Attached files

| file | filename |

|---|---|

| EX-31.1 - EXHIBIT 31.1 - FLOTEK INDUSTRIES INC/CN/ | exhibit311-10q06302017.htm |

| EX-32.1 - EXHIBIT 32.1 - FLOTEK INDUSTRIES INC/CN/ | exhibit321-10q06302017.htm |

| EX-31.2 - EXHIBIT 31.2 - FLOTEK INDUSTRIES INC/CN/ | exhibit312-10q06302017.htm |

| EX-32.2 - EXHIBIT 32.2 - FLOTEK INDUSTRIES INC/CN/ | exhibit322-10q06302017.htm |

| 10-Q - 10-Q - FLOTEK INDUSTRIES INC/CN/ | ftk_2017063010q.htm |

Exhibit 10.2

Execution Version

ASSET PURCHASE AGREEMENT

by and among NATIONAL OILWELL DHT, L.P., DRECO ENERGY SERVICES ULC,

NATIONAL OILWELL VARCO, L.P., acting through its general partner, NOW Oilfield Services, LLC, with branch operations established in Jebel Ali Free Zone, United Emirates, namely “National-Oilwell Varco, L.P.”,

TELEDRIFT COMPANY, TURBECO, INC.,

FLOTEK TECHNOLOGIES ULC, FLOTEK INDUSTRIES FZE, AND

FLOTEK INDUSTRIES, INC.

Dated as of May 2, 2017

Contents

ARTICLE I DEFINITIONS ...........................................................................................................1

ARTICLE II PURCHASE AND SALE.......................................................................................12

Section 2.01 Purchase and Sale. ..............................................................................................12

Section 2.02 Assumed Obligations.. ........................................................................................14

Section 2.03 Excluded Liabilities. ...........................................................................................14

Section 2.04 Non-Assignable Contracts. .................................................................................16

Section 2.05 Purchase Price. ....................................................................................................16

Section 2.06 [Reserved] ...........................................................................................................16

Section 2.07 Determination of Inventory and Holdback Amount. ..........................................16

Section 2.08 Allocation............................................................................................................19

ARTICLE III CLOSING .............................................................................................................21

Section 3.01 Time and Place of Closing. .................................................................................21

Section 3.02 Closing Deliveries of Sellers. .............................................................................21

Section 3.03 Closing Deliveries of Buyers. .............................................................................22

Section 3.04 Release of Encumbrances. ..................................................................................23

ARTICLE IV COVENANTS.......................................................................................................23

Section 4.01 Interim Covenants. ..............................................................................................23

Section 4.02 Access to Information. ........................................................................................24

Section 4.03 Notice of Certain Events. ....................................................................................24

Section 4.04 Restrictive Covenants. ........................................................................................25

Section 4.05 Public Announcements. ......................................................................................27

Section 4.06 Bulk Sales Laws..................................................................................................27

Section 4.07 Release of Certain Past Claims and Dismissal of Pending Litigation. ...............27

Section 4.08 Receipt of Certain Payments...............................................................................28

Section 4.09 Retrieval of the Purchased Assets. ......................................................................28

ARTICLE V CONDITIONS TO CLOSING ...............................................................................29

Section 5.01 Conditions to Obligations of All Parties. ............................................................29

i

Section 5.02 Conditions to Obligations of Buyers. .................................................................29

Section 5.03 Conditions to Obligations of Sellers and Flotek. ................................................29

ARTICLE VI REPRESENTATIONS AND WARRANTIES OF SELLERS AND

FLOTEK .............................................................................................................30

Section 6.01 Organization and Existence. ...............................................................................30

Section 6.02 Title. ....................................................................................................................31

Section 6.03 Authority; Authorization of Agreement..............................................................31

Section 6.04 Consents and Approvals; No Violation. .............................................................31

Section 6.05 Financial Statements. ..........................................................................................31

Section 6.06 Absence of Certain Changes. ..............................................................................32

Section 6.07 Litigation.............................................................................................................32

Section 6.08 Compliance with Laws and Orders.. ...................................................................32

Section 6.09 Labor and Employment Matters. ........................................................................32

Section 6.10 Intellectual Property. ...........................................................................................33

Section 6.11 Customers and Suppliers.....................................................................................33

Section 6.12 Environmental Matters........................................................................................34

Section 6.13 Taxes. ..................................................................................................................35

Section 6.14 Real Property. .....................................................................................................37

Section 6.15 Certain Payments. ...............................................................................................39

Section 6.16 Product Warranties and Liabilities......................................................................40

Section 6.17 Inventory. ............................................................................................................40

Section 6.18 Condition and Sufficiency. .................................................................................41

Section 6.19 Assigned Contracts. ............................................................................................41

Section 6.20 Brokers.. ..............................................................................................................41

ARTICLE VII REPRESENTATIONS AND WARRANTIES OF BUYERS ............................42

Section 7.01 Organization and Existence. ...............................................................................42

Section 7.02 Authority; Authorization of Agreement..............................................................42

Section 7.03 Consents and Approvals; No Violations.............................................................42

Section 7.04 Litigation.. ...........................................................................................................42

Section 7.05 Brokers. ...............................................................................................................42

ii

ARTICLE VIII TAX MATTERS ................................................................................................43

Section 8.01 Transfer Taxes.. ..................................................................................................43

Section 8.02 Property Taxes. ...................................................................................................43

Section 8.03 Canada Taxes. .....................................................................................................43

Section 8.04 Payments by NOV. .............................................................................................44

ARTICLE IX INDEMNIFICATION ...........................................................................................44

Section 9.01 Survival. ..............................................................................................................44

Section 9.02 Indemnification by Sellers and Flotek. ...............................................................44

Section 9.03 Indemnification by Buyers..................................................................................45

Section 9.04 Procedures. ..........................................................................................................45

Section 9.05 Limitation on Liability of Sellers and Flotek......................................................47

Section 9.06 Limitation on Liability of Buyers. ......................................................................48

Section 9.07 Express Negligence; Limitation on Defense to Certain Claims. ........................48

Section 9.08 Exclusive Remedy. .............................................................................................48

ARTICLE X TERMINATION.....................................................................................................49

Section 10.01 Termination.........................................................................................................49

Section 10.02 Effect of Termination..........................................................................................50

ARTICLE XI MISCELLANEOUS..............................................................................................50

Section 11.01 Notices. ...............................................................................................................50

Section 11.02 Assignment. ........................................................................................................51

Section 11.03 Further Assurances..............................................................................................51

Section 11.04 Expenses.. ...........................................................................................................51

Section 11.05 Severability .........................................................................................................51

Section 11.06 Entire Agreement. ...............................................................................................51

Section 11.07 Amendment and Waiver. ....................................................................................51

Section 11.08 Binding Effect. ....................................................................................................51

Section 11.09 Governing Law; Venue; Jurisdiction ..................................................................51

Section 11.10 No Third-Party Beneficiaries. .............................................................................52

Section 11.11 Rules of Construction. ........................................................................................52

Section 11.12 Specific Performance. .........................................................................................53

iii

Section 11.13 Counterparts. .......................................................................................................53

Section 11.14 Sellers’ Representative........................................................................................53

Section 11.15 Buyers’ Representative. ......................................................................................53

Section 11.16 Definitions...........................................................................................................54

SCHEDULES

Section 2.01(a)(i) Purchased Assets – Tangible Personal Property

Section 2.01(a)(ii) Purchased Assets – Motor Vehicles

Section 2.01(a)(iii) Purchased Assets – Assigned Contracts

Section 2.01(a)(iv) Purchased Assets – Assigned Permits

Section 2.01(a)(v) Purchased Assets – Sellers’ Owned Real Property

Section 2.01(a)(vi) Purchased Assets – Sellers’ Intellectual Property

Section 2.05(a) Sellers’ Bank Account Section 6.04 Consents and Approvals Section 6.05 Financial Statements

Section 6.06 Absence of Certain Changes

Section 6.07 Litigation

Section 6.09(a) Employment Contracts

Section 6.10 Sellers’ Intellectual Property

Section 6.11(a) Top Ten Customers Section 6.11(b) Top Ten Suppliers Section 6.12 Environmental Matters

Section 6.13(a) Tax Returns, Liens and Rulings

Section 6.14(b) Real Property Encumbrances

Section 6.16 Product Warranties and Liabilities Section 6.19 Consents under Assigned Contracts Section 6.20 Brokers

