Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Trinseo S.A. | a17-12233_1ex99d1.htm |

| 8-K - 8-K - Trinseo S.A. | a17-12233_18k.htm |

Exhibit 99.2

First Quarter 2017 Financial Results May 3, 2017 ™ Trademark of Trinseo S.A. or its affiliates

Introductions & Disclosure Rules 2 Disclosure Rules Cautionary Note on Forward-Looking Statements. This presentation contains forward-looking statements including, without limitation, statements concerning plans, objectives, goals, projections, strategies, future events or performance, and underlying assumptions and other statements, which are not statements of historical facts or guarantees or assurances of future performance. Forward- looking statements may be identified by the use of words like “expect,” “anticipate,” “intend,” “forecast,” “outlook,” “will,” “may,” “might,” “potential,” “likely,” “target,” “plan,” “contemplate,” “seek,” “attempt,” “should,” “could,” “would” or expressions of similar meaning. Forward-looking statements reflect management’s evaluation of information currently available and are based on our current expectations and assumptions regarding our business, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. Factors that might cause such a difference include, but are not limited to, those discussed in our Annual Report on Form 10-K, under Part I, Item 1A — “Risk Factors” and elsewhere in that report. As a result of these or other factors, our actual results may differ materially from those contemplated by the forward-looking statements. Therefore, we caution you against relying on any of these forward-looking statements. The forward-looking statements included in this presentation are made only as of the date hereof. We undertake no obligation to publicly update or revise any forward-looking statement as a result of new information, future events or otherwise, except as otherwise required by law. This presentation contains financial measures that are not in accordance with generally accepted accounting principles in the US (“GAAP”) including Adjusted EBITDA, Adjusted Net Income, Adjusted EPS, and Free Cash Flow. We believe these measures provide relevant and meaningful information to investors and lenders about the ongoing operating results of the Company. Such measures when referenced herein should not be viewed as an alternative to GAAP measures of performance or liquidity. We have provided a reconciliation of these measures to the most comparable GAAP metric in the Appendix section of this presentation. Introductions Chris Pappas, President & CEO Barry Niziolek, Executive Vice President & CFO David Stasse, Vice President, Treasury & Corporate Finance

3 Key Points * See Appendix for reconciliation of non-GAAP measures. Q1 2017 Results Exceeded Guidance Driven by higher margins in Latex Binders and Feedstocks Record sales volume in Synthetic Rubber Strong Performance Plastics volume Performance Materials on Track to Meet or Exceed Growth Target Latex Binders improvement ahead of schedule Synthetic Rubber SSBR expansion, pilot plant, and new products Performance Plastics ABS capacity in China, organic growth, and new applications Updating 2017 Guidance Net Income of $337MM to $353MM Adj EBITDA* of $600MM to $620MM

4 Note: Division and Segment Adjusted EBITDA excludes Corporate Adjusted EBITDA of ($27) million. Totals may not sum due to rounding. * Includes $24 million pre-tax favorable net timing impact; see Appendix for reconciliation of non-GAAP measures. ** Net Sales represents sales to external customers only; however, the majority of the Feedstocks segment Adj EBITDA* is driven by margin on internal transfers Q1 2017 Financial Results & Highlights Record profitability in Performance Materials Overall strong fundamental performance and business conditions Latex Binders improvement Synthetic Rubber record sales volume Performance Plastics highest sales volume since 2012 Very strong styrene margins through the quarter Polystyrene destocking due to high styrene prices Americas Styrenics impacted by extended outage Completed sale of 50% JV stake in Sumika Styron Polycarbonate Limited Performance Materials Net Sales: $637MM Adj EBITDA: $110MM Latex Binders Net Sales: $289MM Adj EBITDA: $37MM Synthetic Rubber Net Sales: $163MM Adj EBITDA: $46MM Performance Plastics Net Sales: $185MM Adj EBITDA: $27MM Basic Plastics & Feedstocks Net Sales: $468MM Adj EBITDA: $99MM Basic Plastics Net Sales: $381MM Adj EBITDA: $39MM Feedstocks Net Sales**: $87MM Adj EBITDA: $42MM Americas Styrenics Adj EBITDA: $18MM Net Income: $117MM Adj EBITDA*: $182MM EPS / Adj EPS*: $2.59 / $2.42

