Attached files

| file | filename |

|---|---|

| 8-K - 8-K - LegacyTexas Financial Group, Inc. | a8k2017annualmeetingslides.htm |

2017 Annual Meeting of Shareholders

May 22, 2017

EXHIBIT 99.1

2

Safe harbor statement

When used in filings by LegacyTexas Financial Group, Inc. (the "Company”) with the Securities and Exchange Commission (the “SEC”),

in the Company's press releases or other public or stockholder communications, and in oral statements made with the approval of an

authorized executive officer, the words or phrases “will likely result,” “are expected to,” “will continue,” “is anticipated,” “estimate,”

“project,” “intends” or similar expressions are intended to identify “forward-looking statements” within the meaning of the Private

Securities Litigation Reform Act of 1995. Such statements are subject to certain risks and uncertainties that could cause actual

results to differ materially from historical earnings and those presently anticipated or projected, including, among other things: the

expected cost savings, synergies and other financial benefits from acquisition or disposition transactions might not be realized

within the expected time frames or at all and costs or difficulties relating to integration matters might be greater than expected;

changes in economic conditions; legislative changes; changes in policies by regulatory agencies; fluctuations in interest rates; the

risks of lending and investing activities, including changes in the level and direction of loan delinquencies and write-offs and

changes in estimates of the adequacy of the allowance for loan losses; the Company's ability to access cost-effective funding;

fluctuations in real estate values and both residential and commercial real estate market conditions; demand for loans and deposits

in the Company's market area; fluctuations in the price of oil, natural gas and other commodities; competition; changes in

management’s business strategies and other factors set forth in the Company's filings with the SEC.

The Company does not undertake - and specifically declines any obligation - to publicly release the result of any revisions which may

be made to any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the

occurrence of anticipated or unanticipated events.

3

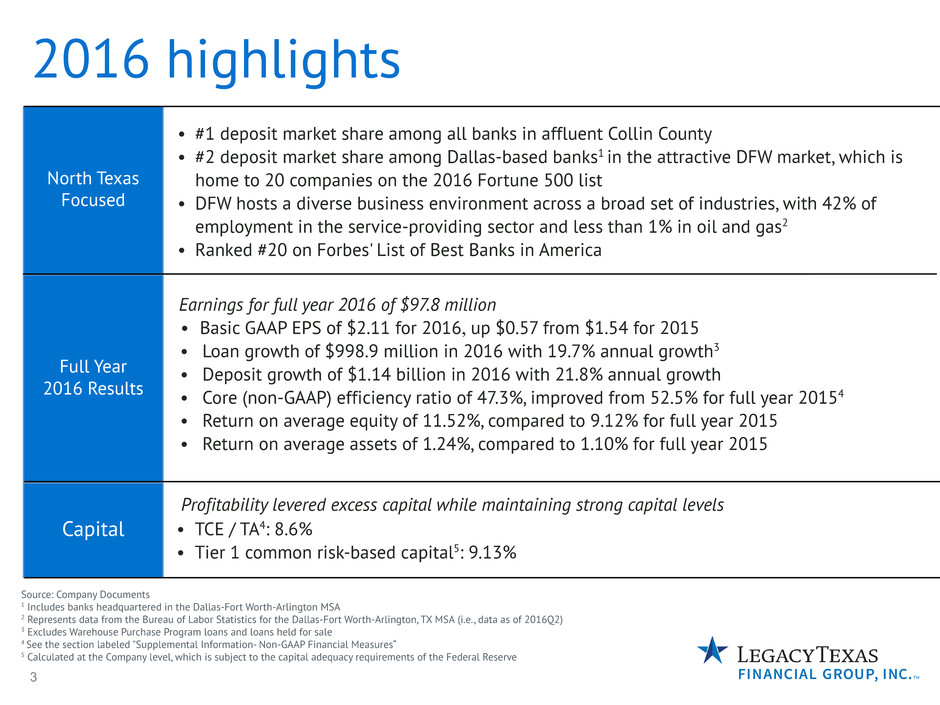

Full Year

2016 Results

North Texas

Focused

• #1 deposit market share among all banks in affluent Collin County

• #2 deposit market share among Dallas-based banks1 in the attractive DFW market, which is

home to 20 companies on the 2016 Fortune 500 list

• DFW hosts a diverse business environment across a broad set of industries, with 42% of

employment in the service-providing sector and less than 1% in oil and gas2

• Ranked #20 on Forbes' List of Best Banks in America

Capital

2016 highlights

Source: Company Documents

1 Includes banks headquartered in the Dallas-Fort Worth-Arlington MSA

2 Represents data from the Bureau of Labor Statistics for the Dallas-Fort Worth-Arlington, TX MSA (i.e., data as of 2016Q2)

3 Excludes Warehouse Purchase Program loans and loans held for sale

4 See the section labeled "Supplemental Information- Non-GAAP Financial Measures“

5 Calculated at the Company level, which is subject to the capital adequacy requirements of the Federal Reserve

Profitability levered excess capital while maintaining strong capital levels

• TCE / TA4: 8.6%

• Tier 1 common risk-based capital5: 9.13%

Earnings for full year 2016 of $97.8 million

• Basic GAAP EPS of $2.11 for 2016, up $0.57 from $1.54 for 2015

• Loan growth of $998.9 million in 2016 with 19.7% annual growth3

• Deposit growth of $1.14 billion in 2016 with 21.8% annual growth

• Core (non-GAAP) efficiency ratio of 47.3%, improved from 52.5% for full year 20154

