Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - BAY BANKS OF VIRGINIA INC | v469458_8k.htm |

Exhibit 99.1

Investor Presentation June 2017

Caution Regarding Forward - Looking Statements 2 This presentation contains forward - looking statements (within the meaning of the Private Securities Litigation Reform Act of 1995 ) . Such statements are not historical facts, but rather are based on our current expectations, estimates and projections about our industry, our beliefs and assumptions . Words including “may,” “will,” “could,” “would,” “should,” “anticipate,” “expect,” “intend,” “plan,” “project,” “believe,” “seek,” “estimate” and similar expressions are intended to identify forward - looking statements . These statements are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, some of which remain beyond our control, are difficult to predict, and could cause actual results to differ materially from those expressed or forecasted in the forward - looking statements . Factors that could cause actual results to differ materially from the results anticipated may include, but are not limited to, the following : ( 1 ) competitive pressures among depository and other financial institutions may increase significantly and have an effect on pricing, spending, third - party relationships, and revenue ; ( 2 ) the strength of the United States economy in general and the strength of the local economies in which we conduct operations may be different than expected resulting in, among other things, a deterioration in credit quality or a reduced demand for credit, including the resultant effect on our loan portfolio and allowance for loan losses ; ( 3 ) the rate of delinquencies and amounts of charge - offs, the level of the allowance for loan losses, the rates of loan growth, or adverse changes in asset quality in our loan portfolio, which may result in increased credit risk - related losses and expenses ; ( 4 ) the risk that the preliminary financial information reported herein and our current preliminary analysis will be different when our review is finalized ; ( 5 ) changes in the U . S . legal and regulatory framework ; ( 6 ) adverse conditions in the stock market, the public debt market, and other capital markets (including changes in interest rate conditions) could have a negative impact on our operations . We caution you not to place undue reliance on these forward - looking statements, which reflect management’s view only as of the date of this presentation . We are not obligated to update these statements or publicly release the result of any revisions to them to reflect events or circumstances after the date of this presentation or to reflect the occurrence of unanticipated events .

Bay Banks of Virginia, Inc. is a growth story in Richmond, Virginia with 19 offices in central and eastern Virginia x Attractive footprint with access to high growth markets and a deep - rooted deposit base x Successful acquisition strategy and steady organic growth have vaulted the institution to $841 million in post - merger assets as of April 1, 2017 x Conservative underwriting standards have led to excellent asset quality x Capital levels to support future growth, both organic and acquisitive x Merger synergies are expected to significantly increase earnings x Resourceful leadership team has recruited top talent in the Richmond market 3 In tr odu c t io n

Corporate Goals 4 □ Reach $1.0 billion in assets by the end of 2018 □ Improve earnings performance through increased efficiency □ Successfully achieve merger cost savings and expense numbers by frequently monitoring and tracking progress ▪ Currently, the Company is on target to achieve anticipated cost save synergies as well as remaining within the budget for merger expenses □ Increase presence and overall talent in the Richmond market □ Scale the new wealth management subsidiary, VCB Financial Group, to complement the Bank’s other business lines □ Continue to provide customers with personalized service while using the increased size to offer improved banking products and solutions

