Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Trinseo S.A. | Financial_Report.xls |

| EX-31.2 - EX-31.2 - Trinseo S.A. | d905802dex312.htm |

| EX-32.2 - EX-32.2 - Trinseo S.A. | d905802dex322.htm |

| EX-32.1 - EX-32.1 - Trinseo S.A. | d905802dex321.htm |

| EX-31.1 - EX-31.1 - Trinseo S.A. | d905802dex311.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2015

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 001-36473

Trinseo S.A.

(Exact name of registrant as specified in its charter)

| Luxembourg | N/A | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification Number) |

1000 Chesterbrook Boulevard

Suite 300

Berwyn, PA 19312

(Address of Principal Executive Offices)

(610) 240-3200

(Registrant’s telephone number)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the Company is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Indicate by a check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of May 7, 2015, there were 48,769,567 shares of the registrant’s ordinary shares outstanding.

Table of Contents

EXPLANATORY NOTE

Trinseo Materials Operating S.C.A., a Luxembourg partnership limited by shares (“Trinseo Materials”), and Trinseo Materials Finance, Inc., a Delaware corporation (together with Trinseo Materials, the “Subsidiary Registrants”) are two wholly-owned subsidiaries of Trinseo S.A., a public limited liability company (société anonyme) existing under the laws of Luxembourg (“Trinseo,” and together with its consolidated subsidiaries, the “Company”). The Subsidiary Registrants are the co-issuers of the Company’s 8.750% Senior Secured Notes due 2019 (the “Senior Notes”) and Trinseo is the parent guarantor of the Senior Notes. Trinseo’s registration statement on Form S-1 relating to the initial public offering of its ordinary shares was declared effective by the Securities and Exchange Commission on June 11, 2014. In reliance on Rule 12h-5 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and Rule 3-10 of Regulation S-X, the Subsidiary Registrants are exempt from, and have ceased to file reports under the Exchange Act.

2

Table of Contents

3

Table of Contents

Trinseo S.A.

Quarterly Report on Form 10-Q

For the quarterly period ended March 31, 2015

Unless otherwise indicated or required by context, as used in this Quarterly Report on Form 10-Q (“Quarterly Report”), the term “Trinseo” refers to Trinseo S.A. (NYSE: TSE), a public limited liability company (société anonyme) existing under the laws of Luxembourg, and not its subsidiaries. The terms “Company,” “we,” “us” and “our” refer to Trinseo and its consolidated subsidiaries, taken as a consolidated entity and as required by context, may also include our business as owned by our predecessor, The Dow Chemical Company, for any dates prior to June 17, 2010. The terms “Trinseo Materials Operating S.C.A.” and “Trinseo Materials Finance, Inc.” refer to Trinseo’s indirect subsidiaries, Trinseo Materials Operating S.C.A., a Luxembourg partnership limited by shares incorporated under the laws of Luxembourg, and Trinseo Materials Finance, Inc., a Delaware corporation, and not their subsidiaries. All financial data provided in this Quarterly Report is the financial data of the Company, unless otherwise indicated.

Prior to our formation, our business was wholly owned by The Dow Chemical Company. We refer to our predecessor business as “the Styron business.” On June 17, 2010, investment funds advised or managed by affiliates of Bain Capital Partners, LLC (“Bain Capital”) acquired the Styron business and Dow Europe Holding B.V., which we refer to as “Dow Europe,” or, together with other affiliates of The Dow Chemical Company, “Dow,” retained an ownership interest in the Styron business through an indirect ownership interest in us. We refer to our acquisition by Bain Capital as the “Acquisition.”

In the first quarter of 2015, we completed a rebranding process to change our operating name and legal entities from “Styron” to “Trinseo.” We believe that this new name reflects our breadth as a company with broad global reach and a diverse portfolio of materials and technologies. We believe Trinseo captures our commitment to deliver innovative and sustainable materials that provide value to our customers’ products.

Cautionary Note on Forward-Looking Statements

This Quarterly Report contains forward-looking statements including, without limitation, statements concerning plans, objectives, goals, projections, strategies, future events or performance, and underlying assumptions and other statements, which are not statements of historical facts. Forward-looking statements may be identified by the use of words like “expect,” “anticipate,” “intend,” “forecast,” “outlook,” “will,” “may,” “might,” “potential,” “likely,” “target,” “plan,” “contemplate,” “seek,” “attempt,” “should,” “could,” “would” or expressions of similar meaning. Forward-looking statements reflect management’s evaluation of information currently available and are based on our current expectations and assumptions regarding our business, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. Specific factors that may impact performance or other predictions of future actions have, in many but not all cases, been identified in connection with specific forward-looking statements. Factors that might cause such a difference include, but are not limited to, those discussed in our Annual Report on Form 10-K for the year ended December 31, 2014 (“Annual Report”) filed with the Securities and Exchange Commission (“SEC”) on March 10, 2015 under Part I, Item 1A — “Risk Factors”, and elsewhere within this Quarterly Report.

As a result of these or other factors, our actual results may differ materially from those contemplated by the forward-looking statements. They are neither statements of historical fact nor guarantees or assurances of future performance. Therefore, we caution you therefore against relying on any of these forward-looking statements. The forward-looking statements included in this Quarterly Report are made only as of the date hereof. We undertake no obligation to publicly update or revise any forward-looking statement as a result of new information, future events or otherwise, except as otherwise required by law.

Where You Can Find Additional Information

Our website is www.trinseo.com. Information contained on our website is not part of this Quarterly Report. Information that we file with or furnish to the SEC, including our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and any amendments to or exhibits included in these reports are available for download, free of charge, on our website soon after such reports are filed with or furnished to the SEC. These reports and other information, including exhibits filed or furnished therewith, are also available at the SEC’s website at www.sec.gov. You may also obtain and copy any document we file with or furnish to the SEC at the SEC’s public reference room at 100 F Street, NE, Washington, D.C. 20549. You may obtain information on the operation of the SEC’s public reference facilities by calling the SEC at 1-800-SEC-0330. You may request copies of these documents, upon payment of a duplicating fee, by writing to the SEC at its principal office at 100 F Street, NE, Washington, D.C. 20549.

4

Table of Contents

PART I —FINANCIAL INFORMATION

TRINSEO S.A.

Condensed Consolidated Balance Sheets

(In thousands, except per share data)

(Unaudited)

| March 31, | December 31, | |||||||

| 2015 | 2014 | |||||||

| Assets |

||||||||

| Current assets |

||||||||

| Cash and cash equivalents |

$ | 218,697 | $ | 220,786 | ||||

| Accounts receivable, net of allowance for doubtful accounts (March 31, 2015—$4,988; December 31, 2014—$6,268) |

590,065 | 601,066 | ||||||

| Inventories |

390,972 | 473,861 | ||||||

| Deferred income tax assets |

8,423 | 11,786 | ||||||

| Other current assets |

11,378 | 15,164 | ||||||

|

|

|

|

|

|||||

| Total current assets |

1,219,535 | 1,322,663 | ||||||

|

|

|

|

|

|||||

| Investments in unconsolidated affiliates |

189,364 | 167,658 | ||||||

| Property, plant and equipment, net of accumulated depreciation (March 31, 2015—$315,614; December 31, 2014—$324,383) |

