Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Impax Laboratories, LLC | ipxl-5x10x2017xex991.htm |

| 8-K - 8-K - Impax Laboratories, LLC | ipxl-5x10x2017x8k.htm |

1

First Quarter 2017 Results

and Business Update

May 10, 2017

2

Impax Cautionary Statement Regarding

Forward Looking Statements

"Safe Harbor" statement under the Private Securities Litigation Reform Act of 1995:

To the extent any statements made in this presentation contain information that is not historical; these statements are forward-looking in nature

and express the beliefs and expectations of management. Such statements are based on current expectations and involve a number of known

and unknown risks and uncertainties that could cause the Company’s future results, performance, or achievements to differ significantly from

the results, performance, or achievements expressed or implied by such forward-looking statements. Such risks and uncertainties include, but

are not limited to, fluctuations in the Company’s operating results and financial condition, the volatility of the market price of the Company’s

common stock, the Company’s ability to successfully develop and commercialize pharmaceutical products in a timely manner, the impact of

competition, the effect of any manufacturing or quality control problems, the Company’s ability to manage its growth, risks related to

acquisitions of or investments in technologies, products or businesses, risks relating to goodwill and intangibles, the reduction or loss of

business with any significant customer, the substantial portion of the Company’s total revenues derived from sales of a limited number of

products, the impact of consolidation of the Company’s customer base, the Company’s ability to sustain profitability and positive cash flows, the

impact of any valuation allowance on the Company’s deferred tax assets, the restrictions imposed by the Company’s credit facility and

indenture, the Company’s level of indebtedness and liabilities and the potential impact on cash flow available for operations, the availability of

additional funds in the future, any delays or unanticipated expenses in connection with the operation of the Company’s manufacturing facilities,

the effect of foreign economic, political, legal and other risks on the Company’s operations abroad, the uncertainty of patent litigation and other

legal proceedings, the increased government scrutiny on the Company’s agreements to settle patent litigations, product development risks and

the difficulty of predicting FDA filings and approvals, consumer acceptance and demand for new pharmaceutical products, the impact of market

perceptions of the Company and the safety and quality of the Company’s products, the Company’s determinations to discontinue the

manufacture and distribution of certain products, the Company’s ability to achieve returns on its investments in research and development

activities, changes to FDA approval requirements, the Company’s ability to successfully conduct clinical trials, the Company’s reliance on third

parties to conduct clinical trials and testing, the Company’s lack of a license partner for commercialization of Numient® (IPX066) outside of the

United States, impact of illegal distribution and sale by third parties of counterfeits or stolen products, the availability of raw materials and

impact of interruptions in the Company’s supply chain, the Company’s policies regarding returns, rebates, allowances and chargebacks, the use

of controlled substances in the Company’s products, the effect of current economic conditions on the Company’s industry, business, results of

operations and financial condition, disruptions or failures in the Company’s information technology systems and network infrastructure caused

by third party breaches or other events, the Company’s reliance on alliance and collaboration agreements, the Company’s reliance on licenses

to proprietary technologies, the Company’s dependence on certain employees, the Company’s ability to comply with legal and regulatory

requirements governing the healthcare industry, the regulatory environment, the effect of certain provisions in the Company’s government

contracts, the Company’s ability to protect its intellectual property, exposure to product liability claims, changes in tax regulations, uncertainties

involved in the preparation of the Company’s financial statements, the Company’s ability to maintain an effective system of internal control over

financial reporting, the effect of terrorist attacks on the Company’s business, the location of the Company’s manufacturing and research and

development facilities near earthquake fault lines, expansion of social media platforms and other risks described in the Company’s periodic

reports filed with the Securities and Exchange Commission. Forward-looking statements speak only as to the date on which they are made,

and the Company undertakes no obligation to update publicly or revise any forward-looking statement, regardless of whether new information

becomes available, future developments occur or otherwise.

Trademarks referenced herein are the property of their respective owners.

©2017 Impax Laboratories, Inc. All Rights Reserved.

