Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - R1 RCM INC. | q2pr.htm |

| 8-K - 8-K - R1 RCM INC. | a8-28xk.htm |

Second Quarter 2017 Results Conference Call

August 2, 2017

2

Forward-Looking Statements and Non-GAAP Financial Measures

This presentation includes information that may constitute “forward-looking statements,” made pursuant to the safe harbor

provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements relate to future, not past, events

and often address our expected future growth, plans and performance or forecasts. These forward-looking statements are often

identified by the use of words such as “anticipate,” “believe,” “designed,” “estimate,” “expect,” “forecast,” “intend,” “may,” “plan,”

“predict,” “project,” “target,” “will,” or “would,” and similar expressions or variations, although not all forward-looking statements

contain these identifying words. Such forward-looking statements are based on management’s current expectations about future

events as of the date hereof and involve many risks and uncertainties that could cause our actual results to differ materially from

those expressed or implied in our forward-looking statements. Subsequent events and developments, including actual results or

changes in our assumptions, may cause our views to change. We do not undertake to update our forward-looking statements

except to the extent required by applicable law. Readers are cautioned not to place undue reliance on such forward-looking

statements.

All forward-looking statements included herein are expressly qualified in their entirety by these cautionary statements. Our actual

results and outcomes could differ materially from those included in these forward-looking statements as a result of various factors,

including, but not limited to successful integration of transitioned Ascension employees, ability to achieve or maintain profitability

and retain existing customers or acquire new customers, implementation of our technologies or services with our customers or

implementation costs that exceed our expectations, fluctuations in our quarterly results of operations and cash flows, as well as

the factors discussed under the heading “Risk Factors” in our annual report on Form 10-K for the year ended December 31, 2016,

our 2017 quarterly reports on Form 10-Q and any other periodic reports that the Company files with the Securities and Exchange

Commission.

This presentation includes the following non-GAAP financial measures : Gross Cash Generated and Net Cash Generated from

Customer Contracting Activities (on a historical basis), and Adjusted EBITDA (on a projected basis). Please refer to the Appendix

located at the end of this presentation for a reconciliation of the non-GAAP financial measures to the most directly comparable

GAAP financial measure.

3

Second Quarter Highlights

Financial Results

Revenue of $99.4 million and adjusted EBITDA of ($3.3) million

RCM and PAS businesses executing well

2017 revenue guidance raised by $25 million, to $425 - $450 million

On track to generate positive adjusted EBITDA and positive free cash flow in 2H’17 and beyond

Ascension Deployment

Phase-1 Update:

Deployment largely complete

Transitioned 93% of work scheduled to move to shared services centers; deployed all R1 Hub

technology and rationalized 77% of targeted vendor spend

Now largely in execution mode at Phase-1 to drive steady improvement in margins

Phase-2 Update:

Onboarding started in late June; onboarded ~900 employees through July

Expect Indiana and Florida deployment to be completed in early 2018

Wisconsin onboarding scheduled to begin in Q4’17

4

Market Commentary and Update on Key Initiatives

Market Commentary

RCM market continues to be served by highly fragmented vendors who largely operate in silos

Lack of integration between vendors is a major source of inefficiency in the revenue cycle

We continue to feel bullish about our offering and competitive positioning:

End-to-end tech-enabled services model is ideal for managing the revenue cycle

Our technology, standardized processes and 13+ years of experience in complex environments are

significant assets and competitive advantage

Key Initiatives

Three pilots underway for transformation of front-end physician-patient experience (discussed on last call).

