Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CHS INC | a8-kaugust12017rochelletow.htm |

1

<JAY>

Before we get started, please take a moment to review this slide,

which has important information for our time together. Some of the

business and financial topics we discuss may be considered

forward–looking statements under U.S. securities laws. It’s

important that all understand that actual events and results could

differ from our comments today.

2

3

<REGIONAL DIRECTOR>

Good morning.

As your regional directors on the CHS Board of Directors, we would

like to welcome you to Rochelle, and introduce ourselves, in case we

haven’t had a chance to meet yet.

Each director introduces himself, gives background and talks about

his farm operation

Thanks again for coming and now we’d like to introduce you to our

CHS Board of Directors chairman, Dan Schurr.

4

<DAN>

Good morning.

Welcome to the 2017 Your CHS Town Hall in Rochelle. This town hall

is one of 10 the board of directors and your CHS management team

is hosting throughout the country – from oil refineries to export

terminals, to ethanol plants and joint ventures with member

cooperatives.

We’re excited for this opportunity for all of us to be together today

and explore these facilities and also talk about some significant

topics impacting our cooperative system.

If we haven’t met before, I’m Dan Schurr. I’ve served on the board

for 11 years, elected by Region 7. I farm in Le Claire, Iowa, where I

grow corn and soybeans and operate a commercial trucking

business.

After Dave Bielenberg stepped down, I was elected by your board to

move from the vice chair role into the board chair role. I want to

thank Dave for his service to this cooperative.

I’m also pleased to welcome Jay Debertin, whom our board elected

as the new president and CEO of CHS in May. Many of you know Jay

because he has been with CHS for more than 30 years, leading a

variety of teams in energy and processing and food ingredients. Jay

is originally from the Red River Valley area of Minnesota and North

Dakota.

4

<JAY>

Thanks, Dan. And, thanks to all of you for coming out today. We

know it’s a busy time of year and we’re going to use your time

wisely.

Before we get into the formal program, I’d like to talk about what is

likely on your minds. I’d like to take a moment and discuss this

recent leadership transition with you.

As you know, Carl Casale served our cooperative as president and

CEO during a period of record growth and profitability in the

agricultural industry. I have a lot of respect for Carl and his vision

for the agricultural industry. He brought a lot of value to our

leadership team as an executive and also as the operator of a family

farm. Over the past several months, everyone – including Carl -

recognized we were entering a new chapter for CHS and for the ag

industry.

Just as we had under Carl’s leadership, we are faced with both

opportunities and challenges – and we will get after all of them.

What I want to say up front about this change is that all parties

involved are satisfied with this outcome. And, all of us are focusing

our time and energy on moving forward, in partnership with all of

you.

<DAN>

And, as for our leadership changes on the board, everyone who has

served and continues to serve has helped create a strong

foundation that we’re going to continue to build upon. Do we have

4

disagreements at times? Yes, we do, that’s what we’re elected to do

– discuss things, debate and sometimes disagree, but in the end,

make our decisions as one board. And all of those decisions are

made with only one objective in mind: helping our owners grow and

prosper. It’s not easy work. Our board members serve with real

purpose on behalf of all of you to ensure the long-term vitality and

success of this cooperative system.

Questions

We’ll have more time for questions throughout the day, so as you

think of questions please feel free to jot them down.

I’d like to ask the board members here today to stand and briefly

introduce themselves to you.

Each board member stands and introduces himself

Thanks all, and I’d encourage everyone to get to know each other

and share insights over lunch or later in the program.

Here is a look at our agenda for this morning:

• Jay will help kick us off with the plan to strengthen and grow

CHS – sharing insights on where we’ve been this year and

where we’re headed in the future

• Tim will give us an overview of the Q3 financials and some

specific events that occurred this year

• Then, we’ll get real-time market updates and insights from some

4

of our CHS business leaders

• Finally, we’ll wrap up by learning more about the asset we are

visiting today, and its importance to CHS

• We’ve also built in plenty of time for conversation – which is the

primary reason we are here - to listen and learn what’s on your

mind and answer the questions you have

So, whether you came from just down the road or across several

states, I welcome you to this CHS town hall.

Now, let’s hear from our president and CEO Jay Debertin…

4

<JAY>

Thanks, Dan. And, thanks to all of you for coming out today.

We know it’s a busy time of year and we’re going to use your

time wisely.

First, I’d like to introduce you to the members of our Strategic

Leadership Team that are here. I’d ask that they stand and

introduce themselves.

Each SLT member in attendance stands and introduces

him/herself.

Thanks again to all, and now let’s get on with our program.

