Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - BANC OF CALIFORNIA, INC. | d433750dex991.htm |

| 8-K - FORM 8-K - BANC OF CALIFORNIA, INC. | d433750d8k.htm |

July 26, 2017 2017 Second Quarter Earnings Investor Presentation Exhibit 99.2

When used in this presentation and in documents filed with or furnished to the Securities and Exchange Commission (the “SEC”), in press releases or other public shareholder communications, or in oral statements made with the approval of an authorized executive officer, the words or phrases “believe,” “will,” “should,” “will likely result,” “are expected to,” “will continue,” “is anticipated,” “estimate,” “project,” “plans,” or similar expressions are intended to identify “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. You are cautioned not to place undue reliance on any forward-looking statements, which speak only as of the date made. These statements may relate to future financial performance, strategic plans or objectives, revenue, expense or earnings projections, or other financial items of Banc of California Inc. and its affiliates (“BANC,” the “Company,” “we,” “us” or “our”). By their nature, these statements are subject to numerous uncertainties that could cause actual results to differ materially from those anticipated in the statements. Factors that could cause actual results to differ materially from the results anticipated or projected include, but are not limited to, the following: (i) pending governmental investigations may result in adverse findings, reputational damage, the imposition of sanctions and other negative consequences; (ii) management time and resources may be diverted to address pending governmental investigations as well as any related litigation; (iii) the resignation of our former chief executive officer in the first quarter of 2017 might cause a loss of confidence among certain customers who may withdraw their deposits or terminate their business relationships with us, notwithstanding the hiring of our new chief executive officer; (iv) our performance may be adversely affected by the management transition resulting from the resignation of our former chief executive officer, notwithstanding the hiring of our new chief executive officer, and the resignation of our former interim chief financial officer, in the second quarter of 2017; (v) risks that the Company’s acquisitions and dispositions, including the acquisitions of branches from Banco Popular, The Private Bank of California, and CS Financial, Inc., the disposition of the Banc Home Loans Division, and the acquisition and disposition of The Palisades Group, may disrupt current plans and operations, the potential difficulties in customer and employee retention as a result of those transactions and the amount of the costs, fees, expenses and charges related to those transactions; (vi) the credit risks of lending activities, which may be affected by further deterioration in real estate markets and the financial condition of borrowers, may lead to increased loan and lease delinquencies, losses and nonperforming assets in our loan portfolio, and may result in our allowance for loan and lease losses not being adequate to cover actual losses and require us to materially increase our loan and lease loss reserves; (vii) the quality and composition of our securities and loan portfolios; (viii) changes in general economic conditions, either nationally or in our market areas; (ix) continuation of the historically low short-term interest rate environment, changes in the levels of general interest rates, and the relative differences between short- and long-term interest rates, deposit interest rates, our net interest margin and funding sources; (x) fluctuations in the demand for loans and leases, the number of unsold homes and other properties and fluctuations in commercial and residential real estate values in our market area; (xi) results of examinations of us by regulatory authorities and the possibility that any such regulatory authority may, among other things, require us to increase our allowance for loan and lease losses, write-down asset values, increase our capital levels, or affect our ability to borrow funds or maintain or increase deposits, which could adversely affect our liquidity and earnings; (xii) legislative or regulatory changes that adversely affect our business, including changes in regulatory capital or other rules; (xiii) our ability to control operating costs and expenses; (xiv) staffing fluctuations in response to product demand or the implementation of corporate strategies that affect our work force and potential associated charges; (xv) errors in our estimates in determining fair value of certain of our assets, which may result in significant declines in valuation; (xvi) the network and computer systems on which we depend could fail or experience a security breach; (xvii) our ability to attract and retain key members of our senior management team; (xviii) costs and effects of litigation, including settlements and judgments; (xix) increased competitive pressures among financial services companies; (xx) changes in consumer spending, borrowing and saving habits; (xxi) adverse changes in the securities markets; (xxii) earthquake, fire or other natural disasters affecting the condition of real estate collateral; (xxiii) the availability of resources to address changes in laws, rules or regulations or to respond to regulatory actions; (xxiv) inability of key third-party providers to perform their obligations to us; (xxv) changes in accounting policies and practices, as may be adopted by the financial institution regulatory agencies or the Financial Accounting Standards Board or their application to our business or final audit adjustments, including additional guidance and interpretation on accounting issues and details of the implementation of new accounting methods; (xxvi) war or terrorist activities; and (xxvii) other economic, competitive, governmental, regulatory, and technological factors affecting our operations, pricing, products and services and the other risks described from time to time in other documents that we file with or furnish to the SEC. You should not place undue reliance on forward-looking statements, and we undertake no obligation to update any such statements to reflect circumstances or events that occur after the date on which the forward-looking statement is made. Forward-looking Statements

