Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - Delek US Holdings, Inc. | dk-ex322xcfocertificationx.htm |

| EX-32.1 - EXHIBIT 32.1 - Delek US Holdings, Inc. | dk-ex321xceocertificationx.htm |

| EX-31.2 - EXHIBIT 31.2 - Delek US Holdings, Inc. | dk-ex312xcfocertificationx.htm |

| EX-31.1 - EXHIBIT 31.1 - Delek US Holdings, Inc. | dk-ex311xceocertificationx.htm |

| EX-10.2 - EXHIBIT 10.2 - Delek US Holdings, Inc. | dk-10qxex102firstamendment.htm |

| 10-Q - 10-Q - Delek US Holdings, Inc. | dk-10qx063017.htm |

Exhibit 10.1

[Execution]

SECOND AMENDMENT TO

AMENDED AND RESTATED CREDIT AGREEMENT

This Second Amendment to Amended and Restated Credit Agreement, dated as of May 17, 2017 (this “Amendment”), is entered into by and among DELEK REFINING, INC., a Delaware corporation (the “Parent”), DELEK REFINING, LTD., a Texas limited partnership (“Delek Refining” and, together with any other Person that may from time to time become a party to the Credit Agreement referred to below as a Borrower, individually each, a “Borrower” and collectively, “Borrowers”), DELEK U.S. REFINING GP, LLC, a Texas limited liability company (“Delek GP”, and together with the Parent and any other Person that may from time to time become a party to the Credit Agreement referred to below as a Guarantor, individually each, a “Guarantor” and collectively, the “Guarantors”; the Guarantors, together with the Borrowers, are hereinafter referred to individually as a “Loan Party” and collectively as the “Loan Parties”), the lenders party hereto (the “Lenders”), WELLS FARGO BANK, NATIONAL ASSOCIATION, as administrative agent for Lenders (in such capacity, together with its successors and assigns in such capacity, “Agent”), and WELLS FARGO BANK, NATIONAL ASSOCIATION and BANK OF AMERICA, N.A., as Co-Collateral Agents (in such capacity, together with their successors and assigns in such capacity, each a “Co-Collateral Agent” and collectively, “Co-Collateral Agents”);

WHEREAS, the Loan Parties, Agent, Co-Collateral Agents and the Lenders are parties to that certain Amended and Restated Credit Agreement, dated as of January 16, 2014, as amended by the Joinder and First Amendment to Amended and Restated Credit Agreement, dated as of September 29, 2016 (as amended, restated, supplemented or otherwise modified from time to time, the “Credit Agreement”; capitalized terms used in this Amendment and not defined herein shall have the applicable meanings given to such terms in the Credit Agreement);

WHEREAS, the Loan Parties have advised Agent that Delek US Holdings, Inc. and certain subsidiaries of Delek US Holdings, Inc. (which entities are not themselves Loan Parties) propose to effect a series of related merger transactions (collectively, the “Merger”) pursuant to various agreements and plans of merger and related agreements, documents and instruments executed and/or delivered in connection therewith (collectively, the “Merger Documents”), in accordance with which Delek US Holdings, Inc. shall continue to be the direct owner of one hundred percent (100%) of the issued and outstanding Equity Interests in Parent;

WHEREAS, in connection with the Merger, Delek US Holdings, Inc. will cease to be a publicly-traded company, and will become a wholly-owned Subsidiary of an entity in which all of the current shareholders of Delek US Holdings, Inc. will then own Equity Interests (the foregoing, the “Holdco Introduction” as hereinafter further defined);

WHEREAS the Holdco Introduction would constitute a “Holdings Change of Control Event” under the Credit Agreement, as defined therein;

WHEREAS, the Loan Parties have requested that Agent, Co-Collateral Agents, and Required Advances Lenders, and Required Term Loan Lenders agree to amend the definition of

“Holdings Change of Control Event” such that the Holdco Introduction does not constitute a Holdings Change of Control Event; and

WHEREAS, the Loan Parties, Agent, Co-Collateral Agents, and Required Advances Lenders, and Required Term Loan Lenders have agreed to so amend the Credit Agreement, subject to the terms and conditions of this Amendment.

