Attached files

| file | filename |

|---|---|

| EX-32.1 - EXHIBIT 32.1 - Asterias Biotherapeutics, Inc. | ex32_1.htm |

| EX-31.2 - EXHIBIT 31.2 - Asterias Biotherapeutics, Inc. | ex31_2.htm |

| EX-31.1 - EXHIBIT 31.1 - Asterias Biotherapeutics, Inc. | ex31_1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| ☒ |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the quarterly period ended June 30, 2017

OR

| ☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from _________ to ________

Commission file number 001-36646

Asterias Biotherapeutics, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware

|

46-1047971

|

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

6300 Dumbarton Circle

Fremont, California 94555

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code

(510) 456-3800

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ☒Yes☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

☐

|

Accelerated filer

|

☐

|

|

|

Non-accelerated filer

|

☒

|

(Do not check if a smaller reporting company)

|

Smaller reporting company

|

☐

|

|

Emerging growth company

|

☒

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☒ No

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date: 49,978,791 shares of Series A Common Stock, $0.0001 par value, as of August 8, 2017.

PART I--FINANCIAL INFORMATION

Statements made in this Report that are not historical facts may constitute forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from those discussed. Such risks and uncertainties include but are not limited to those discussed in this Report under Item 1 of the Notes to Financial Statements, and under Risk Factors in this Report. Words such as “expects,” “may,” “will,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates,” and similar expressions identify forward-looking statements.

References to “Asterias,” “our” or “we” means Asterias Biotherapeutics, Inc.

The description or discussion, in this Form 10-Q, of any contract or agreement is a summary only and is qualified in all respects by reference to the full text of the applicable contract or agreement.

2

| Item 1. |

Financial Statements

|

ASTERIAS BIOTHERAPEUTICS, INC.

CONDENSED BALANCE SHEETS

(IN THOUSANDS EXCEPT PAR VALUE AMOUNTS)

|

June 30,

2017

(unaudited)

|

December 31,

2016

|

|||||||

|

ASSETS

|

||||||||

|

CURRENT ASSETS

|

||||||||

|

Cash and cash equivalents

|

$

|

11,875

|

$

|

19,800

|

||||

|

Available-for-sale securities, at fair value

|

13,141

|

15,269

|

||||||

|

Prepaid expenses and other current assets

|

1,349

|

1,921

|

||||||

|

Total current assets

|

26,365

|

36,990

|

||||||

|

NONCURRENT ASSETS

|

||||||||

|

Intangible assets, net

|

16,787

|

18,130

|

||||||

|

Property, plant and equipment, net

|

4,999

|

5,475

|

||||||

|

Other assets

|

411

|

415

|

||||||

|

TOTAL ASSETS

|

$

|

48,562

|

$

|

61,010

|

||||

|

LIABILITIES AND STOCKHOLDERS' EQUITY

|

||||||||

|

CURRENT LIABILITIES

|

||||||||

|

Amount due to BioTime, Inc.

|

$

|

-

|

$

|

288

|

||||

|

Accounts payable

|

408

|

1,076

|

||||||

|

Accrued expenses

|

1,604

|

2,495

|

||||||

|

Capital lease liability, current

|

7

|

7

|

||||||

|

Deferred grant income

|

-

|

2,185

|

||||||

|

Total current liabilities

|

2,019

|

6,051

|

||||||

|

LONG-TERM LIABILITIES

|

||||||||

|

Warrant liability

|

5,767

|

8,665

|

||||||

|

Capital lease liability, noncurrent

|

18

|

20

|

||||||

|

Deferred rent liability

|

296

|

266

|

||||||

|

Lease liability

|

3,747

|

3,980

|

||||||

|

TOTAL LIABILITIES

|

11,847

|

18,982

|

||||||

|

Commitments and contingencies (see Note 9)

|

||||||||

|

STOCKHOLDERS’ EQUITY

|

||||||||

|

Preferred Stock, $0.0001 par value, authorized 5,000 shares; none issued and outstanding

|

-

|

-

|

||||||

|

Common Stock, $0.0001 par value, authorized 75,000 Series A Common Stock and 75,000 Series B Common Stock; 49,556 and 47,567 shares Series A Common Stock issued and outstanding at June 30, 2017 and December 31, 2016, respectively; no Series B Common Stock issued and outstanding at June 30, 2017 and December 31, 2016

|

5

|

5

|

||||||

|

Additional paid-in capital

|

138,659

|

126,829

|

||||||

|

Accumulated other comprehensive loss

|

(3,206

|

)

|

(1,078

|

)

|

||||

|

Accumulated deficit

|

(98,743

|

)

|

(83,728

|

)

|

||||

|

Total stockholders’ equity

|

36,715

|

42,028

|

||||||

|

TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY

|

$

|

48,562

|

$

|

61,010

|

||||

The accompanying notes are an integral part of these unaudited condensed financial statements.

3

ASTERIAS BIOTHERAPEUTICS, INC.

CONDENSED STATEMENTS OF OPERATIONS

(IN THOUSANDS, EXCEPT PER SHARE DATA)

(UNAUDITED)

|

Three Months Ended

June 30,

|

Six Months Ended

June 30,

|

|||||||||||||||

|

2017

|

2016

|

2017

|

2016

|

|||||||||||||

|

REVENUE

|

||||||||||||||||

|

Grant income

|

$

|

291

|

$

|

1,520

|

$

|

2,185

|

$

|

3,007

|

||||||||

|

Royalties from product sales

|

25

|

12

|

141

|

119

|

||||||||||||

|

Total revenue

|

316

|

1,532

|

2,326

|

3,126

|

||||||||||||

|

Cost of sales

|

(18

|

)

|

(6

|

)

|

(70

|

)

|

(59

|

)

|

||||||||

|

Gross profit

|

298

|

1,526

|

2,256

|

3,067

|

||||||||||||

|

EXPENSES

|

||||||||||||||||

|

Research and development

|

(6,984

|

)

|

(6,019

|

)

|

(13,582

|

)

|

(12,362

|

)

|

||||||||

|

General and administrative

|

(1,847

|

)

|

(2,581

|

)

|

(6,314

|

)

|

(8,871

|

)

|

||||||||

|

Total operating expenses

|

(8,831

|

)

|

(8,600

|

)

|

(19,896

|

)

|

(21,233

|

)

|

||||||||

|

Loss from operations

|

(8,533

|

)

|

(7,074

|

)

|

(17,640

|

)

|

(18,166

|

)

|

||||||||

|

OTHER INCOME/(EXPENSE)

|

||||||||||||||||

|

Gain/(loss) from change in fair value on warrant liability

|

(56

|

)

|

1,628

|

2,898

|

1,628

|

|||||||||||

|

Interest expense, net

|

(114

|

)

|

(139

|

)

|

(239

|

)

|

(285

|

)

|

||||||||

|

Other expense, net

|

(25

|

)

|

(25

|

)

|

(34

|

)

|

(26

|

)

|

||||||||

|

Total other income (expense), net

|

(195

|

)

|

1,464

|

2,625

|

1,317

|

|||||||||||

|

LOSS BEFORE INCOME TAX BENEFIT

|

(8,728

|

)

|

(5,610

|

)

|

(15,015

|

)

|

(16,849

|

)

|

||||||||

|

Deferred income tax benefit

|

-

|

451

|

-

|

1,353

|

||||||||||||

|

NET LOSS

|

$

|

(8,728

|

)

|

$

|

(5,159

|

)

|

$

|

(15,015

|

)

|

$

|

(15,496

|

)

|

||||

|

BASIC AND DILUTED NET LOSS PER SHARE

|

$

|

(0.18

|

)

|

$

|

(0.12

|

)

|

$

|

(0.31

|

)

|

$

|

(0.39

|

)

|

||||

|

WEIGHTED AVERAGE SHARES OUTSTANDING: BASIC AND DILUTED

|

48,511

|

41,777

|

48,129

|

40,201

|

||||||||||||

The accompanying notes are an integral part of these unaudited condensed financial statements.

