Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ENTELLUS MEDICAL INC | d425487d8k.htm |

Exhibit 99.1

Entellus Investor

Presentation

August 2017

entellus MEDICAL

Forward Looking Statements

This presentation may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements

generally can be identified by the use of words such as “expect,” “anticipate,” “could”, “may,” “intend,” “will,” “continue,” “outlook,” “guidance,”

“future,” “look forward,” “next steps,” other words of similar meaning and the use of future dates. Forward-looking statements in this presentation include statements about our total addressable market, financial

guidance and future financial performance, the effect of our acquisition of Spirox, Inc. on our business and operating results, product performance and benefits, ability to implement our business model and strategic plan, ability to integrate the

Spirox operations and ability to manage and grow our business, ability to establish and maintain intellectual property protection for our products or avoid claims of infringement, ability to hire and retain key personnel, and expectations about

market trends, along with third-party payor reimbursement and coverage decisions. These forward-looking statements are based on the current expectations of our management and involve known and unknown risks and uncertainties that may cause our

actual results, performance or achievements expressed or implied by the forward-looking statements. Such risks and uncertainties include, among others, the dependence of our net sales on our XprESS family of products, future market acceptance and

adoption of our products and adequate levels of coverage or reimbursement for procedures using our products; risks involved in our recent acquisition of Spirox, including the failure to achieve the revenues, cost savings, earnings, growth prospects

and any or other synergies expected from the acquisition or delays in realization thereof; delays and challenges in integrating Spirox’s business and operations; operating costs and business disruption following the acquisition, including

adverse effects on employee retention and on business relationships with third parties, including physicians, providers, distributors and vendors; and issues with customers securing reimbursement for nasal surgery procedures using Spirox’s

LATERA device; our ability to successfully develop and commercialize new ENT products; competition; ability to expand, manage and maintain our direct sales organization and market and sell our products in the United States and internationally; risks

and uncertainties involved in our international operations; the compliance of our products and activities with the laws and regulations of the countries in which they are marketed; failure or delay in obtaining FDA or other regulatory approvals or

the effect of FDA or other regulatory actions; our ability to manage our anticipated growth; risk of product recalls, product liability claims and litigation and inadequate insurance coverage relating thereto; intellectual property disputes; loss of

key suppliers; inadequate capital resources and inability to raise additional financing when needed and on favorable terms. Other factors that may cause actual results to differ materially from current expectations include, among other things, those

described in the section entitled “Risk Factors” and elsewhere in greater detail in our Annual Report on Form 10-K for the year ended

December 31,

2016 filed with the Securities and Exchange Commission on February 22, 2017 and other filings with the SEC including our Quarterly Report on Form 10-Q for the quarter ended June 30, 2017. We undertake no obligation to update or revise any

forward-looking statements, even if subsequent events cause our views to change. This presentation contains statistical data that we obtained from industry publications and reports generated by third parties. Although we believe that the

publications and reports are reliable, we have not independently verified this statistical data.

© 2017 Entellus Medical. All rights reserved.

entellus MEDICAL

Note on Non-GAAP Financial Measures

To supplement its consolidated financial statements prepared in accordance with United States generally accepted accounting principles (“GAAP”), Entellus uses certain

non-GAAP financial measures, including adjusted EBITDA and adjusted gross margin. Entellus’s management team believes that the presentation of these measures provides useful information to investors and that these measures may assist investors

in evaluating the company’s operations, period over period. EBITDA is calculated by adding back to net income charges for interest, income taxes and depreciation and amortization expenses. Adjusted EBITDA is calculated by adding back to EBITDA

non-cash stock-based compensation, non-operating income and expense, non-cash contingent consideration adjustments associated with business combinations, non-cash inventory step-up amortization and special charges, including transaction and

integration-related expenses. Entellus’s adjusted gross margin is calculated by excluding the impact of purchase accounting in connection with Entellus’s recent acquisition of Spirox, Inc. With respect to Entellus’s third quarter and

full year 2017 financial guidance regarding non-GAAP adjusted EBITDA and non-GAAP adjusted gross margin in its press release, Entellus cannot provide a quantitative reconciliation to the most directly comparable GAAP measure without unreasonable

effort due to its inability to make accurate projections and estimates related to certain information needed to calculate some of the adjustments as described above. Reconciliations of historical non-GAAP financial measures used in this presentation

to the most comparable GAAP measures can be found on Entellus’s website.

© 2017 Entellus Medical. All rights reserved.

entellus MEDICAL

Large, unpenetrated market and disease states treated by the same physicians

Transforming

Minimally invasive technologies for better the ENT outcomes

Market

Shifting ENT procedures to cost effective settings

© 2017 Entellus Medical. All rights reserved.

entellus MEDICAL

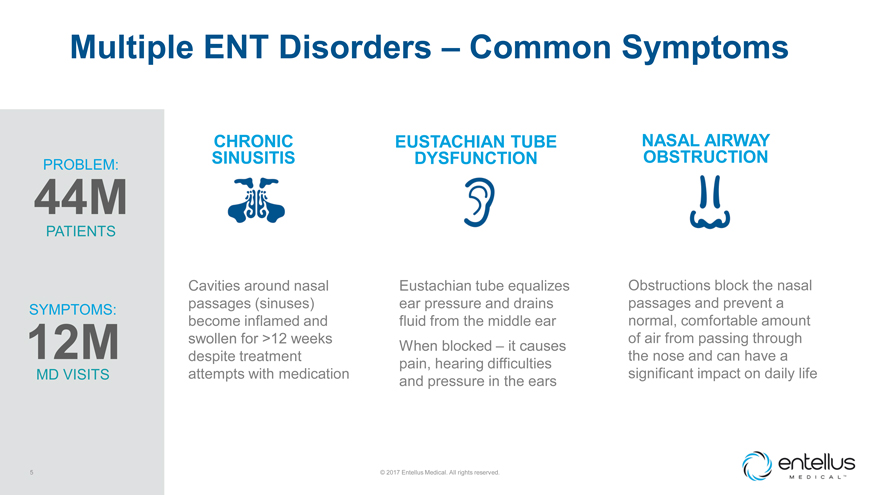

Multiple ENT Disorders – Common Symptoms

PROBLEM: 44M PATIENTS SYMPTOMS: 12M MD VISITS 5 CHRONIC SINUSITIS Cavities around nasal passages (sinuses) become inflamed and swollen for >12 weeks despite treatment attempts

with medication EUSTACHIAN TUBE DYSFUNCTION Eustachian tube equalizes ear pressure and drains fluid from the middle ear When blocked – it causes pain, hearing difficulties and pressure in the ears © 2017 Entellus Medical. All rights

reserved. NASAL AIRWAY OBSTRUCTION Obstructions block the nasal passages and prevent a normal, comfortable amount of air from passing through the nose and can have a significant impact on daily life

entellus MEDICAL

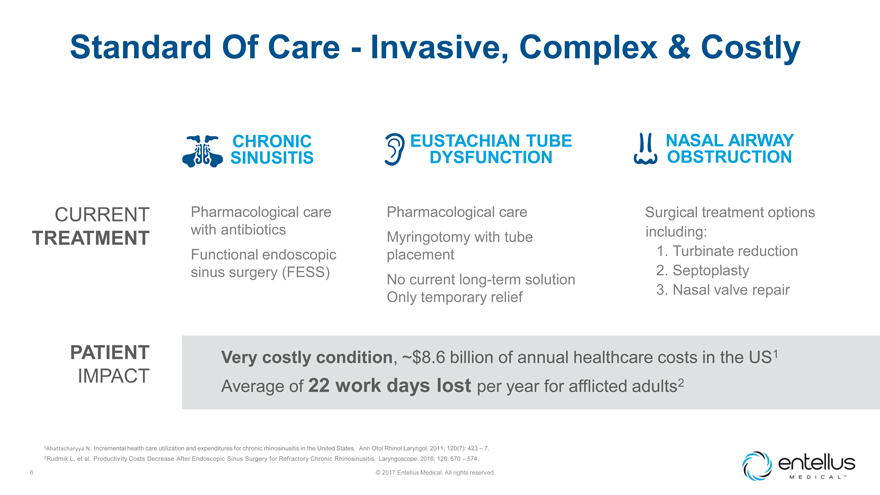

Standard Of Care—Invasive, Complex & Costly

CHRONIC SINUSITIS EUSTACHIAN TUBE DYSFUNCTION NASAL AIRWAY OBSTRUCTION

CURRENT TREATMENT,

Pharmacological care with antibiotics Functional endoscopic sinus surgery (FESS), Pharmacological care Myringotomy with tube placement No current long-term solution Only temporary relief, Surgical treatment options including: 1. 2. 3.,

Turbinate reduction Septoplasty Nasal valve repair

PATIENT

Very costly condition, ~$8.6 billion of annual healthcare costs in the US1

IMPACT

Average of 22 work days lost per year for afflicted adults2

1Ahattacharyya N. Incremental

health care utilization and expenditures for chronic rhinosinusitis in the United States. Ann Otol Rhinol Laryngol. 2011; 120(7): 423 – 7. 2Rudmik L, et al. Productivity Costs Decrease After Endoscopic Sinus Surgery for Refractory Chronic

Rhinosinusitis. Laryngoscope. 2016; 126: 570 – 574.