NOW, THEREFORE, Loan Parties, Agent, Co-Collateral Agents, and Required Advances Lenders, and Required Term Loan Lenders hereby agree as follows:

1.Amendments to Credit Agreement. The Credit Agreement is hereby amended in the following respects:

(a) By adding the following definitions to Schedule 1.1 to the Credit Agreement, in alphabetical order:

“ “Alon Merger Agreement” means that certain Agreement and Plan of Merger among Delek US Holdings, Inc., Delek Holdco, Inc., Dione Mergeco, Inc., Astro Mergeco, Inc. and Alon USA Energy, Inc., dated as of January 27, 2017, as amended by that certain First Amendment to Agreement and Plan of Merger dated as of February 27, 2017 (as further amended, restated, supplemented or otherwise modified from time to time).”

“ “Holdco Introduction” means the series of related transactions to be effected on or after April 1, 2017 but prior to the Outside Date (as defined in the Alon Merger Agreement), pursuant to which Old Holdco will cease to be a publicly-traded company, and will become a wholly-owned Subsidiary of New Holdco, pursuant to the steps identified in Exhibit A to the Second Amendment to Amended and Restated Credit Agreement, dated as of May 17, 2017, and resulting in the corporate organization reflected on such Exhibit A.”

“ “Old Holdco” means, from and after the effectiveness of the Holdco Introduction, the Delaware corporation named Delek US Holdings, Inc. as of the Second Amendment Effective Date.

“ “New Holdco” means, from and after the effectiveness of the Holdco Introduction, the Delaware corporation named

2 | ||

Delek Holdco, Inc. as of the Second Amendment Effective Date.”

“ “Second Amendment Effective Date” means May 17, 2017.”

(b) By adding the following provision to Schedule 1.1 of the Credit Agreement at the end of the existing definition of “Holdings”:

“Provided, however, from and after the effectiveness of the Holdco Introduction, all references in the Credit Agreement to “Holdings” shall be deemed, and shall refer, to: (a) Old Holdco, (b) New Holdco, or (c) both Old Holdco and New Holdco, in each case as specified in the chart below by an “X” with respect to the respective references in each of the following Sections of the Credit Agreement in which such references appear:

Section | Refers only to Old Holdco | Refers only to New Holdco | Refers to both Old Holdco and New Holdco |

2.4(e) | X | ||

2.4(f)(v) | X | ||

2.4(f)(vi) | X | ||

4.17 | X | ||

5.6 | X | ||

6.13(h) | X | ||

8.5 | X | ||

8.7 | X | ||

8.11 | X | ||

Definition of “Capital Expenditures” | X | ||

Definition of “Change of Control” | X | ||

3 | ||

Definition of “Guarantors” | X | ||

Definition of “High Yield Offering” | X | ||

Definition of “Lion Acquisition” | X | ||

Definition of “Lion Acquisition Agreement” | X | ||

Definition of “Loan Documents” | X | ||

Definition of “Loan Party” | X | ||

Definition of “Permitted Holders” | X | ||

Definition of “Permitted JV Investments” | X | ||

Definition of “Refining Agreement” | X | ||

Definition of “Specified Affiliate” | X | ||

Schedule 5.1/5.2 | X | ||

(c) By amending and restating the following definitions set forth in Schedule 1.1 of the Credit Agreement in their entirety, as follows:

“ “High Yield Offering” means the issuance by Holdings of up to $400,000,000 of unsecured, high-yield notes, as described in a Description of Notes and an Offering Memorandum, in each case in form and substance satisfactory to Agent and received by Agent on or before such date as Agent may permit in its sole discretion.”

“ “Permitted Holders” means Holdings.

4 | ||

(d) By amending Section 2.4(f)(vi) to add the following sentence at the end thereof:

“Notwithstanding the foregoing, or any other provision of the Credit Agreement to the contrary, in no event shall the Holdco Introduction be deemed to constitute a Holdings Change of Control Event.”

(e) By amending and restating Section 4.12 in its entirety as follows, and adding a Schedule 4.12 to the Credit Agreement in the form appended to this Amendment:

“4.12 Employee Benefits. Except as set forth on Schedule 4.12, no Loan Party, none of their Subsidiaries, nor any of their ERISA Affiliates maintains or contributes to any Benefit Plan.”

2.Representations and Warranties. Each Loan Party represents and warrants as follows:

(a) The execution, delivery, and performance by such Loan Party of this Amendment and the other Loan Documents to which it is a party have been duly authorized by all necessary action on the part of such Loan Party.