Cash from operations of negative $26 million and Free Cash Flow* of negative $62 million inclusive of a $175 million rise in working capital due to increasing raw material prices $27 million cash returned to shareholders via share repurchases Trinseo Q1 2017 Financial Results 5 * See Appendix for reconciliation of non-GAAP measures. $182 $143 Q1'17 Q1'16 Adjusted EBITDA* ($MM) $2.59 $2.42 $1.56 $1.62 EPS Adj EPS* EPS ($) Q1'17 Q1'16 $1,104 $117 $894 $77 Net Sales Net Income Net Sales & Net Income ($MM) Q1'17 Q1'16

Sales volume increased revenue by 4% excluding the impact of the Latin America divestiture Higher Adj EBITDA driven by strengthening business fundamentals and cost management Latex Binders 6 $289 $209 Q1'17 Q1'16 Net Sales ($ MM) $37 $19 Q1'17 Q1'16 Adjusted EBITDA ($MM) 301 299 Q1'17 Q1'16 Volume (MM Lbs)

Net sales increase driven by record sales volume and the pass through of higher raw material costs Adj EBITDA increase driven by record sales volume and favorable net timing Synthetic Rubber 7 $163 $102 Q1'17 Q1'16 Net Sales ($ MM) $46 $23 Q1'17 Q1'16 Adjusted EBITDA ($MM) 179 146 Q1'17 Q1'16 Volume (MM Lbs)

Net sales increase driven by very strong volumes across all markets – highest since 2012 despite Latin America divestiture Adj EBITDA decline driven by unfavorable price lag Performance Plastics 8 $185 $169 Q1'17 Q1'16 Net Sales ($ MM) $27 $35 Q1'17 Q1'16 Adjusted EBITDA ($MM) 155 143 Q1'17 Q1'16 Volume (MM Lbs)

Net sales increase driven by the pass through of higher raw material costs, partially offset by lower polystyrene sales volume from increasing prices Q1 polystyrene volume and margin negatively impacted by rising price environment Basic Plastics 9 $381 $343 Q1'17 Q1'16 Net Sales ($ MM) $39 $38 Q1'17 Q1'16 Adjusted EBITDA ($MM) 500 570 Q1'17 Q1'16 Volume (MM Lbs)

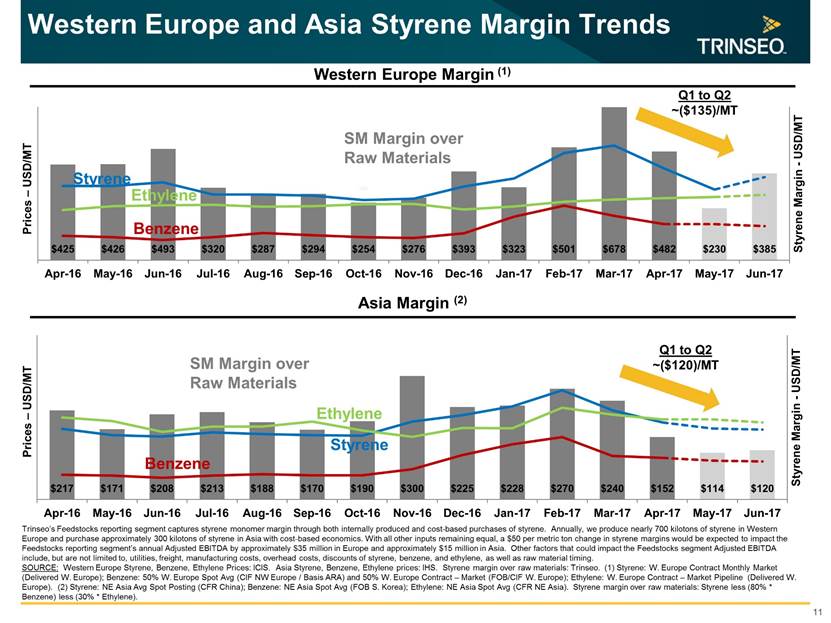

Adjusted EBITDA increase driven by higher styrene margins as well as favorable raw material timing Results exceeded guidance due to spot benzene decline in March Feedstocks & Americas Styrenics 10 FEEDSTOCKS $15 million impact from outage Styrene back to full production in early April AMERICAS STYRENICS $42 $21 Q1'17 Q1'16 Adjusted EBITDA ($MM) $18 $33 Q1'17 Q1'16 Adjusted EBITDA ($MM)