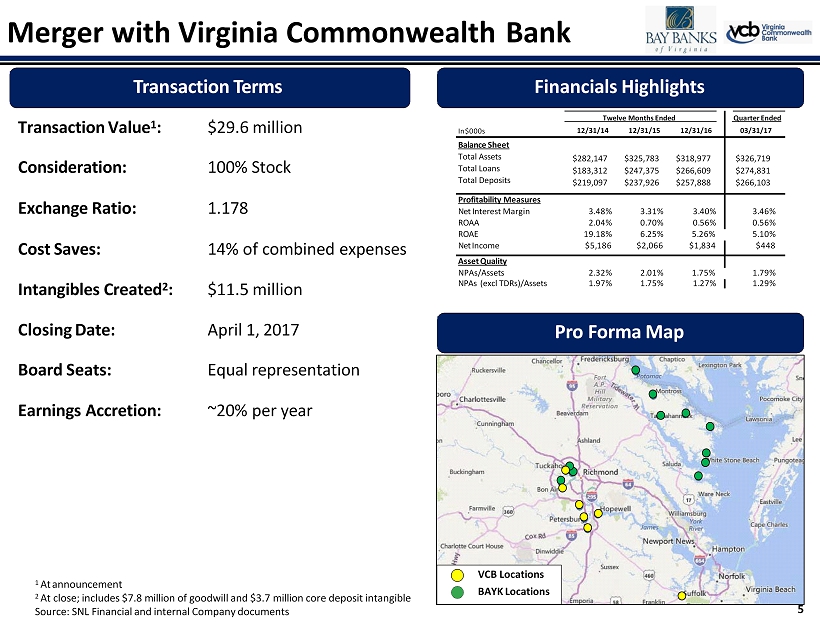

5 Merger with Virginia Commonwealth Bank 1 At announcement 2 At close; includes $7.8 million of goodwill and $3.7 million core deposit intangible Source: SNL Financial and internal Company documents Transaction Value 1 : $29.6 million Consideration: 100% Stock Exchange Ratio: 1.178 Cost Saves: 14% of combined expenses Intangibles Created 2 : $11.5 million Closing Date: April 1, 2017 Board Seats: Equal representation Earnings Accretion: ~20% per year VCB Locations BAYK Locations Transaction Terms Financials Highlights Pro Forma Map In $000s Twelve Months Ended 12/31/14 12/31/15 12/31/16 Quarter Ended 03/31/17 Balance Sheet Total Assets Total Loans Total Deposits $282,147 $183,312 $219,097 $325,783 $247,375 $237,926 $318,977 $266,609 $257,888 $326,719 $274,831 $266,103 Profitability Measures Net Interest Margin 3 . 48 % 3 . 31 % 3 . 40 % 3 . 46 % ROAA 2 . 04 % 0 . 70 % 0 . 56 % 0 . 56 % ROAE 19 . 18 % 6 . 25 % 5 . 26 % 5 . 10 % Net Income $5 , 18 6 $2 , 06 6 $1 , 83 4 $44 8 Asset Quality NPAs/Assets 2 . 32 % 2 . 01 % 1 . 75 % 1 . 79 % NPAs (excl TDRs)/Assets 1 . 97 % 1 . 75 % 1 . 27 % 1 . 29 %

▪ Complementary footprints has created a more diversified franchise ▪ Combination of Bay Bank’s loan generation capacity with Virginia BanCorp’s attractive funding base ▪ Footprint provides significant growth opportunities ▪ Meaningful cost savings and revenue synergies expected ▪ 20%+ EPS accretion for both companies (with full cost savings realized) ▪ Shareholders should benefit from a larger market cap, greater liquidity, and a higher stock valuation ▪ Ability to pay and increase cash dividends going forward ▪ Gaining critical mass – over $800 million in assets ▪ Creates one of the largest community banks headquartered in Richmond ▪ Positioned for future growth with additional M&A opportunities ▪ Attractive franchise in a robust market C omp le - m e n t a r y Markets S ig nif i c a n t Financial Impact Well - P os i t i on ed Franchise Strategic Rationale 6

