Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - AMERICAN CAMPUS COMMUNITIES INC | ex991-q22017earningsrelease.htm |

| 8-K - 8-K - AMERICAN CAMPUS COMMUNITIES INC | form8-kq22017earningsrelea.htm |

Supplemental

Analyst Package

2Q 2017

July 24, 2017

Table of Contents

Financial Highlights 1

Consolidated Balance Sheets 2

Consolidated Statements of Comprehensive Income 3

Consolidated Statements of Funds from Operations 4

Wholly-Owned Properties Results of Operations 5

Same Store Wholly-Owned Properties Operating Expenses 6

Seasonality of Operations 7

2017 / 2018 Leasing Status 8

Investment Update 9

Owned Development Update 10

Third-Party Development Update 11

Management Services Update 12

Capital Structure 13

Interest Coverage 14

Capital Allocation – Long Term Funding Plan 15

2017 Outlook - Summary 16

2017 Outlook - Detail 17

Detail of Property Groupings 18

Definitions 19

Investor Information 21

Financial Highlights

($ in thousands, except share and per share data)

1

Operating Data Three Months Ended June 30, Six Months Ended June 30,

2017 2016 $ Change % Change 2017 2016 $ Change % Change

Total revenues $ 179,008 $ 185,983 $ (6,975) (3.8)% $ 371,946 $ 385,978 $ (14,032) (3.6)%

Operating income 12,610 39,106 (26,496) (67.8)% 61,829 92,141 (30,312) (32.9)%

Net (loss) income attributable to ACC1 (2,762) 18,438 (21,200) (115.0)% 31,288 64,025 (32,737) (51.1)%

Net (loss) income per share - basic and diluted (0.02) 0.14 0.23 0.50

Funds From Operations ("FFO")2 68,507 71,650 (3,143) (4.4)% 154,474 153,496 978 0.6%

FFO per share - diluted2 0.50 0.54 (0.04) (7.4)% 1.14 1.19 (0.05) (4.2)%

Funds From Operations - Modified ("FFOM")2 72,503 72,195 308 0.4% 155,683 150,363 5,320 3.5%

FFOM per share - diluted2 0.53 0.54 (0.01) (1.9)% 1.15 1.16 (0.01) (0.9)%

Market Capitalization and Unsecured Notes Covenants3 June 30, 2017 December 31, 2016

Debt to total market capitalization 26.5% 24.1%

Net debt to EBITDA4 6.0x 5.4x

Unencumbered asset value to total asset value 82.2% 81.0%

Total debt to total asset value 32.6% 31.3%

Secured debt to total asset value 9.2% 9.8%

Unencumbered asset value to unsecured debt 350.2% 378.2%

Interest coverage4 4.3x 4.5x

1. Excluding net loss from dispositions of real estate and impairment charges, net income attributable to ACC for the three and six months ended June 30, 2017 would have been $13.2 million and

$47.2 million, respectively. Excluding net gains from dispositions of real estate, net income attributable to ACC for the six months ended June 30, 2016 would have been $46.6 million.

2. Refer to page 4 for a reconciliation to net income, the most directly comparable GAAP measure.

3. Refer to the definitions outlined on pages 19 and 20 for detailed definitions of terms appearing on this page.

4. Refer to calculations on page 14, including a reconciliation to net income and interest expense, the most directly comparable GAAP measures.

Consolidated Balance Sheets

($ in thousands)

2

June 30, 2017 December 31, 2016

(unaudited)

Assets

Investments in real estate:

Wholly-owned properties, net $ 5,805,403 $ 5,427,014

Wholly-owned properties held for sale — 25,350

On-campus participating properties, net 82,940 85,797

Investments in real estate, net 5,888,343 5,538,161

Cash and cash equivalents 25,476 22,140

Restricted cash 28,319 24,817

Student contracts receivable, net 7,447 8,428

Other assets1 275,388 272,367

Total assets $ 6,224,973 $ 5,865,913

Liabilities and equity

Liabilities:

Secured mortgage, construction and bond debt $ 680,556 $ 688,195

Unsecured notes 1,189,775 1,188,737

Unsecured term loans 347,417 149,065

Unsecured revolving credit facility 142,286 99,300

Accounts payable and accrued expenses 62,547 76,614

Other liabilities2 179,342 158,437

Total liabilities 2,601,923 2,360,348

Redeemable noncontrolling interests 55,344 55,078

Equity:

American Campus Communities, Inc. and

Subsidiaries stockholders' equity:

Common stock 1,363 1,322

Additional paid in capital 4,312,413 4,118,842

Common stock held in rabbi trust (1,688) (975)

Accumulated earnings and dividends (754,660) (670,137)

Accumulated other comprehensive loss (3,428) (4,067)

Total American Campus Communities, Inc. and

3,554,000 3,444,985Subsidiaries stockholders' equity

Noncontrolling interests - partially owned properties 13,706 5,502

Total equity 3,567,706 3,450,487

Total liabilities and equity $ 6,224,973 $ 5,865,913

1. As of June 30, 2017, other assets include approximately $7.7 million related to net deferred financing costs on our revolving credit facility and the net value of in-place leases.

2. As of June 30, 2017, other liabilities include approximately $42.6 million in deferred revenue and fee income.

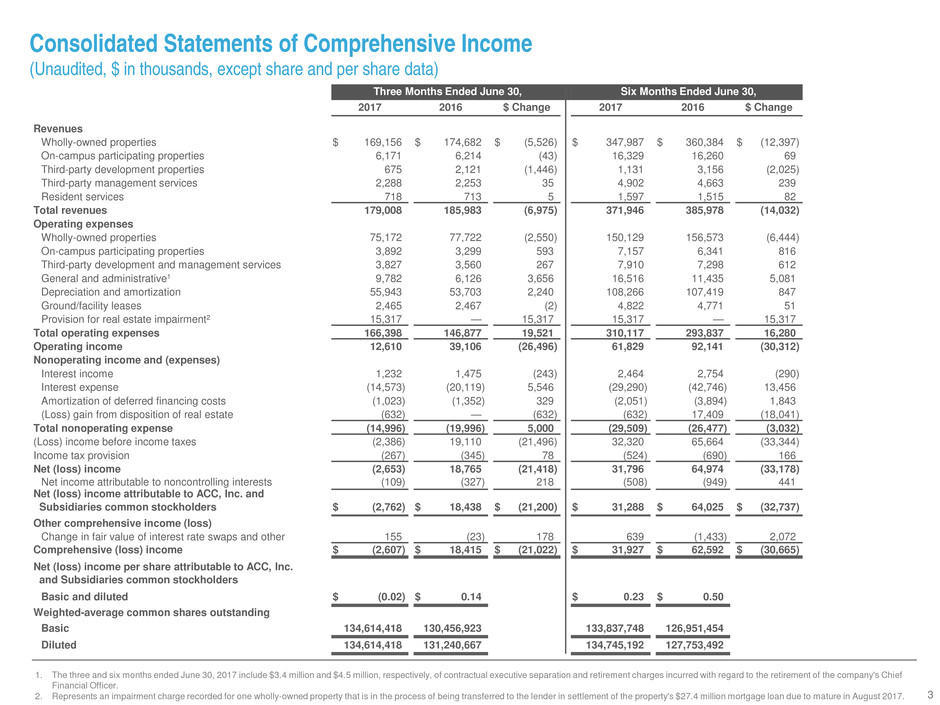

Consolidated Statements of Comprehensive Income

(Unaudited, $ in thousands, except share and per share data)

3

Three Months Ended June 30, Six Months Ended June 30,

2017 2016 $ Change 2017 2016 $ Change

Revenues

Wholly-owned properties $ 169,156 $ 174,682 $ (5,526) $ 347,987 $ 360,384 $ (12,397)

On-campus participating properties 6,171 6,214 (43) 16,329 16,260 69

Third-party development properties 675 2,121 (1,446) 1,131 3,156 (2,025)

Third-party management services 2,288 2,253 35 4,902 4,663 239

Resident services 718 713 5 1,597 1,515 82

Total revenues 179,008 185,983 (6,975) 371,946 385,978 (14,032)

Operating expenses

Wholly-owned properties 75,172 77,722 (2,550) 150,129 156,573 (6,444)

On-campus participating properties 3,892 3,299 593 7,157 6,341 816

Third-party development and management services 3,827 3,560 267 7,910 7,298 612

General and administrative1 9,782 6,126 3,656 16,516 11,435 5,081

Depreciation and amortization 55,943 53,703 2,240 108,266 107,419 847

Ground/facility leases 2,465 2,467 (2) 4,822 4,771 51

Provision for real estate impairment2 15,317 — 15,317 15,317 — 15,317

Total operating expenses 166,398 146,877 19,521 310,117 293,837 16,280

Operating income 12,610 39,106 (26,496) 61,829 92,141 (30,312)

