Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Innophos Holdings, Inc. | d398635dex991.htm |

| EX-10.1 - EX-10.1 - Innophos Holdings, Inc. | d398635dex101.htm |

| 8-K - FORM 8-K - Innophos Holdings, Inc. | d398635d8k.htm |

REVITALIZED FOR GROWTH NOVEL INGREDIENTS ACQUISITION August 1, 2017 – 9:00 am ET Exhibit 99.2

Forward-Looking Statements This presentation contains or may contain forward-looking statements within the meaning of Section 27a of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. The company intends these forward-looking statements to be covered by the safe harbor provisions for such statements. Statements made in this presentation that relate to our future performance or future financial results or other future events (which may be identified by such terms as “expect”, “estimate”, “anticipate”, “assume”, “believe”, “plan”, “intend’, “may”, “will”, “should”, “outlook”, “guidance”, “target”, “opportunity”, “potential” or similar terms and variations or the negative thereof) are forward-looking statements, including the Company’s expectations regarding the business environment and the Company’s overall guidance regarding future performance and growth. These statements are based on our current beliefs and expectations and are subject to significant risks and uncertainties. Actual results may materially differ from the expectations expressed in or implied by these forward-looking statements. Factors that could cause the Company’s actual results to differ materially include, but are not limited to: (1) global macroeconomic conditions and trends; (2) the behavior of financial markets, including fluctuations in foreign currencies, interest rates and turmoil in capital markets; (3) changes in regulatory controls regarding tariffs, duties, taxes and income tax rates; (4) the Company’s ability to implement and refine its Vision 2022; (5) the Company’s ability to successfully identify and complete acquisitions in line with its Vision 2022 and effectively operate and integrate acquired businesses to realize the anticipated benefits of those acquisitions; (5) the Company’s ability to realize expected cost savings and efficiencies from its performance improvement and other optimization initiatives; (6) the Company’s ability to effectively compete in its markets, and to successfully develop new and competitive products that appeal to its customers; (7) changes in consumer preferences and demand for the Company’s products or a decline in consumer confidence and spending; (8) the Company’s ability to benefit from its investments in assets and human capital and the ability to complete projects successfully and on budget; (9) economic, regulatory and political risks associated with the Company’s international operations, most notably Mexico and China; (10) volatility and increases in the price of raw materials, energy and transportation, and fluctuations in the quality and availability of raw materials and process aids; (11) the impact of a disruption in the Company’s supply chain or its relationship with its suppliers; (12) the Company’s ability to comply with, and the costs associated with compliance with, U.S. and foreign environmental protection laws; (13) the Company’s ability to meet quality and regulatory standards in different jurisdictions in which it has operations or conducts business and (14) the Company’s ability to consummate the acquisition of Novel Ingredients and to achieve the benefits anticipated from such acquisition. We caution you to consider the important risks and other factors as set forth in the forward-looking statements section and in Item 1A Risk Factors in our most recent Annual Report on Form 10-K, as amended by subsequent reports on Forms 10-Q and 8-K. We do not undertake to update the forward-looking statements to reflect the impact of circumstances or events that may arise after the date of the forward-looking statements. Regulation G: Adjusted Results The information presented herein regarding certain unaudited adjusted results does not conform to generally accepted accounting principles in the U.S. (U.S. GAAP). Innophos has included this non-GAAP information to assist in understanding the operating performance of the company and its reporting segments. Please see reconciliations to the most directly comparable financial measure prescribed by U.S. GAAP in the appendix. Totals in this presentation may not foot due to rounding.

Kim Ann Mink, Ph.D. Chairman, President and Chief Executive Officer Han Kieftenbeld SVP and Chief Financial Officer Agenda Novel Ingredients Acquisition Q&A Novel Ingredients Acquisition | August 1, 2017

Novel Brings Growth And Complementary Capabilities Innophos announces definitive agreement to acquire Novel Ingredients + Creates nearly $0.5 billion Food, Health and Nutrition (FHN) platform; 60% of total Company sales Advances Vision 2022 growth strategy and enhances innovation Expands Innophos’ offering in high-growth Nutrition end-markets Expected to deliver attractive cost and tax synergies of ~$15 million Prudently financed using existing cost effective credit facility Novel Ingredients Acquisition and Earnings Conference Call Second Quarter 2017 | August 1, 2017

VITAL INGREDIENTS Novel Is A Strong Fit With Our Purpose To provide vital ingredients for the nutrition and health of those around us, leveraging science and technology in partnership with our customers and informed by consumer trends, with a view to create value for our stakeholders. “ ” Food Health Nutrition

A leading specialty ingredients solutions provider to Food, Health and Nutrition end-markets Selective added value player in industrial specialties applications Best-in-class practices, agile supply chain and cost effective operations Aligned with consumer trends and partner of choice through vital solutions and systems Novel Advances Our Vision 2022 On All Strategic Aspects

