Attached files

| file | filename |

|---|---|

| 8-K - 8-K - W R GRACE & CO | gra8-kx051517conferencepre.htm |

1 W. R. Grace & Co. | Confidential Goldman Sachs Conference | May 16, 2017

Company Overview

May 16, 2017

Conference

2 W. R. Grace & Co. | Confidential Goldman Sachs Conference | May 16, 2017

Disclaimer

Statement Regarding Safe Harbor For Forward-Looking Statements

This presentation contains forward-looking statements, that is, information related to future, not past, events. Such statements generally include

the words ―believes,‖ ―plans,‖ ―intends,‖ ―targets,‖ ―will,‖ ―expects,‖ ―suggests,‖ ―anticipates,‖ ―outlook,‖ ―continues,‖ or similar expressions.

Forward-looking statements include, without limitation, expected financial positions; results of operations; cash flows; financing plans; business

strategy; operating plans; capital and other expenditures; competitive positions; growth opportunities for existing products; benefits from new

technology and cost reduction initiatives, plans and objectives; and markets for securities. For these statements, Grace claims the protections

of the safe harbor for forward-looking statements contained in Section 27A of the Securities Act and Section 21E of the Exchange Act. Like

other businesses, Grace is subject to risks and uncertainties that could cause its actual results to differ materially from its projections or that

could cause other forward-looking statements to prove incorrect. Factors that could cause actual results to differ materially from those

contained in the forward-looking statements include, without limitation: risks related to foreign operations, especially in emerging regions; the

cost and availability of raw materials and energy; the effectiveness of its research and development and growth investments; acquisitions and

divestitures of assets and gains and losses from dispositions; developments affecting Grace’s outstanding indebtedness; developments

affecting Grace's funded and unfunded pension obligations; its legal and environmental proceedings; uncertainties related to Grace’s ability to

realize the anticipated benefits of the separation transaction; the inability to establish or maintain certain business relationships and

relationships with customers and suppliers or the inability to retain key personnel; costs of compliance with environmental regulation; and those

additional factors set forth in Grace's most recent Annual Report on Form 10-K, quarterly report on Form 10-Q and current reports on Form 8-K,

which have been filed with the Securities and Exchange Commission and are readily available on the Internet at www.sec.gov. Reported results

should not be considered as an indication of future performance. Readers are cautioned not to place undue reliance on Grace's projections and

forward-looking statements, which speak only as the date thereof. Grace undertakes no obligation to publicly release any revision to the

projections and forward-looking statements contained in this announcement, or to update them to reflect events or circumstances occurring

after the date of this presentation.

Non-GAAP Financial Terms

In this presentation, Grace presents financial information in accordance with U.S. generally accepted accounting principles (U.S. GAAP), as

well as the non-GAAP financial information described in the Appendix. Grace believes that this non-GAAP financial information provides useful

supplemental information about the performance of its businesses, improves period-to-period comparability and provides clarity on the

information management uses to evaluate the performance of its businesses. In the Appendix, Grace has provided reconciliations of these non-

GAAP financial measures to the most directly comparable financial measure calculated and presented in accordance with U.S. GAAP. These

non-GAAP financial measures should not be considered as a substitute for financial measures calculated in accordance with U.S. GAAP, and

the financial results calculated in accordance with U.S. GAAP and reconciliations from those results should be evaluated carefully.

3 W. R. Grace & Co. | Confidential Goldman Sachs Conference | May 16, 2017

Global Public Company Built on talent, technology, and trust,

Grace is a leading global supplier of

specialty chemicals.

Our two industry-leading business segments

—Catalysts Technologies and Materials

Technologies—provide innovative products,

technologies, and services that enhance the

products and processes of our customer

partners around the world.

3,700 employees in 30 countries

Customers in 60 countries

New York Stock Exchange (GRA)

Holding more than 800 active

U.S. patents

23 acquisitions since 2003

Headquarters in Columbia, Maryland

Founded in 1854

Welcome

4 W. R. Grace & Co. | Confidential Goldman Sachs Conference | May 16, 2017

Strong Financial Performance; Seasoned Leaders

SC

FCC

28%

47%

25%

Total

$1.6b1

Catalysts

Technologies

78% Sales

1

ART

31%

33%

8%

28%

Total

$0.4b

Coatings Consumer/

Pharma

Chemical

Process

Materials

Technologies

22% Sales

1

Other

#1 in FCC catalysts

#1 in resid hydroprocessing catalysts

#2 in hydrocracking catalysts

#1 in polyolefin catalysts

#2 in polypropylene catalysts and

process technology licensing

#1 in specialty silica gel, pioneer in multiple segments

Market Leading

Positions

Fred Festa, Chairman and Chief Executive Officer; Hudson La Force, President and Chief Operating Officer; Thomas E. Blaser, Senior Vice President and Chief

Financial Officer; Elizabeth C. Brown, Vice President and Chief Human Resources Officer; Keith N. Cole, Vice President, Government Relations and Environment,

Health, and Safety; Mark A. Shelnitz, Vice President, General Counsel, and Secretary

A $2 Billion Technology Leader

1 Sales based on FY2016; Catalysts Technologies includes unconsolidated ART joint venture

FCC = Fluid Catalytic Cracking, SC = Specialty Catalysts, ART = Advanced Refining Technologies

FCC and ART together are referred to as Refining Technologies

5 W. R. Grace & Co. | Confidential Goldman Sachs Conference | May 16, 2017

Polyolefin

Catalysts

MATERIALS

TECHNOLOGIES

CATALYSTS

TECHNOLOGIES

Refining

Catalysts

Polyolefin

Catalysts

Chemical

Catalysts

Functional

Additives

Processing

Aids

Pharma

RSM and AI

Plastics/

Petrochemicals

Transportation

Fuels

Industrial

Coatings

Consumer/

Pharmaceuticals

Large End Markets; Many Growth Drivers

Fuels

Automotive

Pipes

Cosmetics

Pharmaceuticals

Furniture, Paint

Emission

Control

Packaging

RSM = Regulatory Starting Materials and AI = Advanced Intermediates

6 W. R. Grace & Co. | Confidential Goldman Sachs Conference | May 16, 2017

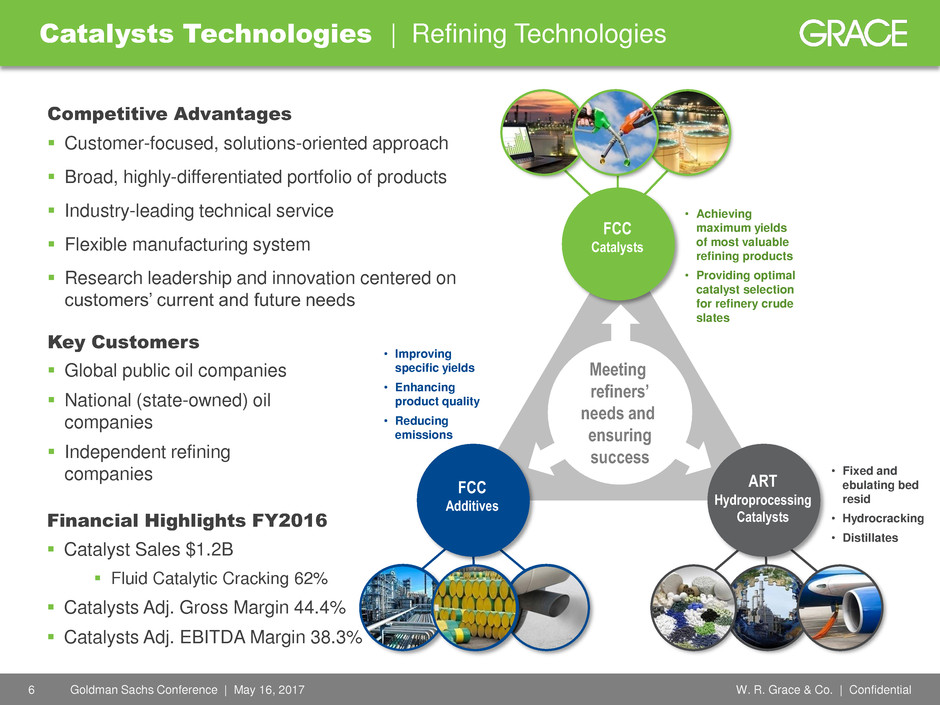

Meeting

refiners’