Nonoperating income and (expenses)

Interest income 1,232 1,475 (243) 2,464 2,754 (290)

Interest expense (14,573) (20,119) 5,546 (29,290) (42,746) 13,456

Amortization of deferred financing costs (1,023) (1,352) 329 (2,051) (3,894) 1,843

(Loss) gain from disposition of real estate (632) — (632) (632) 17,409 (18,041)

Total nonoperating expense (14,996) (19,996) 5,000 (29,509) (26,477) (3,032)

(Loss) income before income taxes (2,386) 19,110 (21,496) 32,320 65,664 (33,344)

Income tax provision (267) (345) 78 (524) (690) 166

Net (loss) income (2,653) 18,765 (21,418) 31,796 64,974 (33,178)

Net income attributable to noncontrolling interests (109) (327) 218 (508) (949) 441

Net (loss) income attributable to ACC, Inc. and

$ (2,762) $ 18,438 $ (21,200) $ 31,288 $ 64,025 $ (32,737)Subsidiaries common stockholders

Other comprehensive income (loss)

Change in fair value of interest rate swaps and other 155 (23) 178 639 (1,433) 2,072

Comprehensive (loss) income $ (2,607) $ 18,415 $ (21,022) $ 31,927 $ 62,592 $ (30,665)

Net (loss) income per share attributable to ACC, Inc.

and Subsidiaries common stockholders

Basic and diluted $ (0.02) $ 0.14 $ 0.23 $ 0.50

Weighted-average common shares outstanding

Basic 134,614,418 130,456,923 133,837,748 126,951,454

Diluted 134,614,418 131,240,667 134,745,192 127,753,492

1. The three and six months ended June 30, 2017 include $3.4 million and $4.5 million, respectively, of contractual executive separation and retirement charges incurred with regard to the retirement of the company's Chief

Financial Officer.

2. Represents an impairment charge recorded for one wholly-owned property that is in the process of being transferred to the lender in settlement of the property's $27.4 million mortgage loan due to mature in August 2017.

Consolidated Statements of Funds from Operations

(Unaudited, $ in thousands, except share and per share data)

4

1. Represents an impairment charge recorded for a wholly-owned property that is in the process of being transferred to the lender in settlement of the property's $27.4 million mortgage loan due to mature

in August 2017.

2. 50% of the properties’ net cash available for distribution after payment of operating expenses, debt service (including repayment of principal) and capital expenditures. Represents actual amounts

accrued for the interim periods, which is included in ground/facility leases expense in the consolidated statements of comprehensive income (refer to page 3).

3. Represents contractual executive separation and retirement charges incurred in the first and second quarter of 2017 with regard to the retirement of the company's Chief Financial Officer.

Three Months Ended June 30, Six Months Ended June 30,

2017 2016 $ Change 2017 2016 $ Change

Net (loss) income attributable to ACC, Inc. and

$ (2,762) $ 18,438 $ (21,200) $ 31,288 $ 64,025 $ (32,737)Subsidiaries common stockholders

Noncontrolling interests 109 327 (218) 508 949 (441)

Loss (gain) from disposition of real estate 632 — 632 632 (17,409) 18,041

Elimination of provision for real estate impairment1 15,317 — 15,317 15,317 — 15,317

Real estate related depreciation and amortization 55,211 52,885 2,326 106,729 105,931 798

Funds from operations ("FFO") attributable to

68,507 71,650 (3,143) 154,474 153,496 978common stockholders and OP unitholders

Elimination of operations of on-campus participating properties

Net loss (income) from on-campus participating properties 1,395 1,097 298 (1,852) (2,067) 215

Amortization of investment in on-campus participating properties (1,869) (1,831) (38) (3,729) (3,654) (75)

68,033 70,916 (2,883) 148,893 147,775 1,118

Modifications to reflect operational performance of on-campus

participating properties

Our share of net cashflow2 778 1,015 (237) 1,535 1,865 (330)

Management fees 272 264 8 740 723 17

Contribution from on-campus participating properties 1,050 1,279 (229) 2,275 2,588 (313)

Contractual executive separation and retirement charges3 3,420 — 3,420 4,515 — 4,515

Funds from operations-modified ("FFOM") attributable to

$ 72,503 $ 72,195 $ 308 $ 155,683 $ 150,363 $ 5,320common stockholders and OP unitholders

FFO per share - diluted $ 0.50 $ 0.54 $ 1.14 $ 1.19

FFOM per share - diluted $ 0.53 $ 0.54 $ 1.15 $ 1.16

Weighted-average common shares outstanding - diluted 136,602,368 132,638,808 135,851,836 129,159,380

Wholly-Owned Properties Results of Operations

($ in thousands)

5

Three Months Ended June 30, Six Months Ended June 30,

2017 2016 $ Change % Change 2017 2016 $ Change % Change

Wholly-owned properties revenues

Same store properties $ 158,548 $ 154,379 $ 4,169 2.7% $ 327,401 $ 317,691 $ 9,710 3.1%

New properties 10,172 17 10,155 19,137 104 19,033

Sold and held for sale properties1 1,154 20,999 (19,845) 3,046 44,104 (41,058)

Total revenues2 $ 169,874 $ 175,395 $ (5,521) (3.1%) $ 349,584 $ 361,899 $ (12,315) (3.4%)

Wholly-owned properties operating expenses

Same store properties3 $ 69,973 $ 67,747 $ 2,226 3.3% $ 140,091 $ 135,598 $ 4,493 3.3%

New properties 4,387 85 4,302 7,920 158 7,762

Sold and held for sale properties1 4 812 9,890 (9,078) 2,118 20,817 (18,699)

Total operating expenses $ 75,172 $ 77,722 $ (2,550) (3.3%) $ 150,129 $ 156,573 $ (6,444) (4.1%)

Wholly-owned properties net operating income

Same store properties5 $ 88,575 $ 86,632 $ 1,943 2.2% $ 187,310 $ 182,093 $ 5,217 2.9%

New properties 5,785 (68) 5,853 11,217 (54) 11,271

Sold and held for sale properties1 342 11,109 (10,767) 928 23,287 (22,359)

Total net operating income $ 94,702 $ 97,673 $ (2,971) (3.0%) $ 199,455 $ 205,326 $ (5,871) (2.9%)

Note: The same store grouping above represents properties owned and operating for both of the entire years ended December 31, 2017 and 2016, which are not conducting or planning to conduct

substantial development, redevelopment, or repositioning activities, and are not classified as held for sale as of June 30, 2017. Refer to page 18 for detail of our same store groupings.

1. Includes properties sold in 2016 and 2017, and one property that is in the process of being transferred to the lender in settlement of the property's $27.4 million mortgage loan due to mature in August

2017.

2. Includes revenues that are reflected as Resident Services Revenue on the accompanying consolidated statements of comprehensive income.

3. See page 6 for detail of same store operating expenses.

4. Does not include the allocation of payroll and other administrative costs related to corporate management and oversight.

5. The three and six months ended June 30, 2017 include a reduction of $90,000 and $132,000, respectively, related to 41 beds damaged by a fire occurring at one of our same store properties in March

2017. The damaged beds are being rebuilt and are anticipated to be available for occupancy in Fall 2017 through Spring 2018. In future quarters, we anticipate a reduction to same store net operating

income of approximately $30,000 per month until such time as the damaged beds are rebuilt and available for occupancy. These losses are covered by the company’s business interruption insurance

policy, although proceeds from this policy are not anticipated to be received and recorded until 2018.

