Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Customers Bancorp, Inc. | a2q17pressrelease.htm |

| 8-K - 8-K - Customers Bancorp, Inc. | a8k063017.htm |

Highly Focused, Low Risk, Above Average Growth

Bank Holding Company

Investor Presentation

July, 2017

NYSE: CUBI

Member FDIC

2

Forward-Looking Statements

This presentation, as well as other written or oral communications made from time to time by us, contains forward-looking information within the meaning of the

safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. These statements relate to future events or future predictions, including events

or predictions relating to future financial performance, and are generally identifiable by the use of forward-looking terminology such as “believe,” “expect,” “may,”

“will,” “should,” “plan,” “intend,” or “anticipate” or the negative thereof or comparable terminology. Forward- looking statements in this presentation include,

among other matters, guidance for our financial performance, and our financial performance targets. Forward-looking statements reflect numerous assumptions,

estimates and forecasts as to future events. No assurance can be given that the assumptions, estimates and forecasts underlying such forward-looking statements

will accurately reflect future conditions, or that any guidance, goals, targets or projected results will be realized. The assumptions, estimates and forecasts

underlying such forward-looking statements involve judgments with respect to, among other things, future economic, competitive, regulatory and financial market

conditions and future business decisions, which may not be realized and which are inherently subject to significant business, economic, competitive and regulatory

uncertainties and known and unknown risks, including the risks described under “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31,

2016 and subsequent Quarterly Reports on Form 10-Q, as such factors may be updated from time to time in our filings with the SEC. Our actual results may differ

materially from those reflected in the forward-looking statements.

In addition to the risks described under “Risk Factors” in our filings with the SEC, important factors to consider and evaluate with respect to our forward-looking

statements include:

• changes in external competitive market factors that might impact our results of operations;

• changes in laws and regulations, including without limitation changes in capital requirements under Basel III;

• changes in our business strategy or an inability to execute our strategy due to the occurrence of unanticipated events;

• our ability to identify potential candidates for, and consummate, acquisition or investment transactions;

• the timing of acquisition, investment or disposition transactions;

• constraints on our ability to consummate an attractive acquisition or investment transaction because of significant competition for these opportunities;

• local, regional and national economic conditions and events and the impact they may have on us and our customers;

• costs and effects of regulatory and legal developments, including the results of regulatory examinations and the outcome of regulatory or other governmental

inquiries and proceedings, such as fines or restrictions on our business activities;

• our ability to attract deposits and other sources of liquidity;

• changes in the financial performance and/or condition of our borrowers;

• changes in the level of non-performing and classified assets and charge-offs;

• changes in estimates of future loan loss reserve requirements based upon the periodic review thereof under relevant regulatory and accounting requirements;

• inflation, interest rate, securities market and monetary fluctuations;

3

Forward-Looking Statements

• timely development and acceptance of new banking products and services and perceived overall value of these products and services by users, including the

products and services being developed and introduced to the market by the BankMobile division of Customers Bank;

• changes in consumer spending, borrowing and saving habits;

• technological changes;

• our ability to increase market share and control expenses;

• continued volatility in the credit and equity markets and its effect on the general economy;

• effects of changes in accounting policies and practices, as may be adopted by the regulatory agencies, as well as the Public Company Accounting Oversight

Board, the Financial Accounting Standards Board and other accounting standard setters;

• the businesses of Customers Bank and any acquisition targets or merger partners and subsidiaries not integrating successfully or such integration being more

difficult, time-consuming or costly than expected;

• material differences in the actual financial results of merger and acquisition activities compared with our expectations, such as with respect to the full realization

of anticipated cost savings and revenue enhancements within the expected time frame;

• our ability to successfully implement our growth strategy, control expenses and maintain liquidity;

• Customers Bank's ability to pay dividends to Customers Bancorp;

• risks related to the sale of BankMobile including:

• our ability to successfully complete a sale and the timing of completion;

• the ability of Customers and a buyer to meet all of the conditions to completion of a sale;

• the impact of an announcement of a sale on the value of our securities, our business and our relationship with employees and customers;

• our use of the proceeds from a sale if any; and

• the effect on Customers' business if a sale is not completed and Customers is unable to sell or otherwise dispose of BankMobile.

• risks relating to BankMobile in the event Customers is unable to sell the BankMobile business, including:

• The execution of our BankMobile integration and business plan may be less successful, more difficult, time-consuming or costly than expected,

and that BankMobile may be unable to realize anticipated cost savings and revenue enhancements within the expected time frame or at all;

• material variances in the adoption rate of BankMobile's services by new students and/or the usage rate of BankMobile's services by current

student customers compared to our expectations;

4

Forward-Looking Statements

• the levels of usage of other BankMobile student customers following graduation of additional product and service offerings of BankMobile or

Customers Bank, including mortgages and consumer loans, and the mix of products and services used;

• our ability to implement changes to BankMobile's product and service offerings under current and future regulations and governmental policies;

• our ability to effectively manage revenue and expense fluctuations that may occur with respect to BankMobile's student-oriented business

activities, which result from seasonal factors related to the higher-education academic year;

• our ability to implement our strategy regarding BankMobile, including with respect to our intent to sell or otherwise dispose of the BankMobile

business in the future, depending upon market conditions and opportunities;

• BankMobile's ability to successfully implement its growth strategy and control expenses; and

• the effects on BankMobile’s results of operations in the event that Customers’ total assets exceed $10 billion at December 31, 2017;

You are cautioned not to place undue reliance on any forward-looking statements we make, which speak only as of the date they are made. We do not undertake

any obligation to release publicly or otherwise provide any revisions to any forward-looking statements we may make, including any forward-looking financial

information, to reflect events or circumstances occurring after the date hereof or to reflect the occurrence of unanticipated events, except as may be required

under applicable law.

5

Investment Proposition

Customers Bank’s BankMobile Division is Classified as Held for Sale in all

Customers’ Consolidated Financial Statements released since January 2017,

Including the January, April and July Earnings Releases, the Form 10K as of,

and for the Period Ending December 31, 2016, and the Form 10Q as of, and

for the Period Ended March 31, 2017. Amounts Included in this Investor

Presentation are “Combined”, Including Both Continuing and Discontinued

Operations, Unless Otherwise Indicated

6

Q2 2017 Highlights

Amounts presented are on a “Combined” basis unless otherwise noted.

(1) Non-GAAP measure calculated as GAAP net income, plus provisions for loan losses and income tax divided by average total assets.

(2) Non-GAAP measure calculated as GAAP net income available to common shareholders, plus provisions for loan losses and income tax expense divided by average common equity.

(3) Non-GAAP measure calculated as GAAP total shareholders equity less preferred stock, less goodwill and other intangibles divided by average total assets less average goodwill and other intangibles

• Q2 2017 Net Income to Common Shareholders of $20.1 million Up 15.4% Over Q2 2016

• Q2 2017 Diluted Earnings Per Common Share of $0.62, Up 5.1% from Q2 2016

• Q2 2017 Net Income from Continuing Operations to Common Shareholders was $25.3 million Up 28.5% Over Q2 2016

• Q2 2017 Diluted Earnings Per Common Share from Continuing Operations was $0.78 for Q2 2017 Up 16.4% from Q2 2016

• Q2 2017 Return on Average Assets of 0.93%

• Q2 2017 Return on Average Common Equity of 11.84%

• Pre-tax, pre-provision ROAA (1) and ROACE (2) for Q2 2017 was 1.43% and 19.42%, respectively

• June 30, 2017 Shareholders Equity of $910 million, up 33.8% from June 30, 2016 with Estimated Tier 1 Risk Based Capital of

10.94% and Tangible Common Equity to Average Tangible Assets (3) of 6.59% for Q2 2017

• Book Value Per Common Share of $22.54 Up 12.8% from Q2 2016

• Total assets of $10.9 billion as of June 30, 2017, up $1.0 billion from March 31, 2017

• Q2 2017 Total Loans Up 6.7% to $9.0 billion, and Total Deposits from Continuing Operations Up 7.8% to $7.0 billion from Q2

2016

• Q2 2017 Efficiency Ratio from Continuing Operations was 40.6% Compared to Q2 2016 Efficiency Ratio from Continuing

Operations of 46.5%

• BankMobile Classified as Held for Sale and Reported as Discontinued Operations in Financial Reports

• Non-Performing Loans to Total Loans only 0.21% and Reserves for Loan Losses 204.59% of Non-Performing Loans

• Customers Bancorp, Inc. issued $100 million five year senior debt bearing interest at 3.95% on June 30, 2017

7

Investment Proposition

Highly Focused, Innovative, Relationship Banking Based Commercial Bank Providing;

Strong Organic Growth, Well Capitalized, Branch Lite Bank in Attractive Markets

Highly skilled teams targeting privately held businesses and high net worth families

Robust risk management driven business strategy

Target market from Boston to Philadelphia along Interstate 95

Strong Profitability, Growth & Efficient Operations

Operating efficiencies offset tighter margins and generate sustainable profitability

Continuing operations efficiency ratio in the 40’s

Target above average ROA (~1%) and ROCE (~11%)

Strong Credit Quality & Low Interest Rate Risk

Unwavering underwriting standards

Loan portfolio performance consistently better than industry and peers

Somewhat asset sensitive

Attractive Valuation

July 19, 2017 share price of $27.95, 10.8x street estimated 2017 earnings and 1.2x book value

June 30, 2017 tangible book value(1) of $21.97, up 90% since Dec 2011 with a CAGR of 12%

Amounts presented are on a “Combined” basis unless otherwise noted.

