Attached files

| file | filename |

|---|---|

| 8-K/A - TRINITY CAPITAL CORP | form8ka_20170627.htm |

1 AnnualShareholderMeeting Free Writing ProspectusFiled Pursuant to Rule 433Registration Statement No. 333-218952Dated June 27, 2017

2 Forward Looking Statements This presentation contains forward looking statements of the Company within the meaning of the Private Securities Litigation Reform Act of 1995, with respect to the financial condition, results of operations, plans, objectives, future performance and business of the Company. Actual results could differ materially from the results indicated in the presentation because of risks and uncertainties, known or unknown (many of which are beyond the Company’s control), including those described in Item 1A “Risk Factors” in the Company’s Form10-K for the year ended December 31, 2016. Although the Company believes that the assumptions underlying the forward-looking statements are reasonable, any of the assumptions could prove to be inaccurate. All subsequent written and oral forward-looking statements attributable to the Company or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements above. All statements in this presentation, including forward-looking statements, speak only as of the date they are made, and the Company undertakes no obligation to update or revise any statement in light of new information or future events, except as required by law. The Company has filed a registration statement (including a prospectus), which is preliminary and subject to completion, with the Securities and Exchange Commission for the offering mentioned in this communication. Before you invest, you should read the prospectus in that registration statement and the other documents that the Company has filed with the Securities and Exchange Commission for more complete information about the Company and the offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the Company, Boenning & Scattergood, Inc., as our financial advisor for the offering, or Continental Stock Transfer & Trust Company, as our subscription agent in the offering, will arrange to send you a prospectus, once available, if you request it by contacting the Company at (505) 662-5171, Boenning & Scattergood at (866) 326-8186 or trinityinfo@boenninginc.com or Continental at (917) 262-2378.

3 James E. Goodwin, Jr.Your new Chairman of the Board Member of the Boards of Directors of Trinity and the Bank since 2013. Chair of the Audit Committee and serves as the audit committee financial expert, as defined under the SEC rules and regulations. Chair of the Board’s Asset/Liability Management Committee and is a member of the Board’s Compensation, and Loan and Strategic Planning Committees. Previously a Partner in the firm of PricewaterhouseCoopers LLP and served as a member of the firm’s U.S. Board of Partners and Principals. Member of the Board of Directors of The National Dance Institute of New Mexico. Member of the Audit Committee of the New Mexico State Investment Council.