Pro Forma Balance Sheet 7 Assets BAYK 3/31/2017 VCB 3/31/2017 FMV Adjustments Purchase Adjustments Pro Forma Combined $ % Cash and securities $69 , 303 13 . 7% $38,329 11 . 6% $0 ( $2) $107 , 630 12 . 8% Loans 401 , 268 79 . 6% 272,479 82 . 8% (6,159) a 667 , 588 79 . 4% Other real estate owned 2 , 436 0 . 5% 3,113 0 . 9% 5 , 549 0 . 7% Fixed assets 10 , 859 2 . 2% 3,333 1 . 0% 1,881 b 16 , 073 1 . 9% Goodwill 2 , 808 0 . 6% 0 0 . 0% 7 , 828 f 10 , 636 1 . 3% Core deposit intangible 0 0 . 0% 0 0 . 0% 3 , 670 g 3 , 670 0 . 4% Other assets 17 , 533 3 . 5% 11,966 3 . 6% 439 c 29 , 938 3 . 6% Total assets $504 , 207 100 . 0% $329,220 100 . 0% $841 , 084 100 . 0% Liabilities and Equity Deposits $382 , 500 75 . 9% $267,196 81 . 2% $733 d $650 , 429 77 . 3% Borrowings 75 , 353 14 . 9% 25,000 7 . 6% 100 , 353 11 . 9% Other liabilities 4 , 737 0 . 9% 1,703 0 . 5% 6 , 440 0 . 8% Total liabilities 462 , 590 91 . 7% 293,899 89 . 3% 757 , 222 90 . 0% Common equity 41 , 617 8 . 3% 35,321 10 . 7% (4,572) e 11 , 496 h 83 , 862 10 . 0% Equity 41 , 617 8 . 3% 35,321 10 . 7% 83 , 862 10 . 0% Total liabilities and equity $504 , 207 100 . 0% $329,220 100 . 0% $841 , 084 100 . 0% Notes : a. Net FMV mark on loans b. Estimated FMV mark on fixed assets (based on tax value) c. Net deferred tax asset associated with the FMV marks and adjustments d. Net FMV mark on deposits e. Net after - tax impact of FMV adjustments on equity f. Goodwill created in the transaction g. Core deposit intangible created (equal to 1.9% of VCB's non - CD deposits) h. Net impact of purchase adjustments on equity

L e a de rs hi p Randal R. “Randy” Greene – Vice Chairman, President & Chief Executive Officer Mr. Greene is the President and CEO of Bay Banks of Virginia. He serves on the Boards of Bay Banks, Virginia Commonwealth Bank and Bay Trust Company. He joined the family of companies in the fall of 2011. Randy received his Bachelor of Business Administration from East Tennessee State University in 1982. He began his banking career in 1984 and brings 27 years of community banking and management experience to his new position with the Bay Banks family. Randy most recently was a Regional President of State of Franklin Bank, a division of Jefferson Federal Bank in Johnson City, Tennessee. From 1996 to 2008, he was President and CEO, Director and Founder of State of Franklin Savings Bank and Chairman of its Executive Committee. Randy has substantial knowledge of successfully growing a community bank with experience in all areas of banking, including managing multiple teams, as a senior credit officer with years of direct experience working with regulatory agencies, 25 years of lending experience, and has been directly responsible for managing the asset quality of a $350 million community bank. He was awarded 2015 Outstanding Alumni for the college of business at Eastern Tennessee State University. C. Frank Scott, III – Chairman of the Board, Chairman of VCB Financial Group & President of Virginia Commonwealth Bank Mr. Scott is currently the Chairman of the Board, Chairman of VCB Financial Group and President of Virginia Commonwealth Bank. Before the merger, he was the Chief Executive Officer of Virginia Commonwealth Bank. He served at Virginia Commonwealth Bank since 1999, before becoming CEO in 2011. He is the past President of the Petersburg Lions Club, the Southside Virginia Association of Realtors, and the Tri Cities Independent Insurance Agent’s Association. He is currently a Member of the Board of the Appomattox Educational Foundation, the Prince George Alliance for Education Association, and the Richard Bland College Foundation. He is a Member of Redeemer Lutheran Church in Midlothian, and currently serves as a Member of the Board and as Treasurer. He received his BS degree in Finance from Virginia Tech in 1974 and his MA from the Charles F. Dolan School of Business at Fairfield University in Fairfield Connecticut in 2003. James A. “Jim” Wilson Jr., Chief Financial Officer James A. Wilson, Jr., 56, serves as Executive Vice President and Chief Financial Officer of Bay Banks of Virginia and Virginia Commonwealth Bank. Prior to the merger, he served as Executive Vice President, Treasurer and Chief Financial Officer of Virginia Commonwealth Bank and as Treasurer/Vice President of Virginia BanCorp. Mr. Wilson joined Virginia Commonwealth Bank in August 1989 as Treasurer/Controller and was soon thereafter promoted to Senior Vice President/Chief Financial Officer. In 2012, he was promoted to Executive Vice President/Chief Financial Officer of Virginia Commonwealth Bank. Mr. Wilson is a Certified Public Accountant, CFA® charterholder and Chartered Global Management Accountant. 8

