Attached files

| file | filename |

|---|---|

| 8-K - 8-K - FORD MOTOR CREDIT CO LLC | sales8-kdated06x01x2017.htm |

§ Ford Motor Company’s overall U.S. sales for May

2017 totaled 241,126 vehicles, a 2.2 percent gain

compared to last year

§ Retail results declined 0.8 percent, with 158,282

vehicle sales

§ Fleet sales totaled 82,844 vehicles, representing

an 8.4 percent gain versus a year ago

§ Ford’s average transaction pricing increased

$2,100 last month, significantly outpacing an overall

industry increase of $500*

§ Ford F-Series sales of 76,027 pickups increased

12.8 percent last month, for the best May results in

13 years. F-Series also saw a $3,300 increase in

average transaction pricing*

§ Ford brand SUVs set May record, with 74,910

vehicles sold – up 4.2 percent versus a year ago

§ Ford Explorer sales increased 20.7 percent, with

22,715 SUVs sold, marking the vehicle’s best May

performance in 13 years

§ Ford Expedition sales of 5,758 SUVs were up 13.9

percent last month

§ Ford Edge sales increased 11.0 percent, with

13,752 vehicles sold

§ Lincoln retail sales increased 9.7 percent in May,

marking the brand’s 16th straight month of year-

over-year sales gains

About Ford Motor Company

Ford Motor Company is a global company based in Dearborn, Michigan.

The company designs, manufacturers, markets and services a full line

of Ford cars, trucks, SUVs, electrified vehicles and Lincoln luxury

vehicles, provides financial services through Ford Motor Credit

Company and is pursuing leadership positions in electrification,

autonomous vehicles and mobility solutions. Ford employs

approximately 202,000 people worldwide. For more information

regarding Ford, its products and Ford Motor Credit Company, please

visit www.corporate.ford.com.

*Average transaction pricing is based on J.D. Power and Associates PIN

data.

M A Y 2 0 17 S A L E S

May 2017 Sales

“May marked a standout month for

Ford brand SUVs, with a May record

74,910 SUVs sold. Plus, we continued

to see strong F-Series performance,

with sales and share rising this year,

along with average transaction pricing.

In May, overall F-Series sales were up

double digits and transaction prices

grew $3,300 per truck.”

Mark LaNeve, vice president,

U.S. Marketing, Sales and Service

Ford F-Series Hit Best May in 13 Years; Ford Brand SUVs

Set Record – up 4.2 percent; Average Transaction Prices

Up Substantially; Company’s U.S. Sales Up 2.2 Percent

Total Vehicle Retail Fleet Truck SUV Car

U.S. Sales 241,126 158,282 82,844 99,237 81,324 60,565

Versus

May 2016 2.2% -0.8% 8.4% 9.4% 4.3% -10.0%

H I G H L I G H T S

K E Y V E H I C L E S

Ford F-Series sales totaled 76,027

trucks. This marks F-Series’ best

May sales performance since 2004,

with F-Series retail sales up in every

region of the U.S.

Ford F-Series Super Duty

2018 Ford Explorer

2018 Ford Expedition

2018 Lincoln Navigator

Ford brand SUV sales totaled

74,910 vehicles, marking another

record-setting May. Growth came

from a 21 percent gain in Explorer

sales, along with a double-digit

increase for both Expedition and

Edge. The 2018 Explorer, left, hits

Ford dealerships this fall.

Ford Expedition sales totaled 5,758

vehicles last month, a 14 percent

increase, for the SUV’s best May

performance in a decade. The all-

new 2018 Expedition, left, goes on

sale this fall.

Lincoln retail sales were up 16

consecutive months in May. Lincoln

MKC delivered strong gains, up 17

percent, followed by the all-new

Lincoln Continental, with sales of

1,061 cars. The all-new Lincoln

Navigator, left, arrives in dealer

showrooms later this year.