4

5

6 6 Board of Directors 6

7 2017 Annual Shareholder Meeting

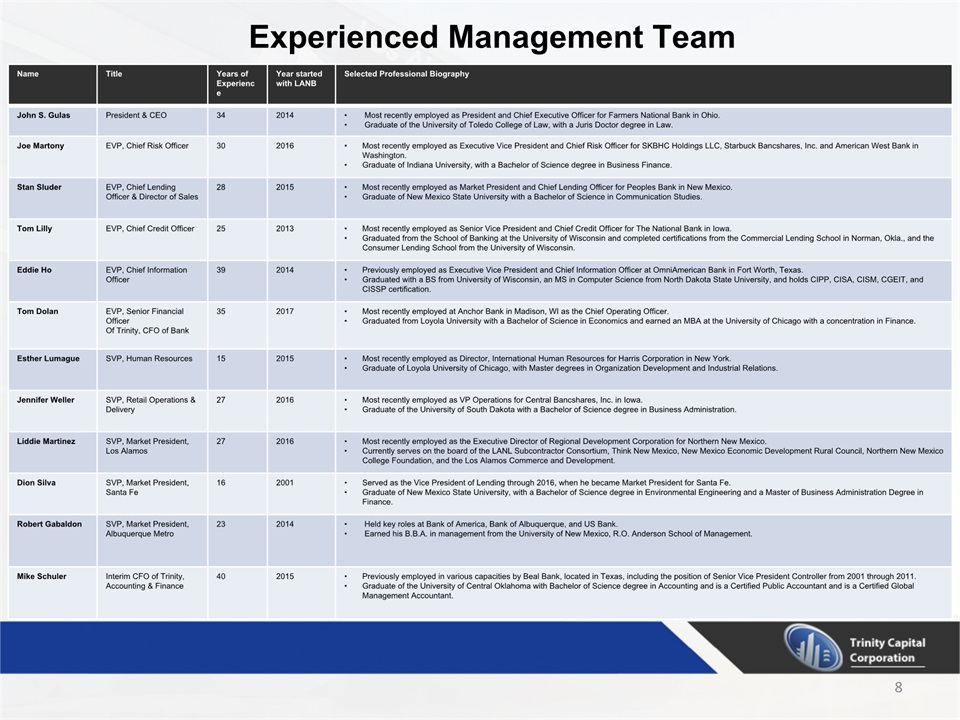

8 Experienced Management Team Name Title Years of Experience Year started with LANB Selected Professional Biography John S. Gulas President & CEO 34 2014 Most recently employed as President and Chief Executive Officer for Farmers National Bank in Ohio. Graduate of the University of Toledo College of Law, with a Juris Doctor degree in Law. Joe Martony EVP, Chief Risk Officer 30 2016 Most recently employed as Executive Vice President and Chief Risk Officer for SKBHC Holdings LLC, Starbuck Bancshares, Inc. and American West Bank in Washington. Graduate of Indiana University, with a Bachelor of Science degree in Business Finance. Stan Sluder EVP, Chief Lending Officer & Director of Sales 28 2015 Most recently employed as Market President and Chief Lending Officer for Peoples Bank in New Mexico. Graduate of New Mexico State University with a Bachelor of Science in Communication Studies. Tom Lilly EVP, Chief Credit Officer 25 2013 Most recently employed as Senior Vice President and Chief Credit Officer for The National Bank in Iowa.Graduated from the School of Banking at the University of Wisconsin and completed certifications from the Commercial Lending School in Norman, Okla., and the Consumer Lending School from the University of Wisconsin. Eddie Ho EVP, Chief Information Officer 39 2014 Previously employed as Executive Vice President and Chief Information Officer at OmniAmerican Bank in Fort Worth, Texas.Graduated with a BS from University of Wisconsin, an MS in Computer Science from North Dakota State University, and holds CIPP, CISA, CISM, CGEIT, and CISSP certification. Tom Dolan EVP, Senior Financial OfficerOf Trinity, CFO of Bank 35 2017 Most recently employed at Anchor Bank in Madison, WI as the Chief Operating Officer.Graduated from Loyola University with a Bachelor of Science in Economics and earned an MBA at the University of Chicago with a concentration in Finance. Esther Lumague SVP, Human Resources 15 2015 Most recently employed as Director, International Human Resources for Harris Corporation in New York. Graduate of Loyola University of Chicago, with Master degrees in Organization Development and Industrial Relations. Jennifer Weller SVP, Retail Operations & Delivery 27 2016 Most recently employed as VP Operations for Central Bancshares, Inc. in Iowa.Graduate of the University of South Dakota with a Bachelor of Science degree in Business Administration. Liddie Martinez SVP, Market President, Los Alamos 27 2016 Most recently employed as the Executive Director of Regional Development Corporation for Northern New Mexico. Currently serves on the board of the LANL Subcontractor Consortium, Think New Mexico, New Mexico Economic Development Rural Council, Northern New Mexico College Foundation, and the Los Alamos Commerce and Development. Dion Silva SVP, Market President, Santa Fe 16 2001 Served as the Vice President of Lending through 2016, when he became Market President for Santa Fe. Graduate of New Mexico State University, with a Bachelor of Science degree in Environmental Engineering and a Master of Business Administration Degree in Finance. Robert Gabaldon SVP, Market President, Albuquerque Metro 23 2014 Held key roles at Bank of America, Bank of Albuquerque, and US Bank. Earned his B.B.A. in management from the University of New Mexico, R.O. Anderson School of Management. Mike Schuler Interim CFO of Trinity, Accounting & Finance 40 2015 Previously employed in various capacities by Beal Bank, located in Texas, including the position of Senior Vice President Controller from 2001 through 2011. Graduate of the University of Central Oklahoma with Bachelor of Science degree in Accounting and is a Certified Public Accountant and is a Certified Global Management Accountant.