6 © 2017 Entellus Medical. All rights reserved.

entellus MEDICAL

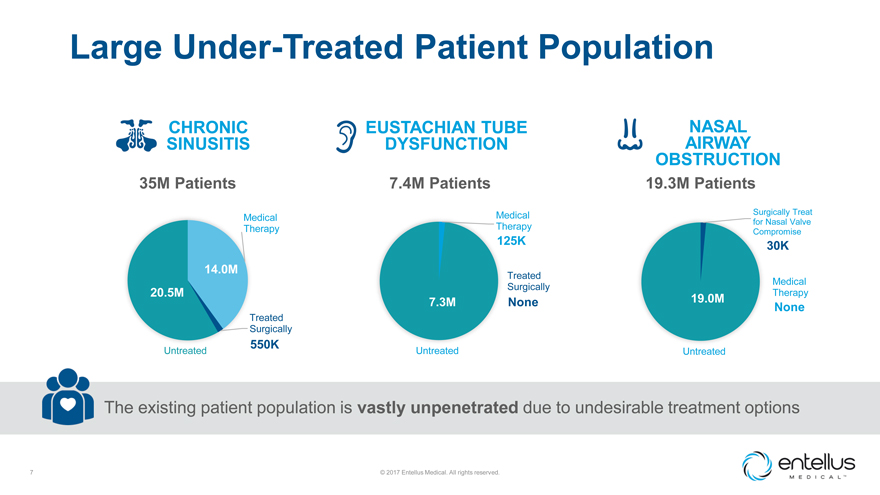

Large Under-Treated Patient Population

CHRONIC EUSTACHIAN TUBE NASAL SINUSITIS DYSFUNCTION AIRWAY

OBSTRUCTION

35M Patients 7.4M Patients 19.3M Patients

Medical Surgically Treat

Medical for Nasal Valve

Therapy Therapy

125K Compromise

30K 14.0M

Treated

Medical Surgically 20.5M Therapy

7.3M None 19.0M

None

Treated Surgically

550K

Untreated Untreated Untreated

The existing patient population is vastly unpenetrated due to

undesirable treatment options

© 2017 Entellus Medical. All rights reserved.

entellus MEDICAL

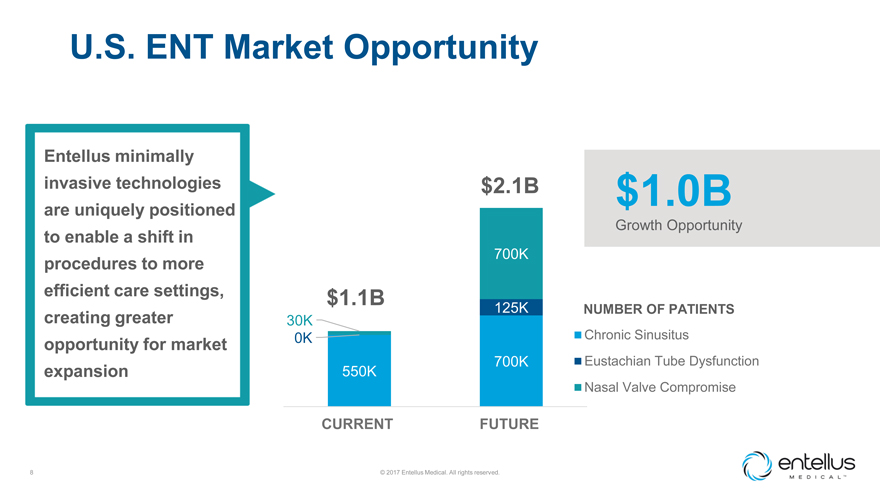

U.S. ENT Market Opportunity

Entellus minimally invasive technologies are uniquely positioned to enable a shift in procedures to more efficient care settings, creating greater opportunity for

market expansion

$2.1B $1.0B

Growth Opportunity

700K

$1.1B

30K 125K NUMBER OF PATIENTS

0K Chronic Sinusitus

700K Eustachian Tube Dysfunction

550K

Nasal Valve Compromise

CURRENT FUTURE

© 2017 Entellus Medical. All rights reserved.

entellus MEDICAL

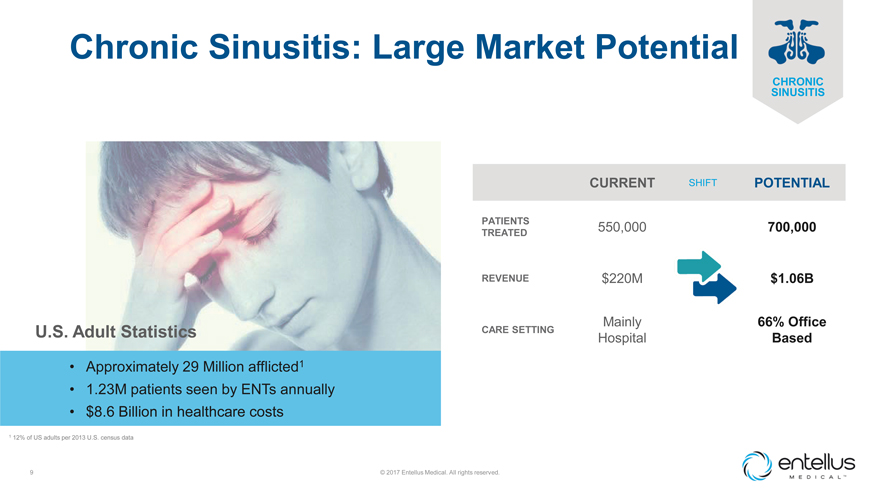

Chronic Sinusitis: Large Market Potential

U.S. Adult Statistics

| • |

|

Approximately 29 Million afflicted1 |

| • |

|

1.23M patients seen by ENTs annually |

| • |

|

$8.6 Billion in healthcare costs |

| 1 | 12% of US adults per 2013 U.S. census data |

CURRENT SHIFT POTENTIAL

PATIENTS 550,000 700,000 TREATED

REVENUE $220M $1.06B

Mainly 66% Office

CARE SETTING

Hospital Based

© 2017 Entellus Medical. All rights reserved.

entellus MEDICAL

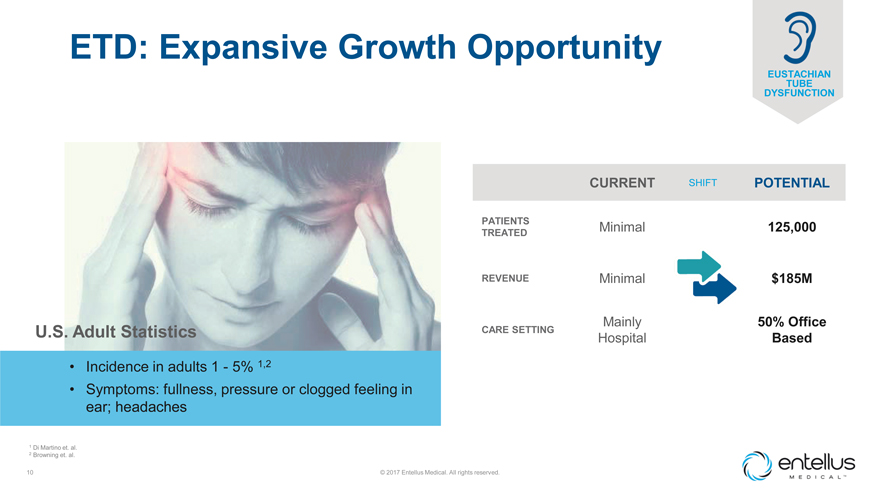

ETD: Expansive Growth Opportunity

EUSTACHIAN TUBE DYSFUNCTION

U.S. Adult Statistics

| • |

|

Incidence in adults 1—5% 1,2 |

| • |

|

Symptoms: fullness, pressure or clogged feeling in ear; headaches |

| 1 | Di Martino et. al. |

| 2 | Browning et. al. |

CURRENT SHIFT POTENTIAL

PATIENTS Minimal 125,000 TREATED

REVENUE Minimal $185M

Mainly 50% Office

CARE SETTING

Hospital Based

10 © 2017 Entellus Medical. All rights reserved.

