Attached files

| file | filename |

|---|---|

| 8-K - 8-K 1Q17 EARNINGS RELEASE - U.S. CONCRETE, INC. | a8-k1q17earningsrelease.htm |

1

Exhibit 99.1

U.S. CONCRETE ANNOUNCES FIRST QUARTER 2017 RESULTS

First Quarter 2017 Highlights Compared to First Quarter 2016

• Consolidated revenue increased 22.1% to $299.1 million

• Ready-mixed concrete revenue increased 22.9% to $275.5 million

• Ready-mixed concrete average sales price improved 6.2% to $134.28 per cubic yard

• Aggregate products revenue increased 17.7% to $17.8 million

• Aggregate products average sales price improved 10.6% to $12.59 per ton

• Net income per diluted share of $0.42 compared to net loss per diluted share of $0.68

• Adjusted Net Income from Continuing Operations per Diluted Share of $0.55 compared to $0.311

• Income from continuing operations of $7.0 million compared to loss from continuing operations of $9.8

million

• Income from continuing operations margin of 2.3% compared to loss from continuing operations margin of

4.0%

• Total Adjusted EBITDA increased 60.2% to $41.1 million1

• Total Adjusted EBITDA margin of 13.7% compared to 10.5%1

• Generated net cash provided by operating activities of $29.5 million and Adjusted Free Cash Flow of $19.6

million

• In April 2017, acquired a fine aggregates operation in New Jersey and access to an additional export dock,

which expanded the Company’s aggregates reserves and transportation options

1 Adjusted Net Income from Continuing Operations per Diluted Share, Total Adjusted EBITDA, Total Adjusted

EBITDA Margin and Adjusted Free Cash Flow are non-GAAP financial measures. Please refer to the

reconciliations and other information at the end of this press release.

EULESS, TEXAS – May 4, 2017 – U.S. Concrete, Inc. (NASDAQ: USCR), a leading producer of construction materials

in select major markets across the United States, today reported results for the quarter ended March 31, 2017. In the first

quarter of 2017, we reported net income of $6.9 million compared to a net loss of $10.0 million in the first quarter of 2016.

Results for the first quarter of 2017 include the recognition of a $1.9 million non-cash derivative related gain compared to

a $12.8 million non-cash derivative related loss in the first quarter of 2016. During the 2017 first quarter, income from

continuing operations was $7.0 million, as compared to a loss from continuing operations of $9.8 million in the 2016 first

quarter. Income from continuing operations as a percentage of revenue was 2.3% in the first quarter of 2017, compared to

a loss from continuing operations as a percentage of revenue of 4.0% in the first quarter of 2016. Total Adjusted EBITDA

2

increased to $41.1 million in the first quarter of 2017, compared to $25.6 million in the prior year first quarter. Total Adjusted

EBITDA as a percentage of revenue was 13.7% in the first quarter of 2017, compared to 10.5% in the first quarter of 2016.

William J. Sandbrook, President and Chief Executive Officer of U.S. Concrete, stated, “Our extremely strong first

quarter results demonstrate that we continue to capitalize on the strong demand trends and our leadership positions that we

have created in our major metropolitan markets. Our results for the quarter are even more satisfying in light of near record

rainfall in California which negatively affected our operations in the Bay Area. On a year-over-year basis, we achieved our

24th straight quarter of ready-mixed price increases, a 16.2% increase in ready-mixed concrete sales volume, an improvement

in income from continuing operations margin of 630 basis points and a 320 basis point expansion in our Total Adjusted

EBITDA margin. Our market leading positions in high growth urban areas with difficult operating environments provide us

significant competitive advantages to drive these impressive results. We continue to benefit from the strong demand in our

major metropolitan markets and strengthen our leadership position in the markets where we operate which has once again

led to the solid quarterly results we are reporting today."

Mr. Sandbrook continued, “The underlying demand trends in metropolitan New York, the San Francisco Bay area,

the Dallas / Fort Worth Metroplex and Washington, D.C. continue to be extremely robust and we have strategically positioned

ourselves in each of these markets to deliver solid earnings growth irrespective of fluctuating levels of federal stimulus or

underlying infrastructure funding. However, I am optimistic that additional federal and state resources will be available in

the coming years which will only enhance the underlying demand for our aggregates and ready-mixed concrete.”

Mr. Sandbrook concluded, “In April, we acquired the assets of a sand and gravel operation in Southern New Jersey

which furthers our strategy of vertical integration and increases our self-sufficiency of internal aggregate products in a market

where natural sand is rapidly depleting. We remain active in the acquisition market and expect to continue to supplement

our organic growth with strategic expansion within our existing markets including further vertical integration. Our acquisition

pipeline continues to provide opportunities for selective, accretive growth in both our ready-mixed concrete and aggregate

products platforms, and we are very focused on the potential to enter into new major metropolitan areas this year."

