Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - AMERICAN CAMPUS COMMUNITIES INC | ex991-q12017earningsrelease.htm |

| 8-K - 8-K - AMERICAN CAMPUS COMMUNITIES INC | form8-kq12017earningsrelea.htm |

Supplemental

Analyst Package

1Q 2017

April 24, 2017

Table of Contents

Financial Highlights 1

Consolidated Balance Sheets 2

Consolidated Statements of Comprehensive Income 3

Consolidated Statements of Funds from Operations 4

Wholly-Owned Properties Results of Operations 5

Same Store Wholly-Owned Properties Operating Expenses 6

Seasonality of Operations 7

2017 / 2018 Leasing Status 8

Investment Update 9

Owned Development Update 10

Third-Party Development Update 11

Management Services Update 12

Capital Structure 13

Interest Coverage 14

Capital Allocation – Long Term Funding Plan 15

2017 Outlook - Summary 16

2017 Outlook – Detail 17

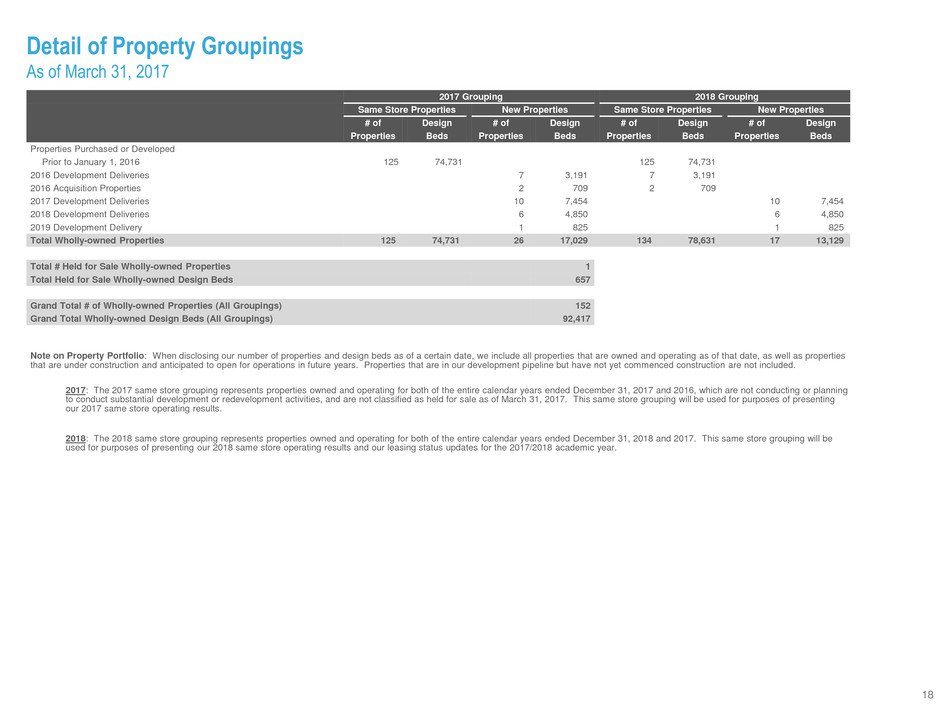

Detail of Property Groupings 18

Definitions 19

Investor Information 21

Financial Highlights

($ in thousands, except share and per share data)

1

Operating Data Three Months Ended March 31,

2017 2016 $ Change % Change

Total revenues $ 192,938 $ 199,995 $ (7,057 ) (3.5 )%

Operating income 49,219 53,035 (3,816 ) (7.2 )%

Net income attributable to ACC1 34,050 45,587 (11,537 ) (25.3 )%

Net income per share - basic 0.25 0.37

Net income per share - diluted 0.25 0.36

Funds From Operations ("FFO")2 85,967 81,846 4,121 5.0 %

FFO per share - diluted2 0.64 0.65 (0.01 ) (1.5 )%

Funds From Operations - Modified ("FFOM")2 83,180 78,168 5,012 6.4 %

FFOM per share - diluted2 0.62 0.62 — — %

Market Capitalization and Unsecured Notes Covenants3 March 31, 2017 December 31, 2016

Debt to total market capitalization 25.4% 24.1%

Net debt to EBITDA4 5.6x 5.4x

Unencumbered asset value to total asset value 81.5% 81.0%

Total debt to total asset value 31.7% 31.3%

Secured debt to total asset value 9.6% 9.8%

Unencumbered asset value to unsecured debt 367.9% 378.2%

Interest coverage4 4.9x 4.5x

1. Excluding net gains from dispositions of real estate, net income attributable to ACC for the three months ended March 31, 2016 would have been $28.2 million.

2. Refer to page 4 for a reconciliation to net income, the most directly comparable GAAP measure.

3. Refer to the definitions outlined on pages 19 and 20 for detailed definitions of terms appearing on this page.

4. Refer to calculations on page 14, including a reconciliation to net income and interest expense, the most directly comparable GAAP measures.

Consolidated Balance Sheets

($ in thousands)

2

March 31, 2017 December 31, 2016

(unaudited)

Assets

Investments in real estate:

Wholly-owned properties, net $ 5,541,499 $ 5,427,014

Wholly-owned properties held for sale 25,381 25,350

On-campus participating properties, net 84,146 85,797

Investments in real estate, net 5,651,026 5,538,161

Cash and cash equivalents 34,130 22,140

Restricted cash 24,386 24,817

Student contracts receivable, net 7,781 8,428

Other assets1 270,643 272,367

Total assets $ 5,987,966 $ 5,865,913

Liabilities and equity

Liabilities:

Secured mortgage, construction and bond debt $ 683,945 $ 688,195

Unsecured notes 1,189,256 1,188,737

Unsecured term loans 149,120 149,065

Unsecured revolving credit facility 186,000 99,300

Accounts payable and accrued expenses 48,510 76,614

Other liabilities2 173,961 158,437

Total liabilities 2,430,792 2,360,348

Redeemable noncontrolling interests 55,665 55,078

Equity:

American Campus Communities, Inc. and

Subsidiaries stockholders' equity:

Common stock 1,336 1,322

Additional paid in capital 4,183,758 4,118,842

Treasury stock (1,223 ) (975 )

Accumulated earnings and dividends (692,510 ) (670,137 )

Accumulated other comprehensive loss (3,583 ) (4,067 )

Total American Campus Communities, Inc. and

3,487,778 3,444,985 Subsidiaries stockholders' equity

Noncontrolling interests - partially owned properties 13,731 5,502

Total equity 3,501,509 3,450,487

Total liabilities and equity $ 5,987,966 $ 5,865,913

1. As of March 31, 2017, other assets include approximately $6.8 million related to net deferred financing costs on our revolving credit facility and the net value of in-place leases.

