Attached files

| file | filename |

|---|---|

| EX-32.2 - EX-32.2 - Great Basin Scientific, Inc. | gbsn-ex322_275.htm |

| EX-32.1 - EX-32.1 - Great Basin Scientific, Inc. | gbsn-ex321_278.htm |

| EX-31.2 - EX-31.2 - Great Basin Scientific, Inc. | gbsn-ex312_276.htm |

| EX-31.1 - EX-31.1 - Great Basin Scientific, Inc. | gbsn-ex311_277.htm |

| EX-23.2 - EX-23.2 - Great Basin Scientific, Inc. | gbsn-ex232_1091.htm |

| EX-23.1 - EX-23.1 - Great Basin Scientific, Inc. | gbsn-ex231_1352.htm |

| EX-3.1 - EX-3.1 - Great Basin Scientific, Inc. | gbsn-ex31_1092.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2016

OR

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 001-36662

GREAT BASIN SCIENTIFIC, INC.

(Exact name of Registrant as specified in its Charter)

|

Delaware |

|

83-0361454 |

|

(State or other jurisdiction of |

|

(I.R.S. Employer |

|

|

|

|

|

420 East South Temple, Suite 520 |

|

84111 |

|

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (801) 990-1055

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: Common stock, par value $0.0001 per share

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ☐ NO ☒

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. YES ☐ NO ☒

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES ☒ NO ☐

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files). YES ☒ NO ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405) is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definition of “large accelerated filer”, “accelerated filer”, and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer |

☐ |

Accelerated filer |

☐ |

|

Non-accelerated filer |

☐ (Do not check if a small reporting company) |

Small reporting company |

☒ |

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES ☐ NO ☒

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the Registrant, based on the closing price of the shares of common stock on The NASDAQ Stock Market on June 30, 2016 was $12.6 million.

The number of shares of Registrant’s Common Stock outstanding as of March 17, 2017 was 1,485,904,493.

|

|

|

Page |

|

|

|

|

|

Item 1. |

3 |

|

|

Item 1A. |

21 |

|

|

Item 1B. |

50 |

|

|

Item 2. |

50 |

|

|

Item 3. |

50 |

|

|

Item 4. |

51 |

|

|

|

|

|

|

|

|

|

|

Item 5. |

52 |

|

|

Item 6. |

53 |

|

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

54 |

|

Item 7A. |

66 |

|

|

Item 8. |

66 |

|

|

Item 9. |

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

66 |

|

Item 9A. |

67 |

|

|

|

|

|

|

|

|

|

|

Item 10. |

69 |

|

|

Item 11. |

72 |

|

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

76 |

|

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

83 |

|

Item 14. |

87 |

|

|

|

|

|

|

|

|

|

|

Item 15. |

89 |

|

|

Item 16. |

94 |

|

|

|

95 |

|

|

|

F-1 |

i

CAUTIONARY NOTE CONCERNING FORWARD-LOOKING STATEMENTS

This annual report on Form 10-K contains forward-looking statements that involve risks and uncertainties. You should not place undue reliance on these forward-looking statements. Our actual results could differ materially from those anticipated in the forward-looking statements for many reasons, including the reasons described in this report at sections “Item 1A. Risk Factors,” “Item 7. Management Discussion and Analysis of Financial Condition and Result of Operations,” and “Item 1. Business”. In some cases, you can identify these forward- looking statements by terms such as “anticipate,” “believe,” “continue,” “could,” “depends,” “estimate,” “expects,” “intend,” “may,” “ongoing,” “plan,” “potential,” “predict,” “project,” “should,” “will,” “would” or the negative of those terms or other similar expressions, although not all forward-looking statements contain those words.

We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy and financial needs. These forward-looking statements are subject to a number of known and unknown risks, uncertainties and assumptions, including risks described in the section titled “Risk Factors” and elsewhere in this 10-K. Factors that could cause actual results to differ materially from those discussed in the forward-looking statements include, but are not limited to:

|

|

• |

our expectation that for the foreseeable future, substantially all of our revenue will be derived from sales of our C. diff, Group B Strep, Staph ID/R and STEC diagnostic tests; |

|

|

• |

our ability to expand our sales and marketing capabilities to increase demand for C. diff, Group B Strep, Staph ID/R and STEC and any other diagnostic tests we may develop and gain approval for; |

|

|

• |

our ability to develop additional revenue opportunities, including new diagnostic tests; |

|

|

• |

the timing of regulatory submissions; |

|

|

• |

our ability to maintain regulatory approval of our C. diff, Group B Strep, Staph ID/R and STEC diagnostic tests and to obtain and maintain regulatory approval for any other diagnostic test we may develop; |

|

|

• |

approvals for clinical trials may be delayed or withheld by regulatory agencies; |

|

|

• |

pre-clinical and clinical studies may not be successful or confirm earlier results or may not meet expectations, regulatory requirements or performance thresholds for commercial success; |

|

|

• |

risks relating to the timing and costs of clinical trials and other expenses; |

|

|

• |

management and employee operations and execution risks; |

|

|

• |

loss of key personnel; |

|

|

• |

competition in the markets we serve; |

|

|

• |

our ability to manufacture C. diff, Group B Strep, Staph ID/R and STEC and any other diagnostic tests we may develop at sufficient volumes to meet customer needs; |

|

|

• |

our ability to reduce the cost to manufacture our C. diff, Group B Strep, Staph ID/R and STEC and any other diagnostic tests; |

|

|

• |

risks related to market acceptance of diagnostic tests; |

|

|

• |

intellectual property risks; |

|

|

• |

assumptions regarding the size of the available market, benefits of our diagnostic tests, product pricing and timing of product launches; |

|

|

• |

our ability to fund our working capital requirements; |

|

|

• |

risks associated with the uncertainty of future financial results; |

|

|

• |

risks related to our proposed March 2017 Reverse Stock Split; |

|

|

• |

risks related to our outstanding convertible notes, warrants and convertible preferred stock; |

1

|

|

• |

risks associated with our reliance on third party suppliers and other organizations that provide goods and services to us. |

These risks are not exhaustive. Other sections of this annual report on Form 10-K may include additional factors that could adversely impact our business and financial performance. Moreover, we operate in a very competitive and rapidly changing environment. New risk factors emerge from time to time, and it is not possible for our management to predict all risk factors nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in, or implied by, any forward-looking statements. You should read this annual report on Form 10-K with the understanding that our actual future results, levels of activity, performance and achievements may be materially different from what we expect. Except as required by law, we undertake no obligation to update publicly any forward-looking statements for any reason after the date of this annual report on Form 10-K or to conform these statements to actual results or to changes in our expectations.

We qualify all of our forward-looking statements by these cautionary statements.

Unless the context requires otherwise references to “Great Basin Scientific,” “Great Basin”, our “Company,” “we,” “us” or “our” refer to Great Basin Scientific, Inc., a Delaware corporation, doing business as Great Basin Corporation.

2

Overview

We are a molecular diagnostic testing company focused on the development and commercialization of our patented, molecular diagnostic platform designed to test for infectious disease, especially hospital-acquired infections. We believe that laboratories in small to medium sized hospitals, those under 400 beds, are in need of simpler and more affordable molecular diagnostic testing methods. We market a system that combines both affordability and ease-of-use, when compared to other commercially available molecular testing methods, which we believe will accelerate the adoption of molecular testing in small to medium sized hospitals. Our system includes an analyzer, which we provide for our customers’ use without charge in the United States, and a diagnostic cartridge, which we sell to our customers. For purposes of this report, we use the term “assay(s)” to describe our existing diagnostic test product as well as our diagnostic test products under development. Our testing platform has the capability to identify up to 64 individual targets at one time. If the assay identifies one to three targets, we refer to them as low-plex tests, or tests, and if they identify four or more targets we refer to them as multi-plex panels, or panels.