FIRST QUARTER 2017 RESULTS COMPARED TO FIRST QUARTER 2016 RESULTS

Consolidated revenue increased 22.1% to $299.1 million, compared to $245.0 million in the prior year first quarter.

Revenue from the ready-mixed concrete segment increased $51.4 million, or 22.9%, compared to the prior year first quarter,

driven by volume and pricing. The Company’s ready-mixed concrete sales volume was 2.0 million cubic yards, up 16.2%

compared to the prior year first quarter. Ready-mixed concrete average sales price per cubic yard increased $7.84, or 6.2%,

to $134.28 compared to $126.44 in the prior year first quarter. Ready-mixed concrete material spread increased 6.2% from

$62.78 per cubic yard in the prior year first quarter to $66.70 for the first quarter of 2017. Ready-mixed concrete backlog

at the end of the 2017 first quarter was approximately 7.4 million cubic yards, up 13.0% compared to the end of the prior

year first quarter. Aggregate products sales volume was 1.2 million tons, up 4.0% compared to the prior year first quarter.

3

Aggregate products average sales price improved 10.6% to $12.59 per ton in the 2017 first quarter compared to the prior

year first quarter.

During the 2017 first quarter, operating income increased $11.1 million to $21.3 million, with an operating income

margin of 7.1% compared to 4.1% in the first quarter of 2016. On a non-GAAP basis, our consolidated Adjusted Gross Profit

increased $17.1 million to $63.4 million in the 2017 first quarter, with an Adjusted Gross Margin of 21.2% compared to

18.9% in the prior year first quarter. Adjusted Gross Profit and Adjusted Gross Margin are non-GAAP financial measures.

Please refer to the reconciliations and other information at the end of this press release.

Selling, general and administrative (“SG&A”) expenses were $25.8 million in the 2017 first quarter compared to

$23.2 million in the prior year first quarter. As a percentage of revenue, SG&A expenses were 8.6% in the 2017 first quarter,

compared to 9.5% in the prior year first quarter, reflecting continued operating leverage from organic growth and acquisition

related expansion.

During the 2017 first quarter, income from continuing operations was $7.0 million, as compared to a loss from

continuing operations of $9.8 million in the 2016 first quarter. Total Adjusted EBITDA of $41.1 million in the 2017 first

quarter increased $15.4 million compared to the prior year first quarter. Ready-mixed concrete segment Adjusted EBITDA

increased $13.7 million to $41.5 million in the 2017 first quarter primarily due to higher volumes and selling prices. Aggregate

products Adjusted EBITDA of $4.0 million in the 2017 first quarter increased $1.1 million compared to the prior year first

quarter.

For the first quarter of 2017, net income was $6.9 million, or $0.42 per diluted share, compared to a net loss of $10.0

million, or $0.68 loss per diluted share, in the first quarter of 2016. Adjusted Net Income from Continuing Operations was

$9.0 million, or $0.55 per diluted share in the first quarter of 2017, compared to $5.0 million, or $0.31 per diluted share, in

the prior year first quarter, including the impact of a normalized tax rate of 40% in both periods. Adjusted Net Income from

Continuing Operations in the first quarter of 2017 excludes a $1.9 million non-cash derivative related gain resulting from

fair value changes in the Company's warrants. This compares to a non-cash derivative related loss of $12.8 million during

the first quarter of 2016. The non-cash derivative related gains and losses were primarily due to changes in the price of the

Company's common stock during each period. These warrants expire on August 31, 2017. Adjusted Net Income from

Continuing Operations is a non-GAAP financial measure. Please refer to the reconciliation and other information at the end

of this press release.

BALANCE SHEET AND LIQUIDITY

Net cash provided by operating activities in the first quarter of 2017 was $29.5 million compared to net cash provided

by operating activities in the prior year first quarter of $20.0 million. The Company’s Adjusted Free Cash Flow in the first

quarter of 2017 was $19.6 million, compared to $9.0 million in the prior year first quarter.

4

At March 31, 2017, the Company had cash and cash equivalents of $291.8 million and total debt of $658.6 million,

resulting in Net Debt of $366.8 million. Net Debt decreased by $6.7 million from December 31, 2016, largely as a result of

cash generated from operating activities during the first quarter of 2017. The Company had $208.2 million of unused

availability under its revolving credit facility at March 31, 2017. Net Debt is a non-GAAP financial measure. Please refer

to the reconciliation and other information at the end of this press release.

ACQUISITIONS

In April 2017, the Company completed the acquisition of certain assets from Corbett Aggregates Companies,

LLC ("Corbett"), in Quinton, New Jersey. The acquisition included approximately 401 acres of land with over 35 million

tons of proven aggregates reserves. The Corbett acquisition also included a long-term lease with the South Jersey Port

Corporation for an export dock located approximately six miles from the aggregates operation, as well as the exclusive right

to move coarse and fine aggregates through the North Shore Terminal located on Staten Island, New York. The acquisition

furthers our strategy of vertical integration and increases our self-sufficiency of internal aggregate products.

