Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CHS INC | a8-kjune142017townhall.htm |

1

FORWARD-LOOKING STATEMENTS

This document and the accompanying oral presentation contains, CHS Inc. (“CHS”) publicly available documents may contain, and CHS officers, directors and other representatives may from time to time make, “forward–looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward–looking statements can be identified by words such as “anticipate,” “intend,” “plan,” “goal,” “seek,” “believe,” “project,” “estimate,” “expect,” “strategy,” “future,” “likely,” “may,” “should,” “will” and similar references to future periods. Forward–looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on CHS’s current beliefs, expectations and assumptions regarding the future of its businesses, financial condition and results of operations, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward–looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of the control of CHS. CHS’s actual results and financial condition may differ materially from those indicated in the forward–looking statements. Therefore, you should not place undue reliance on any of these forward–looking statements. Important factors that could cause CHS’s actual results and financial condition to differ materially from those indicated in the forward–looking statements are discussed or identified in CHS’s public filings made with the U.S. Securities and Exchange Commission, including in the “Risk Factors” discussion in Item 1A of the CHS Annual Report on Form 10–K for the fiscal year ended August 31, 2016. Any forward–looking statements made by CHS or its representatives in this document and the accompanying oral presentation are based only on information currently available to CHS and speak only as of the date on which the statement is made. CHS undertakes no obligation to publicly update any forward–looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise, except as required by applicable law.

<JAY>

Before I begin my remarks, please take a moment to review this slide, which

has important information regarding this presentation.

PAUSE FOR AUDIENCE TO READ SLIDE

This information confirms that some of the business and financial topics that

we will discuss today may be considered forward-looking statements under

U.S. securities laws. Because forward-looking statements relate to the future,

they are subject to inherent uncertainties, risks and changes in

circumstances that are difficult to predict and many of which are outside of

CHS’s control. Accordingly, actual events and results could differ materially

from my comments today, based upon numerous factors. In addition, CHS is

not undertaking any obligation to provide updates to any forward-looking

statements.

2

3

Welcome

<REGIONAL DIRECTORS GREG KRUGER AND MARK FARRELL>

Good morning.

As your regional directors on the CHS Board of Directors, we

would like to welcome you to Whitesville, Indiana, and introduce

ourselves, in case we haven’t had a chance to meet yet.

GREG INTRODUCES HIMSELF, GIVES HIS BACKGROUND AND

TALKS ABOUT HIS OPERATION

MARK INTODUCES HIMSELF, GIVES HIS BACKGROUND AND

TALKS ABOUT HIS OPERATION

Thanks again for coming and now we’d like to introduce you to our

CHS Board of Directors chairman, Dan Schurr…

<DAN>

Good morning.

Welcome to the 2017 Your CHS Town Hall in Whitesville, Indiana,

home of Ceres Solutions. This town hall is one of 10 the board of

4

directors and your CHS management team is hosting throughout

the country – from oil refineries to export terminals, to ethanol

plants and joint ventures with member cooperatives.

We’re excited for this opportunity for all of us to be together today

and explore these facilities and also talk about some significant

topics impacting our cooperative system.

If we haven’t met before, I’m Dan Schurr. I’ve served on the board

for 11 years, elected by Region 7. I farm in Le Claire, Iowa, where I

grow corn and soybeans and operate a commercial trucking

business.

After Dave Bielenberg stepped down, I was elected by your board to

move from the vice chair role into the board chair role. I want to

thank Dave for his service to this cooperative.

I’m also pleased to welcome Jay Debertin, whom our board elected

as the new president and CEO of CHS in May. Many of you know Jay

because he has been with CHS for more than 30 years, leading a

variety of teams in energy and processing and food ingredients. Jay

is originally from the Red River Valley area of Minnesota and North

Dakota.

<JAY>

Thanks, Dan. And, thanks to all of you for coming out today. We

know it’s a busy time of year and we’re going to use your time

wisely.

Before we get into the formal program, I’d like to talk about what is

likely on your minds. I’d like to take a moment and discuss this

recent leadership transition with you.

As you know, Carl Casale served our cooperative as president and

CEO during a period of record growth and profitability in the

agricultural industry. I have a lot of respect for Carl and his vision

for the agricultural industry. He brought a lot of value to our

leadership team as an executive and also as the operator of a family

4

farm. Over the past several months, everyone – including Carl -

recognized we were entering a new chapter for CHS and for the ag

industry.

Just as we had under Carl’s leadership, we are faced with both

opportunities and challenges – and we will get after all of them.

What I want to say up front about this change is that all parties

involved are satisfied with this outcome. And, all of us are focusing

our time and energy on moving forward, in partnership with all of

you.