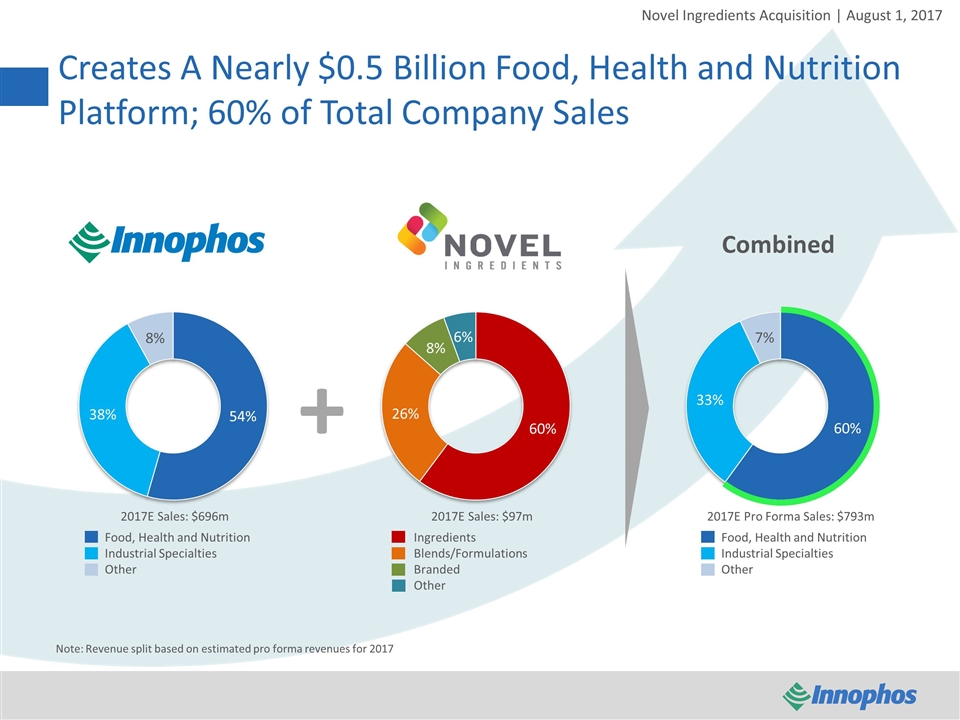

Creates A Nearly $0.5 Billion Food, Health and Nutrition Platform; 60% of Total Company Sales + Note: Revenue split based on estimated pro forma revenues for 2017 Food, Health and Nutrition Industrial Specialties Other Ingredients Blends/Formulations Branded Other Food, Health and Nutrition Industrial Specialties Other Combined 2017E Sales: $696m 2017E Sales: $97m 2017E Pro Forma Sales: $793m

