Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - US ECOLOGY, INC. | usecology_8k.htm |

Exhibit 99.1

1 Third Quarter 2017 Investor Presentation

2 Safe Harbor During the course of this presentation the Company will be making forward - looking statements (as such term is defined in the Private Securities Litigation Reform Act of 1995 ) that are based on our current expectations, beliefs and assumptions about the industry and markets in which US Ecology, Inc . and its subsidiaries operate . Such statements may include, but are not limited to, statements regarding our financial and operating results, strategic objectives and means to achieve those objectives, the amount and timing of capital expenditures, repurchases of its stock under approved stock repurchase plans, the amount and timing of interest expense, the likelihood of our success in expanding our business, financing plans, budgets, working capital needs and sources of liquidity . Such statements involve known and unknown risks, uncertainties and other factors that could cause the actual results of the Company to differ materially from the results expressed or implied by such statements, including general economic and business conditions, conditions affecting the industries served by US Ecology, EQ and their respective subsidiaries, conditions affecting our customers and suppliers, competitor responses to our products and services, the overall market acceptance of such products and services, the integration and performance of acquisitions (including the acquisition of EQ) and other factors disclosed in the Company's periodic reports filed with the Securities and Exchange Commission . For information on other factors that could cause actual results to differ materially from expectations, please refer to US Ecology, Inc . 's December 31 , 2016 Annual Report on Form 10 - K and other reports filed with the Securities and Exchange Commission . Many of the factors that will determine the Company's future results are beyond the ability of management to control or predict . Readers should not place undue reliance on forward - looking statements, which reflect management's views only as of the date such statements are made . The Company undertakes no obligation to revise or update any forward - looking statements, or to make any other forward - looking statements, whether as a result of new information, future events or otherwise . Important assumptions and other important factors that could cause actual results to differ materially from those set forth in the forward - looking information include the replacement of non - recurring event clean - up projects, a loss of a major customer, our ability to permit and contract for timely construction of new or expanded disposal cells, our ability to renew our operating permits or lease agreements with regulatory bodies, loss of key personnel, compliance with and changes to applicable laws, rules, or regulations, failure to realize anticipated benefits and operational performance from acquired operations, access to insurance, surety bonds and other financial assurances, a deterioration in our labor relations or labor disputes, our ability to perform under required contracts, adverse economic or market conditions, government funding or competitive pressures, incidents or adverse weather conditions that could limit or suspend specific operations, access to cost effective transportation services, fluctuations in foreign currency markets, lawsuits, our willingness or ability to repurchase shares or pay dividends, implementation of new technologies, limitations on our available cash flow as a result of our indebtedness and our ability to effectively execute our acquisition strategy and integrate future acquisitions .

3 US Ecology Overview Vision: To be the premier North American provider of environmental services where the highest caliber people work delivering sustainable solutions for our customers and long term value for stockholders and the communities in which we live and operate - Fully Integrated North American Environmental Services Provider - Unique and Irreplaceable Assets with Robust Waste Permits - Diverse, Blue Chip Customer Base across a Broad Range of Industries with over 4,000 Customers - 60 + year Commitment to Health, Safety and the Environment - Strong Financial Performance (4) Mexico Canada (2) (2) United States Treatment & Recycling Disposal Sites Service Centers Headquarters Retail Satellites

4 $25 Billion Industry (1) Strong Growth Drivers Considerable Barriers to Entry - Government Regulation - Track Record of Execution - Capex Requirements - Talented Professionals - Regulation - Industrial - Commercial - Government Environmental Services: Hazardous Waste Field & Industrial Services - $11 billion market (1) - Provides treatment, disposal & recycling services - Radioactive waste constitutes $1 billion - $14 billion market (1) - Consists of cleanup of operating facilities - Government agencies a major customer Retail Hazardous Waste Logistics Industrial Cleaning & Maintenance In - Plant Total Waste Management Terminal Services Petroleum Services Airport Environmental Services Remediation & Construction Emergency Response Household Hazardous Waste Collection Lab - Pack TSDFs / Brokers Other Environmental Services Companies Truck & Rail Services Treatment, Storage & Disposal Facilities (“TSDFs”) Wastewater Treatment Facilities Mobile Recycling Operation Hazardous Landfill Solvent Recycling Oil Recycling Incineration Fuel Blending Non - Haz Landfill Cement Kiln Waste - to - Energy Sourcing from Intermediaries Direct Sourcing Waste Generation Services Transfer, Storage & Treatment Disposal Infrastructure Support LTL Logistics ( 1) Source: Environmental Business Journal, Volume XXIX October 2016

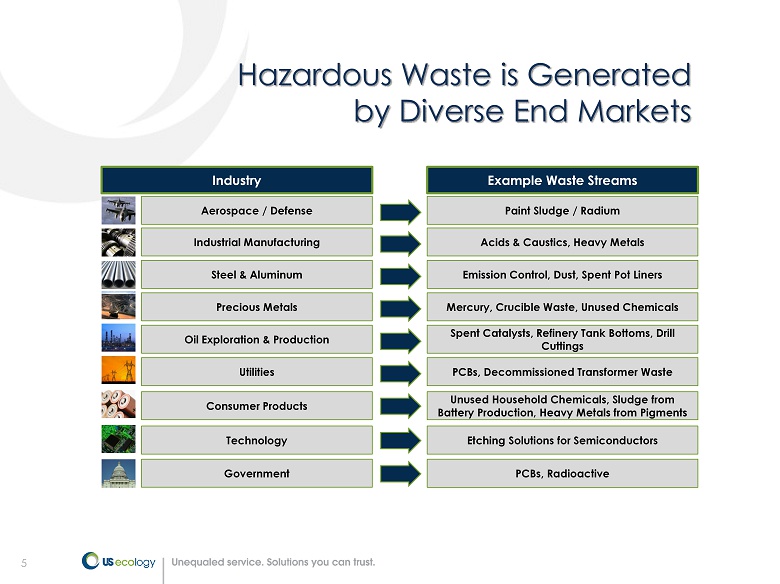

5 Hazardous Waste is Generated by Diverse End Markets Aerospace / Defense Paint Sludge / Radium Industry Example Waste Streams Industrial Manufacturing Steel & Aluminum Precious Metals Oil Exploration & Production Utilities Acids & Caustics, Heavy Metals Emission Control, Dust, Spent Pot Liners Mercury, Crucible Waste, Unused Chemicals Spent Catalysts, Refinery Tank Bottoms, Drill Cuttings Unused Household Chemicals, Sludge from Battery Production, Heavy Metals from Pigments Consumer Products PCBs, Decommissioned Transformer Waste Etching Solutions for Semiconductors Technology PCBs, Radioactive Government

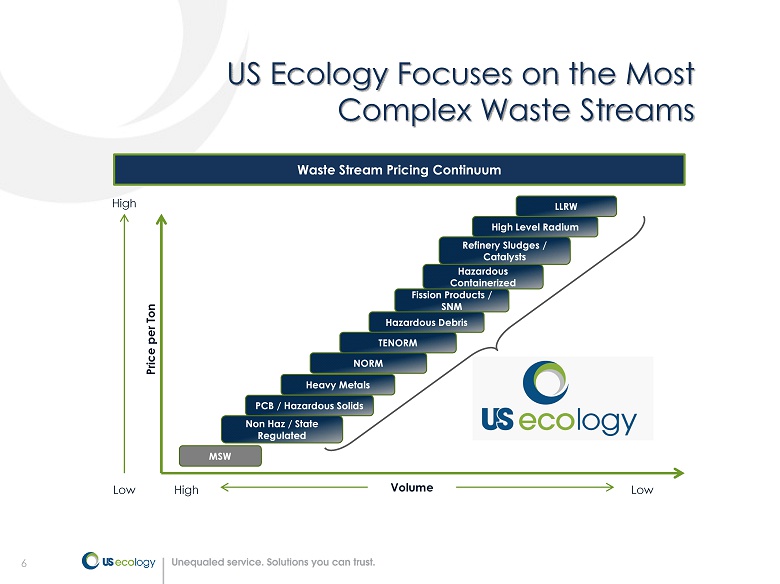

6 US Ecology Focuses on the Most Complex Waste Streams Waste Stream Pricing Continuum Price per Ton MSW LLRW Refinery Sludges / Catalysts Hazardous Containerized Fission Products / SNM Hazardous Debris NORM PCB / Hazardous Solids High Low Volume Low High Non Haz / State Regulated TENORM Heavy Metals High Level Radium 6

7 Our Transformation… Limited Geographic Footprint Acquire Valuable Assets Narrow Service Offering (Haz/Rad Waste Disposal) Event - Centric, Customer - Concentrated Model Limited Growth Prospects Given Idaho Focus National TSDF Footprint Broad Service Capabilities Flexible & Diversified Business Model Ability to Support Customer Needs is Driving Growth Expand Permits / Services Invest in Infrastructure Execute x x x x Dynecol Creating the Premier North American Provider of Environmental Services Our Strategy “Then” – 2008 Today – 2017 ENVIRONMETAL SERVICES INC e VOQUA Vernon

8 …Into a North American Leader ■ 5 Haz/Non - Haz Landfills ■ 1 Radioactive Waste Landfill (Class A, B, C) ■ 22 Treatment & Recycling Facilities 1 ■ Rail - accessible Facilities & Infrastructure ■ 24 Field Service Centers & Retail Satellites 1 Five treatment facilities and one recycling facility co - located with disposal sites Landfills Treatment & Recycling Service Centers Headquarters Retail Satellites (4) Mexico Québec (2) (2) United States (2) Ontario