• Return on average equity of 11.52%, compared to 9.12% for full year 2015

• Return on average assets of 1.24%, compared to 1.10% for full year 2015

4

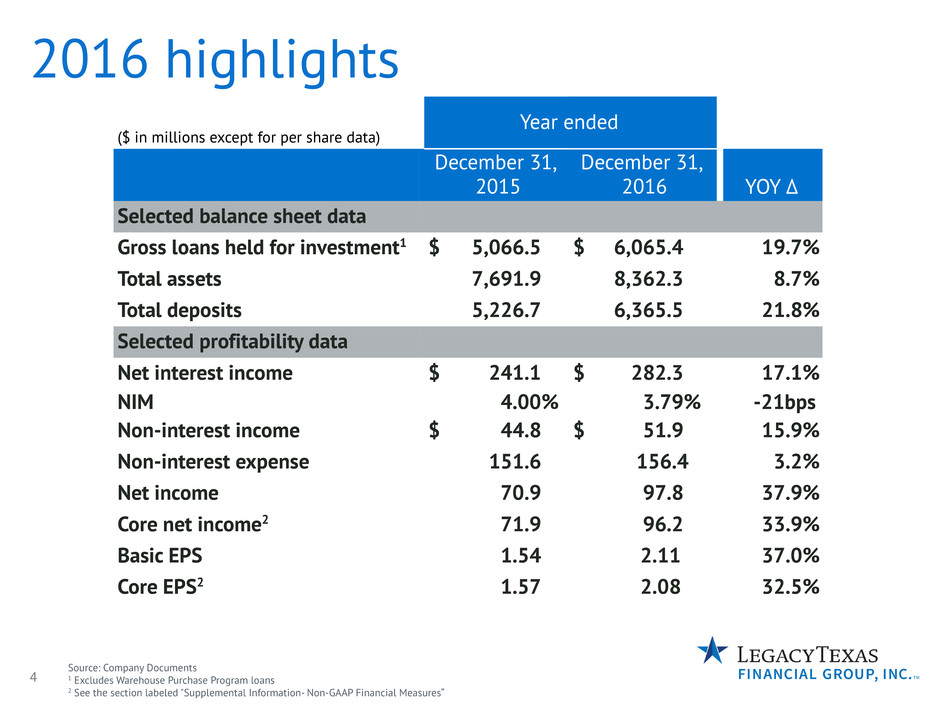

2016 highlights

($ in millions except for per share data)

Year ended

December 31,

2015

December 31,

2016 YOY ∆

Selected balance sheet data

Gross loans held for investment1 $ 5,066.5 $ 6,065.4 19.7%

Total assets 7,691.9 8,362.3 8.7%

Total deposits 5,226.7 6,365.5 21.8%

Selected profitability data

Net interest income $ 241.1 $ 282.3 17.1%

NIM 4.00% 3.79% -21bps

Non-interest income $ 44.8 $ 51.9 15.9%

Non-interest expense 151.6 156.4 3.2%

Net income 70.9 97.8 37.9%

Core net income2 71.9 96.2 33.9%

Basic EPS 1.54 2.11 37.0%

Core EPS2 1.57 2.08 32.5%

Source: Company Documents

1 Excludes Warehouse Purchase Program loans

2 See the section labeled "Supplemental Information- Non-GAAP Financial Measures“

5

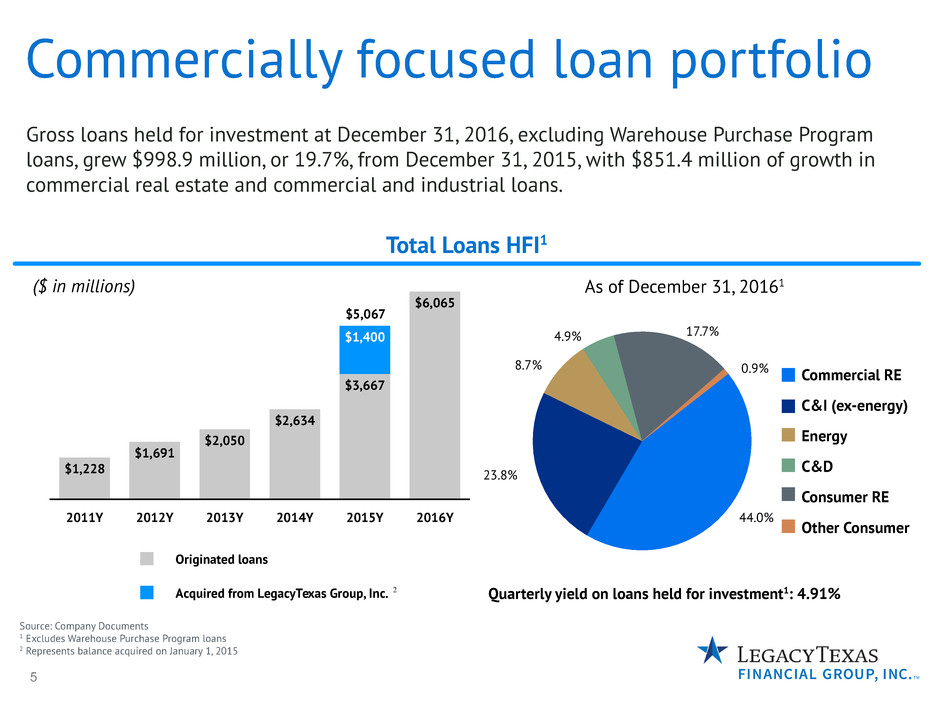

44.0%

23.8%

8.7%

4.9% 17.7%

0.9%

($ in millions)

Commercially focused loan portfolio

Source: Company Documents

1 Excludes Warehouse Purchase Program loans

2 Represents balance acquired on January 1, 2015

Gross loans held for investment at December 31, 2016, excluding Warehouse Purchase Program

loans, grew $998.9 million, or 19.7%, from December 31, 2015, with $851.4 million of growth in

commercial real estate and commercial and industrial loans.

As of December 31, 20161

Total Loans HFI1

Commercial RE

C&I (ex-energy)

Energy

C&D

Consumer RE

Other Consumer

2

$5,067

Quarterly yield on loans held for investment1: 4.91%

Originated loans

Acquired from LegacyTexas Group, Inc.