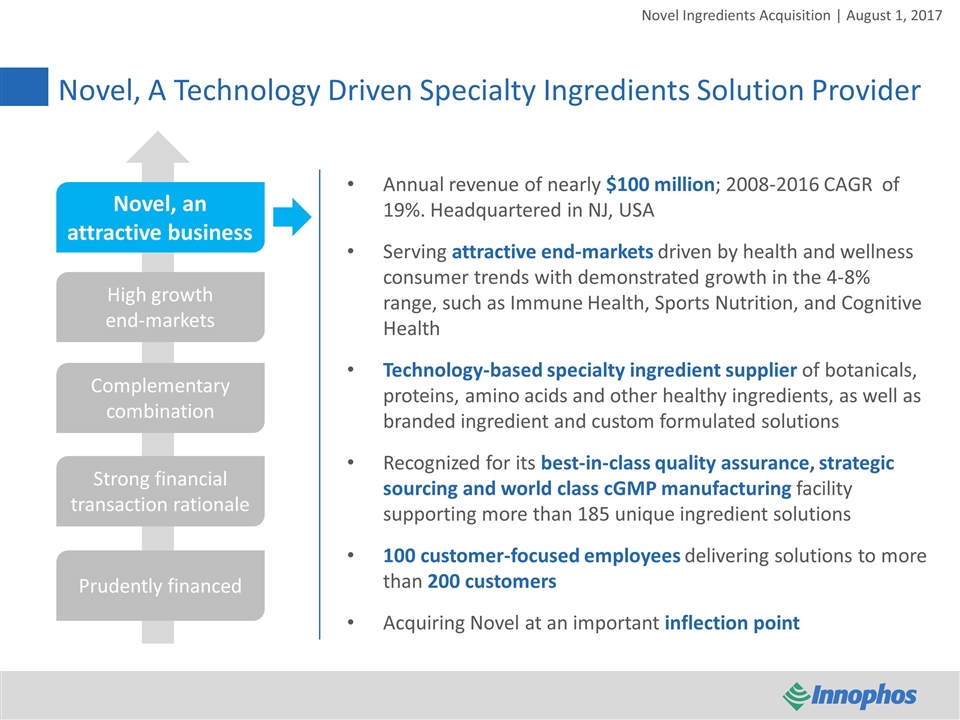

Novel, A Technology Driven Specialty Ingredients Solution Provider High growth end-markets Complementary combination Strong financial transaction rationale Prudently financed Annual revenue of nearly $100 million; 2008-2016 CAGR of 19%. Headquartered in NJ, USA Serving attractive end-markets driven by health and wellness consumer trends with demonstrated growth in the 4-8% range, such as Immune Health, Sports Nutrition, and Cognitive Health Technology-based specialty ingredient supplier of botanicals, proteins, amino acids and other healthy ingredients, as well as branded ingredient and custom formulated solutions Recognized for its best-in-class quality assurance, strategic sourcing and world class cGMP manufacturing facility supporting more than 185 unique ingredient solutions 100 customer-focused employees delivering solutions to more than 200 customers Acquiring Novel at an important inflection point Novel, an attractive business

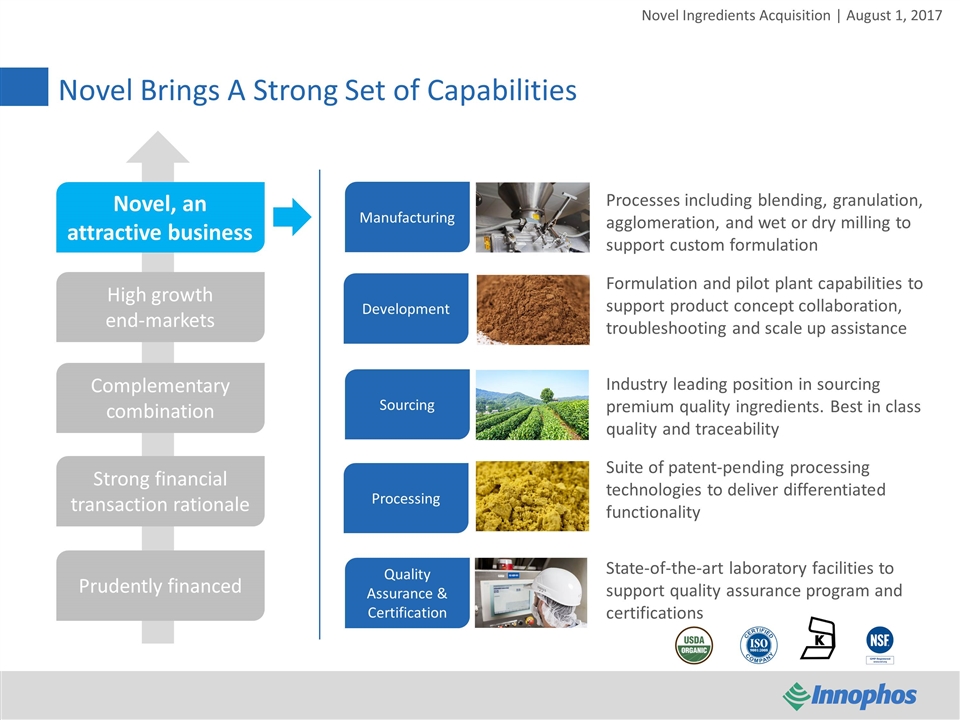

Novel Brings A Strong Set of Capabilities High growth end-markets Complementary combination Strong financial transaction rationale Prudently financed Novel, an attractive business Manufacturing Development Sourcing Processing Quality Assurance & Certification Processes including blending, granulation, agglomeration, and wet or dry milling to support custom formulation Formulation and pilot plant capabilities to support product concept collaboration, troubleshooting and scale up assistance Industry leading position in sourcing premium quality ingredients. Best in class quality and traceability Suite of patent-pending processing technologies to deliver differentiated functionality State-of-the-art laboratory facilities to support quality assurance program and certifications

More Closely Aligned With Consumer Megatrends High growth end-markets Complementary combination Strong financial transaction rationale Prudently financed Novel, an attractive business Health and Wellness Energized Ageing Convenience and Time Effectiveness Protection and Preservation Clean Label/Greener Food Sustainability