(b) The execution, delivery, and performance by such Loan Party of this Amendment and the other Loan Documents to which it is a party do not and will not (i) violate any material provision of federal, state, or local law or regulation applicable to any Loan Party or its Subsidiaries, the Governing Documents of any Loan Party or its Subsidiaries, or any order, judgment, or decree of any court or other Governmental Authority binding on any Loan Party or its Subsidiaries, (ii) conflict with, result in a breach of, or constitute (with due notice or lapse of time or both) a default under any Material Contract of any Loan Party or its Subsidiaries except to the extent that any such conflict, breach or default could not individually or in the aggregate reasonably be expected to have a Material Adverse Effect, (iii) result in or require the creation or imposition of any Lien of any nature whatsoever upon any assets of any Loan Party, other than Permitted Liens, or (iv) require any approval of any Loan Party’s interest holders or any approval or consent of any Person under any Material Contract of any Loan Party, other than consents or approvals that have been obtained and that are still in force and effect and except, in the case of Material Contracts, for consents or approvals, the failure of which to obtain could not individually or in the aggregate reasonably be expected to cause a Material Adverse Effect.

(c) Such Loan Party (i) is duly organized and existing and in good standing under the laws of the jurisdiction of its organization, (ii) is qualified to do business in any state where the failure to be so qualified could reasonably be expected to result in a Material Adverse Effect, and (iii) has all requisite power and authority to own and operate its properties, to carry on its business as now conducted and as proposed to be conducted (except where the failure to do so could not reasonably be expected to result in a Material Adverse Effect), to enter into this Amendment and the other Loan Documents to which it is a party and to carry out the transactions contemplated thereby.

5 | ||

(d) This Amendment and each other Loan Document has been duly executed and delivered by such Loan Party that is a party thereto and is the legally valid and binding obligation of such Loan Party, enforceable against such Loan Party in accordance with its respective terms, except as enforcement may be limited by equitable principles or by bankruptcy, insolvency, reorganization, moratorium, or similar laws relating to or limiting creditors’ rights generally.

(e) Since December 31, 2016, no event, circumstance, or change has occurred that has or could reasonably be expected to result in a Material Adverse Effect.

(f) The Loan Parties have provided to the Agent a true, correct and complete copy of the Alon Merger Agreement in effect as of the date hereof.

(g) The certificate of a senior executive officer of Administrative Borrower delivered to Agent as of the date hereof is true and correct.

(h) The representations and warranties contained in Section 4 of the Credit Agreement are true and correct in all material respects (except that such materiality qualifier shall not be applicable to any representations and warranties that already are qualified or modified by materiality in the text thereof) after giving effect to this Amendment on and as of the date hereof as though made on and as of the date hereof (except to the extent such representations and warranties expressly relate to an earlier date, in which case they are true and correct in all material respects (or in all respects, as applicable) as of such earlier date), and no Default or Event of Default has occurred and is continuing on and as of the date hereof, or would result from this Amendment or any other Loan Document delivered in connection herewith becoming effective in accordance with its terms.

3.Release. Each of the Borrowers and the Guarantors may have certain Claims against the Released Parties (as each such term is defined below), regarding or relating to the Credit Agreement or the other Loan Documents. Agent, Co-Collateral Agents, the Lenders, the Borrowers and the Guarantors desire to resolve each and every one of such Claims in conjunction with the execution of this Amendment and thus each of the Borrowers and the Guarantors makes the releases contained in this Section 3. In consideration of Agent, Co-Collateral Agents and the Lenders entering into this Amendment, each of the Borrowers and the Guarantors hereby fully and unconditionally releases and forever discharges each of Agent, Co-Collateral Agents and the Lenders, and their respective directors, officers, employees, subsidiaries, branches, affiliates, attorneys, agents, representatives, successors and assigns and all persons, firms, corporations and organizations acting on any of their behalves (collectively, the “Released Parties”), of and from any and all claims, allegations, causes of action, costs or demands and liabilities, of whatever kind or nature, from the beginning of the world to the date on which this Amendment is executed, whether known or unknown, liquidated or unliquidated, fixed or contingent, asserted or unasserted, foreseen or unforeseen, matured or unmatured, suspected or unsuspected, anticipated or unanticipated, which the Borrowers or any Guarantor has, had, claims to have had or hereafter claims to have against the Released Parties by reason of any act or omission on the part of the Released Parties, or any of them, occurring prior to the date on which this Amendment is executed, including all such loss or damage of any kind heretofore sustained or that may arise as a consequence of the dealings among the parties up to and including the date on which this Amendment is executed, including the administration or enforcement of the Advances, the Term Loan, the Obligations, the Credit

6 | ||

Agreement or any of the other Loan Documents (collectively, all of the foregoing, the “Claims”). Each of the Borrowers and the Guarantors represents and warrants that it has no knowledge of any claim by it against the Released Parties or of any facts or acts of omissions of the Released Parties which on the date hereof would be the basis of a claim by the Borrowers or the Guarantors against the Released Parties which is not released hereby. Each of the Borrowers and the Guarantors represents and warrants that the foregoing constitutes a full and complete release of all Claims.