Same Store Wholly-Owned Properties Operating Expenses

($ in thousands, except per bed amounts)

6

Three Months Ended June 30,

2017 2016

Total Per Bed

% Change

From Prior

Year

% of Total

Operating

Expenses Total Per Bed

% of Total

Operating

Expenses

Property taxes $ 16,515 $ 224 2.4% 24% $ 16,121 $ 218 24%

Utilities1 15,417 209 4.6% 22% 14,746 200 22%

General & administrative and other2 15,615 211 1.8% 22% 15,340 208 23%

Payroll3 13,627 184 2.9% 19% 13,249 179 19%

Repairs and maintenance4 4,655 63 4.3% 7% 4,461 60 7%

Marketing5 2,544 34 13.2% 4% 2,247 30 3%

Insurance 1,600 22 1.1% 2% 1,583 22 2%

Total same store wholly-owned operating expenses $ 69,973 $ 947 3.3% 100% $ 67,747 $ 917 100%

Same store wholly-owned beds 73,871

Six Months Ended June 30,

2017 2016

Total Per Bed

% Change

From Prior

Year

% of Total

Operating

Expenses Total Per Bed

% of Total

Operating

Expenses

Property taxes $ 32,872 $ 445 3.4% 23% $ 31,786 $ 430 23%

Utilities1 31,298 424 3.8% 22% 30,150 408 22%

General & administrative and other2 30,817 417 1.5% 22% 30,355 411 22%

Payroll3 27,348 370 2.9% 20% 26,566 360 20%

Repairs and maintenance4 9,175 124 4.3% 7% 8,798 119 7%

Marketing5 5,384 73 13.0% 4% 4,765 65 4%

Insurance 3,197 43 0.6% 2% 3,178 43 2%

Total same store wholly-owned operating expenses $ 140,091 $ 1,896 3.3% 100% $ 135,598 $ 1,836 100%

Same store wholly-owned beds 73,871

Note: The same store grouping above represents properties owned and operating for both of the entire years ended December 31, 2017 and 2016, which are not conducting or planning to conduct substantial

development, redevelopment, or repositioning activities, and are not classified as held for sale as of June 30, 2017. Refer to page 18 for detail of our same store groupings.

1. Represents gross expenses prior to any recoveries from tenants, which are reflected in wholly-owned properties revenues.

2. Includes security costs, shuttle costs, and property-level general and administrative costs as well as an allocation of costs related to corporate management and oversight. Also includes acquisition integration

costs, bad debt, food service, and other miscellaneous expenses.

3. Includes payroll and related expenses for on-site personnel including general managers, maintenance staff, and leasing staff.

4. Includes general maintenance costs such as interior painting, routine landscaping, pest control, fire protection, snow removal, elevator maintenance, roof and parking lot repairs, and other miscellaneous

building repair costs. Also includes costs related to the annual turn process.

5. Includes costs related to property marketing campaigns associated with our ongoing leasing efforts.

Seasonality of Operations

($ in thousands, except per bed amounts)

7

Three Months Ended

Total/Weighted Average-

June 30, 2016 September 30, 2016 December 31, 2016 March 31, 2017 June 30, 2017 Last 12 Months

2017 same store properties

Revenue per occupied bed

Rental revenue per occupied bed per month $ 690 $ 701 $ 728 $ 727 $ 710 $ 717

Other income per occupied bed per month1 66 85 57 58 69 67

Total revenue per occupied bed $ 756 $ 786 $ 785 $ 785 $ 779 $ 784

Average number of owned beds 73,871 73,871 73,871 73,857 2 73,773 2 73,843

Average physical occupancy for the quarter 92.1% 92.2% 97.6% 97.1% 92.0% 94.7%

Total revenue $ 154,379 $ 160,636 $ 169,743 $ 168,853 $ 158,548 $ 657,780

Property operating expenses 67,747 85,126 70,918 70,118 69,973 296,135

Net operating income $ 86,632 $ 75,510 $ 98,825 $ 98,735 $ 88,575 $ 361,645

Operating margin 56.1% 47.0% 58.2% 58.5% 55.9% 55.0%

2017 new properties

Revenue per occupied bed

Rental revenue per occupied bed per month $ — $ 798 $ 787 $ 778 $ 787 $ 786

Other income per occupied bed per month1 — 40 43 42 59 47

Total revenue per occupied bed $ — $ 838 $ 830 $ 820 $ 846 $ 833

Average number of owned beds — 1,910 3,868 3,900 4,559 3,559

Average physical occupancy for the quarter — 87.2% 93.2% 93.4% 87.9% 90.8%

Total revenue $ 17 3 $ 4,187 $ 8,980 $ 8,965 $ 10,172 $ 32,304

Property operating expenses 85 3 2,242 3,252 3,533 4,387 13,414

Net operating income $ (68) 3 $ 1,945 $ 5,728 $ 5,432 $ 5,785 $ 18,890

Operating margin N/A 46.5% 63.8% 60.6% 56.9% 58.5%

ALL PROPERTIES

Revenue per occupied bed

Rental revenue per occupied bed per month $ 690 $ 703 $ 731 $ 730 $ 714 $ 720

Other income per occupied bed per month1 66 84 57 57 69 66

Total revenue per occupied bed $ 756 $ 787 $ 788 $ 787 $ 783 $ 786

Average number of owned beds 73,871 75,781 77,739 77,757 78,332 77,402

Average physical occupancy for the quarter 92.1% 92.1% 97.3% 96.9% 91.7% 94.5%

Total revenue $ 154,396 $ 164,823 $ 178,723 $ 177,818 $ 168,720 $ 690,084

Property operating expenses 67,832 87,368 74,170 73,651 74,360 309,549

Net operating income $ 86,564 $ 77,455 $ 104,553 $ 104,167 $ 94,360 $ 380,535

Operating margin 56.1% 47.0% 58.5% 58.6% 55.9% 55.1%

Sold and held for sale properties4

Total revenue $ 20,999 $ 21,681 $ 11,472 $ 1,892 $ 1,154 $ 36,199

Property operating expenses5 9,890 13,234 5,951 1,306 812 21,303

Net operating income $ 11,109 $ 8,447 $ 5,521 $ 586 $ 342 $ 14,896

Note: The same store grouping above represents properties owned and operating for both of the entire years ended December 31, 2017 and 2016, which are not conducting or planning to conduct substantial development,

redevelopment, or repositioning activities, and are not classified as held for sale as of June 30, 2017. Refer to page 18 for detail of our same store groupings.

1. Other income is all income other than Net Student Rent. This includes, but is not limited to, utility income, damages, parking income, summer conference rent, application and administration fees, income from retail tenants, etc.

2. The decrease in the average number of owned beds from the prior quarter is due to beds that are currently being rebuilt or renovated, and will be available for occupancy in Fall 2017 through Spring 2018. These beds have been

removed to appropriately reflect revenue per occupied bed as they did not contribute revenue for the related period.

3. Represents nonrefundable application fees and administrative expenses incurred in relation to properties under development.

4. Includes properties sold in 2016 and 2017, and one property that is in the process of being transferred to the lender in settlement of the property's $27.4 million mortgage loan due to mature in August 2017.

5. Does not include the allocation of payroll and other administrative costs related to corporate management and oversight.

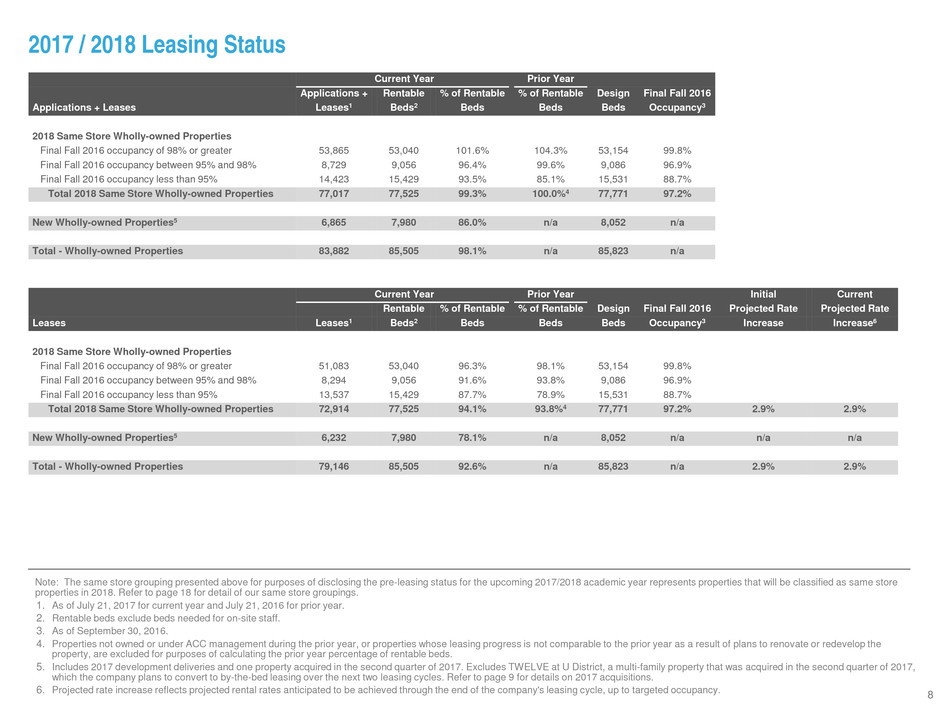

2017 / 2018 Leasing Status

8

Current Year Prior Year

Applications + Rentable % of Rentable % of Rentable Design Final Fall 2016

Applications + Leases Leases1 Beds2 Beds Beds Beds Occupancy3

2018 Same Store Wholly-owned Properties

Final Fall 2016 occupancy of 98% or greater 53,865 53,040 101.6% 104.3% 53,154 99.8%

