Attached files

| file | filename |

|---|---|

| EX-32.2 - EX-32.2 - ENTELLUS MEDICAL INC | entl-ex322_6.htm |

| EX-32.1 - EX-32.1 - ENTELLUS MEDICAL INC | entl-ex321_12.htm |

| EX-31.2 - EX-31.2 - ENTELLUS MEDICAL INC | entl-ex312_9.htm |

| EX-31.1 - EX-31.1 - ENTELLUS MEDICAL INC | entl-ex311_13.htm |

| EX-23.1 - EX-23.1 - ENTELLUS MEDICAL INC | entl-ex231_1613.htm |

| EX-10.32 - EX-10.32 - ENTELLUS MEDICAL INC | entl-ex1032_851.htm |

| EX-10.31 - EX-10.31 - ENTELLUS MEDICAL INC | entl-ex1031_852.htm |

| EX-10.25 - EX-10.25 - ENTELLUS MEDICAL INC | entl-ex1025_1354.htm |

| EX-10.18 - EX-10.18 - ENTELLUS MEDICAL INC | entl-ex1018_853.htm |

| EX-10.17 - EX-10.17 - ENTELLUS MEDICAL INC | entl-ex1017_7.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2016

Or

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File No. 001-36814

Entellus Medical, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware |

20-4627978 |

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

|

|

|

|

3600 Holly Lane North, Suite 40 Plymouth, Minnesota |

55447 |

|

(Address of principal executive offices) |

(Zip Code) |

(763) 463-1595

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

Name of each exchange on which registered |

|

Common Stock, $0.001 par value per share |

The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act:

None

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (Section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer |

☐ |

Accelerated filer |

☒ |

|

|

|

|

|

|

Non-accelerated filer |

☐ (Do not check if a smaller reporting company) |

Smaller reporting company |

☐ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of June 30, 2016, the aggregate market value of the registrant’s common stock held by non-affiliates was approximately $137.3 million based on the closing price of the registrant’s common stock of $18.27 as reported on the Nasdaq Global Market on that date. Shares of common stock held by each executive officer, director, and holder of more than 10% of the registrant’s common stock have been excluded from this calculation as such persons may be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

As of February 15, 2017, there were 21,877,702 shares of the registrant’s common stock issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s proxy statement for the 2017 Annual Meeting of Stockholders expected to be held on June 13, 2017 are incorporated by reference into Part III of this report.

ANNUAL REPORT ON FORM 10-K

YEAR ENDED DECEMBER 31, 2016

TABLE OF CONTENTS

|

Item No. |

|

|

Page No. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 1. |

|

2 |

|

|

|

|

|

|

|

Item 1A. |

|

25 |

|

|

|

|

|

|

|

Item 1B. |

|

51 |

|

|

|

|

|

|

|

Item 2. |

|

51 |

|

|

|

|

|

|

|

Item 3. |

|

51 |

|

|

|

|

|

|

|

Item 4. |

|

51 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 5. |

|

52 |

|

|

|

|

|

|

|

Item 6. |

|

54 |

|

|

|

|

|

|

|

Item 7. |

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

55 |

|

|

|

|

|

|

Item 7A. |

|

67 |

|

|

|

|

|

|

|

Item 8. |

|

68 |

|

|

|

|

|

|

|

Item 9. |

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

95 |

|

|

|

|

|

|

Item 9A. |

|

95 |

|

|

|

|

|

|

|

Item 9B. |

|

95 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 10. |

|

97 |

|

|

|

|

|

|

|

Item 11. |

|

97 |

|

|

|

|

|

|

|

Item 12. |

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

97 |

|

|

|

|

|

|

Item 13. |

|

Certain Relationships and Related Transactions, and Director Independence |

98 |

|

|

|

|

|

|

Item 14. |

|

98 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 15. |

|

99 |

As used in this report, the terms “we,” “us,” “our,” “Entellus Medical,” “Entellus” and the “Company” mean Entellus Medical, Inc. and our consolidated wholly-owned subsidiary, unless the context indicates another meaning.

Cautionary Note Regarding Forward-Looking Statements

Except for historical information, the matters discussed in or incorporated by reference into this Annual Report on Form 10-K are forward looking statements that involve risks, uncertainties and assumptions that, if they never materialize or if they prove incorrect, could cause our actual results to differ materially from those expressed or implied by such forward-looking statements. We make such forward-looking statements under the “Safe Harbor” provisions of the Private Securities Litigation Reform Act of 1995. Actual future results may vary materially from those projected, anticipated or indicated in any forward-looking statements as a result of various factors, including those set forth in Item 1A of this Annual Report on Form 10-K under the heading “Risk Factors.” Readers should also carefully review the risk factors described in the other documents that we file from time to time with the Securities and Exchange Commission, or the SEC. In this Annual Report on Form 10-K, the words “anticipates,” “believes,” “expects,” “intends,” “future,” “could,” “estimates,” “plans,” “would,” “should,” “potential,” “continues” and similar words or expressions (as well as other words or expressions referencing future events, conditions or circumstances) identify forward-looking statements. Forward-looking statements also include the assumptions underlying or relating to any of the foregoing statements. The forward-looking statements contained in this Annual Report on Form 10-K include, but are not limited to, statements related to:

|

|

• |

estimates of our annual total addressable market, future revenue, expenses, capital requirements and our needs for additional financing; |

|

|

• |

the implementation of our business model and strategic plans for our products, technologies and businesses; |

|

|

• |

competitive companies and technologies and our industry; |

|

|

• |

our ability to manage and grow our business by expanding our sales to existing customers, introducing our products to new customers and expanding into new territories; |

|

|

• |

third-party payor reimbursement and coverage decisions; |

|

|

• |

our ability to establish and maintain intellectual property protection for our products or avoid claims of infringement; |

|

|

• |

extensive government regulation; |

|

|

• |

the timing or likelihood of regulatory filings and approvals or other regulatory actions; |

|

|

• |

our ability to hire and retain key personnel; |

|

|

• |

the volatility of the trading price of our common stock; |

|

|

• |

our need and ability to obtain additional financing in the future, on favorable terms or at all; |

|

|

• |

our expectations regarding the use of proceeds from our initial public offering and our recent public offering; and |

|

|

• |

our expectations about market trends. |

Forward-looking statements are based on management’s current expectations, estimates, forecasts and projections about our business and the industry in which we operate, and management’s beliefs and assumptions are not guarantees of future performance or development and involve known and unknown risks, uncertainties and other factors that are in some cases beyond our control. As a result, any or all of our forward-looking statements in this Annual Report on Form 10-K may turn out to be inaccurate. Furthermore, if the forward-looking statements prove to be inaccurate, the inaccuracy may be material. In light of the significant uncertainties in these forward-looking statements, you should not regard these statements as a representation or warranty by us or any other person that we will achieve our objectives and plans in any specified time frame, or at all. Factors that may cause actual results to differ materially from current expectations include, among other things, those described in the section entitled “Risk Factors” and elsewhere in this Annual Report. Readers are urged to consider these factors carefully in evaluating these forward-looking statements. These forward-looking statements speak only as of the date of filing of this Annual Report on Form 10-K. Except as required by law, we assume no obligation to update or revise these forward-looking statements for any reason, even if new information becomes available in the future.