5

<JAY>

One thing that never changes in any cycle, are the CHS shared

values which are core to who we are as a cooperative system.

From…

• Managing our business with the highest integrity

• To our people and their innovative spirit

• Building lasting and mutually rewarding customer

relationships

• Being responsible stewards in our community

• And our tradition of partnership and shared success

Each of these values fuels our promise to all of you – to help our

owners grow. You have my commitment to make sure CHS is

always performing to these standards.

6

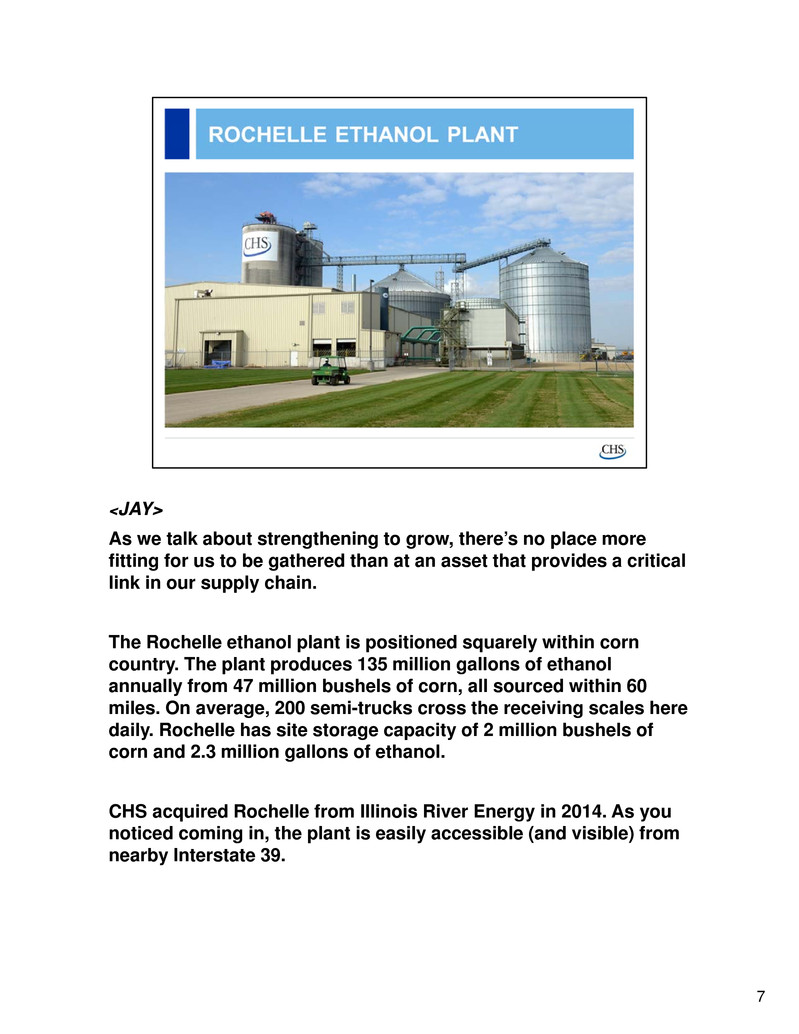

<JAY>

As we talk about strengthening to grow, there’s no place more

fitting for us to be gathered than at an asset that provides a critical

link in our supply chain.

The Rochelle ethanol plant is positioned squarely within corn

country. The plant produces 135 million gallons of ethanol

annually from 47 million bushels of corn, all sourced within 60

miles. On average, 200 semi-trucks cross the receiving scales here

daily. Rochelle has site storage capacity of 2 million bushels of

corn and 2.3 million gallons of ethanol.

CHS acquired Rochelle from Illinois River Energy in 2014. As you

noticed coming in, the plant is easily accessible (and visible) from

nearby Interstate 39.

7

<JAY>

E-85 ethanol leaves the plant by truck and is marketed by CHS

Renewable Fuels locally and to nearby Chicago fuel blenders for

delivery to thousands of gas stations and convenience stores.

CHS Rochelle has earned Environmental Protection Agency (EPA)

recognition as one of the agency’s efficient producers, using fewer

resources (water, electricity, steam) while diligently complying with

EPA regulations and permits.

Recent plant investments include a $1.7 million corn oil centrifuge

to improve corn oil recovery.

Stewardship is a big focus at Rochelle as well, with its 61

employees actively engaged to raise money for the community

through an annual golf tournament, Thanksgiving food drives, 4-H

and county fair funding and Ag in the Classroom. Employees also

visit local schools to discuss career opportunities.

