Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - ESSENDANT INC | esnd-ex991_6.htm |

| 8-K - 8-K - ESSENDANT INC | esnd-8k_20170426.htm |

Earnings Presentation First Quarter 2017 April 27, 2017 Exhibit 99.2

Forward-Looking Statements 2 This presentation contains forward-looking statements, including references to goals, plans, strategies, objectives, projected costs or savings, anticipated future performance, results or events and other statements that are not strictly historical in nature. These statements are based on management’s current expectations, forecasts and assumptions. This means they involve a number of risks and uncertainties that could cause actual results to differ materially from those expressed or implied here. These risks and uncertainties include, but are not limited to the following: Essendant's reliance on key customers, and the risks inherent in continuing or increased customer concentration and consolidations; the impact of price transparency, customer consolidation and product sales mix changes on the Company’s sales and margins; Essendant's reliance on independent resellers for a significant percentage of its net sales and, therefore, the importance of the continued independence, viability and success of these resellers; Essendant's reliance on supplier allowances and promotional incentives; Essendant’s exposure to the credit risk of its customers; continuing or increasing competitive activity and pricing pressures within existing or expanded product categories, including competition from e-tailers and product manufacturers who sell directly to Essendant's customers; the impact of supply chain disruptions or changes in key suppliers’ distribution strategies; continued declines in end-user demand for products in the office, technology and furniture product categories; Essendant may experience financial cycles due to secular consumer demand, recession or other events, most notably in the Company’s Industrial and Automotive businesses; the impact of the Company’s transformation program and possible disruption of business operations and relationships with customers and suppliers; Essendant's ability to manage inventory in order to maximize sales and supplier allowances while minimizing excess and obsolete inventory; Essendant's ability to attract and retain key management personnel; the costs and risks related to compliance with laws, regulations and industry standards affecting Essendant's business; Essendant's ability to maintain its existing information technology systems and to successfully procure, develop and implement new systems and services without business disruption or other unanticipated difficulties or costs; the impact on the Company’s reputation and relationships of a breach of the Company’s information technology systems or a failure to maintain the security of private information; the availability of financing sources to meet Essendant's business needs; Essendant's success in effectively identifying, consummating and integrating acquisitions; and unexpected events that could disrupt business operations, increasing costs and decreasing revenues. Shareholders, potential investors and other readers are urged to consider these risks and uncertainties in evaluating forward-looking statements and are cautioned not to place undue reliance on the forward-looking statements. For additional information about risks and uncertainties that could materially affect Essendant's results, please see the company’s Securities and Exchange Commission filings. The forward-looking information in this presentation is made as of this date only, and the company does not undertake any obligation to update any forward-looking statement. Investors are advised to consult any further disclosure made by Essendant regarding the matters discussed in this presentation in its filings with the Securities and Exchange Commission and in other written statements it makes from time to time. It is not possible to anticipate or foresee all risks and uncertainties, and investors should not consider any list of risks and uncertainties to be exhaustive or complete.

