Attached files

| file | filename |

|---|---|

| EX-32.2 - EX-32.2 - Blackstone Group Inc | d377864dex322.htm |

| EX-32.1 - EX-32.1 - Blackstone Group Inc | d377864dex321.htm |

| EX-31.2 - EX-31.2 - Blackstone Group Inc | d377864dex312.htm |

| EX-31.1 - EX-31.1 - Blackstone Group Inc | d377864dex311.htm |

| EX-10.1 - EX-10.1 - Blackstone Group Inc | d377864dex101.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

(Mark One)

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE QUARTERLY PERIOD ENDED MARCH 31, 2017 |

OR

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM TO |

Commission File Number: 001-33551

The Blackstone Group L.P.

(Exact name of Registrant as specified in its charter)

| Delaware | 20-8875684 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

345 Park Avenue

New York, New York 10154

(Address of principal executive offices)(Zip Code)

(212) 583-5000

(Registrant’s telephone number, including area code)

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☒ |

Accelerated filer ☐ | |

| Non-accelerated filer ☐ |

Smaller reporting company ☐ | |

| (Do not check if a smaller reporting company) |

Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The number of the Registrant’s voting common units representing limited partner interests outstanding as of May 3, 2017 was 609,204,345. The number of the Registrant’s non-voting common units representing limited partner interests outstanding as of May 3, 2017 was 37,538,435.

Table of Contents

| Page | ||||||

| PART I. | ||||||

| ITEM 1. | 5 | |||||

| Unaudited Condensed Consolidated Financial Statements — March 31, 2017 and 2016: |

||||||

| Condensed Consolidated Statements of Financial Condition as of March 31, 2017 and December 31, 2016 |

5 | |||||

| Condensed Consolidated Statements of Operations for the Three Months Ended March 31, 2017 and 2016 |

7 | |||||

| 8 | ||||||

| 9 | ||||||

| Condensed Consolidated Statements of Cash Flows for the Three Months Ended March 31, 2017 and 2016 |

11 | |||||

| 13 | ||||||

| ITEM 1A. | UNAUDITED SUPPLEMENTAL PRESENTATION OF STATEMENTS OF FINANCIAL CONDITION |

55 | ||||

| ITEM 2. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

57 | ||||

| ITEM 3. | 119 | |||||

| ITEM 4. | 123 | |||||

| PART II. | ||||||

| ITEM 1. | 124 | |||||

| ITEM 1A. | 124 | |||||

| ITEM 2. | 124 | |||||

| ITEM 3. | 125 | |||||

| ITEM 4. | 125 | |||||

| ITEM 5. | 125 | |||||

| ITEM 6. | 125 | |||||

| 126 | ||||||||

1

Table of Contents

Forward-Looking Statements

This report may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 which reflect our current views with respect to, among other things, our operations and financial performance. You can identify these forward-looking statements by the use of words such as “outlook,” “indicator,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “should,” “seeks,” “approximately,” “predicts,” “intends,” “plans,” “estimates,” “anticipates” or the negative version of these words or other comparable words. Such forward-looking statements are subject to various risks and uncertainties. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements. We believe these factors include but are not limited to those described under the section entitled “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2016 and in this report, as such factors may be updated from time to time in our periodic filings with the United States Securities and Exchange Commission (“SEC”), which are accessible on the SEC’s website at www.sec.gov. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this report and in our other periodic filings. The forward-looking statements speak only as of the date of this report, and we undertake no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise.

Website and Social Media Disclosure

We use our website (www.blackstone.com), Facebook page (www.facebook.com/blackstone), Twitter (www.twitter.com/blackstone), LinkedIn (www.linkedin.com/company/the-blackstone-group), Instagram (www.instagram.com/blackstone) and YouTube (www.youtube.com/user/blackstonegroup) accounts as channels of distribution of company information. The information we post through these channels may be deemed material. Accordingly, investors should monitor these channels, in addition to following our press releases, SEC filings and public conference calls and webcasts. In addition, you may automatically receive e-mail alerts and other information about Blackstone when you enroll your e-mail address by visiting the “Contact Us/Email Alerts” section of our website at http://ir.blackstone.com. The contents of our website, any alerts and social media channels are not, however, a part of this report.

In this report, references to “Blackstone,” the “Partnership,” “we,” “us” or “our” refer to The Blackstone Group L.P. and its consolidated subsidiaries. Unless the context otherwise requires, references in this report to the ownership of Mr. Stephen A. Schwarzman, our founder, and other Blackstone personnel include the ownership of personal planning vehicles and family members of these individuals.

“Blackstone Funds,” “our funds” and “our investment funds” refer to the private equity funds, real estate funds, funds of hedge funds, credit-focused funds, collateralized loan obligation (“CLO”), real estate investment trusts and registered investment companies that are managed by Blackstone. “Our carry funds” refers to the private equity funds, real estate funds and certain of the hedge fund solutions and credit-focused funds (with multi-year drawdown, commitment-based structures that only pay carry on the realization of an investment) that are managed by Blackstone. We refer to our general corporate private equity funds as Blackstone Capital Partners (“BCP”) funds, our energy-focused private equity funds as Blackstone Energy Partners (“BEP”) funds, our core private equity fund as Blackstone Core Equity Partners (“BCEP”), our opportunistic investment platform that invests globally across asset classes, industries and geographies as Blackstone Tactical Opportunities (“Tactical Opportunities”), our secondary private equity fund of funds business as Strategic Partners Fund Solutions (“Strategic Partners”), a multi-asset investment program for eligible high net worth investors offering exposure to certain of our key illiquid investment strategies through a single commitment as Blackstone Total Alternatives Solution (“BTAS”) and our capital markets services business as Blackstone Capital Markets (“BXCM”). We refer to our real estate opportunistic funds as Blackstone Real Estate Partners (“BREP”) funds and our real estate debt investment funds as Blackstone Real Estate Debt Strategies (“BREDS”) funds. We refer to our core+ real estate funds, which target substantially stabilized assets in prime markets, as Blackstone Property Partners (“BPP”) funds. We refer to our real

2

Table of Contents

estate investment trusts as “REITs”, to Blackstone Mortgage Trust, Inc., our NYSE-listed REIT, as “BXMT”, and to Blackstone Real Estate Income Trust, Inc., our non-exchange traded REIT, as “BREIT”. “Our hedge funds” refers to our funds of hedge funds, certain of our real estate debt investment funds, including a registered investment company, and certain other credit-focused funds which are managed by Blackstone.

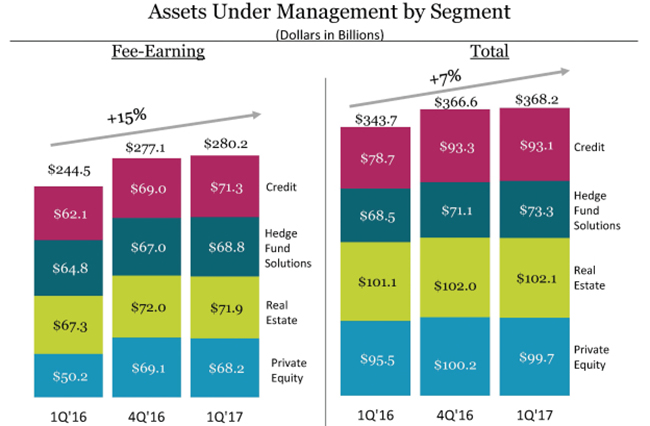

“Assets Under Management” refers to the assets we manage. Our Assets Under Management equals the sum of:

| (a) | the fair value of the investments held by our carry funds and our side-by-side and co-investment entities managed by us, plus the capital that we are entitled to call from investors in those funds and entities pursuant to the terms of their respective capital commitments, including capital commitments to funds that have yet to commence their investment periods, plus for certain credit-oriented funds the amounts available to be borrowed under asset based credit facilities, |

| (b) | the net asset value of (1) our hedge funds, real estate debt carry funds and open ended core+ real estate fund (plus, in each case, the capital that we are entitled to call from investors in those funds, including commitments yet to commence their investment periods), and (2) our funds of hedge funds, our Hedge Fund Solutions registered investment companies, and our non-exchange traded REIT, |

| (c) | the invested capital, fair value or net asset value of assets we manage pursuant to separately managed accounts, |

| (d) | the amount of debt and equity outstanding for our CLOs during the reinvestment period, |

| (e) | the aggregate par amount of collateral assets, including principal cash, for our CLOs after the reinvestment period, |

| (f) | the gross or net amount of assets (including leverage where applicable) for our credit-focused registered investment companies, and |

| (g) | the fair value of common stock, preferred stock, convertible debt, or similar instruments issued by BXMT. |

Our carry funds are commitment-based drawdown structured funds that do not permit investors to redeem their interests at their election. Our funds of hedge funds, hedge funds, funds structured like hedge funds and other open ended funds in our Hedge Fund Solutions, Credit and Real Estate segments generally have structures that afford an investor the right to withdraw or redeem their interests on a periodic basis (for example, annually or quarterly), typically with 30 to 95 days’ notice, depending on the fund and the liquidity profile of the underlying assets. Investment advisory agreements related to certain separately managed accounts in our Hedge Fund Solutions and Credit segments may generally be terminated by an investor on 30 to 90 days’ notice.