1

Overview

We are a medical technology company focused on delivering superior patient and physician experiences through products designed for the minimally invasive treatment of chronic and recurrent sinusitis in both adult and pediatric patients. Our platform of products provides effective and easy-to-use solutions designed to simplify everything from diagnosis and patient selection, to complex case revisions and post-operative care. Our three core product lines, XprESS Multi-Sinus Dilation Systems, MiniFESS Surgical Instruments, and FocESS Imaging & Navigation, are designed to enable ear, nose and throat, or ENT, physicians to conveniently and comfortably perform a broad range of procedures in the ENT physician office and to simplify operating room-based treatment. When used as a stand-alone therapy in the physician’s office, our XprESS balloon sinus dilation products are the only devices proven in a sufficiently powered prospective, multicenter, randomized, controlled trial to be as effective as functional endoscopic sinus surgery, or FESS, the primary surgical treatment for chronic and recurrent sinusitis. Patients treated with our products in this trial in the ENT physician office also experienced faster recovery, less bleeding at discharge, less use of prescription pain medication and fewer post-procedure debridements than patients receiving FESS. We estimate that physicians have treated over 150,000 patients with our XprESS products since the launch of the first XprESS product in February 2010.

Our addressable patient population consists of a portion of patients who undergo FESS, as well as patients who fail medical management but do not undergo sinus surgery. We estimate the annual total addressable market for our products in the United States is approximately 690,000 patients, which, based on our estimate of the average revenue per procedure in the balloon sinus dilation market, represents an annual market opportunity of approximately $1.0 billion.

We believe our minimally invasive balloon sinus dilation devices and additional sinus surgery products sold by us have facilitated a shift towards office-based treatment of chronic and recurrent sinusitis patients who are candidates for sinus surgery in the operating room. We believe this shift has been facilitated by our technology and clinical data, as well as procedure economics that are favorable to the healthcare system, patient and provider. Our XprESS family of products is used to treat patients with inflammation of the frontal, ethmoid, sphenoid and maxillary sinuses and is specifically designed for ease-of-use in the ENT physician office setting. Our XprESS family of products includes our XprESS Pro device, our XprESS LoProfile device and our XprESS Ultra device. We derive a significant portion of our revenue from our XprESS family of products. Our research and development efforts are focused primarily on enhancing our XprESS family of products and broadening their indications for use, as well as developing new, related products.

Product development and innovation are an important part of our strategy. In November 2015, we received clearance from the U.S. Food and Drug Administration, or the FDA, for a pediatric indication for our XprESS Multi-Sinus Dilation System, thereby expanding the patient population to include treatment of maxillary sinuses in patients two years and older, and treatment of the frontal and sphenoid sinuses in patients 12 years and older. We believe we are the only company to have received FDA clearance for balloon sinus dilation to treat the frontal and sphenoid sinuses in adolescents.

In 2016, we acquired and entered into an exclusive license for XeroGel nasal packing material, and we now manufacture and sell XeroGel product to hospitals, physician offices and ambulatory surgery centers, or ASCs. Prior to this transaction, we were the exclusive distributor of XeroGel nasal packing material in the United States. Also in 2016, we introduced several new products, including sterilization trays, Fiagon accessories, and, in the third quarter, our Cyclone Sinonasal Suction and Irrigation System. In the fourth quarter of 2016, we initiated limited launches of our Entellus Medical Shaver System and our FocESS Wireless High Definition (HD) Camera System and completed full launches of both products in the first quarter of 2017.

We have a diverse customer base of ENT physicians, hospitals and ASCs, with no single customer accounting for more than 5% of our revenue during the year ended December 31, 2016. Our customers are generally reimbursed by governmental and private health insurers for procedures using our products pursuant to reimbursement codes specific to the procedure and the setting. In November 2016, Medicare issued a final rule on the Hospital Outpatient Prospective Payment System, or OPPS, for 2017 which includes a reduction of payments for certain outpatient procedures performed in the hospital when FESS is performed on more than two sinuses. The result is to bundle payments for multi-sinus surgery regardless of the number of sinuses being treated. On average, we expect most hospitals will experience a reduction in Centers for Medicare and Medicaid Services, or CMS, reimbursement because the average number of sinuses being treated is more than two. As of December 2016, third-party payor insurance coverage for stand-alone balloon sinus dilation procedures is available for an estimated 230 million persons in the United States, which represents 80% of covered lives.

In December 2016, the National Institute for Health and Care Excellence, or NICE, provided positive guidance for use of our XprESS Multi-Sinus Dilation System in the United Kingdom, recommending it for use in patients with uncomplicated chronic sinusitis who do not have severe nasal polyposis. In these patients, NICE has asserted that, in comparison with FESS, our XprESS Multi-Sinus Dilation System works as well, is associated with faster recovery times and can more often be performed under local anesthesia. NICE provides evidence-based guidance and advice to the National Health Service in England and other public health and social care services to improve health and social care. The NICE guidance is specific to the XprESS Multi-Sinus Dilation System and

2

does not extend to any other balloon sinus dilation technology. NICE estimates that, by adopting our technology, the National Health Service in England may save up to £7.4 million per year by 2020.

We currently sell our products through a direct sales force in the United States and United Kingdom and through international distributors in over 10 countries. As of December 31, 2016, we employed a total of 90 full quota-carrying representatives. We expect to continue to expand our sales force and staffing to further penetrate the sinusitis market. We also intend to continue to increase our presence outside the United States through expansion of our United Kingdom sales force and the addition of distributors. Financial information about our revenues from and assets located in foreign countries is included in Note N of our consolidated financial statements.

Overview of Sinusitis and the Market

Chronic sinusitis is a common medical condition that, according to estimates from the Centers for Disease Control and Prevention, or CDC, impacts approximately 12% of the adult population aged 18 and over in the United States, or approximately 29 million people based on 2013 U.S. Census Bureau data, making it more prevalent than asthma or heart disease. In addition to the adult population, based on research published in The Laryngoscope in 2006, we estimate that approximately 6 million Americans under the age of 18 suffer from chronic sinusitis bringing the total U.S. prevalence to approximately 35 million.

We estimate the annual total addressable market for our products in the United States is approximately 690,000 patients, which, based on our estimate of the average revenue per procedure in the balloon sinus dilation market, represents an annual market opportunity of approximately $1.0 billion. Our addressable patient population consists of a portion of patients who undergo FESS, as well as patients who fail medical management but do not undergo sinus surgery. We believe that out of the adult patients aged 18 and over in the United States who are expected to undergo FESS procedures in 2016, approximately 55% are well-suited for office-based balloon treatment because they present with uncomplicated sinusitis and do not require a septoplasty procedure to correct a severely deviated septum and approximately 30% are well-suited for treatment with a hybrid balloon sinus dilation procedure in the operating room along with a FESS procedure due to the location and nature of their sinusitis. In addition, we believe that approximately 85% of the patients who fail medical management but do not undergo FESS represent a significant market opportunity, as these patients currently avoid sinus surgery, seek a non-surgical alternative procedure to FESS after fewer episodes of failed medical management, or are increasingly referred by primary care physicians to ENT physicians for their chronic sinusitis. We estimate this current market opportunity to be approximately 160,000 patients annually in the United States, and believe that patient population will increase and be amenable to balloon sinus dilation as the number of physicians trained on procedures and clinical evidence supporting the benefits of office-based balloon sinus dilation continues to grow.

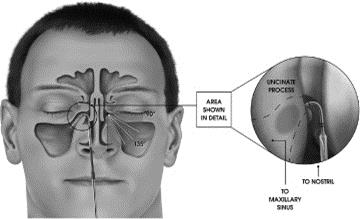

Sinuses are air-filled pockets within the bones of the face and skull. The four types of sinuses are frontal, ethmoid, sphenoid and maxillary. One of each type of sinus lies on each side of the face.

The sinuses are lined with soft, moist tissue, or mucosa, that is covered with a layer of mucus. Mucus moistens the nasal lining and protects the body from inhaled impurities such as dust, pollutants and bacteria. Each of the maxillary, sphenoid and frontal sinuses has a corresponding ostium, or opening, through which mucus drains. The ethmoid sinuses are a series of cells with multiple, often interconnected openings and drainage pathways. The surface tissues of the sinuses are covered with millions of cilia, which are small, hair-like structures that act in coordination to sweep the mucus through the ostium of each sinus cavity to the back of the throat. The drainage of mucus is a normal process that keeps the sinuses healthy.