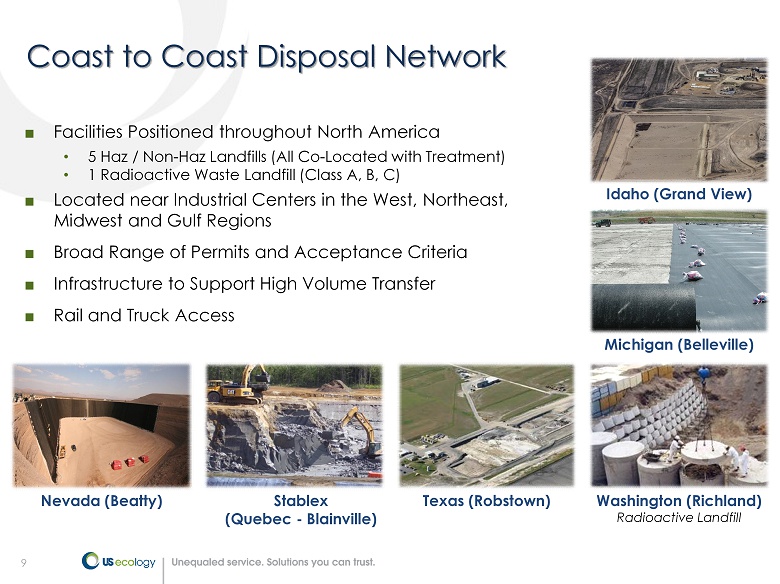

9 Coast to Coast Disposal Network ■ Facilities Positioned throughout North America • 5 Haz / Non - Haz Landfills (All Co - Located with Treatment) • 1 Radioactive Waste Landfill (Class A, B, C) ■ Located near Industrial Centers in the West, Northeast, Midwest and Gulf Regions ■ Broad Range of Permits and Acceptance Criteria ■ Infrastructure to Support High Volume Transfer ■ Rail and Truck Access Idaho (Grand View) Washington (Richland) Radioactive Landfill Michigan (Belleville) Nevada (Beatty) Texas (Robstown) Stablex (Quebec - Blainville)

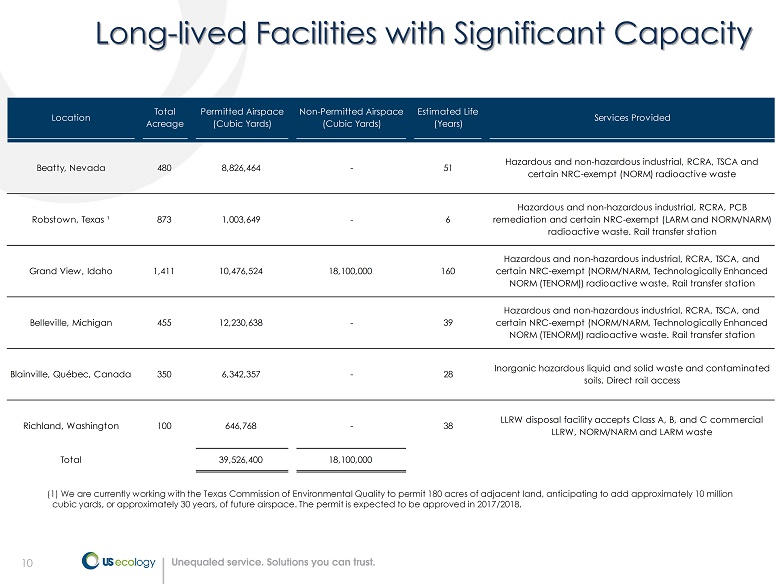

10 Long - lived Facilities with Significant Capacity (1) We are currently working with the Texas Commission of Environmental Quality to permit 180 acres of adjacent land, anticip ati ng to add approximately 10 million cubic yards, or approximately 30 years, of future airspace. The permit is expected to be approved in 2017/2018. Location Total Acreage Permitted Airspace (Cubic Yards) Non-Permitted Airspace (Cubic Yards) Estimated Life (Years) Services Provided Beatty, Nevada 480 8,826,464 - 51 Hazardous and non-hazardous industrial, RCRA, TSCA and certain NRC-exempt (NORM) radioactive waste Robstown, Texas ¹ 873 1,003,649 - 6 Hazardous and non-hazardous industrial, RCRA, PCB remediation and certain NRC-exempt (LARM and NORM/NARM) radioactive waste. Rail transfer station Grand View, Idaho 1,411 10,476,524 18,100,000 160 Hazardous and non-hazardous industrial, RCRA, TSCA, and certain NRC-exempt (NORM/NARM, Technologically Enhanced NORM (TENORM)) radioactive waste. Rail transfer station Belleville, Michigan 455 12,230,638 - 39 Hazardous and non-hazardous industrial, RCRA, TSCA, and certain NRC-exempt (NORM/NARM, Technologically Enhanced NORM (TENORM)) radioactive waste. Rail transfer station Blainville, Québec, Canada 350 6,342,357 - 28 Inorganic hazardous liquid and solid waste and contaminated soils. Direct rail access Richland, Washington 100 646,768 - 38 LLRW disposal facility accepts Class A, B, and C commercial LLRW, NORM/NARM and LARM waste Total 39,526,400 18,100,000

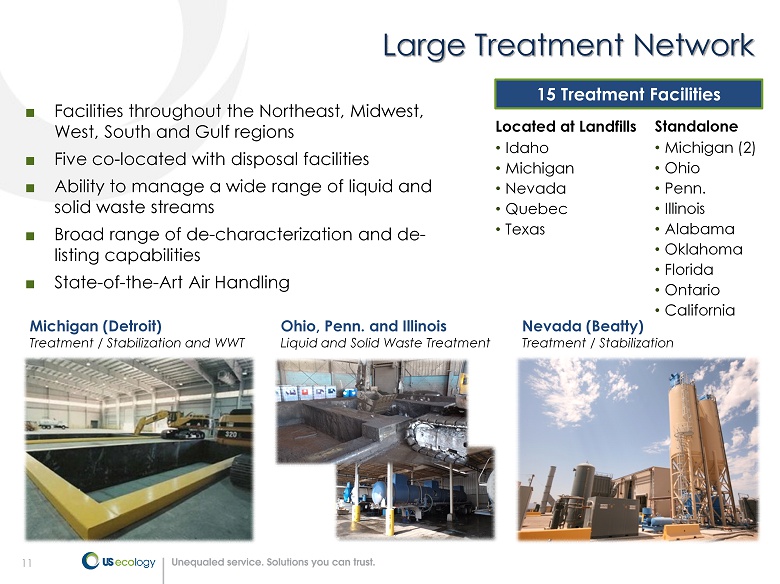

11 Large Treatment Network ■ Facilities throughout the Northeast, Midwest, West, South and Gulf regions ■ Five co - located with disposal facilities ■ Ability to manage a wide range of liquid and solid waste streams ■ Broad range of de - characterization and de - listing capabilities ■ State - of - the - Art Air Handling 15 Treatment Facilities Located at Landfills • Idaho • Michigan • Nevada • Quebec • Texas Standalone • Michigan (2) • Ohio • Penn. • Illinois • Alabama • Oklahoma • Florida • Ontario • California Michigan (Detroit) Treatment / Stabilization and WWT Ohio, Penn. and Illinois Liquid and Solid Waste Treatment Nevada (Beatty) Treatment / Stabilization

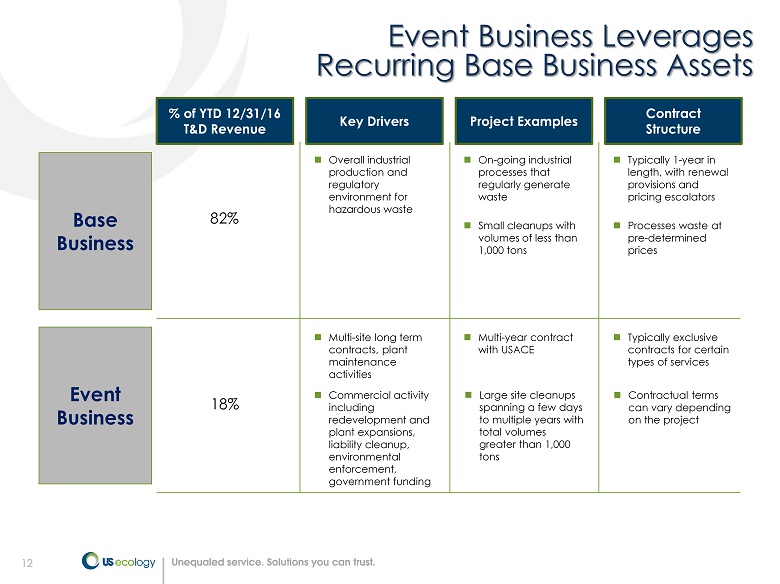

12 Event Business Leverages Recurring Base Business Assets Base Business % of YTD 12/31/16 T&D Revenue Key Drivers Project Examples - Overall industrial production and regulatory environment for hazardous waste - Multi - site long term contracts, plant maintenance activities - Commercial activity including redevelopment and plant expansions, liability cleanup, environmental enforcement, government funding - On - going industrial processes that regularly generate waste - Multi - year contract with USACE - Large site cleanups spanning a few days to multiple years with total volumes greater than 1,000 tons 82% 18% Contract Structure - Typically 1 - year in length, with renewal provisions and pricing escalators - Typically exclusive contracts for certain types of services - Contractual terms can vary depending on the project Event Business - Processes waste at pre - determined prices - Small cleanups with volumes of less than 1,000 tons

13 Recycling ■ Seven recovery / recycling operations in the Gulf, Midwest, Northeast and Southern Regions ■ Market Oriented Solutions: ▪ Thermal Desorption – Oil / Catalyst Recovery ▪ Solvent Distillation – Airline De - icing, Other Solvents ▪ Mobile Distillation – On - site Solvent Recovery for Manufacturing facilities in the South and Midwest ▪ Selective Precipitation – Valuable Metals Recovery Resource Recovery Glycol & NMP Solvent Recycling (MI) Two Airport Recovery Sites (MN & PA) Texas (Robstown) Thermal Recycling North Carolina (Mt. Airy) Mobile Solvent Recovery – South & Midwest Pennsylvania (York) Ohio (Canton) Selective Precipitation Metals Recovery