We currently have four commercially available tests, our first for clostridium difficile, or C. diff , which received clearance from the United States Food and Drug Administration, or FDA, in April 2012, our second for Group B Strep, which received clearance from the FDA in April 2015 and launched commercially in June 2015, our third for Shiga Toxin Direct, or STEC, which received clearance from the FDA in March 2016 and launched commercially in August 2016 and the fourth Staphylococcus Identification and Resistance Blood Culture Panel, or Staph ID/R panel, which received FDA clearance in March 2016 and launched commercially in September 2016. Our customers consist of hospitals, clinics, laboratories and other healthcare providers in the United States, the European Union and New Zealand.

Molecular diagnostic testing generally reduces test time from days to hours compared to culture methods, and typically provides much more accurate results than non-molecular rapid assays. Culture testing utilizes a sample taken from a patient, which is incubated in a culture medium; the operator waits for the microorganisms, if there are any, to grow until they are in large enough quantities to be detected. This method can take days and in some cases requires highly trained laboratory technicians to perform the tests and interpret the results. The accuracy of culture-based methods has been shown to be lower than that of molecular-based approaches. For example, in a multi-arm, multicenter clinical study using our C. diff test, we increased detection sensitivity nearly 20% as compared to the culture-based arm. Molecular testing methods, like our system, utilize technologies to multiply the DNA from a small sample until it can be detected by an automated, visual system. A key difference between our system and other molecular systems is our use of a low-cost, but highly sensitive, semiconductor chip based detection system. This allows us to utilize existing components, for example digital camera components, to provide visual evidence of the result. This provides more accurate answers generally in hours and can be operated by technicians with less extensive training than is required for culture testing. We believe these advantages can lead to shortened hospital stays and improved patient outcomes, resulting in reduced costs for hospitals that implement molecular testing in their labs. We believe this improvement in the time to result and the quality of those results has led to a fast-growing market for molecular diagnostic systems at hospitals. We believe our system is well positioned to meet this need and attract new customers. As of December 31, 2016, we had 265 customers worldwide (244 in the United States and 21 in the rest of the world), who use an aggregate of 498 of our analyzers.

For additional information about our products, see “Our Assay Menu” below.

Our operations to date have been funded primarily through sales of capital stock, convertible notes, sale-leaseback transactions and cash from operations. We expect to continue developing additional diagnostic tests and conducting clinical trials over the next several years. In addition, while we expect our sales and marketing expenses will increase proportionately as we introduce the new tests, we believe commission expenses will decline as a percentage of revenue.

3

Our goal is to become the leading provider of sample-to-result, multiplex and low-plex molecular diagnostic testing in infectious disease by leveraging the strengths of our affordable diagnostic testing platform. We intend to expand the use of our platform by targeting small to medium sized hospitals in the United States with fewer than 400 beds. We believe that our low-cost platform will be attractive to these hospitals in particular, which may not otherwise have sufficient resources to justify the purchase of a molecular diagnostic sample-to-result solution. To achieve this objective, we intend to do the following:

|

|

• |

Leverage our Low-Cost Platform to Quickly Penetrate the Small and Medium Sized Hospital Market. We provide our customers with our analyzer at no cost and sell them the disposable, single-use diagnostic cartridges. This allows us to avoid the long sales cycle inherent in selling capital equipment and expand into hospitals that previously could not afford to implement a molecular diagnostic platform. |

|

|

• |

Accelerate the Growth of our U.S. Customer Base. We intend to expand our sales force to target small to medium hospitals in the United States. We anticipate that increasing our number of customers will drive sales of our diagnostic cartridges. We expect these sales will generate the majority of our revenue for the foreseeable future. |

|

|

• |

Expand our Menu of Molecular Diagnostic Assays. We intend to expand our assay menu to include additional assays for our platform that we believe will satisfy growing medical needs and present attractive commercial opportunities. For example, in 2014 we completed the clinical trials and filed the 510(k) application for our second test for Group B Strep, and in April 2015 we received FDA clearance for our Group B Strep test. In March 2016 we also received clearance for Staph ID/R and for Shiga toxin producing E. coli. In December 2016, we submitted a 510(k) application for our Stool Bacteria Pathogenic Panel (food-borne illness) to the FDA, and in January 2017, we submitted a 510(k) application to the FDA for our Bordatella Pertussis (whooping cough) test. We also have a pipeline of assays in late stage product development, including a test for Chlamydia-Gonorrhea, a pre-surgical screening test, and a panel for Candida blood infections. |

|

|

• |

Reduce our Cost of Sales through Automation and Volume Purchasing. We manufacture our proprietary diagnostic cartridges and analyzers at our manufacturing facility in Salt Lake City, Utah. We currently hand-build our diagnostic cartridges and purchase materials at a higher per unit cost due to low purchase volumes. We believe that investment in automation of portions of the manufacturing and assembly process and volume purchase pricing will significantly improve our gross margins and enhance our ability to provide a low-cost solution to customers. |

The Great Basin Platform

Our platform, which employs a combination of proprietary and patented technology, consists of a bench top analyzer with a touch screen (or, in early models, a laptop computer) into which our self-contained, single-use diagnostic cartridges are inserted. We believe that our platform is user friendly and intuitive and provides the hospital with the ability to perform molecular diagnostic assays in an efficient and cost-effective manner.

|

The Analyzer |

The Diagnostic Cartridge |

The User Placing the Diagnostic Cartridge into the Analyzer |

|

|

|

|

|

|

|

|

4

Once a patient specimen is received in the lab, a technician will typically perform no more than three to five steps of sample preparation before placing the sample in our disposable diagnostic cartridge and inserting it in the analyzer where the assay is run without further technician intervention. Our four FDA-cleared assays were rated by Clinical Laboratory Improvement Amendments of 1988, or CLIA, as moderately complex, which typically eliminates the need for highly-trained and expensive molecular technicians to run the assays, bringing additional cost benefit to our customers. We expect our future assays to be rated moderately complex or meet CLIA waiver criteria, which is reserved for assays that are simple and are judged by the FDA to present a low risk for erroneous results.

Our platform provides accurate results in 45 to 115 minutes depending on the assays. The speed of our assays allows for early diagnosis and treatment, which we believe can lead to better patient outcomes and reduced cost to the hospital.