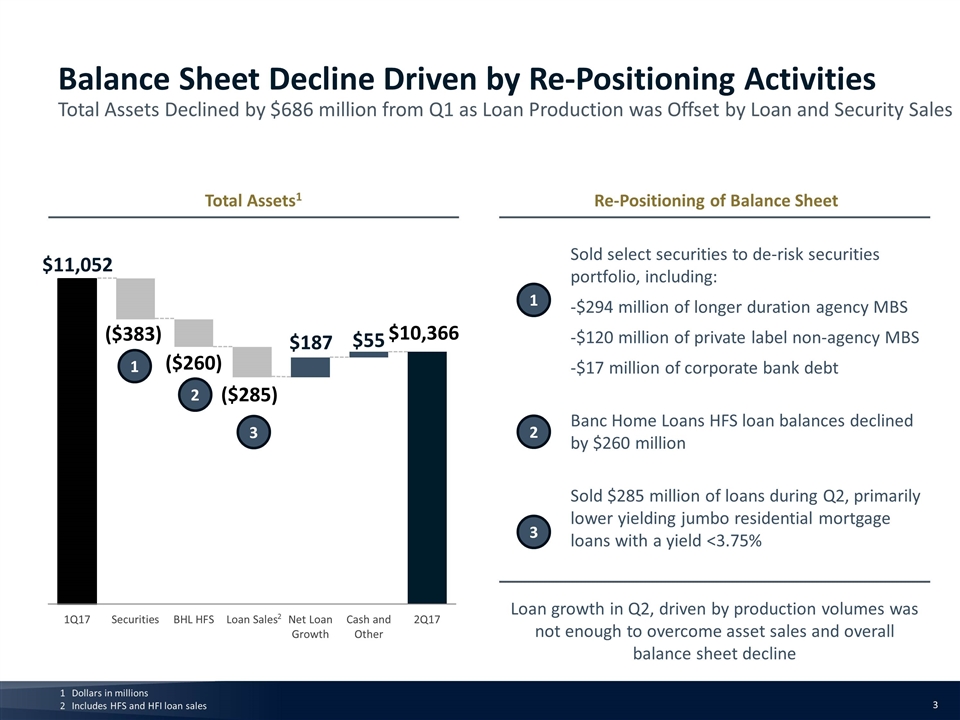

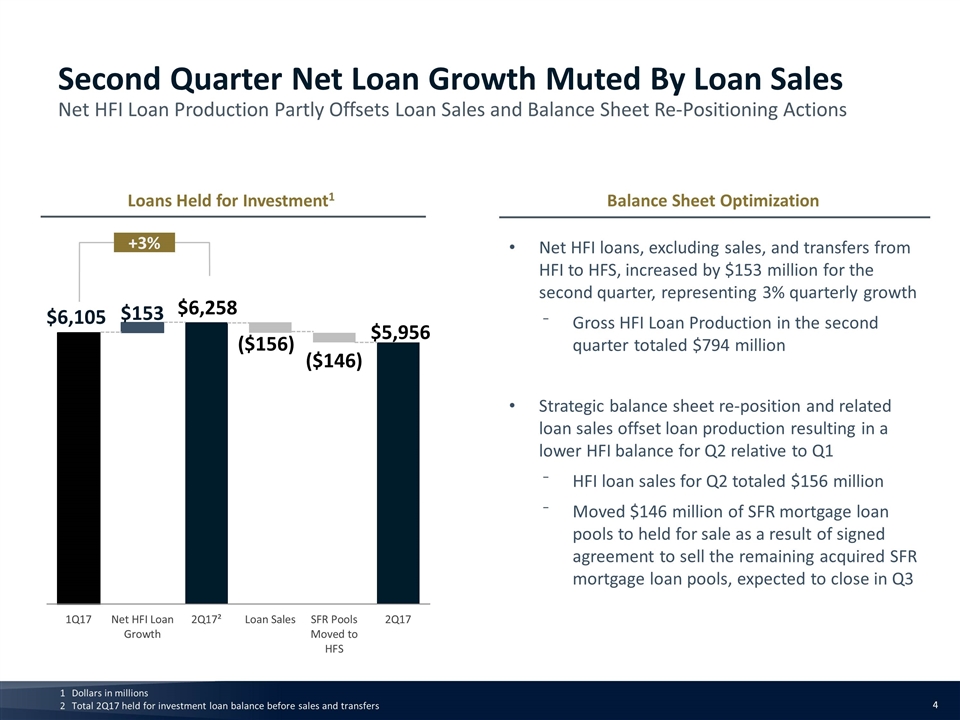

Re-Positioned & De-Risked the Balance Sheet Transitioned BHL Offices & Loan Officers Reduced Expense Run-Rate Securities declined by $383 million from the first quarter, driven by sales of $294 million of longer duration agency MBS, $120 million of private label non-agency MBS and $17 million of corporate bank debt Reclassified HTM securities to AFS during Q2 to facilitate balance sheet management strategy Reduced brokered deposit balances by $576 million during Q2 Signed agreement to sell remaining seasoned SFR mortgage loan pools, expect to close in Q3 Loan officers and branch leases transferred to Caliber during Q2 Majority of BHL held for sale loans to be sold in Q3 (HFS balances of $161 million at 6/30) Loan officer retention lower than expected, no volume retention payment received in Q2 Actioned numerous expense initiatives during Q2 and reduced recurring quarterly run-rate expenses to $60 million1 Additional efficiency actions planned throughout second half Maintained Strong Credit & Capital Credit metrics continued to improve with nonperforming assets to total assets declining to 0.12%, down 73% from a year ago Common equity tier 1 ratio improved to 9.8% Second Quarter 2017 Highlights Successfully Actioned Q2 Phase of Strategic Transformation Focused on Loan & Deposit Growth Operating expenses for continuing operations, excludes loss on investments in alternative energy partnerships. Reconciliation on slide 9. After signing the agreement noted above Held for investment loan balances declined by $149 million, driven by loan sales of $156 million and the transfer of $146 million of seasoned SFR loan pools to held for sale2 during the quarter. Excluding these two items, HFI loans grew by $153 million, or +3% QoQ Loan production for the second quarter of $794 million Focused on loan and deposit production in 2H2017 to grow balance sheet

Dollars in millions Includes HFS and HFI loan sales Total Assets1 Balance Sheet Decline Driven by Re-Positioning Activities Total Assets Declined by $686 million from Q1 as Loan Production was Offset by Loan and Security Sales Sold select securities to de-risk securities portfolio, including: -$294 million of longer duration agency MBS -$120 million of private label non-agency MBS -$17 million of corporate bank debt Banc Home Loans HFS loan balances declined by $260 million Sold $285 million of loans during Q2, primarily lower yielding jumbo residential mortgage loans with a yield <3.75% Re-Positioning of Balance Sheet 1 2 3 1 2 3 Loan growth in Q2, driven by production volumes was not enough to overcome asset sales and overall balance sheet decline 2