4.Miscellaneous.

(a) Continued Effectiveness of the Credit Agreement. Except as otherwise expressly provided herein, the Credit Agreement and the other Loan Documents are, and shall continue to be, in full force and effect and are hereby ratified and confirmed in all respects, except that on and after the date hereof, (i) all references in the Credit Agreement to “this Agreement”, “hereto”, “hereof”, “hereunder” or words of like import referring to the Credit Agreement shall mean the Credit Agreement as amended by this Amendment, and (ii) all references in the other Loan Documents to the “Credit Agreement”, “thereto”, “thereof”, “thereunder” or words of like import referring to the Credit Agreement shall mean the Credit Agreement as amended by this Amendment. To the extent that the Credit Agreement or any other Loan Document purports to pledge to Agent, or to grant to Agent, a security interest or lien, such pledge or grant is hereby ratified and confirmed in all respects. Except as expressly provided herein, the execution, delivery and effectiveness of this Amendment shall not operate as a waiver or an amendment of any right, power or remedy of Agent, Co-Collateral Agents and the Lenders under the Credit Agreement or any other Loan Document, nor constitute a waiver or an amendment of any provision of the Credit Agreement or any other Loan Document.

(b) Counterparts. This Amendment may be executed in any number of counterparts and by different parties hereto in separate counterparts, each of which shall be deemed to be an original, but all of which taken together, shall constitute one and the same agreement. Delivery of an executed counterpart of this Amendment by telefacsimile or other electronic method of transmission shall be equally as effective as delivery of an original executed counterpart of this Amendment. Any party delivering an executed counterpart of this Amendment by telefacsimile or other electronic method of transmission also shall deliver an original executed counterpart of this Amendment but the failure to deliver an original executed counterpart shall not affect the validity, enforceability, and binding effect of this Amendment. The foregoing shall apply to each other Loan Document mutatis mutandis.

(c) Section Headings. Headings and numbers have been set forth herein for convenience only. Unless the contrary is compelled by the context, everything contained in each Section applies equally to this entire Amendment.

(d) Costs and Expenses. The Borrowers agree to pay on demand all Lender Group Expenses of Agent in connection with the preparation, execution and delivery of this Amendment.

(e) Further Assurances. Each Loan Party agrees to execute and deliver such ratifications and confirmations (including, without limitation, with respect to pledged Equity Interests), and other agreements, documents, and instruments, and take such actions, in each case as Agent may request in order to confirm and give effect to the terms hereof.

7 | ||

(f) Amendment as Loan Document. Each Loan Party hereby acknowledges and agrees that this Amendment constitutes a “Loan Document” under the Credit Agreement. Accordingly, it shall be an Event of Default under the Credit Agreement if (i) any representation or warranty made by any Loan Party under or in connection with this Amendment shall have been untrue, false or misleading in any material respect when made, or (ii) any Loan Party shall fail to perform or observe any term, covenant or agreement contained in this Amendment.

(g) Governing Law. THE VALIDITY OF THIS AMENDMENT, THE CONSTRUCTION, INTERPRETATION, AND ENFORCEMENT HEREOF, AND THE RIGHTS OF THE PARTIES HERETO WITH RESPECT TO ALL MATTERS ARISING HEREUNDER OR RELATED HERETO SHALL BE DETERMINED UNDER, GOVERNED BY, AND CONSTRUED IN ACCORDANCE WITH THE LAWS OF THE STATE OF NEW YORK.