needs and

ensuring

success

FCC

Catalysts

ART

Hydroprocessing

Catalysts

FCC

Additives

Customer-focused, solutions-oriented approach

Broad, highly-differentiated portfolio of products

Industry-leading technical service

Flexible manufacturing system

Research leadership and innovation centered on

customers’ current and future needs

Key Customers

Competitive Advantages

Global public oil companies

National (state-owned) oil

companies

Independent refining

companies • Fixed and

ebulating bed

resid

• Hydrocracking

• Distillates

• Improving

specific yields

• Enhancing

product quality

• Reducing

emissions

• Achieving

maximum yields

of most valuable

refining products

• Providing optimal

catalyst selection

for refinery crude

slates

Catalysts Technologies | Refining Technologies

Financial Highlights FY2016

Catalyst Sales $1.2B

Fluid Catalytic Cracking 62%

Catalysts Adj. Gross Margin 44.4%

Catalysts Adj. EBITDA Margin 38.3%

7 W. R. Grace & Co. | Confidential Goldman Sachs Conference | May 16, 2017

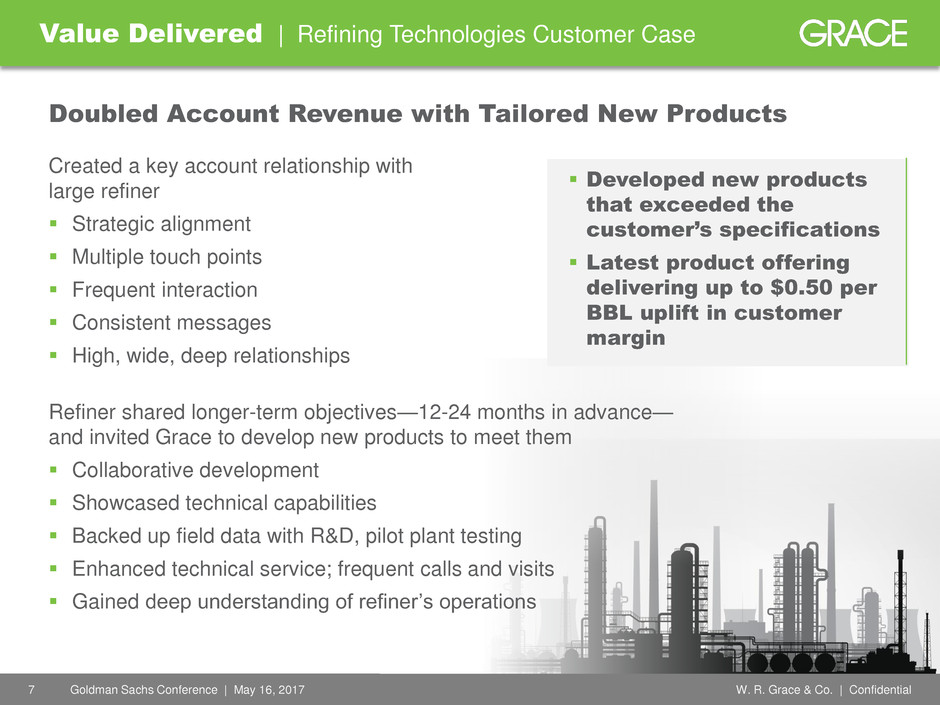

Value Delivered | Refining Technologies Customer Case

Doubled Account Revenue with Tailored New Products

Created a key account relationship with

large refiner

Strategic alignment

Multiple touch points

Frequent interaction

Consistent messages

High, wide, deep relationships

Refiner shared longer-term objectives—12-24 months in advance—

and invited Grace to develop new products to meet them

Collaborative development

Showcased technical capabilities

Backed up field data with R&D, pilot plant testing

Enhanced technical service; frequent calls and visits

Gained deep understanding of refiner’s operations

Developed new products

that exceeded the

customer’s specifications

Latest product offering

delivering up to $0.50 per

BBL uplift in customer

margin

8 W. R. Grace & Co. | Confidential Goldman Sachs Conference | May 16, 2017

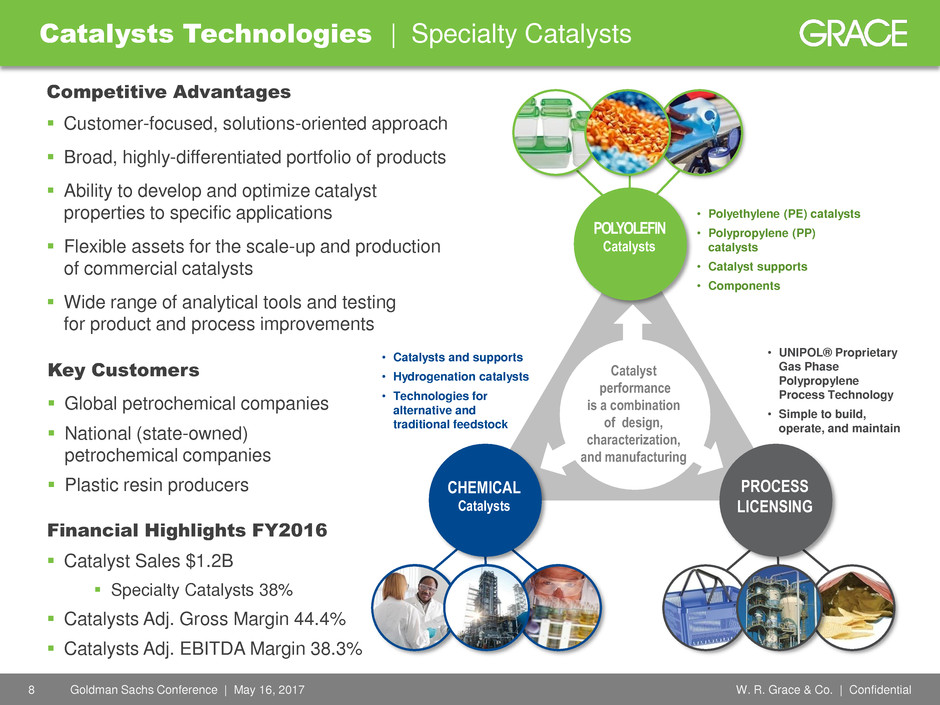

POLYOLEFIN

Catalysts

PROCESS

LICENSING

CHEMICAL

Catalysts

Customer-focused, solutions-oriented approach

Broad, highly-differentiated portfolio of products

Ability to develop and optimize catalyst

properties to specific applications

Flexible assets for the scale-up and production

of commercial catalysts

Wide range of analytical tools and testing

for product and process improvements

Key Customers

Competitive Advantages

Global petrochemical companies

National (state-owned)

petrochemical companies

Plastic resin producers

• UNIPOL® Proprietary

Gas Phase

Polypropylene

Process Technology

• Simple to build,

operate, and maintain

• Catalysts and supports

• Hydrogenation catalysts

• Technologies for

alternative and

traditional feedstock

• Polyethylene (PE) catalysts

• Polypropylene (PP)

catalysts

• Catalyst supports

• Components

Catalyst

performance

is a combination

of design,

characterization,

and manufacturing

Catalysts Technologies | Specialty Catalysts

Financial Highlights FY2016

Catalyst Sales $1.2B

Specialty Catalysts 38%

Catalysts Adj. Gross Margin 44.4%

Catalysts Adj. EBITDA Margin 38.3%

9 W. R. Grace & Co. | Confidential Goldman Sachs Conference | May 16, 2017

Value Delivered | Specialty Catalysts Customer Case

CONSISTA® PP Catalyst and Donor Adds Value, Opens Doors

Our customer:

Commercialized a new

resin line

Making more value-added

products

Typically worth millions to

our customers

Grace:

Increased sales to this

customer by 30% over the

last three years

Positioned to secure new

PP line to be built soon

Value demonstrated to a new UNIPOL®

PP licensee:

Multiple touch points in catalyst and

polymer R&D and operations

Built high, wide, and deep

relationships to support the sales

process

Grace pilot plant demonstrated

CONSISTA®’s superior operability

Validated the value delivered with

samples produced at Grace and by

other licensees demonstrating superior

performing non-phthalate resin

10 W. R. Grace & Co. | Confidential Goldman Sachs Conference | May 16, 2017

Core

Materials And

Manufacturing

Expertise

COATINGS

CHEMICAL

PROCESS

Strong technology base and market positions

Broad scope of industries with high value niches

Strong R&D knowledge and project management

Proven innovation in material sciences

Global footprint to support emerging regions growth

Key Customers

Competitive Advantages

Paint and coatings

companies

Pharmaceutical

companies

Consumer

products companies

Plastics manufacturers

• Process applications for

tires and rubber,

plastics, precision

investment casting

• Environmental catalysts

• Adsorbents for

petrochemical and

natural gas processes

and biofuels

• Toothpaste abrasive and

thickener

• Free-flow agent, carrier or

processing aid in food and

personal care products

• Pharmaceutical, life

science applications

Materials Technologies

CONSUMER /

PHARMA

• Functional additives for

matting and corrosion

protection for industrial

and consumer coatings

• Media and paper

products for ink jet

coatings

Financial Highlights FY2016

Materials Technologies Sales $435M

MT Adj. Gross Margin 39.6%

MT Adj. EBITDA Margin 28.4%

11 W. R. Grace & Co. | Confidential Goldman Sachs Conference | May 16, 2017

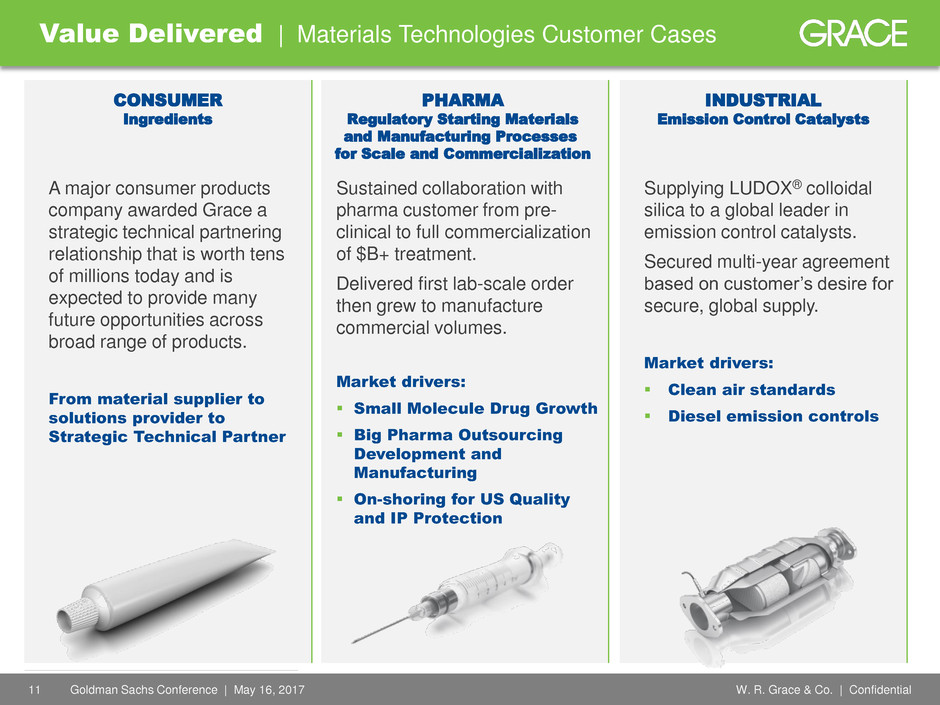

Value Delivered | Materials Technologies Customer Cases

A major consumer products

company awarded Grace a

strategic technical partnering

relationship that is worth tens

of millions today and is

expected to provide many

future opportunities across

broad range of products.

From material supplier to

solutions provider to

Strategic Technical Partner

Sustained collaboration with

pharma customer from pre-

clinical to full commercialization

of $B+ treatment.

Delivered first lab-scale order

then grew to manufacture

commercial volumes.

Market drivers:

Small Molecule Drug Growth

Big Pharma Outsourcing

Development and

Manufacturing

On-shoring for US Quality

and IP Protection

Supplying LUDOX® colloidal

silica to a global leader in

emission control catalysts.

Secured multi-year agreement

based on customer’s desire for

secure, global supply.

Market drivers:

Clean air standards

Diesel emission controls

PHARMA

Regulatory Starting Materials

and Manufacturing Processes

for Scale and Commercialization

CONSUMER

Ingredients

INDUSTRIAL

Emission Control Catalysts

12 W. R. Grace & Co. | Confidential Goldman Sachs Conference | May 16, 2017

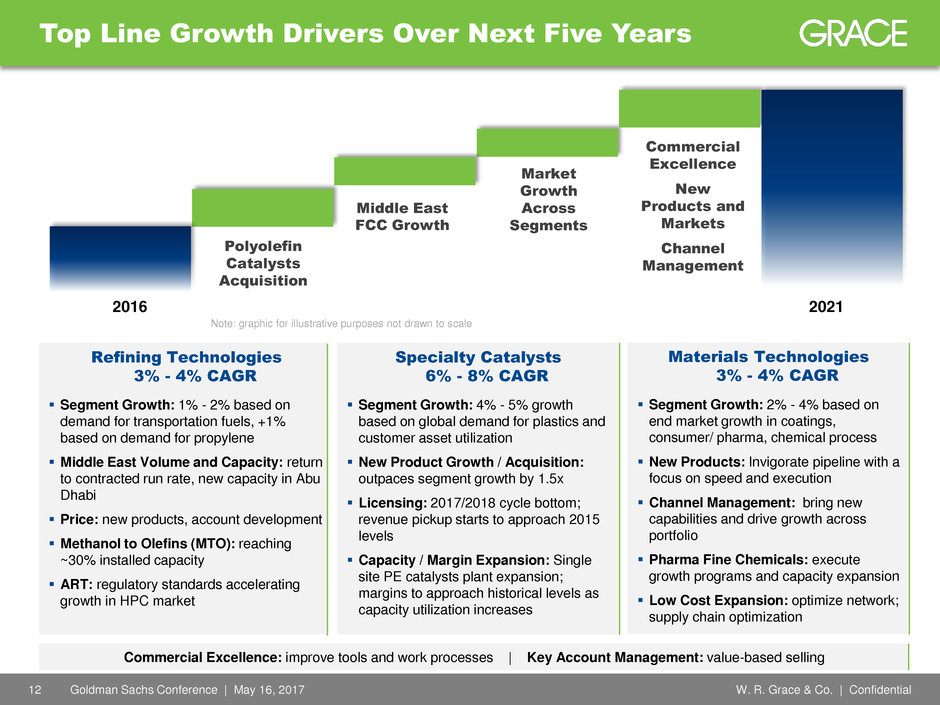

Top Line Growth Drivers Over Next Five Years

Materials Technologies

3% - 4% CAGR

Segment Growth: 2% - 4% based on

end market growth in coatings,

consumer/ pharma, chemical process

New Products: Invigorate pipeline with a

focus on speed and execution

Channel Management: bring new

capabilities and drive growth across

portfolio

Pharma Fine Chemicals: execute

growth programs and capacity expansion

Low Cost Expansion: optimize network;

supply chain optimization

Refining Technologies

3% - 4% CAGR

Segment Growth: 1% - 2% based on

demand for transportation fuels, +1%

based on demand for propylene

Middle East Volume and Capacity: return

to contracted run rate, new capacity in Abu

Dhabi

Price: new products, account development

Methanol to Olefins (MTO): reaching

~30% installed capacity

ART: regulatory standards accelerating

growth in HPC market

Middle East

FCC Growth

Commercial

Excellence

New

Products and

Markets

Channel

Management

2016 2021

Market

Growth

Across

Segments

Polyolefin

Catalysts

Acquisition

Specialty Catalysts

6% - 8% CAGR

Segment Growth: 4% - 5% growth

based on global demand for plastics and

customer asset utilization

New Product Growth / Acquisition:

outpaces segment growth by 1.5x

Licensing: 2017/2018 cycle bottom;

revenue pickup starts to approach 2015

levels

Capacity / Margin Expansion: Single

site PE catalysts plant expansion;

margins to approach historical levels as

capacity utilization increases

Note: graphic for illustrative purposes not drawn to scale

Commercial Excellence: improve tools and work processes | Key Account Management: value-based selling