<DAN>

And, as for our leadership changes on the board, everyone who has

served and continues to serve has helped create a strong

foundation that we’re going to continue to build upon. Do we have

disagreements at times? Yes, we do, that’s what we’re elected to do

– discuss things, debate and sometimes disagree, but in the end,

make our decisions as one board. And all of those decisions are

made with only one objective in mind: helping our owners grow and

prosper. It’s not easy work. Our board members serve with real

purpose on behalf of all of you to ensure the long-term vitality and

success of this cooperative system.

Questions

We’ll have more time for questions throughout the day, so as you

think of questions please feel free to jot them down.

I’d like to ask the board members here today to stand and briefly

introduce themselves to you.

Each board member stands and introduces himself

Thanks all, and I’d encourage everyone to get to know each other

and share insights over lunch or later in the program.

Here is a look at our agenda for this morning:

• Jay will help kick us off with the plan to strengthen and grow

4

CHS

• Then, we’ll get real-time market updates and insights from some

of our CHS business leaders

• Finally, we’ll wrap up by learning more about the asset we are

visiting today, and its importance to CHS

• We’ve also built in plenty of time for conversation – which is the

primary reason we are here - to listen and learn what’s on your

mind and answer the questions you have

So, whether you came from just down the road or across several

states, I welcome you to this CHS town hall.

Now, let’s hear from our president and CEO Jay Debertin…

<JAY>

First, I’d like to introduce you to the members of our Strategic

Leadership Team that are here today. I’d ask that they stand and

introduce themselves.

EACH SLT MEMBER IN ATTENDANCE STANDS AND INTRODUCES

HIM/HERSELF

Thanks again to all, and now let’s get on with our program.

4

© 2017 CHS Inc.

Your CHS Town Hall

Leadership Update

Summer 2017

<JAY>

There’s no doubt recent market declines have caused a number of

challenges for our industry and CHS.

We’ve had these cycles for the past 85 years and we’ll have them

in the future.

Being able to ride these cycles is imperative for us.

So, when you hear us speak about maintaining financial flexibility,

it’s because these cycles will come and go and we need to be

prepared for all of them.

In our businesses - we are price-takers on both ends – with what

we buy and what we sell. So, we have to operate in whatever

market environment is out there. And, in order for us to succeed –

we have to be able to succeed in any environment.

5

Strengthen

and

Grow

<JAY>

The good news is many of our businesses are performing well. • Country Operations has had a strong first half• North American grain the same• International business turnaround• And, Energy is having a fair showing as well

So, when we look at the underlying performance of these businesses, we’re having a pretty solid year so far.

But, it’s clear - we’ve got some gaps in our processes. And, we’re going to get after those.

• We have a large producer loan that we’ve been reporting on for the last few quarters…• There’s a bankruptcy of an important trading partner in Brazil that we are dealing with…• And, we have some execution issues around some past transactions that we need to get better at and we will.

This focus on operational excellence will mean some change, but since the businesses are performing at a high level – we’ll be able to focus on closing the gaps. And, this laser focus on operational excellence will allow us to strengthen and grow CHS.

We’re going to work hard at this. How we grow our company and how we strengthen the processes underlying the company at the same time. It isn’t just strengthen CHS or grow CHS – it’s both.

We have plenty of markets where we can increase share and do better for all of you and for our partners around the world. And, we will strengthen by doing a better job at the processes we have underneath us to execute at a high level so that we can really win when the businesses are performing well.