Dollars in millions Total 2Q17 held for investment loan balance before sales and transfers Loans Held for Investment1 Second Quarter Net Loan Growth Muted By Loan Sales Net HFI Loan Production Partly Offsets Loan Sales and Balance Sheet Re-Positioning Actions Net HFI loans, excluding sales, and transfers from HFI to HFS, increased by $153 million for the second quarter, representing 3% quarterly growth Gross HFI Loan Production in the second quarter totaled $794 million Strategic balance sheet re-position and related loan sales offset loan production resulting in a lower HFI balance for Q2 relative to Q1 HFI loan sales for Q2 totaled $156 million Moved $146 million of SFR mortgage loan pools to held for sale as a result of signed agreement to sell the remaining acquired SFR mortgage loan pools, expected to close in Q3 Balance Sheet Optimization +3%

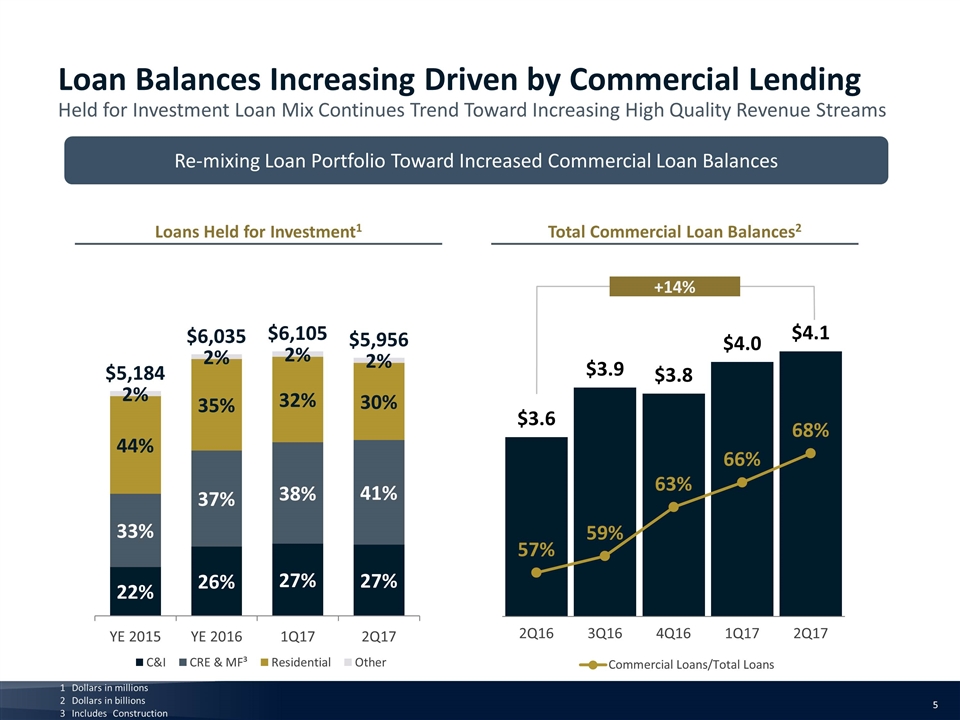

Loan Balances Increasing Driven by Commercial Lending Held for Investment Loan Mix Continues Trend Toward Increasing High Quality Revenue Streams Dollars in millions Dollars in billions Includes Construction Re-mixing Loan Portfolio Toward Increased Commercial Loan Balances Loans Held for Investment1 Total Commercial Loan Balances2 +14%

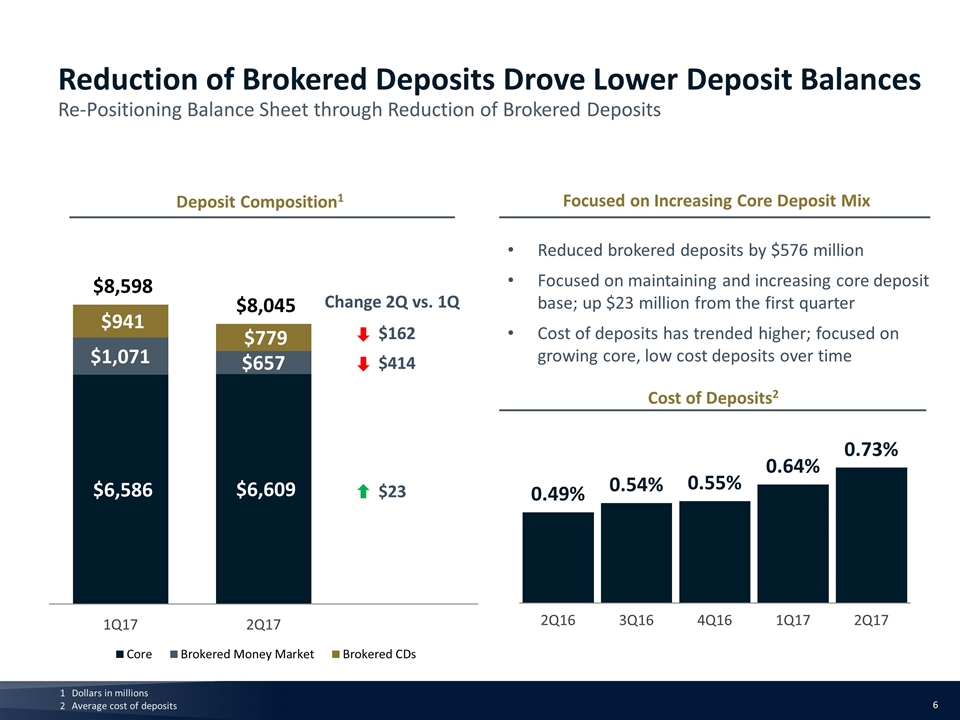

Dollars in millions Average cost of deposits Deposit Composition1 Reduction of Brokered Deposits Drove Lower Deposit Balances Re-Positioning Balance Sheet through Reduction of Brokered Deposits Reduced brokered deposits by $576 million Focused on maintaining and increasing core deposit base; up $23 million from the first quarter Cost of deposits has trended higher; focused on growing core, low cost deposits over time Focused on Increasing Core Deposit Mix Cost of Deposits2 $414 Change 2Q vs. 1Q $162 $23

