Attached files

| file | filename |

|---|---|

| EX-32.2 - EX-32.2 - Blackstone Group Inc | d280098dex322.htm |

| EX-32.1 - EX-32.1 - Blackstone Group Inc | d280098dex321.htm |

| EX-31.2 - EX-31.2 - Blackstone Group Inc | d280098dex312.htm |

| EX-31.1 - EX-31.1 - Blackstone Group Inc | d280098dex311.htm |

| EX-23.1 - EX-23.1 - Blackstone Group Inc | d280098dex231.htm |

| EX-21.1 - EX-21.1 - Blackstone Group Inc | d280098dex211.htm |

| EX-10.83 - EX-10.83 - Blackstone Group Inc | d280098dex1083.htm |

| EX-10.82 - EX-10.82 - Blackstone Group Inc | d280098dex1082.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED DECEMBER 31, 2016 |

OR

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM TO |

Commission File Number: 001-33551

The Blackstone Group L.P.

(Exact name of Registrant as specified in its charter)

| Delaware | 20-8875684 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

345 Park Avenue

New York, New York 10154

(Address of principal executive offices)(Zip Code)

(212) 583-5000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of each exchange on which registered | |

| Common units representing limited partner interests | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein and will not be contained, to the best of the Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☒ |

Accelerated filer ☐ | |

| Non-accelerated filer ☐ |

Smaller reporting company ☐ | |

| (do not check if a smaller reporting company) |

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of the common units of the Registrant held by non-affiliates as of June 30, 2016 was approximately $15.3 billion, which includes non-voting common units with a value of approximately $1.4 billion.

The number of the Registrant’s voting common units representing limited partner interests outstanding as of February 17, 2017 was 587,607,442. The number of the Registrant’s non-voting common units representing limited partner interests outstanding as of February 17, 2017 was 54,470,009.

DOCUMENTS INCORPORATED BY REFERENCE

None

Table of Contents

| Page | ||||||

| PART I. | ||||||

| ITEM 1. | 5 | |||||

| ITEM 1A. | 19 | |||||

| ITEM 1B. | 71 | |||||

| ITEM 2. | 72 | |||||

| ITEM 3. | 72 | |||||

| ITEM 4. | 72 | |||||

| PART II. | ||||||

| ITEM 5. | 73 | |||||

| ITEM 6. | 76 | |||||

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

78 | ||||

| ITEM 7A. | 146 | |||||

| ITEM 8. | 150 | |||||

| ITEM 8A. | UNAUDITED SUPPLEMENTAL PRESENTATION OF STATEMENTS OF FINANCIAL CONDITION |

222 | ||||

| ITEM 9. | CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE |

224 | ||||

| ITEM 9A. | 224 | |||||

| ITEM 9B. | 225 | |||||

| PART III. | ||||||

| ITEM 10. | 226 | |||||

| ITEM 11. | 233 | |||||

| ITEM 12. | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS |

254 | ||||

| ITEM 13. | CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE |

257 | ||||

| ITEM 14. | 265 | |||||

| PART IV. | ||||||

| ITEM 15. | 267 | |||||

| ITEM 16. | 278 | |||||

| 279 | ||||||

1

Table of Contents

Forward-Looking Statements

This report may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 which reflect our current views with respect to, among other things, our operations and financial performance. You can identify these forward-looking statements by the use of words such as “outlook,” “indicator,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “should,” “seeks,” “approximately,” “predicts,” “intends,” “plans,” “estimates,” “anticipates” or the negative version of these words or other comparable words. Such forward-looking statements are subject to various risks and uncertainties. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements. We believe these factors include but are not limited to those described under the section entitled “Risk Factors” in this report, as such factors may be updated from time to time in our periodic filings with the United States Securities and Exchange Commission (“SEC”), which are accessible on the SEC’s website at www.sec.gov. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this report and in our other periodic filings. The forward-looking statements speak only as of the date of this report, and we undertake no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise.

Website and Social Media Disclosure

We use our website (www.blackstone.com), Facebook page (www.facebook.com/blackstone), Twitter (www.twitter.com/blackstone), LinkedIn (www.linkedin.com/company/the-blackstone-group), Instagram (www.instagram.com/blackstone) and YouTube (www.youtube.com/user/blackstonegroup) accounts as channels of distribution of company information. The information we post through these channels may be deemed material. Accordingly, investors should monitor these channels, in addition to following our press releases, SEC filings and public conference calls and webcasts. In addition, you may automatically receive e-mail alerts and other information about Blackstone when you enroll your e-mail address by visiting the “Contact Us/Email Alerts” section of our website at http://ir.blackstone.com. The contents of our website, any alerts and social media channels are not, however, a part of this report.

In this report, references to “Blackstone,” the “Partnership,” “we,” “us” or “our” refer to The Blackstone Group L.P. and its consolidated subsidiaries. Unless the context otherwise requires, references in this report to the ownership of Mr. Stephen A. Schwarzman, our founder, and other Blackstone personnel include the ownership of personal planning vehicles and family members of these individuals.

“Blackstone Funds,” “our funds” and “our investment funds” refer to the private equity funds, real estate funds, funds of hedge funds, credit-focused funds, collateralized loan obligation (“CLO”), real estate investment trusts and registered investment companies that are managed by Blackstone. “Our carry funds” refers to the private equity funds, real estate funds and certain of the hedge fund solutions and credit-focused funds (with multi-year drawdown, commitment-based structures that only pay carry on the realization of an investment) that are managed by Blackstone. We refer to our general corporate private equity funds as Blackstone Capital Partners (“BCP”) funds, our energy-focused private equity funds as Blackstone Energy Partners (“BEP”) funds, our core private equity fund as Blackstone Core Equity Partners (“BCEP”), our opportunistic investment platform that invests globally across asset classes, industries and geographies as Blackstone Tactical Opportunities (“Tactical Opportunities”), our secondary private equity fund of funds business as Strategic Partners Fund Solutions (“Strategic Partners”), a multi-asset investment program for eligible high net worth investors offering exposure to certain of our key illiquid investment strategies through a single commitment as Blackstone Total Alternatives Solution (“BTAS”) and our capital markets services business as Blackstone Capital Markets (“BXCM”). We refer to our real estate opportunistic funds as Blackstone Real Estate Partners (“BREP”) funds and our real estate debt investment funds as Blackstone Real Estate Debt Strategies (“BREDS”) funds. We refer to our core+ real estate funds, which target substantially stabilized assets in prime markets, as Blackstone Property Partners (“BPP”) funds. We refer to our real

2

Table of Contents

estate investment trusts as “REITs” and to Blackstone Mortgage Trust, Inc., our NYSE-listed REIT as “BXMT”. “Our hedge funds” refers to our funds of hedge funds, certain of our real estate debt investment funds, including a registered investment company, and certain other credit-focused funds which are managed by Blackstone.