6

SHARED VALUES

INTEGRITY

REWARDING

CUSTOMER

RELATIONSHIPS

PARTNERSHIP

AND SHARED

SUCCESS

COMMUNITY

STEWARDS

PEOPLE

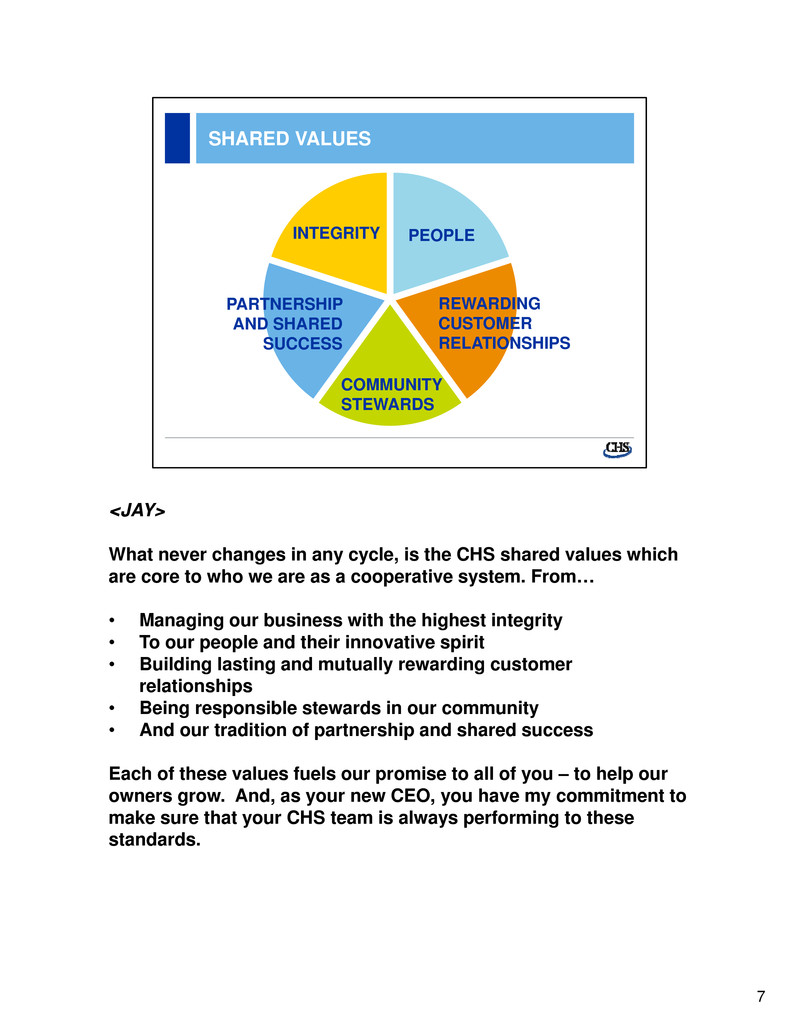

<JAY>

What never changes in any cycle, is the CHS shared values which

are core to who we are as a cooperative system. From…

• Managing our business with the highest integrity

• To our people and their innovative spirit

• Building lasting and mutually rewarding customer

relationships

• Being responsible stewards in our community

• And our tradition of partnership and shared success

Each of these values fuels our promise to all of you – to help our

owners grow. And, as your new CEO, you have my commitment to

make sure that your CHS team is always performing to these

standards.

7

WHITESVILLE FERTILIZER HUB

<JAY>

As we talk about strengthening to grow, there’s no place more

fitting for us to be gathered than at an asset that provides a

strategic and necessary link in our supply chain.

The Whitesville fertilizer hub plant was built in 2010. It is a CHS

Agronomy marketing partnership with Ceres Solutions, LLP, a full-

service, locally owned cooperative, which does business in 13

western Indiana counties.

This facility handles more than 100,000 tons of crop nutrients

annually. It is served by the CSX railroad and has track capacity for

100 rail cars.

With an automated system capable of unloading 800 tons per hour,

and simultaneously, six liquid rail cars per hour, this fertilizer hub

provides 24/7 service to customers every day of the year.

8

INDUSTRY LEADING INFRASTRUCTURE

<JAY>

For crop nutrients, having the fertilizer available where customers

need it is critical, especially during the busy spring months. That

means location, storage, and logistics. Through this partnership

with Ceres, CHS is strategically located to fill the needs of farmers

in western Indiana.

Not only does this fertilizer hub have the capacity to get product in

and out quickly, but it also has the storage needed to make sure

product is on hand when our farmers and cooperatives need it.

It takes a substantial and expansive network to move crop

nutrients around the country and this fertilizer hub is uniquely

situated on an extensive rail network that allows us to get that

product to the right place at the right time.

9

Strengthen

<JAY>

All of us look forward to building on the strength of CHS. Today, I’d

like to talk through two ways we will do that:

1. Through operational excellence, and

2. Financial flexibility– Tim will speak more to financial flexibility,

after I’ve outlined the ways we can enhance our operational

excellence

10

ENHANCE RELATIONSHIPS

<JAY>

We all know that CHS runs on relationships. Relationships with

owners, customers, employees and business partners have been

the driving force behind our shared success. And, when times are

more challenging, those relationships are what get you through.

11

OPERATIONAL EXCELLENCE -

IMPROVING SAFETY PERFORMANCE

<JAY>

We’re a safety-first organization, so our work to further strengthen

the organization will start here.

From the farm gate to our business offices, we all need to take

personal responsibility for safety.

CHS continues to strive to achieve our goal of no accidents, no

injuries and no deaths. We put the environment, health and safety

first in all we do.

12

OPERATIONAL EXCELLENCE –

FOCUSING ON ASSET UTILIZATION

<JAY>

And, the same can be said for how we run our assets. We are

committed to maintaining or upgrading our assets to make sure they

are operating safely. Also, given challenging conditions, we need to

look more deeply at how they are operating for performance. When

combined, these factors figure into our goal to achieve operational

excellence.

Your team at CHS is working diligently to manage expenses, maximize

the role of our enterprise technology platform, institute Centers of

Excellence and to optimize the return on your assets.

As the nation’s largest cooperative and your partner, it’s imperative

that we think strategically about our assets to ensure each is driving

the performance we need and expect.

So, just as you do on your farm each day, we too are thinking

strategically about our assets to drive overall performance. We’re

making sure our business is working as well as it possibly can, and

that the assets and businesses we invest in match the long-term vision

of the company.

To do this, we brought together a group of CHS leaders from across

the company to discuss how to evaluate our assets.