All of the things I’ve outlined, proximity to customer, source of

supply, operational excellence, supply chain, etc. are what makes

this facility of great value to our owners and our system.

8

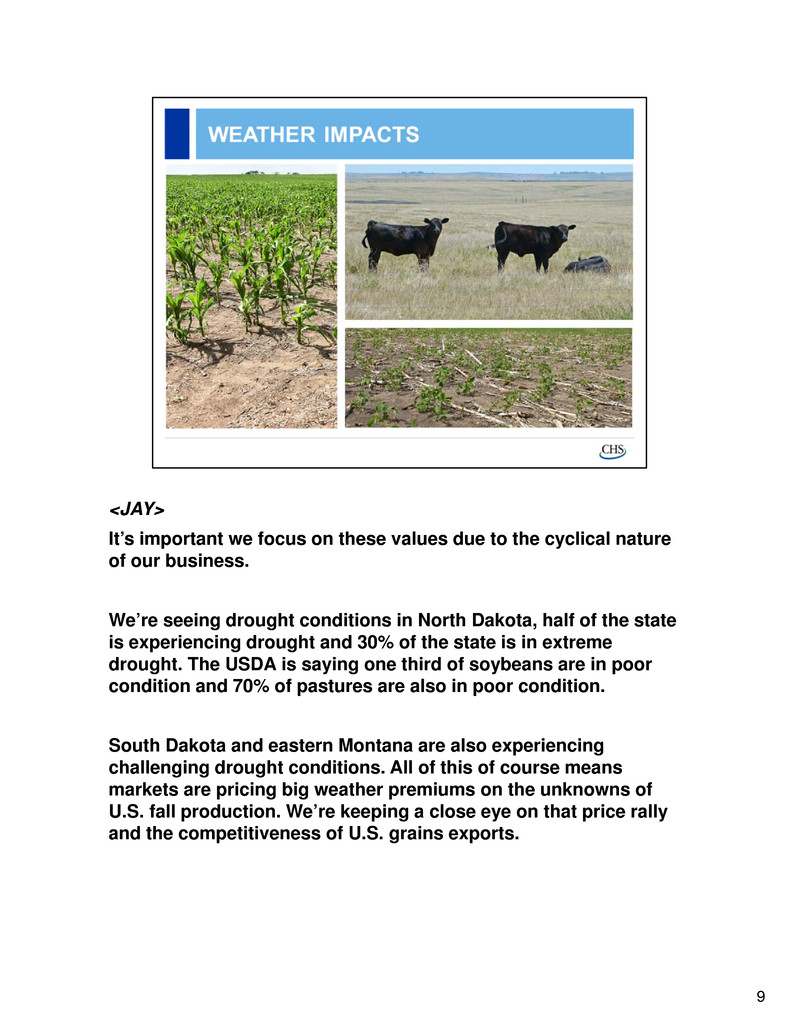

<JAY>

It’s important we focus on these values due to the cyclical nature

of our business.

We’re seeing drought conditions in North Dakota, half of the state

is experiencing drought and 30% of the state is in extreme

drought. The USDA is saying one third of soybeans are in poor

condition and 70% of pastures are also in poor condition.

South Dakota and eastern Montana are also experiencing

challenging drought conditions. All of this of course means

markets are pricing big weather premiums on the unknowns of

U.S. fall production. We’re keeping a close eye on that price rally

and the competitiveness of U.S. grains exports.

9

<Jay>

And while west of us is severely dry, you’ve seen recent heavy rain

and flooding in and around Rochelle. As all of you know, the Kyte

Creek is now back within its banks and it sounds like clean up is

going well.

Our operations here were not impacted by the heavy rain, but this

speaks to our continued ups and downs that can impact our

business. There will always been challenges that are out of our

control – drought in some places and floods in others - but we will

put ourselves in the best position to control what we can.

10

<JAY>

The crop nutrient marketplace shows a pretty quiet market in an

over-supply situation. We’re seeing cautious buying interest into

the fall by retailers and producers due to pressure on profitability

and a cautious risk management approach. Spring of 2018 pricing

likely will take direction from the grain markets, the amount of

acres planted to corn, the financial condition of the U.S. producer

and global market conditions.

11

<JAY>

On the Energy side, crude oil prices currently are near $45,

continuing to trade range bound in the low-to-mid $40’s. Common

external outlook for the balance of 2017 and 2018 is that oil prices

should remain in the $40 to $50 range.

