

Articles of Association for Zhen Ding JV dated as of October 12, 2006 by and between Z&W Zhen Ding Corporation and Jing Xiang Xin Zhou Gold Co. Ltd. (Incorporated by reference to our Registration Statement on Form S-1/A filed on February 13, 2015)

|

|

10.3

|

|

Supply Contract of Gold Concentrate Fines dated July 20, 2012 between Zhen Ding Mining Co., Ltd. and Yantai Jin Ao Metallurgical Co. Ltd.(Incorporated by reference to our Registration Statement on Form S-1/A filed on February 13, 2015)

|

|

10.4

|

|

Mining License No. C3400002009114110049341 dated November 5, 2014 in favor of Jing Xiang Xin Zhou Gold Co. Ltd. (Incorporated by reference to our Registration Statement on Form S-1/A filed on February 13, 2015)

|

|

10.5

|

|

Gold Mining License No. (2005) 042 in favor of Jing Xiang Xin Zhou Gold Co. Ltd. (Incorporated by reference to our Registration Statement on Form S-1/A filed on February 13, 2015)

|

|

10.6

|

|

Form of Loan Agreements between Wen Mei Tu and Zhen Ding Resources Inc. (Incorporated by reference to our Registration Statement on Form S-1/A filed on February 13, 2015)

|

|

10.7

|

|

Business License Registration No. 3425004000003061(1-1) dated November 17, 2014 in favor of Zhen Ding Mining Co. Ltd. (Incorporated by reference to our Registration Statement on Form S-1/A filed June 9, 2015)

|

|

(31)

|

|

Rule 13a-14 (d)/15d-14d) Certifications

|

|

31.1*

|

|

|

|

31.2*

|

|

|

|

(32)

|

|

Section 1350 Certifications

|

|

32.1*

|

|

|

Exhibit

Number |

|

Description

|

|

32.2*

|

|

|

|

101*

|

|

Interactive Data File

|

|

101.INS

|

|

XBRL Instance Document

|

|

101.SCH

|

|

XBRL Taxonomy Extension Schema Document

|

|

101.CAL

|

|

XBRL Taxonomy Extension Calculation Linkbase Document

|

|

101.DEF

|

|

XBRL Taxonomy Extension Definition Linkbase Document

|

|

101.LAB

|

|

XBRL Taxonomy Extension Label Linkbase Document

|

|

101.PRE

|

|

XBRL Taxonomy Extension Presentation Linkbase Document

|

*Filed herewith.

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

ZHEN DING RESOURCES INC.

|

|

|

|

|

(Registrant)

|

|

|

|

|

|

|

|

|

|

|

|

Dated: August 15, 2017

|

|

|

/s/Wen Mei Tu

|

|

|

|

|

Wen Mei Tu

|

|

|

|

|

President, Treasurer, Secretary and Director

|

|

|

|

|

(Principal Executive Officer, Principal Financial Officer

and Principal Accounting Officer) |

|

|

|

|

|

|

|

|

|

|

|

Dated: August 15, 2017

|

|

|

/s/De Gang Wei

|

|

|

|

|

De Gang Wei

|

|

|

|

|

Chairman, Chief Financial Officer and Director

(Principal Financial Officer and Principal Accounting

Officer) |

21