Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - iHeartCommunications, Inc. | d410238dex991.htm |

| 8-K - FORM 8-K - iHeartCommunications, Inc. | d410238d8k.htm |

July 17, 2017 Presentation Regarding iHeart Exhibit 99.2

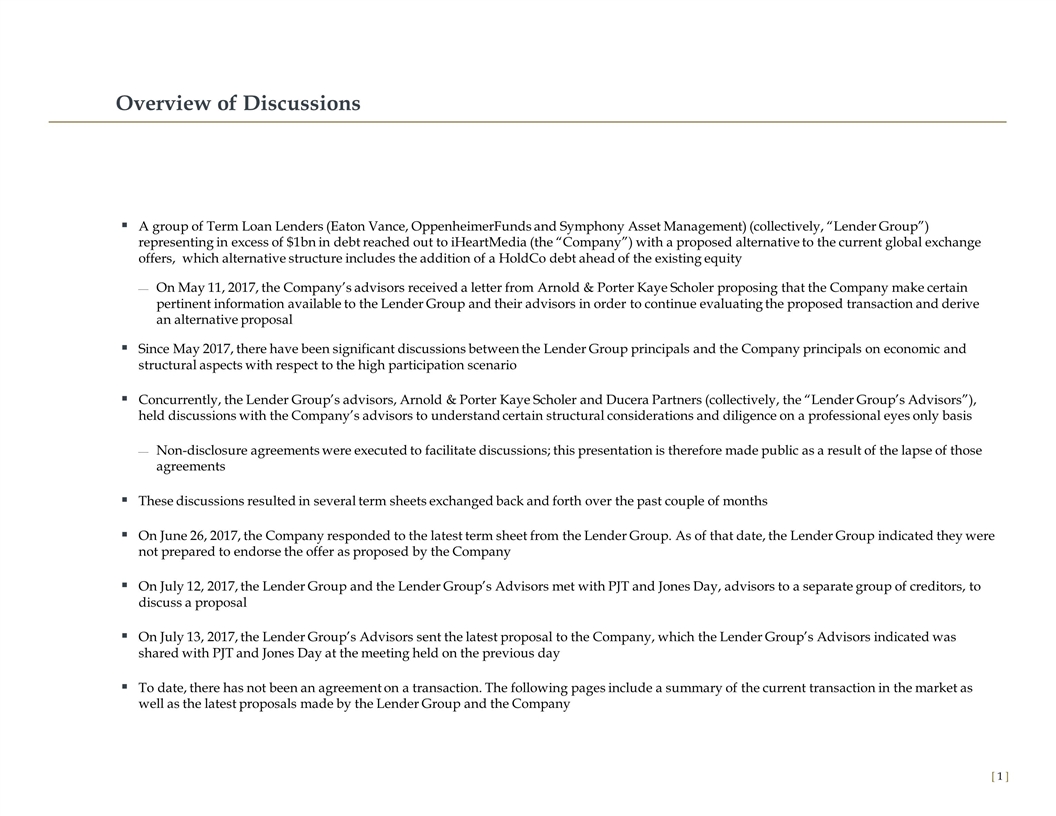

Overview of Discussions [ ] A group of Term Loan Lenders (Eaton Vance, OppenheimerFunds and Symphony Asset Management) (collectively, “Lender Group”) representing in excess of $1bn in debt reached out to iHeartMedia (the “Company”) with a proposed alternative to the current global exchange offers, which alternative structure includes the addition of a HoldCo debt ahead of the existing equity On May 11, 2017, the Company’s advisors received a letter from Arnold & Porter Kaye Scholer proposing that the Company make certain pertinent information available to the Lender Group and their advisors in order to continue evaluating the proposed transaction and derive an alternative proposal Since May 2017, there have been significant discussions between the Lender Group principals and the Company principals on economic and structural aspects with respect to the high participation scenario Concurrently, the Lender Group’s advisors, Arnold & Porter Kaye Scholer and Ducera Partners (collectively, the “Lender Group’s Advisors”), held discussions with the Company’s advisors to understand certain structural considerations and diligence on a professional eyes only basis Non-disclosure agreements were executed to facilitate discussions; this presentation is therefore made public as a result of the lapse of those agreements These discussions resulted in several term sheets exchanged back and forth over the past couple of months On June 26, 2017, the Company responded to the latest term sheet from the Lender Group. As of that date, the Lender Group indicated they were not prepared to endorse the offer as proposed by the Company On July 12, 2017, the Lender Group and the Lender Group’s Advisors met with PJT and Jones Day, advisors to a separate group of creditors, to discuss a proposal On July 13, 2017, the Lender Group’s Advisors sent the latest proposal to the Company, which the Lender Group’s Advisors indicated was shared with PJT and Jones Day at the meeting held on the previous day To date, there has not been an agreement on a transaction. The following pages include a summary of the current transaction in the market as well as the latest proposals made by the Lender Group and the Company