505,105 | 556,697 | ||||||

| Other assets |

||||||||

| Goodwill |

30,540 | 34,574 | ||||||

| Other intangible assets, net |

145,326 | 165,358 | ||||||

| Deferred income tax assets—noncurrent |

48,220 | 46,812 | ||||||

| Deferred charges and other assets |

57,006 | 62,354 | ||||||

|

|

|

|

|

|||||

| Total other assets |

281,092 | 309,098 | ||||||

|

|

|

|

|

|||||

| Total assets |

$ | 2,195,096 | $ | 2,356,116 | ||||

|

|

|

|

|

|||||

| Liabilities and shareholders’ equity |

||||||||

| Current liabilities |

||||||||

| Short-term borrowings |

$ | 4,139 | $ | 7,559 | ||||

| Accounts payable |

395,031 | 434,692 | ||||||

| Income taxes payable |

15,968 | 9,413 | ||||||

| Deferred income tax liabilities |

1,930 | 1,413 | ||||||

| Accrued expenses and other current liabilities |

84,746 | 120,928 | ||||||

|

|

|

|

|

|||||

| Total current liabilities |

501,814 | 574,005 | ||||||

|

|

|

|

|

|||||

| Noncurrent liabilities |

||||||||

| Long-term debt |

1,194,621 | 1,194,648 | ||||||

| Deferred income tax liabilities—noncurrent |

29,146 | 27,311 | ||||||

| Other noncurrent obligations |

220,607 | 239,287 | ||||||

|

|

|

|

|

|||||

| Total noncurrent liabilities |

1,444,374 | 1,461,246 | ||||||

|

|

|

|

|

|||||

| Commitments and contingencies (Note 10) |

||||||||

| Shareholders’ equity |

||||||||

| Common stock, $0.01 nominal value, 50,000,000 shares authorized at March 31, 2015 and December 31, 2014, and 48,770 shares issued and outstanding at March 31, 2015 and December 31, 2014 |

488 | 488 | ||||||

| Additional paid-in-capital |

550,152 | 547,530 | ||||||

| Accumulated deficit |

(114,232 | ) | (151,936 | ) | ||||

| Accumulated other comprehensive loss |

(187,500 | ) | (75,217 | ) | ||||

|

|

|

|

|

|||||

| Total shareholders’ equity |

248,908 | 320,865 | ||||||

|

|

|

|

|

|||||

| Total liabilities and shareholders’ equity |

$ | 2,195,096 | $ | 2,356,116 | ||||

|

|

|

|

|

|||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

5

Table of Contents

TRINSEO S.A.

Condensed Consolidated Statements of Operations

(In thousands, except per share data)

(Unaudited)

| Three Months Ended March 31, |

||||||||

| 2015 | 2014 | |||||||

| Net sales |

$ | 1,018,265 | $ | 1,359,132 | ||||

| Cost of sales |

915,186 | 1,260,503 | ||||||

|

|

|

|

|

|||||

| Gross profit |

103,079 | 98,629 | ||||||

| Selling, general and administrative expenses |

51,775 | 50,030 | ||||||

| Equity in earnings of unconsolidated affiliates |

36,707 | 14,950 | ||||||

|

|

|

|

|

|||||

| Operating income |

88,011 | 63,549 | ||||||

| Interest expense, net |

28,856 | 32,818 | ||||||

| Other expense, net |

3,551 | 895 | ||||||

|

|

|

|

|

|||||

| Income before income taxes |

55,604 | 29,836 | ||||||

| Provision for income taxes |

17,900 | 12,750 | ||||||

|

|

|

|

|

|||||

| Net income |

$ | 37,704 | $ | 17,086 | ||||

|

|

|

|

|

|||||

| Weighted average shares- basic |

48,770 | 37,270 | ||||||

| Net income per share- basic |

$ | 0.77 | $ | 0.46 | ||||

| Weighted average shares- diluted |

48,851 | 37,270 | ||||||

| Net income per share- diluted |

$ | 0.77 | $ | 0.46 | ||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

6

Table of Contents

TRINSEO S.A.

Condensed Consolidated Statements of Comprehensive Income (Loss)

(In thousands, unless otherwise stated)

(Unaudited)

| Three Months Ended March 31, |

||||||||

| 2015 | 2014 | |||||||

| Net income |

$ | 37,704 | $ | 17,086 | ||||

| Other comprehensive income (loss), net of tax (tax amounts shown in millions below for the three months ended March 31, 2015 and 2014, respectively): |

||||||||

| Cumulative translation adjustments |

(114,155 | ) | (1,425 | ) | ||||

| Unrealized gain on foreign exchange cash flow hedges (net of tax of: 2015—$0.1; 2014—$0.0) |

1,035 | — | ||||||

| Pension and other postretirement benefit plans before reclassifications: |

||||||||

| Amounts reclassified from accumulated other comprehensive income: |

||||||||

| Amortization of prior service credit (net of tax of: 2015—$(0.1); 2014—$0.0)(1) |

(340 | ) | (214 | ) | ||||

| Amortization of net loss (net of tax of: 2015—$0.4; 2014—$0.1) (1) |

1,177 | 458 | ||||||

|

|

|

|

|

|||||

| Total other comprehensive loss, net of tax |

(112,283 | ) | (1,181 | ) | ||||

|

|

|

|

|

|||||

| Comprehensive income (loss) |

$ | (74,579 | ) | $ | 15,905 | |||

|

|

|

|

|

|||||

| (1) | These other comprehensive income (loss) components are included in the computation of net periodic benefit costs (see Note 11). |

The accompanying notes are an integral part of these condensed consolidated financial statements.

7

Table of Contents

TRINSEO S.A.

Condensed Consolidated Statements of Shareholders’ Equity

(In thousands)

(Unaudited)

| Common Stock | Additional Paid-In Capital |

Accumulated Other Comprehensive Income (Loss) |

Accumulated Deficit |

Total | ||||||||||||||||||||

| Shares | Amount | |||||||||||||||||||||||

| December 31, 2014 |

48,770 | $ | 488 | $ | 547,530 | $ | (75,217 | ) | $ | (151,936 | ) | $ | 320,865 | |||||||||||

| Net income |

— | — | — | — | 37,704 | 37,704 | ||||||||||||||||||

| Other comprehensive loss |

— | — | — | (112,283 | ) | — | (112,283 | ) | ||||||||||||||||

| Stock-based compensation |

— | — | 2,622 | — | — | 2,622 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| March 31, 2015 |

48,770 | $ | 488 | $ | 550,152 | $ | (187,500 | ) | $ | (114,232 | ) | $ | 248,908 | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| December 31, 2013 |

37,270 | $ | 373 | $ | 339,055 | $ | 88,378 | $ | (84,604 | ) | $ | 343,202 | ||||||||||||

| Net income |

— | — | — | — | 17,086 | 17,086 | ||||||||||||||||||

| Other comprehensive loss |

— | — | — | (1,181 | ) | — | (1,181 | ) | ||||||||||||||||

| Stock-based compensation |

— | — | 2,689 | — | — | 2,689 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| March 31, 2014 |

37,270 | $ | 373 | $ | 341,744 | $ | 87,197 | $ | (67,518 | ) | $ | 361,796 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

8

Table of Contents

TRINSEO S.A.

Condensed Consolidated Statements of Cash Flows

(In thousands)

(Unaudited)

| Three Months Ended March 31, |

||||||||

| 2015 | 2014 | |||||||

| Cash flows from operating activities |

||||||||

| Net income |

$ | 37,704 | $ | 17,086 | ||||

| Adjustments to reconcile net income to net cash provided by (used in) operating activities |