Sinusitis is inflammation of the sinus cavities that may be caused by infections, allergies or environmental factors, as well as structural issues such as blockage of an ostium. If one or more sinus drainage pathways becomes blocked, normal mucus drainage is prevented and damage to ciliary function may occur. There are three categories of sinusitis: acute, recurrent acute and chronic. Acute sinusitis is transient in nature and lasts less than four weeks. Recurrent acute sinusitis is a type of chronic sinusitis that involves four or more episodes of acute sinusitis over a 12-month period. Chronic sinusitis is more severe and lasts 12 weeks or longer. We refer to

3

recurrent acute sinusitis and chronic sinusitis together as chronic sinusitis. The symptoms of sinusitis include facial pain, pressure, nasal congestion, headaches, fatigue and loss of smell. When persistent, these symptoms can severely impact a patient’s day-to-day well-being, resulting in frequent doctor visits and can lead to reduced sleep function, chronic fatigue and depression. The condition significantly reduces work productivity, increases absenteeism and impairs daily activities.

Chronic sinusitis is associated with substantial healthcare utilization and expenditure and ranks as one of the ten costliest physical health conditions, contributing to an estimated $8.6 billion in direct healthcare costs in the United States. The latest CDC ambulatory medical surveys estimated that chronic sinusitis resulted in 12.3 million physician visits annually in the United States in each of 2009 and 2010, of which an estimated 8.1 million were to primary care physicians, 2.8 million were to ENT physicians, and the remainder were to hospital outpatient facilities and emergency rooms. We estimate that the 2.8 million annual patient visits to ENT physicians in the United States represent approximately 1.23 million distinct patients seen annually by ENT physicians. Primary care and ENT physicians rely on medical management for first-line therapy to treat chronic sinusitis. In cases where patients remain symptomatic despite multiple rounds of medical management, a physician may recommend FESS or balloon sinus dilation combined with FESS, or in cases of uncomplicated chronic sinusitis, may recommend stand-alone balloon sinus dilation. Uncomplicated chronic sinusitis is sinus disease that does not include fungus, extensive polyps, or inflammation and infection of the bones below the sinus mucosa. We estimate that, of the 1.23 million adult patients aged 18 and over in the United States with chronic sinusitis who were expected to be seen by ENT physicians in 2015, 552,000 underwent FESS, while 493,000 had symptoms relieved by medical management and 188,000 failed medical management but elected not to undergo FESS.

Current Treatments for Sinusitis and their Limitations

The treatment of sinusitis is progressive in nature and involves therapies that attempt to achieve the most effective solution in the least invasive manner. Treatment typically begins with medical management, and if this is unsuccessful, an ENT physician may perform FESS or a balloon sinus dilation procedure to treat both symptoms and obstruction of the sinus drainage pathways.

Medical Management

Sinusitis patients often present with a sinus infection and nasal congestion. Therefore, first-line therapy typically involves the use of prescription medications, such as antibiotics and decongestants. If the condition persists, physicians may prescribe more aggressive medical management, including additional antibiotics, oral steroids or intra-nasal steroid sprays to reduce inflammation, or saline irrigations to loosen mucus. To facilitate increased delivery of steroids to inflamed sinus tissue, reduce symptoms and reduce recurrence of polyps, physicians may also prescribe off-label use of steroids added to nasal irrigation solutions.

While medical management can be effective, its effect is often temporary, and it is unable to address the underlying anatomical issues such as chronically narrowed or obstructed sinus drainage pathways that may be contributing to the condition. Even where medical management is effective, prolonged medication use can give rise to undesirable side effects. For example, frequent use of antibiotics can lead to the development of antibiotic resistance and repeated use of decongestant sprays can cause nasal congestion rebound, or an increase in nasal congestion after stoppage of use. Similarly, prolonged use of oral steroids can produce potentially serious side effects such as aggressive behavior, sleeplessness, glaucoma, bone loss, weight gain, high blood pressure and psychosis. Medical management also represents an ongoing expense to patients and payors. Based upon published studies, we estimate that approximately 60% of chronic sinusitis patients who are seen by ENT physicians and receive medical management remain symptomatic.

Sinus Surgery

In cases where patients diagnosed with sinusitis are unresponsive to multiple rounds of medical management, an ENT physician may recommend surgical treatment. The primary surgical alternative is FESS, which attempts to open the sinus drainage pathways such as the ostia while attempting to preserve as much bone and sinus mucosa as possible. FESS is typically performed under general anesthesia in an operating room during a procedure that typically takes approximately two hours. During FESS, an ENT physician inserts an endoscope into the nasal cavity to view a patient’s anatomy. The physician typically uses rigid steel instruments and powered cutting tools to remove inflamed sinus tissue and underlying bone to create a larger passage through the nasal anatomy to the infected sinuses, where the physician then removes additional tissue and bone to open the sinus ostia. Surgeons may also perform additional surgery on a deviated nasal septum or enlarged turbinate, a bulbous structure in the nose that warms and humidifies air, in the nose to treat nasal obstruction or simply to gain surgical access to the sinuses. At the conclusion of the procedure, patients often have their nasal cavity packed with a material that acts as a spacer to prevent surgical adhesions and control bleeding. Patients typically require one or more follow-up debridement treatments in which the physician may remove more tissue, crusting, scabs or scar tissue at the area of surgery in order to keep the sinus drainage pathway open and promote proper healing.

While FESS is often effective at treating chronic sinusitis, FESS results in irreversible changes to the anatomy and significant postoperative pain, discomfort and recovery time. In addition, postoperative debridement is unpleasant for the patient and costly to the healthcare system. Although FESS is the standard of care, approximately 7% to 12% of FESS patients require revision surgery, often as a result of ongoing inflammation and scarring associated with the procedure. Within the first year following a FESS procedure,

4

approximately 64% of patients experience recurrent symptoms. In addition, given the use of surgical tools in close proximity to the brain, eyes and other critical anatomy, the potential for significant complications is a concern of physicians and patients alike. The risks of FESS, particularly in the frontal sinuses, cause some ENT physicians to avoid performing surgery in the frontal sinus drainage pathway. Major complications, such as cerebral spinal fluid leaks, swelling of the eye or blindness, occur in approximately 1% of FESS procedures. We believe that patient concerns about undergoing sinus surgery, postoperative discomfort, multiple days of recovery time and potential complications can make patients hesitant to undergo FESS. As an example, in our REMODEL trial, 14 of 75 patients randomized to the FESS arm of the trial refused surgical treatment and withdrew from the study. Eight of these patients indicated they were withdrawing because they did not want to undergo surgical treatment, one indicated withdrawal because the person’s primary physician recommended not undergoing FESS, three indicated they were withdrawing due to other non-sinus medical conditions or a lack of time available for follow-up, and two were found to have exclusion criteria upon further review. Only two of 76 patients randomized to balloon sinus dilation indicated they were withdrawing before treatment because of not wanting the balloon procedure.

Balloon Sinus Dilation

Balloon sinus dilation was developed to provide patients with a minimally invasive, long lasting treatment alternative that was more effective than medical management, at least as safe and efficacious as FESS and that preserves sinus mucosa and future treatment options. By employing balloon sinus dilation as a non-surgical method to open blocked sinus pathways, balloon sinus dilation spares mucosa while increasing ventilation and mucus drainage, which preserves the natural function of the cilia and important natural anatomical structures, such as the uncinate process, which is a tissue bridge that prevents inhaled dust and bacteria from easily entering maxillary sinus ostia.