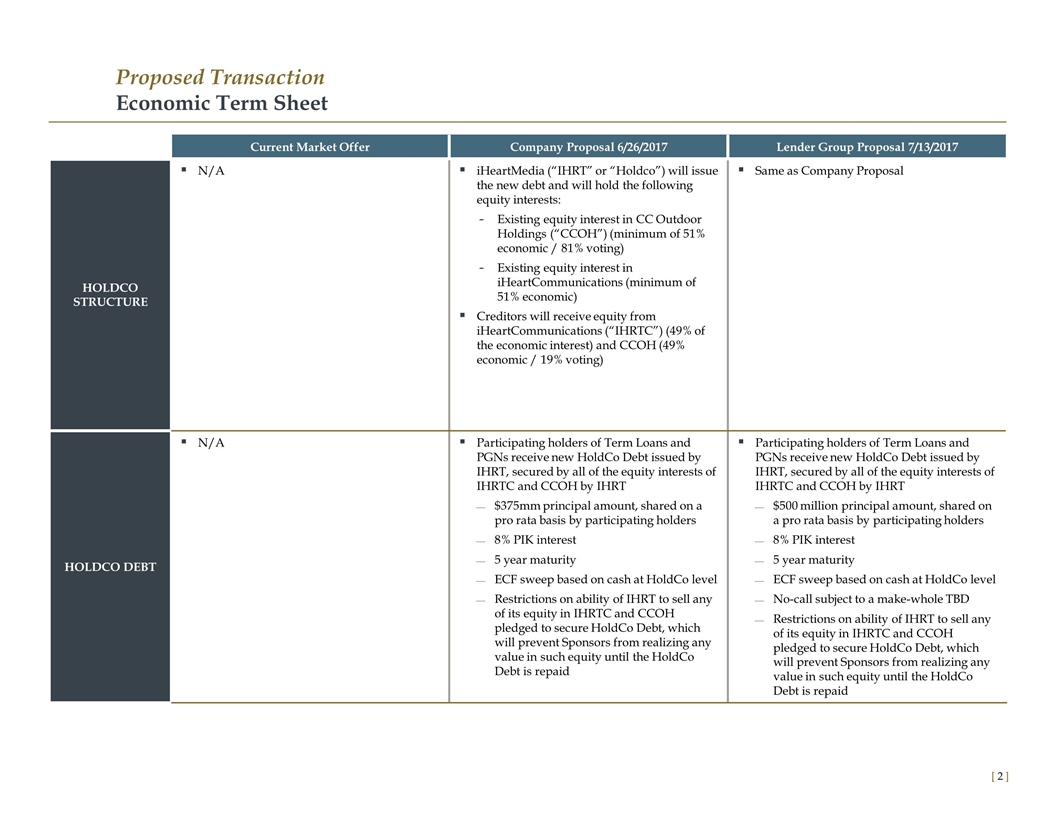

[ ] Proposed Transaction Economic Term Sheet Current Market Offer Company Proposal 6/26/2017 Lender Group Proposal 7/13/2017 HOLDCO STRUCTURE N/A iHeartMedia (“IHRT” or “Holdco”) will issue the new debt and will hold the following equity interests: Existing equity interest in CC Outdoor Holdings (“CCOH”) (minimum of 51% economic / 81% voting) Existing equity interest in iHeartCommunications (minimum of 51% economic) Creditors will receive equity from iHeartCommunications (“IHRTC”) (49% of the economic interest) and CCOH (49% economic / 19% voting) Same as Company Proposal HOLDCO DEBT N/A Participating holders of Term Loans and PGNs receive new HoldCo Debt issued by IHRT, secured by all of the equity interests of IHRTC and CCOH by IHRT $375mm principal amount, shared on a pro rata basis by participating holders 8% PIK interest 5 year maturity ECF sweep based on cash at HoldCo level Restrictions on ability of IHRT to sell any of its equity in IHRTC and CCOH pledged to secure HoldCo Debt, which will prevent Sponsors from realizing any value in such equity until the HoldCo Debt is repaid Participating holders of Term Loans and PGNs receive new HoldCo Debt issued by IHRT, secured by all of the equity interests of IHRTC and CCOH by IHRT $500 million principal amount, shared on a pro rata basis by participating holders 8% PIK interest 5 year maturity ECF sweep based on cash at HoldCo level No-call subject to a make-whole TBD Restrictions on ability of IHRT to sell any of its equity in IHRTC and CCOH pledged to secure HoldCo Debt, which will prevent Sponsors from realizing any value in such equity until the HoldCo Debt is repaid