(1) Non-GAAP measure calculated as GAAP total shareholders equity less preferred stock, less goodwill and other intangibles divided by common shares outstanding.

8

Customers

Bank =

Relationships

& Innovation

Innovator /

Disruptor

Experienced

Leadership

Branch Lite

Unique

“Single Point

of Contact”

Model

High Tech /

High Touch

Product

Dominance

Strong Asset

Quality

High Growth

/ Superior

Performer

Customers Business Model

Approach to Winning Model

Relationship driven but never deviate from following critical success factors

• Only focus on very strong credit quality niches

• Very strong risk management culture

• Operate at lower efficiency ratio than peers to deliver sustainable strong profitability and growth

• Always attract and retain top quality talent

• Culture of innovation and continuous improvement

9

Very Experienced Teams Exceptional Service Risk Based Incentive Compensation

Banking Strategy – Community Business Banking

Community Business Bank is Focused on the following businesses:

• Banking Privately Held Businesses – Commercial C&I loans are

40% of the portfolio

• Manufacturing, service, technology, wholesale,

equipment financing, private mid size mortgage

companies

• Banking High Net Worth Families – Multi Family loans are 40% of

the portfolio; New York and regional multi family lending

• Selected Commercial Real Estate loans are only 14% of portfolio

Amounts presented are on a continuing operations basis.

Non-Owner Occupied

CRE

14%

Commerical - Mortgage

Warehouse

24%

Commercial - C&I,

Owner Occupied

16%

Multi Family loans

40%

Consumer &

Residential

6%

Commercial

40%

10

Our Competitive Advantage: A Highly Experienced Management Team

Name Title

Years of Banking

Experience Background

Jay S. Sidhu Chairman & CEO 41 Chairman and CEO of Sovereign Bank & Sovereign Bancorp, Inc.

Richard A. Ehst President & COO 49 EVP, Commercial Middle Market, Regional President and Managing Director of Corporate Communications at Sovereign Bank

Robert E. Wahlman,

CPA

Chief Financial Officer 36 CFO of Doral Financial and Merrill Lynch Banks; various roles at Bank One, US GAO and KPMG.

Steve Issa

EVP, New England Market President, Chief

Lending Officer

40 EVP, Managing Director of Commercial and Specialty Lending at Flagstar and Sovereign Bank.

George Maroulis

EVP, Group Director of Private &

Commercial Banking - NY Metro

25 Group Director and SVP at Signature Bank; various positions at Citibank and Fleet/Bank of America's Global Commercial & Investment Bank

Timothy D. Romig

EVP, Group Director of Commercial

Banking - PA/NJ

33 SVP and Regional Executive for Commercial Lending (Berks and Montgomery County), VIST Financial; SVP at Keystone / M&T Bank

Ken Keiser

EVP, Director CRE and Multi-Family

Housing Lending

40 SVP and Market Manager, Mid-Atlantic CRE Lending at Sovereign Bank; SVP & Senior Real Estate Officer, Allfirst Bank / M&T Bank

Glenn Hedde

EVP, President Banking for Mortgage

Companies

30 President of Commercial Operations at Popular Warehouse Lending, LLC; various positions at GE Capital Mortgage Services and PNC Bank

James Collins EVP, Chief Administrative Officer 26 Various positions at Sovereign including Director of Small Business Banking

Thomas Jastrem EVP, Chief Credit Officer 39 Various positions at First Union Bank and First Fidelity Bank

Robert B. White EVP, Chief Risk Officer 30 President RBW Financial Consulting; various positions at Citizens Bank and GE Capital

Mary Lou Scalese EVP, Chief Auditor 41 Chief Auditor at Sovereign Bank and Chief Risk Officer at Customers Bank

Michael A. De Tommaso,

Esquire

VP, General Counsel and Corporate

Secretary

23 Former trial attorney and in-house counsel for Univest and National Penn Bank

Karen Kirchner SVP, Director Team Member Services 29 SVP, Human Resources/CoreStates Bank- various positions including Manager for HR Business Partners, Manager of Recruitment and generalist in compensation and training

11

Performance Trend

Amounts presented are on a “Combined” basis.

Source: SNL Financial

Note: Chart begins 2/21/2012, date of first public stock quote for CUBI

CUBI

KBW

Regional

Bank

$0.35

$1.57

$1.30

$1.55

$1.96

$2.31

$1.29

$0

$10

$20

$30

$40

$50

$60

$70

$80

2011 2012 2013 2014 2015 2016 YTD June

2017

Net Income & Earnings Per Share

Net Income Available to Common Shareholders Fully Diluted EPS

12

Customers Bank

Executing On Our Unique High Performing

Banking Model

13

Results in: Organic Growth of Deposits with Controlled Costs

Source: Company data.

Total Deposit Growth ($’s billions) Average DDA Growth ($mm)

Cost of Deposits Total Deposits per Branch ($mm)

Customers’ strategies of single point of contact and recruiting known teams in target markets produce

rapid deposit growth with low total cost

$124 $251

$500 $575

$657

$1,058 $1,044

$34

$42

$57

$75

$127

$353 $361

$0

$400

$800

$1,200

$1,600

Dec-11 Dec-12 Dec-13 Dec-14 Dec-15 Dec-16 Jun-17

$'s in millions

Non Interest Bearing DDA Interest Bearing DDA

CAGR: 49%

1.19%

0.87%

0.70% 0.66% 0.64%

0.76%

0.92%

0.25% 0.25% 0.25% 0.25% 0.26%

0.51%

0.97%

0.00%

0.25%

0.50%

0.75%

1.00%

1.25%

1.50%

Dec-11 Dec-12 Dec-13 Dec-14 Dec-15 Dec-16 Jun-17

Bank COD Average Fed FundsTarget Rate

CAGR: -4%

$0.7 $1.2 $1.1

$1.7 $2.3

$2.8 $2.4$0.7

$1.0 $1.3

$2.2

$2.8

$3.2 $3.6

$0.2

$0.3 $0.5

$0.6

$0.8

$1.3 $1.5

$0.0

$2.0

$4.0

$6.0

$8.0

Dec-11 Dec-12 Dec-13 Dec-14 Dec-15 Dec-16 Jun-17

$'s in billions

CD's Money Market & Savings DDA

CAGR: 33%

$112

$129

$152

$233

$319

$395 $403

$0

$50

$100

$150

$200

$250

$300

$350

$400

Dec-11 Dec-12 Dec-13 Dec-14 Dec-15 Dec-16 Jun-17

$'s in millions

CAGR: 26%

Amounts presented are on a “Combined” basis.

14

Lending Strategy

High Growth with Strong Credit Quality

Continuous recruitment and retention of high quality teams

Centralized credit committee approval for all loans

Loans are stress tested for higher rates and a slower economy

Insignificant delinquencies on loans originated since new management team took over

Creation of solid foundation for future earnings

Source: Company data. Includes deferred costs and fees.

$0.5 $0.6 $0.9 $1.0 $1.3 $1.3$0.1

$0.4

$1.1

$2.3

$2.9 $3.2

$3.5

$0.9

$1.6

$1.3

$2.1

$2.9 $3.5

$3.6

$0.2

$0.3

$0.3

$0.4

$0.4

$0.3 $0.6

$0

$2

$4

$6

$8

$10

Dec-11 Dec-12 Dec-13 Dec-14 Dec-15 Dec-16 Jun-17

Non-Owner Occupied CRE Multi Family loans

Commercial Consumer & Residential

CAGR: 38%

$'

s

in

B

ill

io

ns

Loan Growth

15

NPL

Source: SNL Financial, Company data. Peer data consists of Northeast and Mid-Atlantic banks and thrifts with comparable size in assets and loan portfolios (excluding banks with large

residential mortgage loan portfolios). Industry data includes all commercial and savings banks. Peer and Industry data as of March 31, 2017.