(h) Waiver of Jury Trial. TO THE MAXIMUM EXTENT PERMITTED BY APPLICABLE LAW, EACH LOAN PARTY AND EACH MEMBER OF THE LENDER GROUP HEREBY WAIVE THEIR RESPECTIVE RIGHTS TO A JURY TRIAL OF ANY CLAIM OR CAUSE OF ACTION BASED UPON OR ARISING OUT OF ANY OF THE LOAN DOCUMENTS OR ANY OF THE TRANSACTIONS CONTEMPLATED THEREIN, INCLUDING CONTRACT CLAIMS, TORT CLAIMS, BREACH OF DUTY CLAIMS, AND ALL OTHER COMMON LAW OR STATUTORY CLAIMS. EACH LOAN PARTY AND EACH MEMBER OF THE LENDER GROUP REPRESENT THAT EACH HAS REVIEWED THIS WAIVER AND EACH KNOWINGLY AND VOLUNTARILY WAIVES ITS JURY TRIAL RIGHTS FOLLOWING CONSULTATION WITH LEGAL COUNSEL. IN THE EVENT OF LITIGATION, A COPY OF THIS AMENDMENT MAY BE FILED AS A WRITTEN CONSENT TO A TRIAL BY THE COURT.

[Remainder of page intentionally left blank.]

8 | ||

IN WITNESS WHEREOF, this Amendment has been duly executed as of the date first above written.

BORROWER:

DELEK REFINING, LTD.,

a Texas limited partnership

By: DELEK U.S. REFINING GP, LLC,

its General Partner

By: /s/ Gregory Intemann

Name: Gregory Intemann

Title: Vice President

By: /s/ Danny C. Norris

Name: Danny C. Norris

Title: Vice President

GUARANTORS:

DELEK REFINING, INC.,

a Delaware corporation

By: /s/ Gregory Intemann

Name: Gregory Intemann

Title: Vice President

By: /s/ Danny C. Norris

Name: Danny C. Norris

Title: Vice President

DELEK U.S. REFINING GP, LLC,

a Texas limited liability company

By: /s/ Gregory Intemann

Name: Gregory Intemann

Title: Vice President

By: /s/ Danny C. Norris

Name: Danny C. Norris

Title: Vice President

WELLS FARGO BANK, NATIONAL ASSOCIATION, as Agent, as a Co-Collateral Agent and as a Lender

By: /s/ Ryan Tozier

Name: Ryan Tozier

Title: Vice President

BANK OF AMERICA, N.A., as a Co-Collateral Agent and as a Lender

By: /s/ Steven L. Hipsman

Name: Steven L. Hipsman

Title: Senior Vice President

BANK HAPOALIM B.M., as a Lender

By: /s/ Yael Weinstock-Shemesh

Name: Yael Weinstock-Shemesh

Title: Senior Vice President

Head of the Israeli Business Group

By: /s/ Tal Shpaizer

Name: Tal Shpaizer

Title: Vice President

Israeli Business Group

ISRAEL DISCOUNT BANK OF NEW YORK,

as a Lender

By: /s/ Mali Golan

Name: Mali Golan

Title: First Vice President

By: /s/ Zahi Levy

Name: Zahi Levy

Title: Senior Vice President

ROYAL BANK OF CANADA, as a Lender

By: /s/ Jason S. York

Name: Jason S. York

Title: Authorized Signatory

SUNTRUST BANK, as Lender

By: /s/ Earl Garris

Name: Earl Garris

Title: Director

REGIONS BANK, as a Lender

By: /s/ Stuart A. Hall

Name: Stuart A. Hall

Title: Senior Vice President

COMPASS BANK, as a Lender

By: /s/ Michael Sheff

Name: Michael Sheff

Title: Sr. Vice President

U.S. BANK NATIONAL ASSOCIATION,

as a Lender

By: /s/ Christopher K. Nairne

Name: Christopher K. Nairne

Title: Senior Vice President

EXHIBIT A TO SECOND AMENDMENT TO AMENDED AND

RESTATED CREDIT AGREEMENT

(see attached “Proposed Structure for Acquiring Astro” dated December 27, 2016)