3

Presentation Overview

Paul Bisaro – President & Chief Executive Officer

1Q 2017 Results

Consolidation and Improvement Plan (“CIP”)

Pipeline Update

Bryan Reasons – Senior Vice President, Chief Financial Officer

1Q 2017 Financial Review

Capital Structure

Paul Bisaro

Updated 2017 Financial Guidance

Path Forward

4

Paul Bisaro

President & CEO

5

1Q 2017 Results

$226

$198

$184

1Q16 4Q16 1Q17

$64

$37

$32

1Q16 4Q16 1Q17

$0.43

$0.16

$0.11

1Q16 4Q16 1Q17

Revenues

$ millions

Adjusted EBITDA

$ millions

Adjusted EPS

Year over year results primarily impacted by significant reduction in sales of

diclofenac sodium gel – down $49 million

Solid growth from epinephrine auto-injector, oxymorphone ER and Rytary®

Experienced price erosion on certain products, in-line with expectations

Refer to the GAAP to non-GAAP reconciliation tables in the appendix for a reconciliation of non-GAAP results

6

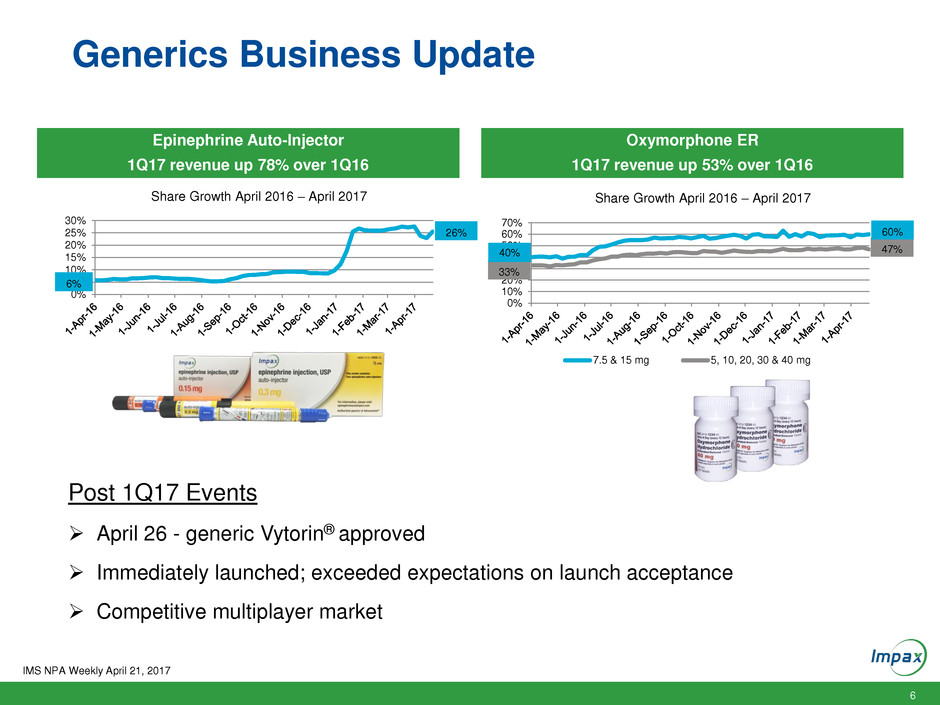

Post 1Q17 Events

April 26 - generic Vytorin® approved

Immediately launched; exceeded expectations on launch acceptance

Competitive multiplayer market

Generics Business Update

IMS NPA Weekly April 21, 2017

0%

5%

10%

15%

20%

25%

30%

Share Growth April 2016 – April 2017

6%

26%

0%

10%

20%

30%

40%

50%

60%

70%

Share Growth April 2016 – April 2017

7.5 & 15 mg 5, 10, 20, 30 & 40 mg

33%

47% 40%

60%

Oxymorphone ER

1Q17 revenue up 53% over 1Q16

Epinephrine Auto-Injector

1Q17 revenue up 78% over 1Q16

7

• 1Q Albenza revenue

impacted by higher mix of

government contracting

sales and prior year

supply issue**

• Combined anthelmintic

share holding in the 42%-

45% range

• Continuing to pursue

Managed Medicaid

contracting opportunities

• 1Q revenue and TRx’s

impacted by timing and

seasonality

• Favorable district court

decision on patent challenge

• Patents expire May 2021

• 36% growth in TRx’s 1Q17

over 1Q16

• 4% growth in TRx’s and 6%

growth in NRx’s 1Q17 over

4Q16 in spite of Managed

Care Resets

• Picked up United Medicare

PDP coverage March 1,

Kaiser (Medicare and

Commercial) and CVS

Commercial in April

Specialty Business Update

** Higher sales in 4Q16 as a resulting of restocking following a supply shortage in 3Q16

Source: IMS NPA March 2017; PDP =Prescription Drug Plan

Launching tele-detailing program for Zomig and

Emverm to select high prescribing pediatric and

primary care offices

8

