Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Elevate Credit, Inc. | exhibit991pressrelease1.htm |

| 8-K - 8-K - Elevate Credit, Inc. | a07-17pressrelease.htm |

Second Quarter 2017 Earnings Call

August 2017

2

Forward-Looking Statements

This presentation and responses to various questions contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities

Exchange Act of 1934, as amended. The forward-looking statements present our current expectations and projections relating to our business, financial condition and results of operations, and do not

refer to historical or current facts. These statements may include words such as “anticipate,” “estimate,” “expect,” “project,” “plan,” “intend,” “believe,” “may,” “will,” “should,” “likely” and other words and

terms of similar meaning. The forward-looking statements include statements regarding: our future financial performance including our outlook for full fiscal year 2017 and our perspectives on the third

quarter of 2017 and our expectations regarding revenue, cost of revenue, growth rate of revenue, cost of borrowing, credit losses, marketing costs, net charge-offs, gross profit or gross margin, operating

expenses, operating margins, Adjusted EBITDA or Adjusted EBITDA margin, ability to generate cash flow and ability to achieve and maintain future profitability; the availability of debt financing, funding

sources and disruptions in credit markets; anticipated trends, growth rates, seasonal fluctuations and challenges in our business and in the markets in which we operate; our growth strategies and our

ability to effectively manage that growth; our expectations regarding the future expansion of the states in which our products are offered; customer demand for the our products; the cost of customer

acquisition; the ability of customers to repay loans; interest rates and origination fees on loans; the impact of competition in our industry and innovation by our competitors; the efficacy and cost of our

marketing efforts and relationships with marketing affiliates; continued innovation of our analytics platform and our ability to prevent security breaches, disruption in service and comparable events that

could compromise the personal and confidential information held in our data systems, reduce the attractiveness of our platform or adversely impact our ability to service loans. Forward‐looking statements

involve certain risks and uncertainties, and actual results may differ materially from those discussed in any such statement. These risks and uncertainties include, but are not limited to: the Company’s

limited operating history in an evolving industry; new laws and regulations in the consumer lending industry in many jurisdictions that could restrict the consumer lending products and services the

Company offers, impose additional compliance costs on the Company, render the Company’s current operations unprofitable or even prohibit the Company’s current operations; scrutiny by regulators and

payment processors of certain online lenders’ access to the Automated Clearing House system to disburse and collect loan proceeds and repayments; a lack of sufficient debt financing at acceptable

prices or disruptions in the credit markets; and other risks related to litigation, compliance and regulation. Additional factors that could cause actual results to differ are discussed under the heading "Risk

Factors" and in other sections of the Prospectus related to the Company’s initial public offering of common stock filed pursuant to Rule 424(b) under the Securities Act of 1933, and in the Company's

current and periodic reports filed from time to time with the SEC. All written and oral forward-looking statements attributable to us, or persons acting on our behalf, are expressly qualified in their entirety

by the cautionary statements regarding risks and uncertainties that are included in our public communications. You should evaluate all forward-looking statements made in this presentation in the context

of these risks and uncertainties. Neither we nor any of our respective agents, employees or advisors intend or have any duty or obligation to supplement, amend, update or revise any of the forward-

looking statements contained in this presentation.

This presentation also contains estimates and other statistical data made by independent parties and by us relating to market size and growth and other data about our industry. This data involves a

number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. Neither we nor any other person makes any representation as to the accuracy or completeness

of such data or undertakes any obligation to update such data after the date of this presentation. In addition, projections, assumptions and estimates of our future performance and the future performance

of the markets in which we operate are necessarily subject to a high degree of uncertainty and risk.

The information and opinions contained in this presentation are provided as of the date of this presentation and are subject to change without notice. This presentation has not been approved by any

regulatory or supervisory agency.

See Appendix for additional information and definitions.

3 3

Elevate is reinventing

non-prime credit with

online products that

provide financial relief

today, and help people

build a brighter

financial future.