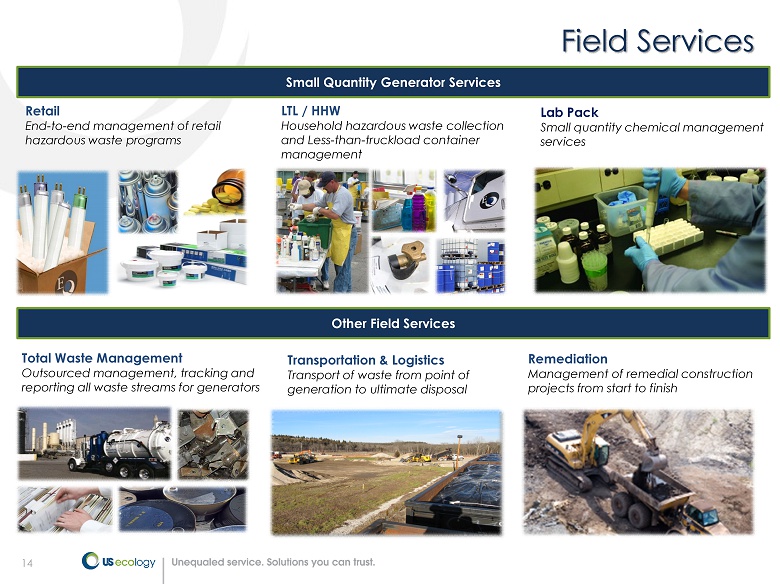

14 Field Services Remediation Management of remedial construction projects from start to finish Retail End - to - end management of retail hazardous waste programs Transportation & Logistics Transport of waste from point of generation to ultimate disposal Lab Pack Small quantity chemical management services Total Waste Management Outsourced management, tracking and reporting all waste streams for generators LTL / HHW Household hazardous waste collection and Less - than - truckload container management Small Quantity Generator Services Other Field Services

15 Industrial Services ■ Represents approximately 5% of total revenues ■ Concentrated in the greater Michigan Area near key disposal assets ■ Provides on - site support at industrial plants and terminals ■ Emergency response services focused on small spills and accidents; limited participation in natural disasters Refinery Services Tank farm cleaning, maintenance and temporary storage Emergency Response 24/7 spill response. Emergency clean - outs, sampling and analysis Marine & Terminal Services 24/7 spill response. Containment booming, saltwater intake cleaning and de - silting Industrial Cleaning & Maintenance Vacuuming, sweeping, blasting, transportation, and pollution control

16 Organic & Inorganic Growth Opportunities Build on Robust Waste Handling Infrastructure Leverage Regulatory Expertise Provide Unequalled Customer Service Generate Sustainable Increases in EPS and Cash Flow Focus on High Value Waste Streams - Target high margin, niche waste streams - Develop new markets and services; cross - sell - Drive volumes to profit from inherent operating leverage - Build base business - Increase win rate on clean - up project pipeline - Expand current permit capabilities - Seek new permits for service expansion - Capitalize on evolving regulatory environment - Take advantage of cross - border, import - export expertise - Introduce new treatment technologies - Maximize throughput at all facilities - Develop low cost airspace - Utilize transportation assets - Expand thermal recycling - Customer - centric focus - Listening to customers is critical to success - Identify innovative and technology - driven solutions for customer challenges Disciplined Acquisition Strategy - Expand disposal network, customer base and geographic footprint - Invest in services that drive growth and margin to Environmental Services Business - Preserve flexibility Execute on Marketing Initiatives

17 Financial Overview

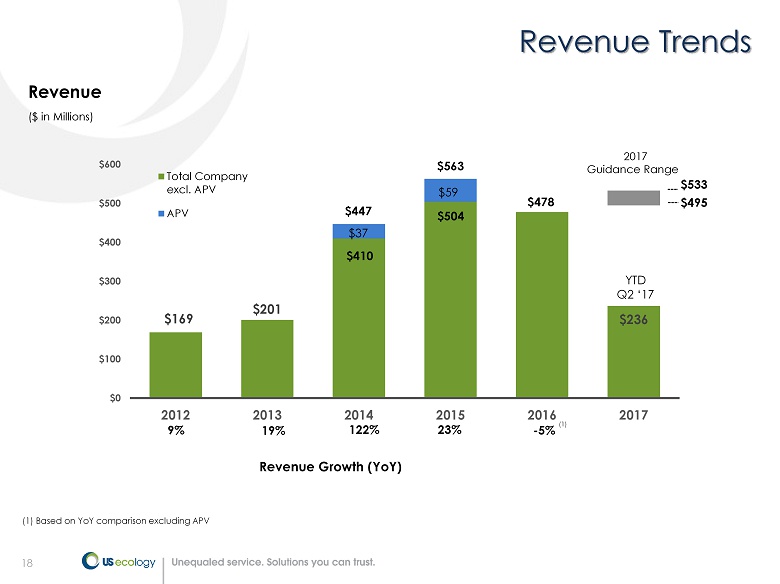

18 ($ in Millions) Revenue Growth (YoY) $169 $201 $236 $0 $100 $200 $300 $400 $500 $600 2012 2013 2014 2015 2016 2017 Total Company excl. APV APV Revenue 9% 19% 122% 23% - 5% (1) (1) Based on YoY comparison excluding APV Revenue Trends $410 $37 $504 $59 $478 $447 $563 2017 Guidance Range YTD Q2 ‘17 $495 $533

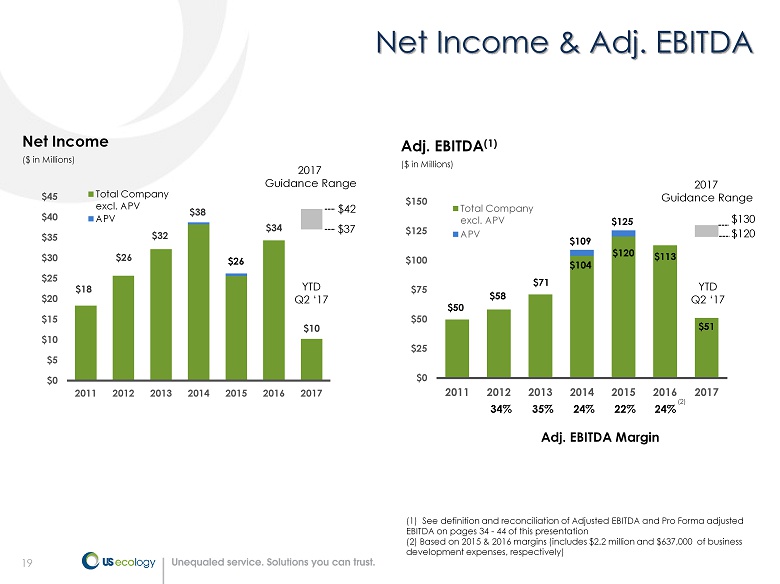

19 ($ in Millions) $18 $26 $32 $38 $34 $10 $0 $5 $10 $15 $20 $25 $30 $35 $40 $45 2011 2012 2013 2014 2015 2016 2017 Total Company excl. APV APV Net Income Net Income & Adj. EBITDA (1) See definition and reconciliation of Adjusted EBITDA and Pro Forma adjusted EBITDA on pages 34 - 44 of this presentation (2) Based on 2015 & 2016 margins (includes $2.2 million and $637,000 of business development expenses, respectively) $50 $58 $113 $51 $0 $25 $50 $75 $100 $125 $150 2011 2012 2013 2014 2015 2016 2017 Total Company excl. APV APV $104 $120 ($ in Millions) Adj. EBITDA (1) 34% 24% 22% 24% Adj. EBITDA Margin (2) 35% 2017 Guidance Range $37 $42 2017 Guidance Range $120 $130 $26 $109 $125 YTD Q2 ‘17 YTD Q2 ‘17 $71

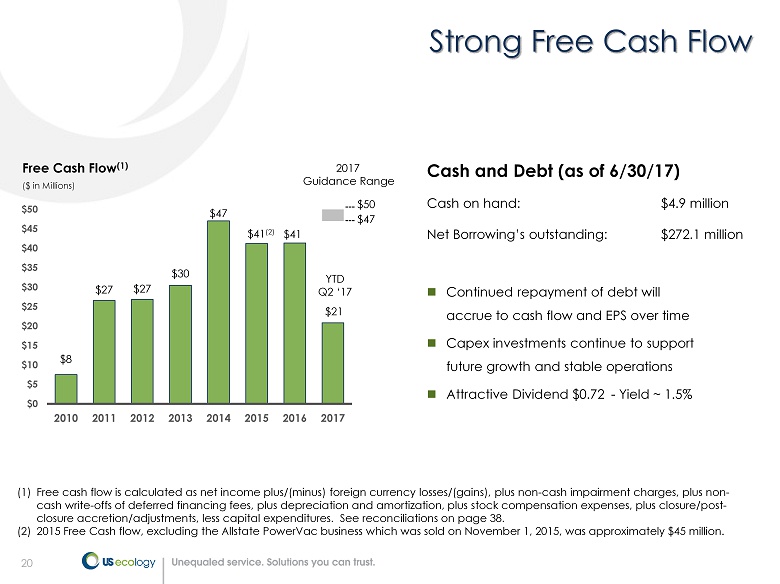

20 Strong Free Cash Flow Cash on hand: $4.9 million Net Borrowing’s outstanding: $ 272.1 million Free Cash Flow (1) ($ in Millions) $8 $27 $27 $30 $ 47 $41 (2) $41 $21 $0 $5 $10 $15 $20 $25 $30 $35 $40 $45 $50 2010 2011 2012 2013 2014 2015 2016 2017 $47 $50 2017 Guidance Range - Continued repayment of debt will accrue to cash flow and EPS over time - Capex investments continue to support future growth and stable operations - Attractive Dividend $0.72 - Yield ~ 1.5% Cash and Debt (as of 6/30/17 ) (1) Free cash flow is calculated as net income plus/(minus) foreign currency losses/(gains), plus non - cash impairment charges, plus non - cash write - offs of deferred financing fees, plus depreciation and amortization, plus stock compensation expenses, plus closure/post - closure accretion/adjustments, less capital expenditures. See reconciliations on page 38. (2) 2015 Free Cash flow, excluding the Allstate PowerVac business which was sold on November 1, 2015, was approximately $45 milli on. YTD Q2 ‘17