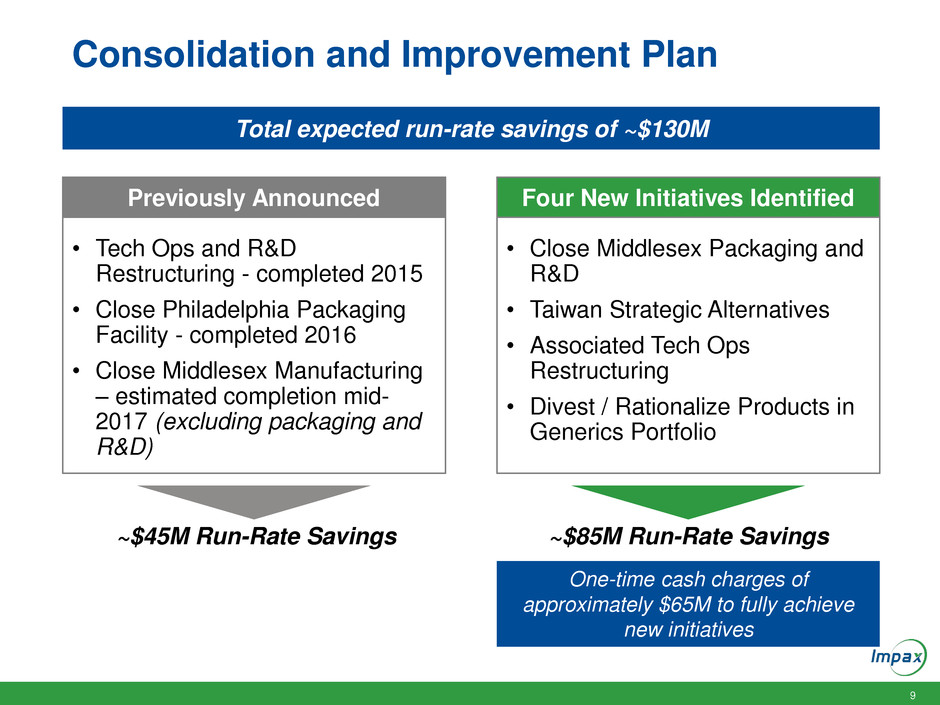

Consolidation and Improvement Plan

Consolidating all of Generic R&D, U.S. manufacturing and packaging

operations to Hayward facility

Continuing previously announced closure of Middlesex

manufacturing site; now includes closure of the Generic R&D site

Reorganizing certain functions including quality, engineering and

supply chain operations

Reviewing strategic alternatives for Taiwan manufacturing site

including sale of the facility or in the alternative, closure of the facility

Rationalizing generic portfolio to eliminate low-value products and

streamline operations

Actions designed to improve efficiencies and profitability; provide

resources to support growth initiatives

9

Consolidation and Improvement Plan

Previously Announced Four New Initiatives Identified

~$45M Run-Rate Savings ~$85M Run-Rate Savings

• Tech Ops and R&D

Restructuring - completed 2015

• Close Philadelphia Packaging

Facility - completed 2016

• Close Middlesex Manufacturing

– estimated completion mid-

2017 (excluding packaging and

R&D)

• Close Middlesex Packaging and

R&D

• Taiwan Strategic Alternatives

• Associated Tech Ops

Restructuring

• Divest / Rationalize Products in

Generics Portfolio

Total expected run-rate savings of ~$130M

One-time cash charges of

approximately $65M to fully achieve

new initiatives

10

Previously Announced Initiatives ~45M Run-Rate

Realized ~$20M of cost savings in 2016

Additional $12M by year-end 2017 (which annualizes to $24M)

Full run-rate of ~$45M in 2018

New Initiatives ~$85M Run-Rate

Limited savings impact in 2017

Full run-rate of ~$85M by year-end 2019

Total run-rate savings and timing dependent on Taiwan strategic

alternatives

Consolidation and Improvement Plan

Total expected run-rate savings of ~$130M

11

Continuing to Expand Pipeline Opportunities

Generic R&D

16

14

6

5

Pending at FDA

$17B

Under Development

$6B

Solid Oral Dose Alternative Dose

22

19

# of Potential

Products

FTF or FTM

9 17

Specialty Pharma R&D

Portfolio of 41 Products

Current U.S. Brand/Generic Market of $23B

IPX203 Carbidopa-Levodopa

Ongoing Phase 2b study

Multiple dose study in patients with

advanced Parkinson’s disease

Interim results expected during the

second half of 2017

Pipeline provides solid platform for growth

Source of sales data: IMS NSP March 2017; *U.S. Brand/Generic market sales; Pipeline data as of Apr 30, 2017