So far, we’ve

originated $4.5 billion

to 1.7 million

customers1

4

Approval in seconds Rates that go down over time Financial wellness features

Credit building features Flexible payment terms

Good Today, Better Tomorrow

The next generation of responsible online credit

5

109MM

US non-prime1

53MM

US credit invisible2

10MM

UK non-prime3

US non-prime population larger than prime

US and UK non-prime population >170MM people

Elevate customer profile4

Non-prime Prime Credit invisible

Prime1

34%

Non-prime1

44%

Credit

invisible2

22%

Banks not serving non-prime

$142B

Total reduction in

non-prime credit

since 20086

1

1

2

US UK

Average income

Attended college

Own home

$48K

~ 79%

~ 39%

£20K

~ 58%

~ 12%

Typical FICO range5 560-600 N/A

Non-prime consumers – the New Middle Class

6

Strong Growth

19% revenue growth YOY

1

29% loans receivable growth YOY

2

Stable Credit Quality Continued performance in target range

Improving Margins

13% Adjusted EBITDA margin ($20mm Adjusted EBITDA)

3

Net income of $3.0mm

Managed CAC High end of range at $294

Outsized Customer

Impact

Continued reduction in average effective APR

Saved customers $300mm vs. payday loans 4

Q2 2017 continues strong performance

Elevate Goals Q2 2017 Performance Highlights

Adjusted EBITDA margin and combined loans receivable – principal are non-GAAP financial measures. See Appendix for a reconciliation to GAAP measures.

7

2Q17 Business Update

RISE enters Kansas

16th state, first state with a RISE line of credit offering

Launch of Elevate Labs

Supports continued leadership in advanced analytics and data science

Expanded funding capacity for Elastic

From $150mm to $250mm

Retirement of Chief Credit Officer, Walt Ramsey

Elastic passes $200mm in outstandings

Now serving more than 120,000 open accounts with Elastic

8

Growth in revenue and combined loans receivable-principal1

Combined loans receivable – principal is a non-GAAP financial measure. See Appendix for a reconciliation to the GAAP measure.

-

50

100

150

200

250

300

350

400

450

500

550

600

-

20

40

60

80

100

120

140

160

180

200

Q4

20

13

Q1

20

14

Q2

20

14

Q3

20

14

Q4

20

14

Q1

20

15

Q2

20

15

Q3

20

15

Q4

20

15

Q1

20

16

Q2

20

16

Q3

20

16

Q4

20

16

Q1

20

17

Q2

20

17

Co

m

bin

ed

L

oa

ns

R

ec

eiv

ab

le

-P

rin

cip

al

($

m

illi

on

s)

Re

ve

nu

es

($

m

illi

on

s)

Revenues Combined Loans Receivable - Principal

S

e

a

s

o

n

a

l

s

lo

w

p

e

rio

d

S

ea

s

ona

l s

low

per

io

d

S

ea

s

ona

l s

low

per

io

d

9

Revenue

Adjusted EBITDA1

+281%

+58%

+34%

+20%

+223%

Growth in key financial measures ($mm)

+66%

Adjusted EBITDA is a non-GAAP financial measure. See Appendix for a reconciliation to GAAP measure.

Net Income / (Loss)

10

Q2 2017 Performance

Adjusted EBITDA and combined loans receivable – principal are non-GAAP financial measures. See Appendix for a reconciliation to GAAP measures.

Q2 Q2 Q2 Q2 Q2 Q2 Q2 Q2

($mm) 2017 2016 2017 2016 2017 2016 2017 2016

Gross Revenue 150.5$ 126.8$ 81.4$ 85.3$ 44.2$ 18.7$ 24.9$ 22.8$

Provision for Loan Losses (72.3) (67.1) (41.7) (47.2) (23.2) (10.6) (7.4) (9.3)

Direct Marketing & Other (24.0) (22.1) (11.0) (10.6) (4.4) (3.1) (8.6) (8.4)

