Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - ZHEN DING RESOURCES INC. | ex32_2.htm |

| EX-31.2 - EXHIBIT 31.2 - ZHEN DING RESOURCES INC. | ex31_2.htm |

| EX-32.1 - EXHIBIT 32.1 - ZHEN DING RESOURCES INC. | ex32_1.htm |

| EX-31.1 - EXHIBIT 31.1 - ZHEN DING RESOURCES INC. | ex31_1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

For the fiscal year ended

|

December 31, 2015

|

|

o

|

TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

For the transition period from [ ] to [ ]

|

|

Commission file number

|

333-188152

|

|

ZHEN DING RESOURCES INC.

|

|

(Exact name of registrant as specified in its charter)

|

|

Delaware

|

11-3350926

|

|

|

(State or other jurisdiction of incorporation or

organization)

|

(I.R.S. Employer Identification No.)

|

|

Suite 205, 353 St. Nicolas, Montreal, Quebec, Canada

|

H2Y 2P1

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

|

Registrant’s telephone number, including area code:

|

438-882-4148

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class

|

Name of Each Exchange On Which Registered

|

|

|

N/A

|

N/A

|

Securities registered pursuant to Section 12(g) of the Act:

|

N/A

|

||||||

|

(Title of class)

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act Yes o No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the last 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-K (§229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No x

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

o |

Accelerated filer

|

o |

|

Non-accelerated filer

|

o |

Smaller reporting company

|

x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes o No x

The aggregate market value of Common Stock held by non-affiliates of the Registrant on June 30, 2015 was $82,574,347 based on a $1.50 average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock as of the latest practicable date.

|

63,968,798 common shares as of April 5, 2016.

|

DOCUMENTS INCORPORATED BY REFERENCE

None.

|

4

|

||

|

21

|

||

|

21

|

||

|

27

|

||

|

27

|

||

|

27

|

||

|

29

|

||

|

29

|

||

|

34

|

||

|

34

|

||

|

35

|

||

|

35

|

||

|

36

|

||

|

36

|

||

|

40

|

||

|

42

|

||

|

43

|

||

|

44

|

||

|

44

|

PART I

This annual report contains forward-looking statements. These statements relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as “may”, “should”, “expects”, “plans”, “anticipates”, “believes”, “estimates”, “predicts”, “potential” or “continue” or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled “Risk Factors” that may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

Our financial statements are stated in United States Dollars (US$) and are prepared in accordance with United States Generally Accepted Accounting Principles.

In this annual report, unless otherwise specified, all dollar amounts are expressed in United States dollars and all references to “common shares” refer to the common shares in our capital stock.

As used in this current report and unless otherwise indicated, the terms “we”, “us” and “our” mean Zhen Ding Resources Inc. and our subsidiaries, Z&W Zhen Ding Corporation and Zhen Ding Mining Co. Ltd., unless otherwise indicated.

General Overview

We are engaged in seeking business partnership opportunities with companies that are in the field of exploration and extraction of precious and/or base metals, primarily in China, which are in need of funding and improved management. We seek to provide the necessary management expertise and assist in financing efforts of these mining operations. In exchange, we seek to acquire metal ores produced by these mines and process the ores in our ore milling plant and sell the ore concentrates to metal refineries. Currently, our only operating company is Zhen Ding Mining Co. Ltd., which engages in the processing of metal ore and the selling of ore concentrates of gold, silver, lead, zinc and copper at purity levels ranging from 65% to 80%. Zhen Ding Mining Co. Ltd. purchases metal ore in rock form from its joint venture partner Jing Xian Xinzhou Gold Co., Ltd, which has rights to explore and mine ore from a property located in the southwestern part of Anhui province in China.

Our principal office is located at 353 St. Nicolas, Suite 205, Montreal, Quebec H2Y 2P1. The offices in Montreal are not under written lease but are rented through a verbal agreement, on a month to month basis, from 150206 Canada Inc. at $500 per month, due and payable at each calendar quarter end. The occupancy began October 1, 2013.

Our operational offices are located at: Zhen Ding Mining Co. Ltd., Wuxi County, Town of Langqiao, Jing Xian, Anhui Province, China, Tel: 86-6270-9018.

We were incorporated in September 1996 as Robotech Inc., and began our business in the development and marketing of specialized technological equipment. At that time we estimated that we would require approximately $6,000,000 to realize our plans. Through the year of 2003, we had not reached our financing goals and therefore abandoned that particular business plan. Since that time, we have been seeking suitable candidates for acquisition.

From the early 2000s until approximately 2013, there was an overall worldwide recovery in the price and markets for precious metals, minerals and industrial commodities. Such interest was fueled to a large degree, by the economic awakening of the two most populous nations, China and India and further bolstered by a sharp decline in the US dollar. These circumstances resulted in significant increases in the market prices of gold, silver and copper. Thus, in early 2010, the business direction of our company was changed to seek to profit from this commodities revival, and we began to focus our acquisition search in that industry, particularly on companies engaged in the mining of gold, silver and copper.

In January 2012, our board of directors, with authorization from the majority of the shareholders of our company, made an offer to the shareholders of Zhen Ding Resources Inc., a Nevada corporation (“Zhen Ding NV”), to acquire, at the very least, the majority of their common shares, and, if available, up to 100% ownership.

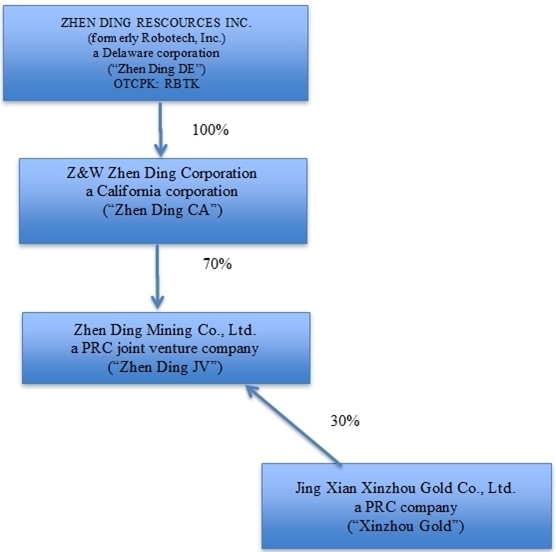

Zhen Ding NV through its wholly owned subsidiary, Z&W Zhen Ding Corporation, a California corporation (“Zhen Ding CA”), has been engaged in a joint venture with Jing Xian Xinzhou Gold Co., Ltd. (“Xinzhou Gold”), a company organized under the laws of the People’s Republic of China (“PRC”). The joint venture company, Zhen Ding Mining Co. Ltd. (“Zhen Ding JV”) is 70% held by Zhen Ding NV through Zhen Ding CA. It is a common practice in China to append the name of the town or city where an enterprise is located to its legally incorporated name. Thus many documents referencing Zhen Ding JV may refer to it as Jing Xian Zhen Ding Mining Co. Ltd. Zhen Ding JV engages in the processing of metal ore and the selling of ore concentrates of gold, silver, lead, zinc and copper at purity levels ranging from 65% to 80%. Zhen Ding JV purchases metal ore in rock form from Xinzhou Gold.

On March 8, 2012, we changed our name from Robotech, Inc. to Zhen Ding Resources Inc., in anticipation of the acquisition of Zhen Ding NV. Our trading symbol, RBTK, however remained unchanged.