We built a custom portfolio review model that allows us to take a

holistic and balanced view of our portfolio of existing assets, as well as

to assist in prioritizing future capital and other resource allocations.

The model includes criteria like whether the investment is in an area

that CHS has proven core competencies in, how much it enables the

supply chain around our owners, and to what degree it generates

patronage, to name a few.

13

HIGH

PORTFOLIO REVIEW –

EXAMPLE

ST

RA

TE

GI

C

PERFORMANCE

LOW

HIG

H

LO

W

<JAY>

This portfolio analysis will help us make decisions now and into

the future, including deciding when and where to invest in assets

and partnerships and, as importantly, where not to.

Moving forward, this tool will help guide our decisions to ensure

they’re strategic, focused and can purposefully move CHS through

even the most challenging of economic times.

14

© 2017 CHS Inc.

Economic

ReturnsMarketsKnowledgeServicesInputs

CHS VALUE CHAIN

Value-

added

<JAY>

If you know me, you know I have a passion for this business and

believe deeply in CHS, our owners and all of our employees.

I’m excited about where we are at as a company and the

opportunities we have to take our work to the next level.

So, as I think about how we can deliver a unique value, I look at a

couple of things…

15

OPERATIONAL EXCELLENCE –

ENHANCED RISK MANAGEMENT FOCUS

<JAY>

One main focus will be to improve our risk management focus and

process. We will speak more about the loan loss reserve issue that

we experienced earlier this year in a few moments – but this will be

another key area of focus – understanding and mitigating our risk

exposure more thoroughly.

It’s important to remember that we will always have risk in our

businesses, we deal with dangerous products and we do business

around the world. It is impossible to eliminate risk.

But, we need to manage it where we can and have transparency

and knowledge about that risk where we should.

16

INTERNATIONAL BUSINESS

ENHANCEMENTS

<JAY>

As we work to enhance our operations around the globe, one key

focus area will be CHS Brazil. Recently, a long-time grain originator

filed for Judicial Reorganization, which is similar to bankruptcy in the

United States.

CHS Brazil had maintained a grain origination relationship with this

vendor for several years. We are also a secured creditor of a certain

percentage of this company’s affiliate companies.

CHS Brazil and CHS Inc. have programs in place that seek to mitigate

potential losses and we expect shipments of products to arrive as

scheduled, without disruption. We are in close contact with valued

customers regarding product orders and shipments.

CHS Brazil will continue to manage the situation to achieve the best

possible outcome for customers and owners. And, CHS Brazil and

CHS Inc. leadership are actively managing the situation to

understand and respond to any potential impact to our business.

This situation is an example of a risk gap we will need to work

hard to fill.

17

ENHANCED BUSINESS DISCIPLINE

<JAY>

As I said earlier, we will be on a path of continuing to grow while

getting stronger. There will be a period of getting our arms around

areas where we need to improve – what needs to happen to

increase business discipline, enterprise-focus and profitability.

You can expect we will continue our work on enhancing internal

processes – significant examples of this are CHS United and our

Centers of Excellence.

Enhancing our execution may mean we need to make some

changes. But as I stand here today, no changes have been

decided. Going forward, we will make decisions thoughtfully and

in the best interest of the company, our owners and team. And I

will communicate to you if and when changes are needed.

For now, we need time to assess and diagnose certain areas and

then make decisions.

You can expect me to communicate change candidly and with

clarity.

18

Growth

<JAY>

Now, on to growth… we see it in:

• Our markets with and for all of you

• In the international markets we choose to be in

• Leveraging our existing investments

• Through partnerships

19

GROWTH OPPORTUNITIES

<JAY>

When it comes to growth, we’re going to look to grow right

alongside all of you. If you grow, we’ll grow. In other words, our

primary focus will be to build organic growth opportunities with

you, our current owners and customers. And we will do this by

creating value together.

Our core businesses and geographies are areas where I anticipate

growth. This includes maintaining a strong overall marketing

presence across Asia and Europe, with deep and strong

origination and execution teams – to provide global customers a

year-round supply of grain and owners like you the inputs crucial

to growing healthy, profitable crops.

20

THE NEXT GENERATION

<JAY>

Another area for us to strengthen and grow is within our new

leaders program.

Our new leaders play a crucial role in helping agriculture and the

cooperative system thrive. Whether you are under 45 years old, or

you are part of the next generation that hasn’t yet taken full

responsibility for the farm or ranch, we need you to opt in to the

cooperative system.

Beyond the every day programs and meetings, we will focus on

helping each of you develop into the cooperative leader you want

to become.

You can also take advantage of a number of other opportunities for

you to explore board leadership, develop advocacy skills, learn

about resources, and much more … all while voicing your opinions

so that the company you own – CHS – successfully evolves to

serve you, your children and your grandchildren.

21

OUR TEAM

<JAY>

Our commitment to talent development will continue as strong as

ever. While we continue to focus on domain expertise – recruiting

it, retaining it, and growing it as we add our own members of the

next generation’s leaders throughout CHS.