U.S. refineries continue to run near record levels with crude inputs

averaging roughly 17 million barrels per day. Overall, U.S.

inventories on crude oil, gasoline and diesel remain near seasonal

highs with inventories likely to remain elevated for the balance of

2017.

We’ve experienced these types of ups and downs in our markets

for the past 85 years and that’s going to continue. In our

businesses, we are price-takers on both ends with what we buy

and what we sell. So, we have to operate in whatever market

environment is out there. Which is why, it’s imperative that we’re

not only able to ride these cycles but that we’re able to succeed in

them.

12

<JAY>

Unfortunately, our challenges this year, especially this quarter, go

beyond the typical ups and downs of cyclical markets. We

experienced significant losses due to three events, two that occurred

this quarter and one that spanned the past three quarters.

This quarter, we took significant specific charges related to a trading

partner in Brazil entering bankruptcy proceedings under Brazilian law

and two asset impairment charges. And, when we look at our results

for the 9-month period year to date, we have the large producer loan

loss that we’ve been reporting on for the last few quarters.

We’ll discuss each of these serious issues today and I’ll walk us

through how we’re responding to these events by aggressively

addressing gaps moving forward to strengthen and grow CHS.

While I won’t understate the seriousness of this quarter’s earnings

results, we remain confident in the future of CHS and our ability to

serve all of you. Overall, our core businesses have had solid

performance so far this year and some business units have had

strong performance.

13

<JAY>

It has been a challenging quarter, but there is good news to share too.

When we look at the performance of many of our businesses in the

current ag economy, I believe that our performance has been good.

And the fact that our core businesses are showing stable

performance allows us to focus our immediate efforts on closing

gaps, driving operational excellence and strengthening and growing

CHS.

We’re going to work hard at this. Make no mistake – we have our

sleeves rolled up on work that we believe will both strengthen and

grow CHS in the days, weeks, and years ahead.

14

<JAY>

The first thing we will focus on is strengthening our relationships,

especially our connection with all of you. CHS runs on

relationships. Relationships with owners, customers, employees

and business partners have been the driving force behind our

shared success. And, when times are more challenging, those

relationships are what get you through. So we’re renewing our

focus on our relationships.

15

<JAY>

We’ll be mindful about safety, always. CHS continues to strive to

achieve our goal of no accidents, no injuries and no deaths. We

will continue to put the environment, health and safety first in all

we do.

16

<JAY>

We are strengthening by enhancing the rigor in how we do business

so we limit losses and really win when the businesses are performing

well.

17

<JAY>

As your partner, it’s vital that we think strategically about our assets

to ensure each is driving the performance we need and expect. To do

this, we’ve created a custom portfolio review tool that is helping us

analyze assets across our company and giving us a holistic look at

what’s performing well, what’s core and what needs improvement.

18

<JAY>

And, we will grow in the markets where we can increase share and

perform well for our owners and our partners around the world.

Now I’d like to turn it over to Tim for the financial update.

19

<TIM>

Thanks Jay and good morning to you all.

The financial results for the third quarter of 2017 are disappointing

and quite frankly challenging. Despite solid year-over-year

performance in most of our base businesses, the three specific

events Jay mentioned are resulting in CHS reporting a substantial

financial loss this quarter.