During 2012, a total of 50,746,358 shares of the issued and outstanding common stock of Zhen Ding NV were tendered to our company. On August 13, 2013, an additional 13,100,000 shares were tendered to us. Thus, as of August 13, 2013 the shareholders of Zhen Ding NV had tendered 100% of the issued and outstanding shares of common stock, representing 100% of the issued and outstanding equity of Zhen Ding NV to us.

On October 23, 2013, we issued 122,440 shares of our common stock, on a one-for-one basis, to the tendering shareholders of Zhen Ding NV making Zhen Ding NV a wholly owned subsidiary of our company.

On October 28, 2013, we dissolved Zhen Ding NV by merging it with and into Zhen Ding DE. As a result, Zhen Ding CA became a wholly-owned subsidiary of Zhen Ding DE. Zhen Ding CA continues to exist as an intermediate holding company with no operations of its own, but which in turn owns our 70% interest in Zhen Ding JV.

The following illustrates our corporate and share ownership structure:

Our Current Business

Presently, we are conducting our operations exclusively through Zhen Ding JV, our joint venture company. However, we continue to look for other attractive potential acquisition targets in the mining industry.

Our joint venture, Zhen Ding JV, is equipped to process ore mined by our joint venture partner Xinzhou Gold. Zhen Ding JV purchases the ore in rock form from Xinzhou Gold and processes the ore into our final product, which is a gold, silver, lead, zinc and copper ore concentrate. We estimate that our processed product is 65% to 80% pure. The product is then sold to refineries which further purify and separate the concentrate. Zhen Ding JV also arranges all exploration, mining process and operations, and financial and administrative support for Xinzhou Gold’s mine, known as the Wuxi Gold Mine.

At the beginning of fiscal 2015, we idled our mineral processing plant due to an overall downturn in the demand and market prices for our concentrates. This downturn has coincided with an overall economic recession in China and downturn in the global commodities market over the past 12 months. We intend to resume selling processed ore concentrate as soon as possible in order to supply Zhen Ding JV with the cash flow needed to keep its plant running and to maintain a viable work force for future expansion. However, we are not able to predict at this time when economic conditions will allow us to resume our ore refinery operation. Additionally, although we do not currently produce pure metals, it is part of our development plan to do so when general economic conditions and our cash resources permit.

In the meantime, we are identifying and evaluating businesses opportunities and other strategic transactions on an ongoing basis with a view toward diversifying our business and optimizing shareholder.

Competition

The mining industry is intensely competitive. We compete with numerous individuals and companies, including many major mining companies, which have substantially greater technical, financial and operational resources and staffs. Accordingly, there is a high degree of competition for access to funds. There are other competitors that have operations in the area and the presence of these competitors could adversely affect our ability to compete for financing and obtain the service providers, staff or equipment necessary for the exploration and exploitation of our properties.

Compliance with Government Regulation

The following summary discusses all regulations that materially affect the business of our Company.

Chinese Regulations Affecting Our Company

Environmental Regulations

We are subject to a variety of governmental regulations related to environmental protection. The major PRC environmental regulations applicable to us include the Environmental Protection Law and the Environmental Impact Appraisal Law.

The Environmental Protection Law sets out the legal framework for environmental protection in the PRC. The Ministry of Environmental Protection (“MEP”) of the PRC is primarily responsible for the supervision and administration of environmental protection work nationwide and formulating national waste discharge limits and standards. Local environmental protection authorities at the county level and above are responsible for the environmental protection in their jurisdictions.

Companies that discharge contaminants must report and register with the MEP or the relevant local environment protection authorities. Companies discharging contaminants in excess of the discharge limits prescribed by the central or local authorities must pay discharge fees for the excess in accordance with applicable regulations, and are also responsible for the treatment of the excessive discharge. Government authorities can impose different penalties on individuals or companies in violation of the Environmental Protection Law, depending on the individual circumstances of each case and the extent of contamination. Such penalties include warnings, fines, impositions of deadlines for remedying the contamination, orders to stop production or use, orders to re-install contamination prevention and treatment facilities which have been removed without permission or left unused, administrative actions against relevant responsible persons or companies, or orders to close down those enterprises. Where the violation is serious, the persons or companies responsible for the violation may be required to pay damages to victims of the contamination. Where serious environmental contamination occurs in violation of the provisions of the Environmental Protection Law which results in serious loss of public and private property, persons or enterprises directly responsible for such contamination may be held criminally liable.

Restriction on Foreign Ownership

The principal regulation governing foreign ownership of our business in the PRC is the Foreign Investment Industrial Guidance Catalogue, effective as of April 10, 2015 (the “Catalogue”). Investment activities in the PRC by foreign investors are principally governed by the Catalogue, which was promulgated and is amended from time to time by the Ministry of Commerce and the National Development and Reform Commission (“NDRC”). The Catalogue divides industries into three categories: encouraged, restricted and prohibited. Industries not listed in the Catalogue are generally deemed as constituting a fourth “permitted” category and open to foreign investment unless specifically restricted by other PRC regulations. Our Company, in consultation with its PRC legal advisor, the Guizhou Zhonggong Law Office, has determined that the business of Zhen Ding JV, ore processing, is not listed in the Catalogue or otherwise restricted by other PRC regulations. As a result, our business is deemed to be a “permitted” industry. This status has effectively been confirmed by the PRC State Administration for Industry and Commerce (“SAIC”), which has issued a business license for Zhen Ding JV, as a foreign invested joint venture, to engage in ore milling activities.

The NDRC and MOFCOM periodically jointly revise the Catalogue. As such, there is a possibility that our company’s business may fall outside the scope of the definition of a permitted industry in the future. Should this occur, we would face a limit or restriction on foreign investment, the likes of which we are currently not subject to. However, based on our observation of past practices of the Chinese government, any new guidelines or changes to foreign ownership restrictions will likely be applied prospectively, and companies such as our Company with existing foreign investments are unlikely to be affected by such changes. Also, we are not aware of any reason why ore processing would in the future be considered a sensitive industry justifying its inclusion in the restricted or prohibited categories.

Draft Law on Foreign Investment

In January 2015, MOFCOM issued a draft Law on Foreign Investment which is expected to be finalized in the near future without major changes. The draft Law on Foreign Investment would liberalize foreign investment in PRC businesses by reducing or eliminating the need for administrative approvals of the form of such investments, provided such investments do not involve investment in a restricted or prohibited industry. Because our Company is engaged in a permitted industry, and after consultation with our PRC counsel, we do not expect any adverse consequences resulting from the final passage of the Law on Foreign Investment.

Regulation of Foreign Currency Exchange and Dividend Distribution

Foreign Currency Exchange

The principal regulations governing foreign currency exchange in China are the Foreign Exchange Administration Regulations (1996), as amended, and the Administration Rules of the Settlement, Sale and Payment of Foreign Exchange (1996). Under these regulations, Renminbi are freely convertible for current account items, including the distribution of dividends, interest payments, trade and service-related foreign exchange transactions, but not for most capital account items, such as direct investment, loan, repatriation of investment and investment in securities outside China, unless the prior approval of SAFE or its local counterparts is obtained. In addition, any loans to an operating subsidiary in China that is a foreign invested enterprise, cannot, in the aggregate, exceed the difference between its respective approved total investment amount and its respective approved registered capital amount. Furthermore, any foreign loan must be registered with SAFE or its local counterparts for the loan to be effective. Any increase in the amount of the total investment and registered capital must be approved by MOFCOM or its local counterpart. We may not be able to obtain these government approvals or registrations on a timely basis, if at all, which could result in a delay in the process of making these loans.