12

Bryan Reasons

Chief Financial Officer

13

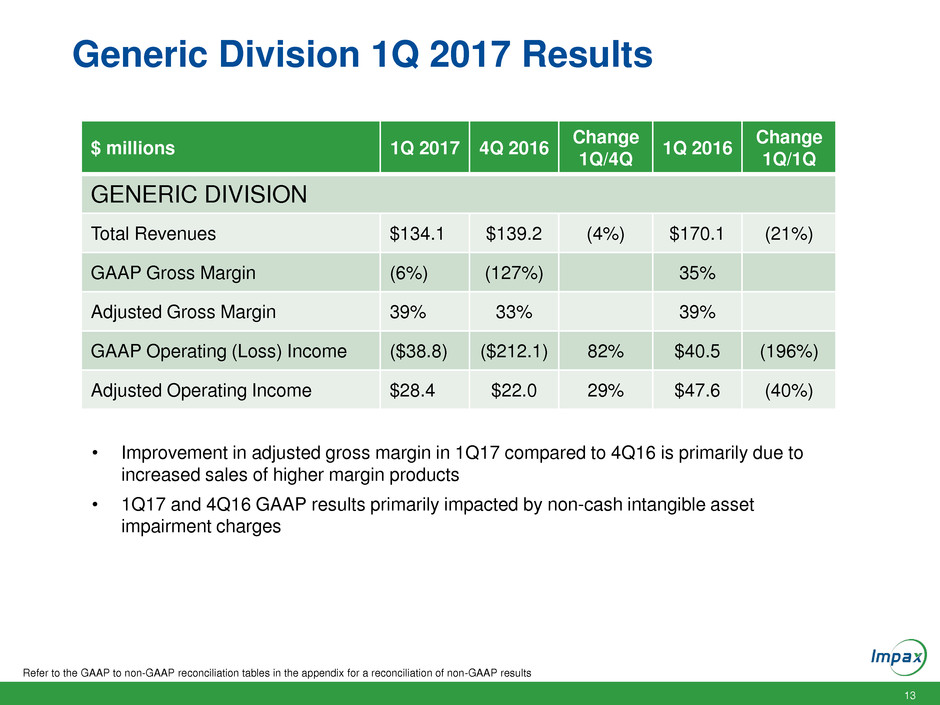

Generic Division 1Q 2017 Results

Refer to the GAAP to non-GAAP reconciliation tables in the appendix for a reconciliation of non-GAAP results

$ millions 1Q 2017 4Q 2016

Change

1Q/4Q

1Q 2016

Change

1Q/1Q

GENERIC DIVISION

Total Revenues $134.1 $139.2 (4%) $170.1 (21%)

GAAP Gross Margin (6%) (127%) 35%

Adjusted Gross Margin 39% 33% 39%

GAAP Operating (Loss) Income ($38.8) ($212.1) 82% $40.5 (196%)

Adjusted Operating Income $28.4 $22.0 29% $47.6 (40%)

• Improvement in adjusted gross margin in 1Q17 compared to 4Q16 is primarily due to

increased sales of higher margin products

• 1Q17 and 4Q16 GAAP results primarily impacted by non-cash intangible asset

impairment charges

14

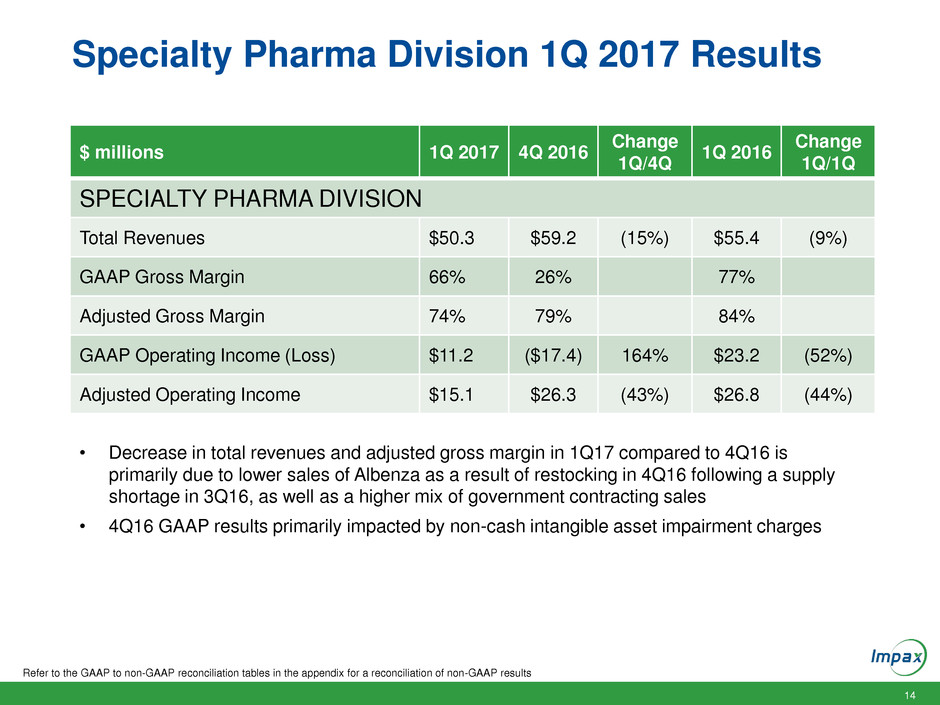

Specialty Pharma Division 1Q 2017 Results

Refer to the GAAP to non-GAAP reconciliation tables in the appendix for a reconciliation of non-GAAP results