Douglas F. Jenkins, Jr. – Chief Banking Officer Mr. Jenkins has served as Executive Vice President of Bank of Lancaster since December 2011 and of Bay Banks since May 2014. He also currently serves as Chief Banking Officer of Bank of Lancaster. Mr. Jenkins was Senior Vice President of Bank of Lancaster from December 2009 until December 2011 and served as Senior Lending Officer from May 2008 until April 2013. He also served as Retail Delivery Administrator from June 2011 until April 2013. Prior to joining Bank of Lancaster in 2006 as a Business Development Officer, Mr. Jenkins was a Vice President at SunTrust Bank, where he was a member of its Financial Institutions Group. C. Rhodes “Dusty” Boyd, Jr. – Chief Lending Officer Mr. Boyd has served as Executive Vice President and Chief Banking Officer of Virginia Commonwealth Bank since July 2012. Mr. Boyd joined Virginia Commonwealth Bank in April 2011 as Executive Vice President and Chief Credit Officer, a role he served in until July 2012. Prior to joining Virginia Commonwealth Bank, Mr. Boyd was a Vice President in Commercial Banking with The Bank of Richmond and Gateway Bank from 2002 until 2009, and was the Richmond Market President for the Bank of Hampton Roads from March 2009 through December 2010. Mr. Boyd is currently serving a two year term as Chairman of the Lending Executive Committee for the Virginia Banker’s Association. Gary Armstrong – Richmond Market Executive Mr. Armstrong, a 31 - year commercial banking veteran, was hired in January as Richmond Market Executive. Mr. Armstrong most recently served as Park Sterling Bank’s Richmond Market President, a position that immediately followed the acquisition of First Capital Bank in January 2016. At First Capital Bank, he was Executive Vice President and Chief Lending Officer. Prior to that, he spent 11 years with and was a founding management member of Richmond - based First Market Bank, where he managed the Commercial Banking Group. Eric F. Nost – President & Chief Executive Officer of VCB Financial Group Mr. Nost, a financial services executive with over 30 years' experience, has joined Bay Banks to lead its new wealth management subsidiary, VCB Financial Group, as President and CEO. He most recently managed a bank - owned investment firm, C&F Wealth Management Corp., building it to over $400 million in assets under management. A U.S. Navy veteran, Mr. Nost is a graduate of Virginia Military Institute, earned an MBA degree from Liberty University, and is a Certified Financial Planner. L e a de rs hi p 9

10 $9 . 3 0 - 5,000 5 , 00 0 15,000 25,000 35,000 45,000 55,000 4 . 0 0 5 . 0 0 6 . 0 0 7 . 0 0 8 . 0 0 9 . 0 0 10 . 0 0 J u n - 1 6 S e p - 1 6 Dec - 16 M a r - 1 7 J u n - 1 7 BAYK Trading Activity BAYK Stock Trading Activity Research Initiated Source: SNL Financial; data as of June 19, 2017 Me rg er Announced