22

FINANCIAL

UPDATE

<TIM>

Good morning and thank you all for joining us at our first 2017

town hall.

Please feel free to ask me questions as I work my way through this

financial update.

23

FIRST HALF EARNINGS

6

GROSS PROFIT +$93

OPERATING INCOME +$29

NET INCOME ($12)

FY17 vs FY16

(in $ millions)

<TIM>

I have many bankers, employees, CHS Board members and owners ask

me how CHS is performing financially. I can only update you through the

first-half of fiscal 2017 today. In about a month, I’ll be able to discuss

CHS’s third quarter results.

Gross profit is the indicator that I look at to determine how businesses

are fundamentally performing. Operating income subtracts out

overheads and certain reserves and net income is the bottom line after

interest and taxes are deducted.

As you can see, through the first-half, our gross profit, that is our sales

less the cost of goods, was up over $90 million, or up 18 percent.

Operating income was up $29 million, or up 17 percent. And, our net

income was down about $12 million, or down 5 percent.

24

TOTAL NET INCOME CHS -

FIRST HALF FISCAL 2017

Energy $ 86.6 $ 129.9

Ag 99.9 38.1

Nitrogen Production 32.4 1.3

Foods 13.7 29.9

Corporate & Other 16.5 14.2

Non-Controlling Interests (0.2) (0.5)

Income Taxes (25.2) 22.6

$ 223.7 $ 235.5

Fiscal Year Fiscal Year

2017 2016

Fiscal Year-to-Date

Sept 1 – Feb 28, Feb 29

(in $ millions)

6

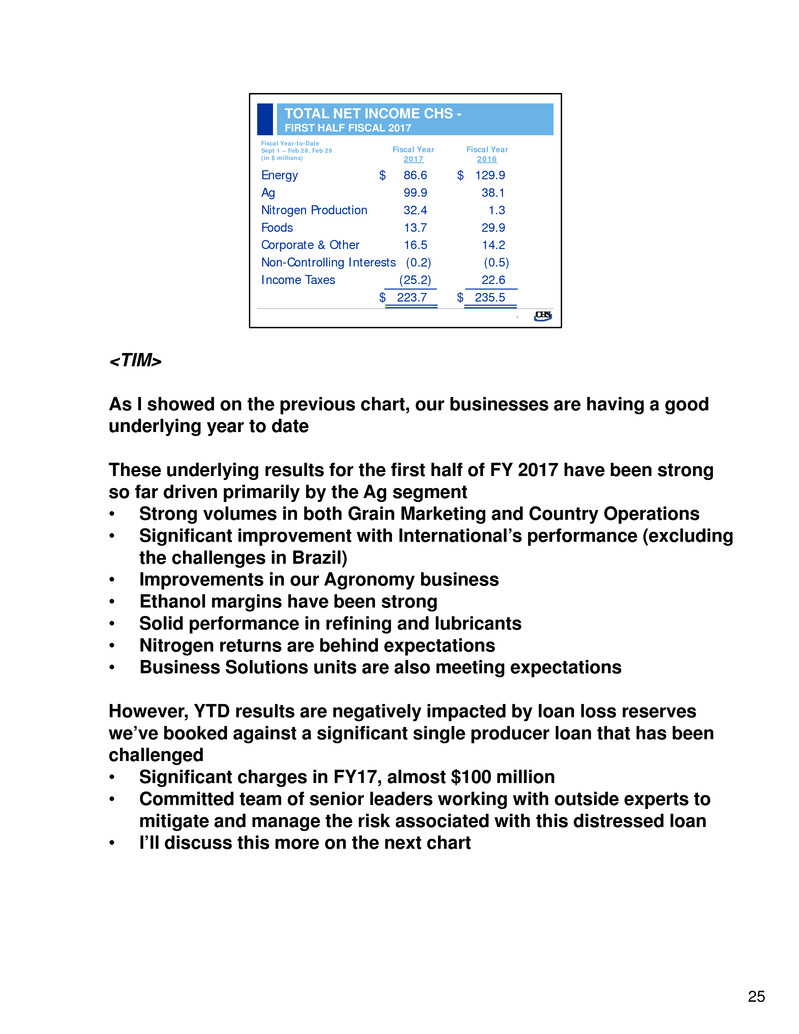

<TIM>

As I showed on the previous chart, our businesses are having a good

underlying year to date

These underlying results for the first half of FY 2017 have been strong

so far driven primarily by the Ag segment

• Strong volumes in both Grain Marketing and Country Operations

• Significant improvement with International’s performance (excluding

the challenges in Brazil)

• Improvements in our Agronomy business

• Ethanol margins have been strong

• Solid performance in refining and lubricants

• Nitrogen returns are behind expectations

• Business Solutions units are also meeting expectations

However, YTD results are negatively impacted by loan loss reserves

we’ve booked against a significant single producer loan that has been

challenged

• Significant charges in FY17, almost $100 million

• Committed team of senior leaders working with outside experts to

mitigate and manage the risk associated with this distressed loan

• I’ll discuss this more on the next chart

25

CHALLENGES

Partner Files for BankruptcyLarge Producer Loan Loss

<TIM>

We will be focused on improving our risk management practices

across the company, including CHS Capital.