EXHIBITS

Exhibit A Bill of Sale

Exhibit B Intellectual Property Assignment

Exhibit C Deeds

Exhibit D Stipulation of Dismissal of Action Without Prejudice

Exhibit E Transition Services Agreement

iv

ASSET PURCHASE AGREEMENT

This Asset Purchase Agreement (this “Agreement”) is dated May 2, 2017, by and among National Oilwell DHT, L.P., a Delaware limited partnership (“NOV US”), Dreco Energy Services ULC, an Alberta corporation (“NOV Canada”), and National Oilwell Varco, L.P., a Delaware limited partnership, formed and existing under the laws of the State of Delaware, with principal offices at 7909 Parkwood Circle Drive, Houston, Texas

77036, acting through its general partner, NOW Oilfield Services, LLC, with branch

operations established in Jebel Ali Free Zone, United Arab Emirates, namely NATIONAL- OILWELL VARCO, L.P., registered with Jebel Ali Free Zone Commercial Registry Dept. under Registration No. OVR-1537, represented herein by NOW Oilfield Services, LLC’s Vice President, Brigitte M. Hunt (“NOV FZE,” and each of NOV US, NOV Canada and NOV FZE, a “Buyer” and together, “Buyers”), Teledrift Company, a Delaware corporation (“Teledrift”), Turbeco, Inc., a Texas corporation (“Turbeco”), Flotek Technologies ULC, an Alberta corporation (“Flotek ULC”), and Flotek Industries FZE, a Jebel Ali Free Zone entity with registration no. 115643 (“Flotek FZE,” and each of Teledrift, Turbeco, Flotek ULC and Flotek FZE, a “Seller,” and together, the “Sellers”), and Flotek Industries, Inc., a Delaware corporation (“Flotek”). Buyers, Sellers and Flotek are each a “Party” and are collectively, the “Parties.”

RECITALS

WHEREAS, upon the terms set forth herein, Sellers desire to sell to Buyers, and Buyers desire to purchase from Sellers, the Purchased Assets (as defined herein), pursuant to the terms and conditions of this Agreement, but excluding certain assets and Liabilities as described in this Agreement.

NOW, THEREFORE, in consideration of the premises, the mutual covenants contained herein and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties hereto agree as follows:

ARTICLE I DEFINITIONS

The following terms have the meanings specified or referred to in this Article I:

“2016 Financial Statements” has the meaning set forth in Section 6.05.

“Accountants” has the meaning set forth in Section 2.07(b)(iv).

“Affiliate(s)” means, with respect to a specified Person, (a) any Person that, directly or indirectly, through one or more intermediaries, controls, is controlled by, or is under common control with the Person specified or (b) if such Person is an individual, any spouse of such individual, or any relative of such Person or of such spouse (such relative being related to the individual in question within the second degree). For purposes of this definition, “control” (including “controlling”, “controlled by” and “under common control with”) means the possession, direct or indirect, or the power to direct or cause the direction

1

of the management and policies of a Person, whether through the ownership of voting securities, by contract or otherwise.

“Agreement” has the meaning set forth in the preamble.

“Allocation” has the meaning set forth in Section 2.08(a).

“Assigned Contracts” has the meaning set forth in Section 2.01(a)(ii).

“Assigned Leases” has the meaning set forth in Section 3.02(h).

“Assumed Obligations” has the meaning set forth in Section 2.02.

“Assumption Notice” has the meaning set forth in Section 9.04(b).

“Balance Sheet Date” has the meaning set forth in Section 6.05.

“Benefit Plans” includes all “employee benefit plans” (as defined in Section 3(3) of ERISA), “multiemployer plans” (as defined in Section 3(37) of ERISA), simplified employee pension, deferred compensation, incentive compensation, stock bonus, stock option, restricted stock, cash bonus, employee stock ownership, severance pay, golden parachute, cafeteria, flexible compensation, life insurance, or vacation plans or arrangements of any kind and any other employee benefit plans, programs or arrangements maintained by Sellers or Flotek or any Commonly Controlled Entities.

“Bill of Sale” has the meaning set forth in Section 3.02(d).

“Business” means the business activities of Sellers as of the Closing Date of designing, manufacturing, assembling, selling, servicing, renting or providing measurement while drilling (MWD) tools, downhole drilling tools, casing accessories, or other tools or products that perform substantially the same function in the oil and gas industry on a global basis.

“Business Day” means any day that is not a Saturday, Sunday or legal holiday in the State of Texas and that is not otherwise a federal holiday in the United States.

“Business Employee” has the meaning set forth in Section 4.04(b).

“Business Facility” or “Business Facilities” means Sellers’ Owned Real Property and Sellers’ Leased Real Property.

“Buyer” and “Buyers” have the meaning set forth in the preamble.

“Buyers’ Closing Certificate” has the meaning set forth in Section 5.03(d).

2

“Buyers’ Indemnified Persons” has the meaning set forth in Section 9.02.

“Buyers’ Representative” has the meaning set forth in Section 11.15.

“Claim” or “Claims” means claims, actions, causes of action, demands, filings, investigations, proceedings, arbitrations, mediations, suits or other legal or administrative Proceedings, whether civil or criminal or based on negligence, trespass, intentional tort, strict liability, contribution or indemnification, common or decisional law, federal or state statute or local ordinance or otherwise, and whether any of the foregoing is the result of a third-party claim, Government Authority claim, or a claim by either Buyers or Sellers.

“Closing” has the meaning set forth in Section 3.01.

“Closing Date” has the meaning set forth in Section 3.01.

“Closing Date Inventory” has the meaning set forth in Section 2.07(b)(i).

“Closing Date Inventory Adjustment Amount” means the Closing Date Inventory Excess, expressed as a positive number, or the Closing Date Inventory Deficiency, expressed as a negative number, as applicable, as reflected in the Closing Statement.

“Closing Date Inventory Deficiency has the meaning set forth in Section 2.07(b)(i).

“Closing Date Inventory Excess” has the meaning set forth in Section 2.07(b)(i).

“Closing Date Payment” has the meaning set forth in Section 2.05(a).

“Closing Statement” has the meaning set forth in Section 2.07(b)(i).

“Closing Statement Submission Deadline” has the meaning set forth in Section

2.07(b)(iv).

“Code” means the Internal Revenue Code of 1986, as amended.

“Commonly Controlled Entity” means any entity (whether or not incorporated) which is a member of a controlled group that includes a Seller or which is under common control with a Seller within the meaning of Sections 414(b), (c), (m) or (o) of the Code.

“Contract” means any agreement, lease, license or contract, or other legally binding commitment, whether written or oral.

“Customs & International Trade Laws” means any law, statute, executive order, regulation, rule, permit, license, directive, ruling, Order, decree, ordinance, award, or other

3

decision or requirement having the force or effect of law, of any arbitrator, court, government or government agency or instrumentality (domestic or foreign), concerning the importation of merchandise, the export or re-export of products (including technology and services), the terms and conduct of international transactions, and making or receiving international payments, including but not limited to the Tariff Act of 1930, as amended, and other laws and programs administered or enforced by the U.S. Customs and Border Protection, the U.S. Immigration and Customs Enforcement, and their predecessor agencies, the Export Administration Act of 1979, as amended, the Export Administration Regulations, the International Emergency Economic Powers Act, as amended, the Arms Export Control Act, the International Traffic in Arms Regulations, any other export controls administered by an agency of the United States government, the Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism Act of 2001 (“USA Patriot Act”), Executive Orders of the President regarding embargoes and restrictions on transactions with designated entities (including countries, terrorists, organizations and individuals), the embargoes and restrictions administered by the United States Office of Foreign Assets Control, the Money Laundering Control Act of

1986, as amended, requirements for the marking of imported merchandise, prohibitions or restrictions on the importation of merchandise made with the use of slave or child labor, the Foreign Corrupt Practices Act, as amended, the anti-boycott regulations administered by the United States Department of Commerce, the anti-boycott regulations administered by the United States Department of the Treasury, legislation and regulations of the United States and other countries implementing the North American Free Trade Agreement and other free trade agreements to which the United States is a party, antidumping and countervailing duty laws and regulations, and laws and regulations adopted by the governments or agencies of other countries concerning the ability of U.S. Persons to own businesses or conduct business in those countries, restrictions by other countries on holding foreign currency or repatriating funds, or otherwise relating to the same subject matter as the United States statutes and regulations described above.

“Disclosure Schedules” means the schedules attached hereto.

“Dollars” and “$” mean the lawful currency of the United States.

“Duty” means any stamp, transaction or registration duty or similar charged imposed by any Government Authority and includes any interest, fine, penalty, charge or other amount imposed with respect to the foregoing.

“Encumbrance” means any mortgage, pledge, assessment, security interest, lease, lien, adverse claims, levy, charge, option, right of first refusal, charge, debenture, indenture, deed of trust, easement, right-of-way, restriction, encroachment, license, lease, security agreement or other encumbrance of any kind or nature.