CONFERENCE CALL AND WEBCAST DETAILS

U.S. Concrete will host a conference call on Thursday, May 4, 2017 at 10:00 a.m. Eastern time (9:00 a.m. Central),

to review its first quarter 2017 results. To participate in the call, please dial (877) 312-8806 – Conference ID: 10815276 at

least ten minutes before the conference call begins and ask for the U.S. Concrete conference call.

A live webcast will be available on the Investor Relations section of the Company's website at www.us-concrete.com.

Please visit the website at least 15 minutes before the call begins to register, download and install any necessary audio

software. A replay of the conference call and archive of the webcast will be available shortly after the call on the Investor

Relations section of the Company’s website at www.us-concrete.com.

ABOUT U.S. CONCRETE

U.S. Concrete serves the construction industry in several major markets in the United States through its two business

segments: ready-mixed concrete and aggregate products. The Company has 155 standard ready-mixed concrete plants, 17

volumetric ready-mixed concrete facilities, and 17 producing aggregates facilities. During 2016, U.S. Concrete sold

approximately 8.1 million cubic yards of ready-mixed concrete and approximately 5.6 million tons of aggregates.

For more information on U.S. Concrete, visit www.us-concrete.com.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This press release contains various forward-looking statements and information that are based on management's beliefs, as well as

assumptions made by and information currently available to management. These forward-looking statements speak only as of the date

of this press release. The Company disclaims any obligation to update these statements and cautions you not to rely unduly on them.

Forward-looking information includes, but is not limited to, statements regarding: the expansion of the business; the opportunities and

results of our acquisitions; the prospects for growth in new and existing markets; encouraging nature of volume and pricing increases;

the business levels of our existing markets; ready-mixed concrete backlog; ability to maintain our cost structure and monitor fixed costs;

ability to maximize liquidity, manage variable costs, control capital spending and monitor working capital usage; and the adequacy of

5

current liquidity. Although U.S. Concrete believes that the expectations reflected in such forward-looking statements are reasonable, it

can give no assurance that those expectations will prove to have been correct. Such statements are subject to certain risks, uncertainties

and assumptions, including, among other matters: general and regional economic conditions; the level of activity in the construction

industry; the ability of U.S. Concrete to complete acquisitions and to effectively integrate the operations of acquired companies;

development of adequate management infrastructure; departure of key personnel; access to labor; union disruption; competitive factors;

government regulations; exposure to environmental and other liabilities; the cyclical and seasonal nature of U.S. Concrete's business;

adverse weather conditions; the availability and pricing of raw materials; the availability of refinancing alternatives; and general risks

related to the industry and markets in which U.S. Concrete operates. Should one or more of these risks materialize, or should underlying

assumptions prove incorrect, actual results or outcomes may vary materially from those expected. These risks, as well as others, are

discussed in greater detail in U.S. Concrete's filings with the Securities and Exchange Commission, including U.S. Concrete's Annual

Report on Form 10-K for the year ended December 31, 2016.

(Tables Follow)