2011Y 2012Y 2013Y 2014Y 2015Y 2016Y

$1,228

$1,691

$2,050

$2,634

$3,667

$6,065

$1,400

6

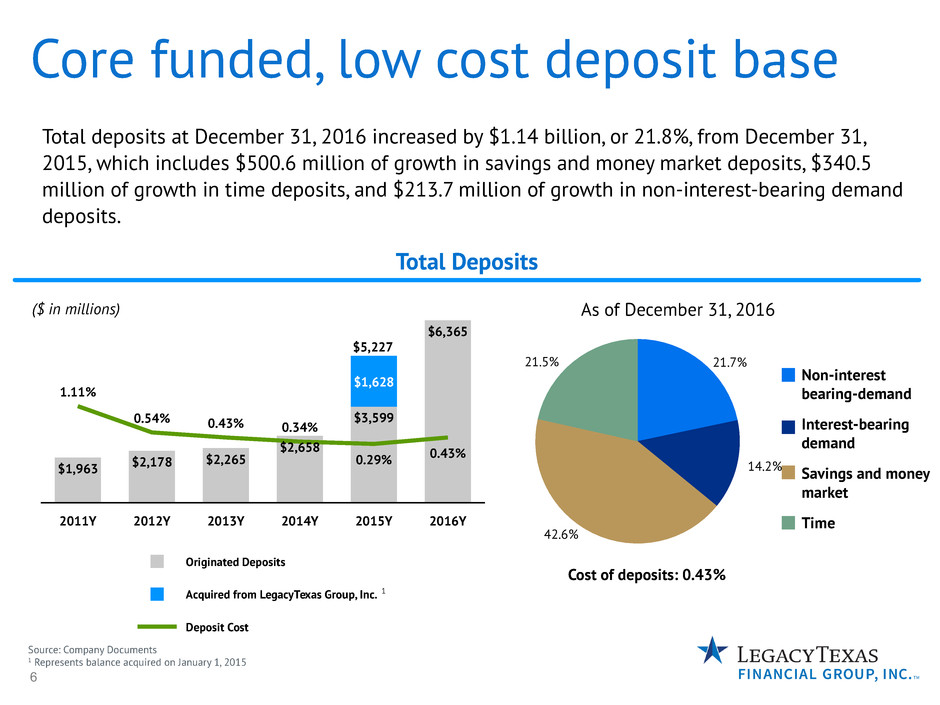

Total deposits at December 31, 2016 increased by $1.14 billion, or 21.8%, from December 31,

2015, which includes $500.6 million of growth in savings and money market deposits, $340.5

million of growth in time deposits, and $213.7 million of growth in non-interest-bearing demand

deposits.

Core funded, low cost deposit base

Source: Company Documents

1 Represents balance acquired on January 1, 2015

($ in millions)

Total Deposits

Cost of deposits: 0.43%

As of December 31, 2016

21.7%

14.2%

42.6%

21.5%

Non-interest

bearing-demand

Interest-bearing

demand

Savings and money

market

Time

$5,227

1

Originated Deposits

Acquired from LegacyTexas Group, Inc.

Deposit Cost

2011Y 2012Y 2013Y 2014Y 2015Y 2016Y

$1,963 $2,178

$2,265

$2,658

$3,599

$6,365

$1,628

1.11%

0.54% 0.43% 0.34%

0.29% 0.43%

7

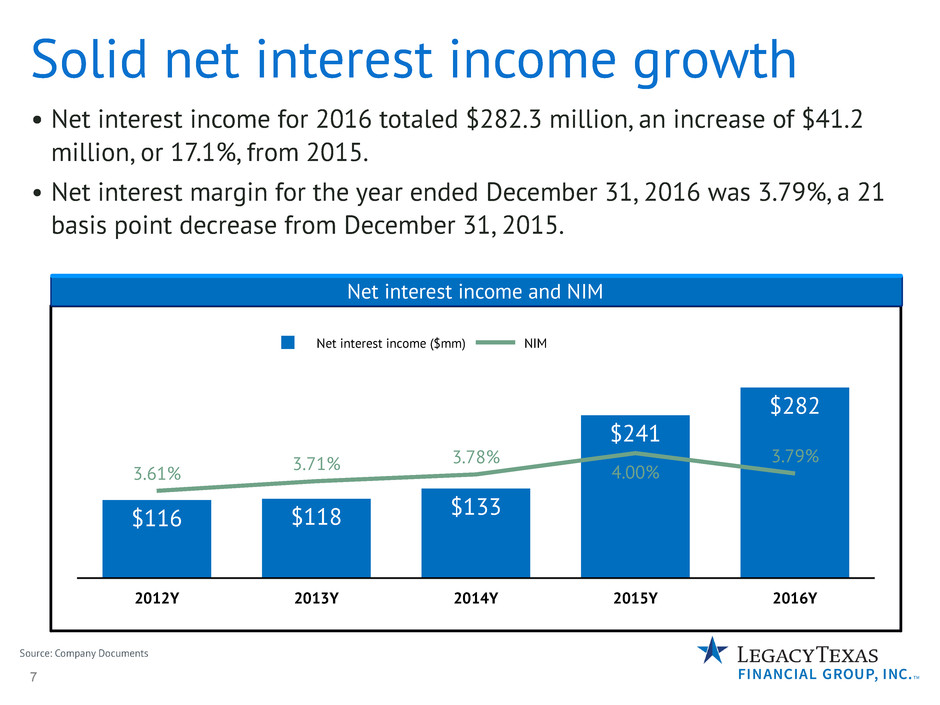

Net interest income ($mm) NIM

2012Y 2013Y 2014Y 2015Y 2016Y

$116 $118 $133

$241

$282

3.61% 3.71%

3.78%

4.00%

3.79%

Solid net interest income growth

Source: Company Documents

Net interest income and NIM

R: 000

G: 048

B: 135

R: 111

G: 162

B: 135

• Net interest income for 2016 totaled $282.3 million, an increase of $41.2

million, or 17.1%, from 2015.

• Net interest margin for the year ended December 31, 2016 was 3.79%, a 21

basis point decrease from December 31, 2015.