Demonstrate Outstanding Loan Quality

Charge Offs

3.33%

2.64%

2.06%

1.70% 1.70%

1.50%

1.83%

1.44%

1.09% 0.91% 0.89% 0.90%0.72% 0.60%

0.20% 0.15% 0.22% 0.21%

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

3.00%

3.50%

2012 2013 2014 2015 2016 Q2 2017

Industry Peer Customers Bancorp, Inc.

1.09%

0.68%

0.48% 0.42% 0.45% 0.47%0.48%

0.28%

0.15%

0.12% 0.12% 0.10%0.29% 0.22% 0.07%

0.19%

0.02% 0.02%

0.00%

0.20%

0.40%

0.60%

0.80%

1.00%

1.20%

2012 2013 2014 2015 2016 Q2 2017

Industry Peer Customers Bancorp, Inc.

Asset Quality Indicators Continue to be Strong

Note: Customers 2015 charge-offs includes 12 bps for a $9 million

fraudulent loan

Charge Off amounts presented are on a “Combined” basis and include $696 thousand of charge offs related to BankMobile in 2016 and $126 thousand

through June 30, 2017.

16

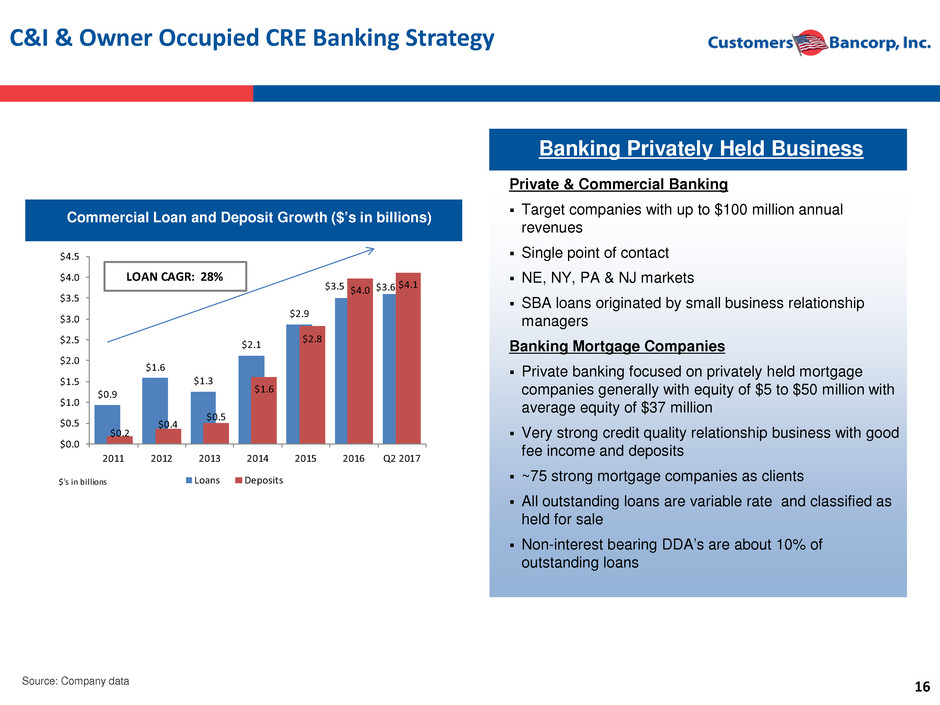

C&I & Owner Occupied CRE Banking Strategy

Private & Commercial Banking

Target companies with up to $100 million annual

revenues

Single point of contact

NE, NY, PA & NJ markets

SBA loans originated by small business relationship

managers

Banking Mortgage Companies

Private banking focused on privately held mortgage

companies generally with equity of $5 to $50 million with

average equity of $37 million

Very strong credit quality relationship business with good

fee income and deposits

~75 strong mortgage companies as clients

All outstanding loans are variable rate and classified as

held for sale

Non-interest bearing DDA’s are about 10% of

outstanding loans

Banking Privately Held Business

Commercial Loan and Deposit Growth ($’s in billions)

Source: Company data

$0.9

$1.6

$1.3

$2.1

$2.9

$3.5 $3.6

$0.2

$0.4

$0.5

$1.6

$2.8

$4.0 $4.1

$0.0

$0.5

$1.0

$1.5

$2.0

$2.5

$3.0

$3.5

$4.0

$4.5

2011 2012 2013 2014 2015 2016 Q2 2017

$'s in billions Loans Deposits

LOAN CAGR: 28%

17

Multi-Family Banking Strategy

Banking High Net Worth Families

Multi-Family Loan and Deposit Growth ($’s in billions)

Focus on families that have income

producing real estate in their portfolios

Private banking approach

Focus Markets: New York & Philadelphia

MSAs

Average Loan Size: $6.8 million

Remote banking for deposits and other

relationship based loans

Portfolio grown organically from a start up

with very experienced teams hired in the

past 4 years

Strong credit quality niche

Interest rate risk managed actively

Source: Company data

$0.1

$0.4

$1.1

$2.3

$2.9

$3.2

$3.5

$0.1 $0.3

$0.3 $0.3

$0.0

$1.0

$2.0

$3.0

$4.0

2011 2012 2013 2014 2015 2016 Q2 2017

$'s in billions Loans Deposits

18

Staff Expense Ratio

Build Efficient Operations

Source: SNL Financial, Company data based on continuing operations. Peer data consists of Northeast and Mid-Atlantic banks and thrifts with comparable size in assets and loan

portfolios (excluding banks with large residential mortgage loan portfolios). Industry data includes SEC reporting banks. Peer and Industry data as of March 31, 2017.

Occupancy Expense Ratio

Total Costs as a % of Assets

Total Revenue per Employee ($000s) Assets per Employee ($mm)

0.37% 0.38% 0.38% 0.36% 0.32%

0.28%

0.39% 0.39% 0.40% 0.38% 0.35% 0.37%0.22% 0.19% 0.15% 0.12% 0.11% 0.10%

0.00%

0.50%

2012 2013 2014 2015 2016 Q2 2017

Industry Peer Customers Bancorp, Inc.

$4.7 $4.7 $5.0 $5.3 $5.5 $5.2

$6.3 $6.5 $6.9 $7.4

$8.0 $8.2$9.3 $9.0

$13.3

$15.1

$17.6 $18.3

$0.0

$10.0

$20.0

2012 2013 2014 2015 2016 Q2 2017

Industry Peer Customers Bancorp, Inc.

1.71% 1.74% 1.71% 1.73% 1.73% 1.71%

1.45% 1.45% 1.43% 1.38% 1.36% 1.40%

1.03% 1.03%

0.83% 0.78% 0.75% 0.67%

0.00%

1.00%

2.00%

2012 2013 2014 2015 2016 Q2 2017

Industry Peer Customers Bancorp, Inc.

3.01% 3.06% 2.99% 2.98% 2.88% 2.51%

2.76% 2.83% 2.63% 2.58% 2.45% 2.53%

2.18% 2.13% 1.75% 1.48% 1.45% 1.23%

0.00%

2.00%

4.00%

2012 2013 2014 2015 2016 Q2 2017

Industry Peer Customers Bancorp, Inc.

$188 $187 $193 $204 $207 $199

$256 $259 $271 $289 $305

$310

$402

$330

$424 $465

$529 $532

$0

$200

$400

$600

2012 2013 2014 2015 2016 Q2 2017

Industry Peer Customers Bancorp, Inc.

Amounts presented are on a Continuing Operations basis.

19

Deposit, Lending and Efficiency Strategies Result in

Disciplined & Profitable Growth

Net Interest Income ($mm) (1)

$39.0

$72.1

$103.9

$151.9

$196.3

$57.6 $62.4

$63.2 $68.6

$64.6

$64.1

$0.0

$50.0

$100.0

$150.0

$200.0

$250.0

$300.0

2011 2012 2013 2014 2015 2016 YTD June

2017

CAGR: 41%

Q3

Q1

Q2

Q1

2Q '17 vs. 2Q '16

Growth

9%

Q2

Q4

$249.5

Q3

$131.0

Q4

(1) Source: Company data

(2) NII Simulation based on ALM model data and assumes a flat balance sheet with no volume increases or decline with the desired basis points increase ramped over 12 months.

(3) Non-GAAP measure calculated as GAAP net income less/plus securities gains and losses (including the impairment loss recognized on the equity investment) .

Amounts presented are on a Continuing Operations basis.