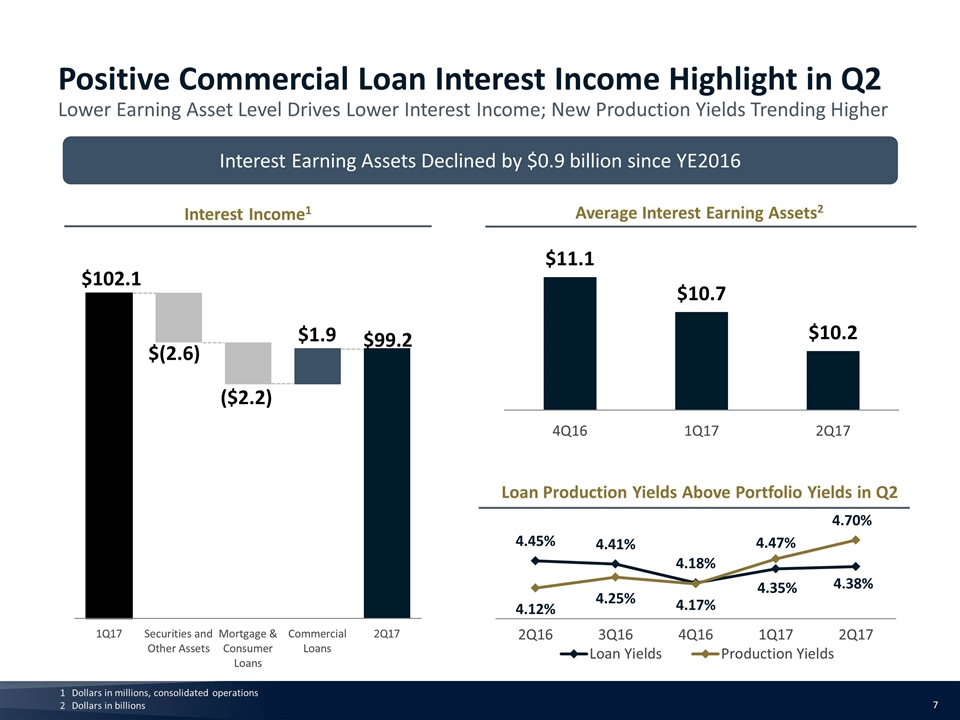

Dollars in millions, consolidated operations Dollars in billions Interest Earning Assets Declined by $0.9 billion since YE2016 Interest Income1 Average Interest Earning Assets2 Loan Production Yields Above Portfolio Yields in Q2 Positive Commercial Loan Interest Income Highlight in Q2 Lower Earning Asset Level Drives Lower Interest Income; New Production Yields Trending Higher