“Fee-Earning Assets Under Management” refers to the assets we manage on which we derive management and/or performance fees. Our Fee-Earning Assets Under Management equals the sum of:

| (a) | for our Private Equity segment funds and Real Estate segment carry funds including certain real estate debt investment funds and certain of our Hedge Fund Solutions funds, the amount of capital commitments, remaining invested capital, fair value or par value of assets held, depending on the fee terms of the fund, |

| (b) | for our credit-focused carry funds, the amount of remaining invested capital (which may include leverage) or net asset value, depending on the fee terms of the fund, |

| (c) | the remaining invested capital or fair value of assets held in co-investment vehicles managed by us on which we receive fees, |

| (d) | the net asset value of our funds of hedge funds, hedge funds, open ended core+ real estate fund, co-investments managed by us on which we receive fees, certain registered investment companies, and our non-exchanged traded REIT, |

3

Table of Contents

| (e) | the invested capital, fair value of assets or the net asset value we manage pursuant to separately managed accounts, |

| (f) | the net proceeds received from equity offerings and accumulated core earnings of BXMT, subject to certain adjustments, |

| (g) | the aggregate par amount of collateral assets, including principal cash, of our CLOs, and |

| (h) | the gross amount of assets (including leverage) or the net assets (plus leverage where applicable) for certain of our credit-focused registered investment companies. |

Each of our segments may include certain Fee-Earning Assets Under Management on which we earn performance fees but not management fees.

Our calculations of assets under management and fee-earning assets under management may differ from the calculations of other asset managers, and as a result this measure may not be comparable to similar measures presented by other asset managers. In addition, our calculation of assets under management includes commitments to, and the fair value of, invested capital in our funds from Blackstone and our personnel, regardless of whether such commitments or invested capital are subject to fees. Our definitions of assets under management or fee-earning assets under management are not based on any definition of assets under management or fee-earning assets under management that is set forth in the agreements governing the investment funds that we manage.

For our carry funds, total assets under management includes the fair value of the investments held, whereas fee-earning assets under management includes the amount of capital commitments, the remaining amount of invested capital at cost depending on whether the investment period has or has not expired or the fee terms of the fund. As such, fee-earning assets under management may be greater than total assets under management when the aggregate fair value of the remaining investments is less than the cost of those investments.

This report does not constitute an offer of any Blackstone Fund.

4

Table of Contents

| ITEM 1. | FINANCIAL STATEMENTS |

THE BLACKSTONE GROUP L.P.

Condensed Consolidated Statements of Financial Condition (Unaudited)

(Dollars in Thousands, Except Unit Data)

| March 31, 2017 |

December 31, 2016 |

|||||||

| Assets |

||||||||

| Cash and Cash Equivalents |

$ | 2,303,680 | $ | 1,837,253 | ||||

| Cash Held by Blackstone Funds and Other |

1,416,904 | 1,005,161 | ||||||

| Investments (including assets pledged of $142,265 and $119,139 at March 31, 2017 and December 31, 2016, respectively) |

18,138,258 | 17,694,975 | ||||||

| Accounts Receivable |

1,274,154 | 772,695 | ||||||

| Reverse Repurchase Agreements |

44,635 | 118,495 | ||||||

| Due from Affiliates |

1,669,124 | 1,442,378 | ||||||

| Intangible Assets, Net |

251,640 | 262,604 | ||||||

| Goodwill |

1,718,519 | 1,718,519 | ||||||

| Other Assets |

257,102 | 264,788 | ||||||

| Deferred Tax Assets |

1,263,148 | 1,286,469 | ||||||

|

|

|

|

|

|||||

| Total Assets |

$ | 28,337,164 | $ | 26,403,337 | ||||

|

|

|

|

|

|||||

| Liabilities and Partners’ Capital |

||||||||

| Loans Payable |

$ | 9,796,933 | $ | 8,866,366 | ||||

| Due to Affiliates |

1,236,067 | 1,321,772 | ||||||

| Accrued Compensation and Benefits |

2,221,161 | 2,327,762 | ||||||

| Securities Sold, Not Yet Purchased |

178,448 | 215,398 | ||||||

| Repurchase Agreements |

94,646 | 75,324 | ||||||

| Accounts Payable, Accrued Expenses and Other Liabilities |

1,707,050 | 1,081,782 | ||||||

|

|

|

|

|

|||||

| Total Liabilities |

15,234,305 | 13,888,404 | ||||||

|

|

|

|

|

|||||

| Commitments and Contingencies |

||||||||

| Redeemable Non-Controlling Interests in Consolidated Entities |

188,658 | 185,390 | ||||||

|

|

|

|

|

|||||

| Partners’ Capital |

||||||||

| The Blackstone Group L.P. Partners’ Capital |

||||||||

| Partners’ Capital (common units: 649,352,407 issued and outstanding as of March 31, 2017; 643,459,542 issued and outstanding as of December 31, 2016) |

6,713,622 | 6,523,929 | ||||||

| Accumulated Other Comprehensive Loss |

(55,201 | ) | (62,887 | ) | ||||

|

|

|

|

|

|||||

| Total The Blackstone Group L.P. Partners’ Capital |

6,658,421 | 6,461,042 | ||||||

| Non-Controlling Interests in Consolidated Entities |

2,650,789 | 2,428,964 | ||||||

| Non-Controlling Interests in Blackstone Holdings |

3,604,991 | 3,439,537 | ||||||

|

|

|

|

|

|||||

| Total Partners’ Capital |

12,914,201 | 12,329,543 | ||||||

|

|

|

|

|

|||||

| Total Liabilities and Partners’ Capital |

$ | 28,337,164 | $ | 26,403,337 | ||||

|

|

|

|

|

|||||

continued…

See notes to condensed consolidated financial statements.

5

Table of Contents

THE BLACKSTONE GROUP L.P.

Condensed Consolidated Statements of Financial Condition (Unaudited)

(Dollars in Thousands)

The following presents the portion of the consolidated balances presented above, after intercompany eliminations, attributable to consolidated Blackstone Funds which are variable interest entities. The following assets may only be used to settle obligations of these consolidated Blackstone Funds and these liabilities are only the obligations of these consolidated Blackstone Funds and they do not have recourse to the general credit of Blackstone.

| March 31, 2017 |

December 31, 2016 |

|||||||

| Assets |

||||||||

| Cash Held by Blackstone Funds and Other |

$ | 1,088,917 | $ | 740,760 | ||||

| Investments |

7,184,513 | 6,459,355 | ||||||

| Accounts Receivable |

938,363 | 355,364 | ||||||

| Due from Affiliates |

14,770 | 21,300 | ||||||

| Other Assets |

3,629 | 2,602 | ||||||

|

|

|

|

|

|||||

| Total Assets |

$ | 9,230,192 | $ | 7,579,381 | ||||

|

|

|

|

|

|||||

| Liabilities |

||||||||

| Loans Payable |

$ | 6,386,217 | $ | 5,466,444 | ||||

| Due to Affiliates |

57,343 | 72,609 | ||||||

| Securities Sold, Not Yet Purchased |

81,417 | 81,309 | ||||||

| Repurchase Agreements |

73,393 | 66,221 | ||||||

| Accounts Payable, Accrued Expenses and Other Liabilities |

1,208,745 | 545,481 | ||||||

|

|

|

|

|

|||||

| Total Liabilities |

$ | 7,807,115 | $ | 6,232,064 | ||||

|

|

|

|

|

|||||

See notes to condensed consolidated financial statements.