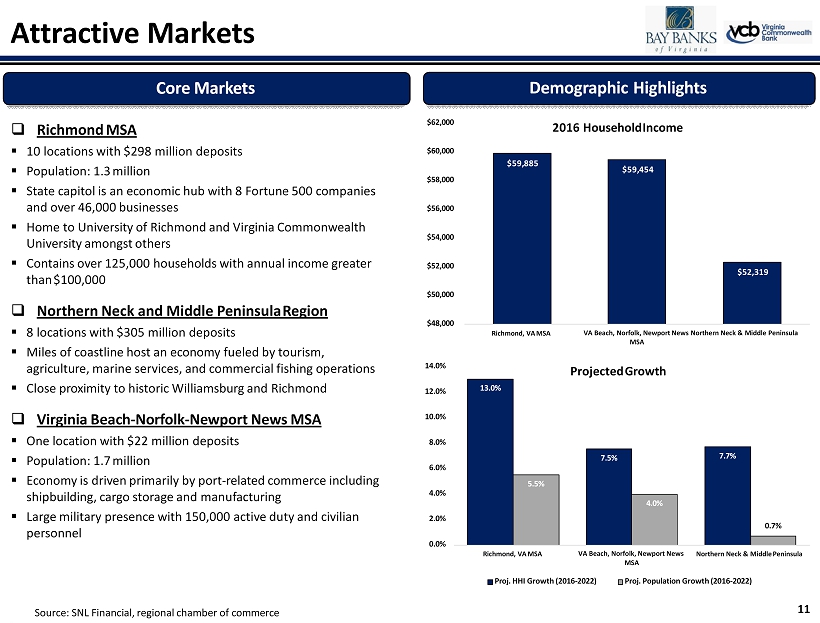

11 Attractive Markets □ Richmond MSA ▪ 10 locations with $298 million deposits ▪ Population: 1.3 million ▪ State capitol is an economic hub with 8 Fortune 500 companies and over 46,000 businesses ▪ Home to University of Richmond and Virginia Commonwealth University amongst others ▪ Contains over 125,000 households with annual income greater than $100,000 □ Northern Neck and Middle Peninsula Region ▪ 8 locations with $305 million deposits ▪ Miles of coastline host an economy fueled by tourism, agriculture, marine services, and commercial fishing operations ▪ Close proximity to historic Williamsburg and Richmond □ Virginia Beach - Norfolk - Newport News MSA ▪ One location with $22 million deposits ▪ Population: 1.7 million ▪ Economy is driven primarily by port - related commerce including shipbuilding, cargo storage and manufacturing ▪ Large military presence with 150,000 active duty and civilian personnel Core Markets 13 . 0% 7 . 5% 7 . 7% 5 . 5% 4.0% 0 . 7% 0 . 0% 2 . 0% 4 . 0% 6 . 0% 8 . 0% 10 . 0% 12 . 0% 14 . 0% Richmond, VA MSA VA Beach, Norfolk, Newport News MSA Northern Neck & Middle Peninsula Projected Growth Proj. HHI Growth (2016 - 2022) Proj. Population Growth (2016 - 2022) $59 , 88 5 $59 , 45 4 $52,319 $48,000 $50,000 $52,000 $54,000 $56,000 $58,000 $60,000 $62,000 Richmond, VA MSA VA Beach, Norfolk, Newport News Northern Neck & Middle Peninsula MSA 2016 Household Income Demographic Highlights Source: SNL Financial, regional chamber of commerce