4

ASTERIAS BIOTHERAPEUTICS, INC.

CONDENSED STATEMENTS OF COMPREHENSIVE LOSS

(IN THOUSANDS)

(UNAUDITED)

|

Three Months Ended

June 30,

|

Six Months Ended

June 30,

|

|||||||||||||||

|

2017

|

2016

|

2017

|

2016

|

|||||||||||||

|

NET LOSS

|

$

|

(8,728

|

)

|

$

|

(5,159

|

)

|

$

|

(15,015

|

)

|

$

|

(15,496

|

)

|

||||

|

Unrealized loss on available-for-sale securities, net of taxes

|

(1,300

|

)

|

(664

|

)

|

(2,128

|

)

|

(5,497

|

)

|

||||||||

|

COMPREHENSIVE LOSS

|

$

|

(10,028

|

)

|

$

|

(5,823

|

)

|

$

|

(17,143

|

)

|

$

|

(20,993

|

)

|

||||

The accompanying notes are an integral part of these unaudited condensed financial statements.

5

ASTERIAS BIOTHERAPEUTICS, INC.

CONDENSED STATEMENTS OF CASH FLOWS

(IN THOUSANDS)

(UNAUDITED)

|

Six Months Ended

June 30,

|

||||||||

|

2017

|

2016

|

|||||||

|

CASH FLOWS FROM OPERATING ACTIVITIES:

|

||||||||

|

Net loss

|

$

|

(15,015

|

)

|

$

|

(15,496

|

)

|

||

|

Adjustments to reconcile net loss to net cash used in operating activities:

|

||||||||

|

Depreciation and amortization expense

|

555

|

605

|

||||||

|

Stock-based compensation

|

2,709

|

2,477

|

||||||

|

Amortization of intangible assets

|

1,343

|

1,343

|

||||||

|

Deferred income tax benefit

|

-

|

(1,353

|

)

|

|||||

|

Common stock issued for services in lieu of cash

|

562

|

644

|

||||||

|

Gain from change in fair value of warrant liability

|

(2,898

|

)

|

(1,628

|

)

|

||||

|

Distribution of Asterias warrants to shareholders other than BioTime, Inc.

|

2,042

|

3,125

|

||||||

|

Changes in operating assets and liabilities:

|

||||||||

|

Prepaid expenses and other current assets

|

647

|

(572

|

)

|

|||||

|

Other assets

|

5

|

5

|

||||||

|

Accounts payable

|

(668

|

)

|

(496

|

)

|

||||

|

Accrued expenses and other current liabilities

|

(1,254

|

)

|

1,291

|

|||||

|

Deferred rent liability

|

29

|

48

|

||||||

|

Lease liability

|

-

|

(203

|

)

|

|||||

|

Deferred grant income

|

(2,185

|

)

|

736

|

|||||

|

Amount due to BioTime, Inc.

|

-

|

(540

|

)

|

|||||

|

Net cash used in operating activities

|

(14,128

|

)

|

(10,014

|

)

|

||||

|

CASH FLOWS FROM INVESTING ACTIVITIES:

|

||||||||

|

Purchase of property, plant and equipment

|

(79

|

)

|

(499

|

)

|

||||

|

Reimbursement of security deposit

|

-

|

32

|

||||||

|

Net cash used in investing activities

|

(79

|

)

|

(467

|

)

|

||||

|

CASH FLOWS FROM FINANCING ACTIVITIES:

|

||||||||

|

Proceeds from sale of common stock and warrants

|

-

|

20,017

|

||||||

|

Financing costs for sale of common stock and warrants

|

-

|

(1,815

|

)

|

|||||

|

Proceeds from sale of common shares under at-the-market transactions

|

6,696

|

177

|

||||||

|

Financing costs for at-the-market sales

|

(198

|

)

|

(6

|

)

|

||||

|

Proceeds from exercise of stock options

|

20

|

1,933

|

||||||

|

Repayment of lease liability and capital lease obligation

|

(236

|

)

|

(4

|

)

|

||||

|

Shares retired to pay for employees’ taxes

|

-

|

(102

|

)

|

|||||

|

Reimbursement from landlord on construction in progress

|

-

|

567

|

||||||

|

Net cash provided by financing activities

|

6,282

|

20,767

|

||||||

|

NET INCREASE/(DECREASE) IN CASH AND CASH EQUIVALENTS CASH AND CASH EQUIVALENTS:

|

(7,925

|

)

|

10,286

|

|||||

|

At beginning of period

|

19,800

|

11,183

|

||||||

|

At end of period

|

$

|

11,875

|

$

|

21,469

|

||||

The accompanying notes are an integral part of these unaudited condensed financial statements.

6

ASTERIAS BIOTHERAPEUTICS, INC.

NOTES TO CONDENSED FINANCIAL STATEMENTS

(UNAUDITED)

| 1. |

Organization, Basis of Presentation and Liquidity

|

Asterias Biotherapeutics, Inc. (“Asterias”) is a biotechnology company focused on the emerging fields of cell therapy and regenerative medicine. Asterias has two core technology platforms. The first is a type of stem cell capable of becoming all of the cell types in the human body, a property called pluripotency. The second is a type of cell called “dendritic cells” used to teach cancer patients’ immune systems to attack their tumors. Asterias currently has three clinical stage programs based on these platforms: AST-OPC1 is a therapy derived from pluripotent stem cells that is currently in a Phase 1/2a clinical trial for spinal cord injuries; AST-VAC1 is a patient-specific cancer immunotherapy for Acute Myeloid Leukemia (AML); and AST-VAC2 is a non-patient specific cancer immunotherapy for which the initiation of a Phase 1/2a clinical trial in non-small cell lung cancer is planned for 2017. Asterias’ technology platforms have the potential for application in additional indications, such as advanced multiple sclerosis and white matter stroke for AST-OPC1 and other additional cancer indications for our cancer immunotherapy platform. Asterias was incorporated in Delaware on September 24, 2012.

The accompanying unaudited condensed financial statements have been prepared in accordance with accounting principles generally accepted in the United States (“GAAP”) for interim financial information and with the instructions to Form 10-Q and Article 10 of Regulation S-X of the Securities Exchange Commission. In accordance with those rules and regulations certain information and footnote disclosures normally included in comprehensive financial statements have been condensed or omitted pursuant to such rules and regulations. The balance sheet as of December 31, 2016 was derived from the audited financial statements at that date, but does not include all the information and footnotes required by GAAP. These financial statements should be read in conjunction with the audited financial statements and notes thereto included in Asterias’ Annual Report on Form 10-K for the year ended December 31, 2016.

The accompanying interim condensed financial statements, in the opinion of management, include all adjustments, consisting only of normal recurring adjustments, necessary for a fair presentation of Asterias’ financial condition and results of operations. The condensed results of operations are not necessarily indicative of the results to be expected for any future interim period or for the entire year.