6

Table of Contents

THE BLACKSTONE GROUP L.P.

Condensed Consolidated Statements of Operations (Unaudited)

(Dollars in Thousands, Except Unit and Per Unit Data)

| Three Months Ended March 31, |

||||||||

| 2017 | 2016 | |||||||

| Revenues |

||||||||

| Management and Advisory Fees, Net |

$ | 642,142 | $ | 608,906 | ||||

|

|

|

|

|

|||||

| Performance Fees |

||||||||

| Realized |

||||||||

| Carried Interest |

1,111,256 | 230,909 | ||||||

| Incentive Fees |

47,160 | 28,419 | ||||||

| Unrealized |

||||||||

| Carried Interest |

(154,683 | ) | 47,586 | |||||

| Incentive Fees |

59,409 | 7,579 | ||||||

|

|

|

|

|

|||||

| Total Performance Fees |

1,063,142 | 314,493 | ||||||

|

|

|

|

|

|||||

| Investment Income (Loss) |

||||||||

| Realized |

251,344 | (12,001 | ) | |||||

| Unrealized |

(40,188 | ) | 3,493 | |||||

|

|

|

|

|

|||||

| Total Investment Income (Loss) |

211,156 | (8,508 | ) | |||||

|

|

|

|

|

|||||

| Interest and Dividend Revenue |

28,495 | 23,075 | ||||||

| Other |

(4,212 | ) | (5,612 | ) | ||||

|

|

|

|

|

|||||

| Total Revenues |

1,940,723 | 932,354 | ||||||

|

|

|

|

|

|||||

| Expenses |

||||||||

| Compensation and Benefits |

||||||||

| Compensation |

351,589 | 346,003 | ||||||

| Performance Fee Compensation |

||||||||

| Realized |

||||||||

| Carried Interest |

366,191 | 58,504 | ||||||

| Incentive Fees |

22,752 | 14,124 | ||||||

| Unrealized |

||||||||

| Carried Interest |

(4,387 | ) | 30,001 | |||||

| Incentive Fees |

23,139 | 3,448 | ||||||

|

|

|

|

|

|||||

| Total Compensation and Benefits |

759,284 | 452,080 | ||||||

| General, Administrative and Other |

106,044 | 123,045 | ||||||

| Interest Expense |

40,246 | 37,356 | ||||||

| Fund Expenses |

24,076 | 5,229 | ||||||

|

|

|

|

|

|||||

| Total Expenses |

929,650 | 617,710 | ||||||

|

|

|

|

|

|||||

| Other Income |

||||||||

| Net Gains from Fund Investment Activities |

66,132 | 19,142 | ||||||

|

|

|

|

|

|||||

| Income Before Provision for Taxes |

1,077,205 | 333,786 | ||||||

| Provision for Taxes |

57,437 | 9,146 | ||||||

|

|

|

|

|

|||||

| Net Income |

1,019,768 | 324,640 | ||||||

| Net Income (Loss) Attributable to Redeemable |

||||||||

| Non-Controlling Interests in Consolidated Entities |

2,000 | (6,401 | ) | |||||

| Net Income Attributable to Non-Controlling |

||||||||

| Interests in Consolidated Entities |

138,685 | 40,086 | ||||||

| Net Income Attributable to Non-Controlling |

||||||||

| Interests in Blackstone Holdings |

417,258 | 131,202 | ||||||

|

|

|

|

|

|||||

| Net Income Attributable to The Blackstone Group L.P. |

$ | 461,825 | $ | 159,753 | ||||

|

|

|

|

|

|||||

| Net Income Per Common Unit |

||||||||

| Common Units, Basic |

$ | 0.70 | $ | 0.25 | ||||

|

|

|

|

|

|||||

| Common Units, Diluted |

$ | 0.69 | $ | 0.23 | ||||

|

|

|

|

|

|||||

| Weighted-Average Common Units Outstanding |

||||||||

| Common Units, Basic |

660,939,708 | 644,897,849 | ||||||

|

|

|

|

|

|||||

| Common Units, Diluted |

1,199,506,983 | 1,194,273,401 | ||||||

|

|

|

|

|

|||||

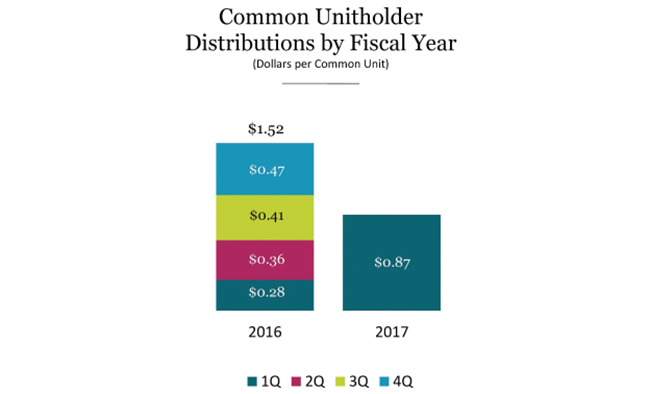

| Distributions Declared Per Common Unit |

$ | 0.47 | $ | 0.61 | ||||

|

|

|

|

|

|||||

| Revenues Earned from Affiliates |

||||||||

| Management and Advisory Fees, Net |

$ | 50,085 | $ | 56,675 | ||||

|

|

|

|

|

|||||

See notes to condensed consolidated financial statements.

7

Table of Contents

THE BLACKSTONE GROUP L.P.

Condensed Consolidated Statements of Comprehensive Income (Loss) (Unaudited)

(Dollars in Thousands)

| Three Months Ended March 31, |

||||||||

| 2017 | 2016 | |||||||

| Net Income |

$ | 1,019,768 | $ | 324,640 | ||||

| Other Comprehensive Income, Net of Tax — Currency Translation Adjustment |

11,504 | 17,612 | ||||||

|

|

|

|

|

|||||

| Comprehensive Income |

1,031,272 | 342,252 | ||||||

| Less: |

||||||||

| Comprehensive Income (Loss) Attributable to Redeemable Non-Controlling Interests in Consolidated Entities |

2,000 | (6,401 | ) | |||||

| Comprehensive Income Attributable to Non-Controlling Interests in Consolidated Entities |

142,503 | 51,243 | ||||||

| Comprehensive Income Attributable to Non-Controlling Interests in Blackstone Holdings |

417,258 | 131,202 | ||||||

|

|

|

|

|

|||||

| Comprehensive Income Attributable to The Blackstone Group L.P. |

$ | 469,511 | $ | 166,208 | ||||

|

|

|

|

|

|||||

See notes to condensed consolidated financial statements.

8

Table of Contents

THE BLACKSTONE GROUP L.P.

Condensed Consolidated Statements of Changes in Partners’ Capital (Unaudited)

(Dollars in Thousands, Except Unit Data)

| The Blackstone Group L.P. | ||||||||||||||||||||||||||||||||

| Common Units |

Partners’ Capital |

Accumulated Other Compre- hensive Income (Loss) |

Total | Non- Controlling Interests in Consolidated Entities |

Non- Controlling Interests in Blackstone Holdings |

Total Partners’ Capital |

Redeemable Non- Controlling Interests in Consolidated Entities |

|||||||||||||||||||||||||

| Balance at December 31, 2016 |

643,459,542 | $ | 6,523,929 | $ | (62,887 | ) | $ | 6,461,042 | $ | 2,428,964 | $ | 3,439,537 | $ | 12,329,543 | $ | 185,390 | ||||||||||||||||

| Net Income |

— | 461,825 | — | 461,825 | 138,685 | 417,258 | 1,017,768 | 2,000 | ||||||||||||||||||||||||

| Currency Translation Adjustment |

— | — | 7,686 | 7,686 | 3,818 | — | 11,504 | — | ||||||||||||||||||||||||

| Capital Contributions |

— | — | — | — | 238,203 | — | 238,203 | 11,484 | ||||||||||||||||||||||||

| Capital Distributions |

— | (308,925 | ) | — | (308,925 | ) | (156,819 | ) | (284,636 | ) | (750,380 | ) | (10,216 | ) | ||||||||||||||||||

| Transfer of Non-Controlling Interests in Consolidated Entities |

— | — | — | — | (2,062 | ) | — | (2,062 | ) | — | ||||||||||||||||||||||

| Deferred Tax Effects Resulting from Acquisition of Ownership Interests from Non-Controlling Interest Holders |

— | 2,297 | — | 2,297 | — | — | 2,297 | — | ||||||||||||||||||||||||

| Equity-Based Compensation |

— | 43,703 | — | 43,703 | — | 36,355 | 80,058 | — | ||||||||||||||||||||||||

| Net Delivery of Vested Blackstone Holdings Partnership Units and Blackstone Common Units |

3,780,081 | (11,940 | ) | — | (11,940 | ) | — | (790 | ) | (12,730 | ) | — | ||||||||||||||||||||

| Change in The Blackstone Group L.P.’s Ownership Interest |

— | (10,789 | ) | — | (10,789 | ) | — | 10,789 | — | — | ||||||||||||||||||||||

| Conversion of Blackstone Holdings Partnership Units to Blackstone Common Units |

2,112,784 | 13,522 | — | 13,522 | — | (13,522 | ) | — | — | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Balance at March 31, 2017 |

649,352,407 | $ | 6,713,622 | $ | (55,201 | ) | $ | 6,658,421 | $ | 2,650,789 | $ | 3,604,991 | $ | 12,914,201 | $ | 188,658 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

continued…

See notes to condensed consolidated financial statements.