Balloon sinus dilation can be performed as a stand-alone procedure using local anesthesia in the ENT physician office, typically in approximately one hour. In a typical office-based balloon sinus dilation procedure, the physician uses topical anesthetics followed by an injection to numb the patient’s sinus lining. Once a patient’s nasal passages and ostia are numb, the physician inserts a balloon sinus dilation product into the nose using endoscopic visualization, and guides the balloon device into a narrowed sinus drainage pathway. Some balloon sinus dilation products use a guide catheter and guidewire to direct the balloon into a sinus drainage pathway. In conjunction with placing the balloon into the ostium, the physician confirms the balloon device has correctly accessed the sinus, often using methods such as direct endoscopic visualization or transcutaneous visualization of light emanating from the tip of a balloon device or guidewire. The balloon is then inflated to a high pressure, resulting in fracture and remodeling of the bones underlying the sinus mucosa. For patients with multiple obstructed sinus drainage pathways, the physician may repeat the process of placement, confirmation and inflation in each affected sinus. Balloon sinus dilation can also be used with FESS performed under general anesthesia in the operating room.

ENT physicians are increasingly treating more complicated sinusitis patients in the office with a procedure known as mini-FESS. This procedure combines office-based balloon sinus dilation of the obstructed sinus drainage pathways with limited excision of adjacent tissue, including polyp removal, removal of diseased ethmoid air cells, or reduction of enlarged turbinates. We expect the adoption of mini-FESS procedures will broaden the population of patients treatable with office-based balloon sinus dilation products, and will also facilitate use of our MiniFESS products, Fiagon Image Guidance System, or Fiagon IGS, Entellus Medical Shaver System and FocESS products. We believe this trend will be enhanced as ENT physicians prescribe on-label as well as off-label use of steroids in nasal irrigations to reduce polyp recurrence and promote healing following excision of sinus tissue.

Despite the advantages of a minimally invasive balloon sinus dilation procedure, we believe its adoption has been limited by a number of historical factors that include:

|

|

• |

initial perceptions among some ENT physicians that the primary indication for balloon sinus dilation was treatment of frontal sinuses in a hybrid procedure that added cost compared to FESS only; |

|

|

• |

reimbursement codes and payment for office-based stand-alone balloon sinus dilation did not come into effect until 2011, six years after sinus dilation balloons were initially launched; |

|

|

• |

until 2013, there was limited clinical evidence to support the use of balloon sinus dilation in a broader patient population and as a stand-alone treatment in the ENT physician office; and |

|

|

• |

a perception among some ENT physicians of patients’ inability to tolerate balloon sinus dilation procedures in the physician office setting. |

In addition, a limitation of balloon sinus dilation is that it does not remove irreversibly diseased sinus mucosa, which may be present in patients with sinusitis complicated by fungus, extensive polyps and infection of the bones below the sinus mucosa.

5

We are focused on the treatment of sinusitis, one of the most common medical conditions in the United States resulting in patient visits to physicians. We have a broad product line of minimally invasive technologies for diagnosing and treating sinusitis patients after failed medical management. Our platform of products provides effective and easy-to-use solutions and is designed to simplify everything from diagnosis and patient selection, to complex case revisions and post-operative care. Our products are intended to further transition the treatment of uncomplicated sinusitis from the operating room to the physician office setting. We believe our following competitive strengths will help drive further adoption of our products:

|

|

• |

Focus on physician office treatment of sinusitis—We believe the majority of sinusitis patients who fail medical management can be treated in the physician office with a stand-alone, office-based balloon sinus dilation procedure. To facilitate the adoption of these procedures, we have focused our product development on creating diagnostic and treatment solutions that are effective, easy to perform and well-tolerated by an awake patient. We educate physicians about our clinical data, which demonstrates efficacy in a broad spectrum of patients who are well-suited for treatment in the ENT physician office setting and about the procedure economics that are favorable to the patient, provider and healthcare system. |

|

|

• |

Significant body of clinical data—We have developed a significant body of clinical data supporting the safety and effectiveness of our balloon sinus dilation products. We have sponsored one meta-analysis and eight clinical studies in which a total of 696 patients were treated with our products and followed to assess safety, and of which 538 patients were followed for an extended period of six, 12 or 24 months to assess long-term efficacy. Our clinical data shows clinically meaningful results across a broad set of clearly defined patient groups. Our REMODEL randomized trial demonstrated that when our balloon sinus dilation devices were used as a stand-alone therapy in the physician office setting, patients experienced similar efficacy rates, faster recovery times, less bleeding at discharge, less use of prescription pain medication and fewer post-procedure debridements than patients receiving FESS. Our XprESS Multi-Sinus Study further demonstrated the efficacy of our products in a broader population of chronic sinusitis patients. Additionally, one of the challenges associated with trans-nasal balloon treatment of the maxillary sinus is the lack of visualization of the ostia. We have completed a cadaver study that demonstrated our XprESS balloon sinus dilation device could consistently and effectively treat the maxillary ostia without puncturing tissue and creating a false channel into the sinus. We believe the data from the cadaver study is unique to our product and partially responsible for driving adoption of office-based balloon sinus dilation in treating maxillary sinuses, the sinus most commonly treated with FESS. |

|

|

• |

Competitive advantages over other balloon sinus dilation products—Our balloon sinus dilation products are intuitive and easy-to-use because they are placed into the diseased sinus like a sinus seeker, a tool commonly used by ENT physicians. Our XprESS family of devices provides depth markings and tactile feel with a controllable tip to allow a user to gently access the ostia and visualize the device insertion depth. Our XprESS products also have fewer components than other balloon sinus dilation products and come with a shaping tool that can bend our XprESS device so that a single device can be used to treat all diseased sinuses in a single procedure. For accessing the approach to the maxillary sinus, our XprESS Ultra provides a small profile, having a 1.5 millimeter diameter ball tip and an adjustable 135-degree angle, compared to a guide catheter used by our main competitor that is 107% larger in diameter and limited to a fixed 110-degree angle. Furthermore, in our XprESS devices, a slideable balloon is used, enabling the balloon to be kept out of the way when the device is advanced into a sinus opening, which allows the user to better visualize and enter the sinuses. Our XprESS products enable unique confirmation methods such as controlled excursion of trans-illuminated light to confirm entry into the frontal sinus, and for accessing the maxillary ostia, observation of the ball tip as it deflects or trans-illuminates the uncinate process, thereby enhancing the accuracy of sinus access. In addition, our XprESS Pro and LoProfile devices are both compatible with the Fiagon IGS, providing physicians an added method to confirm placement of the device in the sinuses. The Fiagon IGS offers a smaller footprint than traditional operating room-based image guidance systems, which we believe makes it ideally suited for adaptation to the ENT physician office. Our XprESS LoProfile and XprESS Ultra Multi-Sinus Dilation Systems provide further convenience for office users by having a self-contained, battery-powered light source, eliminating the need for a separate light cord or xenon lamp light source associated with competing product offerings. |

6

|

|

• |

Comprehensive and broad IP portfolio—As of December 31, 2016, we had 33 issued U.S. patents and 19 pending U.S. patent applications. Our intellectual property portfolio covers our current and anticipated future XprESS products with at least 13 issued U.S. patents, at least seven pending U.S. patent applications and multiple pending foreign applications. |