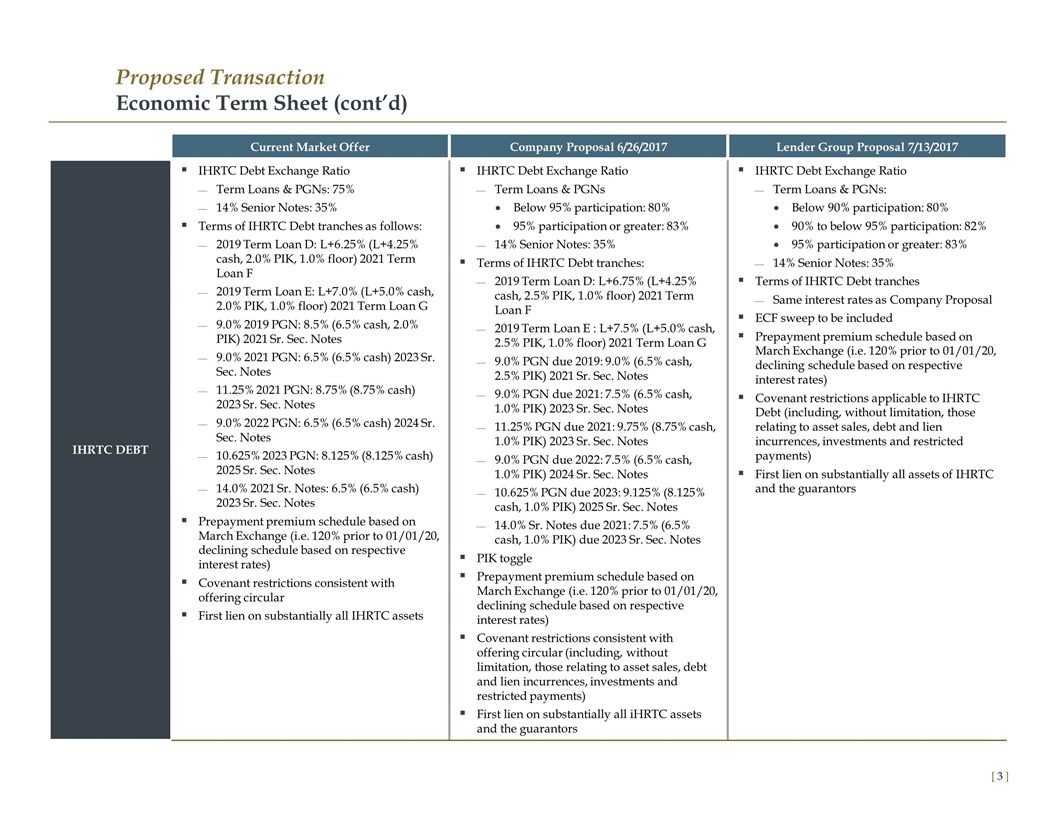

[ ] Proposed Transaction Economic Term Sheet (cont’d) Current Market Offer Company Proposal 6/26/2017 Lender Group Proposal 7/13/2017 IHRTC DEBT IHRTC Debt Exchange Ratio Term Loans & PGNs: 75% 14% Senior Notes: 35% Terms of IHRTC Debt tranches as follows: 2019 Term Loan D: L+6.25% (L+4.25% cash, 2.0% PIK, 1.0% floor) 2021 Term Loan F 2019 Term Loan E: L+7.0% (L+5.0% cash, 2.0% PIK, 1.0% floor) 2021 Term Loan G 9.0% 2019 PGN: 8.5% (6.5% cash, 2.0% PIK) 2021 Sr. Sec. Notes 9.0% 2021 PGN: 6.5% (6.5% cash) 2023 Sr. Sec. Notes 11.25% 2021 PGN: 8.75% (8.75% cash) 2023 Sr. Sec. Notes 9.0% 2022 PGN: 6.5% (6.5% cash) 2024 Sr. Sec. Notes 10.625% 2023 PGN: 8.125% (8.125% cash) 2025 Sr. Sec. Notes 14.0% 2021 Sr. Notes: 6.5% (6.5% cash) 2023 Sr. Sec. Notes Prepayment premium schedule based on March Exchange (i.e. 120% prior to 01/01/20, declining schedule based on respective interest rates) Covenant restrictions consistent with offering circular First lien on substantially all IHRTC assets IHRTC Debt Exchange Ratio Term Loans & PGNs Below 95% participation: 80% 95% participation or greater: 83% 14% Senior Notes: 35% Terms of IHRTC Debt tranches: 2019 Term Loan D: L+6.75% (L+4.25% cash, 2.5% PIK, 1.0% floor) 2021 Term Loan F 2019 Term Loan E : L+7.5% (L+5.0% cash, 2.5% PIK, 1.0% floor) 2021 Term Loan G 9.0% PGN due 2019: 9.0% (6.5% cash, 2.5% PIK) 2021 Sr. Sec. Notes 9.0% PGN due 2021: 7.5% (6.5% cash, 1.0% PIK) 2023 Sr. Sec. Notes 11.25% PGN due 2021: 9.75% (8.75% cash, 1.0% PIK) 2023 Sr. Sec. Notes 9.0% PGN due 2022: 7.5% (6.5% cash, 1.0% PIK) 2024 Sr. Sec. Notes 10.625% PGN due 2023: 9.125% (8.125% cash, 1.0% PIK) 2025 Sr. Sec. Notes 14.0% Sr. Notes due 2021: 7.5% (6.5% cash, 1.0% PIK) due 2023 Sr. Sec. Notes PIK toggle Prepayment premium schedule based on March Exchange (i.e. 120% prior to 01/01/20, declining schedule based on respective interest rates) Covenant restrictions consistent with offering circular (including, without limitation, those relating to asset sales, debt and lien incurrences, investments and restricted payments) First lien on substantially all iHRTC assets and the guarantors IHRTC Debt Exchange Ratio Term Loans & PGNs: Below 90% participation: 80% 90% to below 95% participation: 82% 95% participation or greater: 83% 14% Senior Notes: 35% Terms of IHRTC Debt tranches Same interest rates as Company Proposal ECF sweep to be included Prepayment premium schedule based on March Exchange (i.e. 120% prior to 01/01/20, declining schedule based on respective interest rates) Covenant restrictions applicable to IHRTC Debt (including, without limitation, those relating to asset sales, debt and lien incurrences, investments and restricted payments) First lien on substantially all assets of IHRTC and the guarantors