9 Our Turnaround Story

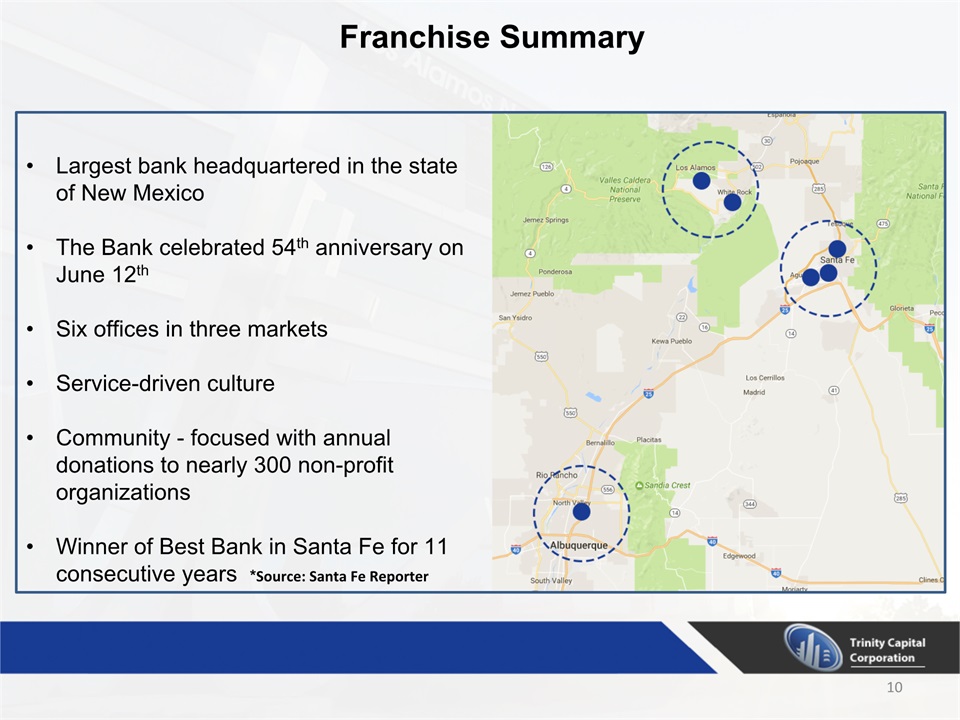

10 Largest bank headquartered in the state of New Mexico The Bank celebrated 54th anniversary on June 12thSix offices in three markets Service-driven cultureCommunity - focused with annual donations to nearly 300 non-profit organizationsWinner of Best Bank in Santa Fe for 11 consecutive years *Source: Santa Fe Reporter Franchise Summary

11 Annual Financial Performance * * Reversal of the majority of the valuation allowance on DTA’s

12 Quarterly Financial Performance

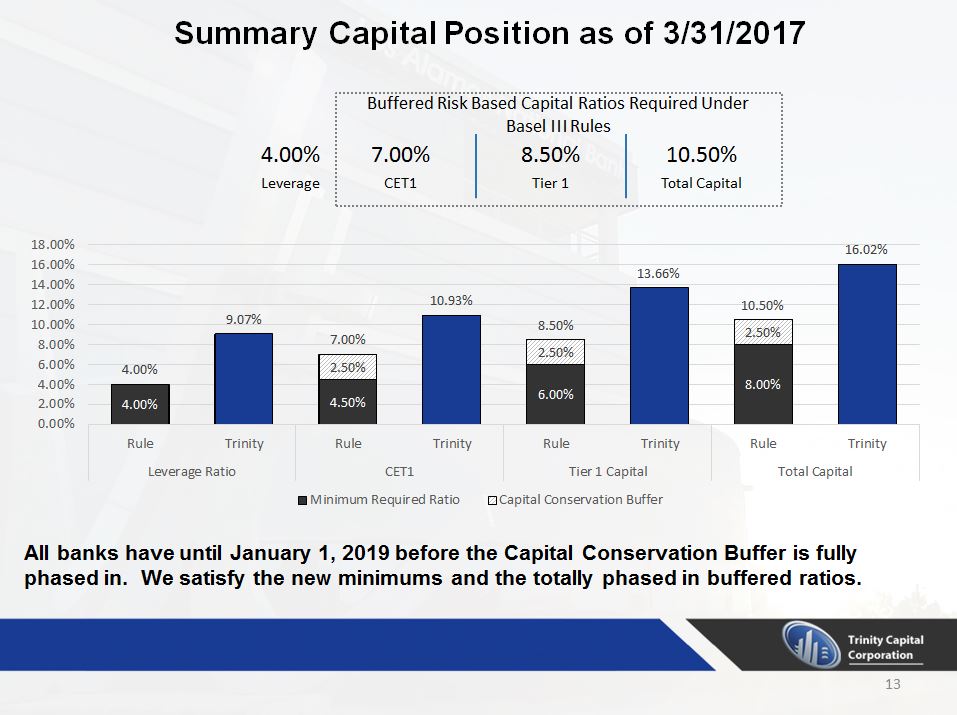

13 7.00% 4.00% 8.50% 10.50% CET1 Leverage Tier 1 Total Capital Summary Capital Position as of 3/31/2017 Buffered Risk Based Capital Ratios Required Under Basel III Rules All banks have until January 1, 2019 before the Capital Conservation Buffer is fully phased in. We satisfy the new minimums and the totally phased in buffered ratios.