8

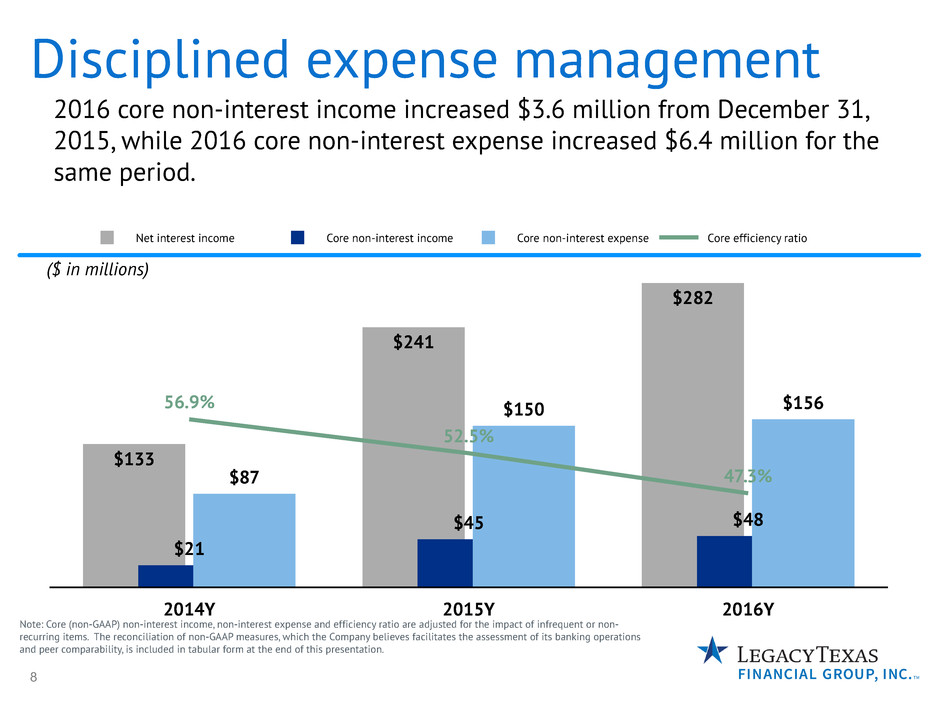

Disciplined expense management

($ in millions)

2016 core non-interest income increased $3.6 million from December 31,

2015, while 2016 core non-interest expense increased $6.4 million for the

same period.

Note: Core (non-GAAP) non-interest income, non-interest expense and efficiency ratio are adjusted for the impact of infrequent or non-

recurring items. The reconciliation of non-GAAP measures, which the Company believes facilitates the assessment of its banking operations

and peer comparability, is included in tabular form at the end of this presentation.

Net interest income Core non-interest income Core non-interest expense Core efficiency ratio

2014Y 2015Y 2016Y

$133

$241

$282

$21

$45 $48

$87

$150 $15656.9%

52.5%

47.3%

9

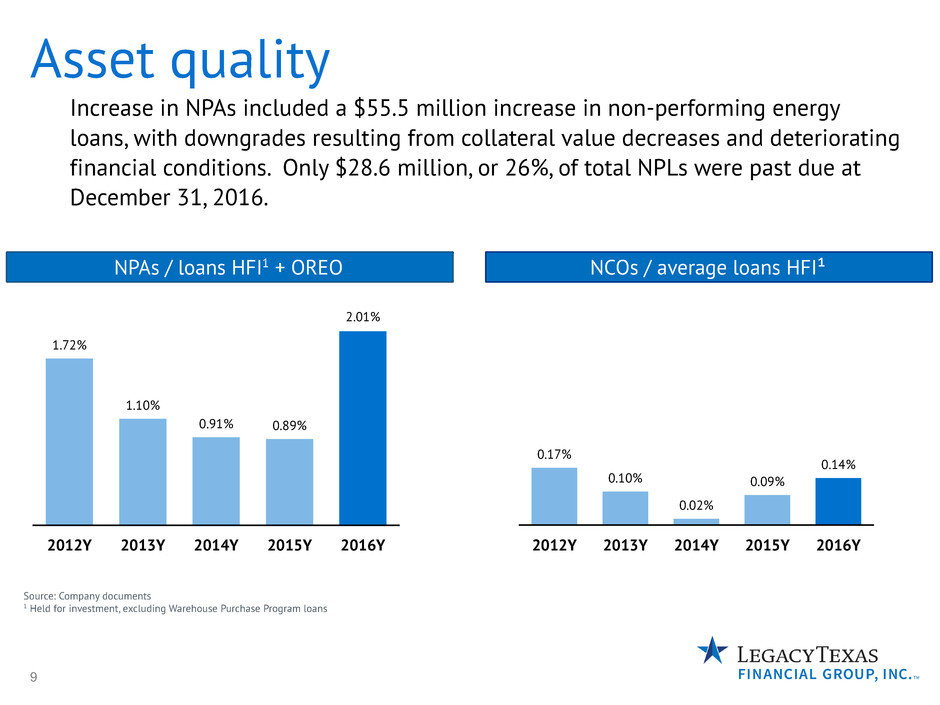

Asset quality

Source: Company documents

1 Held for investment, excluding Warehouse Purchase Program loans

NCOs / average loans HFI¹NPAs / loans HFI1 + OREOR: 000

G: 048

B: 135

R: 111

G: 162

B: 135

2012Y 2013Y 2014Y 2015Y 2016Y

1.72%

1.10%

0.91% 0.89%

2.01%

2012Y 2013Y 2014Y 2015Y 2016Y

0.17%

0.10%

0.02%

0.09%

0.14%

Increase in NPAs included a $55.5 million increase in non-performing energy

loans, with downgrades resulting from collateral value decreases and deteriorating

financial conditions. Only $28.6 million, or 26%, of total NPLs were past due at

December 31, 2016.