Western Europe and Asia Styrene Margin Trends 11 Western Europe Margin (1) Asia Margin (2) Q1 to Q2 ~($110)/MT Q1 to Q2 ~($110)/MT Trinseo’s Feedstocks reporting segment captures styrene monomer margin through both internally produced and cost-based purchases of styrene. Annually, we produce nearly 700 kilotons of styrene in Western Europe and purchase approximately 300 kilotons of styrene in Asia with cost-based economics. With all other inputs remaining equal, a $50 per metric ton change in styrene margins would be expected to impact the Feedstocks reporting segment’s annual Adjusted EBITDA by approximately $35 million in Europe and approximately $15 million in Asia. Other factors that could impact the Feedstocks segment Adjusted EBITDA include, but are not limited to, utilities, freight, manufacturing costs, overhead costs, discounts of styrene, benzene, and ethylene, as well as raw material timing. SOURCE: Western Europe Styrene, Benzene, Ethylene Prices: ICIS. Asia Styrene, Benzene, Ethylene prices: IHS. Styrene margin over raw materials: Trinseo. (1) Styrene: W. Europe Contract Monthly Market (Delivered W. Europe); Benzene: 50% W. Europe Spot Avg (CIF NW Europe / Basis ARA) and 50% W. Europe Contract – Market (FOB/CIF W. Europe); Ethylene: W. Europe Contract – Market Pipeline (Delivered W. Europe). (2) Styrene: NE Asia Avg Spot Posting (CFR China); Benzene: NE Asia Spot Avg (FOB S. Korea); Ethylene: NE Asia Spot Avg (CFR NE Asia). Styrene margin over raw materials: Styrene less (80% * Benzene) less (30% * Ethylene). Styrene Ethylene Benzene SM Margin over Raw Materials Styrene Ethylene Benzene SM Margin over Raw Materials $217 $171 $208 $213 $188 $170 $190 $300 $225 $228 $270 $240 $152 $124 $140 Apr-16 May-16 Jun-16 Jul-16 Aug-16 Sep-16 Oct-16 Nov-16 Dec-16 Jan-17 Feb-17 Mar-17 Apr-17 May-17 Jun-17 Styrene Margin - USD/MT Prices – USD/MT $425 $426 $493 $320 $287 $294 $254 $276 $393 $323 $501 $678 $482 $225 $454 Apr-16 May-16 Jun-16 Jul-16 Aug-16 Sep-16 Oct-16 Nov-16 Dec-16 Jan-17 Feb-17 Mar-17 Apr-17 May-17 Jun-17 Styrene Margin - USD/MT Prices – USD/MT

Styrene Supply / Demand Outlook 12 Global capacity of about 33,000 kT 2016 to 2020 average annual supply growth of 1.6% Over 85% of new capacity over next 3 years is non-integrated in China Estimated annual styrene demand growth is estimated at 2.0% SOURCE: Trinseo Supply / Demand Projections Support Continued Healthy Operating Rates Through 2020 + 825 + 310 + 330 + 640 2017 2018 2019 2020 Projected Styrene Capacity Additions ( kT ) Integrated Non-Integrated 0% 100% 2016 2017 2018 2019 2020 Operating Rate Supply / Demand ( kT ) Global Styrene Supply / Demand Outlook Supply Demand Operating Rate