13 W. R. Grace & Co. | Confidential Goldman Sachs Conference | May 16, 2017

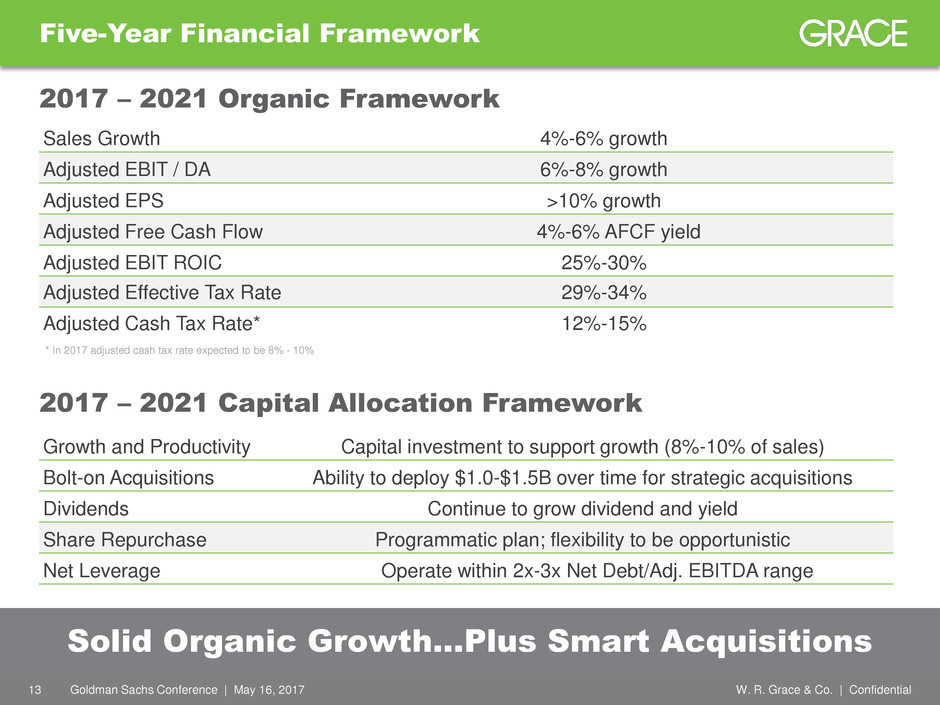

Five-Year Financial Framework

Sales Growth 4%-6% growth

Adjusted EBIT / DA 6%-8% growth

Adjusted EPS >10% growth

Adjusted Free Cash Flow 4%-6% AFCF yield

Adjusted EBIT ROIC 25%-30%

Adjusted Effective Tax Rate 29%-34%

Adjusted Cash Tax Rate* 12%-15%

2017 – 2021 Organic Framework

* In 2017 adjusted cash tax rate expected to be 8% - 10%

2017 – 2021 Capital Allocation Framework

Growth and Productivity Capital investment to support growth (8%-10% of sales)

Bolt-on Acquisitions Ability to deploy $1.0-$1.5B over time for strategic acquisitions

Dividends Continue to grow dividend and yield

Share Repurchase Programmatic plan; flexibility to be opportunistic

Net Leverage Operate within 2x-3x Net Debt/Adj. EBITDA range

Solid Organic Growth…Plus Smart Acquisitions

14 W. R. Grace & Co. | Confidential Goldman Sachs Conference | May 16, 2017

Thank you.

Tania Almond

Investor Relations Officer

+1 410.531.4590 | tania.almond@grace.com

15 W. R. Grace & Co. | Confidential Goldman Sachs Conference | May 16, 2017

Our Businesses

16 W. R. Grace & Co. | Confidential Goldman Sachs Conference | May 16, 2017 16 © 2017 W. R. Grace & Co.

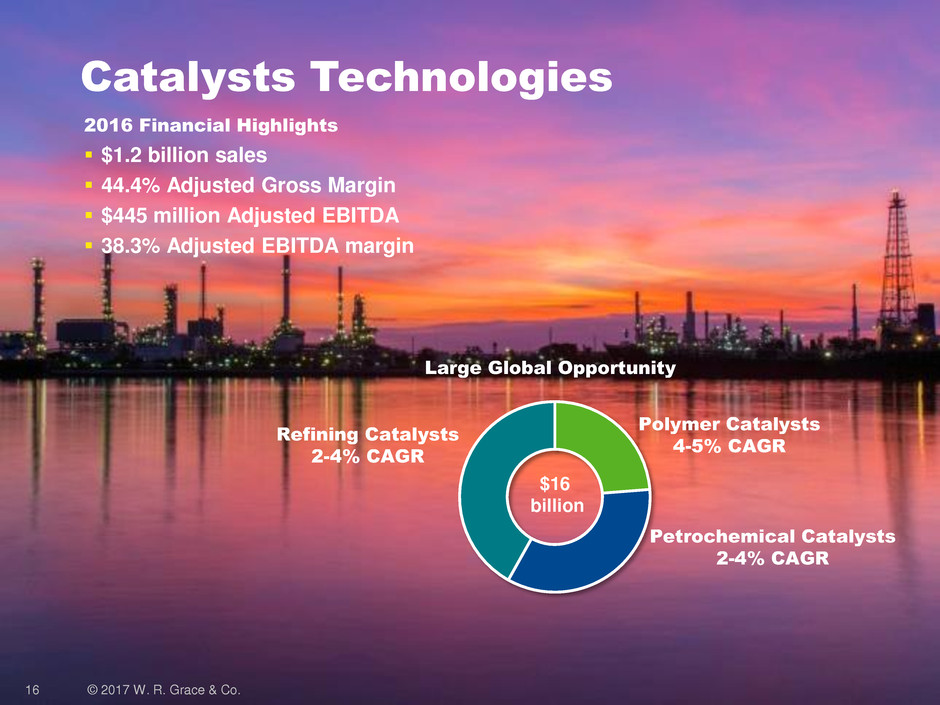

Catalysts Technologies

Polymer Catalysts

4-5% CAGR

Refining Catalysts

2-4% CAGR

Petrochemical Catalysts

2-4% CAGR

$16

billion

2016 Financial Highlights

$1.2 billion sales

44.4% Adjusted Gross Margin

$445 million Adjusted EBITDA

38.3% Adjusted EBITDA margin

Large Global Opportunity

17 W. R. Grace & Co. | Confidential Goldman Sachs Conference | May 16, 2017

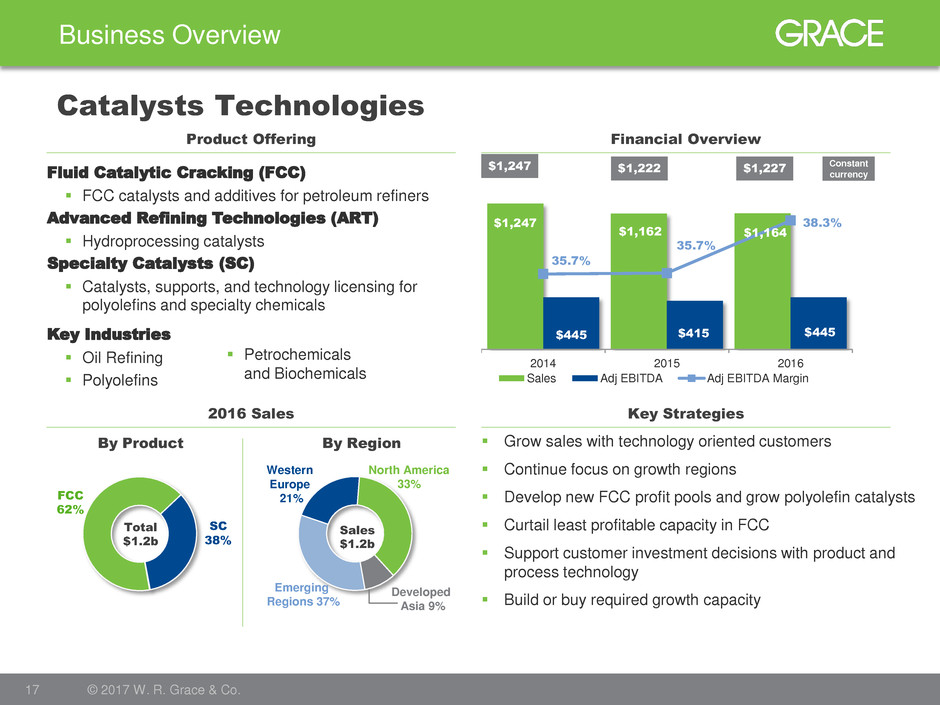

$1,247

$1,162 $1,164

$445 $415 $445

35.7%

35.7%

38.3%

2014 2015 2016

Sales Adj EBITDA Adj EBITDA Margin

$1,247 $1,227

Key Industries

Oil Refining

Polyolefins

SC

38%

FCC

62%

North America

33%

Emerging

Regions 37%

Developed

Asia 9%

Western

Europe

21%

Business Overview

17 © 2017 W. R. Grace & Co.