20

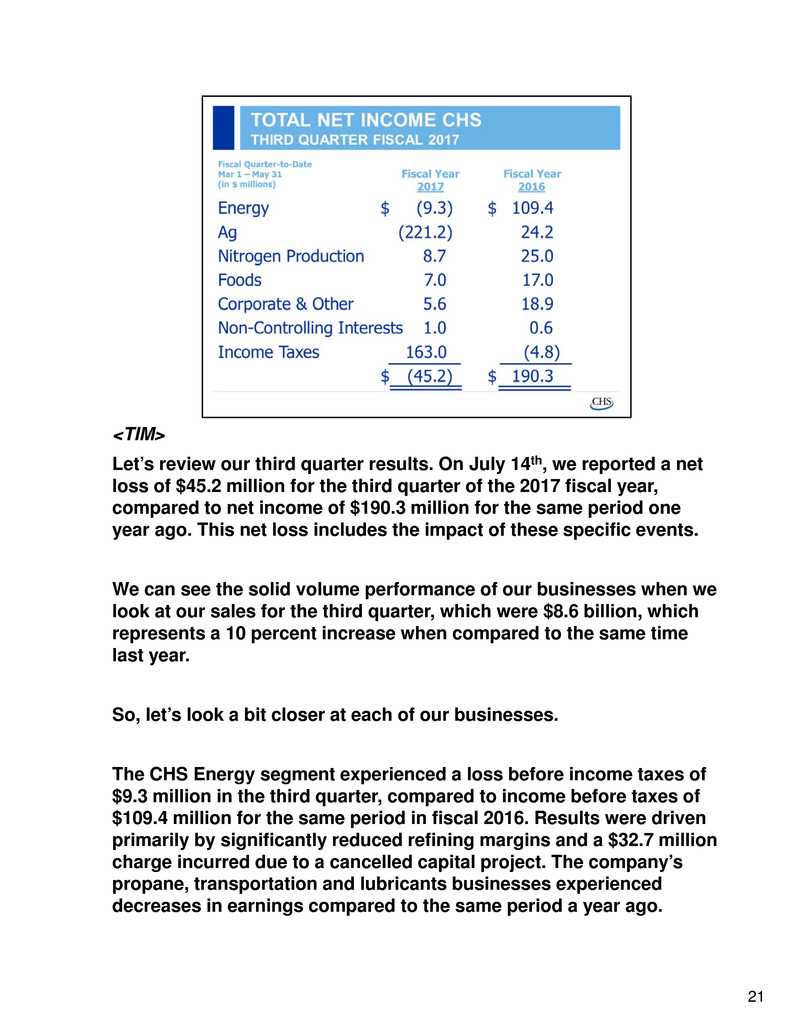

<TIM>

Let’s review our third quarter results. On July 14th, we reported a net

loss of $45.2 million for the third quarter of the 2017 fiscal year,

compared to net income of $190.3 million for the same period one

year ago. This net loss includes the impact of these specific events.

We can see the solid volume performance of our businesses when we

look at our sales for the third quarter, which were $8.6 billion, which

represents a 10 percent increase when compared to the same time

last year.

So, let’s look a bit closer at each of our businesses.

The CHS Energy segment experienced a loss before income taxes of

$9.3 million in the third quarter, compared to income before taxes of

$109.4 million for the same period in fiscal 2016. Results were driven

primarily by significantly reduced refining margins and a $32.7 million

charge incurred due to a cancelled capital project. The company’s

propane, transportation and lubricants businesses experienced

decreases in earnings compared to the same period a year ago.

21

The CHS Ag segment, which includes domestic and global grain

marketing and crop nutrients businesses, renewable fuels, local

retail operations, and processing and food ingredients, generated a

loss before income taxes of $221.2 million in the third quarter,

compared to income before taxes of $24.2 million for the same

period in fiscal 2016. Grain marketing earnings decreased primarily

due to a $230 million charge driven by a trading partner in Brazil

entering bankruptcy proceedings under Brazilian law. The

wholesale crop nutrients and renewable fuels businesses

experienced decreases due to lower margins. The processing and

food ingredients business earnings decreased primarily due to

impairment charges taken on certain assets in the third quarter.

Country Operations earnings increased due primarily to increased

volumes.

The Nitrogen Production segment generated income of $8.7 million

during the third quarter, compared to $25.0 million during the same

period last year. The decrease is primarily due to lower production

margins.

The company’s Foods segment, previously reported as a

component of Corporate and Other, generated pretax earnings of

$7.0 million during the third quarter of fiscal 2017, compared to

$17.0 million in the same period the previous year. The decreases

were primarily due to reduced margins at Ventura Foods, LLC, the

investment that makes up the Foods segment.

Corporate and Other generated pretax income of $5.6 million during

the third quarter, compared to $18.9 million during the same time

period the previous year. Earnings in this category are primarily

derived from the company’s equity investment in the Ardent Mills,

LLC, wheat milling joint venture and our Business Solutions

operations.