$ millions 1Q 2017 4Q 2016

Change

1Q/4Q

1Q 2016

Change

1Q/1Q

SPECIALTY PHARMA DIVISION

Total Revenues $50.3 $59.2 (15%) $55.4 (9%)

GAAP Gross Margin 66% 26% 77%

Adjusted Gross Margin 74% 79% 84%

GAAP Operating Income (Loss) $11.2 ($17.4) 164% $23.2 (52%)

Adjusted Operating Income $15.1 $26.3 (43%) $26.8 (44%)

• Decrease in total revenues and adjusted gross margin in 1Q17 compared to 4Q16 is

primarily due to lower sales of Albenza as a result of restocking in 4Q16 following a supply

shortage in 3Q16, as well as a higher mix of government contracting sales

• 4Q16 GAAP results primarily impacted by non-cash intangible asset impairment charges

15

Consolidated 1Q 2017 Results

Refer to the GAAP to non-GAAP reconciliation tables in the appendix for a reconciliation of non-GAAP results

$ millions, except per share

amounts

1Q 2017 4Q 2016

Change

1Q/4Q

1Q 2016

Change

1Q/1Q

EBITDA ($30.2) ($234.0) 87% $5.6 (639%)

Adjusted EBITDA $31.9 $37.3 (14%) $63.6 (50%)

GAAP EPS ($1.37) ($3.91) 65% ($0.15) (813%)

Adjusted Diluted EPS $0.11 $0.16 (31%) $0.43 (74%)

GAAP Tax Rate (45.8%) (3.2%) 40.5%

Adjusted Tax Rate 30.8% 22.8% 34.7%

• 1Q17 and 4Q16 GAAP results primarily impacted by non-cash intangible asset

impairment charges

16

Capital Structure ($ millions)

Cash and Cash Equivalents $ 157

Revolver ($200) $ 0

2022 Convertible Senior Notes 600

Senior Secured Term Loan 340

Total Debt $ 940

Total Net Debt $ 783

Capital Structure as of March 31, 2017

Revised debt covenants provides additional operating flexibility

Previous Maintenance Covenant

Based on

March 31

Data

5x Net Debt to Trailing 12 Months

Pro-forma EBITDA

3.8x

Revised

2.5x Secured Net Debt to

Trailing 12 Months Pro-

forma EBITDA

1.0x

Covenant calculation: Net debt less up to $125 million of cash and cash equivalents allowed.

Trailing 12 months pro-forma EBITDA includes the products acquired in the Teva Transaction prior to closing the transaction in August 2016.

• Voluntarily pre-paid $50M of the Term Loan in February

• Revised debt covenants at minimal cost

17

Paul Bisaro

President & CEO

18

Updated 2017 Financial Guidance Summary

Previous Guidance

March 1

Updated Guidance

May 10**

Adjusted Gross Margin as a % of

Revenues

~ 47% to 49% No Change

Adjusted R&D & Patent Litigation

Expense

~ $90M to $95M No Change

Adjusted Selling, General &

Administrative Expense

~ $190M to $195M No Change

Adjusted Interest Expense ~ $30M ~ $28M

Adjusted EPS N/A ~ $0.55 to $0.70

Tax Rate ~ 34% to 35% ~33% to 34%

Capital Expenditures ~ $25M to $30M No Change

**Excludes new cost savings initiatives as outlined on slide 9.

The Company’s full year 2017 estimates are based on management’s current expectations, including with respect to prescription trends,

pricing levels, inventory levels, and the anticipated timing of future product launches and events. These statements are forward-looking, and

actual results could differ materially depending on market conditions and the factors set forth under our “Safe Harbor” statement above.