entellus MEDICAL

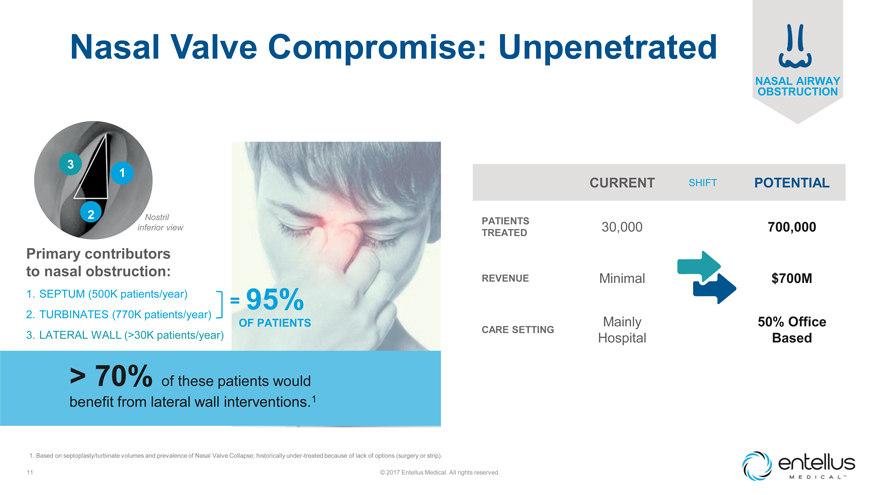

Nasal Valve Compromise: Unpenetrated

3

1

2

Nostril inferior view

Primary contributors to nasal obstruction:

1. SEPTUM

(500K patients/year) = 95%

2. TURBINATES (770K patients/year)

OF PATIENTS

3. LATERAL WALL (>30K patients/year)

> 70% of these patients would

benefit from lateral wall interventions.1

1. Based on septoplasty/turbinate volumes and prevalence of Nasal Valve Collapse; historically under-treated because of

lack of options (surgery or strip).

CURRENT SHIFT POTENTIAL

PATIENTS 30,000

700,000

TREATED

REVENUE Minimal $700M

Mainly 50% Office

CARE SETTING

Hospital Based

11 © 2017 Entellus Medical. All rights reserved.

entellus MEDICAL

Entellus – Improved Treatment Options

Providing less invasive technologies that offer better outcomes in more cost effective settings

CHRONIC SINUSITIS

EUSTACHIAN TUBE DYSFUNCTION

NASAL AIRWAY OBSTRUCTION

© 2017 Entellus Medical. All rights reserved.

entellus MEDICAL

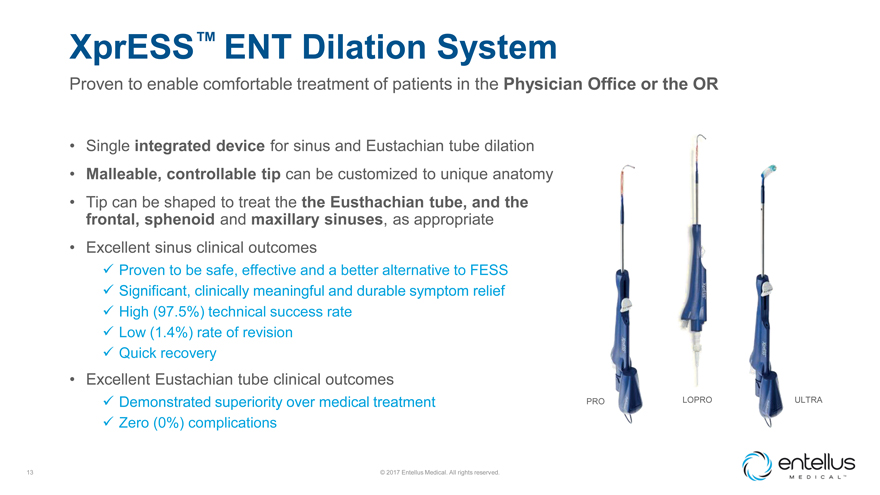

XprESS™ ENT Dilation System

Proven to enable comfortable treatment of patients in the Physician Office or the OR

Single

integrated device for sinus and Eustachian tube dilation

Malleable, controllable tip can be customized to unique anatomy

Tip can be shaped to treat the the Eusthachian tube, and the frontal, sphenoid and maxillary sinuses, as appropriate

Excellent sinus clinical outcomes

? Proven to be safe, effective and a better alternative to

FESS

? Significant, clinically meaningful and durable symptom relief

? High

(97.5%) technical success rate

? Low (1.4%) rate of revision

?

Quick recovery

Excellent Eustachian tube clinical outcomes

? Demonstrated

superiority over medical treatment PRO LOPRO ULTRA

? Zero (0%) complications

© 2017 Entellus Medical. All rights reserved.

entellus MEDICAL

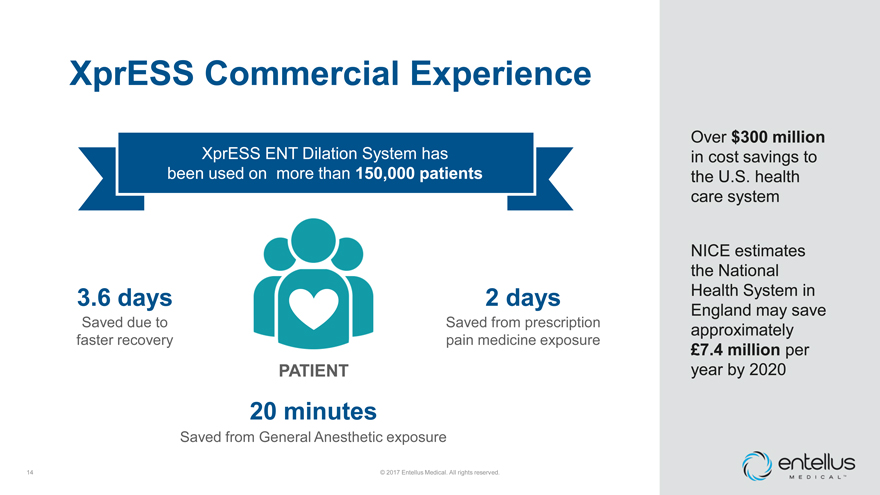

XprESS Commercial Experience

XprESS ENT Dilation System has been used on more than 150,000 patients

3.6 days 2 days

Saved due to Saved from prescription faster recovery pain medicine exposure

PATIENT

20 minutes

Saved from General Anesthetic exposure

14 © 2017 Entellus Medical. All rights reserved.

Over $300 million in cost savings to the U.S. health care system

NICE

estimates the National Health System in England may save approximately

£7.4 million per year by 2020

entellus MEDICAL

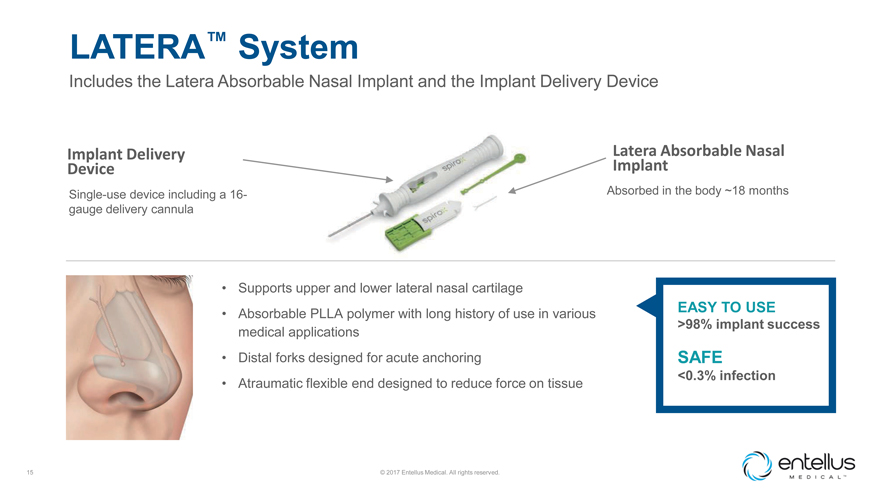

LATERA™ System

Includes the Latera Absorbable Nasal Implant and the Implant Delivery Device

Implant Delivery Device

Single-use device including a 16-gauge delivery

cannula

Latera Absorbable Nasal Implant

Absorbed in the body ~18 months

Supports upper and lower lateral nasal cartilage

Absorbable PLLA polymer with

long history of use in various medical applications

Distal forks designed for acute anchoring

Atraumatic flexible end designed to reduce force on tissue

EASY TO USE

>98% implant success

SAFE

<0.3% infection

© 2017 Entellus Medical. All rights reserved.