6

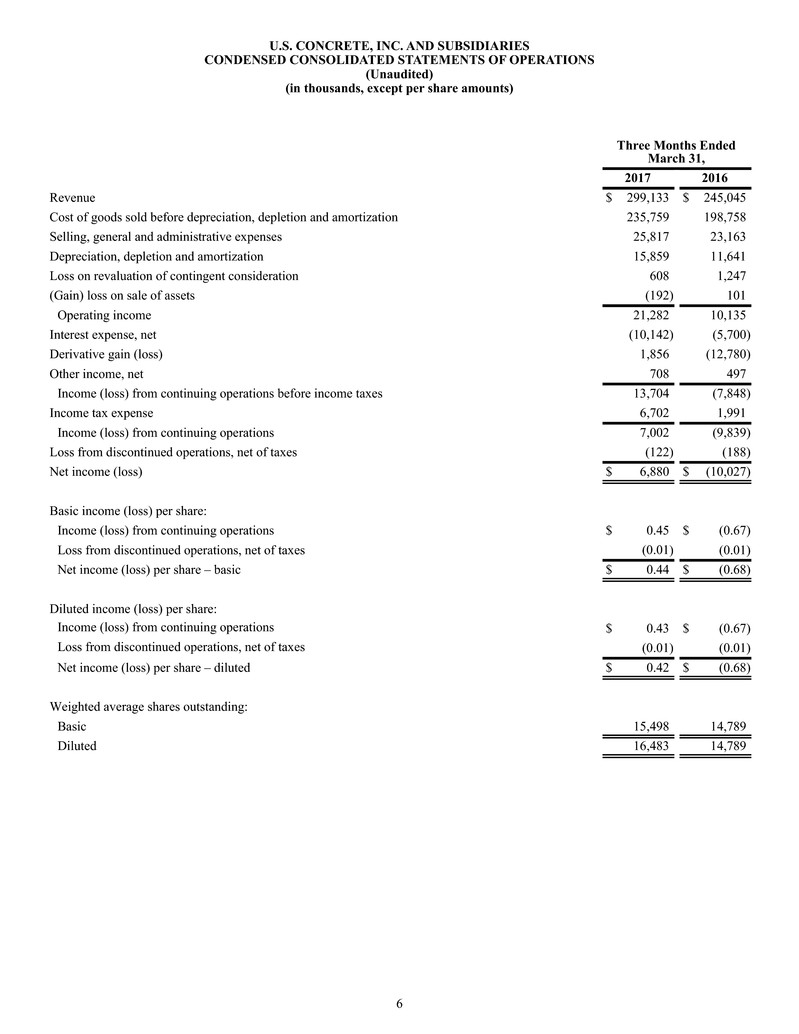

U.S. CONCRETE, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

(in thousands, except per share amounts)

Three Months Ended

March 31,

2017 2016

Revenue $ 299,133 $ 245,045

Cost of goods sold before depreciation, depletion and amortization 235,759 198,758

Selling, general and administrative expenses 25,817 23,163

Depreciation, depletion and amortization 15,859 11,641

Loss on revaluation of contingent consideration 608 1,247

(Gain) loss on sale of assets (192) 101

Operating income 21,282 10,135

Interest expense, net (10,142) (5,700)

Derivative gain (loss) 1,856 (12,780)

Other income, net 708 497

Income (loss) from continuing operations before income taxes 13,704 (7,848)

Income tax expense 6,702 1,991

Income (loss) from continuing operations 7,002 (9,839)

Loss from discontinued operations, net of taxes (122) (188)

Net income (loss) $ 6,880 $ (10,027)

Basic income (loss) per share:

Income (loss) from continuing operations $ 0.45 $ (0.67)

Loss from discontinued operations, net of taxes (0.01) (0.01)

Net income (loss) per share – basic $ 0.44 $ (0.68)

Diluted income (loss) per share:

Income (loss) from continuing operations $ 0.43 $ (0.67)

Loss from discontinued operations, net of taxes (0.01) (0.01)

Net income (loss) per share – diluted $ 0.42 $ (0.68)

Weighted average shares outstanding:

Basic 15,498 14,789

Diluted 16,483 14,789

7

U.S. CONCRETE, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands)

March 31, 2017 December 31, 2016

(Unaudited)

ASSETS

Current assets:

Cash and cash equivalents $ 291,824 $ 75,774

Trade accounts receivable, net 199,826 207,292

Inventories 41,797 41,979

Prepaid expenses 10,027 5,534

Other receivables 6,011 8,691

Other current assets 1,858 2,019

Total current assets 551,343 341,289

Property, plant and equipment, net 341,493 337,412

Goodwill 133,372 133,271

Intangible assets, net 125,685 130,973

Other assets 2,249 2,457

Total assets $ 1,154,142 $ 945,402

LIABILITIES AND EQUITY

Current liabilities:

Accounts payable $ 104,033 $ 110,694

Accrued liabilities 86,798 85,243

Current maturities of long-term debt 17,429 16,654

Derivative liabilities 45,815 57,415

Total current liabilities 254,075 270,006

Long-term debt, net of current maturities 641,206 432,644

Other long-term obligations and deferred credits 42,025 46,267

Deferred income taxes 10,173 7,656

Total liabilities 947,479 756,573

Commitments and contingencies

Equity:

Preferred stock — —

Common stock 17 17

Additional paid-in capital 261,521 249,832

Accumulated deficit (32,416) (39,296)

Treasury stock, at cost (22,459) (21,724)

Total stockholders' equity 206,663 188,829

Total liabilities and stockholders' equity $ 1,154,142 $ 945,402

8

U.S. CONCRETE, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

(in thousands)

Three Months Ended

March 31,

2017 2016

CASH FLOWS FROM OPERATING ACTIVITIES:

Net income (loss) $ 6,880 $ (10,027)

Adjustments to reconcile net income (loss) to net cash provided by operating activities:

Depreciation, depletion and amortization 15,859 11,641

Debt issuance cost amortization 519 538

Amortization of discount on long-term incentive plan and other accrued interest 185 118

Amortization of premium on long-term debt (388) —

Net (gain) loss on derivative (1,856) 12,780

Net loss on revaluation of contingent consideration 608 1,247

Net gain (loss) on sale of assets (192) 101

Deferred income taxes 2,761 499

Provision for doubtful accounts and customer disputes 718 335

Stock-based compensation 1,619 1,377

Changes in assets and liabilities, excluding effects of acquisitions:

Accounts receivable 6,749 13,233

Inventories 182 (1,244)

Prepaid expenses and other current assets (2,246) (3,385)