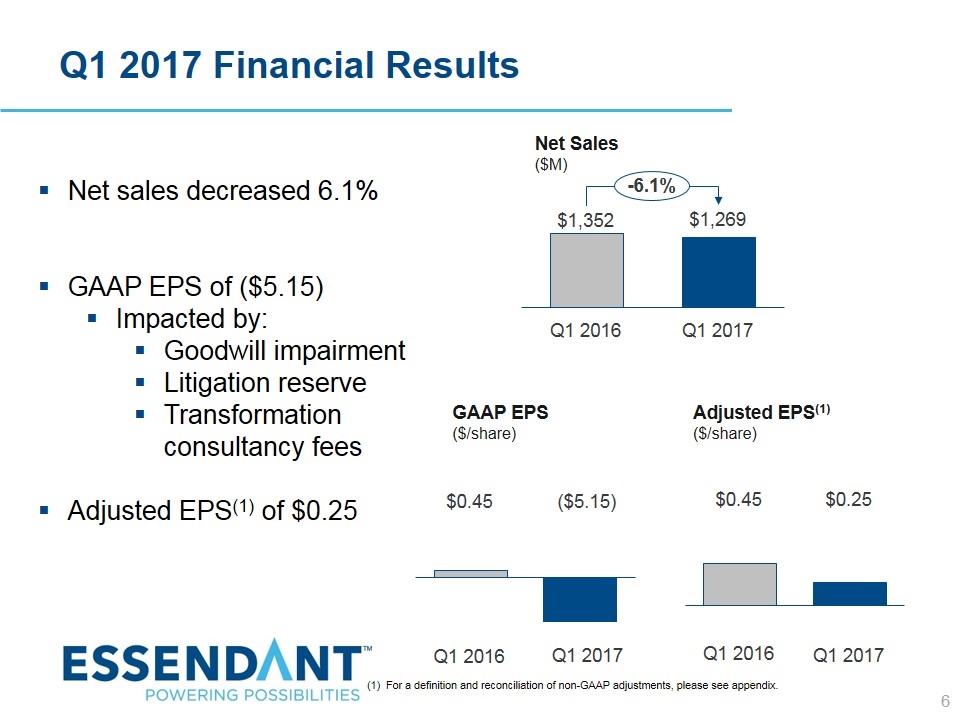

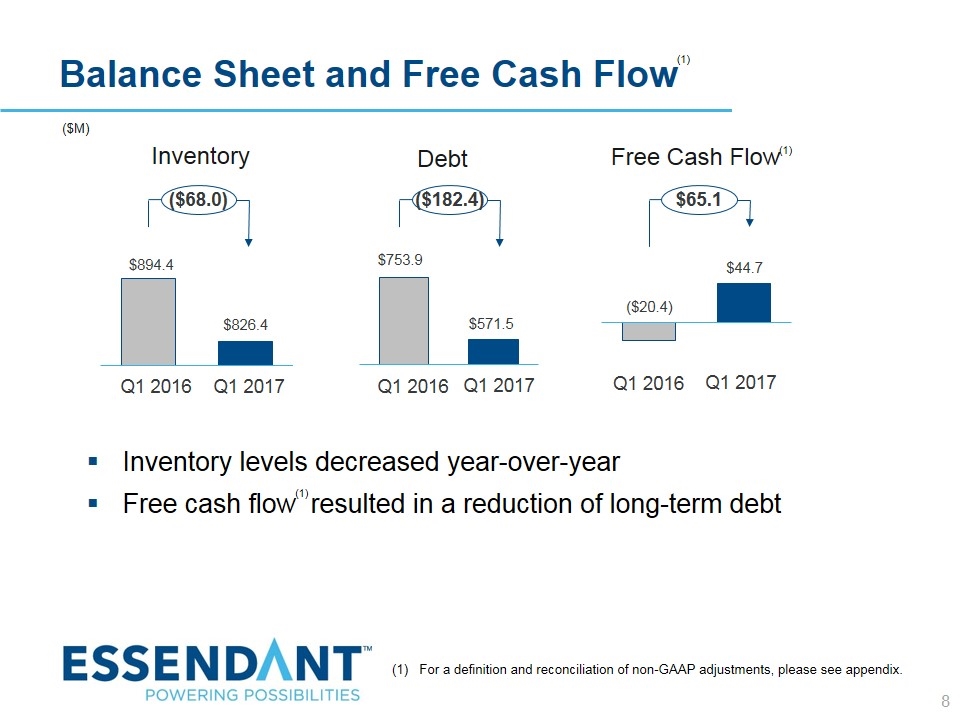

Q1 2017 Overview 3 Net sales declined 6.1%, to $1.27 billion Driven by reduced supplier promotions in low-margin ink and toner sales, as well as declines in big box national retailers and the JanSan distributor channel Gross profit declined due to sales volume Adjusted earnings per share of $0.25 Ahead of expectations Sequential earnings growth aided by transformation initiatives Disciplined inventory management and debt reduction Year-over-year inventory reduction of $68.0 million Year-over-year debt reduction of $182.4 million (1) For a definition and reconciliation of non-GAAP adjustments, please see appendix. (1)

Comprehensive Transformation Program Stabilize our JanSan distributor channel Merchandising Excellence through better sourcing and assortment Drive productivity and reduce costs Align pricing with cost-to-serve Diversify and grow our Industrial business Already seeing positive impacts from the initiatives above; benefit ramp across 2017 with full benefit in 2018 and beyond 1 2 3 4 5 Reduce working capital 6

