Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Great Basin Scientific, Inc. | v470451_8k.htm |

Exhibit 99.1

Insert Section Title The Power of Information July 7, 2017 OTCQB: GBSN

Insert Section Title All statements in this presentation that are not statements of historical fact are forward - looking statements, including stateme nts about any of the following: any projections of earnings, revenue, sales, profit margins, cash, working capital, or any other financial terms; the plans, strategies and objectives of management for future operations or prospects for achieving such plans; statements regarding new, existing or i mpr oved products, including but not limited to, expectations for sales and marketing, expectations for success of new, existing or improved pro duc ts or government approval of new or improved products; future economic conditions or size of market opportunities; expected costs; statements of belief, including as to achieving 2017 and 2018 plans; expected regulatory activities and approvals, product launches, and any statements of as sum ptions underlying any of the foregoing. Forward - looking statements are based on expectations and assumptions as of the date of this presentation and are subject to nume rous risks and uncertainties, which could cause actual results to differ materially from those described in the forward - looking statements. These risks and uncertainties include the following: our limited capital resources and limited access to financing; the discretion of regula tor y agencies to approve or reject new, existing or improved products or to require additional actions before approval or to take enforcement action; res earch and developments efforts will not be successful or may be delayed in delivering products for launch; the purchasing patterns of o ur customers; and the willingness of hospitals and laboratories to adopt a new or improved product. Important additional factors that could cause actual results to differ materially from those indicated by such forward - looking s tatements are set forth in the Company’s Annual Report on Form 10 - K for the year ended December 31, 2016 and in the Company’s Quarterly Report on Form 10 - Q for the quarter ended March 31, 2017, under the caption “Risk Factors,” both of which are on file with the Securities and E xch ange Commission and available on the Company’s website, www.gbscience.com /investors. We disclaim any intention or obligation to update or revise any financial projections or forward - looking statements due to new information or events. 2 Regarding forward - looking statements

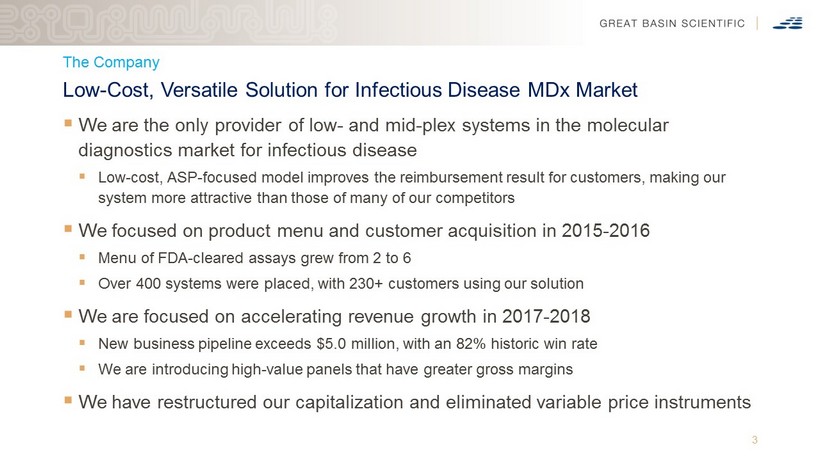

Insert Section Title The Company ▪ We are the only provider of low - and mid - plex systems in the molecular diagnostics market for infectious disease ▪ Low - cost, ASP - focused model improves the reimbursement result for customers, making our system more attractive than those of many of our competitors ▪ We focused on product menu and customer acquisition in 2015 - 2016 ▪ Menu of FDA - cleared assays grew from 2 to 6 ▪ Over 400 systems were placed, with 230+ customers using our solution ▪ We are focused on accelerating revenue growth in 2017 - 2018 ▪ New business pipeline exceeds $5.0 million, with an 82% historic win rate ▪ We are introducing high - value panels that have greater gross margins ▪ We have restructured our capitalization and eliminated variable price instruments 3 Low - Cost, Versatile Solution for Infectious Disease MDx Market