Other assets and liabilities (77) (72)

Accounts payable and accrued liabilities (1,777) (7,101)

Net cash provided by operating activities(1) 29,544 20,040

CASH FLOWS FROM INVESTING ACTIVITIES:

Purchases of property, plant and equipment (10,718) (11,220)

Payments for acquisitions, net of cash acquired (2,731) (18,681)

Proceeds from disposals of property, plant and equipment 485 37

Proceeds from disposal of businesses 294 125

Net cash used in investing activities (12,670) (29,739)

CASH FLOWS FROM FINANCING ACTIVITIES:

Proceeds from revolver borrowings — 84,956

Repayments of revolver borrowings — (64,956)

Proceeds from issuance of debt 211,500 —

Proceeds from exercise of stock options and warrants 327 57

Payments of other long-term obligations (4,500) (2,943)

Payments for other financing (4,246) (2,324)

Debt issuance costs (3,170) (119)

Other treasury share purchases (735) (62)

Net cash provided by financing activities(1) 199,176 14,609

NET INCREASE IN CASH AND CASH EQUIVALENTS 216,050 4,910

CASH AND CASH EQUIVALENTS AT BEGINNING OF PERIOD 75,774 3,925

CASH AND CASH EQUIVALENTS AT END OF PERIOD $ 291,824 $ 8,835

(1) For the three months ended March 31, 2016, we have classified $2.2 million of excess tax benefits as an operating activity rather than a financing

activity due to the adoption of Accounting Standards Update 2016-09.

9

SEGMENT FINANCIAL INFORMATION

Our two reportable segments consist of ready-mixed concrete and aggregate products. Our chief operating decision maker evaluates

segment performance and allocates resources based on Adjusted EBITDA. The following tables set forth certain unaudited financial

information relating to our continuing operations by reportable segment (in thousands, except average sales price amounts):

Three Months Ended

March 31,

2017 2016

Revenue:

Ready-mixed concrete

Sales to external customers $ 275,456 $ 224,089

Aggregate products

Sales to external customers 9,297 7,859

Intersegment sales 8,527 7,286

Total aggregate products 17,824 15,145

Total reportable segment revenue 293,280 239,234

Other products and eliminations 5,853 5,811

Total revenue $ 299,133 $ 245,045

Reportable Segment Adjusted EBITDA

Ready-mixed concrete Adjusted EBITDA $ 41,504 $ 27,755

Aggregate products Adjusted EBITDA $ 3,997 $ 2,924

Three Months Ended

March 31,

Year-

Over-

Year %

Change2017 2016

Ready-Mixed Concrete

Average sales price per cubic yard $ 134.28 $ 126.44 6.2%

Sales volume in cubic yards 2,049 1,764 16.2%

Aggregate Products

Average sales price per ton $ 12.59 $ 11.38 10.6%

Sales volume in tons 1,246 1,198 4.0%

10

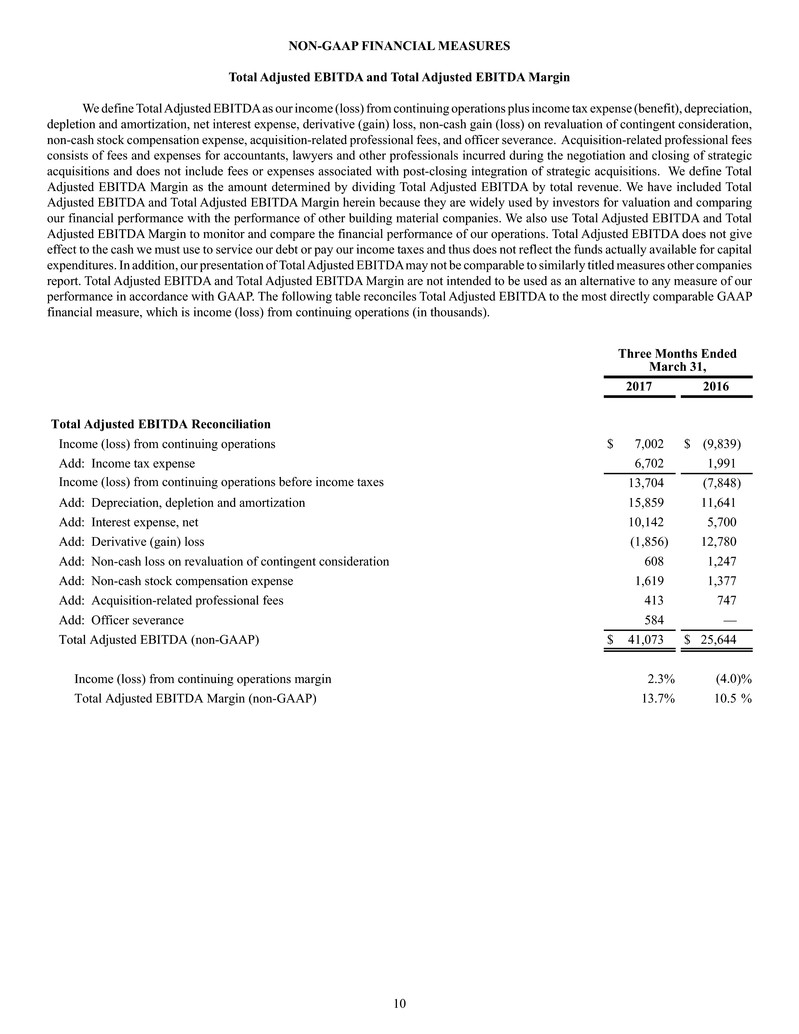

NON-GAAP FINANCIAL MEASURES

Total Adjusted EBITDA and Total Adjusted EBITDA Margin

We define Total Adjusted EBITDA as our income (loss) from continuing operations plus income tax expense (benefit), depreciation,

depletion and amortization, net interest expense, derivative (gain) loss, non-cash gain (loss) on revaluation of contingent consideration,

non-cash stock compensation expense, acquisition-related professional fees, and officer severance. Acquisition-related professional fees

consists of fees and expenses for accountants, lawyers and other professionals incurred during the negotiation and closing of strategic

acquisitions and does not include fees or expenses associated with post-closing integration of strategic acquisitions. We define Total

Adjusted EBITDA Margin as the amount determined by dividing Total Adjusted EBITDA by total revenue. We have included Total

Adjusted EBITDA and Total Adjusted EBITDA Margin herein because they are widely used by investors for valuation and comparing

our financial performance with the performance of other building material companies. We also use Total Adjusted EBITDA and Total

Adjusted EBITDA Margin to monitor and compare the financial performance of our operations. Total Adjusted EBITDA does not give

effect to the cash we must use to service our debt or pay our income taxes and thus does not reflect the funds actually available for capital

expenditures. In addition, our presentation of Total Adjusted EBITDA may not be comparable to similarly titled measures other companies

report. Total Adjusted EBITDA and Total Adjusted EBITDA Margin are not intended to be used as an alternative to any measure of our

performance in accordance with GAAP. The following table reconciles Total Adjusted EBITDA to the most directly comparable GAAP

financial measure, which is income (loss) from continuing operations (in thousands).

Three Months Ended

March 31,

2017 2016

Total Adjusted EBITDA Reconciliation

Income (loss) from continuing operations $ 7,002 $ (9,839)

Add: Income tax expense 6,702 1,991

Income (loss) from continuing operations before income taxes 13,704 (7,848)

Add: Depreciation, depletion and amortization 15,859 11,641

Add: Interest expense, net 10,142 5,700

Add: Derivative (gain) loss (1,856) 12,780

Add: Non-cash loss on revaluation of contingent consideration 608 1,247

Add: Non-cash stock compensation expense 1,619 1,377

Add: Acquisition-related professional fees 413 747

Add: Officer severance 584 —

Total Adjusted EBITDA (non-GAAP) $ 41,073 $ 25,644

Income (loss) from continuing operations margin 2.3% (4.0)%

Total Adjusted EBITDA Margin (non-GAAP) 13.7% 10.5 %

11

Adjusted Gross Profit and Adjusted Gross Margin

We define Adjusted Gross Profit as our operating income, plus depreciation, depletion and amortization, selling, general and

administrative expenses, loss (gain) on revaluation of contingent consideration, and (gain) loss on sale of assets. We define Adjusted

Gross Margin as the amount determined by dividing Adjusted Gross Profit by total revenue. We have included Adjusted Gross Profit

and Adjusted Gross Margin herein because they are widely used by investors for valuing and comparing our financial performance from

period to period. We also use Adjusted Gross Profit and Adjusted Gross Margin to monitor and compare the financial performance of

our operations. The following table reconciles Adjusted Gross Profit to the most directly comparable GAAP financial measure, which

is operating income (in thousands).