4

“Environmental Law” means any applicable federal, state, local or foreign law, statute, ordinance, rule, regulation, code, Permit, legal doctrine, guidance document, order, consent agreement, order or consent judgment, decree, injunction, judicial decision, or other Law of any Government Authority relating to health or safety, Materials of Environmental Concern, pollution, or the protection of the environment (including, without limitation, indoor or ambient air, water, vapor, surface water, groundwater, drinking water supply, surface land, subsurface land, plant and animal life or any other natural resource). The term “Environmental Law” includes, without limitation, the federal Comprehensive Environmental Response Compensation and Liability Act of 1980, the Superfund Amendments and Reauthorization Act, the federal Water Pollution Control Act of 1972, the federal Clean Air Act, the federal Clean Water Act, the federal Resource Conservation and Recovery Act of 1976 (including the Hazardous and Solid Waste Amendments thereto), the federal Toxic Substances Control Act, the Federal Insecticide, Fungicide and Rodenticide Act, the federal Safe Drinking Water Act and the federal Occupational Safety and Health Act of 1970, any regulations promulgated pursuant thereto, and any state or local analogues thereof, each as amended from time to time.

“Environmental Liabilities” means any Claims or Liabilities relating to: (i) any violation of, actual or potential liability under, or noncompliance with, any Environmental Law; (ii) improper use or treatment of wetlands or other protected land or wildlife; (iii) noise; (iv) radioactive materials (including naturally occurring radioactive materials; (v) explosives; (vi) pollution, contamination, preservation, protection, decontamination, or clean-up of, or Environmental Response to, the air, surface water, groundwater, soil or protected lands; (vii) the generation, handling, discharge, release, threatened release, treatment, storage, disposal or transportation of Materials of Environmental Concern; (viii) exposure of persons or property to Materials of Environmental Concern and the effects thereof; (ix) the release or threatened release (into the indoor or outdoor environment), generation, extraction, mining, beneficiating, manufacture, processing, distribution in commerce, use, transfer, transportation, treatment, storage, or disposal of, or Environmental Response to, Materials of Environmental Concern; (x) injury to, death of or threat to the health or safety of, any person or persons caused directly or indirectly by Materials of Environmental Concern; (xi) damage or destruction to real or personal property caused directly or indirectly by Materials of Environmental Concern or the release or threatened release of any Materials of Environmental Concern; (xii) community right- to-know and other disclosure laws relating to Materials of Environmental Concern or Environmental Laws; or (xiii) maintaining, disclosing, or reporting information to Government Authorities or any other third person under any Environmental Law. Further, the term, “Environmental Liabilities” also includes, without limitation, any Losses incurred in connection with any investigation to determine whether Environmental Response is required or for breach or violation of any requirements of Environmental Laws; monitoring or responding to efforts to require Environmental Response, and any claim based upon any asserted or actual breach or violation of any Environmental Law.

5

“Environmental Response” means (i) any action necessary to comply with and ensure compliance with Environmental Laws and/or (ii) taking all actions to protect against and/or respond to, remove, remediate, investigate or monitor the release or threatened release of Materials of Environmental Concern at, on, in, about, under, within or near the air, soil, surface water, groundwater, or soil vapor.

“ERISA” means the Employee Retirement Income Security Act of 1974, as amended.

“Estimated Closing Date Inventory” has the meaning set forth in Section 2.07(c).

“Estimated Closing Statement” has the meaning set forth in Section 2.07(a).

“Estimated Inventory Adjustment Amount” means the Estimated Inventory Excess, expressed as a positive number, or the Estimated Inventory Deficiency, expressed as a negative number, as applicable, as reflected in the Estimated Closing Statement.

“Estimated Inventory Deficiency has the meaning set forth in Section 2.07(a).

“Estimated Inventory Excess” has the meaning set forth in Section 2.07(a).

“Excluded Assets” has the meaning set forth in Section 2.01(b).

“Excluded Liabilities” means all Liabilities of Sellers (unless expressly listed as an Assumed Obligation), whether or not disclosed to Buyers, that, directly or indirectly, relate to, result from or arise out of, facts, conduct, conditions or circumstances in existence on or before the Closing Date, including, without limitation, all Liabilities listed in Section

2.03 other than the Assumed Obligations.

“Financial Statements” has the meaning set forth in Section 6.05.

“Flotek” has the meaning set forth in the preamble.

“Flotek FZE” has the meaning set forth in the preamble.

“Flotek ULC” has the meaning set forth in the preamble.

“Fraud Claims” has the meaning set forth in Section 9.05(a).

“GAAP” means United States generally accepted accounting principles consistently applied.

6

“Government Authority” means any domestic, foreign, international, national, provincial, regional, federal, state, municipal or local executive, legislative, judicial, regulatory or administrative agency, department, commission, board, bureau or other governmental or quasi-governmental authority or instrumentality.

“Holdback Amount” has the meaning set forth in Section 2.05(b).

“Holdback Release Date” has the meaning set forth in Section 2.07(d)(ii).

“Income Taxes” means any income, capital gains, franchise and similar Taxes.

“Indebtedness” of any Person means, as of any date of determination, without duplication: (a) the principal of, and accreted value and accrued and unpaid interest, in respect of: (i) indebtedness of such Person for money borrowed and (ii) indebtedness evidenced by notes, debentures, bonds or other similar instruments the payment of which such Person is responsible or liable; (b) all obligations of such Person issued or assumed as the deferred purchase price of property, including capital leases, all conditional sale obligations of such Person and all obligations of such Person under any title retention agreement; (c) all obligations of the type referred to in clauses (a) and (b) of any Persons the payment of which such Person is responsible or liable for, directly or indirectly, as obligor, guarantor, surety or otherwise; and (d) all obligations of the type referred to in clauses (a) through (c) of other Persons secured by any Encumbrance on any assets and properties of such Person (whether or not such obligation is assumed by such Person).

“Indemnified Person” has the meaning set forth in Section 9.04(a).

“Indemnifying Person” has the meaning set forth in Section 9.04(a).

“Indemnity Notice” has the meaning set forth in Section 9.04(a).

“Intellectual Property” means: (a) all inventions whether patentable or unpatentable (whether or not reduced to practice), all improvements thereto, and all patents, patent applications and patent disclosures, together with all reissuances, continuations, continuations-in-part, revisions, extensions, re-examinations and foreign counterparts thereof; (b) all logos, marks, trademarks, trademark registrations, trade names, product marks, service marks and other commercial symbols, registered or unregistered, held or registered, together with all translations, adaptations, derivations and combinations thereof and all applications, registrations, foreign counterparts and renewals in connection therewith; (c) all copyrightable works, drawings and designs, all copyrights and all applications, registrations and renewals in connection therewith; (d) trade secrets and proprietary information; (e) all intellectual property rights in all computer software (including data and related documentation); (f) all other proprietary rights of a similar nature; and (g) all intellectual property rights in all copies and tangible embodiments thereof (in whatever form or medium).

7

“Intellectual Property Assignment” has the meaning set forth in Section 3.02(e).

“Inventory” means inventory of raw materials, ingredients, packaging, supplies, spare parts, consumable inventory and products, work in progress and finished goods.

“Investigation Period” has the meaning set forth in Section 9.04(b).

“Knowledge of Buyers” means the actual knowledge of the officers of Buyers, after reasonable inquiry, and the knowledge such individuals could reasonably be expected to become aware of in the ordinary course of their employment or duties.

“Knowledge of Sellers” means the actual knowledge of Brad Reeves (Senior Vice President, Operations), Christi Sandel (Assistant Controller), H. Richard Walton (Executive Vice President and Chief Financial Officer, Flotek), and Steve Reeves (Executive Vice President, Operations, Flotek), after due inquiry, and the knowledge such individuals could reasonably be expected to become aware of in the ordinary course of their employment or duties.

“Law” means any law, statute, code, ordinance, order, rule, regulation, judgment, decree, injunction, franchise, permit, certificate, license, authorization, or other directional requirement (including, without limitation, any of the foregoing that relates to environmental standards, and energy regulations, including those arising under Environmental Laws) of any Government Authority.

“Lease” means any lease or sublease covering any of Sellers’ Leased Real Property.

“Liability” or “Liabilities” means any debt, obligation, duty or liability of any nature (including STRICT LIABILITY ARISING UNDER ENVIRONMENTAL LAW OR OTHERWISE, product liability, and any unknown, undisclosed, unfixed, unliquidated, unsecured, unmatured, unaccrued, unasserted, contingent, conditional, inchoate, implied, vicarious, joint, several or secondary liability), regardless of whether such debt, obligation, duty or liability would be required to be disclosed on a balance sheet prepared in accordance with GAAP.