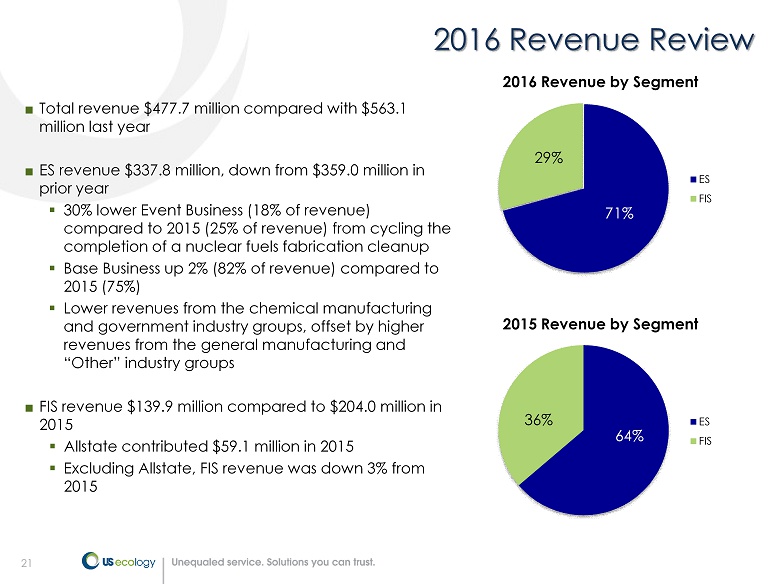

21 ■ Total revenue $477.7 million compared with $563.1 million last year ■ ES revenue $337.8 million, down from $359.0 million in prior year ▪ 30% lower Event Business (18% of revenue) compared to 2015 (25% of revenue) from cycling the completion of a nuclear fuels fabrication cleanup ▪ Base Business up 2% (82% of revenue) compared to 2015 (75%) ▪ Lower revenues from the chemical manufacturing and government industry groups, offset by higher revenues from the general manufacturing and “Other” industry groups ■ FIS revenue $139.9 million compared to $204.0 million in 2015 ▪ Allstate contributed $59.1 million in 2015 ▪ Excluding Allstate, FIS revenue was down 3% from 2015 2016 Revenue Review 71% 29% 2016 Revenue by Segment ES FIS 64% 36% 2015 Revenue by Segment ES FIS

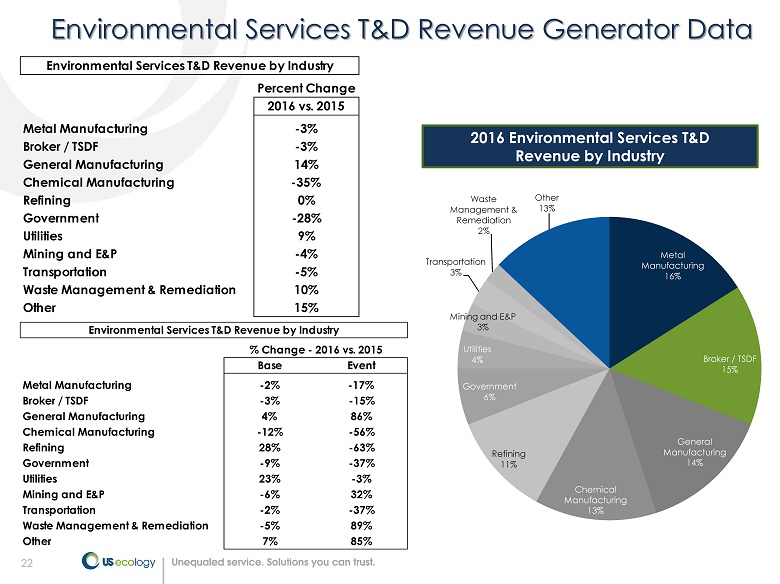

22 Environmental Services T&D Revenue Generator Data Percent Change 2016 vs. 2015 Metal Manufacturing -3% Broker / TSDF -3% General Manufacturing 14% Chemical Manufacturing -35% Refining 0% Government -28% Utilities 9% Mining and E&P -4% Transportation -5% Waste Management & Remediation 10% Other 15% Environmental Services T&D Revenue by Industry Base Event Metal Manufacturing -2% -17% Broker / TSDF -3% -15% General Manufacturing 4% 86% Chemical Manufacturing -12% -56% Refining 28% -63% Government -9% -37% Utilities 23% -3% Mining and E&P -6% 32% Transportation -2% -37% Waste Management & Remediation -5% 89% Other 7% 85% % Change - 2016 vs. 2015 Environmental Services T&D Revenue by Industry Metal Manufacturing 16% Broker / TSDF 15% General Manufacturing 14% Chemical Manufacturing 13% Refining 11% Government 6% Utilities 4% Mining and E&P 3% Transportation 3% Waste Management & Remediation 2% Other 13% 2016 Environmental Services T&D Revenue by Industry

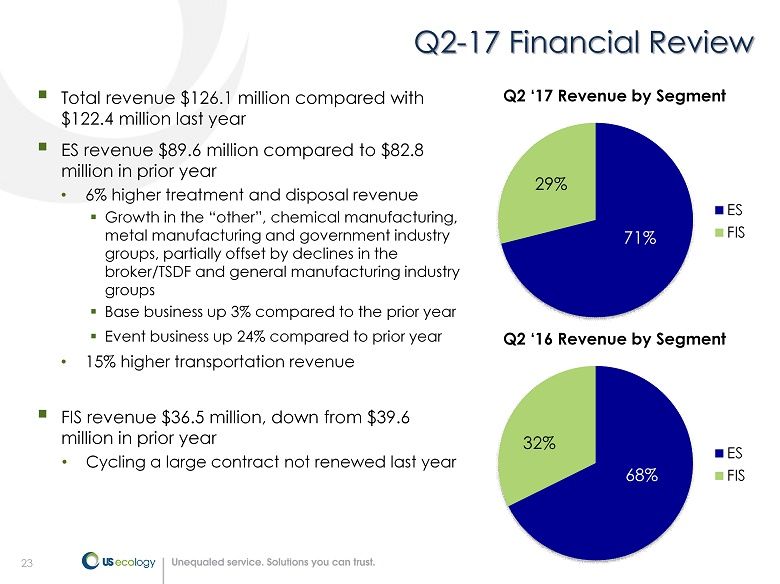

23 Q2 - 17 Financial Review 71% 29% Q2 ‘17 Revenue by Segment ES FIS 68% 32% Q2 ‘16 Revenue by Segment ES FIS ▪ Total revenue $126.1 million compared with $122.4 million last year ▪ ES revenue $89.6 million compared to $82.8 million in prior year • 6% higher treatment and disposal revenue ▪ Growth in the “other”, chemical manufacturing, metal manufacturing and government industry groups, partially offset by declines in the broker/TSDF and general manufacturing industry groups ▪ Base business up 3% compared to the prior year ▪ Event business up 24% compared to prior year • 15% higher transportation revenue ▪ FIS revenue $36.5 million, down from $39.6 million in prior year • Cycling a large contract not renewed last year

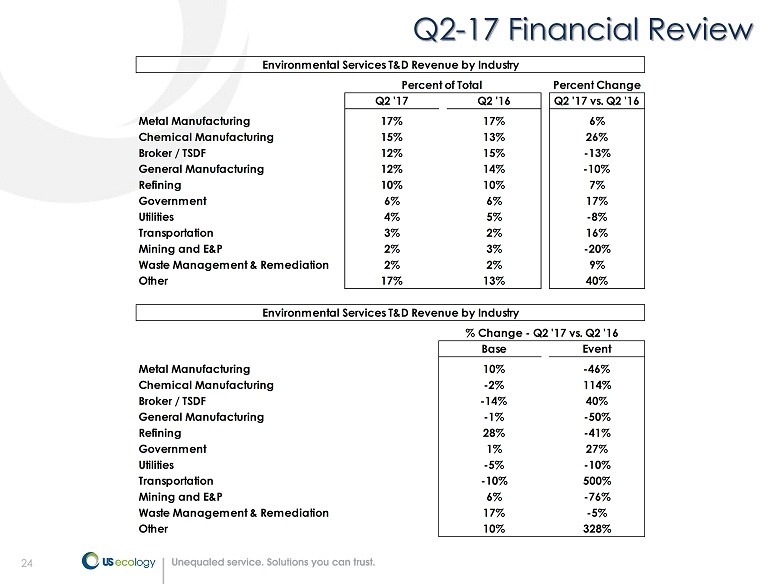

24 Q2 - 17 Financial Review Percent Change Q2 '17 Q2 '16 Q2 '17 vs. Q2 '16 Metal Manufacturing 17% 17% 6% Chemical Manufacturing 15% 13% 26% Broker / TSDF 12% 15% -13% General Manufacturing 12% 14% -10% Refining 10% 10% 7% Government 6% 6% 17% Utilities 4% 5% -8% Transportation 3% 2% 16% Mining and E&P 2% 3% -20% Waste Management & Remediation 2% 2% 9% Other 17% 13% 40% Base Event Metal Manufacturing 10% -46% Chemical Manufacturing -2% 114% Broker / TSDF -14% 40% General Manufacturing -1% -50% Refining 28% -41% Government 1% 27% Utilities -5% -10% Transportation -10% 500% Mining and E&P 6% -76% Waste Management & Remediation 17% -5% Other 10% 328% Environmental Services T&D Revenue by Industry Percent of Total Environmental Services T&D Revenue by Industry % Change - Q2 '17 vs. Q2 '16