Schedule 4.12 to Amended and Restated Credit Agreement

Benefit Plans

Alon USA Pension Plan

Proposed Structure for Acquiring Astro

December 27, 2016

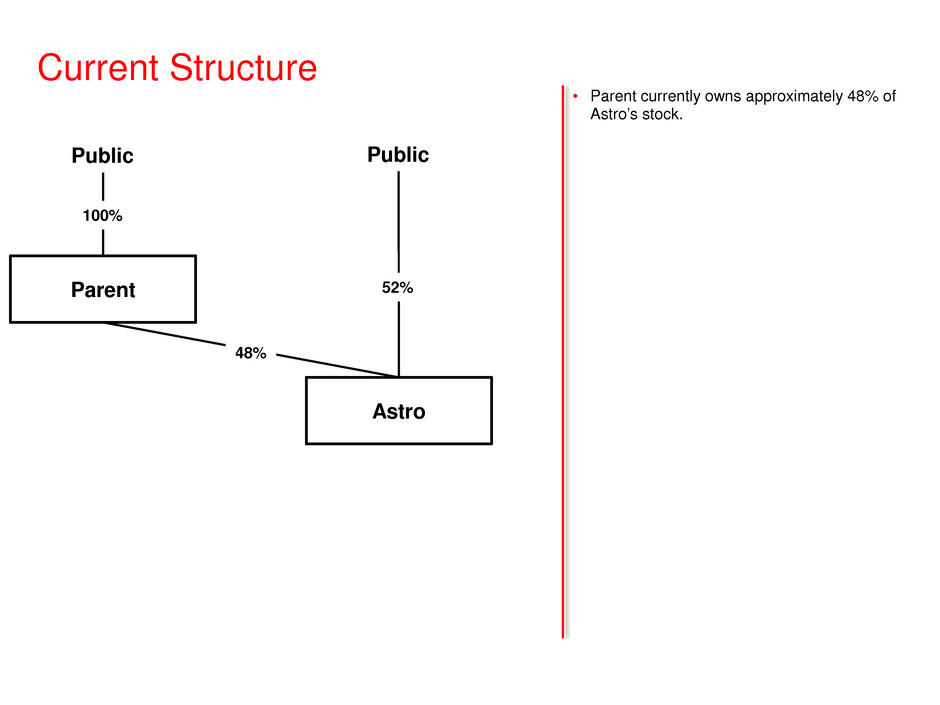

Current Structure

• Parent currently owns approximately 48% of

Astro’s stock.

Parent

Public Public

100%

52%

Astro

48%

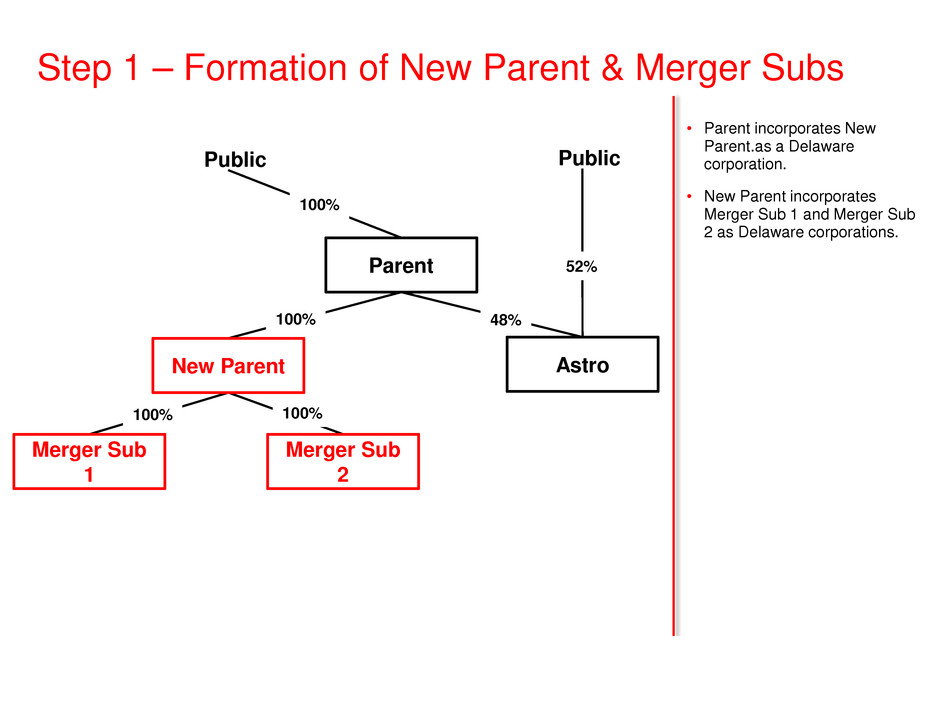

Step 1 – Formation of New Parent & Merger Subs

• Parent incorporates New

Parent.as a Delaware

corporation.

• New Parent incorporates

Merger Sub 1 and Merger Sub

2 as Delaware corporations.