“Losses” means any losses, remediation, injuries, harm, detriments, decline in value, Liabilities (including without limitation, Environmental Liabilities), Environmental Response, product warranties, lost profits, damages (including incidental, consequential, special and punitive damages), penalties, fines, obligations, judgments, liens, costs, expenses (including, without limitation, costs of investigation, attorneys’ fees, experts’ fees, consultants’ fees and disbursements of any kind or of any nature whatsoever) and Claims.

“Loss Threshold” has the meaning set forth in Section 9.05(a).

“March 2017 Financial Statements” has the meaning set forth in Section 6.05.

8

“Material Adverse Effect” means, with respect to the Business, any change that individually or in the aggregate is materially adverse to the business, operations, assets, financial condition or results of operations of Sellers as presently conducted by the Business, taken as a whole; provided, however, that any adverse effect arising out of, resulting from or attributable to any of the following shall not constitute or be deemed to contribute to a Material Adverse Effect, and otherwise shall not be taken into account in determining whether a Material Adverse Effect has occurred: (i) a fact, circumstance, event, change, effect or occurrence, or series of such items, to the extent affecting (A) global, national or regional economic, business, regulatory, market or political conditions or national or global financial markets, including changes in interest or exchange rates or (B) the Sellers’ industry generally, (ii) the negotiation, execution or the announcement of, or the performance of obligations under, this Agreement or the other documents contemplated by this Agreement or the consummation of the transactions contemplated hereby, (iii) any changes or any proposed changes in Law or GAAP or the enforcement, implementation or interpretation thereof, or (iv) any actions expressly permitted to be taken pursuant to this Agreement or taken with the specific written consent of or at the written request of Buyers.

“Materials of Environmental Concern” means: (i) substances, materials, or wastes that are or become classified or regulated under any applicable Environmental Law; (ii) those substances, materials, or wastes included within statutory and/or regulatory definitions or listings of “hazardous substance,” “special waste” “hazardous waste,” extremely hazardous substance,” “solid waste” “medical waste,” “regulated substance,” “hazardous materials,” “toxic substances,” or “air contaminant” under any Environmental Law; and/or (iii) any substance, material, or waste which is or contains: (A) petroleum, oil or any fraction thereof, (B) explosives, or (C) radioactive materials.

“NOV Canada” has the meaning set forth in the preamble.

“NOV FZE” has the meaning set forth in the preamble.

“NOV Inc.” means National Oilwell Varco, Inc.

“NOV US” has the meaning set forth in the preamble.

“Order” means any order, judgment, injunction, ruling, determination, decision, opinion, sentence, subpoena, writ or award issued, made, entered or rendered by any arbitrator, court, administrative agency or other Government Authority with jurisdiction.

“Organizational Document” means (a) with respect to a corporation, its articles or certificate of incorporation and bylaws (including any amendments thereto), (b) with respect to a partnership, its partnership agreement (including any amendments thereto), (c) with respect to a limited liability company, its certificate of formation/organization and

9

limited liability company agreement, and (d) with respect to any other entity, the documents governing the creation, organization and operation thereof.

“Ordinary Course of Business” means the ordinary course of business consistent with past custom and practice (including with respect to quantity and frequency); provided, however, that any breach of, violation of, noncompliance with, or failure to perform under, any Contract or applicable Law shall be deemed not to be in the Ordinary Course of Business.

“Party” and “Parties” have the meaning set forth in preamble.

“Pending Litigation” means National Oilwell DHT, L.P. v. Flotek Industries, Inc., Civil Action Case No. 2:14-cv-01056 pending in the United States District Court for the Southern District of Texas.

“Permit” means any permit, license, registration, identification number, notice of intent, franchise, consent, certificate or other authorization or approval of or by any Government Authority, and any applications for any of the foregoing, and shall include without limitation any of the foregoing required by any Environmental Law.

“Person” means any individual, corporation, partnership, limited liability company, trust, Government Authority or other entity.

“Permitted Encumbrances” means: (a) liens for Taxes and other governmental charges and assessments which are not yet delinquent or the amount or validity of which is being contested in good faith; (b) statutory liens of carriers, warehousemen, mechanics and materialmen and other like statutory liens arising in the Ordinary Course of Business which are for sums not yet delinquent or the amount or validity of which is being contested in good faith; and (c) any customary utility company rights, easements and franchises which do not materially detract from the value of or materially impair the existing use of the property affected by such lien or imperfections.

“Post-Closing Tax Period” means any Tax period beginning on and including the Closing Date and that portion of any Straddle Period beginning on and including the Closing Date.

“Pre-Closing Tax Period” means any Tax period ending before the Closing Date and that portion of any Straddle Period ending before the Closing Date.

“Proceeding” means any action, arbitration, mediation, audit, hearing, investigation, litigation or suit (whether civil, criminal, administrative, judicial or investigative, whether formal or informal) commenced, brought, conducted or heard by or before, or otherwise involving, any Government Authority or arbitrator.

“Product Liability” has the meaning set forth in Section 6.16(b).

10

“Property Taxes” means all real property Taxes, personal property Taxes and similar ad valorem Taxes based upon operation or ownership of the Purchased Assets but excluding, for the avoidance of doubt, Income Taxes and Transfer Taxes.

“Purchased Assets” has the meaning set forth in Section 2.01(a).

“Purchase Price” has the meaning set forth in Section 2.05.

“Purchase Price Deficit” has the meaning set forth in Section 2.07(c).

“Purchase Price Overpayment” has the meaning set forth in Section 2.07(c).

“Restricted Area” means worldwide.

“Restricted Business” means the business of designing, manufacturing, assembling, selling, servicing, renting or providing measurement while drilling (MWD) tools, downhole drilling tools, casing accessories, or other tools or products that perform substantially the same function in the oil and gas industry on a global basis.

“Seller” and “Sellers” have the meaning set forth in the preamble.

“Sellers’ Bank Account” has the meaning set forth in Section 2.05(a).

“Sellers’ Closing Certificate” has the meaning set forth in Section 5.02(d).

“Sellers’ Indemnified Persons” has the meaning set forth in Section 9.03.

“Sellers’ Intellectual Property” has the meaning set forth in Section 2.01(a)(vi).

“Sellers’ Leased Real Property” means any real property leased or subleased by a Seller.

“Sellers’ Owned Real Property” means the real property described on Section 2.01(a)(v) of the Disclosure Schedules and the buildings, fixtures and improvements located thereon, including any cranes or other similar equipment.

“Sellers’ Representative” has the meaning set forth in Section 11.14.

“Straddle Period” means any Tax period beginning before or on and ending after the Closing Date.

“Submission” has the meaning set forth in Section 2.07(b)(iv).

11

“Subsidiary” or “Subsidiaries” shall mean, when used with reference to any Person, any other entity of which membership interests or other ownership interests having ordinary voting power to elect a majority of the managers or other persons performing similar functions, or a majority of the outstanding voting membership interests of which, are owned directly or indirectly by such Person.

“Target Inventory” shall mean $9,000,000.

“Tax” or “Taxes” means any and all taxes or duties imposed or required to be collected by any federal, state or local taxing authority in the United States, or by any foreign taxing authority under any statute or regulation, including, without limitation, all income, gross receipts, sales, value added, goods and services (GST), use, personal property, use and occupancy, business occupation, mercantile, ad valorem, transfer, license, withholding, payroll, employment, excise, real estate, environmental, capital stock, franchise, alternative or add on minimum, estimated or other tax of any kind whatsoever, including any interest, penalties and other additions thereto.

“Tax Return” means any return, declaration, report, claim for refund, or information return or statement relating to Taxes, including any schedule or attachment hereto, and including any amendment thereof.

“Teledrift” has the meaning set forth in the preamble.

“Third-Party Claim” means any Claim, other than any Claim brought by a Party to this Agreement or an Affiliate of a Party to this Agreement.

“Transfer Taxes” has the meaning set forth in Section 8.01.

“Transitional Period” has the meaning set forth in Section 4.09.

“Turbeco” has the meaning set forth in the preamble.

ARTICLE II

PURCHASE AND SALE

Section 2.01 Purchase and Sale.