Selected two key technology partners in Q2, and expect rollout to broader customer base in 2018

Physician RCM is strategically important – our vision is to provide a holistic, integrated commercial

infrastructure to manage the revenue cycle that spans care settings and payment models. Key elements of

Physician RCM approach:

Further build out our physician capabilities through organic and/or inorganic investments

Drive smart process-integration between physician and inpatient environments

Build a leading platform for evolving payment models

5

Sales & Marketing

Gary Long - Chief Commercial Officer

More than 20 years of experience in healthcare, joins R1 from Premier Inc., where he was Senior Vice

President and Chief Sales Officer

Experience with enterprise sales with long sales cycles

Will be responsible for R1’s customer growth initiatives, including sales, marketing, product management

and solution development

• Expanded Portfolio of Modular Solutions:

• Five modules focused around key RCM performance outcomes where R1 is in a strong position to drive

meaningful value for customers

• New effort is proactive, versus historically reactive. Key decision drivers in pursuing a modular strategy:

• Existing R1 capabilities and presence in a market where health systems’ satisfaction with other

vendors is relatively low

• Opportunity to begin relationships and deepen them over time

• Favorable economic profile –ROI is higher due to lower upfront costs, margin rates are better than

end-to-end

• Signed on Central Maine Healthcare for Revenue Capture Solutions

6

2Q’17 non-GAAP Results – Q/Q and Y/Y Comparison

($ in millions) 2Q’17 1Q’17 2Q’16 Key change driver(s)

Revenue (for 2017); Gross

Cash Generated (for 2016)

$99.4 $86.9 $38.3

• Onboarding of Phase-1 Ascension

employees

• PAS growth q/q and y/y

Cost of Services $91.9 $76.8 $41.4

• Phase-1 ABM costs

• Staffing of shared services centers

• Upfront costs in Wisconsin

SG&A $10.8 $11.5 $14.3 • June 2016 restructuring

Adjusted EBITDA (for 2017);

Net Cash Generated (for 2016)

($3.3) ($1.4) ($17.4) • Combination of above reasons

A reconciliation of non-GAAP to GAAP measures is provided in the Appendix of this presentation

7

Additional Commentary

Cash balance of $134 million as of 6/30/17, incl. restricted cash

Declined $10 million from 3/31/17, driven by:

$7 million for capex related to expansion of our India footprint and IT investment

$7 million for the purchase of a contracting software technology

Above factors offset by an $11 million reduction in accounts receivable and other

working capital improvements

8

2017 Guidance

($ in millions) 2017

Revenue $425 - $450

GAAP Operating Income ($25) – ($30)

Adjusted EBITDA* $0 - $5

* Adjusted EBITDA is calculated as GAAP operating income plus depreciation and

amortization expense, share-based compensation expense, and severance and other costs.

9

Appendix

10

Use of Non-GAAP Financial Measures

In order to provide a more comprehensive understanding of the information used by R1’s management team in financial and operational

decision making, the Company supplements its GAAP consolidated financial statements with certain non-GAAP financial measures, which

are included in this presentation.

For the three and six months ended June 30, 2017: As of January 1, 2017, the Company adopted Accounting Standards Update ("ASU") No.

2014-09, Revenue from Contracts with Customers (Topic 606). Subsequent to adoption of Topic 606, the non-GAAP financial measure

referenced in the press release is adjusted EBITDA. Adjusted EBITDA is defined as GAAP net income before net interest income, income tax

provision, depreciation and amortization expense, share-based compensation expense, and severance & certain other items.

For the three and six months ended June 30, 2017 : Prior to the adoption of Topic 606, non-GAAP financial measures utilized by the

company included gross cash generated from customer contracting activities, and net cash generated from customer contacting activities.

Gross cash generated from customer contracting activities was defined as GAAP net services revenue, plus the change in deferred

customer billings. Accordingly, gross cash generated from customer contracting activities is the sum of (i) invoiced or accrued net operating

fees, (ii) cash collections on incentive fees and (iii) other services fees. Net cash generated from customer contracting activities was

defined as net income before net interest income, income tax provision, depreciation and amortization expense, share-based

compensation expense, and severance & certain other items. Deferred customer billings include the portion of both (i) invoiced or accrued

net operating fees and (ii) cash collections of incentive fees, in each case, that have not met our revenue recognition criteria. Deferred

customer billings are included in the detail of our customer liabilities and customer liabilities – related party balance in the condensed

consolidated balance sheets available in the Company’s Quarterly Report on Form 10-Q for the three months ended June 30, 2016.