Liquidity – Since inception, Asterias has incurred operating losses and has funded its operations primarily through issuance of equity securities, warrants, payments from research grants, and royalties from product sales. At June 30, 2017, Asterias had an accumulated deficit of $98.7 million, working capital of $24.3 million and stockholders’ equity of $36.7 million. Asterias has evaluated its projected cash flows and believes that its cash and cash equivalents of $11.9 million and available for sale securities of $13.1 million as of June 30, 2017, will be sufficient to fund Asterias’ operations through at least twelve months from the issuance date of these financial statements. If the value of Asterias’ available-for-sale securities decreases or it is unable to obtain future adequate financing for its clinical trials, it may be required to delay, postpone, or cancel its clinical trials, limit the number of clinical trial sites, or otherwise reduce or curtail its operations. Future financings may not be available to Asterias at acceptable terms, or at all. Sales of additional equity securities would result in the dilution of interests of current shareholders.

| 2. |

Summary of Significant Accounting Policies

|

Basic and diluted net loss per share – The computations of basic and diluted net loss per share are as follows (in thousands, except per share data):

|

Three Months Ended

June 30,

(Unaudited)

|

Six Months Ended

June 30,

(Unaudited)

|

|||||||||||||||

|

2017

|

2016

|

2017 | 2016 | |||||||||||||

|

Net loss

|

$

|

(8,728

|

)

|

$

|

(5,159

|

)

|

$

|

(15,015

|

)

|

$

|

(15,496

|

)

|

||||

|

Weighted average common shares outstanding – basic and diluted

|

48,511

|

41,777

|

48,129

|

40,201

|

||||||||||||

|

Net loss per share – basic and diluted

|

$

|

(0.18

|

)

|

$

|

(0.12

|

)

|

$

|

(0.31

|

)

|

$

|

(0.39

|

)

|

||||

The following common stock equivalents were excluded from the computation of diluted net loss per share of common stock for the periods presented because including them would have been antidilutive (in thousands):

|

As of

June 30,

(Unaudited)

|

||||||||

|

2017

|

2016

|

|||||||

|

Stock options and restricted stock units

|

7,459

|

6,235

|

||||||

|

Warrants

|

6,551

|

6,700

|

||||||

Adoption of ASU 2016-09, Improvements to Employee Share-Based Payment Accounting

7

In March 2016, the FASB issued ASU 2016-09, Compensation - Stock Compensation (Topic 718): Improvements to Employee Share-Based Payment Accounting (“ASU 2016-09”), which simplifies several aspects of the accounting for share-based payment transactions, including the income tax consequences, forfeitures, classification of awards as either equity or liabilities, and classification on the statement of cash flows. Asterias adopted ASU 2016-09 beginning on January 1, 2017.

In connection with the adoption of ASU 2016-09, Asterias changed how it accounts for excess tax benefits and deficiencies, if any, and forfeitures, as applicable. All excess tax benefits and tax deficiencies from stock-based compensation awards accounted for under ASC 718 are recognized as an income tax benefit or expense, respectively, in the statements of operations. Prior to the adoption of ASU 2016-09, Asterias recognized excess tax benefits, if any, in additional paid-in capital only if the tax deduction reduced cash income taxes payable and excess tax deficiencies were recognized either as an offset to accumulated excess tax benefits, if any, on Asterias’ statements of operations. An excess income tax benefit arises when the tax deduction of a share-based award for income tax purposes exceeds the compensation cost recognized for financial reporting purposes and, a tax deficiency arises when the compensation cost exceeds the tax deduction. Because Asterias has a full valuation allowance, there was no impact to Asterias’ statements of operations for any excess tax benefits or deficiencies, as any excess benefit or deficiency would be offset by the change in the valuation allowance (see Note 11).

Forfeitures are now accounted for as they occur instead of based on the number of awards that were expected to vest. Based on the nature and timing of Asterias equity grants, straight-line expense attribution of stock-based compensation for the entire award and the relatively low forfeiture rate on Asterias experience, the impact of adoption of ASU 2016-09 pertaining to forfeitures was not significant to Asterias’ financial statements (see Note 8).

| 3. |

Balance Sheet Components

|

Property, plant and equipment, net

As of June 30, 2017 and December 31, 2016, property, plant and equipment consisted of the following (in thousands):

|

June,

2017

(Unaudited)

|

December 31,

2016

|

|||||||

|

Furniture, fixtures and leasehold improvements

|

$

|

5,421

|

$

|

5,421

|

||||

|

Computers, machinery and equipment

|

2,625

|

2,545

|

||||||

|

8,046

|

7,966

|

|||||||

|

Less - accumulated depreciation and amortization

|

(3,047

|

)

|

(2,491

|

)

|

||||

|

Property, plant and equipment, net

|

$

|

4,999

|

$

|

5,475

|

||||

Depreciation expense for the three and six months ended June 30, 2017 was $278,000 and $555,000, respectively. Depreciation expense for the three and six months ended June 30, 2016 was $303,000 and $605,000, respectively.

| 4. |

Investments in BioTime and OncoCyte

|

Investment in BioTime

BioTime common shares are included in available-for-sale securities at fair value in current assets in Asterias’ balance sheet as the shares are traded on NYSE: MKT (symbol “BTX”) and available for working capital purposes. As of June 30, 2017 and December 31, 2016, Asterias held 3,852,880 BioTime shares which were valued at $12.1 million and $13.9 million based on the closing price on those respective dates.

Investment in OncoCyte

On December 31, 2015, in connection with BioTime’s distribution of OncoCyte common stock to BioTime shareholders, on a pro rata basis, Asterias received 192,644 shares of OncoCyte common stock from BioTime as a dividend in kind. On that date, BioTime shareholders, including Asterias, received one share of OncoCyte common stock for every twenty shares of BioTime common stock held. Asterias recorded the fair value of the OncoCyte common stock as contributed capital from BioTime.

The OncoCyte shares are included in available-for-sale securities at fair value in current assets in Asterias’ balance sheet as the shares are traded on NYSE: MKT (symbol “OCX”) and available for working capital purposes. As of June 30, 2017 and December 31, 2016, the OncoCyte shares were valued at $1.0 million and $1.4 million based on the OncoCyte closing prices on those respective dates.

| 5. |

Cross-License and Share Transfer with BioTime and Subsidiaries

|

On February 16, 2016, Asterias entered into a Cross-License Agreement (the “Cross-License”) with BioTime and BioTime's wholly owned subsidiary ES Cell International Pte Ltd (“ESI”). Under the terms of the Cross-License, Asterias received a fully-paid, non-royalty-bearing, world-wide, non-exclusive, sub-licensable license under certain BioTime patents and related patent rights and ESI patents and related patent rights specified in the Cross-License, for all purposes in the Asterias Licensed Field, as defined in the Cross-License agreement, during the term of the license.

8

Under the terms of the Cross-License, BioTime and ESI received a fully-paid, non-royalty-bearing, world-wide, non-exclusive, sub-licensable license in, to, and under the certain Asterias patents and related patent rights for all purposes in the BioTime/ESI Licensed Field, as defined in the Cross-License agreement, during the term of the license.

On February 16, 2016, Asterias also entered into a Share Transfer Agreement (“Share Transfer”) with BioTime and ESI pursuant to which (a) Asterias transferred to BioTime 2,100,000 shares of common stock of OrthoCyte Corporation (“OrthoCyte) and 21,925 ordinary shares of Cell Cure Neurosciences Ltd (“Cell Cure”), each a majority-owned subsidiary of BioTime, with an aggregate carrying value at the time of the transaction of approximately $416,000 and (b) BioTime transferred to Asterias 75,771 shares of Series A Common Stock of Asterias with a carrying value at the time of the transaction of approximately $197,000 and warrants to purchase 3,150,000 Series A common stock of Asterias at an exercise price of $5.00 per share, with a carrying value at the time of the transaction of approximately $2.0 million, as additional consideration for the license of patents and patent rights from Asterias under the Cross License. On March 20, 2016, the warrants to purchase 3,150,000 shares of Series A common stock were retired by Asterias.