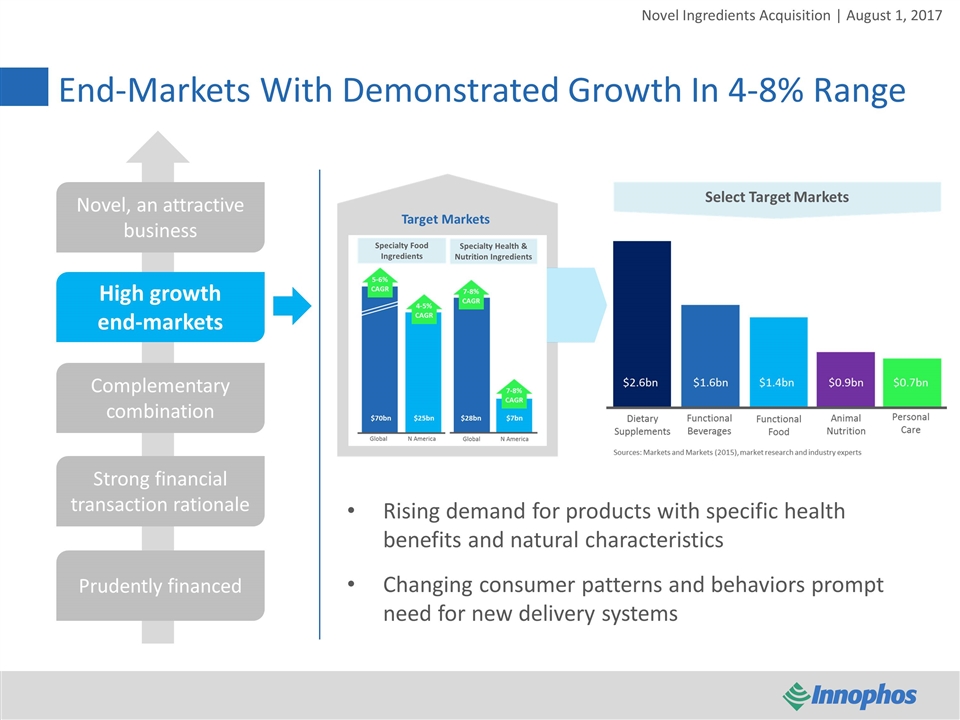

End-Markets With Demonstrated Growth In 4-8% Range High growth end-markets Complementary combination Strong financial transaction rationale Prudently financed Novel, an attractive business Rising demand for products with specific health benefits and natural characteristics Changing consumer patterns and behaviors prompt need for new delivery systems

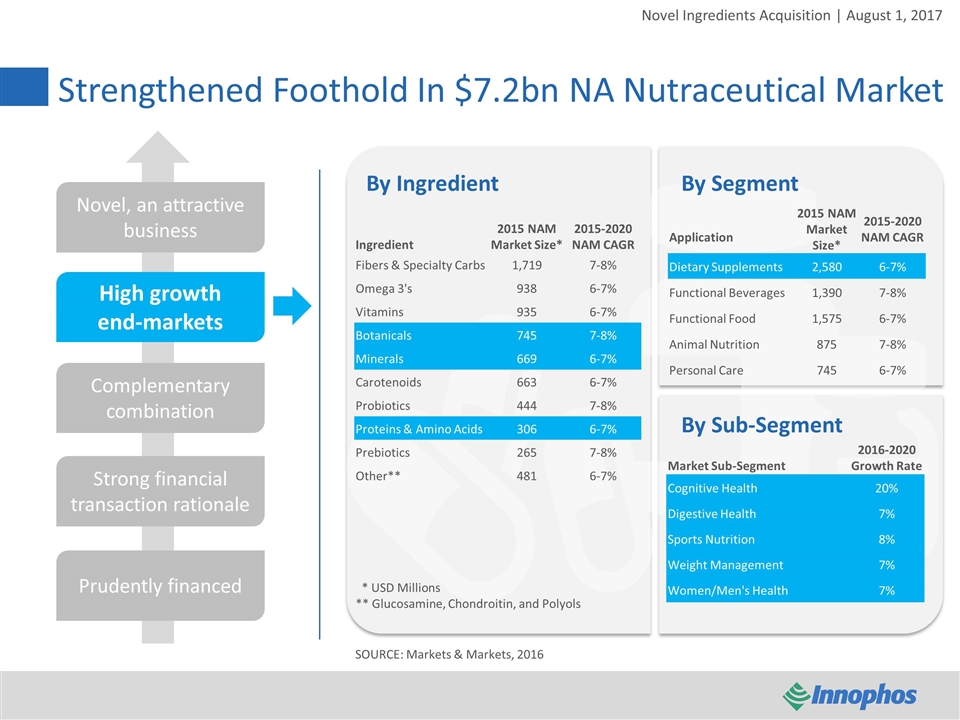

Strengthened Foothold In $7.2bn NA Nutraceutical Market High growth end-markets Complementary combination Strong financial transaction rationale Prudently financed Novel, an attractive business SOURCE: Markets & Markets, 2016 Application 2015 NAM Market Size* 2015-2020 NAM CAGR Dietary Supplements 2,580 6-7% Functional Beverages 1,390 7-8% Functional Food 1,575 6-7% Animal Nutrition 875 7-8% Personal Care 745 6-7% Ingredient 2015 NAM Market Size* 2015-2020 NAM CAGR Fibers & Specialty Carbs 1,719 7-8% Omega 3's 938 6-7% Vitamins 935 6-7% Botanicals 745 7-8% Minerals 669 6-7% Carotenoids 663 6-7% Probiotics 444 7-8% Proteins & Amino Acids 306 6-7% Prebiotics 265 7-8% Other** 481 6-7% * USD Millions ** Glucosamine, Chondroitin, and Polyols Market Sub-Segment 2016-2020 Growth Rate Cognitive Health 20% Digestive Health 7% Sports Nutrition 8% Weight Management 7% Women/Men's Health 7% By Ingredient By Segment By Sub-Segment