Over the past four quarters, CHS has reported on the loan loss

reserve taken by CHS Capital for a loan to a single large producer

in the Midwestern region. In addition, our disclosure has included

information regarding the methodology for that reserve. Currently,

we do not anticipate any changes to the existing loan loss reserve

for our third quarter.

We are working hard to improve our risk governance models.

Moreover, Q3 results will be materially and negatively impacted by

a partner’s bankruptcy in Brazil. This strategic partner is a grain

origination and logistics company located in southern Brazil,

representing a majority of our grain origination volumes in Brazil.

We are confident that CHS Brazil will continue to operate and meet

customers needs as this situation is worked through.

CHS advanced cash into this operation to secure delivery of

26

soybeans to the export market.

During the past months this partner has had increasingly serious

liquidity constraints.

We estimate that CHS Brazil’s total gross exposure is in the range

of $225 to $230 million USD. The ultimate amount of the CHS FY17

Q3 reserve associated with this issues is not finalized at this time,

but the reserve is likely to be in this range absent favorable

information regarding certain variables. In all cases, the ultimate

reserve will be material.

Quite honestly I have to say that, in hindsight, we have a lot to learn

from this situation. We are evaluating our risk management

practices and will make the necessary changes. As I said

previously, Brazil remains an important grain origination geography.

26

Controlling

the

Controllables

<TIM>

CHS remains on a journey of enhancing tools, processes and

capabilities for the future.

• CHS has been and continues on a journey to strengthen its

system of internal financial controls.

• My focus has been on establishing fundamentals including

companywide financial policies, delegations of authority,

segregation of duties, automated system controls, and

establishing enterprise risk management framework.

• Resources are currently deployed around tackling current

challenges; however, many more resources are developing a

more effective future state operating business model.

• Establishing an ERP (Enterprise Resource Planning) system

powered by SAP is foundational for how CHS will operate in

the future and will support operational excellence.

• Our work around the Centers of Excellence will result in more

consistent processes which will enable us to better manage

risk and create value for our owners.

• We will evolve from being backward-looking,

transactional-focused to becoming forward-looking,

analytical decision makers, which will deliver more

effective risk management and better business results.

• During the third fiscal quarter of each year, CHS conducts its

required periodic impairment testing on intangible assets. As a

result of this testing, certain asset impairments will be

27

recorded. It is likely that for some of those asset impairments

the amount recorded will be material.

27

$

RESTORING FINANCIAL FLEXIBILITY

Capital

Spending

Expense

Management

Working

Capital and

Liquidity

Equity

Management

Portfolio

Review

<TIM>

Restoring CHS’s financial flexibility is our #1 priority.

We will improve our risk management practices across CHS.

We are committed to embracing continuous improvement,

starting with a recognition as to where we are as an

organization across multiple dimensions.

We will say what we’ll do, and we will do what we say.

First, we will continue to keep a maniacal focus on controlling

our overheads.

Second, we’re continuing to optimize working capital to

maintain ample undrawn committed bank lines of credit.

28

Third, investment in our base business will be constrained to

safety, maintenance, reliability for the time being. Growth

capital will be limited, if at all.

Fourth, working with your CHS Board Capital Committee we

will analyze your various options to preserve cash and

prudently manage patronage relationships.

And fifth, as Jay mentioned earlier, there will be assets that we

may determine that we should monetize. As we close these

transactions, we will create financial flexibility to either repay

debt or reinvest back into more strategic, higher return

opportunities, if any.

I know that Dan, Jay, the CHS Board and the management team

are committed to restoring CHS’s financial flexibility – and

strong balance sheet.

28

A HISTORY OF SHARED FINANCIAL SUCCESS

CASH RETURNS TO OWNERS - ACTUAL

$ in millions

2012 2013 2014** 2015 2016*** 2017

252

Cash Patronage

163

Preferred Stock

Dividends

101

Equity

Redemptions

____________________

** Includes $200 million in equity retired with preferred stock

*** Actual based on fiscal year FY 2015

516

599

381

Cash Patronage

25 PS Dividends

193

Equity

Redemptions

(FY 2011) (FY 2012) (FY 2013) (FY 2014) (FY 2015) (FY 2016)

432

261

Cash Patronage

146

Equity

Redemptions

25 PS Dividends

533

271

Cash Patronage

134

Preferred Stock

Dividends

128

Equity

Redemptions

637

286

Cash Patronage

300

Equity

Redemptions

51 PS Dividends

104

Cash Patronage

167

Preferred Stock

Dividends

58

Equity Redemptions

329

<TIM>

As a cooperative, CHS returns economic value to our owners

through cash patronage, equity redemption and dividends on

preferred stock.