19

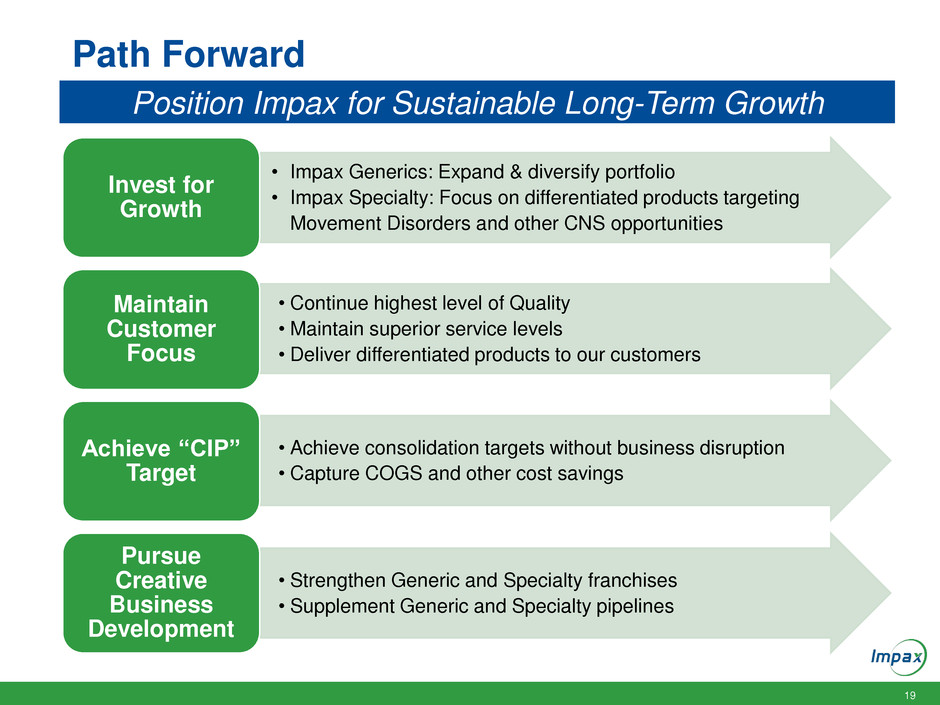

Path Forward

• Impax Generics: Expand & diversify portfolio

• Impax Specialty: Focus on differentiated products targeting

Movement Disorders and other CNS opportunities

Invest for

Growth

• Continue highest level of Quality

• Maintain superior service levels

• Deliver differentiated products to our customers

Maintain

Customer

Focus

• Achieve consolidation targets without business disruption

• Capture COGS and other cost savings

Achieve “CIP”

Target

• Strengthen Generic and Specialty franchises

• Supplement Generic and Specialty pipelines

Pursue

Creative

Business

Development

Position Impax for Sustainable Long-Term Growth

20

Q&A

21

ANDA Pipeline Includes Several Potential High-Value

First-to-Market Opportunities

Source of sales data: IMS NPS Mar 2017; Pipeline data as of Apr 30, 2017; TA = tentative approval

1 Launched authorized generic in April 2016

2 Assuming final FDA approval, earliest potential launch date/timing based on settlement or patent expiration date

Disclosed Pending ANDAs and Tentative Approval Products

Generic Product Name Brand

IMS

Sales

Potential Launch

Timing

FTM

Opportunity

Apixaban IR tablet Eliquis® $3.6M Pending litigation

Oxycodone ER tablet (new formulation) 1 OxyContin® $2.2B Settled, not disclosed

Sevelamer Carbonate IR tablet Renvela® $1.9B Approval

Methylphenidate HCI ER tablet Concerta® $1.8B Approval

Teriflunomide IR tablet Aubagio® $1.2B Settled, not disclosed

Colesevelam IR tablet Welchol® $615M Approval

Oxymorphone ER tablet (new

formulation)

Opana ER® $290M Pending litigation

Carvedilol ER capsule Coreg CR® $224M Approval

Fentanyl Buccal IR tablet Fentora® $134M Settled, not disclosed

Dexmethylphenidate ER capsule

25, 35mg – TA2

Focalin XR® $94M July 2017

Dutasteride/Tamsulosin IR capsule Jalyn® $42M Approval

Risedronate Sodium DR tablet Atelvia® $27M Approval

22

GAAP to Adjusted Results Reconciliation

The following table reconciles total Company reported cost of revenues to adjusted cost of revenues, adjusted gross profit,

adjusted gross margin, adjusted research and development expenses, and adjusted selling, general and administrative expenses.

(Unaudited, In thousands)

Refer to the First Quarter 2017 Earnings Release for an explanation of adjusted items. The sum of the individual amounts may not equal due to rounding.

(a) Adjusted gross profit is calculated as total revenues less adjusted cost of revenues. Adjusted gross margin is calculated as adjusted gross profit divided by

total revenues.