The Cross-License and Share Transfer transaction was accounted for as a transfer of assets between entities under common control and recorded at carrying value, with the resulting gain on transfer of approximately $1.8 million recorded by Asterias in equity as contributed capital from BioTime in accordance with, and pursuant to ASC 805-50, Transactions Between Entities Under Common Control. The transfer of assets was also a taxable transaction to Asterias generating a taxable gain of approximately $3.1 million as further discussed in Note 11.

| 6. |

Intangible Assets

|

Intangible assets net of accumulated amortization at June 30, 2017 and December 31, 2016 are shown in the following table (in thousands):

|

June 30,

2017

(Unaudited)

|

December 31,

2016

|

|||||||

|

Intangible assets

|

$

|

26,860

|

$

|

26,860

|

||||

|

Less- accumulated amortization

|

(10,073

|

)

|

(8,730

|

)

|

||||

|

Intangible assets, net

|

$

|

16,787

|

$

|

18,130

|

||||

Asterias recognized $672,000 and $1.3 million in amortization expense of intangible assets during the three and six months ended June 30, 2017 and 2016, respectively.

| 7. |

Common Stock and Warrants

|

As of June 30, 2017 and December 31, 2016, Asterias had outstanding 49,555,959 and 47,566,596 Series A Shares and no Series B Shares, respectively.

Common Stock Issuance

On March 28, 2017, Asterias entered into an amendment to its at-the-market (ATM) Sales Agreement, dated April 10, 2015, with MLV. The amendment to the Sales Agreement was entered into by Asterias, MLV and FBR Capital Markets & Co. (“FBR” and together with MLV, the “Agents”), which acquired MLV. Under the Sales Agreement, as amended, Asterias may issue and sell shares of its Series A common stock having an aggregate offering price of up to $25 million from time to time on or after March 28, 2017, through the Agents, subject to certain limitations, including the number of shares registered and available under the Company’s previously filed and currently effective shelf registration statement on Form S-3 (File No. 333-215154) (the “Registration Statement”). For the six months ended June 30, 2017, Asterias has sold approximately 1.6 million shares of Series A common stock for gross proceeds of $6.7 million. For the six months ended June 30, 2016, Asterias sold approximately 41,211 shares of Series A common stock for gross proceeds of $0.2 million.

For the six months ended June 30, 2017 and 2016, pursuant to a services agreement with Cell Therapy Catapult Services Limited, Asterias issued 134,766 and 142,020 shares of Asterias Series A common stock with a fair value of $562,000 and $644,000 respectively (see Note 12).

Warrants classified as a liability

On May 13, 2016, as part of the Asterias Series A Common Stock Offering, Asterias issued 2,959,559 warrants (the “Asterias Offering Warrants”). The Asterias Offering Warrants have an exercise price of $4.37 per share and expire in five years of the issuance date, or May 13, 2021. The Asterias Offering Warrants also contain certain provisions in the event of a Fundamental Transaction, as defined in the warrant agreement governing the Asterias Offering Warrants (“Warrant Agreement”), that Asterias or any successor entity will be required to purchase, at a holder’s option, exercisable at any time concurrently with or within thirty days after the consummation of the fundamental transaction, the Asterias Offering Warrants for cash. This cash settlement will be in an amount equal to the value of the unexercised portion of such holder’s warrants, determined in accordance with the Black Scholes-Merton option pricing model as specified in the Warrant Agreement.

9

In accordance with ASC 815-40, Accounting for Derivative Financial Instruments Indexed to, and Potentially Settled in, a Company’s Own Stock, contracts that require or may require the issuer to settle the contract for cash are liabilities recorded at fair value, irrespective of the likelihood of the transaction occurring that triggers the net cash settlement feature. Changes to the fair value of those liabilities are recorded in the statements of operations. Accordingly, since Asterias may be required to net cash settle the Asterias Offering Warrants in the event of a Fundamental Transaction; the Asterias Offering Warrants are classified as noncurrent liabilities at fair value, with changes in fair value recorded in other income or expense, net, in the statements of operations.

The fair value of the Asterias Offering Warrants at the time of issuance was determined by using a combination of the Binomial Lattice and Black-Scholes-Merton option pricing models under various probability-weighted outcomes which take into consideration the probability of the fundamental transaction and net cash settlement occurring, using the contractual term of the warrants. In applying these models, the fair value is determined by applying Level 3 inputs, as defined by ASC 820; these inputs have included assumptions around the estimated future stock price of Asterias common stock, volatility and the timing of, and varying probabilities that certain events will occur. The Asterias Offering Warrants are revalued each reporting period using the same methodology described above. Changes in any of the key assumptions used to value the Asterias Offering Warrants could materially impact the fair value of the warrants and Asterias’ financial statements.

At June 30, 2017, based on a valuation performed on the Asterias Offering Warrants using the methodology described above, the fair value of the Asterias Offering Warrants liability was $5.8 million, resulting in Asterias recording an unrealized gain of $2.9 million for the six months ended June 30, 2017, included in other income and expenses, net, in the statements of operations.

Warrants classified as equity

On March 30, 2016, Asterias’ board of directors declared a distribution of Asterias common stock purchase warrants to all Asterias shareholders other than BioTime, in the ratio of one warrant for every five shares of Asterias common stock owned of record as of the close of business on April 11, 2016. On April 25, 2016, Asterias distributed 3,331,229 warrants (the “Distribution Warrants”). The distribution of the Distribution Warrants was treated as a disproportionate distribution since, in accordance with the terms of the Share Transfer with BioTime, no warrants were distributed to BioTime. The Distribution Warrants are classified as equity, have an exercise price of $5.00 per share, and were set to expire on September 30, 2016. Asterias recorded the Distribution Warrants at a fair value of approximately $3.1 million with a noncash charge to shareholder expense included in general and administrative expenses and a corresponding increase to equity as of March 30, 2016 as the Distribution Warrants were deemed to be issued for accounting purposes on that date.

On September 19, 2016, Asterias extended the expiration date of the Distribution Warrants to February 15, 2017, no other terms were changed. As a result of the extension of the expiration date of these warrants, Asterias recorded a $2.0 million noncash charge to shareholder expense included in general and administrative expenses and a corresponding increase to equity for the year ended December 31, 2016. On February 3, 2017, Asterias extended the expiration date of the Distribution Warrants to September 29, 2017. As a result of this extension, Asterias recorded a $1.7 million noncash charge to shareholder expense included in general and administrative expenses and a corresponding increase to equity for the quarter ended March 31, 2017.