Parent

Public

100%

Public

52%

Astro

48%

Merger Sub

2

New Parent

100%

Merger Sub

1

100% 100%

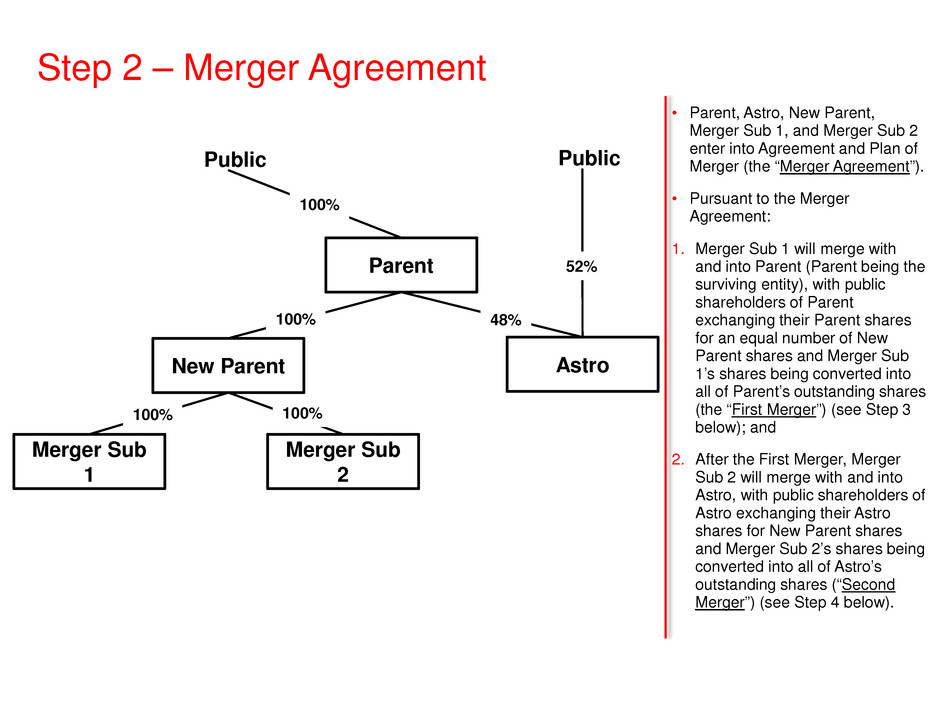

Step 2 – Merger Agreement

• Parent, Astro, New Parent,

Merger Sub 1, and Merger Sub 2

enter into Agreement and Plan of

Merger (the “Merger Agreement”).

• Pursuant to the Merger

Agreement:

1. Merger Sub 1 will merge with

and into Parent (Parent being the

surviving entity), with public

shareholders of Parent

exchanging their Parent shares

for an equal number of New

Parent shares and Merger Sub

1’s shares being converted into

all of Parent’s outstanding shares

(the “First Merger”) (see Step 3

below); and

2. After the First Merger, Merger

Sub 2 will merge with and into

Astro, with public shareholders of

Astro exchanging their Astro

shares for New Parent shares

and Merger Sub 2’s shares being

converted into all of Astro’s

outstanding shares (“Second

Merger”) (see Step 4 below).