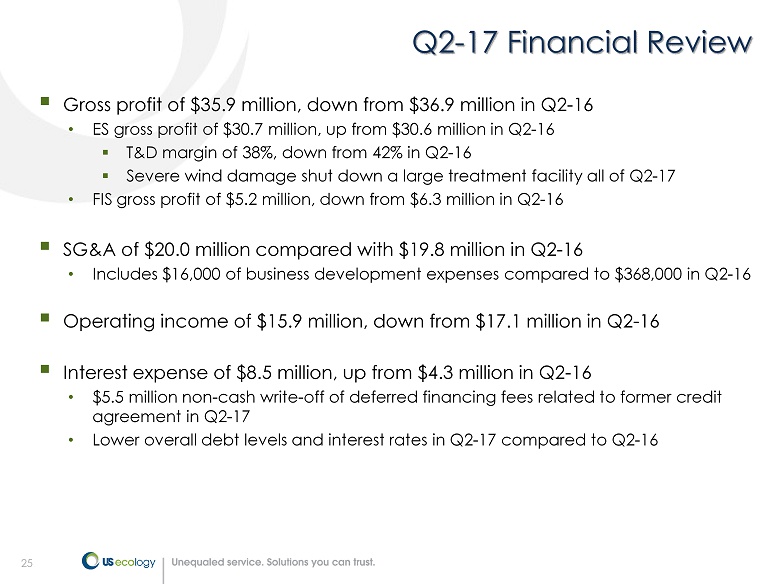

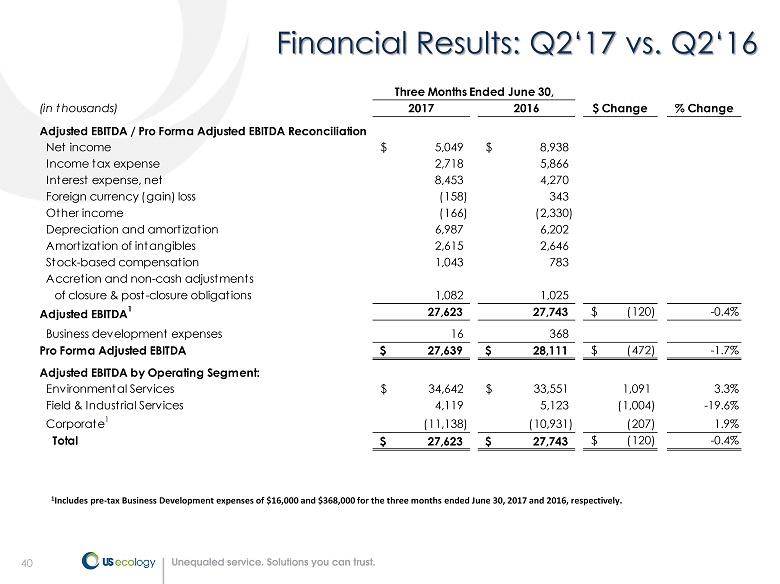

25 ▪ Gross profit of $35.9 million, down from $36.9 million in Q2 - 16 • ES gross profit of $30.7 million, up from $30.6 million in Q2 - 16 ▪ T&D margin of 38%, down from 42% in Q2 - 16 ▪ Severe wind damage shut down a large treatment facility all of Q2 - 17 • FIS gross profit of $5.2 million, down from $6.3 million in Q2 - 16 ▪ SG&A of $20.0 million compared with $19.8 million in Q2 - 16 • Includes $16,000 of business development expenses compared to $368,000 in Q2 - 16 ▪ Operating income of $15.9 million, down from $17.1 million in Q2 - 16 ▪ Interest expense of $8.5 million, up from $4.3 million in Q2 - 16 • $5.5 million non - cash write - off of deferred financing fees related to former credit agreement in Q2 - 17 • Lower overall debt levels and interest rates in Q2 - 17 compared to Q2 - 16 25 Q2 - 17 Financial Review

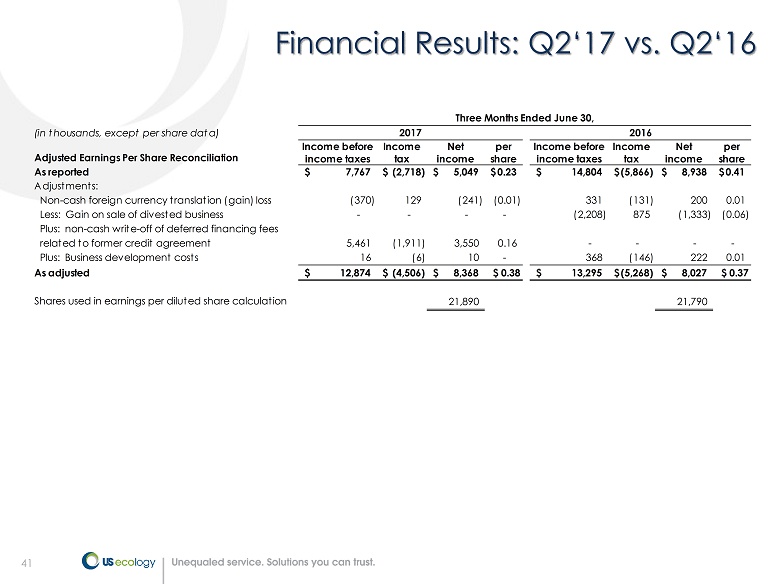

26 ▪ Effective tax rate decreased to 35.0% versus 39.6% in Q2 - 16 • Higher proportion of earnings from Canadian operations in Q2 - 17, taxed at a lower corporate tax rate ▪ Net income of $5.0 million, or $0.23 per diluted share, compared with $8.9 million, or $0.41 per diluted share in Q2 - 16 ▪ Adjusted EPS 1 of $0.38 per share compared with $0.37 per diluted share in Q2 - 16 ▪ Adjusted EBITDA 1 of $27.6 million, flat compared to $27.7 million in Q2 - 16 26 Q2 - 17 Financial Review 1 See definition and reconciliation of adjusted earnings per share and adjusted EBITDA on pages 34 - 44 of this presentation or attached as Exhibit A to our earnings release filed with the SEC on Form 8 - K

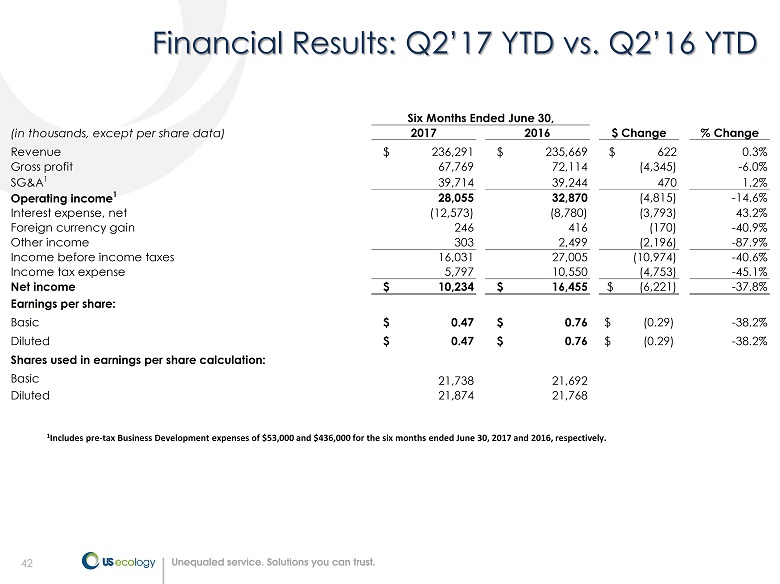

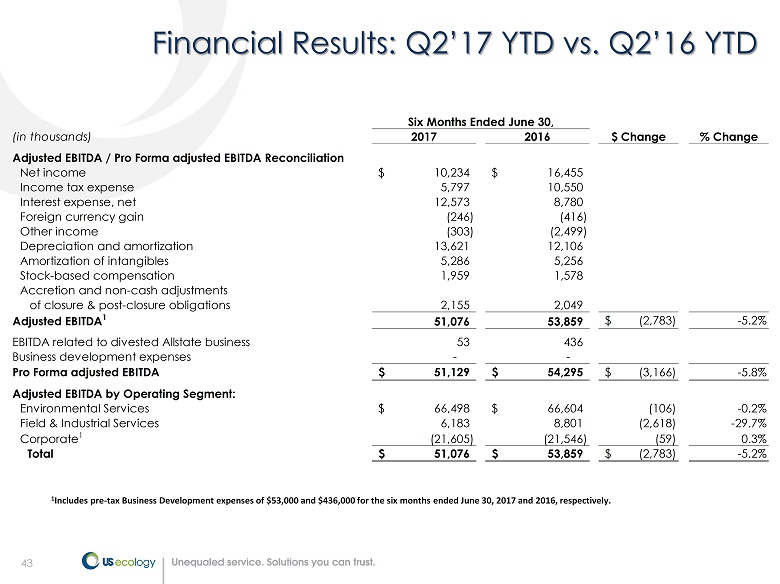

27 ▪ Total revenue of $236.3 million, compared with $235.7 million last year • ES Segment revenue was $170.9 million, compared with $164.3 million last year ▪ 5% higher treatment and disposal revenue • Base business up 3% compared to the prior year • Event business up 7% compared to prior year ▪ Flat transportation revenue • FIS Segment revenue was $65.4 million, compared with $71.3 million last year ▪ Gross profit of $67.8 million, down from $72.1 million last year • ES gross profit of $59.4 million, down from $61.1 million last year • FIS gross profit of $8.4 million, down from $11.1 million last year ▪ SG&A of $39.7 million compared with $39.2 million last year • Includes $53,000 of business development expenses compared to $436,000 last year ▪ Net income was $10.2 million, or $0.47 per diluted share, down from $16.5 million, or $0.76 per diluted share, last year ▪ Adjusted EBITDA 1 was $51.1 million, compared with $53.9 million last year ▪ Adjusted EPS 1 of $0.61 per share, down from $0.69 per share last year 27 First Six Months 2017 Financial Review 1 See definition and reconciliation of adjusted earnings per share and adjusted EBITDA on pages 34 - 44 of this presentation or attached as Exhibit A to our earnings release filed with the SEC on Form 8 - K