We believe that our platform and related assays offer small-to-medium sized hospitals the following benefits:

|

|

• |

Ease of Use. Our platform is a sample-to-result system. Sample preparation can be completed in three to five steps that typically take no more than five minutes. Once the diagnostic cartridge is placed in the analyzer, the technician does not need to monitor the assay and can complete other unrelated tasks. The assay is complete in 45 to 115 minutes depending on the assay. |

|

|

• |

Cost Savings. We believe that our pricing strategy makes it possible for many small-to-medium sized hospitals that have cost constraints to adopt molecular testing. We provide the customer the use of our analyzer for no upfront charge, while we retain ownership. We then sell our assays to the hospital at a cost that we believe is similar to or less expensive than other molecular diagnostic solutions. This reduces the up-front cost for the customer, minimizes customer approval processes and accelerates adoption of our platform. |

|

|

• |

Versatile Platform with the Capability to Deliver a Broad Assay Menu. We believe our platform has broad potential application across a number of areas in molecular diagnostic testing for infectious disease, including the detection of pathogens from whole blood samples. The same analyzer can be utilized for all of our planned future assays. |

|

|

• |

Low-cost Low-plex tests. We believe our platform, including our low-cost chip detection and our single-use diagnostic cartridge, has a cost structure that will allow us to compete effectively in the market for low-plex tests with 1-3 answers like C. diff or pre-surgical and MRSA screening. We expect our low-plex tests like C. diff to drive system placements as hospitals convert from traditional testing methods. |

|

|

• |

Ability to Multiplex. Our platform has the technical ability to analyze up to 64 distinct targets in a single diagnostic panel, including controls. We refer to any test of more than four targets as a multi-plex panel. We believe that this capability will allow hospitals to test for multiple possible causes of an individual patient’s symptoms in a one-step detection process. This capability will reduce the time required for a laboratory to perform a diagnostic analysis that involves testing for multiple infectious disease pathogens. Without our platform, similar testing would require the hospital to run multiple, separate molecular or non-molecular diagnostic assays. |

Our Molecular Testing Process

In our molecular testing process, a clinician places a clinical specimen—processed or unprocessed—into the diagnostic cartridge (such as stool or blood), caps the cartridge and then places the diagnostic cartridge into the analyzer. The assay routine is initiated in the analyzer and starts a simple automated process. Within the instrument, mechanical valves are present to control the flow of fluid through the cartridge and to pierce the blister packs containing the required buffers, solutions and reagents to perform the selected assay. Low cost, reliable heaters are present for assay processing. Imaging occurs with a compact digital camera placed over a window in the cartridge above the chip. Proprietary software interprets the image and provides a clinical result to the laboratory.

5

The disposable diagnostic cartridge contains—in blister packs or freeze dried pellets—all of the reagents required to run the applicable assay. The three steps of a molecular assay (sample preparation, amplification, and detection) are performed in chambers present on the cartridge. All waste is collected in a chamber that is part of the diagnostic cartridge, significantly reducing the risk of lab contamination. After the assay is completed and the result is obtained, the diagnostic cartridge is disposed of with the hospital’s other medical waste.

To simplify processing within the analyzer, fluids are moved within the diagnostic cartridge through relatively large channels by exploiting pressure differences. Proprietary features have been designed into the diagnostic cartridge to allow for bubble-free fluid movement and sensor design permits accurate and precise volumetric delivery.

Our Assay Menu

We have received FDA clearance for four assays, C. diff , Group B Strep, Staph ID/R and E. coli and a CE mark for three assays, C. diff, Group B Strep and STEC. We began marketing the C. diff test in Europe in the first quarter of 2012 and in the United States in the fourth quarter of 2012. We received clearance from the FDA in April 2015 for our second diagnostic test for Group B Strep and launched this test commercially in June of 2015. We received clearance from the FDA in March of 2016 for STEC and launched this test commercially in August of 2016. We also received FDA clearance for our Staph ID/R trial in March of 2016 and launched this test commercially in September of 2016. We have two assays that have been submitted to the FDA for review, a test for pertussis and a food borne pathogen panel. Additionally, we have three other assays in various stages of product development: (i) a pre-surgical nasal screen for Staphylococcus aureus, or SA, (ii) a panel for candida blood infections and, (iii) a test for CT/NG.

Our Commercial Tests:

C. diff Test

C. diff infections are often life-threatening and can create a significant financial burden for hospitals. As a hospital-acquired infection, costs associated with the care of patients with C. diff are not covered by insurance or Medicaid/Medicare. An independent peer reviewed paper, published in the American Journal of Infection Control in 2012, highlights a significant reduction in C. diff infection rates when a hospital switched from culture to molecular testing — reducing cost and improving patient outcomes.

Our C. diff test is a rapid medical diagnostic test for the detection of C. diff , a gram-positive bacteria that causes severe diarrhea and other intestinal disorders. The test detects the presence of the C. diff toxin B gene, or tcdB gene, in the pathogenicity locus, or PaLOC region of C. diff , present in all known toxigenic strains, to diagnose the toxin in a patient’s stool. The test requires minimal sample preparation and can deliver results in 90 minutes. A swab from loose stool is placed into transfer solution and a portion of this solution is placed into the diagnostic cartridge. The diagnostic cartridge is then placed into the analyzer.

Group B Strep Test

Group B streptococcus, or Group B Strep, is a bacterium that colonizes in the warm moist areas of many humans. Harmless to healthy adults, it can be transmitted to a newborn during childbirth and is the single largest cause of meningitis in newborn infants. For this reason nearly every pregnant woman in the United States is tested for Group B Strep in the late third trimester. Historically this test was done by culture, but based on the recent introduction and sales of other Group B Strep molecular diagnostic tests, we believe labs are switching to molecular testing.

Our Group B Strep test is designed to detect Group B Strep from an anal/vaginal swab taken from a pregnant woman. Hospitals can use our test to identify Group B Strep colonization in pregnant women, who can then be treated with antibiotics to reduce the risk of transmission to the baby, reducing the risk of development of sepsis in the newborn. We received clearance from the FDA in April 2015 for our Group B Strep test and launched it commercially in June 2015.

Shiga Toxin Direct (STEC) Test

6

Escherichia coli ( E. coli ) bacteria normally live in the intestines of healthy people and animals. Most varieties of E. coli are harmless or cause relatively brief diarrhea, but a few strains, such as E. coli O157:H7, can cause severe abdominal cramps, bloody diarrhea and vomiting.

Our STEC Test is designed to be a rapid test that identifies Shiga toxin produced by E. coli , including E. coli O157 specifically which is the most serious type of E. coli contracted from contaminated food. We received FDA clearance for our STEC test in March 2016. We launched the product commercially in August of 2016.

Staphylococcus Identification and Resistance Blood Infection Panel

Staphylococcus aureus is a major cause of hospital and community-acquired infections and is associated with high rates of morbidity and mortality. Methicillin-resistant Staphylococcus aureus , or MRSA, is a potentially life-threatening infection that most frequently occurs in the hospital setting. Rapid diagnosis of Staph blood infections has been shown, in a report published in Clinical Practice in 2010, to save up to approximately $7,000 per patient and shorten the length of hospital stays by 6.2 days.

Our Staph ID/R panel is designed to be a multiplex panel to (i) identify species of Staphylococcus infections based on the detection of highly discriminatory and specific DNA sequences within a bacterial replication gene, (ii) detect the mecA gene, which confers drug resistance, directly from positive blood cultures and (iii) provide information on the antibiotic resistance profile of the bacteria. This test is designed to produce a result in less than one hour.

We received FDA clearance for our Staph ID/R panel in March 2016. We launched the product commercially in September of 2016.

Our Assays under FDA Review

Stool Bacterial Pathogenic Panel

According to the Agency for Healthcare Research and Quality, there were nearly five million U.S. hospital visits in 2010 for gastrointestinal distress that suggested food-borne illness. In 2010, inpatient costs attributable to patients suffering from gastrointestinal infections cost the healthcare system nearly $1.8 billion. One of the challenges faced by physicians assessing a patient with symptoms of gastrointestinal infection is determining the underlying cause.