For news releases, related materials and high-resolution photos and video, visit www.media.ford.com.

www.twitter.com/Ford

M A Y 2 0 17 I N V E N T O R Y / F L E E T R E S U LT S

2

May 2017 Sales

C O N TA C T

Erich Merkle

313.806.4562

emerkle2@ford.com

Fleet

Segment

Percent of

Total Sales

YOY Change Percent of

Total Sales

YOY Change

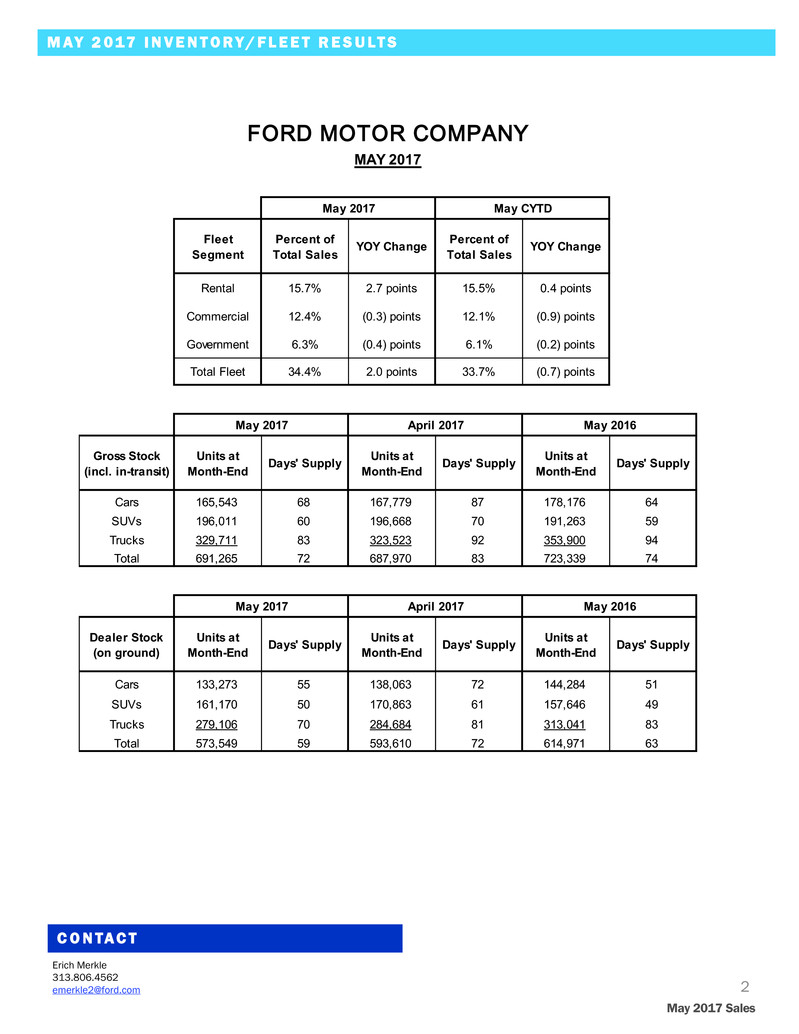

Rental 15.7% 2.7 points 15.5% 0.4 points

Commercial 12.4% (0.3) points 12.1% (0.9) points

Government 6.3% (0.4) points 6.1% (0.2) points

Total Fleet 34.4% 2.0 points 33.7% (0.7) points

Gross Stock

(incl. in-transit)

Units at

Month-End

Days' Supply Units at

Month-End

Days' Supply Units at

Month-End

Days' Supply

Cars 165,543 68 167,779 87 178,176 64

SUVs 196,011 60 196,668 70 191,263 59

Trucks 329,711 83 323,523 92 353,900 94

Total 691,265 72 687,970 83 723,339 74

Dealer Stock

(on ground)

Units at

Month-End

Days' Supply Units at

Month-End

Days' Supply Units at

Month-End

Days' Supply

Cars 133,273 55 138,063 72 144,284 51

SUVs 161,170 50 170,863 61 157,646 49

Trucks 279,106 70 284,684 81 313,041 83

Total 573,549 59 593,610 72 614,971 63

May 2017 April 2017 May 2016

??????????????????

MAY 2017

May 2017 May CYTD

May 2017 April 2017 May 2016