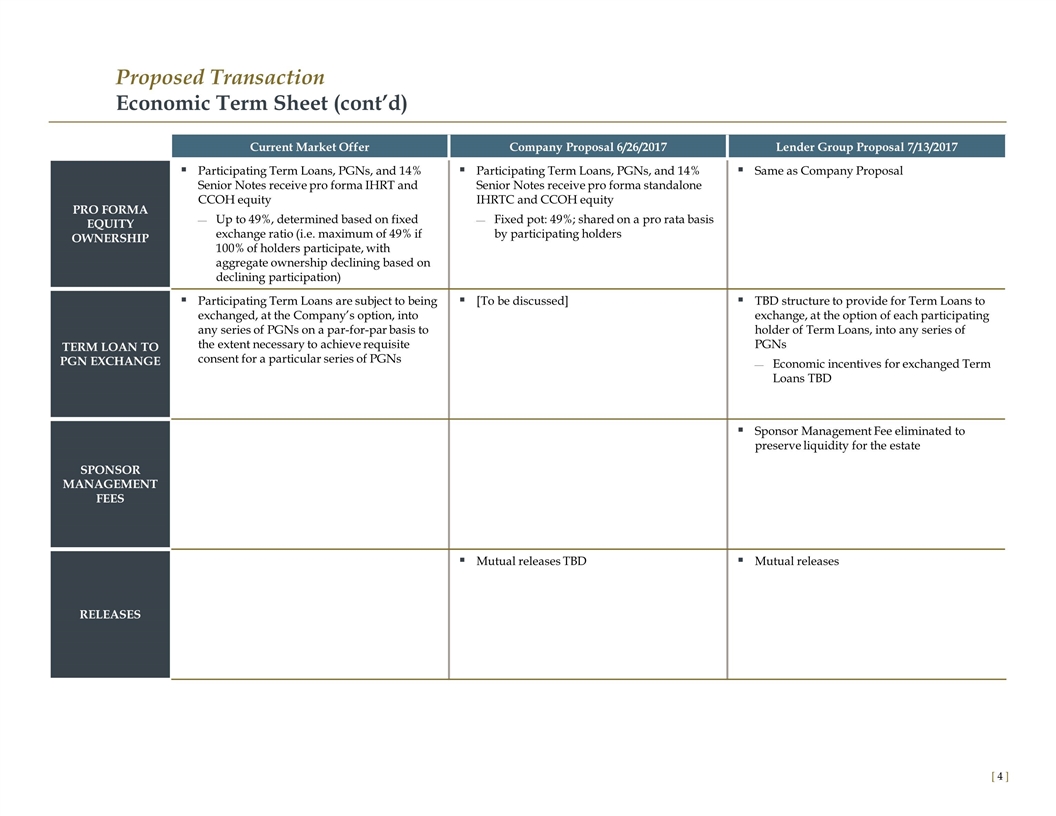

Proposed Transaction Economic Term Sheet (cont’d) [ ] Current Market Offer Company Proposal 6/26/2017 Lender Group Proposal 7/13/2017 PRO FORMA EQUITY OWNERSHIP Participating Term Loans, PGNs, and 14% Senior Notes receive pro forma IHRT and CCOH equity Up to 49%, determined based on fixed exchange ratio (i.e. maximum of 49% if 100% of holders participate, with aggregate ownership declining based on declining participation) Participating Term Loans, PGNs, and 14% Senior Notes receive pro forma standalone IHRTC and CCOH equity Fixed pot: 49%; shared on a pro rata basis by participating holders Same as Company Proposal TERM LOAN TO PGN EXCHANGE Participating Term Loans are subject to being exchanged, at the Company’s option, into any series of PGNs on a par-for-par basis to the extent necessary to achieve requisite consent for a particular series of PGNs [To be discussed] TBD structure to provide for Term Loans to exchange, at the option of each participating holder of Term Loans, into any series of PGNs Economic incentives for exchanged Term Loans TBD SPONSOR MANAGEMENT FEES Sponsor Management Fee eliminated to preserve liquidity for the estate RELEASES Mutual releases TBD Mutual releases