||||||||

| Depreciation and amortization |

22,554 | 23,728 | ||||||

| Amortization of deferred financing costs |

2,446 | 2,516 | ||||||

| Deferred income tax |

3,775 | 5,458 | ||||||

| Stock-based compensation |

2,622 | 2,689 | ||||||

| Earnings of unconsolidated affiliates, net of dividends |

(21,707 | ) | (9,950 | ) | ||||

| Unrealized net losses on foreign exchange forward contracts |

2,815 | — | ||||||

| Changes in assets and liabilities |

||||||||

| Accounts receivable |

(42,091 | ) | (79,204 | ) | ||||

| Inventories |

53,722 | 20,148 | ||||||

| Accounts payable and other current liabilities |

(11,944 | ) | 18,522 | |||||

| Income taxes payable |

7,074 | (720 | ) | |||||

| Other assets, net |

3,892 | (2,649 | ) | |||||

| Other liabilities, net |

(17,948 | ) | 1,193 | |||||

|

|

|

|

|

|||||

| Cash provided by (used in) operating activities |

42,914 | (1,183 | ) | |||||

|

|

|

|

|

|||||

| Cash flows from investing activities |

||||||||

| Capital expenditures |

(27,670 | ) | (41,141 | ) | ||||

| Proceeds from the sale of businesses and other assets |

560 | — | ||||||

| Payment for working capital adjustment from sale of business |

— | (700 | ) | |||||

| Distributions from unconsolidated affiliates |

— | 978 | ||||||

|

|

|

|

|

|||||

| Cash used in investing activities |

(27,110 | ) | (40,863 | ) | ||||

|

|

|

|

|

|||||

| Cash flows from financing activities |

||||||||

| Short-term borrowings, net |

(9,487 | ) | (14,837 | ) | ||||

| Proceeds from Accounts Receivable Securitization Facility |

— | 60,971 | ||||||

| Repayments of Accounts Receivable Securitization Facility |

— | (61,538 | ) | |||||

|

|

|

|

|

|||||

| Cash used in financing activities |

(9,487 | ) | (15,404 | ) | ||||

| Effect of exchange rates on cash |

(8,406 | ) | 36 | |||||

|

|

|

|

|

|||||

| Net change in cash and cash equivalents |

(2,089 | ) | (57,414 | ) | ||||

| Cash and cash equivalents—beginning of period |

220,786 | 196,503 | ||||||

|

|

|

|

|

|||||

| Cash and cash equivalents—end of period |

$ | 218,697 | $ | 139,089 | ||||

|

|

|

|

|

|||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

9

Table of Contents

TRINSEO S.A.

Notes to Condensed Consolidated Financial Statements

(Dollars in thousands, unless otherwise stated)

(Unaudited)

NOTE 1—BASIS OF PRESENTATION

The unaudited interim condensed consolidated financial statements of Trinseo S.A. and its subsidiaries (the “Company”) as of and for the periods ended March 31, 2015 and 2014 were prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”) and reflect all adjustments, consisting only of normal recurring adjustments, which, in the opinion of management, are considered necessary for the fair statement of the results for the periods presented. Because they cover interim periods, the statements and related notes to the financial statements do not include all disclosures normally provided in annual financial statements and, therefore, these statements should be read in conjunction with the 2014 audited consolidated financial statements included within the Company’s Annual Report on Form 10-K (“Annual Report”) filed with the Securities and Exchange Commission (“SEC”) on March 10, 2015.

The December 31, 2014 condensed consolidated balance sheet data presented herein was derived from the Company’s December 31, 2014 audited consolidated financial statements, but does not include all disclosures required by GAAP for annual periods.

Reverse Stock Split and Initial Public Offering

On May 30, 2014, the Company amended its Articles of Association to effect a 1-for-436.69219 reverse stock split of its issued and outstanding common stock (“reverse split”) and to increase its authorized shares to 50.0 billion. All share and per share data have been retroactively adjusted in the accompanying financial statements to give effect to the reverse split.

On June 17, 2014, the Company completed an initial public offering (the “IPO”) of 11,500,000 ordinary shares at a price of $19.00 per share, which included 1,500,000 of shares sold pursuant to the underwriters’ exercise of their over-allotment option. The Company received cash proceeds of $203.2 million from this transaction, net of underwriting discounts.

Company Realignment

Until January 1, 2015, the chief executive officer, who is the Company’s chief operating decision maker, managed the Company’s operations under two divisions, Emulsion Polymers and Plastics, which included the following four reporting segments: Latex, Synthetic Rubber, Styrenics, and Engineered Polymers.

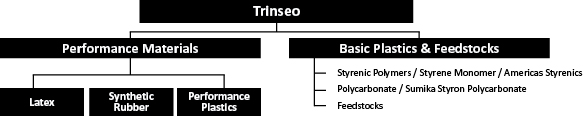

Effective January 1, 2015, the Company was reorganized under two new divisions called Performance Materials and Basic Plastics & Feedstocks. The Performance Materials division now includes the following reporting segments: Synthetic Rubber, Latex, and Performance Plastics. The Basic Plastics & Feedstocks division represents a separate segment for financial reporting purposes. These condensed consolidated financial statements and related notes thereto have been retroactively adjusted to reflect this change in reporting segments. See Note 14 for more information.

NOTE 2—RECENT ACCOUNTING GUIDANCE

In April 2014, the Financial Accounting Standards Board (“FASB”) issued amendments to guidance for reporting discontinued operations and disposals of components of an entity. The amended guidance requires that a disposal representing a strategic shift that has (or will have) a major effect on an entity’s financial results or a business activity classified as held for sale should be reported as discontinued operations. The amendments also expand the disclosure requirements for discontinued operations and add new disclosures for individually significant dispositions that do not qualify as discontinued operations. The Company adopted this guidance effective January 1, 2015, and the adoption did not have a significant impact on the Company’s financial position, results of operations, or disclosures.

In May 2014, the FASB and the International Accounting Standards Board (“IASB”) jointly issued new guidance which clarifies the principles for recognizing revenue and develops a common revenue standard for GAAP and International Financial Reporting Standards (“IFRS”). The core principle of the guidance is that an entity should recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services. This guidance is effective for public entities for annual and interim periods beginning after December 15, 2016. Early adoption is not permitted under GAAP and retrospective application is permitted, but not required. In April 2015, the FASB proposed to defer the effective date of this new guidance by one year. If the proposal is approved, subject to the FASB’s due process requirement, early adoption would be permitted as of the original effective date, and the standard would be effective for the Company beginning January 1, 2018. The Company is currently assessing the impact of adopting this guidance on its financial statements and results of operations.

10

Table of Contents

In January 2015, the FASB issued guidance to simplify income statement classification by removing the concept of extraordinary items from GAAP. The Company adopted this guidance effective January 1, 2015, and the adoption did not have a significant impact on the Company’s financial position or results of operations.

In April 2015, the FASB issued guidance that requires debt issuance costs related to a recognized debt liability be presented in the balance sheet as a direct deduction from the carrying value of that debt liability, consistent with debt discounts. The recognition and measurement guidance for debt issuance costs are not affected. This new guidance, which is to be applied on a retrospective basis, is effective for public companies for annual and interim periods beginning after December 31, 2015, with early adoption permitted. The Company will adopt this guidance effective January 1, 2016.

NOTE 3—INVESTMENTS IN UNCONSOLIDATED AFFILIATES

The Company is supplemented by two strategic joint ventures, the results of which are included within the Basic Plastics & Feedstocks reporting segment: Americas Styrenics LLC (“Americas Styrenics”, a polystyrene joint venture with Chevron Phillips Chemical Company LP) and Sumika Styron Polycarbonate Limited (“Sumika Styron Polycarbonate”, a polycarbonate joint venture with Sumitomo Chemical Company, Limited). Investments held in the unconsolidated affiliates are accounted for by the equity method.

As of March 31, 2015 and December 31, 2014, respectively, the Company’s investment in Americas Styrenics was $153.7 million and $133.5 million, which was $104.5 million and $108.4 million less than the Company’s 50% share of the underlying net assets of Americas Styrenics. This amount represents the difference between the book value of assets contributed to the joint venture at the time of formation (May 1, 2008) and the Company’s 50% share of the total recorded value of the joint venture’s assets and certain adjustments to conform with the Company’s accounting policies. This difference is being amortized over a weighted average remaining useful life of the contributed assets of approximately 5.5 years as of March 31, 2015. The Company received dividends from Americas Styrenics of $15.0 million and $5.0 million during the three months ended March 31, 2015 and 2014, respectively.

As of March 31, 2015 and December 31, 2014, respectively, the Company’s investment in Sumika Styron Polycarbonate was $35.6 million and $34.1 million, which was $21.0 million and $21.3 million greater than the Company’s 50% share of the underlying net assets of Sumika Styron Polycarbonate. This amount represents the fair value of certain identifiable assets which have not been recorded on the historical financial statements of Sumika Styron Polycarbonate. This difference is being amortized over the remaining useful life of the contributed assets of 10.5 years as of March 31, 2015. The Company received dividends from Sumika Styron Polycarbonate of $1.0 million during the three months ended March 31, 2014, with no dividends received during the three months ended March 31, 2015.