Net Interest Income Simulation (1)(2)

1.29%

2.22%

0.80%

1.59%

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

6/30/2017 6/30/2018

+200 basis points +100 basis points

Estimated Increase in Net Interest Income over

the Next Twelve Months

$9 $20 $22 $22 $28 $30 $14

$39

$72

$103

$152

$196

$250

$131

$37 $51

$74

$97 $108

$131

$61

2011 2012 2013 2014 2015 2016 YTD June

2017

0

50

100

150

200

250

300

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21

Non-interest Income Net Interest Income Operating Expenses

Core Income / Expense Growth($mm) (1)

(3)

20

Deposit, Lending and Efficiency Strategies Result in

Disciplined & Profitable Growth

• Strategy execution has produced superior growth in revenues and earnings

Efficiency Ratio(1)

(1) Source: Company data

(2) Non-GAAP measure calculated as GAAP net income less/plus securities gains and losses (including the impairment loss recognized on the equity investment) .

Amounts presented are on a Continuing Operations basis.

78%

55%

59% 56%

48% 47%

42%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

2011 2012 2013 2014 2015 2016 YTD June

2017

CAGR: -10%

Core Net Income ($mm) (1) (2) Total Revenue ($mm) (1)

$50.3

$101.0

$126.6

$177.0

$223.9

$62.9 $67.9

$69.0

$75.6

$75.7

$65.1

$0.0

$50.0

$100.0

$150.0

$200.0

$250.0

$300.0

2011 2012 2013 2014 2015 2016 YTD June

2017

CAGR: 37%

Q4

Q2

Q1 Q1

2Q '17 vs. 2Q '16

Growth

7%

Q3

$272.7

Q2

$143.5

Q3

Q4

$2.1

$17.9

$32.1

$42.7

$60.6

$18.0

$24.4

$19.7

$25.2

$20.7

$27.0

$0.0

$20.0

$40.0

$60.0

$80.0

$100.0

2011 2012 2013 2014 2015 2016 YTD June

2017

CAGR: 101%

Q1

Q2

2Q '17 vs. 2Q '16

Growth 24%

Q3

Q4

Q1

$85.4

Q2

Q3

$49.6

Q4

21

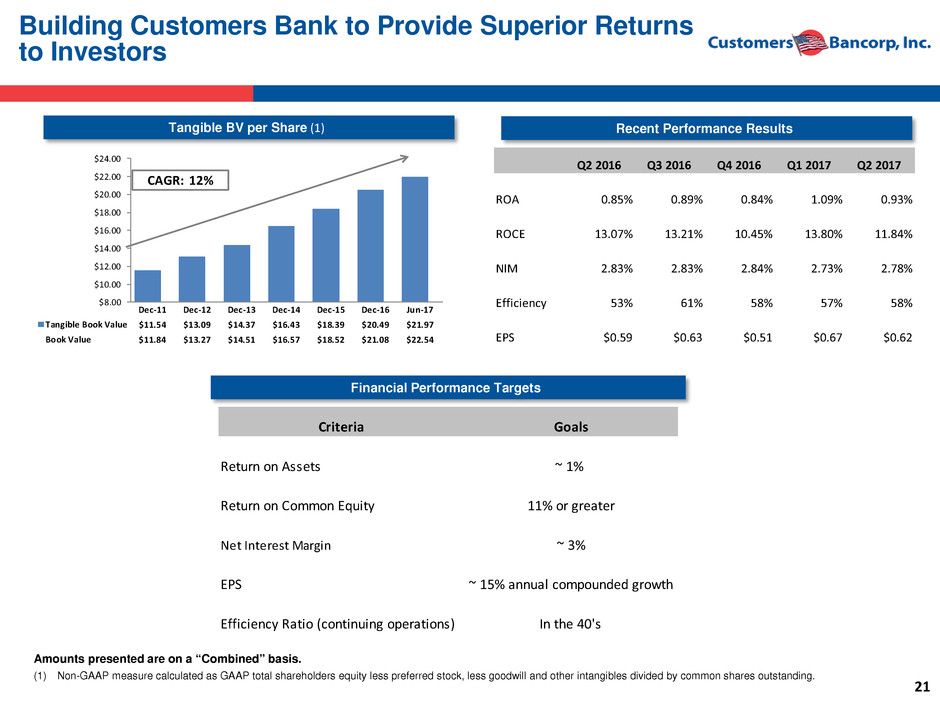

Tangible BV per Share (1)

Building Customers Bank to Provide Superior Returns

to Investors

Recent Performance Results

Financial Performance Targets

$8.00

$10.00

$12.00

$14.00

$16.00

$18.00

$20.00

$22.00

$24.00

Dec-11 Dec-12 Dec-13 Dec-14 Dec-15 Dec-16 Jun-17

Tangible Book Value $11.54 $13.09 $14.37 $16.43 $18.39 $20.49 $21.97

Book Value $11.84 $13.27 $14.51 $16.57 $18.52 $21.08 $22.54

CAGR: 12%

Q2 2016 Q3 2016 Q4 2016 Q1 2017 Q2 2017

ROA 0.85% 0.89% 0.84% 1.09% 0.93%

ROCE 13.07% 13.21% 10.45% 13.80% 11.84%

NIM 2.83% 2.83% 2.84% 2.73% 2.78%

Efficiency 53% 61% 58% 57% 58%

EPS $0.59 $0.63 $0.51 $0.67 $0.62

Criteria Goals

Return on Assets ~ 1%

Return on Common Equity 11% or greater

Net Interest Margin ~ 3%

EPS ~ 15% annual compounded growth

Efficiency Ratio (continuing operations) In the 40's

(1) Non-GAAP measure calculated as GAAP total shareholders equity less preferred stock, less goodwill and other intangibles divided by common shares outstanding.

Amounts presented are on a “Combined” basis.

22

Customers Bank

Community Business Banking and

BankMobile Business Segments

23

Business Segment Disclosures

• Customers Bank acquired the Disbursements Business of Higher One, Inc. on June 15,

2016

• The acquired Disbursements Business was combined with Customers Bank’s existing

BankMobile product line in Q2 2016

• Effective for the 2016 fourth quarter and year end financial reports, Customers begins

reporting BankMobile as discontinued operations/held for sale to the investor

community

• Q1 2017 Customers announces agreement to sell BankMobile

• Q2 2017 Customers announces buyer was not able to raise the capital required per the

contractual requirements, and that Customers had received an alternative proposal

from buyer and two unsolicited proposals, all subject to due diligence

24

History of BankMobile

• 2014 – Customers Bank began development of a consumer bank in alignment with the future model of

banking

– A completely branchless experience

– A fin-tech company with a bank charter

– 10X better customer acquisition and retention strategy than traditional players

– Better product than what exists today

– Sustainable business model

• 2015 (January) – Launched BankMobile app 1.0

– Keep it simple

– Best in class user experience

– App speaks with an authentic voice

• 2016 (June) – Acquired Disbursements Business

– Combined Disbursements and BankMobile

– Transform students into customers for life

– Leverage platform to extend services to white label partners

• 2016 (October) – Announced intent to divest BankMobile

• 2017 (March) – Announced agreement to sell BankMobile

• 2017 (April) – Launched new BankMobile mobile application

• 2017 (May) – Announced receipt of alternate unsolicited proposals

– initial buyer inability to meet contract requirements

25

Segment Financial Performance Results

• Comparable 2016 periods are not provided as BankMobile was not operating as a segment in the second quarter of 2016 and its operations

were not material.

• Segment results presented above include an internal allocation from Community Business Banking to BankMobile of $2.7 million in Q2 2017

for interest on deposits generated by the BankMobile segment used to fund the Community Business Banking Segment. The discontinued

operations loss disclosed in the income statement prepared in accordance with generally accepted accounting principles (“GAAP”) does not

consider the funds transfer pricing benefits of deposits.

• Direct operating revenues and costs are captured separately in the accounting records for each business segment. All corporate overhead

costs are assigned to the Community Business Banking segment as those costs are expected to stay with the segment following the sale of

the BankMobile segment, currently anticipated to occur within 6 to 12 months.

Amounts presented are on a “Combined” basis.

Three months ended June 30, 2017

Community

Business Banking BankMobile Consolidated

Interest income $ 91,107 $ 2,745 $ 93,852

Interest expense 25,228 18 25,246

Net interest income 65,879 2,727 68,606

Provision for loan losses 535 — 535

Non-interest income 6,971 11,420 18,391

Non-interest expense 30,567 19,846 50,413

Income (loss) before income tax expense (benefit) 41,748 (5,699 ) 36,049

Income tax expense (benefit) 14,493 (2,166 ) 12,327

Net income (loss) 27,255 (3,533 ) 23,722

Preferred stock dividends 3,615 — 3,615

Net income (loss) available to common shareholders $ 23,640 $ (3,533 ) $ 20,107

.