The dividends paid by the subsidiary to its shareholder are deemed shareholder income and are taxable in China. Pursuant to the Administration Rules of the Settlement, Sale and Payment of Foreign Exchange (1996), foreign-invested enterprises in China may purchase or remit foreign exchange, subject to a cap approved by SAFE, for settlement of current account transactions without the approval of SAFE. Foreign exchange transactions under the capital account are still subject to limitations and require approvals from, or registration with, SAFE and other relevant PRC governmental authorities.

Dividend Distribution

The principal regulations governing the distribution of dividends by foreign holding companies include the Wholly Foreign Owned Enterprise Law (1986), as amended, and the Administrative Rules under the Wholly Foreign Owned Enterprise Law (1990), as amended.

Under these regulations, WFOEs in China may pay dividends only out of their retained profits, if any, determined in accordance with PRC accounting standards and regulations. In addition, WFOEs in China are required to allocate at least 10% of their respective retained profits each year, if any, to fund certain reserve funds unless these reserves have reached 50% of the registered capital of the enterprises. These reserves are not distributable as cash dividends.

M&A Regulations and Overseas Listings

On August 8, 2006, six PRC regulatory agencies, including the Ministry of Commerce, the State Assets Supervision and Administration Commission, the State Administration for Taxation, the State Administration for Industry and Commerce, CSRC and SAFE, jointly issued the Regulations on Mergers and Acquisitions of Domestic Enterprises by Foreign Investors, or the M&A Rules, which became effective on September 8, 2006 and were amended in 2009. This M&A Rules, among other things, include provisions that purport to require that an offshore special purpose vehicle formed for purposes of overseas listing of equity interests in PRC companies and controlled directly or indirectly by PRC companies or individuals obtain the approval of CSRC prior to the listing and trading of such special purpose vehicle’s securities on an overseas stock exchange.

On September 21, 2006, CSRC published on its official website procedures regarding its approval of overseas listings by special purpose vehicles. The CSRC approval procedures require the filing of a number of documents with the CSRC and it would take several months to complete the approval process. The application of this new PRC regulation remains unclear with no consensus currently existing among leading PRC law firms regarding the scope of the applicability of the CSRC approval requirement.

Our company is not an offshore special purpose vehicle under current PRC laws and regulations, as we currently control our Chinese operating entity through a joint venture arrangement which is permitted under Chinese regulations regarding foreign ownership. As a result, we are not required to obtain the approval of CSRC prior to the listing and trading of our securities on an overseas stock exchange.

Our company, in consultation with our PRC legal advisor, the Guizhou Zhonggong Law Office, has determined that we are not required to obtain PRC approvals and registrations in connection with the CSRC, SAFE, and SAIC for our joint venture arrangement under PRC regulations regarding foreign ownership, and that our company is not an offshore special purpose vehicle under PRC regulations.

This is the case because Zhen Ding JV was established as a joint venture enterprise in 2005 with the approval of the relevant PRC government agencies, with 70% of the joint venture owned by Zhen Ding CA, a California entity with foreign ownership, and 30% of the joint venture owned by Xinzhou Gold, a domestic PRC company. In connection with the formation of Zhen Ding JV, the Anhui Provincial People’s Government issued a Certificate of Approval for Foreign Investment in China in 2005 and a business license was subsequently issued by the SAIC for the period from 2005 to 2025. In connection with the formation of Zhen Ding JV, Zhen Ding CA did not acquire any existing PRC domestic company or equity or assets, but rather established a new joint venture entity with foreign and domestic partners with funds contributed by Zhen Ding CA (70%) and Xinzhou Gold (30%). Zhen Ding CA did not acquire an interest in Xinzhou Gold, but rather established a new joint venture company with Xinzhou Gold as the other partner. Hence there was no acquisition of a PRC domestic company or assets that would implicate the relevant rules on foreign ownership.

The M&A Rules include provisions that purport to require that an offshore special purpose vehicle formed for the purpose of an overseas listing of securities in a PRC company obtain the approval of the CSRC prior to the listing and trading of such special purpose vehicle’s securities on an overseas stock exchange. However, CSRC approval is not required in the context of the current offering covered by this Registration Statement because when our company acquired Zhen Ding CA, it acquired the previously established foreign ownership in a government approved joint venture and not an interest in a PRC domestic company. Accordingly, our Company is not an “offshore special purpose vehicle” and the relevant PRC agencies are not concerned with a change of ownership in a foreign owned joint venture partner.

Our company’s PRC legal advisor, the Guizhou Zhonggong Law Office, also made inquiries with official representatives of each of the CSRC, SAFE, and SAIC and those official representatives all confirmed that there was no requirement for our company to obtain the approval of or register with such agency.

For the foregoing reasons, our company is not required to obtain PRC approvals and registrations in connection with the CSRC, SAFE, and SAIC for its joint venture arrangement under PRC regulations regarding foreign ownership.

Regulations on Offshore Parent Holding Companies’ Direct Investment in and Loans to Their PRC Subsidiaries

An offshore company may invest equity in a PRC company, which will become the PRC subsidiary of the offshore holding company after investment. Such equity investment is subject to a series of laws and regulations generally applicable to any foreign-invested enterprise in China, which include the Wholly Foreign Owned Enterprise Law, the Sino-foreign Equity Joint Venture Enterprise Law, the Sino-foreign Contractual Joint Venture Enterprise Law, all as amended from time to time, and their respective implementing rules; the Tentative Provisions on the Foreign Exchange Registration Administration of Foreign-Invested Enterprise; and the Notice on Certain Matters Relating to the Change of Registered Capital of Foreign-Invested Enterprises.

Under the aforesaid laws and regulations, the increase of the registered capital of a foreign-invested enterprise is subject to the prior approval by the original approval authority of its establishment. In addition, the increase of registered capital and total investment amount shall both be registered with SAIC and SAFE.

Shareholder loans made by offshore parent holding companies to their PRC subsidiaries are regarded as foreign debts in China for regulatory purposes, which are subject to a number of PRC laws and regulations, including the PRC Foreign Exchange Administration Regulations, the Interim Measures on Administration on Foreign Debts, the Tentative Provisions on the Statistics Monitoring of Foreign Debts and its implementation rules, and the Administration Rules on the Settlement, Sale and Payment of Foreign Exchange.

Under these regulations, the shareholder loans made by offshore parent holding companies to their PRC subsidiaries shall be registered with SAFE. Furthermore, the total amount of foreign debts that can be borrowed by such PRC subsidiaries, including any shareholder loans, shall not exceed the difference between the total investment amount and the registered capital amount of the PRC subsidiaries, both of which are subject to the governmental approval.