14 A superior credit culturePre-requisite to long-term fundamental outperformance. High Performing Banks Tend To Exhibit 6 Key Characteristics Excellent cost control and overall operating efficiencyStandard for nearly every high-performing bank. A high quality funding baseThe foundation of relationship banking. A focused, relationship – based business modelBusiness models designed for relationship banking generate greater multiples than those based solely on transactions. A robust organic growth engine The key to enduring through a low growth, low rate environment flush with cheap funding is to grow organically. Ability to protect and steadily compound EPS & TBV over timeSteady and consistent growth in earnings per share along with tangible book value is directly connected to long- term share price outperformance. Source: Joseph Fenech, Hovde Group

15 Continuing Our Recovery & Executing Our Business Plan Building Shareholder Value

16 Summary Asset Quality *NPAs = 90 + days past due & Accruing + Nonaccrual + OREO Source: SEC filings

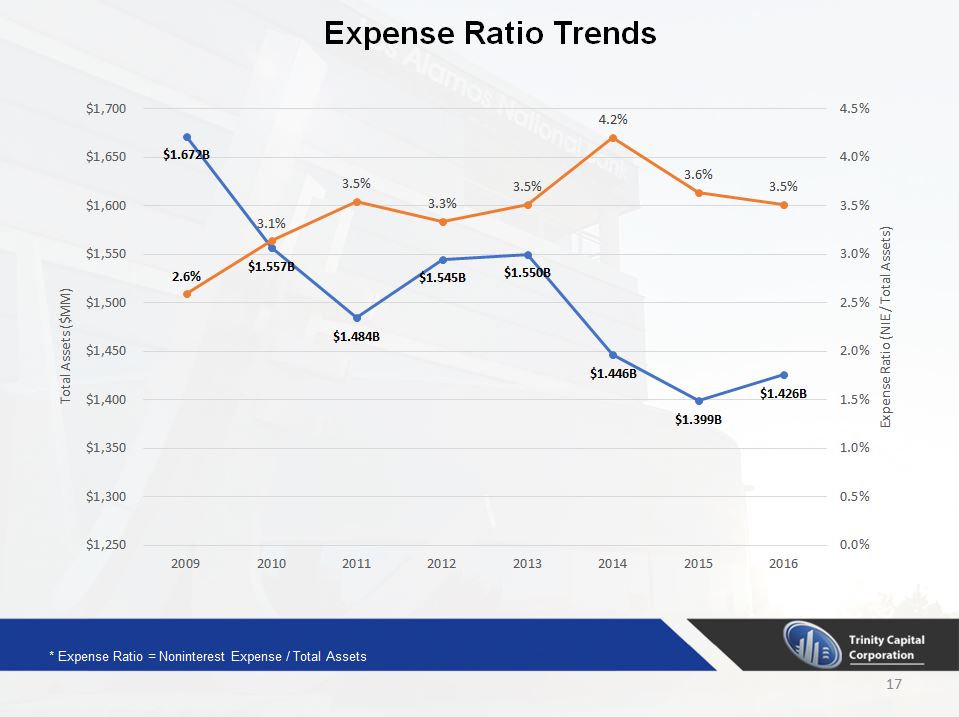

17 Expense Ratio Trends * Expense Ratio = Noninterest Expense / Total Assets

18 Strategic Business Review The Company has undertaken a strategic business review designed to reduce the cost structure of the organization without compromising customer service while mitigating the impact on our employees. We believe this review will: Improve cost controls and overall efficiencies within the Bank.Identify opportunities for expense reduction (sunset legacy systems, space planning, vendor management, operating efficiencies).Improve the budgeting and strategic planning process.Create and distribute internal management reporting to help our managers make more informed decisions. Improve the planning and analysis around making investment decisions.