2. As of March 31, 2017, other liabilities include approximately $42.0 million in deferred revenue and fee income.

Consolidated Statements of Comprehensive Income

(Unaudited, $ in thousands, except share and per share data)

3

Three Months Ended March 31,

2017 2016 $ Change

Revenues

Wholly-owned properties $ 178,831 $ 185,702 $ (6,871 )

On-campus participating properties 10,158 10,046 112

Third-party development properties 456 1,035 (579 )

Third-party management services 2,614 2,410 204

Resident services 879 802 77

Total revenues 192,938 199,995 (7,057 )

Operating expenses

Wholly-owned properties 74,957 78,851 (3,894 )

On-campus participating properties 3,265 3,042 223

Third-party development and management services 4,083 3,738 345

General and administrative1 6,734 5,309 1,425

Depreciation and amortization 52,323 53,716 (1,393 )

Ground/facility leases 2,357 2,304 53

Total operating expenses 143,719 146,960 (3,241 )

Operating income 49,219 53,035 (3,816 )

Nonoperating income and (expenses)

Interest income 1,232 1,279 (47 )

Interest expense (14,717 ) (22,627 ) 7,910

Amortization of deferred financing costs (1,028 ) (2,542 ) 1,514

Gain from disposition of real estate — 17,409 (17,409 )

Total nonoperating expense (14,513 ) (6,481 ) (8,032 )

Income before income taxes 34,706 46,554 (11,848 )

Income tax provision (257 ) (345 ) 88

Net income 34,449 46,209 (11,760 )

Net income attributable to noncontrolling interests (399 ) (622 ) 223

Net income attributable to ACC, Inc. and

$ 34,050 $ 45,587 $ (11,537 ) Subsidiaries common stockholders

Other comprehensive income (loss)

Change in fair value of interest rate swaps and other 484 (1,410 ) 1,894

Comprehensive income $ 34,534 $ 44,177 $ (9,643 )

Net income per share attributable to ACC, Inc.

and Subsidiaries common stockholders

Basic $ 0.25 $ 0.37

Diluted $ 0.25 $ 0.36

Weighted-average common shares outstanding

Basic 133,052,444 123,445,985

Diluted 133,986,322 124,266,312

1. Includes $1.1 million of contractual executive separation and retirement charges incurred with regards to the retirement of the company's Chief Financial Officer.

Consolidated Statements of Funds from Operations

(Unaudited, $ in thousands, except share and per share data)

4

1. 50% of the properties’ net cash available for distribution after payment of operating expenses, debt service (including repayment of principal) and capital expenditures. Represents actual amounts

accrued for the interim periods, which is included in ground/facility leases expense in the consolidated statements of comprehensive income (refer to page 3).

2. Represents contractual executive separation and retirement charges incurred with regards to the retirement of the company's Chief Financial Officer, to be recognized in the first and second quarter of

2017.

Three Months Ended March 31,

2017 2016 $ Change

Net income attributable to ACC, Inc. and

$ 34,050 $ 45,587 $ (11,537 ) Subsidiaries common stockholders

Noncontrolling interests 399 622 (223 )

Gain from disposition of real estate — (17,409 ) 17,409

Real estate related depreciation and amortization 51,518 53,046 (1,528 )

Funds from operations ("FFO") attributable to

85,967 81,846 4,121 common stockholders and OP unitholders

Elimination of operations of on-campus participating properties

Net income from on-campus participating properties (3,247 ) (3,164 ) (83 )

Amortization of investment in on-campus participating properties (1,860 ) (1,823 ) (37 )

80,860 76,859 4,001

Modifications to reflect operational performance of on-campus

participating properties

Our share of net cashflow1 757 850 (93 )

Management fees 468 459 9

Contribution from on-campus participating properties 1,225 1,309 (84 )

Contractual executive separation and retirement charges2 1,095 — 1,095

Funds from operations-modified ("FFOM") attributable to

$ 83,180 $ 78,168 $ 5,012 common stockholders and OP unitholders

FFO per share - diluted $ 0.64 $ 0.65

FFOM per share - diluted $ 0.62 $ 0.62

Weighted-average common shares outstanding - diluted 135,092,966 125,679,948

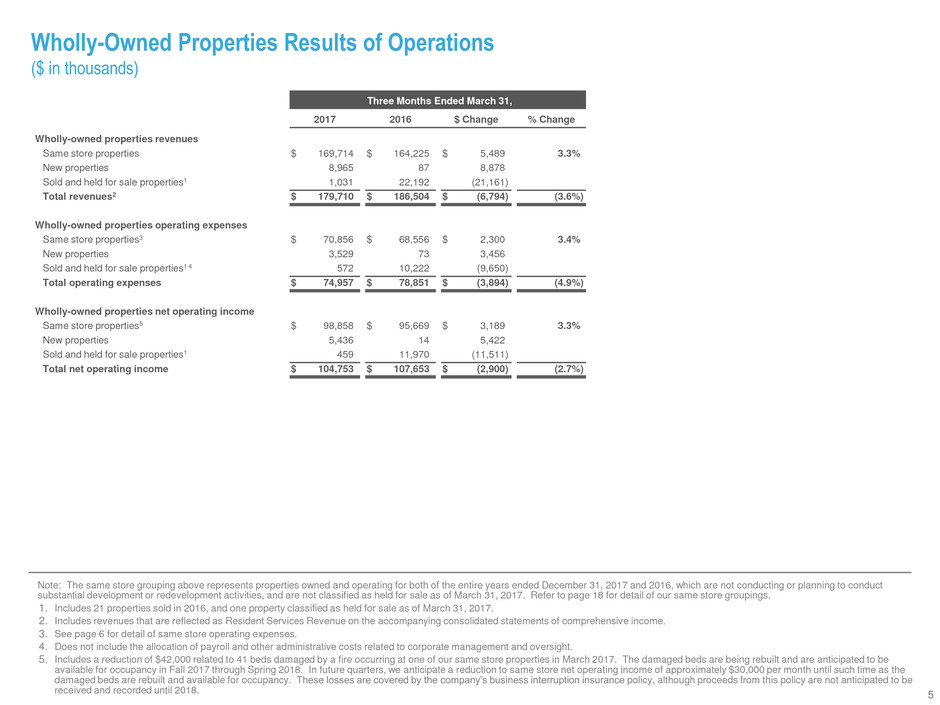

Wholly-Owned Properties Results of Operations

($ in thousands)

5

Three Months Ended March 31,

2017 2016 $ Change % Change

Wholly-owned properties revenues

Same store properties $ 169,714 $ 164,225 $ 5,489 3.3 %

New properties 8,965 87 8,878

Sold and held for sale properties1 1,031 22,192 (21,161 )

Total revenues2 $ 179,710 $ 186,504 $ (6,794 ) (3.6 %)

Wholly-owned properties operating expenses

Same store properties3 $ 70,856 $ 68,556 $ 2,300 3.4 %

New properties 3,529 73 3,456

Sold and held for sale properties1 4 572 10,222 (9,650 )

Total operating expenses $ 74,957 $ 78,851 $ (3,894 ) (4.9 %)

Wholly-owned properties net operating income

Same store properties5 $ 98,858 $ 95,669 $ 3,189 3.3 %

New properties 5,436 14 5,422

Sold and held for sale properties1 459 11,970 (11,511 )

Total net operating income $ 104,753 $ 107,653 $ (2,900 ) (2.7 %)

Note: The same store grouping above represents properties owned and operating for both of the entire years ended December 31, 2017 and 2016, which are not conducting or planning to conduct

substantial development or redevelopment activities, and are not classified as held for sale as of March 31, 2017. Refer to page 18 for detail of our same store groupings.

1. Includes 21 properties sold in 2016, and one property classified as held for sale as of March 31, 2017.

2. Includes revenues that are reflected as Resident Services Revenue on the accompanying consolidated statements of comprehensive income.

3. See page 6 for detail of same store operating expenses.

4. Does not include the allocation of payroll and other administrative costs related to corporate management and oversight.

5. Includes a reduction of $42,000 related to 41 beds damaged by a fire occurring at one of our same store properties in March 2017. The damaged beds are being rebuilt and are anticipated to be

available for occupancy in Fall 2017 through Spring 2018. In future quarters, we anticipate a reduction to same store net operating income of approximately $30,000 per month until such time as the

damaged beds are rebuilt and available for occupancy. These losses are covered by the company’s business interruption insurance policy, although proceeds from this policy are not anticipated to be

received and recorded until 2018.