12 Deposit Market Share Note: Information obtained from regulatory filings as of June 30, 2016 Source: SNL Financial Richmond MSA 2016 N o r t h e rn Neck Region, VA 2016 2016 Number of Total Deposits In Total Market 2016 Number of Total Deposits In Total Market Rank Institution (ST) B r a n c h e s Market ($000) Share (%) Rank Institution (ST) B r a n c h e s Market ($000) Share (%) 1 Bank of America Corp. (NC) 2 3 12 , 319 , 81 0 35 . 6 % 1 Union Bkshs Corp (VA) 8 345 , 92 5 25 . 9 % 2 Wells Fargo & Co. (CA) 6 1 6 , 753 , 64 5 19 . 5 % 2 Bay Banks of Virginia Inc. (VA) 7 294 , 27 5 22 . 0 % 3 SunTrust Banks Inc. (GA) 3 9 4 , 433 , 75 2 12.8% 3 Chesapeake Financial Shares (VA) 6 244,785 18.3% 4 BB&T Corp. (NC) 4 0 3 , 200 , 26 9 9 . 2 % 4 Southern National Bancorp of Virginia (VA) 4 157 , 74 8 11 . 8 % 5 Union Bkshs Corp (VA) 3 6 2 , 501 , 77 6 7 . 2 % 5 BB&T Corp. (NC) 4 128 , 39 0 9 . 6 % 6 C&F Financial Corp. (VA) 1 7 775 , 67 0 2 . 2 % 6 Peoples Bankshares Inc. (VA) 4 114 , 89 9 8 . 6 % 7 TowneBank (VA) 9 735 , 02 1 2 . 1 % 7 Community Bankers Trust Corp (VA) 2 47 , 44 2 3 . 6 % 8 South State Corporation (SC) 8 542 , 04 9 1 . 6 % 8 Woodforest Financial Grp Inc. (TX) 1 1 , 17 2 0 . 1 % 9 Community Bankers Trust Corp (VA) 1 1 518 , 61 9 1 . 5 % Total For Institutions In Market 3 6 1 , 334 , 63 6 100 . 0 % 10 Southern National Bncp of VA (VA) 1 0 416 , 80 3 1 . 2 % 11 First Citizens BancShares Inc. (NC) 5 391 , 05 8 1 . 1 % 12 Village Bank & Trust Finl Corp (VA) 1 0 369 , 63 1 1 . 1 % 13 Bk of Southside Virginia Corp. (VA) 1 0 352 , 68 9 1 . 0 % 14 Bay Banks of Virginia Inc. (VA) 1 0 298 , 12 2 0 . 9 % 15 Capital One Financial Corp. (VA) 1 214 , 28 0 0 . 6 % 16 Bank of McKenney (VA) 7 192 , 92 0 0 . 6 % 17 First Community Bancshares Inc (VA) 5 190 , 66 1 0 . 6 % 18 M&T Bank Corp. (NY) 5 79 , 07 2 0 . 2 % 19 Fulton Financial Corp. (PA) 2 72 , 82 3 0 . 2 % 20 Citizens Bancorp of Virginia (VA) 3 64 , 25 1 0 . 2 % Total For Institutions In Market 32 9 34 , 601 , 86 9 100 . 0 %

13 Recent Richmond Growth With headquarters now in Richmond, Bay Banks is making a strong push to be a dominant presence in the market Gary Armstrong , a 31 - year commercial banking veteran, was hired in January as Richmond Market Executive. Mr. Armstrong most recently served as Park Sterling Bank’s Richmond Market President, a position that immediately followed the acquisition of First Capital Bank in January 2016. At First Capital Bank, he was Executive Vice President and Chief Lending Officer. Prior to that, he spent 11 years with and was a founding management member of Richmond - based First Market Bank, where he managed the Commercial Banking Group. Since joining the team, Mr. Armstrong has filled out his team with a number of talented individuals: ▪ Matt Paciocco - hired as Senior Vice President, Commercial Banking and brings more than 12 years of banking experience in the Richmond area ▪ Del Ward - joined as Senior Vice President, Commercial Banking and brings more than 29 years of banking experience in the Richmond area ▪ Bill Bien - hired as Senior Vice President, Commercial Banking and brings more than 35 years of banking experience in the Richmond area ▪ Additionally, the Company has hired a Residential Construction Lender and Treasury Management Specialist in the Richmond market