We expect that our Stool Bacterial Pathogenic panel will detect the main causes of food poisoning. If approved, we believe that hospitals will be able to use our panel to identify the causative pathogen of food poisoning and provide appropriate treatment quickly, improving patient outcomes. Additionally, the results may be used to aid public health agencies to track causes of food poisoning outbreaks. We started the clinical trial in the second quarter of 2016 and filed a 510(k) application with the FDA in December of 2016. Our Stool Bacterial Pathogenic panel is not cleared by the FDA or available for commercial sale.

Bordatella Pertussis Test

Bordatella Pertussis, also known as whooping cough, is a highly contagious respiratory disease caused by the bacterium Bordetella pertussis. In 2012, there were over 48,000 cases reported in the United States and over 16 million worldwide. We started the clinical trial in the second quarter of 2016 and filed a 510(k) application with the FDA in January of 2017. Our Bordatella Pertussis test is not cleared by the FDA or available for commercial sale.

Our Assays in Development

Staphyloccocus aureus Pre-Surgical Nasal Screen

Staphyloccocus aureus (SA) often colonizes the nasal passages and other warm moist areas in healthy humans. Harmless in most circumstances, the colonization represents real risk to patients undergoing surgery. In fact

7

studies have shown the relative risk of post-surgical infection is up to eight and a half times greater in carriers of SA than in non-carriers.

We expect that our SA nasal screening test will be a rapid test for the presence of SA in the nasal passages of a pre-surgical patient. If approved, we believe that hospitals will be able to use our test to identify pre-surgical patients who are SA carriers and treat those patients with topical antibiotics, which has been shown in multiple peer-reviewed studies to significantly reduce the risk of post-surgical infection. Our SA pre-surgical nasal screen test is not cleared by the FDA or available for commercial sale.

Candida Blood Infections Panel

According to the United States Center for Disease Control there are 46,000 Candida blood infections annually in the U.S. Candida infections, although rare, have mortality rates as high as 40% if not diagnosed quickly. Our candida panel is a multiplex panel that will be designed to identify five species of Candida directly from positive blood cultures. We expect to complete product development in the first half of 2017. Our Candida Blood Infections Panel is not cleared by the FDA or available for commercial sale.

Chlamydia-Gonorrhea (CT/NG) Test

Our test for Chlamydia tracomatis and Neisseria gonorrhoeae (CT/NG) is designed to detect two significant sexually transmitted diseases. According to the CDC, there are over 20 million new CT infections each year in the U.S. and approximately 330,000 cases of NG. We expect to complete the pre-clinical development of our CT/NG test in the first half of 2017. Our CT/NG test is not cleared by the FDA or available for commercial sale.

Our Technology

Our proprietary and patented technology is based on detection of DNA targets on a coated silicon chip with results visible to the naked eye. DNA naturally forms a double-stranded structure, with each strand binding with high affinity and selectivity to a complementary strand. Our technology can detect DNA target strands of interest by attaching complementary strands of DNA to the chip surface, called capture probes, using our proprietary technology and processes. The capture probe can thereby immobilize the DNA target of interest. In order for the DNA target to be detected, it is labeled with biotin, a small molecule which can be used to create a signal in the diagnostic test. Biotin, immobilized onto the chip surface via DNA target hybridization to the DNA probe, will bind to a molecule which recognizes biotin and is conjugated to a signal generating enzyme, horseradish peroxidase, or HRP. Immobilized HRP can be reacted with a complex mixture to create a large colored product which deposits on the chip surface. This deposit causes the color of the chip surface to change. This color change is readily apparent to the naked eye as a dot in the vicinity of the DNA probe. In order to create tests with appropriate sensitivity for the given clinical indication, we can either amplify the quantity of DNA targets of interest or amplify the biotin-based signal. Each of these amplification approaches also serve to label DNA target(s) of interest with biotin.

Our Technology: Detection of On-chip Helicase Dependent Amplification (HDA) Reactions

8

Within the cartridge three distinct processes occur: sample processing, amplification, and detection. During sample processing, the specimen is treated to remove clinical matrices such as blood or feces that may interfere with assay results and is treated to break open cells to release potential DNA targets. Next, the sample is subjected to target amplification to create billions of copies of target DNA to improve assay sensitivity and to label each target with biotin. Finally, detection is triggered by hybridization of the biotin-labeled target DNA with capture probes on the chip surface. The chip is currently configured to hold as many as 64 probes, including controls, each of which can be configured to detect a different target DNA, enabling highly multiplexed testing. If signal amplification is used, a proprietary polymer is added to the detection reaction, which converts each target DNA associated biotin into 80 additional biotins to improve detection sensitivity. All waste generated from the assay is stored in a self-contained waste chamber which significantly reduces contamination risk.

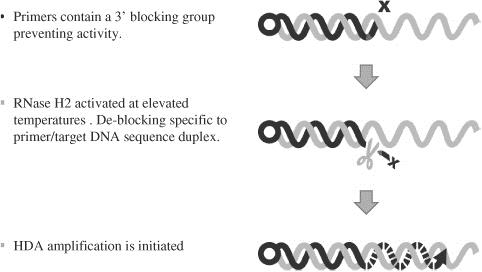

Target Amplification. Helicase-dependent amplification, or HDA, is a process that utilizes an enzyme, helicase, to unwind double-stranded DNA to create two single strands through isothermal, or single temperature, amplification. Once this DNA is single-stranded, complementary DNA primers, which are short pieces of DNA that are complementary to the DNA target, can hybridize. Through the action of an enzyme, DNA polymerase, the DNA primers grow, or extend, to create a complementary strand of the DNA target, creating double-stranded DNA again. This process can be repeated and the degree of copying, or amplification, is exponential, so that billions of copies can be created. HDA is a method already commercially available for detection of DNA targets, however, it is a mistake-prone process. DNA primers can incorrectly hybridize to non-target DNA at lower temperatures and be copied, creating so-called primer artifacts, which leads to tests that are slow and poorly sensitive.

Our patented target amplification approach, termed blocked primer-mediated, helicase-dependent amplification, or bpHDA, utilizes blocked primers to enhance test speed and sensitivity. Blocked primers are DNA primers that contain a block at lower temperatures, where most incorrect hybridization events occur, preventing extension of the DNA primers or copying of the DNA target. As the temperature is raised, incorrect hybridization events are not stable and fall apart, but hybridization of DNA primers to complementary DNA targets is still very strong and an enzyme, RNase H, becomes active which can remove the block in blocked primers hybridized to DNA targets only. As a result, the accuracy of the process is dramatically improved, leading to faster and more sensitive tests. In order to label the DNA target for detection, each DNA primer has a biotin molecule attached to one end.

Our platform is also capable of performing polymerase chain reaction, or PCR, which is a widely used method of DNA amplification. Our Group B Strep test is our first commercial test to utilize PCR.

Signal Amplification. Our patented signal amplification approach, which we refer to as AMPED, utilizes a bridging molecule to connect the biotin label on each DNA target to a polymer containing 80 biotins, thereby amplifying the signal up to 80 times in our diagnostic tests. The AMPED polymer works in the presence of blood, mucus, and feces typically present in clinical samples, thereby simplifying sample processing. The AMPED signal amplification process takes approximately 20 to 30 minutes and is a more rapid approach for detection of DNA targets than target DNA amplification, which typically takes 45 to 120 minutes. The patented AMPED polymer is highly water soluble and stable and displays low non-specific binding properties, which are critical requirements for highly specific signal amplification approaches.