Catalysts Technologies

Financial Overview Product Offering

2016 Sales Key Strategies

Grow sales with technology oriented customers

Continue focus on growth regions

Develop new FCC profit pools and grow polyolefin catalysts

Curtail least profitable capacity in FCC

Support customer investment decisions with product and

process technology

Build or buy required growth capacity

By Product By Region

Total

$1.2b

Fluid Catalytic Cracking (FCC)

FCC catalysts and additives for petroleum refiners

Advanced Refining Technologies (ART)

Hydroprocessing catalysts

Specialty Catalysts (SC)

Catalysts, supports, and technology licensing for

polyolefins and specialty chemicals

Petrochemicals

and Biochemicals

Sales

$1.2b

$1,222

Constant

currency

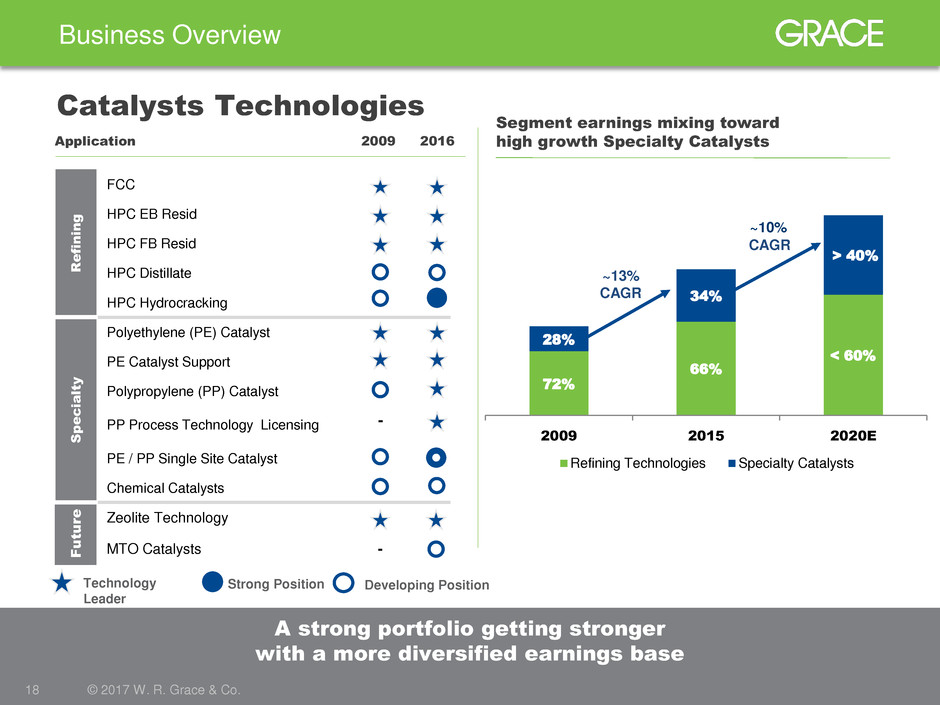

18 W. R. Grace & Co. | Confidential Goldman Sachs Conference | May 16, 2017

72%

66%

< 60%

28%

34%

> 40%

2009 2015 2020E

Refining Technologies Specialty Catalysts

~10%

CAGR

A strong portfolio getting stronger

with a more diversified earnings base

Business Overview

18 © 2017 W. R. Grace & Co.

Catalysts Technologies

Application 2009 2016

R

e

fi

n

in

g

FCC

HPC EB Resid

HPC FB Resid

HPC Distillate

HPC Hydrocracking

S

p

e

c

ia

lt

y

Polyethylene (PE) Catalyst

PE Catalyst Support

Polypropylene (PP) Catalyst

PP Process Technology Licensing -

PE / PP Single Site Catalyst

Chemical Catalysts

F

u

tur

e

Zeolite Technology

MTO Catalysts -

Technology

Leader

Developing Position Strong Position

Segment earnings mixing toward

high growth Specialty Catalysts

~13%

CAGR

19 W. R. Grace & Co. | Confidential Goldman Sachs Conference | May 16, 2017

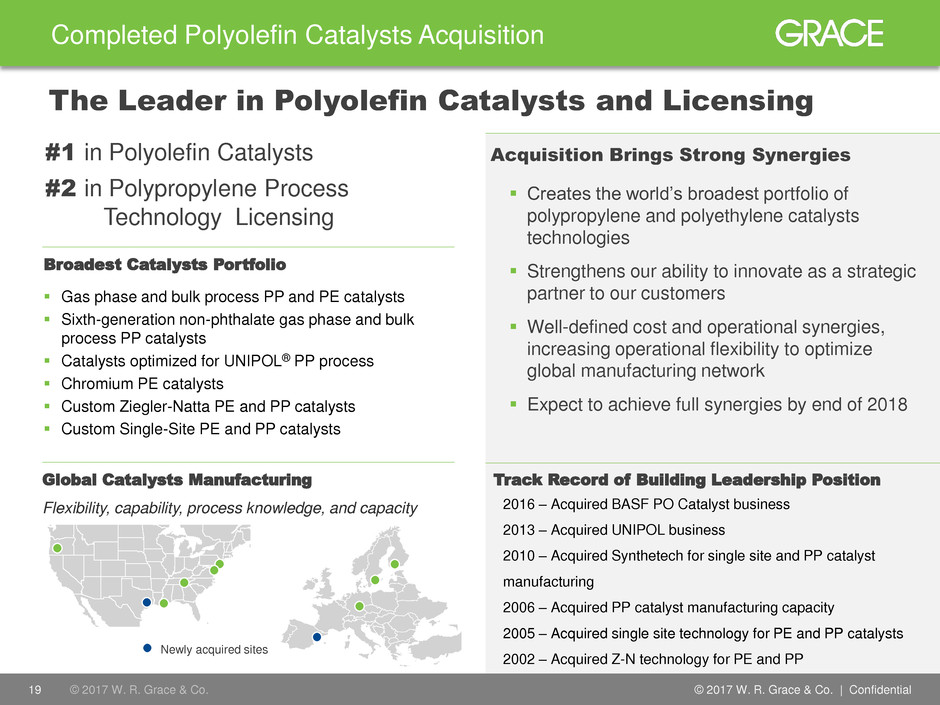

Completed Polyolefin Catalysts Acquisition

Global Catalysts Manufacturing

Creates the world’s broadest portfolio of

polypropylene and polyethylene catalysts

technologies

Strengthens our ability to innovate as a strategic

partner to our customers

Well-defined cost and operational synergies,

increasing operational flexibility to optimize

global manufacturing network

Expect to achieve full synergies by end of 2018

Flexibility, capability, process knowledge, and capacity

Newly acquired sites

© 2017 © 2017 W. R. Grace & Co.

Acquisition Brings Strong Synergies #1 in Polyolefin Catalysts

#2 in Polypropylene Process

Technology Licensing

The Leader in Polyolefin Catalysts and Licensing

Gas phase and bulk process PP and PE catalysts

Sixth-generation non-phthalate gas phase and bulk

process PP catalysts

Catalysts optimized for UNIPOL® PP process

Chromium PE catalysts

Custom Ziegler-Natta PE and PP catalysts

Custom Single-Site PE and PP catalysts

Broadest Catalysts Portfolio

2016 – Acquired BASF PO Catalyst business

2013 – Acquired UNIPOL business

2010 – Acquired Synthetech for single site and PP catalyst

manufacturing

2006 – Acquired PP catalyst manufacturing capacity

2005 – Acquired single site technology for PE and PP catalysts

2002 – Acquired Z-N technology for PE and PP

Track Record of Building Leadership Position

20 W. R. Grace & Co. | Confidential Goldman Sachs Conference | May 16, 2017 20 © 2017 W. R. Grace & Co.

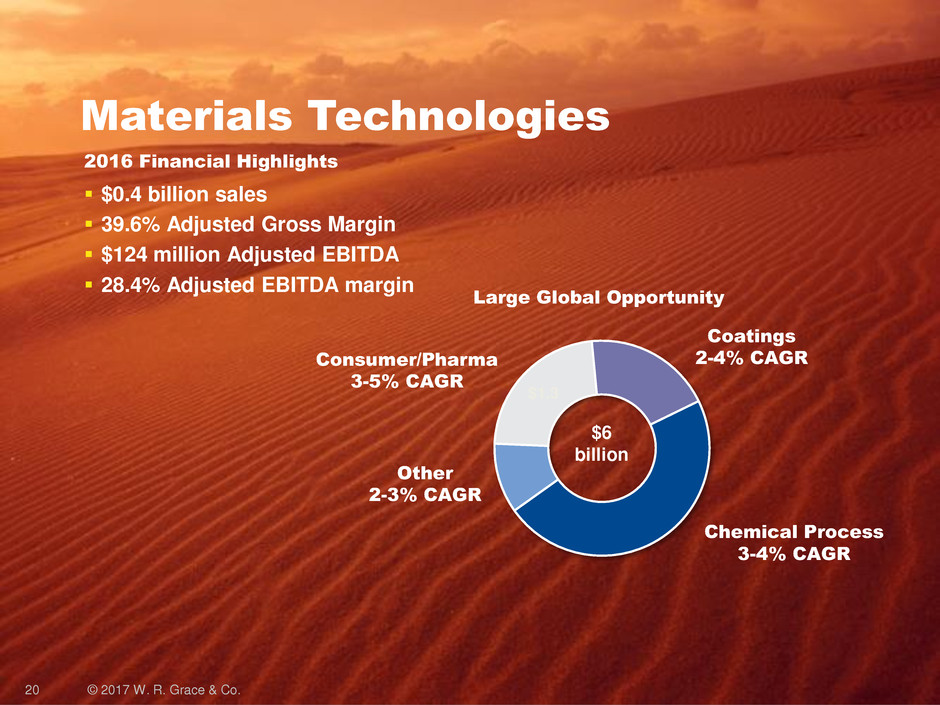

Materials Technologies

Consumer/Pharma

3-5% CAGR

Chemical Process

3-4% CAGR

2016 Financial Highlights

$0.4 billion sales

39.6% Adjusted Gross Margin

$124 million Adjusted EBITDA

28.4% Adjusted EBITDA margin

$1.3

$6

billion

Other

2-3% CAGR

Coatings

2-4% CAGR

Large Global Opportunity

21 W. R. Grace & Co. | Confidential Goldman Sachs Conference | May 16, 2017

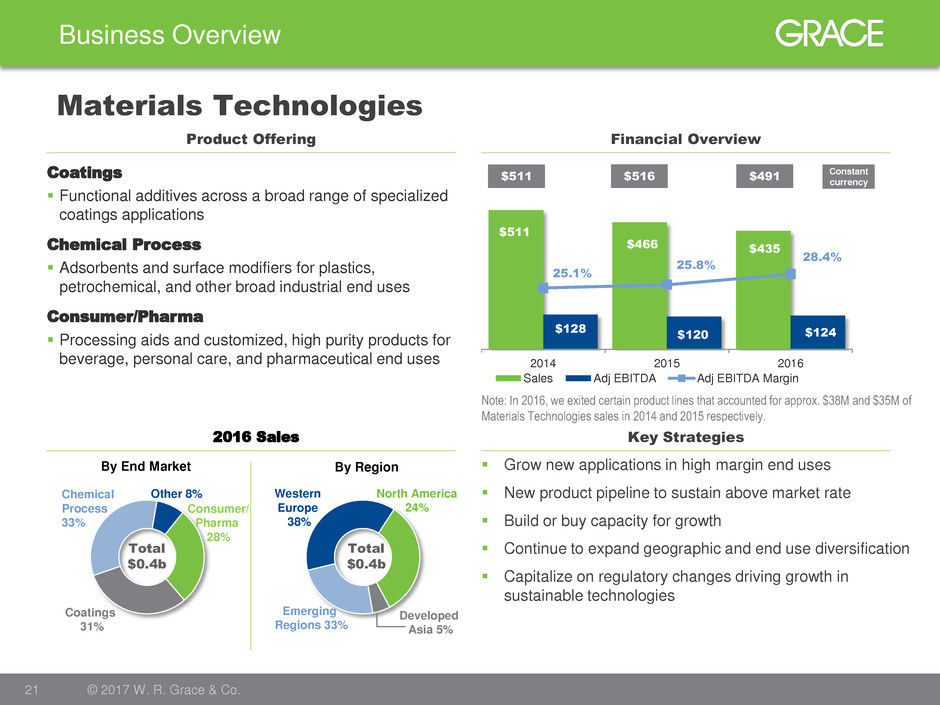

$511

$466 $435

$128

$120 $124

25.1%

25.8%

28.4%

2014 2015 2016

Sales Adj EBITDA Adj EBITDA Margin

$516 $491

Coatings

31%

Chemical

Process

33%

Consumer/

Pharma

28%

Other 8%

North America

24%

Emerging

Regions 33%

Developed

Asia 5%

Western

Europe

38%

Business Overview

21 © 2017 W. R. Grace & Co.