21

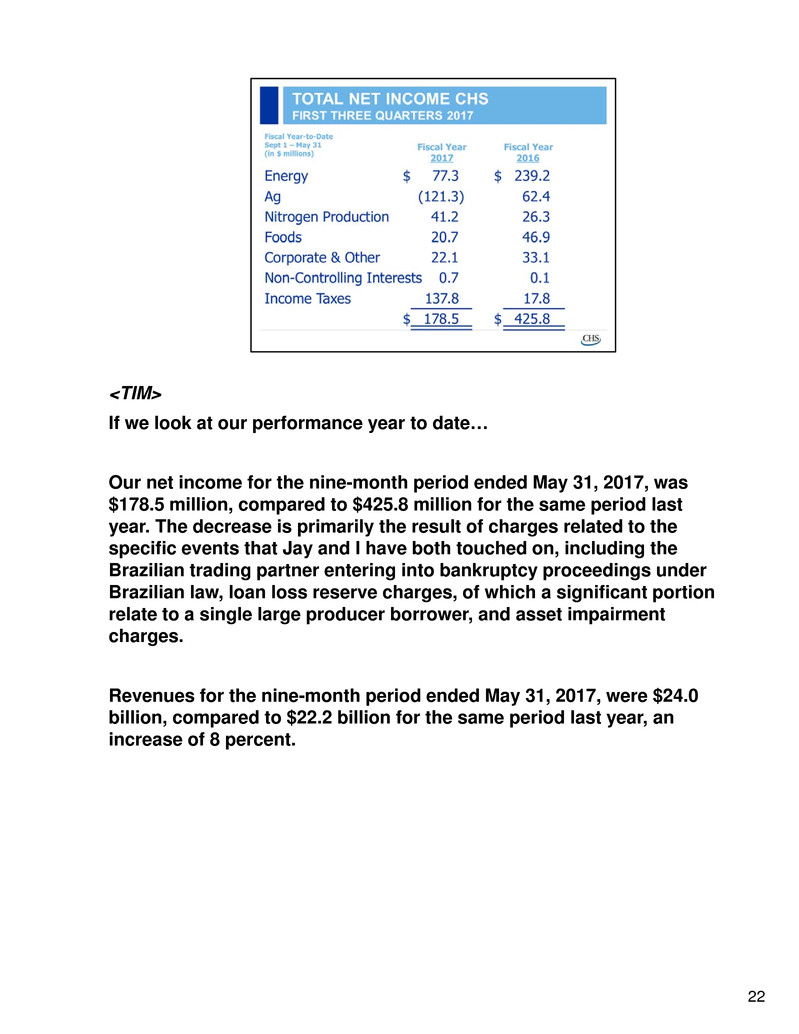

<TIM>

If we look at our performance year to date…

Our net income for the nine-month period ended May 31, 2017, was

$178.5 million, compared to $425.8 million for the same period last

year. The decrease is primarily the result of charges related to the

specific events that Jay and I have both touched on, including the

Brazilian trading partner entering into bankruptcy proceedings under

Brazilian law, loan loss reserve charges, of which a significant portion

relate to a single large producer borrower, and asset impairment

charges.

Revenues for the nine-month period ended May 31, 2017, were $24.0

billion, compared to $22.2 billion for the same period last year, an

increase of 8 percent.

22

<TIM>

Given the impact on our results from these specific events, I’d like to

share a bit more about each. I’ll start with the large producer loan

loss.

Over the past four quarters, we have reported on the loan loss reserve

associated with loans to a single large producer in the Midwestern

region of the U.S.

During the third quarter of fiscal 2017, CHS Capital concluded a

transaction with the single producer borrower whereby CHS Capital

obtained from the borrower approximately 14,000 acres of land and

improvements that, prior to the transaction, were owned by the

borrower and served as collateral for the outstanding loans to CHS

Capital. The amount corresponding to the fair value of the land and

improvements, approximately $139 million, was credited against the

notes receivable from this single producer borrower.

As a result of this arrangement, all remaining outstanding notes

receivable balances and corresponding reserves related to this single

producer borrower were removed from the balance sheet of CHS for

financial reporting purposes. However, we continue to enforce our

rights under the various agreements between CHS Capital and the

producer borrower to pursue future potential recoveries.

The second significant event occurred when Seara, a long-time grain

originator and supply chain partner for our subsidiary in Brazil, filed 23

for Judicial Reorganization under Brazilian law, which is similar to

bankruptcy in the U.S.

CHS Brazil had maintained a grain origination relationship with

Seara for over a decade. The loss represents various advances and

credit that CHS had extended to Seara and these are covered by the

bankruptcy proceedings. We also are a secured creditor of certain

affiliate companies that are part of the bankruptcy proceeding. We

are seeking recovery under Brazilian bankruptcy law and through

other legal proceedings. Any recovery that CHS Brazil receives will

be recognized as income at that time in the future.

CHS is actively managing the situation to mitigate the loss and our

Brazilian affiliate continues its grain origination operation.

This event and the large producer loan loss highlight the need for

us to re-focus and improve our risk management practices. One

example is we are establishing a specific Credit Center of

Excellence that will focus on effective management of the credit

risks CHS faces across the enterprise. This is an important

component of our program to restore CHS’s financial flexibility.

Our third event is a result of impairment testing we conducted

during the third fiscal quarter. In Q3 we took impairment charges on

certain long-lived assets and goodwill in our Ag segment.

Additionally, we recorded a $32.7 million impairment charge in our

energy segment relating to the cancellation of a capital project.