10

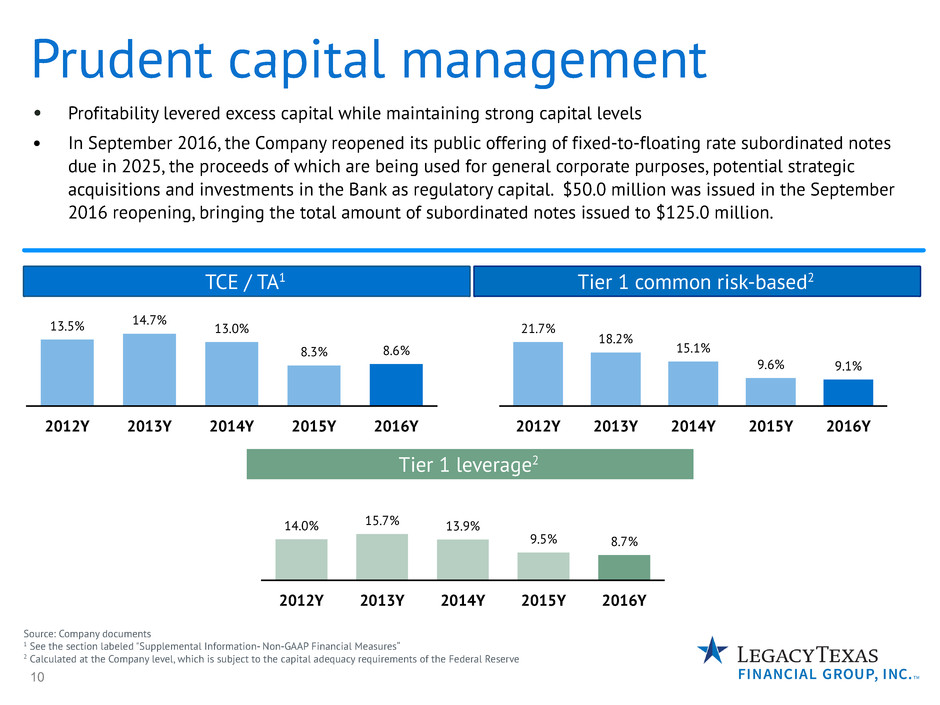

Prudent capital management

Source: Company documents

1 See the section labeled "Supplemental Information- Non-GAAP Financial Measures“

2 Calculated at the Company level, which is subject to the capital adequacy requirements of the Federal Reserve

TCE / TA1 Tier 1 common risk-based2

Tier 1 leverage2

• Profitability levered excess capital while maintaining strong capital levels

• In September 2016, the Company reopened its public offering of fixed-to-floating rate subordinated notes

due in 2025, the proceeds of which are being used for general corporate purposes, potential strategic

acquisitions and investments in the Bank as regulatory capital. $50.0 million was issued in the September

2016 reopening, bringing the total amount of subordinated notes issued to $125.0 million.

2012Y 2013Y 2014Y 2015Y 2016Y

13.5% 14.7% 13.0%

8.3% 8.6%

2012Y 2013Y 2014Y 2015Y 2016Y

21.7%

18.2%

15.1%

9.6% 9.1%

2012Y 2013Y 2014Y 2015Y 2016Y

14.0% 15.7% 13.9%

9.5% 8.7%

11

Key investment highlights

One of the largest independent Texas financial services companies built

upon a strong customer focus and a long history of serving Texans

Commercially focused loan growth and disciplined expense management

Growth balanced with disciplined underwriting and risk management

Capital ratios remain strong; provides dry powder for robust organic growth

12

Looking ahead

Expand our Texas footprint and solidify our deep-rooted culture

Focus on growth – organically and through selective acquisitions

Diversify income sources

Prudent and focused expense management

Maintain asset quality

Strategic capital deployment

Appendix

14

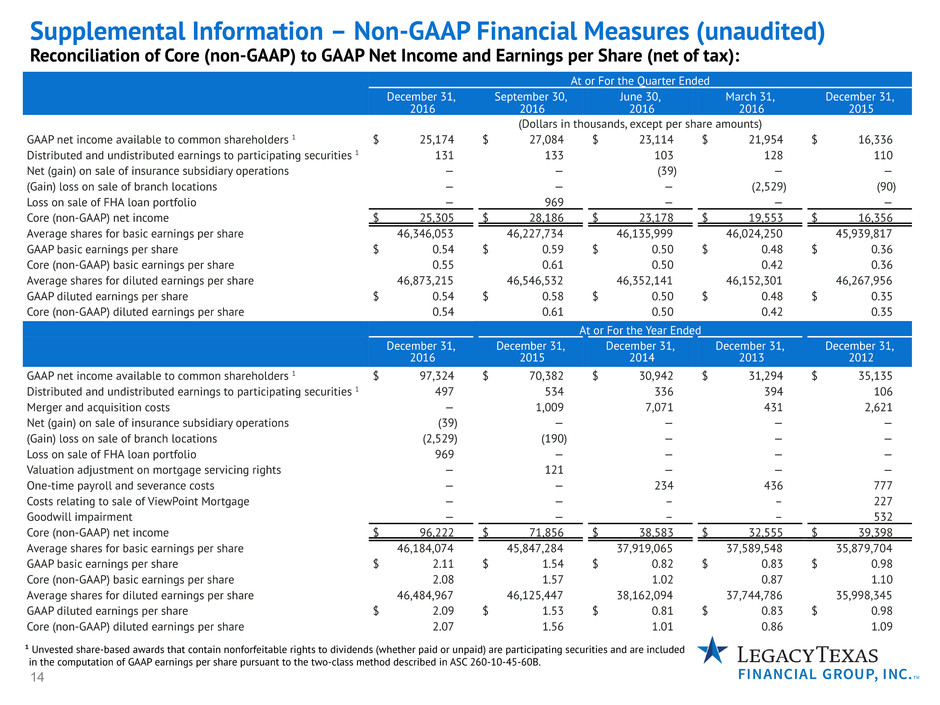

Supplemental Information – Non-GAAP Financial Measures (unaudited)

Reconciliation of Core (non-GAAP) to GAAP Net Income and Earnings per Share (net of tax):

At or For the Quarter Ended

December 31,

2016

September 30,

2016

June 30,

2016

March 31,

2016

December 31,

2015

(Dollars in thousands, except per share amounts)

GAAP net income available to common shareholders 1 $ 25,174 $ 27,084 $ 23,114 $ 21,954 $ 16,336

Distributed and undistributed earnings to participating securities 1 131 133 103 128 110

Net (gain) on sale of insurance subsidiary operations — — (39) — —

(Gain) loss on sale of branch locations — — — (2,529) (90)

Loss on sale of FHA loan portfolio — 969 — — —

Core (non-GAAP) net income $ 25,305 $ 28,186 $ 23,178 $ 19,553 $ 16,356

Average shares for basic earnings per share 46,346,053 46,227,734 46,135,999 46,024,250 45,939,817

GAAP basic earnings per share $ 0.54 $ 0.59 $ 0.50 $ 0.48 $ 0.36

Core (non-GAAP) basic earnings per share 0.55 0.61 0.50 0.42 0.36

Average shares for diluted earnings per share 46,873,215 46,546,532 46,352,141 46,152,301 46,267,956

GAAP diluted earnings per share $ 0.54 $ 0.58 $ 0.50 $ 0.48 $ 0.35

Core (non-GAAP) diluted earnings per share 0.54 0.61 0.50 0.42 0.35

¹ Unvested share-based awards that contain nonforfeitable rights to dividends (whether paid or unpaid) are participating securities and are included

in the computation of GAAP earnings per share pursuant to the two-class method described in ASC 260-10-45-60B.