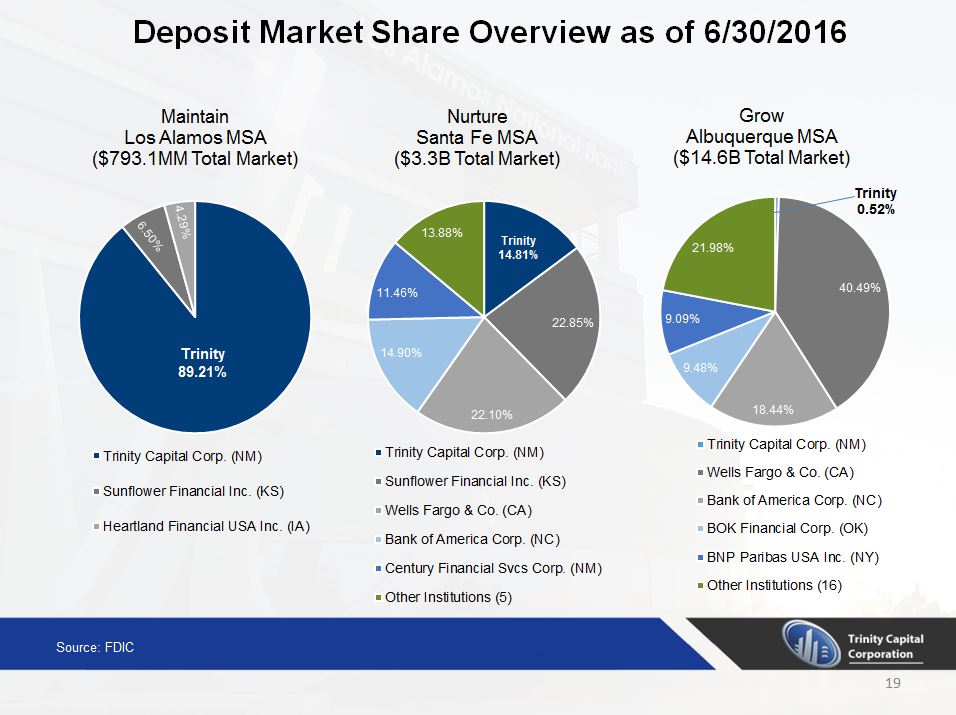

19 Deposit Market Share Overview as of 6/30/2016 Source: FDIC

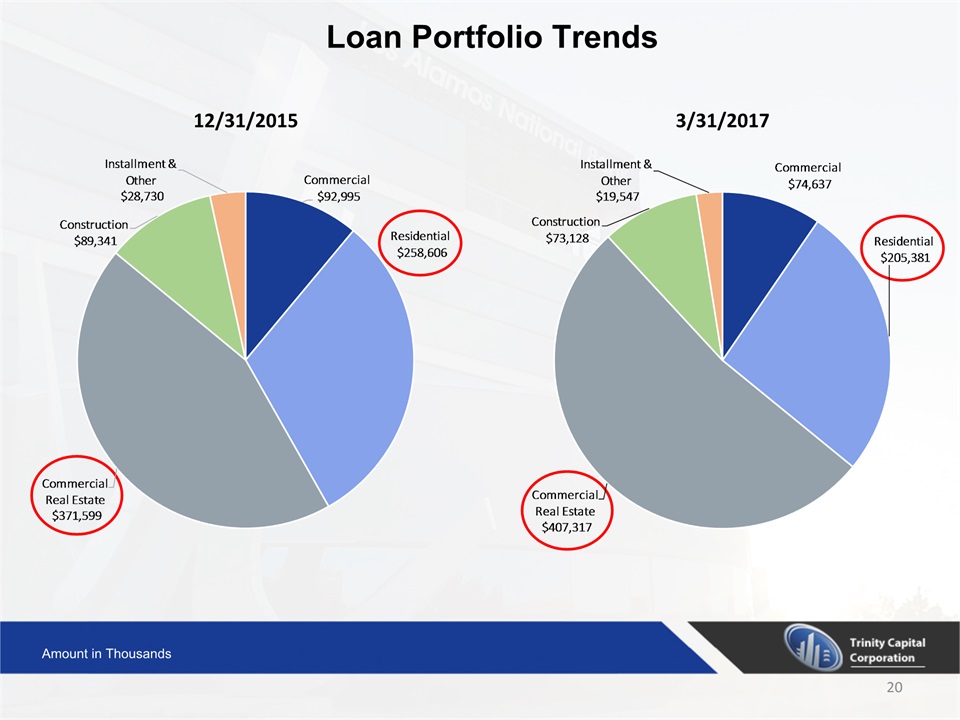

20 Loan Portfolio Trends 12/31/2015 3/31/2017 Amount in Thousands

21 Gross Loan Balance

22 Superior Service Culture WHYTo add value to the lives of our communities, customers and employees.HOWThrough excellent service that is designed to help customers identify and achieve financial goals.WHATProvide deposit and credit products and services that improve the lives of our customers by providing them improved access, information and ideas.