Based on papers published in peer-reviewed journals, we believe our AMPED detector to be among the most sensitive in the industry with a proven limit of detection of 20,000 DNA molecules. We believe this limit of detection will be more than adequate for us to develop assays focused on the nascent “direct from whole blood” market which we believe has the potential to be exceptionally disruptive by eliminating the need for culturing blood prior to testing. Currently patients suspected of having a blood infection (sepsis) have their blood drawn. That sample is then cultured for a day before testing, but published studies consistently show that treatment within 12 hours of symptoms has significant clinical benefit. Direct from whole blood testing has the potential to eliminate the need for culture, speeding diagnosis to under 12 hours, thus potentially improving patient morbidity and mortality.

Diagnostic Cartridges. Our patent-pending diagnostic cartridges are self-contained devices specifically configured for a given diagnostic assay. The diagnostic cartridge is injection molded and includes features such as reaction chambers, a waste chamber, and channels to direct the movement of fluids. The diagnostic cartridge also contains a coated silicon detection chip consisting of an array of up to 64 DNA probes, including controls. Integrated into the diagnostic cartridge are lance devices for the reagent blister packs and stirring devices. Reaction chambers and fluid

9

channels are covered with a clear thermoplastic to form liquid-tight features. All of the reagents necessary to perform the assay are stored within blister packs affixed to the cartridge, other than the target amplification reagents, which are stored as a freeze-dried pellet. The diagnostic cartridge utilizes patent-pending methods for controlling the flow of fluid and managing air to prevent bubbles. The diagnostic cartridge also contains bar coded information related to the test, including the cartridge lot number and expiration date.

Analyzer. The analyzer is an on-demand system controlled by an external touch screen or laptop. Each analyzer contains a module into which individual diagnostic cartridges are placed. Once a diagnostic cartridge has been loaded with a clinical specimen, the cartridge is inserted into the analyzer. The cartridge is then advanced onto a platform allowing access from above and below. The analyzer has three main sub-platforms to execute the diagnostic test: reagent flow control, thermal control, and the optical imaging platforms. To control reagent flow and delivery, valve actuators, which control fluid movements, and lance actuators, which lance blister packs, are located below the cartridge. Motors for mixing reactions and stepper motors, which serve to flatten blister packs and drive fluid into reagent channels, are located above the cartridge. Optical sensors located adjacent to the fluidic paths in the cartridge are used to determine fluidic movements. Compression valves are used to isolate regions of the cartridge for individual steps of the diagnostic assay. Multiple resistive heaters with thermocouple feedback are used to control temperature for each of the steps of the process. Once the test is complete a digital camera captures the resulting visible features. Processing and filtering techniques and multiple custom algorithms are used to determine test results, which are displayed on the touch screen or printed automatically.

The touch screen controls each analyzer, provides power and analyzes and stores data. Technicians can load patient identification numbers and reagent lot codes by using the included bar code scanner or the touch screen.

Advantages of Our Technology

Low Cost Design. Our technology was designed to use injection molded parts and filled blister packs can be produced in high volumes at relatively low cost. Production of the coated silicon chip uses existing semi-conductor processes and capital equipment. Our isothermal target amplification uses a relatively inexpensive heater which does not need to actively manage heat with coolers and fans. A low cost digital camera captures the visible results. Our proprietary DNA probe chemistry enables us to produce assays at relatively low cost.

Easy to Perform On-demand Testing. Our technology uses a sample-to-result approach. The customer loads a liquid clinical specimen into the diagnostic cartridge, closes it, inserts it into the analyzer and enters patient information to initiate each assay. The results are automatically generated with no user interpretation or intervention required. Hands-on time is less than 10 minutes for our C. diff test and we expect hands-on time to be generally less than 5 minutes for assays under development. Additionally, on-demand testing allows the technician to test samples as they come into the laboratory. Finally, the presence of comprehensive built-in controls means that the technician is not required to test external control samples to assure the quality of assay results. This allows laboratories to be more efficient with limited resources.

High Performance Assay Results. Our technology is capable of highly specific and sensitive detection of nucleic acids. For target DNA from multiple pathogen types, we can routinely detect fewer than three organisms using our bpHDA target amplification approach and have detected the identity of as few as 100 organisms using our AMPED signal amplification approach. Because the speed of bpHDA is only limited by the speed of the enzymes, we have demonstrated the ability to detect target DNA in less than 20 minutes of amplification time.

High Content Panels. Each of the 64 capture probes in our cartridge act independently to produce highly specific and sensitive detection for a given DNA target. The chip is optimized so that changes as small as a single base in DNA target sequence can be readily detected, allowing for detection of clinically meaningful mutations in DNA target samples. Our bpHDA technology is highly specific, allowing for simultaneous amplification of multiple DNA targets. The AMPED approach can be used to directly detect clinical specimens, thereby eliminating typical limitations of multiplexing. We expect the combination of highly multiplexed amplification and detection will allow for information-rich, multi-target panel results that allow clinicians to both rule-out and rule-in causes of disease. We believe this approach will lower testing costs and speed up the time to appropriate patient treatment, improving patient outcomes.

10

Ease of Development of New Assays. Early diagnostic test prototypes can be developed using our standard 96 well plates capable of processing 96 samples in a single experiment, rather than processing individual samples in the analyzer. We believe that this capability allows us to more easily develop and optimize new assays before transferring the design to the instrumented platform. Additionally, well-established software tools enable us to design and develop DNA probes and primers. The flexibility of the cartridge design allows for utilization of an efficient, low-cost approach for sample processing.

License Agreements

BioHelix. We hold non-exclusive licenses to key technologies from BioHelix related to isothermal amplification of nucleic acid targets, utilizing helicase-dependent amplification, or HDA. The term of this license agreement extends until the expiration of all the patents associated with the licensed patent rights, or until such time as we elect to terminate with 30 days’ notice. This license is limited to the fields of human diagnostic testing utilizing our solid chip surface detection and contains diligence and U.S. preference provisions. To date, these technologies have resulted in three issued U.S. patents, one issued European patent and one pending international patent family. In addition, these technologies may include related technologies that BioHelix may develop in the future. The BioHelix technologies are the basis of our nucleic acid amplification approach. In May of 2013, Quidel Corporation, a competitor of ours, purchased BioHelix. We pay a royalty fee for the licensing of this technology based on a percentage of our “Net Sales” of assays using these technologies (as defined in the license agreement).

IDT. In August 2010, we entered into a license agreement with Integrated DNA Technologies, or IDT, related to the use of blocked primers in combination with HDA. The term of this license agreement extends until the expiration of all the patents associated with the licensed patent rights, or until such time as we elect to terminate with 90 days’ notice. The license is exclusive to the fields of amplification utilizing HDA and detection of diagnostic targets in human in-vitro diagnostic testing, but is non-exclusive to all oncology and human papilloma virus targets or markers. These technologies have resulted in four pending U.S. patent applications and one issued European patent. We pay a royalty fee for the license of this technology based on a percentage of our “Net Sales” of products using these technologies (as defined in the license agreement).

Pursuant to the terms of these license agreements, we pay royalty fees in the aggregate equal to 14% of our worldwide “Net Sales” of those products that use these technologies (as defined and adjusted pursuant to the terms of the applicable license agreements). Our C. diff product is our only commercial product that uses these technologies. Our products under review by the FDA and all of our products under development do not use these technologies and will not be subject to royalty fees.