“Assets Under Management” refers to the assets we manage. Our Assets Under Management equals the sum of:

| (a) | the fair value of the investments held by our carry funds and our side-by-side and co-investment entities managed by us, plus the capital that we are entitled to call from investors in those funds and entities pursuant to the terms of their respective capital commitments, including capital commitments to funds that have yet to commence their investment periods, plus for certain credit-oriented funds the amounts available to be borrowed under asset based credit facilities, |

| (b) | the net asset value of our funds of hedge funds, hedge funds, real estate debt carry funds (plus the capital that we are entitled to call from investors in those funds), open ended core+ real estate fund, our Hedge Fund Solutions registered investment companies, and our non-exchange traded REIT, |

| (c) | the invested capital, fair value or net asset value of assets we manage pursuant to separately managed accounts, |

| (d) | the amount of debt and equity outstanding for our CLOs during the reinvestment period, |

| (e) | the aggregate par amount of collateral assets, including principal cash, for our CLOs after the reinvestment period, |

| (f) | the gross or net amount of assets (including leverage where applicable) for our credit-focused registered investment companies, and |

| (g) | the fair value of common stock, preferred stock, convertible debt, or similar instruments issued by BXMT. |

Our carry funds are commitment-based drawdown structured funds that do not permit investors to redeem their interests at their election. Our funds of hedge funds, hedge funds and funds structured like hedge funds in our Hedge Fund Solutions, Credit and Real Estate segments generally have structures that afford an investor the right to withdraw or redeem their interests on a periodic basis (for example, annually or quarterly), typically with 30 to 95 days’ notice, depending on the fund and the liquidity profile of the underlying assets. Investment advisory agreements related to certain separately managed accounts in our Hedge Fund Solutions and Credit segments may generally be terminated by an investor on 30 to 90 days’ notice.

“Fee-Earning Assets Under Management” refers to the assets we manage on which we derive management and/or performance fees. Our Fee-Earning Assets Under Management equals the sum of:

| (a) | for our Private Equity segment funds and Real Estate segment carry funds including certain real estate debt investment funds and certain of our Hedge Fund Solutions funds, the amount of capital commitments, remaining invested capital, fair value or par value of assets held, depending on the fee terms of the fund, |

| (b) | for our credit-focused carry funds, the amount of remaining invested capital (which may include leverage) or net asset value, depending on the fee terms of the fund, |

| (c) | the remaining invested capital or fair value of assets held in co-investment vehicles managed by us on which we receive fees, |

| (d) | the net asset value of our funds of hedge funds, hedge funds, open ended core+ real estate fund, co-investments managed by us on which we receive fees, certain registered investment companies, and our non-exchanged traded REIT, |

| (e) | the invested capital, fair value of assets or the net asset value we manage pursuant to separately managed accounts, |

| (f) | the net proceeds received from equity offerings and accumulated core earnings of BXMT, subject to certain adjustments, |

3

Table of Contents

| (g) | the aggregate par amount of collateral assets, including principal cash, of our CLOs, and |

| (h) | the gross amount of assets (including leverage) or the net assets (plus leverage where applicable) for certain of our credit-focused registered investment companies. |

Each of our segments may include certain Fee-Earning Assets Under Management on which we earn performance fees but not management fees.

Our calculations of assets under management and fee-earning assets under management may differ from the calculations of other asset managers, and as a result this measure may not be comparable to similar measures presented by other asset managers. In addition, our calculation of assets under management includes commitments to, and the fair value of, invested capital in our funds from Blackstone and our personnel, regardless of whether such commitments or invested capital are subject to fees. Our definitions of assets under management or fee-earning assets under management are not based on any definition of assets under management or fee-earning assets under management that is set forth in the agreements governing the investment funds that we manage.

For our carry funds, total assets under management includes the fair value of the investments held, whereas fee-earning assets under management includes the amount of capital commitments, the remaining amount of invested capital at cost depending on whether the investment period has or has not expired or the fee terms of the fund. As such, fee-earning assets under management may be greater than total assets under management when the aggregate fair value of the remaining investments is less than the cost of those investments.

This report does not constitute an offer of any Blackstone Fund.

4

Table of Contents

PART I.

| ITEM 1. | BUSINESS |

Overview

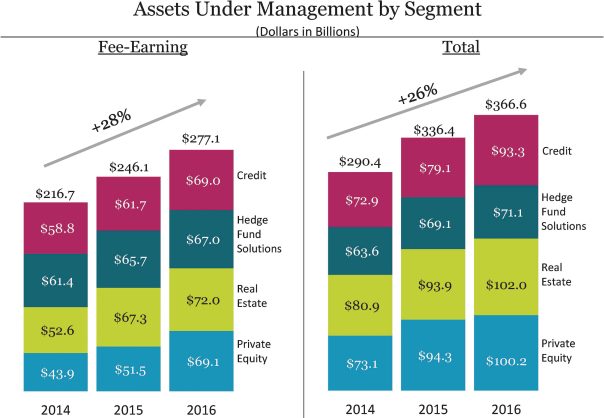

Blackstone is a leading global alternative asset manager, with Total Assets Under Management of $366.6 billion as of December 31, 2016. As stewards of public funds, we look to drive outstanding results for our investors and clients by deploying capital and ideas to help businesses succeed and grow. Our alternative asset management businesses include investment vehicles focused on private equity, real estate, hedge fund solutions, non-investment grade credit, secondary private equity funds of funds and multi-asset class strategies. We also provide capital markets services.

All of Blackstone’s businesses use a solutions oriented approach to drive better performance. We believe our scaled, diversified businesses, coupled with our long track record of investment performance, proven investment approach and strong client relationships, position us to continue to perform well in a variety of market conditions, expand our assets under management and add complementary businesses.

Two of our primary limited partner constituencies are public and corporate pension funds. As a result, to the extent our funds perform well, it supports a better retirement for millions of pensioners.

In addition, because we are a global firm with a footprint on nearly every continent, our investments can make a difference around the world. We are committed to making our family of companies stronger in ways that can have positive impacts on local economies.

As of December 31, 2016, we had 123 senior managing directors and approximately 2,120 other employees at our headquarters in New York and in 29 other cities around the world. We believe hiring, training and retaining talented individuals coupled with our rigorous investment process has supported our excellent investment record over many years. This record in turn has allowed us to successfully and repeatedly raise additional assets from an increasingly wide variety of sophisticated investors.

2016 Highlights

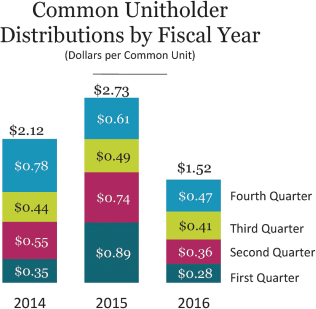

Sustained Healthy Realization Activity Driving Distributions

| • | Continued strong realization activity across business segments despite a volatile market backdrop, with total realizations of $39 billion in 2016, and averaging $42 billion per year over the last three years. |

| • | Blackstone has distributed over $8 billion in value, including the value of the spin-off of our financial advisory business, to common and Holdings unitholders over the past three years, one of the highest returns of capital to equity holders in our industry. |

Platform Expansion Enabling Large Scale Capital Deployment

| • | Global scale and business diversification allow Blackstone to identify attractive investment opportunities around the world, despite more challenging market conditions in certain areas. As a result, the past three years have marked the three largest for capital deployment in our history, with $23 billion deployed in 2016 and a cumulative $82 billion deployed over the past three years. |

| • | We are generating significant deal flow from new strategies. Three of our largest new initiatives in the past five years — Tactical Opportunities, core+ real estate and Strategic Partners — invested an aggregate $7 billion in 2016, or 30% of total capital deployed. In addition, our new core private equity initiative signed its first investment in January 2017. |