Six months ended June 30, 2017

Community

Business Banking BankMobile Consolidated

Interest income $ 169,938 $ 7,008 $ 176,946

Interest expense 45,883 39 45,922

Net interest income 124,055 6,969 131,024

Provision for loan losses 3,585 — 3,585

Non-interest income 12,398 28,746 41,144

Non-interest expense 60,714 39,064 99,778

Income (loss) before income tax expense (benefit) 72,154 (3,349 ) 68,805

Income tax expense (benefit) 20,609 (1,273 ) 19,336

Net income (loss) 51,545 (2,076 ) 49,469

Preferred stock dividends 7,229 — 7,229

Net income (loss) available to common shareholders $ 44,316 $ (2,076 ) $ 42,240

(dollars in thousands )

26

Other BankMobile Results

• Opened over 325,000 new checking accounts since June 16, 2016.

• Funds received from educational institutions and processed to students totaled $1.23 billion during Q2

2017.

• 33% of Title IV funds received by students at colleges to which BankMobile provided disbursement

services in Q2 2017 were deposited into accounts with BankMobile. Other students receiving Title IV

funds at these colleges requested the transfer of funds to existing accounts at other banks or received a

check.

• Signed contracts to provide disbursement services to an additional 13 educational institutions with

student enrollment totaling 88K during 2017, and 24 institutions with student enrollment totaling 147K

during the trailing four quarters. Also notable are 14 institutions totaling 100K student enrollment, which

signed in the first half of 2016 and were launched during the past year.

• Active student checking accounts serviced number 1.2 million as of June 30, 2017, with balances of $321.9

million on that date and $118.6 million non-student customers, including universities, deposits for a total

of $440.5 million deposits.

Amounts presented are on a “Combined” basis.

27

Contacts

Company:

Robert Wahlman, CFO

Tel: 610-743-8074

rwahlman@customersbank.com

www.customersbank.com

Jay Sidhu

Chairman & CEO

Tel: 610-301-6476

jsidhu@customersbank.com

www.customersbank.com

28

Appendix

29

Customers Bank

Risk Management

30

Elements of an Effective Risk Management Program

31

ERM Framework at Customers Bancorp, Inc.

Well Defined ERM Plan – ERM Integration into CAMELS +++++

32

Customers Bancorp, Inc.

Financial Statements

33

Income Statement

CUSTOMERS BANCORP, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS FOR THE THREE MONTHS ENDED - UNAUDITED

(Dollars in thousands, except per share data)

Q2 Q1 Q2

2017 2017 2016

Interest income:

Loans receivable, including fees $ 67,036 $ 61,461 $ 59,013

Loans held for sale 17,524 13,946 17,429

Investment securities 7,823 5,887 3,638

Other 1,469 1,800 1,240

Total interest income 93,852 83,094 81,320

Interest expense:

Deposits 16,218 14,317 11,138

Other borrowings 1,993 1,608 1,620

FHLB advances 5,340 3,060 3,716

Subordinated debt 1,685 1,685 1,685

Total interest expense 25,236 20,670 18,159

Net interest income 68,616 62,424 63,161

Provision for loan losses 535 3,050 786

Net interest income after provision for loan losses 68,081 59,374 62,375

Non-interest income:

Mortgage warehouse transactional fees 2,523 2,221 3,074

Bank-owned life insurance 2,258 1,367 1,120

Gain on sale of SBA and other loans 573 1,328 285

Mortgage banking income 291 155 285

Deposit fees 258 324 278

Interchange and card revenue 126 203 160

Gains (losses) on investment securities 301 (1,703 ) —

Other 641 1,532 651

Total non-interest income 6,971 5,427 5,853

Non-interest expense:

Salaries and employee benefits 16,687 16,163 16,401

Professional services 2,834 2,993 2,750

Technology, communication and bank operations 2,542 3,319 2,448

Occupancy 2,536 2,586 2,363

FDIC assessments, taxes, and regulatory fees 2,320 1,632 4,289

Loan workout 408 521 487

Other real estate owned expense (income) 160 (55 ) 183

Advertising and promotion 153 180 194

Other 2,927 2,808 2,970

Total non-interest expense 30,567 30,147 32,085

Income from continuing operations before income tax expense 44,485 34,654 36,143

Income tax expense 15,533 7,730 14,369

Net income from continuing operations 28,952 26,924 21,774

Loss from discontinued operations (8,436 ) (1,898 ) (3,696 )

Income tax benefit from discontinued operations (3,206 ) (721 ) (1,405 )

Net loss from discontinued operations (5,230 ) (1,177 ) (2,291 )

Net income 23,722 25,747 19,483

Preferred stock dividends 3,615 3,615 2,062

Net income available to common shareholders $ 20,107 $ 22,132 $ 17,421

Basic earnings per common share from continuing operations $ 0.83 $ 0.77 $ 0.73

Basic earnings per common share $ 0.66 $ 0.73 $ 0.64

Diluted earnings per common share from continuing operations $ 0.78 $ 0.71 $ 0.67

Diluted earnings per common share $ 0.62 $ 0.67 $ 0.59

34

Income Statement

CUSTOMERS BANCORP, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS FOR THE SIX MONTHS ENDED - UNAUDITED

(Dollars in thousands, except per share data)

June 30, June 30,

2017 2016

Interest income:

Loans receivable, including fees $ 128,497 $ 113,485

Loans held for sale 31,470 31,534

Investment securities 13,710 7,347

Other 3,269 2,352

Total interest income 176,946 154,718

Interest expense:

Deposits 30,535 21,347

Other borrowings 3,600 3,225

FHLB advances 8,401 5,984

Subordinated debt 3,370 3,370

Total interest expense 45,906 33,926

Net interest income 131,040 120,792

Provision for loan losses 3,585 2,766

Net interest income after provision for loan losses 127,455 118,026

Non-interest income:

Mortgage warehouse transactional fees 4,743 5,622

Bank-owned life insurance 3,624 2,243

Gain on sale of SBA and other loans 1,901 929

Deposit fees 582 531

Mortgage banking income 446 450

Interchange and card revenue 329 304

(Losses) gains on investment securities (1,402 ) 26

Other 2,175 1,016

Total non-interest income 12,398 11,121

Non-interest expense:

Salaries and employee benefits 32,850 32,799

Technology, communication and bank operations 5,861 4,833

Professional services 5,827 5,071

Occupancy 5,121 4,600

FDIC assessments, taxes, and regulatory fees 3,953 8,130

Loan workout 928 905

Advertising and promotion 334 337

Other real estate owned 105 470

Other 5,735 6,812

Total non-interest expense 60,714 63,957

Income from continuing operations before income tax expense 79,139 65,190

Income tax expense 23,263 24,108

Net income from continuing operations 55,876 41,082

Loss from discontinued operations (10,334 ) (5,508 )

Income tax benefit from discontinued operations (3,927 ) (2,093 )

Net loss from discontinued operations (6,407 ) (3,415 )

Net income 49,469 37,667

Preferred stock dividends 7,229 3,348

Net income available to common shareholders $ 42,240 $ 34,319

Basic earnings per common share from continuing operations $ 1.59 $ 1.40

Basic earnings per common share $ 1.38 $ 1.27

Diluted earnings per common share from continuing operations $ 1.49 $ 1.28

Diluted earnings per common share $ 1.29 $ 1.17

35

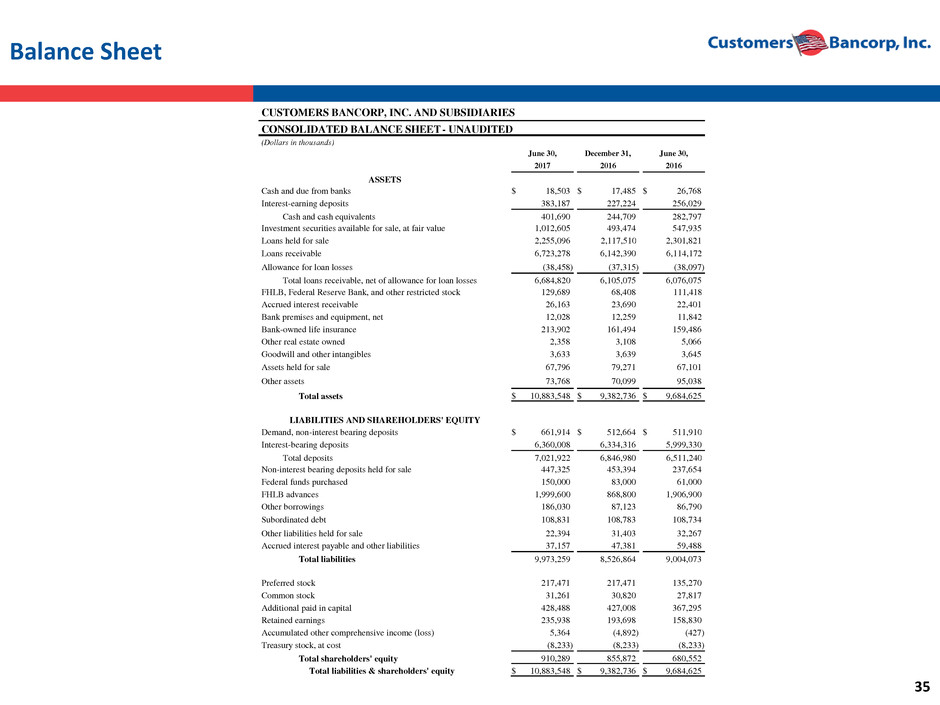

Balance Sheet

CUSTOMERS BANCORP, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEET - UNAUDITED