The past five years have been rewarding to our owners. Fiscal

2016 cash return brings to $2.7 billion the cumulative cash

returned to our owners over the past five years – that’s an average

of $544 million annually.

CHS financial returns are lower today and cash patronage and

equity redemption are reflecting this. Preferred stock dividends,

however are fixed in amount and therefore are currently

representing a higher portion of the total amount of CHS returns to

owners.

29

CHS AND CHS FOUNDATION GIVING

<JAY>

Other returns CHS provides are to the communities in which

we all live and work. This is done through CHS Foundation

and CHS corporate giving. It’s a tradition at CHS – and our

members continue to tell us that giving back is a great way

our cooperative can add value to what matters most to all of

you.

CHS and the CHS Foundation give and volunteer in three vital

areas:

• Developing future leaders

• Improving ag safety

• Supporting rural community vitality

This slide shows our most recent giving results – from fiscal

year 2016. This year, $6 million was given in these three focus

areas.

30

GIVING IN YOUR REGION – REGION 5

Scholarships to 250 students

Funding for FFA and agriculture collegiate clubs

throughout the region

$370,000 to help more than 30,000 kids attend safety

days hosted by the Progressive Ag Foundation

across the country

Grants in nearly 40 rural communities to support local

fire departments, FFA chapters and other

community projects*

<JAY>

Just a few of the many giving examples in Region 5 over the

last five years

Developing future leaders examples:

• Support of national FFA and 15 state FFA associations

• Awarded $325,000 in scholarships to 250 students attending

colleges throughout the region

• Support of seven agriculture collegiate clubs to support

professional development and student learning

• Funding support to University of Illinois agricultural

education classroom renovation project

• Support of Agricultural Rural Leadership programs in

Illinois, Indiana and New York

Improving ag safety examples:

• $370,000 to help more than 30,000 kids attend safety days

31

hosted by the Progressive Agriculture Foundation

• Membership in several organizations that promote ag safety

for producers, families and employees

Building strong rural communities examples:

• $4.7 million and 3.4 million pounds of food donated to hungry

families across the U.S. through CHS Harvest for Hunger

• Grants in nearly 40 rural communities to support local fire

departments, FFA chapters and other community projects

• Celebrating six years of employees giving back through CHS

Days of Service

31

SEEDS FOR STEWARDSHIP

• Competitive matching grants program

to support community projects

• Each cooperative is eligible

for up to $5,000 in

matching funds

• Priority is given to efforts

that improve ag safety of

rural communities and

cultivate ag leaders

• Learn more: chsinc.com/stewardship

<JAY>

We know those local dollars make a big impact in your

hometowns. And, to localize and give even more, the CHS

Foundation this year launched Seeds for Stewardship, which is:

• A grants program that will match your cooperative’s giving

dollars, up to $5,000

• Each CHS member cooperative is eligible to request to receive

this money to support projects that are important within your

own community – from making a playground more safe to

upgrading a fire truck

• There are grant periods throughout the year. For this current

round of giving, cooperatives can apply now through July 1,

2017.

• You can learn more at chsinc.com/stewardship

32

<JAY>

Bringing value to your cooperative in your local market is also

supported by our latest marketing campaign, which focuses on

telling the value of the co-op story, especially to the next

generation.

Since you told us this was one of the top things CHS could do for

you – during our town halls visits in 2015 – we’ve implemented a

campaign that tells the co-op story across our system. But it also

provides you with tools you can access and use for free, using

your co-op’s own branding.

The tool kit is available at co-opstory.com, where you can find

newspaper ads, website or email banners, social media posts,

radio scripts and other ready-made materials to help us all tell the

story in our local communities.

166 co-ops are using these tools to tell the value story of the

cooperative system. If you’re not one of them, we encourage

you to check out these free tools. Please grab a card at the

registration desk for more information.

33

SAVE THE DATE –

2017 CHS ANNUAL MEETING

Dec. 7 and 8

at the

Minneapolis Convention Center

in Minneapolis, Minn.

CHS Confidential Information

<JAY>

Encourage attendees to join us at the 2017 CHS annual meeting –

Dec. 7 and 8 in Minneapolis

34

“SKIN IN THE GAME” ESSAY CONTEST

Enter at

CHSBigGame.com

by Sept. 15

CHS Confidential Information

<JAY>

Immediately following the annual meeting, the local CHS Twin

Cities employee community will be busy getting ready to host the

Super Bowl in Minneapolis.

CHS joined dozens of other Twin Cities based companies as local

hosts to this once-in-a-lifetime event.