5

Table of Contents

Another Year of Double-Digit Growth in Fee-Earning Assets Under Management

| • | Each of our investing businesses saw positive growth in both Assets Under Management and Fee-Earning Assets Under Management in 2016, despite significant levels of realizations, given continued strong fundraising across businesses. Fee-Earning Assets Under Management rose 13% in 2016 to $277 billion and Assets Under Management rose 9% to $367 billion, both of which were firm records. |

| • | Gross organic capital inflows across our businesses reached $70 billion for 2016, our second best year on record. Our limited partners continue to give us large scale capital for our new initiatives, including Tactical Opportunities, which in five years has reached $17 billion in Assets Under Management, core+ real estate, which in three years has reached $14 billion in Assets Under Management and Strategic Partners, which now has over $20 billion in Assets Under Management, more than double the size of the platform when we acquired it three years ago. |

| • | Continued to diversify our sources of capital, including bringing our institutional quality solutions to the retail high net worth area and family office channels, with a meaningful amount of capital inflows coming from the retail channel. |

| • | Maintained focus on developing innovative investment structures and capital raising opportunities, sponsoring (together with Axis Capital) the creation of Harrington Re Ltd., a Bermuda-based multi-line reinsurance company, which will invest a significant portion of its capital across a multi-asset alternative strategy managed by Blackstone. |

Industry-Leading Credit Rating and Strong Balance Sheet

| • | Strong balance sheet with no net debt, $4.6 billion in total cash, cash equivalents and corporate treasury investments, and a $1.5 billion undrawn revolver. |

| • | S&P and Fitch have both affirmed Blackstone’s A+ / A+ credit ratings, making Blackstone the highest rated alternative asset manager and one of the highest rated global financial services firms. |

| • | Successfully executed our second euro bond sale in a highly oversubscribed offering of €600 million of 1.0% notes due 2026, which was priced within a few basis points of the benchmark rate’s all-time low. |

Positively Impacting Communities

| • | The Blackstone Charitable Foundation continued its work with local partners in targeted regions to create or grow non-profit programs that support networks and resources for entrepreneurs. In 2016, the Foundation expanded Blackstone LaunchPad to three universities in Texas. In January 2017, working with the city of Chicago and World Business Chicago, it launched the Blackstone Inclusive Entrepreneurship Challenge, a three-year pilot program that will award up to $3.4 million in grants to create a cohort of innovative organizations that effectively recruit and support diverse entrepreneurs and scale start-ups in the Chicago area. |

| • | In April 2013, Blackstone committed to hire 50,000 American veterans across its portfolio over five years in support of the White House’s “Joining Forces” initiative, and has successfully hired 45,000 to date. For the past four years, Blackstone has hosted a Blackstone Veterans Hiring Summit designed to help hiring executives within corporations share best practices on attracting and recruiting veterans and to assist representatives from the U.S. military and government as they work in coordination with Blackstone portfolio companies |

Business Segments

Our four business segments are: (a) Private Equity, (b) Real Estate, (c) Hedge Fund Solutions and (d) Credit.

Information about our business segments should be read together with “Part II. Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the historical financial statements and related notes included elsewhere in this Form 10-K.

6

Table of Contents

Private Equity

Our Private Equity segment, established in 1987, is a global business with approximately 250 employees managing $100.2 billion of Total Assets Under Management as of December 31, 2016. We are a world leader in private equity investing, having managed seven general private equity funds, as well as three sector-focused funds since we established the business. We are focused on identifying, managing and creating lasting value for our investors. Our Private Equity segment includes our corporate private equity business, which consists of our flagship corporate private equity funds, Blackstone Capital Partners (“BCP”) funds, our sector-focused corporate private equity funds, including our energy-focused funds, Blackstone Energy Partners (“BEP”) funds and our core private equity fund, which targets control-oriented investments in high-quality companies with durable businesses and seeks to offer a lower level of risk and a longer hold period than traditional private equity. In addition, our Private Equity segment includes our opportunistic investment platform that invests globally across asset classes, industries and geographies, Blackstone Tactical Opportunities (“Tactical Opportunities”), our secondary private equity fund of funds business, Strategic Partners Fund Solutions (“Strategic Partners”), a multi-asset investment program for eligible high net worth investors offering exposure to certain of Blackstone’s key illiquid investment strategies through a single commitment, Blackstone Total Alternatives Solutions (“BTAS”) and our capital markets services business, Blackstone Capital Markets (“BXCM”).

Our corporate private equity business pursues transactions throughout the world across a variety of transaction types, including large buyouts, mid-cap buyouts, buy and build platforms (which involve multiple acquisitions behind a single management team and platform) and growth equity/development projects (which involve significant minority investments in operating companies and greenfield development projects in energy and power). Our private equity business’s investment strategies and core themes continually evolve, in anticipation of, or in response to, changes in the global economy, local markets, regulation, capital flows and geopolitical trends. We seek to construct a differentiated portfolio of investments with a well-defined, interventionist, post-acquisition value creation strategy. Similarly, we seek investments that can generate strong unlevered returns regardless of entry or exit cycle timing. Finally, when we can identify sectors or geographies in which the demand for capital greatly exceeds the readily available supply, our private equity business seeks to make investments at or near book value where it can create goodwill or franchise value through post-acquisition actions.

Tactical Opportunities, our opportunistic investment platform, invests globally across asset classes, industries and geographies. Tactical Opportunities’ mandate allows for flexible investing where it seeks to capitalize on time-sensitive, complex or dislocated market situations in areas where it sees mispriced risks. The Tactical Opportunities team leverages intellectual capital from across all of our businesses to inform our investment diligence and execution. A flexible investment mandate allows Tactical Opportunities to structure a broad range of investments, including private and public securities and instruments, where the underlying exposure may be to equity, debt and/or real assets, and to construct a diversified portfolio of investments that provides differentiated exposures relative to traditional alternative asset managers.

Strategic Partners, our secondary private equity fund of funds business was established in 2000 and acquired by Blackstone in 2013. Strategic Partners is focused on investing in a range of opportunities, leveraging its proprietary database to execute transactions ranging from single fund interests to complex, structured portfolio solutions, in an efficient and timely manner.

For more information concerning the revenues and fees we derive from our Private Equity segment, see “—Incentive Arrangements / Fee Structure” in this Item 1.

Real Estate

Our Real Estate group was founded in 1991 and is one of the largest real estate investment managers in the world, with $102.0 billion of Total Assets Under Management as of December 31, 2016. We operate as one globally integrated business with 285 employees and investments in North America, Europe, Asia and Latin America.

7

Table of Contents

Our Blackstone Real Estate Partners (“BREP”) funds are geographically diversified and target a broad range of “opportunistic” real estate and real estate related investments. The BREP funds include global funds as well as funds focused specifically on Europe or Asia investments. We seek to acquire high quality, well-located yet undermanaged assets at an attractive basis, address any property or business issues through active asset management and sell the assets once our business plan is accomplished. BREP has made significant investments in hotels, office buildings, shopping centers, residential and industrial assets, as well as a variety of real estate operating companies.