Same Store Wholly-Owned Properties Operating Expenses

($ in thousands, except per bed amounts)

6

Three Months Ended March 31,

2017 2016

Total Per Bed

% Change

From Prior

Year

% of Total

Operating

Expenses Total Per Bed

% of Total

Operating

Expenses

Property taxes $ 16,404 $ 219 4.3 % 23 % $ 15,730 $ 211 23 %

Utilities1 16,058 215 2.9 % 23 % 15,602 209 23 %

General & administrative and other2 15,392 206 1.2 % 21 % 15,208 203 22 %

Payroll3 13,855 185 3.0 % 20 % 13,449 180 20 %

Repairs and maintenance4 4,654 62 5.6 % 7 % 4,406 59 6 %

Marketing5 2,885 39 13.0 % 4 % 2,553 34 4 %

Insurance 1,608 22 — % 2 % 1,608 22 2 %

Total same store wholly-owned operating expenses $ 70,856 $ 948 3.4 % 100 % $ 68,556 $ 918 100 %

Same store wholly-owned beds6 74,717

Note: The same store grouping above represents properties owned and operating for both of the entire years ended December 31, 2017 and 2016, which are not conducting or planning to conduct substantial

development or redevelopment activities, and are not classified as held for sale as of March 31, 2017. Refer to page 18 for detail of our same store groupings.

1. Represents gross expenses prior to any recoveries from tenants, which are reflected in wholly-owned properties revenues.

2. Includes security costs, shuttle costs, and property-level general and administrative costs as well as an allocation of costs related to corporate management and oversight. Also includes acquisition integration

costs, bad debt, food service, and other miscellaneous expenses.

3. Includes payroll and related expenses for on-site personnel including general managers, maintenance staff, and leasing staff.

4. Includes general maintenance costs such as interior painting, routine landscaping, pest control, fire protection, snow removal, elevator maintenance, roof and parking lot repairs, and other miscellaneous

building repair costs. Also includes costs related to the annual turn process. The increase over the prior year period is above our budgeted expectations, and is primarily attributable to insurance deductibles

related to non-routine occurrences at certain properties.

5. Includes costs related to property marketing campaigns associated with our ongoing leasing efforts. The increase over the prior year period is above our budgeted expectations, and is primarily due to

increases in marketing activities at various markets that are experiencing a slower lease-up due to new supply.

6. Excludes the weighted average effect for the quarter of 41 beds damaged by a fire that occurred at one of our same store properties in March 2017.

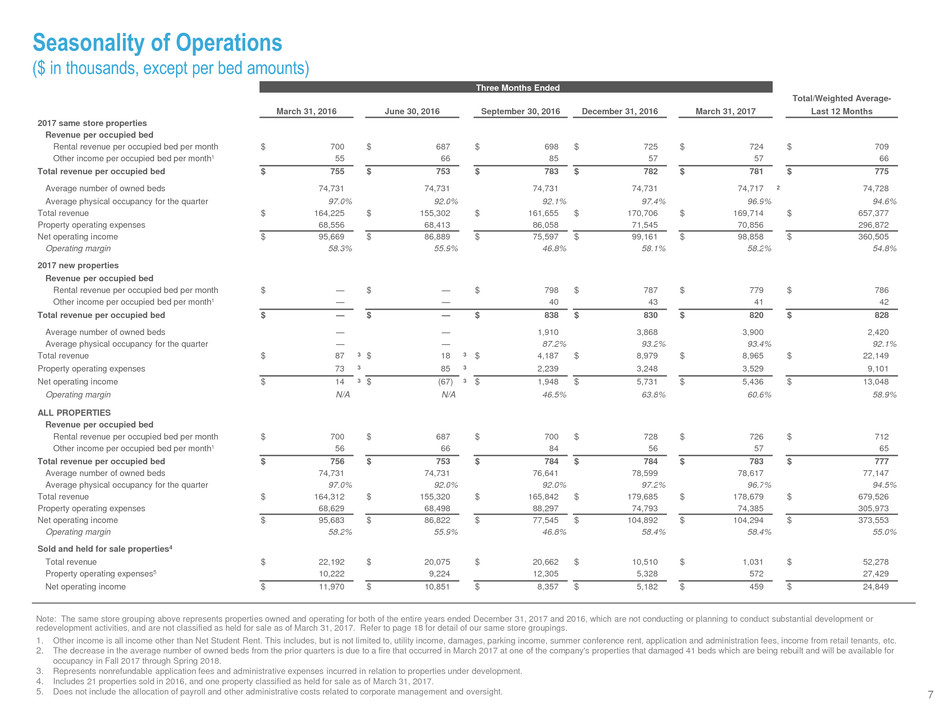

Seasonality of Operations

($ in thousands, except per bed amounts)

7

Three Months Ended

Total/Weighted Average-

March 31, 2016 June 30, 2016 September 30, 2016 December 31, 2016 March 31, 2017 Last 12 Months

2017 same store properties

Revenue per occupied bed

Rental revenue per occupied bed per month $ 700 $ 687 $ 698 $ 725 $ 724 $ 709

Other income per occupied bed per month1 55 66 85 57 57 66

Total revenue per occupied bed $ 755 $ 753 $ 783 $ 782 $ 781 $ 775

Average number of owned beds 74,731 74,731 74,731 74,731 74,717 2 74,728

Average physical occupancy for the quarter 97.0 % 92.0 % 92.1 % 97.4 % 96.9 % 94.6 %

Total revenue $ 164,225 $ 155,302 $ 161,655 $ 170,706 $ 169,714 $ 657,377

Property operating expenses 68,556 68,413 86,058 71,545 70,856 296,872

Net operating income $ 95,669 $ 86,889 $ 75,597 $ 99,161 $ 98,858 $ 360,505

Operating margin 58.3 % 55.9 % 46.8 % 58.1 % 58.2 % 54.8 %

2017 new properties

Revenue per occupied bed

Rental revenue per occupied bed per month $ — $ — $ 798 $ 787 $ 779 $ 786

Other income per occupied bed per month1 — — 40 43 41 42

Total revenue per occupied bed $ — $ — $ 838 $ 830 $ 820 $ 828

Average number of owned beds — — 1,910 3,868 3,900 2,420

Average physical occupancy for the quarter — — 87.2 % 93.2 % 93.4 % 92.1 %

Total revenue $ 87 3 $ 18 3 $ 4,187 $ 8,979 $ 8,965 $ 22,149

Property operating expenses 73 3 85 3 2,239 3,248 3,529 9,101

Net operating income $ 14 3 $ (67 ) 3 $ 1,948 $ 5,731 $ 5,436 $ 13,048

Operating margin N/A N/A 46.5 % 63.8 % 60.6 % 58.9 %

ALL PROPERTIES

Revenue per occupied bed

Rental revenue per occupied bed per month $ 700 $ 687 $ 700 $ 728 $ 726 $ 712

Other income per occupied bed per month1 56 66 84 56 57 65

Total revenue per occupied bed $ 756 $ 753 $ 784 $ 784 $ 783 $ 777

Average number of owned beds 74,731 74,731 76,641 78,599 78,617 77,147

Average physical occupancy for the quarter 97.0 % 92.0 % 92.0 % 97.2 % 96.7 % 94.5 %

Total revenue $ 164,312 $ 155,320 $ 165,842 $ 179,685 $ 178,679 $ 679,526

Property operating expenses 68,629 68,498 88,297 74,793 74,385 305,973

Net operating income $ 95,683 $ 86,822 $ 77,545 $ 104,892 $ 104,294 $ 373,553

Operating margin 58.2 % 55.9 % 46.8 % 58.4 % 58.4 % 55.0 %

Sold and held for sale properties4

Total revenue $ 22,192 $ 20,075 $ 20,662 $ 10,510 $ 1,031 $ 52,278

Property operating expenses5 10,222 9,224 12,305 5,328 572 27,429

Net operating income $ 11,970 $ 10,851 $ 8,357 $ 5,182 $ 459 $ 24,849

Note: The same store grouping above represents properties owned and operating for both of the entire years ended December 31, 2017 and 2016, which are not conducting or planning to conduct substantial development or

redevelopment activities, and are not classified as held for sale as of March 31, 2017. Refer to page 18 for detail of our same store groupings.