At or For the Year Ended

December 31,

2016

December 31,

2015

December 31,

2014

December 31,

2013

December 31,

2012

GAAP net income available to common shareholders 1 $ 97,324 $ 70,382 $ 30,942 $ 31,294 $ 35,135

Distributed and undistributed earnings to participating securities 1 497 534 336 394 106

Merger and acquisition costs — 1,009 7,071 431 2,621

Net (gain) on sale of insurance subsidiary operations (39) — — — —

(Gain) loss on sale of branch locations (2,529) (190) — — —

Loss on sale of FHA loan portfolio 969 — — — —

Valuation adjustment on mortgage servicing rights — 121 — — —

One-time payroll and severance costs — — 234 436 777

Costs relating to sale of ViewPoint Mortgage — — – – 227

Goodwill impairment — — – – 532

Core (non-GAAP) net income $ 96,222 $ 71,856 $ 38,583 $ 32,555 $ 39,398

Average shares for basic earnings per share 46,184,074 45,847,284 37,919,065 37,589,548 35,879,704

GAAP basic earnings per share $ 2.11 $ 1.54 $ 0.82 $ 0.83 $ 0.98

Core (non-GAAP) basic earnings per share 2.08 1.57 1.02 0.87 1.10

Average shares for diluted earnings per share 46,484,967 46,125,447 38,162,094 37,744,786 35,998,345

GAAP diluted earnings per share $ 2.09 $ 1.53 $ 0.81 $ 0.83 $ 0.98

Core (non-GAAP) diluted earnings per share 2.07 1.56 1.01 0.86 1.09

15

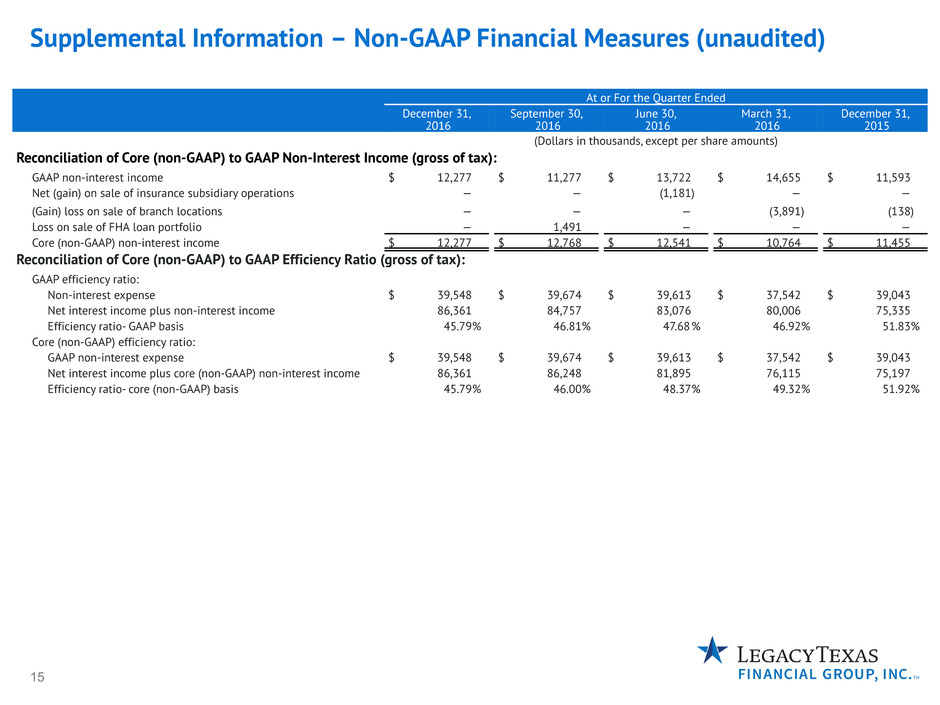

Supplemental Information – Non-GAAP Financial Measures (unaudited)

At or For the Quarter Ended

December 31,

2016

September 30,

2016

June 30,

2016

March 31,

2016

December 31,

2015

(Dollars in thousands, except per share amounts)

Reconciliation of Core (non-GAAP) to GAAP Non-Interest Income (gross of tax):

GAAP non-interest income $ 12,277 $ 11,277 $ 13,722 $ 14,655 $ 11,593

Net (gain) on sale of insurance subsidiary operations — — (1,181) — —

(Gain) loss on sale of branch locations — — — (3,891) (138)

Loss on sale of FHA loan portfolio — 1,491 — — —

Core (non-GAAP) non-interest income $ 12,277 $ 12,768 $ 12,541 $ 10,764 $ 11,455

Reconciliation of Core (non-GAAP) to GAAP Efficiency Ratio (gross of tax):

GAAP efficiency ratio:

Non-interest expense $ 39,548 $ 39,674 $ 39,613 $ 37,542 $ 39,043

Net interest income plus non-interest income 86,361 84,757 83,076 80,006 75,335

Efficiency ratio- GAAP basis 45.79% 46.81% 47.68% 46.92% 51.83%

Core (non-GAAP) efficiency ratio:

GAAP non-interest expense $ 39,548 $ 39,674 $ 39,613 $ 37,542 $ 39,043

Net interest income plus core (non-GAAP) non-interest income 86,361 86,248 81,895 76,115 75,197