We launched Blackstone Real Estate Debt Strategies (“BREDS”), our real estate debt platform, in 2008. Our BREDS vehicles target debt investment opportunities collateralized by commercial real estate. BREDS invests in both public and private markets, primarily in the U.S. and Europe. BREDS’ scale and investment mandates enable it to provide a variety of lending options for our borrowers and investment options for our investors, including mezzanine loans, senior loans and liquid securities. The BREDS platform includes a number of high yield and high grade real estate debt funds, liquid real estate debt funds and Blackstone Mortgage Trust, Inc. (“BXMT”), a NYSE-listed REIT.

We launched our core+ real estate business (“BPP”) in 2013 and we have assembled a global portfolio of high quality core+ investments across the U.S., Europe and Asia. Our BPP vehicles target substantially stabilized assets in prime markets with a focus on office, multifamily, industrial and retail assets. The funds generate returns through both current income and value appreciation over the long term. We manage several core+ real estate funds and a non-exchange traded REIT.

For more information concerning the revenues and fees we derive from our Real Estate segment, see “— Incentive Arrangements / Fee Structure” in this Item 1.

Hedge Fund Solutions

Our Hedge Fund Solutions group is comprised primarily of Blackstone Alternative Asset Management (“BAAM”). BAAM is the world’s largest discretionary allocator to hedge funds, managing a broad range of commingled and customized hedge fund of fund solutions since its inception in 1990. The Hedge Fund Solution segment also includes investment platforms that seed new hedge fund businesses, purchase minority ownership interests in more established hedge funds, invest in special situation opportunities, create alternative solutions in regulated structures and trade directly. Working with our clients over the past 20 plus years, our Hedge Fund Solutions group has developed into a leading manager of institutional hedge fund of funds with approximately 160 employees managing $71.1 billion of Total Assets Under Management as of December 31, 2016. Hedge Fund Solutions’ overall investment philosophy is to protect and grow investors’ assets through both commingled and custom-tailored investment strategies designed to deliver compelling risk-adjusted returns and mitigate risk. Diversification, risk management, due diligence and a focus on downside protection are key tenets of our approach. For more information concerning the revenues and fees we derive from our Hedge Fund Solutions segment, see “— Incentive Arrangements / Fee Structure” in this Item 1.

Credit

Our credit business consists principally of GSO Capital Partners LP (“GSO”) which was founded in 2005 and subsequently acquired by Blackstone in 2008. GSO, with $93.3 billion of Total Assets Under Management as of December 31, 2016 and approximately 180 employees, is one of the largest leveraged finance-focused alternative asset managers in the world and is the largest manager of CLOs globally. The investment portfolios of the funds we manage or sub-advise predominantly consist of loans and securities of non-investment grade companies spread across the capital structure including senior debt, subordinated debt, preferred stock and common equity.

The GSO business is organized into three overarching strategies: performing credit, distressed and long only. Our performing credit strategies include mezzanine lending funds, business development companies (“BDCs”) that we sub-advise and other performing credit strategy funds. Our distressed strategies include hedge fund strategies, rescue lending funds and distressed energy strategies. GSO’s long only strategies consist of CLOs, closed end funds, commingled funds and separately managed accounts.

8

Table of Contents

Financial and Other Information by Segment

Financial and other information by segment for the years ended December 31, 2016, 2015 and 2014 is set forth in Note 21. “Segment Reporting” in the “Notes to Consolidated Financial Statements” in “Part II. Item 8. Financial Statements and Supplementary Data” of this filing.

Pátria Investments

On October 1, 2010, we purchased a 40% equity interest in Pátria Investments Limited and Pátria Investimentos Ltda. (collectively, “Pátria”). Pátria is a leading Brazilian alternative asset manager that was founded in 1988. As of December 31, 2016, Pátria’s alternative asset management businesses had $9.4 billion in assets under management, including the management of private equity funds ($4.4 billion), real estate funds ($1.3 billion), infrastructure funds ($3.6 billion) and new initiatives ($225.4 million). Pátria has approximately 245 employees and is led by a group of three managing partners. Our investment in Pátria is a minority, non-controlling investment, which we record using the equity method of accounting. We have representatives on Pátria’s board of directors in proportion to our ownership, but we do not control the day-to-day management of the firm or the investment decisions of their funds, all of which continues to reside with the local Brazilian partners.

Investment Process and Risk Management

We maintain a rigorous investment process across all of our funds, accounts and other investment vehicles. Each fund, account or other vehicle has investment policies and procedures that generally contain requirements and limitations for investments, such as limitations relating to the amount that will be invested in any one investment and the types of industries or geographic regions in which the fund, account or other vehicle will invest, as well as limitations required by law. Our business’ investment committees review and evaluate investment opportunities in a framework that includes a qualitative and quantitative assessment of the key risks of each investment.

Private Equity Funds

Our Private Equity investment professionals are responsible for selecting, evaluating, structuring, diligencing, negotiating, executing, managing and exiting investments, as well as pursuing operational improvements and value creation. After an initial selection, evaluation and diligence process, the relevant team of investment professionals (i.e., the deal team) submits a proposed transaction for review by the review committee of our private equity funds. Review committee meetings are led by an executive committee of several senior managing directors of our Private Equity segment. Following assimilation of the review committee’s input and its decision to proceed, the proposed investment is vetted by the investment committee. The investment committee of our private equity funds is composed of Stephen A. Schwarzman, Hamilton E. James, Joseph Baratta, Global Head of Private Equity, and selected senior managing directors of our Private Equity segment, including individuals based on the location and sector of the proposed transaction. The investment committee is responsible for approving all investment decisions made on behalf of our private equity funds. Considerations that the investment committee takes into account when evaluating an investment include the quality of a business in which the fund proposes to invest and the quality of the management team of such business, expected levered and unlevered returns of the investment in a variety of investment scenarios, the ability of the company in which the investment is made to service debt in a range of economic and interest rate environments, environmental, social and governance, or ESG, issues and macroeconomic trends in the relevant geographic region.

The investment professionals of our private equity funds are responsible for monitoring an investment once it is made and for making recommendations with respect to exiting an investment. In addition to members of a deal team and our portfolio operations group, which is responsible for assisting in enhancing portfolio companies’ operations and value, all professionals in our private equity business meet several times each year to review the performance of the funds’ portfolio companies.

Our Tactical Opportunities business has a substantially similar process to the Private Equity process described above, with the exception of the composition of the review and investment committee. The Tactical Opportunities

9

Table of Contents

review committee is comprised of the senior managing directors and managing directors of the Tactical Opportunities business and a senior managing director of our Private Equity business, and the investment committee is comprised of Mr. Schwarzman, Mr. James, the business heads of Blackstone’s Private Equity, Real Estate and Credit businesses, and certain other senior managing directors.

Our Strategic Partners business seeks capital appreciation through the purchase of secondary interests in mature, high-quality private equity funds from investors seeking liquidity. After rigorous, highly analytical investment due diligence, the Strategic Partners investment professionals present a proposed transaction to the group’s investment committee. The Strategic Partners investment committee is made up of senior members of the Strategic Partners team, including all of the group’s Senior Managing Directors. The investment committee meets to review, and decide whether to approve or deny, transactions. The investment professionals on the Strategic Partners team are responsible for monitoring each investment once it is made. In addition to members of the investment team, and given the large number of underlying investments, the Strategic Partners Finance team will also track investment valuations pursuant to the group’s valuation policies and procedures.