U.S. Regulations Affecting Our Company

FCPA Policy

The Foreign Corrupt Practices Act, or the FCPA, prohibits companies and individuals subject to FCPA jurisdiction from providing to foreign officials any “corrupt payments” (i.e., bribes, kickbacks, and similar benefits) in order to obtain any unfair advantage with respect to government contracts, regulatory approvals, licenses, and other government actions for the purpose of obtaining or retaining business. The FCPA applies to: (1) “issuers” – U.S. and foreign companies subject to SEC jurisdiction; (2) “domestic concerns” – individuals who are citizens, nationals or residents of the United States and companies with a principal place of business in the United States or organized under U.S. law; and (3) “other persons” – foreign companies or persons who act in the United States to further a corrupt payment. The term “other persons” has been interpreted broadly to include foreign entities that send an email in furtherance of a corrupt act to a U.S. recipient, or that clear a corrupt payment through a U.S. bank. The FCPA requires issuers to maintain accurate books and records that do not misrepresent their payments or expenses. Issuers are also liable for the accuracy of their majority-owned subsidiaries’ books and records and are required to act in good faith to encourage their minority-owned subsidiaries to adopt reasonable internal accounting controls intended to avoid corrupt payments. Issuers, domestic concerns and other persons may be liable for the actions of their foreign subsidiaries and agents if they know or should know that a subsidiary or agent is likely to make a corrupt payment to a foreign official.

Issuers, domestic concerns and other persons subject to the FCPA are subject to severe criminal and civil penalties for violations of the FCPA. Entities that make corrupt payments may be fined as much as $2 million per violation, or twice the amount of the benefit sought in return for the payment. Individuals may be fined up to $100,000 and/or imprisoned for up to five years. Issuers who violate the FCPA’s books and records requirements are subject to fines up to $25 million, and individuals can be fined up to $5 million and/or imprisoned for up to 20 years. Companies may not indemnify their officers or employees for FCPA violations.

Research and Development

We did not incur any research or development expenditures over the last two fiscal years.

Intellectual Property

We do not currently have any intellectual property, other than our domain name and website, www.zhendingresources.com.

Employees

Currently we have no paid employees. Our management team consists of our CEO and CFO and they currently do not receive compensation for their services. We intend to provide compensation to our CEO and CFO in the future and formalize their employment relationship with our company at that time.

Zhen Ding JV currently has 7 employees. The 7 employees occupy the following management positions: CFO, site general manager, mine manager, administrative manager, accountant, and external accounting coordinator. They are adequate to operate the mill when it is idle or at nominal production levels. We anticipate that Zhen Ding JV will re-hire up to 40 mill workers when it resumes its mill operations.

None of the management employees have employee contracts.

Our company may from time to time hire paid consultants to assist it in achieving various goals. Victor Sun has performed consulting services for our company in our very early days, including assisting with the establishment of the Zhen Ding JV, and, due in part to his other business activities in Anhui, China, Mr. Sun is currently assisting our company by helping to co-ordinate certain business activities and functions between our company and Zhen Ding JV. Zhen Ding JV has also employed Wei Dong Sun, a Professor of Geochemistry at the Guangzhou Institute of Geochemistry, as a consultant with respect to certain geological matters at its Wuxi Gold Mine project.

Item 1A. Risk Factors

Our business operations are subject to a number of risks and uncertainties, including, but not limited to those set forth below:

Risks Relating To Our Company

We Are Still Considered To Be A Start-Up Company And Have Little Operating History On Which To Evaluate Our Potential For Future Success.

Our company was formed in 1996. During the years ended December 31, 2015 and 2014, we had total revenue of $Nil and $648,550, respectively, derived from the processing and sale of ore concentrates. We have had limited operating history under our proposed business model upon which you can adequately evaluate our business and prospects. Our limited operating history may prevent a meaningful evaluation of our business, financial performance and prospects.

You must also consider all the risks and uncertainties frequently encountered by developing companies in a very competitive field, such as ours. Our inability to find viable or profitable acquisition candidates and then finding the necessary funding for these purchases may adversely affect our ability to progress.

Our acquisition of Zhen Ding NV provided us with our first business operations. Despite this acquisition, we are still operating at a loss. Until we are able to integrate Zhen Ding JV and obtain enough funding to execute our business plan for Zhen Ding JV, we will not generate sufficient revenue to cover our operating expenses.

Doubts exist about our ability to continue as a going concern.

If We Do Not Obtain Additional Capital, We May Be Unable To Sustain Our Business.

Our operating plan for 2016 is focused on expanding the Wuxi ore milling operations through exploration of further reserves by Xinzhou Gold and the subsequent expansion of the mill. We estimate we will require a minimum of approximately $500,000 to support this plan for the next 12 months. We are actively seeking additional funding, but to date have not entered into any agreements or other arrangements for such financing. There can be no assurance that the required additional financing will be available on terms favorable to us, or if found at all.

Without additional funding, our company will not be able to pursue its business model. If adequate funds are not available or are not available on acceptable terms when required, we would be required to significantly curtail our operations and would not be able to fund the development of the business envisioned by our business model. These circumstances could have a material adverse effect on our business and our ability to continue to operate as a going concern. If additional funds are raised through the issuance of equity or convertible debt securities, our existing shareholders may experience substantial dilution, and such securities may have rights, preferences and privileges senior to those of our common stock.

If we cannot obtain additional funding, we may be required to:

|

•

|

reduce or possibly eliminate our expenditures on exploration; and

|

|

•

|

seek other businesses opportunities and other strategic transactions with a view toward diversifying our business and attracting new investment.

|

Even if we do find a source of additional capital, we may not be able to negotiate acceptable terms and conditions for receiving the additional capital. Any future capital investments could dilute or otherwise materially and adversely affect the holdings or rights of our existing shareholders. In addition, new equity or convertible debt securities issued by us to obtain financing could have rights, preferences and privileges senior to our common stock. We cannot give you any assurance that any additional financing will be available to us, or if available, will be on terms favorable to us.

We May Have Difficulty Raising Necessary Capital To Fund Operations As A Result Of Market Price Volatility Of Our Shares Of Common Stock.

The price per share of our shares on the OTC market may at any time become subject to volatility resulting from purely market forces over which we will have no control. Such volatility may make it more difficult to find investors willing to invest in our common stock, or to negotiate equity financing or terms that are acceptable to us, furthering hampering our plans of expansion and growth.

We Have Incurred Losses In Certain Prior Periods And May Incur Losses In The Future.

We incurred net losses of $18,034,800 for the period from inception (September 6, 1996) to December 31, 2015. As at December 31, 2015 we had a working capital deficit of $7,378,440. We may incur additional losses in the future. We expect our costs and expenses to increase as we expand our operations. Our ability to achieve and maintain profitability depends on the ability to raise necessary funding, our ability to integrate new projects, the extensiveness of any reserves, and the global pricing of precious and base metals. We may not be able to achieve or sustain profitability on a quarterly or annual basis.

Our Profitability Is Heavily Dependent On The World Price Of Commodities.

The selling price that we will obtain for any metal production is almost totally dependent on the world price. Should the price of gold, silver, or copper, our main interests, fall below the cost of production, we may have to cease all mining and milling activities. Our future, at that point, will become extremely doubtful.

Most established and experienced mining enterprises expend time and resources exploring and drilling to establish likely reserves within a given prospect. The method of mining chosen by the previous owners of the Wuxi property, stated in common terms, is to ”follow the veins”, a technique that is cost effective, yet has the very real risk of mining activities being suddenly curtailed as the “veins” may narrow and yields per ton suddenly become unprofitable. This may cause us to terminate extraction and milling activities at this site.

We Cannot Assure You That Our Growth Strategy Will Be Successful.