Efficiency ratio- core (non-GAAP) basis 45.79% 46.00% 48.37% 49.32% 51.92%

16

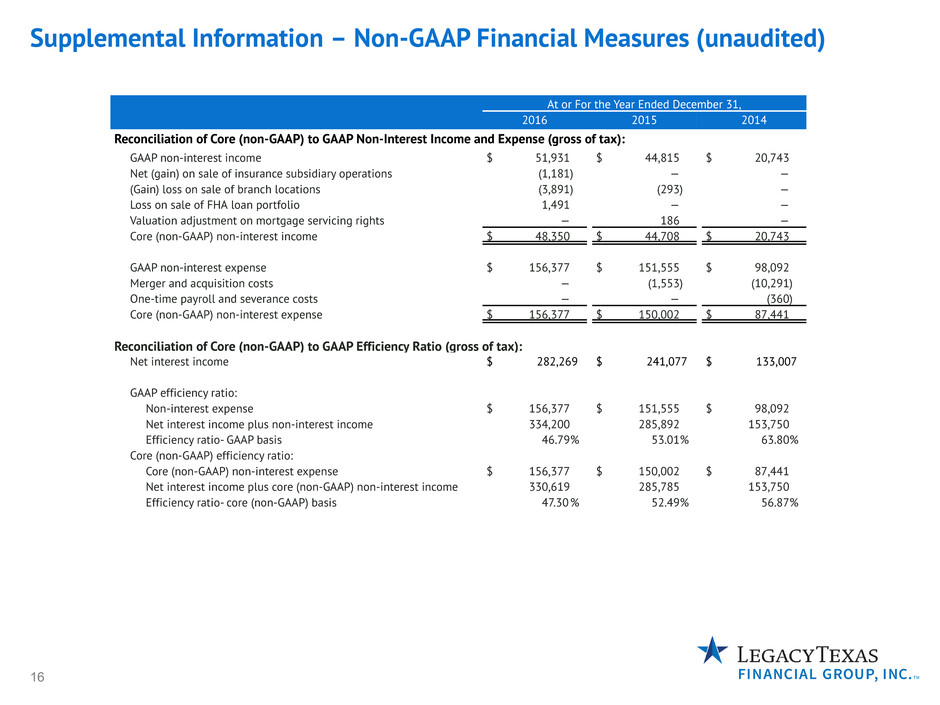

Supplemental Information – Non-GAAP Financial Measures (unaudited)

At or For the Year Ended December 31,

2016 2015 2014

Reconciliation of Core (non-GAAP) to GAAP Non-Interest Income and Expense (gross of tax):

GAAP non-interest income $ 51,931 $ 44,815 $ 20,743

Net (gain) on sale of insurance subsidiary operations (1,181) — —

(Gain) loss on sale of branch locations (3,891) (293) —

Loss on sale of FHA loan portfolio 1,491 — —

Valuation adjustment on mortgage servicing rights — 186 —

Core (non-GAAP) non-interest income $ 48,350 $ 44,708 $ 20,743

GAAP non-interest expense $ 156,377 $ 151,555 $ 98,092

Merger and acquisition costs — (1,553) (10,291)

One-time payroll and severance costs — — (360)

Core (non-GAAP) non-interest expense $ 156,377 $ 150,002 $ 87,441

Reconciliation of Core (non-GAAP) to GAAP Efficiency Ratio (gross of tax):

Net interest income $ 282,269 $ 241,077 $ 133,007

GAAP efficiency ratio:

Non-interest expense $ 156,377 $ 151,555 $ 98,092

Net interest income plus non-interest income 334,200 285,892 153,750

Efficiency ratio- GAAP basis 46.79% 53.01% 63.80%

Core (non-GAAP) efficiency ratio:

Core (non-GAAP) non-interest expense $ 156,377 $ 150,002 $ 87,441

Net interest income plus core (non-GAAP) non-interest income 330,619 285,785 153,750

Efficiency ratio- core (non-GAAP) basis 47.30% 52.49% 56.87%

17

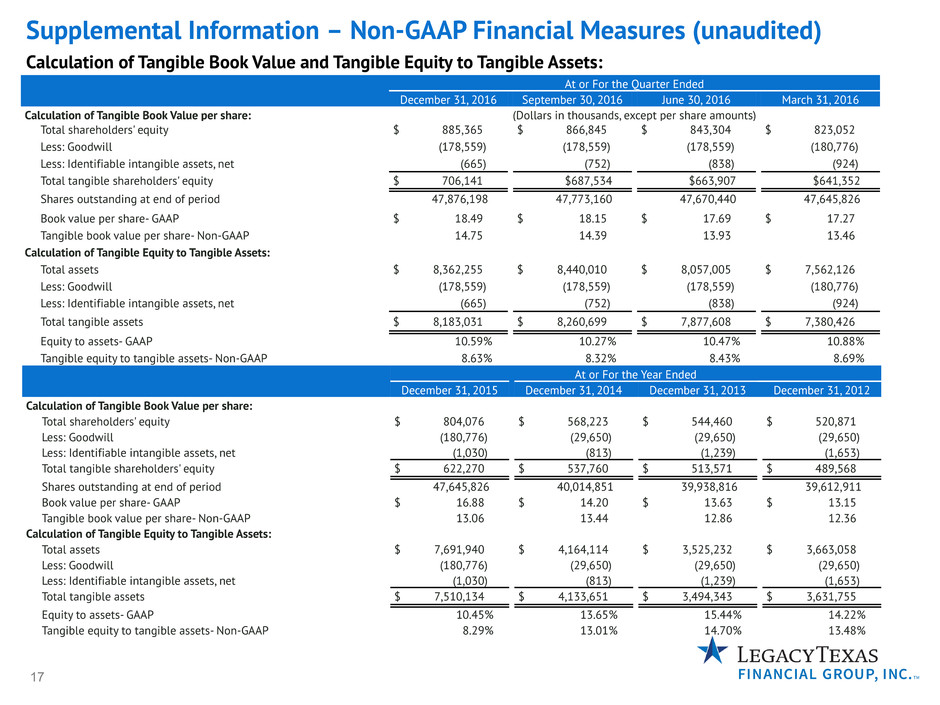

Supplemental Information – Non-GAAP Financial Measures (unaudited)