In connection with the warrant distribution to shareholders discussed above, 350,000 warrants with an exercise price of $5.00 per share held by Romulus Films, Ltd. were adjusted to become exercisable into 409,152 shares at an exercise price of $4.28 per share (the “Romulus Warrants”). These warrants had an original expiration date of September 30, 2016. On September 19, 2016, Asterias extended the expiration date of the Romulus Warrants to February 15, 2017, no other terms were changed. As a result of the extension of the expiration date of these warrants, Asterias recorded a $0.2 million noncash charge to shareholder expense included in general and administrative expenses and a corresponding increase to equity for the year ended December 31, 2016. On February 3, 2017, Asterias extended the expiration date of the Romulus Warrants to September 29, 2017. As a result of this extension of the expiration date of these warrants, Asterias recorded a $0.3 million noncash charge to shareholder expense included in general and administrative expenses and a corresponding increase to equity for the quarter ended March 31, 2017.

| 8. |

Stock-Based Compensation

|

The following table shows the stock-based compensation expenses included in the operating expenses for the three and six months ended June 30, 2017 and 2016 (in thousands):

|

Three Months Ended

June 30,

(Unaudited)

|

Six Months Ended

June 30,

(Unaudited)

|

|||||||||||||||

|

2017

|

2016

|

2017

|

2016

|

|||||||||||||

|

Research and development

|

$

|

502

|

$

|

631

|

$

|

1,427

|

$

|

1,356

|

||||||||

|

General and administrative

|

489

|

237

|

1,282

|

1,121

|

||||||||||||

|

Total stock-based compensation expense

|

$

|

991

|

$

|

868

|

$

|

2,709

|

$

|

2,477

|

||||||||

The fair value of each option award is estimated on the date of grant using a Black-Scholes option valuation model applying the weighted-average assumptions in the following table:

10

|

Three Months Ended

June 30,

(Unaudited)

|

Six Months Ended

June 30,

(Unaudited)

|

|||||||||||||||

|

2017

|

2016

|

2017

|

2016 | |||||||||||||

|

Expected life (in years)

|

6.06

|

5.37

|

5.74

|

5.76

|

||||||||||||

|

Risk-free interest rates

|

1.85

|

%

|

1.28

|

%

|

1.88

|

%

|

1.39

|

%

|

||||||||

|

Volatility

|

74.13

|

%

|

76.62

|

%

|

74.80

|

%

|

74.99

|

%

|

||||||||

|

Dividend yield

|

0

|

0

|

0

|

%

|

0

|

%

|

||||||||||

The risk-free rate is based on the rates in effect at the time of grant for zero coupon U.S. Treasury notes with maturities approximately equal to each grant’s expected term. A dividend yield of zero is applied since Asterias has not historically paid dividends and does not expect to pay dividends in the foreseeable future. The expected volatility is based upon the volatility of Asterias’ own trading stock and a group of publicly traded industry peer companies. The expected term of options granted is derived from using the simplified method under SEC Staff Accounting Bulletin Topic 14.

The determination of stock-based compensation is inherently uncertain and subjective and involves the application of valuation models and assumptions requiring the use of judgment. If Asterias had made different assumptions, its stock-based compensation expense, and net loss for the three and six months ended June 30, 2017 and 2016, may have been significantly different.

| 9. |

Commitments and Contingencies

|

Development and Manufacturing Services Agreement

On August 3, 2016, Asterias entered into a Development and Manufacturing Services Agreement (the “Services Agreement”) with Cognate BioServices, Inc. (“Cognate”), a fully-integrated contract bioservices organization providing development and current Good Manufacturing Practice (“cGMP”) manufacturing services to companies and institutions engaged in the development of cell-based products.

Under the Services Agreement, Cognate is performing under an Initial Statement of Work process development studies in support of Asterias’ clinical and commercial development activities of AST-VAC1 and production and manufacturing services of AST-VAC1 under cGMP under the Second Statement of Work. In consideration for the process development services set forth in the Initial Statement of Work, Asterias agreed to make aggregate payments of up to approximately $1.7 million in fees over the term of the Initial Statement of Work and pay for additional pass through costs for materials and equipment estimated by management to be approximately $0.5 million. In consideration of the production and manufacturing services set forth in the Second Statement of Work, once the services under the Initial Statement of Work are completed and if Asterias receives FDA concurrence on the clinical protocol for an AST-VAC1 trial, then Asterias will make an initial start-up payment, a monthly payment for dedicated manufacturing capacity, and certain other manufacturing fees.

The Services Agreement will expire on the later of (a) August 3, 2019; or (b) the completion of all services contracted for by the parties in the Statements of Work under the Services Agreement prior to August 3, 2019. The term of the Services Agreement and any then pending Statements of Work thereunder may be extended by Asterias continuously for additional two-year periods upon written notice to Cognate with at least thirty days prior to the expiration of the then-current term.

The Services Agreement provides certain termination rights to each party and customary provisions relating to indemnity, confidentiality and other matters. Asterias incurred $216,000 and $424,000 of expense to Cognate pursuant to the Services Agreement for the three and six months ended June 30, 2017.

Fremont Lease

On December 30, 2013, Asterias entered into a lease for an office and research facility located in Fremont, California, consisting of an existing building with approximately 44,000 square feet of space. The building is being used by Asterias as a combined office, laboratory and production facility that can be used to manufacture its product using current good manufacturing procedures. Asterias completed the tenant improvements in November 2015, which cost approximately $4.9 million, of which the maximum of $4.4 million was paid to Asterias by the landlord. Asterias placed the asset into service in November 2015 and is amortizing the leasehold improvements and the landlord liability over the remaining lease term through September 30, 2022.

As of June 30, 2017 and December 31, 2016, the landlord lease liability was $3.7 million and $4.0 million and the deferred rent liability was $296,000 and $266,000, respectively.

Litigation – General

Asterias is subject to various claims and contingencies in the ordinary course of its business, including those related to litigation, business transactions, employee-related matters, and others. When Asterias is aware of a claim or potential claim, it assesses the likelihood of any loss or exposure. If it is probable that a loss will result and the amount of the loss can be reasonably estimated, Asterias will record a liability for the loss. If the loss is not probable or the amount of the loss cannot be reasonably estimated, Asterias discloses the claim if the likelihood of a potential loss is reasonably possible and the amount involved could be material. Asterias is not aware of any claims likely to have a material adverse effect on its financial condition or results of operations.

11

Employment Contracts

Asterias has entered into employment contracts with certain executive officers. Under the provisions of the contracts, Asterias may be required to incur severance obligations for matters relating to changes in control, as defined and involuntary terminations.

Indemnification

In the normal course of business, Asterias may provide indemnifications of varying scope under Asterias’ agreements with other companies or consultants, typically Asterias’ clinical research organizations, investigators, clinical sites, suppliers and others. Pursuant to these agreements, Asterias will generally agree to indemnify, hold harmless, and reimburse the indemnified parties for losses and expenses suffered or incurred by the indemnified parties arising from claims of third parties in connection with the use or testing of Asterias’ products and services. Indemnification provisions could also cover third party infringement claims with respect to patent rights, copyrights, or other intellectual property pertaining to Asterias products and services. The term of these indemnification agreements will generally continue in effect after the termination or expiration of the particular research, development, services, or license agreement to which they relate. The potential future payments Asterias could be required to make under these indemnification agreements will generally not be subject to any specified maximum amount. Historically, Asterias has not been subject to any claims or demands for indemnification. Asterias also maintains various liability insurance policies that limit Asterias’ exposure. As a result, Asterias believes the fair value of these indemnification agreements is minimal. Accordingly, Asterias has not recorded any liabilities for these agreements as of June 30, 2017 and December 31, 2016.

| 10. |

Shared Facilities and Services Agreement

|

On April 1, 2013, Asterias and BioTime executed a Shared Facilities and Services Agreement (“Shared Services Agreement”). Under the terms of the Shared Services Agreement, Asterias has the right to use BioTime's premises and equipment located at Alameda, California, for the sole purpose of conducting Asterias' business. BioTime also may provide certain services, including basic accounting, billing, bookkeeping, payroll, treasury, collection of accounts receivable (excluding the institution of legal proceedings or taking of any other action to collect accounts receivable), payment of accounts payable, and other similar administrative services to Asterias and services of its laboratory and research personnel. BioTime may also provide the services of attorneys, accountants, and other professionals who may also provide professional services to BioTime and its other subsidiaries.