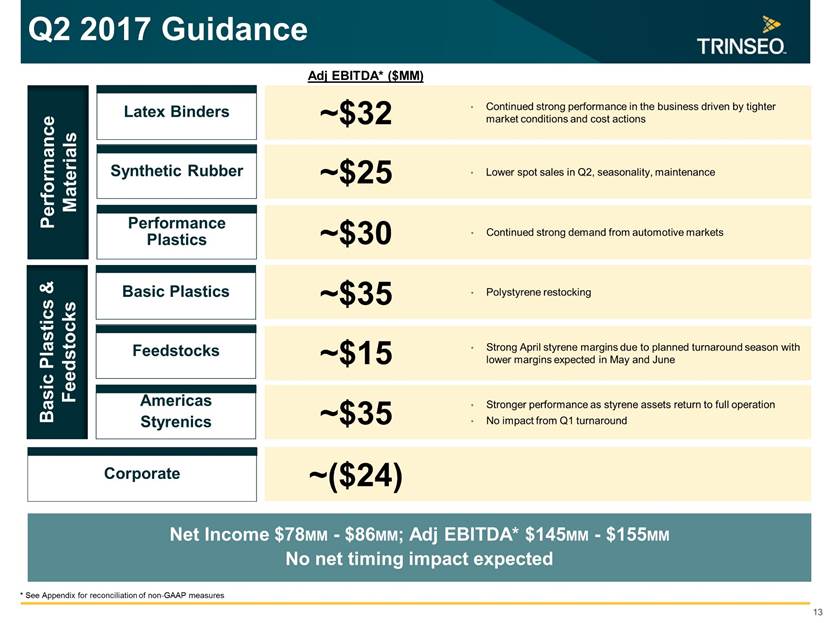

Polystyrene restocking Q2 2017 Guidance 13 Performance Materials Synthetic Rubber Latex Binders Performance Plastics Continued strong performance in the business driven by tighter market conditions and cost actions Lower spot sales in Q2, seasonality, maintenance Continued strong demand from automotive markets Corporate Net Income $78MM - $86MM; Adj EBITDA* $145MM - $155MM No net timing impact expected Adj EBITDA* ($MM) ~$30 * See Appendix for reconciliation of non-GAAP measures ~$30 Basic Plastics & Feedstocks Feedstocks Basic Plastics Americas Styrenics Strong April styrene margins due to planned turnaround season with lower margins expected in May and June ~$35 ~$18 Stronger performance as styrene assets return to full operation No impact from Q1 turnaround ~$35 ~($24) ~$25

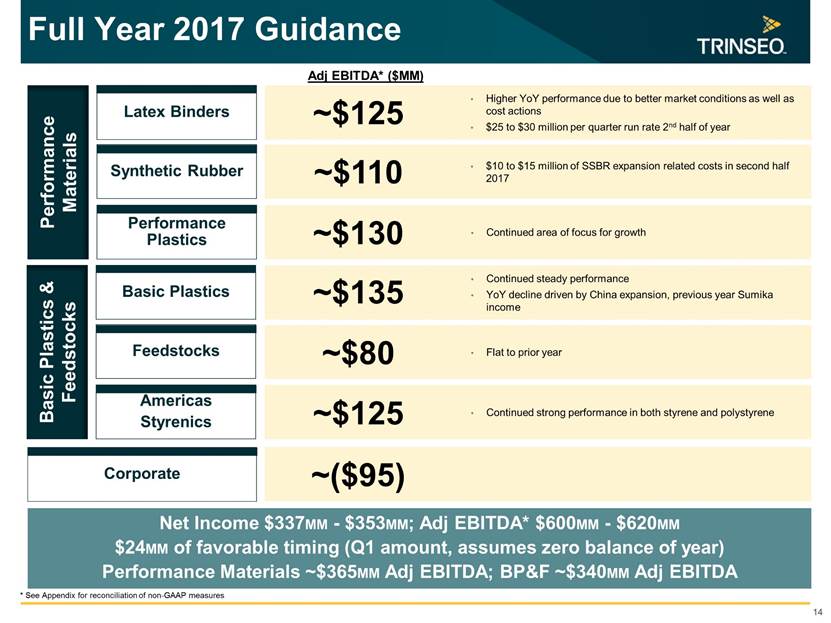

Full Year 2017 Guidance 14 Performance Materials Synthetic Rubber Latex Binders Performance Plastics Higher YoY performance due to better market conditions as well as cost actions $25 to $30 million per quarter run rate 2nd half of year $10 to $15 million of SSBR expansion related costs in second half 2017 Continued area of focus for growth Corporate Adj EBITDA* ($MM) ~$130 * See Appendix for reconciliation of non-GAAP measures ~$120 Basic Plastics & Feedstocks Feedstocks Basic Plastics Americas Styrenics Continued steady performance YoY decline driven by China expansion, previous year Sumika income Slightly above prior year ~$85 Continued strong performance in both styrene and polystyrene ~$125 ~($95) ~$110 Net Income $337MM - $353MM; Adj EBITDA* $600MM - $620MM $24MM of favorable timing (Q1 amount, assumes zero balance of year) Performance Materials ~$360 million; BP&F ~$345 million ~$135