1. Other income is all income other than Net Student Rent. This includes, but is not limited to, utility income, damages, parking income, summer conference rent, application and administration fees, income from retail tenants, etc.

2. The decrease in the average number of owned beds from the prior quarters is due to a fire that occurred in March 2017 at one of the company's properties that damaged 41 beds which are being rebuilt and will be available for

occupancy in Fall 2017 through Spring 2018.

3. Represents nonrefundable application fees and administrative expenses incurred in relation to properties under development.

4. Includes 21 properties sold in 2016, and one property classified as held for sale as of March 31, 2017.

5. Does not include the allocation of payroll and other administrative costs related to corporate management and oversight.

2017 / 2018 Leasing Status

8

Current Year Prior Year

Applications + Rentable % of Rentable % of Rentable Design Final Fall 2016

Applications + Leases Leases1 Beds2 Beds Beds Beds Occupancy3

2018 Same Store Wholly-owned Properties

Final Fall 2016 occupancy of 98% or greater 47,867 53,032 90.3% 92.2% 53,154 99.8%

Final Fall 2016 occupancy between 95% and 98% 7,280 9,055 80.4% 83.6% 9,086 96.9%

Final Fall 2016 occupancy less than 95% 10,996 16,281 67.5% 62.2% 16,391 88.5%

Total 2018 Same Store Wholly-owned Properties 66,143 78,368 84.4% 85.0%4 78,631 97.1%

New Wholly-owned Properties5 5,098 7,979 63.9% n/a 8,052 n/a

Total - Wholly-owned Properties 71,241 86,347 82.5% n/a 86,683 n/a

Current Year Prior Year Initial Current

Rentable % of Rentable % of Rentable Design Final Fall 2016 Projected Rate Projected Rate

Leases Leases1 Beds2 Beds Beds Beds Occupancy3 Increase Increase6

2018 Same Store Wholly-owned Properties

Final Fall 2016 occupancy of 98% or greater 44,879 53,032 84.6% 85.9% 53,154 99.8%

Final Fall 2016 occupancy between 95% and 98% 6,711 9,055 74.1% 76.1% 9,086 96.9%

Final Fall 2016 occupancy less than 95% 10,071 16,281 61.9% 56.0% 16,391 88.5%

Total 2018 Same Store Wholly-owned Properties 61,661 78,368 78.7% 78.6%4 78,631 97.1% 2.9% 2.9%

New Wholly-owned Properties5 4,409 7,979 55.3% n/a 8,052 n/a n/a n/a

Total - Wholly-owned Properties 66,070 86,347 76.5% n/a 86,683 n/a 2.9% 2.9%

Note: The same store grouping presented above for purposes of disclosing the pre-leasing status for the upcoming 2017/2018 academic year represents properties that will be classified as same store

properties in 2018. Refer to page 18 for detail of our same store groupings.

1. As of April 21, 2017 for current year and April 21, 2016 for prior year.

2. Rentable beds exclude beds needed for on-site staff.

3. As of September 30, 2016.

4. Properties not owned or under ACC management during the prior year, or properties whose leasing progress is not comparable to the prior year as a result of plans to renovate or redevelop the

property, are excluded for purposes of calculating the prior year percentage of rentable beds.

5. Includes 2017 development deliveries, and one property acquired in April 2017 as disclosed on page 9.

6. Projected rate increase reflects projected rental rates anticipated to be achieved through the end of the company's leasing cycle, up to targeted occupancy.

Investment Update

($ in thousands)

9

ACQUISITIONS

Assumed

Project Location Primary University Served Beds Closing Date Purchase Price Mortgage Debt

The Arlie Arlington, TX University of Texas Arlington 598 April 5, 2017 $ 46,000 $ —

HELD FOR SALE1

Anticipated

Project Location Primary University Served Beds Closing Date2

The Province - Dayton Dayton, OH Wright State University 657 Q2 2017

1. This property met all necessary criteria required to be classified as held for sale under generally accepted accounting principles (GAAP) as of December 31, 2016. Concurrent with this classification, this property

was recorded at the lower of cost or fair value less estimated selling costs. The net book value of this property is included in wholly-owned properties held for sale on the consolidated balance sheet

as of March 31, 2017 (refer to page 2).

2. The closing of the transaction is subject to the satisfaction of various contingencies and closing conditions.

Owned Development Update

($ in thousands)

10

OWNED DEVELOPMENT PROJECTS UNDER CONSTRUCTION

As of March 31, 2017

Project Estimated Land and Total Costs Scheduled

Project Location Primary University Served Type Beds Project Cost1 CIP2 Other3 Incurred Completion

Tooker House Tempe, AZ Arizona State University ACE 1,594 $ 107,800 $ 81,487 $ 1,225 $ 82,712 August 2017

Sky View Flagstaff, AZ Northern Arizona University ACE 626 56,600 41,044 610 41,654 August 2017

University Square Prairie View, TX Prairie View A&M University ACE 466 26,800 21,020 284 21,304 August 2017

U Centre on Turner Columbia, MO University of Missouri Off-campus 718 69,100 43,474 14,675 58,149 August 2017

U Pointe on Speight Waco, TX Baylor University Off-campus 700 49,800 30,380 5,156 35,536 August 2017

21Hundred @ Overton Park Lubbock, TX Texas Tech University Off-campus 1,204 81,600 51,770 17,722 69,492 August 2017

Suites at 3rd Champaign, IL University of Illinois Off-campus 251 25,000 14,716 996 15,712 August 2017

U Club Binghamton Phase II Binghamton, NY SUNY Binghamton University Off-campus 562 55,800 31,320 12,622 43,942 August 2017

Callaway House Apartments Norman, OK University of Oklahoma Off-campus 915 89,100 52,023 13,394 65,417 August 2017

U Centre on College Clemson, SC Clemson University Off-campus 418 41,500 33,662 275 33,937 August 2017

SUBTOTAL - 2017 DELIVERIES 7,454 $ 603,100 $ 400,896 $ 66,959 $ 467,855

Virginia Commonwealth Univ. Richmond, VA Virginia Commonwealth Univ. ACE 1,524 $ 95,700 $ 25,175 $ — $ 25,175 August 2018

Schwitzer Hall Indianapolis, IN Butler University ACE 648 38,900 4,432 — 4,432 August 2018

Greek Leadership Village Tempe, AZ Arizona State University ACE 957 69,600 8,793 — 8,793 August 2018

Bancroft Residence Hall Berkeley, CA University of California, Berkeley ACE 781 98,700 18,313 — 18,313 August 2018

NAU Honors College Flagstaff, AZ Northern Arizona University ACE 636 43,400 — 4,401 4,401 August 2018

U Club Townhomes Oxford, MS University of Mississippi Off-campus 528 44,300 1,974 5,115 7,089 August 2018

SUBTOTAL - 2018 DELIVERIES 5,074 $ 390,600 $ 58,687 $ 9,516 $ 68,203

Columbus Avenue Student Apts. Boston, MA Northeastern University ACE 825 $ 153,400 $ 11,670 $ — $ 11,670 August 2019

SUBTOTAL - 2019 DELIVERIES 825 $ 153,400 $ 11,670 $ — $ 11,670

PRESALE DEVELOPMENT PROJECT UNDER CONSTRUCTION

As of March 31, 2017

Project Estimated Land and Total Costs Scheduled

Project Location Primary University Served Type Beds Project Cost CIP2 Other3 Incurred Completion

The Edge - Stadium Centre4 Tallahassee, FL Florida State University Off-campus 412 $ 42,600 $ 7,629 $ 472 $ 8,101 August 2018

OWNED DEVELOPMENT PIPELINE5

Project Anticipated Approx. Estimated Targeted

Project Location Primary University Served Type Commencement Targeted Beds Project Cost1 6 Completion

Carbondale Development Carbondale, IL Southern Illinois University Off-campus TBD 650 $ 32,000 TBD

1. In certain instances at ACE properties, the company agrees to construct spaces within the property that will ultimately be owned, managed, and funded by the universities. Such spaces include but are not limited to dining, childcare, retail,

academic, and office facilities. The Estimated Project Cost excludes the costs of the construction of such facilities, as they will be reimbursed by the universities.