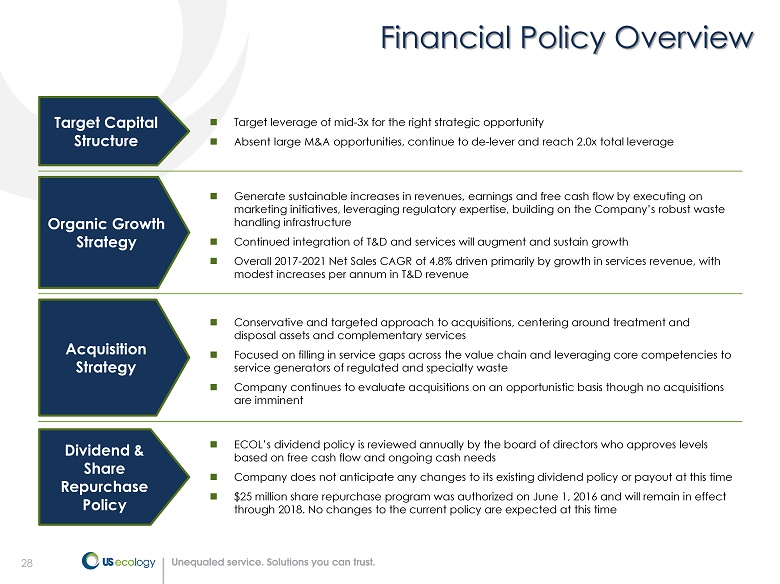

28 Financial Policy Overview 28 Acquisition Strategy - Conservative and targeted approach to acquisitions, centering around treatment and disposal assets and complementary services - Focused on filling in service gaps across the value chain and leveraging core competencies to service generators of regulated and specialty waste - Company continues to evaluate acquisitions on an opportunistic basis though no acquisitions are imminent Organic Growth Strategy - Generate sustainable increases in revenues, earnings and free cash flow by executing on marketing initiatives, leveraging regulatory expertise, building on the Company’s robust waste handling infrastructure - Continued integration of T&D and services will augment and sustain growth - Overall 2017 - 2021 Net Sales CAGR of 4.8% driven primarily by growth in services revenue, with modest increases per annum in T&D revenue Target Capital Structure - Target leverage of mid - 3x for the right strategic opportunity - Absent large M&A opportunities, continue to de - lever and reach 2.0x total leverage Dividend & Share Repurchase Policy - ECOL’s dividend policy is reviewed annually by the board of directors who approves levels based on free cash flow and ongoing cash needs - Company does not anticipate any changes to its existing dividend policy or payout at this time - $25 million share repurchase program was authorized on June 1, 2016 and will remain in effect through 2018. No changes to the current policy are expected at this time

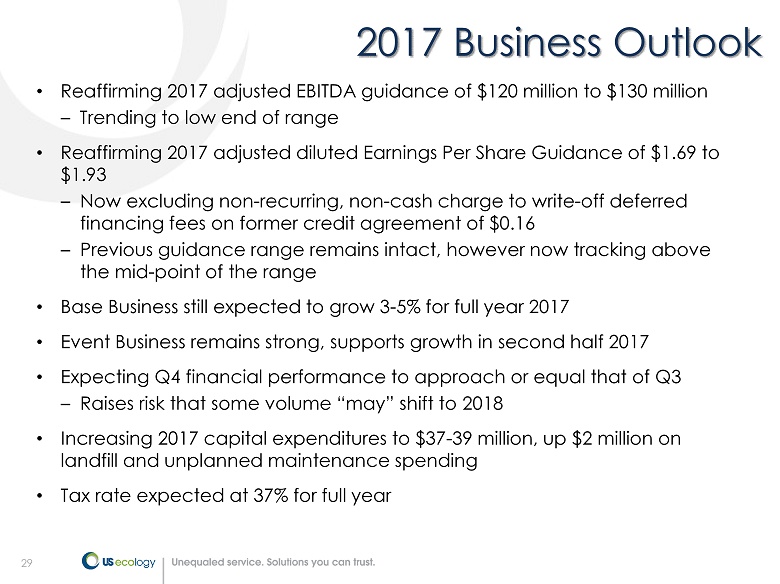

29 29 2017 Business Outlook • Reaffirming 2017 adjusted EBITDA guidance of $120 million to $130 million – Trending to low end of range • Reaffirming 2017 adjusted diluted Earnings Per Share Guidance of $1.69 to $1.93 – Now excluding non - recurring, non - cash charge to write - off deferred financing fees on former credit agreement of $0.16 – Previous guidance range remains intact, however now tracking above the mid - point of the range • Base Business still expected to grow 3 - 5% for full year 2017 • Event Business remains strong, supports growth in second half 2017 • Expecting Q4 financial performance to approach or equal that of Q3 – Raises risk that some volume “may” shift to 2018 • Increasing 2017 capital expenditures to $ 37 - 39 million, up $2 million on landfill and unplanned maintenance spending • Tax rate expected at 37% for full year

30 Experienced Management Team with Proven Ability to Execute Valuable Landfill Position within the Industry Broad Set of Blue Chip Customers from a Wide Range of Industries Strong Cash Flow Highly Strategic Assets and Broad Geographic Reach US Ecology Investment Highlights High Proportion of Recurring Revenue Limiting Cyclicality Highly Regulated Industry that Requires Expertise

31 Appendix

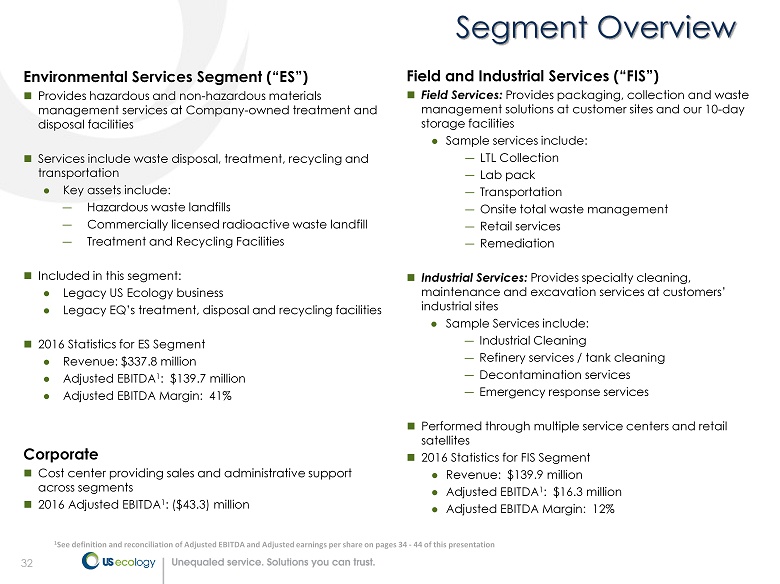

32 Environmental Services Segment (“ES”) - Provides hazardous and non - hazardous materials management services at Company - owned treatment and disposal facilities - Services include waste disposal, treatment, recycling and transportation - Key assets include: ― Hazardous waste landfills ― Commercially licensed radioactive waste landfill ― Treatment and Recycling Facilities - Included in this segment: - Legacy US Ecology business - Legacy EQ’s treatment, disposal and recycling facilities - 2016 Statistics for ES Segment - Revenue: $337.8 million - Adjusted EBITDA 1 : $139.7 million - Adjusted EBITDA Margin: 41% 32 Field and Industrial Services (“FIS”) - Field Services: Provides packaging, collection and waste management solutions at customer sites and our 10 - day storage facilities - Sample services include: ― LTL Collection ― Lab pack ― Transportation ― Onsite total waste management ― Retail services ― Remediation - Industrial Services: Provides specialty cleaning, maintenance and excavation services at customers’ industrial sites - Sample Services include: ― Industrial Cleaning ― Refinery services / tank cleaning ― Decontamination services ― Emergency response services - Performed through multiple service centers and retail satellites - 2016 Statistics for FIS Segment - Revenue: $139.9 million - Adjusted EBITDA 1 : $16.3 million - Adjusted EBITDA Margin: 12% Corporate - Cost center providing sales and administrative support across segments - 2016 Adjusted EBITDA 1 : ($43.3) million Segment Overview 1 See definition and reconciliation of Adjusted EBITDA and Adjusted earnings per share on pages 34 - 44 of this presentation

33 US Ecology reports adjusted EBITDA, Pro Forma adjusted EBITDA and adjusted earnings per diluted share results, which are non - GAAP financial measures, as a complement to results provided in accordance with generally accepted accounting principles in the United States (GAAP) and believes that such information provides analysts, stockholders, and other users information to better understand the Company’s operating performance . Because adjusted EBITDA, Pro Forma adjusted EBITDA and adjusted earnings per diluted share are not measurements determined in accordance with GAAP and are thus susceptible to varying calculations they may not be comparable to similar measures used by other companies . Items excluded from adjusted EBITDA, Pro Forma adjusted EBITDA and adjusted earnings per diluted share are significant components in understanding and assessing financial performance . Adjusted EBITDA, Pro Forma adjusted EBITDA and adjusted earnings per diluted share should not be considered in isolation or as an alternative to, or substitute for, net income, cash flows generated by operations, investing or financing activities, or other financial statement data presented in the consolidated financial statements as indicators of financial performance or liquidity . Adjusted EBITDA, Pro Forma adjusted EBITDA and adjusted earnings per diluted share have limitations as analytical tools and should not be considered in isolation or a substitute for analyzing our results as reported under GAAP . 33 Non - GAAP Financial Measures