Materials Technologies

Financial Overview Product Offering

Key Strategies

Grow new applications in high margin end uses

New product pipeline to sustain above market rate

Build or buy capacity for growth

Continue to expand geographic and end use diversification

Capitalize on regulatory changes driving growth in

sustainable technologies

Coatings

Functional additives across a broad range of specialized

coatings applications

Chemical Process

Adsorbents and surface modifiers for plastics,

petrochemical, and other broad industrial end uses

Consumer/Pharma

Processing aids and customized, high purity products for

beverage, personal care, and pharmaceutical end uses

2016 Sales

By End Market By Region

Total

$0.4b

Total

$0.4b

$511

Constant

currency

Note: In 2016, we exited certain product lines that accounted for approx. $38M and $35M of

Materials Technologies sales in 2014 and 2015 respectively.

22 W. R. Grace & Co. | Confidential Goldman Sachs Conference | May 16, 2017

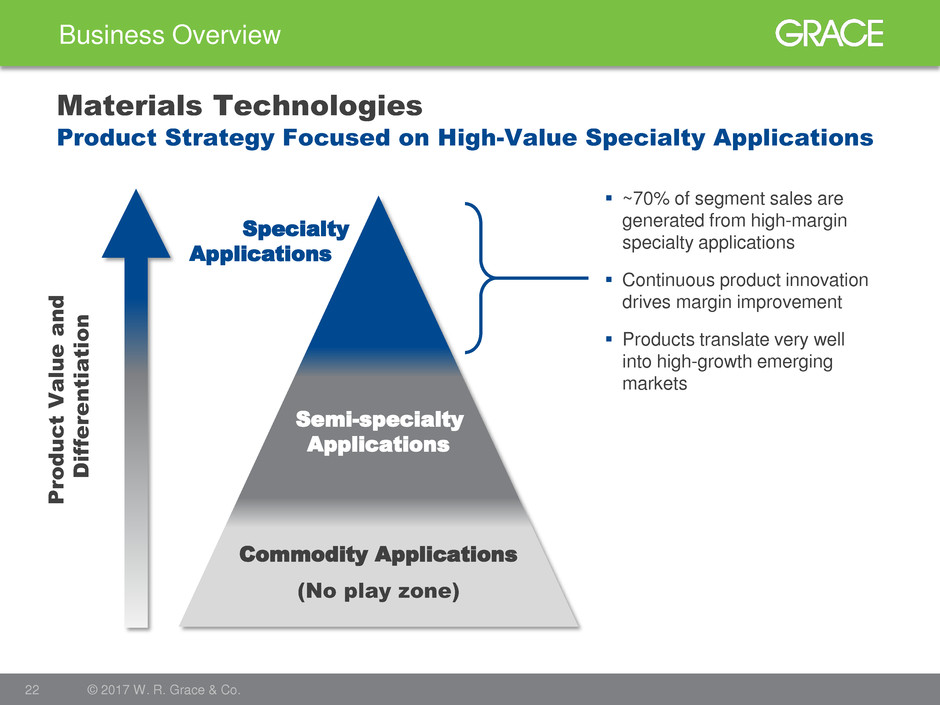

Business Overview

22 © 2017 W. R. Grace & Co.

Materials Technologies

Specialty

Applications

Semi-specialty

Applications

Commodity Applications

Pro

d

u

c

t

V

alu

e

a

n

d

D

iff

e

re

n

tiatio

n

~70% of segment sales are

generated from high-margin

specialty applications

Continuous product innovation

drives margin improvement

Products translate very well

into high-growth emerging

markets

(No play zone)

Product Strategy Focused on High-Value Specialty Applications

23 W. R. Grace & Co. | Confidential Goldman Sachs Conference | May 16, 2017

Business Overview

23 © 2017 W. R. Grace & Co.

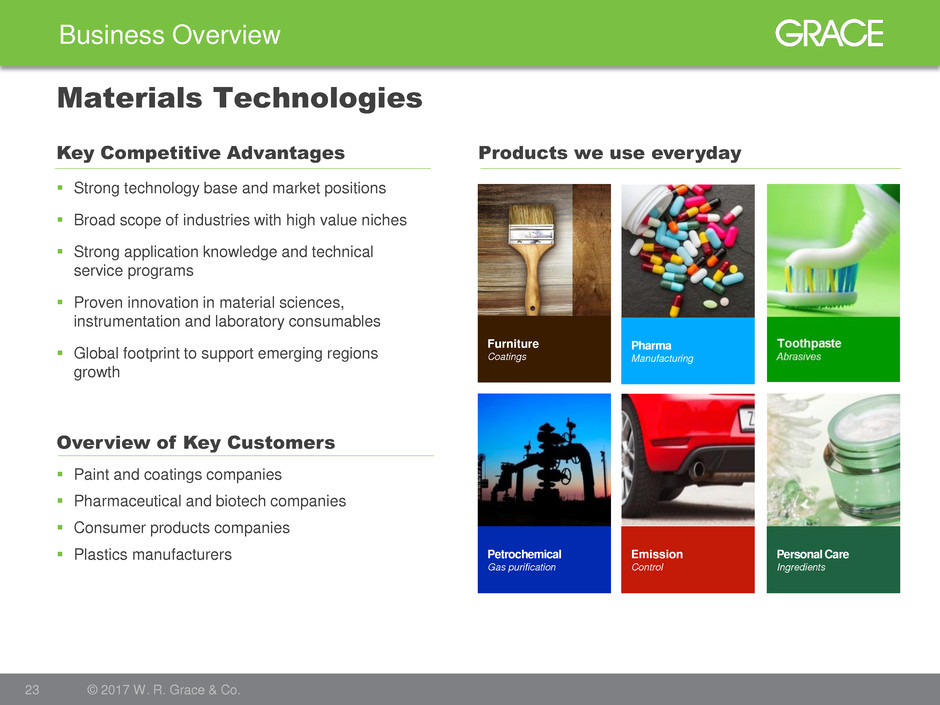

Materials Technologies

Strong technology base and market positions

Broad scope of industries with high value niches

Strong application knowledge and technical

service programs

Proven innovation in material sciences,

instrumentation and laboratory consumables

Global footprint to support emerging regions

growth

Overview of Key Customers

Key Competitive Advantages Products we use everyday

Paint and coatings companies

Pharmaceutical and biotech companies

Consumer products companies

Plastics manufacturers

Furniture

Coatings

Emission

Control

Petrochemical

Gas purification

Personal Care

Ingredients

Pharma

Manufacturing

24 W. R. Grace & Co. | Confidential Goldman Sachs Conference | May 16, 2017

Business Overview

24 © 2017 W. R. Grace & Co.

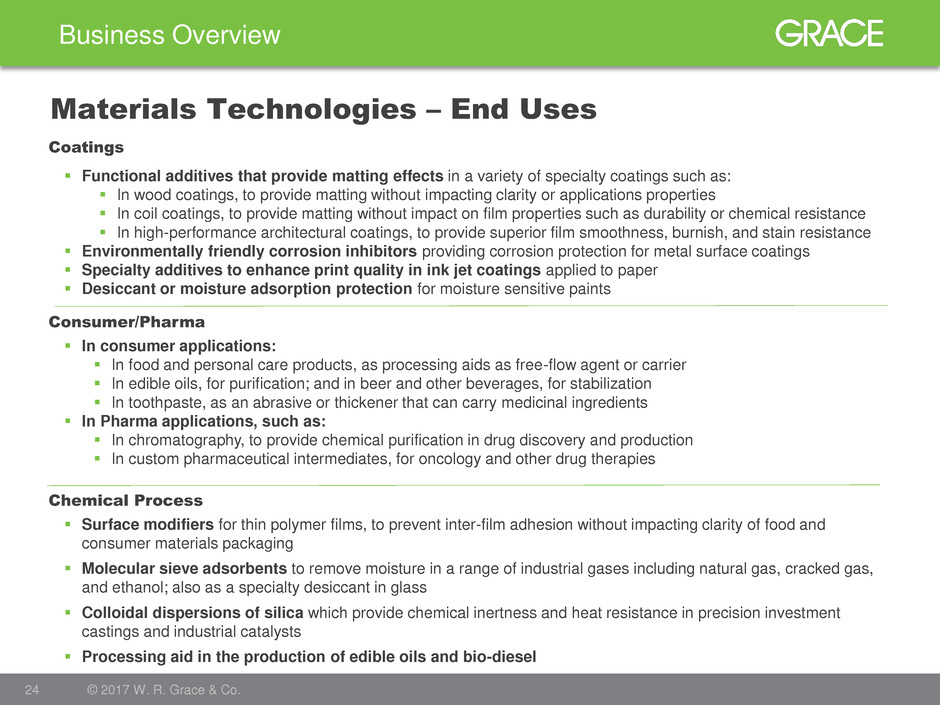

Materials Technologies – End Uses

Functional additives that provide matting effects in a variety of specialty coatings such as:

In wood coatings, to provide matting without impacting clarity or applications properties

In coil coatings, to provide matting without impact on film properties such as durability or chemical resistance

In high-performance architectural coatings, to provide superior film smoothness, burnish, and stain resistance

Environmentally friendly corrosion inhibitors providing corrosion protection for metal surface coatings

Specialty additives to enhance print quality in ink jet coatings applied to paper

Desiccant or moisture adsorption protection for moisture sensitive paints

In consumer applications:

In food and personal care products, as processing aids as free-flow agent or carrier

In edible oils, for purification; and in beer and other beverages, for stabilization

In toothpaste, as an abrasive or thickener that can carry medicinal ingredients

In Pharma applications, such as:

In chromatography, to provide chemical purification in drug discovery and production

In custom pharmaceutical intermediates, for oncology and other drug therapies

Surface modifiers for thin polymer films, to prevent inter-film adhesion without impacting clarity of food and

consumer materials packaging

Molecular sieve adsorbents to remove moisture in a range of industrial gases including natural gas, cracked gas,

and ethanol; also as a specialty desiccant in glass

Colloidal dispersions of silica which provide chemical inertness and heat resistance in precision investment

castings and industrial catalysts

Processing aid in the production of edible oils and bio-diesel

Coatings

Chemical Process

Consumer/Pharma

25 W. R. Grace & Co. | Confidential Goldman Sachs Conference | May 16, 2017

Business Overview

25 © 2017 W. R. Grace & Co.