9

Table of Contents

THE BLACKSTONE GROUP L.P.

Condensed Consolidated Statements of Changes in Partners’ Capital (Unaudited)

(Dollars in Thousands, Except Unit Data)

| The Blackstone Group L.P. | ||||||||||||||||||||||||||||||||

| Common Units |

Partners’ Capital |

Accumulated Other Compre- hensive (Loss) |

Total | Non- Controlling Interests in Consolidated Entities |

Non- Controlling Interests in Blackstone Holdings |

Total Partners’ Capital |

Redeemable Non- Controlling Interests in Consolidated Entities |

|||||||||||||||||||||||||

| Balance at December 31, 2015 |

624,450,162 | $ | 6,322,307 | $ | (52,519 | ) | $ | 6,269,788 | $ | 2,408,701 | $ | 3,368,509 | $ | 12,046,998 | $ | 183,459 | ||||||||||||||||

| Net Income (Loss) |

— | 159,753 | — | 159,753 | 40,086 | 131,202 | 331,041 | (6,401 | ) | |||||||||||||||||||||||

| Currency Translation Adjustment |

— | — | 6,455 | 6,455 | 11,157 | — | 17,612 | — | ||||||||||||||||||||||||

| Capital Contributions |

— | — | — | — | 94,418 | — | 94,418 | — | ||||||||||||||||||||||||

| Capital Distributions |

— | (389,780 | ) | — | (389,780 | ) | (68,692 | ) | (355,360 | ) | (813,832 | ) | (4 | ) | ||||||||||||||||||

| Transfer of Non-Controlling Interests in Consolidated Entities |

— | — | — | — | (5,312 | ) | — | (5,312 | ) | — | ||||||||||||||||||||||

| Deferred Tax Effects Resulting from Acquisition of Ownership Interests from Non-Controlling Interest Holders |

— | (1,145 | ) | — | (1,145 | ) | — | — | (1,145 | ) | — | |||||||||||||||||||||

| Equity-Based Compensation |

— | 36,053 | — | 36,053 | — | 41,455 | 77,508 | — | ||||||||||||||||||||||||

| Net Delivery of Vested Blackstone Holdings Partnership Units and Blackstone Common Units |

4,025,507 | (13,262 | ) | — | (13,262 | ) | — | — | (13,262 | ) | — | |||||||||||||||||||||

| Change in The Blackstone Group L.P.’s Ownership Interest |

— | 3,618 | — | 3,618 | — | (3,618 | ) | — | — | |||||||||||||||||||||||

| Conversion of Blackstone Holdings Partnership Units to Blackstone Common Units |

3,073,286 | 18,931 | — | 18,931 | — | (18,931 | ) | — | — | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Balance at March 31, 2016 |

631,548,955 | $ | 6,136,475 | $ | (46,064 | ) | $ | 6,090,411 | $ | 2,480,358 | $ | 3,163,257 | $ | 11,734,026 | $ | 177,054 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

See notes to condensed consolidated financial statements.

10

Table of Contents

THE BLACKSTONE GROUP L.P.

Condensed Consolidated Statements of Cash Flows (Unaudited)

(Dollars in Thousands)

| Three Months Ended March 31, |

||||||||

| 2017 | 2016 | |||||||

| Operating Activities |

||||||||

| Net Income |

$ | 1,019,768 | $ | 324,640 | ||||

| Adjustments to Reconcile Net Income to Net Cash Provided by Operating Activities |

||||||||

| Blackstone Funds Related |

||||||||

| Net Realized Gains on Investments |

(1,464,126 | ) | (253,857 | ) | ||||

| Change in Unrealized (Gains) Losses on Investments |

63,480 | (18,321 | ) | |||||

| Non-Cash Performance Fees |

100,524 | (15,077 | ) | |||||

| Non-Cash Performance Fee Compensation |

407,696 | 106,076 | ||||||

| Equity-Based Compensation Expense |

91,269 | 79,840 | ||||||

| Amortization of Intangibles |

10,964 | 22,828 | ||||||

| Other Non-Cash Amounts Included in Net Income |

52,123 | 7,652 | ||||||

| Cash Flows Due to Changes in Operating Assets and Liabilities |

||||||||

| Cash Held by Blackstone Funds and Other |

(400,386 | ) | 51,134 | |||||

| Accounts Receivable |

352,788 | (21,063 | ) | |||||

| Reverse Repurchase Agreements |

73,860 | 159,592 | ||||||

| Due from Affiliates |

(146,750 | ) | 124,519 | |||||

| Other Assets |

2,335 | 52,381 | ||||||

| Accrued Compensation and Benefits |

(523,779 | ) | (289,532 | ) | ||||

| Securities Sold, Not Yet Purchased |

(37,632 | ) | (76,620 | ) | ||||

| Accounts Payable, Accrued Expenses and Other Liabilities |

(656,935 | ) | (264,198 | ) | ||||

| Repurchase Agreements |

19,415 | 8,620 | ||||||

| Due to Affiliates |

(65,935 | ) | (3,642 | ) | ||||

| Investments Purchased |

(2,330,873 | ) | (1,333,052 | ) | ||||

| Cash Proceeds from Sale of Investments |

3,583,318 | 1,558,301 | ||||||

|

|

|

|

|

|||||

| Net Cash Provided by Operating Activities |

151,124 | 220,221 | ||||||

|

|

|

|

|

|||||

| Investing Activities |

||||||||

| Purchase of Furniture, Equipment and Leasehold Improvements |

(10,007 | ) | (9,934 | ) | ||||

| Changes in Restricted Cash |

7,990 | 5,843 | ||||||

|

|

|

|

|

|||||

| Net Cash Used in Investing Activities |

(2,017 | ) | (4,091 | ) | ||||

|

|

|

|

|

|||||

continued…

See notes to condensed consolidated financial statements.

11

Table of Contents

THE BLACKSTONE GROUP L.P.

Condensed Consolidated Statements of Cash Flows (Unaudited)

(Dollars in Thousands)

| Three Months Ended March 31, |

||||||||

| 2017 | 2016 | |||||||

| Financing Activities |

||||||||

| Distributions to Non-Controlling Interest Holders in Consolidated Entities |

$ | (139,059 | ) | $ | (68,696 | ) | ||

| Contributions from Non-Controlling Interest Holders in Consolidated Entities |

246,274 | 88,079 | ||||||

| Payments Under Tax Receivable Agreement |

(59,667 | ) | (78,985 | ) | ||||

| Net Settlement of Vested Common Units and Repurchase of Common and Blackstone Holdings Partnership Units |