XprESS device accessing the maxillary sinus with 135° bend angle

and trans-illumination of the uncinate process

Our Products

We have a broad product line of minimally invasive technologies for diagnosing and treating sinusitis patients after failed medical management. Our platform of products provides effective and easy-to-use solutions and is designed to simplify everything from diagnosis and patient selection, to complex case revisions and post-operative care. Our products are intended to further transition the treatment of uncomplicated sinusitis from the operating room to the physician office setting. Our XprESS Multi-Sinus Dilation family of devices and related tools have been specifically designed to enable easy access to the sinus cavities under endoscopic visualization, and provide confirmation of sinus location and device placement using multiple methods. These products facilitate the access and dilation of blocked sinus ostia and pathways in order to reestablish proper mucus transport and drainage with retained ciliary function. When used as a stand-alone therapy in the physician’s office, our XprESS balloon sinus dilation products are the only devices proven in a sufficiently powered prospective, multicenter, randomized, controlled trial to be as effective as FESS, the primary surgical treatment for chronic and recurrent sinusitis. Patients treated with our products in this trial in the ENT physician office also experienced faster recovery, less bleeding at discharge, less use of prescription pain medication and fewer post-procedure debridements than patients receiving FESS. Our array of other products are aimed at assisting in the evaluation and diagnosis of sinusitis and tools to facilitate the treatment of sinusitis and related conditions, and include our Light Fibers, MiniFESS tools and surgical instruments, and FocESS Imaging & Navigation tools, including FocESS Sinuscopes and our recently launched Cyclone Sinonasal Suction and Irrigation System, Entellus Medical Shaver System and our FocESS Wireless High Definition (HD) Camera System. Finally, the Fiagon IGS that we distribute is suited for allowing treatment of more complex cases in the physician’s office, and our XeroGel nasal packing material aids in the post-operative healing process.

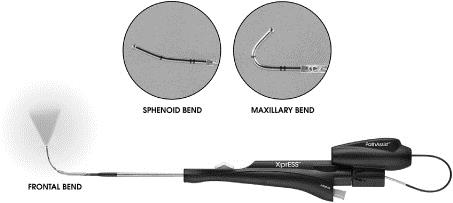

XprESS Multi-Sinus Dilation Product Family

Our XprESS Multi-Sinus Dilation family of products consists of our XprESS Pro device, our XprESS LoProfile device and our XprESS Ultra device. The XprESS LoProfile device and the XprESS Ultra device are always sold with our LED Light Fiber. All of these disposable devices open an obstructed or narrowed drainage pathway of a sinus cavity by means of trans-nasal balloon sinus dilation. These devices combine multiple functions in a hand-held, single, easy-to-use, cost-effective and minimally invasive device designed for efficient balloon sinus dilation procedures in the physician office or operating room. Our XprESS devices combine the features of balloon sinus dilation, suction, irrigation and light confirmation into a single-use device shaped to feel like a sinus seeker, a tool used regularly by ENT physicians to probe for sinus openings and drainage pathways. Our XprESS Pro device is compatible with the Fiagon IGS and enables tracking of the tip of the XprESS device allowing for additional confirmation of device placement.

7

Our XprESS devices include an ergonomic handle attached to a hollow metal shaft with a malleable tip that can be quickly shaped with our disposable bending tool and easily steered into diseased frontal, sphenoid and maxillary sinuses without requiring a guidewire or purchase of another component. Along the shaft of the tip are marks at 1.0 and 2.0 centimeters to denote depth of insertion into the sinus cavities. A balloon is attached to a movable shaft that allows the balloon to be advanced and retracted along the metal shaft. This enables the balloon to be kept out of the way while the device is being placed into a sinus opening, allowing the ENT physician to better visualize and enter the diseased sinus drainage pathway. The handle contains a one-finger balloon slide mechanism that is used to position the balloon within the sinus ostia and an integrated finger suction vent that allows the ENT physician to control active suction in order to maintain good endoscopic visualization throughout the procedure. The proximal end of the handle contains two ports that connect to the balloon inflation lumen and the suction/irrigation lumen of the metal shaft. The port used for suction and irrigation tubing also can accommodate a connection of a light fiber for trans-illumination. The port for balloon inflation connects to a one-handed inflation syringe used to inflate the balloon to a controlled pressure of 12 atmospheres, or approximately 175 pounds per square inch.

Our XprESS Ultra device is our fourth generation balloon sinus dilation device. In addition to the features of our XprESS Pro and LoProfile devices, this device offers the lowest profile re-shapeable atraumatic ball tip balloon device in the industry. The tip of this device measures 1.5 millimeters, compared to 2.0 millimeters for our XprESS Pro and 1.75 millimeters for our XprESS LoProfile devices, allowing for better access to tight spaces within the sinus cavities.

LED Light Fiber and Light Fiber

The LED Light Fiber is a single-use tool that provides real-time high intensity red trans-illumination of the sinus cavity with its own battery power, eliminating the need for extra light sources, cables and adapters. This sinus confirmation tool consists of a flexible illumination fiber that emits light from the distal tip. The instrument snaps easily onto the proximal end of the XprESS device. A reduced diameter LED light fiber was developed and is currently packaged and sold with our XprESS Ultra and LoProfile products.

Our Light Fiber is a single-use tool that also provides real-time trans-illumination of the sinus cavity. The fiber is designed to be loaded into the XprESS device and can connect to various different cables and light sources. When the light fiber is connected to the XprESS device, it allows for suction or irrigation to be performed through that XprESS device.

XprESS multi-sinus dilation device with LED Light Fiber

FocESS Sinuscopes and FocESS Wireless HD Camera

Our FocESS Sinuscopes provide ENT physicians with an easy-to-use solution for endoscopic visualization during a sinus procedure. The scopes are 3.0 millimeters in diameter, which we believe makes them suited for use in tight and inflamed nasal anatomy. These high definition scopes come in three viewing angles; zero-degree, 30-degree and 45-degree to enable physicians’ unique views during sinus procedures.

Our FocESS Wireless HD Camera, which was sold to a limited number of customers in the fourth quarter of 2016 and released to the full market in the first quarter of 2017, provides high quality HD images on which physicians can rely without the hassle of additional cords and light sources. The combination of easy to integrate wireless technology without compromising on image quality makes the wireless camera unique in the ENT space.

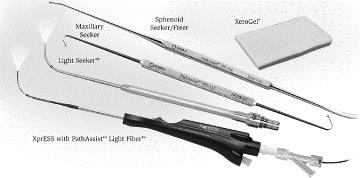

MiniFESS Diagnostic Tools

Our MiniFESS tools are designed to provide ENT physicians with an easy way to confirm sinus location and XprESS device placement. The intent of these tools is to enable users to screen symptomatic patients for in-office balloon sinus dilation and to more

8

easily and efficiently perform balloon sinus dilation procedures in the physician office and operating room. In addition, ENT physicians may use other competing devices to confirm sinus location and placement of XprESS devices.

Our diagnostic MiniFESS tools comprise our Light Seeker, Maxillary Seeker and Sphenoid Seeker/Freer. The Light Seeker is a tool with optical fibers embedded into the device intended to allow ENT physicians to access the frontal sinus and trans-illuminate the sinus cavity and forehead to confirm correct entry into the frontal sinus. The Light Seeker is used to confirm non-surgical access to the frontal sinus prior to opening our XprESS balloon kit. The Maxillary Seeker is a tool designed to allow users to quickly find the correct angle to access the natural maxillary ostia. The Sphenoid Seeker/Freer is a two-in-one tool that is designed to enable ENT physicians to navigate easier access to the sphenoid ostium and to manipulate the middle turbinate. These stainless steel tools are reusable and can be used prior to balloon sinus dilation or as general sinus surgery tools.