Both of the unconsolidated affiliates are privately held companies; therefore, quoted market prices for their stock are not available. The summarized financial information of the Company’s unconsolidated affiliates is shown below:

| Three Months Ended March 31, |

||||||||

| 2015 | 2014 | |||||||

| Sales |

$ | 439,570 | $ | 564,132 | ||||

| Gross profit |

$ | 77,670 | $ | 38,008 | ||||

| Net income |

$ | 66,019 | $ | 21,520 | ||||

11

Table of Contents

NOTE 4—INVENTORIES

Inventories consisted of the following:

| March 31, | December 31, | |||||||

| 2015 | 2014 | |||||||

| Finished goods |

$ | 197,762 | $ | 235,949 | ||||

| Raw materials and semi-finished goods |

162,647 | 205,061 | ||||||

| Supplies |

30,563 | 32,851 | ||||||

|

|

|

|

|

|||||

| Total |

$ | 390,972 | $ | 473,861 | ||||

|

|

|

|

|

|||||

NOTE 5—GOODWILL AND INTANGIBLE ASSETS

Goodwill

The following table shows changes in the carrying amount of goodwill by segment from December 31, 2014 to March 31, 2015:

| Performance Materials | ||||||||||||||||||||

| Latex | Synthetic Rubber |

Performance Plastics |

Basic Plastics & Feedstocks |

Total | ||||||||||||||||

| Balance at December 31, 2014 |

$ | 13,815 | $ | 9,461 | $ | 3,243 | $ | 8,055 | $ | 34,574 | ||||||||||

| Foreign currency impact |

(1,612 | ) | (1,104 | ) | (378 | ) | (940 | ) | (4,034 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Balance at March 31, 2015 |

$ | 12,203 | $ | 8,357 | $ | 2,865 | $ | 7,115 | $ | 30,540 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

Other Intangible Assets

The following table provides information regarding the Company’s other intangible assets as of March 31, 2015 and December 31, 2014, respectively:

| March 31, 2015 | December 31, 2014 | |||||||||||||||||||||||||||

| Estimated Useful Life (Years) |

Gross Carrying Amount |

Accumulated Amortization |

Net | Gross Carrying Amount |

Accumulated Amortization |

Net | ||||||||||||||||||||||

| Developed technology |

15 | $ | 166,823 | $ | (53,003 | ) | $ | 113,820 | $ | 188,854 | $ | (56,782 | ) | $ | 132,072 | |||||||||||||

| Manufacturing Capacity Rights |

6 | 20,400 | (3,308 | ) | 17,092 | 23,095 | (2,809 | ) | 20,286 | |||||||||||||||||||

| Software |

5 | 13,581 | (7,078 | ) | 6,503 | 13,177 | (6,441 | ) | 6,736 | |||||||||||||||||||

| Software in development |

N/A | 7,678 | — | 7,678 | 6,000 | — | 6,000 | |||||||||||||||||||||

| Other |

N/A | 233 | — | 233 | 264 | — | 264 | |||||||||||||||||||||

| Total |

$ | 208,715 | $ | (63,389 | ) | $ | 145,326 | $ | 231,390 | $ | (66,032 | ) | $ | 165,358 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

Amortization expense on other intangible assets totaled $4.5 million and $4.0 million for the three months ended March 31, 2015 and 2014, respectively.

The following table details the Company’s estimated amortization expense for the next five years, excluding any amortization expense related to software currently in development:

| Estimated Amortization Expense for the Next Five Years |

||||

| Remainder of 2015 |

$ | 13,108 | ||

| 2016 |

16,918 | |||

| 2017 |

16,083 | |||

| 2018 |

15,396 | |||

| 2019 |

15,151 | |||

| 2020 |

11,903 | |||

12

Table of Contents

NOTE 6—DEBT

Debt consisted of the following:

| March 31, 2015 |

December 31, 2014 |

|||||||

| Senior Secured Credit Facility |

||||||||

| Revolving Facility |

$ | — | $ | — | ||||

| Senior Notes |

1,192,500 | 1,192,500 | ||||||

| Accounts Receivable Securitization Facility |

— | — | ||||||

| Other indebtedness |

6,260 | 9,707 | ||||||

|

|

|

|

|

|||||

| Total debt |

1,198,760 | 1,202,207 | ||||||

| Less: short-term borrowings |

(4,139 | ) | (7,559 | ) | ||||

|

|

|

|

|

|||||

| Total long-term debt |

$ | 1,194,621 | $ | 1,194,648 | ||||

|

|

|

|

|

|||||

Senior Secured Credit Facility

In January 2013, the Company amended its credit agreement (“Senior Secured Credit Facility”) to, among other things, increase the Company’s revolving credit facility (“Revolving Facility”) borrowing capacity from $240.0 million to $300.0 million, decrease the borrowing rate of the Revolving Facility through a decrease in the applicable margin rate from 4.75% to 3.00% as applied to base rate loans (which shall bear interest at a rate per annum equal to the base rate plus the applicable margin (as defined therein)), or 5.75% to 4.00% as applied to LIBO rate loans (which shall bear interest at a rate per annum equal to the LIBO rate plus the applicable margin and the mandatory cost (as defined therein), if applicable), and extend the maturity date to January 2018. Concurrently, the Company repaid its then outstanding term loans under the Senior Secured Credit Facility (the “Term Loans”) of $1,239.0 million using the proceeds from its sale of $1,325.0 million aggregate principal amount of the 8.750% senior secured notes (“Senior Notes”) issued in January 2013 (refer below for further discussion).

This amendment replaced the Company’s total leverage ratio requirement with a first lien net leverage ratio (as defined under the amended agreement) and removed the interest coverage ratio requirement. If the outstanding balance on the Revolving Facility exceeds 25% of the $300.0 million borrowing capacity (excluding undrawn letters of credit up to $10.0 million) at a quarter end, then the Company’s first lien net leverage ratio may not exceed 5.25 to 1.00 for the quarter ending March 31, 2013, 5.00 to 1.00 for the subsequent quarters through December 31, 2013, 4.50 to 1.00 for each of the quarters ending in 2014 and 4.25 to 1.00 for each of the quarters ending in 2015 and thereafter. As of March 31, 2015, the Company was in compliance with all debt covenant requirements under the Senior Secured Credit Facility.

As of March 31, 2015, the Company had no outstanding borrowings, and had $291.2 million (net of $8.8 million outstanding letters of credit) of funds available for borrowings under the Revolving Facility.

Senior Notes

In January 2013, the Company issued $1,325.0 million 8.750% Senior Notes under the indenture. Interest on the Senior Notes is payable semi-annually on February 1st and August 1st of each year, which commenced on August 1, 2013. The notes will mature on February 1, 2019, at which time the principal amounts then outstanding will be due and payable. The proceeds from the issuance of the Senior Notes were used to repay all of the Company’s outstanding Term Loans and related refinancing fees and expenses.

The Company may redeem all or part of the Senior Notes at any time prior to August 1, 2015 by paying a call premium, plus accrued and unpaid interest to the redemption date. The Company may redeem all or part of the Senior Notes at any time after August 1, 2015 at a redemption price equal to the percentage of principal amount set forth below plus accrued and unpaid interest, if any, on the notes redeemed, to the applicable date of redemption, if redeemed during the twelve-month period beginning on of the year indicated below:

| 12-month period commencing August 1 in Year |

Percentage | |||

| 2015 |

104.375 | % | ||

| 2016 |

102.188 | % | ||

| 2017 and thereafter |

100.000 | % | ||

13

Table of Contents

In addition, at any time prior to August 1, 2015, the Company may redeem up to 35% of the original principal amount of the notes at a redemption price equal to 108.750% of the face amount thereof plus accrued and unpaid interest, if any, to the redemption date, with the net cash proceeds that the Company raises in certain equity offerings. The Company may also redeem, during any 12-month period commencing from the issue date until August 1, 2015, up to 10% of the original principal amount of the Senior Notes at a redemption price equal to 103% of the principal amount thereof, plus accrued and unpaid interest, if any, to, but not including, the date of redemption.

In July 2014, using proceeds from the Company’s IPO (see Note 1), the Company redeemed $132.5 million in aggregate principal amount of the Senior Notes, including a 103% call premium totaling $4.0 million, together with accrued and unpaid interest thereon of $5.2 million. Pursuant to the indenture, the Company may redeem another 10% of the original principal amount of the Senior Notes prior to August 1, 2015.