(12,730 | ) | (13,262 | ) | ||||

| Proceeds from Loans Payable |

996,892 | 158,456 | ||||||

| Repayment and Repurchase of Loans Payable |

(125,425 | ) | (21,327 | ) | ||||

| Distributions to Unitholders |

(593,561 | ) | (745,140 | ) | ||||

|

|

|

|

|

|||||

| Net Cash Provided by (Used in) Financing Activities |

312,724 | (680,875 | ) | |||||

|

|

|

|

|

|||||

| Effect of Exchange Rate Changes on Cash and Cash Equivalents |

4,596 | (27 | ) | |||||

|

|

|

|

|

|||||

| Net Increase (Decrease) in Cash and Cash Equivalents |

466,427 | (464,772 | ) | |||||

| Cash and Cash Equivalents, Beginning of Period |

1,837,253 | 1,837,324 | ||||||

|

|

|

|

|

|||||

| Cash and Cash Equivalents, End of Period |

$ | 2,303,680 | $ | 1,372,552 | ||||

|

|

|

|

|

|||||

| Supplemental Disclosure of Cash Flows Information |

||||||||

| Payments for Interest |

$ | 57,339 | $ | 60,907 | ||||

|

|

|

|

|

|||||

| Payments for Income Taxes |

$ | 16,849 | $ | 6,995 | ||||

|

|

|

|

|

|||||

| Supplemental Disclosure of Non-Cash Investing and Financing Activities |

||||||||

| Non-Cash Contributions from Non-Controlling Interest Holders |

$ | 1,738 | $ | 967 | ||||

|

|

|

|

|

|||||

| Non-Cash Distributions to Non-Controlling Interest Holders |

$ | (27,976 | ) | $ | — | |||

|

|

|

|

|

|||||

| Transfer of Interests to Non-Controlling Interest Holders |

$ | (2,062 | ) | $ | (5,312 | ) | ||

|

|

|

|

|

|||||

| Change in The Blackstone Group L.P.’s Ownership Interest |

$ | (10,789 | ) | $ | 3,618 | |||

|

|

|

|

|

|||||

| Net Settlement of Vested Common Units |

$ | 60,853 | $ | 59,605 | ||||

|

|

|

|

|

|||||

| Conversion of Blackstone Holdings Partnership Units to Common Units |

$ | 13,522 | $ | 18,931 | ||||

|

|

|

|

|

|||||

| Acquisition of Ownership Interests from Non-Controlling Interest Holders |

||||||||

| Deferred Tax Asset |

$ | (15,129 | ) | $ | (14,427 | ) | ||

|

|

|

|

|

|||||

| Due to Affiliates |

$ | 12,832 | $ | 15,572 | ||||

|

|

|

|

|

|||||

| Partners’ Capital |

$ | 2,297 | $ | (1,145 | ) | |||

|

|

|

|

|

|||||

See notes to condensed consolidated financial statements.

12

Table of Contents

THE BLACKSTONE GROUP L.P.

Notes to Condensed Consolidated Financial Statements

(All Dollars Are in Thousands, Except Unit and Per Unit Data, Except Where Noted)

| 1. | ORGANIZATION |

The Blackstone Group L.P., together with its subsidiaries (“Blackstone” or the “Partnership”), is a leading global manager of private capital. The alternative asset management business includes the management of private equity funds, real estate funds, real estate investment trusts (“REITs”), funds of hedge funds, hedge funds, credit-focused funds, collateralized loan obligation (“CLO”) vehicles, separately managed accounts and registered investment companies (collectively referred to as the “Blackstone Funds”). Blackstone’s business is organized into four segments: private equity, real estate, hedge fund solutions and credit.

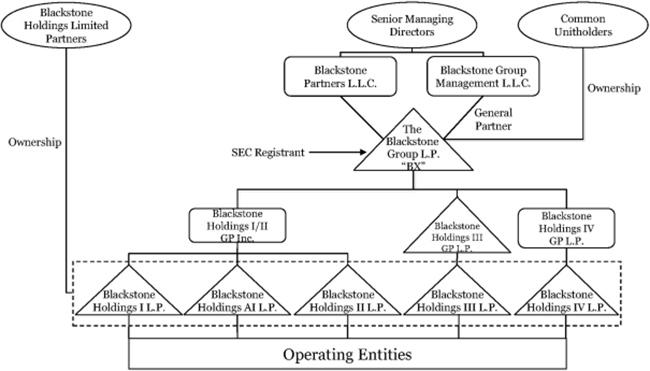

The Partnership was formed as a Delaware limited partnership on March 12, 2007. The Partnership is managed and operated by its general partner, Blackstone Group Management L.L.C., which is in turn wholly owned and controlled by one of Blackstone’s founders, Stephen A. Schwarzman (the “Founder”), and Blackstone’s other senior managing directors. The activities of the Partnership are conducted through its holding partnerships: Blackstone Holdings I L.P., Blackstone Holdings AI L.P., Blackstone Holdings II L.P., Blackstone Holdings III L.P. and Blackstone Holdings IV L.P. (collectively, “Blackstone Holdings”, “Blackstone Holdings Partnerships” or the “Holding Partnerships”). The Partnership, through its wholly owned subsidiaries, is the sole general partner in each of these Holding Partnerships.

Generally, holders of the limited partner interests in the Holding Partnerships may, four times each year, exchange their limited partnership interests (“Partnership Units”) for Blackstone common units, on a one-to-one basis, exchanging one Partnership Unit from each of the Holding Partnerships for one Blackstone common unit.

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES |

Basis of Presentation

The accompanying unaudited condensed consolidated financial statements of the Partnership have been prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”) for interim financial information and the instructions to Form 10-Q. The condensed consolidated financial statements, including these notes, are unaudited and exclude some of the disclosures required in audited financial statements. Management believes it has made all necessary adjustments (consisting of only normal recurring items) so that the condensed consolidated financial statements are presented fairly and that estimates made in preparing its condensed consolidated financial statements are reasonable and prudent. The operating results presented for interim periods are not necessarily indicative of the results that may be expected for any other interim period or for the entire year. These condensed consolidated financial statements should be read in conjunction with the audited consolidated financial statements included in the Partnership’s Annual Report on Form 10-K for the year ended December 31, 2016 filed with the Securities and Exchange Commission. As disclosed in the audited consolidated financial statements, the Partnership adopted certain accounting guidance for the quarter ended June 30, 2016 and any adjustments were reflected prospectively as of January 1, 2016. As such, the condensed consolidated financial statements for the three months ended March 31, 2016 were recast from the amounts originally reported in the Partnership’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2016.

The condensed consolidated financial statements include the accounts of the Partnership, its wholly owned or majority-owned subsidiaries, the consolidated entities which are considered to be variable interest entities and for which the Partnership is considered the primary beneficiary, and certain partnerships or similar entities which are not considered variable interest entities but in which the general partner is presumed to have control.

All intercompany balances and transactions have been eliminated in consolidation.

13

Table of Contents

THE BLACKSTONE GROUP L.P.

Notes to Condensed Consolidated Financial Statements—Continued

(All Dollars Are in Thousands, Except Unit and Per Unit Data, Except Where Noted)

Restructurings within consolidated CLOs are treated as investment purchases or sales, as applicable, in the Condensed Consolidated Statements of Cash Flows.

Consolidation

The Partnership consolidates all entities that it controls through a majority voting interest or otherwise, including those Blackstone Funds in which the general partner has a controlling financial interest. The Partnership has a controlling interest in Blackstone Holdings because the limited partners do not have the right to dissolve the partnerships or have substantive kick out rights or participating rights that would overcome the presumption of control by the Partnership. Accordingly, the Partnership consolidates Blackstone Holdings and records non-controlling interests to reflect the economic interests of the limited partners of Blackstone Holdings.

In addition, the Partnership consolidates all variable interest entities (“VIE”) in which it is the primary beneficiary. An enterprise is determined to be the primary beneficiary if it holds a controlling financial interest. A controlling financial interest is defined as (a) the power to direct the activities of a VIE that most significantly impact the entity’s economic performance and (b) the obligation to absorb losses of the entity or the right to receive benefits from the entity that could potentially be significant to the VIE. The consolidation guidance requires an analysis to determine (a) whether an entity in which the Partnership holds a variable interest is a VIE and (b) whether the Partnership’s involvement, through holding interests directly or indirectly in the entity or contractually through other variable interests (for example, management and performance related fees), would give it a controlling financial interest. Performance of that analysis requires the exercise of judgment.

The Partnership determines whether it is the primary beneficiary of a VIE at the time it becomes involved with a variable interest entity and reconsiders that conclusion continually. In evaluating whether the Partnership is the primary beneficiary, Blackstone evaluates its economic interests in the entity held either directly or indirectly by the Partnership. The consolidation analysis can generally be performed qualitatively; however, if it is not readily apparent that the Partnership is not the primary beneficiary, a quantitative analysis may also be performed. Investments and redemptions (either by the Partnership, affiliates of the Partnership or third parties) or amendments to the governing documents of the respective Blackstone Funds could affect an entity’s status as a VIE or the determination of the primary beneficiary. At each reporting date, the Partnership assesses whether it is the primary beneficiary and will consolidate or deconsolidate accordingly.