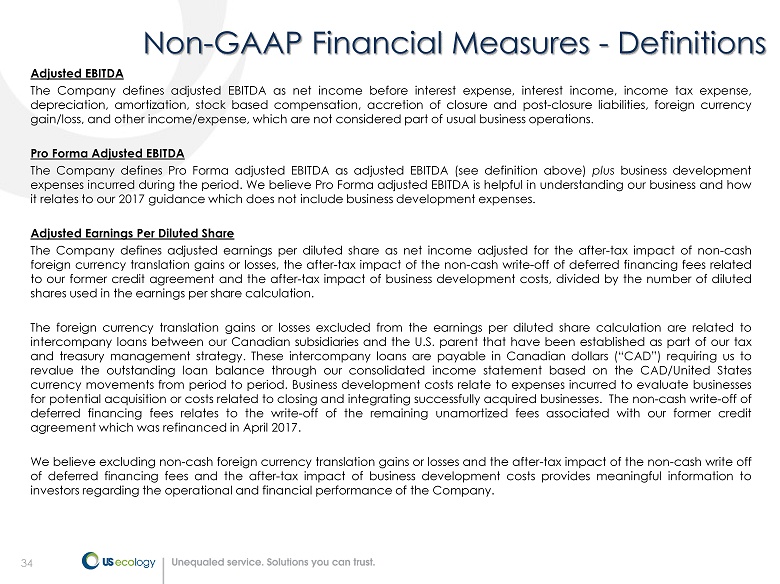

34 Adjusted EBITDA The Company defines adjusted EBITDA as net income before interest expense, interest income, income tax expense, depreciation, amortization, stock based compensation, accretion of closure and post - closure liabilities, foreign currency gain/loss, and other income/expense, which are not considered part of usual business operations . Pro Forma Adjusted EBITDA The Company defines Pro Forma adjusted EBITDA as adjusted EBITDA (see definition above) plus business development expenses incurred during the period . We believe Pro Forma adjusted EBITDA is helpful in understanding our business and how it relates to our 2017 guidance which does not include business development expenses . Adjusted Earnings Per Diluted Share The Company defines adjusted earnings per diluted share as net income adjusted for the after - tax impact of non - cash foreign currency translation gains or losses, the after - tax impact of the non - cash write - off of deferred financing fees related to our former credit agreement and the after - tax impact of business development costs, divided by the number of diluted shares used in the earnings per share calculation . The foreign currency translation gains or losses excluded from the earnings per diluted share calculation are related to intercompany loans between our Canadian subsidiaries and the U . S . parent that have been established as part of our tax and treasury management strategy . These intercompany loans are payable in Canadian dollars (“CAD”) requiring us to revalue the outstanding loan balance through our consolidated income statement based on the CAD/United States currency movements from period to period . Business development costs relate to expenses incurred to evaluate businesses for potential acquisition or costs related to closing and integrating successfully acquired businesses . The non - cash write - off of deferred financing fees relates to the write - off of the remaining unamortized fees associated with our former credit agreement which was refinanced in April 2017 . We believe excluding non - cash foreign currency translation gains or losses and the after - tax impact of the non - cash write off of deferred financing fees and the after - tax impact of business development costs provides meaningful information to investors regarding the operational and financial performance of the Company . 34 Non - GAAP Financial Measures - Definitions

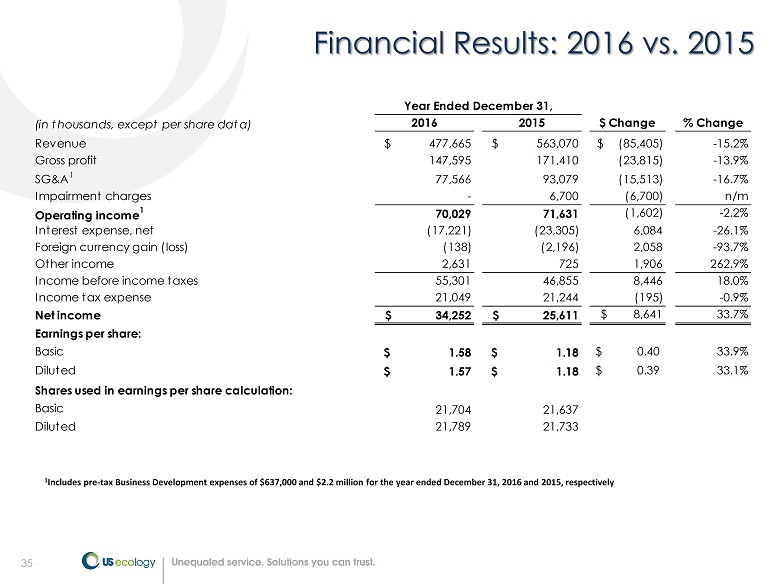

35 35 Financial Results: 2016 vs. 2015 (in thousands, except per share data) 2016 2015 $ Change % Change Revenue $ 477,665 $ 563,070 $ (85,405) -15.2% Gross profit 147,595 171,410 (23,815) -13.9% SG&A 1 77,566 93,079 (15,513) -16.7% Impairment charges - 6,700 (6,700) n/m Operating income 1 70,029 71,631 (1,602) -2.2% Interest expense, net (17,221) (23,305) 6,084 -26.1% Foreign currency gain (loss) (138) (2,196) 2,058 -93.7% Other income 2,631 725 1,906 262.9% Income before income taxes 55,301 46,855 8,446 18.0% Income tax expense 21,049 21,244 (195) -0.9% Net income $ 34,252 $ 25,611 $ 8,641 33.7% Earnings per share: Basic $ 1.58 $ 1.18 $ 0.40 33.9% Diluted $ 1.57 $ 1.18 $ 0.39 33.1% Shares used in earnings per share calculation: Basic 21,704 21,637 Diluted 21,789 21,733 Year Ended December 31, 1 Includes pre - tax Business Development expenses of $637,000 and $2.2 million for the year ended December 31, 2016 and 2015, respe ctively

36 36 Adjusted EBITDA 1 Includes pre - tax Business Development expenses of $637,000, $2.2 million and $6.4 million for the year ended December 31, 2016, 2015 and 2014, respectively (in thousands) 2016 2015 2014 Adjusted EBITDA / Pro Forma adjusted EBITDA Reconciliation Net income 34,252$ 25,611$ 38,236$ Income tax expense 21,049 21,244 22,814 Interest expense, net 17,221 23,305 10,570 Foreign currency loss 138 2,196 1,499 Other income (2,631) (725) (669) Depreciation and amortization 25,304 27,931 24,413 Amortization of intangibles 10,575 12,307 8,207 Stock-based compensation 2,925 2,297 1,250 Accretion and non-cash adjustments of closure & post-closure obligations 3,953 4,584 2,656 Impairment charges - 6,700 - Adjusted EBITDA 1 112,786 125,450 108,976 EBITDA related to divested Allstate business - (5,055) (5,015) Business development expenses 637 2,212 6,402 Pro Forma adjusted EBITDA 113,423$ 122,607$ 110,363$ Adjusted EBITDA by Operating Segment: Environmental Services 139,698$ 150,067$ 123,086$ Field & Industrial Services 16,342 21,388 8,638 Corporate 1 (43,254) (46,005) (22,748) Total 112,786$ 125,450$ 108,976$ Year Ended December 31,

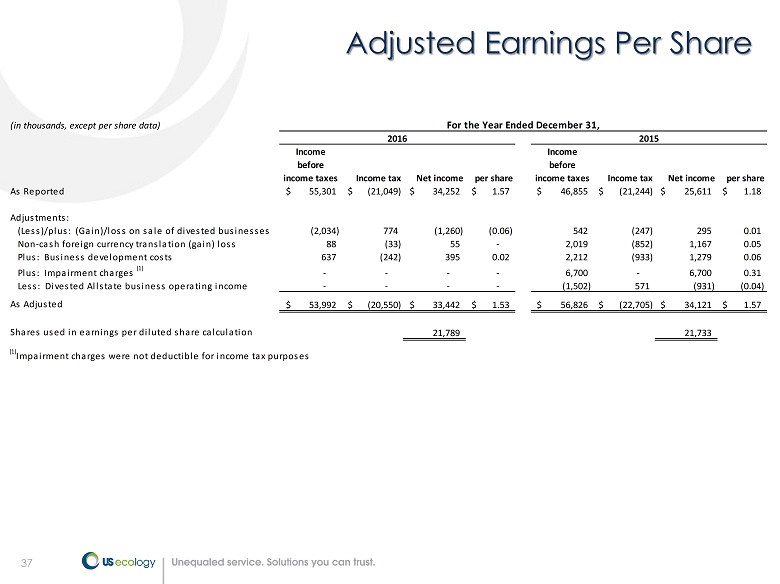

37 37 Adjusted Earnings Per Share (in thousands, except per share data) Income before income taxes Income tax Net income per share Income before income taxes Income tax Net income per share As Reported 55,301$ (21,049)$ 34,252$ 1.57$ 46,855$ (21,244)$ 25,611$ 1.18$ Adjustments: (Less)/plus: (Gain)/loss on sale of divested businesses (2,034) 774 (1,260) (0.06) 542 (247) 295 0.01 Non-cash foreign currency translation (gain) loss 88 (33) 55 - 2,019 (852) 1,167 0.05 Plus: Business development costs 637 (242) 395 0.02 2,212 (933) 1,279 0.06 Plus: Impairment charges (1) - - - - 6,700 - 6,700 0.31 Less: Divested Allstate business operating income - - - - (1,502) 571 (931) (0.04) As Adjusted 53,992$ (20,550)$ 33,442$ 1.53$ 56,826$ (22,705)$ 34,121$ 1.57$ Shares used in earnings per diluted share calculation 21,789 21,733 (1) Impairment charges were not deductible for income tax purposes For the Year Ended December 31, 2016 2015