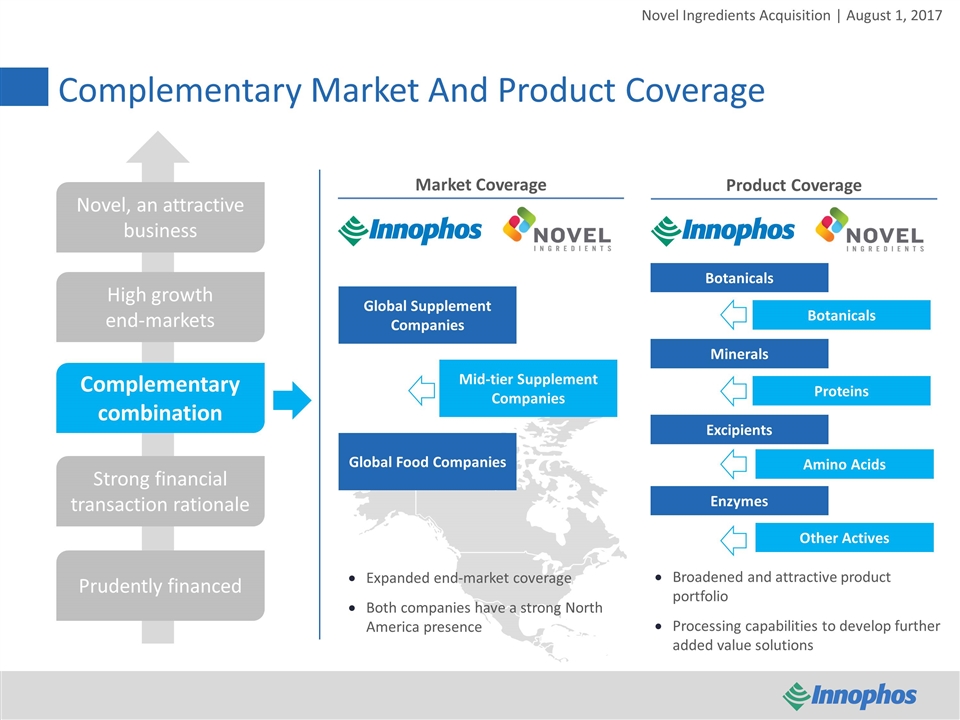

Complementary Market And Product Coverage High growth end-markets Complementary combination Strong financial transaction rationale Prudently financed Novel, an attractive business Global Supplement Companies Mid-tier Supplement Companies Global Food Companies Market Coverage Botanicals Minerals Excipients Enzymes Botanicals Proteins Amino Acids Other Actives Product Coverage Broadened and attractive product portfolio Processing capabilities to develop further added value solutions Expanded end-market coverage Both companies have a strong North America presence