Our growth strategy is primarily through the acquisition of new mines and their expandability. However, many obstacles exist to incorporating any new entity into our existing operations. Acquisitions of businesses or other material operations may require debt financing or additional equity financing, resulting in leverage or dilution of ownership. Integration of acquired business operations could disrupt our business by diverting management away from day-to-day operations. The difficulties of integration may be increased by the necessity of coordinating geographically dispersed organizations, integrating personnel with disparate business backgrounds and combining different corporate cultures. We also may not be able to maintain key employees or customers of an acquired business or realize cost efficiencies or synergies or other benefits we anticipated when selecting our acquisition candidates. In addition, we may need to record write-downs from future impairments of intangible assets, which could reduce our future reported earnings. At times, acquisition candidates may have liabilities or adverse operating issues that we fail to discover through due diligence prior to the acquisition which will be required to comply with laws of PRC, to the extent applicable. There can be no assurance that any proposed acquisition will be able to comply with PRC requirements, rules and/or regulations, or that we will successfully obtain governmental approvals to the extent required, which may be necessary to consummate such acquisitions.

We cannot, therefore, assure you that we will be able to successfully overcome such obstacles and establish these new additions. Our inability to successfully implement our growth strategy may have a negative impact on existing operations and our future financial condition, results of operations or cash flows.

If We Are Not Able To Implement Our Strategies To Achieve Our Business Objectives, Our Business Operations And Financial Performance May Be Adversely Affected.

Our business plan and growth strategy is based on currently prevailing circumstances and the assumption that certain circumstances will or will not occur, as well as the inherent risks and uncertainties involved in various stages of development. However, there is no assurance that we will be successful in implementing our strategies or that our strategies, even if implemented, will lead to the successful achievement of our objectives. If we are not able to successfully implement our strategies, our business operations and financial performance may be adversely affected.

We Depend On Our Key Management Personnel And The Loss Of Their Services Could Adversely Affect Our Business.

We place substantial reliance upon the efforts and abilities of our executive officers, Mr. De Gang Wei, our Chairman and key member of Management of our mining operations and CFO; and Ms. Wen Mei Tu, our President and CEO. The loss of the services of any of our executive officers could have a material adverse effect on our business, operations, revenues or prospects. We do not maintain key man life insurance on the lives of these individuals. As well, both Mr. Wei and Ms. Tu have significant activities outside our company that put demands on their time that could detract from their management of our company’s business.

Failure To Attract And Retain Personnel Could Have An Adverse Impact On Our Operations.

Our future success depends on our ability to identify, attract, hire, retain and motivate other well-qualified managerial, technical, and operational personnel. There is intense competition for these individuals, and there can be no assurance that these professionals will be available in the market or that we will be able to meet their compensation requirements.

We Are An Emerging Growth Company As Defined Under The Jumpstart Our Business Startups Act.

An “emerging growth company” is an issuer whose initial public offering was or will be completed after December 8, 2011, and had total annual gross revenues of less than $1 billion during its most recently completed fiscal year. An issuer’s EGC status terminates on the earliest of:

|

·

|

The last day of the first fiscal year of the issuer during which it had total annual gross revenues of $1 billion or more;

|

|

·

|

The last day of the fiscal year of the issuer following the fifth anniversary of the date of the issuer’s initial public offering;

|

|

·

|

The date on which such issuer has issued more than $1 billion in non-convertible debt securities during the prior three-year period determined on a rolling basis; or

|

|

·

|

The date on which the issuer is deemed to be a “large accelerated filer” under the Exchange Act, which means, among other things, that it has a public float in excess of $700 million.

|

Pursuant to the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”), as an emerging growth company our Company can elect to opt out of the extended transition period for any new or revised accounting standards that may be issued by the PCAOB or the SEC. Our Company has elected not to opt out of such extended transition period which means that when a standard is issued or revised and it has different application dates for public or private companies, our Company, as an emerging growth company, can adopt the standard for the private company. This may make comparison of our Company's financial statements with any other public company which is not either an emerging growth company nor an emerging growth company which has opted out of using the extended transition period difficult or impossible as possible different or revised standards may be used.

Our Company has elected to use the extended transition period for complying with new or revised financial accounting standards available under Section 102(b)(2)(B) of the JOBS Act. Among other things, this means that our Company's independent registered public accounting firm will not be required, as with smaller reporting companies, to provide an attestation report on the effectiveness of our Company's internal control over financial reporting so long as it qualifies as an emerging growth company, which may increase the risk that weaknesses or deficiencies in the internal control over financial reporting go undetected. Likewise, so long as it qualifies as an emerging growth company, our Company may elect not to provide certain information, including certain financial information and certain information regarding compensation of executive officers that would otherwise have been required to provide in filings with the SEC, which may make it more difficult for investors and securities analysts to evaluate our Company. As a result, investor confidence in our Company and the market price of our common stock may be adversely affected.

In addition to qualifying as an emerging growth company, we also currently qualify as a Smaller Reporting Company under Rule 12b-2 of the Securities Exchange Act of 1934, as amended. Rule 12b-2 defines a Smaller Reporting Company as an issuer that is not an investment company, an asset-backed issuer, or a majority-owned subsidiary of a parent that is not a smaller reporting company and that:

|

·

|

Had a public float of less than $75 million as of the last business day of its most recently completed second fiscal quarter, computed by multiplying the aggregate worldwide number of shares of its voting and non-voting common equity held by non-affiliates by the price at which the common equity was last sold, or the average of the bid and asked prices of common equity, in the principal market for the common equity; or

|

|

·

|

In the case of an initial registration statement under the Securities Act or Exchange Act for shares of its common equity, had a public float of less than $75 million as of a date within 30 days of the date of the filing of the registration statement, computed by multiplying the aggregate worldwide number of such shares held by non-affiliates before the registration plus, in the case of a Securities Act registration statement, the number of such shares included in the registration statement by the estimated public offering price of the shares; or

|

|

·

|

In the case of an issuer whose public float as calculated under paragraph (1) or (2) of this definition was zero, had annual revenues of less than $50 million during the most recently completed fiscal year for which audited financial statements are available.

|

As long as we remain a Smaller Reporting Company, we may take advantage of certain scaled or reduced disclosure requirements, some of which are the same as the reduced disclosure requirements applicable to an Emerging Growth Company. In the event that we cease to be an Emerging Growth Company as a result of a lapse of the five year period, but continue to be a Smaller Reporting Company, we would continue to take advantage of the scaled disclosure requirements applicable to a Smaller Reporting Company.

Other Risks Related To Our Business

The Gold Mining License For Our Joint Venture Partner, Xinzhou Gold, From Which We Currently Purchase All Of Our Raw Material, Is Currently Expired. If The Gold Mining License For Our Joint Venture Partner Is Not Reissued Our Operation May Be Seriously Affected.

To date, we have purchased all of our raw material from Xinzhou Gold for our ore processing operation and we have relied solely on Xinzhou Gold for our supply of ores. However, we will look for other sources if and when Xinzhou Gold cannot meet our supply requirements. The Gold Mining License previously issued to Xinzhou Gold recently lapsed and the renewal application is currently pending. Without a valid Gold Mining License, Xinzhou Gold may not mine for gold at its Wuxi Gold Mine. Based on past experience, we are confident that Xinzhou Gold will soon receive a renewal of the Gold Mining License. However, should Xinzhou Gold’s application for a renewal of the Gold Mining License be denied or seriously delayed, we may not be able to secure another source of gold ores for our processing plant on the same terms and our revenues and profitability may be seriously limited.