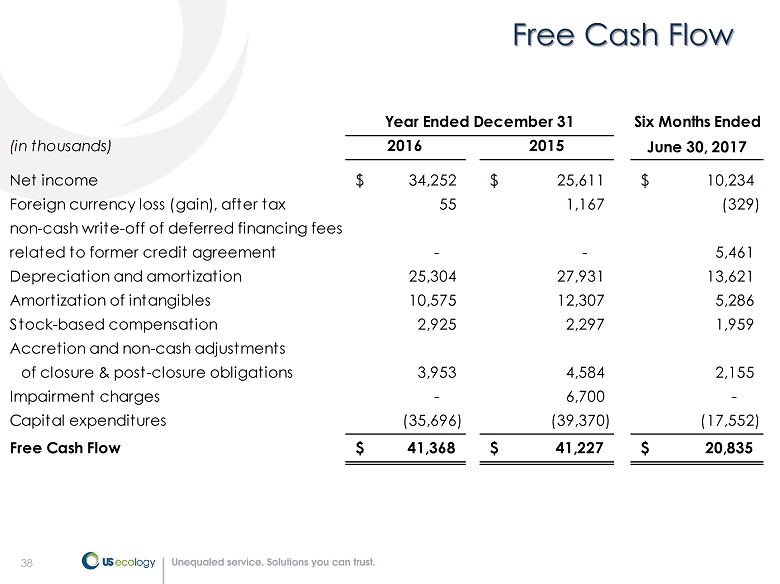

38 38 Free Cash Flow Six Months Ended (in thousands) 2016 2015 June 30, 2017 Net income 34,252$ 25,611$ 10,234$ Foreign currency loss (gain), after tax 55 1,167 (329) non-cash write-off of deferred financing fees related to former credit agreement - - 5,461 Depreciation and amortization 25,304 27,931 13,621 Amortization of intangibles 10,575 12,307 5,286 Stock-based compensation 2,925 2,297 1,959 Accretion and non-cash adjustments of closure & post-closure obligations 3,953 4,584 2,155 Impairment charges - 6,700 - Capital expenditures (35,696) (39,370) (17,552) Free Cash Flow 41,368$ 41,227$ 20,835$ Year Ended December 31

39 39 Financial Results: Q2‘17 vs. Q2‘16 1 Includes pre - tax Business Development expenses of $16,000 and $368,000 for the three months ended June 30, 2017 and 2016, respec tively. (in thousands, except per share data) 2017 2016 $ Change % Change Revenue $ 126,057 $ 122,351 $ 3,706 3.0% Gross profit 35,896 36,906 (1,010) -2.7% SG&A 1 20,000 19,819 181 0.9% Operating income 1 15,896 17,087 (1,191) -7.0% Interest expense, net (8,453) (4,270) (4,183) 98.0% Foreign currency gain (loss) 158 (343) 501 -146.1% Other income 166 2,330 (2,164) -92.9% Income before income taxes 7,767 14,804 (7,037) -47.5% Income tax expense 2,718 5,866 (3,148) -53.7% Net income $ 5,049 $ 8,938 $ (3,889) -43.5% Earnings per share: Basic $ 0.23 $ 0.41 $ (0.18) -43.9% Diluted $ 0.23 $ 0.41 $ (0.18) -43.9% Shares used in earnings per share calculation: Basic 21,751 21,700 Diluted 21,890 21,790 Three Months Ended June 30,

40 40 Financial Results: Q2‘17 vs. Q2‘16 1 Includes pre - tax Business Development expenses of $16,000 and $368,000 for the three months ended June 30, 2017 and 2016, respec tively. (in thousands) 2017 2016 $ Change % Change Adjusted EBITDA / Pro Forma Adjusted EBITDA Reconciliation Net income 5,049$ 8,938$ Income tax expense 2,718 5,866 Interest expense, net 8,453 4,270 Foreign currency (gain) loss (158) 343 Other income (166) (2,330) Depreciation and amortization 6,987 6,202 Amortization of intangibles 2,615 2,646 Stock-based compensation 1,043 783 Accretion and non-cash adjustments of closure & post-closure obligations 1,082 1,025 Adjusted EBITDA 1 27,623 27,743 (120)$ -0.4% Business development expenses 16 368 Pro Forma Adjusted EBITDA 27,639$ 28,111$ (472)$ -1.7% Adjusted EBITDA by Operating Segment: Environmental Services 34,642$ 33,551$ 1,091 3.3% Field & Industrial Services 4,119 5,123 (1,004) -19.6% Corporate 1 (11,138) (10,931) (207) 1.9% Total 27,623$ 27,743$ (120)$ -0.4% Three Months Ended June 30,

41 41 Financial Results: Q2‘17 vs. Q2‘16 (in thousands, except per share data) Adjusted Earnings Per Share Reconciliation Income before income taxes Income tax Net income per share Income before income taxes Income tax Net income per share As reported 7,767$ (2,718)$ 5,049$ 0.23$ 14,804$ (5,866)$ 8,938$ 0.41$ Adjustments: Non-cash foreign currency translation (gain) loss (370) 129 (241) (0.01) 331 (131) 200 0.01 Less: Gain on sale of divested business - - - - (2,208) 875 (1,333) (0.06) Plus: non-cash write-off of deferred financing fees related to former credit agreement 5,461 (1,911) 3,550 0.16 - - - - Plus: Business development costs 16 (6) 10 - 368 (146) 222 0.01 As adjusted 12,874$ (4,506)$ 8,368$ $ 0.38 13,295$ (5,268)$ 8,027$ $ 0.37 Shares used in earnings per diluted share calculation 21,890 21,790 Three Months Ended June 30, 2017 2016

42 42 Financial Results: Q2’17 YTD vs. Q2’16 YTD 1 Includes pre - tax Business Development expenses of $53,000 and $436,000 for the six months ended June 30, 2017 and 2016, respecti vely. (in thousands, except per share data) 2017 2016 $ Change % Change Revenue $ 236,291 $ 235,669 $ 622 0.3% Gross profit 67,769 72,114 (4,345) -6.0% SG&A 1 39,714 39,244 470 1.2% Operating income 1 28,055 32,870 (4,815) -14.6% Interest expense, net (12,573) (8,780) (3,793) 43.2% Foreign currency gain 246 416 (170) -40.9% Other income 303 2,499 (2,196) -87.9% Income before income taxes 16,031 27,005 (10,974) -40.6% Income tax expense 5,797 10,550 (4,753) -45.1% Net income $ 10,234 $ 16,455 $ (6,221) -37.8% Earnings per share: Basic $ 0.47 $ 0.76 $ (0.29) -38.2% Diluted $ 0.47 $ 0.76 $ (0.29) -38.2% Shares used in earnings per share calculation: Basic 21,738 21,692 Diluted 21,874 21,768 Six Months Ended June 30,

43 43 Financial Results: Q2’17 YTD vs. Q2’16 YTD 1 Includes pre - tax Business Development expenses of $53,000 and $436,000 for the six months ended June 30, 2017 and 2016, respecti vely. (in thousands) 2017 2016 $ Change % Change Adjusted EBITDA / Pro Forma adjusted EBITDA Reconciliation Net income 10,234$ 16,455$ Income tax expense 5,797 10,550 Interest expense, net 12,573 8,780 Foreign currency gain (246) (416) Other income (303) (2,499) Depreciation and amortization 13,621 12,106 Amortization of intangibles 5,286 5,256 Stock-based compensation 1,959 1,578 Accretion and non-cash adjustments of closure & post-closure obligations 2,155 2,049 Adjusted EBITDA 1 51,076 53,859 (2,783)$ -5.2% EBITDA related to divested Allstate business 53 436 Business development expenses - - Pro Forma adjusted EBITDA 51,129$ 54,295$ (3,166)$ -5.8% Adjusted EBITDA by Operating Segment: Environmental Services 66,498$ 66,604$ (106) -0.2% Field & Industrial Services 6,183 8,801 (2,618) -29.7% Corporate 1 (21,605) (21,546) (59) 0.3% Total 51,076$ 53,859$ (2,783)$ -5.2% Six Months Ended June 30,

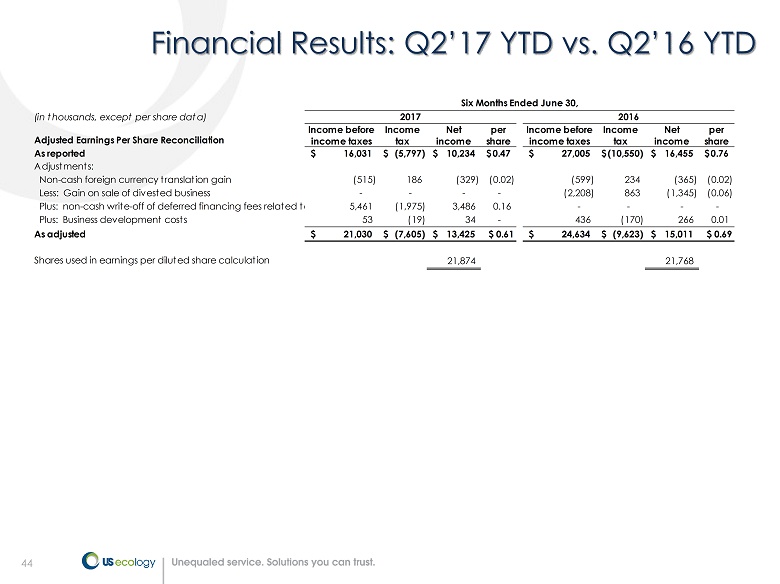

44 44 Financial Results: Q2’17 YTD vs. Q2’16 YTD (in thousands, except per share data) Adjusted Earnings Per Share Reconciliation Income before income taxes Income tax Net income per share Income before income taxes Income tax Net income per share As reported 16,031$ (5,797)$ 10,234$ 0.47$ 27,005$ (10,550)$ 16,455$ 0.76$ Adjustments: Non-cash foreign currency translation gain (515) 186 (329) (0.02) (599) 234 (365) (0.02) Less: Gain on sale of divested business - - - - (2,208) 863 (1,345) (0.06) Plus: non-cash write-off of deferred financing fees related to former credit agreement5,461 (1,975) 3,486 0.16 - - - - Plus: Business development costs 53 (19) 34 - 436 (170) 266 0.01 As adjusted 21,030$ (7,605)$ 13,425$ $ 0.61 24,634$ (9,623)$ 15,011$ $ 0.69 Shares used in earnings per diluted share calculation 21,874 21,768 Six Months Ended June 30, 2017 2016