23

<TIM>

Looking forward, restoring CHS’s financial flexibility is our #1 financial

priority. I’ll provide a quick overview –

• First, we will continue to keep a sharp focus on managing our controllable

operating expenses. Maintaining expense and cost control is basic

blocking and tackling work for all of us.

• Second, we’re continuing to optimize working capital to ensure we

maintain appropriate levels of liquidity.

• Third, we will continue to limit capital investment to safety, regulatory and

maintenance capital. Growth capital will be limited until financial flexibility

is appropriately restored.

• Fourth, working with your CHS Board Capital Committee, we are

analyzing various equity management options.

• And fifth, we have conducted a strategic portfolio review of our assets.

Our commitment is to be prepared to selectively monetize assets as an

important lever to restore financial flexibility. If we complete any such

transactions, we intend to focus those proceeds on repaying debt.

I want to share that we are committed to restoring financial flexibility to our

CHS balance sheet as quickly as possible. We will take prudent actions.

Even with all that we have experienced this quarter, CHS’s financial

foundation is solid and our people remain committed to serving you, our

owners.

I’ll turn it back over to Jay, but will be available at the end for questions.

24

<JAY>

If you know me, you know I have a passion for this business and

believe deeply in CHS, our owners and all of our employees. While

we’ve talked through some tough topics today, it’s important you

know just how encouraged I am about our future together. We have

great opportunities to take our work to the next level.

25

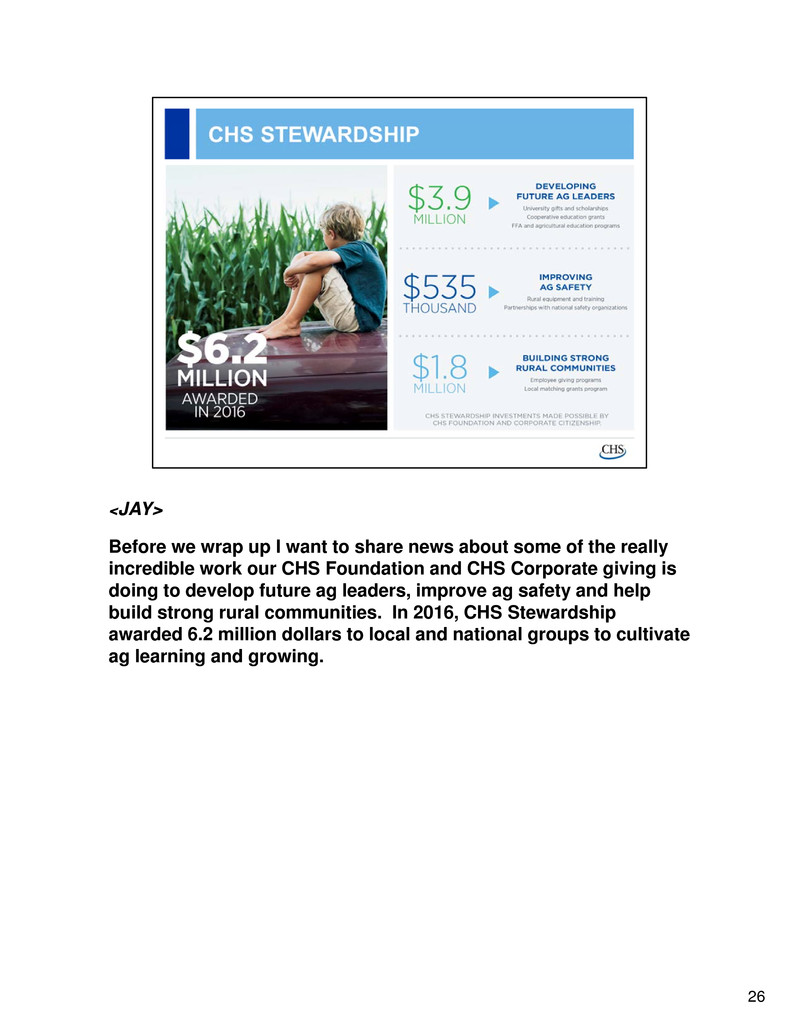

<JAY>

Before we wrap up I want to share news about some of the really

incredible work our CHS Foundation and CHS Corporate giving is

doing to develop future ag leaders, improve ag safety and help

build strong rural communities. In 2016, CHS Stewardship

awarded 6.2 million dollars to local and national groups to cultivate

ag learning and growing.