Gross Profit 54.2$ 37.6$ 28.7$ 27.5$ 16.6$ 5.0$ 8.9$ 5.1$

Adjusted EBITDA

1

19.8$ 7.3$

Net Income (Loss) 3.0$ (7.5)$

Combined loans receivable -

principal 2 481.1$ 373.7$ 245.6$ 235.7$ 196.6$ 102.2$ 38.9$ 35.8$

Loan Loss Provision % of Revenue 48% 53% 51% 55% 52% 57% 30% 41%

Gross Margin 36% 30% 35% 32% 38% 27% 36% 22%

Adjusted EBITDA Margin

1

13% 6%

Total Company RISE ELASTIC SUNNY

11

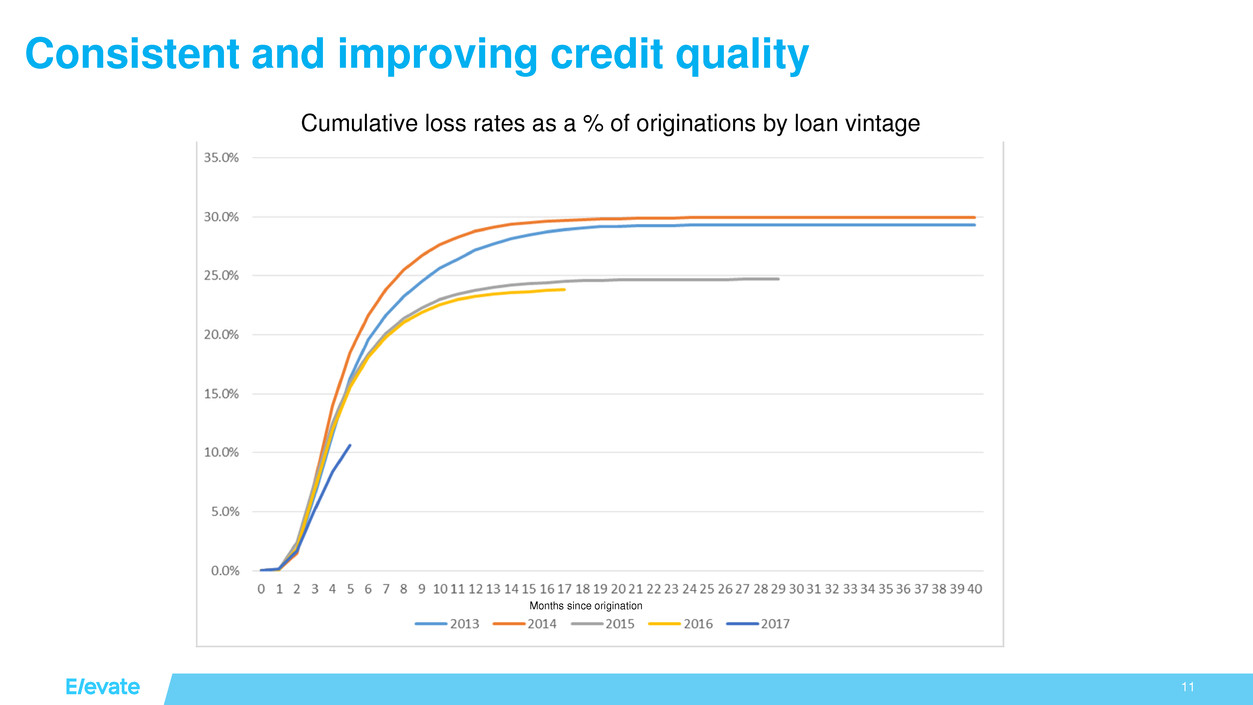

Consistent and improving credit quality

Cumulative loss rates as a % of originations by loan vintage

Months since origination

12

Rapidly expanding margins

% of Gross Revenues

2015 2016 Q2 2017

YTD

2017

LT

Target

Gross Revenue 100% 100% 100% 100% 100%

Loan Loss

Provision

54% 55% 48% 50% 50%

Direct Marketing

and

Other Cost of Sales

18% 14% 16% 13% 10%

Gross Margin 29% 31% 36% 37% 40%

Operating

Expenses

25% 21% 23% 22% 20%

Adjusted EBITDA

Margin

1 4% 10% 13% 15% 20% ➡

Adjusted EBITDA margin is a non-GAAP financial measure. See Appendix for a reconciliation to GAAP measure.