Assets of consolidated VIEs that can only be used to settle obligations of the consolidated VIE and liabilities of a consolidated VIE for which creditors (or beneficial interest holders) do not have recourse to the general credit of Blackstone are presented in a separate section in the Condensed Consolidated Statements of Financial Condition.

Blackstone’s other disclosures regarding VIEs are discussed in Note 9. “Variable Interest Entities”.

Fair Value of Financial Instruments

GAAP establishes a hierarchical disclosure framework which prioritizes and ranks the level of market price observability used in measuring financial instruments at fair value. Market price observability is affected by a number of factors, including the type of financial instrument, the characteristics specific to the financial instrument and the state of the marketplace, including the existence and transparency of transactions between market participants. Financial instruments with readily available quoted prices in active markets generally will have a higher degree of market price observability and a lesser degree of judgment used in measuring fair value.

14

Table of Contents

THE BLACKSTONE GROUP L.P.

Notes to Condensed Consolidated Financial Statements—Continued

(All Dollars Are in Thousands, Except Unit and Per Unit Data, Except Where Noted)

Financial instruments measured and reported at fair value are classified and disclosed based on the observability of inputs used in the determination of fair values, as follows:

| • | Level I — Quoted prices are available in active markets for identical financial instruments as of the reporting date. The types of financial instruments in Level I include listed equities, listed derivatives and mutual funds with quoted prices. The Partnership does not adjust the quoted price for these investments, even in situations where Blackstone holds a large position and a sale could reasonably impact the quoted price. |

| • | Level II — Pricing inputs are other than quoted prices in active markets, which are either directly or indirectly observable as of the reporting date, and fair value is determined through the use of models or other valuation methodologies. Financial instruments which are generally included in this category include corporate bonds and loans, including corporate bonds and loans held within CLO vehicles, government and agency securities, less liquid and restricted equity securities, and certain over-the-counter derivatives where the fair value is based on observable inputs. Senior and subordinated notes issued by CLO vehicles are classified within Level II of the fair value hierarchy. |

| • | Level III — Pricing inputs are unobservable for the financial instruments and includes situations where there is little, if any, market activity for the financial instrument. The inputs into the determination of fair value require significant management judgment or estimation. Financial instruments that are included in this category generally include general and limited partnership interests in private equity and real estate funds, credit-focused funds, distressed debt and non-investment grade residual interests in securitizations, certain corporate bonds and loans held within CLO vehicles, and certain over-the-counter derivatives where the fair value is based on unobservable inputs. |

In certain cases, the inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, the determination of which category within the fair value hierarchy is appropriate for any given financial instrument is based on the lowest level of input that is significant to the fair value measurement. The Partnership’s assessment of the significance of a particular input to the fair value measurement in its entirety requires judgment and considers factors specific to the financial instrument.

Transfers between levels of the fair value hierarchy are recognized at the beginning of the reporting period.

Level II Valuation Techniques

Financial instruments classified within Level II of the fair value hierarchy comprise debt instruments, including certain corporate loans and bonds held by Blackstone’s consolidated CLO vehicles and debt securities sold, not yet purchased. Certain equity securities and derivative instruments valued using observable inputs are also classified as Level II.

The valuation techniques used to value financial instruments classified within Level II of the fair value hierarchy are as follows:

| • | Debt Instruments and Equity Securities are valued on the basis of prices from an orderly transaction between market participants provided by reputable dealers or pricing services. In determining the value of a particular investment, pricing services may use certain information with respect to transactions in such investments, quotations from dealers, pricing matrices and market transactions in comparable investments and various relationships between investments. The valuation of certain equity securities is based on an observable price for an identical security adjusted for the effect of a restriction. |

15

Table of Contents

THE BLACKSTONE GROUP L.P.

Notes to Condensed Consolidated Financial Statements—Continued

(All Dollars Are in Thousands, Except Unit and Per Unit Data, Except Where Noted)

| • | Freestanding Derivatives are valued using contractual cash flows and observable inputs comprising yield curves, foreign currency rates and credit spreads. |

| • | Senior and subordinate notes issued by CLO vehicles are classified based on the more observable fair value of CLO assets less (a) the fair value of any beneficial interests held by Blackstone, and (b) the carrying value of any beneficial interests that represent compensation for services. |

Level III Valuation Techniques

In the absence of observable market prices, Blackstone values its investments using valuation methodologies applied on a consistent basis. For some investments little market activity may exist; management’s determination of fair value is then based on the best information available in the circumstances, and may incorporate management’s own assumptions and involves a significant degree of judgment, taking into consideration a combination of internal and external factors, including the appropriate risk adjustments for non-performance and liquidity risks. Investments for which market prices are not observable include private investments in the equity of operating companies, real estate properties, certain funds of hedge funds and credit-focused investments.

Private Equity Investments — The fair values of private equity investments are determined by reference to projected net earnings, earnings before interest, taxes, depreciation and amortization (“EBITDA”), the discounted cash flow method, public market or private transactions, valuations for comparable companies and other measures which, in many cases, are based on unaudited information at the time received. Valuations may be derived by reference to observable valuation measures for comparable companies or transactions (for example, multiplying a key performance metric of the investee company, such as EBITDA, by a relevant valuation multiple observed in the range of comparable companies or transactions), adjusted by management for differences between the investment and the referenced comparables, and in some instances by reference to option pricing models or other similar methods. Where a discounted cash flow method is used, a terminal value is derived by reference to EBITDA or price/earnings exit multiples.

Real Estate Investments — The fair values of real estate investments are determined by considering projected operating cash flows, sales of comparable assets, if any, and replacement costs, among other measures. The methods used to estimate the fair value of real estate investments include the discounted cash flow method and/or capitalization rates (“cap rates”) analysis. Valuations may be derived by reference to observable valuation measures for comparable companies or assets (for example, multiplying a key performance metric of the investee company or asset, such as EBITDA, by a relevant valuation multiple observed in the range of comparable companies or transactions), adjusted by management for differences between the investment and the referenced comparables, and in some instances by reference to option pricing models or other similar methods. Where a discounted cash flow method is used, a terminal value is derived by reference to an exit EBITDA multiple or capitalization rate. Additionally, where applicable, projected distributable cash flow through debt maturity will be considered in support of the investment’s fair value.

Credit-Focused Investments — The fair values of credit-focused investments are generally determined on the basis of prices between market participants provided by reputable dealers or pricing services. For credit-focused investments that are not publicly traded or whose market prices are not readily available, Blackstone may utilize other valuation techniques, including the discounted cash flow method or a market approach. The discounted cash flow method projects the expected cash flows of the debt instrument based on contractual terms, and discounts such cash flows back to the valuation date using a market-based yield. The market-based yield is estimated using yields of publicly traded debt instruments issued by companies operating in similar industries as the subject investment, with similar leverage statistics and time to maturity.

16

Table of Contents

THE BLACKSTONE GROUP L.P.

Notes to Condensed Consolidated Financial Statements—Continued

(All Dollars Are in Thousands, Except Unit and Per Unit Data, Except Where Noted)

The market approach is generally used to determine the enterprise value of the issuer of a credit investment, and considers valuation multiples of comparable companies or transactions. The resulting enterprise value will dictate whether or not such credit investment has adequate enterprise value coverage. In cases of distressed credit instruments, the market approach may be used to estimate a recovery value in the event of a restructuring.

Level III Valuation Process

Investments classified within Level III of the fair value hierarchy are valued on a quarterly basis, taking into consideration factors including any changes in Blackstone’s weighted-average cost of capital assumptions, discounted cash flow projections and exit multiple assumptions, as well as any changes in economic and other relevant conditions, and valuation models are updated accordingly. The valuation process also includes a review by an independent valuation party, at least annually for all investments, and quarterly for certain investments, to corroborate the values determined by management. The valuations of Blackstone’s investments are reviewed quarterly by a valuation committee chaired by Blackstone’s Vice Chairman and includes senior heads of each of Blackstone’s businesses, as well as representatives of legal and finance. Each quarter, the valuations of Blackstone’s investments are also reviewed by the Audit Committee in a meeting attended by the chairman of the valuation committee. The valuations are further tested by comparison to actual sales prices obtained on disposition of the investments.