While CHS is not a sponsor of the Super Bowl, but rather a local

host company -- which is quite different -- we thought it important

to support our Minnesota employees and their families by helping

to get the game to come to our community. To make the most of

the opportunity, we’ve secured tickets for owners – which you are

all eligible to win just by attending this town hall. At the game, we

will have a section reserved just for the next generation of

cooperative leaders and producers.

For these people to win a VIP Super Bowl experience, they need to

submit an essay about a few different topics important to the

cooperative system. We’ve got a handout for you at the

35

registration table and you can learn more about the essay contest at

CHSBigGame.com.

35

CHS Confidential Information

<JAY>

Before we get to questions, I’d like to share this video as a great

reminder of the value of our cooperative system.

This is a video our government affairs team created to help inform

state and federal legislators about the significant impact the

cooperative system has on the US economy as well as the local

communities where we do business.

You all know that advocating on behalf of your cooperatives is

something our government affairs team is always on top of –

especially now, given the new administration, and when you

consider that only two percent of federal legislators today come

from a rural community.

When we commissioned this study earlier this year, we selected to

tell the story of the impact we made in 2014 – a year when we had

no significant mergers or acquisitions which would have skewed

the numbers a bit. It’s particularly helpful that 2014 happened to be

an excellent one for our markets and our business. I can’t think of

a better way to remind us all about why we exist and what our

work together does…Take a look.

SHOW VIDEO

36

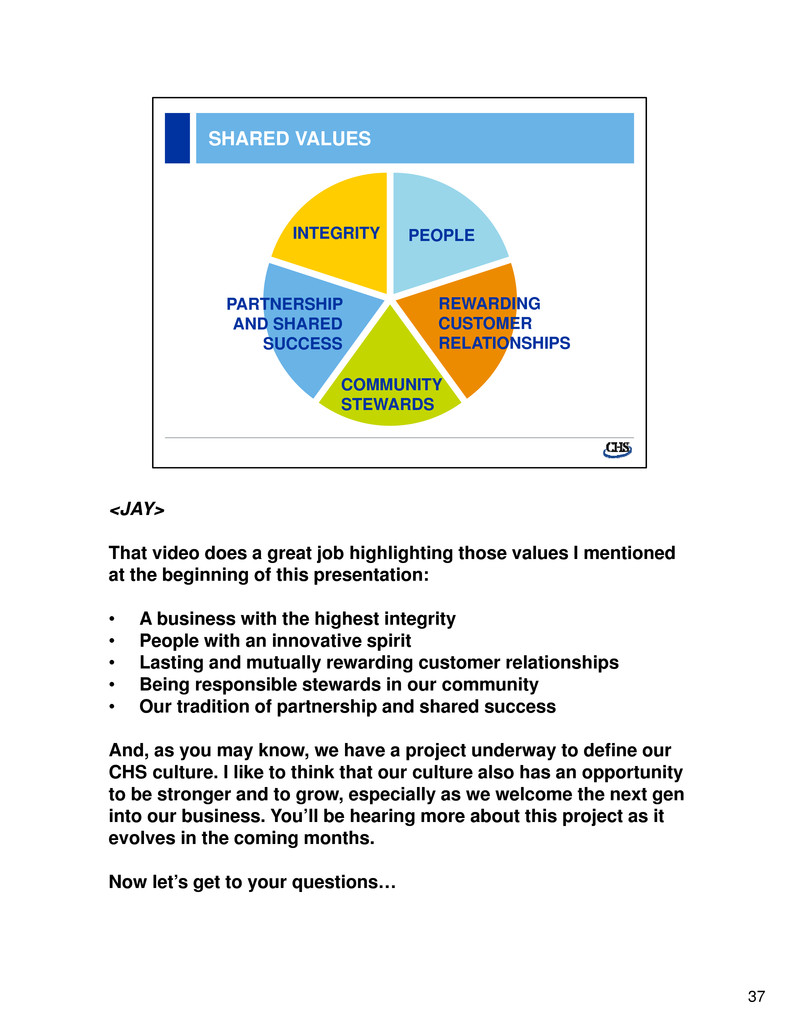

SHARED VALUES

INTEGRITY

REWARDING

CUSTOMER

RELATIONSHIPS

PARTNERSHIP

AND SHARED

SUCCESS

COMMUNITY

STEWARDS

PEOPLE

<JAY>

That video does a great job highlighting those values I mentioned

at the beginning of this presentation:

• A business with the highest integrity

• People with an innovative spirit

• Lasting and mutually rewarding customer relationships

• Being responsible stewards in our community

• Our tradition of partnership and shared success

And, as you may know, we have a project underway to define our

CHS culture. I like to think that our culture also has an opportunity

to be stronger and to grow, especially as we welcome the next gen

into our business. You’ll be hearing more about this project as it

evolves in the coming months.

Now let’s get to your questions…

37

Questions?

<JAY>

Dan and all SLT members present should join Jay and Tim near the

front for questions.

Jay, Tim and Dan will answer questions as well as pass some

along to other CHS Board members and SLT members as

appropriate.

38

39