13

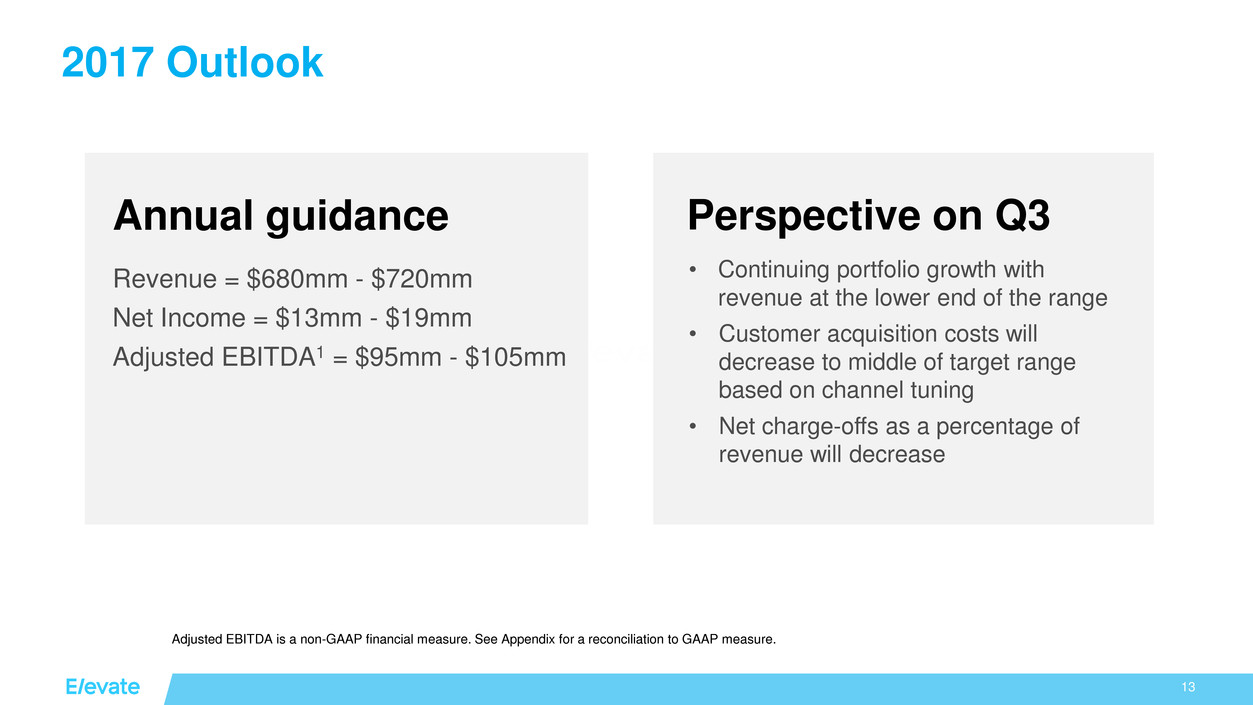

2017 Outlook

Revenue = $680mm - $720mm

Net Income = $13mm - $19mm

Adjusted EBITDA1 = $95mm - $105mm

• Continuing portfolio growth with

revenue at the lower end of the range

• Customer acquisition costs will

decrease to middle of target range

based on channel tuning

• Net charge-offs as a percentage of

revenue will decrease

Perspective on Q3 Annual guidance

Adjusted EBITDA is a non-GAAP financial measure. See Appendix for a reconciliation to GAAP measure.

14 14

We believe

everyone

deserves

a lift.

15

Appendix

16

YTD 2017 Performance

1 Adjusted EBITDA is not a financial measure prepared in accordance with GAAP. Adjusted EBITDA represents our net loss, adjusted to exclude: net interest expense primarily associated with notes payable under the VPC Facility and

ESPV facility used to fund or purchase loans; foreign currency gains and losses associated with our UK operations; depreciation and amortization expense on fixed assets and intangible assets; adjustments to contingent

consideration payable related to companies previously acquired prior to the spin-off; stock compensation expense and income taxes. See the Appendix for a reconciliation to GAAP net loss.

2 Combined loans receivable-principal is a not a financial measure prepared in accordance with GAAP. Combined loans receivable – principal represents loans owned by the company plus loans originated and owned by third-party

lenders pursuant to our CSO programs.