Real Estate Funds

Our Real Estate investment professionals are responsible for selecting, evaluating, structuring, diligencing, negotiating, executing, managing, monitoring and exiting investments, as well as pursuing operational improvements and value creation. Our real estate operation has an investment committee similar to that described under “— Private Equity Funds.” After an initial selection, evaluation and diligence process, the relevant team of investment professionals (i.e., the deal team) will present a proposed transaction at a weekly meeting of the investment committee. The real estate investment committee, which includes Mr. Schwarzman, Mr. James, Jonathan D. Gray, Global Head of Real Estate, and the senior managing directors in the Real Estate segment, scrutinizes potential transactions, provides guidance and instructions at the appropriate stage of the transaction and approves the investments. Considerations that the investment committee takes into account when evaluating an investment include current and anticipated market fundamentals (including, for example, supply and demand fundamentals) and macroeconomic trends in the relevant geographic region, the quality of the asset in which the fund proposes to invest, the appropriateness of existing or planned leverage levels of the business or asset and our ability to successfully implement operational plans and improvements and exit the investment at an expected rate of return. Deal team members and our asset management group are responsible for monitoring and enhancing investments’ operations and value.

Hedge Fund Solutions

Before deciding to invest in a new hedge fund or with a new hedge fund manager, our Hedge Fund Solutions team conducts extensive due diligence, including an on-site “front office” review of the fund’s/manager’s performance, investment terms, investment strategy and investment personnel, a “back office” review of the fund’s/manager’s operations, processes, risk management and internal controls, industry reference checks and a legal review of the investment structures and legal documents. Once initial due diligence procedures are completed and the investment and other professionals are satisfied with the results of the review, the team will present the potential investment to the relevant Hedge Fund Solutions investment committee. The investment committees are comprised of relevant senior managing directors and senior investment personnel. Existing investments are reviewed and monitored on a regular and continuous basis, and J. Tomilson Hill, CEO of the Hedge Fund Solutions group and Vice Chairman of Blackstone, and other senior members of our Hedge Fund Solutions team meet regularly with Mr. Schwarzman and Mr. James to review the group’s business and affairs

Credit

Each of our credit-focused funds has an investment committee similar to that described under “— Private Equity Funds.” The investment committees for the credit-focused funds, which typically include Bennett J. Goodman and J. Albert Smith III and senior members of the respective investment teams associated with each

10

Table of Contents

credit-focused fund, review potential transactions, provide input regarding the scope of due diligence and approve recommended investments and dispositions, subject to delineated exceptions set forth in the funds’ investment charters. In addition, senior members of GSO, including Mr. Goodman and Mr. Smith III, meet regularly with Mr. Schwarzman and Mr. James to discuss investment and risk management activities and market conditions.

The investment decisions for the customized credit long only clients and other clients whose portfolios are actively traded are made by separate investment committees, each of which is composed of certain of the group’s respective senior managing directors, managing directors and other investment professionals. With limited exceptions where the portfolio managers wish to capitalize on time sensitive market opportunities, the investment committee approves all assets that are held by the applicable client. The investment team is staffed by professionals within research, portfolio management, trading and capital formation to ensure active management of the portfolios. Industry-focused research analysts provide the committee with a formal and comprehensive review of any new investment recommendation, while our portfolio managers and trading professionals provide opinions on other technical aspects of the recommendation as well as the risks associated with the overall portfolio composition. Investments are subject to predetermined periodic reviews to assess their continued fit within the funds. Our research team monitors the operating performance of the underlying issuers, while portfolio managers, in concert with our traders, focus on optimizing asset composition to maximize value for our investors.

Structure and Operation of Our Investment Vehicles

Our private investment funds are generally organized as limited partnerships with respect to U.S. domiciled vehicles and limited liability (and other similar) companies with respect to non-U.S. domiciled vehicles. In the case of our separately managed accounts, the investor, rather than us, generally controls the investment vehicle that holds or has custody of the investments we advise the vehicle to make. We conduct the sponsorship and management of our carry funds and other similar vehicles primarily through a partnership structure in which limited partnerships organized by us accept commitments and/or funds for investment from institutional investors and, to a more limited extent, high net worth individuals. Such commitments are generally drawn down from investors on an as-needed basis to fund investments over a specified term. With the exception of certain core+ real estate and real estate debt funds, our private equity and private real estate funds are commitment structured funds. For certain core+ real estate and real estate debt funds, all or a portion of the committed capital is funded on or promptly after the investor’s subscription date and cash proceeds resulting from the disposition of investments can be reused indefinitely for further investment, subject to certain investor withdrawal rights. Our Real Estate business also includes a NYSE-listed REIT, BXMT, a non-exchange traded REIT, and a registered open-ended investment company complex, each of which is externally managed or advised by Blackstone-owned entities. Our credit-focused funds are generally commitment structured funds or open-ended where the investor’s capital is fully funded into the fund upon or soon after the subscription for interests in the fund. Ten credit-focused vehicles that we manage or sub-advise in whole or in part are registered investment companies (including BDCs). The CLO vehicles we manage are structured investment vehicles that are generally private companies with limited liability. Most of our funds of hedge funds as well as our hedge funds are structured as funds where the investor’s capital is fully funded into the fund upon the subscription for interests in the fund.

Our investment funds, separately managed accounts and other vehicles are generally advised by a Blackstone entity serving as investment adviser that is registered under the U.S. Investment Advisers Act of 1940, or “Advisers Act.” Substantially all of the day-to-day operations of each investment vehicle are typically carried out by the Blackstone entity serving as investment adviser pursuant to an investment advisory (or similar) agreement. Generally, the material terms of our investment advisory agreements relate to the scope of services to be rendered by the investment adviser to the applicable vehicle, the calculation of management fees to be borne by investors in our investment vehicles, the calculation of and the manner and extent to which other fees received by the investment adviser from funds or fund portfolio companies serve to offset or reduce the management fees payable by investors in our investment vehicles and certain rights of termination with respect to our investment advisory agreements. With the exception of the registered funds described below, the investment vehicles themselves do not generally register as investment companies under the U.S. Investment Company Act of 1940, or “1940 Act,” in reliance on the

11

Table of Contents

statutory exemptions provided by Section 3(c)(7) or Section 7(d) thereof or, typically in the case of vehicles formed prior to 1997, Section 3(c)(1) thereof. Section 3(c)(7) of the 1940 Act exempts from its registration requirements investment vehicles privately placed in the United States whose securities are owned exclusively by persons who, at the time of acquisition of such securities, are “qualified purchasers” as defined under the 1940 Act. Section 3(c)(1) of the 1940 Act exempts from its registration requirements privately placed investment vehicles whose securities are beneficially owned by not more than 100 persons. In addition, under current interpretations of the SEC, Section 7(d) of the 1940 Act exempts from registration any non-U.S. investment vehicle all of whose outstanding securities are beneficially owned either by non-U.S. residents or by U.S. residents that are qualified purchasers. BXMT is externally managed by a Blackstone-owned entity pursuant to a management agreement, conducts its operations in a manner that allows it to maintain its REIT qualification and also avail itself of the statutory exemption provided by Section 3(c)(5)(C) of the 1940 Act for companies engaged primarily in investment in mortgages and other liens or investments in real estate. Our non-exchange traded REIT is externally advised by a Blackstone-owned entity pursuant to an advisory agreement, conducts its operations in a manner that allows it to maintain its REIT qualification and also avails itself of the statutory exemption provided by Section 3(c)(5)(C) of the 1940 Act.