Appendix

US GAAP to Non-GAAP Reconciliation TRINSEO. Profitability Guidance (In millions, except per share data) Three Months Ended June 30, 2017 Year Ended December 31, 2017 Adjusted EBITDA Interest expense, net Provision for income taxes Depreciation and amortization 145 — 155 (19) (23) — (25) (25) $ 600 — 620 (74) (97) — (101) (100) Reconciling items to Adjusted EBITDA Net Income 78 — 86 337 — 353 Reconciling items to Adjusted Net Income (8) Adjusted Net Income 78 — 86 329 — 345 Weighted average shares- diluted 45.3 45.3 Adjusted EPS 1.71 — 1.89 $ 7.26 — 7.61 Free Cash Flow Three Months Ended March 31, March 31, (in millions) 2017 2016 Cash provided by (used in) operating activities (25.7) $ 84.9 Capital expenditures Free Cash Flow (36.0) (26.4) (61.7) $ 58.5 NOTE: For definitions of non-GAAP measures as well as descriptions of reconciling items from Net Income to Adjusted EBITDA and to Adjusted Net Income, refer to the accompanying Exhibit 99.1 — Press Release, May 2, 2017. Totals may not sum due to rounding.

US GAAP to Non-GAAP Reconciliation (in $millions, unless noted) Q195 Q215 Q315 Q415 Q116 Q216 Q316 Q416 Q197 2014 2015 2016 Net Income (Loss) 37.7 0.8 52.1 43.1 76.7 95.8 67.3 78.5 117.3 (67.3) 133.6 318.3 Interest expense, net 28.9 25.6 19.5 19.3 18.9 18.8 18.8 18.4 18.2 124.9 93.2 75.0 Provision for (benefit from) income tams 17.9 7.5 21.2 23.6 21.9 28.6 16.0 20.5 29.3 19.7 70.2 87.0 Depreciation and amortization 22.5 21.7 23.0 29.5 23.2 24.9 23.8 24.7 24.7 103.7 96.8 96.4 EBITDA 107.0 55.6 115.8 115.5 140.7 168.1 125.9 142.1 189.5 181.0 393.8 576.7 Loss on extinguishment of long-term debt 95.2 - - - - 7.4 95.2 Other items 1.3 0.6 0.3 - 1.8 0.3 0.3 (6.8) - 38.4 2.2 (4.4) Restructuring and other charges 0.5 (0.1) 0.1 0.2 0.7 1.1 16.8 4.9 2.1 10.0 0.8 23.5 Net (gains) / losses on dispositions of businesses and assets - - - - 12.9 0.3 1.8 (9.9) (0.6) - 15.1 Fees paid pursuant to advisory agreement - - - - - - 25.4 - Adjusted EBITDA 108.8 151.3 116.2 115.7 143.2 182.4 143.3 142.0 181.7 261.6 492.0 610.9 Adjusted EBITDA to Adjusted Net Income Adjusted EBITDA 108.8 151.3 116.2 115.7 143.2 182.4 143.3 142.0 181.7 261.6 492.0 610.9 Interest expense, net 28.9 25.6 19.5 19.3 18.9 18.8 18.8 18.4 18.2 124.9 93.2 75.0 Provision for (benefit from) income tams - Adjusted 18.3 25.5 22.3 18.7 22.4 28.8 21.4 22.0 29.5 29.4 84.9 94.6 Depreciation and amortization - Adjusted 22.3 21.6 22.1 23.4 22.6 24.9 23.3 24.7 24.2 99.6 89.3 95.4 Adjusted Net Income 39.3 78.6 52.3 54.3 79.3 109.9 79.8 76.9 109.8 7.7 224.6 345.9 Wtd Avg Shares - Diluted (000) 48,851 48,907 48,989 49,067 49,086 47,857 46,961 45,754 45,313 43,476 48,970 47,478 Adjusted EPS - Diluted ($) 0.80 1.61 1.07 1.11 1.62 2.30 1.70 1.68 2.42 0.18 4.59 7.28 Adjustments by Statement of Operations Caption Loss on extinguishment of long-term debt - 95.2 - - - - - - 7.4 95.2 - Selling general and administrative expenses 1.8 a5 0.4 0.2 25 1.4 17.1 4.9 2.1 41.3 3.0 25.9 Other expense (income), net - - - 129 0.3 (5.0) (9.9) 31.9 - 8.3 Total EBITDA Adjustments 1.8 95.7 0.4 0.2 25 14.3 17.4 (0.1) (7.8) 80.6 98.2 34.2 Free Cash Flow Reconciliation Cash provided by operating activities 84.9 94.8 145.0 79.0 (25.7) 117.2 353.2 403.7 Capital expenditures (26.4) (26.7) (29.5) (41.2) (36.0) (98.6) (109.3) (123.9) Free Cash Flow 58.4 68.1 115.5 37.8 (61.7) 18.6 243.9 279.8 NOTE: Totals may not sum due to rounding.