2. The total construction in progress (―CIP‖) balance above excludes $11.6 million related to ongoing renovation projects at operating properties.

3. Consists of amounts incurred to purchase the land for off-campus development projects, as well as other development-related expenditures not included in CIP such as deposits, furniture, etc.

4. In December 2016, the company entered into a pre-sale agreement to purchase The Edge - Stadium Centre, a property which will be completed in August 2018. The company is obligated to purchase the property as long as certain construction

completion deadlines and other closing conditions are met. The company is responsible for leasing, management, and initial operations of the project while the third-party developer retains development risk during the construction period. In

accordance with accounting guidance, the company is including this property in its consolidated financial statements. Estimated project cost includes purchase price, elected upgrades and transaction costs.

5. Does not include land parcels in eight university markets totaling $50.1 million. Commencement of owned off-campus development projects is subject to final determination of feasibility, execution and closing on definitive agreements, municipal

approval processes, fluctuations in the construction market, and current capital market conditions. ACE awards provide the company with the opportunity to exclusively negotiate with the subject universities. Commencement of ACE projects is

subject to various levels of university board approval, final determination of feasibility, execution and closing on definitive agreements, municipal approval processes, fluctuations in the construction market, and current capital market conditions.

6. Estimated Project Cost includes land and other predevelopment costs of $4.1 million incurred as of March 31, 2017 for owned development pipeline projects.

Third-Party Development Update

($ in thousands)

11

Three Months Ended March 31,

2017 2016 $ Change

Development services revenue $ 456 $ 1,035 $ (579 )

% of total revenue 0.2 % 0.5 %

CONTRACTED PROJECTS IN PROGRESS

Fees Earned Fees Remaining Fees

as of Earned in as of Scheduled

Project Location Primary University Served Beds Total Fees March 31, 2017 Current Year March 31, 2017 Completion

Momentum Village Phase II Corpus Christi, TX Texas A&M University Corpus Christi 560 $ 2,300 $ 1,847 $ 267 $ 453 August 2017

Esperanza Hall San Antonio, TX Texas A&M University San Antonio 382 1,100 873 138 227 August 2017

942 $ 3,400 $ 2,720 $ 405 $ 680

1. These awards relate to speculative development projects that are subject to final determination of feasibility, negotiation, final award, procurement rules and other applicable law, execution and closing of

definitive agreements on terms acceptable to the company, and fluctuations in the construction and financing markets. Anticipated commencement and fees are dependent upon the availability of project

financing, which is affected by current capital market conditions.

2. Under the terms of a Consultant Agreement, and with the consent of the University’s Board of Regents, the company will earn fees for the performance of advisory services related to a not-for-profit entity’s

purchase of a 1,790-bed apartment community for the benefit of the University.

3. The University of Arizona Honors College project includes the construction of office facilities and a student recreation and wellness center as part of the overall development project. These components will be

owned, managed and funded by the University, and the company anticipates earning third-party development fees for its role in providing development services for those components of the project.

ON-CAMPUS AWARD PIPELINE1

Anticipated Anticipated Targeted Estimated

Project Location Financing Structure Commencement Completion Fees

Texas A&M University Corpus Christi2 Corpus Christi, TX Third-party n/a 2017/2018 $1,400

Northern Kentucky University Highland Heights, KY Third-party Q4 2017/Q1 2018 Fall 2019 TBD

University of Illinois - Chicago Chicago, IL Third-party Q4 2017/Q1 2018 Fall 2019 TBD

University of California Irvine Phase IV Irvine, CA Third-party Q3/Q4 2017 Fall 2019 TBD

Louisville Village Site Louisville, KY ACE TBD Fall 2019 n/a

University of Arizona Honors College3 Tucson, AZ ACE TBD Fall 2019 n/a

University of Arizona Honors College Tucson, AZ Third-party TBD Fall 2019 TBD

Office and Student Center3

Management Services Update

($ in thousands)

12

Three Months Ended March 31,

2017 2016 $ Change

Management services revenue $ 2,614 $ 2,410 $ 204

% of total revenue 1.4 % 1.2 %

NEW / PENDING MANAGEMENT CONTRACTS

Actual or

Approximate Stabilized Anticipated

Project Location Primary University Served Beds Annual Fees1 Commencement

Momentum Village Phase II Corpus Christi, TX Texas A&M University Corpus Christi 560 $ 180 August 2017

Esperanza Hall San Antonio, TX Texas A&M University San Antonio 382 100 August 2017

Collegeview Commons Phase II Ontario, Canada Conestoga College 513 50 September 2017

CampusOne2 Toronto, Canada University of Toronto 892 291 September 2017

Texas A&M University Corpus Christi Corpus Christi, TX Texas A&M University Corpus Christi 1,790 480 2017/2018

4,137 $ 1,101

DISCONTINUED MANAGEMENT CONTRACTS

2017 Fee

Contribution

Prior to

Project Location Primary University Served Beds Termination Discontinued As Of

Saban Real Estate Group3 Various Various 7,060 $ 278 March 2017

1. Stabilized annual fees are dependent upon the achievement of anticipated occupancy levels.

2. The stabilized annual fee amount does not include an initial operations fee of $60,000 anticipated to be earned from February 2017 through August 2017. Subsequent to August 2017, the stabilized

annual fee is anticipated to be approximately $291,000 per year.

3. In November 2016, the company sold a portfolio of 19 properties to Saban Real Estate Group. The company continued to manage 11 of the properties during a transition period subsequent to the

sale for up to five months. The transition period concluded on March 31, 2017.

Capital Structure as of March 31, 2017

($ in millions, except per share data)

13

Market Capitalization & Unsecured Notes Covenants Debt Maturity Schedule

Total Debt1 $ 2,199

Total Equity Market Value2 6,455

Total Market Capitalization $ 8,654

Debt to Total Market Capitalization 25.4%

Net Debt to EBITDA3 5.6x

Total Asset Value4 $ 6,930

Unencumbered Asset Value $ 5,650

Unencumbered Asset Value to Total Asset Value 81.5%

Requirement Current Ratio

Total Debt to Total Asset Value ≤ 60% 31.7%

Secured Debt to Total Asset Value ≤ 40% 9.6%

Unencumbered Asset Value to Unsecured Debt > 150% 367.9%

Interest Coverage3 > 1.5x 4.9x

Weighted Average

Principal Average Term To

Outstanding Interest Rate Maturity

Fixed Rate Mortgage Loans $ 558 4.8%5 3.9 Yrs

Unsecured Revolving Credit Facility6 186 2.1% 5.0 Yrs

Unsecured Term Loan7 150 1.9% 3.8 Yrs

Unsecured Notes 1,200 3.8% 5.6 Yrs

On-Campus Participating Properties 105 5.1% 15.0 Yrs

Total/Weighted Average $ 2,199 3.8% 5.5 Yrs

Variable Rate Debt as % of Total Debt8 15.3 %

Note – refer to the definitions outlined on pages 19 and 20 for detailed definitions of terms appearing on this page.