If The Mining License Extension Application For Our Joint Venture Partner, Xinzhou Gold, Whom We Purchase Our Raw Material From, Is Not Granted Our Operation May Be Seriously Affected.

To date, we have purchased all of our raw material from Xinzhou Gold for our ore processing operation and we have relied solely on Xinzhou Gold for our supply of ores. However, we will look for other sources if and when Xinzhou Gold cannot meet our supply requirements. The veins currently being excavated by Xinzhou Gold in the permitted areas of its mines are very low grade and as such the production is minimal. The higher yielding and thereby more profitable veins run outside Xinzhou Gold’s permitted mining area boundaries under its current license. Xinzhou Gold is currently making preparations to apply for an extension of the area permitted to be mined under its license, and we anticipate a positive response. We continue production at less profitable levels with low grade metal ores. However, should Xinzhou Gold’s application for an extension of the mining area be denied, we may not be able to secure another source with higher grade ores for our processing plant and our profitability may be seriously limited.

Reserves And Mineralization Estimates Are Uncertain.

We rely on Xinzhou Gold for our supply of ores. There are numerous uncertainties inherent in estimating proven and probable reserves and mineralization, including many factors beyond our control. The estimation of reserves and mineralization is a subjective process and the accuracy of any such estimates is a function of the quality of available data and of engineering and geological interpretation and judgment. Results of drilling, metallurgical testing and production and the evaluation of mine plans subsequent to the date of any estimate may justify revision of such estimates. No assurances can be given that the volume and grade of reserves recovered and rates of production will not be less than anticipated. Assumptions about prices are subject to great uncertainty and gold prices have fluctuated widely in the past. Declines in the market price of gold or other precious metals also may render reserves or mineralization containing relatively lower grades of ore uneconomic to exploit. Changes in operating and capital costs and other factors including, but not limited to, short-term operating factors such as the need for sequential development of ore bodies and the processing of new or different ore grades, may materially and adversely affect Xinzhou Gold’s mine reserves and as a result affect our production.

We Potentially Face Intense Competition From Other Companies In The Mining Field That Have Greater Resources Than Us.

Most of our potential competitors have substantially greater financial, technical, production and other resources than we do. Greater size in some cases provides them with a competitive advantage with respect to production costs because of their economies of scale and their ability to purchase raw materials at lower prices. These companies may be more attractive for qualified and experienced personnel. Companies with greater financial resources may readily outbid us for potential lucrative acquisitions.

Acts Of Terrorism, Responses To Acts Of Terrorism And Acts Of War May Impact Our Business And Our Ability To Raise Capital.

Future acts of war or terrorism, national or international responses to such acts, and measures taken to prevent such acts may harm our ability to raise capital or our ability to operate, especially to the extent we depend upon activities conducted in foreign countries, such as China. In addition, the threat of future terrorist acts or acts of war may have effects on the general economy or on our business that are difficult to predict. We are not insured against damage or interruption of our business caused by terrorist acts or acts of war.

Risks Relating To The People's Republic Of China

Currency Conversion And Exchange Rate Volatility Could Adversely Affect Our Financial Condition.

The PRC government imposes control over the conversion of Renminbi into foreign currencies. Under the current unified floating exchange rate system, the People's Bank of China publishes an exchange rate, which we refer to as the People's Bank of China exchange rate, based on the previous day's dealings in the inter-bank foreign exchange market. Financial institutions authorized to deal in foreign currency may enter into foreign exchange transactions at exchange rates within an authorized range above or below the People's Bank of China exchange rate according to market conditions. Pursuant to the Foreign Exchange Control Regulations of the PRC issued by the State Council which came into effect on April 1, 1996, and the Regulations on the Administration of Foreign Exchange Settlement, Sale and Payment of the PRC which came into effect on July 1, 1996, regarding foreign exchange control, conversion of Renminbi into foreign exchange by Foreign Investment Enterprises, for use on current account items, including the distribution of and profits to foreign investors, is permissible. Conversion of Renminbi into foreign currencies for capital account items, including direct investment, loans, and security investment, is still under certain restrictions. On January 14, 1997, the State Council amended the Foreign Exchange Control Regulations and added, among other things, an important provision, which provides that the PRC government shall not impose restrictions on recurring international payments and transfers under current account items.

Enterprises in the PRC (including Foreign Investment Enterprises) which require foreign exchange for transactions relating to current account items, may, without approval of the State Administration of Foreign Exchange, or SAFE, effect payment from their foreign exchange account or convert and pay at the designated foreign exchange banks by providing valid receipts and proofs.

To The Extent Our Assets Are Located In China, Any Dividends Or Proceeds From Liquidation Is Subject To The Approval Of The Relevant Chinese Government Agencies.

If we pursue our plans to operate mainly in China, our assets will be predominantly located inside China. Under the laws governing foreign invested enterprises in China, dividend distribution and liquidation are allowed but subject to special procedures under the relevant laws and rules. Any dividend payment will be subject to the decision of the board of directors and subject to foreign exchange rules governing such repatriation. Any liquidation is subject to both the relevant government agency's approval and supervision as well the foreign exchange control. This may generate additional risk for our investors in case of dividend payment and liquidation.

To the extent our assets will be located in China and to the extent our revenue will be derived from our operations in China, our results of business and prospects would be subject to the economic, political and legal developments in China.

While China's economy has experienced a significant growth in the past twenty years, growth has been irregular, both geographically and among various sectors of the economy. The Chinese government has implemented various measures to encourage economic growth and guide the allocation of resources. Some of these measures benefit the overall economy of China, but may also have a negative effect on us. For example, our sales results and financial condition may be adversely affected by the government control over capital investments or changes in tax regulations with our future investors and/or customers.

The economy of China has been transitioning from a planned economy to a more market-oriented economy. In recent years the Chinese government has implemented measures emphasizing the utilization of market forces for economic reform and the reduction of state ownership of productive assets and the establishment of corporate governance in business enterprises; however, a substantial portion of productive assets in China are still owned by the Chinese government. In addition, the Chinese government continues to play a significant role in regulating industry development by imposing industrial policies. It also exercises significant control over China's economic growth through the allocation of resources, controlling payment of foreign currency-denominated obligations, setting monetary policy and providing preferential treatment to particular industries or companies.

We May Face Obstacles From The Communist System In The People's Republic Of China.

Foreign companies conducting operations in The People's Republic of China face significant political, economic and legal risks. The Communist regime in The People's Republic of China includes a stifling bureaucracy that may discourage Western investment.

We May Have Difficulty Establishing Adequate Management, Legal And Financial Controls In The People's Republic Of China.

The People's Republic of China historically has been deficient in Western style management and financial reporting concepts and practices, as well as in modern banking, computer and other control systems. We may have difficulty in hiring and retaining a sufficient number of qualified employees to work in The People's Republic of China. As a result of these factors, we may experience difficulty in establishing management, legal and financial controls, collecting financial data and preparing financial statements, books of account and corporate records and instituting business practices that meet Western standards.

Because Our Assets And Operations Are Located In China, You May Have Difficulty Enforcing Any Civil Liabilities Against Us Under The Securities And Other Laws Of The United States Or Any State.

All of our assets are currently located in the Republic of China. In addition, our directors and officers are non-residents of the United States, and all or a substantial portion of the assets of these non-residents are located outside the United States. As a result, it may be difficult for investors to effect service of process within the United States upon these non-residents, or to enforce against them judgments obtained in United States courts, including judgments based upon the civil liability provisions of the securities laws of the United States or any state.