Three Months Ended

March 31,

2017 2016

Adjusted Gross Profit Reconciliation

Operating income $ 21,282 $ 10,135

Add: Depreciation, depletion and amortization 15,859 11,641

Add: Selling, general and administrative expenses 25,817 23,163

Add: Loss on revaluation of contingent consideration 608 1,247

Add: (Gain) loss on sale of assets (192) 101

Adjusted Gross Profit (non-GAAP) $ 63,374 $ 46,287

Operating income margin 7.1% 4.1%

Adjusted Gross Margin (non-GAAP) 21.2% 18.9%

12

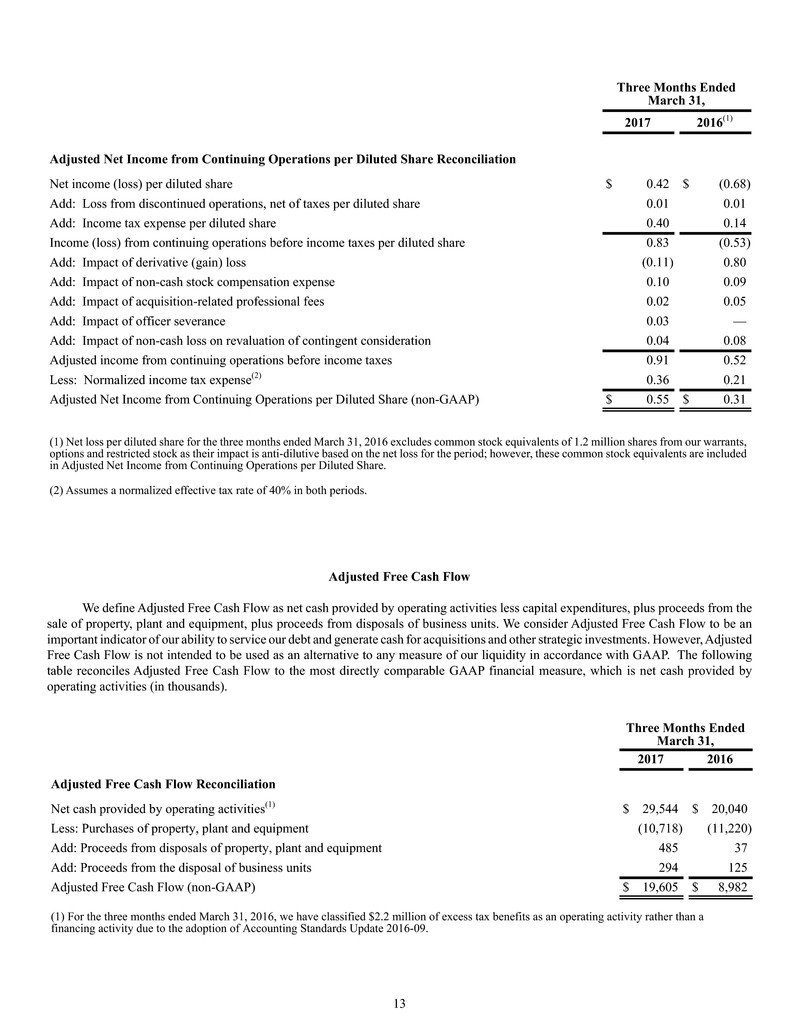

Adjusted Net Income from Continuing Operations and Adjusted Net Income from Continuing Operations per Diluted Share

We define Adjusted Net Income from Continuing Operations as net income, plus loss from discontinued operations, net of taxes,

income tax expense (benefit), derivative (gain) loss, non-cash stock compensation expense, acquisition-related professional fees, officer

severance and non-cash loss (gain) on revaluation of contingent consideration. We also adjust Adjusted Net Income from Continuing

Operations for a normalized effective income tax rate of 40%. We define Adjusted Net Income from Continuing Operations per Diluted

Share as Adjusted Net Income from Continuing Operations on a diluted per share basis. Acquisition-related professional fees consists

of fees and expenses for accountants, lawyers and other professionals incurred during the negotiation and closing of strategic acquisitions

and does not include fees or expenses associated with post-closing integration of strategic acquisitions.

We have included Adjusted Net Income from Continuing Operations and Adjusted Net Income from Continuing Operations per

Diluted Share herein because they are used by investors for valuation and comparing our financial performance with the performance of

other building material companies. We use Adjusted Net Income from Continuing Operations and Adjusted Net Income from Continuing

Operations per Diluted Share to monitor and compare the financial performance of our operations.

The following tables reconcile (i) Adjusted Net Income from Continuing Operations to the most directly comparable GAAP

financial measure, which is net income and (ii) Adjusted Net Income from Continuing Operations per Diluted Share to the most directly

comparable GAAP financial measure, which is net income per diluted share (in thousands, except per share amounts).

Three Months Ended

March 31,

2017 2016

Adjusted Net Income from Continuing Operations Reconciliation

Net income (loss) $ 6,880 $ (10,027)

Add: Loss from discontinued operations, net of taxes 122 188

Add: Income tax expense 6,702 1,991

Income (loss) from continuing operations before income taxes 13,704 (7,848)

Add: Derivative (gain) loss (1,856) 12,780

Add: Non-cash stock compensation expense 1,619 1,377

Add: Acquisition-related professional fees 413 747

Add: Officer severance 584 —

Add: Non-cash loss on revaluation of contingent consideration 608 1,247

Adjusted income from continuing operations before income taxes 15,072 8,303

Less: Normalized income tax expense(1) 6,029 3,321

Adjusted Net Income from Continuing Operations (non-GAAP) $ 9,043 $ 4,982

(1) Assumes a normalized effective tax rate of 40% in both periods.