The Senior Notes rank equally in right of payment with all of the Company’s existing and future senior secured debt and pari passu with the Company and the Guarantors’ (as defined below) indebtedness that is secured by first-priority liens, including the Company’s Senior Secured Credit Facility (as defined above), to the extent of the value of the collateral securing such indebtedness and ranking senior in right of payment to all of the Company’s existing and future subordinated debt. However, claims under the Senior Notes effectively rank behind the claims of holders of debt, including interest, under the Senior Secured Credit Facility in respect of proceeds from any enforcement action with respect to the collateral or in any bankruptcy, insolvency or liquidation proceeding. The Senior Notes are unconditionally guaranteed on a senior secured basis by each of the Company’s existing and future wholly-owned subsidiaries that guarantee the Senior Secured Credit Facility (other than the Company’s subsidiaries in France and Spain) (the “Guarantors”). The note guarantees rank equally in right of payment with all of the Guarantors’ existing and future senior secured debt and senior in right of payment to all of the Guarantors’ existing and future subordinated debt. The notes are structurally subordinated to all of the liabilities of each of the Company’s subsidiaries that do not guarantee the notes.

The indenture contains covenants that, among other things, limit the Company’s ability and the ability of the Company’s restricted subsidiaries to incur additional indebtedness, pay dividends or make other distributions, subject to certain exceptions. If the Senior Notes are assigned an investment grade by the rating agencies and the Company is not in default, certain covenants will be suspended. If the ratings on the Senior Notes decline to below investment grade, the suspended covenants will be reinstated. As of March 31, 2015, the Company was in compliance with all debt covenant requirements under the indenture.

Accounts Receivable Securitization Facility

In May 2013, the Company amended its existing accounts receivable securitization facility (“Accounts Receivable Securitization Facility”) which increased its borrowing capacity from $160.0 million to $200.0 million, extended the maturity date to May 2016 and allows for the expansion of the pool of eligible accounts receivable to include previously excluded U.S. and Netherlands subsidiaries.

The Accounts Receivable Securitization Facility is subject to interest charges against the amount of outstanding borrowings as well as the amount of available, but undrawn borrowings. As a result of the amendment to the Accounts Receivable Securitization Facility, in regards to outstanding borrowings, fixed interest charges decreased from 3.25% plus commercial paper rates to 2.60% plus variable commercial paper rates. In regards to available, but undrawn borrowings, fixed interest charges decreased from 1.50% to 1.40%.

As of March 31, 2015 and December 31, 2014, there were no amounts outstanding under the Accounts Receivable Securitization Facility, with approximately $147.7 million and $136.1 million, respectively, of accounts receivable available to support this facility, based on the pool of eligible accounts receivable.

NOTE 7— DERIVATIVE INSTRUMENTS

Foreign Exchange Forward Contracts

Certain subsidiaries have assets and liabilities denominated in currencies other than their respective functional currencies, which creates foreign exchange risk. The Company’s principal strategy in managing its exposure to changes in foreign currency exchange rates is to naturally hedge the foreign currency-denominated liabilities on our balance sheet against corresponding assets of the same currency such that any changes in liabilities due to fluctuations in exchange rates are offset by changes in their corresponding foreign currency assets. In order to further reduce its exposure, the Company also uses foreign exchange forward contracts to economically hedge the impact of the variability in exchange rates on our assets and liabilities denominated in certain foreign currencies. These derivative contracts are not designated for hedge accounting treatment. The Company does not hold or enter into financial instruments for trading or speculative purposes.

As of March 31, 2015, the Company had open foreign exchange forward contracts with a net notional U.S. dollar equivalent of $33.8 million. The following table displays the notional amounts of the most significant net foreign exchange hedge positions outstanding as of March 31, 2015.

14

Table of Contents

| Buy / (Sell) |

March 31, 2015 |

|||

| Euro |

$ | 167,979 | ||

| Chinese Yuan |

$ | (97,476 | ) | |

| Swiss Franc |

$ | 40,700 | ||

| Indonesian Rupiah |

$ | (37,450 | ) | |

| British Pound |

$ | (12,157 | ) | |

Foreign Exchange Cash Flow Hedges

In March 2015, the Company entered into forward contracts with the objective of managing the currency risk associated with forecasted U.S. dollar-denominated raw materials purchases by one of its subsidiaries whose functional currency is the euro. By entering into these forward contracts, which are designated as cash flow hedges, the Company will sell a designated amount of euros and buy U.S. dollars at the prevailing market rate to mitigate the risk associated with the fluctuations in the euro-to-U.S. dollar foreign currency exchange rates. The qualifying hedge contracts are marked-to-market at each reporting date and any unrealized gains or losses are included in accumulated other comprehensive income to the extent effective, and reclassified to cost of goods sold in the period during which the transaction affects earnings or it becomes probable that the forecasted transaction will not occur.

The foreign exchange cash flow hedges, all of which remained open as of March 31, 2015, have maturities occurring over a period of 18 months, and have a net notional U.S. dollar equivalent of $90.0 million.

Summary of Derivative Instruments

Information regarding changes in the fair value of the Company’s derivative instruments, including those not designated for hedge accounting treatment is as follows:

| Gain (Loss) Recognized in Other Comprehensive Income (Loss) on Balance Sheet |

Gain (Loss) Recognized in Statement of Operations |

|||||||||||||||||

| Three Months Ended March 31, | Statement of Operations Classification | |||||||||||||||||

| 2015 | 2014 | 2015 | 2014 | |||||||||||||||

| Designated as Cash Flow Hedges |

||||||||||||||||||

| Foreign exchange cash flow hedges |

$ | 1,035 | $ | — | $ | — | $ | — | Cost of sales | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

| Total |

$ | 1,035 | $ | — | $ | — | $ | — | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

| Not Designated as Hedges |

||||||||||||||||||

| Foreign exchange forward contracts |

$ | — | $ | — | $ | (20,962 | ) | $ | — | Other expense, net | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

| Total |

$ | — | $ | — | $ | (20,962 | ) | $ | — | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

The Company recorded losses from settlements and changes in the fair value of outstanding forward contracts (not designated as hedges) of $21.0 million during the three months ended March 31, 2015. These losses offset net foreign exchange transaction gains of $18.0 million during the quarter, which resulted from the remeasurement of the Company’s foreign currency denominated assets and liabilities. The cash settlements of these foreign exchange forward contracts are included within operating activities in the condensed consolidated statement of cash flows.

As of March 31, 2015, none of the foreign exchange cash flow hedges entered into during the quarter had settled. As a result, no amounts have been reclassified out of other comprehensive income (loss). The Company has no ineffectiveness related to its foreign exchange cash flow hedges. Further, the Company expects to reclassify in the next twelve months approximately $0.7 million from other comprehensive income (loss) into earnings related to the Company’s outstanding cash flow hedges as of March 31, 2015 based on current foreign exchange rates.

Forward contracts are entered into with a limited number of counterparties, each of which allows for net settlement of all contracts through a single payment in a single currency in the event of a default on or termination of any one contract. As such, in accordance with the Company’s accounting policy, we record these foreign exchange forward contracts on a net basis, by counterparty within the condensed consolidated balance sheet. Net unrealized gains and losses are recorded within “Accounts receivable, net of allowance” and “Accounts payable,” respectively, in the condensed consolidated balance sheets.