Insert Section Title $107,172 $618,020 $1,406,740 $105,192 $980,044 $2,122,968 $446,628 $667,524 $1,512,498 Q3 2016 Q4 2016 As of 6/22/17 Total Expected Revenue of Sites in Evaluation Scheduled Active Evals Onboarding • Expected revenue from evaluations, scheduled evaluations and onboarding accounts are based on customer estimate of testing vo lum e multiplied by the assay price quoted. • Onboarding accounts have placed at least one paid order and stated their intent to use the GBSN assay for reporting patient r esu lts 4 Expanded Menu Driving Pipeline of New Business $5,032,206 $2,265,588 $658,992

Insert Section Title Expected Average Customer Size has Increased 5 Rapidly Growing New Customer A nnual R evenue Projections $7,260 $12,620 $16,740 $38,120 $47,866 $- $10,000 $20,000 $30,000 $40,000 $50,000 $60,000 1Q2016 2Q2016 3Q2016 4Q2016 1Q2017

Insert Section Title Our Markets Problem ▪ Leading cause of morbidity & mortality ▪ Culture takes ~ 3 days for a result ▪ Increased cost, delayed treatment, higher patient risk MDx Testing Improves Patient Outcomes & Lowers Cost of Care Solution ▪ MDx reduces Time to Result to 1 day ▪ Length of stay reduced by 6.2 days ▪ Average savings is ~ $7,000 per incident Example: Blood Sepsis

Insert Section Title Our Markets ▪ Gastro Intestinal Distress $800MM* ▪ Blood Sepsis $200MM ▪ Whooping Cough $250MM ▪ Group B Strep (Neo - natal Meningitis) $200MM ▪ Products in Development Pipeline $300MM+ 7 Our Tests Target an Estimated $1.75B Addressable U.S. Market * Company estimates

Insert Section Title Our System Analyzer ▪ Works with all Great Basin assays ▪ Does not require special staffing to read results ▪ Small footprint – requires little bench space ▪ No CapEx , value proposition Cartridges ▪ Single - use, minimal steps to prep ▪ Up to 5 answers per specimen ▪ Same cartridge design for all assays ▪ Designed for cost and manufacturability 8 Great Basin’s Affordable Solution Designed for Small - Medium Hospitals

Insert Section Title Our Technology ▪ First U.S. Patent issued 2013 ▪ $0.23 per chip ▪ Up to 64 target array ▪ Sensitivity for direct - from - specimen detection 9 Highly Sensitive Multi - Plex Detection

Insert Section Title Our Product Offering Great Basin Product Menu Commercially Available Products Launch Date • Toxigenic C. difficile Test November 2012 • Group B Streptococcus Test May 2015 • Shiga Toxin Direct Test September 2016 • Staph ID/R Blood Culture Panel October 2016 • Bordetella Direct Test April 2017 Awaiting FDA Clearance • Stool Bacterial Pathogens Panel Feb 2017 (Investigation Use Only) In Development Expected Clinical Trial Start • CT/NG/TV Test 2018 • Stool Parasite Pathogens Panel 2018 • Candida Blood Infections Panel 2018 • SA Nasal Screen Test TBD

Insert Section Title The Competition 11 Only Great Basin Offers a Single Capital Solution vs. Requiring Two Capital Expenditures from Two Vendors 1 - 2 pathogen tests that answer: “Is it X?” Lower Reimbursement Lower Cost C. diff MRSA Sexually transmitted disease 5 - 25 pathogen panels that answer: “What is causing it?” Higher Reimbursement Higher Cost Diarrhea Blood sepsis Respiratory

Insert Section Title Mid - Plex » 3 - 6 pathogens » Reasonable cost » Single syndrome per panel (leverages empirical diagnosis) » Cover 90% - 95% of likely cause of disease » Answers drive therapy Mega Panels » 10 - 25 pathogens in a single assay » High cost » Multi - syndromic (include more than one disease state) » Contain obscure, rarely seen pathogens » Not therapy oriented 12 Market Dynamics The Competitive Advantages of Mid - Plex over Mega Panels