Our Board and management team use non-GAAP measures as (i) one of the primary methods for planning and forecasting overall

expectations and for evaluating actual results against such expectations; and (ii) a performance evaluation metric in determining

achievement of certain executive incentive compensation programs, as well as for incentive compensation programs for employees.

These adjusted measures are non-GAAP and should be considered in addition to, but not as a substitute for, the information prepared in

accordance with GAAP.

11

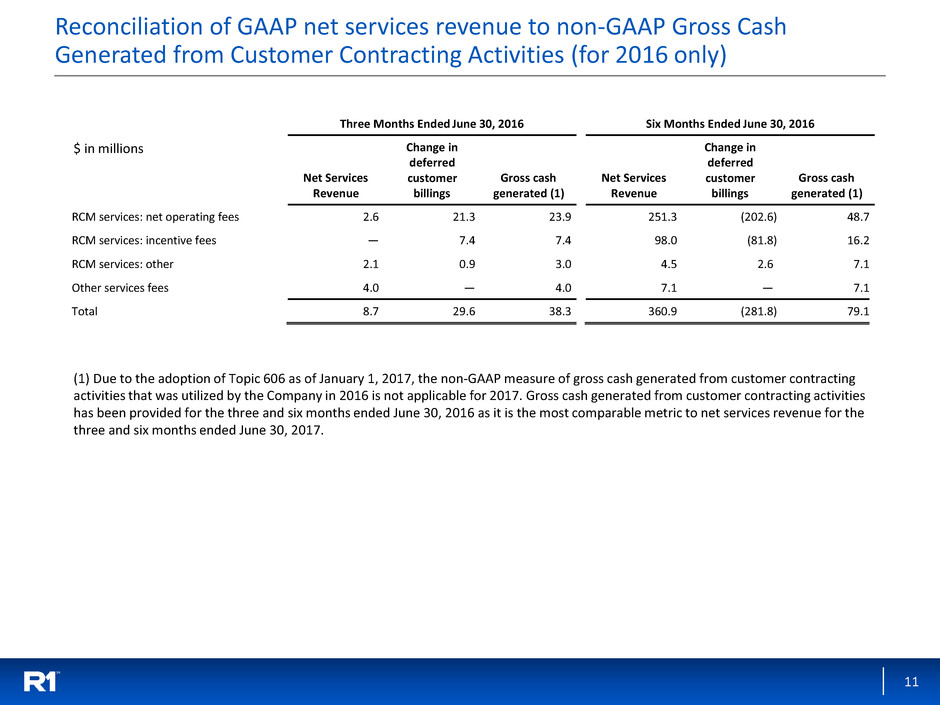

Reconciliation of GAAP net services revenue to non-GAAP Gross Cash

Generated from Customer Contracting Activities (for 2016 only)

(1) Due to the adoption of Topic 606 as of January 1, 2017, the non-GAAP measure of gross cash generated from customer contracting

activities that was utilized by the Company in 2016 is not applicable for 2017. Gross cash generated from customer contracting activities

has been provided for the three and six months ended June 30, 2016 as it is the most comparable metric to net services revenue for the

three and six months ended June 30, 2017.

$ in millions

Three Months Ended June 30, 2016 Six Months Ended June 30, 2016

Net Services

Revenue

Change in

deferred

customer

billings

Gross cash

generated (1)

Net Services

Revenue

Change in

deferred

customer

billings

Gross cash

generated (1)

RCM services: net operating fees 2.6 21.3 23.9 251.3 (202.6 ) 48.7

RCM services: incentive fees — 7.4 7.4 98.0 (81.8 ) 16.2

RCM services: other 2.1 0.9 3.0 4.5 2.6 7.1

Other services fees 4.0 — 4.0 7.1 — 7.1

Total 8.7 29.6 38.3 360.9 (281.8 ) 79.1

12

Three Months

Ended June 30,

2017 vs. 2016

Change

Six Months

Ended June 30,

2017 vs. 2016

Change

2017 2016 Amount % 2017 2016 Amount %

(In millions except percentages)