Information regarding the gross amounts of the Company’s derivative instruments and the amounts offset in the condensed consolidated balance sheets is as follows:

15

Table of Contents

| March 31, 2015 | ||||||||||||

| Description |

Gross Amounts of Recognized Assets |

Gross Amounts of Offset in the Condensed Consolidated Balance Sheet |

Net Amounts of Assets Presented in the Condensed Consolidated Balance Sheet |

|||||||||

| Foreign exchange forward contracts |

$ | 1,779 | $ | (1,779 | ) | $ | — | |||||

| Foreign exchange cash flow hedges |

1,074 | — | 1,074 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total |

$ | 2,853 | $ | (1,779 | ) | $ | 1,074 | |||||

|

|

|

|

|

|

|

|||||||

| March 31, 2015 | ||||||||||||

| Description |

Gross Amounts of Recognized Liabilities |

Gross Amounts of Offset in the Condensed Consolidated Balance Sheet |

Net Amounts of Liabilities Presented in the Condensed Consolidated Balance Sheet |

|||||||||

| Foreign exchange forward contracts |

$ | 9,148 | $ | (1,779 | ) | $ | 7,369 | |||||

| Foreign exchange cash flow hedges |

— | — | — | |||||||||

|

|

|

|

|

|

|

|||||||

| Total |

$ | 9,148 | $ | (1,779 | ) | $ | 7,369 | |||||

|

|

|

|

|

|

|

|||||||

| December 31, 2014 | ||||||||||||

| Description |

Gross Amounts of Recognized Assets |

Gross Amounts of Offset in the Condensed Consolidated Balance Sheet |

Net Amounts of Assets Presented in the Condensed Consolidated Balance Sheet |

|||||||||

| Foreign exchange forward contracts |

$ | 2,037 | $ | (1,739 | ) | $ | 298 | |||||

|

|

|

|

|

|

|

|||||||

| Total |

$ | 2,037 | $ | (1,739 | ) | $ | 298 | |||||

|

|

|

|

|

|

|

|||||||

| December 31, 2014 | ||||||||||||

| Description |

Gross Amounts of Recognized Liabilities |

Gross Amounts of Offset in the Condensed Consolidated Balance Sheet |

Net Amounts of Liabilities Presented in the Condensed Consolidated Balance Sheet |

|||||||||

| Foreign exchange forward contracts |

$ | 6,589 | $ | (1,739 | ) | $ | 4,850 | |||||

|

|

|

|

|

|

|

|||||||

| Total |

$ | 6,589 | $ | (1,739 | ) | $ | 4,850 | |||||

|

|

|

|

|

|

|

|||||||

Refer to Note 8 of the condensed consolidated financial statements for further information regarding the fair value of the Company’s derivative instruments.

NOTE 8—FAIR VALUE MEASUREMENTS

Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. Assets and liabilities measured at fair value are classified using the following hierarchy, which is based upon the transparency of inputs to the valuation as of the measurement date.

Level 1—Valuation is based upon quoted prices (unadjusted) for identical assets or liabilities in active markets.

Level 2—Valuation is based upon quoted prices for similar assets and liabilities in active markets, or other inputs that are observable for the asset or liability, either directly or indirectly, for substantially the full term of the financial instrument.

Level 3—Valuation is based upon other unobservable inputs that are significant to the fair value measurement.

16

Table of Contents

The following table summarizes the basis used to measure certain assets and liabilities at fair value on a recurring basis in the condensed consolidated balance sheets as of March 31, 2015 and December 31, 2014.

| March 31, 2015 | ||||||||||||||||

| Assets (Liabilities) at Fair Value |

Quoted Prices in Active Markets for Identical Items (Level 1) |

Significant Other Observable Inputs (Level 2) |

Significant Unobservable Inputs (Level 3) |

Total | ||||||||||||

| Foreign exchange forward contracts—Assets |

$ | — | $ | — | $ | — | $ | — | ||||||||

| Foreign exchange forward contracts—(Liabilities) |

— | (7,369 | ) | — | (7,369 | ) | ||||||||||

| Foreign exchange cash flow hedges —Assets |

— | 1,074 | — | 1,074 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total fair value |

$ | — | $ | (6,295 | ) | $ | — | $ | (6,295 | ) | ||||||

|

|

|

|

|

|

|

|

|

|||||||||

| December 31, 2014 | ||||||||||||||||

| Assets (Liabilities) at Fair Value |

Quoted Prices in Active Markets for Identical Items (Level 1) |

Significant Other Observable Inputs (Level 2) |

Significant Unobservable Inputs (Level 3) |

Total | ||||||||||||

| Foreign exchange forward contracts—Assets |

$ | — | $ | 298 | $ | — | $ | 298 | ||||||||

| Foreign exchange forward contracts—(Liabilities) |

— | (4,850 | ) | — | (4,850 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total fair value |

$ | — | $ | (4,552 | ) | $ | — | $ | (4,552 | ) | ||||||

|

|

|

|

|

|

|

|

|

|||||||||

The Company uses an income approach to value its derivative instruments, utilizing discounted cash flow techniques, considering the terms of the contract and observable market information available as of the reporting date. Significant inputs to the valuation for foreign exchange forward contracts are obtained from broker quotations or from listed or over-the-counter market data, and are classified as Level 2 in the fair value hierarchy.

Fair Value of Debt Instruments

The following table presents the estimated fair value of the Company’s outstanding debt not carried at fair value as of March 31, 2015 and December 31, 2014, respectively:

| As of March 31, 2015 |

As of December 31, 2014 |

|||||||

| Senior Notes (Level 2) |

$ | 1,253,616 | $ | 1,212,045 | ||||

|

|

|

|

|

|||||

| Total fair value |

$ | 1,253,616 | $ | 1,212,045 | ||||

|

|

|

|

|

|||||

There were no other significant financial instruments outstanding as of March 31, 2015 and December 31, 2014.

NOTE 9—PROVISION FOR INCOME TAXES

| Three Months Ended March 31, |

||||||||

| 2015 | 2014 | |||||||

| Effective income tax rate |

32.2 | % | 42.7 | % | ||||

Provision for income taxes for the three months ended March 31, 2015 was $17.9 million, resulting in an effective tax rate of 32.2%. Provision for income taxes for the three months ended March 31, 2014 was $12.8 million, resulting in an effective tax rate of 42.7%.

The effective income tax rate is impacted by losses primarily within our holding companies incorporated in Luxembourg, which do not provide a tax benefit to the Company. For the three months ended March 31, 2015 and 2014 these losses totaled approximately $18.0 million and $23.9 million, respectively. In both periods, these losses were primarily from non-deductible interest and stock-based compensation expenses. Specifically, the decrease in losses is the result of a decrease in non-deductible interest expense within our holding companies incorporated in Luxembourg, primarily attributable to the redemption of $132.5 million in aggregate principal amount of the Senior Notes in July 2014.

17

Table of Contents

NOTE 10—COMMITMENTS AND CONTINGENCIES

Environmental Matters

Accruals for environmental matters are recorded when it is probable that a liability has been incurred and the amount of the liability can be reasonably estimated, based on current law, existing technologies and other information. At March 31, 2015 and December 31, 2014, the Company had no accrued obligations for environmental remediation and restoration costs. Pursuant to the terms of the Styron sales and purchase agreement, the pre-closing environmental conditions were retained by Dow and the Company has been indemnified by Dow from and against all environmental liabilities incurred or relating to the predecessor periods. There are several properties which the Company now owns on which Dow has been conducting investigation, monitoring, or remediation to address historical contamination. Those properties include Allyn’s Point, Connecticut; Dalton, Georgia; and Livorno, Italy. There are other properties with historical contamination that are owned by Dow that the Company leases for its operations, including its facilities in Midland, Michigan; Schkopau, Germany; Terneuzen, The Netherlands; and Guaruja, Brazil. No environmental claims have been asserted or threatened against the Company, and the Company is not a potentially responsible party at any Superfund Sites.

Inherent uncertainties exist in the Company’s potential environmental liabilities primarily due to unknown conditions, whether future claims may fall outside the scope of the indemnity, changing governmental regulations and legal standards regarding liability, and evolving technologies for handling site remediation and restoration. In connection with the Company’s existing indemnification, the possibility is considered remote that environmental remediation costs will have a material adverse impact on the condensed consolidated financial statements.

Purchase Commitments

In the normal course of business, the Company has certain raw material purchase contracts where it is required to purchase certain minimum volumes at current market prices. These commitments range from 1 to 6 years. In certain raw material purchase contracts, the Company has the right to purchase less than the required minimums and pay a liquidated damages fee, or, in case of a permanent plant shutdown, to terminate the contracts. In such cases, these obligations would be less than the annual commitment as disclosed in the consolidated financial statements included in the 2014 Annual Report.