Investments, at Fair Value

The Blackstone Funds are accounted for as investment companies under the American Institute of Certified Public Accountants Accounting and Auditing Guide, Investment Companies, and reflect their investments, including majority-owned and controlled investments (the “Portfolio Companies”), at fair value. Such consolidated funds’ investments are reflected in Investments on the Condensed Consolidated Statements of Financial Condition at fair value, with unrealized gains and losses resulting from changes in fair value reflected as a component of Net Gains (Losses) from Fund Investment Activities in the Condensed Consolidated Statements of Operations. Fair value is the amount that would be received to sell an asset or paid to transfer a liability, in an orderly transaction between market participants at the measurement date, at current market conditions (i.e., the exit price).

Blackstone’s principal investments are presented at fair value with unrealized appreciation or depreciation and realized gains and losses recognized in the Condensed Consolidated Statements of Operations within Investment Income (Loss).

For certain instruments, the Partnership has elected the fair value option. Such election is irrevocable and is applied on an investment by investment basis at initial recognition. The Partnership has applied the fair value option for certain loans and receivables and certain investments in private debt securities that otherwise would not have been carried at fair value with gains and losses recorded in net income. Accounting for these financial instruments at fair value is consistent with how the Partnership accounts for its other principal investments. Loans extended to third parties are recorded within Accounts Receivable within the Condensed Consolidated Statements of Financial Condition. Debt securities for which the fair value option has been elected are recorded within Investments. The methodology for measuring the fair value of such investments is consistent with the methodology applied to private equity, real estate, credit-focused and funds of hedge funds investments. Changes in the fair value of such instruments are recognized in Investment Income (Loss) in the Condensed Consolidated Statements of Operations. Interest income on interest bearing loans and receivables and debt securities on which the fair value option has been elected is based on stated coupon rates adjusted for the accretion of purchase discounts and the amortization of purchase premiums. This interest income is recorded within Interest and Dividend Revenue.

17

Table of Contents

THE BLACKSTONE GROUP L.P.

Notes to Condensed Consolidated Financial Statements—Continued

(All Dollars Are in Thousands, Except Unit and Per Unit Data, Except Where Noted)

In addition, the Partnership has elected the fair value option for the assets and liabilities of CLO vehicles that are consolidated as of January 1, 2010, as a result of the initial adoption of variable interest entity consolidation guidance. The Partnership has also elected the fair value option for CLO vehicles consolidated as a result of the acquisitions of CLO management contracts or the acquisition of the share capital of CLO managers. Historically, the adjustment resulting from the difference between the fair value of assets and liabilities for each of these events was presented as a transition and acquisition adjustment to Appropriated Partners’ Capital. Assets of the consolidated CLOs are presented within Investments within the Condensed Consolidated Statements of Financial Condition and Liabilities within Loans Payable for the amounts due to unaffiliated third parties and Due to Affiliates for the amounts held by non-consolidated affiliates. Changes in the fair value of consolidated CLO assets and liabilities and related interest, dividend and other income subsequent to adoption and acquisition are presented within Net Gains (Losses) from Fund Investment Activities. Expenses of consolidated CLO vehicles are presented in Fund Expenses. Historically, amounts attributable to Non-Controlling Interests in Consolidated Entities had a corresponding adjustment to Appropriated Partners’ Capital. On the adoption of the new CLO measurement guidance, there is no attribution of amounts to Non-Controlling Interests and no corresponding adjustments to Appropriated Partners’ Capital.

The Partnership has elected the fair value option for certain proprietary investments that would otherwise have been accounted for using the equity method of accounting. The fair value of such investments is based on quoted prices in an active market or using the discounted cash flow method. Changes in fair value are recognized in Investment Income (Loss) in the Condensed Consolidated Statements of Operations.

Further disclosure on instruments for which the fair value option has been elected is presented in Note 7. “Fair Value Option”.

The investments of consolidated Blackstone Funds in funds of hedge funds (“Investee Funds”) are valued at net asset value (“NAV”) per share of the Investee Fund. In limited circumstances, the Partnership may determine, based on its own due diligence and investment procedures, that NAV per share does not represent fair value. In such circumstances, the Partnership will estimate the fair value in good faith and in a manner that it reasonably chooses, in accordance with the requirements of GAAP.

Certain investments of Blackstone and of the consolidated Blackstone funds of hedge funds and credit-focused funds measure their investments in underlying funds at fair value using NAV per share without adjustment. The terms of the investee’s investment generally provide for minimum holding periods or lock-ups, the institution of gates on redemptions or the suspension of redemptions or an ability to side pocket investments, at the discretion of the investee’s fund manager, and as a result, investments may not be redeemable at, or within three months of, the reporting date. A side pocket is used by hedge funds and funds of hedge funds to separate investments that may lack a readily ascertainable value, are illiquid or are subject to liquidity restriction. Redemptions are generally not permitted until the investments within a side pocket are liquidated or it is deemed that the conditions existing at the time that required the investment to be included in the side pocket no longer exist. As the timing of either of these events is uncertain, the timing at which the Partnership may redeem an investment held in a side pocket cannot be estimated. Further disclosure on instruments for which fair value is measured using NAV per share is presented in Note 5. “Net Asset Value as Fair Value”.

Security and loan transactions are recorded on a trade date basis.

18

Table of Contents

THE BLACKSTONE GROUP L.P.

Notes to Condensed Consolidated Financial Statements—Continued

(All Dollars Are in Thousands, Except Unit and Per Unit Data, Except Where Noted)

Equity Method Investments

Investments in which the Partnership is deemed to exert significant influence, but not control, are accounted for using the equity method of accounting. Under the equity method of accounting, the Partnership’s share of earnings (losses) from equity method investments is included in Investment Income (Loss) in the Condensed Consolidated Statements of Operations. The carrying amounts of equity method investments are reflected in Investments in the Condensed Consolidated Statements of Financial Condition. As the underlying investments of the Partnership’s equity method investments in Blackstone Funds are reported at fair value, the carrying value of the Partnership’s equity method investments approximates fair value.

Repurchase and Reverse Repurchase Agreements

Securities purchased under agreements to resell (“reverse repurchase agreements”) and securities sold under agreements to repurchase (“repurchase agreements”), comprised primarily of U.S. and non-U.S. government and agency securities, asset-backed securities and corporate debt, represent collateralized financing transactions. Such transactions are recorded in the Condensed Consolidated Statements of Financial Condition at their contractual amounts and include accrued interest. The carrying value of repurchase and reverse repurchase agreements approximates fair value.

The Partnership manages credit exposure arising from reverse repurchase agreements and repurchase agreements by, in appropriate circumstances, entering into master netting agreements and collateral arrangements with counterparties that provide the Partnership, in the event of a counterparty default, the right to liquidate collateral and the right to offset a counterparty’s rights and obligations.

The Partnership takes possession of securities purchased under reverse repurchase agreements and is permitted to repledge, deliver or otherwise use such securities. The Partnership also pledges its financial instruments to counterparties to collateralize repurchase agreements. Financial instruments pledged that can be repledged, delivered or otherwise used by the counterparty are recorded in Investments in the Condensed Consolidated Statements of Financial Condition. Additional disclosures relating to reverse repurchase and repurchase agreements are discussed in Note 10. “Reverse Repurchase and Repurchase Agreements”.

Blackstone does not offset assets and liabilities relating to reverse repurchase agreements and repurchase agreements in its Condensed Consolidated Statements of Financial Condition. Additional disclosures relating to offsetting are discussed in Note 11. “Offsetting of Assets and Liabilities”.

Securities Sold, Not Yet Purchased

Securities Sold, Not Yet Purchased consist of equity and debt securities that the Partnership has borrowed and sold. The Partnership is required to “cover” its short sale in the future by purchasing the security at prevailing market prices and delivering it to the counterparty from which it borrowed the security. The Partnership is exposed to loss in the event that the price at which a security may have to be purchased to cover a short sale exceeds the price at which the borrowed security was sold short.

Securities Sold, Not Yet Purchased are recorded at fair value in the Condensed Consolidated Statements of Financial Condition.

Derivative Instruments

The Partnership recognizes all derivatives as assets or liabilities on its Condensed Consolidated Statements of Financial Condition at fair value. On the date the Partnership enters into a derivative contract, it designates and

19

Table of Contents

THE BLACKSTONE GROUP L.P.