YTD Q2 YTD Q2 YTD Q2 YTD Q2 YTD Q2 YTD Q2 YTD Q2 YTD Q2

($mm) 2017 2016 2017 2016 2017 2016 2017 2016

Gross Revenue 306.8$ 257.5$ 170.7$ 176.6$ 86.4$ 34.6$ 49.7$ 46.3$

Provision for Loan Losses (155.1) (126.2) (90.4) (89.7) (45.2) (17.8) (19.5) (18.7)

Direct Marketing & Other (38.6) (35.2) (16.3) (16.7) (7.7) (4.4) (14.6) (14.1)

Gross Profit 113.1$ 96.1$ 64.0$ 70.2$ 33.5$ 12.4$ 15.6$ 13.5$

Adjusted EBITDA

1

44.7$ 36.7$

Net Income (Loss) 4.7$ (1.7)$

Combined loans receivable -

principal 2 481.1$ 373.7$ 245.6$ 235.7$ 196.6$ 102.2$ 38.9$ 35.8$

Loan Loss Provision % of Revenue 51% 49% 53% 51% 52% 51% 39% 40%

Gross Margin 37% 37% 37% 40% 39% 36% 31% 29%

Adjusted EBITDA Margin

1

15% 14%

Total Company RISE ELASTIC SUNNY

17

Footnotes

Page 3:

1 Originations and customers from 2002-June 2017, attributable to the combined current and predecessor direct and branded products

Page 5:

1 According to an analysis of TransUnion data through the third quarter of 2014 by the Corporation for Enterprise Development

2 FICO, Expanding Credit Opportunities, July 2015

3 House of Commons Welsh Affairs Committee, The Impact of Changes Benefit in Wales, October 2013

4 Elevate analysis 2015-2016; US income and home ownership data from Elevate internal database for customers acquired in 2016; other data from self-reported customer research.

5 Range of middle quintile of Elevate US customers (2016)

6 According to our analysis of master pool trust data of securitizations for the five major credit card issuers, we estimate that from 2008 to 2016, revolving credit to US borrowers with FICO scores of less than 660 was reduced by approximately $142 billion

Page 6:

1 Q2 2016 revenue of $127 million and Q2 2017 revenue of $150 million.

2 Combined loans receivable – principal at June 30, 2016 of $374 million and at June 30, 2017 of $481 million. Combined loans receivable-principal is a not a financial measure prepared in accordance with GAAP. Combined loans receivable – principal

represents loans owned by the company plus loans originated and owned by third-party lenders pursuant to our CSO programs.

3 Adjusted EBITDA is not a financial measure prepared in accordance with GAAP. Adjusted EBITDA represents our net income/loss, adjusted to exclude: net interest expense primarily associated with notes payable under the VPC Facility and ESPV facility

used to fund or purchase loans; foreign currency gains and losses associated with our UK operations; depreciation and amortization expense on fixed assets and intangible assets; adjustments to contingent consideration payable related to companies

previously acquired prior to the spin-off; stock compensation expense and income taxes. See the Appendix for a reconciliation to GAAP net income/loss.

4 Based on an average APR of 131% for the quarter. This estimate, which has not been independently confirmed, is based on our own internal comparison of revenues from our combined loan portfolio and the same portfolio with an APR of 400%, which is

the approximate average APR for a payday loan according to the Consumer Financial Protection Bureau, or “CFPB.”

Page 8

1 Combined loans receivable-principal is a not a financial measure prepared in accordance with GAAP. Combined loans receivable – principal represents loans owned by the company plus loans originated and owned by third-party lenders pursuant to our

CSO programs. For additional reconciliations, see the Prospectus related to the Company’s initial public offering, filed pursuant to Rule 424(b) under the Securities Act of 1933 on April 7, 2017.

Page 9

1 Adjusted EBITDA is not a financial measure prepared in accordance with GAAP. Adjusted EBITDA represents our net income/loss, adjusted to exclude: net interest expense primarily associated with notes payable under the VPC Facility and ESPV facility

used to fund or purchase loans; foreign currency gains and losses associated with our UK operations; depreciation and amortization expense on fixed assets and intangible assets; adjustments to contingent consideration payable related to companies

previously acquired prior to the spin-off; stock compensation expense and income taxes. See the Appendix for a reconciliation to GAAP net income/loss.