5 Key Value Drivers | Next Day Fulfillment | Channel Category Expertise | | Broad Assortment | Advanced Digital Capabilities |

Q1 2017 Financial Results 6 Net sales decreased 6.1% GAAP EPS of ($5.15) Impacted by: Goodwill impairment Litigation reserve Transformation consultancy fees Adjusted EPS(1) of $0.25 GAAP EPS ($/share) Adjusted EPS(1) ($/share) $0.45 Q1 2016 $0.25 Q1 2017 -6.1% Q1 2016 Q1 2017 $1,269 $1,352 Net Sales ($M) Q1 2017 Q1 2016 ($5.15) $0.45 (1) For a definition and reconciliation of non-GAAP adjustments, please see appendix.

7 Q1 2017 Category Sales ($M) YoY ∆ Q1 2016 Q1 2017 $ % Jan San 365.5 334.4 ($31.1) -8.5% Technology 352.0 306.4 (45.6) -13.0% Office Products 212.3 194.0 (18.3) -8.6% Industrial Supplies 139.5 146.7 7.3 5.2% Cut Sheet Paper 91.4 102.0 10.6 11.6% Automotive 79.4 78.8 (0.6) -0.8% Furniture 74.7 70.1 (4.6) -6.1% Freight and Other 37.4 37.0 (0.4) -1.2% Net Sales 1,352.3 1,269.4 (82.9) -6.1%

8 Balance Sheet and Free Cash Flow Inventory levels decreased year-over-year Free cash flow resulted in a reduction of long-term debt Inventory Debt Free Cash Flow $894.4 $826.4 $753.9 $571.5 ($20.4) $44.7 ($M) Q1 2016 Q1 2016 Q1 2016 Q1 2017 Q1 2017 Q1 2017 (1) (1) (1) (1) For a definition and reconciliation of non-GAAP adjustments, please see appendix. ($68.0) ($182.4) $65.1