Insert Section Title The Mid - Plex to Mega Panel Difference 13 Stool Bacterial Pathogens Panel Competitive Analysis Comparative features Targets 5 (Bacterial) 22 (Bacterial, Viral, Protozoa) Panel pricing $60 - $75 $120 - $130 Reimbursement ~$134 to $290 ~$134 to $290* 2015 Payor r ejection rate 6.5% 19.5 %+ ** *Mega - panel providers suggest their customers use CPT codes that allow for higher reimbursement rates. However, Great Basin’s su rveys of hospitals indicate a lack of success with that tactic, as well as a growing challenge by hospitals to get reimbursement adequate to cover the fu lly - burdened costs associated with running mega panels. **Source: CodeMap and CMS Mega Panels

Insert Section Title Market Dynamics ▪ Palmetto Local Coverage Determination Draft ▪ Panel must be “reasonable and necessary” ▪ Targets must represent a common syndrome (i.e. truly syndromic) ▪ There must be broad applicability (pathogens found in only select populations not appropriate) ▪ Must aid physician in directing therapy; not just identify what pathogen is present • Reimbursement not appropriate for epidemiological studies • Reimbursement not appropriate for confirmatory testing or screening 14 Growing Clinical and Payor Resistance to Larger Panels: “[For] most patients, negative test results for common pathogens should precede testing for uncommon pathogens in the interes t of controlling the cost of testing for both the patient and the institution.” - Dr. Alexander McAdam, MD, PhD, Harvard Med School and Boston Children’s Hospital JCM, 2015 53:10 “A panel that includes pathogens that are very rare, or a panel in which all pathogens do not cause overlapping clinical synd rom es, or when some pathogens are found only in specific patient populations (immunocompromised patients) is not reasonable and necessa ry. ” - Palmetto GBA (Medicare contractor), Local Coverage Determinations (LCDs), June 14, 2017, www.cms.org

Insert Section Title The Great Basin Mid - Plex Advantage x Contains only targets likely after physician provides empirical diagnosis x Targets represent a single syndromic group x No confusing, statistically unlikely or unnecessary information x Answers limited to those that guide patient therapy x Reimbursement above cost of test x Lower rate of payment denial post - testing 15 Great Basin Mid - Plex Meets Palmetto and Clinical Preference

Insert Section Title The Winning Solution 16 Great Basin’s Low/Mid - Plex Advantage Yes No Yes Yes Yes No Low - Plex Mid - Plex Low - Plex Low - Plex Mega - Plex Mega - Plex Low - Plex Multi - Plex No No Yes Yes Yes Yes Sample to Result Menu CapEx Required

Insert Section Title The Solution 17 What our customers are saying My techs were unanimous the Great Basin assays were easier to use than our current platform for CDIFF, GBS and MRSA. - Microbiology Supervisor I love this system. So easy to run and easy to adopt since we don’t have capital equipment to purchase. We’ll use every test you have. - Lab Director We actually had 2 patients this past week which were Negative by the Meridian kit. One was a child and the other an adult. We ran your assay [STEC] and got Positive results for both. How timely. Glad we switched. - Microbiology Supervisor A panel like this is what we need for a limited micro staff in terms of numbers and experience reading culture plates. [SBPP] will primarily do away with our stool bench. - Micro Biology Supervisor