Page 10

1 Adjusted EBITDA is not a financial measure prepared in accordance with GAAP. Adjusted EBITDA represents our net income/loss, adjusted to exclude: net interest expense primarily associated with notes payable under the VPC Facility and ESPV facility

used to fund or purchase loans; foreign currency gains and losses associated with our UK operations; depreciation and amortization expense on fixed assets and intangible assets; adjustments to contingent consideration payable related to companies

previously acquired prior to the spin-off; stock compensation expense and income taxes. See the Appendix for a reconciliation to GAAP net income/loss.

2 Combined loans receivable-principal is a not a financial measure prepared in accordance with GAAP. Combined loans receivable – principal represents loans owned by the company plus loans originated and owned by third-party lenders pursuant to our

CSO programs.

18

Footnotes (continued)

Page 12

1 Adjusted EBITDA is not a financial measure prepared in accordance with GAAP. Adjusted EBITDA represents our net income/loss, adjusted to exclude: net interest expense primarily associated with notes payable under the VPC Facility and ESPV facility

used to fund or purchase loans; foreign currency gains and losses associated with our UK operations; depreciation and amortization expense on fixed assets and intangible assets; adjustments to contingent consideration payable related to companies

previously acquired prior to the spin-off; stock compensation expense and income taxes. See the Appendix for a reconciliation to GAAP net income/loss.

Page 13

1 Adjusted EBITDA is not a financial measure prepared in accordance with GAAP. Adjusted EBITDA represents our net income/loss, adjusted to exclude: net interest expense primarily associated with notes payable under the VPC Facility and ESPV

facility used to fund or purchase loans; foreign currency gains and losses associated with our UK operations; depreciation and amortization expense on fixed assets and intangible assets; adjustments to contingent consideration payable related to

companies previously acquired prior to the spin-off; stock compensation expense and income taxes. See the Appendix for a reconciliation to GAAP net income/loss.

19

Non-GAAP financials reconciliation

Adjusted EBITDA Reconciliation

The Company’s Adjusted EBITDA guidance does not include certain charges and costs. The adjustments in future periods are generally expected to be similar to the kinds of charges and costs excluded

from Adjusted EBITDA in prior periods, such as the impact of income tax benefit or expense, non-operating income or expense, foreign currency transaction gain or loss associated with our UK

operations, net interest expense, stock-based compensation expense and depreciation and amortization expense, among others. The Company is not able to provide a reconciliation of the Company’s

non-GAAP financial guidance to the corresponding GAAP measure without unreasonable effort because of the uncertainty and variability of the nature and amount of these future charges and costs.

($mm) 2016 2015 2014 2013 2017 2016 2017 2016

Net income (22)$ (20) (55) (45)$ 3$ (7) 5$ (2)

Adjustments:

Net interest expense 64 37 13 - 18 14 37 28

Stock-based compensation 2 1 1 - 2 - 3 -

Foreign currency transaction (gain) loss 9 2 1 - (2) 3 (2) 5

Depreciation and amortization 11 9 8 5 2 3 5 6

Income tax expense (benefit) (3) (5) (21) (9) (1) (6) - -

Non-operating expense (income) - (6) - (1) (2) - (3) -

Loss on discontinued operations - - - 2 - - - -

Adjusted EBITDA 60$ 19 (53) (47) 20$ 7$ 45$ 37$

Adjusted EBITDA Margin 10% 4% -19% -65% 13% 5% 15% 14%

Three months ended

June 30,For the years ended December 31,

Six months ended

June, 30

20

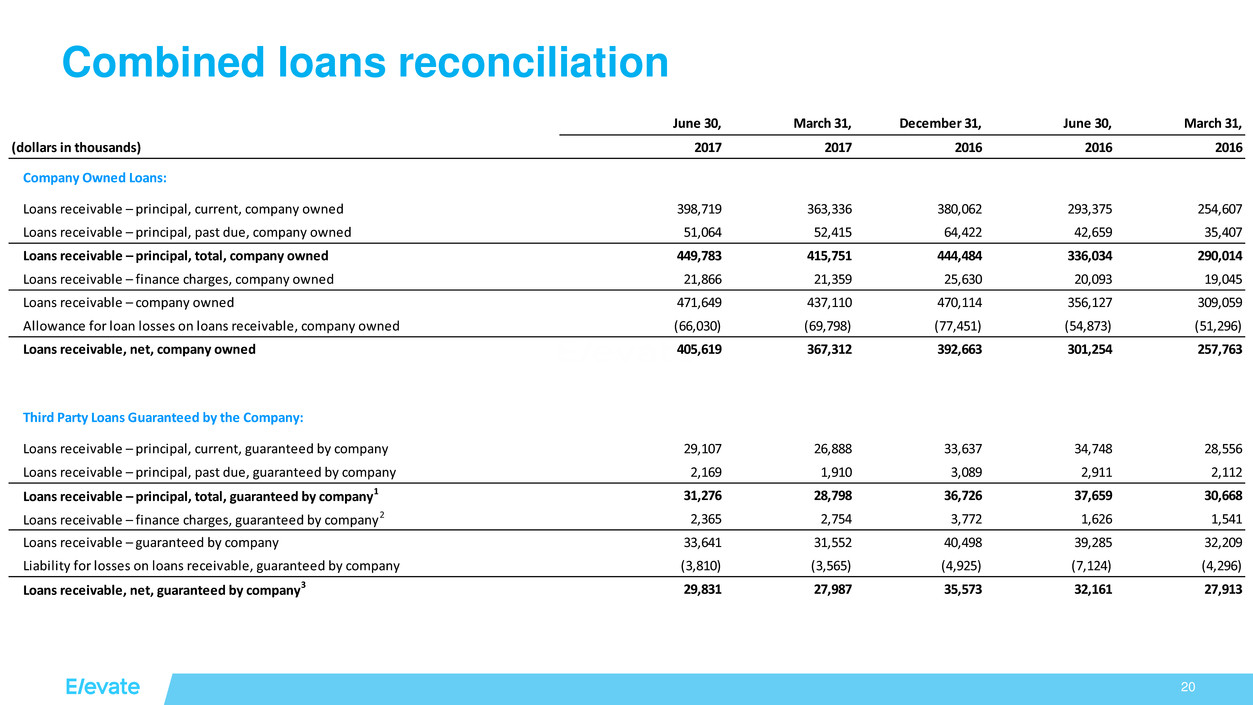

Combined loans reconciliation

June 30, March 31, December 31, June 30, March 31,

(dollars in thousands) 2017 2017 2016 2016 2016

Company Owned Loans:

Loans receivable – principal, current, company owned 398,719 363,336 380,062 293,375 254,607

Loans receivable – principal, past due, company owned 51,064 52,415 64,422 42,659 35,407

Loans receivable – principal, total, company owned 449,783 415,751 444,484 336,034 290,014

Loans receivable – finance charges, company owned 21,866 21,359 25,630 20,093 19,045

Loans receivable – company owned 471,649 437,110 470,114 356,127 309,059

Allowance for loan losses on loans receivable, company owned (66,030) (69,798) (77,451) (54,873) (51,296)

Loans receivable, net, company owned 405,619 367,312 392,663 301,254 257,763

Third Party Loans Guaranteed by the Company:

Loans receivable – principal, current, guaranteed by company 29,107 26,888 33,637 34,748 28,556

Loans receivable – principal, past due, guaranteed by company 2,169 1,910 3,089 2,911 2,112

Loans receivable – principal, total, guaranteed by company1 31,276 28,798 36,726 37,659 30,668

Loans receivable – finance charges, guaranteed by company2 2,365 2,754 3,772 1,626 1,541

Loans receivable – guaranteed by company 33,641 31,552 40,498 39,285 32,209

Liability for losses on loans receivable, guaranteed by company (3,810) (3,565) (4,925) (7,124) (4,296)