(a) Purchased Assets. Upon the terms of this Agreement, and on the basis of the representations and warranties hereinafter set forth, at the Closing, Sellers are selling, transferring, conveying, assigning, and delivering to Buyers, and Buyers are acquiring and purchasing from Sellers, all of Sellers’ right, title and interest in and to the assets of Sellers described in Section 2.01(a)(i) through Section 2.01(a)(viii) (collectively, the “Purchased Assets”), free and clear of all Encumbrances, with all of Teledrift and Turbeco’s Purchased Assets being transferred, conveyed, assigned and delivered to NOV US, all of Flotek ULC’s Purchased Assets being transferred, conveyed, assigned and delivered to NOV Canada, and all of Flotek FZE’s Purchased Assets being transferred, conveyed, assigned and delivered to NOV FZE:

12

(i) the machinery, equipment, trade fixtures, tools, furniture, computers, appliances, implements, leasehold improvements, supplies, inventory (including inventory of raw materials, construction or work in process, finished products and goods), spare parts and all other tangible personal property owned by Sellers and which relates to the Business listed on Section 2.01(a)(i) of the Disclosure Schedules;

(ii) the motor vehicles and rolling stock listed on Section 2.01(a)(ii) of the Disclosure Schedules;

(iii) all right, title and interest in, to and under only those Contracts which are described on Section 2.01(a)(iii) of the Disclosure Schedules (collectively, the “Assigned Contracts”);

(iv) to the extent transferable, all right, title and interest in all Permits relating to the Purchased Assets, including without limitation those listed on Section

2.01(a)(iv) of the Disclosure Schedules (collectively, the “Assigned Permits”);

(v) Sellers’ Owned Real Property described on Section 2.01(a)(v) of the Disclosure Schedules and all fixtures, buildings and improvements located on or under such real property interests and all related security deposits and prepaid rents;

(vi) all of the Intellectual Property listed on Section 2.01(a)(vi) of the Disclosure Schedules, including without limitation run and operating history, product drawings, customer lists and product manuals (collectively, the “Sellers’ Intellectual Property”);

(vii) all rights under express or implied warranties from the suppliers with respect to the Purchased Assets, to the extent they are transferable or assignable;

(viii) all of Sellers’ right, title and interest in, to, and under all rights, privileges, Claims, and options relating or pertaining to the Purchased Assets, but only to the extent such rights, privileges, claims, causes of action and options are not related to the Excluded Liabilities; and

(ix) subject to the exclusions set forth in Section 2.01(b), and to the extent transferable or assignable, all other or additional privileges, rights, interests, assets of every kind and description of Sellers, whether tangible or intangible, wherever located, that are used or intended for use in connection with, or that are necessary to the continued conduct of, the Business as presently conducted.

(b) Excluded Assets. Notwithstanding Section 2.01(a), Sellers are not selling, transferring, conveying, assigning, or delivering, and Buyers are not purchasing pursuant to this Agreement, any of Sellers’ right, title and interest to, in or under the items set forth below, all of which shall be retained by, and whose right, title and interest to, shall remain vested in Sellers (collectively, the “Excluded Assets”):

(i) all cash and cash equivalents;

13

(ii) all accounts receivable relating to the Business arising before the Closing Date;

(iii) all Contracts that are not expressly listed on Section 2.01(a)(ii) of the Disclosure Schedules as Assigned Contracts and all rights and obligations arising thereunder;

(iv) stock ledgers and company minute books;

(v) any Benefit Plans covering any Business Employees, including all rights and obligations thereunder;

(vi) the assets solely relating to the Galleon business of Turbeco;

(vii) the stock owned by Turbeco in Flotek Export, Inc., a Texas corporation;

(viii) the stock owned by Turbeco in Flotek Hydralift, Inc., a Texas corporation; and

(ix) Claims with respect to property damage suffered in connection with an accident that occurred pursuant to the transportation of equipment and inventory by Levinge Trucking on or about February 8, 2017.

Section 2.02 Assumed Obligations. Subject to the terms and conditions of this Agreement, at Closing, Buyers will assume and agree to pay, perform and discharge when due from and after the Closing Date, only those Liabilities (i) arising from the performance of warranty obligations in the ordinary course of business which relates to products sold or services provided prior to Closing by the Business; provided, however, that Sellers shall promptly reimburse Buyers (and in any case no later than thirty (30) days after Sellers’ Representative’s receipt of a reasonably detailed invoice from Buyer’s Representative) for Buyers’ cost (without markup) in providing such warranty work, and (ii) that otherwise initially occur and are attributable to the period after Closing in respect of the Assigned Contracts and assigned to Buyers hereunder in conformity with the provisions of such Assigned Contracts (and that do not relate to or arise out of any breach of any representation, warranty or covenant of Sellers or Flotek hereunder or under such Assigned Contracts). The Liabilities assumed by Buyers under this Section 2.02 are collectively referred to as the “Assumed Obligations.” Nothing herein prevents Buyers from contesting in good faith any of the Assumed Obligations. Sellers agree to satisfy and discharge all Liabilities that are not assumed by Buyers pursuant to the terms of this Agreement, whether known as of the date hereof or thereafter determined. Sellers represent that all payments due and all obligations to be performed as of the Closing Date in respect of the Assigned Contracts and the other Purchased Assets have been timely made and performed.

Section 2.03 Excluded Liabilities. Notwithstanding anything to the contrary set forth in this Agreement, it is expressly understood and agreed that Buyers shall not be

14

obligated to pay, perform or discharge, and Sellers shall retain, the Excluded Liabilities of

Sellers, including, without limitation, the Liabilities of Sellers and Flotek listed below:

(a) all accounts payable, trade payables and notes payable arising on or before or relating to or attributable to the period ending on or before the Closing Date;

(b) Environmental Liabilities arising out of, attributable to or relating to the Purchased Assets (including without limitation the ownership or operation thereof), the Business, any Business Facility, or Sellers on or prior to the Closing Date;

(c) Liabilities of any Seller or its Affiliates for Taxes except as set forth in Section 8.01 (Transfer Taxes) and Section 8.02 (Property Taxes), including any Liabilities for successor liability attaching to any of the Purchased Assets after the Closing Date;

(d) Liabilities of any Seller or its Affiliates for Duties, importation costs, fees, tariffs or other such costs relating to the Purchased Assets for the period ending on or before the Closing Date;

(e) Liabilities of any kind arising from or relating to any Contract, Lease or

Permit that is not an Assigned Contract or Assigned Permit;

(f) the costs and expenses of Sellers or their Affiliates incurred in negotiating, entering into and carrying out their obligations pursuant to this Agreement, including, without limitation, all legal, accounting, brokers’, finders’ and other professional fees and expenses;

(g) Liabilities with respect to any of Sellers’ employees (and employees of its Affiliates) in their capacity as such, including, without limitation, wages, salaries, federal withholding and social security taxes, worker’s compensation, unemployment compensation, employee benefit plans, termination costs, severance payments, any retention, bonus or similar compensatory amounts payable to any employees or service providers of any Seller that become payable by any Seller solely as a result of the closing of the transactions contemplated by this Agreement, accrued vacation and Liabilities under any Benefit Plans, all in any way relating to (i) events occurring on or prior to the Closing Date or (ii) the employment of employees by Sellers or their Affiliates, regardless of when any Claim relating to any such Liabilities may arise;

(h) Liabilities of any kind arising out of or in connection with any Benefit Plan, including without limitation any obligations to provide continuation benefits under Section 4980B of the Code, the Consolidated Omnibus Budget Reconciliation Act of

1985, as amended, to terminated employees and their dependents, unless otherwise required by applicable Law;

(i) any Claims (warranty related, product liability or otherwise) arising out of or related to products that are manufactured, sold, leased modified or delivered by Sellers or their Affiliates prior to the Closing Date (regardless of whether such Claims arise or are made, filed or brought before, on or after the Closing Date);

15

(j) any Liabilities arising out of the Excluded Assets; and

(k) Liabilities, including any Liability pursuant to any Claim or Proceeding, that relate to (i) contractual or other obligations of Sellers or their Affiliates (other than the Assumed Obligations) or (ii) the ownership, operation or conduct of the Business or Purchased Assets, in each case arising from any acts, omissions, events, conditions or circumstances occurring before or relating to or attributable to the period ending before the Closing Date.

Section 2.04 Non-Assignable Contracts. If any Assigned Contract is not by its terms assignable, Sellers agree to use commercially reasonable efforts to obtain, or cause to be obtained, any written consents necessary to convey to Buyers the benefit thereof. To the extent that any such consents cannot be obtained, Sellers and Buyers will use commercially reasonable efforts (but in no event shall Buyers be required to pay any amounts in connection therewith) to take such actions as may be possible without violation or breach of any such non-assignable Assigned Contract to effectively provide Buyers with the same rights and economic benefits of such Assigned Contract.