Final Fall 2016 occupancy between 95% and 98% 8,729 9,056 96.4% 99.6% 9,086 96.9%

Final Fall 2016 occupancy less than 95% 14,423 15,429 93.5% 85.1% 15,531 88.7%

Total 2018 Same Store Wholly-owned Properties 77,017 77,525 99.3% 100.0%4 77,771 97.2%

New Wholly-owned Properties5 6,865 7,980 86.0% n/a 8,052 n/a

Total - Wholly-owned Properties 83,882 85,505 98.1% n/a 85,823 n/a

Current Year Prior Year Initial Current

Rentable % of Rentable % of Rentable Design Final Fall 2016 Projected Rate Projected Rate

Leases Leases1 Beds2 Beds Beds Beds Occupancy3 Increase Increase6

2018 Same Store Wholly-owned Properties

Final Fall 2016 occupancy of 98% or greater 51,083 53,040 96.3% 98.1% 53,154 99.8%

Final Fall 2016 occupancy between 95% and 98% 8,294 9,056 91.6% 93.8% 9,086 96.9%

Final Fall 2016 occupancy less than 95% 13,537 15,429 87.7% 78.9% 15,531 88.7%

Total 2018 Same Store Wholly-owned Properties 72,914 77,525 94.1% 93.8%4 77,771 97.2% 2.9% 2.9%

New Wholly-owned Properties5 6,232 7,980 78.1% n/a 8,052 n/a n/a n/a

Total - Wholly-owned Properties 79,146 85,505 92.6% n/a 85,823 n/a 2.9% 2.9%

Note: The same store grouping presented above for purposes of disclosing the pre-leasing status for the upcoming 2017/2018 academic year represents properties that will be classified as same store

properties in 2018. Refer to page 18 for detail of our same store groupings.

1. As of July 21, 2017 for current year and July 21, 2016 for prior year.

2. Rentable beds exclude beds needed for on-site staff.

3. As of September 30, 2016.

4. Properties not owned or under ACC management during the prior year, or properties whose leasing progress is not comparable to the prior year as a result of plans to renovate or redevelop the

property, are excluded for purposes of calculating the prior year percentage of rentable beds.

5. Includes 2017 development deliveries and one property acquired in the second quarter of 2017. Excludes TWELVE at U District, a multi-family property that was acquired in the second quarter of 2017,

which the company plans to convert to by-the-bed leasing over the next two leasing cycles. Refer to page 9 for details on 2017 acquisitions.

6. Projected rate increase reflects projected rental rates anticipated to be achieved through the end of the company's leasing cycle, up to targeted occupancy.

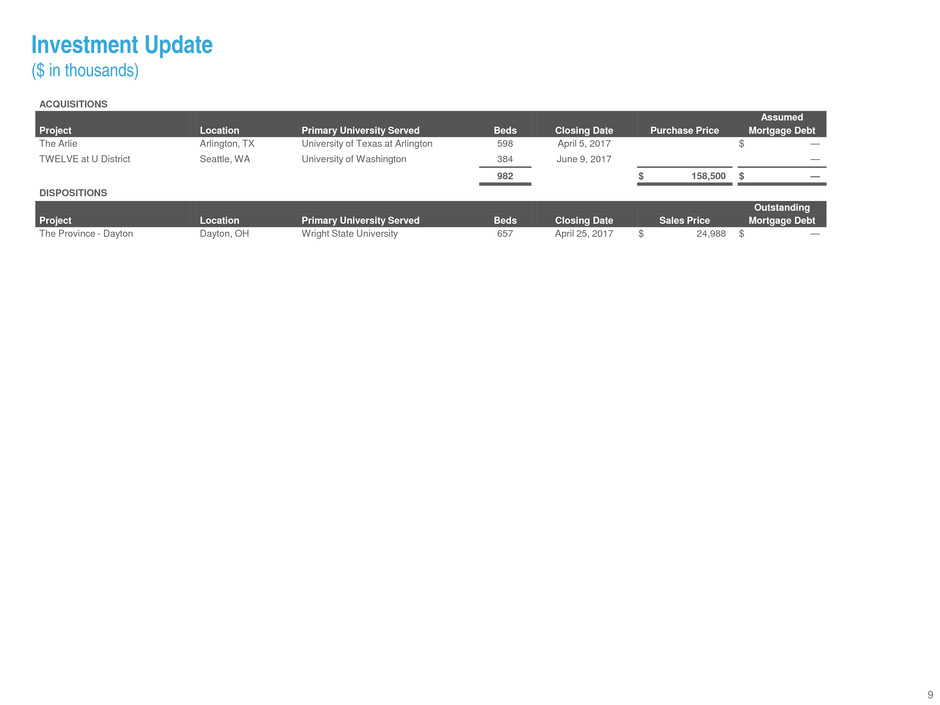

Investment Update

($ in thousands)

9

ACQUISITIONS

Assumed

Project Location Primary University Served Beds Closing Date Purchase Price Mortgage Debt

The Arlie Arlington, TX University of Texas at Arlington 598 April 5, 2017 $ —

TWELVE at U District Seattle, WA University of Washington 384 June 9, 2017 —

982 $ 158,500 $ —

DISPOSITIONS

Outstanding

Project Location Primary University Served Beds Closing Date Sales Price Mortgage Debt

The Province - Dayton Dayton, OH Wright State University 657 April 25, 2017 $ 24,988 $ —

Owned Development Update

($ in thousands)

10

OWNED DEVELOPMENT PROJECTS UNDER CONSTRUCTION

As of June 30, 2017

Project Estimated Land and Total Costs Scheduled

Project Location Primary University Served Type Beds Project Cost1 CIP2 Other3 Incurred Completion

Tooker House Tempe, AZ Arizona State University ACE 1,594 $ 107,800 $ 91,666 $ 1,248 $ 92,914 August 2017

Sky View Flagstaff, AZ Northern Arizona University ACE 626 56,600 51,902 617 52,519 August 2017

University Square Prairie View, TX Prairie View A&M University ACE 466 26,800 23,920 291 24,211 August 2017

U Centre on Turner Columbia, MO University of Missouri Off-campus 718 69,100 49,908 14,686 64,594 August 2017

U Pointe on Speight Waco, TX Baylor University Off-campus 700 49,800 40,417 5,256 45,673 August 2017

21Hundred @ Overton Park Lubbock, TX Texas Tech University Off-campus 1,204 81,600 58,267 17,735 76,002 August 2017

Suites at 3rd Champaign, IL University of Illinois Off-campus 251 25,000 20,780 1,000 21,780 August 2017

U Club Binghamton Phase II Binghamton, NY SUNY Binghamton University Off-campus 562 55,800 39,960 12,631 52,591 August 2017

Callaway House Apartments Norman, OK University of Oklahoma Off-campus 915 89,100 67,443 13,495 80,938 August 2017

U Centre on College Clemson, SC Clemson University Off-campus 418 41,500 39,819 344 40,163 August 2017

SUBTOTAL - 2017 DELIVERIES 7,454 $ 603,100 $ 484,082 $ 67,303 $ 551,385

Virginia Commonwealth Univ. Richmond, VA Virginia Commonwealth Univ. ACE 1,524 $ 95,700 $ 40,082 $ — $ 40,082 August 2018

Schwitzer Hall Indianapolis, IN Butler University ACE 648 38,900 8,882 — 8,882 August 2018

Greek Leadership Village Tempe, AZ Arizona State University ACE 957 69,600 14,181 — 14,181 August 2018

Bancroft Residence Hall Berkeley, CA University of California, Berkeley ACE 781 98,700 28,099 — 28,099 August 2018

NAU Honors College Flagstaff, AZ Northern Arizona University ACE 636 43,400 7,497 — 7,497 August 2018

U Club Townhomes Oxford, MS University of Mississippi Off-campus 528 44,300 4,891 5,115 10,006 August 2018

SUBTOTAL - 2018 DELIVERIES 5,074 $ 390,600 $ 103,632 $ 5,115 $ 108,747

Columbus Avenue Student Apts. Boston, MA Northeastern University ACE 825 $ 153,400 $ 21,558 $ — $ 21,558 August 2019

191 College Auburn, AL Auburn University Off-campus 495 59,300 2,667 5,435 8,102 July 2019

SUBTOTAL - 2019 DELIVERIES 1,320 $ 212,700 $ 24,225 $ 5,435 $ 29,660

PRESALE DEVELOPMENT PROJECT UNDER CONSTRUCTION

As of June 30, 2017

Project Estimated Land and Total Costs Scheduled

Project Location Primary University Served Type Beds Project Cost CIP2 Other3 Incurred Completion

The Edge - Stadium Centre4 Tallahassee, FL Florida State University Off-campus 412 $ 42,600 $ 11,561 $ 481 $ 12,042 August 2018

OWNED DEVELOPMENT PIPELINE5

Project Anticipated Approx. Estimated Targeted

Project Location Primary University Served Type Commencement Targeted Beds Project Cost1 6 Completion

University of Arizona Honors College Tucson, AZ University of Arizona ACE Q4 2017 1,042 $ 97,000 Fall 2019

1. In certain instances at ACE properties, the company agrees to construct spaces within the property that will ultimately be owned, managed, and funded by the universities. Such spaces include but are not limited to dining, childcare, retail,

academic, and office facilities. The Estimated Project Cost excludes the costs of the construction of such facilities, as they will be reimbursed by the universities.