Market Opportunity

We believe the global market for molecular diagnostic testing is approximately $5.0 billion per year and will experience a growth rate of approximately 12% per year over the course of the next several years based on research published by outside market research firms. We believe our proprietary sample-to-result platform is best suited to address a subset of this market, including hospital-acquired infections and other infectious diseases.

|

|

• |

C. diff. According to the Agency for Healthcare Research and Quality, there are 347,000 cases of C. diff annually in the United States; |

|

|

• |

Group B Strep. According to the CDC, there were 4.0 million live births in the United States in 2012 and nearly every pregnant woman in the United States is tested for Group B Strep in the late third trimester; |

|

|

• |

Staphylococcus Identification and Resistance Panel. According to a market survey, there are 4.2 million positive blood cultures each year in the United States; |

|

|

• |

Shiga Toxin Producing E. coli. According to the Agency for Healthcare Research and Quality, there were nearly five million U.S. Hospital visits in 2010 for gastrointestinal distress that suggested food-borne illness and each of these patients could potentially be tested for STEC; |

11

|

|

• |

Stool Bacterial Pathogenic Panel. According to the Agency for Healthcare Research and Quality, there were nearly five million U.S. hospital visits in 2010 for gastrointestinal distress that suggested food-borne illness and each of these patients could potentially be tested for food borne pathogens. |

We anticipate that the market for the molecular diagnostic assays on which we are focused will increase significantly over the next several years. We believe that many factors are driving growth of this market, particularly the accelerating adoption of molecular testing inside the hospital micro-biology lab. Based on published research we believe that fewer than half of all hospitals are currently using molecular testing for their infectious disease testing. More importantly, we believe that a far smaller fraction of all testing done in hospital labs is molecular. We believe that as molecular testing becomes more cost effective, its advantages of faster time to result and higher sensitivity relative to legacy testing methods will lead more and more hospitals to convert to molecular testing.

Our diagnostic tests are currently sold in the United States, Europe and New Zealand. We currently utilize a direct sales and support team in the United States and in certain key European countries and New Zealand we utilize distributors, which we expect will be augmented by marketing partners and distributors in other strategic areas as we expand internationally.

According to the US Center for Disease Control, in 2011 there were approximately 5,700 hospitals in the United States, approximately 4,900 of which are under 400 beds and which we refer to as small to medium sized hospitals. According to outside research, fewer than half of those smaller hospitals have made the switch to molecular methods for diagnosing infectious disease. Based on our competitors’ public statements and published independent reports, we believe that 20% of small-to-medium sized hospitals have a sample to result molecular system. We believe these hospitals are excellent candidates for our molecular diagnostic systems. We believe that our platform will enable these hospitals—many of which could not previously afford more expensive or complex molecular diagnostic testing platforms—to modernize their laboratory testing and provide better patient care at an affordable cost.

The first step to acquiring a customer is an evaluation. During the evaluation period, potential customers utilize our platform alongside their current testing method (molecular or non-molecular) and at the end of the evaluation period determine if they are interested in switching to our platform, as evidenced by the purchase of our assays on a recurring basis, or by remaining with their current testing method. Our recent customer and evaluation history is as follows (excluding Staph ID/R and STEC diagnostic assays as they were in the beginning stages of the evaluation period):

|

|

|

Total U.S. Customers |

|

|

C. Diff Customers |

|

C. Diff Penetration |

|

Group B Strep Customers |

|

|

Group B Strep Penetration |

||

|

Third Quarter 2014 |

|

|

80 |

|

|

80 |

|

100% |

|

|

0 |

|

|

NA |

|

Fourth Quarter 2014 |

|

|

84 |

|

|

84 |

|

100% |

|

|

0 |

|

|

NA |

|

First Quarter 2015 |

|

|

101 |

|

|

101 |

|

100% |

|

|

0 |

|

|

NA |

|

Second Quarter 2015 |

|

|

115 |

|

|

115 |

|

100% |

|

|

0 |

|

|

NA |

|

Third Quarter 2015 |

|

|

143 |

|

|

142 |

|

99% |

|

|

25 |

|

|

17% |

|

Fourth Quarter 2015 |

|

|

186 |

|

|

185 |

|

99% |

|

|

47 |

|

|

25% |

|

First Quarter 2016 |

|

|

222 |

|

|

219 |

|

99% |

|

|

61 |

|

|

27% |

|

Second Quarter 2016 |

|

|

260 |

|

|

253 |

|

99% |

|

|

78 |

|

|

30% |

|

Third Quarter 2016 |

|

|

255 |

|

|

248 |

|

99% |

|

|

78 |

|

|

30% |

|

Fourth Quarter 2016 |

|

|

244 |

|

|

234 |

|

96% |

|

|

74 |

|

|

30% |

Research and Development

As of December 31, 2016 we had 50 employees focused on research and development. Our research and development expenditures were approximately $13.4 million and $8.5 million for the years ended

12

December 31, 2016 and 2015, respectively. The increase in research and development expenses from 2015 to 2016 was primarily due to our focus on growing our diagnostic assay pipeline. In the future we expect to continue to allocate resources to developing and obtaining regulatory approval for assays under development and expect to continue developing additional assays and conducting clinical trials. We will also allocate research and development resources to improve our product reliability and enhance our diagnostic cartridge manufacturing process.

In addition to the four assays that have received FDA approval, we have two assays submitted for FDA approval and four assays in late stage development. Our product offerings will include low-plex tests, multi-plex panels and direct from whole blood tests or panels.

Manufacturing

We manufacture our proprietary diagnostic cartridges and analyzers in Salt Lake City, Utah. We currently hand-build our diagnostic cartridges and purchase materials at higher per unit cost due to lower purchase volumes. We believe that investment in automation of portions of our manufacturing and assembly process and volume purchase pricing will significantly improve our gross margins and enhance our ability to provide a low cost solution to customers. We perform reagent formulation, diagnostic cartridge manufacturing and packaging of final components and diagnostic cartridges in accordance with applicable guidelines for medical device manufacturing. We currently lease approximately 33,000 square feet of manufacturing space, which we believe will be adequate to meet our manufacturing needs for the foreseeable future. The lease expires in April 2017 and has two options, each for a three year renewal term. We also rely on third party suppliers, including sole source suppliers in certain instances, for certain reagents used in our products and much of the disposable component molding for our test cartridges.

We have implemented a quality management platform designed to comply with FDA regulations and ISO standards governing diagnostic medical device products. These regulations carefully control the design, manufacture, testing and release of diagnostic testing products, as well as raw material receipt and control. We also have controlled methods for the consistent manufacturing of our proprietary diagnostic cartridge, and analyzers at our facility.

Sales and Marketing

Our current sales and marketing strategy is to both expand our footprint of installed hospitals and stand-alone laboratory sites in addition to increasing the number and volume of diagnostic assays utilized at our existing installed base of customers. Our assays are sold in the United States through a nine person direct sales force and a technical specialist service organization of five, which is supported by a centralized team of marketing, customer support, and technical support personnel.