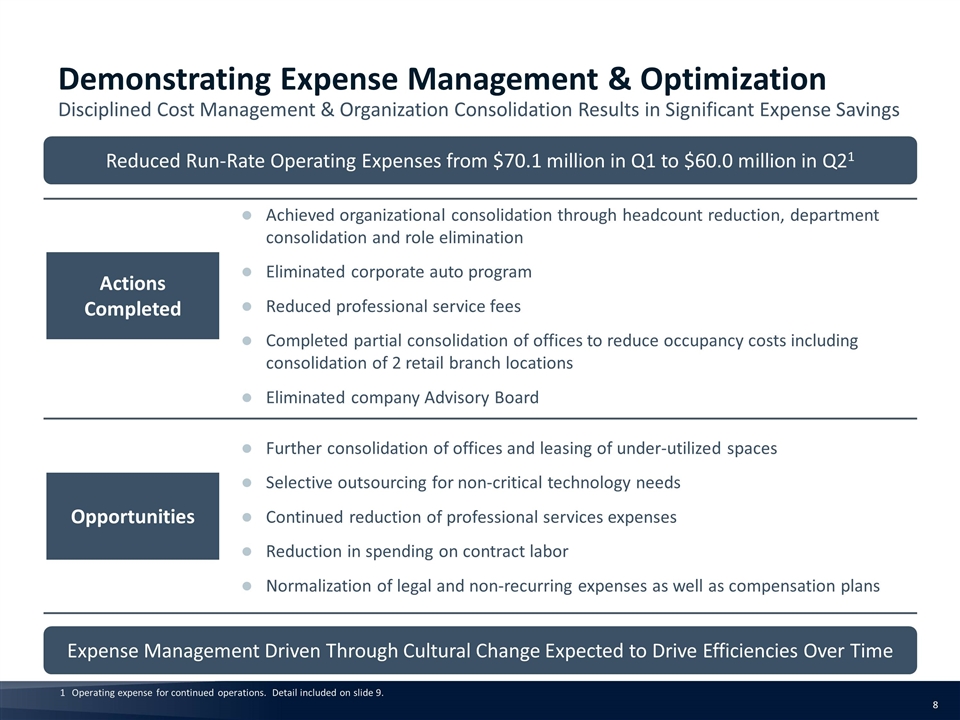

Demonstrating Expense Management & Optimization Disciplined Cost Management & Organization Consolidation Results in Significant Expense Savings Actions Completed Achieved organizational consolidation through headcount reduction, department consolidation and role elimination Eliminated corporate auto program Reduced professional service fees Completed partial consolidation of offices to reduce occupancy costs including consolidation of 2 retail branch locations Eliminated company Advisory Board Opportunities Further consolidation of offices and leasing of under-utilized spaces Selective outsourcing for non-critical technology needs Continued reduction of professional services expenses Reduction in spending on contract labor Normalization of legal and non-recurring expenses as well as compensation plans Expense Management Driven Through Cultural Change Expected to Drive Efficiencies Over Time Reduced Run-Rate Operating Expenses from $70.1 million in Q1 to $60.0 million in Q21 Operating expense for continued operations. Detail included on slide 9.

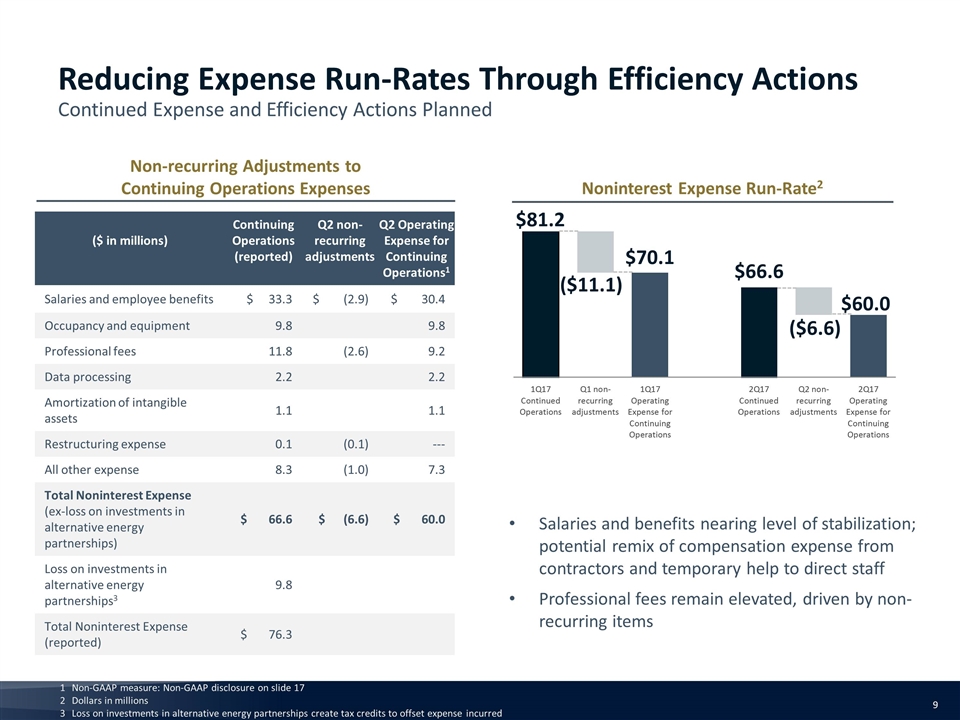

Reducing Expense Run-Rates Through Efficiency Actions Continued Expense and Efficiency Actions Planned Noninterest Expense Run-Rate2 Non-GAAP measure: Non-GAAP disclosure on slide 17 Dollars in millions Loss on investments in alternative energy partnerships create tax credits to offset expense incurred Non-recurring Adjustments to Continuing Operations Expenses ($ in millions) Continuing Operations (reported) Q2 non-recurring adjustments Q2 Operating Expense for Continuing Operations1 Salaries and employee benefits $ 33.3 $ (2.9) $ 30.4 Occupancy and equipment 9.8 9.8 Professional fees 11.8 (2.6) 9.2 Data processing 2.2 2.2 Amortization of intangible assets 1.1 1.1 Restructuring expense 0.1 (0.1) --- All other expense 8.3 (1.0) 7.3 Total Noninterest Expense (ex-loss on investments in alternative energy partnerships) $ 66.6 $ (6.6) $ 60.0 Loss on investments in alternative energy partnerships3 9.8 Total Noninterest Expense (reported) $ 76.3 Salaries and benefits nearing level of stabilization; potential remix of compensation expense from contractors and temporary help to direct staff Professional fees remain elevated, driven by non-recurring items