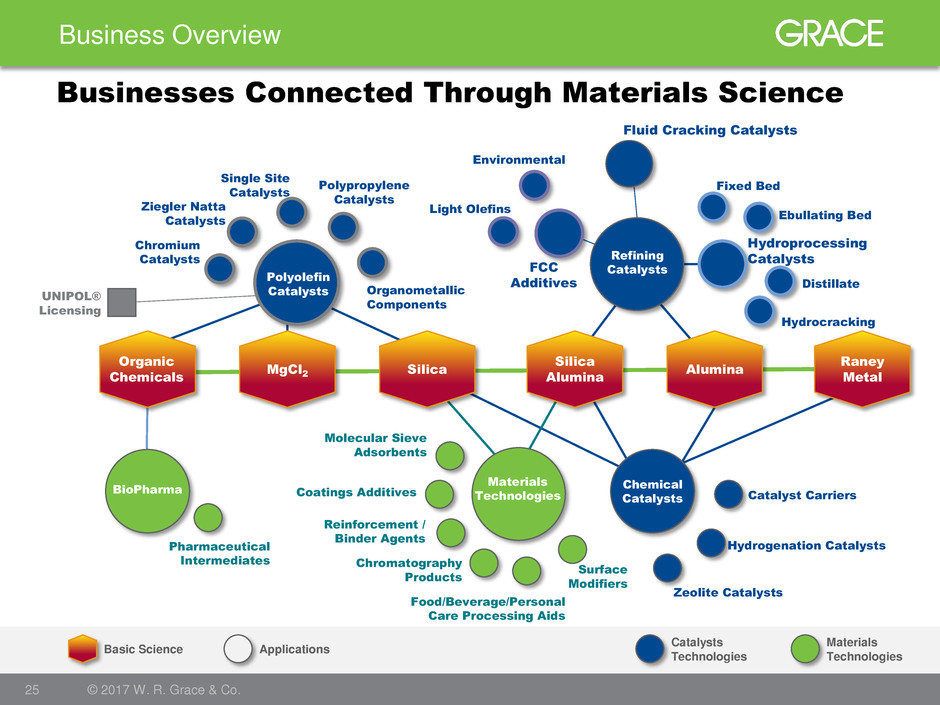

Applications Basic Science

Organic

Chemicals

MgCl2 Silica

Silica

Alumina

Alumina

Raney

Metal

BioPharma Chemical

Catalysts

Materials

Technologies

Polyolefin

Catalysts

Refining

Catalysts

Pharmaceutical

Intermediates

Molecular Sieve

Adsorbents

Coatings Additives

Reinforcement /

Binder Agents

Chromatography

Products

Food/Beverage/Personal

Care Processing Aids

Surface

Modifiers

Catalyst Carriers

Hydrogenation Catalysts

Zeolite Catalysts

Ebullating Bed

Distillate

Hydroprocessing

Catalysts

Fixed Bed

Hydrocracking

Fluid Cracking Catalysts

FCC

Additives

Light Olefins

Environmental

UNIPOL®

Licensing

Chromium

Catalysts

Ziegler Natta

Catalysts

Single Site

Catalysts

Organometallic

Components

Polypropylene

Catalysts

Catalysts

Technologies

Materials

Technologies

Businesses Connected Through Materials Science

26 W. R. Grace & Co. | Confidential Goldman Sachs Conference | May 16, 2017

Capital Allocation and Structure

27 W. R. Grace & Co. | Confidential Goldman Sachs Conference | May 16, 2017

Capital Allocation and Structure

27 © 2017 W. R. Grace & Co.

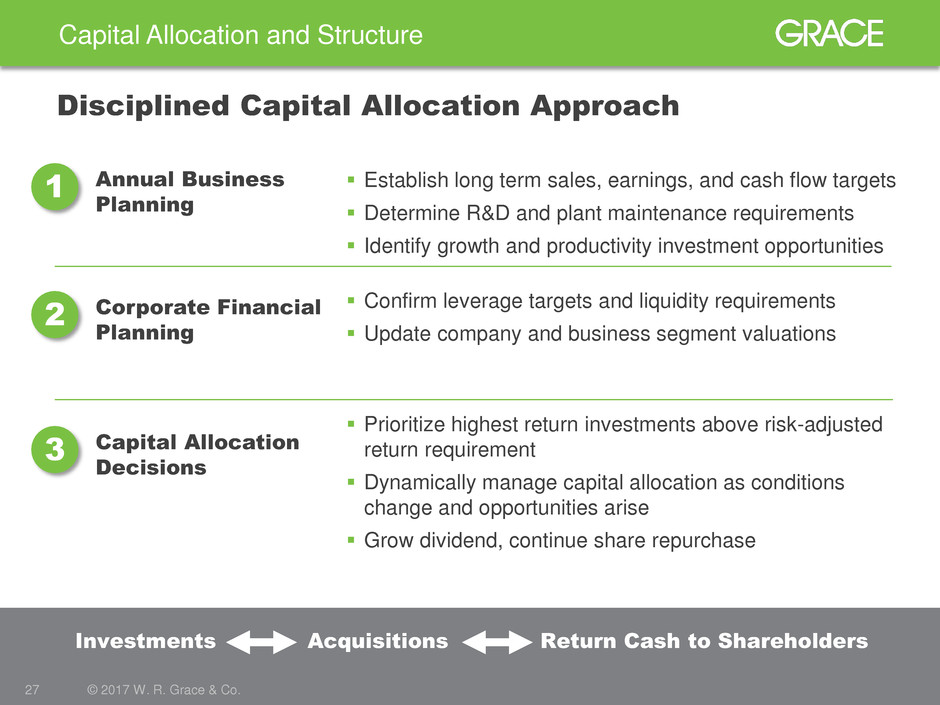

Disciplined Capital Allocation Approach

Annual Business

Planning

Corporate Financial

Planning

Capital Allocation

Decisions

Confirm leverage targets and liquidity requirements

Update company and business segment valuations

Establish long term sales, earnings, and cash flow targets

Determine R&D and plant maintenance requirements

Identify growth and productivity investment opportunities

Prioritize highest return investments above risk-adjusted

return requirement

Dynamically manage capital allocation as conditions

change and opportunities arise

Grow dividend, continue share repurchase

Investments Acquisitions Return Cash to Shareholders

1

2

3

28 W. R. Grace & Co. | Confidential Goldman Sachs Conference | May 16, 2017

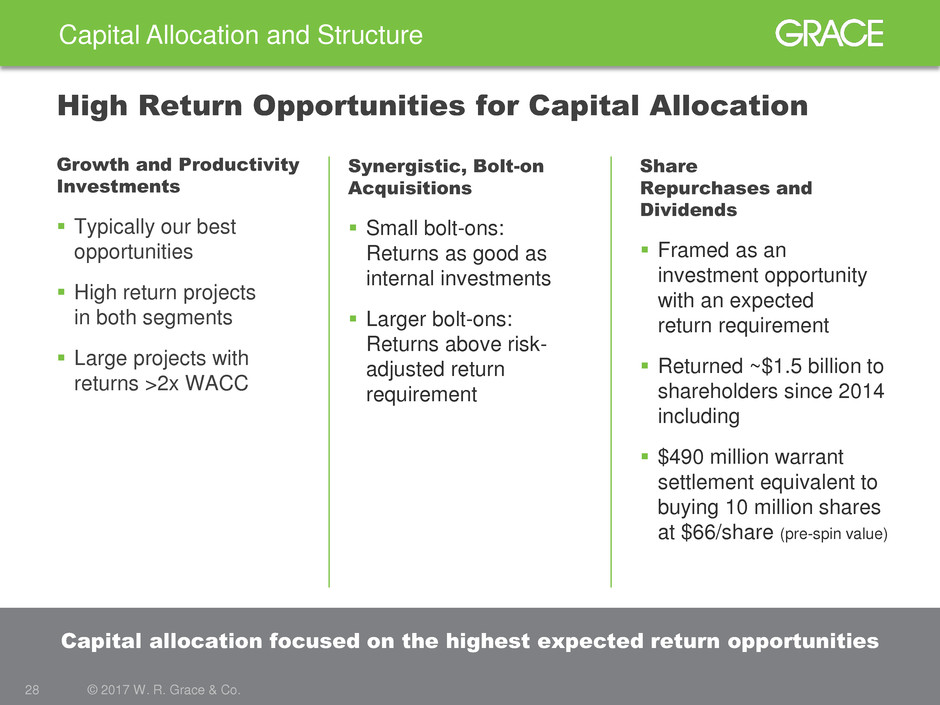

Capital Allocation and Structure

28 © 2017 W. R. Grace & Co.

Capital allocation focused on the highest expected return opportunities

High Return Opportunities for Capital Allocation

Synergistic, Bolt-on

Acquisitions

Small bolt-ons:

Returns as good as

internal investments

Larger bolt-ons:

Returns above risk-

adjusted return

requirement

Share

Repurchases and

Dividends

Framed as an

investment opportunity

with an expected

return requirement

Returned ~$1.5 billion to

shareholders since 2014

including

$490 million warrant

settlement equivalent to

buying 10 million shares

at $66/share (pre-spin value)

Growth and Productivity

Investments

Typically our best

opportunities

High return projects

in both segments

Large projects with

returns >2x WACC

29 W. R. Grace & Co. | Confidential Goldman Sachs Conference | May 16, 2017

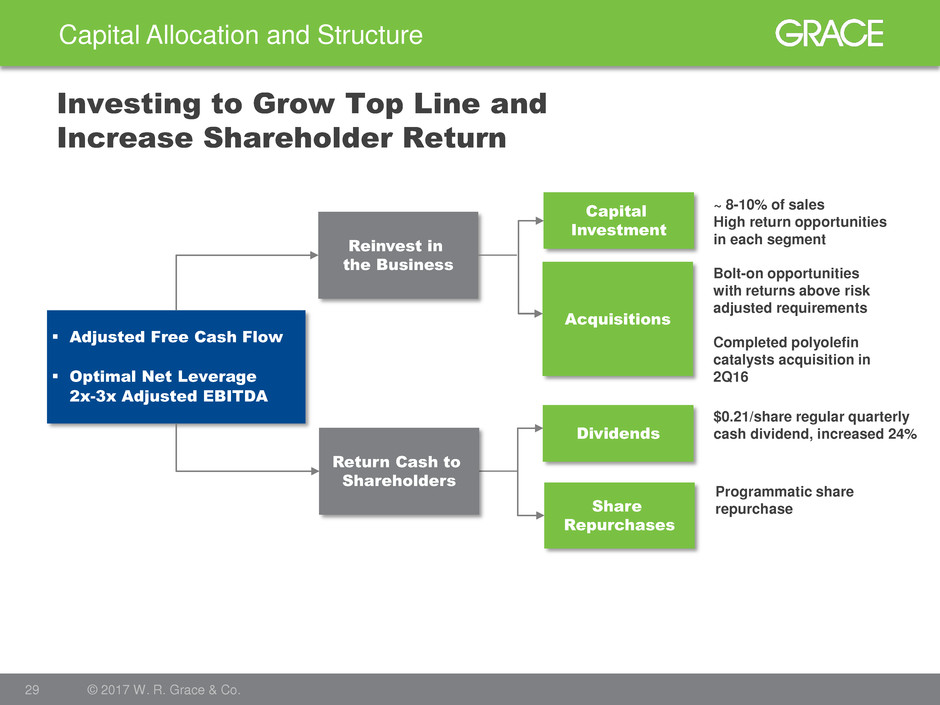

Capital Allocation and Structure

29 © 2017 W. R. Grace & Co.