2. The total construction in progress (“CIP”) balance above excludes $22.2 million related to ongoing renovation projects at operating properties.

3. Consists of amounts incurred to purchase the land for off-campus development projects, as well as other development-related expenditures not included in CIP such as deposits, furniture, etc.

4. In December 2016, the company entered into a pre-sale agreement to purchase The Edge - Stadium Centre, a property which will be completed in August 2018. The company is obligated to purchase the property as long as certain construction

completion deadlines and other closing conditions are met. The company is responsible for leasing, management, and initial operations of the project while the third-party developer retains development risk during the construction period. In

accordance with accounting guidance, the company is including this property in its consolidated financial statements. Estimated project cost includes purchase price, elected upgrades and transaction costs.

5. Does not include land parcels in seven university markets totaling $40.5 million. Commencement of owned off-campus development projects is subject to final determination of feasibility, execution and closing on definitive agreements, municipal

approval processes, fluctuations in the construction market, and current capital market conditions. ACE awards provide the company with the opportunity to exclusively negotiate with the subject universities. Commencement of ACE projects is

subject to various levels of university board approval, final determination of feasibility, execution and closing on definitive agreements, municipal approval processes, fluctuations in the construction market, and current capital market conditions.

6. Estimated Project Cost includes land and other predevelopment costs of $9.3 million incurred as of June 30, 2017 for owned development pipeline projects.

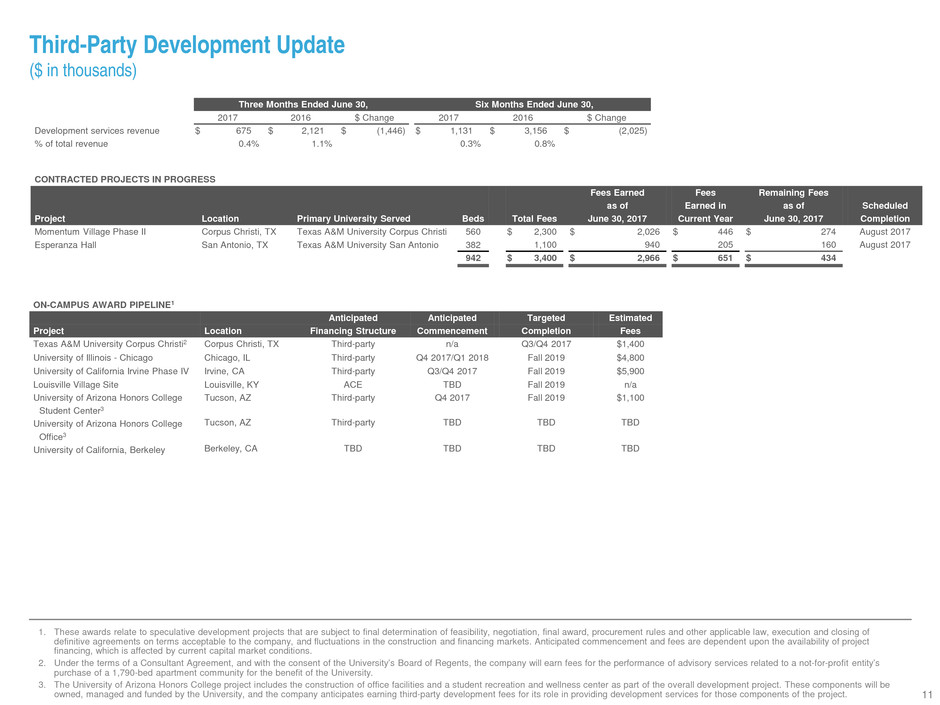

Third-Party Development Update

($ in thousands)

11

Three Months Ended June 30, Six Months Ended June 30,

2017 2016 $ Change 2017 2016 $ Change

Development services revenue $ 675 $ 2,121 $ (1,446) $ 1,131 $ 3,156 $ (2,025)

% of total revenue 0.4% 1.1% 0.3% 0.8%

CONTRACTED PROJECTS IN PROGRESS

Fees Earned Fees Remaining Fees

as of Earned in as of Scheduled

Project Location Primary University Served Beds Total Fees June 30, 2017 Current Year June 30, 2017 Completion

Momentum Village Phase II Corpus Christi, TX Texas A&M University Corpus Christi 560 $ 2,300 $ 2,026 $ 446 $ 274 August 2017

Esperanza Hall San Antonio, TX Texas A&M University San Antonio 382 1,100 940 205 160 August 2017

942 $ 3,400 $ 2,966 $ 651 $ 434

1. These awards relate to speculative development projects that are subject to final determination of feasibility, negotiation, final award, procurement rules and other applicable law, execution and closing of

definitive agreements on terms acceptable to the company, and fluctuations in the construction and financing markets. Anticipated commencement and fees are dependent upon the availability of project

financing, which is affected by current capital market conditions.

2. Under the terms of a Consultant Agreement, and with the consent of the University’s Board of Regents, the company will earn fees for the performance of advisory services related to a not-for-profit entity’s

purchase of a 1,790-bed apartment community for the benefit of the University.

3. The University of Arizona Honors College project includes the construction of office facilities and a student recreation and wellness center as part of the overall development project. These components will be

owned, managed and funded by the University, and the company anticipates earning third-party development fees for its role in providing development services for those components of the project.

ON-CAMPUS AWARD PIPELINE1

Anticipated Anticipated Targeted Estimated

Project Location Financing Structure Commencement Completion Fees

Texas A&M University Corpus Christi2 Corpus Christi, TX Third-party n/a Q3/Q4 2017 $1,400

University of Illinois - Chicago Chicago, IL Third-party Q4 2017/Q1 2018 Fall 2019 $4,800

University of California Irvine Phase IV Irvine, CA Third-party Q3/Q4 2017 Fall 2019 $5,900

Louisville Village Site Louisville, KY ACE TBD Fall 2019 n/a

University of Arizona Honors College Tucson, AZ Third-party Q4 2017 Fall 2019 $1,100

Student Center3

University of Arizona Honors College Tucson, AZ Third-party TBD TBD TBD

Office3

University of California, Berkeley Berkeley, CA TBD TBD TBD TBD

Management Services Update

($ in thousands)

12

Three Months Ended June 30, Six Months Ended June 30,

2017 2016 $ Change 2017 2016 $ Change

Management services revenue $ 2,288 $ 2,253 $ 35 $ 4,902 $ 4,663 $ 239

% of total revenue 1.3% 1.2% 1.3% 1.2%

NEW / PENDING MANAGEMENT CONTRACTS

Actual or

Approximate Stabilized Anticipated

Project Location Primary University Served Beds Annual Fees1 Commencement

Momentum Village Phase II Corpus Christi, TX Texas A&M University Corpus Christi 560 $ 180 August 2017

Esperanza Hall San Antonio, TX Texas A&M University San Antonio 382 100 August 2017

Collegeview Commons Phase II Ontario, Canada Conestoga College 513 50 September 2017

CampusOne2 Toronto, Canada University of Toronto 892 291 September 2017

Texas A&M University Corpus Christi Corpus Christi, TX Texas A&M University Corpus Christi 1,790 480 Q3/Q4 2017

Annex at Laurier3 Ontario, Canada University of Ottawa 503 150 August 2018

4,640 $ 1,251

DISCONTINUED MANAGEMENT CONTRACTS

2017 Fee

Contribution

Prior to

Project Location Primary University Served Beds Termination Discontinued As Of

Saban Real Estate Group4 Various Various 7,060 $ 278 March 2017

SUNO - New Orleans New Orleans, LA Southern University at New Orleans 698 75 June 2017

Indiana University - Purdue University Fort Wayne Fort Wayne, IN Indiana University - Purdue University Fort Wayne 1,204 150 September 2017

8,962 $ 503

1. Stabilized annual fees are dependent upon the achievement of anticipated occupancy levels.

2. The stabilized annual fee amount does not include an initial operations fee of $60,000 anticipated to be earned from February 2017 through August 2017. Subsequent to August 2017, the stabilized

annual fee is anticipated to be approximately $291,000 per year.