15

entellus MEDICAL

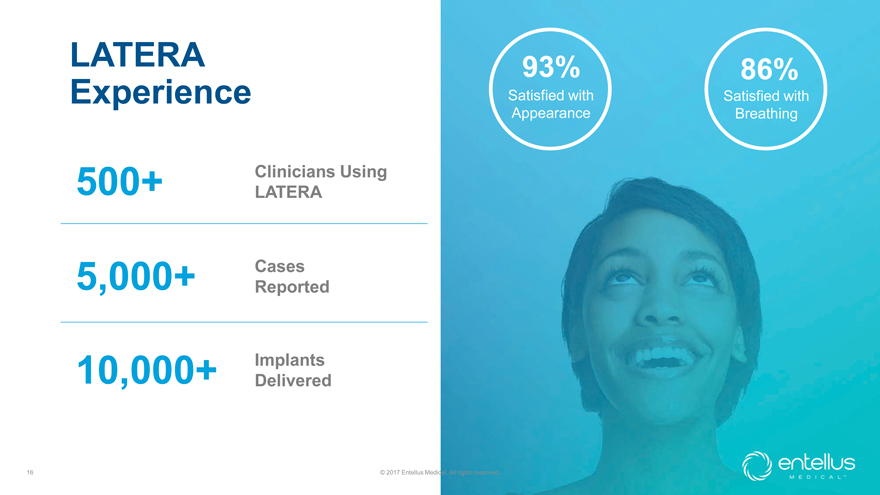

LATERA

Experience

500+ Clinicians Using LATERA

5,000+ Cases

Reported

10,000+ Implants Delivered

16 © 2017 Entellus Medical. All rights reserved.

93%

Satisfied with Appearance

86%

Satisfied with Breathing

entellus MEDICAL

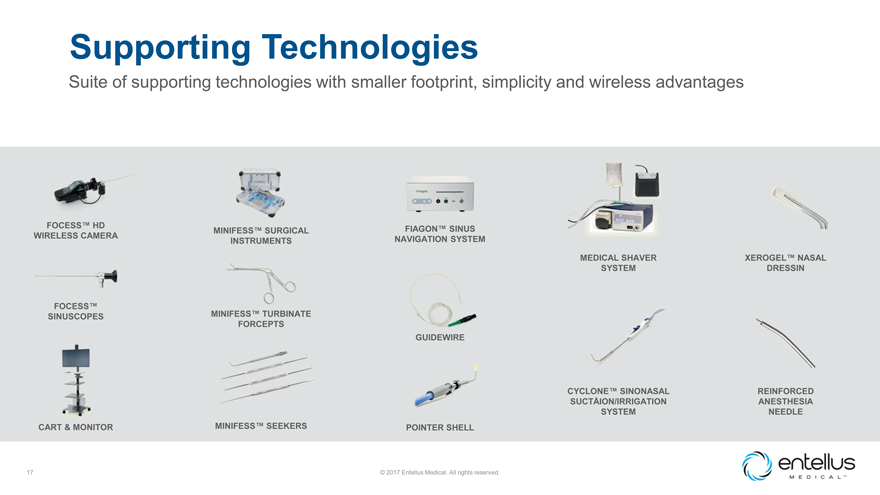

Supporting Technologies

Suite of supporting technologies with smaller footprint, simplicity and wireless advantages

FOCESS™ HD FIAGON™ SINUS MINIFESS™ SURGICAL

WIRELESS CAMERA NAVIGATION SYSTEM

INSTRUMENTS

MEDICAL SHAVER XEROGEL™ NASAL SYSTEM DRESSIN

FOCESS™

MINIFESS™ TURBINATE

SINUSCOPES FORCEPTS

GUIDEWIRE

CYCLONE™ SINONASAL REINFORCED SUCTÅION/IRRIGATION ANESTHESIA

SYSTEM NEEDLE

CART & MONITOR MINIFESS™ SEEKERS POINTER SHELL

© 2017 Entellus Medical. All rights reserved.

entellus MEDICAL

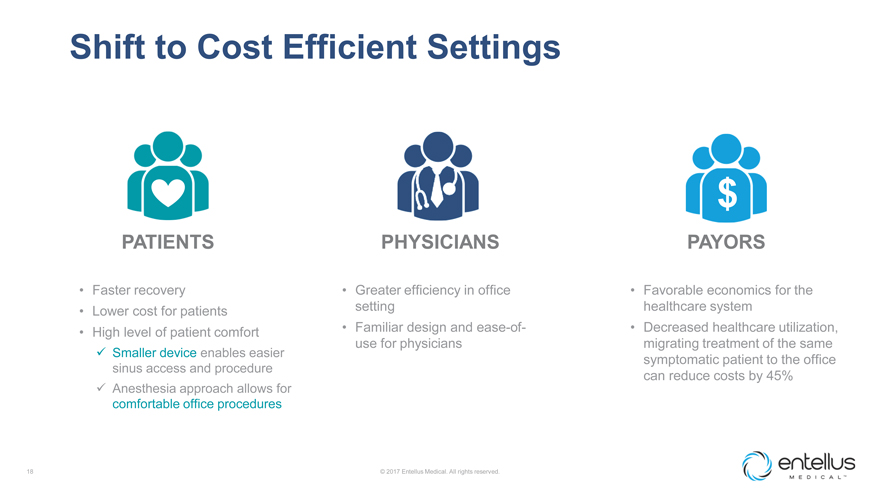

Shift to Cost Efficient Settings

$

PATIENTS PHYSICIANS PAYORS

Faster recovery Greater efficiency in office Favorable economics for the

Lower cost for

patients setting healthcare system

High level of patient comfort Familiar design and ease-of- Decreased healthcare utilization, use for physicians migrating

treatment of the same

? Smaller device enables easier symptomatic patient to the office sinus access and procedure can reduce costs by 45%

? Anesthesia approach allows for comfortable office procedures

18 © 2017 Entellus

Medical. All rights reserved.

entellus MEDICAL

|

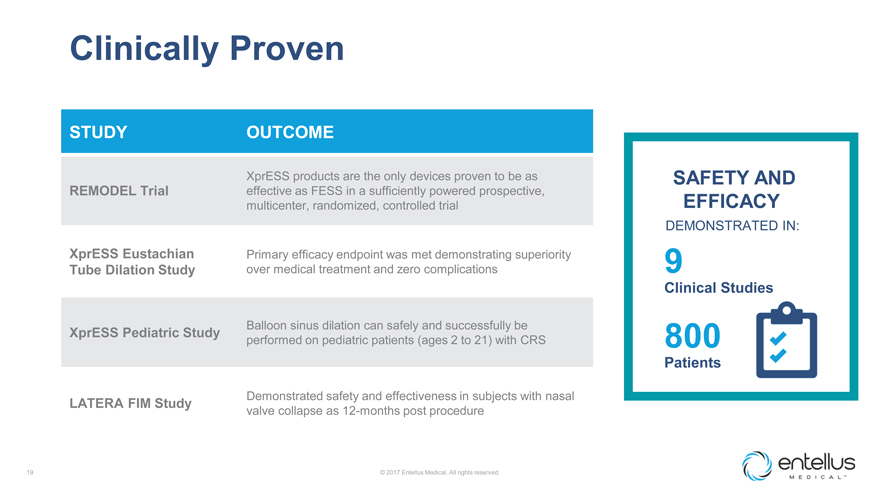

Clinically Proven

STUDY

OUTCOME

REMODEL Trial

XprESS products are the only devices proven to be as effective as FESS in a

sufficiently powered prospective, multicenter, randomized, controlled trial

XprESS Eustachian Tube Dilation Study

Primary efficacy endpoint was met demonstrating superiority over medical treatment and zero complications

XprESS Pediatric Study

Balloon sinus dilation can safely and successfully be performed on

pediatric patients (ages 2 to 21) with CRS

LATERA FIM Study

Demonstrated

safety and effectiveness in subjects with nasal valve collapse as 12-months post procedure

19 © 2017 Entellus Medical. All rights reserved.

entellus MEDICAL

|

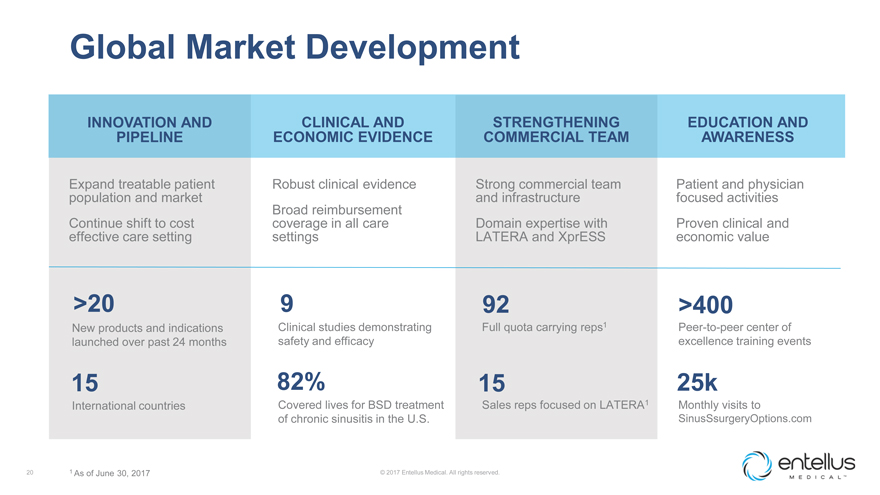

Global Market Development

INNOVATION AND PIPELINE

CLINICAL AND ECONOMIC EVIDENCE

STRENGTHENING COMMERCIAL TEAM

EDUCATION AND AWARENESS

Expand treatable patient population and market

Robust clinical evidence Broad reimbursement

Strong commercial team and infrastructure

Patient and physician focused

activities

Continue shift to cost effective care setting

coverage in all care

settings

Domain expertise with LATERA and XprESS

Proven clinical and economic

value

>20

9

92

>400

New products and indications launched over past 24 months

Clinical studies

demonstrating safety and efficacy

Full quota carrying reps1

Peer-to-peer

center of excellence training events

15

82%

15

25k

International countries

Covered lives for BSD treatment of chronic sinusitis

in the U.S.

