Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Covisint Corp | exhibit991q42017.htm |

| 8-K - 8-K - Covisint Corp | a8-kcovsq42017earningsrele.htm |

6/5/2017 1

Covisint Corporation

Fourth Quarter and Full Year Fiscal 2017 Results

June 5, 2017

This presentation contains “forward-looking” statements that involve risks, uncertainties and assumptions. If the risks or uncertainties ever materialize or the

assumptions prove incorrect, our results may differ materially from those expressed or implied by such forward-looking statements. All statements other than

statements of historical fact could be deemed forward-looking, including, but not limited to, any projections of financial information; any statements about

historical results that may suggest trends for our business and results of operations; any statements of the plans, strategies and objectives of management for

future operations; any statements of expectation or belief regarding future events, potential markets or market size, technology developments, or enforceability

of our intellectual property rights; and any statements of assumptions underlying any of the foregoing.

These statements are based on estimates and information available to us at the time of this presentation and are not guarantees of future performance. Actual

results could differ materially from our current expectations as a result of many factors, including but not limited to: our ability to attract new customers; the

extent to which customers renew their contracts for our solutions; the extent we are able to maintain pricing with our customers at renewal; the seasonality of our

business; our ability to manage our growth; the continued growth of the market for our solutions; the success of our channel partner and certified partner

strategies; competition from current competitors and new market entrants; our ability to penetrate new vertical markets; unpredictable macro-economic

conditions; the loss of any of our key employees; the length of the sales and implementation cycles for our solutions; increased demands on our infrastructure

and costs associated with operating as a public company; failure to protect our intellectual property; the occurrence of any event, change or other circumstances

that could give rise to the termination of the merger agreement; the failure to obtain the requisite approval of Covisint’s shareholders or the failure to satisfy other

closing conditions; risks related to disruption of management’s attention from Covisnt’s on-going business operations due to the pending transaction; and the

effect of the announcement of the pending transaction on the ability of Covisint to retain and hire key personnel, maintain relationships with its customers and

suppliers, and maintain its operating results and business generally. These and other risks and uncertainties associated with our business are described in Item

1A “Risk Factors” in our Quarterly Report on Form 10-K for the period ended March 31, 2017. We assume no obligation and do not intend to update these

forward-looking statements.

In addition to U.S. GAAP financials, this presentation includes certain non-GAAP financial measures. These historical and forward-looking non-GAAP measures

are in addition to, not a substitute for or superior to, measures of financial performance prepared in accordance with GAAP. A reconciliation between GAAP and

non-GAAP measures is included in the appendix to this presentation.

Covisint is a registered trademark of Covisint Corporation. This presentation also contains additional trademarks and service marks of ours and of other

companies. We do not intend our use or display of other companies’ trademarks or service marks to imply a relationship with, or endorsement or sponsorship of

us by, these other companies.

Forward Looking Statements

2

3

Fiscal 2017: Financial Overview

Key Metrics ($ in thousands)

* Excludes the impact of stock compensation and the expensing of certain R&D costs (rather than capitalizing such costs), refer to the reconciliation of quarterly results

on slide 6

Highlights

• Cash at $33 million

• Non-GAAP Gross Margin at plan levels

• Cash Flow better than expectations

Q4 FY 17 Y/Y Q/Q FY 17 Y/Y

Subscription Revenue $ 16,788 (2%) 14% $ 60,727 (4%)

Services Revenue $ 2,194 (21%) 15% $ 9,516 (25%)

Total Revenue $ 18,982 (5%) 14% $ 70,243 (8%)

Q4 FY 17 Y/Y Q/Q FY 17 Y/Y

Gross Profit $ 11,296 (7%) 39% $ 36,964 (10%)

Gross Margin 60% 53%

Stock Compensation Expense $ 16 $ 53

Amortization of Capitalized Software $ 1,128 $ 4,274

Non-GAAP Gross Profit* $ 12,440 (4%) 34% $ 41,291 (7%)

Non-GAAP Gross Margin 66% 59%

Net Income/(Loss) $ 1,589 $ (12,726)

Stock Compensation Expense $ 480 $ 1,899

Capitalized internal software costs $ (644) $ (2,819)

Amortization of Capitalized Software $ 1,128 $ 4,274

Non-GAAP Net Income/( Loss)* $ 2,553 $ (9,372)

Net Change in Cash $ 2,786 $ (6,454)

Net proceeds from exercise of stock awards $ - $ (239)

Vendor Financing Payment $ - $ 614

Effect of Exchange Rate Changes on Cash $ (42) $ 96

Free Cash Flow $ 2,744 $ (5,983)

Executive Commentary and Perspective

• Covisint Enters Definitive Agreement to be Acquired by OpenText

• $2.45 per share, or approximately $103 million

• 23% premium to the prior closing price on June 2, 2017

• 27% premium to the 30-day volume-weighted average price

• 46% cash-adjusted premium to the 30-day volume-weighted average price*

• All-cash transaction with no financial contingencies

• Approved by the Board of Directors at both Covisint and OpenText

• Expected to close in the third quarter of calendar 2017, subject to a shareholder vote and customary

closing conditions

• Expected Benefits for Covisint's Employees and Customers

• Enhanced financial scale and greater development and support resources to reach our growth potential