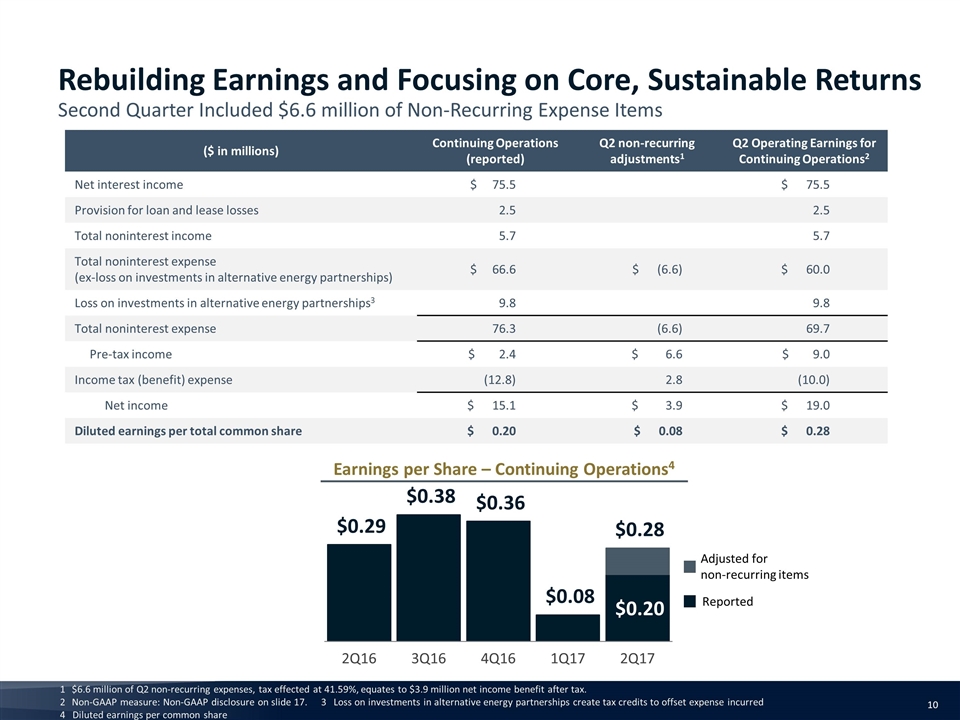

($ in millions) Continuing Operations (reported) Q2 non-recurring adjustments1 Q2 Operating Earnings for Continuing Operations2 Net interest income $ 75.5 $ 75.5 Provision for loan and lease losses 2.5 2.5 Total noninterest income 5.7 5.7 Total noninterest expense (ex-loss on investments in alternative energy partnerships) $ 66.6 $ (6.6) $ 60.0 Loss on investments in alternative energy partnerships3 9.8 9.8 Total noninterest expense 76.3 (6.6) 69.7 Pre-tax income $ 2.4 $ 6.6 $ 9.0 Income tax (benefit) expense (12.8) 2.8 (10.0) Net income $ 15.1 $ 3.9 $ 19.0 Diluted earnings per total common share $ 0.20 $ 0.08 $ 0.28 $6.6 million of Q2 non-recurring expenses, tax effected at 41.59%, equates to $3.9 million net income benefit after tax. Non-GAAP measure: Non-GAAP disclosure on slide 17. 3 Loss on investments in alternative energy partnerships create tax credits to offset expense incurred 4 Diluted earnings per common share Earnings per Share – Continuing Operations4 Rebuilding Earnings and Focusing on Core, Sustainable Returns Second Quarter Included $6.6 million of Non-Recurring Expense Items Reported Adjusted for non-recurring items

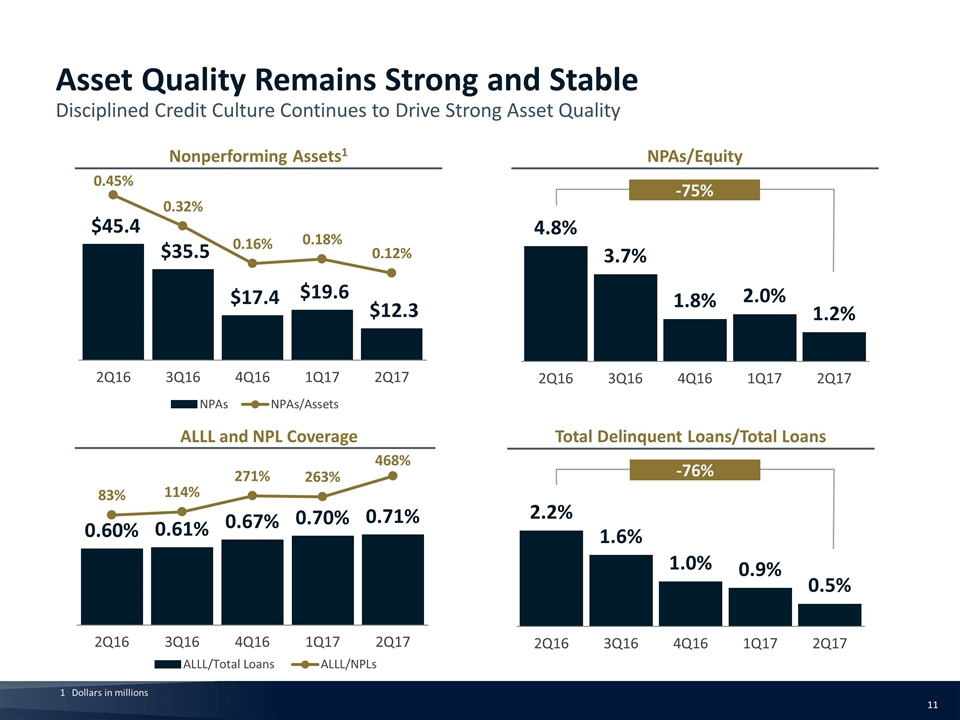

NPAs/Equity Nonperforming Assets1 ALLL and NPL Coverage Total Delinquent Loans/Total Loans -75% -76% Asset Quality Remains Strong and Stable Disciplined Credit Culture Continues to Drive Strong Asset Quality Dollars in millions