1. Excludes net unamortized debt premiums related to mortgage loans assumed in connection with acquisitions of $24.8 million, unamortized original issue discount on unsecured notes of $1.8 million, and unamortized deferred

financing costs of $13.3 million.

2. Based on share price of $47.59 and fully diluted share count of 135,633,382 as of March 31, 2017. Assumes conversion of 1,106,644 common and preferred Operating Partnership units and 883,179 unvested restricted stock

awards.

3. Refer to calculations on page 14, including a reconciliation to net income and interest expense, the most directly comparable GAAP measures.

4. Excludes accumulated depreciation of $991.5 million and receivables and intangible assets, net of accumulated amortization, of $49.6 million.

5. Including the amortization of net debt premiums related to mortgage loans assumed in connection with property acquisitions, the effective interest rate for fixed rate mortgage loans is 3.4%.

6. In January 2017, the company amended and extended its senior unsecured revolving credit facility, increasing the facility from $500 million to $700 million and extending the maturity date from March 2018 to March 2022.The

amended facility has an accordion feature that allows the company to expand the facility by up to an additional $500 million, subject to the satisfaction of certain conditions.

7. In January 2017, the interest rate swap associated with the company's $150 million term loan maturing March 2021 expired. Prior to the expiration of the interest rate swap, the company's $150 million term loan was classified

as fixed rate debt; however, upon expiration it became classified as variable rate debt.

8. The company's variable rate debt consists of the unsecured revolving credit facility and the unsecured term loan.

Weighted Average Interest Rate Of Debt Maturing Each Year

Fixed Rate

Mortgage

Loans

6.3% 4.2% 0.0% 5.6% 5.2% 4.0% 0.0% 4.5% 0.0% 3.7%

Total

Debt

6.3% 4.2% 0.0% 3.6% 3.9% 2.3% 3.9% 4.3% 7.6% 3.9%

+

Interest Coverage

($ in thousands)

14

Three Months Ended

June 30, September 30, December 31, March 31, Last Twelve

2016 2016 2016 2017 Months

Net income attributable to ACC, Inc. and Subsidiaries common stockholders $ 18,438 $ 9,644 $ 25,392 $ 34,050 $ 87,524

Net income attributable to noncontrolling interests 327 201 412 399 1,339

Interest expense 20,119 19,016 16,925 14,717 70,777

Income tax provision 345 345 115 257 1,062

Depreciation and amortization 53,703 52,067 51,901 52,323 209,994

Amortization of deferred financing costs 1,352 1,344 1,282 1,028 5,006

Share-based compensation 2,842 2,328 2,222 4,256 11,648

Provision for real estate impairment — — 4,895 — 4,895

Loss on early extinguishment of debt — — 12,841 — 12,841

Gain from disposition of real estate — — (3,788 ) — (3,788 )

Earnings Before Interest, Taxes, Depreciation,

and Amortization ("EBITDA") $ 97,126 $ 84,945 $ 112,197 $ 107,030 $ 401,298

Pro-forma adjustments to EBITDA1 (13,636 )

Adjusted EBITDA $ 387,662

Interest Expense from consolidated statement of comprehensive income $ 20,119 $ 19,016 $ 16,925 $ 14,717 $ 70,777

Amortization of mortgage debt premiums/discounts 3,188 3,104 2,454 2,010 10,756

Capitalized interest 3,565 3,301 3,302 4,411 14,579

Change in accrued interest payable (4,275 ) (1,778 ) 3,320 (2,203 ) (4,936 )

Cash Interest Expense $ 22,597 $ 23,643 $ 26,001 $ 18,935 $ 91,176

Pro-forma adjustments to Cash Interest Expense1 (12,616 )

Adjusted Interest Expense $ 78,560

Interest Coverage 4.9x

Note: refer to the definitions outlined on pages 19 and 20 for detailed definitions of terms appearing on this page.

1. Adjustment to reflect all acquisitions, development deliveries, dispositions, debt repayments and debt refinancings as if such transactions had occurred on the first day of the 12 month period

presented.

Capital Allocation – Long Term Funding Plan

($ in millions)

15

Sources and Uses for Development - As of March 31, 2017

Estimated Project Total Costs Remaining

Estimated Capital Uses for Acquisitions Completed and Development Pipeline1: Cost Incurred Capital Needs

The Arlie Acquisition - Subsequent to March 31, 2017 $ 46 $ — $ 46

2017 Developments Underway 603 468 135

2018 Developments Underway or Expected to Start in Current Year2 433 76 357

2019 Developments Underway or Expected to Start in Current Year 153 12 141

Total $ 1,235 $ 556 $ 679

Estimated Sources: Capital Sources

Cash and Cash Equivalents $ 34

Estimated Cash Flow Available for Investment - through 20193 159

Equity Raised via ATM Subsequent to March 31, 2017, to-date 19

Remaining Capital Needs4 467

Total $ 679

Selected Credit Metrics5

Credit Metric: March 31, 2017 Pro Forma6

Total Debt to Total Asset Value 31.7% 29.0% - 35.2%

Net Debt to EBITDA7 5.6x 4.6x - 5.7x

Note: This analysis demonstrates anticipated funding for the developments currently underway or with expected starts in the current year. As future developments commence,

they are expected to be funded via additional dispositions, free cash available for investment, and capital market transactions.

1. Includes development projects under construction, and management’s Estimated Project Cost for future development deliveries that are expected to commence construction during the current

year, as disclosed on page 10. Also includes the purchase price of completed acquisitions.

2. Includes the presale development project disclosed on page 10.

3. Available cash flow is derived from disclosures in our 2016 Form 10-K and is calculated as net cash provided by operating activities of $308.1 million less dividend payments of $218.7 million, less

principal payments on debt of $15.1 million, less recurring capital expenditures of $16.4 million. Calculation results in available cash flow for investment in 2016 of $57.9 million, which is then

annualized over the remaining 11 quarters through the end of 2019.

4. Remaining capital needs are expected to come from a mix of debt, equity, and dispositions, including the proceeds from the sale of one property classified as held for sale as of March 31, 2017,

which is anticipated to close in Q2 2017.

5. Refer to definitions outlined on pages 19 and 20 for detailed definitions of terms appearing on this page.

6. Ratios represent the pro forma impact of development deliveries and funding alternatives assumed in the Sources and Uses table. The lower end of the pro forma leverage ranges assumes

remaining capital needs are funded with equity, while the higher end assumes funding with debt. Actual ratios will vary based on the timing of construction funding and ultimate mix of sources from

debt, equity, or dispositions.

7. Refer to page 14 for a reconciliation of EBITDA to net income, the most directly comparable GAAP measure.

2017 Outlook - Summary1

($ in thousands, except share and per-share data)

16

Low High

Net income $ 103,400 $ 116,500

Noncontrolling interests 1,700 1,900

Depreciation and amortization 211,700 211,700

Funds from operations ("FFO") $ 316,800 $ 330,100

Elimination of operations from on-campus

participating properties (11,700 ) (12,100 )

Contribution from on-campus participating properties 4,100 4,700

Contractual executive separation and retirement charges2 4,550 4,550

Funds from operations - modified ("FFOM") $ 313,750 $ 327,250

Net income per share - diluted $ 0.76 $ 0.86

FFO per share - diluted $ 2.34 $ 2.44

FFOM per share - diluted $ 2.32 $ 2.42

Weighted-average common shares outstanding -

diluted 135,500,000 135,500,000

1. The company believes that the financial results for the fiscal year ending December 31, 2017 may be affected by, among other factors:

• national and regional economic trends and events;

• the timing of acquisitions and/or dispositions;

• interest rate risk;

• the timing of commencement of construction on owned development projects;

• the ability of the company to be awarded and the timing of the commencement of construction on third-party development projects;

• university enrollment, funding and policy trends;

• the ability of the company to earn third-party management revenues;

• the amount of income recognized by the taxable REIT subsidiaries and any corresponding income tax expense;

• the ability of the company to integrate acquired properties;

• the outcome of legal proceedings arising in the normal course of business;

• the finalization of property tax rates and assessed values in certain jurisdictions; and

• the success of releasing the company's owned properties for the 2017-2018 academic year.