Calculation of Tangible Book Value and Tangible Equity to Tangible Assets:

At or For the Quarter Ended

December 31, 2016 September 30, 2016 June 30, 2016 March 31, 2016

Calculation of Tangible Book Value per share: (Dollars in thousands, except per share amounts)

Total shareholders' equity $ 885,365 $ 866,845 $ 843,304 $ 823,052

Less: Goodwill (178,559) (178,559) (178,559) (180,776)

Less: Identifiable intangible assets, net (665) (752) (838) (924)

Total tangible shareholders' equity $ 706,141 $687,534 $663,907 $641,352

Shares outstanding at end of period 47,876,198 47,773,160 47,670,440 47,645,826

Book value per share- GAAP $ 18.49 $ 18.15 $ 17.69 $ 17.27

Tangible book value per share- Non-GAAP 14.75 14.39 13.93 13.46

Calculation of Tangible Equity to Tangible Assets:

Total assets $ 8,362,255 $ 8,440,010 $ 8,057,005 $ 7,562,126

Less: Goodwill (178,559) (178,559) (178,559) (180,776)

Less: Identifiable intangible assets, net (665) (752) (838) (924)

Total tangible assets $ 8,183,031 $ 8,260,699 $ 7,877,608 $ 7,380,426

Equity to assets- GAAP 10.59% 10.27% 10.47% 10.88%

Tangible equity to tangible assets- Non-GAAP 8.63% 8.32% 8.43% 8.69%

At or For the Year Ended

December 31, 2015 December 31, 2014 December 31, 2013 December 31, 2012

Calculation of Tangible Book Value per share:

Total shareholders' equity $ 804,076 $ 568,223 $ 544,460 $ 520,871

Less: Goodwill (180,776) (29,650) (29,650) (29,650)

Less: Identifiable intangible assets, net (1,030) (813) (1,239) (1,653)

Total tangible shareholders' equity $ 622,270 $ 537,760 $ 513,571 $ 489,568

Shares outstanding at end of period 47,645,826 40,014,851 39,938,816 39,612,911

Book value per share- GAAP $ 16.88 $ 14.20 $ 13.63 $ 13.15

Tangible book value per share- Non-GAAP 13.06 13.44 12.86 12.36

Calculation of Tangible Equity to Tangible Assets:

Total assets $ 7,691,940 $ 4,164,114 $ 3,525,232 $ 3,663,058

Less: Goodwill (180,776) (29,650) (29,650) (29,650)

Less: Identifiable intangible assets, net (1,030) (813) (1,239) (1,653)

Total tangible assets $ 7,510,134 $ 4,133,651 $ 3,494,343 $ 3,631,755

Equity to assets- GAAP 10.45% 13.65% 15.44% 14.22%

Tangible equity to tangible assets- Non-GAAP 8.29% 13.01% 14.70% 13.48%

18

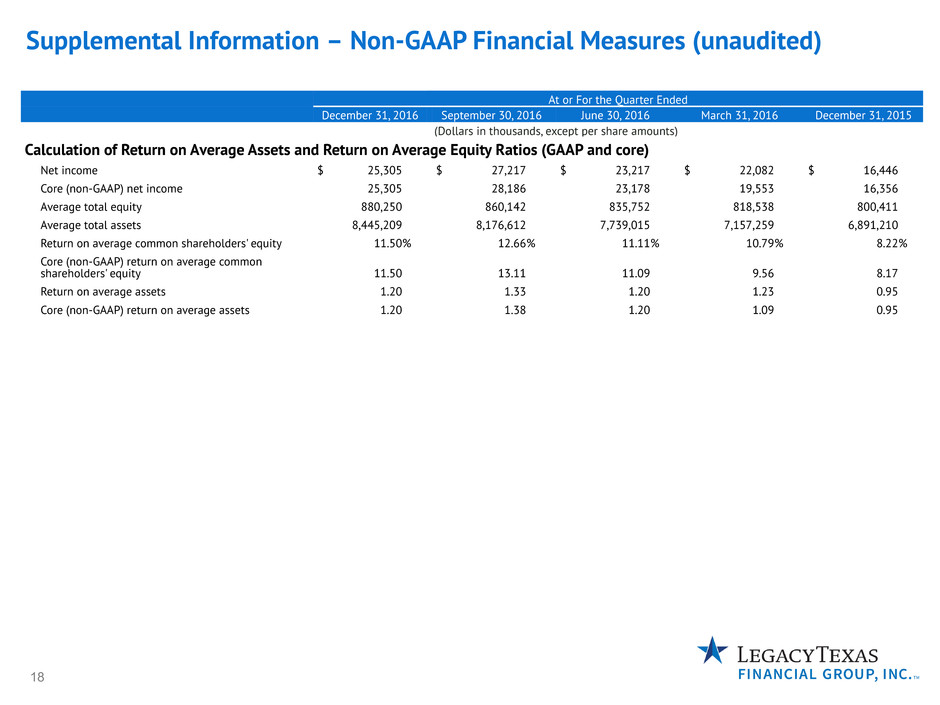

Supplemental Information – Non-GAAP Financial Measures (unaudited)

At or For the Quarter Ended

December 31, 2016 September 30, 2016 June 30, 2016 March 31, 2016 December 31, 2015

(Dollars in thousands, except per share amounts)

Calculation of Return on Average Assets and Return on Average Equity Ratios (GAAP and core)

Net income $ 25,305 $ 27,217 $ 23,217 $ 22,082 $ 16,446

Core (non-GAAP) net income 25,305 28,186 23,178 19,553 16,356

Average total equity 880,250 860,142 835,752 818,538 800,411

Average total assets 8,445,209 8,176,612 7,739,015 7,157,259 6,891,210

Return on average common shareholders' equity 11.50% 12.66% 11.11% 10.79% 8.22%

Core (non-GAAP) return on average common

shareholders' equity 11.50 13.11 11.09 9.56 8.17

Return on average assets 1.20 1.33 1.20 1.23 0.95

Core (non-GAAP) return on average assets 1.20 1.38 1.20 1.09 0.95