(Dollars in thousands)

June 30, December 31, June 30,

2017 2016 2016

ASSETS

Cash and due from banks $ 18,503 $ 17,485 $ 26,768

Interest-earning deposits 383,187 227,224 256,029

Cash and cash equivalents 401,690 244,709 282,797

Investment securities available for sale, at fair value 1,012,605 493,474 547,935

Loans held for sale 2,255,096 2,117,510 2,301,821

Loans receivable 6,723,278 6,142,390 6,114,172

Allowance for loan losses (38,458 ) (37,315 ) (38,097 )

Total loans receivable, net of allowance for loan losses 6,684,820 6,105,075 6,076,075

FHLB, Federal Reserve Bank, and other restricted stock 129,689 68,408 111,418

Accrued interest receivable 26,163 23,690 22,401

Bank premises and equipment, net 12,028 12,259 11,842

Bank-owned life insurance 213,902 161,494 159,486

Other real estate owned 2,358 3,108 5,066

Goodwill and other intangibles 3,633 3,639 3,645

Assets held for sale 67,796 79,271 67,101

Other assets 73,768 70,099 95,038

Total assets $ 10,883,548 $ 9,382,736 $ 9,684,625

LIABILITIES AND SHAREHOLDERS' EQUITY

Demand, non-interest bearing deposits $ 661,914 $ 512,664 $ 511,910

Interest-bearing deposits 6,360,008 6,334,316 5,999,330

Total deposits 7,021,922 6,846,980 6,511,240

Non-interest bearing deposits held for sale 447,325 453,394 237,654

Federal funds purchased 150,000 83,000 61,000

FHLB advances 1,999,600 868,800 1,906,900

Other borrowings 186,030 87,123 86,790

Subordinated debt 108,831 108,783 108,734

Other liabilities held for sale 22,394 31,403 32,267

Accrued interest payable and other liabilities 37,157 47,381 59,488

Total liabilities 9,973,259 8,526,864 9,004,073

Preferred stock 217,471 217,471 135,270

Common stock 31,261 30,820 27,817

Additional paid in capital 428,488 427,008 367,295

Retained earnings 235,938 193,698 158,830

Accumulated other comprehensive income (loss) 5,364 (4,892 ) (427 )

Treasury stock, at cost (8,233 ) (8,233 ) (8,233 )

Total shareholders' equity 910,289 855,872 680,552

Total liabilities & shareholders' equity $ 10,883,548 $ 9,382,736 $ 9,684,625

36

Net Interest Margin

CUSTOMERS BANCORP, INC. AND SUBSIDIARIES

AVERAGE BALANCE SHEET / NET INTEREST MARGIN (UNAUDITED)

(Dollars in thousands)

Three months ended

June 30, March 31, June 30,

2017 2017 2016

Average

Balance

Average

yield or cost

(%)

Average

Balance

Average

yield or cost

(%)

Average

Balance

Average

yield or cost

(%)

Assets

Interest earning deposits $ 201,774 1.09% $ 498,364 0.79% $ 213,509 0.51%

Investment securities 1,066,277 2.94% 829,730 2.88% 550,130 2.65%

Loans held for sale 1,708,849 4.11% 1,426,701 3.96% 2,056,929 3.41%

Loans receivable 6,807,093 3.95% 6,427,682 3.88% 6,050,321 3.92%

Other interest-earning assets 105,908 3.48% 75,980 4.41% 102,599 3.79%

Total interest earning assets 9,889,901 3.81% 9,258,457 3.63% 8,973,488 3.64%

Non-interest earning assets 299,598 271,606 271,495

Assets held for sale 75,834 77,478 14,209

Total assets $ 10,265,333 $ 9,607,541 $ 9,259,192

Liabilities

Total interest bearing deposits (1) $ 6,252,293 1.04% $ 6,213,186 0.93% $ 5,770,969 0.78%

Borrowings 1,951,282 1.85% 1,130,490 2.28% 2,014,452 1.40%

Total interest bearing liabilities 8,203,575 1.23% 7,343,676 1.14% 7,785,421 0.94%

Non-interest bearing deposits (1) 556,947 524,211 475,968

Non-interest bearing deposits held for sale

(1) 525,853

790,983

283,405

Total deposits & borrowings 9,286,375 1.09% 8,658,870 0.97% 8,544,794 0.85%

Other non-interest bearing liabilities 46,819 50,351 51,854

Other liabilities held for sale 33,626 30,326 7,493

Total liabilities 9,366,820 8,739,547 8,604,141

Shareholders' equity 898,513 867,994 655,051

Total liabilities and shareholders'

equity $ 10,265,333

$ 9,607,541

$ 9,259,192

Net interest margin 2.78% 2.73% 2.83%

Net interest margin tax equivalent 2.78% 2.73% 2.83%

(1) Total costs of deposits (including interest bearing and non-interest bearing) were 0.89%, 0.77% and 0.68% for the three months ended June

30, 2017, March 31, 2017 and June 30, 2016, respectively.

37

Net Interest Margin

CUSTOMERS BANCORP, INC. AND SUBSIDIARIES

AVERAGE BALANCE SHEET / NET INTEREST MARGIN (UNAUDITED)

(Dollars in thousands)

Six months ended

June 30, June 30,

2017 2016

Average

Balance

Average

yield or cost

(%)

Average

Balance

Average

yield or cost

(%)

Assets

Interest earning deposits $ 349,250 0.88% $ 198,938 0.52%

Investment securities 948,657 2.91% 556,295 2.64%

Loans held for sale 1,568,555 4.05% 1,810,164 3.50%

Loans receivable 6,618,436 3.92% 5,864,596 3.89%

Other interest-earning assets 91,026 3.87% 91,367 4.03%

Total interest earning assets 9,575,924 3.73% 8,521,360 3.65%

Non-interest earning assets 285,609 281,916

Assets held for sale 76,722 8,436

Total assets $ 9,938,255 $ 8,811,712

Liabilities

Total interest bearing deposits (1) $ 6,232,847 0.99% $ 5,622,382 0.76%

Borrowings 1,543,154 2.01% 1,747,640 1.45%

Total interest-bearing liabilities 7,776,001 1.19% 7,370,022 0.93%

Non-interest-bearing deposits (1) 540,669 452,446

Non-interest bearing deposits held for sale (1) 657,686 316,027

Total deposits & borrowings 8,974,356 1.03% 8,138,495 0.84%

Other non-interest bearing liabilities 48,576 50,217

Other liabilities held for sale 31,985 2,470

Total liabilities 9,054,917 8,191,182

Shareholders' equity 883,338 620,530

Total liabilities and shareholders' equity $ 9,938,255

$ 8,811,712

Net interest margin 2.75% 2.85%

Net interest margin tax equivalent 2.76% 2.85%

(1) Total costs of deposits (including interest bearing and non-interest bearing) were 0.83% and 0.67% for the six months ended June 30,

2017 and 2016, respectively.

38

Loan Composition

Amounts presented are on a Continuing Operations basis.

CUSTOMERS BANCORP, INC. AND SUBSIDIARIES

PERIOD END LOAN COMPOSITION (UNAUDITED)

(Dollars in thousands)

June 30, December 31, June 30,

2017 2016 2016

Commercial:

Multi-family $ 3,550,375 $ 3,214,999 $ 3,336,083

Commercial & industrial (1) 3,607,128 3,487,668 3,464,567

Commercial real estate- non-owner occupied 1,216,012 1,193,715 1,139,711

Construction 61,226 64,789 99,615

Total commercial loans 8,434,741 7,961,171 8,039,976

Consumer:

Residential 447,150 194,197 264,968

Manufactured housing 96,148 101,730 107,874

Other consumer 2,561 2,726 2,873

Total consumer loans 545,859 298,653 375,715

Deferred (fees)/costs and unamortized (discounts)/premiums, net (2,226 ) 76 302

Total loans $ 8,978,374 $ 8,259,900 $ 8,415,993

(1) Commercial & industrial loans, including mortgage warehouse and owner occupied commercial real estate loans.