Sales reps focused on LATERA1

Monthly visits to

SinusSsurgeryOptions.com

20 1 As of June 30, 2017 © 2017 Entellus Medical. All rights reserved.

entellus MEDICAL

|

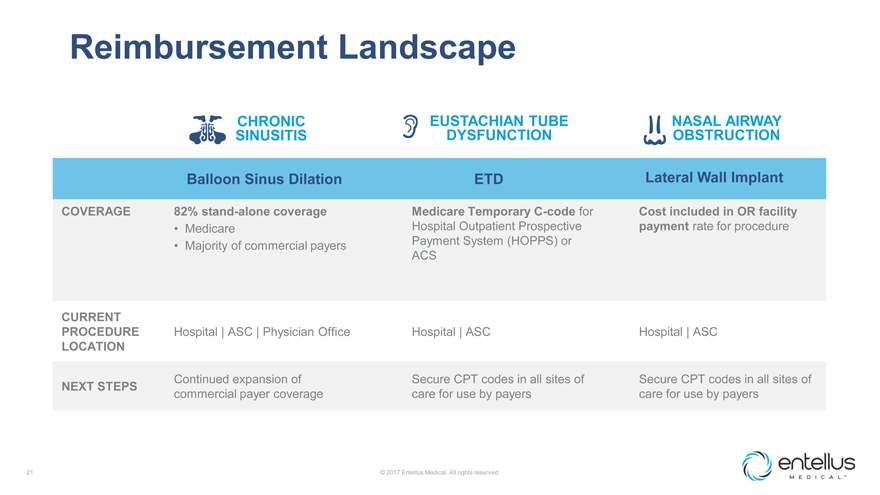

Reimbursement Landscape

CHRONIC SINUSITIS

EUSTACHIAN TUBE DYSFUNCTION

NASAL AIRWAY OBSTRUCTION

Balloon Sinus Dilation

ETD

Lateral Wall Implant

COVERAGE

82% stand-alone coverage

Medicare Temporary C-code for

Cost included in OR facility

Medicare

Hospital Outpatient Prospective

payment rate for procedure

Majority of commercial payers

Payment System (HOPPS) or

ACS

CURRENT PROCEDURE LOCATION

Hospital

ASC

Physician Office

Hospital

ASC

Hospital

ASC

NEXT STEPS

Continued expansion of commercial payer coverage

Secure CPT codes in all sites of care for use by payers

Secure CPT codes in all sites of care

for use by payers

21 © 2017 Entellus Medical. All rights reserved.

entellus MEDICAL

|

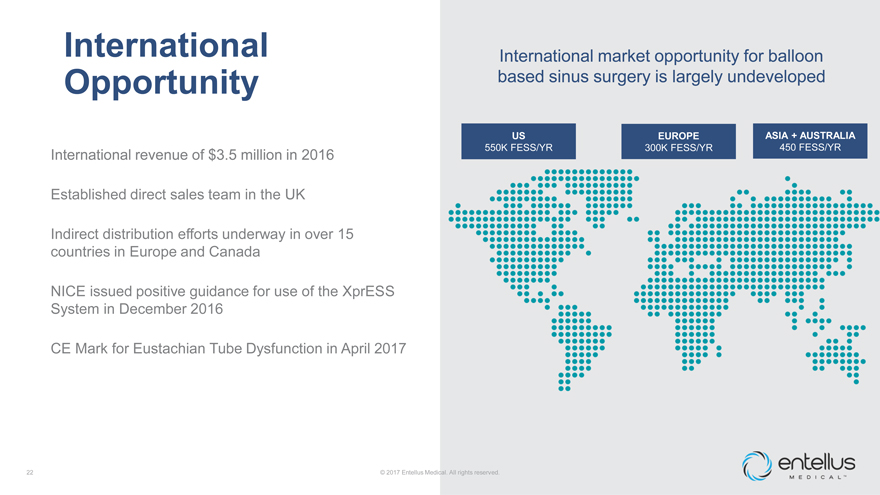

International Opportunity

International revenue of $3.5 million in 2016

Established direct sales team in the UK

Indirect distribution efforts underway in over 15 countries in Europe and Canada

NICE issued positive guidance for use of the XprESS System in December 2016

CE Mark for

Eustachian Tube Dysfunction in April 2017

International market opportunity for balloon based sinus surgery is largely undeveloped

US

EUROPE

ASIA + AUSTRALIA

550K FESS/YR

300K FESS/YR

450 FESS/YR

22 © 2017 Entellus Medical. All rights reserved.

entellus MEDICAL

|

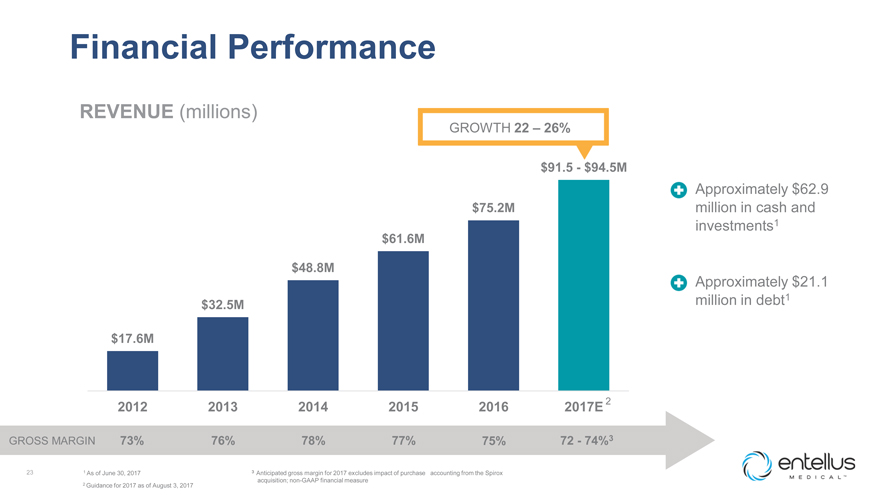

Financial Performance

REVENUE (millions)

GROWTH 22 – 26%

$91.5—$94.5M

Approximately $62.9 $75.2M million in cash and investments1 $61.6M

$48.8M

Approximately $21.1 million in debt1 $32.5M

$17.6M

2012 2013 2014 2015 2016 2017E 2

GROSS MARGIN 73% 76% 78% 77% 75% 72—74%3

23 1 As of June 30, 2017 3 Anticipated

gross margin for 2017 excludes impact of purchase accounting from the Spirox

2 Guidance for 2017 as of August 3, 2017 acquisition; non-GAAP financial measure

entellus MEDICAL

|

2017 Outlook

Total revenue $91.5 – $94.5 million, growth of 22% – 26%1 Expect international sales to be in the mid-single digits as a percentage of total 2017 revenue Gross margin is

expected to be in a range of 72% to 74%2 Sales force expansion

Adding 10-20 full quota-carrying reps in 2017

1 Guidance for 2017 as of August 3, 2017

24 2 Anticipated gross margin for 2017 excludes

impact of purchase accounting from the Spirox acquisition; non-GAAP financial measure

entellus MEDICAL

|

LARGE MARKET

Significant opportunities to shift patients from surgical and medical management options, $2.1 billion opportunity in the U.S.

CLINICAL EVIDENCE

Randomized trial shows Entellus balloon dilation is as effective as sinus

surgery

BETTER OUTCOMES

Provides superior economic outcomes for patients,

physicians and payors

GLOBAL OPPORTUNITY

Attractive OUS markets for growth

and expansion

STRONG POSITION

Well capitalized, strong financial position,

established performance and revenue growth

© 2017 Entellus Medical. All rights reserved.