BioTime charges Asterias a fee for the services and usage of facilities, equipment, and supplies aforementioned. For each billing period, BioTime equitably prorates and allocates its employee costs, equipment costs, insurance costs, lease costs, professional costs, software costs, supply costs, and utilities costs, if any, between BioTime and Asterias based upon actual documented use and cost by or for Asterias or upon proportionate usage by BioTime and Asterias, as reasonably estimated by BioTime. Asterias pays 105% of the allocated costs (the “Use Fee”). The allocated cost of BioTime employees and contractors who provide services is based upon records maintained of the number of hours of such personnel devoted to the performance of services.

The Use Fee is determined and invoiced to Asterias on a quarterly basis for each calendar quarter of each calendar year. If the Shared Services Agreement terminates prior to the last day of a billing period, the Use Fee will be determined for the number of days in the billing period elapsed prior to the termination of the Shared Services Agreement. Each invoice is payable in full by Asterias within 30 days after receipt. Any invoice or portion thereof not paid in full when due will bear interest at the rate of 15% per annum until paid, unless the failure to make a payment is due to any inaction or delay in making a payment by BioTime employees from Asterias funds available for such purpose, rather than from the unavailability of sufficient funds legally available for payment or from an act, omission, or delay by any employee or agent of Asterias.

Asterias in turn may charge BioTime or any Other Subsidiary for similar services provided by Asterias at the same rate and terms as aforementioned. “Other Subsidiary” means a subsidiary of BioTime other than a subsidiary of Asterias.

The Shared Services Agreement was renewed through December 31, 2017. The term of the Shared Services Agreement will automatically be renewed and the termination date will be extended for an additional year each year, unless either party gives the other party written notice stating that the Shared Services Agreement will terminate on December 31 of that year.

BioTime allocated $74,000 and $437,000 of general overhead expenses to Asterias during the six months ended June 30, 2017, and 2016, respectively. At June 30, 2017 Asterias had no net payable to BioTime under the Shared Services Agreement.

| 11. |

Income Taxes

|

The provision for income taxes is determined using an estimated annual effective tax rate. The effective tax rate may be subject to fluctuations during the year as new information is obtained, which may affect the assumptions used to estimate the annual effective tax rate, including factors such as valuation allowances against deferred tax assets, the recognition or de-recognition of tax benefits related to uncertain tax positions, if any, and changes in or the interpretation of tax laws in jurisdictions where Asterias conducts business.

Management believes that the Asterias net operating losses generated during the three and six months ended June 30, 2017 will result in no income tax benefit or provision in the current year due to the full valuation allowance on its net deferred tax assets for the year ended December 31, 2016 and a full valuation allowance expected on its net deferred tax assets for the year ending December 31, 2017.

12

A valuation allowance is provided when it is more likely than not that some portion of the deferred tax assets will not be realized. Asterias established a full valuation allowance as of December 31, 2016 due to the uncertainty of realizing future tax benefits from its net operating loss carryforwards and other deferred tax assets.

A deferred federal income tax benefit of approximately $1.4 million was recorded for the six months ended June 30, 2016 as Asterias’ deferred tax liabilities exceeded their deferred tax assets and recorded no valuation allowance on its deferred tax assets. Asterias established deferred tax liabilities primarily related to its acquisition of certain intellectual property and available for sale securities held in BioTime and OncoCyte common stock. For state income tax purposes Asterias has a full valuation allowance on its state deferred tax assets as of June 30, 2017 and December 31, 2016 and, accordingly, no state tax provision or benefit was recorded for any period presented.

As discussed in Note 5, in connection with the Cross-License and Share Transfer transaction completed on February 16, 2016, the transfer of assets was a taxable transaction to Asterias generating a taxable gain of approximately $3.1 million. Asterias had sufficient current year losses from operations to offset the entire gain resulting in no income taxes due. As the transfer of assets and the resulting taxable gain is due to a direct effect of transactions between the former parent company, BioTime, and its former subsidiary, Asterias recorded the tax effect of this gain through equity in accordance with ASC 740-20-45-11(g).

| 12. |

License and Royalty Obligations

|

Services Agreement with Cell Therapy Catapult Services Limited

In October 2015, Asterias entered into a Services Agreement (the “Services Agreement”) with Cell Therapy Catapult Services Limited (“Catapult”), a research organization specializing in the development of technologies which speed the growth of the cell and gene therapy industry. Under the Services Agreement, Catapult will license to Asterias, certain background intellectual property and will develop a scalable manufacturing and differentiation process for Asterias’ human embryonic stem cell derived dendritic cell cancer vaccine development program. In consideration for the license and Catapult’s performance of services, at the time of the Services Agreement Asterias agreed to make aggregate payments of up to GBP £4,350,000 over the next five years (approximately $5.6 million based on the foreign currency exchange rate on June 30, 2017). At the option of Asterias, up to GBP £3,600,000 (approximately $4.7 million based on the foreign currency exchange rate on June 30, 2017) of such payments may be settled in shares of Asterias Series A Common Stock instead of cash. If Asterias elects to pay for the services in stock and Catapult is unable to sell the stock in the market within 60 days of issuance, after reasonable and diligent efforts through its broker, Catapult may request that the unsold portion of the stock payment, if any, be paid by Asterias in cash at a value equal to approximately 91% of the total amount that was issued in stock. This right by Catapult to put the unsold shares back to Asterias for cash expires the earlier to occur of the sale of the stock in the market or after 60 days of issuance.

Advance payments for research and development services to be performed by Catapult are deferred and recognized as research and development expense ratably as the services are performed. Advance payments related to licenses will be expensed when paid due to the experimental nature of the project. Pursuant to the Services Agreement, if there are any issued, but unsold Asterias stock, to Catapult for payment of services and the 60-day put right has not expired as of the period end being reported on, Asterias will present that amount as “temporary” equity in accordance with ASC 480-10-S99. Once the put right expires or the shares are sold by Catapult, the temporary equity amount will be reclassified by Asterias to permanent equity without adjustment to the carrying value of the stock.

In the six months ended June 30, 2017 and 2016, pursuant to the Services Agreement, Asterias issued 134,766 and 142,020 shares of Asterias Series A Common Stock with a fair market values of $562,000 and $644,000 at the time of issuance which Asterias reclassified into permanent equity. For the six months ended June 30, 2017 and 2016, in connection with payments under the Services Agreement, Asterias expensed as stock-based compensation for services in lieu of cash of $562,000 and $644,000, respectively.

| 13. |

Clinical Trial and Option Agreement and CIRM Grant Award

|

On October 16, 2014 Asterias signed a Notice of Grant Award (“NGA”) with CIRM, effective October 1, 2014, with respect to a $14.3 million grant award for clinical development of Asterias’ product, AST-OPC1. The NGA was subsequently amended effective November 26, 2014 and March 2, 2016. The NGA includes the terms under which CIRM will release grant funds to Asterias. Under the NGA as amended on March 2, 2016, CIRM will disburse the grant funds to Asterias based on Asterias’ attainment of certain progress milestones.

Asterias received initial payment from CIRM in the amount of $917,000 during October 2014 and had received $12.8 million through December 31, 2016. For the three and six months ended June 30, 2017, we have not received any payment under the CIRM grant with approximately $1.5 million expected upon further clinical milestone achievements. We had no deferred grant income relating to the CIRM grant as of June 30, 2017 and deferred grant income relating to the CIRM grant was $2.2 million at December 31, 2016.