2. Represents contractual executive separation and retirement charges to be incurred with regards to the retirement of the company's Chief Financial Officer, to be recognized in the first and second

quarter 2017.

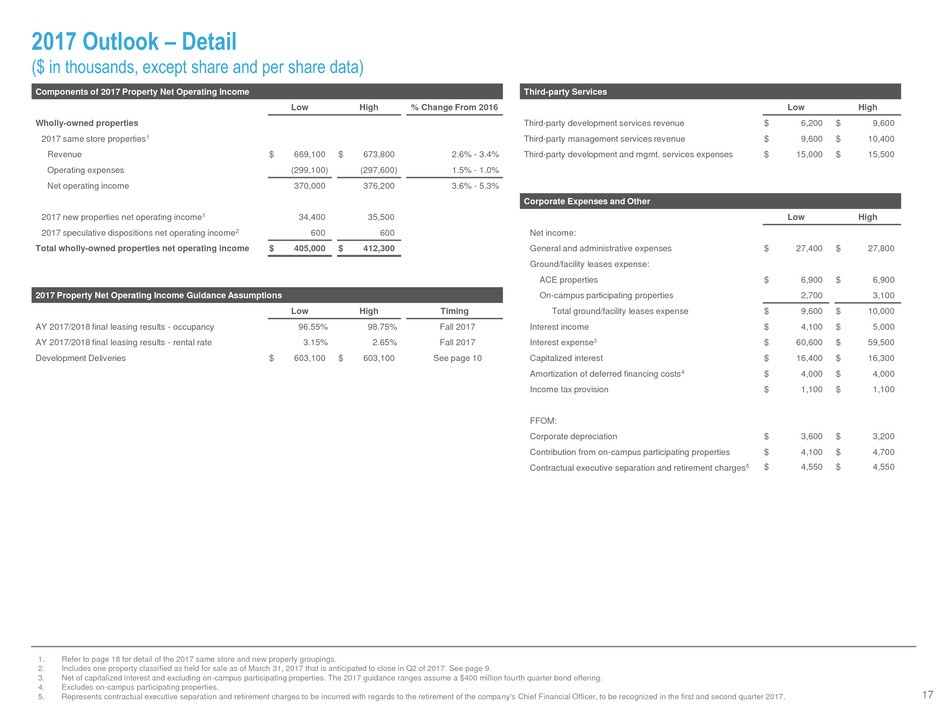

2017 Outlook – Detail

($ in thousands, except share and per share data)

17

1. Refer to page 18 for detail of the 2017 same store and new property groupings.

2. Includes one property classified as held for sale as of March 31, 2017 that is anticipated to close in Q2 of 2017. See page 9.

3. Net of capitalized interest and excluding on-campus participating properties. The 2017 guidance ranges assume a $400 million fourth quarter bond offering.

4. Excludes on-campus participating properties.

5. Represents contractual executive separation and retirement charges to be incurred with regards to the retirement of the company's Chief Financial Officer, to be recognized in the first and second quarter 2017.

Components of 2017 Property Net Operating Income Third-party Services

Low High % Change From 2016 Low High

Wholly-owned properties Third-party development services revenue $ 6,200 $ 9,600

2017 same store properties1 Third-party management services revenue $ 9,600 $ 10,400

Revenue $ 669,100 $ 673,800 2.6% - 3.4% Third-party development and mgmt. services expenses $ 15,000 $ 15,500

Operating expenses (299,100 ) (297,600 ) 1.5% - 1.0%

Net operating income 370,000 376,200 3.6% - 5.3%

Corporate Expenses and Other

2017 new properties net operating income1 34,400 35,500 Low High

2017 speculative dispositions net operating income2 600 600 Net income:

Total wholly-owned properties net operating income $ 405,000 $ 412,300 General and administrative expenses $ 27,400 $ 27,800

Ground/facility leases expense:

ACE properties $ 6,900 $ 6,900

2017 Property Net Operating Income Guidance Assumptions On-campus participating properties 2,700 3,100

Low High Timing Total ground/facility leases expense $ 9,600 $ 10,000

AY 2017/2018 final leasing results - occupancy 96.55% 98.75% Fall 2017 Interest income $ 4,100 $ 5,000

AY 2017/2018 final leasing results - rental rate 3.15% 2.65% Fall 2017 Interest expense3 $ 60,600 $ 59,500

Development Deliveries $ 603,100 $ 603,100 See page 10 Capitalized interest $ 16,400 $ 16,300

Amortization of deferred financing costs4 $ 4,000 $ 4,000

Income tax provision $ 1,100 $ 1,100

FFOM:

Corporate depreciation $ 3,600 $ 3,200

Contribution from on-campus participating properties $ 4,100 $ 4,700

Contractual executive separation and retirement charges5 $ 4,550 $ 4,550

Detail of Property Groupings

As of March 31, 2017

18

2017 Grouping 2018 Grouping

Same Store Properties New Properties Same Store Properties New Properties

# of Design # of Design # of Design # of Design

Properties Beds Properties Beds Properties Beds Properties Beds

Properties Purchased or Developed

Prior to January 1, 2016 125 74,731 125 74,731

2016 Development Deliveries 7 3,191 7 3,191

2016 Acquisition Properties 2 709 2 709

2017 Development Deliveries 10 7,454 10 7,454

2018 Development Deliveries 6 4,850 6 4,850

2019 Development Delivery 1 825 1 825

Total Wholly-owned Properties 125 74,731 26 17,029 134 78,631 17 13,129

Total # Held for Sale Wholly-owned Properties 1

Total Held for Sale Wholly-owned Design Beds 657

Grand Total # of Wholly-owned Properties (All Groupings) 152

Grand Total Wholly-owned Design Beds (All Groupings) 92,417

Note on Property Portfolio: When disclosing our number of properties and design beds as of a certain date, we include all properties that are owned and operating as of that date, as well as properties

that are under construction and anticipated to open for operations in future years. Properties that are in our development pipeline but have not yet commenced construction are not included.

2017: The 2017 same store grouping represents properties owned and operating for both of the entire calendar years ended December 31, 2017 and 2016, which are not conducting or planning

to conduct substantial development or redevelopment activities, and are not classified as held for sale as of March 31, 2017. This same store grouping will be used for purposes of presenting

our 2017 same store operating results.

2018: The 2018 same store grouping represents properties owned and operating for both of the entire calendar years ended December 31, 2018 and 2017. This same store grouping will be

used for purposes of presenting our 2018 same store operating results and our leasing status updates for the 2017/2018 academic year.

Definitions

ACE The company’s American Campus Equity program, whereby the company enters into long-term ground/facility lease agreements with

Universities to invest our capital and to develop, own, and operate on-campus student housing communities. Properties under this

structure are considered to be wholly-owned and are included in the company's consolidated financial statements.

Adjusted EBITDA* EBITDA, including pro forma adjustments to reflect acquisitions, development deliveries, and dispositions as if such transactions had

occurred on the first day of the 12-month period presented.

Adjusted Interest Expense* Interest Expense, including pro forma adjustments to reflect acquisitions, development deliveries, dispositions, debt repayments, and

debt refinancings as if such transactions had occurred on the first day of the 12-month period presented.