Litigation Matters

From time to time, the Company may be subject to various legal claims and proceedings incidental to the normal conduct of business, relating to such matters as product liability, antitrust/competition, past waste disposal practices and release of chemicals into the environment. While it is impossible at this time to determine with certainty the ultimate outcome of these routine claims, the Company does not believe that the ultimate resolution of these claims will have a material adverse effect on the Company’s results of operations, financial condition or cash flow.

Legal costs, including those legal costs expected to be incurred in connection with a loss contingency, are expensed as incurred.

NOTE 11—PENSION PLANS AND OTHER POSTRETIREMENT BENEFITS

The components of net periodic benefit costs for all significant plans were as follows:

| Three Months Ended March 31, |

||||||||

| 2015 | 2014 | |||||||

| Defined Benefit Pension Plans |

||||||||

| Service cost |

$ | 4,301 | $ | 3,515 | ||||

| Interest cost |

1,360 | 1,933 | ||||||

| Expected return on plan assets |

(421 | ) | (621 | ) | ||||

| Amortization of prior service credit |

(423 | ) | (256 | ) | ||||

| Amortization of net loss |

1,381 | 467 | ||||||

|

|

|

|

|

|||||

| Net periodic benefit cost |

$ | 6,198 | $ | 5,038 | ||||

|

|

|

|

|

|||||

| Three Months Ended March 31, |

||||||||

| 2015 | 2014 | |||||||

| Other Postretirement Plans |

||||||||

| Service cost |

$ | 88 | $ | 75 | ||||

| Interest cost |

140 | 78 | ||||||

| Amortization of prior service cost |

26 | 26 | ||||||

| Amortization of net gain |

— | (37 | ) | |||||

|

|

|

|

|

|||||

| Net periodic benefit cost |

$ | 254 | $ | 142 | ||||

|

|

|

|

|

|||||

18

Table of Contents

As of March 31, 2015 and December 31, 2014, the Company’s benefit obligations included primarily in “Other noncurrent obligations” in the condensed consolidated balance sheets were $178.5 million and $196.6 million, respectively. The net periodic benefit costs are recognized in the condensed consolidated statement of operations as “Cost of sales” and “Selling, general and administrative expenses.”

The Company made cash contributions of approximately $4.8 million during the three months ended March 31, 2015. The Company expects to make additional cash contributions, including benefit payments to unfunded plans, of approximately $12.0 million to its defined benefit plans for the remainder of 2015.

NOTE 12—STOCK-BASED COMPENSATION

Restricted Stock Awards issued by the Parent

On June 17, 2010, Bain Capital Everest Manager Holding SCA (“the Parent”), an affiliate of Bain Capital, authorized the issuance of up to 750,000 shares in time-based and performance-based restricted stock to certain key members of management. Any related compensation associated with these awards is allocated to the Company from the Parent. With the adoption of the Company’s 2014 Omnibus Incentive Plan (see discussion below), no further restricted stock awards will be issued by the Parent on behalf of the Company.

Time-based Restricted Stock Awards

For the three months ended March 31, 2015, there were no grants of time-based restricted stock awards. Total compensation expense for time-based restricted stock awards was $1.1 million and $2.4 million for the three months ended March 31, 2015 and 2014, respectively. As of March 31, 2015, there was $3.9 million of total unrecognized compensation cost related to time-based restricted stock awards, which is expected to be recognized over a weighted-average period of 2.3 years.

Modified Time-based Restricted Stock Awards

For the three months ended March 31, 2015, there were no grants of modified time-based restricted stock awards. Total compensation expense recognized for modified time-based restricted stock awards was $0.9 million for the three months ended March 31, 2015. As of March 31, 2015, there was $8.3 million of total unrecognized compensation cost related to the modified time-based restricted stock awards, which is expected to be recognized over a weighted-average period of 2.3 years.

Management Retention Awards

During the year ended December 31, 2012, the Parent agreed to retention awards with certain officers. These awards generally vest over one to four years, and are payable upon vesting subject to the participant’s continued employment with the Company on the vesting date. Compensation expense related to these retention awards is equivalent to the value of the award, and is being recognized ratably over the applicable service period. Total compensation expense for these retention awards was $0.1 million and $0.2 million for the three months ended March 31, 2015 and 2014, respectively. As of March 31, 2015, there was $0.3 million in unrecognized compensation cost related to these retention awards. This cost is expected to be recognized over a period of 0.8 years.

2014 Omnibus Incentive Plan

In connection with the IPO, the Company’s board of directors approved the Trinseo S.A. 2014 Omnibus Incentive Plan (“2014 Omnibus Plan”), adopted on May 28, 2014, under which the maximum number of shares of common stock that may be delivered upon satisfaction of awards granted under such plan is 4.5 million shares. During the three months ended March 31, 2015, the Board of Directors of the Company approved equity award grants for certain executives and employees, comprised of restricted share units (or RSUs) and options to purchase shares.

The RSUs vest in full on the third anniversary of the date of grant, generally subject to the employee remaining continuously employed by the Company on the vesting date. Upon a termination of employment due to the employee’s death or retirement or a termination of employment by the Company without cause in connection with a restructuring or redundancy or due to the employee’s disability prior to the vesting date, the RSUs will vest in full or in part, depending on the type of termination. Dividends and dividend equivalents will not accumulate on unvested RSUs. Compensation cost for the RSUs is measured at the grant date based on the fair value of the award and is recognized ratably as expense over the three year vesting term.

The option awards, which contain an exercise term of nine years from the date of grant, vest in three equal annual installments beginning on the on the first anniversary of the date of grant, generally subject to the employee remaining continuously employed on the applicable vesting date. Upon a termination of employment due to the employee’s death or retirement or a termination of employment by the Company without cause in connection with a restructuring or redundancy or due to the employee’s disability prior to a vesting date, the options will vest in full or will continue to vest on the original vesting schedule, depending on the type of termination. In the event employment is terminated for cause, all vested and unvested options will be forfeited. Compensation cost for the option awards is measured at the grant date based on the fair value of the award and is recognized as expense over the appropriate service period utilizing graded vesting.

19

Table of Contents

The fair value of RSUs is equal to the fair market value of the Company’s common shares based on the closing price on the date of grant. During the three months ended March 31, 2015, the Company granted 412,538 RSUs at a weighted-average grant date fair value of $18.14 per unit. Total compensation expense recognized for the RSUs was $0.2 million for the three months ended March 31, 2015. As of March 31, 2015, there was $7.3 million of total unrecognized compensation cost related to the RSUs, which is expected to be recognized over a weighted-average period of 2.9 years.

The fair value for option awards is computed using the Black-Scholes pricing model, whose significant inputs and assumptions are determined at the date of grant. Determining the fair value of the option awards requires considerable judgment, including estimating the expected term of stock options and the expected volatility of the Company’s stock price. During the three months ended March 31, 2015, the Company granted 603,702 option awards to purchase common shares at a weighted-average grant date fair value of $7.79 per option award.

Since the Company’s equity interests were privately held prior to the IPO in June 2014, there is limited publicly traded stock history, and as a result the expected volatility used in the Black-Scholes pricing model is based on the historical volatility of similar companies’ stock that are publicly traded as well as the Company’s debt-to-equity ratio. Until such time that the Company has enough publicly traded stock history to determine expected volatility based solely on its stock, estimated volatility of options granted will be based on a combination of our historical volatility and similar companies’ stock that are publicly traded. The expected term of options represents the period of time that options granted are expected to be outstanding. For the grants presented herein, the simplified method was used to calculate the expected term of options, given the Company’s limited historical exercise data. The risk free interest rate for the periods within the expected term of the option is based on the U.S. Treasury yield curve in effect at the time of grant. The dividend yield is assumed to be zero based on historical and expected dividend activity.