13

| Item 2. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

The matters addressed in this Item 2 that are not historical information constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, including statements about any of the following: any projections of earnings, revenue, gross profit, cash, effective tax rate, use of net operating losses, or any other financial items; the plans, strategies and objectives of management for future operations or prospects for achieving such plans, and any statements of assumptions underlying any of the foregoing. Any statements contained herein that are not statements of historical fact may be deemed to be forward-looking statements. Without limiting the foregoing, the words “believes,” “anticipates,” “plans,” “expects,” “seeks,” “estimates,” and similar expressions are intended to identify forward-looking statements. While Asterias may elect to update forward-looking statements in the future, it specifically disclaims any obligation to do so, even if the Asterias’ estimates change and readers should not rely on those forward-looking statements as representing Asterias’ views as of any date subsequent to the date of the filing of this Quarterly Report. Although we believe that the expectations reflected in these forward-looking statements are reasonable, such statements are inherently subject to risks and Asterias can give no assurances that its expectations will prove to be correct. Actual results could differ materially from those described in this report because of numerous factors, many of which are beyond the control of Asterias. A number of important factors could cause the results of the company to differ materially from those indicated by such forward-looking statements, including those detailed under the heading “Risk Factors” in Part I, Item 1A of Asterias’ Form 10-K for the year ended December 31, 2016, and the additional risk factors contained in this Quarterly Report on Form 10-Q.

The following discussion should be read in conjunction with Asterias’ interim condensed financial statements and the related notes provided under “Item 1- Financial Statements” above.

Company Overview

Asterias is a biotechnology company focused on the emerging fields of cell therapy and regenerative medicine. Asterias has two core technology platforms. The first is a type of stem cell capable of becoming all of the cell types in the human body, a property called pluripotency. The second is the use of a cell type called “dendritic cells” to teach cancer patients’ immune systems to attack their tumors.

Asterias currently has three clinical stage programs based on these platforms: AST-OPC1 is a therapy derived from pluripotent stem cells that is currently in a Phase 1/2a clinical trial for spinal cord injuries; AST-VAC1 is a patient-specific cancer immunotherapy using dendritic cells being evaluated by Asterias in Acute Myeloid Leukemia (AML); and AST-VAC2 is a non-patient specific cancer immunotherapy using dendritic cells for which the initiation of a Phase 1/2a clinical trial in non-small cell lung cancer is planned for the first half of 2017. Asterias’ technology platforms have the potential for application in additional indications, such as advanced multiple sclerosis and white matter stroke for AST-OPC1 and other additional cancer indications for our cancer immunotherapy platform.

Recent Developments

Below are recent updates regarding Asterias’ clinical programs:

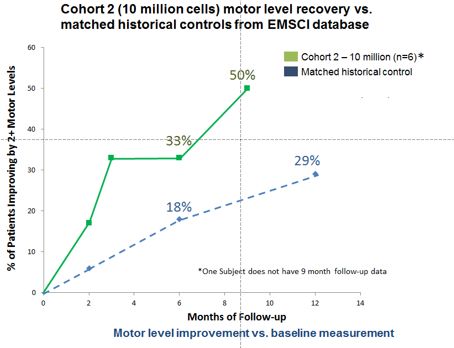

In June 2017, Asterias announced new 9-month follow-up data from the AIS-A 10 million cell cohort in its SCiStar Phase 1/2a clinical trial (the “SCiStar study”), and included the following observations:

14

| · |

Motor Level Improvement – Additional motor level improvement was seen in the AIS-A 10 million cell cohort at 9 months.

|

| o |

Three of six patients (50%) achieved two motor levels of improvement over baseline on at least one side as of their latest follow-up visit through 9 months. This compares to two of six patients (33%) that had improved two motor levels on at least one side through 3- and 6-months of follow-up.

|

| o |

In addition, all six patients (100%) achieved at least one motor level of improvement on at least one side as of their latest follow-up through 9-months.

|

| · |

Upper Extremity Motor Score (UEMS) – Additional improvement in the average UEMS score for this cohort was observed at 9 months. The average UEMS improvement at 9 months was 11.2 points, compared to 9.7 points at 6 months.

|

| · |

Matched Historical Control Data - The 9-month results show a meaningful improvement in the motor function recovery in the AIS-A patients receiving 10 million AST-OPC1 cells compared to a historical control group of 62 closely matched patients from the EMSCI database.

|

| · |

Safety - The trial results to date continue to indicate a positive safety profile for AST-OPC1.

|

On July 10, 2017, Asterias announced that the U.S. Food and Drug Administration accepted the company's amendment to the clinical research protocol for the SCiStar study. The amendment expands the eligibility criteria to include patients with a C-4 spinal cord injury and extends the dosing window from 14 to 30 days to 21 to 42 days post-injury.

In July 2017, Asterias announced completion of enrollment and dosing of the AIS-A 20 million cell cohort and the AIS-B 10 million cell cohort in the SCiStar study. The enrollment of the fifth patient in the AIS-A 20 million cell cohort triggered the final $1.5 million grant payment from CIRM under the existing $14.3 million Strategic Partnerships Award grant awarded to Asterias. Asterias expects to receive this $1.5 million grant payment in the third quarter of 2017.

In July 2017, Asterias announced that two additional clinical sites have opened to enroll subjects for the SCiStar study, providing additional geographical reach and previous experience with spinal cord injury trials. Asterias now has eight clinical sites throughout the country enrolling patients in the study.

In August, Asterias announced it enrolled and dosed the first patient in the fifth and final cohort in the SCiStar study. Asterias has now completed enrollment and dosing in four of the five planned SCiStar study cohorts and enrolled twenty-two patients in the SCiStar study. Twenty-seven patients have been administered AST-OPC1 after including patients from a previous Phase 1 safety trial and results-to-date continue to support the safety of AST-OPC1. Asterias intends to complete enrollment of the entire SCiStar study later this year, with multiple safety and efficacy readouts anticipated during the remainder of 2017 and 2018.

In August, Asterias announced that Cancer Research UK, supported by Asterias technical personnel, has successfully completed manufacture of the first cGMP (current Good Manufacturing Practice) clinical grade lot of AST-VAC2, which meets all release specifications. This lot will provide clinical trial material for patients enrolling in the upcoming Phase 1/2a study evaluating AST-VAC2 in non-small cell lung cancer.

Critical Accounting Policies

This Management's Discussion and Analysis of Financial Condition and Results of Operations discusses and analyzes data in our unaudited Condensed Financial Statements, which we have prepared in accordance with U.S. generally accepted accounting principles. Preparation of these financial statements requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenue and expenses, and related disclosure of contingent assets and liabilities. Management bases its estimates on historical experience and on various other assumptions that it believes to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Senior management has discussed the development, selection and disclosure of these estimates with the Audit Committee of our Board of Directors. Actual conditions may differ from our assumptions and actual results may differ from our estimates.

An accounting policy is deemed critical if it requires an accounting estimate to be made based on assumptions about matters that are highly uncertain at the time the estimate is made, if different estimates reasonably could have been used, or if changes in the estimate that are reasonably likely to occur could materially impact the financial statements. Management believes that there have been no significant changes during the three and six months ended June 30, 2017 to the items that we disclosed as our critical accounting policies and estimates in Management's Discussion and Analysis of Financial Condition and Results of Operations in our Annual Report on Form 10-K for the year ended December 31, 2016.