13

Three Months Ended

March 31,

2017 2016(1)

Adjusted Net Income from Continuing Operations per Diluted Share Reconciliation

Net income (loss) per diluted share $ 0.42 $ (0.68)

Add: Loss from discontinued operations, net of taxes per diluted share 0.01 0.01

Add: Income tax expense per diluted share 0.40 0.14

Income (loss) from continuing operations before income taxes per diluted share 0.83 (0.53)

Add: Impact of derivative (gain) loss (0.11) 0.80

Add: Impact of non-cash stock compensation expense 0.10 0.09

Add: Impact of acquisition-related professional fees 0.02 0.05

Add: Impact of officer severance 0.03 —

Add: Impact of non-cash loss on revaluation of contingent consideration 0.04 0.08

Adjusted income from continuing operations before income taxes 0.91 0.52

Less: Normalized income tax expense(2) 0.36 0.21

Adjusted Net Income from Continuing Operations per Diluted Share (non-GAAP) $ 0.55 $ 0.31

(1) Net loss per diluted share for the three months ended March 31, 2016 excludes common stock equivalents of 1.2 million shares from our warrants,

options and restricted stock as their impact is anti-dilutive based on the net loss for the period; however, these common stock equivalents are included

in Adjusted Net Income from Continuing Operations per Diluted Share.

(2) Assumes a normalized effective tax rate of 40% in both periods.

Adjusted Free Cash Flow

We define Adjusted Free Cash Flow as net cash provided by operating activities less capital expenditures, plus proceeds from the

sale of property, plant and equipment, plus proceeds from disposals of business units. We consider Adjusted Free Cash Flow to be an

important indicator of our ability to service our debt and generate cash for acquisitions and other strategic investments. However, Adjusted

Free Cash Flow is not intended to be used as an alternative to any measure of our liquidity in accordance with GAAP. The following

table reconciles Adjusted Free Cash Flow to the most directly comparable GAAP financial measure, which is net cash provided by

operating activities (in thousands).

Three Months Ended

March 31,

2017 2016

Adjusted Free Cash Flow Reconciliation

Net cash provided by operating activities(1) $ 29,544 $ 20,040

Less: Purchases of property, plant and equipment (10,718) (11,220)

Add: Proceeds from disposals of property, plant and equipment 485 37

Add: Proceeds from the disposal of business units 294 125

Adjusted Free Cash Flow (non-GAAP) $ 19,605 $ 8,982

(1) For the three months ended March 31, 2016, we have classified $2.2 million of excess tax benefits as an operating activity rather than a

financing activity due to the adoption of Accounting Standards Update 2016-09.

14

Net Debt

We define Net Debt as total debt, including current maturities and capital lease obligations, less cash and cash equivalents. We

believe that Net Debt is useful to investors as a measure of our financial position. We use Net Debt to monitor and compare our financial

position. However, Net Debt is not intended to be used as an alternative to any measure of our financial position in accordance with

GAAP. The following table reconciles Net Debt to the most directly comparable GAAP financial measure, which is total debt, including

current maturities and capital lease obligations (in thousands).

As of As of

March 31,

2017

December 31,

2016

Net Debt Reconciliation

Total debt, including current maturities and capital lease obligations $ 658,635 $ 449,298

Less: Cash and cash equivalents 291,824 75,774

Net Debt (non-GAAP) $ 366,811 $ 373,524

Net Debt to Total Adjusted EBITDA

We define Net Debt to Total Adjusted EBITDA as Net Debt divided by Total Adjusted EBITDA for the applicable last twelve

month period. We believe that Net Debt to Total Adjusted EBITDA is useful to investors as a measure of our financial position. We use

this measure to monitor and compare our financial position from period to period. However, Net Debt to Total Adjusted EBITDA is not

intended to be used as an alternative to any measure of our financial position in accordance with GAAP. The following table presents

our calculation of Net Debt to Total Adjusted EBITDA and the most directly comparable GAAP ratio, which is total debt to LTM income

from continuing operations (in thousands).

Twelve Month Period

April 1, 2016 to

March 31, 2017

Total Adjusted EBITDA Reconciliation

Income from continuing operations $ 26,419

Add: Income tax expense 25,862

Income from continuing operations before income taxes 52,281

Add: Depreciation, depletion and amortization 59,070

Add: Interest expense, net 32,151

Add: Loss on extinguishment of debt 12,003

Add: Derivative loss 5,302

Add: Non-cash loss on revaluation of contingent consideration 4,586

Add: Non-cash stock compensation expense 7,341

Add: Acquisition-related professional fees 1,916

Add: Officer severance 584

Total Adjusted EBITDA (non-GAAP) $ 175,234

Net Debt $ 366,811

Total debt to LTM income from continuing operations 24.93x

Net Debt to LTM Total Adjusted EBITDA as of March 31, 2017 (non-GAAP) 2.09x

Contact: U.S. Concrete, Inc. Investor Relations

844-828-4774

IR@us-concrete.com