MiniFESS tools and XeroGel Nasal Packing Material

MiniFESS Surgical Instruments

Our MiniFESS family of surgical instruments includes eight devices designed to enable physicians to perform several traditional surgical procedures with ease and confidence. These devices include a turbinate forceps, two Blakesley thru-cutters, a 2.5 millimeter Takahashi forceps, a sickle knife and Blakesley forceps in zero-degree, 45-degree and 90-degree orientations, respectively. Each device is designed to be used in specific sinus procedures, which enables them to be utilized easily in the office setting on appropriate patients. In addition, our Turbinate forceps product enables physicians to create greater space in tight anatomy through the controlled and precise compression of an enlarged middle turbinate, which we believe can make sinus procedures easier for physicians to perform.

Our MiniFESS family’s Shaver System, released to a limited market in the fourth quarter of 2016 and to the full market in the first quarter of 2017, offers advanced technology in a compact size and is designed to be easy to use and provide high performance and reliability. With a combination of both disposable and reusable blades, we believe our shaver system offers physicians the flexibility they need to perform complex office procedures in a cost-efficient manner.

Our Cyclone Sinonasal Suction/Irrigation System is designed to provide simultaneous suction and irrigation for easy, comfortable saline lavage. In a recent survey over 40% of physicians say they regularly irrigate their sinusitis patients. Irrigation is a common practice but one that physicians may avoid due to patient discomfort. By simultaneously irrigating and suctioning the related effluent, our Cyclone Sinonasal Suction/Irrigation System is intended to minimize patient discomfort. This product was released to a limited market in the third quarter of 2016 and to the full market in the fourth quarter of 2016.

Fiagon Image Guidance System

The Fiagon IGS consists of a navigation unit, navigation sensor, software instruments and a patient localizer. The system is designed to be integrated into any endoscopy tower. We believe the easy-to-use interface, compact size and flexibility and ability of the Fiagon system to track tools from multiple manufacturers are advantages over traditional image guidance systems that require much larger physical footprints. Further, the Fiagon IGS has the capability to track our XprESS Pro device, which should provide physicians an added layer of confidence in device placement when desired. We believe the Fiagon IGS will help in the adoption of our products in treating more complex anatomical structures. In addition, the Fiagon IGS offers several additional disposable products including trackable suction and sinus-seeker like devices.

We are the exclusive distributor of the Fiagon IGS and related ancillary products to ENT physicians in physician offices, clinics and surgery centers, located in the United States, certain U.S. territories and Canada, subject to certain exceptions for third parties that distributed the Fiagon products, at the time we entered into the original five-year distribution agreement in August 2015. In June 2016, we expanded our agreement with Fiagon to include sales to hospital customers, including the sale of Fiagon’s Premium Navigation System allowing more advanced ENT and cranio-maxillofacial applications. We are also the exclusive distributor of Fiagon GuideWires attached to or sold with our balloon products to hospitals in the United States, certain U.S. territories and Canada. Under

9

the terms of our distribution agreement, Fiagon has agreed not to collaborate with or support our competitors or any company intending to develop or commercialize products that are competitive with the Fiagon products we distribute or our balloon products in the United States, certain U.S. territories and Canada during the term of the agreement.

XeroGel Nasal Packing Material

Our XeroGel Nasal Packing Material is indicated for use in patients undergoing nasal or sinus surgery as a space-occupying packing to separate tissue or structures compromised by surgical trauma, prevent adhesions between mucosal surfaces, help control bleeding following surgery or trauma, and act as an aid in the natural healing process. XeroGel nasal packing material is also indicated for use to treat epistaxis, or nasal bleeding. XeroGel nasal packing material is a dissolvable co-polymer that contains chitosan, a naturally occurring element from chitin, or the exoskeleton of crustaceans. The co-polymer absorbs fluids, swells to conform to the treatment site and dissolves gradually, typically by the first postoperative visit.

Other Products

In addition to our internal product development efforts, we may leverage our direct U.S. sales force by licensing or acquiring other products that can be used by ENT physicians for the treatment of sinusitis and related diseases.

Clinical Results and Studies

Overview

We have developed a significant body of clinical data supporting the safety and effectiveness of our balloon sinus dilation products. We have sponsored one meta-analysis and eight clinical studies in which a total of 696 patients were treated with our products and followed to assess safety, and 538 patients were followed for an extended period of six to 24 months to assess long-term efficacy. Over 50 different clinical investigators participated in these clinical studies. Our clinical evidence includes the only published meta-analysis of patient-level data for stand-alone balloon dilation and the only published randomized trial with sufficient statistical power to demonstrate advantages of a nonsurgical treatment compared to traditional FESS for the treatment of chronic sinusitis. While we are aware of a limited number of studies comparing balloon dilation to FESS, these studies were small single-center studies that were under-powered, meaning their sample sizes were too small to prove their endpoints with sufficient statistical power. In contrast, the sample size for the REMODEL trial was calculated with sufficient statistical power (90%) at a one-sided alpha level of 0.025 to prove the two primary endpoints and hypotheses. The minimum required sample size was 72 patients (36 in each arm) and the trial exceed this requirement, with 130 patients completing 12-month follow-up. Our REMODEL prospective, multicenter, randomized, controlled trial demonstrated that when our balloon sinus dilation products were used as a stand-alone therapy performed in the ENT physician office, patients experienced better recovery outcomes and similar efficacy to FESS. Throughout all our clinical studies, symptom reduction was shown in a broad set of clearly defined patient groups, including those presenting with chronic sinusitis, mild to moderate septal deviations, multi-sinus disease including disease in all eight sinuses or sinusitis present in any combination of the sinuses, and accessory ostia, which are multiple drainage pathways from the maxillary sinus. We also completed two additional studies in which our products were studied in cadaver specimens. The first cadaver study demonstrated effective and accurate trans-nasal entrance through the maxillary ostia with our XprESS device. The second cadaver study demonstrated that access to frontal sinuses using our XprESS device with trans-illumination is as effective as placement of a probe with a CT image guidance system. Finally, we are currently conducting a clinical study to treat Eustachian tube dysfunction with our XprESS device. Outcomes data and information on recent key studies is described below.

Our clinical study data showed clinically meaningful and persistent levels of symptom reduction at one, three, six, 12 and 24 months. A study published in 2010 demonstrated that symptom improvements measured with QOL surveys after treatment with FESS do not appear to change between six and 20 months and recommended that clinical trial designs incorporating QOL outcomes following FESS should consider the six-month time frame as an appropriate long-term primary endpoint. Therefore, we believe that six-month follow-up is sufficient to assess long-term outcomes of our products. All but two of our eight clinical studies followed patients for at least 12 months.

Meta-analysis of Stand-alone Balloon Sinus Dilation Studies

A meta-analysis of stand-alone balloon sinus dilation studies was completed on patient-level data from six of our studies to evaluate long-term outcomes in a large patient sample and compare them with the outcomes from the REMODEL FESS cohort. The studies included the REMODEL randomized controlled trial balloon dilation arm and five prospective, multicenter, single-arm studies: XprESS Multi-Sinus, XprESS Maxillary Pilot, RELIEF, FinESS Registry, and BREATHE. Data were compiled from 358 patients with 846 treated sinuses. There were no statistically significant differences across studies for the demographics and baseline characteristics. Along with the final REMODEL results, the meta-analysis was published online on July 31, 2015, ahead of print publication in The Laryngoscope. It was subsequently published in the printed version in the January 2016 issue of The Laryngoscope.