Section 2.05 Purchase Price. Subject to the terms and conditions of this Agreement, and as full consideration for the purchase of the Purchased Assets and the representations, warranties, covenants and agreements contemplated herein, Buyers shall pay to Sellers on the Closing Date, the aggregate purchase price (the “Purchase Price”) of Seventeen Million Dollars ($17,000,000.00), subject to adjustment as provided hereunder. At Closing, the Purchase Price shall be paid in the following manner:

(a) an amount equal to (i) Fifteen Million Five Hundred Thousand Dollars ($15,500,000.00) (the “Closing Date Payment”) in cash, payable in immediately available funds to the account set forth on Section 2.05(a) of the Disclosure Schedules (“Sellers’ Bank Account”), plus (ii) the Estimated Inventory Excess (if any), less (iii) the Estimated Inventory Deficiency (if any); and

(b) One Million Five Hundred Thousand Dollars ($1,500,000.00) (the “Holdback Amount”) shall not be paid at Closing and shall be withheld to provide funds against which Buyers’ Indemnified Persons may assert claims of indemnification pursuant to Article VIII and Article IX. The Holdback Amount will be held, administered and distributed by Buyers in accordance with Section 2.07(d).

Section 2.06 [Reserved]

Section 2.07 Determination of Inventory and Holdback Amount.

(a) Estimates. At least five (5) Business Days prior to Closing, Sellers’ Representative shall prepare and deliver to Buyers a statement (the “Estimated Closing Statement”), setting forth a reasonably detailed determination of Sellers’ Representative’s good faith estimation of the Inventory as of the Closing Date (the “Estimated Closing Date Inventory”) and the Estimated Closing Date Adjustment

16

Amount, together with reasonably detailed supporting information. If the Estimated Closing Date Inventory is less than the Target Inventory, the amount equal to such difference is the “Estimated Inventory Deficiency.” If the Estimated Closing Date Inventory is greater than the Target Inventory, the amount equal to such difference is the “Estimated Inventory Excess.” The Estimated Inventory Excess, if any, shall be capped at One Hundred Thousand Dollars ($100,000.00). If Buyers have any questions or disagreements regarding the Estimated Closing Date Inventory, Buyers’ Representative shall contact Sellers’ Representative at least two (2) Business Days prior to the Closing Date, and in such case Sellers’ Representative and Buyers’ Representative shall attempt to resolve any questions or disagreements in good faith. If Sellers’ Representative and Buyers’ Representative agree to changes to Sellers’ Representative’s proposed Estimated Closing Date Inventory based on such discussions, then the Estimated Closing Date Inventory shall be so revised. If Sellers’ Representative and Buyers’ Representative do not agree to changes to such amounts, then the Estimated Closing Date Inventory shall be based on the amounts set forth in the Estimated Closing Statement initially delivered by Sellers’ Representative. In either such case, appropriate adjustments to the Purchase Price shall be made after the Closing pursuant to Section 2.07(b) and Section 2.07(c). Adjustments pursuant to this Section shall be made solely based on the physical count of the Inventory, utilizing the same methodology, valuations and assumptions utilized by the Sellers with respect to the Inventory under GAAP prior to the Closing Date, including the methodology, valuations and assumptions with respect to the Inventory’s usability.

(b) Post-Closing Purchase Price Reconciliation.

(i) Within ninety (90) days of the Closing Date, Buyers’ Representative shall prepare in good faith and deliver to Sellers’ Representative a statement (the “Closing Statement”), setting forth a reasonably detailed proposed final calculation of the Inventory as of the Closing Date (the “Closing Date Inventory”), and the Closing Date Inventory Adjustment Amount, together with reasonably detailed supporting information. If the Closing Date Inventory is less than the Target Inventory, the amount equal to such difference is the “Closing Date Inventory Deficiency.” If the Closing Date Inventory is greater than the Target Inventory, the amount equal to such difference is the “Closing Date Inventory Excess.” The Closing Date Inventory Excess, if any, shall be capped at One Hundred Thousand Dollars ($100,000).

(ii) From and after the delivery of the Closing Statement, Buyers’ Representative shall provide Sellers’ Representative reasonable access to the records and employees of Buyers and their Affiliates and shall cause the employees of Buyers and their Affiliates to cooperate in all reasonable respects with Sellers’ Representative in connection with its review of such work papers and other documents and information relating to the calculation of the Closing Date Inventory, as Sellers’ Representative shall reasonably request and that are available to Buyers and their Affiliates.

(iii) Within thirty (30) days after Sellers’ Representative’s receipt of the Closing Statement, Sellers’ Representative shall notify Buyers’ Representative if Sellers’

17

Representative disagrees with the Closing Statement, which notice shall set forth in reasonable detail the particulars of such disagreement (the “Objection Notice”). If Sellers’ Representative provides a notice of agreement or does not deliver to Buyers’ Representative an Objection Notice within such thirty (30)-day period, then Sellers’ Representative shall be deemed to have accepted the calculations and the amounts set forth in the Closing Statement delivered by Buyers’ Representative, which shall then be final, binding and conclusive for all purposes hereunder. If any such Objection Notice is timely delivered, then Sellers’ Representative and Buyers’ Representative shall each endeavor for a period of thirty (30) days thereafter to resolve in good faith any disagreements with respect to the calculations in the Closing Statement.

(iv) If, at the end of the thirty (30)-day resolution period, Sellers’ Representative and Buyers’ Representative are unable to resolve any disagreement between them with respect to the preparation of the Closing Statement, then each such Party shall deliver simultaneously to KPMG LLP (or if such firm is unwilling or unable to serve, another nationally recognized accounting firm mutually agreed on by such Parties, the accounting firm ultimately chosen, the “Accountants”) the Objection Notice, the Closing Statement and any engagement, indemnity and other agreements as the Accountants may require as a condition to such engagement (each a “Submission”) within five (5) days of retaining the Accountants (the “Closing Statement Submission Deadline”). Such Parties shall instruct the Accountants to deliver to the Parties a written determination (such determination to include a worksheet setting forth all material calculations used in arriving at such determination and to be based solely on information provided to the Accountants by the Parties, or their respective Affiliates) of, and the Accountants’ engagement shall be limited to the resolution of, disputed amounts set forth in the Closing Statement that have been identified by Sellers’ Representative in the Objection Notice, which resolution shall be in accordance with this Agreement, and no other matter relating to the Closing Statement shall be subject to determination by the Accountants except to the extent affected by resolution of the disputed amounts. In resolving any disputed item, the Accountants shall not assign a value to any item greater than the greatest value for such item claimed by Buyers’ Representative or Sellers’ Representative or less than the smallest value for such item claimed by Buyers’ Representative or Sellers’ Representative. Such Parties shall cooperate diligently with any reasonable request of the Accountants to resolve any disputed matter as soon as reasonably possible after the Accountants are engaged. If possible, the decision of the Accountants shall be made within twenty (20) days after the Closing Statement Submission Deadline. The fees and expenses of the Accountants shall be allocated by the Accountants between Buyers, on the one hand, and Sellers and Flotek, jointly and severally, on the other hand, so that the aggregate amount of such fees and expenses paid by Sellers bears the same proportion to the total fees and expenses as the aggregate dollar amount of items unsuccessfully disputed by Sellers’ Representative, if any (as determined by the Accountants), bears to the total dollar amount of items in dispute, and Buyers shall pay the remainder of such fees and expenses, if any. The determination

18

of the Accountants shall be final, binding and conclusive for all purposes hereunder, absent manifest error or fraud.

(c) True-Up Payment. If the Closing Date Inventory Adjustment Amount is less than the Estimated Inventory Adjustment Amount (the amount of such shortfall, if any, the “Purchase Price Overpayment”), Sellers shall, within forty-five (45) Business Days after the final determination of the Closing Statement, promptly pay to Buyers in cash by wire transfer of immediately available funds to an account designated by Buyers, an amount equal to the Purchase Price Overpayment. If the Closing Date Inventory Adjustment Amount is greater than the Estimated Inventory Adjustment Amount (the amount of such excess, the “Purchase Price Deficit”), Buyers shall, within forty-five (45) Business Days after the final determination of the Closing Statement, promptly pay to Sellers’ Bank Account in cash by wire transfer of immediately available funds, an amount equal to the Purchase Price Deficit.

(d) Holdback Amount and Payment.

(i) When Sellers are the Indemnifying Persons, once a Loss is agreed to or finally adjudicated to be payable pursuant to Article VIII or Article IX, Buyers’ Indemnified Persons shall first be paid from the Holdback Amount. Buyers shall be immediately entitled to distribute funds in the amount of such agreed to or finally adjudicated Loss, and the Holdback Amount shall be reduced by such Loss. Buyers’ Representative shall notify Sellers in writing within five (5) Business Days of such a distribution and reduction of the Holdback Amount, and such notice shall also contain the then-remaining balance in the Holdback Amount.