Investment Highlights

25

entellus MEDICAL

|

Thank You

26 © 2017 Entellus Medical. All rights reserved.

entellus MEDICAL

|

Appendix

27 © 2017 Entellus Medical. All rights reserved.

entellus MEDICAL

|

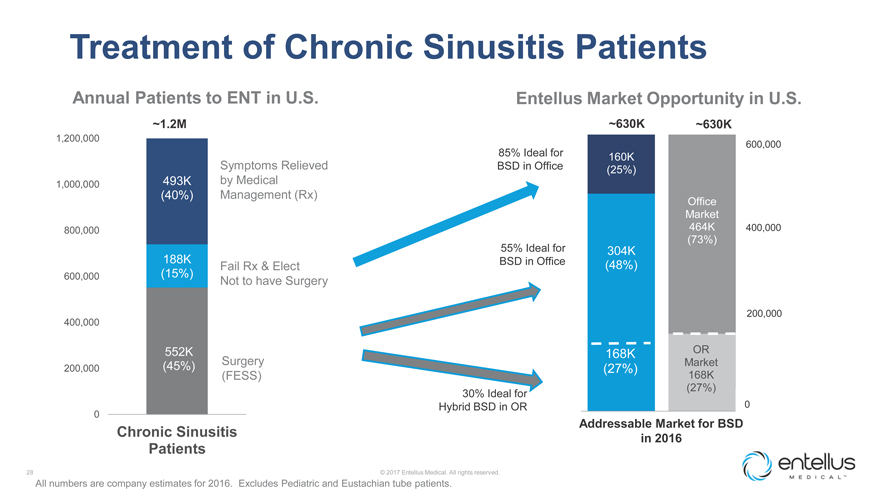

Treatment of Chronic Sinusitis Patients

Annual Patients to ENT in U.S. Entellus Market Opportunity in U.S.

~1.2M ~630K ~630K

1,200,000

600,000

85% Ideal for 160K

Symptoms Relieved BSD in Office (25%)

1,000,000 493K by Medical

(40%) Management (Rx)

Office Market

800,000 464K 400,000

(73%) 55% Ideal for 304K

188K BSD in Office

Fail Rx & Elect (48%)

600,000 (15%)

Not to have Surgery

400,000 200,000

552K 168K OR

(45%) Surgery Market

200,000 (27%)

(FESS) 168K (27%) 30% Ideal for Hybrid BSD in OR 0

0 Addressable Market for BSD

Chronic Sinusitis

in 2016

Patients

28 © 2017 Entellus Medical. All rights reserved.

All numbers are company estimates for

2016. Excludes Pediatric and Eustachian tube patients.

entellus MEDICAL

|

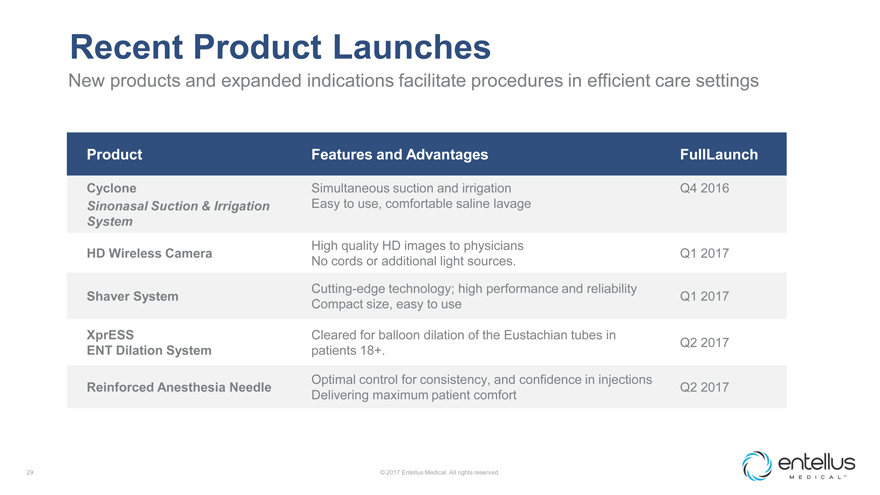

Recent Product Launches

New products and expanded indications facilitate procedures in efficient care settings

Product

Features and Advantages FullLaunch

Cyclone Simultaneous suction and irrigation Q4 2016 Sinonasal Suction & Irrigation Easy to use, comfortable saline

lavage

System

High quality HD images to physicians

HD Wireless Camera Q1 2017 No cords or additional light sources.

Cutting-edge technology; high

performance and reliability

Shaver System Q1 2017 Compact size, easy to use

XprESS Cleared for balloon dilation of the Eustachian tubes in

Q2 2017

ENT Dilation System patients 18+.

Optimal control for consistency, and

confidence in injections

Reinforced Anesthesia Needle Q2 2017 Delivering maximum patient comfort

29 © 2017 Entellus Medical. All rights reserved.

entellus MEDICAL

|

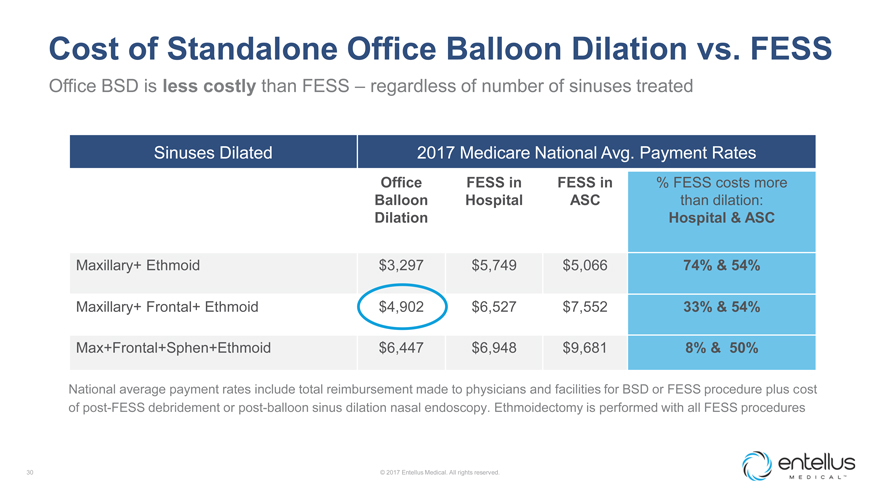

Cost of Standalone Office Balloon Dilation vs. FESS

Office BSD is less costly than FESS – regardless of number of sinuses treated

Sinuses Dilated 2017 Medicare National Avg. Payment Rates

Office FESS in FESS in % FESS costs

more Balloon Hospital ASC than dilation: Dilation Hospital & ASC

Maxillary+ Ethmoid $3,297 $5,749 $5,066 74% & 54% Maxillary+ Frontal+ Ethmoid

$4,902 $6,527 $7,552 33% & 54% Max+Frontal+Sphen+Ethmoid $6,447 $6,948 $9,681 8% & 50%

National average payment rates include total reimbursement

made to physicians and facilities for BSD or FESS procedure plus cost of post-FESS debridement or post-balloon sinus dilation nasal endoscopy. Ethmoidectomy is performed with all FESS procedures

30 © 2017 Entellus Medical. All rights reserved.

entellus MEDICAL

|

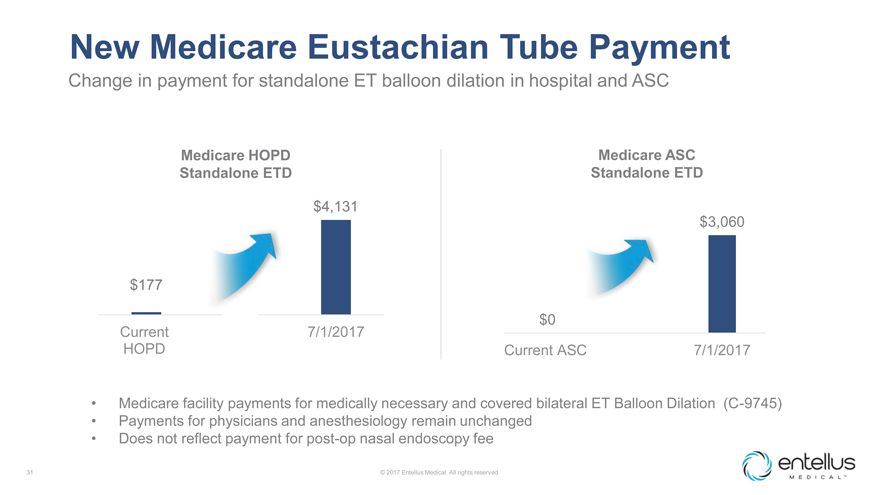

New Medicare Eustachian Tube Payment

Change in payment for standalone ET balloon dilation in hospital and ASC

Medicare HOPD

Medicare ASC Standalone ETD Standalone ETD

$4,131 $3,060

$177

Current 7/1/2017 $0

HOPD Current ASC 7/1/2017

Medicare facility payments for medically necessary and covered bilateral ET Balloon Dilation (C-9745)

Payments for physicians and anesthesiology remain unchanged

Does not reflect payment for

post-op nasal endoscopy fee

31 © 2017 Entellus Medical. All rights reserved.