In some cases, one or more of our investment advisers, including within GSO, BAAM and BREDS advisers, advises or sub-advises funds registered under the 1940 Act. In addition to having an investment adviser, each investment fund that is a limited partnership, or “partnership” fund, also has a general partner that generally makes all operational and investment decisions, including the making, monitoring and disposing of investments. The limited partners of the partnership funds take no part in the conduct or control of the business of the investment funds, have no right or authority to act for or bind the investment funds and have no influence over the voting or disposition of the securities or other assets held by the investment funds. With the exception of certain of our funds of hedge funds, hedge funds, certain credit-focused funds, and other funds or separately managed accounts for the benefit of one or more specified investors, third party investors in our funds have the right to remove the general partner of the fund or to accelerate the liquidation date of the investment fund without cause by a simple majority vote. In addition, the governing agreements of our investment funds provide that in the event certain “key persons” in our investment funds do not meet specified time commitments with regard to managing the fund, then investors in certain funds have the right to vote to terminate the investment period by a specified percentage (including, in certain cases a simple majority) vote in accordance with specified procedures, accelerate the withdrawal of their capital on an investor-by-investor basis, or the fund’s investment period will automatically terminate and the vote of a simple majority of investors is required to restart it. In addition, the governing agreements of some of our investment funds provide that investors have the right to terminate, for any reason, the investment period by a vote of 75% of the investors in such fund.

Incentive Arrangements / Fee Structure

Management Fees

The following describes the management fees received by the Blackstone investment advisers.

| • | The investment adviser of each of our carry funds generally receives an annual management fee based upon a percentage of the fund’s capital commitments, invested capital and/or undeployed capital during the investment period and the fund’s invested capital or investment fair value after the investment period, except that the investment advisers to certain of our credit-focused carry/incentive funds and core+ real estate funds receive an annual management fee that is based upon a percentage of invested capital or net asset value throughout the term of the fund. These management fees are payable on a regular basis (typically quarterly) in the contractually prescribed amounts over the life of the fund. Depending on the base upon which management fees are calculated, negative performance of one or more investments in the fund may reduce the total management fee paid, but not the fee rate. |

| • | The investment adviser of each of our funds that are structured like hedge funds, or of our funds of hedge funds, registered mutual funds and separately managed accounts that invest in hedge funds, generally receives an annual management fee that is based upon a percentage of the fund’s or account’s net asset |

12

Table of Contents

| value. These management fees are also payable on a regular basis (typically quarterly). These funds often afford investors increased liquidity through annual, semi-annual or quarterly, or in the case of registered mutual funds, daily, withdrawal or redemption rights, in some cases following the expiration of a specified period of time when capital may not be withdrawn. The amount of management fees to which the investment adviser is entitled with respect thereto will proportionately increase as the net asset value of each investor’s capital account grows and will proportionately decrease as the net asset value of each investor’s capital account decreases. |

| • | The investment adviser of each of our CLOs typically receives annual management fees based upon a percentage of each fund’s assets, subject to certain performance measures related to the underlying assets the vehicle owns, and additional management fees which are incentive-based (that is, subject to meeting certain return criteria). These management fees are also payable on a regular basis (typically quarterly). The term of each CLO varies from deal to deal and may be subject to early redemption or extension; typically, however, a CLO will be wound down within eight to eleven years of being launched. While the management fees tend to be approximately 0.5% per annum of each fund’s aggregate par amount of collateral assets, including principal cash, for the term of the deal, the quantum of fees will decrease as the fund deleverages toward the end of its term. |

| • | The investment adviser of our separately managed accounts generally receives annual management fees typically based upon a percentage of each account’s net asset value or invested capital. The management fees we receive from our separately managed accounts are generally paid on a regular basis (typically quarterly) and may alternatively be based on invested capital or proportionately increase or decrease based on the net asset value of the separately managed account. The management fees we are paid for managing a separately managed account will generally be subject to contractual rights the investor has to terminate our management of an account on as short as 30 days’ prior notice. |

| • | The investment adviser of each of our credit-focused registered and non-registered investment companies typically receives annual management fees based upon a percentage of each company’s net asset value or total managed assets. The management fees we receive from the registered investment companies we manage are generally paid on a regular basis (typically quarterly) and proportionately increase or decrease based on the net asset value or gross assets of the investment company. The management fees we are paid for managing the investment company will generally be subject to contractual rights the company’s board of directors (or, in the case of the BDCs we sub-advise, the investment adviser) has to terminate our management of an account on as short as 30 days’ prior notice. |

| • | The investment adviser of BXMT receives annual management fees based upon a percentage of BXMT’s net proceeds received from equity offerings and accumulated “core earnings” (which is generally equal to its net income, calculated under accounting principles generally accepted in the United States of America (“GAAP”), excluding certain non-cash and other items), subject to certain adjustments. The management fees we receive from managing BXMT are paid quarterly and increase or decrease based on, among other things, BXMT’s net proceeds received from equity offerings and accumulated core earnings (subject to certain adjustments). |

| • | The investment adviser of our non-exchange traded REIT receives a management fee based on a percentage of the REIT’s net asset value, payable monthly. |

For additional information regarding the management fee rates we receive, see “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations — Critical Accounting Policies — Revenue Recognition — Management and Advisory Fees, Net.”

Incentive Fees

The general partners or similar entities of each of our hedge fund structures receive performance based allocation fees (“incentive fees”) of generally up to 20% of the applicable fund’s net capital appreciation per annum, subject to certain net loss carry forward (known as a “high water mark”) and/or other hurdle provisions. In some

13

Table of Contents

cases, the investment adviser of each of our funds of hedge funds, separately managed accounts that invest in hedge funds and certain non-U.S. registered investment companies, is entitled to an incentive fee of generally up to 15% of the applicable investment vehicle’s net appreciation, subject to a high water mark and in some cases a preferred return. In addition, for the BDCs we sub-advise, we receive incentive fees of 10% of the vehicle’s net appreciation per annum (in certain cases paid quarterly), subject to a preferred return. The external manager of BXMT is entitled to an incentive fee, payable quarterly, in an amount, not less than zero, equal to the product of (a) 20% and (b) the excess of (i) BXMT’s core earnings for the previous 12-month period over (ii) an amount equal to 7% per annum multiplied by BXMT’s average outstanding equity (as defined in the management agreement), provided that BXMT’s core earnings over the prior three-year period are greater than zero. The special limited partner, an affiliate of our non-exchange traded REIT, is entitled to a performance participation interest, which is paid annually and accrues monthly, in an amount equal to 12.5% of it’s total return, subject to a 5% hurdle amount and a high water mark with a catch-up. In addition, the general partner of certain core+ real estate funds is entitled to an incentive fee allocation of up to 10% of excess profits, subject to a 7% hurdle amount and a loss recovery amount with a catch-up. Incentive Fees are realized at the end of a measurement period, typically annually for hedge funds and every three years from when a limited partner makes its initial investment for a certain core+ real estate fund. Once realized, such fees are not subject to clawback.