(ii) Subject to Section 2.07(d)(iii), one-third (1/3) of the Holdback Amount shall be released six (6) months after the Closing Date, one-third (1/3) of the Holdback Amount shall be released twelve (12) months after the Closing Date, and one- third (1/3) of the Holdback Amount shall be released eighteen (18) months after the Closing Date (each, a “Holdback Release Date”).

(iii) On the date of each Holdback Release Date, such portion of the Holdback Amount as may be necessary, in the reasonable judgment of Buyers, to satisfy any then-unresolved or unsatisfied claims for Loss, shall remain in the Holdback Amount until such claims for Loss have been resolved or satisfied in accordance with Article VIII or Article IX. Within ten (10) Business Days after each Holdback Release Date, each 1/3 portion of the Holdback Amount, less any amount determined pursuant to the previous sentence, shall be paid by Buyers to Sellers’s Bank Account by wire transfer of immediately available funds. For the avoidance of doubt, the Holdback Amount shall not be the sole source of recovery for any Loss for which Sellers are obligated to indemnify Buyers or Buyers’ Indemnified Persons pursuant to Article VIII or Article IX.

Section 2.08 Allocation.

(a) Sellers and Buyers shall allocate the Purchase Price (and all other amounts constituting consideration for applicable income Tax purposes), among the Purchased

19

Assets in accordance with Section 1060 of the Code and the Treasury Regulations promulgated thereunder (and any similar provision of state, local or foreign law, as appropriate) (the “Allocation”). The Allocation shall be delivered by Buyers to Sellers within ninety (90) days after the Closing Date for their approval, which approval shall not be unreasonably withheld, conditioned or delayed. If the Purchase Price is adjusted because an indemnification payment is made pursuant to the provisions of this Agreement, or if there is any other subsequent adjustment to the Purchase Price or any other amount constituting consideration for applicable income Tax purposes, then Buyers shall adjust the Allocation to reflect such adjustment in a manner consistent with Section

1060 of the Code and the Treasury Regulations promulgated thereunder. The principles

of this Section 2.08(a) shall apply to each revised Allocation.

(b) The Allocation shall be deemed final unless Sellers’ Representative notifies Buyers in writing that Sellers object to one or more items reflected in the Allocation within thirty (30) days after the applicable delivery of the Purchase Price Allocation. In the event of any such objection, Sellers’ Representative and Buyers’ Representative shall negotiate in good faith to resolve such dispute; provided, however, that if Sellers’ Representative and Buyers’ Representative are unable to resolve any dispute with respect to the Allocation within fifteen (15) days after any objection is raised, such Allocation shall not be binding on the Parties and such dispute shall be resolved by the Accountants. The Accountants will appraise the Purchased Assets as such exist as of immediately prior to the Closing. The cost of such appraisal shall be divided equally between Sellers and Buyers. Buyers and Sellers will use the Allocation as the basis for reporting asset values and other items for purposes of all required Tax Returns (including any Tax Returns required to be filed under Section 1060(b) of the Code and the Treasury Regulations thereunder, including Internal Revenue Service Form

8594), and neither Buyers nor Sellers shall take any position for Tax purposes that is

inconsistent with the Allocation; provided, however, that nothing contained herein shall prevent Buyers or Sellers from settling any proposed deficiency or adjustment by any Government Authority based upon or arising out of the Allocation, and neither Buyers nor Sellers shall be required to litigate before any court any proposed deficiency or adjustment by any Government Authority challenging such Allocation.

(c) Sellers agree to provide Buyers and their representatives reasonable access to the books and records of the Business, the personnel of, and work papers prepared by, Sellers or Sellers’ representatives to the extent that they relate to the Purchase Price Allocation and to such historical financial information (to the extent in Sellers’ possession) relating to the Allocation as Buyers may reasonably request for the purpose of preparing the Allocation; provided, however, that such access shall be in a manner that does not interfere with the normal business operations of Sellers.

20

ARTICLE III

CLOSING

Section 3.01 Time and Place of Closing. The closing of the transactions described in this Agreement (the “Closing”) shall take place at the offices of Buyers, 7909

Parkwood Circle Drive, Houston, Texas 77036, within two Business Days of the

satisfaction of each of the conditions set forth in Article V, or such other time and place as the Parties mutually agree, on the date of this Agreement, or at such other time, date or place as Buyers and Sellers may mutually agree in writing (the “Closing Date”).

Section 3.02 Closing Deliveries of Sellers. At Closing, Sellers shall deliver or cause to be delivered, the following to Buyers:

(a) a counterpart to this Agreement, duly executed by Sellers;

(b) assignments of the Assigned Contracts, duly executed by the relevant

Sellers, assigning such Contracts to Buyers;

(c) the consents and approvals identified on Section 6.04 of the Disclosure

Schedules;

(d) a counterpart to the Bill of Sale and Assignment (the “Bill of Sale”) in the form attached hereto as Exhibit A, duly executed by Sellers;

(e) a counterpart to the Intellectual Property Assignment (the “Intellectual Property Assignment”) in the form attached hereto as Exhibit B, duly executed by the relevant Sellers;

(f) special warranty deeds, duly executed by the relevant Sellers, conveying to the relevant Buyers good and indefeasible title to Sellers’ Owned Real Property, free and clear of any Encumbrances, other than the Permitted Encumbrances, in the forms attached hereto as Exhibit C (the “Deeds”), in sufficient duplicate originals to facilitate recording in counties in which each tract of Sellers’ Owned Real Property is located;