There is uncertainty as to whether courts of the Republic of China would enforce:

|

·

|

Judgments of United States courts obtained against us or these non-residents based on the civil liability provisions of the securities laws of the United States or any state; or

|

|

·

|

In original actions brought in the Republic of China, liabilities against us or non-residents predicated upon the securities laws of the United States or any state. Enforcement of a foreign judgment in the Republic of China also may be limited or otherwise affected by applicable bankruptcy, insolvency, liquidation, arrangement, moratorium or similar laws relating to or affecting creditors' rights generally and will be subject to a statutory limitation of time within which proceedings may be brought.

|

The PRC Legal System Embodies Uncertainties, Which Could Limit Law Enforcement Availability.

The PRC legal system is a civil law system based on written statutes. Unlike common law systems, decided legal cases have little precedence. In 1979, the PRC government began to promulgate a comprehensive system of laws and regulations governing economic matters in general. The overall effect of legislation over the past 27 years has significantly enhanced the protections afforded to various forms of foreign investment in China. Each of our PRC operating subsidiaries and affiliates is subject to PRC laws and regulations. However, these laws and regulations change frequently and the interpretation and enforcement involve uncertainties. For instance, we may have to resort to administrative and court proceedings to enforce the legal protection that we are entitled to by law or contract. However, since PRC administrative and court authorities have significant discretion in interpreting statutory and contractual terms, it may be difficult to evaluate the outcome of administrative court proceedings and the level of law enforcement that we would receive in more developed legal systems. Such uncertainties, including the inability to enforce our contracts, could affect our business and operation. In addition, intellectual property rights and confidentiality protections in China may not be as effective as in the United States or other countries. Accordingly, we cannot predict the effect of future developments in the PRC legal system, particularly with regard to the industries in which we operate, including the promulgation of new laws. This may include changes to existing laws or the interpretation or enforcement thereof, or the preemption of local regulations by national laws. These uncertainties could limit the availability of law enforcement, including our ability to enforce our agreements with the government entities and other foreign investors.

Any Dividends And Other Distributions From Any Subsidiaries In China Are Subject To Various Legal And Contractual Restrictions And Uncertainties, And Our Ability To Pay Dividends Or Make Other Distributions To Our Shareholders Are Negatively Affected By Those Restrictions And Uncertainties.

We plan to operate in China through PRC subsidiaries. As a result, our profits available for distribution to our shareholders are dependent on the profits available for distribution from PRC subsidiaries. If the subsidiary incurs debt on its own behalf, the debt instruments may restrict its ability to pay dividends or make other distributions, which in turn would limit our ability to pay dividends on our shares. Under the current PRC laws, because we are incorporated in the Delaware, any PRC subsidiaries would be regarded as Sino-foreign joint venture enterprises in China. Although dividends paid by foreign invested enterprises, such as wholly foreign-owned enterprises and Sino-foreign joint ventures, are not subject to any PRC corporate withholding tax, the PRC laws permit payment of dividends only out of net income as determined in accordance with PRC accounting standards and regulations. Determination of net income under PRC accounting standards and regulations may differ from determination under U.S. GAAP in significant aspects, such as the use of different principles for recognition of revenues and expenses. In addition, if we make additional capital contributions to PRC subsidiaries, (which may occur through the capitalization of undistributed profits), then additional approval of the PRC government would be required due to an increase in our registered capital and total investment . Under the PRC laws, a Sino-foreign joint venture enterprise is required to set aside a portion of its net income each year to fund designated statutory reserve funds. These reserves are not distributable as cash dividends. As a result, our primary internal source of funds of dividend payments from PRC subsidiaries are subject to these and other legal and contractual restrictions and uncertainties, which in turn may limit or impair our ability to pay dividends to our shareholders. Moreover, any transfer of funds from us to PRC subsidiaries, either as a shareholder loan or as an increase in registered capital, is subject to registration with or approval by PRC governmental authorities. We currently do not intend on paying any dividends in the future and expect to retain all available funds to support our operations and to finance growth and development of our business. We have never declared dividends or paid cash dividends. Our board of directors will make any future decisions regarding dividends. We currently intend to retain and use any future earnings for the development and expansion of our business and do not anticipate paying any cash dividends in the near future. Therefore, any gains on an investment in our common stock will likely occur through an increase in our stock price, which may or may not occur.

We May Be Exposed To Liabilities Under The Foreign Corrupt Practices Act, And Any Determination That We Violated The Foreign Corrupt Practices Act Could Have A Material Adverse Effect On Our Business.

We are subject to the Foreign Corrupt Practice Act, or FCPA, and other laws that prohibit improper payments or offers of payments to foreign governments and their officials and political parties by U.S. persons and issuers as defined by the statute, for the purpose of obtaining or retaining business. We have operations, agreements with third parties and we make sales in China. Our activities in China create the risk of unauthorized payments or offers of payments by the employees, consultants, sales agents or distributors of our Company, even though they may not always be subject to our control. It is our policy to implement safeguards to discourage these practices by our employees. However, our existing safeguards and any future improvements may prove to be less than effective, and the employees, consultants, sales agents or distributors of our Company may engage in conduct for which we might be held responsible. Violations of the FCPA may result in severe criminal or civil sanctions, and we may be subject to other liabilities, which could negatively affect our business, operating results and financial condition. In addition, the U.S. government may seek to hold our Company liable for successor liability FCPA violations committed by companies in which we invest or that we acquire.

Risks Related To Corporate And Stock Matters

Our Common Stock Is A Penny Stock. Trading Of Our Stock May Be Restricted By The SEC’s Penny Stock Regulations That May Limit A Stockholder’s Ability To Buy And Sell Our Stock.

Our common shares are deemed “a penny stock”. The SEC has adopted Rule 15g-9 which generally defines “penny stock” to be any equity security that has a market price (as defined) less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exceptions. Our securities are covered by the penny stock rules, which impose additional sales practice requirements on broker-dealers who sell to persons other than established customers and “accredited investors”. The term “accredited investor” refers generally to institutions with assets in excess of $5,000,000 or individuals with a net worth in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly with their spouse. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document in a form prepared by the SEC which provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction and monthly account statements showing the market value of each penny stock held in the customer’s account. The bid and offer quotations, and the broker-dealer and salesperson compensation information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer’s confirmation. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from these rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for the stock that is subject to these penny stock rules. Consequently, these penny stock rules may affect the ability of broker-dealers to trade our securities. We believe that the penny stock rules discourage investor interest in and limit the marketability of our common stock.

In addition, we intend to apply for our common stock to be quoted on NASDAQ (FINRA)’s the Over-the-Counter Bulletin Board (OTCBB). There can be no assurance that we will succeed in this effort. Failure to list our shares on the OTCBB may impair the liquidity of our common stock.

NASD Sales Practice Requirements May Also Limit A Stockholder’s Ability To Buy And Sell Our Stock.

Section 15(g) of the Securities Exchange Act of 1934, as amended, and Rule 15g-2 promulgated thereunder by the SEC require broker-dealers dealing in penny stocks to provide potential investors with a document disclosing the risks of penny stocks and to obtain a manually signed and dated written receipt of the document before effecting any transaction in a penny stock for the investor’s account.