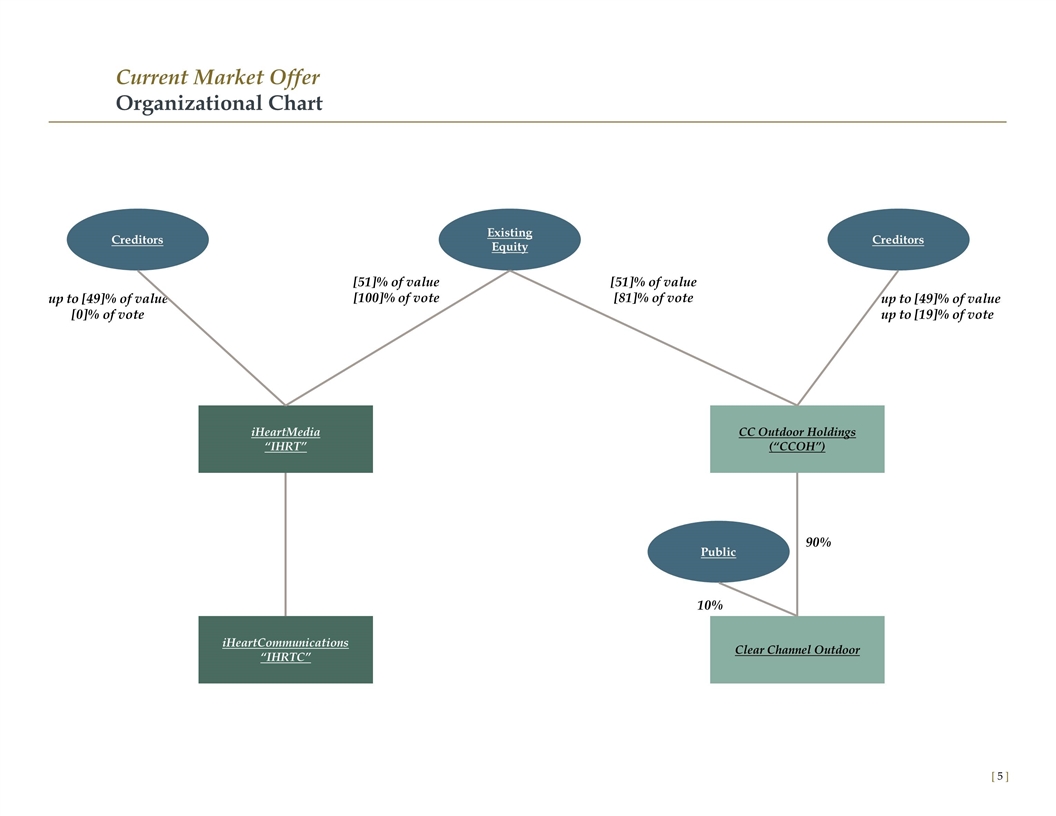

Current Market Offer Organizational Chart [ ] Existing Equity 90% 10% Creditors iHeartMedia “IHRT” CC Outdoor Holdings (“CCOH”) Clear Channel Outdoor Public [51]% of value [81]% of vote [51]% of value [100]% of vote up to [49]% of value [0]% of vote up to [49]% of value up to [19]% of vote iHeartCommunications “IHRTC” Creditors