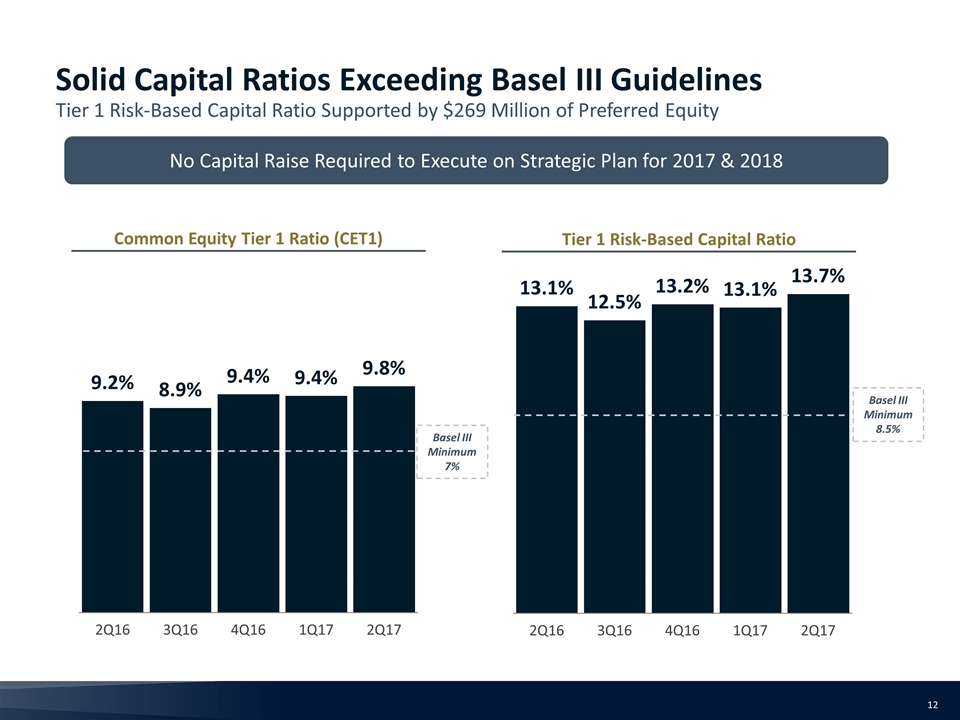

Solid Capital Ratios Exceeding Basel III Guidelines Tier 1 Risk-Based Capital Ratio Supported by $269 Million of Preferred Equity Common Equity Tier 1 Ratio (CET1) Tier 1 Risk-Based Capital Ratio No Capital Raise Required to Execute on Strategic Plan for 2017 & 2018 Basel III Minimum 7% Basel III Minimum 8.5%

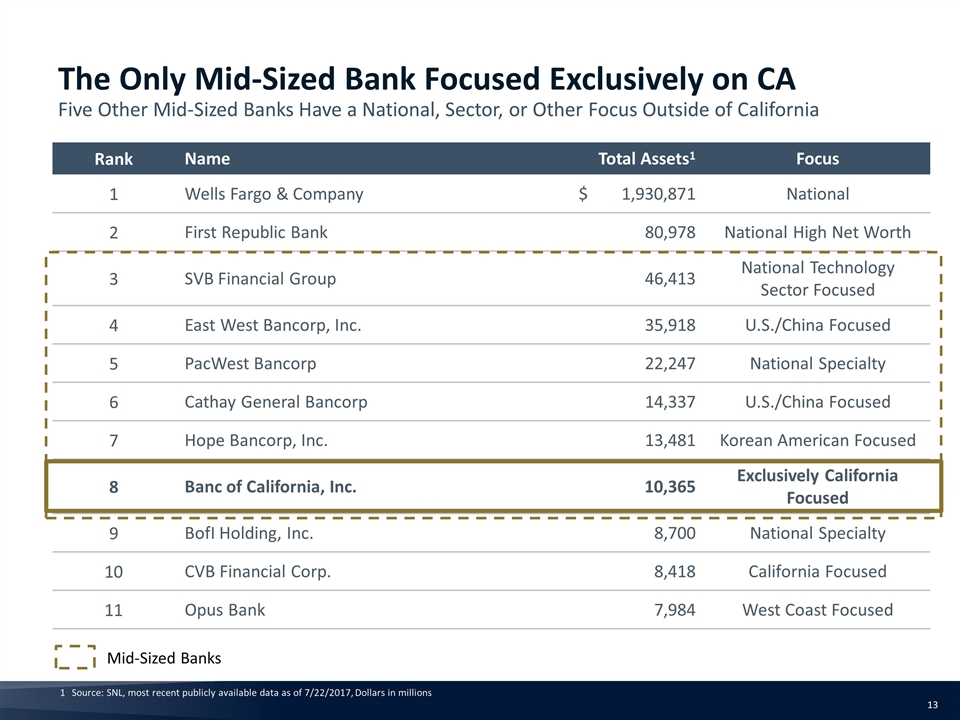

Rank Name Total Assets1 Focus 1 Wells Fargo & Company $ 1,930,871 National 2 First Republic Bank 80,978 National High Net Worth 3 SVB Financial Group 46,413 National Technology Sector Focused 4 East West Bancorp, Inc. 35,918 U.S./China Focused 5 PacWest Bancorp 22,247 National Specialty 6 Cathay General Bancorp 14,337 U.S./China Focused 7 Hope Bancorp, Inc. 13,481 Korean American Focused 8 Banc of California, Inc. 10,365 Exclusively California Focused 9 BofI Holding, Inc. 8,700 National Specialty 10 CVB Financial Corp. 8,418 California Focused 11 Opus Bank 7,984 West Coast Focused Mid-Sized Banks The Only Mid-Sized Bank Focused Exclusively on CA Five Other Mid-Sized Banks Have a National, Sector, or Other Focus Outside of California Source: SNL, most recent publicly available data as of 7/22/2017, Dollars in millions