Cash Cash and cash equivalents, determined on a consolidated basis in accordance with GAAP.

Cash Interest Expense* Consolidated interest expense calculated in accordance with GAAP, plus amounts which have been deducted and minus amounts which

have been added for, without duplication: (i) the amortization of mark-to-market premiums/discounts on mortgage loans assumed in

connection with acquisitions; (ii) capitalized interest; and (iii) the change in accrued interest during the period presented.

Design Beds Total beds based on the original property design, generally as specified in the construction documents.

EBITDA* Consolidated net income calculated in accordance with GAAP, plus amounts which have been deducted and minus amounts which have

been added for, without duplication: (i) interest expense; (ii) provision for income taxes; (iii) depreciation, amortization and all other non-

cash items; (iv) provision for gains and losses; (v) noncontrolling interests; and (vi) extraordinary and other non-recurring items, as we

determine in good faith.

Funds from Operations

(”FFO”)

Determined based on the definition adopted by the Board of Governors of the National Association of Real Estate Investment Trusts

(“NAREIT”). Calculated as consolidated net income or loss attributable to common shares computed in accordance with GAAP,

excluding gains or losses from depreciable operating property sales, plus real estate depreciation and amortization, and after

adjustments for unconsolidated partnerships and joint ventures. Also excludes non-cash impairment charges.

FFO Modified

(”FFOM”)

FFO modified to reflect certain adjustments related to the economic performance of our on-campus participating properties, and the

elimination of property acquisition costs, contractual executive separation and retirement charges and other non-cash items, as we

determine in good faith. The company believes it is meaningful to eliminate the FFO generated from the on-campus participating

properties and instead to reflect the company's 50% share of the properties' net cash flow and management and development fees

received, as this measure better reflects the economic benefit derived from the company's involvement in the operation of these

properties.

* These definitions are provided for purposes of calculating the company’s unsecured notes covenants and other key ratios.

19

Definitions

GAAP Accounting principles generally accepted in the United States of America.

Interest Coverage* Adjusted EBITDA / Adjusted Interest Expense.

Net Debt* Total Debt less Cash.

Net Debt to EBITDA* Net Debt divided by Adjusted EBITDA.

Net Operating Income

“NOI”

Property revenues less direct property operating expenses, excluding depreciation, but including allocated corporate general and

administrative expenses.

On-campus Participating

Properties

A transaction structure whereby the company enters into long-term ground/facility lease agreements with Universities to develop,

construct, and operate student housing communities. Under the terms of the leases, title to the constructed facilities is held by the

University/lessor and such lessor receives 50% of net cash flows, as defined, on an annual basis through the term of the lease.

Physical Occupancy Occupied beds, including staff accommodations, divided by Design Beds.

Rentable Beds Design beds less beds used by on-site staff.

Same Store Grouping Wholly-owned properties owned and operating for both of the entire annual periods presented, which are not conducting or planning to

conduct substantial development or redevelopment activities, and are not classified as held for sale as of the current period-end.

Secured Debt* The portion of Total Debt that is secured by a mortgage, trust, deed of trust, deed to secure indebtedness, pledge, security interest,

assignment of collateral, or any other security agreement.

Total Asset Value* Undepreciated book value of real estate assets and all other assets, excluding receivables and intangibles, of our consolidated

subsidiaries, all determined in accordance with GAAP.

Total Debt* Total consolidated debt calculated in accordance with GAAP, including capital leases and excluding mark-to-market premiums/discounts

on mortgage loans assumed in connection with acquisitions, the original issued discount on unsecured notes, and deferred financing

costs.

Total Equity Market Value Fully diluted common shares times the company’s stock price at period-end.

Unencumbered Asset Value* The sum of (i) the undepreciated book value of real estate assets which are not subject to secured debt; and (ii) all other assets,

excluding accounts receivable and intangibles, for such properties. Does not include assets of unconsolidated joint ventures.

Unsecured Debt* The portion of Total Debt that is not Secured Debt.

* These definitions are provided for purposes of calculating the company’s unsecured notes covenants and other key ratios.

20

Investor Information

Corporate Headquarters Investor Relations

American Campus Communities, Inc. Tel: (512) 732-1000 Ryan Dennison (512) 732-1000

12700 Hill Country Blvd., Suite T-200 Fax: (512) 732-2450 SVP, Investor Relations rdennison@americancampus.com

Austin, Texas 78738 www.americancampus.com

Executive Management

Bill Bayless Chief Executive Officer

Jim Hopke President

Jennifer Beese Chief Operating Officer

Daniel Perry Chief Financial Officer

William Talbot Chief Investment Officer

Kim Voss Chief Accounting Officer

Research Coverage

Jacob Kilstein Argus Research Company (646) 747-5447 jkilstein@argusresearch.com

Jeffery Spector / Juan Sanabria Bank of America / Merrill Lynch (646) 855-1363 / (646) 855-1589 jeff.spector@baml.com / juan.sanabria@baml.com

Ryan Meliker / Michael Kodesch Canaccord Genuity (212) 389-8094 / (212) 389-8095 rmeliker@canaccordgenuity.com / mkodesch@canaccordgenuity.com

Thomas Lesnick / Ryan Wineman Capital One (571) 633-8191 / (571) 633-8414 thomas.lesnick@capitalone.com / ryan.wineman@capitalone.com

Michael Bilerman / Nick Joseph Citigroup Equity Research (212) 816-1383 / (212) 816-1909 michael.bilerman@citi.com / nicholas.joseph@citi.com

Vincent Chao / Vlad Rudnytsky Deutsche Bank Securities, Inc. (212) 250-6799 / (212) 250-6090 vincent.chao@db.com / vlad.rudnytsky@db.com

Steve Sakwa / Gwen Clark Evercore ISI (212) 446-9462 / (212) 446-5611 steve.sakwa@evercoreisi.com / gwen.clark@evercoreisi.com

David Corak FBR & Co. (703) 312-1610 dcorak@fbr.com

Andrew Rosivach / Jeff Pehl Goldman Sachs (212) 902-2796 / (212) 357-4474 andrew.rosivach@gs.com / jeffrey.pehl@gs.com

Ryan Burke Green Street Advisors (949) 640-8780 rburke@greenst.com

Carol Kemple Hilliard Lyons (502) 588-1839 ckemple@hilliard.com

Aaron Hecht JMP Securities (415) 835-3963 ahecht@jmpsecurities.com

Anthony Paolone J.P. Morgan Securities (212) 622-6682 anthony.paolone@jpmorgan.com

Jordan Sadler / Austin Wurschmidt KeyBanc Capital Markets (917) 368-2280 / (917) 368-2311 jsadler@keybanccm.com / awurschmidt@key.com

Drew Babin Robert W. Baird & Co. (610) 238-6634 dbabin@rwbaird.com

Alexander Goldfarb / Daniel Santos Sandler O'Neill + Partners, L.P. (212) 466-7937 / (212) 466-7927 agoldfarb@sandleroneill.com / dsantos@sandleroneill.com

American Campus Communities, Inc. is followed by the analysts listed above. Please note that any opinions, estimates or forecasts regarding American Campus Communities, Inc.'s

performance made by such analysts are theirs alone and do not represent the opinions, forecasts or predictions of the company or its management. American Campus Communities,

Inc. does not by its reference above or distribution imply its endorsement of or concurrence with such information, conclusions or recommendations.

21

Forward-looking Statements

In addition to historical information, this supplemental package contains forward-looking statements under the federal

securities law. These statements are based on current expectations, estimates and projections about the industry

and markets in which American Campus operates, management's beliefs, and assumptions made by management.

Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties,

which are difficult to predict.