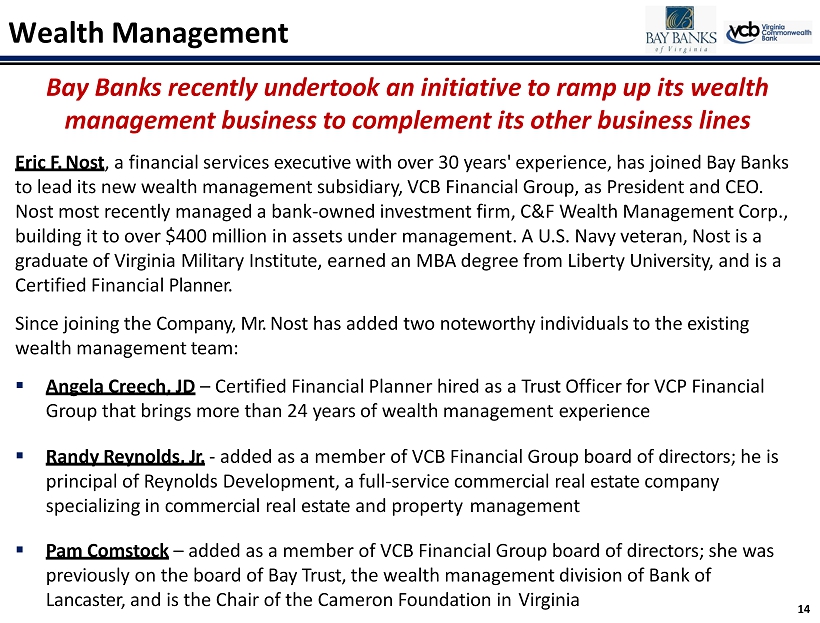

14 Wealth Management Bay Banks recently undertook an initiative to ramp up its wealth management business to complement its other business lines Eric F. Nost , a financial services executive with over 30 years' experience, has joined Bay Banks to lead its new wealth management subsidiary, VCB Financial Group, as President and CEO. Nost most recently managed a bank - owned investment firm, C&F Wealth Management Corp., building it to over $400 million in assets under management. A U.S. Navy veteran, Nost is a graduate of Virginia Military Institute, earned an MBA degree from Liberty University, and is a Certified Financial Planner. Since joining the Company, Mr. Nost has added two noteworthy individuals to the existing wealth management team: ▪ Angela Creech, JD – Certified Financial Planner hired as a Trust Officer for VCP Financial Group that brings more than 24 years of wealth management experience ▪ Randy Reynolds, Jr. - added as a member of VCB Financial Group board of directors; he is principal of Reynolds Development, a full - service commercial real estate company specializing in commercial real estate and property management ▪ Pam Comstock – added as a member of VCB Financial Group board of directors; she was previously on the board of Bay Trust, the wealth management division of Bank of Lancaster, and is the Chair of the Cameron Foundation in Virginia

$334.8 $331.1 $390.5 $456 . 3 $486 . 7 $504 . 2 $334.0 $ 0 . 0 $ 1 0 0 . 0 $ 2 0 0 . 0 $ 3 0 0 . 0 $ 4 0 0 . 0 $ 5 0 0 . 0 $ 6 0 0 . 0 $ 7 0 0 . 0 $ 8 0 0 . 0 $1,000.0 $ 9 0 0 . 0 2 0 12 2 0 13 2 0 14 2 0 15 2 0 16 2 0 1 7 Q 1 A ss e t s ( $ M ) Transformational Asset Growth Merger With Virginia Commonwealth Bank Total: $838.2 15 Source: SNL Financial Note: Regulatory data; dollars in millions