Our sales representatives typically have experience in molecular diagnostic testing and a network of hospital contacts within their respective territories. We utilize our representatives’ knowledge along with market research databases and relationships with Group Purchasing Organizations (GPOs), Integrated Delivery Networks (IDNs) and other strategic partnerships to target and qualify prospects. We execute a variety of surveys and strategies to determine the buying criteria of the different customer segments we serve, and adapt our offering and strategies to best serve our target audience. To support our expanding molecular assay menu and the anticipated growth in our customer base, we continue to make investments in a variety of market outreach programs, campaigns and technologies.

In the United States, our sales process nearly always includes a customer evaluation period during which a site receives training on our platform and on the specific assay(s) they are evaluating. As part of the evaluation process, the evaluating site runs validations against their current method to assess accuracy, overall cost and workflow of the Great Basin platform. Upon successful validation and upon purchase of product, the evaluating entity becomes a customer. This process has taken between 25 and 64 days, depending on the product(s) being evaluated, from the time we install the analyzer at the evaluation site to acceptance as a customer. Our sales cycle has decreased over time due improvements we have made to the selling process and to higher market acceptance of molecular testing for infectious diseases. For example, for our customers

13

that run the C. diff test, during 2014 the sales cycle was 74 days, during the first half of 2015 the sales cycle was 65 days, during the second half of 2015 the sales cycle was 35 days and the sales cycle was 20 days by the end of 2016.

The analyzer is provided to the customers for their use with our assay but we retain ownership and control of the analyzer; we refer to our relationship with our customers as a vending machine model (or modified razor/razor blade). The customer buys our proprietary diagnostic cartridge from us and utilizes one disposable test cartridge each time an assay is run. Our revenue from U.S. customers is derived solely from the sales of assays.

We refer to the percentage of customers that elect to switch to our platform and purchase our diagnostic tests after receiving and evaluating our platform as our “win rate”. This is a metric that we use to determine our sales efficiency and our market acceptance. Our win rate calculation is determined without any minimum or recurring purchase threshold. Our win rates over various periods since we launched our first product commercially are as follows:

|

|

|

Number of Evaluations |

|

|

Win Rate |

|

||

|

Full Year 2013 |

|

|

86 |

|

|

|

69% |

|

|

Full Year 2014 |

|

|

49 |

|

|

|

76% |

|

|

Full Year 2015 |

|

|

125 |

|

|

|

85% |

|

|

1st Quarter 2016 |

|

|

40 |

|

|

|

85% |

|

|

2nd Quarter 2016 |

|

|

49 |

|

|

|

88% |

|

|

3rd Quarter 2016 |

|

|

24 |

|

|

|

79% |

|

|

4th Quarter 2016 |

|

|

7 |

|

|

|

86% |

|

|

Since Commercial Launch |

|

|

397 |

|

|

|

80% |

|

We offer our C. diff test and our platform for sale in the European Union and New Zealand through a network of distributors. Unlike the U.S. market, we sell the platform and assay to the distributor, who then sells them directly to the customer. There were no sales of the analyzer platform during the years ended December 31, 2016 and 2015.

Customers

For the year ended on December 31, 2016, we did not have any customer that represented more than 5% of our total revenue. For the year ended December 31, 2015 one customer, Vista Clinical Lab, represented 7.4% of our total revenue.

We define customers in terms of the number of customer sites actively reporting results using our platform. As of December 31, 2016, we had 265 customers worldwide (244 in the United States and 21 in the rest of the world), who use an aggregate of 498 analyzers.

Our U.S. customers represented approximately 99% of our total revenue for the year ended December 31, 2016 and approximately 98% of our total revenue for the year ended December 31, 2015. We do not enter into sales agreements with our U.S. customers and sell our products using purchase orders. We enter into distribution agreements with distribution partners for sales outside the U.S.

Competition

We primarily compete with other molecular diagnostic testing manufacturers, such as Cepheid, Meridian Bioscience, Inc., Nanosphere, Inc., Qiagen NV, Roche Diagnostics, Quidel Corporation, bioMerieux (which recently acquired Biofire Diagnostics, Inc.), T2 Biosystems, Becton, Dickinson and Company, GenMark Diagnostics, Inc., Hologic and others. We believe that we compete primarily on the basis of our platform’s speed, accuracy, ease of use and relatively low cost. We believe that the approval of additional assays will make our solution more attractive to our customers and prospective customers.

14

Many of our competitors have substantially greater financial, technical, research and other resources and larger, more established marketing, sales and distribution organizations than we do. Many of our competitors also offer broader product lines and have greater brand recognition than we do. Moreover, our existing and new competitors may make rapid technological developments that may result in our technologies and products becoming obsolete before we recover the expenses incurred to develop them or before they generate significant revenue.

Intellectual Property, Proprietary Technology

We integrate capabilities in platform design, development, production and DNA amplification technologies, along with design, development and manufacture of primers, probes, dyes, quenchers and other individual reagent components. We have and are continuing to develop our own proprietary intellectual property along with licensing specific third-party technologies.

We have an issued patent covering bpHDA, which is used in our C. diff test. bpHDA, or Blocked Primer Helicase Dependent Amplification, is our patented technology creating “target-dependent hot start” functionality in HDA amplification reactions. bpHDA utilizes a blocked primer technology such that amplification is not activated until the target analyte of interest is bound to the blocked primer at an elevated temperature used for HDA amplification, wherein the block is removed by a highly specific enzyme, allowing for amplification to proceed. We believe this approach significantly improves assay speed and limits of sensitivity such that single cells present in clinical specimens may be amplified to detectable levels in as few as 17 minutes. Multiplex product development is also simplified, allowing for more complex assays in a single reaction with up to four unique primer sets demonstrated to work since December 31, 2014.

(BP)-HDA: Great Basin Proprietary Hot Start Amplification Technology

We also have an issued patent for our amplification method in the presence of the coated silicon chip, a method which we intend to use in each of our assays. We also have an issued patent for the AMPED signal amplification method, which we intend to utilize in assays currently under development. The issued patents described above were issued in the United States and each expires in 2029. Our issued patents are pending in Europe and Canada as well. All current maintenance fees payable regarding these issued patents have been paid.

Our competitive success will be affected in part by our continued ability to obtain and maintain patent protection for our inventions, technologies and discoveries, including intellectual property that includes technologies that we license. We have patents covering technologies of our own and have licensed technologies from others. Our pending patent applications may lack priority over applications submitted by third parties or may not result in the issuance of

15

patents. Even if issued, our patents may not be sufficiently broad to provide protection against competitors with similar technologies and may be challenged, invalidated or circumvented.

In addition to patents, we rely on a combination of trade secrets, copyright and trademark laws, nondisclosure agreements, licenses and other contractual provisions and technical measures to maintain and develop our competitive position with respect to intellectual property. Nevertheless, these measures may not be adequate to safeguard the technology underlying our products. For example, employees, consultants and others who participate in the development of our products may breach their agreements with us regarding our intellectual property, and we may not have adequate remedies for the breach. We also may not be able to effectively protect our intellectual property rights in some foreign countries, as many countries do not offer the same level of legal protection for intellectual property as the United States. Furthermore, for a variety of reasons, we may decide not to file for patent, copyright or trademark protection outside of the United States. Our trade secrets could become known through other unforeseen means. Notwithstanding our efforts to protect our intellectual property, our competitors may independently develop similar or alternative technologies or products that are equal or superior to our technology. Our competitors may also develop similar products without infringing on any of our intellectual property rights or design around our proprietary technologies. Furthermore, any efforts to enforce our proprietary rights could result in disputes and legal proceedings that could be costly and divert attention from our business. We could also be subject to third-party claims that we require additional licenses for our products, and such claims could interfere with our business. If our products infringe the intellectual property rights of others, we could face costly litigation, which could cause us to pay substantial damages and limit our ability to sell some or all of our products. Even if our products were determined not to infringe the intellectual property rights of others, we could incur substantial costs in defending any such claims.