Investing to Grow Top Line and

Increase Shareholder Return

Adjusted Free Cash Flow

Optimal Net Leverage

2x-3x Adjusted EBITDA

Reinvest in

the Business

Capital

Investment

Acquisitions

Share

Repurchases

Dividends

~ 8-10% of sales

High return opportunities

in each segment

Bolt-on opportunities

with returns above risk

adjusted requirements

Completed polyolefin

catalysts acquisition in

2Q16

Return Cash to

Shareholders

Programmatic share

repurchase

$0.21/share regular quarterly

cash dividend, increased 24%

30 W. R. Grace & Co. | Confidential Goldman Sachs Conference | May 16, 2017

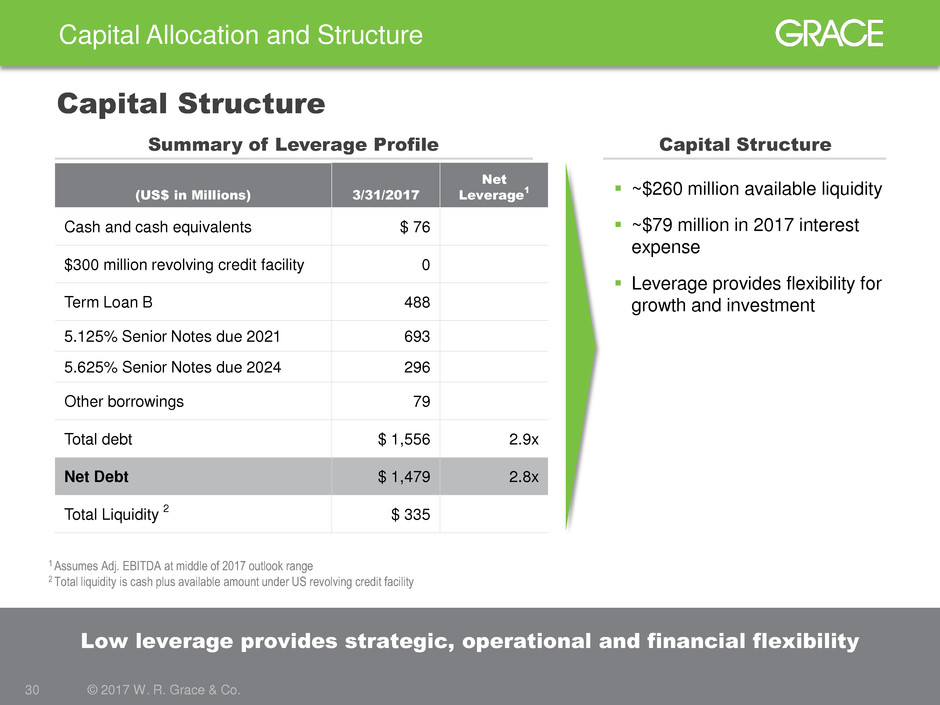

Capital Allocation and Structure

30 © 2017 W. R. Grace & Co.

Low leverage provides strategic, operational and financial flexibility

Capital Structure

Summary of Leverage Profile

~$260 million available liquidity

~$79 million in 2017 interest

expense

Leverage provides flexibility for

growth and investment

Capital Structure

1 Assumes Adj. EBITDA at middle of 2017 outlook range

2 Total liquidity is cash plus available amount under US revolving credit facility

(US$ in Millions) 3/31/2017

Net

Leverage

1

Cash and cash equivalents $ 76

$300 million revolving credit facility 0

Term Loan B 488

5.125% Senior Notes due 2021 693 X

5.625% Senior Notes due 2024 296 X

Other borrowings 79 x

Total debt $ 1,556 2.9x

Net Debt $ 1,479 2.8x

Total Liquidity

2

$ 335

31 W. R. Grace & Co. | Confidential Goldman Sachs Conference | May 16, 2017

Appendix

32 W. R. Grace & Co. | Confidential Goldman Sachs Conference | May 16, 2017

Appendix – Additional Information

32 © 2017 W. R. Grace & Co.

Trademark Notices

GRACE®, ACHIEVE®, MIDAS® GOLD, MAGNAPORE®, CONSISTA®, SmART Catalyst System® (Stylized),

SYLOID®, SYLOBLOC®, LUDOX®, SYLOBEAD®, CBA®, ADVA®, HEA2®, DCI®, are trademarks, registered in

the United States and/or other countries, of W. R. Grace & Co.-Conn.

TALENT | TECHNOLOGY | TRUST™ is a trademark of W. R. Grace & Co.-Conn.

UNIPOL® is a trademark of The Dow Chemical Company or an affiliated company of Dow. W. R. Grace & Co.-

Conn. and/or its affiliates are licensed to use the UNIPOL trademark in the area of polypropylene.

SIX SIGMA® is a trademark, registered in the United States and/or other countries, of Motorola, Inc.

This trademark list has been compiled using available published information as of the publication date of this

brochure and may not accurately reflect current trademark ownership or status. © Copyright 2017 W. R. Grace

& Co.-Conn. All rights reserved.

33 W. R. Grace & Co. | Confidential Goldman Sachs Conference | May 16, 2017 © 2017 W. R. Grace & Co. 33

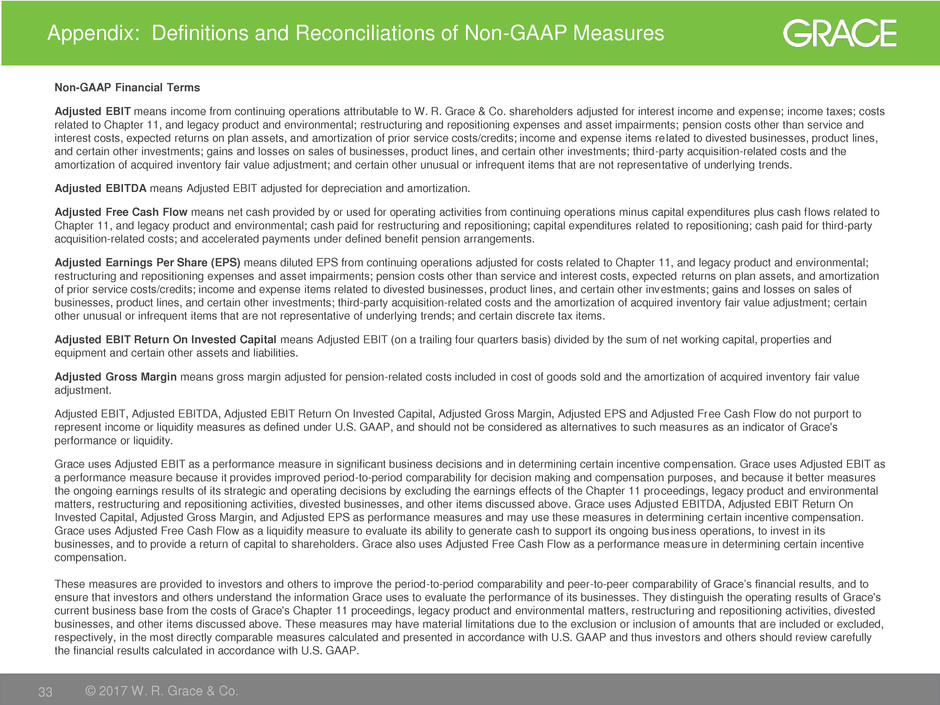

Appendix: Definitions and Reconciliations of Non-GAAP Measures

Non-GAAP Financial Terms

Adjusted EBIT means income from continuing operations attributable to W. R. Grace & Co. shareholders adjusted for interest income and expense; income taxes; costs

related to Chapter 11, and legacy product and environmental; restructuring and repositioning expenses and asset impairments; pension costs other than service and

interest costs, expected returns on plan assets, and amortization of prior service costs/credits; income and expense items related to divested businesses, product lines,

and certain other investments; gains and losses on sales of businesses, product lines, and certain other investments; third-party acquisition-related costs and the

amortization of acquired inventory fair value adjustment; and certain other unusual or infrequent items that are not representative of underlying trends.

Adjusted EBITDA means Adjusted EBIT adjusted for depreciation and amortization.

Adjusted Free Cash Flow means net cash provided by or used for operating activities from continuing operations minus capital expenditures plus cash flows related to

Chapter 11, and legacy product and environmental; cash paid for restructuring and repositioning; capital expenditures related to repositioning; cash paid for third-party

acquisition-related costs; and accelerated payments under defined benefit pension arrangements.

Adjusted Earnings Per Share (EPS) means diluted EPS from continuing operations adjusted for costs related to Chapter 11, and legacy product and environmental;

restructuring and repositioning expenses and asset impairments; pension costs other than service and interest costs, expected returns on plan assets, and amortization

of prior service costs/credits; income and expense items related to divested businesses, product lines, and certain other investments; gains and losses on sales of

businesses, product lines, and certain other investments; third-party acquisition-related costs and the amortization of acquired inventory fair value adjustment; certain

other unusual or infrequent items that are not representative of underlying trends; and certain discrete tax items.

Adjusted EBIT Return On Invested Capital means Adjusted EBIT (on a trailing four quarters basis) divided by the sum of net working capital, properties and

equipment and certain other assets and liabilities.

Adjusted Gross Margin means gross margin adjusted for pension-related costs included in cost of goods sold and the amortization of acquired inventory fair value

adjustment.

Adjusted EBIT, Adjusted EBITDA, Adjusted EBIT Return On Invested Capital, Adjusted Gross Margin, Adjusted EPS and Adjusted Free Cash Flow do not purport to

represent income or liquidity measures as defined under U.S. GAAP, and should not be considered as alternatives to such measures as an indicator of Grace's

performance or liquidity.

Grace uses Adjusted EBIT as a performance measure in significant business decisions and in determining certain incentive compensation. Grace uses Adjusted EBIT as

a performance measure because it provides improved period-to-period comparability for decision making and compensation purposes, and because it better measures

the ongoing earnings results of its strategic and operating decisions by excluding the earnings effects of the Chapter 11 proceedings, legacy product and environmental

matters, restructuring and repositioning activities, divested businesses, and other items discussed above. Grace uses Adjusted EBITDA, Adjusted EBIT Return On

Invested Capital, Adjusted Gross Margin, and Adjusted EPS as performance measures and may use these measures in determining certain incentive compensation.

Grace uses Adjusted Free Cash Flow as a liquidity measure to evaluate its ability to generate cash to support its ongoing business operations, to invest in its

businesses, and to provide a return of capital to shareholders. Grace also uses Adjusted Free Cash Flow as a performance measure in determining certain incentive

compensation.

These measures are provided to investors and others to improve the period-to-period comparability and peer-to-peer comparability of Grace’s financial results, and to

ensure that investors and others understand the information Grace uses to evaluate the performance of its businesses. They distinguish the operating results of Grace's

current business base from the costs of Grace's Chapter 11 proceedings, legacy product and environmental matters, restructuring and repositioning activities, divested

businesses, and other items discussed above. These measures may have material limitations due to the exclusion or inclusion of amounts that are included or excluded,

respectively, in the most directly comparable measures calculated and presented in accordance with U.S. GAAP and thus investors and others should review carefully

the financial results calculated in accordance with U.S. GAAP.