Notes to Condensed Consolidated Financial Statements—Continued

(All Dollars Are in Thousands, Except Unit and Per Unit Data, Except Where Noted)

documents each derivative contract as one of the following: (a) a hedge of a recognized asset or liability (“fair value hedge”), (b) a hedge of a forecasted transaction or of the variability of cash flows to be received or paid related to a recognized asset or liability (“cash flow hedge”), (c) a hedge of a net investment in a foreign operation, or (d) a derivative instrument not designated as a hedging instrument (“freestanding derivative”). For a fair value hedge, Blackstone records changes in the fair value of the derivative and, to the extent that it is highly effective, changes in the fair value of the hedged asset or liability attributable to the hedged risk, in current period earnings in General, Administrative and Other in the Condensed Consolidated Statements of Operations. Changes in the fair value of derivatives designated as hedging instruments caused by factors other than changes in the risk being hedged, which are excluded from the assessment of hedge effectiveness, are recognized in current period earnings. Gains or losses on a derivative instrument that is designated as, and is effective as, an economic hedge of a net investment in a foreign operation are reported in the cumulative translation adjustment section of other comprehensive income to the extent it is effective as a hedge. The ineffective portion of a net investment hedge is recognized in current period earnings.

The Partnership formally documents at inception its hedge relationships, including identification of the hedging instruments and the hedged items, its risk management objectives, strategy for undertaking the hedge transaction and the Partnership’s evaluation of effectiveness of its hedged transaction. At least monthly, the Partnership also formally assesses whether the derivative it designated in each hedging relationship is expected to be, and has been, highly effective in offsetting changes in estimated fair values or cash flows of the hedged items using either the regression analysis or the dollar offset method. For net investment hedges, the Partnership uses a method based on changes in spot rates to measure effectiveness. If it is determined that a derivative is not highly effective at hedging the designated exposure, hedge accounting is discontinued. The Partnership may also at any time remove a designation of a fair value hedge. The fair values of hedging derivative instruments are reflected within Other Assets in the Condensed Consolidated Statements of Financial Condition.

For freestanding derivative contracts, the Partnership presents changes in fair value in current period earnings. Changes in the fair value of derivative instruments held by consolidated Blackstone Funds are reflected in Net Gains (Losses) from Fund Investment Activities or, where derivative instruments are held by the Partnership, within Investment Income (Loss) in the Condensed Consolidated Statements of Operations. The fair value of freestanding derivative assets of the consolidated Blackstone Funds are recorded within Investments, the fair value of freestanding derivative assets that are not part of the consolidated Blackstone Funds are recorded within Other Assets and the fair value of freestanding derivative liabilities are recorded within Accounts Payable, Accrued Expenses and Other Liabilities in the Condensed Consolidated Statements of Financial Condition.

The Partnership has elected to not offset derivative assets and liabilities or financial assets in its Condensed Consolidated Statements of Financial Condition, including cash, that may be received or paid as part of collateral arrangements, even when an enforceable master netting agreement is in place that provides the Partnership, in the event of counterparty default, the right to liquidate collateral and the right to offset a counterparty’s rights and obligations.

Blackstone’s other disclosures regarding derivative financial instruments are discussed in Note 6. “Derivative Financial Instruments”.

Blackstone’s disclosures regarding offsetting are discussed in Note 11. “Offsetting of Assets and Liabilities”.

Affiliates

Blackstone considers its Founder, senior managing directors, employees, the Blackstone Funds and the Portfolio Companies to be affiliates.

20

Table of Contents

THE BLACKSTONE GROUP L.P.

Notes to Condensed Consolidated Financial Statements—Continued

(All Dollars Are in Thousands, Except Unit and Per Unit Data, Except Where Noted)

Distributions

Distributions are reflected in the condensed consolidated financial statements when declared.

Recent Accounting Developments

In May 2014, the Financial Accounting Standards Board (“FASB”) issued amended guidance on revenue from contracts with customers. The guidance requires that an entity should recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services. An entity is required to (a) identify the contract(s) with a customer, (b) identify the performance obligations in the contract, (c) determine the transaction price, (d) allocate the transaction price to the performance obligations in the contract, and (e) recognize revenue when (or as) the entity satisfies a performance obligation. In determining the transaction price, an entity may include variable consideration only to the extent that it is probable that a significant reversal in the amount of cumulative revenue recognized would not occur when the uncertainty associated with the variable consideration is resolved.

The guidance introduces new qualitative and quantitative disclosure requirements about contracts with customers including revenue and impairments recognized, disaggregation of revenue and information about contract balances and performance obligations. Information is required about significant judgments and changes in judgments in determining the timing of satisfaction of performance obligations and determining the transaction price and amounts allocated to performance obligations. Additional disclosures are required about assets recognized from the costs to obtain or fulfill a contract.

In August 2015, the FASB issued new guidance deferring the effective date of the new revenue recognition standard by one year. The new guidance should be applied for annual reporting periods beginning after December 15, 2017, including interim periods within that reporting period.

Blackstone has concluded that capital allocation-based Performance Fees (“Capital Allocation-Based Arrangements”) represent equity method investments that are not in the scope of the amended revenue recognition guidance. Therefore, effective January 1, 2018, Blackstone will amend the recognition and measurement of Capital Allocation-Based Arrangements. This accounting change will not change the timing or amount of revenue recognized related to Capital Allocation-Based Arrangements. These amounts are currently recognized within Realized and Unrealized Performance Fees — Carried Interest and Incentive Fees in the Consolidated Statements of Operations. Under the equity method of accounting Blackstone will recognize its allocations of Carried Interest or Incentive Fees within Investment Income along with the allocations proportionate to Blackstone’s ownership interests in the Blackstone Funds. Blackstone will apply a retrospective application and prior periods shall be restated. The impact of adoption is a reclassification of Carried Interest to Investment Income. This change will have no impact on Net Income Attributable to The Blackstone Group L.P. Blackstone has concluded that the majority of its Incentive Fees are not part of a Capital Allocation-Based Arrangement (“Contractual Incentive Fees”), and are within the scope of the amended revenue recognition guidance. This accounting change will delay recognition of Contractual Incentive Fees compared to our current accounting treatment, and it is not expected to have a material impact on Blackstone’s financial statements.

The Partnership is evaluating the impact of the amended revenue recognition guidance on other revenue streams including management fees and considerations for reporting revenue gross versus net.

In February 2016, the FASB issued amended guidance on the accounting for leases. The guidance requires the recognition of lease assets and lease liabilities for those leases classified as operating leases under previous GAAP. The guidance retains a distinction between finance leases and operating leases. The classification criteria for

21

Table of Contents

THE BLACKSTONE GROUP L.P.

Notes to Condensed Consolidated Financial Statements—Continued

(All Dollars Are in Thousands, Except Unit and Per Unit Data, Except Where Noted)

distinguishing between finance leases and operating leases are substantially similar to the classification criteria for distinguishing between capital leases and operating leases under previous GAAP. The recognition, measurement and presentation of expenses and cash flows arising from a lease by a lessee have not changed significantly from previous GAAP.

For operating leases, a lessee is required to do the following: (a) recognize a right-of-use asset and a lease liability, initially measured at the present value of the lease payments, in the Statement of Financial Condition, (b) recognize a single lease cost, calculated so that the cost of the lease is allocated over the lease term on a generally straight-line basis, and (c) classify all cash payments within operating activities in the statement of cash flows.

The guidance is effective for fiscal periods beginning after December 15, 2018. Early application is permitted. Blackstone is evaluating the impact of the amended guidance on the Consolidated Statement of Financial Condition. It is not expected to have a material impact on the Consolidated Statements of Operations or the Consolidated Statements of Cash Flows.

| 3. | INTANGIBLE ASSETS |

Intangible Assets, Net consists of the following:

| March 31, 2017 |

December 31, 2016 |

|||||||

| Finite-Lived Intangible Assets/Contractual Rights |

$ | 1,400,876 | $ | 1,400,876 | ||||

| Accumulated Amortization |

(1,149,236 | ) | (1,138,272 | ) | ||||

|

|

|

|

|

|||||

| Intangible Assets, Net |

$ | 251,640 | $ | 262,604 | ||||

|

|

|

|

|

|||||

Amortization expense associated with Blackstone’s intangible assets was $11.0 million for the three months ended March 31, 2017 and $22.8 million for the three months ended March 31, 2016.