39

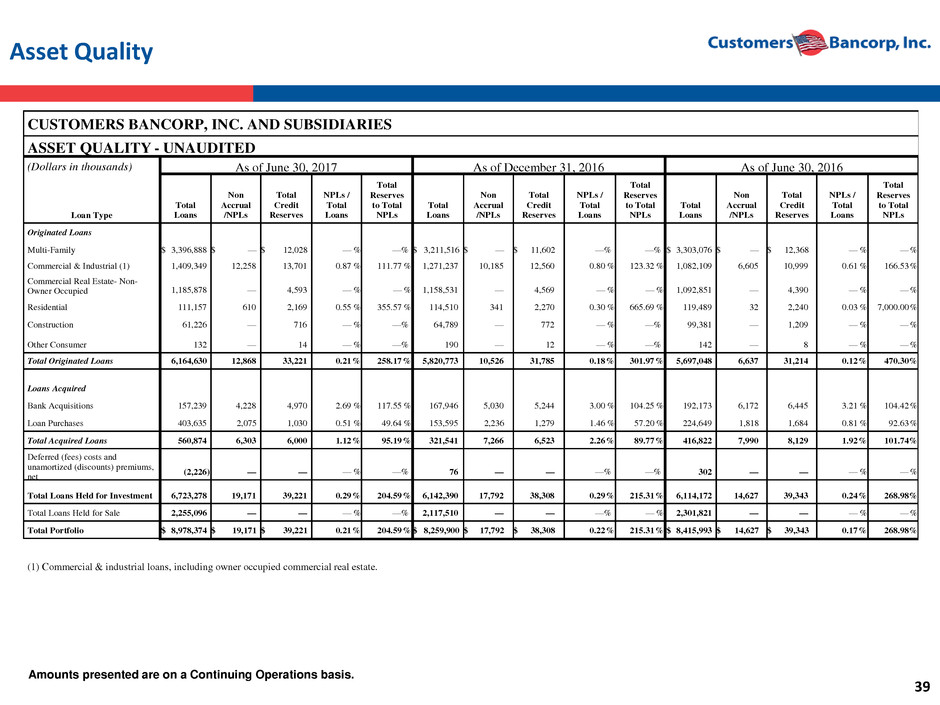

Asset Quality

Amounts presented are on a Continuing Operations basis.

CUSTOMERS BANCORP, INC. AND SUBSIDIARIES

ASSET QUALITY - UNAUDITED

(Dollars in thousands) As of June 30, 2017 As of December 31, 2016 As of June 30, 2016

Total

Loans

Non

Accrual

/NPLs

Total

Credit

Reserves

NPLs /

Total

Loans

Total

Reserves

to Total

NPLs

Total

Loans

Non

Accrual

/NPLs

Total

Credit

Reserves

NPLs /

Total

Loans

Total

Reserves

to Total

NPLs

Total

Loans

Non

Accrual

/NPLs

Total

Credit

Reserves

NPLs /

Total

Loans

Total

Reserves

to Total

NPLs Loan Type

Originated Loans

Multi-Family $ 3,396,888 $ — $ 12,028 — % —% $ 3,211,516 $ — $ 11,602 —% —% $ 3,303,076 $ — $ 12,368 — % — %

Commercial & Industrial (1) 1,409,349 12,258 13,701 0.87 % 111.77 % 1,271,237 10,185 12,560 0.80 % 123.32 % 1,082,109 6,605 10,999 0.61 % 166.53 %

Commercial Real Estate- Non-

Owner Occupied 1,185,878

—

4,593

— % — % 1,158,531

—

4,569

— % — % 1,092,851

—

4,390

— % — %

Residential 111,157 610 2,169 0.55 % 355.57 % 114,510 341 2,270 0.30 % 665.69 % 119,489 32 2,240 0.03 % 7,000.00 %

Construction 61,226 — 716 — % —% 64,789 — 772 — % —% 99,381 — 1,209 — % — %

Other Consumer 132 — 14 — % —% 190 — 12 — % —% 142 — 8 — % — %

Total Originated Loans 6,164,630 12,868 33,221 0.21 % 258.17 % 5,820,773 10,526 31,785 0.18 % 301.97 % 5,697,048 6,637 31,214 0.12 % 470.30 %

Loans Acquired

Bank Acquisitions 157,239 4,228 4,970 2.69 % 117.55 % 167,946 5,030 5,244 3.00 % 104.25 % 192,173 6,172 6,445 3.21 % 104.42 %

Loan Purchases 403,635 2,075 1,030 0.51 % 49.64 % 153,595 2,236 1,279 1.46 % 57.20 % 224,649 1,818 1,684 0.81 % 92.63 %

Total Acquired Loans 560,874 6,303 6,000 1.12 % 95.19 % 321,541 7,266 6,523 2.26 % 89.77 % 416,822 7,990 8,129 1.92 % 101.74 %

Deferred (fees) costs and

unamortized (discounts) premiums,

net

(2,226 ) —

—

— % —% 76

—

—

—% —% 302

—

—

— % — %

Total Loans Held for Investment 6,723,278

19,171

39,221

0.29 % 204.59 % 6,142,390

17,792

38,308

0.29 % 215.31 % 6,114,172

14,627

39,343

0.24 % 268.98 %

Total Loans Held for Sale 2,255,096 — — — % —% 2,117,510 — — —% — % 2,301,821 — — — % — %

Total Portfolio $ 8,978,374 $ 19,171 $ 39,221 0.21 % 204.59 % $ 8,259,900 $ 17,792 $ 38,308 0.22 % 215.31 % $ 8,415,993 $ 14,627 $ 39,343 0.17 % 268.98 %

(1) Commercial & industrial loans, including owner occupied commercial real estate.

40

Net Charge Offs

Amounts presented are on a “Combined” basis.

CUSTOMERS BANCORP, INC. AND SUBSIDIARIES

NET CHARGE-OFFS/(RECOVERIES) - UNAUDITED

(Dollars in thousands)

For the Quarter Ended

Q2 Q1 Q2

2017 2017 2016

Originated Loans

Commercial & Industrial (1) $ 1,840 $ (45 ) $ 41

Residential 69 31 —

Other Consumer 24 — 5

Total Net Charge-offs (Recoveries) from Originated Loans 1,933

(14 ) 46

Loans Acquired

Bank Acquisitions (121 ) 518 874

Loan Purchases — — —

Total Net Charge-offs (Recoveries) from Acquired Loans (121 ) 518

874

Total Net Charge-offs from Loans Held for Investment 1,812

504

920

Total Net Charge-offs (Recoveries) from BankMobile Loans (2) 148

(22 ) 140

Total Net Charge-offs $ 1,960 $ 482 $ 1,060

(1) Commercial & industrial loans, including owner occupied commercial real estate.

(2) Includes activity for BankMobile related loans, primarily overdrawn deposit accounts.

41

Reconciliation of Non-GAAP Measures - Unaudited

Amounts presented are on a “Combined” basis.

Pre-tax Pre-provision Return on Average Assets

Q2 2017 Q1 2017 Q4 2016 Q3 2016 Q2 2016

GAAP Net Income $ 23,722 $ 25,747 $ 19,828 $ 21,207 $ 19,483

Reconciling Items:

Provision for loan losses 535 3,050 187 88 786

Income tax expense 12,327 7,009 9,320 14,558 12,964

Pre-Tax Pre-provision Net Income $ 36,584

$ 35,806

$ 29,335

$ 35,853

$ 33,233

Average Total Assets $ 10,265,333 $ 9,607,541 $ 9,339,158 $ 9,439,573 $ 9,259,192

Pre-tax Pre-provision Return on Average Assets 1.43 % 1.51 % 1.25 % 1.51 % 1.44 %

Pre-tax Pre-provision Return on Average Common Equity

Q2 2017 Q1 2017 Q4 2016 Q3 2016 Q2 2016

GAAP Net Income Available to Common Shareholders $ 20,107

$ 22,132

$ 16,213

$ 18,655

$ 17,421

Reconciling Items:

Provision for loan losses 535 3,050 187 88 786

Income tax expense 12,327 7,009 9,320 14,558 12,964

Pre-tax Pre-provision Net Income Available to Common

Shareholders $ 32,969

$ 32,191

$ 25,720

$ 33,301

$ 31,171

Average Total Shareholders' Equity $ 898,513 $ 867,994 $ 834,480 $ 710,403 $ 655,051

Reconciling Item:

Average Preferred Stock (217,471 ) (217,471 ) (217,493 ) (148,690 ) (118,793 )

Average Common Equity $ 681,042 $ 650,523 $ 616,987 $ 561,713 $ 536,258

Pre-tax Pre-provision Return on Average Common Equity 19.42 % 20.07 % 16.58 % 23.59 % 23.38 %

(dollars in thousands except per share amounts)

42

Reconciliation of Non-GAAP Measures - Unaudited

Amounts presented are on a “Combined” basis.