10

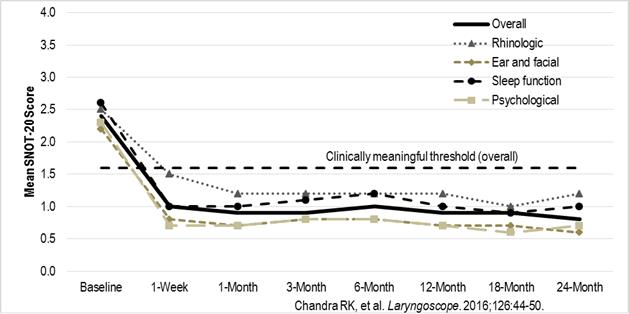

The meta-analysis demonstrated statistically significant and clinically meaningful improvements in mean SNOT-20 overall scores at all follow-up time points. For the 310 patients who received 12 month follow-up and the 74 patients who received 24 month follow up, the average decrease from baseline in the SNOT-20 score was 1.5 and 1.8, respectively. The results of the random effects model on the overall and subscale SNOT-20 scores are shown in the figure below. The changes in SNOT-20 scores were statistically significant, clinically meaningful, and durable through 24 months. A further analysis of variance comparison demonstrated no statistically significant differences between the SNOT-20 results from the FESS arm of the REMODEL trial, the balloon arm of the REMODEL trial and the five pooled single arm studies.

Meta-analysis Random Effect Model of Sino-Nasal Outcome Test (SNOT-20) Overall and Subscale Scores after Balloon Sinus Dilation

The meta-analysis results of the RSI scores indicated statistically significant improvements from baseline in both healthcare utilization and work/social measures. Using the Work Limitations Questionnaire work productivity was demonstrated to improve significantly in four of the five domains (time management, mental/interpersonal, outcome and productivity loss) for employed patients for up to two years after balloon sinus dilation. The meta-analysis was published online on July 31, 2015 along with the final REMODEL results in The Laryngoscope.

|

Meta-analysis: changes in Rhinosinusitis Symptom Inventory (RSI) healthcare use and work status |

||||||||||

|

RSI Parameter |

|

N |

|

Baseline Mean ± SD |

|

12-Month Mean ± SD |

|

Change Mean ± SD |

|

P valuea |

|

Work/school missed due to nasal problems (days) |

|

161 |

|

8.5 ± 11.0 |

|

3.6 ± 5.9 |

|

-5.0 ± 9.5 |

|

<0.0001 |

|

Number of physician/nurse visits for nasal problems |

|

172 |

|

6.8 ± 10.6 |

|

2.3 ± 7.0 |

|

-4.5 ± 11.5 |

|

<0.0001 |

|

Number of acute infections of nose/sinuses |

|

167 |

|

5.4 ± 4.8 |

|

1.5 ± 2.4 |

|

-3.9 ± 4.5 |

|

<0.0001 |

|

Number of antibiotic courses |

|

165 |

|

4.5 ± 2.9 |

|

1.6 ± 2.1 |

|

-2.9 ± 3.1 |

|

<0.0001 |

From: Chandra RK, et al. The Laryngoscope. 2016;126:44-50.

a Comparison of mean change from baseline to follow-up; p value from paired t-test.

REMODEL Randomized Trial of Entellus Balloon Sinus Dilation versus FESS

We sponsored the REMODEL trial, which was a prospective, multicenter, randomized, controlled trial, in which 135 adult patients at 14 centers in the United States were treated between December 2011 and February 2013. The trial was designed to test the hypothesis that symptom improvement after balloon sinus dilation with our products in an ENT physician office was noninferior to FESS and that balloon sinus dilation with our products was superior to FESS for postoperative debridements. No study center contributed more than 20% of patient enrollments and results were consistent across sites. Patients were randomized one-to-one to either balloon sinus dilation or FESS.

11

The two primary endpoints in the REMODEL trial were long-term improvement in sinus symptoms as assessed by the mean change in overall SNOT-20 QOL survey score between treatment and 12-month follow-up and the mean number of debridements per patient following treatment. Secondary and additional endpoints included the complication rate, recovery time, surgical revision rate, ostial patency, change in number of sinusitis episodes, and changes in activity impairment and work productivity. Post-procedure follow-up assessment of patients was performed at one week, and at months one, three, six and 12. A minimum of 36 patients were needed in each study arm to assess the primary endpoints with sufficient statistical power.

After randomization, 135 of 151 enrolled patients completed treatment. Fourteen patients randomized to FESS withdrew their consent for treatment. Eight of these patients indicated they were withdrawing because they did not want to undergo surgical treatment, one person indicated withdrawal because the person’s primary physician recommended not undergoing FESS, three indicated they were withdrawing due to other non-sinus medical conditions or a lack of time available for follow-up and two were found to have exclusion criteria upon further review. Two patients indicated they were withdrawing from the balloon sinus dilation arm of the study, with one of them doing so because they did not want to undergo the balloon procedure. Six-month follow-up was achieved in 133, or 98.5%, of the 135 patients who completed treatment. Twelve-month follow-up was achieved in 130, or 96.3% of the patients. Additionally, each of the 66 eligible patients completed 18-month follow-up and each of the 25 eligible patients completed 24-month follow-up. Patients in this trial had suffered with chronic sinusitis symptoms for an average of over 11 years and had not undergone a previous sinus surgery or balloon dilation procedure before study enrollment. The mean SNOT-20 score prior to treatment in the REMODEL study was 2.5 in each arm of the study.

Both primary endpoints were achieved in this trial. Comparison of changes between each trial group confirmed the mean symptom improvement for patients undergoing balloon sinus dilation was noninferior to that of patients undergoing FESS. Both trial groups experienced clinically meaningful and statistically significant improvements in overall SNOT-20 QOL survey scores. The mean number of postoperative debridements per patient showed a significant difference between the trial groups, demonstrating the superiority of balloon sinus dilation where patients in this group received an average of 0.2 debridements compared to an average of 1.0 debridements per patient in the FESS group.

12

The trial demonstrated that when our balloon sinus dilation devices were used as a stand-alone therapy in the physician office setting, patients experienced similar efficacy rates in terms of symptom improvement, ostial patency, reduction of sinusitis episodes, and very low surgical revision rates, with faster recovery times, less bleeding at discharge, less use of prescription pain medication, and fewer post-procedure debridements than patients receiving FESS. The results of the final, larger cohort of 135 patients with between one and two years of follow-up, were published online on July 31, 2015, ahead of print publication in The Laryngoscope. The following table summarizes the final outcomes from the larger REMODEL trial cohort:

|

REMODEL Overall Outcomes |

|

Our Balloon Sinus Dilation |

|

|

FESS |

|

|

p-Value |

|

|

Compared to FESS, Balloon Sinus Dilation is: |

||||||

|

Primary Efficacy Endpoints |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Change in SNOT-20 symptoms score at 12 months |

|

|

-1.59 |

|

|

|

-1.60 |

|

|

<0.001 |

|

|

Noninferior1 |

||||

|

Mean number of debridements per patient |

|

|

0.2 |

|

|

|

1.0 |

|

|

<0.0001 |

|

|

Superior2 |

||||

|

Secondary Efficacy Outcomes (Recovery and Short Term) |

|

|

|||||||||||||||

|

Patients discharged with nasal bleeding |

|

|

32 |

% |

|

|

56 |

% |

|

|

0.009 |

|

|

Significantly better3 |

|||

|

Recovery time (days) |

|

|

1.7 |

|

|

|

5.0 |

|

|

|

<0.0001 |

|

|

Significantly better3 |

|||

|

Duration of prescription pain medications (days) |

|

|

1.0 |

|

|

|

2.8 |

|

|

<0.0001 |

|

|

Significantly better3 |

||||

|

Secondary Outcomes (1 Year) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Change in number of sinusitis episodes per patient |

|

|

-4.2 |

|

|

|

-3.7 |

|

|

NS |

|

|

Not significantly different3 |

||||

|

Ostial patency |

|

|

>90 |

% |

|

|

>90 |

% |

|

NS |

|

|

Not significantly different4 |

||||

|

Mean reduction of activity impairment due to chronic sinusitis |

|

|

68 |

% |

|

|

76 |

% |

|

NS |

|

|

Not significantly different3 |

||||

|

Mean reduction in overall work impairment due to chronic sinusitis |

|

|

72 |

% |

|

|

80 |

% |

|

NS |

|

|

Not significantly different3 |

||||

|

Mean reduction in productivity loss |

|

|

74 |

% |

|

|

78 |

% |

|

NS |

|

|

Not significantly different3 |

||||

|

Safety outcomes |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Complications |

|

|

0 |

% |

|

|

0 |

% |

|

NS |

|

|

Not significantly different3 |

||||

|

Revision surgery rate (1-year) |

|

|

1.4 |

% |

|

|

1.7 |

% |

|

NS |

|

|

Not significantly different3 |

||||

|

1 |

Based on one-sided Student’s t-test for noninferiority. Values of p < 0.025 were considered statistically significant. |

|

2 |

Based on one-sided two-sample Wilcoxon test for superiority. Value of p < 0.025 was considered statistically significant. |

|

3 |

Based on two-sided two-sample t-tests. Values of p < 0.05 were considered statistically significant. |

|

4 |

Based on a repeated measures regression model. Values of p < 0.05 were considered statistically significant. |