March 31, December March 31,

2017 2016 2016

Cost of revenues 120,232$ 129,047$ 122,918$

Cost of revenues impairment charges 39,280 230,625 -

Adjusted to deduct:

Amortization 17,232 16,886 8,768

Intangible asset impairment charges 39,280 230,625 -

Business development 8 - -

Restructuring and severance charges 6,139 6,414 1,733

Middlesex plant closure 1,636 - -

Adjusted cost of revenues 95,217$ 105,747$ 112,417$

Adjusted gross profit (a) 89,186$ 92,675$ 113,091$

Adjusted gross margin (a) 48.4% 46.7% 50.1%

Research and development expenses 22,489$ 20,530$ 19,022$

In-process research and development impairment charges 6,079 23,248 -

Adjusted to deduct:

Intangible asset impairment charges 6,079 23,248 -

Other 650 600 300

Adjusted research and development expenses 21,839$ 19,930$ 18,722$

Selling, general and administrative expenses 47,055$ 57,586$ 44,298$

Adjusted to deduct:

Business development expenses 42 251 768

Turing legal expenses (495) 2,111 -

Restructuring and severance charges - 5,291 10

Adjusted selling, general and administrative expenses 47,508$ 49,933$ 43,520$

Three Months Ended

23

GAAP to Adjusted Net Income Reconciliation

The following table reconciles reported net loss to adjusted net income.

(Unaudited, In thousands, except per share and per share data)

Refer to the First Quarter 2017 Earnings Release for an explanation of adjusted items. The sum of the individual amounts may not equal

due to rounding.

March 31, December 31, March 31,

2017 2016 2016

Net loss (98,431)$ (279,585)$ (10,408)$

Adjusted to add (deduct):

Amortization 17,232 16,886 8,768

Non-cash interest expense 6,312 6,241 5,305

Business development expenses 50 251 768

Intangible asset impairment charges 45,359 253,873 -

Reserve for Turing receivable 317 (7,731) 48,043

Turing legal expenses (495) 2,111 -

Restructuring and severance charges 6,139 11,705 1,568

Fixed asset impairment charges - 1,644 -

Loss on debt extinguishment 1,215 - -

Middlesex plant closure 1,636 - -

Other 931 1,118 300

Income tax effect 27,463 5,136 (23,490)

Adju ted net income 7,728$ 11,649$ 30,854$

Adjusted net income per diluted share 0.11$ 0.16$ 0.43$

Net loss per diluted share (1.37)$ (3.91)$ (0.15)$

Diluted weighted-average common shares outstanding 71,600 71,489 71,649

Three Months Ended

24

GAAP to Adjusted EBITDA Reconciliation

Refer to the First Quarter 2017 Earnings Release for an explanation of adjusted items. The sum of the individual amounts may not equal

due to rounding.

The following table reconciles reported net loss to adjusted EBITDA.

(Unaudited, In thousands)

March 31, December 31, March 31,

2017 2016 2016

Net loss (98,431)$ (279,585)$ (10,408)$

Adjusted to add (deduct):

Interest expense 13,380 13,567 8,331

Interest income (154) (127) (333)

Income taxes 30,901 8,572 (7,086)

Depreciation and amortization 24,098 23,573 15,098

EBITDA (30,206) (234,000) 5,602

Adjusted to add (deduct):