3. The stabilized annual fee amount does not include an initial operations fee of $90,000 anticipated to be earned from July 2017 through July 2018. Subsequent to July 2018, the stabilized annual fee

is anticipated to be approximately $150,000 per year.

4. In November 2016, the company sold a portfolio of 19 properties to Saban Real Estate Group. The company continued to manage 11 of the properties during a transition period subsequent to the

sale for up to five months. The transition period concluded on March 31, 2017.

Capital Structure as of June 30, 2017

($ in millions, except per share data)

13

Market Capitalization & Unsecured Notes Covenants Debt Maturity Schedule

Total Debt1 $ 2,354

Total Equity Market Value2 6,539

Total Market Capitalization $ 8,893

Debt to Total Market Capitalization 26.5%

Net Debt to EBITDA3 6.0x

Total Asset Value4 $ 7,211

Unencumbered Asset Value $ 5,927

Unencumbered Asset Value to Total Asset Value 82.2%

Requirement Current Ratio

Total Debt to Total Asset Value ≤ 60% 32.6%

Secured Debt to Total Asset Value ≤ 40% 9.2%

Unencumbered Asset Value to Unsecured Debt > 150% 350.2%

Interest Coverage3 > 1.5x 4.3x

Weighted Average

Principal Average Term To

Outstanding Interest Rate Maturity

Fixed Rate Mortgage Loans $ 556 4.8%5 3.7 Yrs

Construction Loan 1 3.7% 2.6 Yrs

Unsecured Revolving Credit Facility 142 2.3% 4.7 Yrs

Unsecured Term Loans6 350 2.3% 4.4 Yrs

Unsecured Notes 1,200 3.8% 5.4 Yrs

On-Campus Participating Properties 105 5.1% 14.8 Yrs

Total/Weighted Average $ 2,354 3.8% 5.2 Yrs

Variable Rate Debt as % of Total Debt7 21.0%

Note – refer to the definitions outlined on pages 19 and 20 for detailed definitions of terms appearing on this page.

1. Excludes net unamortized debt premiums related to mortgage loans assumed in connection with acquisitions of $22.8 million, unamortized original issue discount on unsecured notes of $1.8 million, and unamortized deferred

financing costs of $14.7 million.

2. Based on share price of $47.30 and fully diluted share count of 138,242,190 as of June 30, 2017. Assumes conversion of 1,106,644 common and preferred Operating Partnership units and 819,354 unvested restricted stock

awards.

3. Refer to calculations on page 14, including a reconciliation to net income and interest expense, the most directly comparable GAAP measures.

4. Excludes accumulated depreciation of $1.0 billion and receivables and intangible assets, net of accumulated amortization, of $53.4 million.

5. Including the amortization of net debt premiums related to mortgage loans assumed in connection with property acquisitions, the effective interest rate for fixed rate mortgage loans is 3.6%.

6. In June 2017, the company closed on a $200 million term loan which matures in June 2022.

7. The company's variable rate debt consists of the unsecured revolving credit facility and the unsecured term loans.

Weighted Average Interest Rate Of Debt Maturing Each Year

Fixed Rate

Mortgage

Loans

6.3% 4.2% 0.0% 5.6% 5.2% 4.0% 0.0% 4.5% 0.0% 3.7%

Total

Debt 6.3% 4.2% 0.0% 3.6% 4.0% 2.4% 3.9% 4.3% 7.6% 3.9%

+

Interest Coverage

($ in thousands)

14

Three Months Ended

September 30, December 31, March 31, June 30, Last Twelve

2016 2016 2017 2017 Months

Net income (loss) attributable to ACC, Inc. and Subsidiaries common stockholders $ 9,644 $ 25,392 $ 34,050 $ (2,762) $ 66,324

Net income attributable to noncontrolling interests 201 412 399 109 1,121

Interest expense 19,016 16,925 14,717 14,573 65,231

Income tax provision 345 115 257 267 984

Depreciation and amortization 52,067 51,901 52,323 55,943 212,234

Amortization of deferred financing costs 1,344 1,282 1,028 1,023 4,677

Share-based compensation 2,328 2,222 4,256 4,646 13,452

Provision for real estate impairment — 4,895 — 15,317 20,212

Loss on early extinguishment of debt — 12,841 — — 12,841

(Gain) loss from disposition of real estate — (3,788) — 632 (3,156)

Earnings Before Interest, Taxes, Depreciation,

and Amortization ("EBITDA") $ 84,945 $ 112,197 $ 107,030 $ 89,748 $ 393,920

Pro-forma adjustments to EBITDA1 (5,851)

Adjusted EBITDA $ 388,069

Interest Expense from consolidated statement of comprehensive income $ 19,016 $ 16,925 $ 14,717 $ 14,573 $ 65,231

Amortization of mortgage debt premiums/discounts 3,104 2,454 2,010 2,010 9,578

Capitalized interest 3,301 3,302 4,411 5,677 16,691

Change in accrued interest payable (1,778) 3,320 (2,203) 1,981 1,320

Cash Interest Expense $ 23,643 $ 26,001 $ 18,935 $ 24,241 $ 92,820

Pro-forma adjustments to Cash Interest Expense1 (1,855)

Adjusted Interest Expense $ 90,965

Interest Coverage 4.3x

Note: refer to the definitions outlined on pages 19 and 20 for detailed definitions of terms appearing on this page.

1. Adjustment to reflect all acquisitions, development deliveries, dispositions, debt repayments and debt refinancings as if such transactions had occurred on the first day of the 12 month period

presented.

Capital Allocation – Long Term Funding Plan

($ in millions)

15

Sources and Uses for Development - As of June 30, 2017

Estimated Project Total Costs Remaining

Estimated Capital Uses for Development Pipeline1: Cost Incurred Capital Needs

2017 Developments Underway $ 603 $ 551 $ 52

2018 Developments Underway2 433 121 312

2019 Developments Underway or Expected to Start in Current Year 310 39 271

Total $ 1,346 $ 711 $ 635

Estimated Sources: Capital Sources

Cash and Cash Equivalents and Equity ATM proceeds subsequent to June 30, 2017 $ 27

Estimated Cash Flow Available for Investment - through 20193 145

Remaining Capital Needs4 463

Total $ 635

Selected Credit Metrics5

Credit Metric: June 30, 2017 Pro Forma6

Total Debt to Total Asset Value 32.6% 30.1% - 36.0%

Net Debt to EBITDA7 6.0x 4.9x - 5.9x

Note: This analysis demonstrates anticipated funding for the developments currently underway or with expected starts in the current year. As future developments commence,

they are expected to be funded via additional dispositions, free cash available for investment, and capital market transactions.

1. Includes development projects under construction, and management’s Estimated Project Cost for future development deliveries that are expected to commence construction during the current

year, as disclosed on page 10.

2. Includes the presale development project disclosed on page 10.

3. Available cash flow is derived from disclosures in our 2016 Form 10-K and is calculated as net cash provided by operating activities of $308.1 million less dividend payments of $218.7 million, less

principal payments on debt of $15.1 million, less recurring capital expenditures of $16.4 million. Calculation results in available cash flow for investment in 2016 of $57.9 million, which is then

annualized over the remaining 10 quarters through the end of 2019.

4. Remaining capital needs are expected to come from a mix of debt, equity, and dispositions.

5. Refer to definitions outlined on pages 19 and 20 for detailed definitions of terms appearing on this page.

6. Ratios represent the pro forma impact of development deliveries and funding alternatives assumed in the Sources and Uses table. The lower end of the pro forma leverage ranges assumes

remaining capital needs are funded with equity, while the higher end assumes funding with debt. Actual ratios will vary based on the timing of construction funding and ultimate mix of sources from

debt, equity, or dispositions.