26

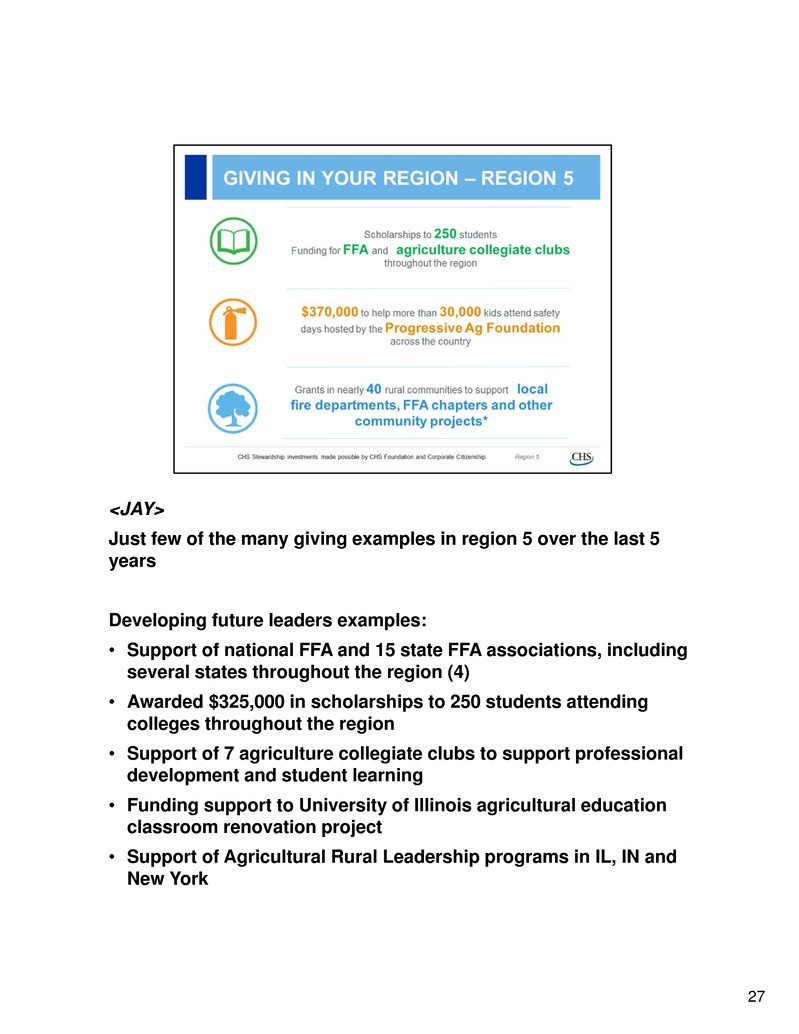

<JAY>

Just few of the many giving examples in region 5 over the last 5

years

Developing future leaders examples:

• Support of national FFA and 15 state FFA associations, including

several states throughout the region (4)

• Awarded $325,000 in scholarships to 250 students attending

colleges throughout the region

• Support of 7 agriculture collegiate clubs to support professional

development and student learning

• Funding support to University of Illinois agricultural education

classroom renovation project

• Support of Agricultural Rural Leadership programs in IL, IN and

New York

27

Improving ag safety examples:

• $370,000 to help more than 30,000 kids attend safety days hosted

by the Progressive Agriculture Foundation

• Membership in several organizations that promote ag safety for

producers, families and employees

Building strong rural communities examples:

• $4.7 million and 3.4 million pounds of food donated to hungry

families across the U.S. through CHS Harvest for Hunger

• Grants in nearly 40 rural communities to support local fire

departments, FFA chapters and other community projects

• Celebrating six years of employees giving back through CHS

Days of Service

27

<JAY>

Those local dollars are what’s important to you. And, to localize

and give even more, the CHS Foundation this year launched Seeds

for Stewardship, which is:

• A grants program that will match your cooperative’s giving

dollars, up to $5,000

• Each CHS member cooperative is eligible to request to receive

this money to support projects that are important within your

own community – from making a playground more safe to

upgrading a fire truck

• There are grant periods throughout the year. For this current

round of giving, cooperatives can apply now through July 1,

2017.

• You can learn more at chsinc.com/stewardship

28

<JAY>

I’d like to talk more about our future with all of you. If you can

share some of your time this December please consider attending

the CHS annual meeting this year. It’s a great chance for you to

connect with other producers, leaders and folks at CHS. We

always love the opportunity to connect in person at this annual

event.

29

<JAY>

Dan and all SLT members present should join Jay and Jean near

the front for questions.

Jay, Jean and Dan will answer questions as well as pass some

along to other CHS Board members and SLT members as

appropriate.

30

31