Carried Interest

The general partner or an affiliate of each of our carry funds also receives carried interest from the investment fund. Carried interest entitles the general partner (or an affiliate) to a preferred allocation of income and gains from a fund. Our ability to generate carried interest is an important element of our business and carried interest has historically accounted for a very significant portion of our income.

The carried interest is typically structured as a net profits interest in the applicable fund. In the case of our carry funds, carried interest is calculated on a “realized gain” basis, and each general partner is generally entitled to a carried interest equal to 20% of the net realized income and gains (generally taking into account realized and unrealized losses) generated by such fund, except that the general partners (or affiliates) of certain of our credit-focused funds, real estate debt funds, core+ real estate funds, Tactical Opportunities funds, multi-asset class investment funds and secondary funds of funds, and our core private equity fund, are generally entitled to a carried interest that ranges between 10% and 20%, depending on the specific fund (subject to variation across our business units and funds). Net realized income or loss is not netted between or among funds, and in some cases our carry funds provide for carried interest on current income distributions (subject to certain conditions).

For most carry funds, the carried interest is subject to an annual preferred limited partner return ranging from 5% to 8%, subject to a catch-up allocation to the general partner. Some of our carry funds (e.g., our Tactical Opportunities funds generally) do not provide for a preferred return, and generally the terms of our carry funds vary in certain respects across our business units and vintages. If, at the end of the life of a carry fund (or earlier with respect to certain of our real estate, real estate debt, core+ real estate and multi-asset class and/or opportunistic investment funds), as a result of diminished performance of later investments in a carry fund’s life, (a) the general partner receives in excess of the relevant carried interest percentage(s) applicable to the fund as applied to the fund’s cumulative net profits over the life of the fund, or (in certain cases) (b) the carry fund has not achieved investment returns that exceed the preferred return threshold (if applicable), then we will be obligated to repay an amount equal to the carried interest that was previously distributed to us that exceeds the amounts to which the relevant general partner was ultimately entitled on an after tax basis. This obligation is known as a “clawback” obligation and is an obligation of any person who directly received such carried interest, including us and our employees who participate in our carried interest plans.

Although a portion of any distributions by us to our unitholders may include any carried interest received by us, we do not intend to seek fulfillment of any clawback obligation by seeking to have our unitholders return any portion of such distributions attributable to carried interest associated with any clawback obligation. To the extent we are required to fulfill a clawback obligation, however, our general partner may determine to decrease the amount

14

Table of Contents

of our distributions to common unitholders. The clawback obligation operates with respect to a given carry fund’s own net investment performance only and carried interest of other funds is not netted for determining this contingent obligation. Moreover, although a clawback obligation is several, the governing agreements of most of our funds provide that to the extent another recipient of carried interest (such as a current or former employee) does not fund his or her respective share of the clawback obligation then due, then we and our employees who participate in such carried interest plans may have to fund additional amounts (generally an additional 50-67%) although we retain the right to pursue any remedies that we have under such governing agreements against those carried interest recipients who fail to fund their obligations. We have recorded a contingent repayment obligation equal to the amount that would be due on December 31, 2016, if the various carry funds were liquidated at their current carrying value.

For additional information concerning the clawback obligations we could face, see “Item 1A. Risk Factors — We may not have sufficient cash to pay back ‘clawback’ obligations if and when they are triggered under the governing agreements with our investors.”

Advisory and Transaction Fees

Some of our investment advisers, particularly real estate and credit advisers, receive customary fees (for example, acquisition, origination and other transaction fees) upon consummation of their funds’ transactions, and may from time to time receive advisory, monitoring and other fees in connection with their activities. The transaction fees that they receive are generally calculated as a percentage (that generally can range up to 3%) of the total value of the acquired asset or the par value of the originated loan, as applicable. For most of the funds where we receive such fees, we are required to reduce the management fees charged to the funds’ limited partners by 50% to 100% of such limited partner’s share of such fees.

Capital Invested In and Alongside Our Investment Funds

To further align our interests with those of investors in our investment funds, we have invested the firm’s capital and that of our personnel in the investment funds we sponsor and manage. Minimum general partner capital commitments to our investment funds are determined separately with respect to our investment funds and, generally, are less than 5% of the limited partner commitments of any particular fund. See “Part II. Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations — Liquidity Needs” for more information regarding our minimum general partner capital commitments to our funds. We determine whether to make general partner capital commitments to our funds in excess of the minimum required commitments based on, among other things, our anticipated liquidity, working capital and other capital needs. In many cases, we require our senior managing directors and other professionals to fund a portion of the general partner capital commitments to our funds. In other cases, we may from time to time offer to our senior managing directors and employees a part of the funded or unfunded general partner commitments to our investment funds. Our general partner capital commitments are funded with cash and not with carried interest or deferral of management fees.

Investors in many of our funds also receive the opportunity to make additional “co-investments” with the investment funds. Our personnel, as well as Blackstone itself, also have the opportunity to make co-investments, which we refer to as “side-by-side investments,” with many of our carry funds. Co-investments and side-by-side investments are investments in portfolio companies or other assets on the same terms and conditions as those acquired by the applicable fund. Co-investments refer to investments arranged by us that are made by our limited partner investors (and other investors in some instances) in a portfolio company or other assets alongside an investment fund. In certain cases, limited partner investors may pay additional management fees or carried interest in connection with such co-investments. Side-by-side investments are similar to co-investments but are made by directors, officers, senior managing directors, employees and certain affiliates of Blackstone. These investments are generally made pursuant to a binding election, subject to certain limitations, made once a year for the estimated activity during the ensuing 12 months under which those persons are permitted to make investments alongside a particular carry fund in all transactions of that fund for that year. Side-by-side investments are funded in cash and are not generally subject to management fees or carried interest.

15

Table of Contents

Competition

The asset management industry is intensely competitive, and we expect it to remain so. We compete both globally and on a regional, industry and niche basis. We compete on the basis of a number of factors, including investment performance, transaction execution skills, access to capital, access to and retention of qualified personnel, reputation, range of products and services, innovation and price.

We face competition both in the pursuit of outside investors for our investment funds and in acquiring investments in attractive portfolio companies and making other investments. Although many institutional and individual investors have increased the amount of capital they commit to alternative investment funds, such increases may create increased competition with respect to fees charged by our funds. Certain institutional investors are demonstrating a preference to in-source their own investment professionals and to make direct investments in alternative assets without the assistance of private equity advisers like us. Such institutional investors may become our competitors and could cease to be our clients.

Depending on the investment, we face competition primarily from sponsors managing other private equity funds, specialized investment funds, hedge funds and other pools of capital, other financial institutions including sovereign wealth funds, corporate buyers and other parties. Several of these competitors have significant amounts of capital and many of them have investment objectives similar to ours, which may create additional competition for investment opportunities. Some of these competitors may also have a lower cost of capital and access to funding sources or other resources that are not available to us, which may create competitive disadvantages for us with respect to investment opportunities. In addition, some of these competitors may have higher risk tolerances, different risk assessments or lower return thresholds, which could allow them to consider a wider variety of investments and to bid more aggressively than us for investments that we want to make. Corporate buyers may be able to achieve synergistic cost savings with regard to an investment or be perceived by sellers as otherwise being more desirable bidders, which may provide them with a competitive advantage in bidding for an investment.

In all of our businesses, competition is also intense for the attraction and retention of qualified employees. Our ability to continue to compete effectively in our businesses will depend upon our ability to attract new employees and retain and motivate our existing employees.