Net Interest Margin, tax equivalent

Six months ended

June 30,

2017 2016 Q2 2017 Q1 2017 Q4 2016 Q3 2016 Q2 2016

GAAP Net interest income $ 131,040 $ 120,792 $ 68,616 $ 62,424 $ 64,134 $ 64,590 $ 63,161

Tax-equivalent adjustment 197 202 104 93 92 96 98

Net interest income tax equivalent $ 131,237 $ 120,994 $ 68,720 $ 62,517 $ 64,226 $ 64,686 $ 63,259

Average total interest earning assets $ 9,575,924 $ 8,521,360 $ 9,889,901 $ 9,258,457 $ 9,007,206 $ 9,103,560 $ 8,973,488

Net interest margin, tax equivalent 2.76 % 2.85 % 2.78 % 2.73 % 2.84 % 2.83 % 2.83 %

43

Reconciliation of Non-GAAP Measures - Unaudited

Tangible Common Equity to Average Tangible Assets

Q2 2017 Q1 2017 Q4 2016 Q3 2016 Q2 2016

GAAP - Total Shareholders' Equity $ 910,289 $ 879,817 $ 855,872 $ 789,811 $ 680,552

Reconciling Items:

Preferred Stock (217,471 ) (217,471 ) (217,471 ) (217,549 ) (135,270 )

Goodwill and Other Intangibles (17,615 ) (17,618 ) (17,621 ) (16,924 ) (17,197 )

Tangible Common Equity $ 675,203 $ 644,728 $ 620,780 $ 555,338 $ 528,085

Average Total Assets $ 10,265,333 $ 9,607,541 $ 9,339,158 $ 9,439,573 $ 9,259,192

Reconciling Items:

Average Goodwill and Other Intangibles (17,616 ) (17,620 ) (16,847 ) (17,101 ) (6,037 )

Average Tangible Assets $ 10,247,717 $ 9,589,921 $ 9,322,311 $ 9,422,472 $ 9,253,155

Tangible Common Equity to Average Tangible Assets 6.59 % 6.72 % 6.66 % 5.89 % 5.71 %

Tangible Book Value per Common Share

Q2 2017 Q1 2017 Q4 2016 Q3 2016 Q2 2016

GAAP - Total Shareholders' Equity $ 910,289 $ 879,817 $ 855,872 $ 789,811 $ 680,552

Reconciling Items:

Preferred Stock (217,471 ) (217,471 ) (217,471 ) (217,549 ) (135,270 )

Goodwill and Other Intangibles (17,615 ) (17,618 ) (17,621 ) (16,924 ) (17,197 )

Tangible Common Equity $ 675,203 $ 644,728 $ 620,780 $ 555,338 $ 528,085

Common shares outstanding 30,730,784 30,636,327 30,289,917 27,544,217 27,286,833

Tangible Book Value per Common Share $ 21.97 $ 21.04 $ 20.49 $ 20.16 $ 19.35

44

Reconciliation of Non-GAAP Measures - Unaudited

Tangible Book Value per Common Share

Q2 2017 2016 2015 2014 2013 2012 2011

GAAP - Total Shareholders' Equity $ 910,289 $ 855,872 $ 553,902 $ 443,145 $ 386,623 $ 269,475 $ 147,748

Reconciling Items:

Preferred Stock (217,471 ) (217,471 ) (55,569 ) — — — —

Goodwill and Other Intangibles (17,615 ) (17,621 ) (3,651 ) (3,664 ) (3,676 ) (3,689 ) (3,705 )

Tangible Common Equity $ 675,203 $ 620,780 $ 494,682 $ 439,481 $ 382,947 $ 265,786 $ 144,043

Common shares outstanding 30,730,784 30,289,917 26,901,801 26,745,529 26,646,566 20,305,452 12,482,451

Tangible Book Value per Common

Share $ 21.97

$ 20.49

$ 18.39

$ 16.43

$ 14.37

$ 13.09

$ 11.54

45

Reconciliation of Non-GAAP Measures - Unaudited

Core Net Income

Q2 2017 Q1 2017 Q4 2016 Q3 2016 Q2 2016 Q1 2016

GAAP Net Income from

continuing operations $ 28,952

$ 26,924

$ 23,337

$ 23,288

$ 21,774

$ 19,308

Preferred stock dividends

3,615 3,615 3,615 2,552 2,062 1,286

Net income from continuing

operations available to

common shareholders 25,337

23,309

19,722

20,736

19,712

18,022

Reconciling Items:

Impairment losses on

investment securities 2,882

1,703

7,262

—

—

—

(Gains) losses on sale of

investment securities (3,183 ) —

—

1

—

(26 )

Tax effect 114 (647 ) — — — 10

Core Net Income $ 25,150 $ 24,365 $ 26,984 $ 20,737 $ 19,712 $ 18,006

YTD June

2017 2016 2015 2014 2013 2012 2011

GAAP Net Income from

continuing operations $ 55,876

$ 87,707

$ 63,073

$ 44,532

$ 32,910

$ 23,818

3,990

Preferred stock dividends

7,229 9,515 2,493 — — — —

Net income from continuing

operations available to

common shareholders 48,647

78,192

60,580

44,532

32,910

23,818

3,990

Reconciling Items:

Impairment losses on

investment securities 4,585

7,262

—

—

—

—

—

(Gains) losses on sale of

investment securities (3,183 ) (25 ) 85

(3,191 ) (1,274 ) (9,017 ) (2,731 )

Tax effect (533 ) 10 (32 ) 1,323 446 3,065 854

Core Net Income $ 49,516 $ 85,439 $ 60,633 $ 42,664 $ 32,082 $ 17,866 $ 2,113

46

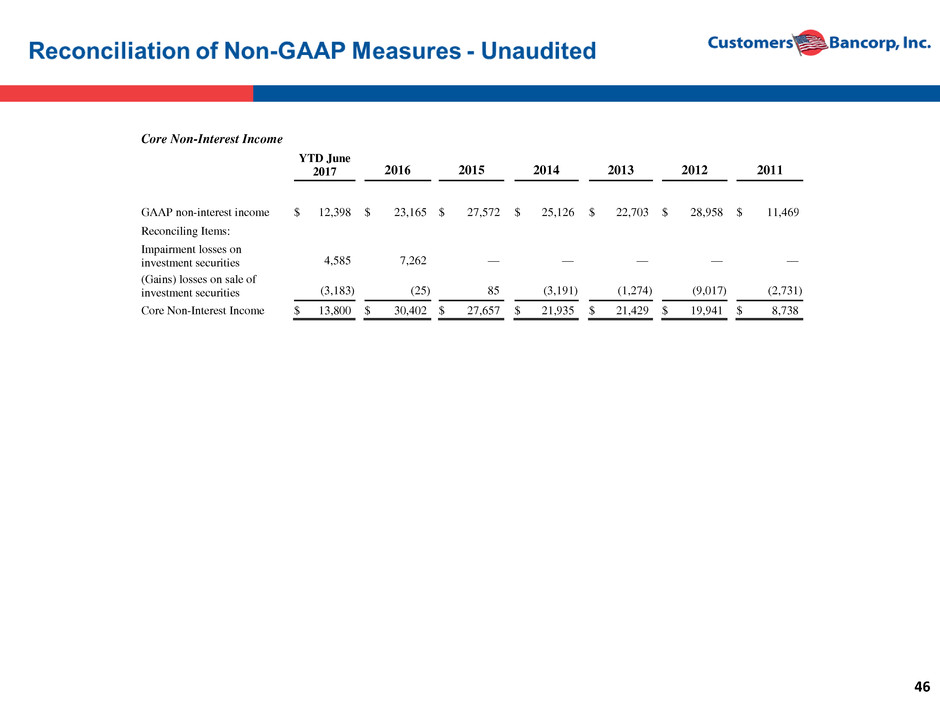

Core Non-Interest Income

YTD June

2017 2016 2015 2014 2013 2012 2011

GAAP non-interest income $ 12,398

$ 23,165

$ 27,572

$ 25,126

$ 22,703

$ 28,958

$ 11,469

Reconciling Items:

Impairment losses on

investment securities 4,585

7,262

—

—

—

—

—

(Gains) losses on sale of

investment securities (3,183 ) (25 ) 85

(3,191 ) (1,274 ) (9,017 ) (2,731 )

Core Non-Interest Income $ 13,800 $ 30,402 $ 27,657 $ 21,935 $ 21,429 $ 19,941 $ 8,738