Results of Operations

Comparison of three and six months ended June 30, 2017 and 2016.

For the three months ended June 30, 2017 and 2016 we recorded net loss of $8.7 million and $5.2 million, respectively. For the six months ended June 30, 2017 and 2016 we recorded net losses of $15.0 million and $15.5 million, respectively.

15

Revenues

The following table shows certain information about our revenues for the three and six months ended June 30, 2017 and 2016 (in thousands, except for percentages):

|

Three Months Ended

June 30,

|

$

Increase

(Decrease)

|

%

Increase

(Decrease)

|

||||||||||||||

|

2017

|

2016

|

|||||||||||||||

|

Grant income

|

$

|

291

|

$

|

1,520

|

$

|

-1,229

|

-81

|

%

|

||||||||

|

Royalties from product sales

|

25

|

12

|

+13

|

+108

|

%

|

|||||||||||

|

Total revenues

|

316

|

1,532

|

-1,216

|

-79

|

%

|

|||||||||||

|

Cost of sales

|

(18

|

)

|

(6

|

)

|

-12

|

-200

|

%

|

|||||||||

|

Gross profit

|

$

|

298

|

$

|

1,526

|

$

|

-1,228

|

- 80

|

%

|

||||||||

|

Six Months Ended

June 30,

|

$

Increase

(Decrease)

|

%

Increase

(Decrease)

|

||||||||||||||

|

2017

|

2016

|

|||||||||||||||

|

Grant income

|

$

|

2,185

|

$

|

3,007

|

$

|

-822

|

- 27

|

%

|

||||||||

|

Royalties from product sales

|

141

|

119

|

+22

|

+ 18

|

%

|

|||||||||||

|

Total revenues

|

2,326

|

3,126

|

-800

|

- 26

|

%

|

|||||||||||

|

Cost of sales

|

(70

|

)

|

(59

|

)

|

-11

|

-19

|

%

|

|||||||||

|

Gross profit

|

$

|

2,256

|

$

|

3,067

|

$

|

- 811

|

- 26

|

%

|

||||||||

Our royalty revenues from product sales is entirely from non-exclusive license agreements with Stem Cell Technologies, Inc., Corning Life Science, Life Tech, and Millipore each of which we assumed as part of the consideration received from Geron under the 2013 Asset Contribution Agreement.

Grant income in 2016 was entirely from CIRM, which awarded us a $14.3 million grant for clinical development of AST-OPC1. We received our first payment from CIRM in the amount of $917,000 during October 2014 and had received $12.8 million through December 31, 2016. For the six months ended June 30, 2017, we have not received any payment under the CIRM grant with approximately $1.5 million expected in the third quarter upon further clinical milestone achievements. Revenues recognized under the CIRM grant during the six months ended June 30, 2017 and 2016 were $2.2 and $3.0 million, respectively.

Operating Expenses

The following table shows our operating expenses for the three and six months ended June 30, 2017 and 2016 (in thousands, except for percentages):

|

Three Months Ended

June 30,

|

$

Increase/

(Decrease)

|

%

Increase/

Decrease

|

||||||||||||||

|

2017

|

2016

|

|||||||||||||||

|

Research and development expenses

|

$

|

6,984

|

$

|

6,019

|

$

|

+965

|

+16

|

%

|

||||||||

|

General and administrative expenses

|

1,847

|

2,581

|

-734

|

-28

|

%

|

|||||||||||

|

Six Months Ended

June 30,

|

$

Increase/

(Decrease)

|

%

Increase/

Decrease

|

||||||||||||||

|

2017

|

2016

|

|||||||||||||||

|

Research and development expenses

|

$

|

13,582

|

$

|

12,362

|

$

|

+1,220

|

+10

|

%

|

||||||||

|

General and administrative expenses

|

6,314

|

8,871

|

-2,557

|

-29

|

%

|

|||||||||||

Research and development expenses – Research and development expenses increased $1.0 million to $7.0 million for the three months ended June 30, 2017 compared to $6.0 million for the three months ending June 30, 2016. This increase was largely associated with our AST-OPC1 clinical trial and AST-OPC1-related manufacturing planning expenses. Research and development expenses increased $1.2 million to $13.6 million for the six months ended June 30, 2017 compared to $12.4 million for the six months ending June 30, 2016. This increase was largely associated with our AST-OPC1 clinical trial and AST-OPC1-related manufacturing planning expenses.

16

General and administrative expenses – General and administrative expenses decreased by approximately $0.7 million to $1.8 million for the three months ended June 30, 2017 compared to $2.6 million for the same period in 2016. The decrease in general and administrative expense is primarily attributable to the following: a decrease of $0.6 million in shareholder warrant distribution expense related to revaluing warrants outstanding. General and administrative expenses decreased by approximately $2.6 million to $6.3 million for the six months ended June 30, 2017 compared to $8.9 million for the same period in 2016. The decrease in general and administrative expense is primarily attributable to the following: a decrease of $1.7 million in shareholder warrant distribution expense related to revaluing warrants outstanding, a decrease of $0.4 million in salaries due to severance paid to two executives in 2016, and a decrease of $0.3 million due lower legal related expenses.

Other income/(expense), net

Other income/(expense), net – Other expense, net, in 2017 and 2016 consists primarily of the change in fair value of the warrants classified as liabilities.

Income Taxes

Management believes that our net operating losses incurred during the three and six months ended June 30, 2017 will result in no income tax benefits in the current year due to the full valuation allowance as of December 31, 2016 and a full valuation allowance expected on its net deferred tax assets for the year ending December 31, 2017.

A deferred federal income tax benefit of approximately $451,000 and $1.4 million was recorded for the three and six months ended June 30, 2016 as Asterias had no valuation allowance on its deferred tax assets as of December 31, 2015. Asterias established deferred tax liabilities primarily related to its acquisition of certain intellectual property and available for sale securities held in BioTime and OncoCyte common stock.

Liquidity and Capital Resources

At June 30, 2017, we had $11.9 million of cash and cash equivalents on hand, held 3,852,880 BioTime common shares and 192,644 shares of OncoCyte common stock, with a market value of $12.1 million and $1.0 million, respectively. We may raise capital from time to time through the sale of our Series A Shares or other securities, and our BioTime or OncoCyte common shares. We may sell our Series A Shares or other securities in public offerings registered under the Securities Act of 1933, as amended (the “Securities Act”), including in at-the-market transactions, or in private placements to select investors. We may sell our BioTime common shares, from time to time, by any method that is deemed to be an “at-the-market” equity offering as defined in Rule 415 promulgated under the Securities Act, including sales made directly on or through the NYSE MKT or any other existing trading market for the common shares in the U.S. or to or through a market maker, at prices related to the prevailing market price, or through block trades in which the broker-dealer will attempt to sell the shares as agent but may position and resell a portion of the block as principal to facilitate the transaction, or through one more of the foregoing transactions. We may also sell some or all of our BioTime common shares and OncoCyte common shares by any other method permitted by law, including in privately negotiated transactions. We will bear all broker-dealer commissions payable in connection with the sale of our Series A Shares, our BioTime common shares, OncoCyte common shares or other securities. Broker-dealers may receive commissions or discounts from us (or, if any broker-dealer acts as agent for the purchaser of shares, from the purchaser) in amounts to be negotiated. The prices at which we may issue and sell our Series A Shares, our BioTime common shares, OncoCyte common shares or other securities in the future are not presently determinable and will depend upon many factors, including prevailing prices for those securities in the public market.