For additional information concerning the competitive risks that we face, see “Item 1A. Risk Factors — Risks Related to Our Business — The asset management business is intensely competitive.”

Employees

As of December 31, 2016, we employed approximately 2,240 people, including our 123 senior managing directors. We strive to maintain a work environment that fosters professionalism, excellence, integrity and cooperation among our employees.

Regulatory and Compliance Matters

Our businesses, as well as the financial services industry generally, are subject to extensive regulation in the United States and elsewhere.

All of the investment advisers of our investment funds operating in the U.S. are registered as investment advisers with the SEC (other investment advisers are registered in non-U.S. jurisdictions). Registered investment advisers are subject to the requirements and regulations of the Advisers Act. Such requirements relate to, among other things, fiduciary duties to clients, maintaining an effective compliance program, solicitation agreements, conflicts of interest, recordkeeping and reporting requirements, disclosure requirements, limitations on agency cross and principal transactions between an adviser and advisory clients, and general anti-fraud prohibitions.

16

Table of Contents

Blackstone Advisory Partners L.P., a subsidiary of ours through which we conduct our capital markets services business and certain of our fund marketing and distribution, is registered as a broker-dealer with the SEC and is subject to regulation and oversight by the SEC, is a member of the Financial Industry Regulatory Authority, or “FINRA,” and is registered as a broker-dealer in 50 states, the District of Columbia, the Commonwealth of Puerto Rico and the Virgin Islands. In addition, FINRA, a self-regulatory organization that is subject to oversight by the SEC, adopts and enforces rules governing the conduct, and examines the activities, of its member firms, including our broker-dealer entity. State securities regulators also have regulatory or oversight authority over our broker-dealer entity.

Broker-dealers are subject to regulations that cover all aspects of the securities business, including, among others, the implementation of a supervisory control system over the securities business, advertising and sales practices, conduct of and compensation in connection with public securities offerings, maintenance of adequate net capital, record keeping and the conduct and qualifications of employees. In particular, as a registered broker-dealer and member of FINRA, Blackstone Advisory Partners L.P. is subject to the SEC’s uniform net capital rule, Rule 15c3-1. Rule 15c3-1 specifies the minimum level of net capital a broker-dealer must maintain and also requires that a significant part of a broker-dealer’s assets be kept in relatively liquid form. The SEC and various self-regulatory organizations impose rules that require notification when net capital falls below certain predefined criteria, limit the ratio of subordinated debt to equity in the capital structure of a broker-dealer and constrain the ability of a broker-dealer to expand its business under certain circumstances. Additionally, the SEC’s uniform net capital rule imposes certain requirements that may have the effect of prohibiting a broker-dealer from distributing or withdrawing capital and requiring prior notice to the SEC for certain withdrawals of capital.

In addition, certain of the closed-end and open-end mutual funds and investment management companies we manage, advise or sub-advise are registered under the 1940 Act. The 1940 Act and the rules thereunder govern, among other things, the relationship between us and such investment vehicles and limit such investment vehicles’ ability to enter into certain transactions with us or our affiliates, including other funds managed, advised or sub-advised by us.

Pursuant to the U.K. Financial Services and Markets Act 2000, or “FSMA,” certain of our subsidiaries are subject to regulations promulgated and administered by the Financial Conduct Authority (“FCA”). The Blackstone Group International Partners LLP and GSO Capital Partners International LLP are both authorized and regulated by the FCA in the United Kingdom. The FSMA and rules promulgated thereunder form the cornerstone of legislation which governs all aspects of our investment business in the United Kingdom, including sales, research and trading practices, provision of investment advice, use and safekeeping of client funds and securities, regulatory capital, record keeping, approval standards for individuals, anti-money laundering, periodic reporting and settlement procedures. Blackstone Property Management Limited is authorized and regulated by the FCA in the United Kingdom as a property management and advisory company with the ability to administer contracts of insurance.

Blackstone/GSO Debt Funds Management Europe Limited is authorized by the Central Bank of Ireland as an Investment Firm under the European Communities (Markets in Financial Instruments) Regulations 2007. Blackstone/GSO Debt Funds Management Europe II Limited is authorized by the Central Bank of Ireland as an Alternative Investment Fund Manager under the European Union Alternative Investment Fund Managers Regulations 2013. The Blackstone Group Denmark ApS is regulated as an investment adviser by the Danish Financial Supervisory Authority. Certain Blackstone operating entities are licensed and subject to regulation by financial regulatory authorities in Japan, Hong Kong, Australia and Singapore: The Blackstone Group Japan K.K., a financial instruments firm, is registered with Kanto Local Finance Bureau (Kin-sho) and regulated by the Japan Financial Services Agency; The Blackstone Group (HK) Limited is regulated by the Hong Kong Securities and Futures Commission; The Blackstone Group (Australia) Pty Limited ACN 149 142 058 and Blackstone Real Estate Australia Pty Limited ACN 604 167 651 each holds an Australian financial services license authorizing it to provide financial services in Australia (AFSL 408376 and AFSL 485716, respectively) and is regulated by the Australian Securities and Investments Commission; and The Blackstone Singapore Pte. Ltd is regulated by the Monetary Authority of Singapore (Company Registration Number: 201020503E).

17

Table of Contents

The SEC and various self-regulatory organizations and state securities regulators have in recent years increased their regulatory activities, including regulation, examination and enforcement in respect of asset management firms.

As described above, certain of our businesses are subject to compliance with laws and regulations of U.S. federal and state governments, non-U.S. governments, their respective agencies and/or various self-regulatory organizations or exchanges relating to, among other things, marketing of investment products, disclosure and the privacy of client information, and any failure to comply with these regulations could expose us to liability and/or damage our reputation. Our businesses have operated for many years within a legal framework that requires our being able to monitor and comply with a broad range of legal and regulatory developments that affect our activities. However, additional legislation, changes in rules promulgated by self-regulatory organizations or changes in the interpretation or enforcement of existing laws and rules, either in the United States or elsewhere, may directly affect our mode of operation and profitability.

Rigorous legal and compliance analysis of our businesses and investments is endemic to our culture and risk management. Our Chief Legal Officer and Global Head of Compliance, together with the Chief Compliance Officers of each of our businesses, supervise our compliance personnel, who are responsible for addressing all regulatory and compliance matters that affect our activities. We strive to maintain a culture of compliance through the use of policies and procedures such as codes of conduct, compliance systems, testing and monitoring, communication of compliance guidance and employee education and training. Our compliance policies and procedures address a variety of regulatory and compliance matters such as the handling of material non-public information, personal securities trading, marketing practices, gifts and entertainment, valuation of investments on a fund-specific basis, document retention, potential conflicts of interest, the allocation of investment opportunities, collection of fees and expense allocation.

Our compliance group also monitors the information barriers that we maintain between the public and private sides of Blackstone’s businesses. We believe that our various businesses’ access to the intellectual knowledge and contacts and relationships that reside throughout our firm benefits all of our businesses. To maximize that access without compromising compliance with our legal and contractual obligations, our compliance group oversees and monitors the communications between groups that are on the private side of our information barrier and groups that are on the public side, as well as between different public side groups. Our compliance group also monitors contractual obligations that may be impacted and potential conflicts that may arise in connection with these inter-group discussions.