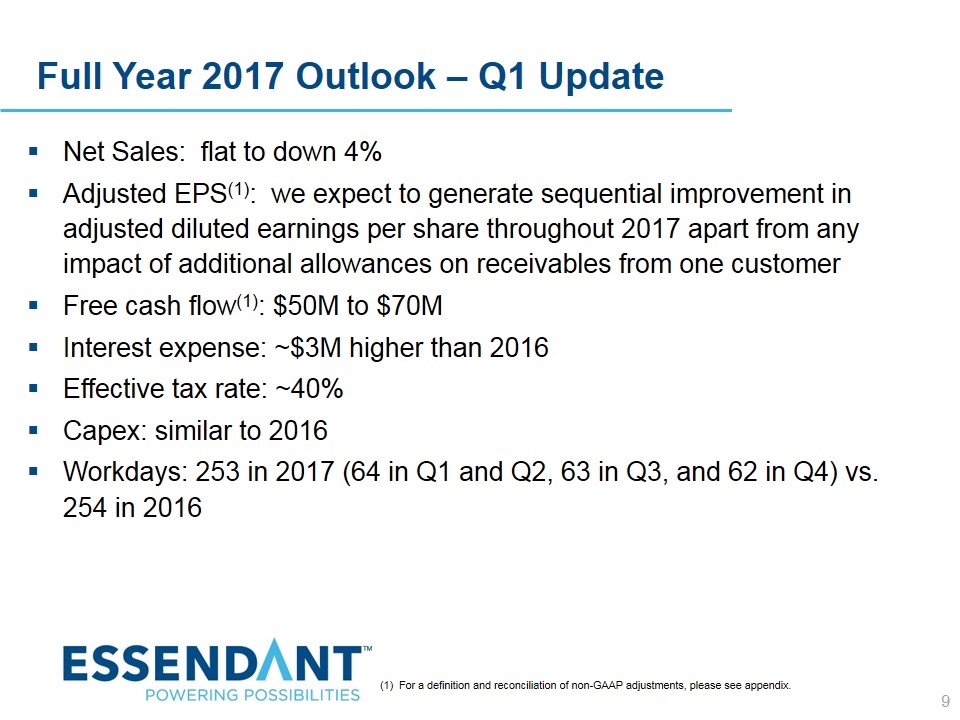

9 Full Year 2017 Outlook – Q1 Update Net Sales: flat to down 4% Adjusted EPS(1): we expect to generate sequential improvement in adjusted diluted earnings per share throughout 2017 apart from any impact of additional allowances on receivables from one customer Free cash flow(1): $50M to $70M Interest expense: ~$3M higher than 2016 Effective tax rate: ~40% Capex: similar to 2016 Workdays: 253 in 2017 (64 in Q1 and Q2, 63 in Q3, and 62 in Q4) vs. 254 in 2016 (1) For a definition and reconciliation of non-GAAP adjustments, please see appendix.

Appendix

11 The Non-GAAP table below presents Adjusted Operating Expenses, Adjusted Operating Income, Adjusted Net Income, Adjusted Diluted Earnings per Share, Adjusted EBITDA and Free Cash Flow for the three months ended March 31, 2017 and 2016. These non-GAAP measures exclude certain non-recurring items and exclude other items that do not reflect the Company’s ongoing operations and are included to provide investors with useful information about the financial performance of our business. The presented non-GAAP financial measures should not be considered in isolation or as substitutes for the comparable GAAP financial measures. The non-GAAP financial measures do not reflect all of the amounts associated with our results of operations as determined in accordance with GAAP, and these non-GAAP financial measures should only be used to evaluate our results of operations in conjunction with the corresponding GAAP financial measures. In order to calculate the non-GAAP measures, management excludes the following items to the extent they occur in the reporting period, to facilitate the comparison of current and prior year results and ongoing operations, as management believes these items do not reflect the underlying cost structure of our business. These items can vary significantly in amount and frequency. Restructuring charges. Workforce reduction and facility closure charges such as employee termination costs, facility closure and consolidation costs, and other costs directly associated with shifting business strategies or business conditions that are part of a restructuring program. Restructuring actions were taken in 2015 to improve our operational utilization, labor spend, inventory performance and functional alignment of the organization. This included workforce reductions and facility consolidations with an expense impact of $0.3 million in the first quarter of 2016. Gain or loss on sale of assets or businesses. Sales of assets, such as buildings or equipment, and businesses can cause gains or losses. These transactions occur as the Company is repositioning its business and reviewing its cost structure. Severance costs for operating leadership. Employee termination costs related to members of the Company’s operating leadership team are excluded as they are based upon individual agreements. Asset impairments. Changes in strategy or macroeconomic events may cause asset impairments. In the quarter ended March 31, 2017, the Company recorded impairment of goodwill of $198.8 million, based on a decline in market capitalization. Other actions. Actions, which may be non-recurring events, that result from the changing strategies and needs of the Company and do not reflect the underlying expense of the on-going business. These include charges related to litigation totaling $6.0 million and transformational consultancy expenses totaling $3.0 million. Essendant Inc. and Subsidiaries Reconciliation of Non-GAAP Financial Measures Adjusted Operating Expenses, Adjusted Operating Income, Adjusted Net Income, Adjusted Diluted Earnings Per Share, Adjusted EBITDA, and Free Cash Flow