34 W. R. Grace & Co. | Confidential Goldman Sachs Conference | May 16, 2017 © 2017 W. R. Grace & Co. 34

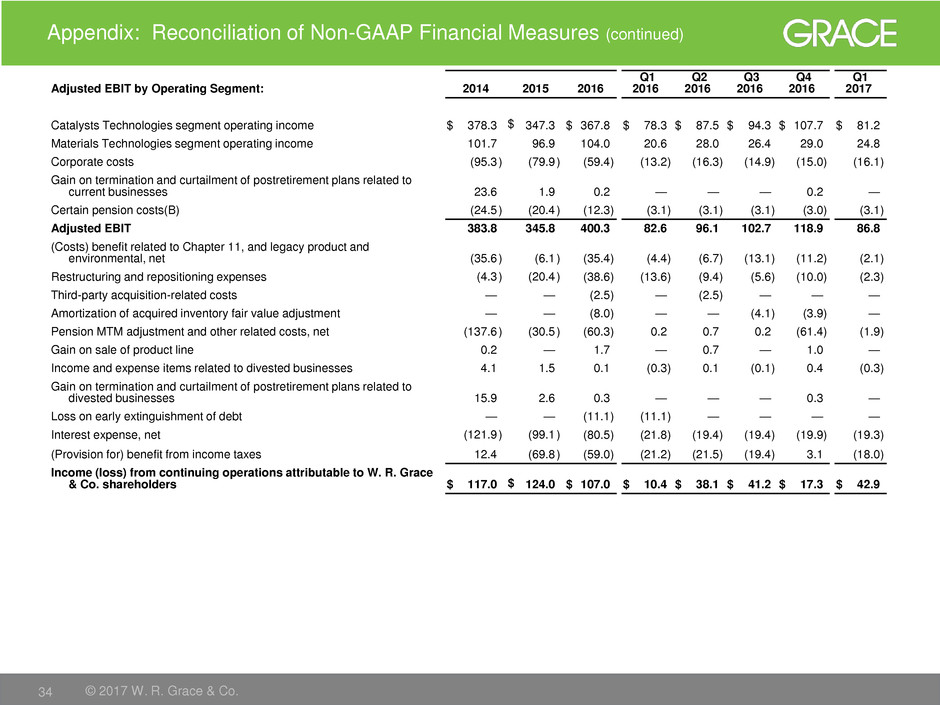

Appendix: Reconciliation of Non-GAAP Financial Measures (continued)

Adjusted EBIT by Operating Segment: 2014 2015 2016

Q1

2016

Q2

2016

Q3

2016

Q4

2016

Q1

2017

Catalysts Technologies segment operating income $ 378.3 $

347.3 $ 367.8 $ 78.3 $ 87.5 $ 94.3 $ 107.7 $ 81.2

Materials Technologies segment operating income 101.7 96.9 104.0 20.6 28.0 26.4 29.0 24.8

Corporate costs (95.3 ) (79.9 ) (59.4 ) (13.2 ) (16.3 ) (14.9 ) (15.0 ) (16.1 )

Gain on termination and curtailment of postretirement plans related to

current businesses 23.6 1.9 0.2 — — — 0.2 —

Certain pension costs(B) (24.5 ) (20.4 ) (12.3 ) (3.1 ) (3.1 ) (3.1 ) (3.0 ) (3.1 )

Adjusted EBIT 383.8 345.8 400.3 82.6 96.1 102.7 118.9 86.8

(Costs) benefit related to Chapter 11, and legacy product and

environmental, net (35.6 ) (6.1 ) (35.4 ) (4.4 ) (6.7 ) (13.1 ) (11.2 ) (2.1 )

Restructuring and repositioning expenses (4.3 ) (20.4 ) (38.6 ) (13.6 ) (9.4 ) (5.6 ) (10.0 ) (2.3 )

Third-party acquisition-related costs — — (2.5 ) — (2.5 ) — — —

Amortization of acquired inventory fair value adjustment — — (8.0 ) — — (4.1 ) (3.9 ) —

Pension MTM adjustment and other related costs, net (137.6 ) (30.5 ) (60.3 ) 0.2 0.7 0.2 (61.4 ) (1.9 )

Gain on sale of product line 0.2 — 1.7 — 0.7 — 1.0 —

Income and expense items related to divested businesses 4.1 1.5 0.1 (0.3 ) 0.1 (0.1 ) 0.4 (0.3 )

Gain on termination and curtailment of postretirement plans related to

divested businesses 15.9 2.6 0.3 — — — 0.3 —

Loss on early extinguishment of debt — — (11.1 ) (11.1 ) — — — —

Interest expense, net (121.9 ) (99.1 ) (80.5 ) (21.8 ) (19.4 ) (19.4 ) (19.9 ) (19.3 )

(Provision for) benefit from income taxes 12.4 (69.8 ) (59.0 ) (21.2 ) (21.5 ) (19.4 ) 3.1 (18.0 )

Income (loss) from continuing operations attributable to W. R. Grace

& Co. shareholders $ 117.0 $

124.0 $ 107.0 $ 10.4 $ 38.1 $ 41.2 $ 17.3 $ 42.9

35 W. R. Grace & Co. | Confidential Goldman Sachs Conference | May 16, 2017 © 2017 W. R. Grace & Co. 35

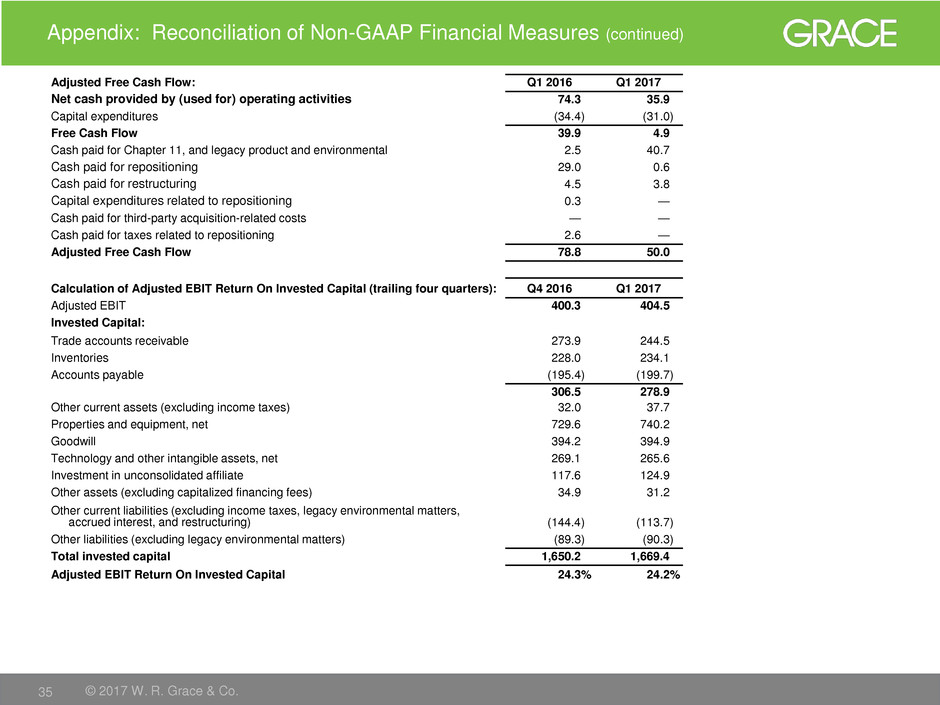

Appendix: Reconciliation of Non-GAAP Financial Measures (continued)

Adjusted Free Cash Flow: Q1 2016 Q1 2017

Net cash provided by (used for) operating activities 74.3 35.9

Capital expenditures (34.4 ) (31.0 )

Free Cash Flow 39.9 4.9

Cash paid for Chapter 11, and legacy product and environmental 2.5 40.7

Cash paid for repositioning 29.0 0.6

Cash paid for restructuring 4.5 3.8

Capital expenditures related to repositioning 0.3 —

Cash paid for third-party acquisition-related costs — —

Cash paid for taxes related to repositioning 2.6 —

Adjusted Free Cash Flow 78.8 50.0

Calculation of Adjusted EBIT Return On Invested Capital (trailing four quarters): Q4 2016 Q1 2017

Adjusted EBIT 400.3 404.5

Invested Capital:

Trade accounts receivable 273.9 244.5

Inventories 228.0 234.1

Accounts payable (195.4 ) (199.7 )

306.5 278.9

Other current assets (excluding income taxes) 32.0 37.7

Properties and equipment, net 729.6 740.2

Goodwill 394.2 394.9

Technology and other intangible assets, net 269.1 265.6

Investment in unconsolidated affiliate 117.6 124.9

Other assets (excluding capitalized financing fees) 34.9 31.2

Other current liabilities (excluding income taxes, legacy environmental matters,

accrued interest, and restructuring) (144.4 ) (113.7 )

Other liabilities (excluding legacy environmental matters) (89.3 ) (90.3 )

Total invested capital 1,650.2 1,669.4

Adjusted EBIT Return On Invested Capital 24.3 % 24.2 %

36 W. R. Grace & Co. | Confidential Goldman Sachs Conference | May 16, 2017 © 2017 W. R. Grace & Co. 36

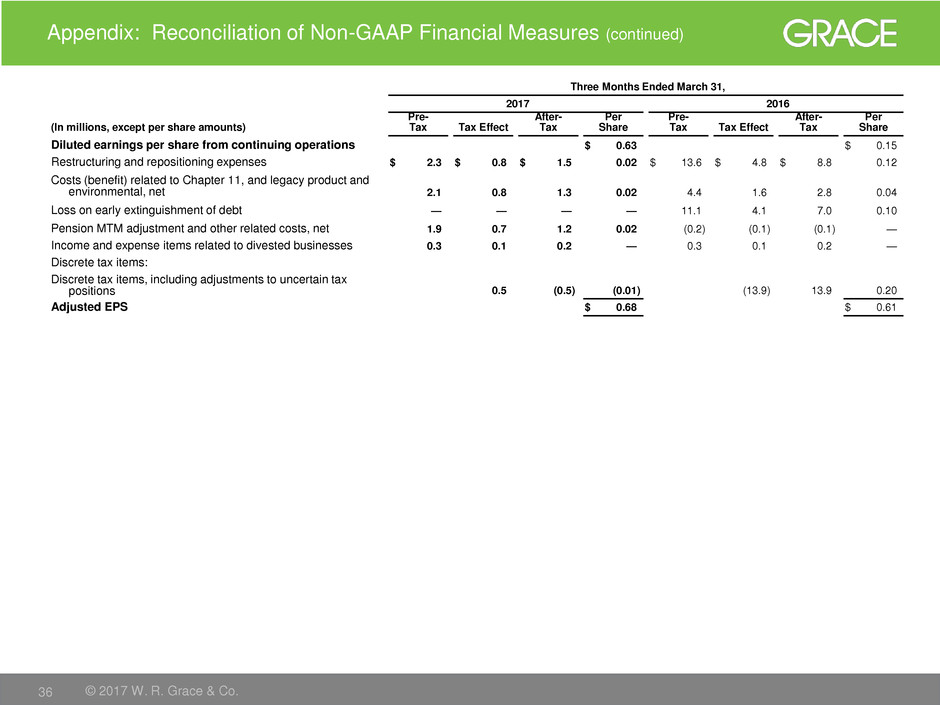

Appendix: Reconciliation of Non-GAAP Financial Measures (continued)

Three Months Ended March 31,

2017 2016

(In millions, except per share amounts)

Pre-

Tax Tax Effect

After-

Tax

Per

Share

Pre-

Tax Tax Effect

After-

Tax

Per

Share

Diluted earnings per share from continuing operations $ 0.63 $ 0.15

Restructuring and repositioning expenses $ 2.3 $ 0.8 $ 1.5 0.02 $ 13.6 $ 4.8 $ 8.8 0.12

Costs (benefit) related to Chapter 11, and legacy product and

environmental, net 2.1 0.8 1.3 0.02 4.4 1.6 2.8 0.04

Loss on early extinguishment of debt — — — — 11.1 4.1 7.0 0.10

Pension MTM adjustment and other related costs, net 1.9 0.7 1.2 0.02 (0.2 ) (0.1 ) (0.1 ) —

Income and expense items related to divested businesses 0.3 0.1 0.2 — 0.3 0.1 0.2 —

Discrete tax items:

Discrete tax items, including adjustments to uncertain tax

positions 0.5 (0.5 ) (0.01 ) (13.9 ) 13.9 0.20

Adjusted EPS $ 0.68 $ 0.61