Selected Segment Information TRINSEO.. (in $millions, unless noted) Q1'15 Q215 Q3'15 Q415 Q116 Q2'16 Q3'16 Q416 Q1'17 2014 2015 2016 Q117 LTM Latex Binders 305 312 307 308 299 310 318 309 301 1,193 1,233 1,236 1,238 Synthetic Rubber 162 153 152 134 146 148 150 159 179 568 601 604 636 Performance Plastics 150 150 144 146 143 154 145 137 155 581 590 579 591 Performance Materials 617 616 603 588 588 613 613 604 634 2,342 2,423 2,419 2,465 Basic Plastics 585 557 493 525 570 539 504 506 500 2,174 2,160 2,118 2,049 Feedstocks 209 151 231 165 194 195 207 163 168 693 755 759 733 Basic Plastics & Feedstocks 793 708 724 690 764 734 711 669 668 2,867 2,915 2,877 2,782 Trade Volume (MMLbs) 1,411 1,323 1,327 1,277 1,352 1,347 1,324 1,273 1,302 5,210 5,339 5,296 5,246 Latex Binders 238 248 255 226 209 232 243 241 289 1,261 966 925 1,005 Synthetic Rubber 129 115 126 104 102 111 113 124 163 634 475 451 512 Performance Plastics 197 185 180 181 169 184 175 166 185 821 743 693 709 Performance Materials 565 548 561 510 480 528 531 531 637 2,716 2,184 2,069 2,226 Basic Plastics 375 411 364 327 343 363 324 323 381 1,978 1,478 1,353 1,391 Feedstocks 78 69 103 60 71 79 81 64 87 434 310 294 310 Basic Plastics & Feedstocks 454 480 467 387 414 442 405 387 468 2,412 1,788 1,647 1,701 Net Sales 1,018 1,029 1,028 897 894 970 935 917 1,104 5,128 3,972 3,717 3,927 Latex Binders 21 15 24 18 19 21 30 24 37 97 79 94 112 Synthetic Rubber 26 18 27 21 23 30 28 29 46 137 93 111 134 Performance Plastics 30 28 20 30 35 38 30 32 27 85 108 136 128 Performance Materials 77 61 72 69 77 90 88 86 110 320 280 341 374 Basic Plastics 14 39 25 37 38 43 34 33 39 (15) 116 148 149 Feedstocks 5 35 7 3 21 33 13 14 42 (21) 51 80 101 Americas Styrenics 35 41 32 27 33 38 34 31 18 50 135 136 121 Basic Plastics & Feedstocks 55 115 65 67 92 113 81 78 99 15 302 364 372 Corporate (23) (25) (21) (20) (25) (21) (26) (22) (27) (73) (90) (95) (97) Adjusted EBITDA 109 151 116 116 143 182 143 142 182 262 492 611 649 Adj EBITDA Variance Analysis Net Timing* Impacts - Fav/(Unfav) Performance Materials 6 (6) 0 5 (2) (5) 4 9 2 (0) 5 6 9 Basic Plastics & Feedstocks (20) 22 (22) (7) (4) 6 3 5 22 (47) (27) 9 36 Trinseo (14) 16 (22) (2) (6) 1 6 14 24 (48) (23) 15 45 *Net Timing is the difference between Raw Material Timing and Price Lag. Raw Material Timing represents the timing of raw material cost changes flowing through cost of goods sold versus current pricing. Price Lag represents the difference in revenue between the current contractual price and the current period price. NOTE: Totals may not sum due to rounding.