entellus MEDICAL

|

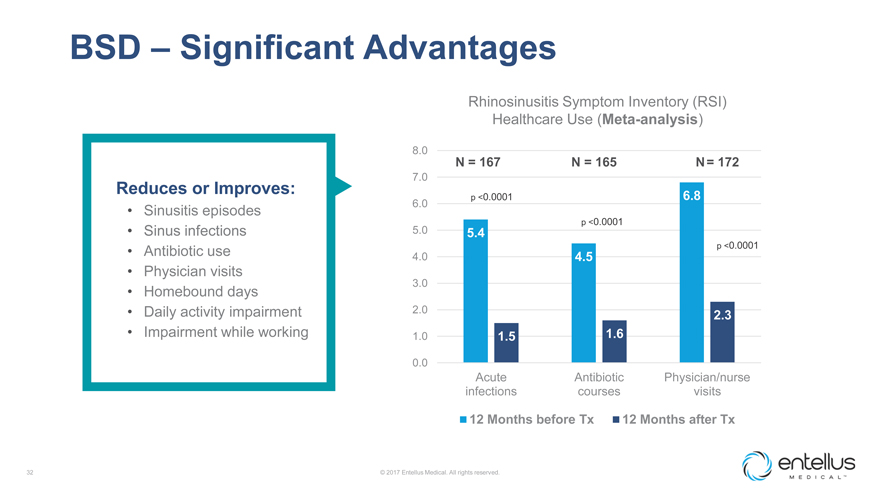

BSD – Significant Advantages

Rhinosinusitis Symptom Inventory (RSI) Healthcare Use (Meta-analysis)

8.0

N = 167 N = 165 N = 172

7.0

Reduces or Improves:

p <0.0001 6.8

6.0

Sinusitis episodes

p <0.0001

Sinus infections 5.0 5.4

Antibiotic use p <0.0001

4.0 4.5

Physician visits

3.0

Homebound days

Daily activity impairment 2.0 2.3

Impairment while working 1.0 1.5 1.6

0.0

Acute Antibiotic Physician/nurse infections courses visits

12 Months before Tx 12 Months after

Tx

32 © 2017 Entellus Medical. All rights reserved.

entellus MEDICAL

|

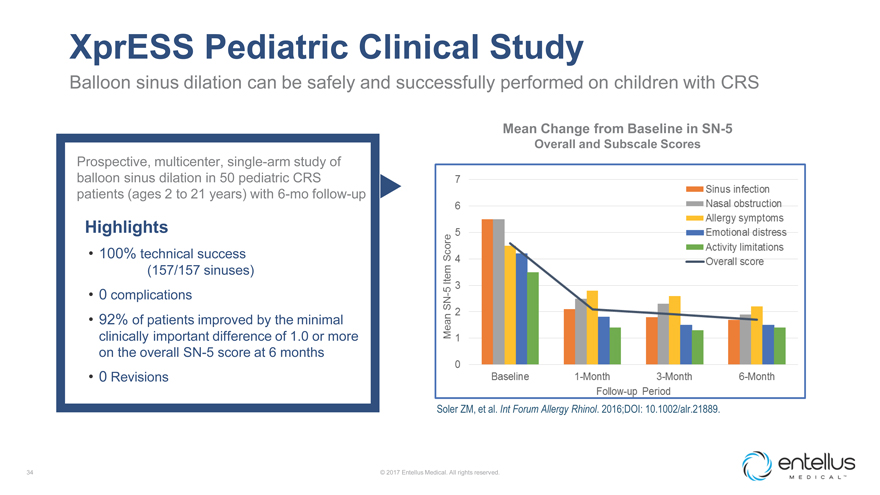

XprESS Pediatric Study Published Nov 2016

Prospective, Multicenter Evaluation of Balloon Sinus Dilation for

Treatment

of Pediatric Chronic Rhinosinusitis

Zachary M. Soler, MD, MSc; Jeffrey S. Rosenbloom, MD; Michael Gutman, MD;

Mark J. Hoy, MD and Shaun A. Nguyen, MD

International Forum of Allergy & Rhinology.

Nov, 2016.

[printed version]

Prospective, multicenter, single-arm study of

balloon sinus dilation in 50

pediatric CRS patients (ages 2 to 21 years)

Follow-up conducted at one-, three- and six-months post procedure

33 ©

2017 Entellus Medical. All rights reserved.

entellus MEDICAL

|

XprESS Pediatric Clinical Study

Balloon sinus dilation can be safely and successfully performed on children with CRS

Mean

Change from Baseline in SN-5

Overall and Subscale Scores

Prospective,

multicenter, single-arm study of balloon sinus dilation in 50 pediatric CRS patients (ages 2 to 21 years) with 6-mo follow-up

Highlights

100% technical success (157/157 sinuses)

0 complications

92% of patients improved by the minimal clinically important difference of 1.0 or more on the overall SN-5 score at 6 months

0 Revisions

Soler ZM, et al. Int Forum Allergy Rhinol. 2016;DOI: 10.1002/alr.21889.

© 2017 Entellus Medical. All rights reserved.

entellus MEDICAL

|

XprESS Eustachian Tube Dilation Study

Prospective, multicenter, randomized controlled trial

60 ETD patients randomized to balloon

dilation or continued medical therapy

Primary endpoints

? Comparison between

arms in the change from baseline to 6 weeks in mean overall ETDQ-7 score: Balloon dilation was superior to medical therapy (p<0.0001)

? Complication rate = 0%

Nearly 75% of patients were treated in the office under local anesthesia only

Long-term (12-month) follow-up is ongoing

35 © 2017 Entellus Medical.

All rights reserved.

entellus MEDICAL

|

REMODEL Study Published Jan 2016

REMODEL Larger Cohort With Long-term Outcomes and Meta-Analysis of Standalone Balloon Dilation Studies

Rakesh K. Chandra, MD; Robert C. Kern, MD; Jeffrey L. Cutler, MD; Kevin C. Welch, MD; Paul T. Russell, MD

The Laryngoscope. January, 2016. [printed version]

REMODEL randomized trial data on larger

cohort of 135 patients with 1 to 2 years of follow-up

Meta-analysis of 7 standalone balloon dilation studies including 358 patients with follow-up from 6 months to

2 years

36 © 2017 Entellus Medical. All rights reserved.

entellus

MEDICAL

|

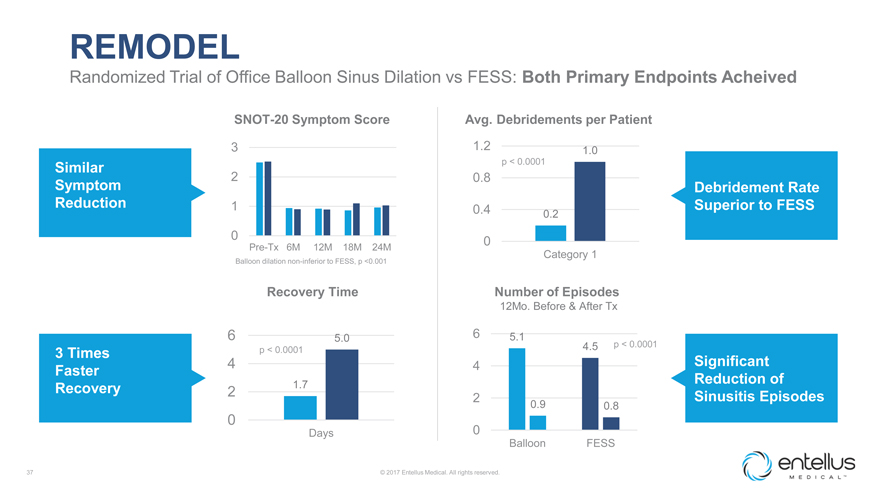

REMODEL

Randomized Trial of Office Balloon Sinus Dilation vs FESS: Both Primary Endpoints Acheived

SNOT-20 Symptom Score Avg. Debridements per Patient

3 1.2 1.0

Similar p < 0.0001

2 0.8

Symptom Debridement Rate Reduction 1 Superior to FESS

0.4 0.2 0 0

Pre-Tx 6M 12M 18M 24M

Category 1

Balloon dilation non-inferior to FESS, p <0.001

Recovery Time Number of Episodes

12Mo. Before & After Tx

6 5.0 6 5.1

4.5 p < 0.0001

3 Times p < 0.0001 Significant

4 4

Faster

1.7 Reduction of Recovery 2

2 Sinusitis Episodes

0.9 0.8

0

Days 0

Balloon FESS

37 © 2017 Entellus Medical. All rights reserved.

entellus MEDICAL

|

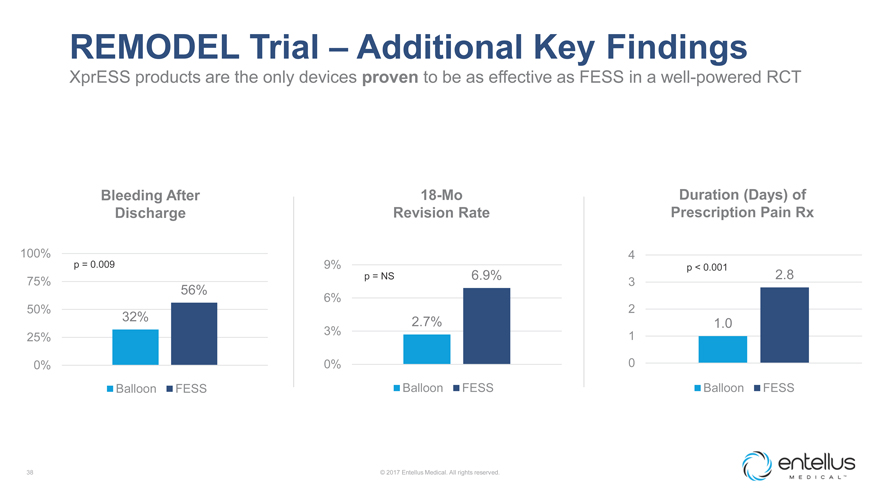

REMODEL Trial – Additional Key Findings

XprESS products are the only devices proven to be as effective as FESS in a well-powered RCT