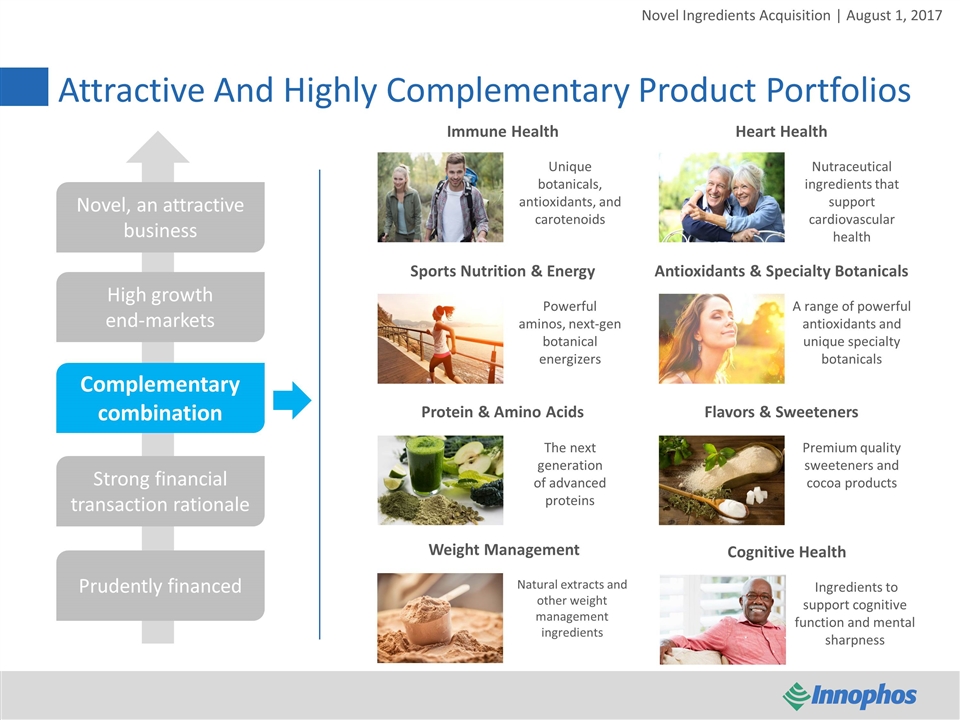

Attractive And Highly Complementary Product Portfolios High growth end-markets Complementary combination Strong financial transaction rationale Prudently financed Novel, an attractive business Immune Health Heart Health Sports Nutrition & Energy Antioxidants & Specialty Botanicals Protein & Amino Acids Flavors & Sweeteners Cognitive Health Weight Management Unique botanicals, antioxidants, and carotenoids Nutraceutical ingredients that support cardiovascular health Powerful aminos, next-gen botanical energizers A range of powerful antioxidants and unique specialty botanicals Ingredients to support cognitive function and mental sharpness The next generation of advanced proteins Premium quality sweeteners and cocoa products Natural extracts and other weight management ingredients

Novel Brings Strong Portfolio Of Branded Products High growth end-markets Complementary combination Strong financial transaction rationale Prudently financed Novel, an attractive business Kinetiq™ Cera-Q™ Acumin™ QU995™ PhysiCor™ A next-gen, natural citrus aurantium extract clinically demonstrated to deliver resistance training performance benefits safely and without stimulants First of its kind, patented turmeric complex providing a range of naturally occurring turmeric root nutrients Dual-path plant extract clinically demonstrated to reduce body fat while increasing lean mass and strength Protein hydrolysate ingredient derived from a silk fibroin delivering a range of cognitive health benefits The most advanced quercetin offering on the market with unsurpassed purity and superior absorption

Sharing A Strong And Diverse Customer Base High growth end-markets Complementary combination Strong financial transaction rationale Prudently financed Novel, an attractive business Opportunity to leverage combined portfolio and grow customer base Innophos has longstanding relationships with market leading food and health customers where Novel has limited presence; opportunity to cross-sell and develop new offerings Develop innovative, technology-based ingredient solutions using combined product portfolios and processing capabilities Existing products and joint development provides potential access to new adjacencies

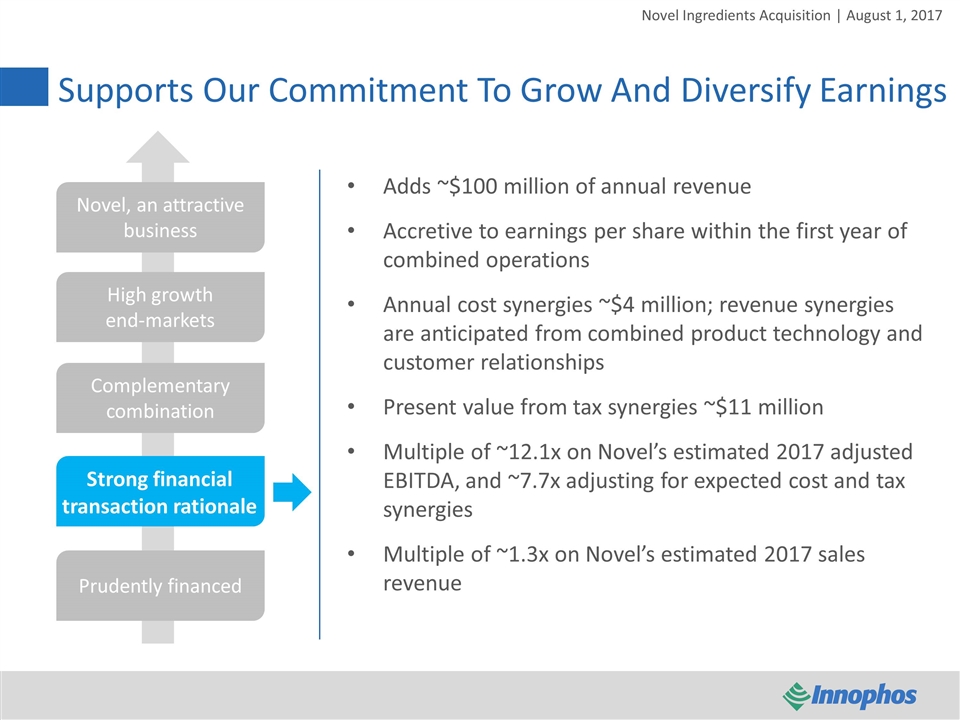

Supports Our Commitment To Grow And Diversify Earnings High growth end-markets Complementary combination Prudently financed Novel, an attractive business Strong financial transaction rationale Adds ~$100 million of annual revenue Accretive to earnings per share within the first year of combined operations Annual cost synergies ~$4 million; revenue synergies are anticipated from combined product technology and customer relationships Present value from tax synergies ~$11 million Multiple of ~12.1x on Novel’s estimated 2017 adjusted EBITDA, and ~7.7x adjusting for expected cost and tax synergies Multiple of ~1.3x on Novel’s estimated 2017 sales revenue