XprESS Pediatric Study

We sponsored the XprESS Pediatric Study, a prospective, multicenter, nonrandomized study, in which 50 pediatric patients ranging in age from two to 21 years were treated at four clinical centers in the United States from October 2014 to June 2015. The primary outcome measures were the procedural technical success rates and the complication rate through 3-month follow-up. Secondary outcome measures were changes in quality of life instruments and the revision surgery rate through 6-month follow-up. A total of 157 sinus dilations were attempted in 50 participants. All 157 dilation attempts were successfully completed for an overall XprESS technical success rate of 100%. No complications (0%) were reported. Significant improvement in sinus symptoms, as measured by the Sinus and Nasal Quality of Life Survey (SN-5), was seen between baseline and 6 months (4.6 vs 1.7, p<0.0001). A minimal clinically important difference threshold of 1.0 in the overall SN-5 score was achieved by 92% of the participants. FDA clearance for the expanded indication was received in November 2015. The expanded indication includes treatment of maxillary sinuses in patients two years and older, and treatment of the frontal and sphenoid sinuses in patients 12 years and older. We believe we are the only company to have received FDA clearance for balloon sinus dilation to treat the frontal and sphenoid sinuses in adolescents. The results of this study were published online on November 26, 2016, ahead of print publication in the International Forum for Allergy and Rhinology.

Eustachian Tube Study

In 2016, we completed enrollment for Phase 2 of our clinical study to treat Eustachian tube dysfunction with our XprESS device. This study is limited to 70 patients and follows the completion of Phase 1 of the study, which included 10 patients.

13

Sales and Marketing and Physician Training

We have focused our sales and marketing efforts on educating ENT physicians about the clinical value, ease-of-use, convenience and cost-effectiveness of office-based sinus dilation as both an alternative to FESS for uncomplicated patients, and for patients who repeatedly fail aggressive medical management and are progressing toward becoming a surgical candidate. We also sell our products to ENT physicians who perform balloon sinus dilation in a hospital outpatient operating room or surgery center.

We maintain a direct sales organization in the United States, which as of December 31, 2016 consisted of 90 full quota-carrying representatives. We intend to continue to increase our presence outside the United States through expansion of our United Kingdom sales force and the addition of distributors. As of December 31, 2016, we had several distributors selling our products in over 10 countries.

Sales in the United States accounted for approximately 95% of our net revenues for the year ended December 31, 2016. Sales outside of the United States accounted for approximately 5% of our net revenues for the year ended December 31, 2016. Prior to 2015, we did not sell any products outside of the United States.

Our marketing group and clinically focused personnel support our sales personnel through the following initiatives:

|

|

• |

Education of ENT physicians is performed using a variety of methods and custom training tools including head model training, observation of video-taped procedures, online visualization of live procedures, cadaver lab training and visits to peers who perform office-based balloon sinus dilation. Our products typically do not require extensive clinical training for most new physician customers. Approximately 15% of newly trained physicians opt to visit a peer for physician training, whereas, other new users are trained with our custom training tools by field trainers from our sales, clinical and research and development organizations. |

|

|

• |

We educate patients about the benefits of our sinus dilation procedure. We utilize online patient education information, and find-a-doctor resource to help patients who are exploring sinusitis treatment options to be able to discuss treatment options with their physician. |

|

|

• |

We promote to physicians the advantages of our products and the clinical outcomes they enable for patients. |

Reimbursement and Procedure Economics

When balloon sinus dilation is performed adjunctively with standard FESS as a hybrid procedure, existing FESS codes are used and insurance coverage is available for an estimated 88% of covered lives in the United States as of December 2016.

Effective January 1, 2011, when balloon sinus dilation is performed as a stand-alone procedure, providers use CPT codes 31295, -96, and -97 for dilation of the maxillary, frontal, and sphenoid sinus ostia, respectively. When a stand-alone balloon procedure is performed in the physician office, the reimbursement associated with these CPT codes includes a non-facility practice expense component of payment intended to cover the cost of equipment, supplies, and overhead associated with these procedures performed in the physician office, including the cost of our devices. In addition, physicians receive additional value from the convenience and efficiency of treating patients in their office setting compared to treatments in a hospital or surgery center. We believe that this, along with excellent clinical outcomes, motivates many ENT physicians and practices to adopt our balloon sinus dilation products.

As an example of cost savings to the healthcare system from office balloon sinus dilation procedures, the 2017 Medicare national average payment rate to a physician performing bilateral maxillary sinus dilation in the office and a nasal endoscopy exam one week later is $3,297. By comparison, treating the same patient with FESS, including ethmoidectomy in an ASC, and performing a debridement one week later costs Medicare $5,749, or 54% more, including ENT physician professional fees of $968. Treating that same patient with FESS, including ethmoidectomy in a hospital out-patient department with a debridement one week later costs Medicare, $5,749, or 74% more than balloon sinus dilation office treatment. When more complex cases are performed involving dilation of four or six sinuses, the level of savings to the healthcare system for office sinus dilation increases. Publication in November 2016 by the Centers for Medicare & Medicaid Services, or CMS, the federal agency responsible for administering the Medicare program, of final 2017 payment rates for stand-alone balloon sinus dilation resulted in 2017 rates very similar to 2016 rates.

|

Sinuses Dilated |

|

2017 Medicare National Average Payment Rates |

||||||||||||

|

|

|

Office Balloon Sinus Dilation |

|

|

FESS in Hospital |

|

|

FESS in ASC |

|

|

% FESS costs more than office dilation: Hospital & ASC |

|||

|

Maxillary |

|

$ |

3,297 |

|

|

$ |

5,749 |

|

|

$ |

5,066 |

|

|

74% & 54% |

|

Maxillary+Frontal |

|

$ |

4,902 |

|

|

$ |

6,527 |

|

|

$ |

7,552 |

|

|

33% & 54% |

|

Maxillary+Frontal+Sphenoid |

|

$ |

6,447 |

|

|

$ |

6,948 |

|

|

$ |

9,681 |

|

|

8% & 50% |

Note: National average payment rates include the total reimbursement made to physicians and facilities for the balloon sinus dilation or FESS procedure plus cost of post-FESS debridement or post-balloon sinus dilation nasal endoscopy. Ethmoidectomy is performed with all FESS procedures.

14

Medicare issued a final rule on the Hospital Outpatient Prospective Payment System, or OPPS, for 2017 which includes a reduction of payments for certain outpatient procedures performed in the hospital when FESS is performed on more than two sinuses. The result is to bundle payments for multi-sinus surgery regardless of the number of sinuses being treated. On average, we expect most hospitals will experience a reduction in CMS reimbursement depending on the number of sinuses being treated.