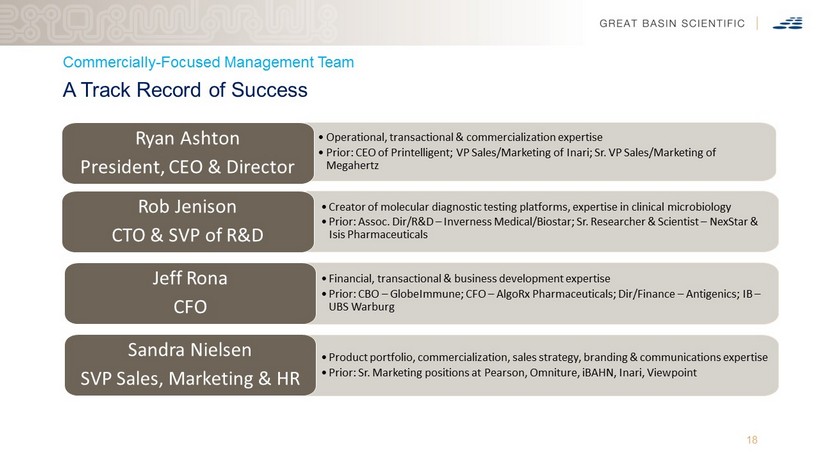

Insert Section Title Commercially - Focused Management Team • Operational, transactional & commercialization expertise • Prior: CEO of Printelligent ; VP Sales/Marketing of Inari; Sr. VP Sales/Marketing of Megahertz • Creator of molecular diagnostic testing platforms, expertise in clinical microbiology • Prior: Assoc. Dir/R&D – Inverness Medical/ Biostar ; Sr. Researcher & Scientist – NexStar & Isis Pharmaceuticals • Financial, transactional & business development expertise • Prior: CBO – GlobeImmune ; CFO – AlgoRx Pharmaceuticals; Dir/Finance – Antigenics ; IB – UBS Warburg 18 A Track Record of Success • Product portfolio, commercialization, sales strategy, branding & communications expertise • Prior: Sr. Marketing positions at Pearson, Omniture, iBAHN , Inari, Viewpoint Ryan Ashton President, CEO & Director Rob Jenison CTO & SVP of R&D Jeff Rona CFO Sandra Nielsen SVP Sales, Marketing & HR

Insert Section Title Board of Directors • Founding investor of GBSN; Chairman since inception • Founder track record, operations and transaction expertise • Co - founder of Megahertz, sold to US Robotics for $450M; angel investor & philanthropist. David Spafford Executive Chairman • GBSN director since 2014 • Private equity partner at Linden Capital Partners – investing in healthcare & life sciences • Past CEO of several HC companies; current director of Wright Medical Group (Nasdaq: WMGI) Ron Labrum Director • GBSN director since 2014 • Portfolio manager Perceptive Advisors – healthcare - focused investment fund • UBS Securities & Credit Suisse IB experience; current director of VBI Vaccines (Nasdaq: VBVI) Sam Chawla Director 19 Diversified and Experienced • GBSN director since 2015 • Audit and accounting expertise; deep knowledge and experience in pharmaceutical industry • Current director of Ryerson Holding Corp (NYSE:RYI) & NanHealth (OTC: NH) + 3 private cos. Kirk Calhoun Director

Insert Section Title Capital Structure ▪ Common shares & equivalents outstanding – 11.6MM (incl. shares from Series K Warrants) ▪ No variable priced instruments ▪ $20.3 million Series A Convertible Note ▪ Convertible at $3.00 a share, no resets or variable rate conversions, 6.8 million shares ▪ Not convertible for 6 months from issuance (April 17, 2017) ▪ Other debt of $1.8MM, including $0.1MM Series B Convertible Note, convertible at $1.10 ▪ Enterprise value of approximately $ 26.7MM ▪ Series J warrants are exercisable into 22.4MM shares until August 21, 2017 ▪ Exercise price of $0.30 (subject to adjustment by the Company) 20 Restructured Capitalization

Insert Section Title Investment Highlights ▪ One of only 4 pure plays in infectious disease molecular diagnostics market ▪ Expanded menu and installed customer - base provide a strong foundation to accelerate revenue growth ▪ $5.05MM New Business Pipeline with historical 82% new customer conversion rate validates our competitive advantage ▪ Our no capex model, exceptionally low - ASP and strong reimbursement profile can make testing profitable for our customers’ labs ▪ Only provider of low - and mid - plex sample - to - result solution — only one system needed to meet all MDx needs ▪ Restructured capitalization/no variable priced instruments 21 Summary

Insert Section Title Thank you