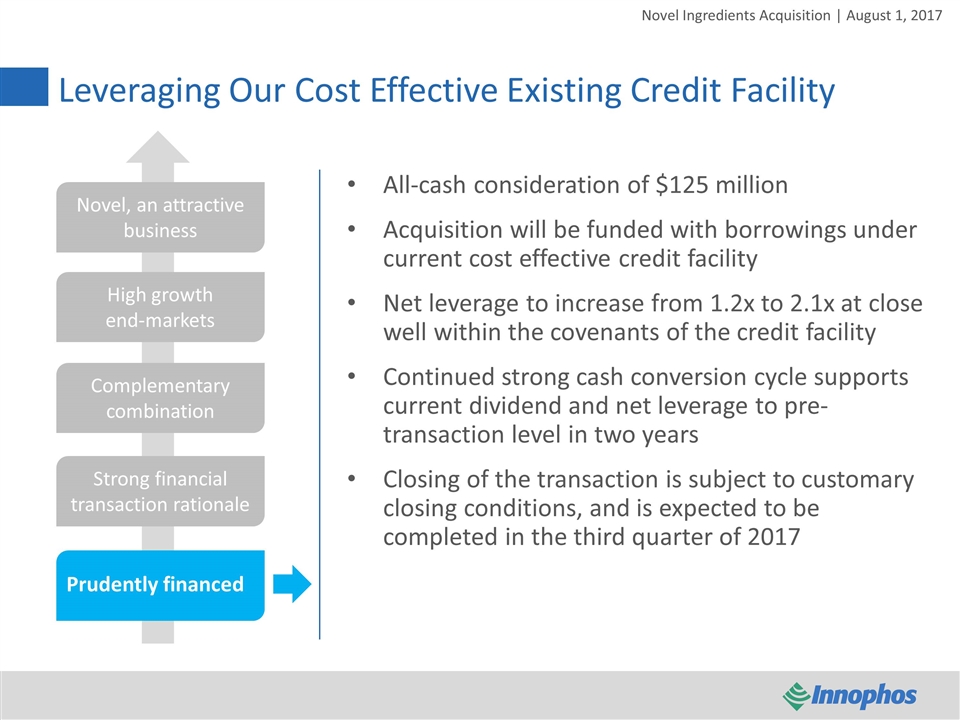

Leveraging Our Cost Effective Existing Credit Facility High growth end-markets Complementary combination Novel, an attractive business All-cash consideration of $125 million Acquisition will be funded with borrowings under current cost effective credit facility Net leverage to increase from 1.2x to 2.1x at close well within the covenants of the credit facility Continued strong cash conversion cycle supports current dividend and net leverage to pre-transaction level in two years Closing of the transaction is subject to customary closing conditions, and is expected to be completed in the third quarter of 2017 Strong financial transaction rationale Prudently financed