RCM services: net operating fees $ 80.1 $ 2.6 $ 77.5 n.m. 150.8 251.3 $ (100.5 ) (40.0 )%

RCM services: incentive fees 7.1 — 7.1 n.m. 12.7 98.0 (85.3 ) (87.0 )%

RCM services: other 4.1 2.1 2.0 95.2 % 7.0 4.5 2.5 55.6 %

Other services fees 8.1 4.0 4.1 102.5 % 15.8 7.1 8.7 122.5 %

Net services revenue 99.4 8.7 90.7 n.m. 186.3 360.9 (174.6 ) (48.4 )%

Change in deferred customer

billings (non-GAAP)

n.a. 29.6

n.m. n.m.

n.a

. (281.8 ) n.m. n.m.

Gross cash generated from customer

contracting activities (non-GAAP)

n.a. $ 38.3

n.m. n.m.

n.a.

79.1

n.m. n.m.

Net income (loss) (6.7 ) (40.8 ) $ 34.1 (83.6 )% (15.0 ) 126.6 $ (141.6 ) (111.8 )%

Net interest income — — — — % $ (0.1 ) 0.1 (0.2 ) (200.0 )%

Income tax provision (benefit) (3.5 ) (28.9 ) 25.4 (87.9 )% (3.6 ) 82.5 (86.1 ) (104.4 )%

Depreciation and amortization

3.8 2.4 1.4 58.3 % 7.0 4.6 2.4 52.2 %

Share-based compensation expense

2.1 11.8 (9.7 ) (82.2 )% 5.8 18.7 (12.9 ) (69.0 )%

Other 1.0 8.7 (7.7 ) (88.5 )% 1.2 19.5 (18.3 ) (93.8 )%

Adjusted EBITDA (non-GAAP) (3.3 ) (46.8 ) 43.5 (92.9 )% (4.7 ) 251.8 (256.5 ) (101.9 )%

Change in deferred customer billings (non-

GAAP) n.a. 29.6

n.m. n.m. n.a. (281.8 ) n.m. n.m.

Net cash generated from customer

contracting activities n.a $ (17.4 ) n.m. n.m. n.a $ (30.0 ) n.m. n.m.

Reconciliation of GAAP to non-GAAP Financials

n.m. - not meaningful

n.a. - Due to the adoption of Topic 606 as of January 1, 2017, the non-GAAP measure of gross and net cash generated from customer

contracting activities, that was utilized by the Company in 2016, is not applicable for 2017. Gross and net cash generated from customer

contracting activities has been provided for the three and six months ended June 30, 2016 as they are the most comparable metric to

net services revenue and adjusted EBTIDA for the three and six months ended June 30, 2017.

Due to rounding, numbers may not add up precisely to the totals provided.

13

Share-Based Compensation and D&A Expense included within Operating Expenses

Share-Based Compensation Expense Allocation Details

Depreciation and Amortization Expense Allocation Details

$ in millions

$ in millions

Three Months Ended June 30, Six Months Ended June 30,

2017 2016 2017 2016

Cost of services $ 3.5 $ 2.2 $ 6.4 $ 4.3

Selling, general and administrative 0.3 0.1 0.6 0.3

Total share-based compensation expense $ 3.8 $ 2.3 $ 7.0 $ 4.6

Three Months Ended June 30, Six Months Ended June 30,

2017 2016 2017 2016

Cost of services $ 1.0 $ 1.5 $ 2.1 $ 3.5

Selling, general and administrative 1.1 10.3 3.6 15.2

Other 0.1 1.8 0.1 1.8

Total share-based compensation expense $ 2.2 $ 13.6 $ 5.8 $ 20.5

14

Consolidated non-GAAP Financial Information

$ in millions

(1) Excludes share-based compensation, depreciation and amortization and other costs

(2) Due to the adoption of Topic 606 as of January 1, 2017, the non-GAAP measure of gross and net cash generated from customer

contracting activities that were utilized by the Company in 2016 are not applicable for 2017. Gross and net cash generated from customer

contracting activities have been provided for the three and six months ended June 30, 2016 as they are the most comparable metric to net

services revenue and adjusted EBITDA, respectively, for the three and six months ended June 30, 2017.