The following are the weighted-average assumptions used within the Black-Scholes pricing model for grants during the three months ended March 31, 2015:

| Assumptions |

Three Months Ended March 31, 2015 |

|||

| Expected term (in years) |

5.50 | |||

| Expected volatility |

45.00 | % | ||

| Risk-free interest rate |

1.65 | % | ||

| Dividend yield |

0.00 | % | ||

Total compensation expense for the option awards was $0.2 million for the three months ended March 31, 2015. As of March 31, 2015, there was $4.5 million of total unrecognized compensation cost related to the option awards, which is expected to be recognized over a weighted-average period of 2.9 years.

NOTE 13—RELATED PARTY TRANSACTIONS

In connection with the Acquisition, the Company entered into a ten year initial term advisory agreement with Bain Capital (the “Advisory Agreement”) wherein Bain Capital provides management and consulting services and financial and other advisory services to the Company. The Advisory Agreement terminated upon consummation of the Company’s IPO in June 2014. Bain Capital will continue to provide an immaterial level of ad hoc advisory services for the Company going forward. In conjunction with the above, we paid Bain Capital fees (including out-of-pocket expenses) of $0.1 million and $1.2 million for the three months ended March 31, 2015 and 2014, respectively.

Bain Capital also provided advice pursuant to a 10-year transaction services agreement with fees payable equaling 1% of the transaction value of each financing, acquisition or similar transaction. In connection with the IPO, Bain Capital received $2.2 million of transaction fees, which were recorded within “Additional paid-in-capital” on the condensed consolidated balance sheet as of March 31, 2015 and December 31, 2014. This transaction services agreement also terminated upon consummation of the Company’s IPO in June 2014.

NOTE 14—SEGMENTS

Until January 1, 2015, the chief executive officer, who is the Company’s chief operating decision maker, managed the Company’s operations under two divisions, Emulsion Polymers and Plastics, which included the following four reporting segments: Latex, Synthetic Rubber, Styrenics, and Engineered Polymers.

Effective January 1, 2015, the Company was reorganized under two new divisions called Performance Materials and Basic Plastics & Feedstocks. The Performance Materials division now includes the following reporting segments: Synthetic Rubber, Latex, and Performance Plastics. The Basic Plastics & Feedstocks division represents a separate segment for financial reporting purposes. This new organizational structure better reflects the nature of the Company by grouping together segments with similar strategies, business drivers and operating characteristics.

20

Table of Contents

The information below for the three months ended March 31, 2014 has been retroactively adjusted to reflect this change in reporting segments.

The Latex segment produces SB latex primarily for coated paper and packaging board, carpet and artificial turf backings, as well as a number of performance latex applications. The Synthetic Rubber segment produces synthetic rubber products used predominantly in tires, with additional applications in polymer modification and technical rubber goods, including conveyer and fan belts, hoses, seals and gaskets. The Performance Plastics segment produces highly engineered compounds and blends for automotive end markets, as well as consumer electronics, medical, and lighting, collectively consumer essential markets, or CEM. The Basic Plastics & Feedstocks segment includes styrenic polymers, polycarbonate, or PC, and styrene monomer, and also includes the results of the Company’s two 50%-owned joint ventures, Americas Styrenics and Sumika Styron Polycarbonate.

| Performance Materials | ||||||||||||||||||||||||

| Three Months Ended | Latex | Synthetic Rubber |

Performance Plastics |

Basic Plastics & Feedstocks |

Corporate Unallocated |

Total | ||||||||||||||||||

| March 31, 2015 |

||||||||||||||||||||||||

| Sales to external customers |

$ | 238,256 | $ | 129,404 | $ | 196,944 | $ | 453,661 | $ | — | $ | 1,018,265 | ||||||||||||

| Equity in earnings of unconsolidated affiliates |

— | — | — | 36,707 | — | 36,707 | ||||||||||||||||||

| EBITDA(1) |

21,459 | 26,177 | 25,097 | 59,012 | ||||||||||||||||||||

| Investment in unconsolidated affiliates |

— | — | — | 189,364 | — | 189,364 | ||||||||||||||||||

| Depreciation and amortization |

6,370 | 7,790 | 1,413 | 6,230 | 751 | 22,554 | ||||||||||||||||||

| March 31, 2014 |

||||||||||||||||||||||||

| Sales to external customers |

$ | 326,305 | $ | 176,714 | $ | 202,005 | $ | 654,108 | $ | — | $ | 1,359,132 | ||||||||||||

| Equity in earnings of unconsolidated affiliates |

— | — | — | 14,950 | — | 14,950 | ||||||||||||||||||

| EBITDA(1) |

25,513 | 43,101 | 17,349 | 22,558 | ||||||||||||||||||||

| Investment in unconsolidated affiliates |

— | — | — | 164,859 | — | 164,859 | ||||||||||||||||||

| Depreciation and amortization |

6,304 | 7,170 | 1,243 | 7,920 | 1,091 | 23,728 | ||||||||||||||||||

| (1) | Reconciliation of EBITDA to net income is as follows: |

| Three Months Ended March 31, |

||||||||

| 2015 | 2014 | |||||||

| Total Segment EBITDA |

$ | 131,745 | $ | 108,521 | ||||

| Corporate unallocated |

(24,731 | ) | (22,139 | ) | ||||

| Less: Interest expense, net |

28,856 | 32,818 | ||||||

| Less: Provision for income taxes |

17,900 | 12,750 | ||||||

| Less: Depreciation and amortization |

22,554 | 23,728 | ||||||

|

|

|

|

|

|||||

| Net income |

$ | 37,704 | $ | 17,086 | ||||

|

|

|

|

|

|||||

Corporate unallocated includes corporate overhead costs and certain other income and expenses.

The primary measure of segment operating performance is EBITDA, which is defined as net income (loss) before interest, income taxes, depreciation and amortization. EBITDA is a key metric that is used by management to evaluate business performance in comparison to budgets, forecasts, and prior year financial results, providing a measure that management believes reflects the Company’s core operating performance. EBITDA is useful for analytical purposes; however, it should not be considered an alternative to the Company’s reported GAAP results, as there are limitations in using such financial measures. Other companies in the industry may define EBITDA differently than the Company, and as a result, it may be difficult to use EBITDA, or similarly-named financial measures, that other companies may use to compare the performance of those companies to the Company’s performance.

Asset and capital expenditure information is not accounted for at the segment level and consequently is not reviewed or included with the Company’s internal management reporting. Therefore, the Company has not disclosed asset and capital expenditure information for each reportable segment.

21

Table of Contents

NOTE 15—DIVESTITURES

EPS Divestiture

In June 2013, the Company’s board of directors approved the sale of its expandable polystyrene (“EPS”) business within the Company’s Basic Plastics & Feedstocks segment, under a sale and purchase agreement which was signed in July 2013. The sale closed on September 30, 2013, subject to a $0.7 million working capital adjustment, which was paid by the Company during the first quarter of 2014 and is reflected within investing activities in the condensed consolidated statement of cash flows the three months ended March 31, 2014.

Further, under the terms of the sale and purchase agreement, should the divested EPS business record EBITDA (as defined therein) greater than zero for fiscal year 2014, the Company would receive an incremental payment of €0.5 million. The EBITDA threshold was met for fiscal year 2014 and the Company received the €0.5 million payment (approximately $0.6 million based upon the applicable foreign exchange rate in the period the payment was received) during the three months ended March 31, 2015, which is reflected within cash flows used in investing activities in the condensed consolidated statement of cash flows for the period.

NOTE 16—RESTRUCTURING

Restructuring in Polycarbonate

During the second quarter of 2014, the Company announced a restructuring within its Basic Plastics & Feedstocks segment to exit the commodity market for polycarbonate in North America and to terminate existing arrangements with Dow regarding manufacturing services for the Company at Dow’s Freeport, Texas facility (the “Freeport facility”). The Company also entered into a new long-term supply contract with a third party to supply polycarbonate in North America. These revised arrangements became operational in the fourth quarter of 2014. In addition, the Company executed revised supply contracts for certain raw materials that were processed at its polycarbonate manufacturing facility in Stade, Germany, which took effect January 1, 2015. These revised agreements are expected to facilitate improvements in future results of operations for the Basic Plastics & Feedstocks segment. Production at the Freeport facility ceased as of September 30, 2014, and decommissioning and demolition began thereafter, with completion in the first quarter of 2015.