7. Refer to page 14 for a reconciliation of EBITDA to net income, the most directly comparable GAAP measure.

2017 Outlook - Summary1

($ in thousands, except share and per share data)

16

Low High

Net income $ 103,400 $ 116,500

Noncontrolling interests 1,700 1,900

Depreciation and amortization 211,700 211,700

Funds from operations ("FFO") $ 316,800 $ 330,100

Elimination of operations from on-campus

participating properties (11,700) (12,100)

Contribution from on-campus participating properties 4,100 4,700

Contractual executive separation and retirement charges2 4,550 4,550

Funds from operations - modified ("FFOM") $ 313,750 $ 327,250

Net income per share - diluted $ 0.76 $ 0.86

FFO per share - diluted $ 2.34 $ 2.44

FFOM per share - diluted $ 2.32 $ 2.42

Weighted-average common shares outstanding -

diluted 135,500,000 135,500,000

1. The company believes that the financial results for the fiscal year ending December 31, 2017 may be affected by, among other factors:

• national and regional economic trends and events;

• the timing of acquisitions and/or dispositions;

• interest rate risk;

• the timing of commencement of construction on owned development projects;

• the ability of the company to be awarded and the timing of the commencement of construction on third-party development projects;

• university enrollment, funding and policy trends;

• the ability of the company to earn third-party management revenues;

• the amount of income recognized by the taxable REIT subsidiaries and any corresponding income tax expense;

• the ability of the company to integrate acquired properties;

• the outcome of legal proceedings arising in the normal course of business;

• the finalization of property tax rates and assessed values in certain jurisdictions; and

• the success of releasing the company's owned properties for the 2017-2018 academic year.

2. Represents contractual executive separation and retirement charges incurred with regard to the retirement of the company's Chief Financial Officer, recognized in the first and second quarter 2017.

2017 Outlook - Detail

($ in thousands, except share and per share data)

17

1. Refer to page 18 for detail of the 2017 same store and new property groupings.

2. Includes disposition of The Province - Dayton which closed in the second quarter of 2017. See page 9.

3. Net of capitalized interest and excluding on-campus participating properties. The 2017 guidance ranges assume a $400 million fourth quarter bond offering.

4. Excludes on-campus participating properties.

5. Represents contractual executive separation and retirement charges incurred with regard to the retirement of the company's Chief Financial Officer, recognized in the first and second quarter 2017.

Components of 2017 Property Net Operating Income Third-party Services

Low High % Change From 2016 Low High

Wholly-owned properties Third-party development services revenue $ 6,200 $ 9,600

2017 same store properties1 Third-party management services revenue $ 9,600 $ 10,400

Revenue $ 669,100 $ 673,800 2.6% - 3.4% Third-party development and mgmt. services expenses $ 15,000 $ 15,500

Operating expenses (299,100) (297,600) 1.5% - 1.0%

Net operating income 370,000 376,200 3.6% - 5.3%

Corporate Expenses and Other

2017 new properties net operating income1 34,400 35,500 Low High

2017 speculative dispositions net operating income2 600 600 Net income:

Total wholly-owned properties net operating income $ 405,000 $ 412,300 General and administrative expenses $ 27,400 $ 27,800

Ground/facility leases expense:

ACE properties $ 6,900 $ 6,900

2017 Property Net Operating Income Guidance Assumptions On-campus participating properties 2,700 3,100

Low High Timing Total ground/facility leases expense $ 9,600 $ 10,000

AY 2017/2018 final leasing results - occupancy 96.55% 98.75% Fall 2017 Interest income $ 4,100 $ 5,000

AY 2017/2018 final leasing results - rental rate 3.15% 2.65% Fall 2017 Interest expense3 $ 60,600 $ 59,500

Development Deliveries $ 603,100 $ 603,100 See page 10 Capitalized interest $ 16,400 $ 16,300

Amortization of deferred financing costs4 $ 4,000 $ 4,000

Income tax provision $ 1,100 $ 1,100

FFOM:

Corporate depreciation $ 3,600 $ 3,200

Contribution from on-campus participating properties $ 4,100 $ 4,700

Contractual executive separation and retirement charges5 $ 4,550 $ 4,550

Detail of Property Groupings

As of June 30, 2017

18

2017 Grouping 2018 Grouping

Same Store Properties New Properties Same Store Properties New Properties

# of Design # of Design # of Design # of Design

Properties Beds Properties Beds Properties Beds Properties Beds

Properties Purchased or Developed

Prior to January 1, 2016 124 73,871 124 73,871

2016 Development Deliveries 7 3,191 7 3,191

2016 Acquisition Properties 2 709 2 709

2017 Acquisition Properties 2 982 2 982

2017 Development Deliveries 10 7,454 10 7,454

2018 Development Deliveries 7 5,486 7 5,486

2019 Development Deliveries 2 1,320 2 1,320

Total Wholly-owned Properties 124 73,871 30 19,142 133 77,771 21 15,242

Total # of Wholly-owned Properties Excluded1 1

Total Wholly-owned Design Beds Excluded1 860

Grand Total # of Wholly-owned Properties (All Groupings) 155

Grand Total Wholly-owned Design Beds (All Groupings) 93,873

Note on Property Portfolio: When disclosing our number of properties and design beds as of a certain date, we include all properties that are owned and operating as of that date, as well as properties

that are under construction and anticipated to open for operations in future years. Properties that are in our development pipeline but have not yet commenced construction are not included.

2017: The 2017 same store grouping represents properties owned and operating for both of the entire calendar years ended December 31, 2017 and 2016, which are not conducting or planning

to conduct substantial development, redevelopment, or repositioning activities, and are not classified as held for sale as of June 30, 2017. This same store grouping will be used for purposes of

presenting our 2017 same store operating results.

2018: The 2018 same store grouping represents properties owned and operating for both of the entire calendar years ended December 31, 2018 and 2017. This same store grouping will be

used for purposes of presenting our 2018 same store operating results and our leasing status updates for the 2017/2018 academic year.

1. Includes a wholly-owned property that is in the process of being transferred to the lender in settlement of the property's $27.4 million mortgage loan due to mature in August 2017.

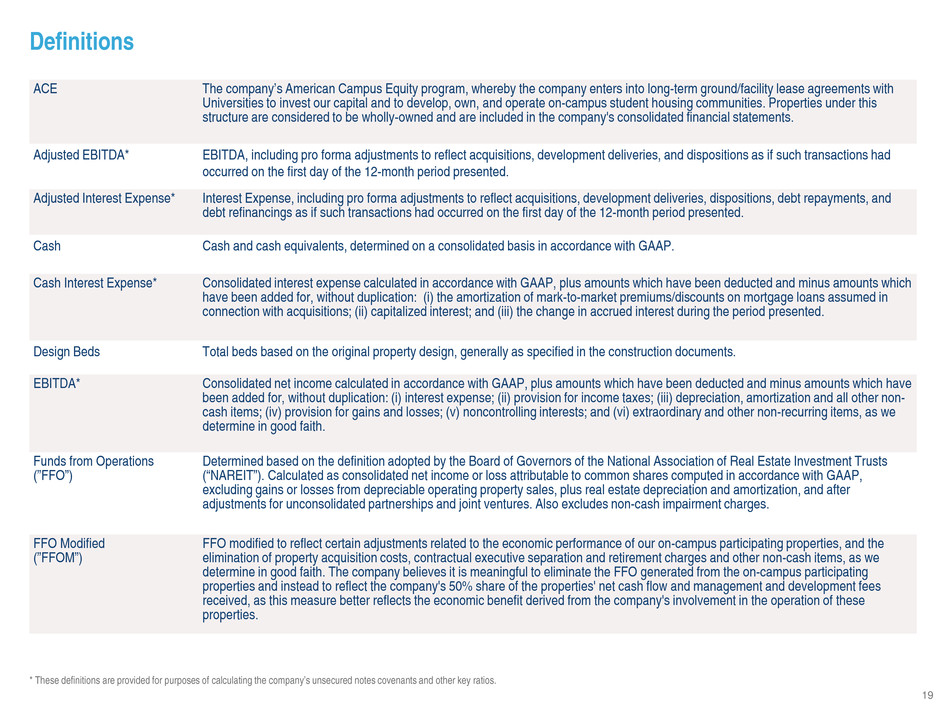

Definitions

ACE The company’s American Campus Equity program, whereby the company enters into long-term ground/facility lease agreements with

Universities to invest our capital and to develop, own, and operate on-campus student housing communities. Properties under this

structure are considered to be wholly-owned and are included in the company's consolidated financial statements.

Adjusted EBITDA* EBITDA, including pro forma adjustments to reflect acquisitions, development deliveries, and dispositions as if such transactions had

occurred on the first day of the 12-month period presented.

Adjusted Interest Expense* Interest Expense, including pro forma adjustments to reflect acquisitions, development deliveries, dispositions, debt repayments, and

debt refinancings as if such transactions had occurred on the first day of the 12-month period presented.

Cash Cash and cash equivalents, determined on a consolidated basis in accordance with GAAP.

Cash Interest Expense* Consolidated interest expense calculated in accordance with GAAP, plus amounts which have been deducted and minus amounts which

have been added for, without duplication: (i) the amortization of mark-to-market premiums/discounts on mortgage loans assumed in

connection with acquisitions; (ii) capitalized interest; and (iii) the change in accrued interest during the period presented.