Three Months Ended June 30, Six Months Ended June 30,

2017 2016 2017 2016

(Unaudited) (Unaudited)

RCM services: net operating fees 80.1 23.9 150.8 48.7

RCM services: incentive fees 7.1 7.4 12.7 16.2

RCM services: other 4.1 3.0 7.0 7.1

Other services fees 8.1 4.0 15.8 7.1

Net services revenue (GAAP) (2017), Gross cash generated from customer

contracting activities (non-GAAP) (2016) (2) 99.4

38.3

186.3

79.1

Operating expenses (1) :

Cost of services (non-GAAP) 91.9 41.4 168.7 82.4

Selling, general and administrative (non-GAAP) 10.8 14.3 22.3 26.7

Sub-total 102.7 55.7 191.0 109.1

Adjusted EBITDA (non-GAAP) (2017), Net cash generated from customer

contracting activities (non-GAAP) (2016) (2) (3.3 ) (17.4 ) (4.7 ) (30.0 )

15

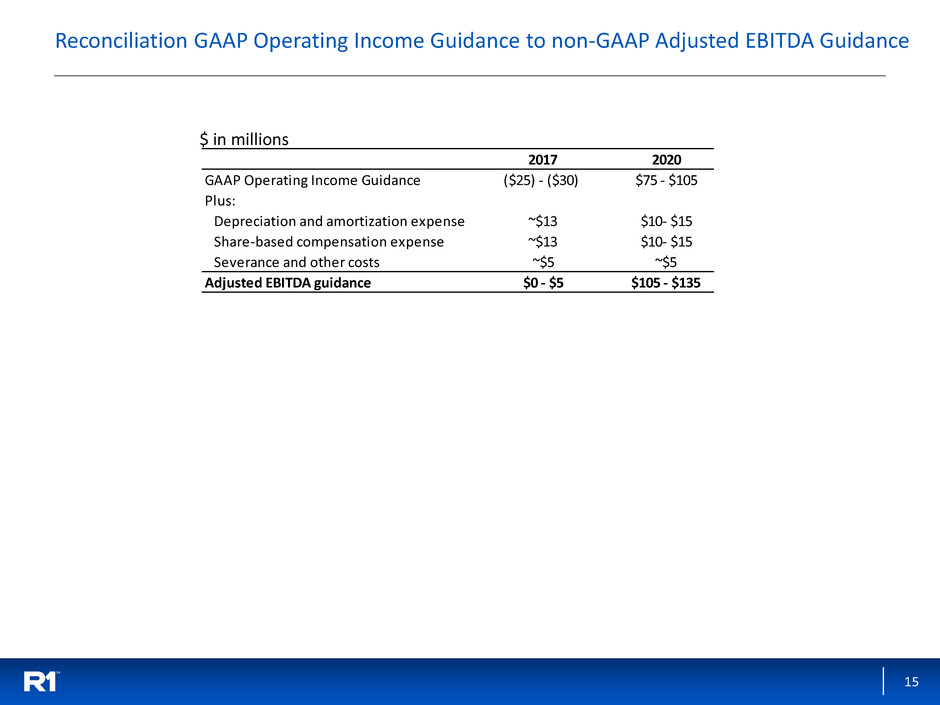

Reconciliation GAAP Operating Income Guidance to non-GAAP Adjusted EBITDA Guidance

$ in millions

2017 2020

GAAP Operating Income Guidance ($25) - ($30) $75 - $105

Plus:

Depreciation and amortization expense ~$13 $10- $15

Share-based compensation expense ~$13 $10- $15

Severance and other costs ~$5 ~$5

Adjusted EBITDA guidance $0 - $5 $105 - $135