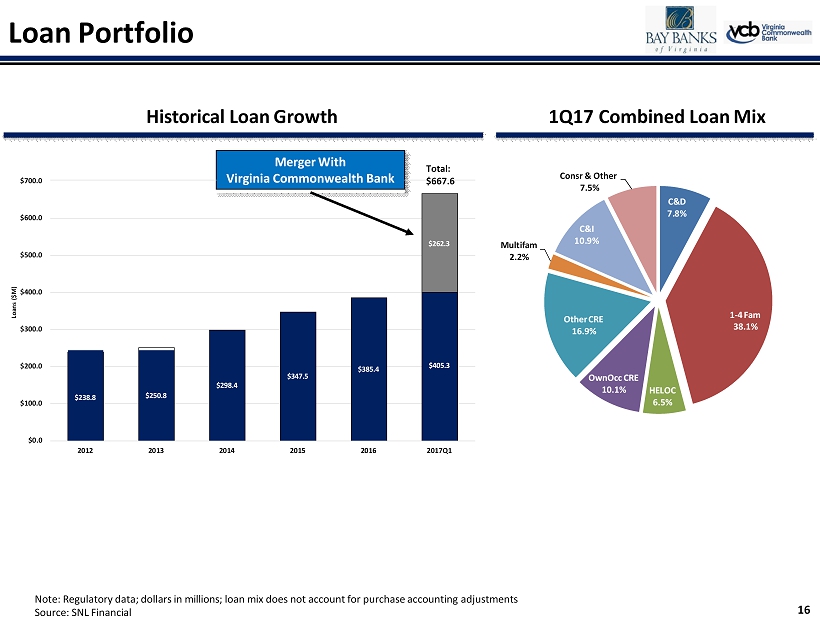

Loan Portfolio Historical Loan Growth 1Q17 Combined Loan Mix $238.8 $250.8 $298.4 $347.5 $385.4 $405.3 $262.3 $ 0 . 0 $100.0 $200.0 $300.0 $400.0 $500.0 $600.0 $700.0 2 0 12 2 0 13 2 0 14 2 0 15 2 0 16 2017Q1 L o a ns ( $ M ) Merger With Virginia Commonwealth Bank Total: $667.6 Note: Regulatory data; dollars in millions; loan mix does not account for purchase accounting adjustments C & D 7 . 8 % 16 Source: SNL Financial 1 - 4 Fam 38.1% H E L O C 6.5% OwnOcc CRE 10.1% Other CRE 16.9% M u l t i f a m 2.2% C&I 10 . 9 % Consr & Other 7.5%

Deposit Growth 1Q17 Combined Deposit Mix Historical Deposit Growth $275.2 $268.3 $307 . 6 $359 . 9 $381 . 7 $382 . 5 $267.9 $ 0 . 0 $ 1 0 0 . 0 $ 2 0 0 . 0 $ 3 0 0 . 0 $ 4 0 0 . 0 $ 5 0 0 . 0 $ 6 0 0 . 0 $ 7 0 0 . 0 2 0 12 2 0 13 2 0 14 2 0 15 2 0 16 2 0 1 7 Q 1 D e po si t s ( $ M ) Total: $650.4 Merger With Virginia Commonwealth Bank Non Int. Bearing 3.8% Note: Regulatory data; dollars in millions; deposit mix does not include purchase accounting adjustments Source: SNL Financial 17 NOW Accts 20.1% MMDA & Sav 38.5% Time Deposits < $100k 28.9% Time Deposits > $100k 8.7%

C a pi tal 6.5% 5.0% 10.0% 8.0% 5.0% 4.1% 3.3% 3.5% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% Common Equity Tier 1 Capital Ratio (%) Tier 1 Leverage Ratio (%) Total Risk Based Capital Ratio (%) Tier 1 Capital Ratio (%) Reg. Well Capitalized Threshold BAYK Capital in Excess of requirement Note: Data reflects holding company financials and completed merger with Virginia Commonwealth Bank; includes purchase accounting adjustments Source: SNL Financial 18 11 . 5% Pro Forma Capital Adequacy 3/31/2017 13 . 3% 9 . 1% 11 . 5%

19 Why Bay Banks of Virginia? x Attractive franchise in central and eastern Virginia x Emerging presence and 3 rd largest community bank headquartered in Virginia’s most attractive market: Richmond x Improving performance with capacity for earnings growth x Management team is on target to achieve anticipated cost save synergies as well as remaining within the budget for merger costs x Capital strength to focus on continued growth in promising markets and acquisition opportunities x Low relative valuation on both a tangible book value and earnings basis compared to peers x Talented leadership with the ability to take the Company to the next level

www.baybanks.com