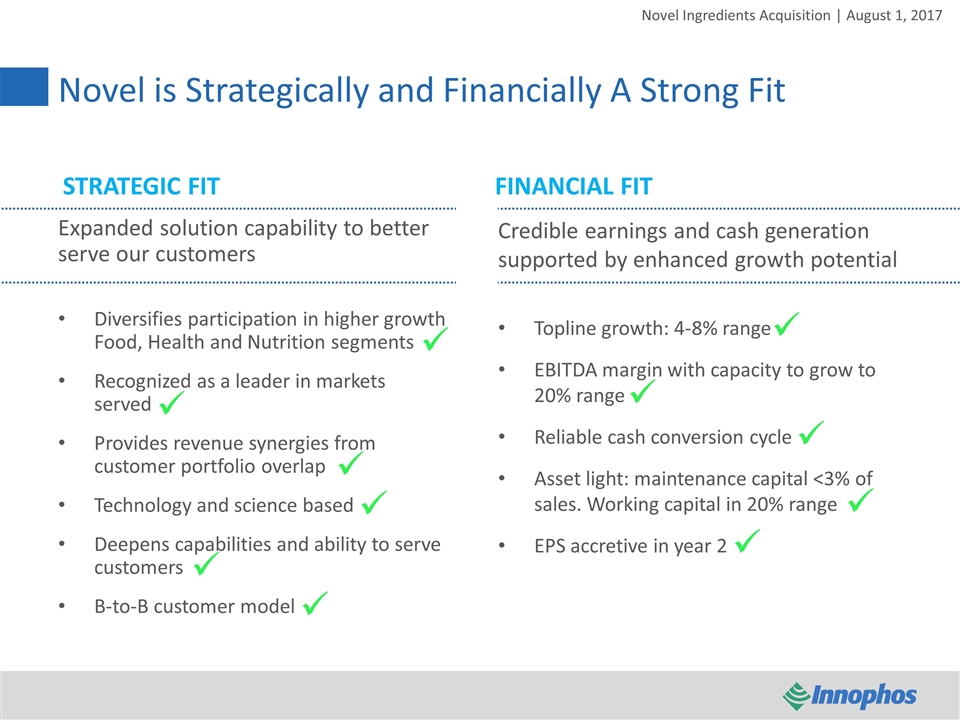

Novel is Strategically and Financially A Strong Fit STRATEGIC FITFINANCIAL FIT Expanded solution capability to better serve our customers Diversifies participation in higher growth Food, Health and Nutrition segments Recognized as a leader in markets served Provides revenue synergies from customer portfolio overlap Technology and science based Deepens capabilities and ability to serve customers B-to-B customer model Credible earnings and cash generation supported by enhanced growth potential Topline growth: 4-8% range EBITDA margin with capacity to grow to 20% range Reliable cash conversion cycle Asset light: maintenance capital <3% of sales. Working capital in 20% range EPS accretive in year 2

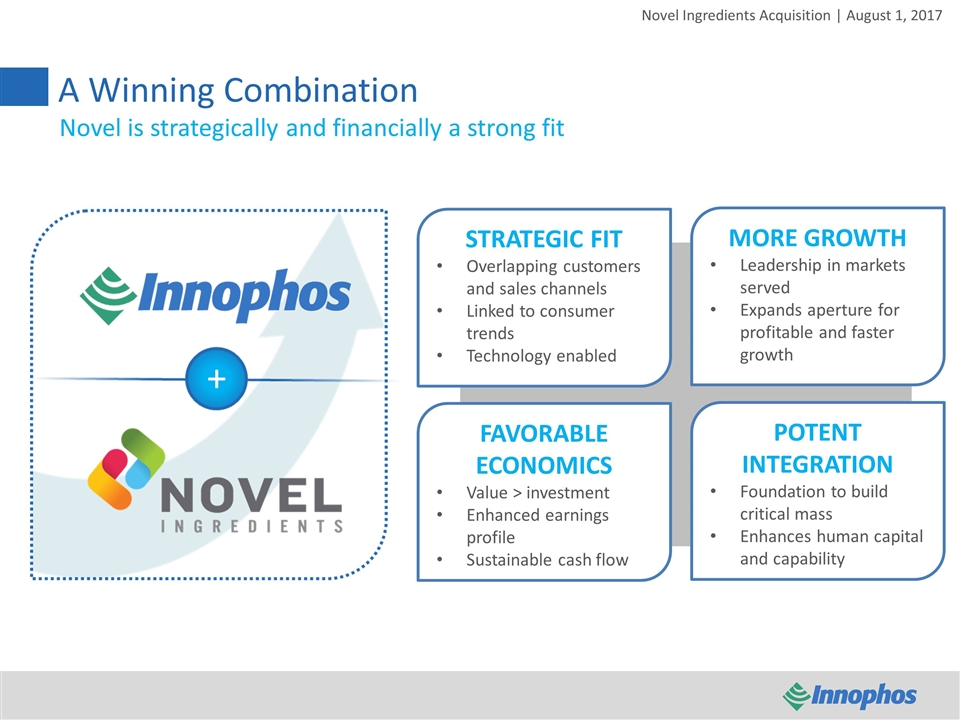

A Winning Combination STRATEGIC FIT Overlapping customers and sales channels Linked to consumer trends Technology enabled MORE GROWTH Leadership in markets served Expands aperture for profitable and faster growth FAVORABLE ECONOMICS Value > investment Enhanced earnings profile Sustainable cash flow POTENT INTEGRATION Foundation to build critical mass Enhances human capital and capability Novel is strategically and financially a strong fit

Q2 2017 EARNINGS CALL and NOVEL INGREDIENTS ACQUISITION August 1, 2017 – 9:00 am ET Q&A

ABOUT THE COMPANY Innophos (NASDAQ: IPHS) is a leading international producer of specialty ingredient solutions that deliver far-reaching, versatile benefits for the food, health, nutrition and industrial markets. We leverage our expertise in the science and technology of blending and formulating phosphate, mineral and botanical based ingredients to help our customers offer products that are tasty, healthy, nutritious and economical. Headquartered in Cranbury, New Jersey, Innophos has manufacturing operations across the United States, in Canada, Mexico and China. For more information please visit www.innophos.com CONTACT Investors: Mark Feuerbach, 609-366-1204 or investor.relations@innophos.com Media: Ryan Flaim, Sharon Merrill Associates, 617-542-5300 or iphs@investorrelations.com