Loans receivable, net, guaranteed by company3 29,831 27,987 35,573 32,161 27,913

21

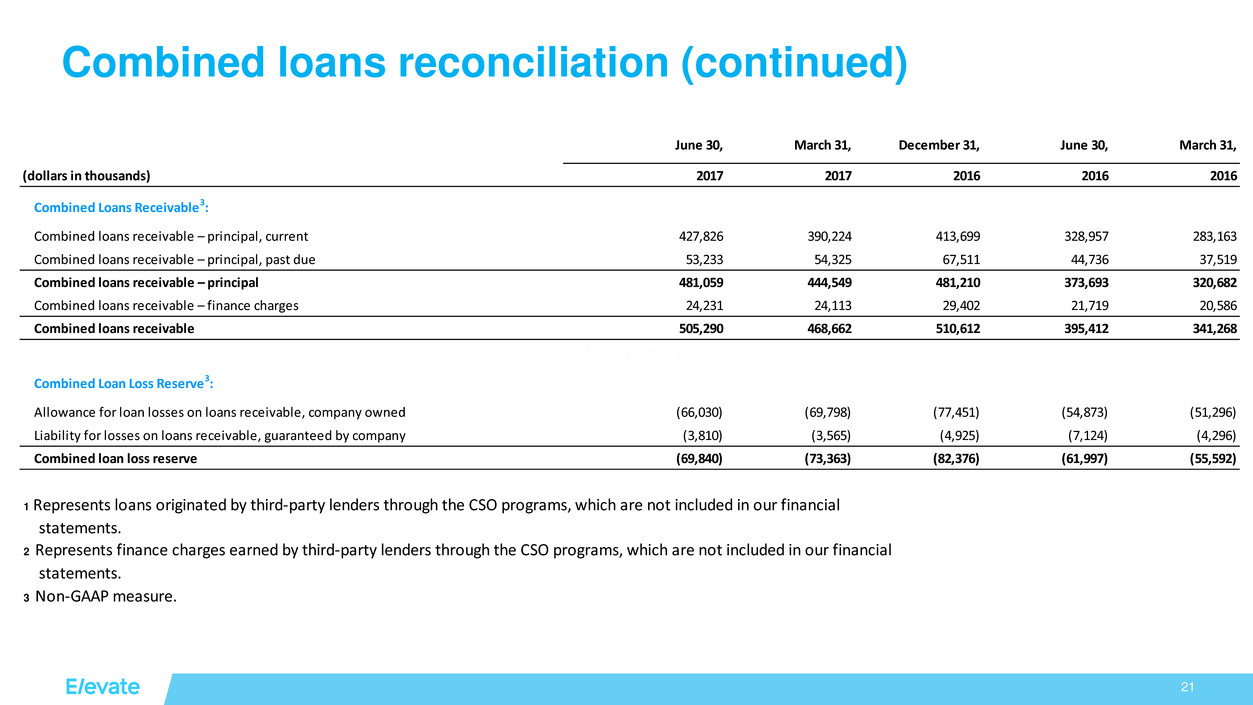

Combined loans reconciliation (continued)

June 30, March 31, December 31, June 30, March 31,

(dollars in thousands) 2017 2017 2016 2016 2016

Combined Loans Receivable3:

Combined loans receivable – principal, current 427,826 390,224 413,699 328,957 283,163

Combined loans receivable – principal, past due 53,233 54,325 67,511 44,736 37,519

Combined loans receivable – principal 481,059 444,549 481,210 373,693 320,682

Combined loans receivable – finance charges 24,231 24,113 29,402 21,719 20,586

Combined loans receivable 505,290 468,662 510,612 395,412 341,268

Combined Loan Loss Reserve3:

Allowance for loan losses on loans receivable, company owned (66,030) (69,798) (77,451) (54,873) (51,296)

Liability for losses on loans receivable, guaranteed by company (3,810) (3,565) (4,925) (7,124) (4,296)

Combined loan loss reserve (69,840) (73,363) (82,376) (61,997) (55,592)

3 Non-GAAP measure.

1 Represents loans originated by third-party lenders through the CSO programs, which are not included in our financial

statements.

2 Represents finance charges earned by third-party lenders through the CSO programs, which are not included in our financial

statements.

© 2017 Elevate. All Rights Reserved.