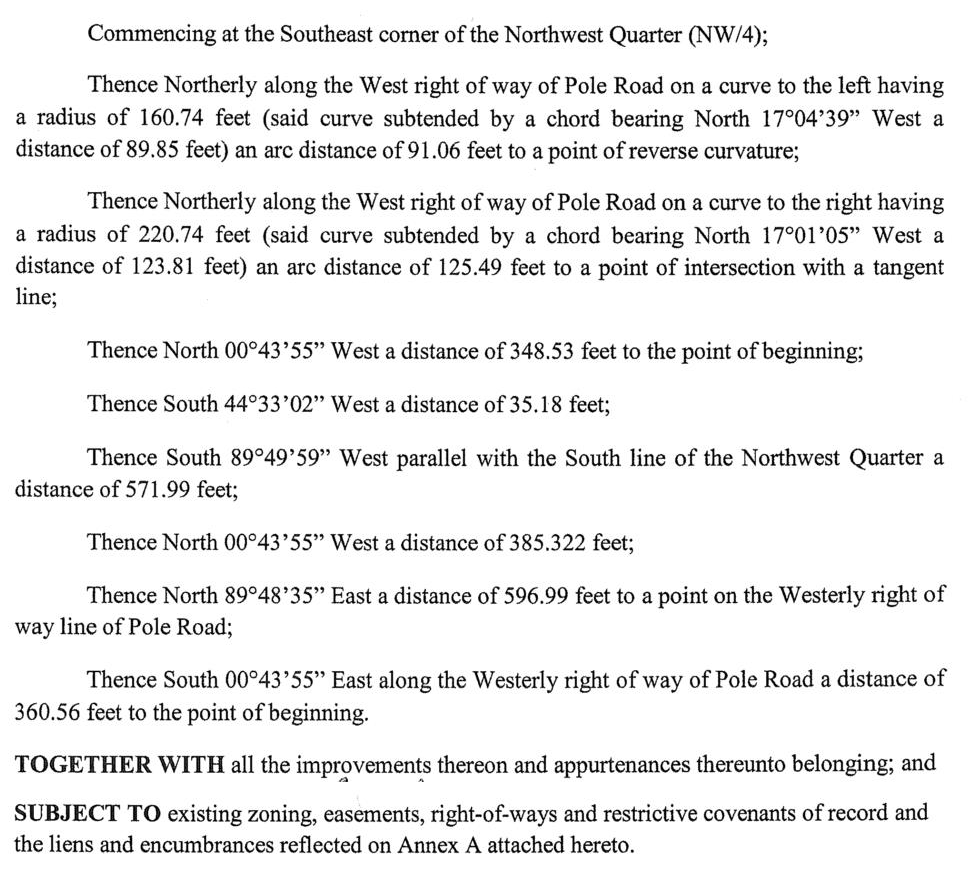

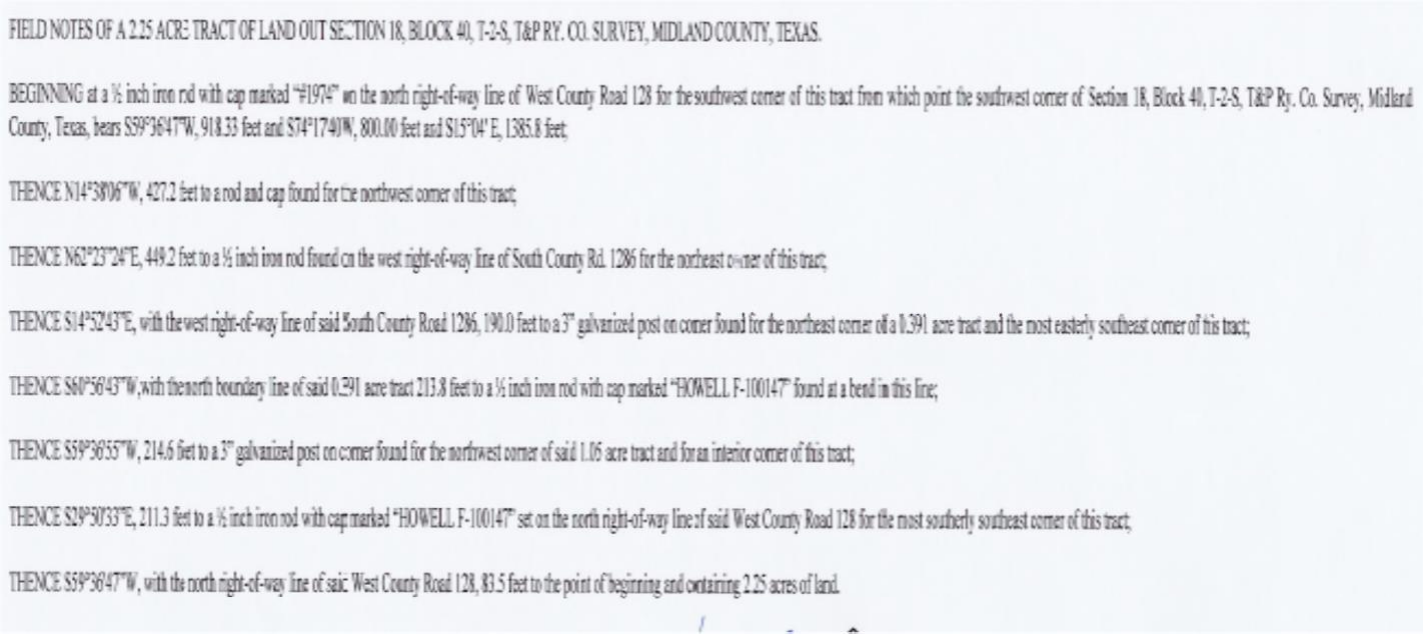

(g) evidence, reasonably satisfactory to Buyers, that that certain 0.392 acre tract of land comprising a portion of the Sellers’ Owned Real Property in Midland County, Texas in Section 18, Block 40, T-2-S, T&P RR Co. Survey referenced in the Deed for such Sellers’ Owned Real Property has been adequately surveyed in relation to the whole of the Sellers’ Owned Real Property being conveyed to NOV US in such Deed such that there are no reasonable grounds for confusion with respect to such Deed or such conveyance;

(h) counterparts to assignments of Leases included in the Assigned Contracts (the “Assigned Leases”), duly executed by the relevant Seller and the lessors under such Leases;

(i) a counterpart to the Transition Services Agreement, in the form attached hereto as Exhibit E, duly executed by Flotek;

21

(j) a certificate of Sellers conforming to the requirements of Treasury Regulations Section 1.1445-2(b)(2) stating that Sellers are not “foreign persons” within the meaning of Section 1445 of the Code, in the form and substance reasonably satisfactory to Buyers, dated as of the Closing Date and duly executed by the relevant Sellers;

(k) evidence of the full and unconditional termination and releases of any Encumbrances relating to Indebtedness for borrowed money that encumber the Purchased Assets in any respect, dated and executed by each of the lenders with respect to any such Indebtedness, including from PNC Bank, National Association, with respect to Turbeco and Teledrift;

(l) a Statement of Occasional Sale (Texas Comptroller of Public Accounts Form 01-917) certifying that the sales of the Purchased Assets located in Texas qualify as an occasional sale, dated as of the Closing Date and duly executed by the relevant Sellers;

(m) a certificate, dated and executed by an officer of Sellers, certifying to the resolutions of the boards of directors of Sellers authorizing and approving the execution and delivery of this Agreement and the Transaction Documents, and the consummation of the transactions contemplated hereby and thereby; and

(n) such further instruments and documents, as may be reasonably requested by Buyers to consummate the transactions contemplated hereby.

Section 3.03 Closing Deliveries of Buyers. At Closing, Buyers shall deliver, or cause to be delivered, the following to Sellers:

(a) the Closing Date Payment in accordance with Section 2.05(a);

(b) a counterpart to this Agreement, duly executed by Buyers;

(c) assignments of the Assigned Contracts, duly executed by the relevant

Buyers;

(d) a counterpart to the Bill of Sale, duly executed by Buyers;

(e) a counterpart to the Intellectual Property Assignment, duly executed by the relevant Buyers;

(f) counterparts to the Deeds, duly executed by the relevant Buyers;

(g) counterparts to assignments of the Assigned Leases, duly executed by the relevant Buyer (NOV US with respect to Assigned Leases in the US, and NOV Canada with respect to the Assigned Lease in Canada);

(h) a counterpart to the Transition Services Agreement, in the form attached hereto as Exhibit E, duly executed by NOV US;

22

(i) resale certificates with respect to the Inventory located in the states of

Pennsylvania, Oklahoma, and Texas, in forms reasonably acceptable to Sellers; and

(j) such further instruments and documents as may be reasonably requested by Sellers to consummate the transactions contemplated hereby.

Section 3.04 Release of Encumbrances. Promptly following the Closing, Sellers shall file or cause to be filed any and all recordable form Encumbrance releases in respect of or related to any Indebtedness for borrowed money relating to any Encumbrance on the Purchased Assets, which obligation shall include, for the avoidance of doubt, the filing of UCC termination statements and/or making any other filings necessary to effect the termination and full release of any security interest in any of the Purchased Assets encumbered by such Indebtedness.

ARTICLE IV

COVENANTS

Section 4.01 Interim Covenants.

(a) From the date hereof until the Closing, except as otherwise provided in this Agreement or consented to in writing by Buyers’ Representative (which consent shall not be unreasonably withheld or delayed), Sellers shall use commercially reasonable efforts to:

(i) maintain the properties and assets included in the Purchased Assets in substantially the same condition as they were on the date of this Agreement, subject to reasonable wear and tear and actions taken or omitted in the ordinary course of business;

(ii) pay the debts, Taxes and other obligations of the Business when due; (iii) defend and protect the properties and assets included in the

Purchased Assets from infringement or usurpation;

(iv) perform all of its obligations under all Assigned Contracts;

(v) comply in all material respects with all Laws applicable to the conduct of the Business or the ownership and use of the Purchased Assets;

(vi) secure, as soon as practicable and in any event prior to the Closing, all approvals, consents and waivers of third parties required for the consummation of the transactions contemplated hereby; and

(vii) not take or permit any action that would cause any of the following changes, events or conditions to occur:

(A) an event, occurrence or development that has had, or could reasonably be expected to have, individually or in the aggregate, a Material Adverse Effect;

23

(B) transfer, assignment, sale or other disposition of any of the Purchased Assets, except for the sale of Inventory in the ordinary course of business;

(C) cancellation of any debts or claims or amendment, termination or waiver of any rights constituting Purchased Assets;

(D) transfer, assignment or grant of any license or sublicense of any material rights under or with respect to any Intellectual Property Assets or Intellectual Property Agreements;

(E) material damage, destruction or loss, or any material interruption in use, of any Purchased Assets, whether or not covered by insurance;

(F) acceleration, termination, material modification to or cancellation of any Assigned Contract or Permit;

(G) imposition of any Encumbrance upon any of the Purchased

Assets; or

(H) any Contract to do any of the foregoing, or any action or omission that would result in any of the foregoing.

(b) From the date hereof until the Closing, each Party shall use its reasonable best efforts to fulfill its respective conditions to Closing set forth in Article V.

Section 4.02 Access to Information. From the date hereof until the Closing, the Sellers shall afford the Buyer and its Representatives full and free access to and the right to inspect all of the Purchased Assets during the Sellers’ normal business hours upon at least forty-eight (48) hours’ notice.

Section 4.03 Notice of Certain Events.