Share-based compensation expense 6,957 8,334 7,278

Business development expenses 50 251 768

Intangible asset impairment charges 45,359 253,873 -

Reserve for Turing receivable 317 (7,731) 48,043

Turing legal expenses (495) 2,111 -

Restructuring and severance charges 6,139 11,705 1,568

Fixed asset impairment charges - 1,644 -

Loss on debt extinguishment 1,215 - -

Middlesex plant closure 1,636 - -

Other 931 1,118 300

Adjusted EBITDA 31,903$ 37,305$ 63,559$

Three Months Ended

25

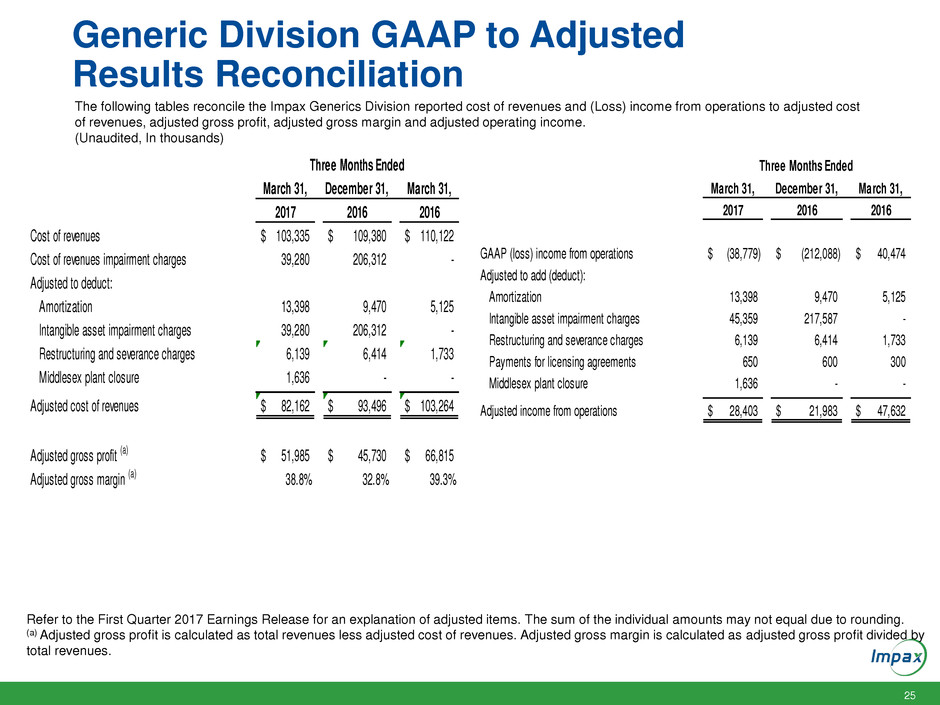

Generic Division GAAP to Adjusted

Results Reconciliation

The following tables reconcile the Impax Generics Division reported cost of revenues and (Loss) income from operations to adjusted cost

of revenues, adjusted gross profit, adjusted gross margin and adjusted operating income.

(Unaudited, In thousands)

Refer to the First Quarter 2017 Earnings Release for an explanation of adjusted items. The sum of the individual amounts may not equal due to rounding.

(a) Adjusted gross profit is calculated as total revenues less adjusted cost of revenues. Adjusted gross margin is calculated as adjusted gross profit divided by

total revenues.

March 31, December 31, March 31,

2017 2016 2016

Cost of revenues 103,335$ 109,380$ 110,122$

Cost of revenues impairment charges 39,280 206,312 -

Adjusted to deduct:

Amortization 13,398 9,470 5,125

Intangible asset impairment charges 39,280 206,312 -

R tructuring and sev rance charges 6,139 6,414 1,733

Middlesex plant closure 1,636 - -

Adjusted cost of revenues 82,162$ 93,496$ 103,264$

Adjusted gross profit (a) 51,985$ 45,730$ 66,815$

Adjusted gross margin (a) 38.8% 32.8% 39.3%

Three Months Ended

March 31, December 31, March 31,

2017 2016 2016

GAAP (loss) income from operations (38,779)$ (212,088)$ 40,474$

Adjusted to add (deduct):

Amortization 13,398 9,470 5,125

Int ngible asset impairment charges 45, 59 217,587 -

Re tructuring nd everance charges ,139 6,414 1,733

Payments for licensing agreements 650 600 300

Middlesex plant closure 1,636 - -

Adjusted income from operations 28,403$ 21,983$ 47,632$

Three Months Ended

26

Specialty Pharma Division GAAP to

Adjusted Results Reconciliation

The following tables reconcile the Impax Specialty Pharma Division reported cost of revenues and (Loss) income from operations

to adjusted cost of revenues, adjusted gross profit, adjusted gross margin and adjusted income from operations.

(Unaudited, In thousands)

Refer to the First Quarter 2017 Earnings Release for an explanation of adjusted items. The sum of the individual amounts may not equal due to rounding.

(a) Adjusted gross profit is calculated as total revenues less adjusted cost of revenues. Adjusted gross margin is calculated as adjusted gross profit divided by

total revenues.

March 31, December 31, March 31,

2017 2016 2016

GAAP income (loss) from operations 11,232$ (17,437)$ 23,183$

Adjusted to add:

Amortization 3,834 7,416 3,643

Intangible asset impairment charges - 36,286 -

Adjusted income from operations 15,066$ 26,265$ 26,826$

Three Months Ended

March 31, December 31, March 31,

2017 2016 2016

Cost of revenues 16,897$ 19,667$ 12,796$

Cost of revenues impairment charges - 24,313 -

Adjusted to deduct:

A ortiz ti n 3,834 7,416 3,643

Intangible asset impairment charges - 24,313 -

Adjusted cost of revenues 13,063$ 12,251$ 9,153$

Adjusted gross profit (a) 7,193$ 46,945$ 46,276$

Adjusted gross margin (a) 74.0% 79.3% 83.5%

Three Months Ended