Potential investors in our common stock are urged to obtain and read such disclosure carefully before purchasing any shares that are deemed to be “penny stock.” Moreover, Rule 15g-9 requires broker-dealers in penny stocks to approve the account of any investor for transactions in such stocks before selling any penny stock to that investor. This procedure requires the broker-dealer to (i) obtain from the investor information concerning his or her financial situation, investment experience and investment objectives; (ii) reasonably determine, based on that information, that transactions in penny stocks are suitable for the investor and that the investor has sufficient knowledge and experience as to be reasonably capable of evaluating the risks of penny stock transactions; (iii) provide the investor with a written statement setting forth the basis on which the broker-dealer made the determination in (ii) above; and (iv) receive a signed and dated copy of such statement from the investor, confirming that it accurately reflects the investor’s financial situation, investment experience and investment objectives. Compliance with these requirements may make it more difficult for holders of our common stock to resell their shares to third parties or to otherwise dispose of them in the market or otherwise.

Shares Eligible For Future Sale May Adversely Affect The Market Price Of Our Common Stock, As The Future Sale Of A Substantial Amount Of Our Restricted Stock In The Public Marketplace Could Reduce The Price Of Our Common Stock.

From time to time, certain of our stockholders may be eligible to sell all or some of their shares of common stock by means of ordinary brokerage transactions in the open market pursuant to Rule 144, promulgated under the Securities Act (“Rule 144”), subject to certain limitations. In general, pursuant to Rule 144, a stockholder (or stockholders whose shares are aggregated) who has satisfied a one-year holding period may, under certain circumstances, sell within any three-month period a number of securities which does not exceed the greater of 1% of the then outstanding shares of common stock or the average weekly trading –volume of the class during the four calendar weeks prior to such sale. Rule 144 also permits, under certain circumstances, the sale of securities, without any limitations, by a non-affiliate of our company that has satisfied a two-year holding period. Any substantial sale of common stock pursuant to Rule 144 or pursuant to any resale prospectus may have an adverse effect on the market price of our securities.

You May Not Be Able To Liquidate Your Investment Since There Is No Assurance That A Public Market Will Develop For Our Common Stock Or That Our Common Stock Will Ever Be Approved For Trading On A Recognized Exchange.

There is no established public trading market for our securities. After this document is declared effective by the U.S. Securities and Exchange Commission, we intend to seek a market maker to apply for a quotation on the OTCBB in the United States. We cannot assure you that a market maker will agree to file the necessary documents with the OTCBB, nor can there be any assurance that such an application for quotation will be approved or that a regular trading market will develop or that if developed, will be sustained. In the absence of a trading market, you may be unable to liquidate its investment, which will result in the loss of your investment.

Our Directors And Executive Officers, Collectively, Own Approximately 34% Of Our Outstanding Common Stock And May Be Able To Control Our Management And Affairs.

As of December 31, 2015, our executive officers and directors beneficially owned an aggregate of approximately 34.0% of our outstanding common stock. As a result, our directors and executive officers, acting together, may be able to control our management and affairs, including the election of directors and approval of significant corporate transactions, such as mergers, consolidation, and sale of all or substantially all of our assets. Consequently, this concentration of ownership may have the effect of delaying or preventing a change of control, including a merger, consolidation or other business combination involving us, even if such a change of control would benefit our stockholders. It could also deprive our shareholders of an opportunity to receive a premium for their shares as part of a sale of our company and it may affect the market price of our common stock. In deciding how to vote on such matters, those shareholders’ interests may conflict with yours.

Other Risks

Trends, Risks and Uncertainties

We have sought to identify what we believe to be the most significant risks to our business, but we cannot predict whether, or to what extent, any of such risks may be realized nor can we guarantee that we have identified all possible risks that might arise. Investors should carefully consider all of such risk factors before making an investment decision with respect to our common stock.

As a “smaller reporting company”, we are not required to provide the information required by this Item.

Our principal office is located at 353 St. Nicolas, Suite 205, Montreal, Quebec H2Y 2P1. The offices in Montreal are not under written lease but are rented through a verbal agreement, on a month to month basis, from 150206 Canada Inc. at $500 per month, due and payable at each calendar quarter end. The occupancy began October 1, 2013.

Our operational offices are located at: Zhen Ding Mining Co. Ltd., Wuxi County, Town of Langqiao, Jing Xian, Anhui Province, China, Tel: 86-6270-9018.

Mineral Properties

Description of the Property of the Wuxi Gold Project

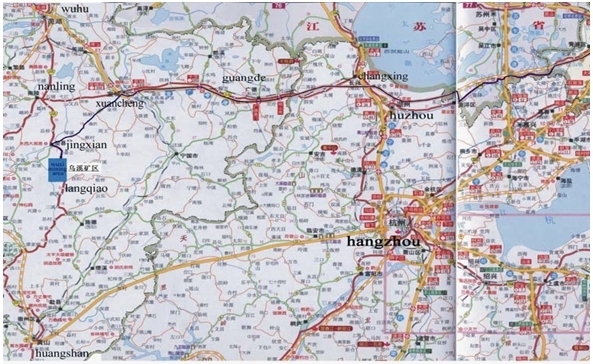

Zhen Ding JV relies on Xinzhou Gold for its supply of metal ores and its processing plant is located on the site of the underground mine where Xinzhou Gold has licenses to explore and mine ore (the “Wuxi Gold Project”) to reduce transportation cost. The Wuxi Gold Project is located in Jingxian county, situated in the southeastern part of Anhui Province, PRC. The site is 63km southwest of the city of Xuancheng, a significant city of about 2.8 million inhabitants, and is 15 km south of the town of Jingxian. The project site falls under the administration of the township of Langqaio and is located near the village of Wuxi (see Figure 1).

Figure 1- Location of Wuxi

The geographical position of the Wuxi Gold Project is located within the area bounded by the coordinates: 118°24′20″ to 118°27′20″ E and 30°31′30″ to 30°35′30″ N.

Access to the site from the city of Huangshan, the nearest city with regular air service, is by Express Highway #205 for approximately 125km to the village of Wuxi and subsequently by a 2 km all-weather road to the project site. All roads are public roads. Access is also available through the rail system at Xuancheng. (Please refer to Figure 2 for access to Wuxi via highways).

The area was eroded by glacial activity and subsequently by meteoric waters to a rolling landform. The elevations in the Wuxi Gold Project area are generally higher in the east and lower in the west. The highest elevation, in the area, is less than 300m above sea level.

Gullies and creeks are well developed and are recharged by meteoric water. A river near the Wuxi Gold Project site will, via surface channel, conduit sufficient water for process and mining purposes. All rivers, gullies and creeks in the area flow into the Shuiyang river system.

The area has a mild climate. The highest temperatures occur in July and August reaching highs of + 41ºC and the lowest are during January and February reaching lows of –8ºC. Annual precipitation varies between 1348.2mm and 1422.8mm, concentrated from April to August.

The Wuxi Gold Project is located near the village of Wuxi and the work force comes from this and other nearby villages. A plentiful, although inexperienced, work force is available locally.

Electric power is supplied by the local power grid and additional demand can be met by existing infrastructure. Energy cost is low and reliability is reportedly good. No backup power supply is provided or required on site. Telephone lines are available. Cellular phone coverage is good. Required roads, power lines, and water lines are in place.

Our joint venture partner, Xinzhou Gold currently mines ores at the Wuxi Gold Project under two permits: (1) Mining License No. C3400002009114110049341 (the “Mining License”) and (2) Gold Mining License No. (2005) 42 (the “Gold Mining License”).