• Shared values, commitment to customer success, passion for engineering solutions, and disciplined

execution

* The cash-adjusted calculation deducts the Company’s cash and cash equivalents of $33 million or $0.79 per share as of March 31, 2017 from both its current share

price and from the total Merger Consideration implied by the offer in order to better measure the premium being offered

4

Appendix

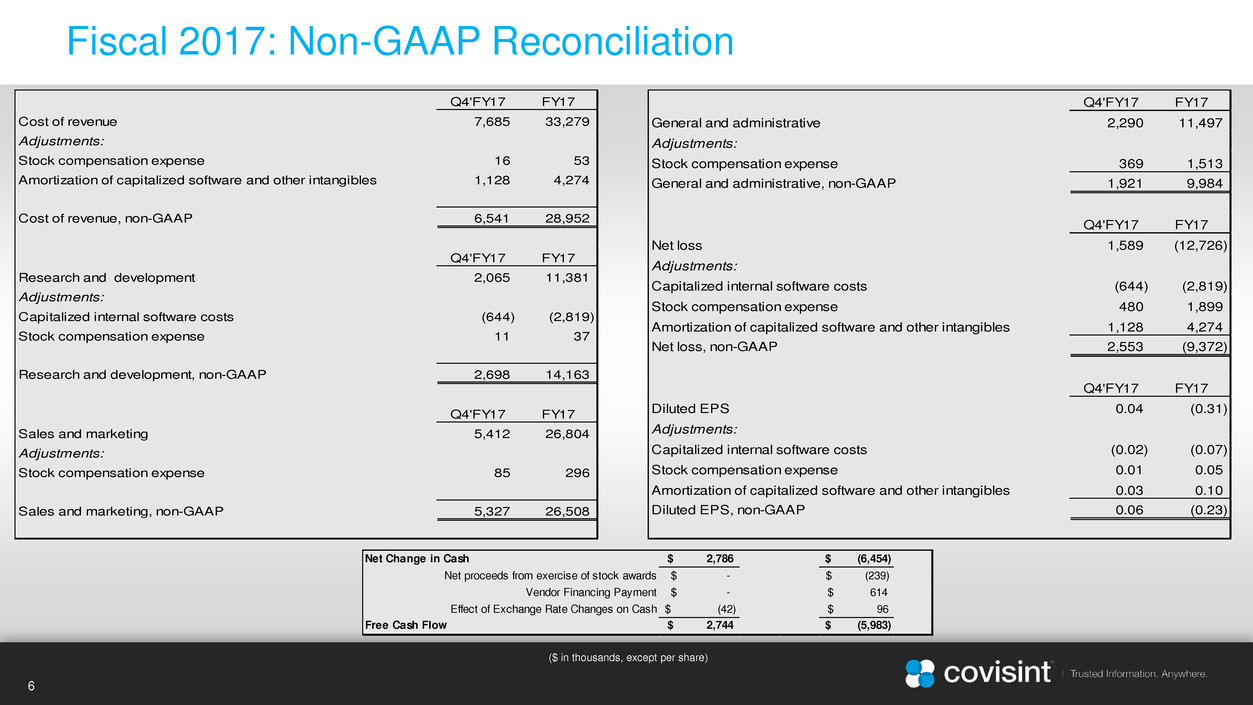

Fiscal 2017: Non-GAAP Reconciliation

($ in thousands, except per share)

Q4'FY17 FY17

Cost of revenue 7,685 33,279

Adjustments:

Stock compensation expense 16 53

Amortization of capitalized software and other intangibles 1,128 4,274

Cost of revenue, non-GAAP 6,541 28,952

Q4'FY17 FY17

Research and development 2,065 11,381

Adjustments:

Capitalized internal software costs (644) (2,819)

Stock compensation expense 11 37

Research and development, non-GAAP 2,698 14,163

Q4'FY17 FY17

Sales and marketing 5,412 26,804

Adjustments:

Stock compensation expense 85 296

Sales and marketing, non-GAAP 5,327 26,508

Net Change in Cash $ 2,786 $ (6,454)

Net proceeds from exercise of stock awards $ - $ (239)

Vendor Financing Payment $ - $ 614

Effect of Exchange Rate Changes on Cash $ (42) $ 96

Free Cash Flow $ 2,744 $ (5,983)

Q4'FY17 FY17

General and administrative 2,290 11,497

Adjustments:

Stock compensation expens 369 1,513

General and administrative, non-GAAP 1,921 9,984

Q4'FY17 FY17

Net loss 1,589 (12,726)

Adjustments:

Capitalized internal software costs (644) (2,819)

Stock comp nsation expense 480 1,899

Amortization of capitalized software and other intangibles 1,128 4,274

Net loss, non-GAAP 2,553 (9,372)

Q4'FY17 FY17

Diluted EPS 0.04 (0.31)

Adjustments:

Capitalized internal software costs (0.02) (0.07)

Stock compensation expense 0.01 0.05

Amortization of capitalized software and other intangibles 0.03 0.10

Diluted EPS, non-GAAP 0.06 (0.23)

6