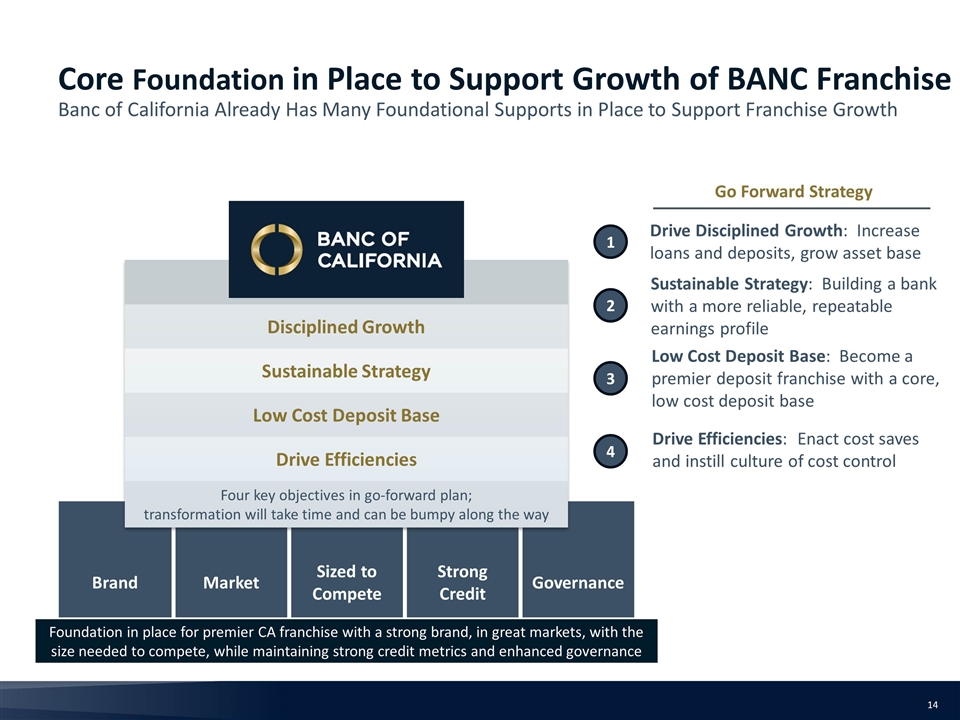

Core Foundation in Place to Support Growth of BANC Franchise Banc of California Already Has Many Foundational Supports in Place to Support Franchise Growth Drive Disciplined Growth: Increase loans and deposits, grow asset base Go Forward Strategy 1 2 3 Sustainable Strategy: Building a bank with a more reliable, repeatable earnings profile Low Cost Deposit Base: Become a premier deposit franchise with a core, low cost deposit base Drive Efficiencies: Enact cost saves and instill culture of cost control 4 Brand Market Sized to Compete Strong Credit Governance Foundation in place for premier CA franchise with a strong brand, in great markets, with the size needed to compete, while maintaining strong credit metrics and enhanced governance Disciplined Growth Sustainable Strategy Low Cost Deposit Base Drive Efficiencies Four key objectives in go-forward plan; transformation will take time and can be bumpy along the way

Appendix

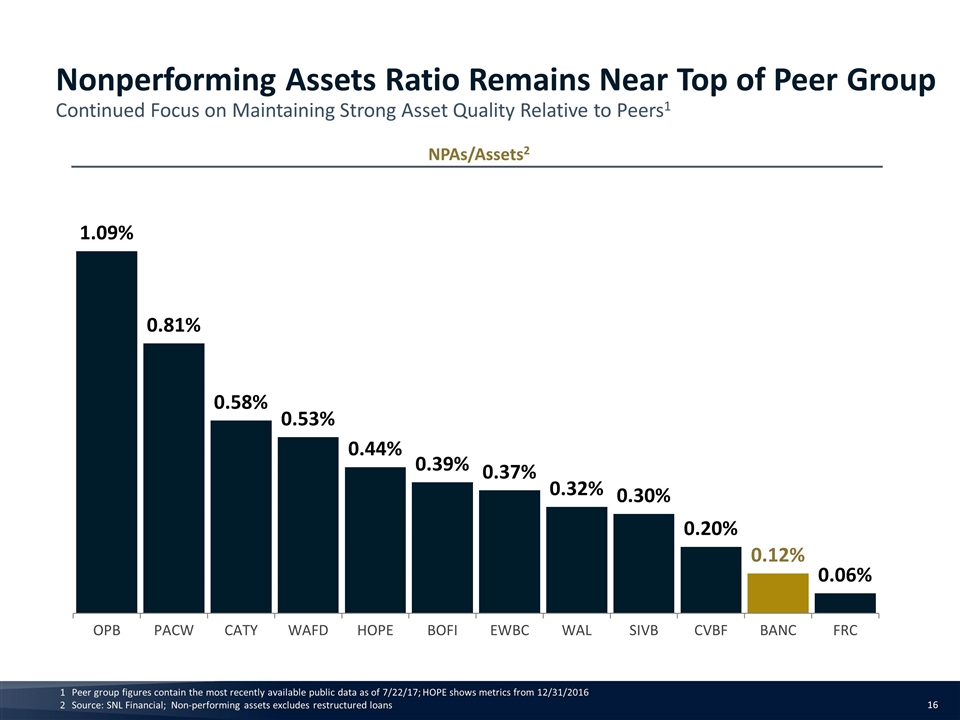

NPAs/Assets2 Peer group figures contain the most recently available public data as of 7/22/17; HOPE shows metrics from 12/31/2016 Source: SNL Financial; Non-performing assets excludes restructured loans Nonperforming Assets Ratio Remains Near Top of Peer Group Continued Focus on Maintaining Strong Asset Quality Relative to Peers1

This presentation contains certain financial measures determined by methods other than in accordance with U.S. generally accepted accounting principles (GAAP), including operating expense for continuing operations, operating earnings for continuing operations and operating earnings per common share for continuing operations. These measures exclude loss on investments in alternative energy partnerships and reflect adjustments for non-recurring items. Management believes that these measures provide useful supplemental information in understanding our core operating performance. These measures should not be viewed as substitutes for measures determined in accordance with GAAP, nor are they necessarily comparable to non‐GAAP performance measures that may be presented by other companies. Reconciliations of these measures to measures determined in accordance with GAAP are contained on slides 9 and 10 of this presentation. Non-GAAP Financial Information