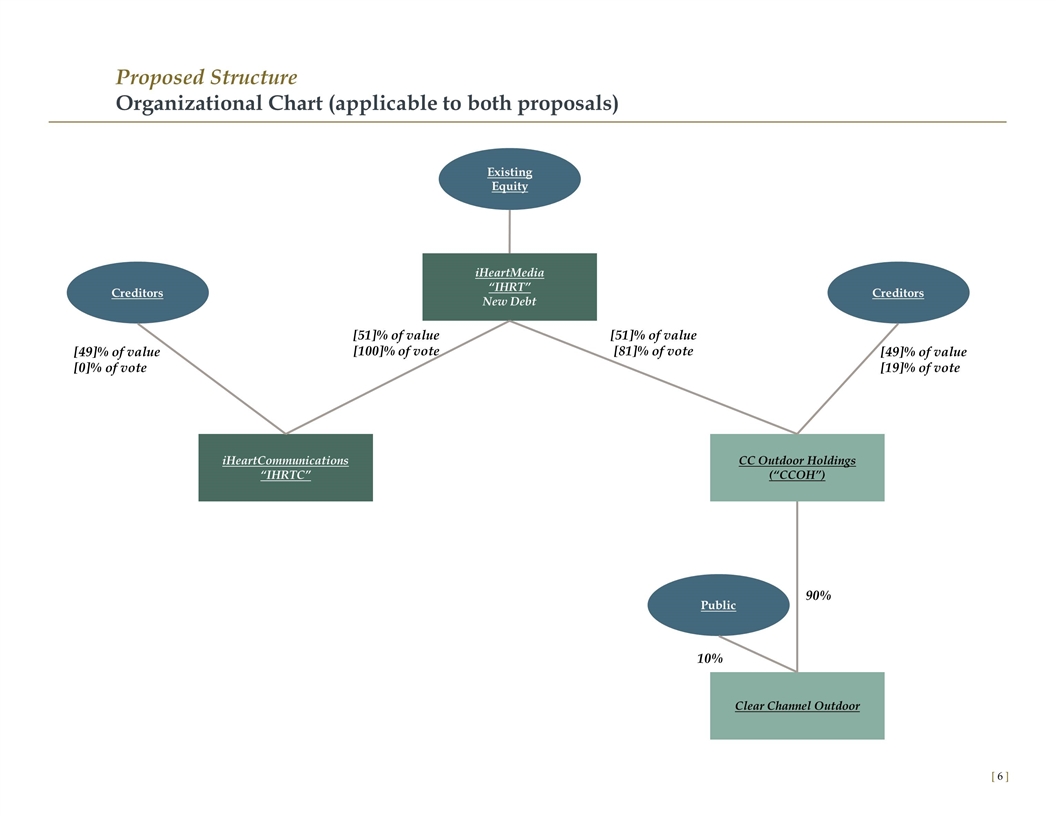

[ ] Proposed Structure Organizational Chart (applicable to both proposals) Existing Equity 90% 10% Creditors iHeartMedia “IHRT” New Debt CC Outdoor Holdings (“CCOH”) Clear Channel Outdoor Public [51]% of value [81]% of vote [51]% of value [100]% of vote [49]% of value [0]% of vote [49]% of value [19]% of vote iHeartCommunications “IHRTC” Creditors