Bleeding After 18-Mo Duration (Days) of Discharge Revision Rate Prescription Pain Rx

100% 4 p

= 0.009 9% p < 0.001 2.8 75% p = NS 6.9%

3

56%

6% 2 50%

32% 2.7%

1.0

3% 1 25%

0% 0% 0

Balloon FESS Balloon FESS Balloon FESS

38 © 2017 Entellus Medical. All rights reserved.

entellus MEDICAL

|

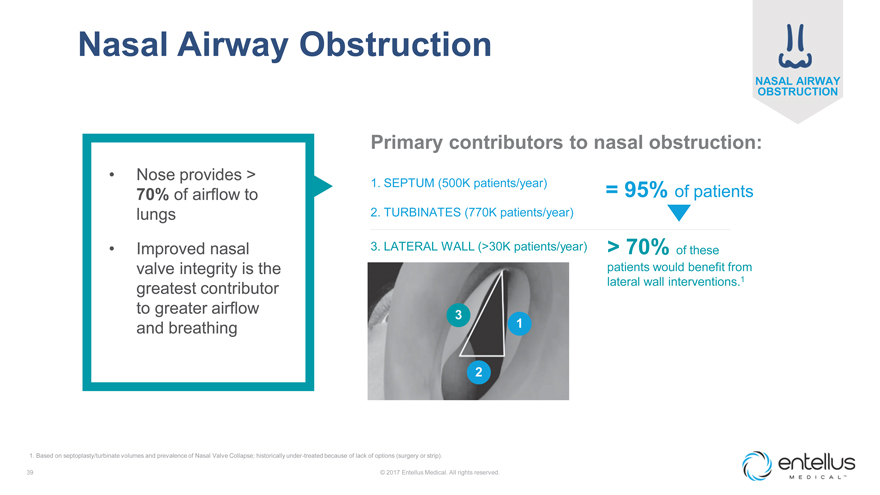

Nasal Airway Obstruction

NASAL AIRWAY OBSTRUCTION

Primary contributors to nasal obstruction:

Nose provides >

1. SEPTUM (500K patients/year)

70% of airflow to = 95% of patients

lungs 2. TURBINATES (770K patients/year)

Improved nasal 3. LATERAL WALL (>30K patients/year) > 70% of these valve integrity is the patients would benefit from lateral wall interventions.1

greatest contributor to greater airflow 3 and breathing 1

2

1. Based on septoplasty/turbinate volumes and prevalence of Nasal Valve Collapse; historically under-treated because of lack of options (surgery or strip).

39 © 2017 Entellus Medical. All rights reserved.

entellus MEDICAL

|

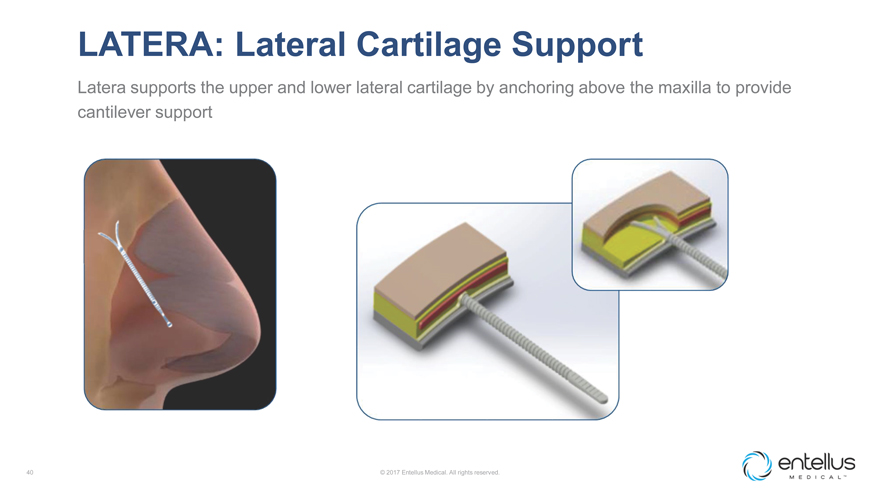

LATERA: Lateral Cartilage Support

Latera supports the upper and lower lateral cartilage by anchoring above the maxilla to provide cantilever support

40 © 2017 Entellus Medical. All rights reserved.

entellus MEDICAL

|

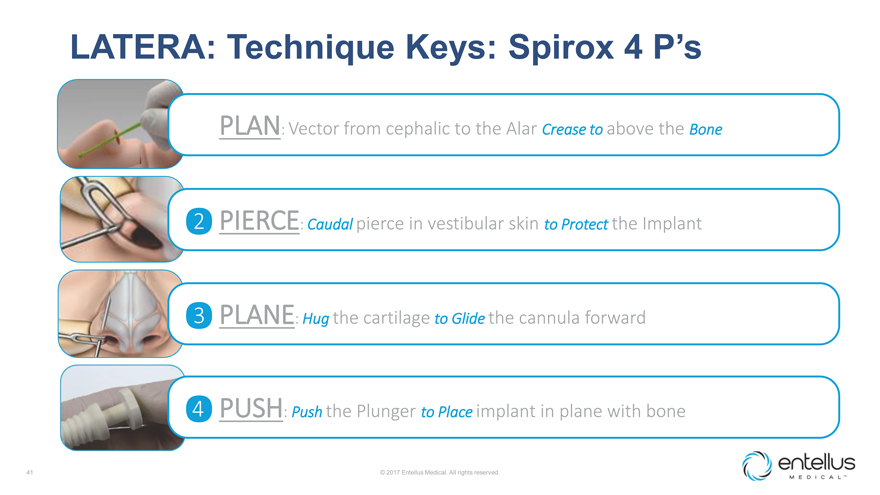

LATERA: Technique Keys: Spirox 4 P’s

? PLAN: Vector from cephalic to the Alar Crease to above the Bone

? PIERCE:

Caudal pierce in vestibular skin to Protect the Implant

? PLANE: Hug the cartilage to Glide the cannula forward

? PUSH: Push the Plunger to Place implant in plane with bone

41 © 2017 Entellus Medical.

All rights reserved.

entellus MEDICAL

|

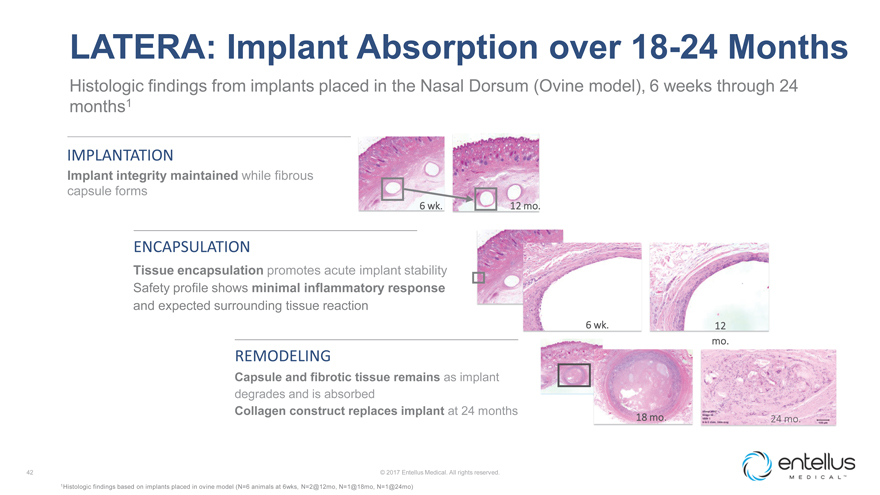

LATERA: Implant Absorption over 18-24 Months

Histologic findings from implants placed in the Nasal Dorsum (Ovine model), 6 weeks through 24 months1

12 mo.

6 wk.

Tissue encapsulation promotes acute implant stability

Safety profile shows minimal

inflammatory responseand expected surrounding tissue reaction

ENCAPSULATION

6

wk.

Implant integrity maintainedwhile fibrous capsule forms

IMPLANTATION

12 mo.

REMODELING

18 mo.

24 mo.

Capsule and fibrotic tissue remainsas implant degrades and is absorbed

Collagen construct

replaces implant at 24 months

1Histologic findings based on implants placed in ovine model (N=6 animals at 6wks, N=2@12mo, N=1@18mo, N=1@24mo)© 2017 Entellus

Medical. All rights reserved. 42

entellus MEDICAL