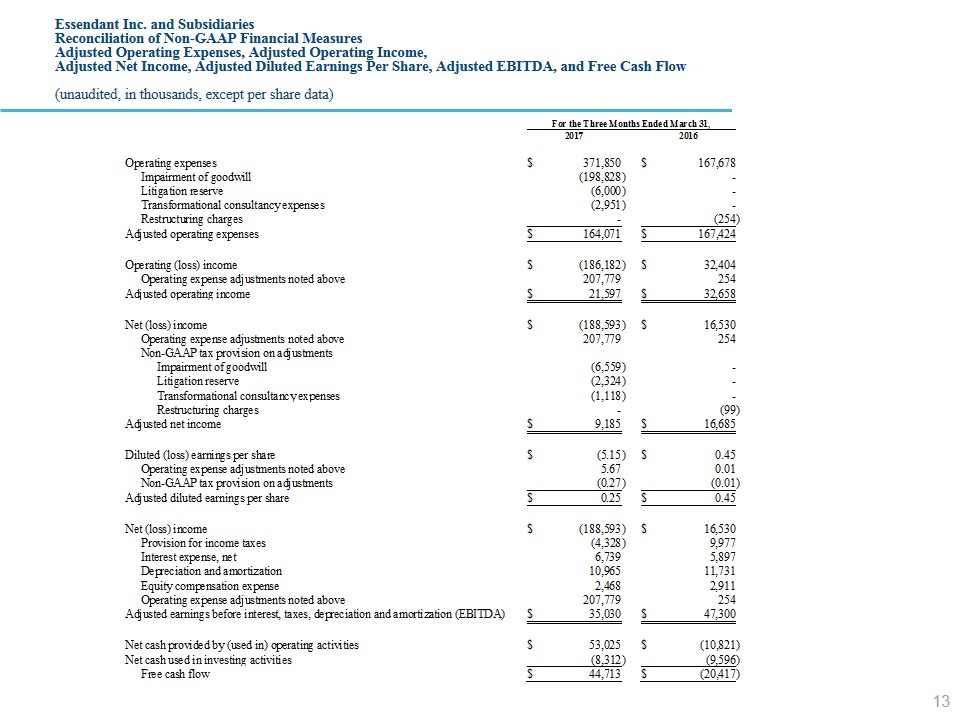

12 Adjusted operating expenses and adjusted operating income. Adjusted operating expenses and adjusted operating income provide management and our investors with an understanding of the results from the primary operations of our business by excluding the effects of items described above that do not reflect the ordinary expenses and earnings of our operations. Adjusted operating expenses and adjusted operating income are used to evaluate our period-over-period operating performance as they are more comparable measures of our continuing business. These measures may be useful to an investor in evaluating the underlying operating performance of our business. Adjusted net income and adjusted diluted earnings per share. Adjusted net income and adjusted diluted earnings per share provide a more comparable view of our Company’s underlying performance and trends than the comparable GAAP measures. Net income and diluted earnings per share are adjusted for the effect of items described above that do not reflect the ordinary earnings of our operations. Adjusted earnings before interest, taxes, depreciation and amortization (EBITDA). Adjusted EBITDA is helpful in evaluating our operating performance and is used by management for various purposes, including as a measure of performance and as a basis for strategic planning and forecasting. Net income is adjusted for the effect of interest, taxes, depreciation and amortization and stock-based compensation expense. Management believes that adjusted EBITDA is also commonly used by investors to evaluate operating performance between competitors because it helps reduce variability caused by differences in capital structures, income taxes, stock-based compensation accounting policies, and depreciation and amortization policies. Free cash flow. Free cash flow is useful to management and our investors as it is a measure of the Company’s liquidity. It provides a more complete understanding of factors and trends affecting our cash flows than the comparable GAAP measure. Net cash provided by (used in) operating activities and net cash provided by (used in) investing activities are aggregated and adjusted to exclude the impact of acquisitions, net of cash acquired and divestitures. Outlook. Adjusted diluted earnings per share and free cash flow are non-GAAP measures. A quantitative reconciliation of our non-GAAP guidance to the corresponding GAAP information is not available because the non-GAAP guidance excludes certain GAAP information that is uncertain and difficult to predict. The adjusted diluted EPS guidance excludes expenses in the first three months of 2017 of $(5.40) per share related to goodwill impairment, litigation charges and transformational consultancy expenses. Actual amounts for these expenses appear in the non-GAAP table included later in this section. For the remainder of the year, the factors that will be excluded are currently unknown due to the level of unpredictability and uncertainty associated with these items, but may include actions such as future restructuring charges, gain or loss on future sales of assets or businesses, cash flow impacts of acquisitions, and other actions. Essendant Inc. and Subsidiaries Reconciliation of Non-GAAP Financial Measures Adjusted Operating Expenses, Adjusted Operating Income, Adjusted Net Income, Adjusted Diluted Earnings Per Share, Adjusted EBITDA, and Free Cash Flow

13 Essendant Inc. and Subsidiaries Reconciliation of Non-GAAP Financial Measures Adjusted Operating Expenses, Adjusted Operating Income, Adjusted Net Income, Adjusted Diluted Earnings Per Share, Adjusted EBITDA, and Free Cash Flow (unaudited, in thousands, except per share data)