Design Beds Total beds based on the original property design, generally as specified in the construction documents.

EBITDA* Consolidated net income calculated in accordance with GAAP, plus amounts which have been deducted and minus amounts which have

been added for, without duplication: (i) interest expense; (ii) provision for income taxes; (iii) depreciation, amortization and all other non-

cash items; (iv) provision for gains and losses; (v) noncontrolling interests; and (vi) extraordinary and other non-recurring items, as we

determine in good faith.

Funds from Operations

(”FFO”)

Determined based on the definition adopted by the Board of Governors of the National Association of Real Estate Investment Trusts

(“NAREIT”). Calculated as consolidated net income or loss attributable to common shares computed in accordance with GAAP,

excluding gains or losses from depreciable operating property sales, plus real estate depreciation and amortization, and after

adjustments for unconsolidated partnerships and joint ventures. Also excludes non-cash impairment charges.

FFO Modified

(”FFOM”)

FFO modified to reflect certain adjustments related to the economic performance of our on-campus participating properties, and the

elimination of property acquisition costs, contractual executive separation and retirement charges and other non-cash items, as we

determine in good faith. The company believes it is meaningful to eliminate the FFO generated from the on-campus participating

properties and instead to reflect the company's 50% share of the properties' net cash flow and management and development fees

received, as this measure better reflects the economic benefit derived from the company's involvement in the operation of these

properties.

* These definitions are provided for purposes of calculating the company’s unsecured notes covenants and other key ratios.

19

Definitions

GAAP Accounting principles generally accepted in the United States of America.

Interest Coverage* Adjusted EBITDA / Adjusted Interest Expense.

Net Debt* Total Debt less Cash.

Net Debt to EBITDA* Net Debt divided by Adjusted EBITDA.

Net Operating Income

“NOI”

Property revenues less direct property operating expenses, excluding depreciation, but including allocated corporate general and

administrative expenses.

On-campus Participating

Properties

A transaction structure whereby the company enters into long-term ground/facility lease agreements with Universities to develop,

construct, and operate student housing communities. Under the terms of the leases, title to the constructed facilities is held by the

University/lessor and such lessor receives 50% of net cash flows, as defined, on an annual basis through the term of the lease.

Physical Occupancy Occupied beds, including staff accommodations, divided by Design Beds.

Rentable Beds Design beds less beds used by on-site staff.

Same Store Grouping Wholly-owned properties owned and operating for both of the entire annual periods presented, which are not conducting or planning to

conduct substantial development or redevelopment, or repositioning activities, and are not classified as held for sale as of the current

period-end.

Secured Debt* The portion of Total Debt that is secured by a mortgage, trust, deed of trust, deed to secure indebtedness, pledge, security interest,

assignment of collateral, or any other security agreement.

Total Asset Value* Undepreciated book value of real estate assets and all other assets, excluding receivables and intangibles, of our consolidated

subsidiaries, all determined in accordance with GAAP.

Total Debt* Total consolidated debt calculated in accordance with GAAP, including capital leases and excluding mark-to-market premiums/discounts

on mortgage loans assumed in connection with acquisitions, the original issued discount on unsecured notes, and deferred financing

costs.

Total Equity Market Value Fully diluted common shares times the company’s stock price at period-end.

Unencumbered Asset Value* The sum of (i) the undepreciated book value of real estate assets which are not subject to secured debt; and (ii) all other assets,

excluding accounts receivable and intangibles, for such properties. Does not include assets of unconsolidated joint ventures.

Unsecured Debt* The portion of Total Debt that is not Secured Debt.

* These definitions are provided for purposes of calculating the company’s unsecured notes covenants and other key ratios.

20

Investor Information

Corporate Headquarters Investor Relations

American Campus Communities, Inc. Tel: (512) 732-1000 Ryan Dennison (512) 732-1000

12700 Hill Country Blvd., Suite T-200 Fax: (512) 732-2450 SVP, Capital Markets and Investor

Relations

rdennison@americancampus.com

Austin, Texas 78738 www.americancampus.com

Executive Management

Bill Bayless Chief Executive Officer

Jim Hopke President

Jennifer Beese Chief Operating Officer

Daniel Perry Chief Financial Officer

William Talbot Chief Investment Officer

Kim Voss Chief Accounting Officer

Research Coverage

Jacob Kilstein Argus Research Company (646) 747-5447 jkilstein@argusresearch.com

Jeffery Spector / Juan Sanabria Bank of America / Merrill Lynch (646) 855-1363 / (646) 855-1589 jeff.spector@baml.com / juan.sanabria@baml.com

Ryan Meliker / Peter Abramowitz Canaccord Genuity (212) 389-8094 / (212) 389-8053 rmeliker@canaccordgenuity.com / pabramowitz@canaccordgenuity.com

Michael Bilerman / Nick Joseph Citigroup Equity Research (212) 816-1383 / (212) 816-1909 michael.bilerman@citi.com / nicholas.joseph@citi.com

Vincent Chao / Vlad Rudnytsky Deutsche Bank Securities, Inc. (212) 250-6799 / (212) 250-6090 vincent.chao@db.com / vlad.rudnytsky@db.com

Steve Sakwa / Gwen Clark Evercore ISI (212) 446-9462 / (212) 446-5611 steve.sakwa@evercoreisi.com / gwen.clark@evercoreisi.com

David Corak FBR & Co. (703) 312-1610 dcorak@fbr.com

Andrew Rosivach / Jeff Pehl Goldman Sachs (212) 902-2796 / (212) 357-4474 andrew.rosivach@gs.com / jeffrey.pehl@gs.com

Ryan Burke Green Street Advisors (949) 640-8780 rburke@greenst.com

Carol Kemple Hilliard Lyons (502) 588-1839 ckemple@hilliard.com

Aaron Hecht JMP Securities (415) 835-3963 ahecht@jmpsecurities.com

Anthony Paolone J.P. Morgan Securities (212) 622-6682 anthony.paolone@jpmorgan.com

Jordan Sadler / Austin Wurschmidt KeyBanc Capital Markets (917) 368-2280 / (917) 368-2311 jsadler@keybanccm.com / awurschmidt@key.com

Drew Babin Robert W. Baird & Co. (610) 238-6634 dbabin@rwbaird.com

Alexander Goldfarb / Daniel Santos Sandler O'Neill + Partners, L.P. (212) 466-7937 / (212) 466-7927 agoldfarb@sandleroneill.com / dsantos@sandleroneill.com

American Campus Communities, Inc. is followed by the analysts listed above. Please note that any opinions, estimates or forecasts regarding American Campus Communities, Inc.'s

performance made by such analysts are theirs alone and do not represent the opinions, forecasts or predictions of the company or its management. American Campus Communities,

Inc. does not by its reference above or distribution imply its endorsement of or concurrence with such information, conclusions or recommendations.

21

Forward-looking Statements and Non-GAAP Financial Measures

In addition to historical information, this supplemental package contains forward-looking statements under the federal securities law. These statements are based on current expectations, estimates and projections about

the industry and markets in which American Campus operates, management's beliefs, and assumptions made by management. Forward-looking statements are not guarantees of future performance and involve certain

risks and uncertainties, which are difficult to predict.

This presentation also contains certain financial information not derived in accordance with United States generally accepted accounting principles (“GAAP”). These items include earnings before interest, tax,

depreciation and amortization ("EBITDA"), net operating income (“NOI”), funds from operations (“FFO”) and FFO-Modified (“FFOM”). The National Association of Real Estate Investment Trusts (“NAREIT”) currently

defines FFO as net income or loss attributable to common shares computed in accordance with GAAP, excluding gains or losses from depreciable operating property sales, plus real estate depreciation and amortization,

and after adjustments for unconsolidated partnerships and joint ventures. The Company presents FFO because it considers FFO an important supplemental measure of its operating performance and believes it is

frequently used by securities analyst, investors and other interested parties in evaluation of REITs, many of which present FFO when reporting their results. We also believe it is meaningful to present a measure we refer

to as FFO-Modified, or FFOM, which reflects certain adjustments related to the economic performance of our on-campus participating properties and excludes property acquisition costs, contractual executive separation

and retirement charges, and other non-cash items, as we determine in good faith. FFO and FFOM should not be considered as alternatives to net income or loss computed in accordance with GAAP as an indicator of its

liquidity, nor are these measures indicative of funds available to fund its cash needs, including its ability to pay dividends or make distributions. The Company defines property NOI as property revenues less direct

property operating expenses, excluding depreciation, but including allocated corporate general and administrative expenses.