We hold non-exclusive licenses to key technologies from BioHelix related to isothermal amplification of nucleic acid targets, utilizing helicase-dependent amplification, or HDA. This license is limited to the fields of human diagnostic testing utilizing our solid chip surface detection and contains diligence and U.S. preference provisions. To date, these technologies have resulted in three issued U.S. patents, one issued European patent and one pending international patent family. Additionally, these technologies may include related technologies that BioHelix may develop in the future. The BioHelix technologies are the basis of our DNA amplification approach. In August 2010, we entered into a license agreement with Integrated DNA Technologies, or IDT, related to the use of blocked primers. The license is exclusive to the fields of amplification utilizing HDA and detection of diagnostic targets in human in-vitro diagnostics, but is non-exclusive to all oncology and human papilloma virus targets or markers. These technologies have resulted in three pending U.S. patent applications and one issued European patent.

Government Regulation

The design, development, manufacture, testing and sale of our molecular diagnostic assays are subject to regulation by numerous governmental authorities, principally the FDA, and corresponding state and foreign regulatory agencies.

Regulation by the FDA

In the United States, the Food, Drug and Cosmetic Act, or FDCA, FDA regulations and other federal and state statutes and regulations govern, among other things, medical device design and development, pre-clinical and clinical testing, premarket clearance or approval, registration and listing, manufacturing, labeling, storage, advertising and promotion, sales and distribution, export and import, and post-market surveillance. The FDA regulates the design, manufacturing, servicing, sale and distribution of medical devices, including molecular diagnostic test kits and instrumentation platforms. Failure to comply with applicable U.S. requirements may subject a company to a variety of administrative or judicial sanctions, such as FDA refusal to approve pending applications, warning letters, product recalls, product seizures, total or partial suspension of production or distribution, injunctions, fines, civil penalties and criminal prosecution.

Unless an exemption applies, each medical device we wish to distribute commercially in the United States will require marketing authorization from the FDA prior to distribution. The two primary types of FDA marketing authorization required applicable to a device are premarket notification, also called 510(k) clearance, and premarket approval, also called PMA. The type of marketing authorization required is generally linked to the classification of

16

the device. The FDA classifies medical devices into one of three classes (Class I, II or III) based on the degree of risk the FDA determines to be associated with a device and the level of regulatory control deemed necessary to ensure the device’s safety and effectiveness. Devices requiring fewer controls because they are deemed to pose lower risk are placed in Class I. Class I devices are deemed to pose the least risk and are subject only to general controls applicable to all devices, such as requirements for device labeling and adherence to the FDA’s current Good Manufacturing Practices and Quality Platform Requirements, as reflected in its Quality System Regulation, or QSR. Class II devices are intermediate risk devices that are subject to general controls and may also be subject to special controls such as performance standards, product-specific guidance documents, special labeling requirements, patient registries or post-market surveillance. Class III devices are high risk devices for which insufficient information exists to assure safety and effectiveness solely through general or special controls. Class III devices include life-sustaining, life-supporting or implantable devices, devices of substantial importance in preventing impairment of human health, or which present a potential, unreasonable risk of illness or injury.

Most Class I devices and some Class II devices are exempted by regulation from FDA’s premarket review requirement and can be commercialized without prior authorization from the FDA. Some Class I devices that have not been so exempted and most Class II devices are eligible for marketing through the 510(k) clearance process. By contrast, devices placed in Class III generally require PMA or 510(k) de novo clearance prior to commercial marketing.

Our Stool Bacterial Pathogen Panel and Group B Strep Test are both Class I devices and are eligible for marketing through the 510(k) clearance process. Our C. Diff test and Staphylococcus Identification and Resistance Panel are Class II devices and also are eligible for marketing through the 510(k) clearance process. Our two assays currently under FDA review have been submitted as Class II devices with a 501(k) application.

510(k) Clearance

To obtain 510(k) clearance for a medical device, an applicant must submit a premarket notification to the FDA demonstrating that the device is “substantially equivalent” to a device legally marketed in the United States that is not subject to PMA, commonly known as the “predicate device.” A device is substantially equivalent if, with respect to the predicate device, it has the same intended use and has either (i) the same technological characteristics or (ii) different technological characteristics and the information submitted demonstrates that the device is as safe and effective as a legally marketed device and does not raise different questions of safety or effectiveness. Demonstration of substantial equivalence may require clinical data. Although completion of the 510(k) review process is targeted for 90 days, these reviews typically take longer (e.g., up to 12 months or more) due to stoppage of the FDA review clock to address requests for additional information. Payment of a user fee is required for the FDA to initiate review of a 510(k) submission.

After a device has received 510(k) clearance for a specific intended use, any change or modification that significantly affects its safety or effectiveness, such as a significant change in the design, materials, method of manufacture or intended use, may require a new 510(k) clearance or PMA. The determination as to whether or not a modification could significantly affect the device’s safety or effectiveness is initially left to the manufacturer using available FDA guidance; however, the FDA may review this determination to evaluate the regulatory status of the modified product at any time and may require the manufacturer to cease marketing and recall the modified device until 510(k) clearance or PMA is obtained. The manufacturer may also be subject to significant regulatory fines or penalties.

Before submitting a medical device for 510(k) clearance, a series of studies (e.g., method comparison, precision, reproducibility, interference and stability studies) must be conducted to characterize the performance of the test.

In addition, clinical studies may be required to validate these performance characteristics in a clinical setting as well as to ensure that the intended users can perform the test successfully.

Although clinical investigations of most devices are subject to the investigational device exemption, or IDE, requirements, clinical investigations of molecular diagnostic tests, including our assays and assays under development, are generally exempt from the IDE requirements. Thus, clinical investigations by intended users for intended uses of our assays generally do not require the FDA’s prior approval, provided the clinical evaluation

17

testing is non-invasive, does not require an invasive sampling procedure that presents a significant risk, does not intentionally introduce energy into the subject and is not used as a diagnostic procedure without confirmation by another medically established test or procedure. In addition, products must be appropriately labeled per FDA regulations to reflect the intended use of the product (e.g., for research use only or for investigational use only) and distribution controls must be established to assure that such products are distributed for those specified purposes.

PMA Applications

PMA applications must be supported by valid scientific evidence, which typically requires extensive performance data, including technical, pre-clinical, clinical and stability data, to demonstrate the safety and effectiveness of the device. A PMA application must also include a complete description of the device and its components, a detailed description of the methods, facilities and controls used to manufacture the device, and the proposed labeling. Payment of a user fee is required for FDA to initiate review of a PMA application.

During the PMA application review period, the FDA may request additional information or clarification of information provided in the application. In addition, the FDA will conduct a pre-approval inspection of the manufacturing facility or facilities to ensure compliance with the QSR, which requires manufacturers to follow design, testing, control, documentation and other quality assurance procedures.

Although FDA review of an initial PMA application is required by statute to take between six to ten months, these reviews typically take longer (e.g., up to 2 years) due to stoppage of the FDA review clock to address requests for additional information. The FDA can delay, limit or deny approval of a PMA application for many reasons, including:

|

|

• |