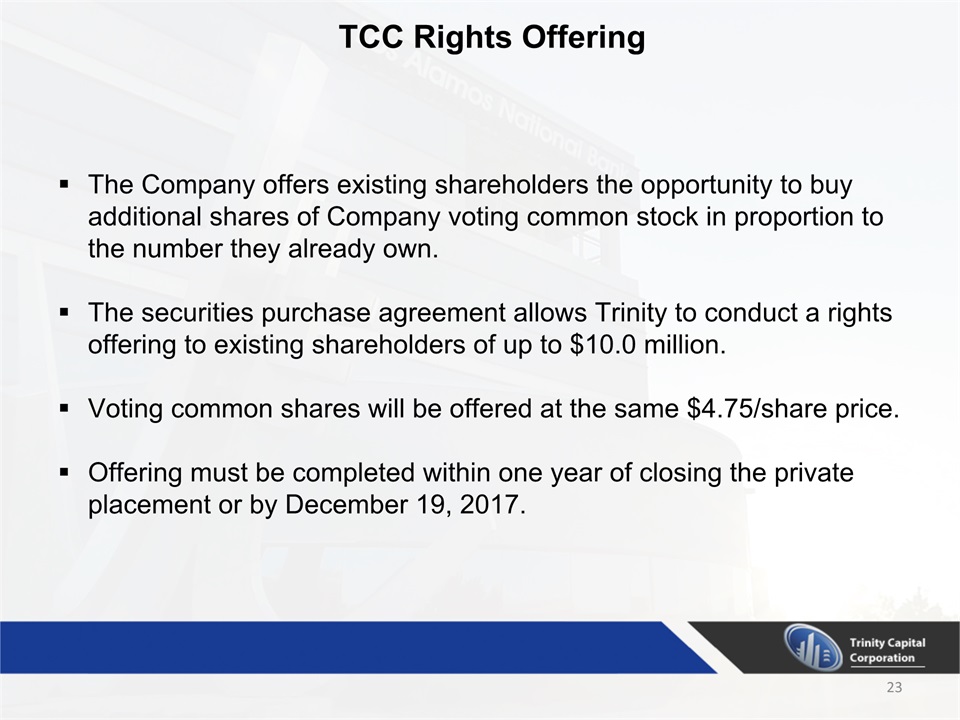

23 TCC Rights Offering The Company offers existing shareholders the opportunity to buy additional shares of Company voting common stock in proportion to the number they already own.The securities purchase agreement allows Trinity to conduct a rights offering to existing shareholders of up to $10.0 million.Voting common shares will be offered at the same $4.75/share price.Offering must be completed within one year of closing the private placement or by December 19, 2017.

24 Key Highlights Experienced and Qualified Management TeamWell-known banking executives with considerable financial service experienceBusiness and community - oriented Board of DirectorsExperienced market presidents and leadersStable Balance Sheet and Strong Capital PositionAs of March 31, 2017, Trinity had 16.0156% total capital ratio, 13.6632% Tier 1 capital ratio, 9.0656% Tier 1 leverage ratio, and 10.9289% CET1 ratioAs of March 31, 2017, Trinity had total assets of $1.4 billion and $778.7 million in total gross loansNonperforming assets have declined 70.1% from December 31, 2011 to March 31, 2017Desirable MarketsLos Alamos since Bank's inception in 1963Santa Fe since 1999Albuquerque since 2011 and positioned for growthCharitable GivingContribute to nearly 300 non-profit organizations annually in excess of $700,000Employee giving campaign raised over $50,000 in aggregate for United Way of Northern New Mexico, Santa Fe Community Foundation and United Way of Central New Mexico in 2016Winner of the 2016 St. Vincent’s Hospital Foundation and Albuquerque Journal’s Philanthropist of the Year Award

25