Parent

Public

100%

Public

52%

Astro

48%

Merger Sub

2

New Parent

100%

Merger Sub

1

100% 100%

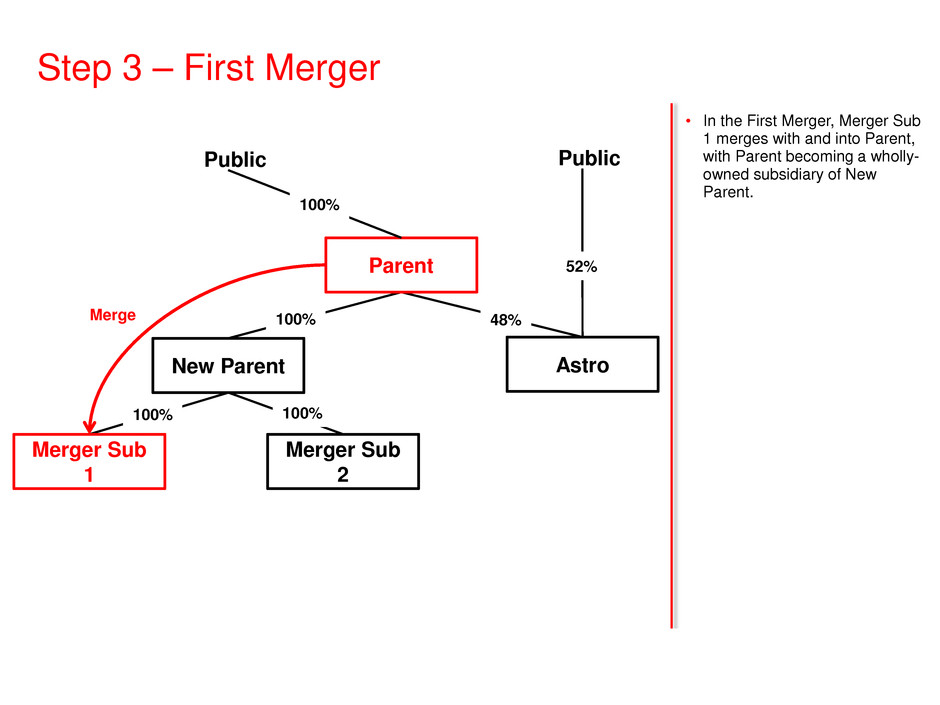

Step 3 – First Merger

• In the First Merger, Merger Sub

1 merges with and into Parent,

with Parent becoming a wholly-

owned subsidiary of New

Parent.

Merge

Parent

Public

100%

Public

52%

Astro

48%

Merger Sub

2

New Parent

100%

Merger Sub

1

100% 100%

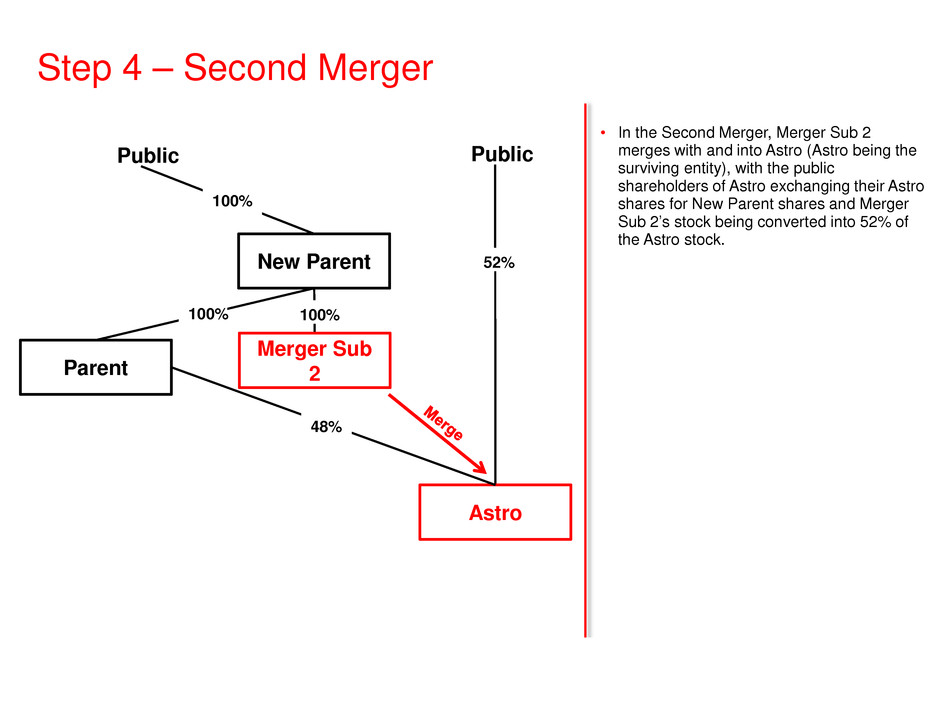

Step 4 – Second Merger

• In the Second Merger, Merger Sub 2

merges with and into Astro (Astro being the

surviving entity), with the public

shareholders of Astro exchanging their Astro

shares for New Parent shares and Merger

Sub 2’s stock being converted into 52% of

the Astro stock.

New Parent

Public

100%

Public

52%

Astro

48%

Merger Sub

2 Parent

100% 100%

Final Structure

• After the Second Merger, New Parent

will wholly-own Parent, and together,

Parent and New Parent will own all of the

outstanding stock of Astro.

New Parent

Public

100%

52%

Astro

48%

Parent

100%